Form 8-K QUANTUM CORP /DE/ For: Sep 13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 13, 2016

Quantum Corporation

(Exact name of Registrant as Specified in its Charter)

| Delaware | 1-13449 | 94-2665054 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

224 Airport Parkway

San Jose, CA 95110

(Address of Principal Executive Offices)

(408) 944-4000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instructions A.2 below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 20.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure |

Quantum Corporation (“Quantum”) has prepared an investor presentation (the “Presentation”) that management intends to use from time to time on and after September 13, 2016, in presentations about Quantum’s operations and performance. Quantum may use the Presentation in presentations to current and potential investors, lenders, creditors, vendors, customers, employees and others with an interest in Quantum and its business. The Presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and will also be posted in the Investor Relations section of Quantum’s website www.quantum.com.

The information contained in the Presentation is summary information that should be considered within the context of Quantum’s filings with the Securities and Exchange Commission and other public announcements that Quantum may make by press release or otherwise from time to time. The Presentation speaks as of the date of this Current Report on Form 8-K. While Quantum may elect to update the Presentation in the future or reflect events and circumstances occurring or existing after the date of this Current Report on Form 8-K, Quantum specifically disclaims any obligation to do so.

The information furnished in Item 7.01 and Exhibit 99.1 to this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| Exhibit |

Exhibit Description | |

| 99.1 | Quantum Investor Presentation, dated September 2016 | |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: September 13, 2016 | Quantum Corporation | |||||

| By: | /s/ Shawn D. Hall | |||||

| Name: | Shawn D. Hall | |||||

| Its: | Senior Vice President, General Counsel and Secretary | |||||

Exhibit Index

| Exhibit |

Exhibit Description | |

| 99.1 | Quantum Investor Presentation, dated September 2016 | |

QUANTUM INVESTOR PRESENTATION September 2016 Exhibit 99.1

Safe Harbor Safe Harbor Statement “Safe Harbor” Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Specifically, without limitation, statements regarding anticipated market forecasts and trends, and Quantum’s financial forecast, business prospects and strategies are forward-looking statements within the meaning of the Safe Harbor. All forward-looking statements are based on information available to Quantum on the date hereof. These statements involve known and unknown risks, uncertainties and other factors that may cause Quantum’s actual results to differ materially from those implied by the forward-looking statement. More detailed information about these risk factors, and additional risk factors, are set forth in Quantum’s periodic filings with the Securities and Exchange Commission, including, but not limited to, those risks and uncertainties listed in the section entitled “Risk Factors,” in Quantum’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on June 3, 2016. Quantum expressly disclaims any obligation to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise. Non-GAAP Financial Measures Quantum believes that non-GAAP financial measures provide useful and supplemental information to investors regarding its quarterly financial performance. The non-GAAP financial measures Quantum uses are not prepared in accordance with generally accepted accounting principles and may be different from non-GAAP financial measures used by other companies. For a description of the specific adjustments Quantum makes in preparing its non-GAAP financial measures, and the rationale for these adjustments, please refer to the section entitled “Use of Non-GAAP Financial Measures” in Quantum’s most recent quarterly earnings release filed on Form 8-K with the Securities and Exchange Commission July 27, 2016.

Key Investment Highlights Profit/Cash-Generating Data Protection Portfolio, Install Base and Channel High-Growth Scale-out Storage Portfolio 36-Year Storage Specialist and Leader in Key Markets Scalable Financial Model Providing Significant Leverage

Who We Are Enable customers to capture, share and preserve digital assets over their entire lifecycle, creating new opportunities to maximize data’s business value What We Do A leading expert in highly scalable storage, data protection and archive focused on the most demanding workflow challenges

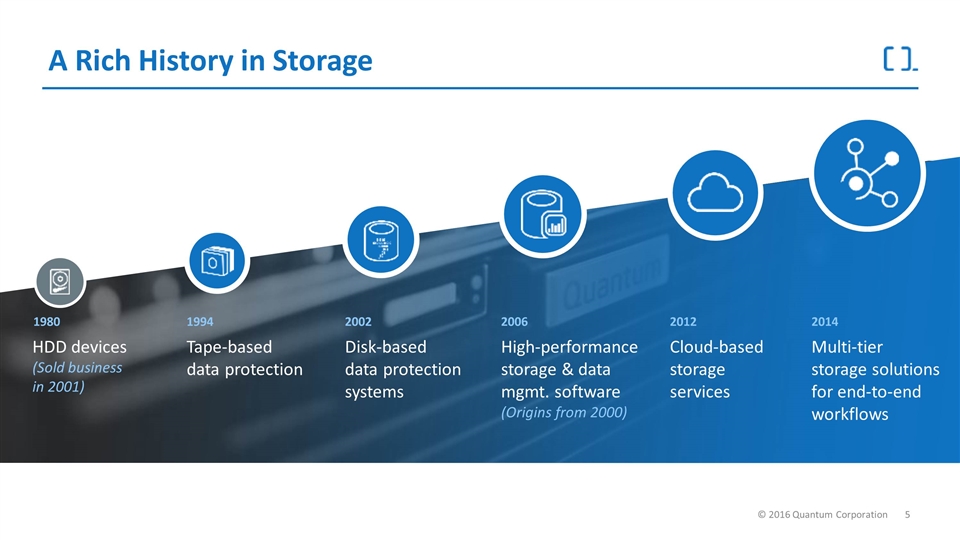

A Rich History in Storage 2014 HDD devices (Sold business in 2001) Tape-based data protection Disk-based data protection systems High-performance storage & data mgmt. software (Origins from 2000) Cloud-based storage services Multi-tier storage solutions for end-to-end workflows 1994 2002 2006 2012 1980

