Form 8-K PPL Corp For: Nov 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 3, 2015

| Commission File Number |

Registrant; State of Incorporation; Address and Telephone Number |

IRS Employer Identification No. | ||

| 1-11459 | PPL Corporation (Exact name of Registrant as specified in its charter) (Pennsylvania) Two North Ninth Street Allentown, PA 18101-1179 (610) 774-5151 |

23-2758192 | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 1 - Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement

The information contained in Item 2.03 of this Current Report on Form 8-K is incorporated by reference into this Item 1.01.

Section 2 - Financial Information

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

Issue of Notes by Western Power Distribution plc

Pursuant to a subscription agreement, dated November 3, 2015, by and among Western Power Distribution plc (the “Issuer”), Banco Santander, S.A., Barclays Bank plc, Lloyds TSB Bank plc and RBC Europe Limited (together the “Joint Lead Managers”), HSBC Bank plc, Mitsubishi UFJ Securities International plc, Mizuho International plc and The Royal Bank Of Scotland plc (together the “Co-Lead Managers”, together with the Joint Lead Managers, the “Managers”), the Issuer agreed to issue and the Managers agreed to subscribe for £500 million aggregate nominal value of 3.625% Notes due 2023 (“the Notes”). The Issuer is an indirect wholly owned subsidiary of PPL Corporation (“PPL”) and the principal holding company for the four distribution network operating companies that comprise PPL’s U.K. Regulated segment: Western Power Distribution (East Midlands) plc, Western Power Distribution (South Wales) plc, Western Power Distribution (South West) plc and Western Power Distribution (West Midlands) plc. The Notes were issued on a standalone basis pursuant to the key terms of the Notes as set forth in the Prospectus dated November 3, 2015 (the “Prospectus”). On November 6, 2015, the Issuer issued the Notes and received proceeds of £495,480,000, net of fees paid to the Managers of the offering. The net proceeds from the offering will be used by the Issuer for general corporate purposes (including the re-financing of existing debt). The Notes have been admitted to the official list of the UK Listing Authority and have been admitted to trading on the London Stock Exchange’s Regulated Market.

A copy of the Prospectus is filed as Exhibit 1.1 to this Form 8-K and is incorporated herein by reference. The foregoing description is qualified in its entirety by reference to the actual terms of the exhibits filed herewith.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

| (d) | Exhibits |

| 1.1 | Prospectus of Western Power Distribution plc £500,000,000 3.625% Notes due 2023. | |||

| 4.1 | Trust Deed, dated November 6, 2015, by and among Western Power Distribution plc as Issuer, and HSBC Corporate Trustee Company (UK) Limited as Note Trustee. | |||

| 4.2 | Agency Agreement, dated November 6, 2015, by and among Western Power Distribution plc as Issuer, HSBC Corporate Trustee Company (UK) Limited and HSBC Bank plc as Principal Paying Agent. | |||

| 4.3 | Subscription Agreement, dated November 3, 2015, by and among Western Power Distribution plc as Issuer, Banco Santander, S.A., Barclays Bank plc, Lloyds TSB Bank plc, RBC Europe Limited, HSBC Bank plc, Mitsubishi UFJ Securities International plc, Mizuho International plc and The Royal Bank Of Scotland plc. | |||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PPL CORPORATION | ||||||

| By: | /s/ Stephen K. Breininger |

|||||

| Stephen K. Breininger | ||||||

| Vice President and Controller | ||||||

Dated: November 6, 2015

Exhibit 1.1

IMPORTANT NOTICE

NOT FOR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON OR ADDRESS IN THE UNITED STATES.

IMPORTANT: You must read the following before continuing. The following applies to the prospectus following this page (the “Prospectus”), and you are therefore advised to read this carefully before reading, accessing or making any other use of the Prospectus. In accessing the Prospectus, you agree to be bound by the following terms and conditions, including any modifications to them at any time you receive any information from us as a result of such access.

NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED IN THE PROSPECTUS IN THE UNITED STATES OR ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DO SO.

THE SECURITIES HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES. THE SECURITIES MAY NOT BE OFFERED OR SOLD DIRECTLY OR INDIRECTLY WITHIN THE UNITED STATES OR TO OR FOR THE ACCOUNT OR BENEFIT OF U.S. PERSONS (AS DEFINED BELOW) EXCEPT IN CERTAIN TRANSACTIONS EXEMPT FROM, OR NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE OR LOCAL SECURITIES LAWS. IN ORDER TO BE ELIGIBLE TO READ THE PROSPECTUS OR MAKE AN INVESTMENT DECISION WITH RESPECT TO THE SECURITIES DESCRIBED THEREIN, YOU MUST NOT BE A “U.S. PERSON” AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT (A “U.S. PERSON”).

THE PROSPECTUS MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER AND IN PARTICULAR MAY NOT BE FORWARDED TO ANY U.S. PERSON OR TO ANY U.S. ADDRESS. ANY FORWARDING, DISTRIBUTION OR REPRODUCTION OF THIS DOCUMENT IN WHOLE OR IN PART IS UNAUTHORISED. FAILURE TO COMPLY WITH THIS DIRECTIVE MAY RESULT IN A VIOLATION OF THE SECURITIES ACT OR THE APPLICABLE LAWS OF OTHER JURISDICTIONS.

Confirmation of your representation: The Prospectus is being sent at your request and by accessing the Prospectus, you shall be deemed to have represented to us that you have understood and agreed to the terms set out herein and you are not a U.S. Person or acting for the account or benefit of a U.S. Person and the electronic mail address that you have given to us and to which this email has been delivered is not located in the United States, its territories and possessions (including Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, Wake Island and the Northern Mariana Islands) or the District of Columbia and that you consent to delivery of the Prospectus by electronic transmission.

You are reminded that the Prospectus has been delivered to you on the basis that you are a person into whose possession the Prospectus may be lawfully delivered in accordance with the laws of the jurisdiction in which you are located and you may not, nor are you authorised to, deliver the Prospectus to any other person. If you are in any doubt as to the contents of the Prospectus or the action you should take, you are recommended to seek your own financial advice immediately from your stockbroker, bank manager, solicitor, accountant or other independent financial adviser authorised under the Financial Services and Markets Act 2000, or from another appropriately authorised independent financial adviser.

The materials relating to the offering do not constitute, and may not be used in connection with, an offer or solicitation in any place where offers or solicitations are not permitted by law. If a jurisdiction requires that the offering be made by a licensed broker or dealer and a Manager (as defined below) or any affiliate of a Manager is a licensed broker or dealer in that jurisdiction, the offering shall be deemed to be made by such Manager or such affiliate on behalf of the Issuer in such jurisdiction.

This communication is directed solely at (i) persons outside the United Kingdom, (ii) persons with professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 as amended (the “Order”), (iii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order and (iv) persons to whom an invitation or inducement to engage in investment activity (within the meaning of section 21 of the Financial Services and Markets Act 2000) in connection with the issue or sale of any securities of the Issuer, may otherwise lawfully be communicated or caused to be communicated (all such persons in (i)-(iv) above being “relevant persons”). Any investment activity to which this communication relates will only be available to and will only be engaged with relevant persons. Any person who is not a relevant person should not act or rely on this communication.

The Prospectus has been sent to you in an electronic form. You are reminded that documents transmitted via this medium may be altered or changed during the process of electronic transmission and consequently none of the Issuer, Banco Santander, S.A., Barclays Bank PLC, Lloyds Bank plc and RBC Europe Limited (together the “Joint Lead Managers”), HSBC Bank plc, Mitsubishi UFJ Securities International plc, Mizuho International plc and The Royal Bank of Scotland plc (together the “Co-Lead Managers”, and together with the Joint Lead Managers, the “Managers”, each a “Manager”), nor any person who controls any Manager, nor any director, officer, employee or agent or affiliate of any such person accepts any liability or responsibility whatsoever in respect of any difference between the Prospectus distributed to you in electronic format herewith and the hard copy version available to you on request from a Manager.

