Form 8-K QUANTUM FUEL SYSTEMS For: Aug 06

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) August 6, 2015

QUANTUM FUEL SYSTEMS TECHNOLOGIES WORLDWIDE, INC.

(Exact name of registrant as specified in its charter)

DE | 000-49629 | 33-0933072 | |

(State or Other Jurisdiction of Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | |

25242 Arctic Ocean Drive, Lake Forest, CA 92630

(Address of principal executive offices) (Zip Code)

(949) 399-4500

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On August 6, 2015, Quantum Fuel Systems Technologies Worldwide, Inc. issued an earnings release announcing its second quarter 2015 financial results. A copy of the earnings release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information in this Current Report on Form 8-K, including the exhibits attached hereto, is furnished pursuant to Item 2.02 and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Item 9.01 Financial Statements and Exhibits

99.1 Press release dated August 6, 2015 (furnished pursuant to Item 2.02 of Form 8-K).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

QUANTUM FUEL SYSTEMS TECHNOLOGIES WORLDWIDE, INC. | ||||

August 6, 2015 | By: | /s/ Kenneth R. Lombardo | ||

Kenneth R. Lombardo | ||||

General Counsel | ||||

EXHIBIT INDEX

Exhibit No. | Description | |

99.1 | Press Release dated August 6, 2015 | |

Quantum Technologies Reports Second Quarter 2015 Financial Results

• | Total revenues increased 64% and product sales increased 75% in the second quarter of 2015 compared to the same period in the prior year |

LAKE FOREST, Calif., August 6, 2015 /Globe Newswire-FirstCall/ - Quantum Fuel Systems Technologies Worldwide, Inc. (“Quantum” or the “Company”) (Nasdaq: QTWW), a leader in compressed natural gas (CNG) storage systems, integration and vehicle system technologies, today reported its financial results for the second quarter of 2015. Conference call information is provided below.

Second Quarter Highlights:

• | Total revenues of $10.7 million reported for the second quarter, representing a year-over-year increase of 64% compared to same period of the prior year |

• | Product sales of $8.4 million increased 75% compared to same period of the prior year |

• | Exclusive of indirect production overhead costs and other charges, product sales during the second quarter of 2015 contributed a positive direct margin of $2.6 million, or 30%, which reflects continued direct margin improvement specific to fuel storage systems |

• | Cost of product sales for the second quarter of 2015 negatively impacted by incremental costs of $1.2 million, of which $1.0 million relates to a specific warranty charge recognized in connection with retrofit activities to incorporate design enhancements associated with first generation back-of-cab system |

• | Internal development efforts during the quarter for next-generation storage system products support product launches in third quarter of 2015: |

◦ | Next-generation of systems for existing family of fuel storage modules featuring enhanced design attributes completed in second quarter with production initiated in July |

◦ | High capacity family of back-of-cab fuel storage modules in storage configurations of 160 or 180 diesel gallon equivalent (DGEs) of CNG expected to begin production runs in September; UPS first customer for new family of back-of-cab systems and took delivery of early production units in July |

◦ | New 30-inch diameter tanks integrated within the high capacity back-of-cab system family |

• | Reduction in selling, general and administrative costs of 7% reported for the quarter compared to same period in prior year |

• | Product backlog remained significant at $21.8 million as of June 30, 2015 |

Second Quarter 2015 Operating Results

Overview of Continuing Operations

All revenues from continuing operations are generated by the Fuel Storage & Systems segment.

Total revenues amounted to $10.7 million for the second quarter of 2015, of which $8.4 million related to product sales, $1.0 million related to contract engineering services and $1.3 million related to software license fees. This represents an increase of $4.2 million, or 64%, in total revenues compared to the second quarter of 2014, in which total revenues amounted to $6.5 million, of which $4.8 million related to product sales and $1.7 million related to contract engineering services. Current period product revenue primarily resulted from sales of CNG fuel storage systems, including shipments of the Company’s Q-CabLITE™ and Q-RailLITE™ product lines, and individual CNG fuel storage tanks.

In May 2014, the Company shifted its strategic direction from selling stand-alone CNG tank products to a focus on selling complete CNG fuel storage modules and systems. Under this new strategy, the Company has experienced and is continuing to target revenue streams from sales of its back-of-cab and frame-rail mounted CNG fuel storage

modules in addition to revenues from the sale of individual CNG storage tanks. The Company has made significant progress to date in introducing and commercializing CNG storage systems, growing its customer base and gaining market share since its shift in strategic direction. The growth in product revenues also reflects the impact of a significant shift in product mix, from substantially all individual CNG tank products in the first six months of 2014 to a product mix comprised predominantly of complete CNG storage systems in the first six months of 2015.