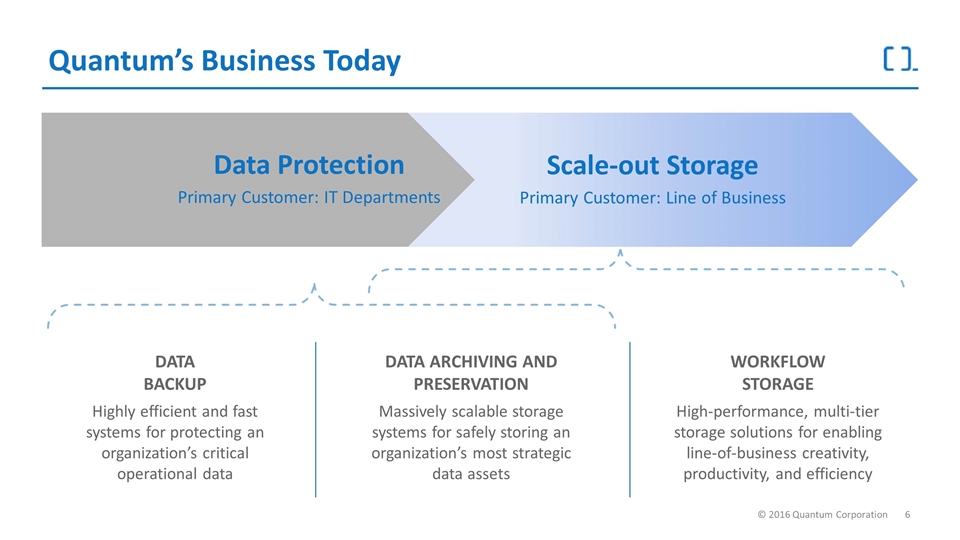

Quantum’s Business Today High-performance, multi-tier storage solutions for enabling line-of-business creativity, productivity, and efficiency WORKFLOW STORAGE Highly efficient and fast systems for protecting an organization’s critical operational data DATA BACKUP Massively scalable storage systems for safely storing an organization’s most strategic data assets DATA ARCHIVING AND PRESERVATION Data Protection Primary Customer: IT Departments SPECIALIZED STORAGE Scale-out Storage Primary Customer: Line of Business

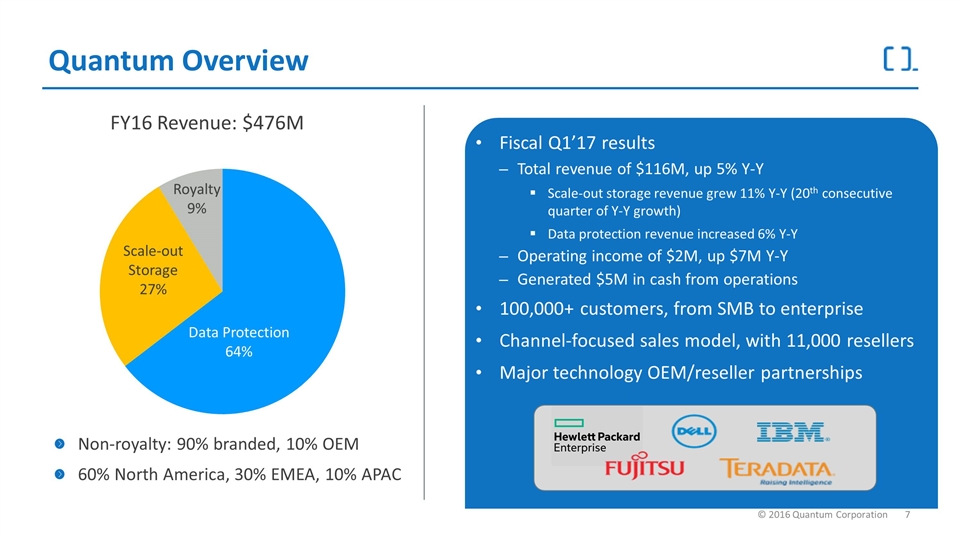

Quantum Overview FY16 Revenue: $476M Data Protection 64% Scale-out Storage 27% Royalty 9% Non-royalty: 90% branded, 10% OEM 60% North America, 30% EMEA, 10% APAC Fiscal Q1’17 results Total revenue of $116M, up 5% Y-Y Scale-out storage revenue grew 11% Y-Y (20th consecutive quarter of Y-Y growth) Data protection revenue increased 6% Y-Y Operating income of $2M, up $7M Y-Y Generated $5M in cash from operations 100,000+ customers, from SMB to enterprise Channel-focused sales model, with 11,000 resellers Major technology OEM/reseller partnerships