PROSPECTUS

(Dated 3 November 2015)

WESTERN POWER DISTRIBUTION PLC

(incorporated with limited liability in England and Wales with registered number 09223384)

Issue of £500,000,000 3.625 per cent. Notes due 6 November 2023

Issue price: 99.581 per cent.

Western Power Distribution plc, a public limited company incorporated under the laws of England and Wales (the Issuer), will issue £500,000,000 aggregate principal amount of 3.625 per cent. Notes due 6 November 2023 (the Notes). The issue price of the Notes is 99.581 per cent. of their principal amount.

Interest on the Notes will be payable annually in arrear on 6 November each year, beginning on 6 November 2016. Payments on the Notes will be made in GBP without deduction for or on account of taxes imposed or levied by the United Kingdom to the extent described under “Terms and Conditions of the Notes – Taxation”.

This Prospectus includes information on the terms of the Notes, including redemption and repurchase prices and covenants.

Application has been made to the United Kingdom Financial Conduct Authority in its capacity as competent authority under Part IV of the Financial Services and Markets Act 2000, as amended (FSMA) (the UK Listing Authority or UKLA) for the Notes to be admitted to the official list of the UK Listing Authority (the Official List) and to the London Stock Exchange plc (the London Stock Exchange) for the Notes to be admitted to trading on the London Stock Exchange’s Regulated Market (the Market). The Market is a regulated market for the purposes of the Markets in Financial Instruments Directive 2004/39/EC.

The Notes will be in bearer form and in denominations of GBP 100,000 and integral multiples of GBP 1,000 in excess thereof, up to and including GBP 199,000. The Notes will initially be represented by a temporary global note (the Temporary Global Note), without interest coupons, which will be deposited on or about 6 November 2015 (the Closing Date) with a common safekeeper (the Common Safekeeper) for Euroclear Bank SA/NV (Euroclear) and Clearstream Banking, société anonyme (Clearstream, Luxembourg). Interests in the Temporary Global Note will be exchangeable for interests in a permanent global note (the Permanent Global Note and, together with the Temporary Global Note, the Global Notes), without interest coupons, not earlier than 40 days after the Closing Date upon certification as to non-U.S. beneficial ownership. Interest payments in respect of the Notes cannot be collected without such certification of non-U.S. beneficial ownership.

Interests in the Permanent Global Note will be exchangeable for definitive Notes only in certain limited circumstances – see “Summary of Provisions relating to the Notes while represented by the Global Notes”.

The Notes have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “Securities Act”) or with any securities regulatory authority of any state or other jurisdiction of the United States, and are subject to United States tax law requirements. The Notes are being offered outside the United States in offshore transactions by the Managers in accordance with Regulation S under the Securities Act (“Regulation S”) to persons who are not “U.S. persons” as defined in Regulation S and may not be offered, sold or delivered within the United States or to, or for the account or benefit of U.S. persons except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Each purchaser of the Notes in making its purchase will be deemed to have made certain acknowledgements, representations and agreements. See “Subscription and Sale” in this Prospectus.

Neither the United States Securities and Exchange Commission nor any state securities commission in the United States nor any other United States regulatory authority has approved or disapproved the Notes or determined that this Prospectus is truthful or complete.

Please see “Risk Factors” to read about certain factors you should consider before buying any Notes.

The Notes are expected to be rated on issue BBB+ by Standard & Poor’s Credit Market Services Europe Limited (Standard & Poor’s) and Baa3 by Moody’s Investors Service, Ltd. (Moody’s and together with Standard & Poor’s, the Rating Agencies). Ratings ascribed to all of the Notes reflect only the views of Standard & Poor’s and Moody’s. A credit rating is not a recommendation to buy, sell or hold securities and may be subject to revision, suspension or withdrawal at any time by any one or all of the Rating Agencies. A suspension, reduction or withdrawal of the rating assigned to any of the Notes may adversely affect the market price of such Notes. Standard & Poor’s and Moody’s are established in the European Community and are registered under Regulation (EC) No 1060/2009 (the CRA Regulation).

| Joint Lead Managers | ||||

| Barclays | Lloyds Bank | |||

| RBC Capital Markets | Santander Global Banking & Markets | |||

| Co-Lead Managers | ||||

| HSBC | MUFG | |||

| Mizuho Securities | The Royal Bank of Scotland | |||

NOTICE TO INVESTORS

This Prospectus constitutes a prospectus for the purposes of Article 5.3 of Directive 2003/71/EC, as amended, including by Directive 2010/73/EU, to the extent that such amendments have been implemented in the relevant Member State of the European Economic Area (the Prospectus Directive) and for the purpose of giving information with regard to the Issuer, the Issuer and its subsidiaries as a whole (the Group) and the Notes which, according to the particular nature of the Issuer and the Notes, is necessary to enable investors to make an informed assessment of the assets and liabilities, financial position, profits and losses and prospects of the Issuer.

The Issuer accepts responsibility for the information contained in this Prospectus. To the best of the knowledge and belief of the Issuer, having taken all reasonable care to ensure that such is the case, the information contained in this Prospectus is in accordance with the facts and does not omit anything likely to affect the import of such information.

None of the Issuer, the Managers (as defined below in “Subscription and Sale”), HSBC Bank Plc (the Principal Paying Agent), HSBC Corporate Trustee Company (UK) Limited (the Trustee) nor any of their respective representatives is making any representation to investors regarding the legality of an investment in the Notes, and investors should not construe anything in this Prospectus as legal, business, financial, tax or other advice. Investors should consult their own advisors as to the legal, tax, business, financial and related aspects of an investment in the Notes. In making an investment decision regarding the Notes, investors must rely on their own examination of the Issuer and the terms of the offering and the Notes, including the merits and risks involved. Neither this Prospectus nor any other information supplied in connection with the offering of the Notes constitutes an offer or invitation by or on behalf of the Issuer, any of the Managers, the Principal Paying Agent or the Trustee to any person to subscribe for or to purchase any Notes.

The Issuer has confirmed to the Managers that this Prospectus contains all information regarding the Issuer and the Notes which is (in the context of the issue of the Notes) material; such information is true and accurate in all material respects and is not misleading in any material respect; any opinions, predictions or intentions expressed in this Prospectus on the part of the Issuer are honestly held or made and are not misleading in any material respect; this Prospectus does not omit to state any material fact necessary to make such information, opinions, predictions or intentions (in such context) not misleading in any material respect; and all proper enquiries have been made to ascertain and verify the foregoing.

This Prospectus is based on information provided by the Issuer and other sources that the Issuer believes are reliable. Neither the Managers, the Principal Paying Agent nor the Trustee have independently verified the information contained herein. Accordingly, no representation, warranty or undertaking, express or implied, is made and no responsibility or liability is accepted by the Managers, the Principal Paying Agent or the Trustee as to the accuracy or completeness of the information contained in this Prospectus or any other information provided by the Issuer in connection with the offering of the Notes. No Manager or the Principal Paying Agent or the Trustee accepts any liability in relation to the information contained in this Prospectus or any other information provided by the Issuer in connection with the offering of the Notes or their distribution. In this Prospectus, the Issuer has summarised certain documents and other information in a manner it believes to be accurate, but it refers investors to the actual documents for a more complete understanding.

No person is or has been authorised by the Issuer, the Managers, the Principal Paying Agent or the Trustee to give any information or to make any representation not contained in this Prospectus and, if given or made, any other information or representation must not be relied upon as having been authorised by the Issuer, the Managers, the Principal Paying Agent or the Trustee.

The information contained in this Prospectus is given as of the date hereof. Neither the delivery of this Prospectus nor the offering, sale nor delivery of the Notes shall, under any circumstances, create an implication that there has been no change in the affairs of the Issuer or the information set forth in this Prospectus since the date of this Prospectus. The Managers, the Principal Paying Agent and the Trustee expressly do not undertake to review the financial condition or affairs of the Issuer during the life of the Notes or to advise any investor in the Notes of any information coming to their attention. Investors should be aware that they may be required to bear the financial risks of an investment in the Notes for an indefinite period of time.

