Form 8-K Prologis, Inc. For: Aug 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 12, 2016

PROLOGIS, INC.

PROLOGIS, L.P.

(Exact name of registrant as specified in charter)

| Maryland (Prologis, Inc.) Delaware (Prologis, L.P.) |

001-13545 (Prologis, Inc.) 001-14245 (Prologis, L.P.) |

94-3281941 (Prologis, Inc.) 94-3285362 (Prologis, L.P.) | ||

| (State or other jurisdiction of Incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

| Pier 1, Bay 1, San Francisco, California | 94111 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrants’ Telephone Number, including Area Code: (415) 394-9000

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On August 12, 2016, the Prologis, Inc. 2016 Outperformance Plan (“POP”) was executed, replacing the Prologis, Inc. Outperformance Plan. POP amends and restates the earlier plan to, among other things, implement an additional performance hurdle and lock-up requirement on equity paid under the plan.

Generally, under POP, in the event that our annualized total stockholder return (“TSR”) during the performance period exceeds the annualized TSR of the Morgan Stanley Capital Index US REIT Index (“RMS”) by more than 100 basis points during the performance period, then a performance pool will be formed under POP equal to 3% of such excess return to stockholders. The performance pool shall not exceed an amount equal to the greater of (i) $75,000,000 or (ii) 0.5% of our common equity market capitalization as calculated under POP (the “Capitalization Cap”). This performance threshold and the performance pool cap did not change from the previous plan.

POP implements an additional performance hurdle to earn the amount of the performance pool in excess of the $75,000,000 up to the Capitalization Cap (the “Excess Award Amount”), if any. Starting with the 2016 – 2018 performance period, if the relevant performance thresholds are met, participants can earn POP awards for their share of an aggregate performance pool up to $75,000,000. If earned, these POP awards will be paid after the end of the initial three-year performance period. If our levels of outperformance warrant an aggregate performance pool greater than $75,000,000, then participants can earn their share of the Excess Award Amount during the course of a three-year period after the end of the initial performance period. One-third of this Excess Award Amount can be earned at the end of each of the three years after the initial performance period, if our performance meets or exceeds the RMS in each of such three years.

In addition, POP imposes a new lock-up requirement on equity paid under the plan. Generally, participants will not be able to sell or transfer any equity they receive as initial or excess POP awards until three years after the end of the initial performance period. If the performance criteria are not met, any POP participation points and POP LTIP Units of Prologis, L.P. for the applicable performance period will be forfeited. As with the previous plan, POP also has certain positive TSR requirements, which must be met before participants can be paid awards under POP.

POP and the form of POP LTIP Unit Award Agreement (amended to reflect corresponding changes) have been included herewith as Exhibits 10.1 and 10.2, respectively, and are incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits |

| (d) | Exhibits |

| Exhibit No. |

Description | |

| 10.1 | Prologis, Inc. 2016 Outperformance Plan | |

| 10.2 | Form of Prologis, Inc. 2016 Outperformance Plan LTIP Unit Award Agreement | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

| Prologis, Inc. | ||||||

| (Registrant) | ||||||

| Date: August 16, 2016 | By: | /s/ Michael T. Blair | ||||

| Name: | Michael T. Blair | |||||

| Title: | Managing Director, Deputy General Counsel | |||||

| Prologis, L.P. | ||||||

| (Registrant) | ||||||

| By: | Prologis, Inc., | |||||

| Its general partner | ||||||

| Date: August 16, 2016 | By: | /s/ Michael T. Blair | ||||

| Name: | Michael T. Blair | |||||

| Title: | Managing Director, Deputy General Counsel | |||||

Exhibit 10.1

PROLOGIS, INC.

2016 OUTPERFORMANCE PLAN

ARTICLE 1 - GENERAL

1.1 Purpose and Authority. This 2016 Outperformance Plan (as amended, restated and supplemented from time to time, this “2016 Outperformance Plan”) was adopted by the Compensation Committee (the “Committee”) of the Board of Directors (the “Board”) of Prologis, Inc. (the “Company”) effective as of August 12, 2016, pursuant to authority delegated to it by the Board as set forth in the Committee’s charter. Equity awards granted under this 2016 Outperformance Plan shall be issued pursuant to the Company’s existing equity incentive plans, or any equity incentive plan approved by the Company’s stockholders in the future, and only to the extent there are shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), available under such equity incentive plans. This 2016 Outperformance Plan will apply to all Awards granted on or after the date hereof. The purpose of this 2016 Outperformance Plan is to create a supplemental long-term incentive opportunity to support the Company’s multi-year business plans and to drive outstanding performance.

1.2 Administration. This 2016 Outperformance Plan and all Awards issued hereunder shall be administered by the Committee; provided that all powers of the Committee hereunder can be exercised by the full Board if the Board so elects.

1.3 Definitions.

“Absolute Shareholder Return” means, with respect to any measurement period, the cumulative return that would have been realized by a stockholder who (1) bought one share of Common Stock for the Common Stock Price on the last trading day immediately preceding the first date of such measurement period, (2) reinvested each dividend and other distribution declared and having an ex-dividend date during such measurement period with respect to such share of Common Stock (and any other shares previously received upon reinvestment of dividends or other distributions) in additional shares of Common Stock at the Fair Market Value on the ex-dividend date for such dividend or other distribution, and (3) sold such shares of Common Stock on the last day of such measurement period for the Common Stock Price on such date. Appropriate adjustments to the Absolute Shareholder Return shall be made to take into account all stock dividends, stock splits, reverse stock splits and other events that in the good faith judgment of the Committee necessitates action by way of equitable or proportionate adjustment.

“Additional Share Baseline Value” means, with respect to each Additional Share, the gross proceeds received by the Company upon the issuance of such Additional Share, which amount shall be deemed to equal, as applicable:

(a) if such Additional Share is issued for cash in a public offering or private placement, the gross price to the public or to the purchaser(s);

(b) if such Additional Share is issued in exchange for assets or securities of another Person or upon the acquisition of another Person, the cash value imputed to such Additional Share for purposes of such transaction by the parties thereto, as determined by the Committee, or, if no such value was imputed, the Common Stock Price as of the date of issuance of such Additional Share;

(c) if such Additional Share is issued upon conversion or exchange of equity or debt securities of the Company or any Related Company, which securities were not previously counted as either Initial Shares or Additional Shares, the conversion or exchange price in effect as of the date of conversion or exchange pursuant to the terms of the security being exchanged or converted;

(d) if such Additional Share is issued in connection with a Time-Based Award granted after the Initial Date to employees, non-employee directors, consultants, advisors or other persons or entities as incentive or other compensation for services provided or to be provided to the Company or any Related Company, the grant date fair value per share of Common Stock subject to such Time-Based Award, determined in accordance with generally accepted accounting principles;

(e) if such Additional Share is issued in connection with a Performance-Based Award earned after the Initial Date by employees, non-employee directors, consultants, advisors or other persons or entities as incentive or other compensation for services provided or to be provided to the Company or any Related Company (without regard to (i) the date when such award was granted or (ii) time-based vesting conditions (if any) that may apply after the award becomes earned on the basis of performance-based vesting conditions), the Fair Market Value of a share of Common Stock, on the date the Performance-Based Award is earned, used by the Committee to convert Base Value or Excess Value, as applicable, into LTIPs or into shares of Common Stock (if such Performance-Based Award was granted under this 2016 Outperformance Plan), or otherwise, the Fair Market Value of a share of Common Stock used to determine the number of LTIPs or shares of Common Stock (as applicable) earned under the terms of the applicable Performance-Based Award; and

(f) if the Additional Share is issued in lieu of cash dividends in a transaction where the stockholder made an election between receipt of cash dividends or Common Stock in lieu thereof, the value of the dividends that would otherwise have been paid.