Proven Market Leader 100,000+ customer deployments Awards and other honors

Tightly Integrated with the Ecosystem

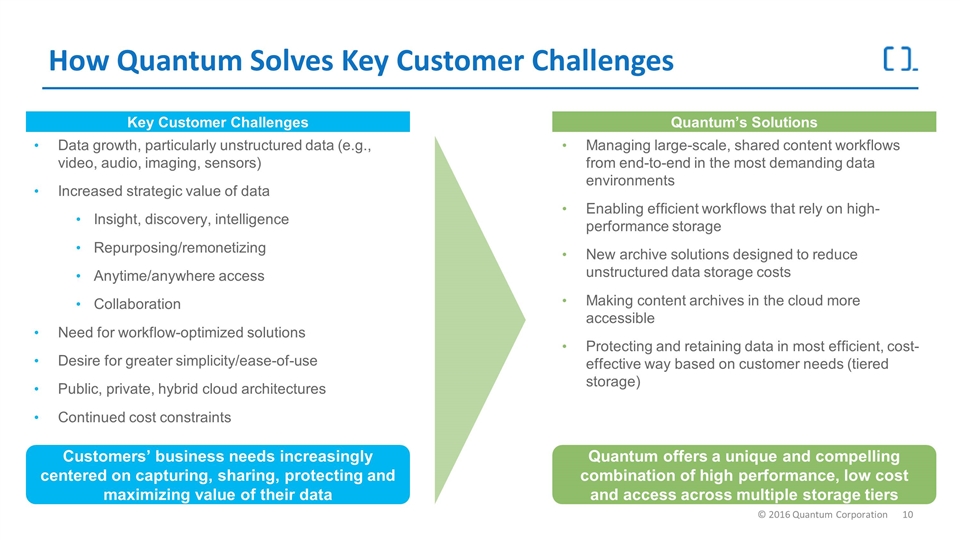

How Quantum Solves Key Customer Challenges Data growth, particularly unstructured data (e.g., video, audio, imaging, sensors) Increased strategic value of data Insight, discovery, intelligence Repurposing/remonetizing Anytime/anywhere access Collaboration Need for workflow-optimized solutions Desire for greater simplicity/ease-of-use Public, private, hybrid cloud architectures Continued cost constraints Key Customer Challenges Quantum’s Solutions Managing large-scale, shared content workflows from end-to-end in the most demanding data environments Enabling efficient workflows that rely on high-performance storage New archive solutions designed to reduce unstructured data storage costs Making content archives in the cloud more accessible Protecting and retaining data in most efficient, cost-effective way based on customer needs (tiered storage) Customers’ business needs increasingly centered on capturing, sharing, protecting and maximizing value of their data Quantum offers a unique and compelling combination of high performance, low cost and access across multiple storage tiers

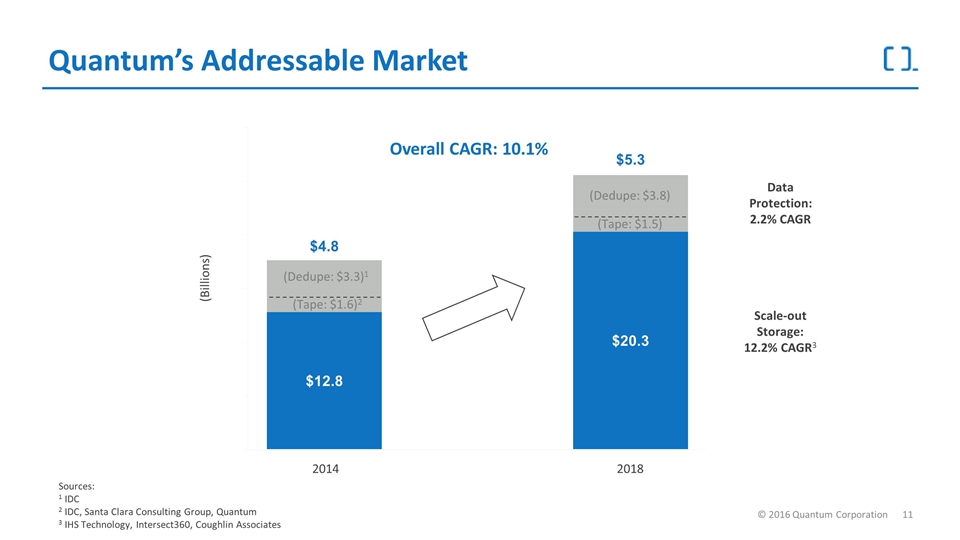

Quantum’s Addressable Market Data Protection: 2.2% CAGR (Billions) 2018 Scale-out Storage: 12.2% CAGR3 (Tape: $1.6)2 (Tape: $1.5) (Dedupe: $3.3)1 Overall CAGR: 10.1% (Dedupe: $3.8) Sources: 1 IDC 2 IDC, Santa Clara Consulting Group, Quantum 3 IHS Technology, Intersect360, Coughlin Associates 2014