This Prospectus does not constitute an offer to sell or the solicitation of an offer to buy the Notes in any jurisdiction to any person to whom it is unlawful to make the offer or solicitation in such jurisdiction. The distribution of this Prospectus and the offer or sale of Notes may be restricted by law in certain jurisdictions. The Issuer, the Managers, the Principal Paying Agent and the Trustee do not represent that this Prospectus may be lawfully distributed, or that the Notes may be lawfully offered, in compliance with any applicable registration or other requirements in any such jurisdiction, or pursuant to an exemption available thereunder, or assume any responsibility for facilitating any such distribution or offering. In particular, no action has been taken by the Issuer, the Managers, the Principal Paying Agent or the Trustee which is intended to permit a public offering of the Notes or the distribution of this Prospectus in any jurisdiction where action for that purpose is required. Accordingly, no Notes may be offered or sold, directly or indirectly, and neither this Prospectus nor any advertisement or other offering material may be distributed or published in any jurisdiction, except under circumstances that will result in compliance with any applicable laws and regulations.

2

Persons into whose possession this Prospectus or any Notes may come must inform themselves about, and observe, any such restrictions on the distribution of this Prospectus and the offering and sale of Notes. In particular, there are restrictions on the distribution of this Prospectus and the offer or sale of Notes in the United States and the United Kingdom. See “Subscription and Sale”.

The Notes may not be a suitable investment for all investors.

Each potential investor in the Notes must determine the suitability of that investment in light of their own circumstances. In particular, each potential investor should:

| 1. | have sufficient knowledge and experience to make a meaningful evaluation of the merits and risks of investing in the Notes; |

| 2. | have access to, and knowledge of, appropriate analytical tools to evaluate, in the context of their particular financial situation, an investment in the Notes and the impact such investment will have on their overall investment portfolio; |

| 3. | have sufficient financial resources and liquidity to bear all of the risks of an investment in the Notes; |

| 4. | understand thoroughly the terms of the Notes and be familiar with the behaviour of any relevant markets; and |

| 5. | be able to evaluate (either alone or with the help of a financial adviser) possible scenarios for economic, interest rate and other factors that may affect their investment and their ability to bear the applicable risks. |

In this Prospectus, unless otherwise specified, references to a “Member State” are references to a Member State of the European Economic Area and references to “Sterling”, “GBP” or “£” are to the lawful currency of the United Kingdom.

IN CONNECTION WITH THE ISSUE OF THE NOTES, BARCLAYS BANK PLC AS STABILISING MANAGER (OR PERSONS ACTING ON BEHALF OF THE STABILISING MANAGER) MAY OVER-ALLOT NOTES OR EFFECT TRANSACTIONS WITH A VIEW TO SUPPORTING THE MARKET PRICE OF THE NOTES AT A LEVEL HIGHER THAN THAT WHICH MIGHT OTHERWISE PREVAIL. HOWEVER, THERE IS NO ASSURANCE THAT THE STABILISING MANAGER (OR PERSONS ACTING ON BEHALF OF THE STABILISING MANAGER) WILL UNDERTAKE STABILISATION ACTION. ANY STABILISATION ACTION MAY BEGIN ON OR AFTER THE DATE ON WHICH ADEQUATE PUBLIC DISCLOSURE OF THE TERMS OF THE OFFER OF THE NOTES IS MADE AND, IF BEGUN, MAY BE ENDED AT ANY TIME, BUT IT MUST END NO LATER THAN THE EARLIER OF 30 DAYS AFTER THE ISSUE DATE OF THE NOTES AND 60 DAYS AFTER THE DATE OF THE ALLOTMENT OF THE NOTES. ANY STABILISATION ACTION OR OVER-ALLOTMENT MUST BE CONDUCTED BY THE STABILISING MANAGER (OR PERSONS ACTING ON BEHALF OF THE STABILISING MANAGER) IN ACCORDANCE WITH ALL APPLICABLE LAWS AND RULES.

FORWARD-LOOKING STATEMENTS

This Prospectus contains various forward-looking statements regarding events and trends that are subject to risks and uncertainties that could cause the actual results and financial position of the Issuer to differ materially from the information presented herein. When used in this Prospectus, the words “estimate”, “project”, “intend”, “anticipate”, “believe”, “expect”, “should” and similar expressions, as they relate to the Issuer and its management, are intended to identify such forward-looking statements. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Issuer does not undertake any obligations publicly to release the result of any revisions to these forward-looking statements to reflect the events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

3

CONTENTS

| OVERVIEW |

5 | |||

| RISK FACTORS |

10 | |||

| SELECTED FINANCIAL INFORMATION AND SUMMARY OF RESULTS |

19 | |||

| USE OF PROCEEDS |

21 | |||

| DESCRIPTION OF THE ISSUER AND ITS PRINCIPAL SUBSIDIARIES |

22 | |||

| DIRECTORS AND SENIOR MANAGEMENT OF THE ISSUER |

31 | |||

| TERMS AND CONDITIONS OF THE NOTES |

32 | |||

| PROVISIONS RELATING TO THE NOTES WHILE REPRESENTED BY THE GLOBAL NOTES |

47 | |||

| TAX CONSIDERATIONS |

50 | |||

| FATCA DISCLOSURE |

51 | |||

| SUBSCRIPTION AND SALE |

54 | |||

| GENERAL INFORMATION |

56 | |||

| APPENDIX – CONSOLIDATED AUDITED FINANCIAL STATEMENTS OF THE ISSUER |

58 | |||

4

OVERVIEW

This overview highlights certain information contained in this Prospectus. This overview does not contain all of the information prospective investors should consider before investing in the Notes. Prospective investors should read this entire Prospectus carefully, including the sections entitled “Risk Factors”, “Forward-Looking Statements” and the financial information and the notes included elsewhere in this Prospectus.

The Issuer is a holding company of four regulated monopoly distributors of electricity in the Midlands area of England, the South West of England and South Wales, namely Western Power Distribution (East Midlands) plc, Western Power Distribution (South Wales) plc, Western Power Distribution (South West) plc, and Western Power Distribution (West Midlands) plc (together, the Distribution Companies). The Issuer heads the WPD Group whose principal activity is the distribution of electricity in the South West of England, South Wales and East and West Midlands of England conducted by the Distribution Companies and certain other subsidiaries (the WPD Group).

KEY STRENGTHS

The business of the WPD Group has a number of strengths, deriving both from the commercial strength of the business, and from the status of the Distribution Companies as regulated monopoly distributors of electricity. The key strengths of the business of the WPD Group are based on:

| (a) | a stable, well established transparent regulatory regime; |

| (b) | strong and predictable operating cash flow; |

| (c) | no volume risk; |

| (d) | inflation linked earnings and asset base; |

| (e) | positive cash flow generation before financing; |

| (f) | industry leading delivery of output targets set by the Office of Gas and Electricity Markets of Great Britain (Ofgem); and |