The Company also continued to make advancements to its tank and fuel storage system product family offerings during the second quarter and expects to ramp up production of a high capacity back-of-cab storage system family in September 2015 that can be configured to store up to either 160 or 180 DGEs of CNG. The Company believes the 180 DGE system version will provide the highest storage capacity available and that both configurations will provide the lightest weight per DGE compared to any back-of-cab systems currently available in the industry. This new family of systems will integrate the Company’s recently developed 30-inch diameter storage tanks.

During the first six months of 2015, the Company added additional new fuel storage system customers including UPS. As previously announced on April 2, 2015, the Company received an order to provide 319 fuel storage systems for UPS’ heavy duty CNG vehicle program, a substantial portion of which are targeted to be shipped in the second half of 2015. UPS was the first customer to order the new family of high capacity systems and took delivery of early production systems configured for 160 DGEs in July 2015.

As a result of orders associated with UPS, other new customers and follow on orders from existing customers over the first six months of 2015, the Company’s backlog of product orders increased from $17.8 million at December 31, 2014 to $21.8 million as of June 30, 2015.

"We are pleased to report strong product and overall revenue growth for the quarter and excited about our next generation of product offerings that take advantage of our latest storage technology and system designs, further enabling our customers to reduce weight and drive efficiency through their delivery fleets," said Brian Olson, President and CEO of Quantum. "The investments we are making to establish production efficiencies and to bring forth the most cost efficient and innovative products to market are building an even stronger foundation from which we can continue to grow our business," concluded Mr. Olson.

Product Sales

The Company has made significant progress to date in commercializing its CNG fuel storage systems. These efforts have led to a 75% increase in year-over-year product revenues in the second quarter of 2015.

The gross margins recognized on product sales include both direct material and labor costs associated with each unit produced along with absorption of indirect manufacturing overhead costs that are allocated to the units produced. In addition, the Company also incurred costs and set aside significant additional reserves during the second quarter of 2015 associated with its first generation back-of-cab storage modules that it believes will require retrofits to incorporate recent design enhancements. These design enhancements are being incorporated into a targeted list of first generation systems installed on existing customer trucks.

Exclusive of indirect overhead costs and costs associated with first generation product retrofits, product sales during the second quarter of 2015 contributed a positive direct margin of $2.6 million, or 30%. Included in indirect overhead and other cost of product sales for the second quarter of 2015 were normalized overhead costs of $1.5 million and incremental costs of $1.2 million, of which $1.0 million relates to a specific warranty charge recognized in connection with the first generation system retrofit enhancements. The overall gross product margin reported for the second quarter of 2015 was negative 1%. Other factors that provided downward pressure on the Company’s margins on a year-over-year basis include volume and promotional price incentives provided to certain customers of its system products and change in product mix.

Although the Company’s year-over-year gross margins have been negatively impacted by these dynamics and certain incremental costs, the Company did realize a continuing reduction in the per unit direct material and manufacturing costs for its fuel module products in the second quarter and first six months of 2015 compared to the cost levels recognized in the second half of 2014. Specifically, the Company realized a manufactured cost per unit decline over the first half of 2015 of approximately 30% for its back-of-cab module with fuel storage capacity of up to 123 DGEs of natural gas, which represented Quantum's highest revenue generating product line in the first half of 2015. The Company expects incremental production costs to continue to decline during the second half of 2015 as it further refines its processes and realizes higher volume levels.

Over the course of 2015, the Company has continued to innovate and enhance its products. The Company also developed its next generation of natural gas fuel module systems. These new systems, which went into production beginning in July 2015, incorporate enhanced design and product features.

Contract Engineering Services & Licensing Fees

Contract engineering services revenue in the first six months of 2015 came primarily from engineering services associated with a hydrogen tank development program with an automotive OEM alliance that commenced in September 2014 and a PHEV software development program with the Fisker Automotive and Technology Group (Fisker) that commenced in November 2014. The Company also recognized $1.3 million and $1.9 million of software license fees in the second quarter and first six months of 2015, respectively, associated with contractual arrangements with Fisker to support the re-launch of the Karma vehicle line and Fisker’s advancement of its Atlantic vehicle line. These contract engineering services and software license fees in 2015 partially offset the decline in CNG fuel storage development activities that were recognized in the first six months of 2014, primarily related to services provided to Advanced Green Innovations, LLC, and its affiliate, ZHRO Solutions LLC (collectively "AGI"), and for services to General Motors. The CNG fuel storage development programs with AGI are for the design, development and validation of a complete packaged CNG fuel storage and delivery system for aftermarket conversions of heavy and medium-duty trucks. Activities under these AGI programs were suspended by AGI in 2014 and remain on hold due to AGI’s liquidity constraints. The CNG fuel storage program with General Motors’ was associated with the Impala platform and that transitioned to a production program in the fall of 2014.