Scale-out Storage Solutions

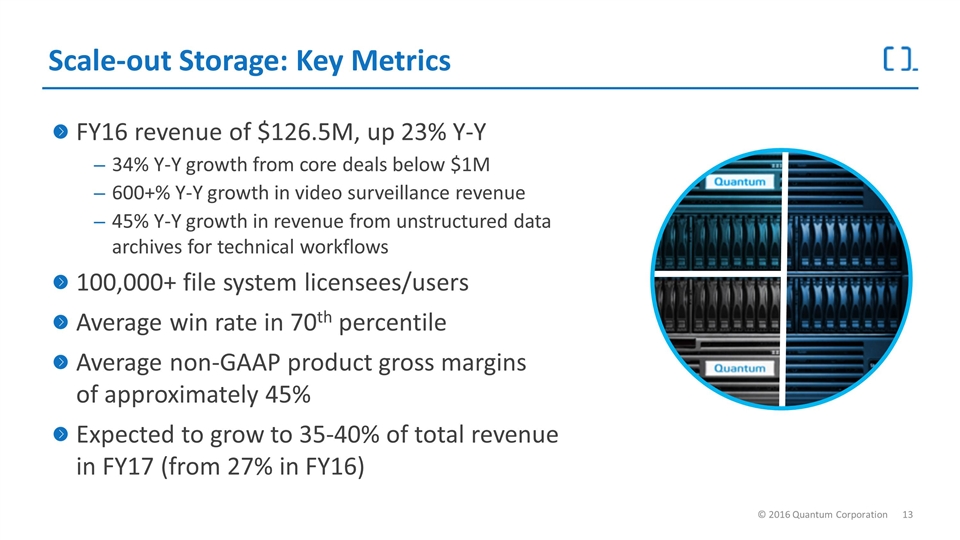

Scale-out Storage: Key Metrics FY16 revenue of $126.5M, up 23% Y-Y 34% Y-Y growth from core deals below $1M 600+% Y-Y growth in video surveillance revenue 45% Y-Y growth in revenue from unstructured data archives for technical workflows 100,000+ file system licensees/users Average win rate in 70th percentile Average non-GAAP product gross margins of approximately 45% Expected to grow to 35-40% of total revenue in FY17 (from 27% in FY16)

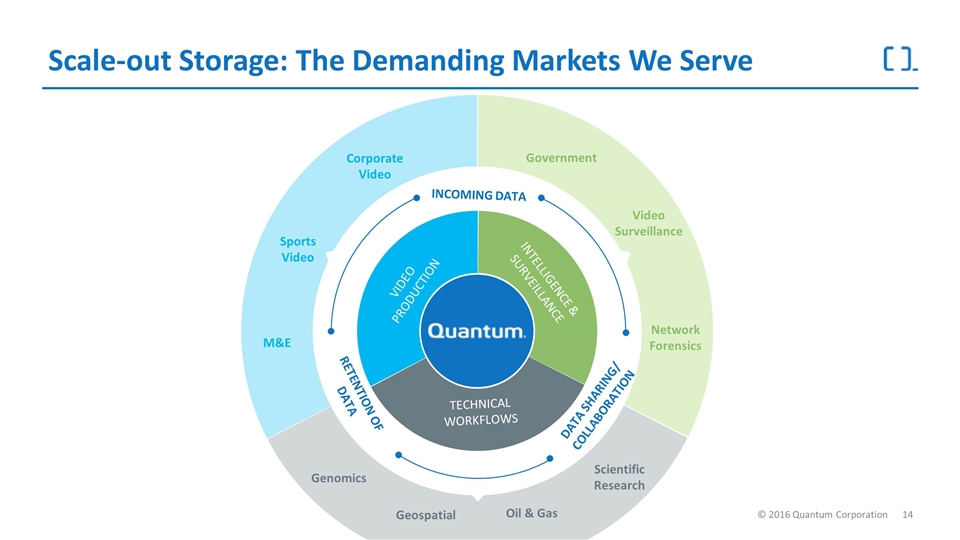

Oil & Gas Genomics Geospatial Scientific Research Government Video Surveillance Network Forensics Corporate Video Sports Video M&E TECHNICAL WORKFLOWS INTELLIGENCE & SURVEILLANCE VIDEO PRODUCTION INCOMING DATA DATA SHARING/ COLLABORATION RETENTION OF DATA Scale-out Storage: The Demanding Markets We Serve © 2016 Quantum Corporation