| (g) | accurate forecasting and efficient delivery of investment programmes. |

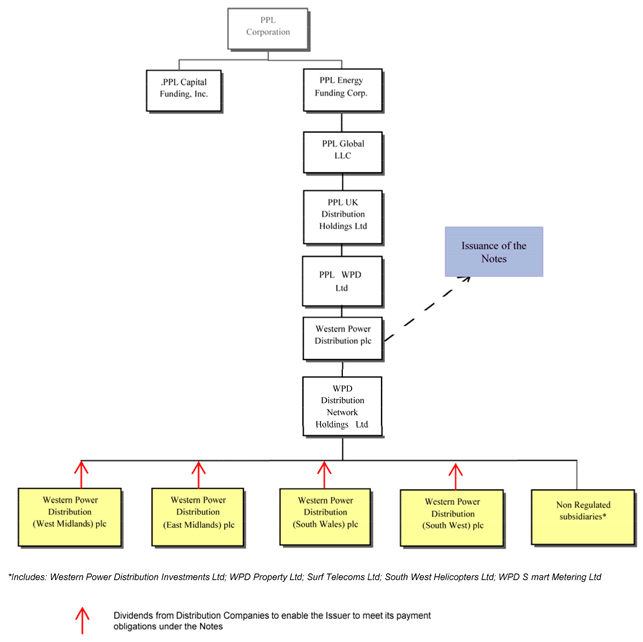

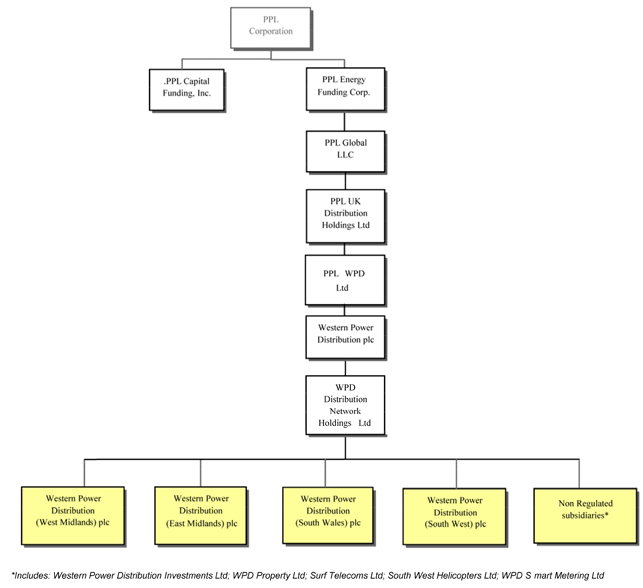

CORPORATE AND FINANCING STRUCTURE

The following chart summarises the Issuer’s corporate and financing structure as at the date of this Prospectus.

6

THE NOTES

The overview below describes the principal terms of the Notes and is qualified in its entirety by the detailed information appearing elsewhere in this Prospectus and, in particular, the “Terms and Conditions of the Notes”. Potential purchasers of the Notes are urged to read this Prospectus in its entirety. Terms used in this overview and not otherwise defined shall have the meanings given to them in the Terms and Conditions of the Notes.

| Issuer | Western Power Distribution plc | |

| Notes to be Issued | £500,000,000 aggregate principal amount of 3.625 per cent. Notes due 6 November 2023 (the Notes). | |

| Issue Date | 6 November 2015. | |

| Maturity Date | 6 November 2023. | |

| Issue Price | 99.581 per cent. | |

| Net proceeds | £495,480,000 | |

| Interest Rate | The Notes will bear interest at a rate of 3.625 per cent. per annum, provided that if a Step-up Event has occurred and is continuing, the interest rate will be increased by 1.25 per cent. from and including the Interest Payment Date immediately following the occurrence of that Step-up Event until, and including the Interest Payment Date immediately following the date on which the relevant Step-up Event ceases to be continuing. | |

| Interest Payment Dates | Interest will be payable annually in arrear on 6 November in each year, commencing on 6 November 2016. | |

| Form and Denomination | The Notes will be issued in bearer form in denominations of £100,000 and integral multiples of £1,000 in excess thereof up to and including £199,000. The Notes will initially be in the form of a Temporary Global Note, without interest coupons, which will be deposited on or around the Closing Date with a Common Safekeeper. The Temporary Global Note will be exchangeable, in whole or in part, for interests in a Permanent Global Note, without interest coupons, not earlier than 40 days after the Closing Date upon certification as to non-U.S. beneficial ownership. Interest payments in respect of the Notes cannot be collected without such certification of non-U.S. beneficial ownership. The Permanent Global Note will be exchangeable in certain limited circumstances in whole, but not in part, for Notes in definitive form in denominations of £100,000 and integral multiples of £1,000 in excess thereof, up to and including £199,000 and with interest coupons attached. Full information is set out in “Summary of Provisions Relating to the Notes in Global Form”. | |

| Status | The Notes and the Coupons relating to them constitute direct, general, unconditional and unsecured obligations of the Issuer and shall at all times rank pari passu and without any preference among themselves. The payment obligations of the Issuer under the Notes and the Coupons relating to them shall, save for such exceptions as may be provided by applicable legislation, at all times rank at least equally with all other unsecured and unsubordinated indebtedness of the Issuer present and future. | |

| Redemption for Taxation Reasons | The Issuer may, at its option, redeem all, but not some only, of the Notes at any time at par plus accrued interest in the event of certain tax changes, as described under Condition 5(b) (Redemption for Taxation Reasons). | |

| Redemption at the Option of the Issuer | The Issuer may, at its option, redeem all, or some only, of the Notes at any time after the Issue Date at the relevant redemption amount described under Condition 5(c) (Redemption at the Option of the Issuer). | |

7

| Redemption at the Option of the | ||

| Noteholders | The Noteholders may, at their option, require the Issuer to redeem all, or some only, of the Notes on the occurrence of certain specific events, and in accordance with Condition 5(d) (Redemption at the Option of Noteholders) | |

| Mandatory Redemption | If a Disposal Event occurs (being certain disposals in relation to the Distribution Companies), the Issuer shall on giving not less than 15 nor more than 30 days’ irrevocable notice to the Trustee and the Noteholders, redeem all of the Notes in accordance with Condition 5(e) (Redemption on disposal of a Distribution Company). | |

| Negative Pledge | The Issuer shall not, so long as any Note remains outstanding, create or permit to subsist any encumbrance (unless arising by operation of law) or other security interest whatsoever over any of its assets or undertaking without the prior written consent of the Trustee. | |

| Additional Amounts | All payments of principal and interest in respect of the Notes and the Coupons shall be made free and clear of, and without withholding or deduction for or on account of, any present or future taxes, duties, assessments or governmental charges of whatever nature imposed, levied, collected, withheld or assessed by or within the United Kingdom or any authority therein or thereof having power to tax, unless such withholding or deduction is required by law. In that event, the Issuer will pay such additional amounts as shall result in receipt by the Noteholders and the Couponholders of such amounts as would have been received by them had no such withholding or deduction been required, subject to customary exceptions. Full details are set out in Condition 7 (Taxation). | |

| Events of Default | Events of Default under the Notes include: non-payment of principal, or interest under the Notes; breach of the covenants and other terms contained in the Conditions; cross-default of any indebtedness of the Issuer and cross-acceleration of any indebtedness of any Distribution Company; enforcement proceedings against the Issuer, insolvency events or winding-up relating to the Issuer, nationalisation of the assets of the Issuer, or an illegality making it unlawful for the Issuer to perform any of its obligations under the Notes or the Trust Deed;, in each case, subject to the provisions described in Condition 9 (Events of Default). | |

| Risk Factors | There are certain factors that may affect the Issuer’s ability to fulfil its obligations under the Notes. Certain of these factors are set out under “Risk Factors” below and include, among others, risks relating to regulatory and legislative changes, market, liquidity and legal risks and the general economic situation. In addition, there are certain factors in relation to assessing the risks associated with holding the Notes. | |

| Modification, Waiver and Substitution | The Trustee may, without the consent of the Noteholders or Couponholders, agree to (i) any modification of, or to the waiver or authorisation of any breach or proposed breach of, any of the provisions of the Notes, the Trust Deed, the Coupons or the conditions of the Notes, which is of a formal, minor or technical nature or is made to correct a manifest error, or which, in the opinion of the Trustee, is not materially prejudicial to the interests of the Noteholders (save in relation to a Reserved Matter) (ii) the substitution in place of the Issuer as principal debtor under the Notes, in each case in the circumstances and subject to the conditions described in Conditions 10(b) (Modification of the Trust Deed) and 10(c) (Substitution). | |

| Use of Proceeds | The net proceeds of the issue of the Notes will be used by the Issuer and its subsidiaries (including the Distribution Companies) for general corporate purposes (including to refinance certain existing indebtedness). | |

| Principal Paying Agent | HSBC Bank Plc | |

| Trustee | HSBC Corporate Trustee Company (UK) Limited | |

8

| Joint Lead Managers | Banco Santander, S.A., Barclays Bank PLC, Lloyds Bank plc and RBC Europe Limited | |

| Co-Lead Managers | HSBC Bank plc, MUFG, Mizuho International plc and The Royal Bank of Scotland plc | |

| Listing and Trading | Application has been made to the Financial Conduct Authority for the Notes to be admitted to listing on the Official List and to trading on the Market. There are no assurances that the Notes will be admitted to the Market. | |