Our customer funded development and licensing related activities are reported as costs of engineering services & fees. Gross margins realized on these revenue streams improved in the 2015 period, primarily due to the relatively low level of costs associated with revenues from software licensing fees.

Operating Expenses

The operating results include research and development expenses associated with internally funded engineering development programs. The expenses for these programs were $2.0 million in the second quarter of 2015, compared to $1.7 million in the second quarter of 2014. Internally funded research and development in 2015 primarily relates to the Company’s efforts to advance its CNG tank and fuel storage module technologies, including efforts to develop and validate its next generation systems for existing product family offerings and efforts to develop its high-capacity 30-inch diameter tank and associated BOC storage systems discussed above.

Selling, general and administrative costs of continuing operations amounted to $2.4 million and $2.5 million for the second quarters of 2015 and 2014, respectively, of which $1.4 million and $1.6 million, was recognized in the Corporate operating segment for those periods, respectively, and the remaining costs were recognized in the Fuel Storage & Systems operating segment.

Renewable Energy Segment - held for sale

As previously announced, the Company is in the process of selling the assets of its wholly owned subsidiary, Schneider Power Inc. (Schneider Power), and is actively pursuing buyers for the remaining business operations. Schneider Power, an operator of the 10 megawatt Zephyr Wind Farm and holder of interests in certain renewable energy projects, represents the entire operations of the Company’s Renewable Energy business segment. As a result of the Company’s intent to sell the remaining assets of the business, the historical activities and balances of the Renewable Energy business segment are reported as discontinued operations held for sale in the accompanying condensed consolidated financial information presented herein.

The Renewable Energy segment reported a net income after taxes of $0.1 million in the second quarters of both 2015 and 2014.

Net income reported for discontinued operations includes the recognition of $0.5 million of revenue from energy sales in the second quarter of 2015, as compared to $0.6 million in the second quarter of 2014. Operating expenses amounted to $0.2 million and interest on debt obligations amounted to $0.3 million for the second quarters of both 2015 and 2014, respectively.

Non-Reporting Segment Results

Interest Expense. Interest expense decreased to $0.4 million in the second quarter of 2015, as compared to $0.5 million in the same period in the prior year. Approximately half of the expense recognized in both periods relates to non-cash imputed interest associated with equity-linked features of outstanding convertible notes that the Company issued in September 2013.

Fair Value Adjustments of Derivative Instruments. Derivative instruments consisted of embedded features contained within certain warrant contracts. Fair value adjustments of derivative instruments represent non-cash unrealized gains or losses. The share price of the Company’s common stock represents the primary underlying variable that impacts the value of the derivative instruments. The income recognized during the prior year second quarter in 2014 was primarily associated with derivative liabilities related to warrants that were issued in October 2006. The October 2006 Warrants expired in April 2014 and as a result, the level of derivative liabilities declined substantially thereafter and the Company does not expect to recognize significant unrealized gains or losses on derivative instruments in the foreseeable future.

Other expenses. The Company did not recognize any other expenses in the second quarter of 2015. The charge of $1.8 million recognized in the prior year period was in connection with the litigation matter involving Iroquois Master Fund related to a contractual provision contained in the October 2006 Warrants.

Operating and Net Loss - Second Quarter

The Company reported operating losses for its continuing operations of $2.9 million and $2.8 million for the second quarters of 2015 and 2014, respectively. The increased operating loss in 2015 mainly resulted from the lower gross margins realized on product shipments in the current year.

The Company reported net losses of $3.2 million and $2.2 million for the second quarter of 2015 and 2014, respectively.

