Form 8-K Philip Morris Internatio For: Jul 16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 16, 2015

Philip Morris International Inc.

(Exact name of registrant as specified in its charter)

Virginia | 1-33708 | 13-3435103 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

120 Park Avenue, New York, New York | 10017-5592 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant's telephone number, including area code: (917) 663-2000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On July 16, 2015, Philip Morris International Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2015 and held a live audio webcast to discuss such results. In connection with this webcast, the Company is furnishing to the Securities and Exchange Commission the following documents attached as exhibits to this Current Report on Form 8-K and incorporated herein by reference to this Item 2.02: the earnings release attached as Exhibit 99.1 hereto, the conference call script attached as Exhibit 99.2 hereto and the webcast slides attached as Exhibit 99.3 hereto.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibits 99.1, 99.2 and 99.3, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in Item 2.02 of this Current Report on Form 8-K shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as may be expressly set forth by specific reference in such filing or document.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 | Philip Morris International Inc. Press Release dated July 16, 2015 (furnished pursuant to Item 2.02) |

99.2 | Conference Call Script dated July 16, 2015 (furnished pursuant to Item 2.02) |

99.3 | Webcast Slides dated July 16, 2015 (furnished pursuant to Item 2.02) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PHILIP MORRIS INTERNATIONAL INC. | ||

By: | /s/ JERRY WHITSON | |

Name: | Jerry Whitson | |

Title: | Deputy General Counsel and Corporate Secretary | |

DATE: July 16, 2015

EXHIBIT INDEX

Exhibit No. Description

99.1 | Philip Morris International Inc. Press Release dated July 16, 2015 (furnished pursuant to Item 2.02) |

99.2 | Conference Call Script dated July 16, 2015 (furnished pursuant to Item 2.02) |

99.3 | Webcast Slides dated July 16, 2015 (furnished pursuant to Item 2.02) |

Exhibit 99.1

PRESS RELEASE |  | |||

Investor Relations: | Media: | |||

New York: +1 (917) 663 2233 | Lausanne: +41 (0)58 242 4500 | |||

Lausanne: +41 (0)58 242 4666 | ||||

PHILIP MORRIS INTERNATIONAL INC. (PMI) REPORTS 2015 SECOND-QUARTER RESULTS;

REAFFIRMS 2015 FULL-YEAR REPORTED DILUTED EPS FORECAST;

EXPECTS TO BE TOWARDS UPPER END OF FULL-YEAR CURRENCY-NEUTRAL ADJUSTED DILUTED EPS GROWTH RATE OF 9%-11%

2015 Second-Quarter

• | Reported diluted earnings per share of $1.21, up by $0.04 or 3.4% versus $1.17 in 2014 |

• | Excluding unfavorable currency of $0.33, reported diluted earnings per share up by $0.37 or 31.6% versus $1.17 in 2014 as detailed in the attached Schedule 13 |

• | Adjusted diluted earnings per share of $1.21, down by $0.20 or 14.2% versus $1.41 in 2014 |

• | Excluding unfavorable currency of $0.33, adjusted diluted earnings per share up by $0.13 or 9.2% versus $1.41 in 2014 as detailed in the attached Schedule 12 |

• | Cigarette shipment volume of 219.8 billion units, down by 1.4% excluding acquisitions |

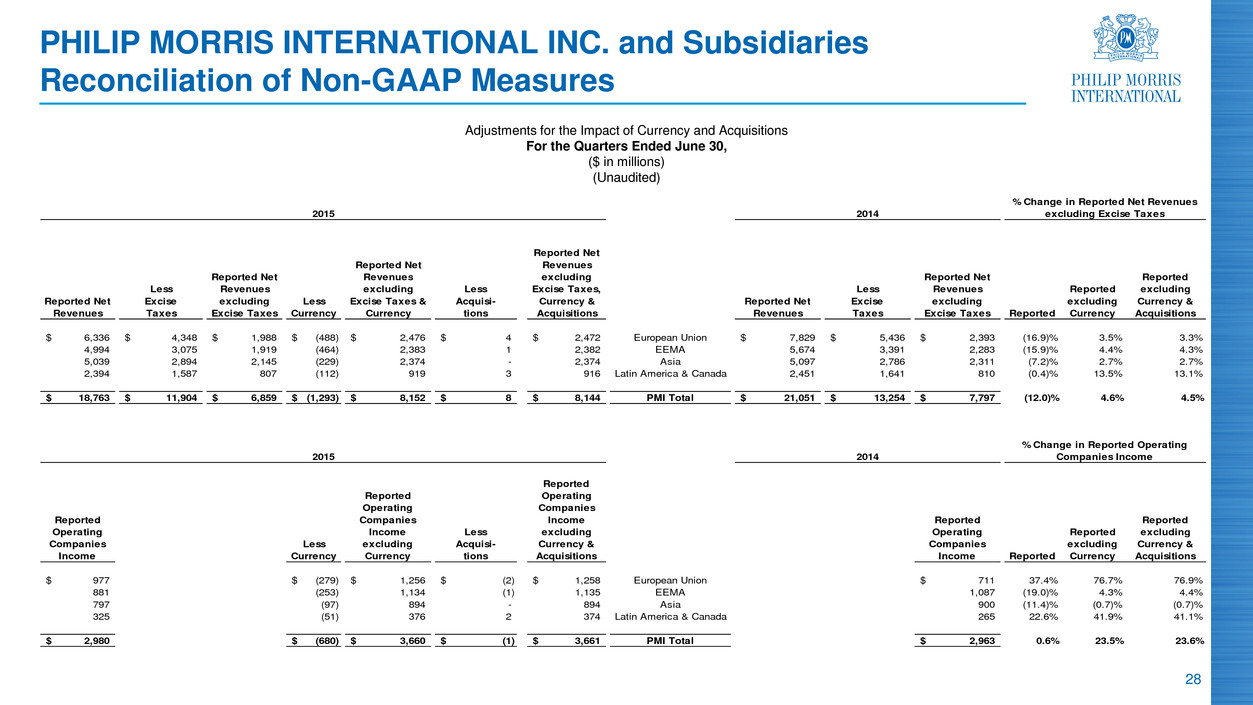

• | Reported net revenues, excluding excise taxes, of $6.9 billion, down by 12.0% |

• | Excluding unfavorable currency of $1.3 billion and the impact of acquisitions, reported net revenues, excluding excise taxes, up by 4.5% as detailed in the attached Schedule 10 |

• | Reported operating companies income of $3.0 billion, up by 0.6% |

• | Excluding unfavorable currency of $680 million and the impact of acquisitions, reported operating companies income up by 23.6% |

• | Adjusted operating companies income, reflecting the items detailed in the attached Schedule 11, of $3.0 billion, down by 13.7% |

• | Excluding unfavorable currency and the impact of acquisitions, adjusted operating companies income up by 6.1% |

• | Reported operating income of $2.9 billion, up by 0.6% |

2015 Six Months Year-to-Date

• | Reported diluted earnings per share of $2.37, up by $0.02 or 0.9% versus $2.35 in 2014 |

• | Excluding unfavorable currency of $0.64, reported diluted earnings per share up by $0.66 or 28.1% versus $2.35 in 2014 as detailed in the attached Schedule 17 |

• | Adjusted diluted earnings per share of $2.37, down by $0.23 or 8.8% versus $2.60 in 2014 |

• | Excluding unfavorable currency of $0.64, adjusted diluted earnings per share up by $0.41 or 15.8% versus $2.60 in 2014 as detailed in the attached Schedule 16 |

• | Cigarette shipment volume of 418.6 billion units, down by 0.1% excluding acquisitions |

• | Reported net revenues, excluding excise taxes, of $13.5 billion, down by 8.4% |

• | Excluding unfavorable currency of $2.2 billion and the impact of acquisitions, reported net revenues, excluding excise taxes, up by 6.6% as detailed in the attached Schedule 14 |

• | Reported operating companies income of $5.9 billion, down by 0.8% |

• | Excluding unfavorable currency of $1.3 billion and the impact of acquisitions, reported operating companies income up by 20.3% |

• | Adjusted operating companies income, reflecting the items detailed in the attached Schedule 15, of $5.9 billion, down by 8.6% |

• | Excluding unfavorable currency and the impact of acquisitions, adjusted operating companies income up by 10.9% |

• | Reported operating income of $5.8 billion, down by 1.1% |

2015 Full-Year Forecast

• | PMI reaffirms its 2015 full-year reported diluted earnings per share (“EPS”) forecast to be in a range of $4.32 to $4.42, at prevailing exchange rates, versus $4.76 in 2014. |

• | On an adjusted basis, diluted EPS are projected to increase in the range of 9% to 11% versus adjusted diluted EPS of $5.02 in 2014, as detailed in the attached Schedule 20, excluding an unfavorable currency impact, at prevailing exchange rates, of approximately $1.15 per share for the full-year 2015 |

• | PMI anticipates that its currency-neutral 2015 full-year adjusted diluted EPS growth rate will be towards the upper end of its projected range of 9% to 11% |

• | This forecast includes incremental spending versus 2014 for the deployment of PMI's Reduced-Risk Product, iQOS. The spending, which is skewed towards the second half of the year, will support plans for national expansion in Japan and Italy, as well as pilot or national launches in additional markets |

• | This forecast does not include any share repurchases in 2015 |

• | This forecast excludes the impact of any future acquisitions, unanticipated asset impairment and exit cost charges, future changes in currency exchange rates, any potential impact of Canadian tobacco litigation described in the section entitled "Litigation" in this press release, and any unusual events. Factors described in the Forward-Looking and Cautionary Statements section of this release represent continuing risks to these projections |

NEW YORK, July 16, 2015 -- Philip Morris International Inc. (NYSE / Euronext Paris: PM) today announced its 2015 second-quarter results.

"Our second-quarter results were very solid, further reinforcing our great start to the year," said André Calantzopoulos, Chief Executive Officer.

"Our organic volume trends, market share growth and robust pricing, exemplified by our flagship brand Marlboro, are driving excellent operational performance within an improving macroeconomic environment for our business."

"Based on this strong business momentum, we now anticipate we will be towards the upper end of our projected full-year, constant currency adjusted diluted EPS growth rate range of 9% to 11%."

"While currency headwinds remain stubbornly high, we are ever focused on the prudent management of cash flow. We are committed to returning around 100% of our free cash flow to shareholders."

Conference Call

A conference call, hosted by Jacek Olczak, Chief Financial Officer, with members of the investor community and news media, will be webcast at 9:00 a.m., Eastern Time, on July 16, 2015. Access is at www.pmi.com/webcasts.

The audio webcast may also be accessed on iOS or Android devices by downloading PMI’s free Investor Relations Mobile Application at www.pmi.com/irapp.

- -2 -

Dividends and Share Repurchase Program

During the quarter, PMI declared a regular quarterly dividend of $1.00, representing an annualized rate of $4.00 per common share. Since its spin-off in March 2008, PMI has increased its regular quarterly dividend by 117.4% from the initial annualized rate of $1.84 per common share. PMI did not make any share repurchases in the first six months of 2015.