| Governing Law | The Notes, the Trust Deed and the Agency Agreement will be governed by the laws of England and Wales. | |

| Clearing Systems | Euroclear and Clearstream, Luxembourg | |

| Credit Ratings | The Notes are expected to be rated on issue BBB+ by Standard & Poor’s and Baa3 by Moody’s. A credit rating is not a recommendation to buy, sell or hold securities and may be subject to suspension, reduction or withdrawal at any time by the assigning rating agency. Standard & Poor’s and Moody’s are established in the European Community and are registered under the CRA Regulation. | |

| Selling Restrictions | The Notes have not been and will not be registered under the Securities Act and, subject to certain exceptions, may not be offered or sold within the United States or to U.S. persons. The Notes may be sold in other jurisdictions (including the United Kingdom) only in compliance with applicable laws and regulations. See “Subscription and Sale” below. | |

| United States Selling Restriction | Regulation S, Category 1 | |

| ISIN Code | XS1315962602 | |

| Common Code | 131596260 | |

9

RISK FACTORS

The Issuer believes that the factors below may affect its ability to fulfil its obligations under the Notes. All of these factors are contingencies which may or may not occur and the Issuer is not in a position to express a view on the likelihood of any such contingency occurring.

In addition, factors which are material for the purpose of assessing the market risks associated with the Notes are described below.

The Issuer believes that the factors described below represent the principal risks inherent in investing in the Notes, but the Issuer may be unable to pay interest, principal or other amounts on or in connection with the Notes for other reasons which may not be considered significant risks by the Issuer based on information currently available to it or which it may not currently be able to anticipate. Prospective investors should also read the detailed information set out elsewhere in this Prospectus and reach their own views prior to making any investment decision. Noteholders may lose the value of their entire investment in certain circumstances.

Words and expressions defined in “Terms and Conditions of the Notes” below or elsewhere in this Prospectus have the same meaning in this section.

FACTORS THAT MAY AFFECT THE ISSUER’S ABILITY TO FULFIL ITS OBLIGATIONS UNDER OR IN CONNECTION WITH NOTES

Regulatory Risk

Under current regulation by Ofgem the revenue of the Distribution Companies available for distribution is determined by the distribution price controls set out under the terms of their respective distribution licences by Ofgem every eight years, the current distribution price control is the first to reflect the new RIIO (Revenue = Incentive + Innovation + Output) model for electricity network regulation (RIIO-ED1). Pursuant to this, each Distribution Company has agreed the price control with Ofgem that covers the eight year period from 1 April 2015 to 31 March 2023. Therefore, unless Ofgem reopens the price control, which the Issuer considers unlikely, there is a high degree of certainty as to the level of revenue permitted by regulation until 31 March 2023.

However, there can be no assurance that future price controls will permit the generation of sufficient revenues to enable the Issuer to meet its respective payment obligations under the Notes. Any adverse price control in the future may negatively impact the net operating revenue of the Distribution Companies. This may adversely affect the Distribution Companies’ ability to pay sufficient dividends to the Issuer for the Issuer to be able to comply with its payment obligations under the Notes.

Distribution licence

Failure by a Distribution Company to comply with the terms of its distribution licence may lead to Ofgem making an enforcement order or levying a fine on it. In respect of any of the Distribution Companies, Ofgem has the power to levy fines of up to 10 per cent of turnover of that company for any breach of its distribution licence. While the distribution licence may be terminated immediately in exceptional circumstances, such as in the event of insolvency proceedings, it otherwise continues indefinitely until revoked following no less than 25 years’ written notice.

Any future termination by Ofgem of the distribution license of the Distribution Companies will result in the loss of business for such Distribution Companies, which may have an adverse effect on the Distribution Companies’ ability to pay sufficient dividends to the Issuer for the Issuer to be able to comply with its payment obligations under the Notes.

10

Retail price index movements and cost-base variations

The annual revenues of each Distribution Company are adjusted by the published retail price index (RPI) in the UK. There is therefore a risk that each Distribution Company’s cost base may increase at a faster rate than the RPI due to inflation as measured by the RPI being less than the rate of inflation on components of such Distribution Company’s cost base, even though Ofgem’s price control does allow for some cost increases in excess of RPI. If that were to happen, each Distribution Company’s profitability would be reduced and, if the differential between RPI-linked inflation and experienced operating cost inflation were sufficiently large, it could adversely affect the business, financial position and results of operations of such Distribution Company, and consequently, the revenues available to the Issuer. The effects of deflation would also be similar. The annual revenue of each Distribution Company may reduce at a greater degree to any deflationary impact on the component costs of the business. Again if this were to happen each Distribution Company’s profitability would be reduced and, if the differential between RPI-linked deflation and experienced operating cost deflation was sufficiently large, it could adversely affect each Distribution Company’s business, financial position and results of operations and ultimately that of the Issuer.

Change to measure of inflation

On 8 January 2015, the UK Statistics Authority published a review recommending that the Office for National Statistics adopt the so-called “CPIH” measure of inflation (which, among other things, would include housing costs in its measure of inflation) as its main measure of inflation.

No final decision will be made before the end of 2015 but if Ofgem decides to use the CPIH measure of inflation, after the expiry of the RIIO-ED1 period, this could have an impact on the Distribution Companies’ revenue growth and, ultimately, on their respective businesses, financial positions and results of operations. In turn, this may impact the Distribution Companies’ ability to pay sufficient dividends to the Issuer for the Issuer to be able to comply with its payment obligations under the Notes.

Supply Installation Regulations

Failure to comply with current supply installation regulations could lead to prosecution by the Department of Energy and Climate Change. While each Distribution Company has robust inspection and maintenance programmes in place to mitigate this risk, no assurance can be given that any Distribution Company will not be subject to such action in the future. Any such action may impact the Distribution Companies’ ability to pay sufficient dividends to the Issuer for the Issuer to be able to comply with its payment obligations under the Notes.

Health and Safety

Failure to comply with legislation, or a health and safety incident, could lead to prosecution by the Health and Safety Executive (the HSE). Each Distribution Company places the highest priority on health and safety, and invests in robust training and auditing of all its employees. No assurance can be given that any Distribution Company will not be subject to HSE action in the future. Any such action may impact the Distribution Companies’ ability to pay sufficient dividends to the Issuer for the Issuer to be able to comply with its payment obligations under the Notes.

Ofgem Requirements

Each Distribution Company’s activities are regulated by Ofgem. Failure to operate the network properly could lead to compensation payments or penalties or loss of incentive revenues under incentive arrangements. Failure to invest capital expenditure in line with agreed programmes could also lead to deterioration of the network and clawback of investment deferred if specified outputs are not met. While each Distribution Company’s investment programme is targeted to maintain asset condition and meet the prescribed outputs over an eight year period and improve customer interruptions and customer minutes lost over the period, no guarantee can be given that these regulatory requirements will be met. If such regulatory requirements are not met, this may result in insufficient cash being available to the Distribution Companies for them to pay sufficient dividends to the Issuer for the Issuer to be able to comply with its payment obligations under the Notes.

11

IT Systems

The Distribution Companies rely on a number of key IT systems for network operation. Failure to plan and execute suitable contingencies in the event of critical IT system breakdowns could result in poor customer service and/or an inability to operate the network effectively. Each Distribution Company has robust contingency plans in place to cover such eventualities and regularly tests these plans, but no assurance can be given as to their effectiveness going forward.

Environment

Failure to comply with legislation in the event of an environmental incident could lead to prosecution by the Environment Agency. While each Distribution Company has robust operating, inspection and maintenance procedures in place to mitigate this risk, ongoing compliance cannot be guaranteed.

Storm Related Supply Interruptions

Failure to manage storm related supply interruptions adequately could lead to negative customer perception, adverse publicity and a potential financial impact on the business. Each Distribution Company has developed robust operating procedures to manage storm related supply interruptions and has, through independent review, achieved benchmark performance in previous incidents. However, no assurance can be given that satisfactory performance can be delivered in the future.