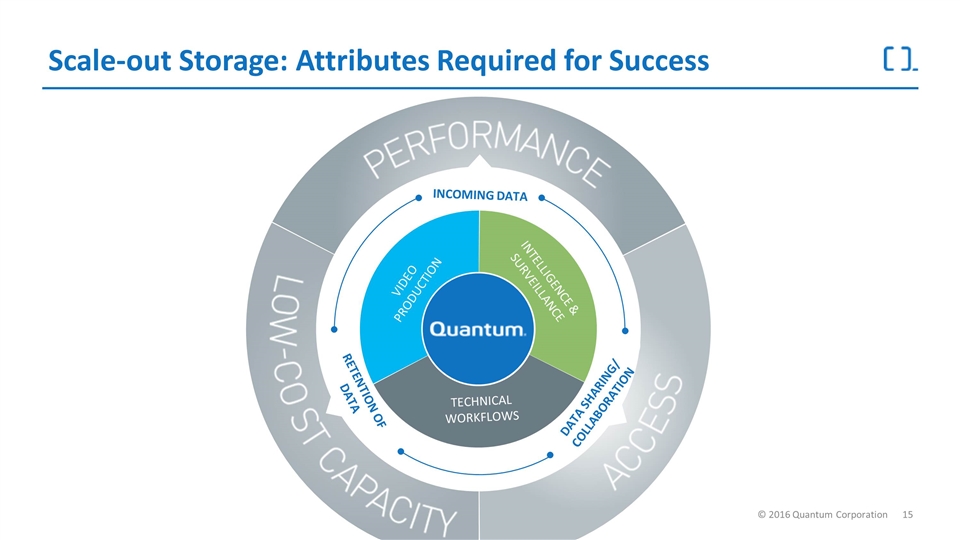

INCOMING DATA DATA SHARING/ COLLABORATION RETENTION OF DATA INTELLIGENCE & SURVEILLANCE VIDEO PRODUCTION TECHNICAL WORKFLOWS Scale-out Storage: Attributes Required for Success © 2016 Quantum Corporation

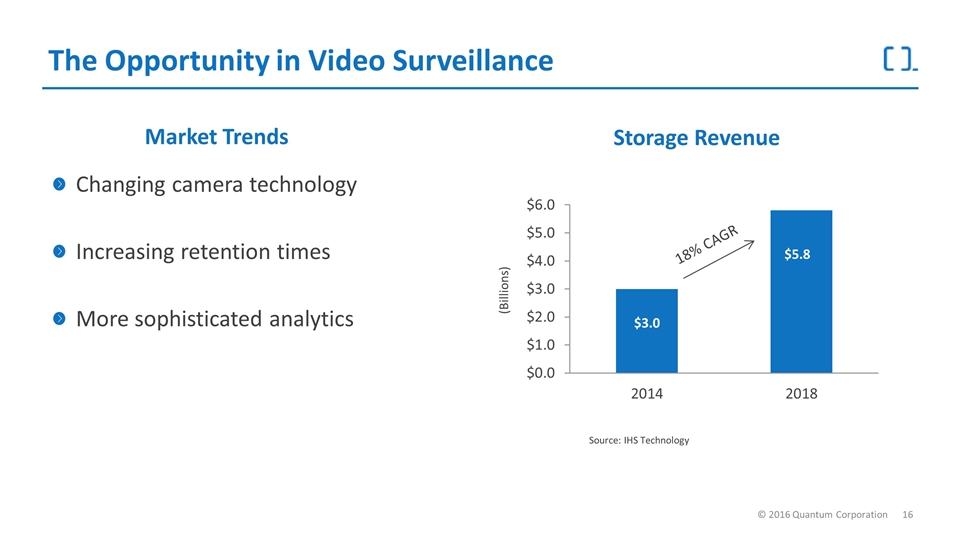

Changing camera technology Increasing retention times More sophisticated analytics The Opportunity in Video Surveillance (Billions) $5.8 18% CAGR Source: IHS Technology Market Trends Storage Revenue

Multi-Tier Scale-out Storage Portfolio that Delivers on All Attributes LOW-COST CAPACITY PERFORMANCE Artico Archive Appliance STORNEXT DATA MANAGEMENT STORNEXT DATA MANAGEMENT StorNext AEL (Tape) Lattus Object Storage Q-Cloud Archive/Vault Xcellis Workflow Storage QXS Hybrid Storage ACCESS

Scale-out Storage: Quantum Growth Drivers Extend M&E leadership (e.g., corporate video, sports video, ad agencies) Build on video surveillance momentum Capitalize on unstructured data archive opportunities in technical workflows Leverage data protection assets and unified sales organization Further expand our solution set to the cloud and cloud providers

Scale-out Storage Use Case: 4K High-resolution Workflow CUSTOMER NEED Meet demanding 4K content workflow QUANTUM SOLUTION StorNext high-performance primary storage WHY QUANTUM Superior technology – performed flawlessly in POC, including capabilities to edit in 8K, while scale-out NAS competition couldn’t handle workload Value – competition was 30-40% more in cost for initial quote, with less functional solution

Scale-out Storage Use Case: Video Surveillance CUSTOMER NEED Law enforcement pilot program equipped 50 police officers with on-body cameras, creating requirement for large video storage QUANTUM SOLUTION StorNext primary storage and tape archive WHY QUANTUM Ability to provide complete tiered storage solution End-to-end workflow enabling customer to store less than ¼ of video files on expensive disk and put rest on low-cost tape 2X lower TCO than competitive NAS offering

