Form 8-K RENAISSANCERE HOLDINGS For: Nov 23

�

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

�

�

FORM 8-K

�

�

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November�24, 2014 (November�23, 2014)

�

�

RenaissanceRe Holdings Ltd.

(Exact name of registrant as specified in its charter)

�

�

�

| Bermuda | � | 001-14428 | � | 98-014-1974 |

| (State or other jurisdiction of incorporation) |

� | (Commission File Number) |

� | (I.R.S. Employer Identification No.) |

Renaissance House

12 Crow Lane

Pembroke, HM19 Bermuda

(Address of principal executive office)

(441) 295-4513

(Registrant�s telephone number, including area code)

�

�

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

�

| x | Written communications pursuant to Rule�425 under the Securities Act (17 CFR 230.425) |

�

| � | Soliciting material pursuant to Rule�14a-12 under the Exchange Act (17 CFR 240.14a-12) |

�

| � | Pre-commencement communications pursuant to Rule�14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

�

| � | Pre-commencement communications pursuant to Rule�13e-4(c) under the Exchange Act (17 CFR 240.133-4(c)) |

�

�

�

| Item�8.01. | Other Events |

On November�23, 2014, RenaissanceRe Holdings Ltd. (�RenaissanceRe�) entered into an Agreement and Plan of Merger (the �Merger Agreement�), with Port Holdings Ltd., a Bermuda exempted company and a wholly owned subsidiary of RenaissanceRe (�Acquisition Sub�), and Platinum Underwriters Holdings, Ltd., a Bermuda exempted company (�Platinum�). The Merger Agreement provides that, upon the terms and subject to the conditions set forth therein, Acquisition Sub will be merged with and into Platinum, with Platinum continuing as the surviving corporation and as a wholly owned subsidiary of RenaissanceRe.

On November�24, 2014, RenaissanceRe issued a press release regarding its entry into the Merger Agreement. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference into this Item�8.01.

On and after November�24, 2014, representatives of RenaissanceRe and Platinum will present to various investors the information described in the slides attached to this report as Exhibit 99.2, which are incorporated by reference herein.

Important Information for Investors and Shareholders

This communication relates to a proposed merger between RenaissanceRe and Platinum that will become the subject of a registration statement on Form S-4, which will include a proxy statement/prospectus, to be filed with the U.S. Securities and Exchange Commission (the �SEC�) that will provide full details of the proposed merger and the attendant benefits and risks. This communication is not a substitute for the proxy statement/prospectus or any other document that RenaissanceRe or Platinum may file with the SEC or that Platinum may send to its shareholders in connection with the proposed merger. Investors and Platinum security holders are urged to read the registration statement on Form S-4, including the definitive proxy statement/prospectus, and all other relevant documents filed with the SEC or sent to Platinum shareholders as they become available because they will contain important information about the proposed merger. All documents, when filed, will be available free of charge at the SEC�s website (www.sec.gov). You may also obtain documents filed by RenaissanceRe with the SEC by contacting RenaissanceRe�s Legal Department at RenaissanceRe Holdings Ltd., Renaissance House, 12 Crow Lane, Pembroke HM 19 Bermuda, or via e-mail at [email protected]; and you may obtain copies of documents filed by Platinum with the SEC by contacting Platinum�s Legal Department at Platinum Underwriters Holdings, Ltd., Waterloo House, 100 Pitts Bay Road, Pembroke, Bermuda HM08, or visiting Platinum�s website at www.platinumre.com. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

RenaissanceRe, Platinum and their respective directors and executive officers may be deemed to be participants in any solicitation of proxies in connection with the proposed merger. Information about RenaissanceRe�s directors and executive officers is available in RenaissanceRe�s proxy statement dated April�10, 2014 for its 2014 Annual General Meeting of Shareholders. Information about Platinum�s directors and executive officers is available in Platinum�s proxy statement dated March�21, 2014 for its 2014 Annual General Meeting of Shareholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

Cautionary Statement Regarding Forward Looking Statements

Any forward-looking statements made in this Form 8-K reflect RenaissanceRe�s current views with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are subject to numerous factors that could cause actual results to differ materially from those set forth in or implied by such forward-looking statements, including the following: the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the inability to obtain Platinum�s shareholder approval or the failure to satisfy other conditions to completion of the merger, including receipt of regulatory approvals; risks that the proposed transaction disrupts each company�s current plans and operations; the ability to retain key personnel; the ability to recognize the benefits of the merger; the amount of the costs, fees, expenses and charges related to the merger; the frequency and severity of catastrophic and other events; uncertainties in the companies� reserving processes; the lowering or loss of any of the financial strength, claims paying or enterprise wide risk management ratings of either company or their respective subsidiaries or joint ventures; risks associated with appropriately modeling, pricing for, and contractually addressing new or potential factors in loss emergence; risks that the companies might be bound to policyholder obligations beyond their underwriting intent; risks due to the companies� reliance on a small and decreasing number of reinsurance brokers and other distribution services; risks relating to operating in a highly competitive