Combined Operating Activities of WPDE, WPDW, WPD South West and WPD South Wales

As required by Ofgem in its regulation of distribution network operators (DNOs and each a DNO), each Distribution Company is a separate legal entity, which is subject to financial ring-fencing and which holds a separate distribution licence. However, on a management and commercial level the Distribution Companies are operated on a combined basis under the commercial brand “Western Power Distribution”. As a result, any event which has an adverse impact on the WPD Group may affect the management and delivery of operations for each Distribution Company. In turn, this may impact the Distribution Companies’ ability to pay sufficient dividends to the Issuer for the Issuer to be able to comply with its payment obligations under the Notes.

Procurement Risk

In order to support its core business activities, it is necessary for each Distribution Company to purchase significant quantities of resources and enter into contracts for the supply of other products and services. Although each Distribution Company routinely enters into long-term contracts to protect its commercial position, significant price rises and/or failure to secure key materials could have a significant adverse effect on the operations and/or financial position of such Distribution Company. Whilst each Distribution Company receives protection from inflation through its price controls being linked to the retail price index, it will be exposed or benefit from any changes relative to inflation, either as a result of commodity prices or issues around supply and demand for plant and equipment or with its contractors. To the extent it purchases equipment from overseas, this exposure would also extend to exchange rate fluctuations.

Key management personnel and employees

Each Distribution Company’s business depends upon the efforts and dedication of its senior management team. Competition for highly qualified personnel is intense, and the loss of the services of any of these key personnel without adequate replacement or the inability to attract new qualified personnel could have a material adverse effect on each Distribution Company’s business, financial condition and results of operations.

Each Distribution Company’s future business success depends in part on its ability to continue to recruit, train, motivate and retain employees and on its ability to continue to employ creative employees and consultants. The loss of service of any key personnel, or an inability to attract and retain qualified employees and consultants, could have a material adverse impact on each Distribution Company’s business, financial condition and results of operations.

12

Each Distribution Company’s workforce is covered by collective bargaining agreements, which impacts its labour costs. The current collective bargaining agreements are renewed on a rolling basis and no Distribution Company can ensure that the collective bargaining agreements will continue without required amendments or that it will reach new agreements with the unions on satisfactory terms if this event occurs. Furthermore, work stoppages, strikes or similar industrial actions could adversely impact each Distribution Company’s business, financial position and results of operations.

RISKS RELATING TO FINANCING STRUCTURE

The Issuer is a holding company and must rely on the Distribution Companies for payments on the Notes.

As a holding company, the primary assets of the Issuer are its investments in the Distribution Companies. Substantially all of the Issuer’s operations are conducted by the Distribution Companies. Consequently, the operating cash flow of the Issuer and its ability to service its indebtedness and fund its other obligations depends upon the operating cash flow and distributions from the Distribution Companies. The Distribution Companies are separate legal entities that have no obligation to pay any amounts due pursuant to the obligations of the Issuer or to make any funds available for that purpose, whether by dividends or otherwise. In addition, each Distribution Company’s ability to pay dividends to the Issuer depends on any statutory, regulatory and/or contractual restrictions that may be applicable to each one, which may include without limitation, pensions liabilities and requirements to maintain minimum levels of equity ratios, working capital or other assets.

In particular, under their respective licences, unless Ofgem grants its consent, a Distribution Company is prohibited from paying any dividends to the Issuer if such Distribution Company loses its investment grade issuer rating from any rating agency or if it already has the lowest investment grade rating and its rating is on review for possible downgrade or on a negative credit or rating watch or its rating outlook becomes negative.

Ofgem have the following events as additional dividend stopper trigger events:

| ● | any report by the licensee of adverse circumstances under the availability of resources condition that the licensee’s board considers that it will not have sufficient financial/operational resources for the next twelve months or is not compliant with the stipulated license conditions or there has been a change in circumstances from a previously positive certificate; and |

| ● | any material breach of a formal financial covenant entered into by the licensee. This restriction would not apply where the breach was remedied, or the covenant renegotiated, to the satisfaction of the counter party and Ofgem is notified in writing, or Ofgem had given advance confirmation that a particular breach would not trigger the restriction. |

If the Issuer ceases directly or indirectly to own or control a majority stake in any of the Distribution Companies, and consequently a Rating Downgrade (as defined in Condition 5(e) (Redemption on disposal of a Distribution Company)) occurs, then a Disposal Event (as defined in Condition 5(e) (Redemption on disposal of a Distribution Company)) will be triggered pursuant to Condition 5(e) (Redemption on disposal of a Distribution Company), which may adversely affect the remaining Distribution Companies’ ability to pay sufficient dividends to the Issuer for the Issuer to be able to comply with its payment obligations under the Notes. If a Disposal Event occurs, then the Issuer shall redeem all of the Notes in accordance with Condition 5(e) (Redemption on disposal of a Distribution Company).

The level of indebtedness of any Distribution Company could adversely affect the financial condition of the Issuer.

As of 31 August 2015, the Distribution Companies had a consolidated total of £3,935 million aggregate principal amount of debt outstanding. WPDW, WPDE and WPD South West each have revolving credit facilities permitting WPDW and WPDE to borrow up to £300 million, respectively and WPD South West to borrow up to £245 million. Each of these facilities expires in 2020. In addition, the Distribution Companies have issued and may from time to time issue further notes under a £3,000,000,000 euro medium term note programme.

13

The amount of indebtedness of the Distribution Companies could limit their ability to obtain additional financing for working capital, capital expenditures, debt service requirements or other purposes. It may also increase their vulnerability to adverse economic, market and industry conditions, and limit their flexibility in planning for, or reacting to, changes in our business operations or the industry overall.

If the results of operations and financial condition of the Distribution Companies are adversely affected by their level of indebtedness, their ability to make dividend payments or other distributions to the Issuer may be impaired. As a result, the financial condition and ability to meet the obligations of the Issuer, including under the Notes, would be adversely affected.

Despite current indebtedness levels, the Issuer and the Distribution Companies may still be able to incur substantially more debt, which could further exacerbate the risks faced by the Issuer. In addition, the Issuer could be negatively affected by rising interest rates, downgrades to its credit ratings or other negative developments in its ability to access capital markets.

Together with each of the Distribution Companies, the Issuer may incur substantially more debt in the future. The terms of the Notes do not restrict the ability of the Issuer to incur additional indebtedness. Any future debt agreement entered into by the Issuer may contain covenants and restrictions limiting the ability of the Issuer to finance its capital needs, or expand its business and pursue its business strategies. If further debt is added, the related restrictions and covenants could materially and adversely affect the ability of the Issuer to finance its future operations or capital needs. In order to finance its significant capital expenditures, debt service requirements and other operating needs, each Distribution Company expects to be reliant upon adequate long-term and short-term financing. Consequently, the Distribution Companies are likely to be sensitive to movements in interest rates, credit rating considerations, market liquidity and credit availability. Adverse changes in these conditions could result in increased costs and decreased liquidity to them and the Issuer.

FACTORS WHICH ARE MATERIAL FOR THE PURPOSE OF ASSESSING THE MARKET RISKS ASSOCIATED WITH NOTES

Risks related to Notes generally

Set out below is a description of material risks relating to the Notes generally:

The Issuer has the right to redeem the Notes at its option; this may limit the market value of the Notes and an investor may not be able to reinvest the redemption proceeds in a manner which achieves a similar effective return.

The Issuer has the option to redeem the Notes prior to their scheduled maturity date as described in Condition 5(c) (Redemption at the Option of the Issuer) of the conditions of the Notes. Such optional redemption feature is likely to limit the market value of Notes. During any period when the Issuer may elect to redeem Notes, the market value of the Notes generally will not rise substantially above the price at which they can be redeemed. This also may be true prior to any redemption period.

The Issuer may be expected to redeem Notes when its cost of borrowing is lower than the interest rate on the Notes. At those times, an investor generally would not be able to reinvest the redemption proceeds at an effective interest rate as high as the interest rate on the Notes being redeemed and may only be able to do so at a significantly lower rate. Potential investors should consider reinvestment risk in light of other investments available at that time.