Business Development

Dissolution of Joint Venture Agreement with Swedish Match AB

PMI announces today the dissolution of its exclusive joint venture agreement with Swedish Match AB (“SWMA”) to commercialize Swedish snus and other smoke-free tobacco products worldwide, outside of Scandinavia and the United States. The dissolution, mutually agreed with SWMA, means that both companies will now focus on independent strategies for the commercialization of these products and the trademarks and intellectual property licensed to the joint venture by the companies will revert to their original owners.

The two companies have concurrently entered into transitional agreements under which SWMA will contract manufacture snus products for PMI for certain markets, including Canada and Russia, and PMI will distribute Swedish Match’s brand General in Canada and Russia.

The dissolution of this agreement will not have a material impact on PMI’s consolidated results of operations, cash flows or financial position.

Extension of Strategic Framework with Altria Group, Inc.

PMI announces today the extension of its strategic framework with Altria Group, Inc. (“Altria”), signed in December 2013, to include a Joint Research, Development and Technology Sharing Agreement. The additional Agreement provides the framework under which PMI and Altria will collaborate to develop the next generation of e-vapor products for commercialization in the United States by Altria and in markets outside the United States by PMI. The collaboration between PMI and Altria in this endeavor is enabled by exclusive technology cross licenses and technical information sharing. The Joint Research, Development and Technology Sharing Agreement also provides for cooperation between PMI and Altria on scientific assessment, regulatory engagement and approval related to e-vapor products.

Under the existing strategic framework Agreements, Altria is making available its e-vapor products exclusively to PMI for commercialization outside the United States and PMI will make available two of its candidate reduced-risk tobacco products exclusively to Altria for commercialization in the United States. It is envisaged that PMI’s candidate products would be regulated in the United States as Modified Risk Tobacco Products (“MRTPs”) and any commercialization would be subject to U.S. Food and Drug Administration (“FDA”) authorization. As previously announced, PMI expects to apply to the FDA during the course of 2016 for one of these two candidate reduced-risk products, its heat-not-burn iQOS product, to be approved as an MRTP.

Litigation

As of the date of this press release, the Québec Court of Appeal has yet to issue its decision regarding a motion, heard by the court on July 9, 2015, to cancel the order of the Superior Court of the District of Montréal, issued on May 27, 2015, that PMI’s Canadian affiliate, Rothmans, Benson & Hedges Inc. (“RBH”), pay an initial deposit of approximately CAD 246 million into a trust account pending the merits appeal of the Québec class actions judgment.

- -3 -

The trial court had ordered, as part of its judgment, that RBH and the other defendants make initial deposits of a portion of the damages award within 60 days.

Should the Court of Appeal deny the motion for cancellation of the order, PMI expects to incur a pre-tax charge of approximately CAD 246 million (approximately $199 million), or an after-tax charge of $0.09 per share. Depending on developments, this charge would likely be recorded as tobacco litigation-related expenses in the second quarter of 2015. Given that the Court of Appeal's decision has yet to be issued, the Schedules to this press release do not reflect any such charge. In the event of a denial of the motion for cancellation by the court, revised Schedules and any other relevant information will be furnished promptly in a filing with the U.S. Securities and Exchange Commission, to the extent relevant.

The cases are Cécilia Létourneau v. JTI-Macdonald Corp., Imperial Tobacco Canada Ltd., Rothmans, Benson & Hedges Inc., and Conseil Québécois sur le Tabac et la Santé and Jean-Yves Blais v. JTI-Macdonald Corp., Imperial Tobacco Canada Ltd., Rothmans, Benson & Hedges Inc. (Superior Court of the District of Montréal, Province of Québec).

Productivity and Cost Savings Program

In 2015, PMI's productivity and cost savings initiatives will include, but are not limited to, the continued enhancement of production processes, the harmonization of tobacco blends, the streamlining of product specifications and number of brand variants, supply chain improvements and overall spending efficiency across the company. PMI anticipates that these initiatives, combined with savings associated with the manufacturing footprint restructuring implemented in 2014, notably in Australia and the Netherlands, should result in a total company cost base increase, excluding RRPs and currency, of approximately 1%.

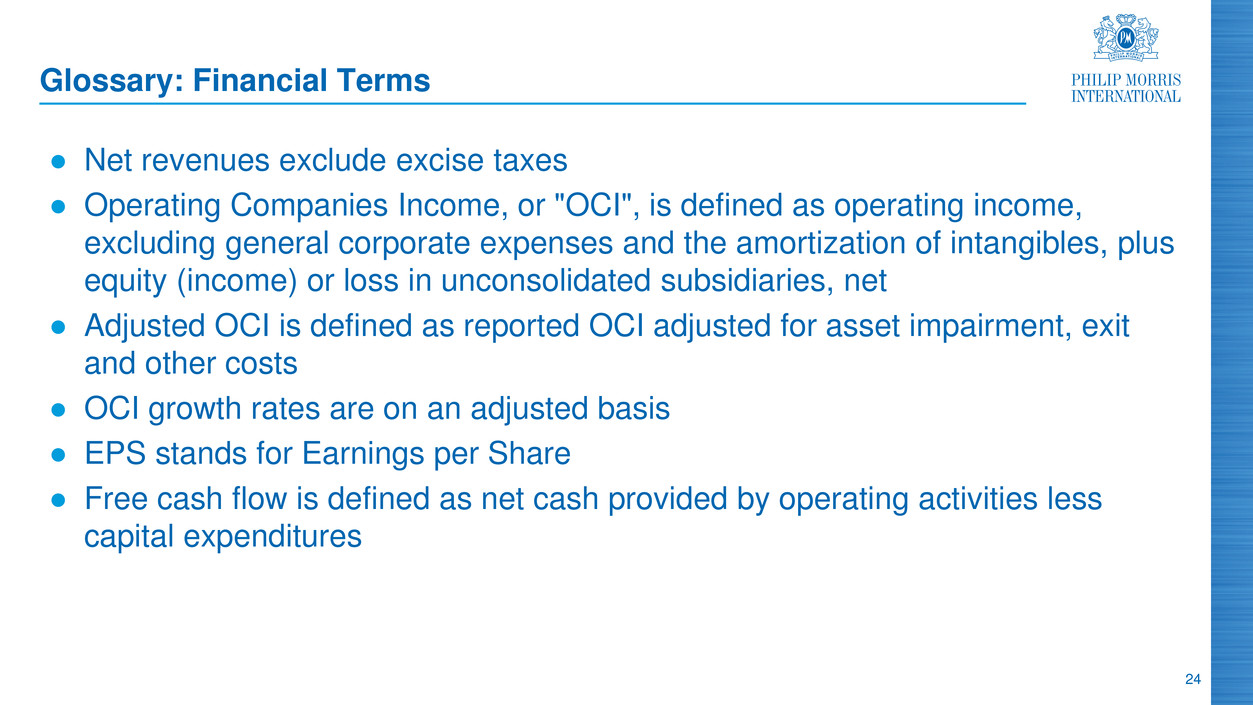

2015 SECOND-QUARTER CONSOLIDATED RESULTS

In this press release, “PMI” refers to Philip Morris International Inc. and its subsidiaries. References to total international cigarette market, defined as worldwide cigarette volume excluding the United States, total cigarette market, total market and market shares are PMI tax-paid estimates based on the latest available data from a number of internal and external sources and may, in defined instances, exclude the People's Republic of China and/or PMI's duty free business. North Africa is defined as Algeria, Egypt, Libya, Morocco and Tunisia. "OTP" is defined as other tobacco products. "EEMA" is defined as Eastern Europe, Middle East and Africa and includes PMI's international duty free business. The term “net revenues” refers to operating revenues from the sale of our products, excluding excise taxes and net of sales and promotion incentives. Operating companies income, or “OCI,” is defined as operating income, excluding general corporate expenses and the amortization of intangibles, plus equity (income)/loss in unconsolidated subsidiaries, net. PMI's management evaluates business segment performance and allocates resources based on OCI. “Adjusted EBITDA” is defined as earnings before interest, taxes, depreciation and amortization, excluding asset impairment and exit costs, discrete tax items and unusual items. Management also reviews OCI, OCI margins and earnings per share, or “EPS,” on an adjusted basis (which may exclude the impact of currency and other items such as acquisitions, asset impairment and exit costs, discrete tax items and unusual items), as well as free cash flow, defined as net cash provided by operating activities less capital expenditures, and net debt. PMI believes it is appropriate to disclose these measures as they improve comparability and help investors analyze business performance and trends. Non-GAAP measures used in this release should be neither considered in isolation nor as a substitute for the financial measures prepared in accordance with U.S. GAAP. Comparisons are to the same prior-year period unless otherwise stated. For a reconciliation of non-GAAP measures to corresponding GAAP measures, see the relevant schedules provided with this press release. Reduced-Risk Products (“RRPs”) is the term the company uses to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes. PMI’s RRPs are in various stages of development and commercialization, and we are conducting extensive and rigorous scientific studies to determine whether we can support claims for such products of reduced exposure to harmful and potentially harmful constituents in smoke, and ultimately claims of reduced disease risk, when compared to smoking combustible cigarettes. Before making any such claims, we will rigorously evaluate the full set of data from the relevant scientific studies to determine whether they substantiate reduced exposure or risk. Any such claims may also be subject to government review and approval, as is the case in the United States today. Trademarks

- -4 -

and service marks in this press release that are the registered property of, or licensed by, the subsidiaries of PMI, are italicized.

NET REVENUES

PMI Net Revenues | Second-Quarter | Six Months Year-to-Date | |||||||||||||||||||||

(in millions) | Excl. | Excl. | |||||||||||||||||||||

2015 | 2014 | Change | Curr. | 2015 | 2014 | Change | Curr. | ||||||||||||||||

European Union | $ | 1,988 | $ | 2,393 | (16.9 | )% | 3.5 | % | $ | 3,880 | $ | 4,406 | (11.9 | )% | 5.4 | % | |||||||

EEMA | 1,919 | 2,283 | (15.9 | )% | 4.4 | % | 3,762 | 4,292 | (12.3 | )% | 8.8 | % | |||||||||||

Asia | 2,145 | 2,311 | (7.2 | )% | 2.7 | % | 4,300 | 4,493 | (4.3 | )% | 3.7 | % | |||||||||||

Latin America & Canada | 807 | 810 | (0.4 | )% | 13.5 | % | 1,533 | 1,523 | 0.7 | % | 13.8 | % | |||||||||||

Total PMI | $ | 6,859 | $ | 7,797 | (12.0 | )% | 4.6 | % | $ | 13,475 | $ | 14,714 | (8.4 | )% | 6.7 | % | |||||||

In the quarter, net revenues of $6.9 billion were down by 12.0%. Excluding unfavorable currency of $1.3 billion, net revenues increased by 4.6%, or by 4.5% excluding currency and the impact of acquisitions, driven by favorable pricing of $514 million from across all Regions, led: in the EU, by Germany and Italy; in EEMA, by Russia and Ukraine; in Asia, by Australia, Indonesia and Korea, principally driven by a gain from inventories built ahead of the announced excise tax increase effective January 2015; and in Latin America & Canada, by Argentina, Brazil, Canada and Mexico. The favorable pricing was partly offset by unfavorable volume/mix of $167 million from across all Regions.