�

-�2�-

environment; risks relating to deteriorating market conditions; the risk that the companies� customers may fail to make premium payments due to them; the risk of failures of the companies� reinsurers, brokers or other counterparties to honor their obligations to the companies; a contention by the Internal Revenue Service that Renaissance Reinsurance Ltd., Platinum Underwriters Bermuda, Ltd. or any of the companies� other Bermuda subsidiaries, is subject to U.S. taxation; other risks relating to potential adverse tax developments; risks relating to adverse legislative developments; risks associated with the companies� investment portfolios; changes in economic conditions or inflation; and other factors affecting future results disclosed in RenaissanceRe�s and Platinum�s filings with the SEC, including its Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

�

-�3�-

| Item�9.01 | Financial Statements and Exhibits |

�

| (d) | Exhibits |

�

| Exhibit No. |

�� | Description of Exhibit |

| 99.1 | �� | Copy of Press Release issued by RenaissanceRe Holdings Ltd., dated November 24, 2014 |

| 99.2 | �� | Investor Presentation Slides, dated November 24, 2014 |

�

-�4�-

SIGNATURES

Pursuant to the requirement of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

�

| � | � | � | RENAISSANCERE HOLDINGS LTD. | |||

| Date: November 24, 2014 | � | � | By: | � | /s/ Stephen H. Weinstein | |

| � | � | Name: | � | Stephen H. Weinstein | ||

| � | � | Title: | � | Senior Vice President, General Counsel & Corporate Secretary | ||

�

-�5�-

Exhibit 99.1

�

RenaissanceRe Holdings Ltd. to Acquire Platinum Underwriters in $1.9 Billion Transaction

Expands Market Presence, Product Offerings and Client Relationships

Accelerates Growth in U.S. Specialty and Casualty Reinsurance Business

Transaction Accretive to RenaissanceRe�s Shareholders

PEMBROKE, Bermuda, November�24, 2014 � RenaissanceRe Holdings Ltd. (NYSE: RNR) (�RenaissanceRe� or the �Company�) and Platinum Underwriters Holdings, Ltd. (NYSE: PTP) (�Platinum�) announced today that the companies have entered into a definitive merger agreement under which RenaissanceRe will acquire Platinum. Under the terms of the transaction, the common shareholders of Platinum will receive $76.00 per common share in stock and cash, or approximately $1.9 billion. RenaissanceRe expects the transaction to be accretive to book value per share and earnings per share and that the combined company will have substantial financial strength and flexibility post-closing.

Kevin J. O�Donnell, President and Chief Executive Officer of RenaissanceRe, commented: �We are very pleased to have entered into the definitive agreement to acquire Platinum. It is a well-run company and its integration with RenaissanceRe will benefit our combined companies� clients through an expanded product offering and broker relationships. It will also accelerate the growth of our U.S. specialty and casualty reinsurance platform and as a result, create enhanced value for our shareholders.�

Mr.�O�Donnell continued: �Platinum is a company we know well as we supported its formation and initial public offering in 2002. Platinum�s disciplined approach to underwriting and risk management is a strategic and cultural fit for RenaissanceRe and its book of business will be integrated within our risk management framework. After the transaction closes, we anticipate our combined company will continue to have the very strong capital and liquidity position you have come to expect from RenaissanceRe.�

The aggregate consideration for the transaction will consist of 7.5�million RenaissanceRe common shares, valued at approximately $761 million, and $1.16 billion of cash. The cash consideration will be funded through a pre-closing dividend from Platinum, RenaissanceRe available funds and the proceeds from the issuance of new senior debt.

The acquisition price of $76.00 represents a 24% premium to Platinum�s closing price per common share as of November�21, 2014. At closing, Platinum shareholders will receive a $10.00 per share special pre-closing dividend and will be entitled to elect to receive, for each Platinum share held, either (i)�$66.00 in cash, (ii)�0.6504 RenaissanceRe common shares or (iii)�0.2960 RenaissanceRe common shares and $35.96 in cash. All elections will be subject to proration such that RenaissanceRe issues exactly 7.5�million common shares. Following completion of the transaction, Platinum�s existing shareholders will own approximately 16% of RenaissanceRe�s outstanding shares.

RenaissanceRe�s senior management team, led by Kevin O�Donnell, and eleven member Board of Directors will remain in place. The combined company will retain RenaissanceRe�s name and headquarters.

For the twelve months ended September�30, 2014, the two companies had pro forma gross premiums written of $2.0 billion. Shareholders� equity will increase from $3.7 billion to $4.5 billion and total cash and invested assets will increase from $7.0 billion to $9.4 billion on a pro forma basis. RenaissanceRe expects to achieve approximately $30 million of run-rate annual cost savings and to realize meaningful capital efficiencies from the combination.

The agreement has been unanimously approved by both companies� Boards of Directors. The transaction is expected to close in the first half of 2015 and is subject to customary regulatory approvals as well as the approval of Platinum�s shareholders.

Morgan Stanley�& Co. LLC is acting as financial advisor to RenaissanceRe in connection with the transaction and Willkie Farr�& Gallagher LLP as legal counsel. Wachtell, Lipton, Rosen�& Katz is acting as legal counsel to RenaissanceRe�s Board of Directors in connection with the transaction.

Conference Call and Webcast:

RenaissanceRe will conduct an investor conference call on�November 24, 2014�at�9:00 a.m. Eastern Time�to discuss the transaction with interested investors and shareholders. On the call will be RenaissanceRe�s President and CEO, Kevin J. O�Donnell, and Executive Vice President and Chief Financial Officer, Jeffrey D. Kelly.