“Additional Shares” means (without double-counting), as of a particular date of determination, the sum of:

(a) shares of Common Stock issued after the Initial Date and on or before such date of determination in a capital raising transaction, in exchange for assets or securities, upon the acquisition of another entity, upon conversion or exchange of equity or debt securities of the Company, which securities were not previously counted as either Initial Shares or Additional Shares, or through the reinvestment of dividends; plus

2

(b) the REIT Shares Amount for all Units not held by the Company (assuming that such Units were converted, exercised, exchanged or redeemed for shares of Common Stock as of such date of determination at the applicable conversion, exercise, exchange or redemption rate (or rate deemed applicable by the Committee if there is no such stated rate) pursuant to the applicable instrument governing such Units as of such date), issued after the Initial Date and on or before such date of determination in a capital raising transaction, in exchange for assets or securities, or upon the acquisition of another entity; plus

(c) shares of Common Stock (including, without duplication, the REIT Shares Amount for Units, as applicable) underlying Time-Based Awards granted after the Initial Date and Performance-Based Awards earned after the Initial Date and on or before such date of determination to employees, non-employee directors, consultants, advisors or other persons or entities as incentive or other compensation for services provided or to be provided to the Company or any Related Company; plus

(d) shares of Common Stock (including, without duplication, the REIT Shares Amount for Units, as applicable) issued in lieu of cash dividends in a transaction where the stockholder (or Unit-holders) made an election between receipt of cash dividends or Common Stock (or Units) in lieu thereof.

For the avoidance of doubt, the definition of “Additional Shares” shall exclude (i) shares of Common Stock issued after the Initial Date upon exercise of stock options granted to employees, non-employee directors, consultants, advisors or other persons or entities as incentive or other compensation for services provided or to be provided to the Company or any Related Company, whether such stock options are outstanding on the Initial Date or are awarded thereafter and (ii) all Initial Shares.

“Award” means an award of Participation Points to a Participant under this 2016 Outperformance Plan.

“Award Letter” means the individual letter provided by the Company to a Participant in connection with the Participant’s participation in this 2016 Outperformance Plan that sets forth the number of Participation Points granted to the Participant with respect to a Performance Period.

“Base Value” means, with respect to an Award, the dollar value of such Award multiplied by a fraction, the numerator of which is the Dollar-Based Cap and the denominator of which is the sum of the Dollar-Based Cap and the Excess Amount.

“Baseline Value” means the average of the Fair Market Value of one share of Common Stock over the 20 consecutive trading days immediately preceding the Initial Date of any Performance Period.

“Buyback Shares” means (without double-counting), as of a particular date of determination:

(a) shares of Common Stock repurchased or redeemed for cash by the Company after the Initial Date and on or before such date of determination in a stock buyback or other similar transaction;

3

(b) the REIT Shares Amount for all Units not held by the Company (assuming that such Units were converted, exercised, exchanged or redeemed for shares of Common Stock as of such date of determination at the applicable conversion, exercise, exchange or redemption rate (or rate deemed applicable by the Committee if there is no such stated rate) pursuant to the applicable instrument governing such Units as of such date) repurchased or redeemed for cash by the Company after the Initial Date and on or before such date of determination; and

(c) shares of Common Stock (including, without duplication, the REIT Shares Amount for Units, as applicable) underlying previously granted Time-Based Awards and Performance-Based Awards (excluding, for the avoidance of doubt, stock options) to employees, non-employee directors, consultants, advisors or other persons or entities as incentive or other compensation for services provided or to be provided to the Company or any Related Company to the extent they are forfeited for failure to become vested or are repurchased for cash (including in respect of tax withholding) by the Company after the Initial Date and on or before such date of determination, if such shares were included in either Initial Shares or Additional Shares.

“Buyback Value” means the cash amount paid to repurchase or redeem a Buyback Share, or in the case of a Buyback Share forfeited without any expenditure of cash by the Company, the Fair Market Value of a share of Common Stock on the date of forfeiture.

“Capitalization-Based Cap” means one-half percent (0.5%) of the product of the Initial Shares and the Common Stock Price as of the Initial Date.

“Cause” means, with respect to a Participant, except as otherwise provided in a separate agreement between the Participant and the Company, (a) the willful and continued failure by the Participant to substantially perform his or her duties with the Company or any Related Company after written notification by the Company or any Related Company, (b) the willful engaging by the Participant in conduct which is demonstrably injurious to the Company or any Related Company, monetarily or otherwise, or (c) the engaging by the Participant in egregious misconduct involving serious moral turpitude, determined in the reasonable judgment of the Committee. For purposes hereof, no act, or failure to act, on the Participant’s part shall be deemed “willful” unless done, or omitted to be done, by the Participant not in good faith and without reasonable belief that such action was in the best interest of the Company or any Related Company.

“Change of Control” means any transaction that constitutes a change in the ownership or effective control of the Company or in the ownership of a substantial portion of the assets of the Company within the meaning of Section 409A of the Code and applicable guidance issued thereunder. For purposes of applying the foregoing requirements, the default provisions of Section 409A of the Code and applicable guidance shall apply; provided, however, that for purposes of determining (a) whether a change in effective control of a corporation has occurred based on the acquisition of stock ownership, the percentage threshold that shall be applied shall be “50 percent or more” (rather than “30 percent or more”), and (b) whether a change in the ownership of a substantial portion of a corporation’s assets has occurred, based on an acquisition of threshold of assets having a total gross fair market value equal to or more than 50 percent of the total gross fair market value of all of the assets of the corporation (rather than 40 percent thereof).

4

“Code” means the Internal Revenue Code of 1986, as amended.

“Common Stock Price” means, as of a particular date, the average of the Fair Market Value of one share of Common Stock over the twenty (20) consecutive trading days immediately preceding and including such date; provided, however, that if such date is the date of the Public Announcement of a Transactional Change of Control, the Common Stock Price as of such date shall be equal to the fair market value, as determined by the Committee, of the total consideration payable in the transaction that ultimately results in the Transactional Change of Control for one share of Common Stock, or if such transaction is an asset disposition the fair market value of a share of Common Stock after giving affect to receipt of the total consideration payable for the asset so disposed of, in each case as determined by the Committee.

“Cumulative Index Return” means, with respect to any measurement period, the cumulative return that would have been realized by an investor who invested in the MSCI US REIT Index on the first date of such measurement period and liquidated the entire investment on the last day of such measurement period on the following basis: (i) determine the initial investment using the average daily value of the MSCI US REIT Index over the twenty (20) consecutive trading days immediately preceding the first date of such measurement period, (ii) assume full dividend reinvestment based on the methodology used for the index, and (iii) determine the final proceeds using the average daily value of the MSCI US REIT Index over the twenty (20) consecutive trading days immediately preceding and including the last date of such measurement period, as calculated by the Committee or its delegate in the Committee’s reasonable discretion. The intent of the Committee is that Cumulative Index Return be calculated in a manner designed to produce a fair comparison between Absolute Shareholder Return and the MSCI US REIT Index over the applicable period for the purpose of determining whether the conditions set forth in Section 2.4(b)(i)-(iii) have been met.

“Disability” means, with respect to a Participant, except as otherwise provided by the Committee, the Participant’s inability, by reason of a medically determinable physical or mental impairment, to engage in the material and substantial duties of his or her regular occupation, which condition is expected to be permanent.

“Dollar-Based Cap” means $75,000,000.

“Eligible Person” means any executive or employee of the Company or any Related Company.