OPERATING COMPANIES INCOME

PMI OCI | Second-Quarter | Six Months Year-to-Date | |||||||||||||||||||||

(in millions) | Excl. | Excl. | |||||||||||||||||||||

2015 | 2014 | Change | Curr. | 2015 | 2014 | Change | Curr. | ||||||||||||||||

European Union | $ | 977 | $ | 711 | 37.4 | % | 76.7 | % | $ | 1,890 | $ | 1,689 | 11.9 | % | 39.7 | % | |||||||

EEMA | 881 | 1,087 | (19.0 | )% | 4.3 | % | 1,761 | 2,014 | (12.6 | )% | 13.5 | % | |||||||||||

Asia | 797 | 900 | (11.4 | )% | (0.7 | )% | 1,731 | 1,815 | (4.6 | )% | 5.1 | % | |||||||||||

Latin America & Canada | 325 | 265 | 22.6 | % | 41.9 | % | 555 | 467 | 18.8 | % | 39.2 | % | |||||||||||

Total PMI | $ | 2,980 | $ | 2,963 | 0.6 | % | 23.5 | % | $ | 5,937 | $ | 5,985 | (0.8 | )% | 20.3 | % | |||||||

In the quarter, reported operating companies income of $3.0 billion was up by 0.6%. Excluding unfavorable currency of $680 million and the impact of acquisitions, operating companies income increased by 23.6%, reflecting: favorable pricing and a favorable asset impairment and exit cost comparison with the second quarter of 2014 of $489 million related to the discontinuation of cigarette production in the Netherlands and the factory closure in Australia; partly offset by unfavorable volume/mix of $171 million, and higher costs in EEMA, and Asia, mainly associated with the realignment of production from hand-rolled to machine-made kretek cigarettes in Indonesia.

Adjusted operating companies income is shown in the table below and detailed in Schedule 11. Adjusted operating companies income margin, excluding currency and acquisitions, increased by 0.7 points to 45.0%, as detailed in Schedule 11, reflecting the factors mentioned above.

- -5 -

PMI OCI | Second-Quarter | Six Months Year-to-Date | |||||||||||||||||||||

(in millions) | Excl. | Excl. | |||||||||||||||||||||

2015 | 2014 | Change | Curr. | 2015 | 2014 | Change | Curr. | ||||||||||||||||

Reported OCI | $ | 2,980 | $ | 2,963 | 0.6 | % | 23.5 | % | $ | 5,937 | $ | 5,985 | (0.8 | )% | 20.3 | % | |||||||

Asset impairment & exit costs | — | (489 | ) | — | (512 | ) | |||||||||||||||||

Adjusted OCI | $ | 2,980 | $ | 3,452 | (13.7 | )% | 6.0 | % | $ | 5,937 | $ | 6,497 | (8.6 | )% | 10.9 | % | |||||||

Adjusted OCI Margin* | 43.4 | % | 44.3 | % | (0.9 | ) | 0.6 | 44.1 | % | 44.2 | % | (0.1 | ) | 1.7 | |||||||||

*Margins are calculated as adjusted OCI, divided by net revenues, excluding excise taxes. | |||||||||||||||||||||||

SHIPMENT VOLUME & MARKET SHARE

PMI cigarette shipment volume by Region is shown in the table below.

PMI Cigarette Shipment Volume by Region | Second-Quarter | Six Months Year-to-Date | |||||||||||||

(million units) | |||||||||||||||

2015 | 2014 | Change | 2015 | 2014 | Change | ||||||||||

European Union | 48,159 | 49,913 | (3.5 | )% | 90,880 | 91,618 | (0.8 | )% | |||||||

EEMA | 73,829 | 74,170 | (0.5 | )% | 138,550 | 136,176 | 1.7 | % | |||||||

Asia | 75,256 | 75,653 | (0.5 | )% | 145,381 | 146,454 | (0.7 | )% | |||||||

Latin America & Canada | 22,589 | 23,065 | (2.1 | )% | 43,779 | 44,514 | (1.7 | )% | |||||||

Total PMI | 219,833 | 222,801 | (1.3 | )% | 418,590 | 418,762 | — | % | |||||||

- -6 -

2015 Second-Quarter and Six Months Year-to-Date

In the quarter, PMI's cigarette shipment volume decreased by 1.3%, or by 1.4% excluding acquisitions. The decline was principally due to the EU, mainly Italy. Estimated net inventory movements in the quarter were favorable, driven mainly by Japan, reflecting a positive comparison with the second quarter of 2014 that was impacted by retail trade inventory reductions following the consumption tax-driven retail price increases of April 1, 2014. Excluding these inventory movements, PMI's total cigarette shipment volume decreased by 1.6%.

PMI cigarette shipment volume by brand is shown in the table below.

PMI Cigarette Shipment Volume by Brand | Second-Quarter | Six Months Year-to-Date | |||||||||||||

(million units) | |||||||||||||||

2015 | 2014 | Change | 2015 | 2014 | Change | ||||||||||

Marlboro | 72,322 | 73,151 | (1.1 | )% | 139,569 | 139,032 | 0.4 | % | |||||||

L&M | 24,546 | 24,201 | 1.4 | % | 47,224 | 45,154 | 4.6 | % | |||||||

Parliament | 11,514 | 12,394 | (7.1 | )% | 21,084 | 22,307 | (5.5 | )% | |||||||

Bond Street | 11,777 | 11,137 | 5.8 | % | 20,957 | 20,415 | 2.7 | % | |||||||

Chesterfield | 10,611 | 11,797 | (10.1 | )% | 20,151 | 20,583 | (2.1 | )% | |||||||

Philip Morris | 8,831 | 7,779 | 13.5 | % | 16,593 | 15,808 | 5.0 | % | |||||||

Lark | 8,270 | 6,879 | 20.2 | % | 14,714 | 13,706 | 7.4 | % | |||||||

Others | 71,962 | 75,463 | (4.6 | )% | 138,298 | 141,757 | (2.4 | )% | |||||||

Total PMI | 219,833 | 222,801 | (1.3 | )% | 418,590 | 418,762 | — | % | |||||||

In the quarter, the decrease in cigarette shipment volume of Marlboro reflected declines in: the EU, notably Italy and the United Kingdom, partly offset by France and Spain; EEMA, notably North Africa and Ukraine, partly offset by Saudi Arabia and Turkey; and Latin America & Canada, mainly Argentina, Brazil and Mexico. Cigarette shipment volume of Marlboro increased in Asia, driven by the Philippines and Vietnam, partly offset by Indonesia and Japan.

The increase in cigarette shipment volume of L&M was driven by growth in EEMA, notably Egypt, Turkey and Ukraine, partly offset by a decline in the EU, mainly Spain, and in Asia, mainly Thailand. The decrease in cigarette shipment volume of Parliament was primarily due to Japan, Korea and Ukraine. The increase in cigarette shipment volume of Bond Street was predominantly driven by Australia and Russia, partly offset by Kazakhstan and Ukraine. The decrease in cigarette shipment volume of Chesterfield was primarily due to the EU, mainly Italy and Spain, and EEMA, mainly Russia, Turkey and Ukraine. The increase in cigarette shipment volume of Philip Morris primarily reflects the morphing from Diana in Italy. The increase in cigarette shipment volume of Lark was predominantly driven by Japan, benefiting from trade inventory movements, partly offset by Korea and Turkey.

Total shipment volume of OTP, in cigarette equivalent units, increased by 3.3%. Total shipment volume for cigarettes and OTP, in cigarette equivalent units, decreased by 1.2%, excluding acquisitions.

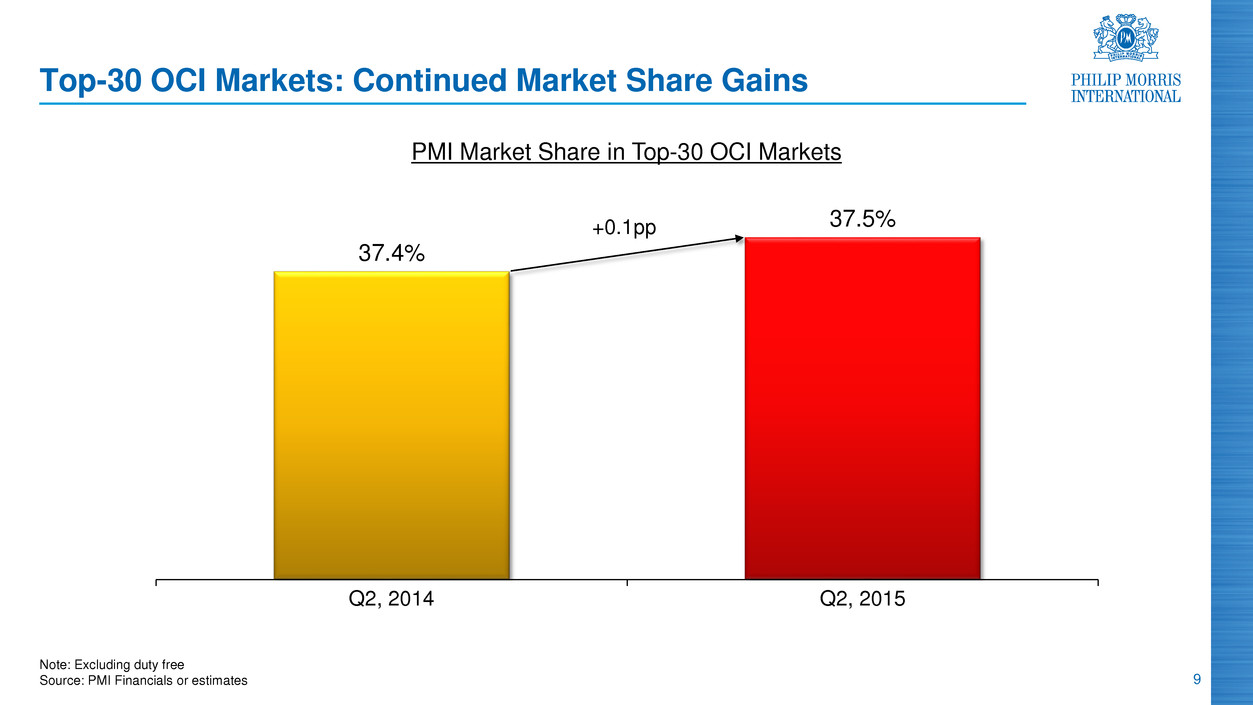

PMI's cigarette market share increased in a number of key markets, including Algeria, Argentina, Austria, Belgium, Brazil, Egypt, France, Germany, Hong Kong, Indonesia, Korea, Russia, Saudi Arabia, Singapore, Spain and Switzerland.

- -7 -

Year-to-date, PMI's cigarette shipment volume was flat, or down by 0.1% excluding acquisitions, with growth in EEMA, driven principally by Russia and Saudi Arabia, offset by declines in: the EU, mainly Italy; Asia, largely due to Korea and the Philippines, partly offset by Indonesia; and Latin America & Canada, mainly due to Argentina. Estimated net inventory movements year-to-date were favorable, driven mainly by Japan. Excluding these inventory movements, PMI's total cigarette shipment volume decreased by 1.0%.