The details of the call are as follows:

Date:�November 24, 2014

Time:�9:00 a.m. Eastern Time

Toll-free number (U.S. callers): 1 (877)�512-9165

International callers: 1 (706)�679-5795

Passcode: 38834873

Please dial in five to ten minutes prior to the start of the call.

In addition, interested persons may listen to the call, and access a slide presentation to be referenced during the call, via the website of RenaissanceRe at�www.renre.com.

RenaissanceRe Holdings Ltd. is a global provider of reinsurance and insurance. The Company�s business consists of three reportable segments: (1)�Catastrophe Reinsurance, which includes catastrophe reinsurance and certain property catastrophe joint ventures managed by the Company�s ventures unit; (2)�Specialty Reinsurance, which includes specialty reinsurance and certain specialty joint ventures managed by the Company�s ventures unit; and (3)�Lloyd�s, which includes reinsurance and insurance business written through RenaissanceRe Syndicate 1458.

Cautionary Statement Regarding Forward-Looking Statements

Any forward-looking statements made in this press release reflect RenaissanceRe�s current views with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.�These statements are subject to numerous factors that could cause actual results to differ materially from those set forth in or implied by such forward-looking statements, including the following: the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the inability to obtain Platinum�s shareholder approval or the failure to satisfy other conditions to completion of the merger, including receipt of regulatory approvals; risks that the proposed transaction disrupts each company�s current plans and operations; the ability to retain key personnel; the ability to recognize the benefits of the merger; the amount of the costs, fees, expenses and charges related to the merger; the frequency and

�

2

severity of catastrophic and other events; uncertainties in the companies� reserving processes; the lowering or loss of any of the financial strength, claims paying or enterprise wide risk management ratings of either company or their respective subsidiaries or joint ventures; risks associated with appropriately modeling, pricing for, and contractually addressing new or potential factors in loss emergence; risks that the companies might be bound to policyholder obligations beyond their�underwriting intent; risks due to the companies� reliance on a small and decreasing number of reinsurance brokers and other distribution services; risks relating to operating in a highly competitive environment; risks relating to deteriorating market conditions; the risk that the companies� customers may fail to make premium payments due to them; the risk of failures of the companies� reinsurers, brokers or other counterparties to honor their obligations to the companies; a contention by the Internal Revenue Service that Renaissance Reinsurance Ltd., Platinum Underwriters Bermuda, Ltd. or any of the companies� other Bermuda subsidiaries, is subject to U.S. taxation; other risks relating to potential adverse tax developments; risks relating to adverse legislative developments; risks associated with the companies� investment portfolios; changes in economic conditions or inflation; and other factors affecting future results disclosed in RenaissanceRe�s and Platinum�s filings with the SEC, including its Annual Reports on Form 10-K and Quarterly Reports on Form�10-Q.

Additional Information About the Proposed Merger and Where to Find It

This press release relates to a proposed merger between RenaissanceRe and Platinum that will become the subject of a registration statement on Form S-4, which will include a proxy statement/prospectus, to be filed with the U.S. Securities and Exchange Commission (the �SEC�) that will provide full details of the proposed merger and the attendant benefits and risks. This press release is not a substitute for the proxy statement/prospectus or any other document that RenaissanceRe or Platinum may file with the SEC or that Platinum may send to its shareholders in connection with the proposed merger. Investors and Platinum security holders are urged to read the registration statement on Form S-4, including the definitive proxy statement/prospectus, and all other relevant documents filed with the SEC or sent to Platinum shareholders as they become available because they will contain important information about the proposed merger. All documents, when filed, will be available free of charge at the SEC�s website (www.sec.gov). You may also obtain documents filed by RenaissanceRe with the SEC by contacting RenaissanceRe�s Legal Department at RenaissanceRe Holdings Ltd., Renaissance House, 12 Crow Lane, Pembroke HM 19 Bermuda, or via e-mail at [email protected]; and you may obtain copies of documents filed by Platinum with the SEC by contacting Platinum�s Legal Department at Platinum Underwriters Holdings, Ltd., Waterloo House, 100 Pitts Bay Road, Pembroke, Bermuda HM08, or visiting Platinum�s website at www.platinumre.com. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

Participants in the Solicitation

RenaissanceRe, Platinum and their respective directors and executive officers may be deemed to be participants in any solicitation of proxies in connection with the proposed merger. Information about RenaissanceRe�s directors and executive officers is available in RenaissanceRe�s proxy statement dated April�10, 2014 for its 2014 Annual General Meeting of Shareholders. Information about Platinum�s directors and executive officers is available in Platinum�s proxy statement dated March�21, 2014 for its

�

3

2014 Annual General Meeting of Shareholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

###

Investor Contact:

RenaissanceRe Holdings Ltd.

Rohan Pai, 1 (441)�295-4513

Director � Corporate Finance

Media Contact:

Kekst and Company

Peter Hill or Dawn Dover, 1 (212)�521-4800

�

4

RenaissanceRe Holdings Ltd.

RenaissanceRe Agreed Acquisition of

Platinum Underwriters

Investor Presentation

November 24, 2014

Exhibit 99.2 |

2

Disclaimer

Information set forth in this presentation, including financial estimates and

statements as to the expected timing, completion and effects of the

proposed acquisition (the �Acquisition�) of Platinum Underwriters Holdings, Ltd.