“Ending Value” with respect to any Performance Period means (without double-counting), as of the Valuation Date, a dollar amount equal to the sum of:

(a) the Total Shares as of the Valuation Date multiplied by the Common Stock Price as of the Valuation Date, plus

(b) the Buyback Value for all Buyback Shares, plus

5

(c) an amount equal to the amount that would have been realized had (i) each dividend and other distribution declared by the Company and having an ex-dividend date during a Performance Period (or the portion thereof for which Additional Shares or Buyback Shares are included in the calculation of the Relative Baseline, as applicable) been reinvested in additional shares of Common Stock (“Dividend Stock”) at the Fair Market Value on the ex-dividend date for such dividend or other distribution and (ii) such shares of Dividend Stock been sold as of the Valuation Date for such Performance Period for the Common Stock Price as of such date. For the avoidance of doubt, this dividend reinvestment component of Ending Value shall (i) not include dividends originally paid in Common Stock in lieu of cash dividends to the extent that such shares are included in Additional Shares pursuant to clause (d) of the definition thereof, and (ii) include dividends and other distributions declared thereafter on such Additional Shares.

“Excess Amount” means, with respect to the Performance Period for which a Performance Pool has been generated, the excess, if any, of such Performance Pool above the Dollar-Based Cap, if any, up to the applicable Capitalization-Based Cap.

“Excess Value” means, with respect to an Award, the dollar value of such Award multiplied by a fraction, the numerator of which is the Excess Amount and the denominator of which is the sum of the Dollar-Based Cap and the Excess Amount.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Fair Market Value” means, as of any given date, the fair market value of a security determined by the Committee using any reasonable method and in good faith (such determination will be made in a manner that satisfies Section 409A of the Code); provided that with respect to a share of Common Stock, “Fair Market Value” means the value of such share determined as follows: (a) if on the determination date the Common Stock is listed on the New York Stock Exchange, The NASDAQ Stock Market, Inc. or another national securities exchange or is publicly traded on an established securities market, the Fair Market Value of a share of Common Stock shall be the last reported sale price at which Common Stock is traded on such exchange or in such market (if there is more than one such exchange or market, the Committee shall determine the appropriate exchange or market) on the determination date or, if no sale of Common Stock is reported for such trading day, on the next preceding day on which any sale shall have been reported; or (b) if the Common Stock is not listed on such an exchange, quoted on such system or traded on such a market, Fair Market Value of a share of Common Stock shall be the value determined by the Committee in good faith in a manner consistent with Code Section 409A.

“First Anniversary” has the meaning set forth in Section 2.4(b)(i) hereof.

“Good Reason” means, with respect to a Participant, except as otherwise provided in a separate agreement between the Participant and the Company, (a) a material diminution in the Participant’s responsibilities, authority or duties, (b) a material reduction in the Participant’s base salary and bonus opportunity, or (c) a material change in the geographical location at which the Participant provides services to the Company, and in any case, the Company fails to take corrective action within 30 days after the Participant notifies the Company of the event giving rise to “Good Reason.”

6

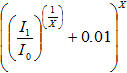

“Index Return Multiplier” means, with respect to any measurement period, a factor representing (a) the compound, annualized percentage return for the MSCI US REIT Index (assuming dividends reinvested on a daily basis) plus (b) one percent (1%) per year, converted to a non-annualized percentage return for the measurement period, which is expressed by the following formula:

Where:

I0 = The average of the MSCI US REIT Index value over the twenty (20) consecutive trading days (I) immediately preceding the first day of such measurement period (0), such average calculated as of such day.

I1 = The average of the MSCI US REIT Index value over the twenty (20) consecutive trading days (I) immediately preceding and including the last day of such measurement period (1), such average calculated as of such day.

x = The period between the first day of such measurement period (0) and the last day of such measurement period (1) expressed as a number of years to the fourth decimal (e.g., 365 days = 1.0000 year).

“Initial Date” with respect to any Performance Period means the first day of the Performance Period.

“Initial Shares” means a number of shares of Common Stock equal to the sum of:

(a) the number of shares of Common Stock outstanding as of the Initial Date (including all shares of Common Stock or, without duplication, the REIT Shares Amount for Units, as applicable, underlying Time-Based Awards and Performance-Based Award granted prior to the Initial Date), plus

(b) the number of shares of Common Stock representing the REIT Shares Amount for all of the Units (other than those held by the Company and those underlying Performance-Based Awards or Time-Based Awards, which are provided for in clause (a) above) outstanding as of the Initial Date, assuming that all such Units were exchanged, converted or redeemed for shares of Common Stock as of such date.

For the avoidance of doubt, Initial Shares exclude all shares of Common Stock issuable upon exercise of currently outstanding stock options.

“LTIPs” means partnership interests intended to be treated as profits interests under the Code which are convertible into, exchangeable for or redeemable in consideration of shares of Common Stock or the value thereof in cash pursuant to the applicable instrument governing such interests.

7

“MSCI US REIT Index” means the MSCI US REIT Index (RMS) as published from time to time (or a successor index including a comparable universe of publicly traded U.S. real estate investment trusts), provided that if (a) the MSCI US REIT Index ceases to exist or be published prior to the Valuation Date and the Committee determines that there is no successor to such index or (b) the Committee reasonably determines that the MSCI US REIT Index is no longer suitable for the purposes of this 2016 Outperformance Plan, then the Committee in its good faith reasonable discretion shall select for subsequent Performance Periods, or if the Committee in its reasonable good faith discretion so determines, for any portion of an outstanding Performance Period, a substitute comparable index for purposes of calculating the Relative Baseline.

“Participant” means an Eligible Person designated by the Committee to receive an Award.

“Participation Point” means, with respect to a Participant, the unit measurement used to determine the Participant’s share of the Performance Pool generated with respect to a Performance Period.

“Performance-Based Awards” means, as of a particular date of determination and to the extent that that the sum of (i) and (ii) below is denominated in shares of Common Stock, Units or other equity securities or interests, in each case (if applicable) as converted, exercised, exchanged or redeemed for a number of shares of Common Stock as of such date of determination at the applicable conversion, exercise, exchange or redemption rate (or rate deemed applicable by the Committee if there is no such stated rate), the sum of (i) in respect of Awards, if and to the extent that each of the following conditions has been satisfied: (A) the date of determination is after the Valuation Date for the applicable Performance Period, (B) the Base Value and/or Excess Value, as applicable, has been earned, in whole or in part, (C) such earned portion of the Award has been paid in shares of Common Stock or, if the Award is represented by LTIPs, a number of LTIPs has become vested based on performance, (D) Positive TSR has been achieved and, (E) with respect to the Excess Value, the Absolute Shareholder Return requirements set forth in Section 2.4(b)(i)-(iii) have been satisfied and (ii) in respect of performance-based incentive compensation awards other than Awards, if and to the extent that the performance-based vesting conditions applicable to such awards have been satisfied as of the determination date.

“Performance Period” means the three-year period commencing on January 1 of a calendar year and ending on December 31 of the second calendar year that follows such calendar year. The first Performance Period under this 2016 Outperformance Plan runs from January 1, 2016 through December 31, 2018. There shall be overlapping Performance Periods.

“Performance Pool” with respect to any Performance Period means, as of the Valuation Date, a dollar amount determined pursuant to the provisions of Section 2.2.

“Person” means an individual, corporation, partnership, limited liability company, joint venture, association, trust, unincorporated organization, other entity or “group” (as defined in the Exchange Act).

“Positive TSR” means, as of a particular date of determination, the Company’s Absolute Shareholder Return is positive.