Year-to-date, the increase in cigarette shipment volume of Marlboro reflected growth in: the EU, notably France and Spain, partly offset by Italy; and EEMA, notably Turkey and Saudi Arabia, partly offset by Egypt and Ukraine. Cigarette shipment volume of Marlboro decreased in: Asia, mainly due to Japan and Korea, partly offset by the Philippines; and Latin America & Canada, mainly due to Argentina.

The increase in cigarette shipment volume of L&M was driven by growth in EEMA, notably Egypt, Turkey and Ukraine, partly offset by a decline in the EU, mainly Spain. The decrease in cigarette shipment volume of Parliament was primarily due to Japan, Korea and Ukraine, partly offset by Turkey. The increase in cigarette shipment volume of Bond Street was predominantly driven by Australia and Russia, partly offset by Kazakhstan and Ukraine. The decrease in cigarette shipment volume of Chesterfield was primarily due to EEMA, mainly Russia, Turkey and Ukraine, partly offset by the EU, mainly Italy. The increase in cigarette shipment volume of Philip Morris primarily reflects the morphing from Diana in Italy, partly offset by the morphing to Lark in Japan. The increase in cigarette shipment volume of Lark was predominantly driven by Japan, benefiting from trade inventory movements, partly offset by Korea and Turkey.

Total shipment volume of OTP, in cigarette equivalent units, increased by 2.7%. Total shipment volume for cigarettes and OTP, in cigarette equivalent units, was flat, excluding acquisitions.

PMI's cigarette market share increased in a number of key markets, including Algeria, Argentina, Austria, Belgium, Brazil, Egypt, France, Germany, Hong Kong, Indonesia, Korea, Poland, Russia, Saudi Arabia, Singapore, Spain and Switzerland.

EUROPEAN UNION REGION (EU)

2015 Second-Quarter

Reported net revenues of $2.0 billion decreased by 16.9%. Excluding unfavorable currency of $488 million, net revenues increased by 3.5%, or by 3.3% excluding currency and the impact of acquisitions, reflecting favorable pricing of $139 million across the Region, notably in Germany and Italy, partly offset by unfavorable volume/mix of $60 million, mainly due to unfavorable inventory movements and lower market share in Italy and a lower total market and market share in the United Kingdom.

Reported operating companies income of $977 million increased by 37.4%. Excluding unfavorable currency of $279 million and the impact of acquisitions, operating companies income increased by 76.9%, reflecting higher pricing and a favorable asset impairment and exit cost comparison with the second quarter of 2014 of $488 million related to the discontinuation of cigarette production in the Netherlands, partly offset by unfavorable volume/mix of $53 million.

Adjusted operating companies income is shown in the table below and detailed on Schedule 11. Adjusted operating companies income margin, excluding unfavorable currency and the impact of acquisitions, increased by 0.8 points to 50.9%, as detailed in Schedule 11, reflecting the factors mentioned above.

- -8 -

EU OCI | Second-Quarter | Six Months Year-to-Date | |||||||||||||||||||||

(in millions) | Excl. | Excl. | |||||||||||||||||||||

2015 | 2014 | Change | Curr. | 2015 | 2014 | Change | Curr. | ||||||||||||||||

Reported OCI | $ | 977 | $ | 711 | 37.4 | % | 76.7 | % | $ | 1,890 | $ | 1,689 | 11.9 | % | 39.7 | % | |||||||

Asset impairment & exit costs | — | (488 | ) | — | (488 | ) | |||||||||||||||||

Adjusted OCI | $ | 977 | $ | 1,199 | (18.5 | )% | 4.8 | % | $ | 1,890 | $ | 2,177 | (13.2 | )% | 8.4 | % | |||||||

Adjusted OCI Margin* | 49.1 | % | 50.1 | % | (1.0 | ) | 0.6 | 48.7 | % | 49.4 | % | (0.7 | ) | 1.4 | |||||||||

*Margins are calculated as adjusted OCI, divided by net revenues, excluding excise taxes. | |||||||||||||||||||||||

2015 Second-Quarter and Six Months Year-to-Date

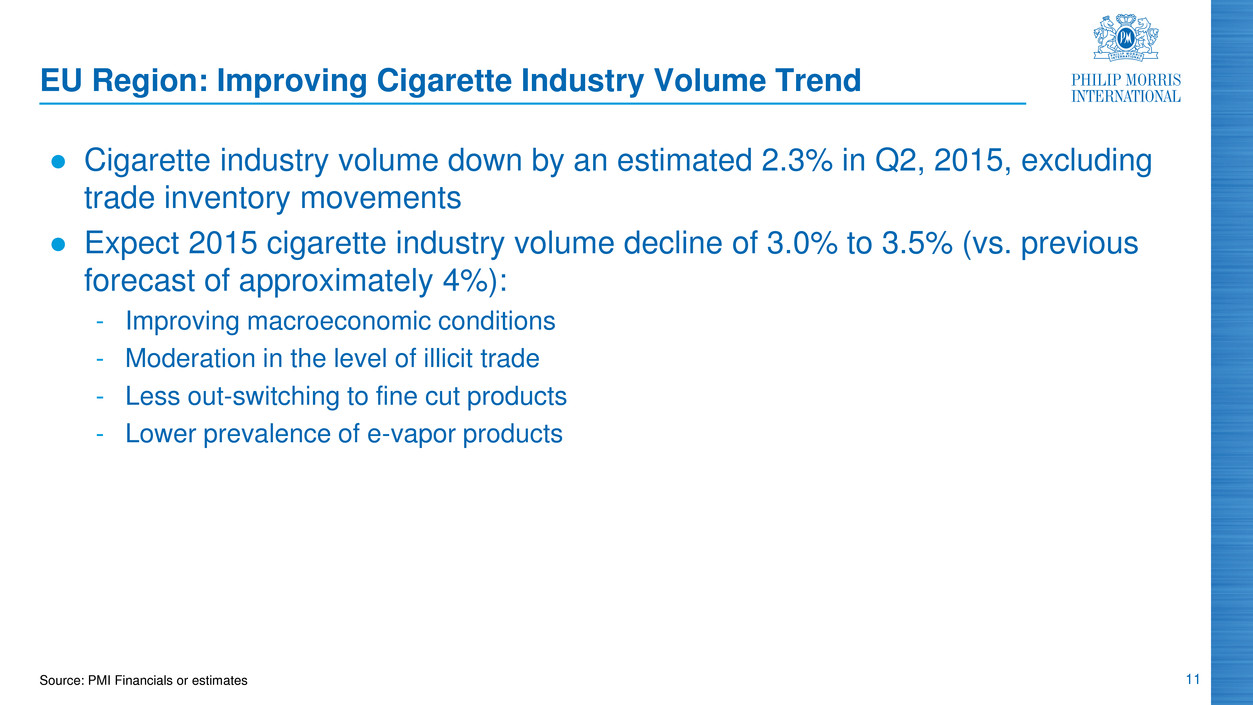

The total cigarette market in the EU of 117.1 billion units decreased by 3.0% in the quarter and by 2.3% to 221.8 billion units year-to-date. Excluding the impact of estimated trade inventory movements, the total cigarette market declined by 2.3% in the quarter and by 2.5% year-to-date, reflecting, in certain key geographies, improving economies, a moderation in the level of illicit trade, lower out-switching to the fine cut category and a lower prevalence of e-vapor products. In 2015, the total cigarette market in the EU is now forecast to decrease by approximately 3.0% to 3.5%.

The total OTP market in the EU in the quarter of 41.5 billion cigarette equivalent units decreased by 0.5%, reflecting a lower total fine cut market, down by 0.1% to 36.2 billion cigarette equivalent units. Year-to-date, the total OTP market in the EU of 79.2 billion cigarette equivalent units decreased by 1.1%, reflecting a lower total fine cut market, down by 1.0% to 69.2 billion cigarette equivalent units.

Cigarette shipment volume and market share performance by brand are shown in the tables below.

EU Cigarette Shipment Volume by Brand | Second-Quarter | Six Months Year-to-Date | |||||||||||||

(in millions) | |||||||||||||||

2015 | 2014 | Change | 2015 | 2014 | Change | ||||||||||

Marlboro | 23,554 | 23,913 | (1.5 | )% | 44,346 | 44,144 | 0.5 | % | |||||||

L&M | 8,528 | 8,717 | (2.2 | )% | 15,926 | 16,122 | (1.2 | )% | |||||||

Chesterfield | 6,905 | 7,501 | (7.9 | )% | 13,210 | 12,908 | 2.3 | % | |||||||

Philip Morris | 3,634 | 2,590 | 40.3 | % | 6,016 | 4,941 | 21.8 | % | |||||||

Others | 5,538 | 7,192 | (23.0 | )% | 11,382 | 13,503 | (15.7 | )% | |||||||

Total EU | 48,159 | 49,913 | (3.5 | )% | 90,880 | 91,618 | (0.8 | )% | |||||||

EU Cigarette Market Shares by Brand | Second-Quarter | Six Months Year-to-Date | ||||||||||||||

Change | Change | |||||||||||||||

2015 | 2014 | p.p. | 2015 | 2014 | p.p. | |||||||||||

Marlboro | 19.6 | % | 19.4 | % | 0.2 | 19.4 | % | 19.3 | % | 0.1 | ||||||

L&M | 7.3 | % | 7.2 | % | 0.1 | 7.2 | % | 7.1 | % | 0.1 | ||||||

Chesterfield | 5.8 | % | 5.7 | % | 0.1 | 5.8 | % | 5.4 | % | 0.4 | ||||||

Philip Morris | 2.5 | % | 2.2 | % | 0.3 | 2.4 | % | 2.1 | % | 0.3 | ||||||

Others | 5.2 | % | 5.9 | % | (0.7 | ) | 5.2 | % | 5.9 | % | (0.7 | ) | ||||

Total EU | 40.4 | % | 40.4 | % | — | 40.0 | % | 39.8 | % | 0.2 | ||||||

In the quarter, PMI's cigarette shipment volume of 48.2 billion units decreased by 3.5%, or by 2.9% excluding inventory movements, mainly due to Italy and Spain, partly offset by France. Market share was flat at 40.4%, with gains, mainly in France, Germany and Spain, mainly offset by Italy.

- -9 -

In the quarter, PMI's shipments of OTP of 6.1 billion cigarette equivalent units increased by 3.6%, driven principally by higher market share. PMI's total OTP market share increased by 0.2 points to 14.5%, reflecting a gain in the fine cut category.

Year-to-date, PMI's cigarette shipment volume of 90.9 billion units decreased by 0.8%, or by 1.4% excluding inventory movements, notably due to Italy, partly offset by France and Spain. Market share increased by 0.2 points to 40.0%, driven notably by France, Germany and Spain, partly offset by the United Kingdom.

Year-to-date, PMI's shipments of OTP of 11.6 billion cigarette equivalent units increased by 3.7%, driven principally by higher market share. PMI's total OTP market share increased by 0.2 points to 14.4%, reflecting a slight gain in the fine cut category.