(�Platinum�) by RenaissanceRe Holdings Ltd. (�RenaissanceRe� or

�RenRe�) may be considered "forward-looking�. These statements are subject to

risks and uncertainties that could cause actual results to differ from those set forth in or

implied by such forward-looking statements. Such estimates and statements include, but are not limited to, statements

concerning the benefits of the Acquisition, including future financial and operating results, the

combined company�s plans, objectives, expectations and intentions, and other statements

that are not statements of historical fact. Such statements are based upon the current beliefs and expectations

of the management of RenRe and are subject to significant risks and uncertainties outside of our

control.

Among the risks and uncertainties that could cause actual results to differ from those described in

the forward-looking statements include, but are not limited to the occurrence of any event,

change or other circumstances that could give rise to the termination of the merger agreement; the

inability to obtain Platinum�s shareholder approval or the failure to satisfy other conditions to

completion of the merger, including receipt of regulatory approvals; risks that the proposed

transaction disrupts each company�s current plans and operations; the ability to retain key personnel; the ability to

recognize the benefits of the merger; the amount of the costs, fees, expenses and charges related to

the merger; the frequency and severity of catastrophic and other events; uncertainties in the

companies� reserving processes; the lowering or loss of any of the financial strength, claims

paying or enterprise wide risk management ratings of either company or their respective subsidiaries

or joint ventures; risks associated with appropriately modeling, pricing for, and contractually

addressing new or potential factors in loss emergence; risks that the companies� might be

bound to policyholder obligations beyond their underwriting intent; risks due to the companies�

reliance on a small and decreasing number of reinsurance brokers and other distribution

services; risks relating to operating in a highly competitive environment; risks relating to deteriorating

market conditions; the risk that the companies� customers may fail to make premium payments due

to them; the risk of failures of the companies� reinsurers, brokers or other

counterparties to honor their obligations to the companies; a contention by the Internal Revenue Service that

Renaissance Reinsurance Ltd., Platinum Underwriters Bermuda, Ltd. or any of the companies� other

Bermuda subsidiaries, is subject to U.S. taxation; other risks relating to potential adverse

tax developments; risks relating to adverse legislative developments; risks associated with the

companies� investment portfolios; changes in economic conditions or inflation; and other factors

affecting future results disclosed in RenaissanceRe�s and Platinum�s filings with the

SEC, including its Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.�

Discussions of additional risks and uncertainties are contained in Platinum�s and RenRe�s

filings with the Securities and Exchange Commission. Neither Platinum nor RenRe is under any

obligation, and each expressly disclaims any such obligation, to update, alter or otherwise revise any

forward-looking statements, whether written or oral, that may be made from time to time, whether

as a result of new information, future events or otherwise. Persons reading this presentation

are cautioned not to place undue reliance on these forward-looking statements which speak only as of

the date hereof.

|

3

Transaction highlights

Benefits our clients

Accelerates growth of U.S. platform

Efficiencies in property portfolio

Increases operating leverage and capital efficiency

Accretive to shareholders

Integrates well with our risk management culture |

4

Key transaction features

(1)

Based

on

RenRe�s

average

daily

volume

weighted

average

price

for

the

20

trading

days

ending

11/21/2014

of

$101.48

(2)

Based on 25.33MM net fully diluted Platinum shares as of 9/30/2014

(3)

Multiple based on Platinum�s fully converted book value per common share as

of 9/30/2014 (per Platinum�s 9/30/2014 Financial Supplement) (4)

Subject to proration

Transaction Structure

Acquisition of Platinum Underwriters Holdings, Ltd. (�Platinum�) by

RenaissanceRe Holdings Ltd. (�RenaissanceRe�

or �RenRe�) in a cash and stock transaction

Value

$76.00 per Platinum share

(1)

$1.9Bn transaction equity value

(1) (2)

1.13x Platinum BVPS as of 9/30/2014

(3)

24% premium to Platinum closing price of $61.27 on 11/21/2014

Consideration Mix

Aggregate consideration mix of approximately 39.5% stock and 60.5% cash to

Platinum shareholders, including on a per share basis:

�

$10.00 per share special pre-closing dividend of cash, and

�

Election to receive

(4)

(i) $66.00 in cash, (ii) 0.6504 RenaissanceRe shares, or (iii)

0.2960 RenaissanceRe shares and $35.96 in cash

Financing

$1.2Bn aggregate cash consideration, funded by special pre-closing dividend by

Platinum, new senior debt issuance and RenaissanceRe available funds

Required Approvals

Customary regulatory approvals

Approval of Platinum shareholders

Timing

Expected closing in first six months of 2015

Management / Board

RenaissanceRe management and Board of Directors to remain in place

|

5

Detail on transaction consideration

Total Consideration to Platinum

$MM

Per Share

(1)

Cash Dividend

253

$10.00

Other Cash

911

$35.96

Total Cash

1,164

$45.96

Stock

761

$30.04

Total Consideration

1,925

$76.00

Other Cash

Stock

(1)

Based on 25.33MM net fully diluted Platinum shares as of 9/30/2014

(2)