8

“Public Announcement” means, with respect to a Transactional Change of Control, the earliest press release, filing with the SEC or other publicly available or widely disseminated communication issued by the Company or another Person who is a party to such transaction which discloses the consideration payable in and other material terms of the transaction that ultimately results in the Transactional Change of Control; provided, however, that if such consideration is subsequently increased or decreased, then the term “Public Announcement” shall be deemed to refer to the most recent such press release, filing or communication disclosing a change in consideration whereby the final consideration and material terms of the transaction that ultimately results in the Transactional Change of Control are announced. For the avoidance of doubt, the foregoing definition is intended to provide the Committee in the application of the proviso clause in the definition of “Common Stock Price” with the information required to determine the fair market value of the consideration payable in the transaction that ultimately results in the Transactional Change of Control as of the earliest time when such information is publicly disseminated, particularly if the transaction consists of an unsolicited tender offer or a contested business combination where the terms of the transaction change over time.

“Qualified Termination” has the meaning set forth in Section 2.5(b) hereof.

“REIT Shares Amount” means the per Unit number of shares of Common Stock into which a Unit is convertible, for which a Unit is exchangeable for or in consideration of which a Unit is redeemable pursuant to the applicable instrument governing such Unit.

“Related Company” means any corporation, partnership, joint venture or other entity during any period in which a controlling interest in such entity is owned, directly or indirectly, by the Company (or any entity that is a successor to the Company), and any business venture designated by the Committee in which the Company (or any entity that is a successor to the Company) has, directly or indirectly, a significant interest (whether through the ownership of securities or otherwise), as determined in the discretion of the Committee.

“Relative Baseline” with respect to a Performance Period means, as of the applicable Valuation Date, an amount representing (without double-counting) the sum of:

| (a) | the Baseline Value multiplied by: | |||||||

| (i) | the difference between: | |||||||

| (x) | the Initial Shares and | |||||||

| (y) | all Buyback Shares repurchased, redeemed or forfeited between the Initial Date and the Valuation Date, | |||||||

| and then multiplied by: | ||||||||

| (ii) | the Index Return Multiplier for the Performance Period; plus | |||||||

| (b) | with respect to each Additional Share issued after the Initial Date, the product of: | |||||||

9

| (i) | the Additional Share Baseline Value of such Additional Share, multiplied by | |||||||

| (ii) | the Index Return Multiplier for the period beginning on the date of issuance of such Additional Share and ending on the Valuation Date; plus | |||||||

| (c) | with respect to each Buyback Share repurchased, redeemed or forfeited after the Initial Date, the product of: | |||||||

| (i) | the Baseline Value multiplied by | |||||||

| (ii) | the Index Return Multiplier for the period beginning on the Initial Date and ending on the date such Buyback Share was repurchased, redeemed or forfeited. | |||||||

If the Company consummates an individual issuance involving 500,000 or more Additional Shares and/or an individual repurchase, redemption or forfeiture involving 500,000 or more Buyback Shares during any calendar quarter, the Company will track the precise issuance date and value of each such individual Additional Share and/or repurchase, redemption or forfeiture date and value of each such individual Buyback Share. If the Company consummates one or more issuances each involving less than 500,000 Additional Shares and/or repurchases, redemptions or forfeitures each involving less that 500,000 Buyback Shares during any calendar quarter, it would be impractical to track the precise issuance date and value of each such Additional Share and/or repurchase, redemption or forfeiture date and value of each such Buyback Share, and in such event (a) the Company will consider all such issuances and/or repurchases, redemptions or forfeitures (on a net basis if both issuances and repurchases, redemptions or forfeitures occur in the same quarter) to have taken place on the last day of the quarter during which such transaction or transactions occurred and (b) the Additional Share Baseline Value (if the netting of all such transactions results in a net issuance of Additional Shares) or the Buyback Value (if the netting of all such transactions results in a net repurchase, redemption or forfeiture of Buyback Shares) of the shares of Common Stock involved shall be calculated using the weighted average price at which such shares were issued and/or repurchased, redeemed or forfeited.

“Retirement” means, with respect to a Participant, the occurrence of the Participant’s Termination Date after the Participant has attained at least age 62 and provided that the sum of the Participant’s age plus the Participant’s years of service to the Company or any Related Company is equal to at least 75 years.

“SEC” means the U.S. Securities and Exchange Commission.

“Second Anniversary” has the meaning set forth in Section 2.4(b)(ii) hereof.

“Securities Act” means the Securities Act of 1933, as amended.

“Third Anniversary” has the meaning set forth in Section 2.4(b)(iii) hereof.

10

“Time-Based Awards” means, as of a particular date of determination, the sum of all then-outstanding (whether or not vested) restricted stock unit awards and other incentive compensation awards denominated in shares of Common Stock, Units, LTIPs or other equity securities or interests, in each case, granted under the Company’s equity incentive plans and LTIPs, in each case, subject to time-based vesting requirements and (if applicable) assuming that such awards were converted, exercised, exchanged or redeemed for a number of shares of Common Stock as of such date of determination at the applicable conversion, exercise, exchange or redemption rate (or rate deemed applicable by the Committee if there is no such stated rate).

“Total Participation Points” with respect to any Performance Period means the total outstanding Participation Points held by Participants on the Valuation Date (after taking into account all awards and all forfeitures of Participation Points for such Performance Period).

“Total Shares” with respect to any Performance Period means (without double-counting), as of the Valuation Date, the algebraic sum of:

(a) the Initial Shares, plus

(b) all Additional Shares issued between the Initial Date and the Valuation Date, minus

(c) all Buyback Shares repurchased, redeemed or forfeited between the Initial Date and the Valuation Date.

“Transactional Change of Control” means a Change of Control arising as a result of one of the following events:

(a) the consummation of a transaction, approved by the stockholders of the Company, to merge the Company into or consolidate the Company with another entity where the Company is not the surviving entity, or to sell or otherwise dispose of all or substantially all of its assets or adopt a plan of liquidation; or

(b) a “person” or “group” as defined in Sections 13(d) and 14(d) of the Exchange Act (other than any trustee or other fiduciary holding securities under an employee benefit or other similar equity plan of the Company) making a tender offer for Common Stock.

“Units” means interests in limited partnerships, limited liability companies or other similar entities which are convertible into, exchangeable for or redeemable in consideration of shares of Common Stock or the value thereof in cash pursuant to the applicable instrument governing such interests.

“Valuation Date” with respect to any Performance Period means the earliest of:

(a) the last day of such Performance Period,

(b) in the event of a Change of Control that is not a Transactional Change of Control, the date on which such Change of Control shall occur, or

11

(c) in the event of a Transactional Change of Control, and subject to the consummation of such Transactional Change of Control, the date of the Public Announcement of such Transactional Change of Control.

ARTICLE 2 - AWARDS, PERFORMANCE POOL AND PAYMENTS

2.1 Awards. For each Performance Period, the Committee, in its discretion, shall (a) select those Eligible Persons who shall be Participants and (b) determine the size of each Participant’s Award, which will consist of a number of Participation Points. Promptly after the Committee selects a Participant to receive an Award, the Company will notify the Participant of his or her Award with an Award Letter that may include additional or modified terms that the Committee decided to make applicable to such Award.

2.2 Determination of Performance Pool. As soon as practical following the Valuation Date of a Performance Period, the Committee shall determine the size of the Performance Pool in accordance with the following steps: (a) determine the Relative Baseline and the Ending Value, (b) subtract the Relative Baseline from the Ending Value, (c) multiply the resulting amount by three percent (3%), provided that in no event shall the Performance Pool exceed an amount equal to the greater of (i) the Dollar-Based Cap or (ii) the Capitalization-Based Cap. If the Performance Pool is not a positive number, no amount shall be payable to any Participant with respect to such Performance Period. If the Performance Pool is a positive number, the Committee shall certify in writing the size of the Performance Pool.