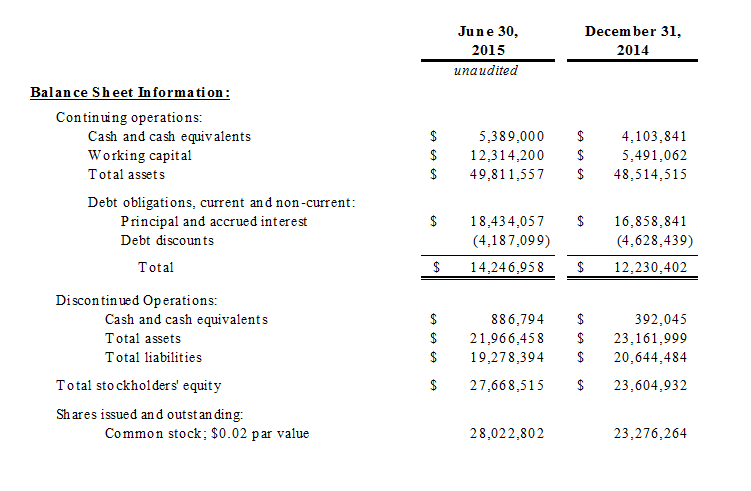

Balance Sheet and Capital Resources

For its continuing operations, the Company had working capital of $12.3 million (defined as current assets less current liabilities) as of June 30, 2015, which includes $4.5 million of outstanding borrowings under its revolving line of credit that is classified as a current liability.

Financial Tables

The Company’s condensed consolidated financial information for the three and six month periods ended June 30, 2015 and 2014 is as follows:

Financial Results Call Scheduled:

The financial results conference call will be held on Thursday, August 6, 2015 at 1:30 p.m. Pacific time (4:30 p.m. Eastern time). If you are interested in participating in the financial results conference call, please call 800-207-9287, or 706-679-1155 for those dialing internationally, and provide the Conference ID #97553447, approximately ten minutes prior to the starting time. An operator will request your name and organization. You will then be placed on hold until the call begins.

For those of you unable to join the earnings call, a playback of the call will be available via telephone approximately three hours after the call. The number for this service is: 855-859-2056 or 404-537-3406, using Conference ID #97553447. The playback will be available until 8:59 p.m. Pacific Time on August 20, 2015. The call will also be available on the Company's Investor Relations web page approximately two days after the call at:

http://www.qtww.com/about/investor_information/conference_calls/index.php

About Quantum

Quantum Fuel Systems Technologies Worldwide, Inc. is a leader in the innovation, development and production of natural gas fuel storage systems and the integration of vehicle system technologies, including engine and vehicle control systems and drivetrains. Quantum produces innovative, advanced, and light-weight compressed natural gas storage tanks, and supplies these tanks, in addition to fully integrated natural gas storage systems, to truck and automotive OEMs and aftermarket and OEM truck integrators. Quantum provides low emission and fast-to-market solutions to support the integration and production of natural gas fuel and storage systems, hybrid, fuel cell, and specialty vehicles, as well as modular, transportable hydrogen refueling stations. Quantum is headquartered in Lake Forest, California, and has operations and affiliations in the United States, Canada, and India.

Forward Looking Statements:

This press release contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, without limitation, statements regarding our revenue growth in 2015, the amount of expenses we will incur related to our systems strategy and first generation retrofits and the impact that these costs will have on our product margins in the future, and our intent to sell the remaining assets of Schneider Power Inc. All statements included in this report, other than those that are historical, are forward looking statements and can generally be identified by words such as "may," "could," "will," "should," "assume," "expect," "anticipate," "plan," "intend," "believe," "predict," "estimate," "forecast," "outlook," "potential," or "continue," or the negative of these terms, and other comparable terminology. Various risks and other factors could cause actual results, and actual events that occur, to differ materially from those contemplated by the forward looking statements. Risk factors include the cancellation of orders, the acceptance of the Company's products, the anticipated timing of new product releases, receipt of follow-on and/or higher volume orders in future periods, timing of launch for the Company’s higher storage capacity back-of-cab system family, the Company’s ability to reduce price incentives and charge a higher price for its next generation fuel systems, our ability to find a buyer for Schneider Power’s remaining assets at a price and on terms acceptable to us, and other risk factors that the Company discloses in its filings with the Securities and Exchange Commission. The Company undertakes no obligation to update the information in this press release to reflect events or circumstances after the date hereof or to reflect the occurrence of anticipated or unanticipated events.

More information about the products and services of Quantum can be found at http://www.qtww.com or you may contact:

Quantum Investor Relations

Phone: 949-399-4555

Email: [email protected]

2015 Quantum Fuel Systems Technologies Worldwide, Inc.

Quantum Headquarters & Advanced Technology Center

25242 Arctic Ocean Drive, Lake Forest, CA 92630

Phone 949-399-4500 Fax 949-399-4600

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Construction contract (E-class aircraft platform area)

- AS Tallink Grupp Unaudited Consolidated Interim Report Q1 2024

- Bank of Åland Plc: Interim Report for the period January - March 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share