RenRe�s

average

daily

volume

weighted

average

price

for

the

20

trading

days

ending

11/21/2014

B

A

B

A

New Senior Debt Issuance ($MM)

300

RenaissanceRe

Available Funds ($MM)

611

Total Value ($MM)

911

Other

Cash

Per

Platinum

Share

($)

(1)

$35.96

RenaissanceRe

Shares Issued (MM)

7.50

RenaissanceRe

Share

Price

($)

(2)

$101.48

Total Value ($MM)

761

Stock

Per

Platinum

Share

($)

(1)

$30.04

RenaissanceRe

Share Per Platinum Share

0.2960 |

6

RenaissanceRe overview

Headquarters:

Bermuda

Employees:

285

(as

of

9/30/2014)

Financial Strength Ratings:

S&P: AA-

/ A+

A.M. Best: A+ / A

Products:

Property catastrophe reinsurance

Casualty and specialty reinsurance

Third party capital management

Corporate Structure:

Principal operating subsidiaries in

Bermuda, U.S. and at Lloyd�s

Listed

on

NYSE;

market

cap:

$3.9Bn

(4)

History:

Formed in 1993

Key Financial Highlights

$MM

2012

2013

9M�14

GPW

1,552

1,605

1,418

NPW

1,103

1,204

956

Operating

Income

(1)

402

631

329

Operating

ROE

(%)

(1)

12.6

19.4

12.9

(2)

Combined Ratio (%)

58

44

56

Cash & Investments

6,660

7,230

7,032

Common Equity

3,103

3,504

3,336

Property

Cat.

Reins.

60%

Casualty

and

Specialty

Reins.

22%

Lloyd's

18%

Business Mix

LTM

(3)

GPW: $1,502MM

(1)

See �Appendix�Comments on Regulation G� for a reconciliation of non-GAAP financial

measures

(2)

Annualized

(3)

Trailing last twelve months as of 9/30/2014 (4)

Market close as of 11/21/2014; based on basic common shares outstanding as of 11/3/2014 as reported in

the 3Q�14 10-Q |

7

RenaissanceRe Strategy:

Acquisition is consistent with our strategy

Competitive

advantages:

Superior customer

relationships

Superior capital

management

Superior risk selection

Superior portfolio

Well-structured risk

Most efficient capital

�matched

with�

Acquisition Benefits:

�

Larger combined U.S. platform

�

Expands client base and

product offering

�

Provides strong counterparty

for Platinum clients

�

Integrates well with our risk

management culture

�

Complementary portfolio and

capabilities

�

Combines two strong

underwriting platforms

�

Greater diversification

reduces required capital on a

combined basis

�

Apply RenaissanceRe risk &

capital frameworks

�

Apply RenaissanceRe ceded

and third party capital

strategies |

8

Platinum overview

Headquarters:

Bermuda

Employees:

123

(as

of

9/30/2014)

Financial Strength Ratings:

Products:

Corporate Structure:

History:

Key Financial Highlights

(1)

$MM

2012

2013

9M�14

GPW

570

580

394

NPW

565

567

380

Operating Income

(2)

247

204

128

Operating ROE (%)

(2)

13.8

11.2

9.9

(3)

Combined Ratio (%)

63

63

70

Cash & Investments

3,948

3,492

3,279

Common Equity

1,895

1,747

1,697

Property

Cat.

Reins.

21%

Casualty

and

Specialty

Reins.

58%

Property

Other

21%

Business Mix

LTM

(4)

GPW: $544MM

S&P: A-

A.M. Best: A

100% property and casualty reinsurance

Principal operating subsidiaries in U.S. and

Bermuda

Listed on NYSE; market cap: $1.5Bn

(5)

Formed in 2002; RenRe invested in IPO

(1)

Platinum metrics as disclosed in Platinum�s 9/30/2014 and 12/31/2013 Financial Supplements (2)

See �Appendix�Comments on Regulation G� for a reconciliation of non-GAAP financial

measures

(3)

Annualized

(4)

Trailing last twelve months as of 9/30/2014 (5)

Market close as of 11/21/2014; based on basic common shares outstanding as of 10/16/2014 as reported

in the 3Q�14 10-Q |

9

Key transaction benefits

Benefits our

clients

Applies core strengths to a broader client base

Expands market presence and product offerings

Enhances our flexibility to deploy capacity

Accelerates

growth of U.S.

platform

Expands domestic client base

Platinum�s portfolio is complementary to our existing business

Enhanced expertise and local market presence

Efficiencies in

property portfolio

Plan to retain the Platinum Bermuda portfolio

Implement

Renaissance

Exposure

Management

System

(�REMS�

�)

Utilize third party capital, ceded strategies and multiple balance sheets

Industry leading proprietary modeling and scientific resources

1

2

3 |

10

Key transaction benefits (continued)