2.3 Allocation of Performance Pool. The Committee shall then determine the dollar value of the Award (or all Awards in case of multiple Awards to a particular Participant for the same Performance Period) of each Participant with respect to the Performance Period for which a Performance Pool has been generated by multiplying the Performance Pool by a fraction, the numerator of which shall be the Participation Points held by such Participant with respect to the Performance Period (after giving effect to all Awards to such Participant with respect to the applicable Performance Period and any forfeitures of Awards by such Participant with respect to the applicable Performance Period) and the denominator of which shall be the Total Participation Points outstanding for the Performance Period (after giving effect to all Awards to all Participants with respect to the applicable Performance Period and any forfeitures of Awards by any Participants with respect to the applicable Performance Period). If the Performance Pool exceeds the Dollar-Based Cap, then the Award shall be bifurcated, concurrently with the Committee’s determination of the dollar value of the Award in accordance with Section 2.3, into the Base Value and the Excess Value.

2.4 Payment to Participants.

(a) The Base Value as determined pursuant to Section 2.3 for a Participant shall be payable either in cash or in shares of Common Stock or other property, as determined by the Committee, to the Participant as soon as reasonably practicable, but no later than 75 days after the end of the Performance Period. If the Participant is paid out in shares of Common Stock, the dollar amount of the Award determined pursuant to Section 2.3 shall be converted into a fixed number of shares of Common Stock based on the Fair Market Value as of the date the Committee makes its final determination pursuant to Section 2.3.

12

(b) the Excess Value (if any) as determined pursuant to Section 2.3 for a Participant shall be payable either in cash or in shares of Common Stock or other property, as determined by the Committee, to the Participant as follows, subject to the Participant’s continuous employment with the Company or a Related Company or a Qualified Termination:

(i) one-third on the first anniversary of the Valuation Date for the applicable Performance Period (the “First Anniversary”) if the Absolute Shareholder Return from the Valuation Date to the First Anniversary equals or exceeds the Cumulative Index Return over the same period;

(ii) one-third on the second anniversary of the Valuation Date for the applicable Performance Period (the “Second Anniversary”) if the Absolute Shareholder Return from the Valuation Date to the Second Anniversary equals or exceeds the Cumulative Index Return over the same period; and

(iii) one-third on the third anniversary of the Valuation Date for the applicable Performance Period (the “Third Anniversary”) if the Absolute Shareholder Return from the Valuation Date to the Third Anniversary equals or exceeds the Cumulative Index Return over the same period.

Any portion of the Excess Value that becomes payable to a Participant pursuant to this Section 2.4(b) shall be payable either in cash or in shares of Common Stock or other property, as determined by the Committee, to the Participant as soon as reasonably practicable, but no later than 75 days after the First Anniversary, Second Anniversary or Third Anniversary, as applicable. Any portion of the Excess Value that does not become payable in accordance with Section 2.4(b)(i)-(iii) shall be immediately cancelled after the Committee’s determination following the anniversary on which such amount could become payable. If the Participant receives shares of Common Stock, the dollar amount of the applicable portion of the Excess Value payable pursuant to this Section 2.4(b) shall be converted into a fixed number of shares of Common Stock based on the Fair Market Value as of the date the Committee makes its final determination pursuant to this Section 2.4(b).

(c) Subject to Section 2.6 below in the event of a Change of Control, except as otherwise permitted by the Committee, if any portion of the Base Value or Excess Value is paid to the Participant in shares of Common Stock or LTIPs, such shares (or LTIPs) shall not be sold, assigned, transferred, pledged, hypothecated, given away or in any other manner disposed of, or encumbered, whether voluntarily or by operation of law (each such action a “Transfer”) until after the Third Anniversary; provided, however, that (i) the Participant may elect to have a portion of such shares of Common Stock or LTIPs, as applicable, used to satisfy taxes with respect to such payments in accordance with Section 3.6 hereof and (ii) such shares of Common Stock or LTIPs may be Transferred prior to such date in accordance with the Company’s equity incentive plan pursuant to which such shares of Common Stock or LTIPs were granted, so long as the transferee agrees in writing with the Company to be bound by all the terms and conditions of this Agreement and that subsequent Transfers shall be prohibited except those in accordance with this Section 2.4(c). Any attempted Transfer of such shares of Common Stock or LTIPs not in accordance with the terms and conditions of this Section 2.4(c) shall be null and void, and the Company shall not reflect on its records any change in record ownership of any such shares of Common Stock or LTIPs as a result of any such Transfer, shall otherwise refuse to recognize any such Transfer and shall not in any way give effect to any such Transfers.

13

(d) Notwithstanding the foregoing, subject to Section 2.6 below in the event of a Change of Control, if Positive TSR has not been achieved, then no payments to Participants (including the Base Value and the Excess Value) shall be made unless Positive TSR is achieved within seven (7) years following the end of the Performance Period. For purposes of the preceding sentence, the Company’s Absolute Shareholder Return shall be measured at the end of each quarter, beginning with the first quarter following the end of the applicable Performance Period, and it shall be measured from the beginning of the Performance Period through the end of such quarter. With respect to the Positive TSR requirement, the Participant’s employment with the Company or a Related Company need not continue past the Valuation Date for delayed payment of the Base Value in accordance with Section 2.4(d) or past the First Anniversary, Second Anniversary or Third Anniversary, as applicable, for delayed payment of the applicable portion of the Excess Value in accordance with Section 2.4(b).

(e) If Positive TSR is achieved within the seven (7) year period following the end of the Performance Period, then all amounts (including the Base Value and any portion of the Excess Value) that would otherwise have been payable prior thereto shall be paid either in cash or in shares of Common Stock or other property, as determined by the Committee, to the Participant as soon as reasonably practicable, but no later than 75 days after the end of the quarter during which Positive TSR is achieved. If the Participant is paid out in shares of Common Stock, the dollar amount of the Base Value or Excess Value, as applicable, shall be converted into a fixed number of shares of Common Stock based on the Fair Market Value as of the last day of the quarter during which Positive TSR is achieved. Any portion of the Excess Value that had not become payable as of the last day of the quarter during which Positive TSR is achieved shall be paid in accordance with Section 2.4(b) above without further regard to the Company’s Absolute Shareholder Return being a positive or negative number as of the date such payment is due.

(f) Subject to Section 2.6 below in the event of a Change of Control, if Positive TSR is not achieved within the seven (7) year period following the end of the Performance Period, then notwithstanding Section 2.3 all Awards held by the Participant with respect to the applicable Performance Period shall, without payment of any consideration by the Company, automatically and without notice terminate, be forfeited and be and become null and void, and neither the Participant nor any of his or her successors, heirs, assigns, or personal representatives will thereafter have any further rights or interests in such Awards.

2.5 Termination of Participant’s Employment; Death and Disability.

(a) If a Participant’s employment with the Company or a Related Company terminates, the provisions of this Section 2.5 shall govern the treatment of the Participant’s Award exclusively, regardless of the provision of any employment or other agreement to which the Participant is a party or any termination or severance policies of the Company then in effect, which shall be superseded by this 2016 Outperformance Plan such that, by way of illustration, any provisions thereof with respect to payout or the lapse of forfeiture restrictions relating to the Participant’s incentive or other compensation awards in the event of certain types of termination of the Participant’s employment with the Company (such as, for example, termination at the end of the term, termination without Cause by the employer) shall not be interpreted as requiring that any calculations set forth in Sections 2.2 and 2.3 hereof be performed.

14

(b) In the event of termination of a Participant’s employment (i) by the Participant upon Retirement or (ii) by reason of the Participant’s death or Disability (each a “Qualified Termination”) after the Initial Date, but prior to the Valuation Date of any Performance Period, then the Participant will retain the number of Participation Points initially granted to him or her with respect to such Performance Period, but all calculations and payments, if any, with respect to the Participant’s Award shall be made at the same time and on the same conditions set forth in Sections 2.2, 2.3 and 2.4 hereof for all other Participants.