Scale-out Storage Use Case: Corporate Video Management CUSTOMER NEED Major consumer products company with extensive video content struggling with incomplete backups, system crashes, and hard-to-access archives QUANTUM SOLUTION StorNext high-performance primary storage and tape archive WHY QUANTUM System advantages, including ability to archive on data ingest rather than in two separate processes Quantum’s understanding of workflows and data protection Value for money

Data Protection Solutions

Data Protection: Key Metrics FY16 revenue of $306M (excludes royalty revenue) 220 new DXi customers 300 new branded midrange/enterprise tape customers 100,000+ deployments Average win rates over 75% for tape automation and mid-60th percentile for DXi Average branded non-GAAP product gross margins Tape automation and DXi: approximately 50% Tape devices and media: approximately 5-10% Strategy is to generate overall data protection profit/cash

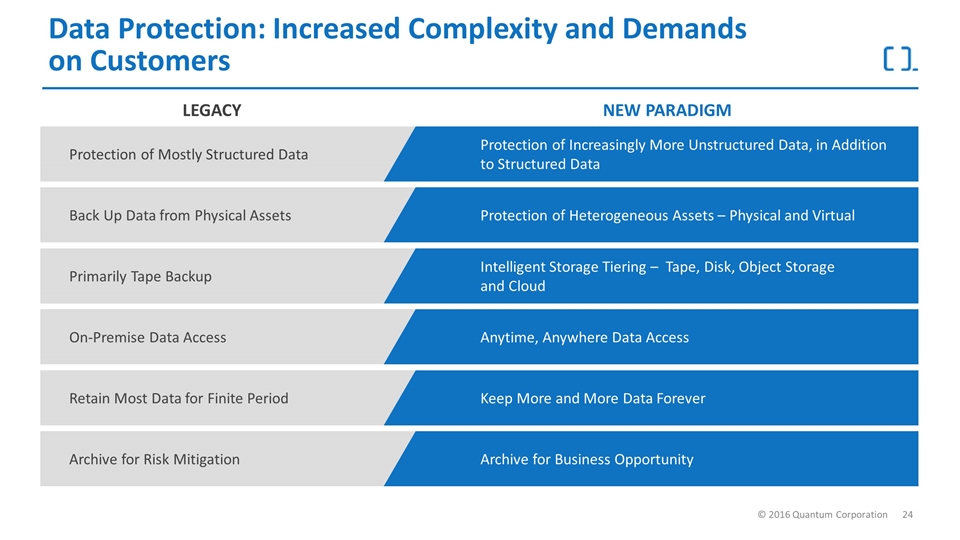

Data Protection: Increased Complexity and Demands on Customers Protection of Increasingly More Unstructured Data, in Addition to Structured Data Protection of Heterogeneous Assets – Physical and Virtual Intelligent Storage Tiering – Tape, Disk, Object Storage and Cloud Anytime, Anywhere Data Access Keep More and More Data Forever Protection of Mostly Structured Data Back Up Data from Physical Assets Primarily Tape Backup On-Premise Data Access Retain Most Data for Finite Period Archive for Risk Mitigation Archive for Business Opportunity LEGACY NEW PARADIGM

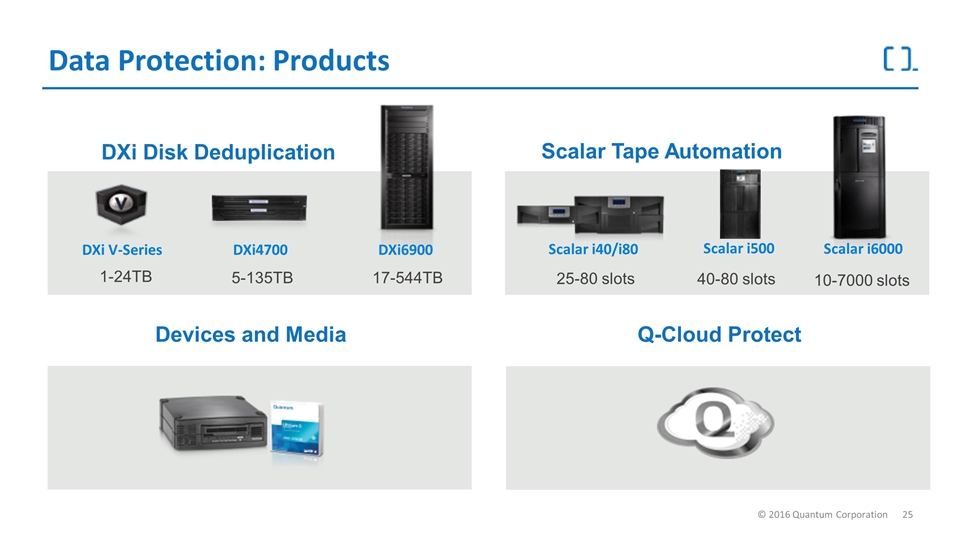

25-80 slots Scalar i40/i80 40-80 slots Scalar i500 10-7000 slots Scalar i6000 1-24TB DXi V-Series 5-135TB DXi4700 17-544TB DXi6900 DXi Disk Deduplication Data Protection: Products Q-Cloud Protect Devices and Media Scalar Tape Automation