Increases

operating leverage

and capital

efficiency

Reduces required capital on a combined basis

Enhanced capital flexibility from a larger, more diversified business

Meaningful cost savings from combination and integration of businesses

Accretive to

shareholders

Expected

to

be

accretive

to

book

value

per

share,

earnings

per

share

and

ROE

Maintain substantial financial strength and flexibility

Integrates well

with our risk

management

culture

Well underwritten book of business in markets we know and understand

Apply unified risk management across the business

Strong cultural compatibility and historical relationship

4

5

6 |

11

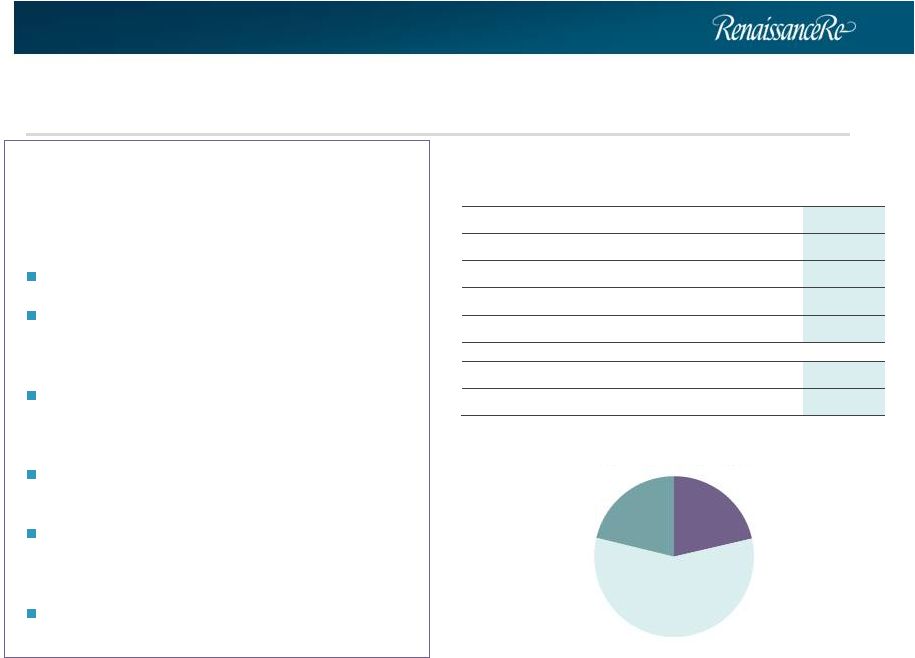

Increased product offering and market presence

Standalone RenRe

(LTM

(2)

GPW)

Pro Forma RenRe

(LTM

(2)

GPW)

Standalone Platinum

(1)

(LTM

(2)

GPW)

(3)

(1)

Platinum metrics as disclosed in Platinum�s 9/30/2014 and 12/31/2013 Financial

Supplements (2)

Trailing last twelve months as of 9/30/2014

(3)

Based on transaction financing including $0.76Bn stock and $0.30Bn new senior debt

issuance and assumed Platinum debt of $0.25Bn (1)

(1)

Property Cat.

Reins.

60%

Casualty and

Specialty

Reins.

22%

Lloyd's

18%

Property Cat.

Reins.

21%

Casualty and

Specialty

Reins.

58%

Property Other

21%

Property Cat.

Reins.

50%

Casualty and

Specialty

Reins.

31%

Lloyd's

13%

Property Other

6%

1.5

0.5

2.0

RenRe

Platinum

Pro Forma

LTM GPW

(2)

$Bn

4.0

1.9

5.3

RenRe

Platinum

Pro Forma

3Q�14 Total Capital

$Bn |

12

Accelerates growth of our U.S. platform

Bermuda

U.S.

London

Business

Property cat

Casualty & specialty

Property, casualty

and specialty

Property, casualty and

specialty re/insurance

Offices

Hamilton

Connecticut

London

People

135 employees

8 employees

(1)

76 employees

Balance sheet

RRL, RSRL

JV balance sheets

RSUSL

Lloyd�s cover holder

Lloyd�s Syndicate 1458

Ratings

(S&P / AM Best)

RRL:� AA-

/ A+

RSRL:� A+ / A

NR / A

A+ / A

(2)

Notes:

General: RenaissanceRe Singapore and Dublin branches not shown (headcount

excluded); Bermuda and U.S. offices are exclusively reinsurance (1)

RenaissanceRe U.S. headcount excludes Weather Predict

(2)

London ratings represent Lloyd�s Overall Market Ratings

(3)

Platinum detail as disclosed in Platinum�s SEC filings

Business

Property

International casualty

& specialty

Casualty and

specialty, and

property per risk

Offices

Hamilton

Connecticut, New

York, Chicago

People

37 employees

86 employees

Balance sheet

Platinum Bermuda

Platinum U.S.

Ratings

(S&P / AM Best)

A-

/ A

A-

/ A

RenaissanceRe

Platinum

(3) |

13

Capital and expense efficiencies

Capital efficiencies

Reduces required capital for combined underwriting portfolios

Transaction financing is efficient

Prudent use of financial leverage reduces cost of capital

Cash portion of transaction financed through excess capital

We believe that our pro forma excess capital position will remain

substantial Improved operating leverage

Approximately $30MM of run-rate annual cost savings

Integration plan

Expect

to

complete

in

12

�

18

months

Approximately $30MM of one-time costs expected

Maintain RenaissanceRe headquarters in Bermuda and Platinum�s offices in New

York and Chicago |

14

$ in billions

3Q�14 Metrics

RenaissanceRe

Platinum

(1)

Pro Forma

Cash and Investment Assets

7.0

3.3

9.4

Total Assets

8.4

3.7

11.4

Shareholders�

Equity

3.7

1.7

4.5

Total Capital

(2)

