Form 8-K PINNACLE WEST CAPITAL For: Sep 25 Filed by: ARIZONA PUBLIC SERVICE CO

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 25, 2015

Commission File Number | Exact Name of Registrant as Specified in Charter; State of Incorporation; Address and Telephone Number | IRS Employer Identification Number |

1-8962 | Pinnacle West Capital Corporation (an Arizona corporation) 400 North Fifth Street, P.O. Box 53999 Phoenix, AZ 85072-3999 (602) 250-1000 | 86-0512431 |

1-4473 | Arizona Public Service Company (an Arizona corporation) 400 North Fifth Street, P.O. Box 53999 Phoenix, AZ 85072-3999 (602) 250-1000 | 86-0011170 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

This combined Form 8-K is separately filed or furnished by Pinnacle West Capital Corporation and Arizona Public Service Company. Each registrant is filing or furnishing on its own behalf all of the information contained in this Form 8-K that relates to such registrant and, where required, its subsidiaries. Except as stated in the preceding sentence, neither registrant is filing or furnishing any information that does not relate to such registrant, and therefore makes no representation as to any such information.

Item 7.01 Regulation FD Disclosure.

Investor and Analyst Meetings

Pinnacle West Capital Corporation (“Pinnacle West”) will be participating in various meetings with securities analysts and investors on September 28 through October 1, 2015 and will be utilizing handouts during those meetings. Copies of the handouts are attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. | Registrant(s) | Description |

99.1 | Pinnacle West Arizona Public Service Company | Pinnacle West handouts for use at meetings on September 28 through October 1, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PINNACLE WEST CAPITAL CORPORATION | ||

(Registrant) | ||

Dated: September 25, 2015 | By: /s/ James R. Hatfield | |

James R. Hatfield | ||

Executive Vice President and | ||

Chief Financial Officer | ||

ARIZONA PUBLIC SERVICE COMPANY | ||

(Registrant) | ||

Dated: September 25, 2015 | By: /s/ James R. Hatfield | |

James R. Hatfield | ||

Executive Vice President and | ||

Chief Financial Officer | ||

Powering Growth, Delivering Value Investor Meetings | September 28 - October 1, 2015 POWERING GROWTH DELIVERING VALUE

Powering Growth, Delivering Value2 FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume” and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels; variations in demand for electricity, including those due to weather, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation or regulation, including those relating to environmental requirements, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs, including returns on debt and equity capital; our ability to meet renewable energy and energy efficiency mandates and recover related costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona, particularly in real estate markets; the development of new technologies which may affect electric sales or delivery; the cost of debt and equity capital and the ability to access capital markets when required; environmental and other concerns surrounding coal-fired generation; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional baseload generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2014 which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law.

Powering Growth, Delivering Value3 PINNACLE WEST: WHO WE ARE We are a vertically integrated, regulated electric utility in the growing southwest U.S. Pinnacle West (NYSE: PNW) - Market Capitalization*: $6.8 billion - Enterprise Value*: $10.8 billion - Consolidated Assets: $14.3 billion - Indicated Annual Dividend*: $2.38 - Dividend Yield*: 4.2% Principal subsidiary: - Arizona Public Service Company, Arizona’s largest and longest-serving electric utility Customers: 1.2 million (89% residential) 2014 Peak Demand: 7,007 MW - All time high of 7,236 in July 2006 Generation Capacity: Over 6,400 MW of owned or leased capacity (~9,400 MW with long-term contracts) - Including 29.1% interest in Palo Verde Nuclear Generating Station, the largest in the U.S. - Regulated utility provides stable, regulated earnings and cash flow base for Pinnacle West * As of September 18, 2015

Powering Growth, Delivering Value4 • Top quartile ratings in Customer Satisfaction, Reliability and Safety • APS operates the Palo Verde Nuclear Generating Station, the largest nuclear plant in the country, which continues record levels of electricity production • Disciplined cost management Operational Excellence • Arizona’s long-term growth fundamentals remain largely intact, including population growth, job growth and economic development Leverage to Economic Recovery • Creating a sustainable energy future for Arizona • Working with Arizona Corporation Commission and key stakeholders to modernize rates Proactively Addressing Rate Design • Rate base growth of 6-7% through 2018 • Focus on core electric utility business • Investing in a portfolio that is flexible, responsive, reliable and cost-effective Executing on Long-Term Investment Plan • Consolidated earned ROE more than 9.5% through 2016, weather-normalized • Dividend growth target of 5%* • Strong credit ratings and balance sheet Financial Strength Driving Competitive Returns VALUE PROPOSITION * Future dividends subject to declaration at Board of Director’s discretion.