The conditions of the Notes contain provisions which may permit their modification without the consent of all investors and confer significant discretions on the Trustee which may be exercised without the consent of the Noteholders or Couponholders and without regard to the individual interests of particular Noteholders.

The conditions of the Notes contain provisions for calling meetings of Noteholders to consider matters affecting their interests generally. These provisions permit defined majorities to bind all Noteholders including Noteholders who did not attend and vote at the relevant meeting and Noteholders who voted in a manner contrary to the majority.

14

The conditions of the Notes also provide that the Trustee may, without the consent of Noteholders or Couponholders and without regard to the interests of particular Noteholders, agree to (i) any modification of, or to the waiver or authorisation of any breach or proposed breach of, any of the provisions of the Notes, the Trust Deed, the Coupons or the conditions of the Notes which is of a formal, minor or technical nature or to correct a manifest error or which in the opinion of the Trustee is not materially prejudicial to the Noteholders (save in relation to a Reserved Matter), or (ii) determine without the consent of the Noteholders or Couponholders that any Event of Default shall not be treated as such or (iii) the substitution the Issuer’s successor in business as principal debtor under any Notes in place of the Issuer, and in case of such a substitution, to a change of the law governing the Notes and the Coupons, in the circumstances described in Condition 10 (Meetings of Noteholders, Modification, Waiver and Substitution).

The Notes may be subject to withholding taxes in circumstances where the Issuer is not obliged to make gross up payments and this would result in holders receiving less interest than expected and could significantly adversely affect their return on the Notes.

Withholding under the EU Savings Directive.

Under Council Directive 2003/48/EC on the taxation of savings income (the Savings Directive), EU Member States are required to provide to the tax authorities of other EU Member States details of certain payments of interest or similar income paid or secured by a person established in an EU Member State to or for the benefit of an individual resident in another EU Member State or certain limited types of entities established in another EU Member State.

For a transitional period, Austria is instead required (unless during that period it elects otherwise) to operate a withholding system in relation to such payments (subject to a procedure whereby, on meeting certain conditions, the beneficial owner of the interest or other income may request that no tax be withheld). The end of the transitional period is dependent upon the conclusion of certain other agreements relating to information exchange with certain other countries. A number of non-EU countries and territories have adopted similar measures and the EU Member States have adopted similar measures with certain dependent or associated territories of certain EU Member States.

On 24 March 2014, the Council of the European Union adopted a Council Directive (the Amending Directive) amending and broadening the scope of the requirements described above. The Amending Directive requires EU Member States to apply these new requirements from 1 January 2017 and if they were to take effect the changes would expand the range of payments covered by the Savings Directive, in particular to include additional types of income payable on securities. They would also expand the circumstances in which payments must be reported or subject to withholding. This approach would apply to payments made to, or secured for, persons, entities or legal arrangements (including trusts) where certain conditions are satisfied, and may in some cases apply where the person, entity or arrangement is established or effectively managed outside of the European Union.

However, the European Commission has proposed the repeal of the Savings Directive from 1 January 2017 in the case of Austria and from 1 January 2016 in the case of all other EU Member States (subject to ongoing requirements to fulfil administrative obligations such as the reporting and exchange of information relating to, and accounting for withholding taxes on, payments made before those dates). This is to prevent overlap between the Savings Directive and a new automatic exchange of information regime to be implemented under Council Directive 2011/16/EU on Administrative Cooperation in the field of Taxation (as amended by Council Directive 2014/107/EU). The new regime under Council Directive 2011/16/EU (as amended) is in accordance with the Global Standard released by the Organisation for Economic Cooperation and Development in July 2014. Council Directive 2011/16/EU (as amended) is generally broader in scope than the Savings Directive, although it does not impose withholding taxes. The proposal also provides that, if it proceeds, EU Member States will not be required to apply the new requirements of the Amending Directive.

If a payment were to be made or collected through an EU Member State which has opted for a withholding system and an amount of, or in respect of, tax were to be withheld from that payment, neither the Issuer nor any Paying Agent (as defined in the Conditions of the Notes) nor any other person would be obliged to pay

15

additional amounts with respect to any Note as a result of the imposition of such withholding tax. The Issuer is required to maintain a Paying Agent in an EU Member State that is not obliged to withhold or deduct tax pursuant to the Savings Directive.

U.S. Foreign Account Tax Compliance Act Withholding

Whilst the Notes are in global form and held within Euroclear or Clearstream, Luxembourg (together the ICSDs), in all but the most remote circumstances, it is not expected that the new reporting regime and potential withholding tax imposed by sections 1471 through 1474 of the U.S. Internal Revenue Code of 1986 (FATCA) will affect the amount of any payment received by the ICSDs (see FATCA Disclosure under Tax Considerations). However, FATCA may affect payments made to custodians or intermediaries in the subsequent payment chain leading to the ultimate investor if any such custodian or intermediary generally is unable to receive payments free of FATCA withholding. It also may affect payment to any ultimate investor that is a financial institution that is not entitled to receive payments free of withholding under FATCA, or an ultimate investor that fails to provide its broker (or other custodian or intermediary from which it receives payment) with any information, forms, other documentation or consents that may be necessary for the payments to be made free of FATCA withholding. Investors should choose the custodians or intermediaries with care (to ensure each is compliant with FATCA or other laws or agreements related to FATCA) and provide each custodian or intermediary with any information, forms, other documentation or consents that may be necessary for such custodian or intermediary to make a payment free of FATCA withholding. Investors should consult their own tax adviser to obtain a more detailed explanation of FATCA and how FATCA may affect them. The Issuer’s obligations under the Notes are discharged once it has made payment to, or to the order of, the Common Safekeeper (as bearer of the Notes) and the Issuer has therefore no responsibility for any amount thereafter transmitted through the ICSDs and custodians or intermediaries. Further, foreign financial institutions in a jurisdiction which has entered into an intergovernmental agreement with the United States (an IGA) are generally not expected to be required to withhold under FATCA or an IGA (or any law implementing an IGA) from payments they make.

The value of the Notes could be adversely affected by a change in English law or administrative practice.

The conditions of the Notes are based on English law in effect as at the date of the issue of the Notes. No assurance can be given as to the impact of any possible judicial decision or change to English law or administrative practice after the date of the issue of the Notes and any such change could materially adversely impact the value of the Notes.

Risks related to the market generally

Set out below is a description of material market risks, including liquidity risk, exchange rate risk, interest rate risk and credit risk:

An active secondary market in respect of the Notes may never be established or may be illiquid and this would adversely affect the value at which an investor could sell his Notes.

The Notes may have no established trading market when issued, and one may never develop. If a market does develop, it may not be very liquid. Therefore, investors may not be able to sell their Notes easily or at prices that will provide them with a yield comparable to similar investments that have a developed secondary market. Although application has been made for the Notes to be admitted to listing on the Official List and to trading on the Market, there is no assurance that such application will be accepted or that an active trading market will develop. Illiquidity may have a severely adverse effect on the market value of Notes.

Exchange rate risks and exchange controls

The Issuer will pay principal and interest on the Notes in Sterling (the Specified Currency). This presents certain risks relating to currency conversions if an investor’s financial activities are denominated principally in a currency or currency unit (the Investor’s Currency) other than the Specified Currency. These include the risk that exchange rates may significantly change (including changes due to devaluation of the Specified Currency or revaluation of the Investor’s Currency) and the risk that authorities with jurisdiction over the

16

Investor’s Currency may impose or modify exchange controls. An appreciation in the value of the Investor’s Currency relative to the Specified Currency would decrease (1) the Investor’s Currency-equivalent yield on the Notes, (2) the Investor’s Currency-equivalent value of the principal payable on the Notes and (3) the Investor’s Currency-equivalent market value of the Notes.

Government and monetary authorities may impose (as some have done in the past) exchange controls that could adversely affect an applicable exchange rate or the ability of the Issuer to make payments in respect of the Notes. As a result, investors may receive less interest or principal than expected, or no interest or principal.

Interest rate risks

Investment in the Notes involves the risk that if market interest rates subsequently increase above the rate paid on the Notes, this will adversely affect the value of the Notes.