EU Key Market Commentaries

In France, industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

France Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 11.8 | 11.8 | 0.1 | % | 22.4 | 22.3 | 0.3 | % | |||||||||

PMI Shipments (million units) | 5,126 | 4,816 | 6.4 | % | 9,704 | 9,378 | 3.5 | % | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 25.9 | % | 25.5 | % | 0.4 | 25.7 | % | 25.3 | % | 0.4 | |||||||

Philip Morris | 9.6 | % | 9.4 | % | 0.2 | 9.6 | % | 9.4 | % | 0.2 | |||||||

Chesterfield | 3.3 | % | 3.4 | % | (0.1 | ) | 3.3 | % | 3.4 | % | (0.1 | ) | |||||

Others | 3.0 | % | 3.1 | % | (0.1 | ) | 2.9 | % | 3.1 | % | (0.2 | ) | |||||

Total | 41.8 | % | 41.4 | % | 0.4 | 41.5 | % | 41.2 | % | 0.3 | |||||||

In the quarter, the total cigarette market was essentially flat, reflecting its general recovery since the second half of 2014 and a lower prevalence of e-vapor products. Excluding the net impact of inventory movements, PMI's cigarette shipment volume increased by 0.9%, reflecting market share growth, notably of premium brands Marlboro and Philip Morris. The total industry fine cut category of 3.7 billion cigarette equivalent units increased by 7.2%. PMI's market share of the category decreased by 1.6 points to 25.0%.

Year-to-date, the increase in the total cigarette market reflected the same dynamics as in the quarter. Excluding the net impact of inventory movements, PMI's cigarette shipment volume increased by 1.2%, reflecting market share growth, notably of premium brands Marlboro and Philip Morris. The total industry fine cut category of 7.0 billion cigarette equivalent units increased by 6.2%. PMI's market share of the category decreased by 1.3 points to 25.0%.

- -10 -

In Germany, industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

Germany Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 19.9 | 20.9 | (5.0 | )% | 38.0 | 39.1 | (2.7 | )% | |||||||||

PMI Shipments (million units) | 7,756 | 7,732 | 0.3 | % | 14,501 | 14,440 | 0.4 | % | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 23.0 | % | 21.8 | % | 1.2 | 22.5 | % | 21.9 | % | 0.6 | |||||||

L&M | 12.7 | % | 11.9 | % | 0.8 | 12.5 | % | 11.8 | % | 0.7 | |||||||

Chesterfield | 1.8 | % | 1.7 | % | 0.1 | 1.7 | % | 1.7 | % | — | |||||||

Others | 1.5 | % | 1.5 | % | — | 1.4 | % | 1.5 | % | (0.1 | ) | ||||||

Total | 39.0 | % | 36.9 | % | 2.1 | 38.1 | % | 36.9 | % | 1.2 | |||||||

In the quarter, the decline of the total cigarette market was mainly due to unfavorable trade inventory movements. Excluding these inventory movements, the total cigarette market declined by 2.2%, mainly due to the annualized impact of price increases in the third quarter of 2014, partly offset by a lower prevalence of illicit trade. The increase in PMI's market share was driven by Marlboro, mainly reflecting the positive impact of the new 2.0 Architecture, and L&M, benefiting from a rounded retail price point of €5.00 per pack. While the total industry fine cut category of 10.2 billion cigarette equivalent units decreased by 2.2%, PMI's market share of the category increased by 0.4 points to 13.4%.

Year-to-date, the decline of the total cigarette market was partly due to unfavorable trade inventory movements. Excluding these inventory movements, the total cigarette market declined by 2.1%, reflecting the same dynamics as in the quarter. The increase in PMI's market share was driven by the same factors as in the quarter. While the total industry fine cut category of 19.7 billion cigarette equivalent units decreased by 2.9%, PMI's market share of the category was flat at 13.0%.

- -11 -

In Italy, industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

Italy Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 18.9 | 19.2 | (1.6 | )% | 35.4 | 36.0 | (1.7 | )% | |||||||||

PMI Shipments (million units) | 10,564 | 11,402 | (7.3 | )% | 20,214 | 20,469 | (1.2 | )% | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 24.1 | % | 25.0 | % | (0.9 | ) | 24.2 | % | 25.3 | % | (1.1 | ) | |||||

Chesterfield | 10.8 | % | 10.0 | % | 0.8 | 10.7 | % | 7.7 | % | 3.0 | |||||||

Diana | 6.2 | % | 8.5 | % | (2.3 | ) | 6.9 | % | 9.2 | % | (2.3 | ) | |||||

Others | 12.7 | % | 11.8 | % | 0.9 | 12.1 | % | 12.0 | % | 0.1 | |||||||

Total | 53.8 | % | 55.3 | % | (1.5 | ) | 53.9 | % | 54.2 | % | (0.3 | ) | |||||

In the quarter and year-to-date, the decline in the total cigarette market was mainly due to the tax-driven price increases in January 2015 and out-switching to less expensive other tobacco product categories, particularly fine cut, partly offset by a lower prevalence of illicit trade and e-vapor products. Excluding the net impact of inventory movements, PMI's cigarette shipment volume decreased by 4.0% in the quarter and by 2.2% year-to-date, reflecting market share loss, notably of Marlboro, largely due to its price increase in the first quarter of 2015 to €5.20 per pack from its round retail price point of €5.00 per pack, and low-price Diana, which is currently being morphed into Philip Morris, and which had been impacted by the growth of the super-low price segment, partly offset by Chesterfield, reflecting the annualized impact of the brand's repositioning into the super-low price segment. In the quarter, the total industry fine cut category of 1.6 billion cigarette equivalent units increased by 6.2%. PMI's market share of the category decreased by 0.9 points to 41.3%. Year-to-date, the total industry fine cut category of 3.1 billion cigarette equivalent units increased by 5.2%. PMI's market share of the category decreased by 0.3 points to 41.4%.

In Poland, industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

Poland Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 10.6 | 11.1 | (4.7 | )% | 20.3 | 21.6 | (5.7 | )% | |||||||||

PMI Shipments (million units) | 4,266 | 4,489 | (5.0 | )% | 8,023 | 8,159 | (1.7 | )% | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 11.4 | % | 10.9 | % | 0.5 | 11.0 | % | 10.6 | % | 0.4 | |||||||

L&M | 17.9 | % | 17.8 | % | 0.1 | 17.7 | % | 17.1 | % | 0.6 | |||||||

Chesterfield | 8.6 | % | 7.9 | % | 0.7 | 8.3 | % | 7.5 | % | 0.8 | |||||||

Others | 2.4 | % | 3.8 | % | (1.4 | ) | 2.4 | % | 3.6 | % | (1.2 | ) | |||||

Total | 40.3 | % | 40.4 | % | (0.1 | ) | 39.4 | % | 38.8 | % | 0.6 | ||||||

- -12 -

In the quarter and year-to-date, the decline in the total cigarette market was mainly due the prevalence of e-vapor products, illicit trade and non-duty paid OTP products. While PMI's cigarette shipment volume in the quarter and year-to-date decreased, reflecting a lower total market, market share was essentially flat in the quarter, and up by 0.6 points year-to-date, with declines from super-low price brands Red & White and RGD offset by Marlboro, partly reflecting the positive impact of the new 2.0 Architecture, L&M, driven by new product launches, and Chesterfield, partly driven by its round corner box super-slims variants. In the quarter, the total industry fine cut category of 1.0 billion cigarette equivalent units increased by 12.7%. PMI's market share of the category decreased by 2.2 points to 33.1%. Year-to-date, the total industry fine cut category of 2.0 billion cigarette equivalent units increased by 5.1%. PMI's market share of the category decreased by 1.7 points to 33.4%.

In Spain, industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

Spain Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 11.8 | 12.3 | (4.1 | )% | 22.3 | 22.8 | (2.4 | )% | |||||||||

PMI Shipments (million units) | 4,121 | 4,337 | (5.0 | )% | 7,688 | 7,524 | 2.2 | % | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 16.8 | % | 15.8 | % | 1.0 | 16.4 | % | 15.5 | % | 0.9 | |||||||

Chesterfield | 9.1 | % | 9.2 | % | (0.1 | ) | 9.3 | % | 9.3 | % | — | ||||||

L&M | 5.9 | % | 6.1 | % | (0.2 | ) | 5.9 | % | 6.2 | % | (0.3 | ) | |||||

Others | 1.4 | % | 0.9 | % | 0.5 | 1.4 | % | 0.7 | % | 0.7 | |||||||

Total | 33.2 | % | 32.0 | % | 1.2 | 33.0 | % | 31.7 | % | 1.3 | |||||||

In the quarter and year-to-date, the decline of the total cigarette market was mainly due to unfavorable trade inventory movements. Excluding these inventory movements, the total cigarette market declined by 0.5% in the quarter and by 1.0% year-to-date, mainly due to the impact of price increases in the second half of 2014 and the first quarter of 2015, partly offset by an improving economy, a lower prevalence of illicit trade and e-vapor products, and in-switching from fine cut. Excluding inventory movements, PMI's cigarette shipment volume decreased by 0.4% in the quarter and increased by 1.6% year-to-date. The increase in PMI's market share in the quarter and year-to-date was driven mainly by Marlboro, benefiting from a round price point in the vending channel, the new 2.0 Architecture, and an improving economy. In the quarter, the total industry fine cut category of 2.5 billion cigarette equivalent units decreased by 2.2%. PMI's market share of the fine cut category decreased by 1.2 points to 13.5%. Year-to-date, the total industry fine cut category of 4.7 billion cigarette equivalent units decreased by 1.5%. PMI's market share of the fine cut category decreased by 1.3 points to 13.9%.

- -13 -

EASTERN EUROPE, MIDDLE EAST & AFRICA REGION (EEMA)

2015 Second-Quarter

Reported net revenues of $1.9 billion decreased by 15.9%. Excluding unfavorable currency of $464 million and the impact of acquisitions, net revenues increased by 4.3%, reflecting favorable pricing of $142 million, driven principally by Russia and Ukraine, partly offset by unfavorable volume/mix of $43 million, mainly due to Kazakhstan and Ukraine.

Reported operating companies income of $881 million decreased by 19.0%. Excluding unfavorable currency of $253 million and the impact of acquisitions, operating companies income increased by 4.4%, driven primarily by higher pricing, partly offset by unfavorable volume/mix of $39 million.

Adjusted operating companies income is shown in the table below and detailed on Schedule 11. Adjusted operating companies income margin, excluding unfavorable currency and the impact of acquisitions, was flat at 47.6%, as detailed on Schedule 11, reflecting the factors mentioned above.