Powering Growth, Delivering Value5 ARIZONA ECONOMIC INDICATORS Business services, healthcare, tourism, and consumer services leading job recovery – each growing 3-7% YoY 0% 5% 10% 15% 20% 25% '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Industrial Nonresidential Building Vacancy – Metro Phoenix Single Family & Multifamily Housing Permits Maricopa County Home Prices – Metro Phoenix Value Relative to Jan ‘05 50 75 100 125 150 175 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Vacancy Rate Office Retail Job Growth (Total Nonfarm) - Arizona (10.0)% (5.0)% 0.0% 5.0% 10.0% '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 YoY Change E Q2Apr 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 '07 '08 '09 '10 '11 '12 '13 '14 '15 Single Family Multifamily Q2

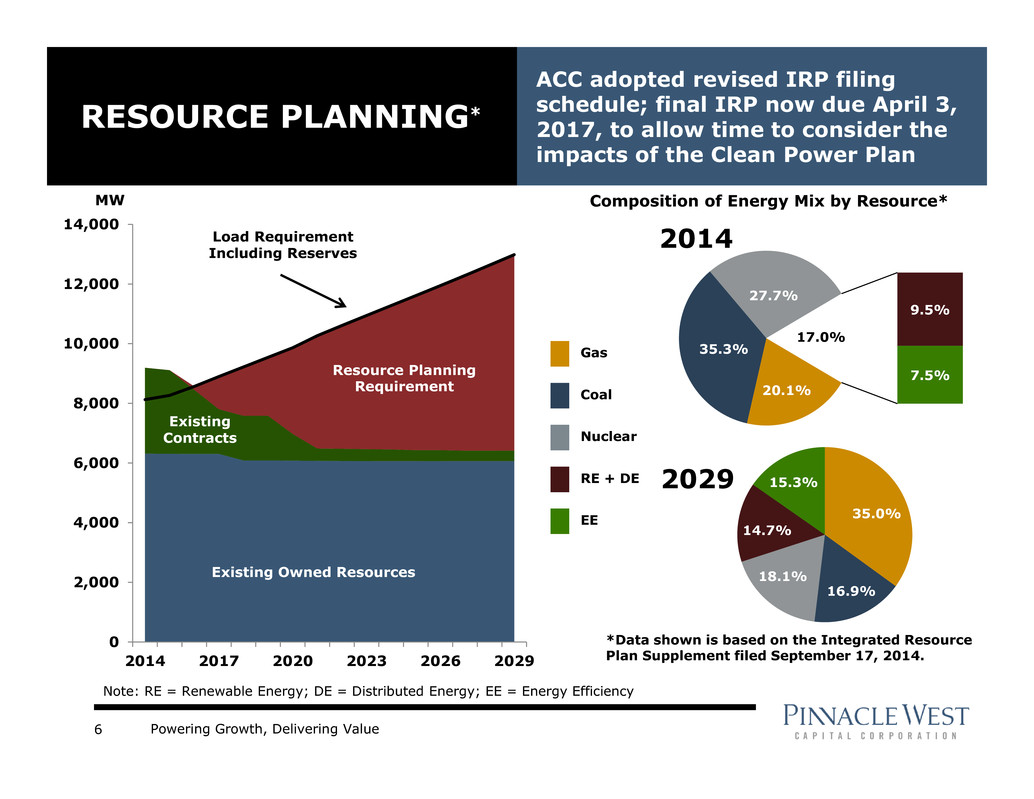

Powering Growth, Delivering Value6 RESOURCE PLANNING* ACC adopted revised IRP filing schedule; final IRP now due April 3, 2017, to allow time to consider the impacts of the Clean Power Plan 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 2014 2017 2020 2023 2026 2029 Existing Owned Resources Existing Contracts Resource Planning Requirement Load Requirement Including Reserves MW 20.1% 35.3% 27.7% 9.5% 7.5% 17.0% 2014 Gas Coal Nuclear RE + DE EE Composition of Energy Mix by Resource* Note: RE = Renewable Energy; DE = Distributed Energy; EE = Energy Efficiency 35.0% 16.9% 18.1% 14.7% 15.3% *Data shown is based on the Integrated Resource Plan Supplement filed September 17, 2014. 2029