(c) In the event of a termination of a Participant’s employment for any reason other than a Qualified Termination prior to a Valuation Date for a Performance Period, all Awards held by the Participant shall, without payment of any consideration by the Company, automatically and without notice terminate, be forfeited and be and become null and void, and neither the Participant nor any of his or her successors, heirs, assigns, or personal representatives will thereafter have any further rights or interests in such Awards or any related Participation Points.

2.6 Change of Control.

(a) In the event of a Change of Control, the Committee will determine the size of the Performance Pool for each outstanding Performance Period in accordance with Section 2.2 and the dollar value of the Awards in accordance with Section 2.3 no later than the date of consummation of the Change of Control. For avoidance of doubt, in the event of a Change of Control, the performance of all calculations and actions pursuant to Sections 2.2 and 2.3 hereof using the applicable Valuation Date shall be conditioned upon the final consummation of such Change of Control.

(b) After the determination of the dollar value of the Awards payable to each Participant, the Awards (including both the Base Value and the Excess Value, if any) payable to Participants who have incurred a Qualified Termination shall be paid out in cash as soon as reasonably practicable, but no later than 30 days following consummation of a Change of Control. The Awards (including both the Base Value and the Excess Value, if any) payable to all other Participants shall be fixed at the dollar amount determined pursuant to Sections 2.2 and 2.3 hereof and be payable in cash, but shall only be paid to them upon the earlier of (i) the last day of the Performance Period if the Participant remains employed by the Company (or its successor) until such day, or (ii) the termination of the Participant’s employment by the Company (or its successor) without Cause or by the Participant with Good Reason prior to the end of the Performance Period if such termination of employment occurs within 24 months following the Change of Control. Notwithstanding the foregoing, if the Company’s successor does not irrevocably and unconditionally agree to assume the Awards in connection with the Change of Control, the Awards (including both the Base Value and the Excess Value, if any) shall be fully paid out to the Participants in cash within 30 days of the consummation of the Change of Control.

15

(c) In the event of a Change of Control: (i) payment of the Excess Value, if any, shall no longer be subject to the performance-based and employment-based conditions set forth in Section 2.4(b); (ii) the Positive TSR requirement shall no longer apply; and (iii) the Transfer restrictions set forth in Section 2.4(c) shall no longer apply to shares of Common Stock or LTIPs issued in respect of the Awards.

2.7 LTIP Units. The Committee may award LTIPs to a Participant. In such event, the agreement granting such LTIPs shall set forth (i) whether and how the LTIPs will be subject to forfeiture to reflect the economic terms of this 2016 Outperformance Plan in light of the different award structure, (ii) whether LTIPs will be issued prior to or after the Valuation Date, it being understood that the Committee may decide to award LTIPs in multiple tranches with respect to a single Award to a Participant, and (iii) the methodology to be followed to convert the dollar amount of any Award determined under Section 2.3 or 2.6 to a number of LTIPs to be earned, or forfeited, as the case may be, and (iv) if such LTIPs constitute equity awards, under which equity incentive plan of the Company they are being issued, whether shares of Common Stock need to be reserved for issuance under such plan, and if so how that number will be determined, which may, depending on the circumstances, include calculations made or to be made under Sections 2.2 or 2.3, capital account allocations and/or balances under the applicable partnership agreement, and the conversion ratio between LTIPs (directly or indirectly) and Common Stock.

2.8 Nature of Awards. The Awards granted under this 2016 Outperformance Plan shall be used solely as a device for the measurement and determination of certain amounts to be paid to each Participant as provided herein and such Awards shall not constitute or be treated as property or as a trust fund of any kind or as stock options or other form of equity or security of the Company or any Related Company. A Participant shall have only those rights set forth in this 2016 Outperformance Plan and the Participant’s Award Letter with respect to Awards granted to such Participant and shall have no ownership rights in the Company or any Related Company by virtue of having been granted Awards. Any benefits which become payable hereunder shall be paid from the general assets of the Company.

ARTICLE 3 - MISCELLANEOUS

3.1 Amendments. This 2016 Outperformance Plan and any Awards granted hereunder may be amended or modified only with the consent of the Company acting through the Committee or the Board; provided that any amendment or modification which adversely affects a Participant must be consented to by such Participant to be effective as against him or her.

3.2 Interpretation by Committee. The Committee may interpret this 2016 Outperformance Plan, with such interpretations to be conclusive and binding on all persons and otherwise accorded the maximum deference permitted by law, provided that the Committee’s interpretation shall not be entitled to deference on and after a Change of Control except to the extent that such interpretations are made exclusively by members of the Committee who are individuals who served as Committee members before the Change of Control and take any other actions and make any other determinations or decisions that it deems necessary or appropriate in connection with this 2016 Outperformance Plan or the administration or interpretation thereof. In the event of any dispute or disagreement as to interpretation of this 2016 Outperformance Plan or of any rule, regulation or procedure, or as to any question, right or obligation arising from or related to this 2016 Outperformance Plan, the decision of the Committee, except as provided above, shall be final and binding upon all persons.

16

3.3 Assignability. Except as otherwise provided by law, no benefit hereunder shall be assignable, or subject to alienation, garnishment, execution or levy of any kind, and any attempt to cause any benefit to be so subject shall be void.

3.4 No Contract for Continuing Services. This 2016 Outperformance Plan shall not be construed as creating any contract for continued services between the Company and any Participant and nothing herein contained shall give any Participant the right to be retained as an employee of the Company.

3.5 Governing Law. This 2016 Outperformance Plan shall be construed, administered, and enforced in accordance with the laws of the State of California, without giving effect to the principles of conflict of laws of such State.

3.6 Tax Withholding. The Company shall have the right to deduct from all payments hereunder any taxes required by law to be withheld with respect to such payments. In the event payment is made in the form of shares of Common Stock, with the approval of the Committee, the minimum tax withholding may be satisfied by the Company withholding from shares of Common Stock to be issued, shares having an aggregate Fair Market Value (as of the date the withholding is in effect) that would satisfy the minimum withholding amount due (or other rates that will not have a negative accounting impact).

3.7 Effect on Other Plans. Nothing in this 2016 Outperformance Plan shall be construed to limit the rights of Participants under the Company’s benefit plans, programs or policies.

3.8 Benefits and Burdens. This 2016 Outperformance Plan shall inure to the benefit of and be binding upon the Company and the Participants, their respective successors, executors, administrators, heirs and permitted assigns.

3.9 Enforceability. If any portion or provision of this 2016 Outperformance Plan shall to any extent be declared illegal or unenforceable by a court of competent jurisdiction, then the remainder of this 2016 Outperformance Plan, or the application of such portion or provision in circumstances other than those as to which it is so declared illegal or unenforceable, shall not be affected thereby, and each portion and provision of this 2016 Outperformance Plan shall be valid and enforceable to the fullest extent permitted by law.

3.10 Waiver. No waiver of any provision hereof shall be effective unless made in writing and signed by the waiving party. The failure of any party to require the performance of any term or obligation of this 2016 Outperformance Plan, or the waiver by any party of any breach of this 2016 Outperformance Plan, shall not prevent any subsequent enforcement of such term or obligation or be deemed a waiver of any subsequent breach.

3.11 Notices. Any notices, requests, demands, and other communications provided for by this 2016 Outperformance Plan shall be sufficient if in writing and delivered in person or sent by registered or certified mail, postage prepaid, to a Participant at the last address the Participant has filed in writing with the Company, or to the Company at their main office, attention of the Committee.