4.0

1.9

5.3

Debt / Capital (%)

6.3%

12.8%

15.1%

BVPS

$85.78

$67.01

(3)

$88.32

Accretion / (Dilution)

3.0%

TBVPS

(4)

$84.90

$67.01

(3)

$82.66

Accretion / (Dilution)

(2.6%)

Substantial pro forma financial strength and

flexibility

(1)

Platinum metrics as disclosed in Platinum�s 9/30/2014 Financial

Supplement (2)

Includes common equity, preferred equity and debt

(3)

Fully converted basis

(4)

See

�Appendix�Comments

on

Regulation

G�

for

a

reconciliation

of

non-GAAP

financial

measures |

15

Conclusion

Benefits our clients

Accelerates growth of U.S. platform

Efficiencies in property portfolio

Increases operating leverage and capital efficiency

Accretive to shareholders

Integrates well with our risk management culture |

RenaissanceRe Holdings Ltd.

Appendix |

17

Pro forma balance sheet (9/30/14)

(4)

(1)

Platinum metrics as disclosed in Platinum�s 9/30/2014 Financial

Supplement (2)

Excludes purchase accounting adjustments and transaction fees

(3)

See

�Appendix�Comments

on

Regulation

G�

for

a

reconciliation

of

non-GAAP

financial

measures

(4)

At September 30, 2014, goodwill and other intangibles included $26.1 million of

goodwill and other intangibles included in investments in other ventures, under equity method

(5)

Platinum book value per share presented on a fully converted basis (per

Platinum�s 9/30/2014 Financial Supplement) ($ in millions)

RenaissanceRe

Platinum

(1)

Transaction

Pro Forma

(9/30/14)

(9/30/14)

Eliminations

Adjustments

(2)

Consolidated

Assets

Total investments

$ 6,731

$ 1,940

$� -

$� -

$ 8,672

Cash and cash equivalents

301

1,339

-

(864)

776

Goodwill and other intangibles

8

-

-

228

236

Other assets

1,317

407

-

-

1,724

Total assets

$ 8,357

$ 3,686

$� -

$ (636)

$ 11,408

Liabilities

Reserve for claims and claim expenses

$ 1,533

$ 1,498

$� -

$� -

$ 3,031

Other liabilities

1,748

241

-

-

1,989

Debt

249

250

-

300

799

Total liabilites

$ 3,530

$ 1,990

$� -

$ 300

$ 5,819

Redeemable noncontrolling interest

1,091

-

-

-

1,091

Preference shares

400

-

-

-

400

Total common shareholders' equity

$ 3,336

$ 1,697

$ (1,697)

$ 761

$ 4,097

Total tangible common shareholders' equity

(3)

3,302

1,697

(1,697)

533

3,834

Book value per common share

(3) (5)

$ 85.78

$ 67.01

$ 88.32

Tangible book value per common share

(3)

$ 84.90

$ 67.01

$ 82.66

Total capital

$ 3,985

$ 1,947

$ 5,296

Total debt to total capitalization

6.3%

12.8%

15.1% |

18

Additional information about the proposed merger

and where to find It

This

presentation

relates

to

a

proposed

merger

between

RenRe

and

Platinum

that

will

become

the

subject

of

a

registration statement on Form S-4, which will include a proxy

statement/prospectus, to be filed with the U.S. Securities and Exchange

Commission (the �SEC�) that will provide full details of the proposed merger and the

attendant benefits and risks.� This presentation is not a substitute for the

proxy statement/prospectus or any other document that RenRe or Platinum may

file with the SEC or that Platinum may send to its shareholders in connection

with the proposed merger.� Investors and Platinum security holders are urged

to read the registration statement on Form S-4, including the definitive

proxy statement/prospectus, and all other relevant documents filed with the SEC

or sent to Platinum shareholders as they become available because they will contain

important information about the proposed merger.� All documents, when

filed, will be available free of charge at the SEC�s website (www.sec.gov).

You may also obtain documents filed by RenaissanceRe with the SEC by contacting

RenaissanceRe�s Legal Department

at

RenaissanceRe

Holdings

Ltd.,

Renaissance

House,

12

Crow

Lane,

Pembroke

HM

19

Bermuda,

or

via e-mail at [email protected]; and you may obtain copies of

documents filed by Platinum with the SEC by contacting Platinum�s Legal

Department at Platinum Underwriters Holdings, Ltd., Waterloo House, 100 Pitts Bay

Road, Pembroke, Bermuda HM08, or visiting Platinum�s website at

www.platinumre.com. This communication does not constitute an offer to sell

or the solicitation of an offer to buy any securities or a solicitation of any vote or

approval. |

19

Participants in the solicitation

RenaissanceRe, Platinum and their respective directors and executive officers may

be deemed to be participants in any

solicitation

of

proxies

in

connection

with

the

proposed

merger.

Information

about

RenaissanceRe�s

directors

and

executive officers is available in RenaissanceRe�s proxy statement dated April

10, 2014 for its 2014 Annual General Meeting

of

Shareholders.

Information

about

Platinum�s

directors

and

executive

officers

is

available

in

Platinum�s

proxy

statement

dated

March

21,

2014

for

its

2014

Annual

General

Meeting

of

Shareholders.