Powering Growth, Delivering Value7 • Total Capacity: 4,000 MW (3 units) o APS share: 1,146 MW; APS operated o Output: 32.3 million MWh in 2014 o Approximately 2,800 employees • Fukushima-related impacts o Total Fukushima-related costs are approximately $131 million (APS share is 29.1%), through 2016 o National Strategic Alliance for FLEX Emergency Response (SAFER) Centers are located in Phoenix and Memphis, opened in 2014 PALO VERDE NUCLEAR GENERATING STATION Largest generating nuclear plant in the United States Palo Verde Phoenix Low risk of natural events at Palo Verde In Service License* Unit 1 1985 2045 Unit 2 1986 2046 Unit 3 1987 2047 * NRC approved 20-year license extensions in April 2011. Note: Each of the pressurized water reactor units has a planned refueling outage every 18 months (i.e. two total outages per year).

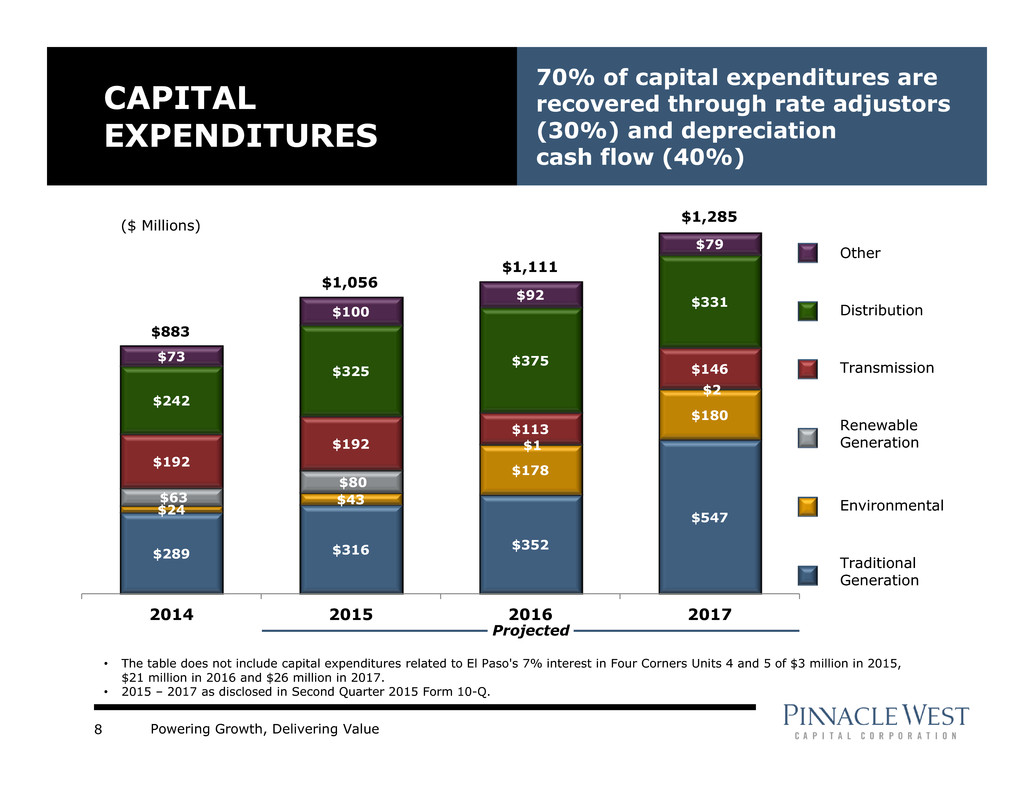

Powering Growth, Delivering Value8 $289 $316 $352 $547$24 $43 $178 $180 $63 $80 $1 $2 $192 $192 $113 $146 $242 $325 $375 $331 $73 $100 $92 $79 2014 2015 2016 2017 CAPITAL EXPENDITURES 70% of capital expenditures are recovered through rate adjustors (30%) and depreciation cash flow (40%) ($ Millions) $883 $1,056 $1,111 Other Distribution Transmission Renewable Generation Environmental Traditional Generation Projected $1,285 • The table does not include capital expenditures related to El Paso's 7% interest in Four Corners Units 4 and 5 of $3 million in 2015, $21 million in 2016 and $26 million in 2017. • 2015 – 2017 as disclosed in Second Quarter 2015 Form 10-Q.