17

3.12 Section 409A. The provisions regarding all payments to be made hereunder shall be interpreted in such a manner that all such payments either comply with Section 409A of the Code or are exempt from the requirements of Section 409A of the Code as “short-term deferrals” as described in Section 409A of the Code. To the extent that any amounts payable hereunder are determined to constitute “nonqualified deferred compensation” within the meaning of Section 409A of the Code, such amounts shall be subject to such additional rules and requirements as specified by the Committee from time to time in order to comply with Section 409A of the Code and the payment of any such amounts may not be accelerated or delayed except to the extent permitted by Section 409A of the Code. The Company makes no representation or warranty and shall have no liability to any Participant or any other person if any payments under any provisions of this Plan are determined to constitute deferred compensation under Section 409A of the Code that are subject to the twenty percent (20%) additional tax under Section 409A of the Code.

18

Exhibit 10.2

PROLOGIS, INC.

2016 OUTPERFORMANCE PLAN

LTIP UNIT AWARD AGREEMENT

Name of the Grantee: [ ] (the “Grantee”)

Performance Period: January 1, 201 through December 31, 201

Participation Points Awarded: [ ]

No. of LTIP Units Issued: [ ]

Grant Effective Date: [ ]

RECITALS

A. The Grantee is an employee of Prologis, Inc. (the “Company”) or a “Related Company” as defined in the Prologis, Inc. Long-Term Incentive Plan (as amended and supplemented from time to time, the “Plan”) and provides services to Prologis, L.P., through which the Company conducts substantially all of its operations (the “Partnership”).

B. Pursuant to the Plan, the Prologis, Inc. Outperformance Plan (as amended, restated and supplemented from time to time, the “POP”), and the Limited Partnership Agreement of the Partnership (as amended and supplemented from time to time, the “Partnership Agreement”), the Company as general partner of the Partnership hereby grants to the Grantee a Full Value Award (as defined in the Plan, referred to herein as an “Award”) in the form of, and by causing the Partnership to issue to the Grantee, the number of LTIP Units (as defined in the Partnership Agreement) set forth above (the “Award LTIP Units”) having the rights, voting powers, restrictions, limitations as to distributions, qualifications and terms and conditions of redemption and conversion set forth herein and in the Partnership Agreement, in lieu of settling the Participation Points set forth above in cash or shares of common stock of the Company, at the election of the Company, upon the conclusion of the Performance Period set forth above.

C. The Compensation Committee (the “Committee”) of the Board of Directors of the Company (or a subcommittee thereof) estimated, in accordance with Section 2.7 of the POP, that the Participation Points set forth above, as previously awarded for the Performance Period set forth above, could, as of the end of the Performance Period, represent a value that would, based on reasonable assumptions used by the Committee in arriving at its estimate or its methodology to determine the estimate, be converted into a number of LTIP Units up to the Award LTIP Units. After the date hereof the Committee may determine that the Grantee is entitled to additional Participation Points with respect to the Performance Period set forth above, in which case the number of additional Participation Points awarded, the number of additional LTIP Units issued and the Grant Effective Date thereof shall be set forth in an addendum hereto (an “Award Addendum”) which thereafter shall be deemed part of this award agreement for all purposes as if it were an amendment hereto. The Award LTIP Units were calculated pursuant to an approximation, based on reasonable assumptions, of the final Performance Pool (as defined in the POP) and of the percentage of such Performance Pool that would be attributable to the Grantee at the conclusion of the Performance Period pursuant to the POP based on the aggregate Participation Points awarded to Grantee relative to all Participation Points then outstanding for all POP participants. The exact number of LTIP Units earned shall be determined at the conclusion of the applicable performance period in accordance with the POP.

D. Generally, under the POP, in the event that the Company’s annualized total return to shareholders during the Performance Period exceeds the annualized total shareholder return of the MSCI US REIT Index (RMS) by more than 100 basis points during the Performance Period, then a Performance Pool will be formed under the POP equal to three percent (3%) of the Company’s excess return to shareholders, provided that in no event shall the Performance Pool exceed an amount equal to the greater of (i) the Dollar-Based Cap (as defined in the POP) or (ii) the Capitalization-Based Cap (as defined in the POP). The Grantee’s earned Award, generally, will equal (A) the Grantee’s aggregate Participation Points divided by the Total Participation Points granted by the Company for the Performance Period, multiplied by (B) the Performance Pool. If the Performance Pool exceeds the Dollar-Based Cap, then the Grantee’s Award shall be bifurcated, as set forth below, into the Base Value (as defined in the POP) and the Excess Value (as defined in the POP). The Grantee’s earned Award shall also be subject to achievement of Positive TSR (as defined in the POP). Special provisions will apply, and the Award may be forfeited in the event that Grantee’s employment is terminated prior to the end of the Performance Period or, with respect to the Excess Value, if any, prior to the First Anniversary, Second Anniversary or Third Anniversary (each as defined in the POP), as applicable. The Award will be governed by the terms of the POP.

E. Upon the close of business on the Grant Effective Date pursuant to this LTIP Unit Award Agreement (this “Agreement”), the Grantee shall receive the number of LTIP Units specified above, subject to the restrictions and conditions set forth herein, in the POP, in the Plan, and in the Partnership Agreement. Unless otherwise indicated, capitalized terms used herein but not defined shall have the meanings given to those terms in the POP.

NOW, THEREFORE, the Company, the Partnership and the Grantee agree as follows:

1. Effectiveness of Award. The Grantee shall be admitted as a partner of the Partnership with beneficial ownership of the Award LTIP Units as of the Grant Effective Date by (i) signing and delivering to the Partnership a copy of this Agreement, (ii) signing, as a Limited Partner, and delivering to the Partnership a counterpart signature page to the Partnership Agreement (attached hereto as Exhibit A) and (iii) making a Capital Contribution (as defined in the Partnership Agreement) in cash in the amount of [$ ] per Award LTIP Unit to the Partnership (the “Per Unit Contribution”). Upon execution of this Agreement by the Grantee, the Partnership and the Company, the books and records of the Partnership maintained by the General Partner shall reflect the issuance to the Grantee of the Award LTIP Units. Thereupon, the Grantee shall have all the rights of a Limited Partner of the Partnership with respect to a number of LTIP Units equal to the Award LTIP Units, subject, however, to the restrictions and conditions specified in Section 2 below and elsewhere herein. The LTIP Units are uncertificated securities of the Partnership and upon the Grantee’s request the General Partner shall confirm the number of LTIP Units issued to the Grantee.

2

2. Vesting of Award LTIP Units.

(i) This Award is subject to performance vesting and a continuous service requirement during the Performance Period and, with respect to the Excess Value, if any, through the applicable anniversary of the Valuation Date. The Award LTIP Units will be subject to forfeiture (a) based on the Company’s performance to the extent provided in Section 2(ii) by reference to the provisions of Sections 2.1, 2.2, 2.3 and 2.4 of the POP, and (b) in the event of termination of the Grantee’s employment, death or disability to the extent provided in Section 2(iii) by reference to the provisions of Section 2.5 of the POP. At any time prior to or in connection with the determination and allocation of the Performance Pool pursuant to the POP, the Partnership may issue additional LTIP Units to the Grantee as provided in Section 3 hereof that shall also be considered Award LTIP Units and subject to all of the terms and conditions of this Agreement and the POP; provided that such issuance will be subject to the Grantee confirming the truth and accuracy of the representations set forth in Section 12 hereof and executing and delivering such documents, comparable to the documents executed and delivered in connection with this Agreement, as the Company and/or the Partnership reasonably request in order to comply with all applicable legal requirements, including, without limitation, federal and state securities laws, and the Grantee making a Capital Contribution (as defined in the Partnership Agreement) in cash on or before the issuance date in such amount as the Company, in its capacity as general partner of the Partnership, shall determine for each such additional LTIP Unit issued.