Credit ratings assigned to the Issuer or the Notes may not reflect all the risks associated with an investment in the Notes.

One or more independent credit rating agencies may assign credit ratings to the Issuer or the Notes. The ratings may not reflect the potential impact of all risks related to structure, market, additional factors discussed above, and other factors that may affect the value of the Notes. A credit rating is not a recommendation to buy, sell or hold securities and may be revised, suspended or withdrawn by the rating agency at any time.

In general, European regulated investors are restricted under Regulation (EC) No. 1060/2009 (as amended) (the CRA Regulation) from using credit ratings for regulatory purposes, unless such ratings are issued by a credit rating agency established in the EU and registered under the CRA Regulation (and such registration has not been withdrawn or suspended), subject to transitional provisions that apply in certain circumstances whilst the registration application is pending. Such general restriction will also apply in the case of credit ratings issued by non-EU credit rating agencies, unless the relevant credit ratings are endorsed by an EU-registered credit rating agency or the relevant non-EU rating agency is certified in accordance with the CRA Regulation (and such endorsement action or certification, as the case may be, has not been withdrawn or suspended). The list of registered and certified rating agencies published by the European Securities and Markets Authority (ESMA) on its website in accordance with the CRA Regulation is not conclusive evidence of the status of the relevant rating agency included in such list, as there may be delays between certain supervisory measures being taken against a relevant rating agency and the publication of the updated ESMA list. Certain information with respect to the credit rating agencies and ratings is set out on the cover of this Prospectus.

Legal investment considerations may restrict certain investments

The investment activities of certain investors are subject to legal investment laws and regulations, or review or regulation by certain authorities. Each potential investor should consult its legal advisors to determine whether and to what extent (1) the Notes are legal investments for it; (2) the Notes can be used as security for indebtedness; and (3) other restrictions apply to its purchase or pledge of any of the Notes. Financial institutions should consult their legal advisors or the appropriate regulators to determine the appropriate treatment of the Notes under any applicable risk-based capital or similar rules.

Definitive Notes not having denominations in integral multiples of the minimum authorised denomination may have difficulty in trading in the secondary market

The Notes have a denomination consisting of a minimum authorised denomination of £100,000 plus higher integral multiples of £1,000 up to £199,000. Accordingly, it is possible that the Notes may be traded in amounts in excess of the minimum authorised denomination that are not integral multiples of such denomination. In such a case, if Definitive Notes are required to be issued, a Noteholder who holds a principal amount less than the minimum authorised denomination at the relevant time may not receive a Definitive Note in respect of such holding and may need to purchase a principal amount of Notes such that its holding amounts to the minimum authorised denomination (or another relevant denomination amount).

17

If Definitive Notes are issued, Noteholders should be aware that Definitive Notes which have a denomination that is not an integral multiple of the minimum authorised denomination may be illiquid and difficult to trade.

Notes in a book-entry form will be subject to the rules of Euroclear and Clearstream, Luxembourg, respectively, which may not be adequate to ensure the owners their timely exercise of rights under the Notes

The Notes will initially only be issued in global form and deposited with a common safekeeper for Euroclear and Clearstream, Luxembourg. Interests in the Global Notes will trade in book-entry form only. The Common Safekeeper, or its nominee, for Euroclear and Clearstream, Luxembourg, will be the sole holder of the Global Notes. Accordingly, owners of book-entry interests must rely on the procedures of Euroclear and Clearstream, Luxembourg, and non-participants in Euroclear or Clearstream, Luxembourg must rely on the procedures of the participant through which they own their interests, to exercise any rights and obligations of a holder of the Notes.

Unlike the holders of the Notes themselves, owners of book-entry interests will not have the direct right to act upon the Issuer’s solicitations for consents, requests for waivers or other actions from holders of the Notes. The procedures to be implemented through Euroclear and Clearstream, Luxembourg may not be adequate to ensure the timely exercise of rights under the Notes.

18

SELECTED FINANCIAL INFORMATION AND SUMMARY OF RESULTS

In October 2014, as part of an intra-group corporate reorganisation, the Issuer became the parent of substantially all of the subsidiaries and assets and liabilities previously reported by the PPL WW Holdings Limited Group (PPL WW Group) and PPL WEM Holdings Limited Group (PPL WEM Group). The Issuer has elected to present the consolidated financial statements as if the subsidiaries and assets and liabilities of the PPL WW Group and PPL WEM Group had been owned by the Issuer for the financial year ended 31 March 2015 in accordance with the pooling of interests principles for business combinations of entities under common control. Set out in the Appendix to this Prospectus are the audited consolidated annual accounts of the Issuer for the financial year ended 31 March 2015.

Revenue

Revenue for the WPD Group for the financial year ended 31 March 2015 was £1,620,100,000 compared to £1,574,000,000 for the previous financial year, an increase of £46,100,000 (2.9 per cent.). This was principally due to an average tariff increase of 3.0 per cent. in WPD South West, 3.1 per cent. in WPD South Wales, 6.0 per cent. in WPD West Midlands and 11.7 per cent. in WPD East Midlands, effective from 1 April 2014. The tariff increase has been partly offset by the reduction of £5 per residential end-user, as agreed with Ofgem, equating to £35,600,000 being offset across the WPD Group.

Operating costs

Operating costs for the WPD Group were broadly in line with the previous financial year decreasing by £12,900,000 (2.2 per cent.) from £589,800,000 in the financial year ended 31 March 2014 to £576,900,000 in the financial year ended 31 March 2015. This includes a decrease in the depreciation of network assets (calculated to be circa. £5,500,000) resulting from an increase in the weighted average useful lives of network assets effective from 1 December 2014.

Other operating expenses

Other operating expenses were £700,000 for the financial year ended 31 March 2015 compared to £5,300,000 for the previous financial year. The movement has arisen due to a lower decrease in fair value of investment properties.

Impairment of intangible assets

During the financial year ended 31 March 2015, the WPD Group recognised an impairment loss in respect of goodwill of £72,000,000 (compared to £248,400,000 in the financial year ended 31 March 2014, which was allocated between WPD East Midlands (accounting for £186,200,000 in the financial year ended 31 March 2014) and WPD West Midlands (accounting for £62,200,000 in the financial year ended 31 March 2014)). All of the impairment loss in respect of goodwill in the financial year ended 31 March 2015 is attributable to WPD West Midlands.

The impairment in the financial year ended 31 March 2015 has largely arisen as a result of changes to the short-term inflation assumption which has reduced both the operating cash flows and the terminal value used in the discounted cash flow model, and the growth in the carrying amount of the cash generating unit in the year exceeding the underlying growth in its recoverable amount. These factors are partly offset by higher than previously anticipated levels of capital expenditure in the current year which has increased both the future operating cash flows and terminal value used in the discounted cash flow model, and a reduction to the discount rate.

Finance costs

Finance costs for the financial year ended 31 March 2015 were £259,900,000 compared to £267,700,000 for the financial year ended 31 March 2014. The decrease of £7,800,000 (2.9 per cent) mainly arose due to the movement in the foreign exchange variance on US$ denominated financial assets and liabilities (of a decrease of £160 million) offset by the movement in the transfers from the hedging reserve in relation to cash flow hedges of £169.8 million.

19

Tax expense

Tax expenses incurred by the WPD Group increased from £57,200,000 for the financial year ended 31 March 2014 to £144,400,000 for the financial year ended 31 March 2015 (an increase of £87,200,000 (152.4 per cent.)). The current tax expense decreased by £11.1 million due to the reduction in the corporation tax rate from 23 per cent. to 21 per cent., partly offset by an increase in taxable profits. The deferred tax expense increased by £98.3 million to £53.2 million, mainly due to the beneficial impact of the tax rate change in 2014 of £85.4 million.

Reconciliation to previously reported results

The financial information for the WPD Group has been prepared on the basis that the restructuring transactions that took place in October 2014 are all between entities under common control and hence are outside the scope of IFRS 3 “Business combinations.” As such, the financial information does not include the effects of acquisition accounting principles, with all values being based on amounts previously recorded for assets and liabilities, without the recognition of any fair value adjustments.