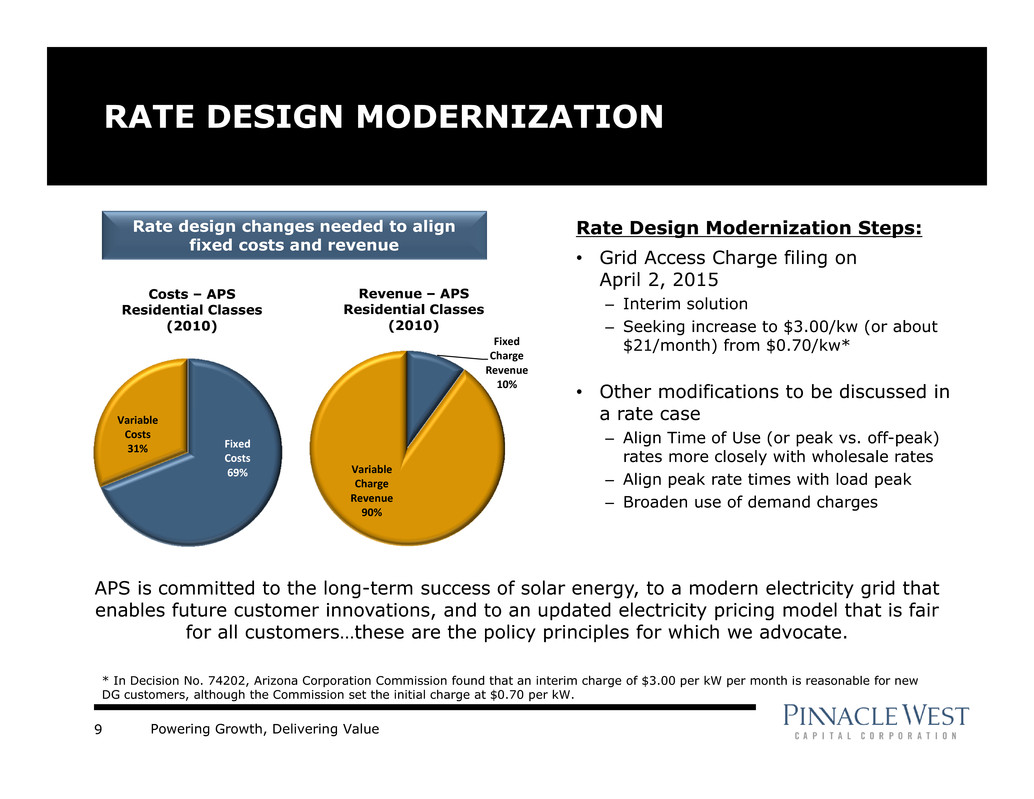

Powering Growth, Delivering Value9 Rate Design Modernization Steps: • Grid Access Charge filing on April 2, 2015 – Interim solution – Seeking increase to $3.00/kw (or about $21/month) from $0.70/kw* • Other modifications to be discussed in a rate case – Align Time of Use (or peak vs. off-peak) rates more closely with wholesale rates – Align peak rate times with load peak – Broaden use of demand charges RATE DESIGN MODERNIZATION Fixed Costs 69% Variable Costs 31% Costs – APS Residential Classes (2010) Fixed Charge Revenue 10% Variable Charge Revenue 90% Revenue – APS Residential Classes (2010) Rate design changes needed to align fixed costs and revenue * In Decision No. 74202, Arizona Corporation Commission found that an interim charge of $3.00 per kW per month is reasonable for new DG customers, although the Commission set the initial charge at $0.70 per kW. APS is committed to the long-term success of solar energy, to a modern electricity grid that enables future customer innovations, and to an updated electricity pricing model that is fair for all customers…these are the policy principles for which we advocate.