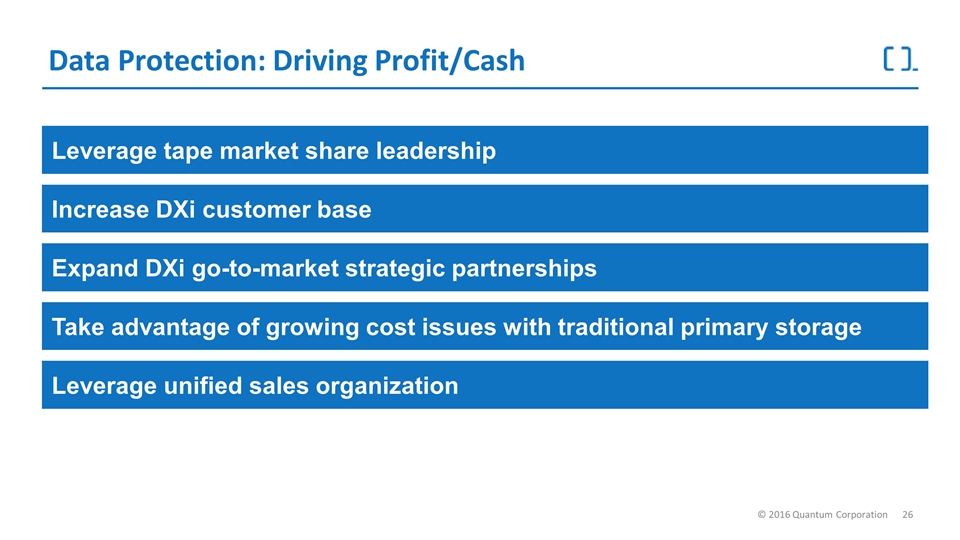

Data Protection: Driving Profit/Cash Leverage tape market share leadership Increase DXi customer base Expand DXi go-to-market strategic partnerships Leverage unified sales organization Take advantage of growing cost issues with traditional primary storage

Data Protection Use Case: Virtual Machine Data Backup and Disaster Recovery Customer Need State health department faced with significant data growth and challenges of large VMware adoption Quantum Solution DXi appliances Veeam backup software Why Quantum Positive experience with earlier generation DXi appliance Ability to partition DXi appliance as virtual tape library and NAS target DXi archive capability