Other

information

regarding the participants in the proxy solicitation and a description of their

direct and indirect interests, by security holdings or otherwise, will be

contained in the proxy statement/prospectus and other relevant materials to be filed with

the

SEC

regarding

the

merger

when

they

become

available.

Investors

should

read

the

proxy

statement/prospectus

carefully when it becomes available before making any voting or investment

decisions. |

20

Comments on Regulation G

This presentation includes certain non-GAAP financial measures relating to

RenRe within the meaning of Regulation G

including,

"operating

income",

�operating

ROE�,

�tangible

common

shareholders�

equity�

and

�tangible

book

value

per common share�. Definitions of such measures and a reconciliation of these

measures to the most comparable GAAP

figures

in

accordance

with

Regulation

G

is

available,

for

�operating

income�,

�operating

ROE�

and

�tangible

book value per common share�, in RenRe�s 9/30/14 and 12/31/13 Financial

Supplements, which are located on RenRe�s website www.renre.com under

�Investor Information/Financial Reports, and for �tangible common

shareholders�

equity�

is set forth below.

Set

forth

below

is

a

reconciliation

of

total

common

shareholders�

equity

to

total

tangible

common

shareholders�

equity.

This

measurement

is

defined

as

total

common

shareholders�

equity

excluding

goodwill

and

intangible

assets.��

RenRe�s

management

believes

that

�total

tangible

common

shareholders�

equity

is

important

to

investors

and

other

interested persons and is a useful measure of corporate performance.

RenaissanceRe Holdings Ltd.

Reconciliation of Total Common Shareholders' Equity to Total Tangible Common Shareholders'

Equity (in thousands of U.S. dollars)

Sept. 30,

2014

Dec. 31,

2013

Dec. 31,

2012

Total common shareholders' equity

3,335,860

$�

3,504,384

$�

3,103,065

$�

Less:

7,954

8,111

8,486

26,122

29,213

30,395

Total tangible common shareholders' equity

3,301,784

$�

3,467,060

$�

3,064,184

$�

Goodwill and other intangibles

Goodwill and other intangibles included in investment

in other ventures, under equity method |

21

Comments on Regulation G (continued)

This presentation also includes certain non-GAAP financial measures relating to

Platinum within the meaning of Regulation G including "operating

income�, "operating ROE�, �tangible common shareholders�

equity�

and �tangible book value per common share�.

A reconciliation of these measures to the most

comparable GAAP figures in accordance with Regulation G is available, for

�operating income�, in Platinum�s 9/30/14 and 12/31/13

Financial Supplements, which are located on Platinum's website

www.platinumre.com

or,

for

"operating

ROE�,

�tangible

common

shareholders�

equity�

and

�tangible

book

value per common share�, is set forth below.

As discussed above, the reconciliation of �operating income�

to �net income�

is set forth in Platinum�s

9/30/14

and

12/31/13

Financial

Supplements.

Set

forth

below

is

a

calculation

of

Platinum�s

�operating

ROE�

for the applicable periods based on the information provided in Platinum�s

9/30/14 and 12/31/13 Financial Supplements.

Platinum Underwriting Holdings Ltd.

Calculation of Operating ROE

(in thousands of U.S. dollars)

Sept. 30,

2014

Dec. 31,

2013

Dec. 31,

2012

Net Operating Income

(1)

127,820

$�����

204,416

$�����

246,851

$�����

Total Average Common Shareholders' Equity

(2)

1,721,678

1,820,621

1,792,697

Operating ROE

9.9%

(3)

11.2%

13.8%

(1)

As provided in Platinum�s 9/30/14 and 12/31/13 Financial Supplements, net operating income is a

non-GAAP financial measure as defined by Regulation G and represents net income after taxes

excluding net realized gains and losses on investments, net impairment losses on investments and net foreign currency exchange

gains and losses

(2)

Based on the average of Platinum�s beginning of period and end of period Common

Shareholders� Equity

(3)

Annualized

|

22

Comments on Regulation G (continued)

Tangible Book Value Per Common Share

Platinum�s

�tangible

book

value

per

common

share�

as

of

the

end

of

the

applicable

periods

as

set

forth

in

this

presentation

is

identical

to

Platinum�s

�book

value

per

common

share�

(which

is

the

most

directly

comparable

GAAP

measure)

as

of

the

end

of

such

periods.

Thus,

no

reconciliation

is

provided.

Tangible Common Shareholders�

Equity

Similarly, Platinum�s �tangible common shareholders�

equity�

as of the end of the applicable periods as set forth in this

presentation

is

identical

to

Platinum�s

�common

shareholders�

equity�

(which

is

the

most

directly

comparable

GAAP

measure)

as

of

the

end

of

such

periods.

Thus,

no

reconciliation

is

provided. |

23

RenaissanceRe Holdings Ltd.

Renaissance House

12 Crow Lane

Pembroke HM19

Bermuda

www.renre.com |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Blackstone Credit and Insurance appoints Dan Leiter as Head of International

- The First Bancshares, Inc. Reports Results for First Quarter ended March 31, 2024

- Leading Industry Publication: Black & Veatch Remains Among Global Critical Infrastructure Leaders as Sustainability, Decarbonization Solutions Drive Growth

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share