EEMA OCI | Second-Quarter | Six Months Year-to-Date | |||||||||||||||||||||

(in millions) | Excl. | Excl. | |||||||||||||||||||||

2015 | 2014 | Change | Curr. | 2015 | 2014 | Change | Curr. | ||||||||||||||||

Reported OCI | $ | 881 | $ | 1,087 | (19.0 | )% | 4.3 | % | $ | 1,761 | $ | 2,014 | (12.6 | )% | 13.5 | % | |||||||

Asset impairment & exit costs | — | — | — | — | |||||||||||||||||||

Adjusted OCI | $ | 881 | $ | 1,087 | (19.0 | )% | 4.3 | % | $ | 1,761 | $ | 2,014 | (12.6 | )% | 13.5 | % | |||||||

Adjusted OCI Margin* | 45.9 | % | 47.6 | % | (1.7 | ) | — | 46.8 | % | 46.9 | % | (0.1 | ) | 2.0 | |||||||||

*Margins are calculated as adjusted OCI, divided by net revenues, excluding excise taxes. | |||||||||||||||||||||||

2015 Second-Quarter and Six Months Year-to-Date

In the quarter, PMI's cigarette shipment volume of 73.8 billion units decreased by 0.5%, or by 0.6% excluding acquisitions. The decline was principally due to Kazakhstan, reflecting a lower total market and share, and Ukraine, partly offset by Russia and the Middle East, notably Saudi Arabia. PMI's cigarette shipment volume of premium brands decreased by 2.5%, mainly due to: Marlboro, down by 3.1% to 21.1 billion units, principally due to Egypt and Ukraine, partly offset by Saudi Arabia, and Turkey; and Parliament, down by 2.1% to 8.8 billion units, mainly due to Ukraine. PMI's cigarette shipment volume of L&M increased by 5.4% to 13.2 billion units, driven by Egypt, Turkey and Ukraine, partially offset by Russia.

Year-to-date, PMI's cigarette shipment volume of 138.6 billion units increased by 1.7%, or by 1.6% excluding acquisitions, mainly driven by Russia and the Middle East, notably Saudi Arabia, partly offset by Kazakhstan and Ukraine. PMI's cigarette shipment volume of premium brands increased by 1.8%, mainly driven by: Marlboro, up by 2.8% to 41.4 billion units, driven notably by Saudi Arabia and Turkey, partly offset by Egypt and Ukraine; and Parliament, up by 0.2% to 16.2 billion units, driven principally by Turkey, partly offset by Ukraine. PMI's cigarette shipment volume of L&M increased by 9.6% to 25.5 billion units, driven by Egypt, Turkey and Ukraine.

- -14 -

EEMA Key Market Commentaries

In North Africa, estimated industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

North Africa Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 34.8 | 36.1 | (3.8 | )% | 67.1 | 70.6 | (4.9 | )% | |||||||||

PMI Shipments (million units) | 8,806 | 9,204 | (4.3 | )% | 18,008 | 17,760 | 1.4 | % | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 13.9 | % | 14.2 | % | (0.3 | ) | 14.3 | % | 14.7 | % | (0.4 | ) | |||||

L&M | 10.6 | % | 8.4 | % | 2.2 | 10.7 | % | 8.2 | % | 2.5 | |||||||

Others | 1.8 | % | 1.8 | % | — | 1.9 | % | 1.8 | % | 0.1 | |||||||

Total | 26.3 | % | 24.4 | % | 1.9 | 26.9 | % | 24.7 | % | 2.2 | |||||||

In the quarter, the decline of the estimated total market was principally due to Algeria, Egypt, mainly reflecting the impact of excise tax-driven price increases in July 2014 and February 2015, partly offset by Libya and Tunisia. Year-to-date, the estimated total market decreased by 4.9%, due to Algeria, Egypt, Libya and Morocco, partly offset by Tunisia. The decline in PMI's cigarette shipment volume in the quarter mainly reflected the lower total market, notably in Egypt, partly offset by higher market share. PMI's cigarette shipment volume year-to-date increased by 1.4%. PMI's market share growth in the quarter and year-to-date was driven mainly by L&M in Egypt, reflecting improved territorial coverage, brand building activities and the growth of round corner box versions, partly offset by Marlboro mainly in Egypt.

In Russia, estimated industry size, PMI cigarette shipment volume and May quarter-to-date and year-to-date market share performance, as measured by Nielsen, are shown in the table below.

Russia Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 77.2 | 80.6 | (4.2 | )% | 138.6 | 148.3 | (6.5 | )% | |||||||||

PMI Shipments (million units) | 23,075 | 21,906 | 5.3 | % | 42,084 | 40,495 | 3.9 | % | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 1.4 | % | 1.6 | % | (0.2 | ) | 1.4 | % | 1.6 | % | (0.2 | ) | |||||

Parliament | 3.8 | % | 3.6 | % | 0.2 | 3.9 | % | 3.5 | % | 0.4 | |||||||

Bond Street | 8.1 | % | 7.4 | % | 0.7 | 8.0 | % | 7.2 | % | 0.8 | |||||||

Others | 14.3 | % | 14.2 | % | 0.1 | 14.3 | % | 14.5 | % | (0.2 | ) | ||||||

Total | 27.6 | % | 26.8 | % | 0.8 | 27.6 | % | 26.8 | % | 0.8 | |||||||

In the quarter and year-to-date, the decline of the estimated total cigarette market was mainly due to the unfavorable impact of tax-driven prices increases and lower consumer purchasing power as a result of a weak economy. The increase in PMI's cigarette shipment volume in the quarter and year-to-date largely reflected market

- -15 -

share growth. The increase in PMI's market share in the quarter and year-to-date was driven by above premium price Parliament and low-price Bond Street.

In Turkey, estimated industry size, PMI cigarette shipment volume and May quarter-to-date and year-to-date market share performance, as measured by Nielsen, are shown in the table below.

Turkey Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 25.8 | 24.1 | 7.2 | % | 45.8 | 42.2 | 8.5 | % | |||||||||

PMI Shipments (million units) | 12,012 | 12,248 | (1.9 | )% | 21,283 | 21,205 | 0.4 | % | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 9.3 | % | 8.6 | % | 0.7 | 9.1 | % | 8.6 | % | 0.5 | |||||||

Parliament | 11.6 | % | 10.8 | % | 0.8 | 11.5 | % | 10.6 | % | 0.9 | |||||||

Lark | 7.4 | % | 9.9 | % | (2.5 | ) | 7.3 | % | 10.1 | % | (2.8 | ) | |||||

Others | 15.0 | % | 15.6 | % | (0.6 | ) | 15.4 | % | 15.3 | % | 0.1 | ||||||

Total | 43.3 | % | 44.9 | % | (1.6 | ) | 43.3 | % | 44.6 | % | (1.3 | ) | |||||

In the quarter, the increase in the estimated total cigarette market mainly reflected an increase in the adult population and a lower prevalence of illicit trade. Year-to-date, the increase in the total cigarette market reflected the same dynamics as in the quarter, as well as the favorable net impact of estimated trade inventory movements. Excluding these inventory movements, the total cigarette market increased by 6.8%. The decrease in PMI's cigarette shipment volume in the quarter was mainly due to market share loss in the low price segment. PMI's cigarette shipment volume year-to-date increased by 0.4%. In the quarter and year-to-date, the decrease in PMI's market share was primarily due to low-price Lark, reflecting the impact of price repositioning by PMI's principal competitor in May 2014. The decline was partly offset by PMI's premium brands, notably Parliament, reflecting its strengthening brand equity, and by up-trading from the mid-price segment.

In Ukraine, estimated industry size, PMI cigarette shipment volume and May quarter-to-date and year-to-date market share performance, as measured by Nielsen, are shown in the table below.

Ukraine Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 18.9 | 20.4 | (7.5 | )% | 33.6 | 34.7 | (3.1 | )% | |||||||||

PMI Shipments (million units) | 5,070 | 6,176 | (17.9 | )% | 9,678 | 11,287 | (14.3 | )% | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 3.9 | % | 4.9 | % | (1.0 | ) | 4.3 | % | 5.0 | % | (0.7 | ) | |||||

Parliament | 2.8 | % | 2.9 | % | (0.1 | ) | 2.9 | % | 3.0 | % | (0.1 | ) | |||||

Bond Street | 7.9 | % | 9.2 | % | (1.3 | ) | 7.9 | % | 9.3 | % | (1.4 | ) | |||||

Others | 15.8 | % | 15.6 | % | 0.2 | 16.2 | % | 15.6 | % | 0.6 | |||||||

Total | 30.4 | % | 32.6 | % | (2.2 | ) | 31.3 | % | 32.9 | % | (1.6 | ) | |||||

- -16 -

In the quarter and year-to-date, the decline of the estimated total cigarette market was mainly due to lower consumer purchasing power as a result of a weak economy, and continued business disruption due to the political instability in the east of the country, partly offset by a lower prevalence of illicit trade. The decrease in PMI's cigarette shipment volume in the quarter and year-to-date largely reflected a lower total market and market share loss. The decrease in PMI's market share in the quarter and year-to-date was due to Marlboro, reflecting the impact of lower consumer purchasing power, and Bond Street, mainly resulting from competitive price pressure in the low price segment. The year-to-date share growth of "Others" was mainly driven by growth of low-price L&M and super low-price President, partly offset by mid-price Chesterfield and super low-price Optima.

ASIA REGION

2015 Second-Quarter

Reported net revenues of $2.1 billion decreased by 7.2%. Excluding unfavorable currency of $229 million, net revenues increased by 2.7%, driven by favorable pricing of $105 million, mainly in Australia, Indonesia and Korea, principally driven by a gain from inventories built ahead of the announced excise tax increase effective January 2015. The favorable pricing was partially offset by unfavorable volume/mix of $42 million, mainly due to a lower total market and market share in Australia and a lower total market in Indonesia and Korea, partly offset by a higher total market and favorable inventory movements in Japan and a higher estimated total tax-paid market and improved mix in the Philippines.

Reported operating companies income of $797 million decreased by 11.4%. Excluding unfavorable currency of $97 million, operating companies income decreased by 0.7%, reflecting unfavorable volume/mix of $55 million and higher costs, mainly related to: distribution expenses and the realignment of production from hand-rolled to machine-made kretek cigarettes in Indonesia; and the commercialization of the company's Reduced-Risk Product, iQOS, in Japan; partly offset by favorable pricing.

Adjusted operating companies income is shown in the table below and detailed on Schedule 11. Adjusted operating companies income margin, excluding unfavorable currency and the impact of acquisitions, decreased by 1.3 points to 37.7%, as detailed on Schedule 11, reflecting the factors mentioned above.

Asia OCI | Second-Quarter | Six Months Year-to-Date | |||||||||||||||||||||

(in millions) | Excl. | Excl. | |||||||||||||||||||||

2015 | 2014 | Change | Curr. | 2015 | 2014 | Change | Curr. | ||||||||||||||||

Reported OCI | $ | 797 | $ | 900 | (11.4 | )% | (0.7 | )% | $ | 1,731 | $ | 1,815 | (4.6 | )% | 5.1 | % | |||||||

Asset impairment & exit costs | — | (1 | ) | — | (24 | ) | |||||||||||||||||

Adjusted OCI | $ | 797 | $ | 901 | (11.5 | )% | (0.8 | )% | $ | 1,731 | $ | 1,839 | (5.9 | )% | 3.7 | % | |||||||

Adjusted OCI Margin* | 37.2 | % | 39.0 | % | (1.8 | ) | (1.3 | ) | 40.3 | % | 40.9 | % | (0.6 | ) | — | ||||||||

*Margins are calculated as adjusted OCI, divided by net revenues, excluding excise taxes. | |||||||||||||||||||||||

2015 Second-Quarter and Six Months Year-to-Date

In the quarter, PMI's cigarette shipment volume of 75.3 billion units decreased by 0.5%, largely due to Australia, mainly reflecting the lower total market, Indonesia, Korea and the Philippines. The decrease was partly offset by higher cigarette shipment volume in Japan, mainly driven by a higher total market and favorable net trade inventory movements. Excluding these inventory movements, PMI's cigarette shipment volume decreased by 1.8%.

- -17 -

Cigarette shipment volume of Marlboro of 18.9 billion units increased by 2.2%, predominantly driven by the Philippines and Vietnam, partly offset by Indonesia and Japan. Cigarette shipment volume of Parliament of 2.4 billion units decreased by 21.8%, due to Japan and Korea. Cigarette shipment volume of Lark of 5.7 billion units increased by 53.3%, driven by Japan, benefiting from trade inventory movements.

Year-to-date, PMI's cigarette shipment volume of 145.4 billion units decreased by 0.7%, mainly due to Korea and the Philippines, partly offset by Indonesia. Estimated net inventory movements year-to-date were favorable, driven by Japan. Excluding these inventory movements, PMI's cigarette volume decreased by 1.4%.

Cigarette shipment volume of Marlboro of 36.9 billion units decreased by 1.6%, predominantly due to Japan and Korea, partly offset by the Philippines. Cigarette shipment volume of Parliament of 4.3 billion units decreased by 22.5%, due to Japan and Korea. Cigarette shipment volume of Lark of 10.2 billion units increased by 23.2%, driven by Japan, benefiting from trade inventory movements.

Asia Key Market Commentaries

In Indonesia, estimated industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

Indonesia Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 78.6 | 82.4 | (4.6 | )% | 156.9 | 156.2 | 0.4 | % | |||||||||

PMI Shipments (million units) | 27,659 | 28,598 | (3.3 | )% | 55,343 | 54,133 | 2.2 | % | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Sampoerna A | 15.0 | % | 14.1 | % | 0.9 | 15.0 | % | 14.2 | % | 0.8 | |||||||

Dji Sam Soe | 7.0 | % | 6.2 | % | 0.8 | 7.0 | % | 5.9 | % | 1.1 | |||||||

U Mild | 4.9 | % | 5.6 | % | (0.7 | ) | 5.0 | % | 5.4 | % | (0.4 | ) | |||||

Others | 8.3 | % | 8.8 | % | (0.5 | ) | 8.3 | % | 9.1 | % | (0.8 | ) | |||||

Total | 35.2 | % | 34.7 | % | 0.5 | 35.3 | % | 34.6 | % | 0.7 | |||||||

In the quarter, the decline of the estimated total market was mainly due to a soft economic environment. Year-to-date, the estimated total market increased by 0.4%. The decline in PMI's cigarette shipment volume in the quarter mainly reflected U Mild's crossing a critical price point ahead of competition earlier in the year, and the impact of the softer macro-economic environment. The increase in PMI's cigarette shipment volume year-to-date mainly reflected market share growth. PMI's market share growth in the quarter and year-to-date was driven by a strong performance from its machine-made kretek brands, notably Sampoerna A, Dji Sam Soe Magnum and Dji Sam Soe Magnum Blue, partly offset by U Mild and a decline in its hand-rolled kretek portfolio, notably due to Sampoerna Hijau in "Others," down by 0.5 points to 2.9%, largely reflecting the decline of the total segment. While Marlboro's market share decreased slightly by 0.1 point to 5.1%, its share of the “white” cigarettes segment, which represented 6.2% of the total cigarette market, increased by 2.0 points to 81.3%. The machine-made kretek segment, representing 75.0% of the total cigarette market, increased by 1.6 points and PMI's share of the segment increased by 1.1 points to 30.7%. The hand-rolled kretek segment, representing 18.8% of the total cigarette market, decreased by 1.3 points. PMI's share of the segment decreased by 1.1 points to 37.9%.

- -18 -

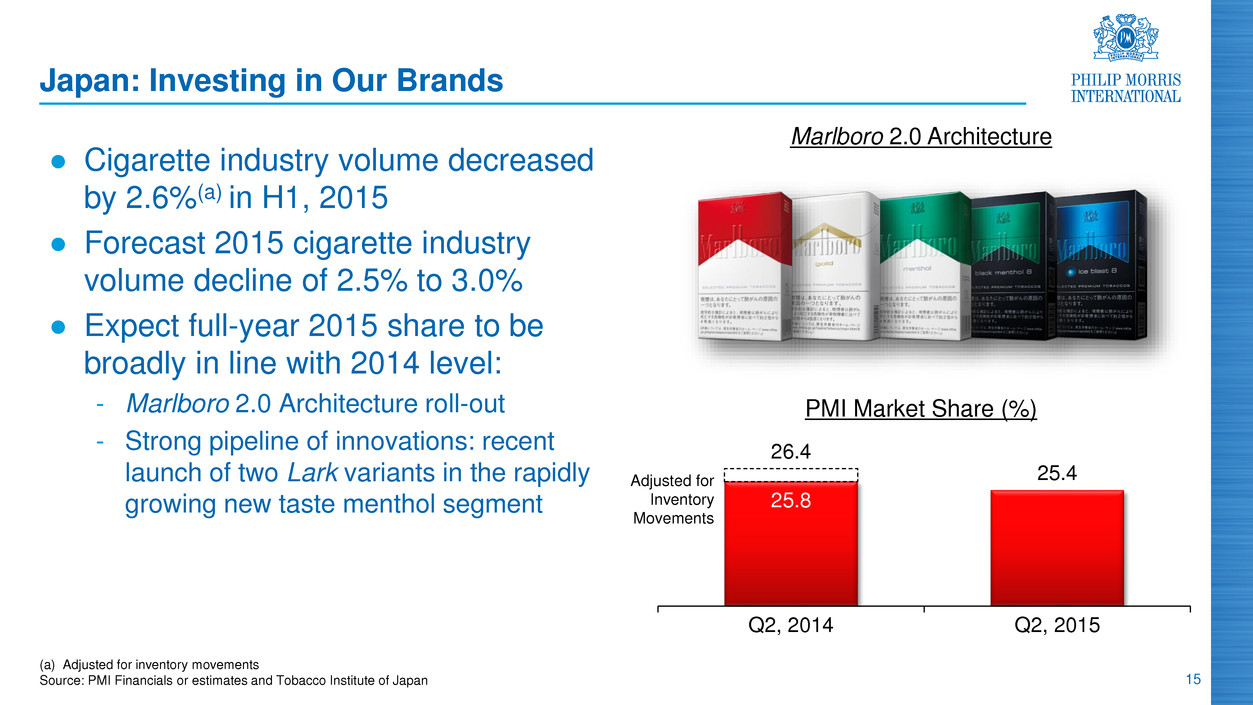

In Japan, industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

Japan Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 46.0 | 41.5 | 11.0 | % | 88.5 | 90.9 | (2.5 | )% | |||||||||

PMI Shipments (million units) | 13,552 | 11,750 | 15.3 | % | 25,398 | 25,237 | 0.6 | % | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 11.3 | % | 11.5 | % | (0.2 | ) | 11.4 | % | 11.7 | % | (0.3 | ) | |||||

Parliament | 2.3 | % | 2.4 | % | (0.1 | ) | 2.3 | % | 2.2 | % | 0.1 | ||||||

Lark | 10.0 | % | 10.4 | % | (0.4 | ) | 10.0 | % | 9.8 | % | 0.2 | ||||||

Others | 1.8 | % | 2.1 | % | (0.3 | ) | 1.8 | % | 2.2 | % | (0.4 | ) | |||||

Total | 25.4 | % | 26.4 | % | (1.0 | ) | 25.5 | % | 25.9 | % | (0.4 | ) | |||||

In the quarter, the increase of the total cigarette market primarily reflected a favorable comparison with the second quarter of 2014 in which the total market decreased by 14.4%, mainly driven by unfavorable estimated retail trade inventory movements following the consumption tax-driven retail price increases of April, 2014. Excluding the impact of these inventory movements, the total cigarette market declined by 1.7%, mainly reflecting the unfavorable impact of price increases. Year-to-date, the total market declined by 2.5% and by 2.6% excluding estimated retail trade inventory movements. The increase of PMI's cigarette shipment volume in the quarter mainly reflected the higher total market and favorable trade inventory movements. PMI's cigarette shipment volume year-to-date increased by 0.6%. Excluding the impact of estimated retail trade inventory movements, PMI's market share in the quarter and year-to-date declined by 0.4 and 0.3 points, respectively.

In Korea, industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

Korea Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 18.1 | 22.4 | (19.2 | )% | 30.7 | 41.8 | (26.6 | )% | |||||||||

PMI Shipments (million units) | 3,732 | 4,404 | (15.3 | )% | 6,190 | 8,230 | (24.8 | )% | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 9.2 | % | 7.6 | % | 1.6 | 9.2 | % | 7.8 | % | 1.4 | |||||||

Parliament | 7.1 | % | 7.2 | % | (0.1 | ) | 6.9 | % | 7.2 | % | (0.3 | ) | |||||

Virginia S. | 3.8 | % | 4.0 | % | (0.2 | ) | 3.8 | % | 4.0 | % | (0.2 | ) | |||||

Others | 0.6 | % | 0.8 | % | (0.2 | ) | 0.5 | % | 0.7 | % | (0.2 | ) | |||||

Total | 20.7 | % | 19.6 | % | 1.1 | 20.4 | % | 19.7 | % | 0.7 | |||||||

In the quarter, the decline of total cigarette market reflected the impact of the January 2015 excise tax increase and related retail price increases. Year-to-date, the total market declined by 26.6%, or by 20.2% excluding the impact of estimated inventory movements associated with the timing of the excise tax increase. The decline

- -19 -

in PMI's cigarette shipment volume in the quarter and year-to-date was in line with the lower total market, partly offset by share growth, driven by Marlboro, reflecting the positive impact of line-pricing to PMI's principal domestic competitor's main brands.

In the Philippines, estimated tax-paid industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

Philippines Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 21.2 | 20.0 | 6.0 | % | 39.8 | 38.8 | 2.7 | % | |||||||||

PMI Shipments (million units) | 16,725 | 17,243 | (3.0 | )% | 32,629 | 33,408 | (2.3 | )% | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 20.2 | % | 18.1 | % | 2.1 | 21.1 | % | 18.7 | % | 2.4 | |||||||

Fortune | 32.1 | % | 36.0 | % | (3.9 | ) | 32.5 | % | 34.7 | % | (2.2 | ) | |||||

Jackpot | 13.7 | % | 17.6 | % | (3.9 | ) | 15.2 | % | 17.7 | % | (2.5 | ) | |||||

Others | 12.9 | % | 14.5 | % | (1.6 | ) | 13.2 | % | 15.1 | % | (1.9 | ) | |||||

Total | 78.9 | % | 86.2 | % | (7.3 | ) | 82.0 | % | 86.2 | % | (4.2 | ) | |||||

In the quarter and year-to-date, the increase in the estimated total tax-paid industry cigarette volume reflected higher estimated duty-paid volume by PMI's principal domestic competitor. The decline in PMI's cigarette shipment volume in both periods was mainly due to lower consumption of low and super-low price brands, following consecutive price increases in late 2014 and early 2015, partly offset by the growth of Marlboro, reflecting the narrowing of retail price gaps with brands at the bottom end of the market.

LATIN AMERICA & CANADA REGION

2015 Second-Quarter

Reported net revenues of $807 million decreased by 0.4%. Excluding unfavorable currency of $112 million and the impact of acquisitions, net revenues increased by 13.1%, driven by favorable pricing of $128 million, principally in Argentina, Brazil, Canada and Mexico, partially offset by unfavorable volume/mix of $22 million, principally due to a lower market share in Canada.

Reported operating companies income of $325 million increased by 22.6%. Excluding unfavorable currency of $51 million and the impact of acquisitions, operating companies income increased by 41.1%, principally reflecting favorable pricing, partly offset by unfavorable volume/mix of $24 million.

Adjusted operating companies income is shown in the table below and detailed on Schedule 11. Adjusted operating companies income margin, excluding unfavorable currency and the impact of acquisitions, increased by 8.1 points to 40.8%, as detailed on Schedule 11, reflecting the factors mentioned above.

- -20 -

Latin America & Canada OCI | Second-Quarter | Six Months Year-to-Date | |||||||||||||||||||||

(in millions) | Excl. | Excl. | |||||||||||||||||||||

2015 | 2014 | Change | Curr. | 2015 | 2014 | Change | Curr. | ||||||||||||||||

Reported OCI | $ | 325 | $ | 265 | 22.6 | % | 41.9 | % | $ | 555 | $ | 467 | 18.8 | % | 39.2 | % | |||||||

Asset impairment & exit costs | — | — | — | — | |||||||||||||||||||

Adjusted OCI | $ | 325 | $ | 265 | 22.6 | % | 41.9 | % | $ | 555 | $ | 467 | 18.8 | % | 39.2 | % | |||||||

Adjusted OCI Margin* | 40.3 | % | 32.7 | % | 7.6 | 8.2 | 36.2 | % | 30.7 | % | 5.5 | 6.8 | |||||||||||

*Margins are calculated as adjusted OCI, divided by net revenues, excluding excise taxes. | |||||||||||||||||||||||

2015 Second-Quarter and Six Months Year-to-Date

In the quarter, PMI's cigarette shipment volume of 22.6 billion units decreased by 2.1%, notably due to Argentina and Mexico. Although shipment volume of Marlboro of 8.8 billion units decreased by 2.1%, its Regional market share increased by 0.2 points to an estimated 14.9%. Market share of Marlboro increased notably in Argentina, Brazil and Colombia, by 0.5, 0.2 and 1.4 points to 24.3%, 9.4% and 9.1%, respectively. Shipment volume of Philip Morris of 4.6 billion units increased by 2.2%, driven notably by Canada.

Year-to-date, PMI's cigarette shipment volume of 43.8 billion units decreased by 1.7%, largely due to Argentina and Canada. Although shipment volume of Marlboro of 17.0 billion units decreased by 1.3%, its Regional market share increased by 0.4 points to an estimated 14.8%. Market share of Marlboro increased notably in Argentina, Brazil and Colombia, by 0.4, 0.7 and 1.4 points to 24.4%, 9.5% and 9.0%, respectively. Shipment volume of Philip Morris of 9.4 billion units increased by 1.6%, driven notably by Canada.

Latin America & Canada Key Market Commentaries

In Argentina, industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

Argentina Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 9.4 | 10.0 | (5.3 | )% | 19.7 | 20.6 | (4.4 | )% | |||||||||

PMI Shipments (million units) | 7,463 | 7,656 | (2.5 | )% | 15,586 | 15,935 | (2.2 | )% | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 24.3 | % | 23.8 | % | 0.5 | 24.4 | % | 24.0 | % | 0.4 | |||||||

Parliament | 2.1 | % | 2.1 | % | — | 2.1 | % | 2.1 | % | — | |||||||

Philip Morris | 45.3 | % | 42.9 | % | 2.4 | 44.9 | % | 43.1 | % | 1.8 | |||||||

Others | 7.1 | % | 7.5 | % | (0.4 | ) | 7.3 | % | 7.5 | % | (0.2 | ) | |||||

Total | 78.8 | % | 76.3 | % | 2.5 | 78.7 | % | 76.7 | % | 2.0 | |||||||

In the quarter and year-to-date, the decline of the total cigarette market was mainly due to the cumulative impact of price increases in 2014 and 2015 and a challenging economic environment. The decrease in PMI's shipment volume in the quarter and year-to-date reflected a lower total market, partly offset by market share growth, driven by Marlboro and Philip Morris, reflecting the positive impact of the latter's capsule variants.

- -21 -

In Canada, industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

Canada Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 7.3 | 7.3 | 0.6 | % | 12.8 | 13.1 | (2.2 | )% | |||||||||

PMI Shipments (million units) | 2,647 | 2,707 | (2.2 | )% | 4,700 | 4,932 | (4.7 | )% | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Belmont | 3.2 | % | 2.9 | % | 0.3 | 3.1 | % | 2.9 | % | 0.2 | |||||||

Canadian Classics | 10.2 | % | 10.3 | % | (0.1 | ) | 10.4 | % | 10.7 | % | (0.3 | ) | |||||

Next | 10.3 | % | 10.7 | % | (0.4 | ) | 10.4 | % | 10.8 | % | (0.4 | ) | |||||

Others | 12.5 | % | 13.3 | % | (0.8 | ) | 12.8 | % | 13.4 | % | (0.6 | ) | |||||

Total | 36.2 | % | 37.2 | % | (1.0 | ) | 36.7 | % | 37.8 | % | (1.1 | ) | |||||

In the quarter, the increase of the total cigarette market was mainly driven by favorable estimated trade inventory movements of competitors' products. Excluding the impact of these inventory movements, the total cigarette market declined by 0.7%. Year-to-date, the total market declined by 2.2% or by 5.3% excluding estimated trade inventory movements, mainly due to the impact of tax-driven price increases in 2014 and 2015. The decrease in PMI's cigarette shipment volume in the quarter was mainly due to market share declines of PMI's low price brands, notably Next and Quebec Classic, partially offset by share growth of premium Belmont and super-low price Philip Morris. The decrease in PMI's cigarette shipment volume year-to-date was mainly due to the same factors as in the quarter, as well as a lower total market.

In Mexico, industry size, PMI cigarette shipment volume and market share performance are shown in the table below.

Mexico Key Market Data | Second-Quarter | Six Months Year-to-Date | |||||||||||||||

Change | Change | ||||||||||||||||

2015 | 2014 | % / p.p. | 2015 | 2014 | % / p.p. | ||||||||||||

Total Cigarette Market (billion units) | 8.6 | 8.4 | 1.9 | % | 16.1 | 15.6 | 3.2 | % | |||||||||

PMI Shipments (million units) | 5,891 | 5,991 | (1.7 | )% | 10,887 | 10,862 | 0.2 | % | |||||||||

PMI Cigarette Market Share | |||||||||||||||||

Marlboro | 47.5 | % | 49.3 | % | (1.8 | ) | 46.5 | % | 48.2 | % | (1.7 | ) | |||||

Delicados | 10.7 | % | 11.5 | % | (0.8 | ) | 10.8 | % | 11.1 | % | (0.3 | ) | |||||

Benson & Hedges | 4.6 | % | 5.2 | % | (0.6 | ) | 4.6 | % | 5.2 | % | (0.6 | ) | |||||

Others | 5.7 | % | 5.0 | % | 0.7 | 5.6 | % | 5.0 | % | 0.6 | |||||||

Total | 68.5 | % | 71.0 | % | (2.5 | ) | 67.5 | % | 69.5 | % | (2.0 | ) | |||||

In the quarter, the increase of the total cigarette market was unfavorably impacted by the timing of estimated trade inventory movements compared to the second quarter of 2014. Excluding the impact of these inventory movements, the total cigarette market increased by 3.2%. Year-to-date, the total market increased by 3.2% or by 1.3% excluding estimated trade inventory movements. The decrease in PMI's cigarette shipment volume in the

- -22 -

quarter was mainly due to market share declines. PMI's cigarette shipment volume year-to-date increased by 0.2%. The decline in PMI's market share in the quarter and year-to-date was mainly due to Marlboro, reflecting adult smoker down-trading and the timing of price increases by PMI's principal competitor in the first quarter of 2015, partly offset by gains for certain low price local trademark brands.

Philip Morris International Inc. Profile

Philip Morris International Inc. (PMI) is the leading international tobacco company, with six of the world's top 15 international brands, including Marlboro, the number one cigarette brand worldwide. PMI's products are sold in more than 180 markets. In 2014, the company held an estimated 15.6% share of the total international cigarette market outside of the U.S., or 28.6% excluding the People's Republic of China and the U.S. For more information, see www.pmi.com.

Forward-Looking and Cautionary Statements

This press release contains projections of future results and other forward-looking statements. Achievement of projected results is subject to risks, uncertainties and inaccurate assumptions. In the event that risks or uncertainties materialize, or underlying assumptions prove inaccurate, actual results could vary materially from those contained in such forward-looking statements. Pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, PMI is identifying important factors that, individually or in the aggregate, could cause actual results and outcomes to differ materially from those contained in any forward-looking statements made by PMI.

PMI's business risks include: significant increases in cigarette-related taxes; the imposition of discriminatory excise tax structures; fluctuations in customer inventory levels due to increases in product taxes and prices; increasing marketing and regulatory restrictions, often with the goal of reducing or preventing the use of tobacco products; health concerns relating to the use of tobacco products and exposure to environmental tobacco smoke; litigation related to tobacco use; intense competition; the effects of global and individual country economic, regulatory and political developments; changes in adult smoker behavior; lost revenues as a result of counterfeiting, contraband and cross-border purchases; governmental investigations; unfavorable currency exchange rates and currency devaluations; adverse changes in applicable corporate tax laws; adverse changes in the cost and quality of tobacco and other agricultural products and raw materials; and the integrity of its information systems. PMI's future profitability may also be adversely affected should it be unsuccessful in its attempts to produce products that have the potential to reduce individual risk and population harm; if it is unable to successfully introduce new products, promote brand equity, enter new markets or improve its margins through increased prices and productivity gains; if it is unable to expand its brand portfolio internally or through acquisitions and the development of strategic business relationships; or if it is unable to attract and retain the best global talent.

PMI is further subject to other risks detailed from time to time in its publicly filed documents, including the Form 10-Q for the quarter ended March 31, 2015. PMI cautions that the foregoing list of important factors is not a complete discussion of all potential risks and uncertainties. PMI does not undertake to update any forward-looking statement that it may make from time to time, except in the normal course of its public disclosure obligations.

- -23 -

Schedule 1 | ||||||||

PHILIP MORRIS INTERNATIONAL INC. | ||||||||

and Subsidiaries | ||||||||