Financials

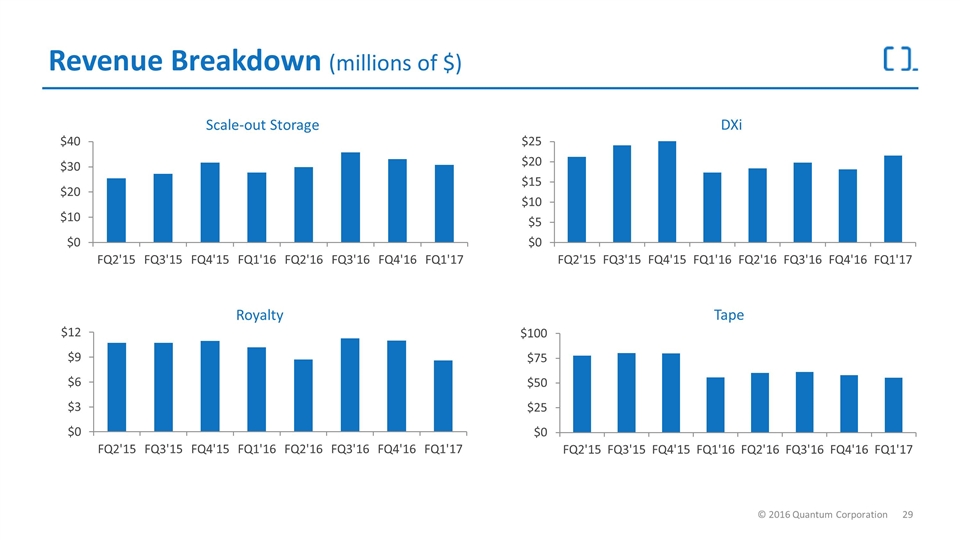

Revenue Breakdown (millions of $) Royalty Tape Scale-out Storage DXi

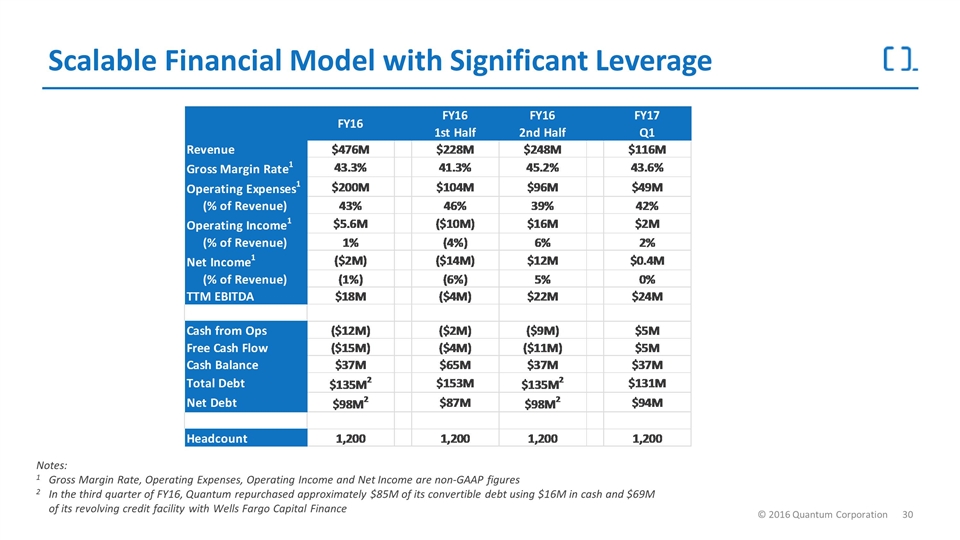

Scalable Financial Model with Significant Leverage Notes: 1 Gross Margin Rate, Operating Expenses, Operating Income and Net Income are non-GAAP figures 2 In the third quarter of FY16, Quantum repurchased approximately $85M of its convertible debt using $16M in cash and $69M of its revolving credit facility with Wells Fargo Capital Finance FY15 FY16 FY161st Half FY162nd Half FY17Q1 Revenue $553M $476M $228M $248M $116M 128048 56697 Gross Margin Rate1 0.44700000000000001 0.433 0.41299999999999998 0.45200000000000001 0.436 117025 46317 Operating Expenses1 $213M $200M $104M $96M $49M 110856 46965 (% of Revenue) 0.38517179023508136 0.43 0.46 0.39 0.42 355929 149979 0.42137336378884555 Operating Income1 $34M $5.6M ($10M) $16M $2M (% of Revenue) 6.148282097649186E-2 0.01 -0.04 0.06 1.7999999999999999E-2 Net Income1 $38M ($2M) ($14M) $12M $0.4M (% of Revenue) 6.8716094032549732E-2 -0.01 -0.06 0.05 0 TTM EBITDA $43M $18M ($4M) $22M $24M 55172 55936 Cash from Ops $6M ($12M) ($2M) ($9M) $5M 54743 Free Cash Flow $3M ($15M) ($4M) ($11M) $5M 165851 Cash Balance $71M $37M $65M $37M $37M 0.46596652703207664 Total Debt $152M3 $135M2 $153M $135M2 $131M Net Debt $82M3 $98M2 $87M $98M2 $94M -9081 -15914 Headcount 1300 1200 1200 1200 1200 -2.5513515335923737E-2 0 32919 2763 35682 0 69138

Additional Information and Where to Find it Quantum Corporation (the “Company”), its directors and certain executive officers will be participants in the solicitation of proxies from stockholders in connection with the Company’s Annual Meeting of Stockholders for the fiscal year ended March 31, 2016 (the “Annual Meeting”). The Company has received a notice of nominations for the election of directors from VIEX Capital Advisors, LLC in connection with the Annual Meeting and it is possible that there may be a contested solicitation in connection with the Annual Meeting. The Company plans to file a proxy statement (the “Proxy Statement”) with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for the Annual Meeting. The members of the Board of Directors of the Company and Fuad Ahmad, Chief Financial Officer, would be participants in the Company’s solicitation of proxies in connection with the Annual Meeting. None of such participants owns in excess of 1% of the Company’s common stock. Additional information regarding such participants, including their direct or indirect interests, by security holdings or otherwise, will be included in the Proxy Statement and other relevant documents to be filed with the SEC in connection with the Annual Meeting. Information relating to the foregoing can also be found in the Company’s 10-K/A filed with the SEC on July 27, 2016. To the extent that holdings of the Company’s securities have changed since the amounts reflected in the foregoing 10-K/A, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Promptly after filing its definitive Proxy Statement with the SEC, the Company will mail the definitive Proxy Statement to each stockholder entitled to vote at the Annual Meeting. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the Company’s preliminary proxy statement, any amendments or supplements thereto and any other relevant documents filed by the Company with the SEC in connection with the Annual Meeting at the SEC’s website (http://www.sec.gov). Copies of the Company’s definitive proxy statement, any amendments or supplements thereto and any other relevant documents filed by the Company with the SEC in connection with the Annual Meeting will also be available, free of charge, at the Company’s website (www.quantum.com) or by writing to Investor Relations, Quantum Corporation, 224 Airport Parkway, Suite 300, San Jose, CA 95110.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- 420 with CNW — Study Enumerates Therapeutic Effects, Quality of Life Benefits of Medical Cannabis

- Celestica Announces Election of Directors and Approval to Proceed with Share Reclassification

- Erie Indemnity Reports First Quarter 2024 Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share