(ii) The performance vesting provisions of Sections 2.2, 2.3 and 2.4 of the POP shall be applied to this Award as follows:

(a) Determination of Performance Pool. As soon as practical following the Valuation Date of a Performance Period, the Committee shall determine the size of the Performance Pool in accordance with the steps provided in Section 2.2 of the POP. If the Performance Pool is not a positive number, all Award LTIP Units shall, without payment of any consideration by the Partnership, automatically and without notice be forfeited and be and become null and void, and neither the Grantee nor any of his or her successors, heirs, assigns, or personal representatives will thereafter have any further rights or interests in such Award LTIP Units.

(b) Allocation of Performance Pool. If the Performance Pool is a positive number, the Committee shall certify in writing the size of the Performance Pool and shall then determine the dollar value of the Award (or all Awards in case of multiple Awards to the Grantee for the same Performance Period) with respect to the Performance Period for which the Performance Pool has been generated by multiplying the Performance Pool by a fraction, the numerator of which shall be the Participation Points held by the Grantee with respect to the Performance Period (after giving effect to all Awards to the Grantee with respect to the Performance Period and any forfeitures of Awards by the Grantee with respect to the Performance Period) and the denominator of which shall be the Total Participation Points outstanding for the Performance Period (after giving effect to all Awards to all Participants with respect to the Performance Period and any forfeitures of Awards by any Participants with respect to the Performance Period). If the Performance Pool exceeds the Dollar-Based Cap, then the dollar value of the Award shall be bifurcated, concurrently with the Committee’s determination of the dollar value of the Award, into the Base Value and the Excess Value.

3

(c) Vesting of Award LTIP Units. After applying Section 2(iii) hereof in the event of termination of the Grantee’s employment, death or disability prior to the Valuation Date, the dollar value of the Award as determined pursuant to Section 2(ii)(a) and (b) above for the Grantee shall be divided by the Fair Market Value of a share of Common Stock (as defined in the POP) as of the date the Committee makes its final determination of the Base Value pursuant to Section 2.3 of the POP or, in the case of the Excess Value, if any, the date the Committee makes its final determination following the applicable Valuation Date anniversary subject to satisfaction of the applicable performance criteria set forth in Section 2.4(b)(i)-(iii) of the POP (in either case, appropriately adjusted to the extent that the “REIT Shares Amount” or the “Deemed Partnership Interest Value” with respect to “Common Units” (all as defined in the Partnership Agreement) have been adjusted since the Grant Effective Date); the resulting number is hereafter referred to as the “Earned LTIP Unit Equivalent,” provided that the determination of the Earned LTIP Unit Equivalent is subject to the contingency and deferral provisions of Section 2(ii)(d) below, if applicable. Notwithstanding the foregoing, the Award shall not be converted into the Earned LTIP Unit Equivalent unless and until the Company has Positive TSR as set forth in Section 2(ii)(d)(III) below.

(d) Positive TSR Return Modifier.

(I) Notwithstanding Section 2(ii)(c) above, if Positive TSR has not been achieved upon completion of the applicable Performance Period, then the Earned LTIP Unit Equivalent (including the Base Value and the Excess Value, if any) shall not be determined unless Positive TSR is achieved within seven (7) years following the end of the Performance Period. For purposes of the preceding sentence, the Company’s Absolute Shareholder Return shall be measured at the end of each quarter, beginning with the first quarter following the end of the Performance Period, and it shall be measured from the beginning of the Performance Period through the end of such quarter.

(II) The Grantee’s employment with the Company or a Related Company need not continue past the Valuation Date with respect to the Performance Period for determination of the Earned LTIP Unit Equivalent in respect of the Base Value to be made pursuant to this Section 2(ii)(d) or the applicable anniversary of the Valuation Date with respect to the Performance Period for determination of the Earned LTIP Unit Equivalent in respect of the Excess Value.

4

(III) If Positive TSR is achieved within the seven (7) year period following the end of the Performance Period, then as soon as reasonably practicable, but no later than seventy-five (75) days after the end of the quarter during which Positive TSR is achieved, the Earned LTIP Unit Equivalent shall be determined (including the Base Value and any portion of the Excess Value, if any, that would otherwise have been payable prior thereto) in the same manner as provided in Section 2(ii)(c) above, except that the dollar value of the Award as originally determined pursuant to Section 2(ii)(b) shall be divided by the Fair Market Value of a share of Common Stock (as defined in the POP) as of the last day of the quarter during which Positive TSR is achieved with respect to the Base Value and any portion of the Excess Value that would otherwise have been paid prior to the last day of the quarter during which Positive TSR is achieved, rather than as of the earlier date provided in Section 2(ii)(c). If Positive TSR is achieved prior to the First Anniversary, Second Anniversary or Third Anniversary then any portion of the Excess Value that does not become payable as of the last day of the quarter during which Positive TSR is achieved shall be paid in accordance with Section 2.4(b)(i)-(iii) of the POP, as applicable, without further regard to the Company’s Absolute Shareholder Return being a positive or negative number as of the date such payment is due. The term “Earned LTIP Unit Equivalent” refers to the number of Award LTIP Units calculated pursuant to Section 2(ii)(c) or this Section 2(ii)(d)(III), as the case may be.

(IV) If Positive TSR is not achieved within the seven (7) year period following the end of the Performance Period, then notwithstanding Section 2(ii)(b), the Award and all Award LTIP Units held by the Grantee with respect to the Performance Period shall, without payment of any consideration by the Company, automatically and without notice terminate, be forfeited and be and become null and void, and neither the Grantee nor any of his or her successors, heirs, assigns, or personal representatives will thereafter have any further rights or interests in the Award or such Award LTIP Units.

(e) Earned LTIP Unit Equivalent Compared to Award LTIP Units. If the Earned LTIP Unit Equivalent (including the Base Value and the Excess Value earned pursuant to Section 2.4(b)(i)-(iii) of the POP, if any) is smaller than the aggregate number of Award LTIP Units previously issued to the Grantee, then the Grantee shall forfeit a number of Award LTIP Units equal to the difference without payment of any consideration by the Partnership; thereafter the term Award LTIP Units will refer only to the Award LTIP Units that were not so forfeited and neither the Grantee nor any of his or her successors, heirs, assigns, or personal representatives will thereafter have any further rights or interests in the LTIP Units that were so forfeited. For purposes of the foregoing forfeitures, the Committee shall have the power in the Committee’s reasonable discretion and from time to time to estimate the number of Award LTIP Units that can be earned by the Grantee in accordance with this Section 2. If the Earned LTIP Unit Equivalent is greater than the aggregate number of Award LTIP Units previously issued to the Grantee (as adjusted for forfeitures pursuant to this Section 2(ii)(e), if applicable), then, upon the performance of the calculations set forth in Section 2(ii) above: (A) the Company shall cause the Partnership to issue to the Grantee a number of additional LTIP Units equal to the difference; (B) such additional LTIP Units shall be added to the Award LTIP Units previously issued, if any, and thereby become part of this Award; (C) the Company and the Partnership shall take such corporate and partnership action as is necessary to accomplish the grant of such additional LTIP Units; and (D) thereafter the term Award LTIP Units will refer collectively to the Award LTIP Units, if any, issued prior to such additional grant plus such additional LTIP Units; provided that such issuance will be subject to the Grantee confirming the truth and accuracy of the representations set forth in Section 12 hereof and executing and delivering such documents, comparable to the documents executed and delivered in connection with this Agreement, as the Company and/or the Partnership reasonably request in order to comply with all applicable legal requirements, including, without limitation, federal and state securities laws, and the Grantee making a Capital Contribution (as defined in the Partnership Agreement), if any, in cash on or before the issuance date in such amount as the Company, in its capacity as general partner of the Partnership, shall determine for each such additional LTIP Unit issued. If the Earned LTIP Unit Equivalent is the same as the number of Award LTIP Units previously issued to the Grantee, then there will be no change to the number of Award LTIP Units.

5

(iii) The continuous service requirements of Section 2.5 of the POP shall be applied to this Award as follows: