Form 8-K PROGRESSIVE CORP/OH/ For: Aug 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 12, 2016

THE PROGRESSIVE CORPORATION

(Exact name of registrant as specified in its charter)

| Ohio | 1-9518 | 34-0963169 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

6300 Wilson Mills Road, Mayfield Village, Ohio 44143

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code 440-461-5000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure.

On August 12, 2016, The Progressive Corporation released a Report on Loss Reserving Practices (the “Report”), which provides a discussion of the loss reserving practices used by Progressive’s insurance subsidiaries. A copy of the Report is attached hereto as Exhibit 99.

Item 9.01 Financial Statements and Exhibits.

| (d) | Exhibits. |

See exhibit index on page 4.

- 2 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: August 12, 2016 |

||||||

| THE PROGRESSIVE CORPORATION | ||||||

| By: | /s/ Jeffrey W. Basch |

|||||

| Name: Jeffrey W. Basch |

||||||

| Title: Vice President and Chief Accounting Officer |

||||||

- 3 -

EXHIBIT INDEX

| Exhibit No. | Form 8-K | |||

| Under Reg. | Exhibit | |||

| S-K Item 601 |

No. |

Description | ||

| 99 | 99 | The Progressive Corporation’s Report on Loss Reserving Practices, dated August 2016 | ||

- 4 -

Table of Contents

Exhibit 99

Table of Contents

Preface

The artwork1 on the cover of the 2016 Report on Loss Reserving Practices shows a thread tying together a variety of triangles. The thread is a Progressive-wide symbol that ties together our brand, our people, and our customers. The thread runs through us and binds us toward a common goal. In loss reserving, our goal is to accurately set reserves. We tie together data, often in the form of triangles, to reach this goal. The thread runs through us.

The primary purpose of this report is to help interested stakeholders better understand our loss reserving process and how it affects our financial results. Reserves in this report refer to loss and loss adjustment expense reserves.

The 2016 Report on Loss Reserving Practices is very similar to the 2015 report. However, we updated financial information throughout the report.

As the Appendix is a separate document, you can electronically link to it anywhere that you see the blue underlined word: Appendix.

Consistent with Progressive’s culture of self-examination, our analysis of loss reserves demands continuous change and continuous improvement. Each section of this report focuses on a different aspect of our reserving process.

| ● | Section I provides an overview of our financial objectives and results, and explains why accurate reserving is important |

| ● | Section II defines our overall goal of the reserving process, the different types of reserves, how they are related and how we analyze them |

| ● | Section III defines reserve development and describes how it affects our financial results, and also how historical results compare to our goal of having total reserves that are adequate and develop with minimal variation |

| ● | Section IV describes how and why we estimate our required reserves by segment |

| ● | Section V defines many of the terms we use throughout the report |

| ● | Sections VI and VII in the Appendix present two case studies of segment reserve reviews – one for loss reserves and one for Loss Adjustment Expense (LAE) reserves, including discussion of the issues we consider and the calculations involved |

The 2016 Report on Loss Reserving Practices was revised by Karen VanCleave. Despite the technical nature of our reserve analysis, we strive to make this report as accessible and understandable as possible to a wide audience. We welcome your comments so that we may continue to enhance it. Comments and questions should be directed to Gary Traicoff, Corporate Actuary or Karen VanCleave, Actuarial Director, at The Progressive Corporation, 6300 Wilson Mills Road, Mayfield Village, Ohio 44143 or e-mailed to [email protected] or [email protected].

1 Artwork for the cover of this report was designed by **John Burke.

Table of Contents

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: Investors are cautioned that certain statements in this report not based upon historical fact are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These statements often use words such as “estimate,” “expect,” “intend,” “plan,” “believe,” and other words and terms of similar meaning, or are tied to future periods, in connection with a discussion of future operating or financial performance. Forward-looking statements are based on current expectations and projections about future events, and are subject to certain risks, assumptions and uncertainties that could cause actual events and results to differ materially from those discussed herein. These risks and uncertainties include, without limitation, uncertainties related to estimates, assumptions, and projections generally; inflation and changes in general economic conditions (including changes in interest rates and financial markets); the accuracy and adequacy of our pricing, loss reserving, and claims methodologies; the competitiveness of our pricing and the effectiveness of our initiatives to attract and retain more customers; our ability to obtain regulatory approval for requested rate changes and the timing thereof and for any proposed acquisitions; legislative and regulatory developments at the state and federal levels, including, but not limited to, matters relating to vehicle and homeowners insurance; the outcome of litigation or governmental investigations that may be pending or filed against us; severe weather conditions and other catastrophe events; the effectiveness of our reinsurance programs; changes in driving and residential occupancy patterns; our ability to accurately recognize and appropriately respond in a timely manner to changes in loss frequency and severity trends; technological advances; court decisions, new theories of insurer liability or interpretations of insurance policy provisions and other trends in litigation; changes in health care and auto and property repair costs; and other matters described from time to time in our releases and publications, and in our periodic reports and other documents filed with the United States Securities and Exchange Commission.

Table of Contents

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| External Reporting of Reserve Changes and Reserve Development |

17 | |||

| Internal Reporting of Reserve Changes and Reserve Development |

19 | |||

| 20 | ||||

| 21 | ||||

| 24 | ||||

| Appendix | ||||

| Appendix | ||||

| 01P00102.A (07/13) | Copyright © Progressive Casualty Insurance Company. All Rights Reserved. |

Table of Contents

The Progressive insurance organization began business in 1937. The Progressive Corporation, an insurance holding company, was formed in 1965. In April 2015, The Progressive Corporation acquired a majority interest in ARX Holding Corp (“ARX”). The financial results include The Progressive Corporation and ARX and their respective wholly owned insurance and non-insurance subsidiaries and affiliates (references to “subsidiaries” include affiliates as well).

The insurance subsidiaries provide personal and commercial vehicle and property insurance and other specialty property-casualty insurance and related services. Our property-casualty auto insurance products protect our customers against losses due to collision and physical damage to their insured motor vehicles, uninsured and underinsured bodily injury, and liability to others for personal injury or property damage arising out of the use of those vehicles. Our property insurance products protect homeowners, other property owners, and renters against losses caused by fire, windstorms, hail, lightning, theft, or vandalism, among certain other losses. Our non-insurance subsidiaries generally support our insurance and investment operations.

We operate our personal and commercial auto businesses throughout the United States, and sell personal auto physical damage and auto property damage liability insurance in Australia. Our homeowners business is underwritten by select carriers, including ARX, in most states throughout the U.S.

Progressive generated net income of $1.27 billion, or $2.15 per share, for 2015. From an operations standpoint, the Company generated an underwriting profit of 7.5% which exceeded our targeted goal of 4.0%. The Company generated $20.6 billion of net written premiums across all business units, an increase of 10% from the prior year. Policies in force—our preferred measure of growth—increased 3.9% for our vehicle businesses, which represented almost 544,000 additional policies. Our 2015 results show a Return on Shareholders’ Equity (ROE) of 17.2%2 and a Comprehensive ROE of 14.2%3.

Progressive’s vision is to be consumers’ number one choice and destination for auto and other insurance. Our financial objectives balance and prioritize our desire for growth with the desire to maintain financial stability that enables us to have lasting relationships with our customers based on our ability to deliver on the promises we make them.

We measure ourselves against two specific goals designed to maximize the value of our Company. Our most important goal is for our insurance subsidiaries to produce an aggregate

2 Based on net income

3 Use of Comprehensive ROE is consistent with the Company’s policy to manage on a total return basis and reflects changes in unrealized gains and losses on securities held in our portfolio. This is our preferred measure of business profitability and capital efficiency. For Progressive, Comprehensive ROE consists primarily of:

| (Net Income) + (Changes in Unrealized Security Gains, Net of Taxes)

|

||||

|

|

||||

| (Average Shareholders’ Equity) |

To review all components of Progressive’s Comprehensive ROE, refer to our “Consolidated Statements of Comprehensive Income” and related notes in our 2015 Annual Report to Shareholders, which is attached as an appendix to the Company’s 2016 Proxy Statement.

Page 1

Table of Contents

calendar year underwriting profit of at least 4%. Second, we seek to grow our business as fast as possible so long as doing so is consistent with our profitability objective and our ability to provide high quality service. We communicate these two corporate goals to every Progressive employee and work together to achieve them.

Our financial policies evaluate our exposure to risk, including the chance that actual events turn out to be significantly different than expected and result in a loss of capital. Our Risk Management area, along with our business units, identifies risks that have the potential to significantly impair our strategic objectives. We use risk management tools to quantify the amount of capital needed, in addition to surplus, to absorb consequences of unfavorable but foreseeable events. These events include items such as unfavorable loss development, weather catastrophes, and investment market corrections, among other events. We include these estimates in our capital models.

Our risks are classified into the following four categories:

| ● | Insurance Risks – risks associated with assuming, or indemnifying for, the losses of, or liabilities incurred by, policyholders |

| ● | Operating Risks –risks stemming from external or internal events or circumstances that may directly or indirectly affect our insurance operations |

| ● | Market Risks – risks that may cause changes in the value of assets held in our investment portfolios, and |

| ● | Credit and Other Financial Risks – the risks that the other party to a transaction will fail to perform according to the terms of a contract or that we will be unable to satisfy our obligations when due or obtain capital when necessary |

Loss reserving is a source of insurance risk because significant variations in loss reserve estimates affect our operating profit and our ability to price accurately.

Loss reserving is an activity that is central to the achievement of our goals. It involves estimating the magnitude and timing of future claim payments and loss adjustment expenses for accidents that have already occurred. These estimates take into account not only claims that are in the process of being settled but also claims on accidents that have occurred but have not yet been recorded by the Company. The latter is known as Incurred But Not Recorded, or IBNR claims. At year-end 2015, Progressive’s estimated gross Loss and Loss Adjustment Expense (LAE) reserves amounted to $10.0 billion.

Relationship between Loss Reserving and Pricing Functions

Unlike most industries, insurers do not know their costs until well after a sale has been made. Thus, one of the most important functions for an insurance company is setting rates or pricing. The goal of our pricing function is to properly evaluate future risks the Company will assume but has not yet written. Estimates of future claim payments are essential for accurately measuring Progressive’s underwriting profit and for determining whether pricing changes are needed to achieve the Company’s underwriting target. Reserve estimates that are too low can lead to the conclusion that pricing is adequate when it is not, and additionally, we may experience unprofitable growth. Reserve estimates that are too high may lead to inflated prices, potentially limiting our ability to attract and retain customers.

Our product-focused business units continue to seek ways to advance the science of rate-making to achieve accurate cost-based pricing at the most detailed level our data will support. This allows us to more accurately match our rates with expected loss costs by risk classification.

The role of the pricing function is to determine rates that are adequate to achieve our profitability goals without being excessive or unfairly discriminatory to consumers. The Pricing Group develops their own projections of ultimate losses for the purposes of ratemaking. The Loss

Page 2

Table of Contents

Reserving Group’s projections of ultimate loss may also be considered by the Pricing Group when they are generating these projections. Although the pricing function is very different from the loss reserving function, the data used is consistent between the functions. Typical information that the Loss Reserving Group shares with the Pricing Group includes:

| ● | Overall changes in the level of reserves by type of reserve (see Section III) |

| ● | History of claim development and selected ultimate losses by accident period |

| ● | Changes in selected ultimate loss amounts over time |

| ● | Selected severity by historical accident period and resulting trends |

| ● | Selected frequency by historical accident period and resulting trends |

| ● | Changes in actuarially determined case average reserves by age (see Section III) |

| ● | Changes in the level of average adjuster case reserve estimates (see Section III) |

| ● | Changes in claim closure rates |

| ● | Changes in the closed without payment (CWP) rate |

Judgments made by both the Loss Reserving and Pricing Groups consider additional information. Growth and process changes may cause claims to settle faster or slower than previous experience. Changes to regulatory requirements made by state insurance departments, as well as changes in the mix of business and in the underwriting process, may also contribute to unexpected changes in the data.

We use a cost-plus strategy in pricing, beginning with the projected ultimate losses and LAE. The Pricing Group estimates the ultimate losses and LAE for each coverage for the state under review. Their projection methods are similar to those used by the Loss Reserving Group, as described in Section IV.

Trend selections have a significant impact on how much the rates will change. Changes in the average cost of a claim (severity trend), in the proportion of insured cars that have a claim (frequency trend), and in average premium adjusted for current rate levels (premium trend) are analyzed and selected.

The Loss Reserving Group meets regularly with the Product Management Group, Pricing Group and Claims Group to discuss these trends.

Loss Reserve Uncertainty and Capital Planning

With recommended regulatory changes and other developments (Solvency II & Own Risk Solvency Assessment or ORSA), companies taking advantage of Loss Reserve Disclosures are likely to benefit in many ways. Disclosure regarding an insurer’s practice of setting loss reserves, generally an insurer’s largest balance sheet liability, helps explain business decisions to investors, rating agencies and other interested parties such as regulators, employees and other stakeholders in the firm. Disclosures such as this 2016 Report on Loss Reserving Policies, which we file with the SEC on Form 8-K, allow management to explain its rationale and practices in setting reserves, the methods used to model reserves and the varying degree of results that are produced by various reserving methods.

Actuarial estimates of future loss payments resulting from accidents that have already occurred are imprecise by their nature. The amount that will actually be paid is uncertain for many reasons and may deviate, sometimes substantially, from the estimated liability. Because loss reserves are inherently imprecise, insurers are faced with the real risk that they will pay out differently than they have estimated. It is for this reason that Progressive’s Risk Management area built a loss reserve estimation risk model which measures the magnitude of that potential difference between what we forecast to happen and actual loss payments made. We use the results of this model in conjunction with other risk models to determine the amount of Economic Capital held for the consolidated entity.

Page 3

Table of Contents

Economic Capital can be defined as the amount of capital that a business needs to ensure that it remains solvent. Economic Capital is a measure of risk, not of actual capital available to the business. As such, it is distinct from familiar accounting and regulatory capital measures. Economic Capital is based on a probabilistic assessment of potential future losses and is therefore a more forward-looking measure of capital adequacy than traditional accounting measures. Progressive calculates Economic Capital internally as the estimated additional capital we need to withstand potential losses from all sources of risk. Progressive uses the Value at Risk measure, or VaR, which is defined as a threshold loss value, such that the probability that the aggregate losses exceeds a selected confidence level. The VaR measurement process involves assigning to each given risk an amount of capital that would be required to respond to any unexpected loss, while taking account of the diversification benefits of managing a portfolio of risks, some of which are not highly correlated. Volatility in losses results in volatility in estimated loss reserves, which in turn increases the amount of Economic Capital required for capital planning purposes.

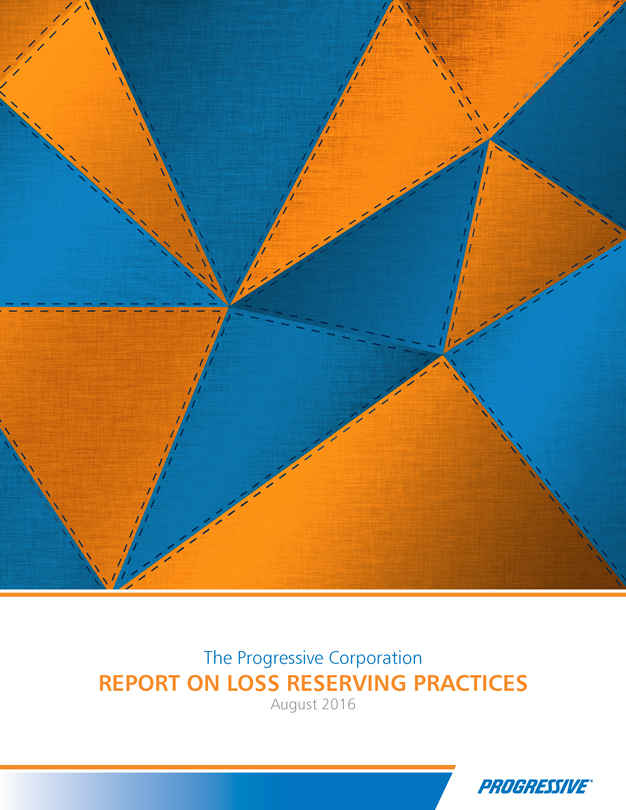

Loss reserve uncertainty arises for a variety of reasons. Therefore, no single method of estimating loss reserve uncertainty is appropriate under all circumstances. For example, unanticipated spikes in medical inflation will result in actual loss payments that exceed our estimates (an unanticipated increase in reserve need). By contrast, changes in claims handling procedures may allow us to settle claims more quickly and efficiently than previously thought, with the result of lower actual adjusting expenses than previously estimated (an unanticipated decrease in reserve need). Even different types of hurricanes must be reviewed independently as reserve development from one hurricane can be very different from another. See the graph below.

We see in the above graph that three different hurricanes and tropical storms created very different claim reporting patterns within the first seven to ten days. Wilma, a typical hurricane, hit urban areas which caused flooding, but the flood waters retreated fairly quickly allowing policyholders to return home and report damages within a reasonable period of time. Frances, a storm with a large eye that struck during Labor Day weekend, caused significant flooding and resulted in delayed reporting patterns. Superstorm Sandy on the other hand, the second costliest

Page 4

Table of Contents

storm in US history (estimated at $75B USD) with a diameter on record of 1,100 miles, allowed policyholders’ early re-entry into the affected area. Losses were reported quickly, resulting in prompt claim settlements. As you can see in the graph above, by day 15, nearly all of the Superstorm Sandy claims were reported allowing for improved reserve accuracy and less dependency on estimates for incurred but not reported (IBNR) claims.

Modeling loss reserve uncertainty is accomplished by using historical loss payment data to statistically estimate the relationship between loss payments made in the first development year of each accident year and payments in each subsequent development year. Although these statistical relationships are accurate on average, actual loss payments do vary as discussed above. The risk management model measures the magnitude (standard deviation) of these variations as a percentage of the estimated needed reserve and applies this estimate to expected future loss payments.

We currently estimate loss reserve uncertainty separately from loss adjustment expense reserve uncertainty because economics, process, pricing and other changes may affect loss adjustment reserves differently from loss reserves. Unanticipated fluctuations can occur for many reasons some of which include:

| ● | History of claim development and selected ultimate losses by accident period |

| ● | Changes in claim closure rates |

| ● | Selected severity by accident period and resulting trends |

| ● | Selected frequency by accident period and resulting trends |

| ● | Unanticipated spike in medical inflation |

| ● | Changes in the rate of claims closed without payment (CWP rate) |

| ● | Acute change (increase/decrease) in driving behaviors of our policyholders |

| ● | Economic factors such as inflation/deflation |

| ● | Unanticipated changes in the costs of repairing vehicles |

The loss reserve estimation risk model results are combined with other stochastic risk models such as investment portfolio returns, operating risk and other financial risks to determine the total Economic Capital required at various confidence levels.

Page 5

Table of Contents

Section II – Key Definitions and Types of Reserves

In order to understand Progressive’s Reserving Practices, it is important to first have an understanding of our overall goal as well as several definitions of various types of reserves. Additional definitions can be found in our Glossary in Section V.

Reserves are liabilities established on our Generally Accepted Accounting Principles (GAAP) balance sheet as of a specific accounting date. They are estimates of the unpaid portion of what we ultimately expect to pay out on claims for insured events that occurred prior to the end of any given accounting period, regardless of whether or not those claims have been recorded by Progressive. These estimates are reported net of the anticipated amounts recoverable from salvage and subrogation. Loss reserves are our best estimate of future payments to claimants, and LAE reserves are the estimated future expense payments related to claims settlement. The types of reserves are explained below.

We estimate the needed reserves based on facts and circumstances known to us at the time the loss and LAE costs are evaluated. There is inherent uncertainty in the process of establishing property and casualty loss and LAE reserves, caused in part by changes in the Company’s mix of business (by state, policy limit or deductible, etc.), changes in claims staffing and processes, inflation on vehicle repair costs and medical costs, changes in state legal and regulatory environments, and unexpected judicial decisions regarding lawsuits, changes in theories of liability, and interpretation of insurance policy provisions, among other reasons.

|

Progressive’s goal is to ensure that total reserves are adequate to cover all loss and LAE costs while sustaining minimal variation from the time reserves are initially established until losses have fully developed.

|

The Corporate Actuary is accountable for the adequacy and accuracy of the reserves. The Loss Reserving Group reports to the Corporate Actuary and is part of the Corporate Finance department. Personal Auto, Commercial Lines, and Special Lines have their own Product Management and Pricing Groups. The Loss Reserving Group works closely with Product Management, Pricing, and Claims to fully understand the underlying data used in our reviews. The Corporate Actuary uses this information to make reserving decisions independent of these business groups.

In order to make the most accurate estimate, we divide our book of business into smaller groups of data known as segments. A segment is generally defined as a state, product, and coverage grouping with reasonably similar loss characteristics. Reserve estimation and segmentation are further explained in Section IV. Our analysis of reserves is described in greater detail in the Appendix, which presents sample reserve reviews for loss and LAE segments. The Appendix includes a discussion of the issues we consider during the analysis as well as the calculations involved.

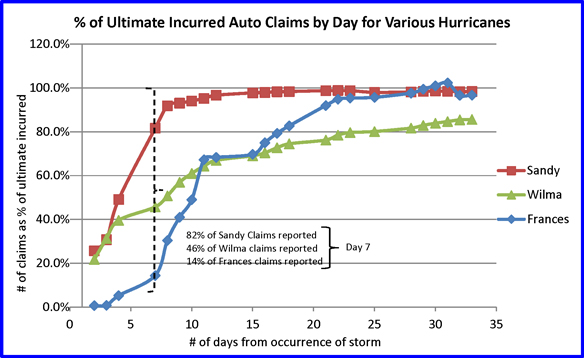

At the end of 2015, we reported a $10.0 billion reserve liability ($8.6 billion net of reinsurance recoverable on unpaid claims) on our GAAP balance sheet. We separate reserves into two categories: loss and LAE. While each of these two reserve categories are reported in the aggregate on the GAAP balance sheet, when we analyze the loss reserves, we further break them into two distinct types: case and IBNR. There are also two categories of LAE: Defense and Cost Containment (DCC) and Adjusting and all Other (A&O) expenses. Below we discuss these reserve types and how we evaluate them to achieve a total reserve balance that is as accurate as possible.

Page 6

Table of Contents

Exhibit 1 illustrates the types of reserves as a percent of our total reserve liability as of December 31, 2015. In 2015, 85.0% of our reserve liability (Loss case + Loss IBNR) was set aside to pay claimants, while 15.0% of our reserve liability (Total DCC + Total A&O) was established to accommodate costs associated with settling those claims. These costs are described in more detail later in this section.

We evaluate our total indicated loss reserve need by sorting and analyzing claims by accident date. This analysis, discussed in detail in Section VII of the Appendix, is completed concurrently with the evaluations of case and IBNR reserves for the same segmentation of business.

Loss case reserves represented 67.1% of our total carried reserves at December 31, 2015. Case reserves are estimates of amounts required to pay claims that have already been reported and recorded into Progressive’s systems, but have not yet been fully paid. We evaluate our indicated case reserve need, as discussed in Section VII of the Appendix, by sorting and analyzing claims by record date (the date the claim was recorded by the Company).

For each open claim, the Company carries a financial case reserve on its books. The financial case reserve is either an average reserve, determined by the Loss Reserving group or the adjuster reserve, which is our adjuster’s estimate of the remaining cost for the claim.

Average Reserves: Our objective is to use an average reserve for claims which we feel have a more predictable level of severity. We have determined a dollar threshold (which may vary by product, state, line coverage, and limit) under which a claim’s severity is sufficiently predictable to receive an average from Loss Reserving.

Page 7

Table of Contents

Adjuster Reserves: Our claims adjusters often will estimate the ultimate loss on a claim. We call this estimate the adjuster reserve. In cases where our adjuster sets a reserve equal to or above a pre-determined threshold, the adjuster reserve will be used to determine the financial case reserve rather than the average reserve.

When a claim is first recorded by the Company, there may not be enough known about the claim for an adjuster to determine its cost. The use of average reserves allows claims personnel to concentrate their efforts on adjusting claims rather than accounting for them. Also, average reserves are not as affected by changes in claims processes, and they provide more accurate financial reporting in aggregate.

Loss Reserving determines the average reserves, which vary by segment. In the months that a segment is not reviewed, an inflation factor is applied to the average reserves to keep up with changing costs between reviews. The inflation factor is generally based upon a projected future severity trend based on our analysis.

Once an average reserve is assigned to a claim, we monitor the age of a claim. The age of a claim is defined as the length of time from the accident date to the current accounting date. In certain coverages, such as Bodily Injury, more severe claims tend to remain open longer than less severe claims and tend to be more expensive due to litigation, medical treatments, and other associated costs. In order to recognize this cost differential, the average reserve increases as the claim ages for such coverages.

Our analysis has shown that all else being equal, claims recorded on time (i.e. immediately after occurrence) ultimately settle at a different average cost compared to claims recorded late. In order to recognize this cost differential, we began implementing a record-age segmentation to our case reserves in 2015.

Financial Reserves: The reserve carried on our books is the financial reserve. For claims in which the adjuster has not set a reserve, or for which the adjuster reserve has been set below the threshold, the average reserve from Loss Reserving is used as the financial reserve. If the adjuster reserve is set at or above threshold, however, the adjuster reserve is used as the financial reserve.

Severities may vary significantly on claims above the threshold. The adjuster reserves more accurately estimate the ultimate liability for these claims because the adjusters have typically spent a great deal of time on these larger claims and understand their unique characteristics. While only 14.8% of our total open claims count for Personal Auto Bodily Injury is set at or above the current threshold, these claims represent 33.6% of our total Personal Auto Bodily Injury case reserve liability as of year-end 2015. For Commercial Auto Bodily Injury, only 3.7% of our total open claim count is set at or above the threshold, accounting for about 31.1% of our total Commercial Auto Bodily Injury case reserve liability.

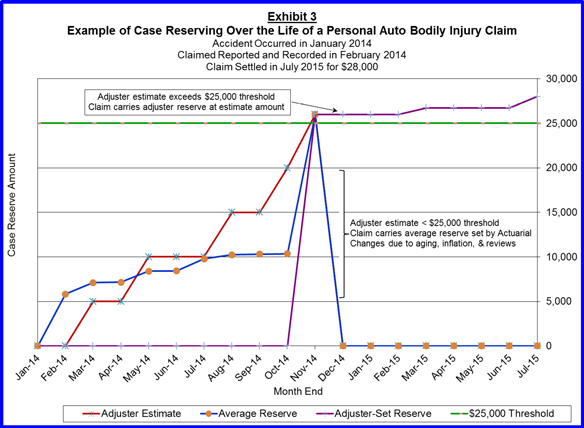

Example: Exhibits 2 and 3 illustrate the life of a hypothetical Personal Auto Bodily Injury claim. When the claim was originally recorded, we assigned the actuarially determined average reserve of $5,829. As the claim aged from the time it was reported in February through the end of October, the average reserve changed due to the application of the inflation factor, results of actuarial reserve reviews, and aging. Over this same period of time, the adjuster increased the reserve estimate (red line) multiple times as more information was obtained about the claim. When the adjuster’s estimate exceeded the sample threshold of $25,000, the financial reserve changed from an average reserve to an adjuster reserve.

Page 8

Table of Contents

Exhibit 2

Example of Loss Case Reserving Over the Life of a Personal Auto Bodily Injury Claim

Policy Limits = $30,000/$60,000

Threshold = $25,000

State XYZ

Inflation Factor = 6% per year

(Excludes Loss Adjustment Expenses)

| Month |

Claim Activity |

Age in Months* |

Adjuster Estimate |

Carried Reserve |

Amount Paid |

Explanation for Reserve Change | ||||||

| Jan-14 | Accident occurs | 1 | - | IBNR | - | Aggregate amount based on factor of EP for segment | ||||||

| Feb-14 | Claim is reported | 2 | - | 5,829 | - | Average reserve for 1-2 month age group from actuarial review | ||||||

| Mar-14 | Adjuster sets estimate | 3 | 5,000 | 7,121 | - | Aging to 3-4 month age group and inflation | ||||||

| Apr-14 | 4 | 5,000 | 7,157 | - | Inflation | |||||||

| May-14 | Adjuster revises estimate | 5 | 10,000 | 8,391 | - | Actuarial review and aging to 5-6 month age group | ||||||

| Jun-14 | 6 | 10,000 | 8,432 | - | Inflation | |||||||

| Jul-14 | 7 | 10,000 | 9,789 | - | Aging to 7-12 month age group and inflation | |||||||

| Aug-14 | Adjuster revises estimate | 8 | 15,000 | 10,250 | - | Actuarial review revised averages | ||||||

| Sep-14 | 9 | 15,000 | 10,300 | - | Inflation | |||||||

| Oct-14 | Adjuster revises estimate | 10 | 20,000 | 10,350 | - | Inflation | ||||||

| Nov-14 | Adjuster revises estimate | 11 | 26,000 | 26,000 | - | Adjuster estimate pierces threshold, so claim takes adjuster reserve | ||||||

| Dec-14 | 12 | 26,000 | 26,000 | - | ||||||||

| Jan-15 | 13 | 26,000 | 26,000 | - | ||||||||

| Feb-15 | 14 | 26,000 | 26,000 | - | ||||||||

| Mar-15 | Adjuster revises estimate | 15 | 26,725 | 26,725 | - | Still above threshold, so we continue to take adjuster reserve | ||||||

| Apr-15 | 16 | 26,725 | 26,725 | - | ||||||||

| May-15 | 17 | 26,725 | 26,725 | - | ||||||||

| Jun-15 | 18 | 26,725 | 26,725 | - | ||||||||

| Jul-15 | Claim is paid and closed | 19 | 28,000 | 0 | 28,000 | Carried reserve goes to zero as claim is closed with payment |

| Note: Age in Months = |

Number of Days since the Date of Loss |

rounded up to the nearest integer | ||

| 30 Days |

Page 9

Table of Contents

Incurred But Not Recorded (IBNR) Reserves

We establish a reserve for claims that have occurred, but have not been reported by the claimants or recorded by the Company as of the accounting date. IBNR Reserves are estimates of the amounts needed to pay these claims. At year-end 2015, the loss IBNR reserves were 17.9% of our total carried reserves.

The IBNR reserve need is evaluated by the same segmentation process used for case reserves. We perform this analysis by sorting historical claims according to the time lag between the accident dates and the dates that these claims were recorded by the Company. The case study in Section VII of the Appendix shows a detailed IBNR reserve analysis.

Late reported claims are evaluated to determine the estimated ultimate losses for each accident quarter within each lag period. For example, Lag month 1 consists of claims for which the accidents occurred during one month but were not recorded until the next calendar month. Similarly, Lag month 2 consists of all claims for which the accidents occurred during one month but were recorded by the Company two months later. Lag month 0 claims were recorded in the same month they occurred.

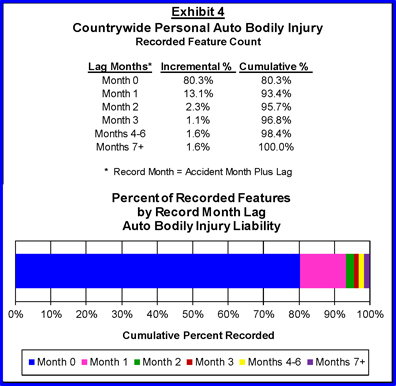

Exhibit 4 below shows our approximate percent of recorded features for Personal Auto Bodily Injury by record month lag. This exhibit shows 80.3% of our Auto BI features are reported and recorded in our systems by the end of the month in which they occurred. However, 19.7% of the features had not been recorded by the end of the accident month. Therefore, we need to estimate IBNR reserves for these claims.

Page 10

Table of Contents

The reserve analysis develops estimated IBNR factors based on the needed reserves by age divided by the earned premium for each age group. The carried IBNR reserves are calculated at the end of each month (by segment) by applying these IBNR factors to trailing periods of earned premium for up to four years. In almost all cases, the largest IBNR factors are applied to the premium in the most recent accident quarters because of their greater IBNR reserve need. The IBNR reserves change with our premium volume, allowing these reserves to keep up with growth, inflation, business mix, etc.

Loss Adjustment Expense (LAE) Reserves

In addition to loss payments (which indemnify claimants), the Company incurs expenses in the process of settling claims. Therefore, we need to establish a reserve liability to cover estimated LAE to be paid as loss reserves develop to closure. The two categories of LAE are DCC and A&O, which are defined4 as follows:

| Defense and Cost Containment (DCC) includes all defense, litigation and medical cost containment expenses, including in-house counsel. We evaluate the total indicated DCC expense reserve need by sorting and analyzing these expenses by accident date, similar to how we review the needed loss reserves. In addition to being analyzed in total, the DCC expenses are split into Attorney & Legal and Medical & Other components, which are analyzed separately. |

| Adjusting & all Other Expense (A&O) includes all other claims adjusting expenses, whether internal or external to the Company. A&O consists of fees, salaries and overhead expenses of those employees involved in a claim adjusting function, as well as other related expenses incurred in determination of coverage. We evaluate our total indicated A&O reserve need by taking A&O Charges to date and allocating them across states, products, coverages, and feature age. Based on this, we are able to create accident period triangles across the same segmentation. We generally create a triangle of total charged A&O and a triangle of the ratio of charged A&O dollars to Property Damage earned exposures. We then analyze and project these A&O costs to ultimate value, using development techniques that are discussed in more detail in the appendix. We then back out charged A&O to date from our ultimate projection to obtain our overall indicated A&O reserve. |

At year-end 2015, the LAE reserves were 15.0% of our total carried reserves. Similar to loss reserves, we carry case reserves for DCC and A&O expenses by applying selected averages to each open feature. For DCC, we carry the adjuster reserve if it exceeds a certain threshold, which occurs less frequently than for loss. Similar to loss IBNR reserves, carried DCC IBNR and A&O IBNR are calculated as a percentage of the trailing earned premium for each respective segment.

Analysis of needed DCC and A&O expense reserves are performed independently. For Personal Auto DCC Bodily Injury, we review reserves for each state at least once a year, though many states are not reviewed individually, but rather as part of a more aggregate review. We also review all A&O reserves by state and by line coverage at least once per year for Auto. For Commercial Auto the reviews are completed on a more aggregated basis. Section VIII of the Appendix contains a case study of our LAE reserve analysis.

4 The definitions are consistent with those prescribed by the NAIC under the Statutory Accounting Regulations

Page 11

Table of Contents

Involuntary Market Operating Loss Reserves

Progressive is required by the laws of most states to participate in involuntary market plans. Below we discuss the two major types of involuntary market plans in which we participate.

Private Passenger Assigned Risk Plans: Certain state insurance regulations require us to participate in various assigned risk plans. Applicants who cannot obtain insurance in the voluntary market are assigned to insurers in proportion to the volume of written exposures or vehicles each insurer writes in that state. Historical data indicates an operating loss is to be expected on these assignments. Participation requirements in assigned risk plans differ from state to state. Reserves are established for these expected operating losses based on our current written exposures. Since the plans assign business to policy years two years in the future based on our current writings, we carry the reserves until we are actually assigned the risks.

The carried reserves for assigned risk plans comprised less than one-tenth of one percent of our total net carried reserves at year-end 2015. However, since this is a unique type of exposure, we evaluate it separately.

The process of determining the assigned risk reserve for a state is as follows:

| ● | Determine Progressive’s estimated portion of the assigned risk pool by multiplying our projected market share by the estimated future size of the assigned risk pool in that state |

| ● | Reduce this by any credits a state may allow such as voluntarily writing risks that generally populate the plans in a higher portion than in the general market |

| ● | Estimate the operating loss that we expect to incur from this business |

| ● | Factor in the impact when excess credits are sold to competitors along with charges from Limited Assigned Distribution (LAD) carriers when such agreements are in force |

Commercial Auto Insurance Procedure (CAIP): In most states, Progressive is also required to share in the operating results of the involuntary CAIP plan. Due to the more complex nature of commercial business, these plans do not assign policies to specific insurance companies. Instead, a small number of carriers (including Progressive) service the business, but generally do not bear underwriting risk. The servicing carriers transfer the insurance risk, or cede 100% of the business, to the state pools. These pools then retrocede the loss experience of the plan to all companies in proportion to their respective shares of the commercial automobile voluntary market for the respective state.

Other Considerations to Reserves

Salvage and Subrogation

GAAP requires loss reserves to be stated net of anticipated salvage and subrogation recoveries. Statutory Accounting Principles (SAP), which are mandated by state insurance departments or regulators, allows reserves to be reduced by the expected recovery amounts but does not require it. We report our SAP loss reserves net of anticipated salvage and subrogation recoveries.

Salvage: Progressive generally assumes the title to a vehicle when it is declared a total loss. We may then sell the vehicle to a salvage dealer and these proceeds net of expenses are referred to as salvage recovery. Salvage is most relevant in analyzing the needed reserves for Collision claims.

Subrogation: When a Progressive policyholder is involved in an accident in which the other party is at fault or partially at fault, he or she may submit the claim to us. When we pay that claim, we obtain our policyholder’s right to recover damages from the at-fault party or the at-fault party’s insurance company. Subrogation is most relevant for Collision claims (damage to our insureds’ vehicles) and Personal Injury Protection (PIP) claims.

Page 12

Table of Contents

As we collect salvage or subrogation from third parties, it reduces our net paid and incurred loss amount for that claim. We analyze our claims data net of these recoveries, so that our estimated ultimate loss amounts are net of anticipated salvage and subrogation. Since most of our recoveries are realized after claims have been closed, we may carry negative IBNR reserves on the Company’s books for anticipated future recoverable salvage and subrogation.

Catastrophes

The United States does not allow insurance companies to set up reserves for catastrophes ahead of time due to accounting and tax principles. An event/storm is declared a catastrophe by an external agency if the industry wide total insured losses will amount to more than $25 million. The type of loss will vary depending on the type of storm. For example, losses from a hurricane will be different than losses from a hail storm or a forest fire.

Progressive predicts its total comprehensive losses for a catastrophe by looking at data from prior storms. Specifically, we will look at prior storms’ development factors, frequency and severity. If a catastrophe occurs too close to the end of the month, there is less time for claims to be reported, and therefore we may put up IBNR reserves to cover the additional amount we think we will need for the total amount of losses. We also know that we will receive some amount of salvage, and we factor this into the projection for total losses.

Page 13

Table of Contents

Section III – About Reserves and Development

In order to measure how well we are achieving our stated goals, we track the development of reserves from the time they are initially booked until losses are fully developed. In order to understand how reserve development impacts Progressive’s financial statements it is important to understand the difference between Calendar Period and Accident Period data.

Calendar Period versus Accident Period

Financial statements report data on a calendar period basis. However, payments and reserve changes may be made on accidents that occurred in prior periods, thus not giving an accurate picture of the business that is currently insured. Therefore, it is important to understand the difference between calendar period and accident period losses.

Calendar Period Losses consist of payments and reserve changes that are recorded on the Company’s financial records during the period in question, without regard to the period in which the accident occurred. Calendar period results do not change after the end of the period, even as new claim information develops.

Accident Period Losses consist of payments and reserves for losses that occurred in a particular period (i.e., the accident period). Accident period results will change over time as the estimates of losses change due to payments and reserve changes for all accidents that occurred during that period.

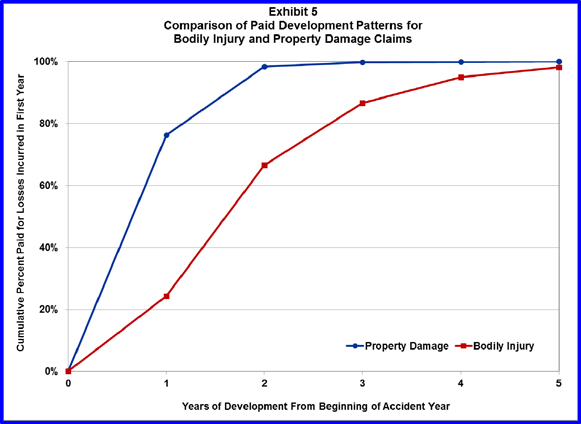

Incurred losses consist of payments and reserve changes, so it is important to understand paid development patterns. The longer a claim is expected to stay open (not settled), the more difficult it is to establish an accurate reserve at the time the accident is reported. Since injury claims tend to take longer to settle than property claims, total reserve estimates for injury claims are more sensitive to the uncertainties mentioned above, such as changes in mix of business, inflation, and legal, regulatory or judicial issues. As more information is obtained about open claims, the reserves are revised accordingly. The ultimate amounts, however, are not known until the claims are settled and paid.

The following chart (Exhibit 5) compares the time it takes to settle a typical segment of Bodily Injury liability claims versus a typical segment of Property Damage liability claims. Each annual development point represents the cumulative percent of paid dollars for accidents that occur in the first year.

Page 14

Table of Contents

The ultimate paid losses (i.e., our projection of fully-developed paid losses) and ultimate LAE may deviate, perhaps substantially, from point-in-time estimates of reserves contained in our financial statements. The actual claims payments in subsequent calendar years may exceed or may be less than the year-end carried loss reserves causing losses incurred in subsequent calendar years to be higher or lower than anticipated. Changes in the estimated ultimate cost of claims are referred to as development.

There are several ways for reserve development to occur:

| ● | Claims settle for more or less than the established reserves for those claims. |

| ● | Adjuster reserve estimates on open (reported) claims change, such that a claim previously set below threshold is now set at or above the threshold (or vice versa). |

| ● | Average reserves set by Loss Reserving for open (reported) claims change |

| ● | Unrecorded claims emerge (i.e., they are recorded after the accounting date) at a rate greater or less than anticipated. This can be due to either or both of the following: |

| ¡ | The actual number (frequency) of “late reported” claims differs from the estimate |

| ¡ | The average amount (severity) of these claims differs from the estimate |

| ● | Loss Reserving’s estimates of future emergence patterns on unreported claims change |

| ● | Salvage and subrogation recoveries are greater or less than anticipated |

| ● | Changes in earned premium affect carried IBNR (incurred but not recorded) reserves which are calculated as a percentage of earned premium |

Page 15

Table of Contents

Exhibit 6 illustrates Progressive’s reserve development over the past ten years. It shows the booked reserves at each year-end, and the re-estimated needed reserves at each subsequent year-end (down the column for each original accounting date). The last diagonal (in red) in Exhibit 6 represents our evaluation, as of December 31, 2015, of the needed reserves as of each respective year-end. The difference between the current evaluation (last diagonal) and the original amount of booked reserves in each column represents cumulative reserve development for that accident year and all prior accident years combined. This measures our performance against the goal, stated above, that total reserves are intended to be adequate and to develop with minimal variation.

|

Exhibit 6 Analysis of Loss and Loss Adjustment Expense (LAE) Development (in millions) (unaudited) | ||||||||||||||||||||||||||||||||||||||||||

|

For years ending Dec. 31, |

2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||||||||||||||||||||

|

Net Loss & LAE reserves |

$5,313.1 | $5,363.6 | $5,655.2 | $5,932.9 | $6,123.6 | $6,366.9 | $6,460.1 | $6,976.3 | $7,433.8 | $7,893.9 | $8,596.3 | |||||||||||||||||||||||||||||||

| Re-estimated reserves, as of |

|

|||||||||||||||||||||||||||||||||||||||||

| One year later |

$5,066.2 | $5,443.9 | $5,688.4 | $5,796.9 | $5,803.2 | $6,124.9 | $6,482.1 | $7,021.4 | $7,409.7 | $7,578.8 | ||||||||||||||||||||||||||||||||

| Two years later |

$5,130.5 | $5,469.8 | $5,593.8 | $5,702.1 | $5,647.7 | $6,074.4 | $6,519.6 | $6,994.7 | $7,402.4 | |||||||||||||||||||||||||||||||||

| Three years later |

$5,093.6 | $5,381.9 | $5,508.0 | $5,573.8 | $5,575.0 | $6,075.9 | $6,495.4 | $6,983.2 | ||||||||||||||||||||||||||||||||||

| Four years later |

$5,046.7 | $5,336.5 | $5,442.1 | $5,538.5 | $5,564.6 | $6,050.6 | $6,459.8 | |||||||||||||||||||||||||||||||||||

| Five years later |

$5,054.6 | $5,342.8 | $5,452.8 | $5,580.0 | $5,605.6 | $6,097.4 | ||||||||||||||||||||||||||||||||||||

| Six years later |

$5,060.8 | $5,352.8 | $5,475.6 | $5,609.1 | $5,638.8 | |||||||||||||||||||||||||||||||||||||

| Seven years later |

$5,070.2 | $5,369.7 | $5,501.3 | $5,634.9 | ||||||||||||||||||||||||||||||||||||||

| Eight years later |

$5,081.7 | $5,391.2 | $5,527.1 | |||||||||||||||||||||||||||||||||||||||

| Nine years later |

$5,100.6 | $5,406.4 | ||||||||||||||||||||||||||||||||||||||||

| Ten years later |

$5,110.2 | |||||||||||||||||||||||||||||||||||||||||

| Cumulative Development: |

||||||||||||||||||||||||||||||||||||||||||

|

favorable/(unfavorable) |

$202.9 | ($42.8) | $128.1 | $298.0 | $484.8 | $269.5 | $0.3 | ($6.9) | $31.4 | $315.1 | ||||||||||||||||||||||||||||||||

|

% of Original Reserves |

3.8% | -0.8% | 2.3% | 5.0% | 7.9% | 4.2% | 0.0% | -0.1% | 0.4% | 4.0% | ||||||||||||||||||||||||||||||||

The reserves set as of December 31, 2014 appeared to be adequate as of year-end 2015, since reserves developed favorably over the course of 2015. In other words, as of year-end 2015, we estimate that claims will cost less than what we projected at year-end 2014. Recall that excessively adequate or deficient reserves can, respectively, limit competitive opportunities or cause unprofitable growth. It is important to recognize both favorable and unfavorable development as quickly as possible, so that these inefficiencies are corrected and our financial results are presented as accurately as possible.

As seen in Exhibit 6, we have developed favorably year-to-date for most year-end evaluations except 2006 and 2012. We experienced cumulative development of 5% or more for 2008 and, 2009. In contrast, the cumulative reserve development for 2005, 2007, 2010, 2011, 2013, and 2014 was favorable, but much more modest in magnitude. For these years, reserves have run-off between 0.005% and 4.2% of the originally-held amount. Reserves for 2006 and 2012 experienced modest unfavorable development. Exhibit 6 quantifies the amount of favorable development in 2015 at the bottom of the 2014 column. Reserves from accident years 2014 and prior developed favorably by $315.1 million, representing 4.0% of the originally held reserves or 1.6% of our 2015 earned premium ($19.9 billion, found on page 18).

We make many projections in loss reserve analyses that may change as the claims mature. The least mature claims are those that occurred during the most recent accident year, so the Company believes that the estimated severity for the 2015 accident year is the projection with the highest likelihood to change. For further discussion of the 2015 results and how they are affected by loss and LAE reserves, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s 2015 Annual Report to Shareholders, which is attached as an appendix to the Company’s 2016 Proxy Statement.

Page 16

Table of Contents

Reserve development influences our reported earnings. Reported earnings for any period may be understated (relative to accidents that occur in that period) when either or both of the following items occur:

| ● | There is unfavorable development of prior accident years during the current period |

| ● | Reserves for accidents that occur in the current period are overestimated (i.e., subsequent evaluation shows a lower estimate of ultimate incurred losses) |

On the other hand, reported earnings for any period may be overstated when the opposite of these items occurs.

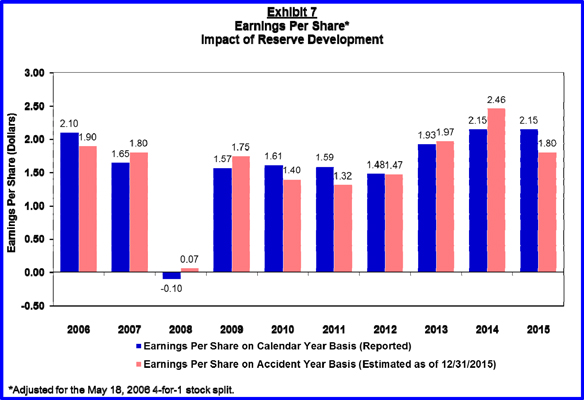

Exhibit 7 shows how reported Earnings Per Share (EPS) are affected by the reserve development in Exhibit 6. It shows the reported EPS for specified fiscal years and what the EPS would have been if the Company had had no reserve development, i.e., if the specific year’s earnings were based on only that year’s accidents. Each specific year’s adjusted EPS excludes prior accident years’ development during the specific year and includes future development of the current accident year, estimated as of year-end 2015. For example, it can be seen in Exhibits 6 and 7 that in calendar year 2015 reserves developed favorably. Note that the negative EPS in 2008 was driven by losses in the investment portfolio.

External Reporting of Reserve Changes and Reserve Development

Since reserve changes affect calendar period earnings, our monthly earnings release shows actuarial reserve changes by Personal Lines (Agency and Direct), Commercial Lines, and Property. We also report reserve development monthly, in addition to the quarterly and annual reporting requirements. This information for the current month and year-to-date is included in the “Supplemental Information” section of our monthly earnings release. The following excerpt is from our December 2015 earnings release and is unaudited:

Page 17

Table of Contents

| December 2015 Year-to-Date ($ in millions) |

Companywide Total | |

| Net Premiums Earned |

$19,899.1 | |

| Actuarial Adjustments |

||

| Reserve Decrease/(Increase) |

||

| Prior accident years |

$95.1 | |

| Current accident year |

97.0 | |

| Calendar year actuarial adjustment |

$192.1 | |

| Prior Accident Years Development |

||

| Favorable/(Unfavorable) |

||

| Actuarial adjustment |

$95.1 | |

| All other development |

220.0 | |

| Total development |

$315.1 | |

| Calendar year loss/LAE Ratio |

72.1 | |

| Accident year loss/LAE Ratio |

73.7 | |

The table shows that we decreased our loss and LAE reserves during 2015 by $192.1 million as a result of regularly scheduled actuarial reviews. Each month, we generally complete between 50 and 75 reviews, representing slightly more than 25% of our total amount of reserves. Some reviews result in needed changes to the carried reserves. The total change is reported as Actuarial Adjustments in the table. A reserve decrease is shown as a positive value on the earnings report because it increases our earnings for the reporting period.

Actuarial adjustments decreased reserves for accident year 2015 by $97.0 million, while reserves for claims in prior accident years were decreased by $95.1 million. However, this actuarial reserve decrease, which applies to claims in prior accident years, represents only one portion of the prior year development.

As stated earlier in this section, favorable or unfavorable development is due to a combination of factors. The favorable actuarial adjustment of $95.1 million includes changes to averages on open claims and the estimated emergence of claims that were unreported as of prior year-end. The all other favorable development of $220.0 million includes claims settling for amounts different from the established reserves, changes to adjuster reserves, actual emergence of claims that was different than the expected emergence included in IBNR reserves, and salvage and subrogation recoveries greater or less than expected.

The total prior accident years’ development listed above ties back to the cumulative development listed in Exhibit 6. Through December 31, 2015, including actuarial adjustments and all other development, the total prior accident years’ development was favorable by $315.1 million. In other words, with updated information as of December 31, 2015, we estimated that our reserves as of December 31, 2014 should have been $315.1 million lower than they were.

The $315.1 million favorable prior accident years’ development during 2015 is included in our calendar results for 2015. As a result, our 2015 calendar year incurred loss and LAE ratio of 72.1% is lower than our 2015 accident year incurred loss and LAE ratio of 73.7%. The difference of 1.6 points reflects the $315.1 million favorable development through December 31, 2015 divided by the net earned premium of $19.9 billion for the same period.

Reserve changes made as a result of actuarial reviews are intended to keep our current reserve liability accurate for the business reviewed. We change the reserves for the reviewed business

Page 18

Table of Contents

based upon current information and our projections of expected future development. This is not the same as the aggregate development of prior year-end reserves.

Internal Reporting of Reserve Changes and Reserve Development

After completing each segment review, Loss Reserving analysts send summaries of the reviews to all affected areas of the Company. Loss Reserving meets with Product Management, Pricing, and Claims to discuss the current change, development, trend, and other issues that were considered in reserve analysis and exchange information that may be considered in future reviews. The participation of these business units allows Loss Reserving to better understand changes in processes and business operations that may be affecting the underlying data.

To help Product Management understand the case reserve changes shown on their income statements, we provide a monthly Decomposition Report that summarizes the changes in the following categories (terms are explained in Sections II and VI):

| ● | features that closed |

| ● | features that opened (including reopened features) |

| ● | changes in reserve averages on new features (due to loss reserving) |

| ● | changes in reserve averages on open features (due to loss reserving) |

| ● | inflationary impact on open features (inflation factor applied to average reserves) |

| ● | aging of open features (features moving to the next age group) |

| ● | changes from adjuster reserve to average reserve (reserve amount changes from above threshold to below threshold) |

| ● | changes from average reserve to adjuster reserve (reserve amount changes from below threshold to above threshold) |

| ● | changes in adjuster reserves (reserve amount changes, but stays above threshold) |

| ● | changes due to re-segmentation of data |

The business units are also provided with updated information regarding the impact of prior accident years’ development on their current calendar year results. We track the reserve development on prior accident years, which allow us to retrospectively test our prior assumptions and apply that knowledge in future judgments. It also helps the Product Managers to better understand how their calendar year earnings are affected by reserve development.

Page 19

Table of Contents

Section IV – Estimating Loss Reserves

During a reserve review we generally estimate the ultimate loss amounts for the past seven accident years using up to six different projections (discussed in more detail below). We may use additional techniques if there are wide variations between the various projections or if underlying process changes make those projections less reliable. To estimate the required reserve balance (i.e., unpaid losses) for the segment, we subtract the payments we have already made on claims that occurred during that same period. We change the reserve level for that segment based upon this review.

In this section, we discuss segmentation and describe the projections we consider in the review. The Appendix contains case studies that show more details involved in the segment reviews, including the calculations and the issues involved in performing the reviews. However, the application of judgment is a key component of our reserve analysis and decisions on the necessary reserve changes. This is especially true in dynamic environments such as those we have experienced at Progressive, in which changes in mix of business (e.g., by policy limit and geographic area) can be significant.

Segmentation of Reserves for Analysis

Segments are identified to allow us to review reserve needs at the most detailed level our data supports, and provide us with the ability to identify and measure variances and trends in severity and frequency. They also allow us to identify process changes within states/regions, which helps us to understand changes within the underlying data and to reflect them in the reviews. Each segment is generally required to have enough data to deliver reliable (credible) results. Our objective is to achieve adequacy in the reserve levels with minimal variation for each segment. This enhances the accuracy of our financial reporting, supports the income statements of our business units, and allows us to make better business decisions.

The projection of frequency for the lines of business we write is usually stable even though actual frequency experienced will tend to vary depending on external factors. Examples include change in the mix of classes of drivers we insure, weather, or economic pressures like the price of gas. The severity experienced by the Company is more difficult to estimate, and it is affected by changes in underlying costs, such as medical costs, jury verdicts, etc. In addition, severity will vary based on the change in the Company’s mix of business by policy limit or deductible.

Internal and external considerations are better understood at the state level than at a more macro countrywide level. Internal considerations that are process-related may result from changes in the claims organization’s activities, including claim closure rates, the number of claims that are closed without payment, and the level of estimated needed case reserves by claim. External considerations include the litigation environment, regulatory and legislative actions, state-by-state changes in medical costs, and the availability of services to resolve claims.

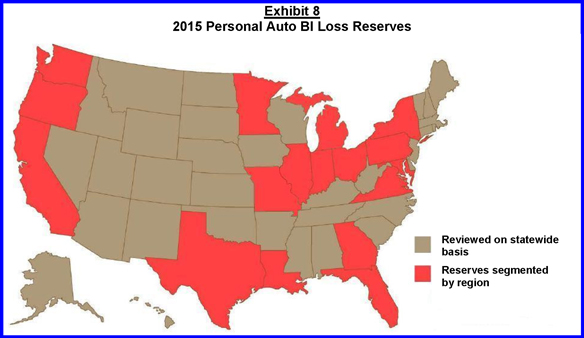

Due to our volume, we review each state separately for Personal Auto Bodily Injury loss reserves. Even though a few of these states may be considered too small to have fully credible data, we feel there is value in studying and interpreting each individual state’s trends and development. Some states are so large that we can segment the data into regions within the state. Exhibit 8 is a map showing how we currently segment our loss reserve reviews for Personal Auto Bodily Injury.

For some coverages, where the underlying data is not large enough to be credible, we may combine states with similar loss characteristics and review them together. We continually look at ways to further segment our reviews to add value to our process. Examples include enhanced accuracy and information provided to our Product Management and Pricing groups.

Page 20

Table of Contents

With respect to Personal Auto Bodily Injury and Uninsured Motorist coverage, we split loss data into groups based on policy limits and analyze the data. It is valuable to analyze these groups of segments, as they tend to have different severity, frequency and loss development patterns. We also split the data by policy limit for our Commercial Auto Bodily Injury analyses (Specialty truck is analyzed separately from Business Auto). Each identified segment is reviewed annually, semiannually, or quarterly depending on the size, the volatility, and other unique aspects of the individual segment. As the need to further analyze expenses at a finer breakout by limit presents itself, we have structured these more in-depth reviews.

LAE reserves are analyzed at a level of segmentation using many of the same considerations as loss reserves. Since the volume of LAE reserves is much less than that of loss reserves, we combine most of the states for Auto DCC reviews for coverages other than Bodily Injury and PIP. This produces more credible results. A&O is reviewed by state for all Auto line coverages. As mentioned earlier, all LAE segments are evaluated at least once per year, generally twice. Commercial Auto is also broken out similar to Auto for LAE, but not to the same level of geographic detail.

Projections of Ultimate Losses

Our standard procedures are to review the results of the different projections in order to determine if a reserve change is required. Three of the six available projections use paid data and the other three projections use incurred data (payments plus case reserves). There are strengths and weaknesses to each of the projections. In the event of a wide variation between results generated by the different projections, we further analyze the data using additional techniques.

The six available standard projections we use to estimate ultimate losses are:

| 1. | Amount Paid, in which we organize the total loss dollars paid by accident period and age of development into a triangular format (refer to Exhibit B of the Appendix) and project them to estimated ultimate amounts. We base our selections of future expected loss development largely on the historical development of prior periods. |

Page 21

Table of Contents

| 2. | Average Paid, in which we organize the paid severity (average amount paid per feature) by accident period and age of development into a triangular format and project the severities to estimated ultimate levels. Ultimate loss amounts are then calculated as the ultimate severities multiplied by the estimated ultimate number of features to be paid. |

| 3. | Bornhuetter-Ferguson Paid, which uses the paid loss development pattern to determine the percent unpaid. We apply the percent unpaid to the expected ultimate loss amount to arrive at the expected unpaid amount, which is added to actual losses paid-to-date. |

| 4. | Amount Incurred, in which we organize the total loss dollars incurred by accident period and age of development into a triangular format and project them to estimated ultimate amounts. We base our future expected loss development largely on the historical development of prior periods. |

| 5. | Average Incurred, in which we organize the incurred severity (average amount incurred per feature) by accident period and age of development into a triangular format and project the severities to estimated ultimate levels. Ultimate loss amounts are then calculated as the ultimate severities multiplied by the estimated ultimate number of features to be paid. |

| 6. | Bornhuetter-Ferguson Incurred, which uses the incurred loss development pattern to determine the percent not yet recorded. We apply the percent unrecorded to the expected ultimate losses to arrive at the expected unrecorded amount, which is added to actual losses incurred-to-date. |

The three paid projections – amount paid, average paid, and Bornhuetter-Ferguson paid – all use paid loss data. The paid projections estimate growth and development of claims in an accident period by looking at the paid development of earlier accident periods. This assumes that past paid loss development is a predictor of future paid loss development. The primary strength of using paid data is that it removes the potential for distortions that may be created by including estimated data (i.e., case reserves). The drawback is that it is more difficult to accurately project ultimate losses in the most recent periods under review. For example, with longer-tailed lines of insurance such as Bodily Injury, the early development periods are more volatile because a large proportion of the payments are made later, as was illustrated in Exhibit 5 of Section III. Accurate paid projections also depend heavily on consistent claims closure or settlement practices. If the closure rate changes, the paid projections could be misleading. In addition, shifts in mix of business (e.g., changes by policy limit) are not as readily identified in the past paid development as in the incurred loss development.

The three incurred projections – amount incurred, average incurred, and Bornhuetter-Ferguson incurred – use paid losses plus case loss reserves in each accident period. They assume that historical incurred loss development will be predictive of our future incurred loss development. The primary strength of using incurred data is that we can make use of reserve estimates for open claims. These estimates are based on the judgment of claims adjusters, in addition to our prior actuarial reviews. This is especially critical when estimating ultimate losses for longer-tailed claims such as Bodily Injury. The drawback of using incurred data for projection is that it depends heavily on adjusters using consistent reserving practices, which can vary over time.

We study changes in closure rates and average adjuster reserve levels through our segmentation of data and also through discussions with management. We adjust for these changes in our projections of losses. The case study in Section VII of the Appendix includes more thorough explanations of how changes in the closure rate affect paid loss development, and how changes in average adjuster reserves affect incurred loss development.

For the year, we conducted 729 reviews involving 328 segments of business.

Page 22

Table of Contents

ARX Holding Corporation

On April 1, 2015, Progressive acquired a controlling interest in ARX, the parent company of one of our Progressive Home Advantage (PHA) partners, American Strategic Insurance (ASI). As of this writing, Progressive owns about 69% of ARX Holding Corporation, with an agreement in place providing the right to acquire 100% ownership within six (6) years from the date of acquisition.

ARX’s business is primarily made up of Homeowners insurance, which is a short-tailed coverage. Homeowners and dwelling/fire accounts for approximately 90% of the carried reserves. The remaining 10% is made up of umbrella and commercial multi-peril. Both the personal lines and commercial lines are heavily reinsured, with the intent of providing ARX with increased capacity to write larger risks while maintaining exposure to losses within its capital resources.

ARX reviews data on a monthly basis, segmented by product, annual statement line, and state. Standard actuarial techniques, including Paid, Incurred, Average Paid, Average Incurred, Bornhuetter-Ferguson Paid, and Bornhuetter-Ferguson Incurred, which are described on pages 21-22, are reviewed.

Page 23

Table of Contents

Accident Period Losses: Losses for each accident are assigned to the period in which the accident occurred. Accident periods used in our analysis are generally three months (accident quarter), six months (accident semester), or twelve months (accident year). Payments and reserve changes, regardless of when they are made, are assigned to that same period in which the accident occurred. Therefore, accident period results will change over time as the losses develop.

Adjuster Reserves: See Case Reserves.

Adjusting & All Other Expense (A&O): A component of loss adjustment expense. A&O expenses include all claims adjusting expenses (whether internal or external to the Company) that are not included in Defense and Cost Containment (DCC). This category includes fees and salaries of those involved in a claim’s adjusting function, and other related expenses incurred in determination of coverage. Adjusting and Other expense reserves are a bulk reserve, meaning they are not attributable to any specific feature or claim. A&O is sometimes called “AOE” outside of Progressive.

Assigned Risk: People unable to obtain auto insurance in the voluntary market apply for coverage in the state automobile plan. In most cases, the insurance coverage is not actually provided by the state but instead is “assigned” to an insurance company. Each insurance company is required in most states to accept a share of these risks proportionate to its volume of business in any given state.

Average Reserves: See Case reserves.

Bodily Injury (BI) Liability Coverage: Covers legal liability arising from an insured who causes injury or death to another person while using the insured vehicle. In most states, this is a mandatory coverage. Each state mandates the minimum required limit. BI coverage pays when our insured is liable for an accident in which another party is injured.

Bornhuetter-Ferguson Method: The “BF” method is an actuarial methodology that calculates the projected ultimate losses using a blend of a pure incurred or paid development method and an expected loss ratio (or expected pure premium) method.

Business Auto Commercial Vehicles: Commercial vehicles that generally have a gross vehicle weight under 26,000 pounds. These vehicles are used in the insured’s business but are not the primary source of revenue for the business.

Calendar Period Losses: Payments and reserve changes which are recorded in the Company’s financial system during the period in question, without regard to the period in which the accident occurred or was recorded. Calendar period results do not change after the end of the period, even as new claim information develops.

Case Reserves: Estimates of amounts required to settle claims that have already been recorded but have not yet been closed. Case reserves represent the largest portion of the reserves for automobile insurance products. The case reserves carried on the Company’s financial records are called the financial case reserves.

| ● | Adjuster Reserves: The claims adjuster’s best estimate of how much a specific claim will cost (or the average reserve, if the claims adjuster does not make an estimate). If the estimate is above a predetermined threshold, it is used to determine the financial case reserves. All adjuster reserves are included in the actuarial reserve analyses. |

Page 24

Table of Contents

| ● | Average Reserves: When the adjuster estimate for a feature is below a predetermined threshold, the financial case reserve is the average reserve. These are determined by the Loss Reserving group and vary by segment. Within each segment, they may also vary by age (months since the accident occurred), policy limit, and geographic area. |

| ● | Financial Case Reserve: The reserve carried on the books for an open claim. This amount is equal to the average reserve if there is no adjuster reserve, or if the adjuster reserve is below the threshold. If the adjuster sets a reserve at or above threshold, then that amount is taken as the financial reserve. |