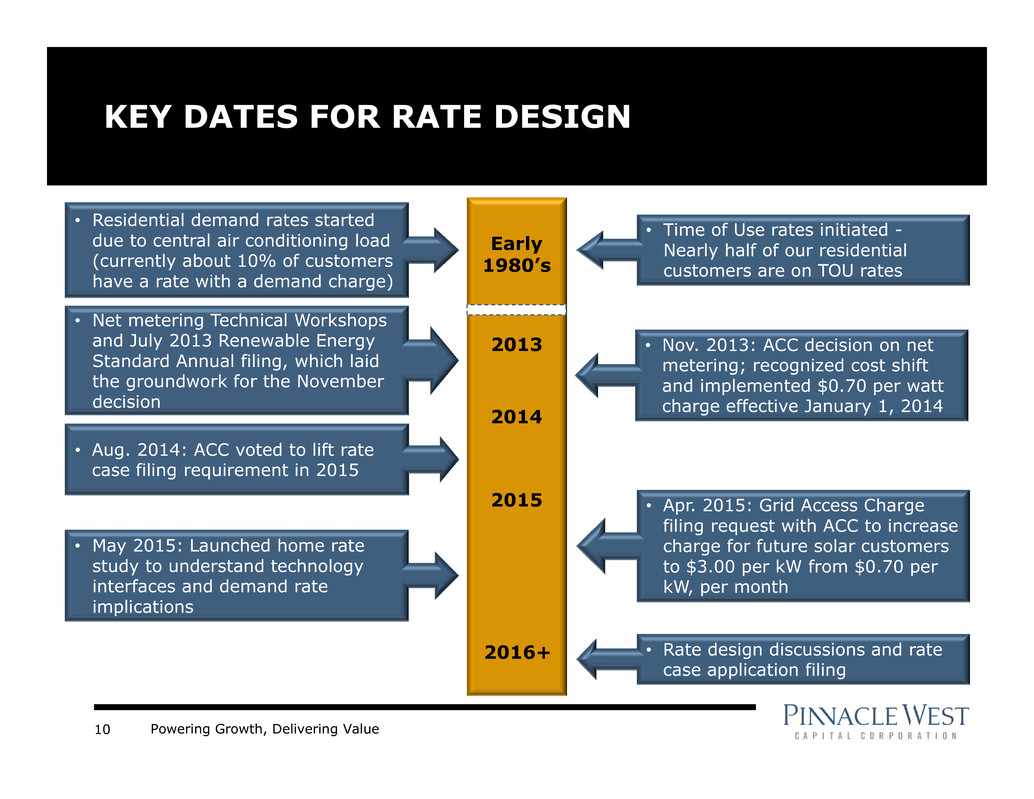

Powering Growth, Delivering Value10 KEY DATES FOR RATE DESIGN 2013 2014 2015 • Net metering Technical Workshops and July 2013 Renewable Energy Standard Annual filing, which laid the groundwork for the November decision • Nov. 2013: ACC decision on net metering; recognized cost shift and implemented $0.70 per watt charge effective January 1, 2014 • Time of Use rates initiated - Nearly half of our residential customers are on TOU rates • Residential demand rates started due to central air conditioning load (currently about 10% of customers have a rate with a demand charge) Early 1980’s 2016+ • Aug. 2014: ACC voted to lift rate case filing requirement in 2015 • May 2015: Launched home rate study to understand technology interfaces and demand rate implications • Apr. 2015: Grid Access Charge filing request with ACC to increase charge for future solar customers to $3.00 per kW from $0.70 per kW, per month • Rate design discussions and rate case application filing

Powering Growth, Delivering Value11 • Installing 10 MW of APS-owned residential rooftop solar − Equates to approximately 1,500 customers − Will be filed for recovery in next general rate case − 2 MW (of the 10 MW) will be coupled with storage − Participating customers receive monthly payment through the 20-year life • Benefits: − Provides an alternative for those who cannot afford solar or do not want a lease − Study system benefits (i.e. strategic deployment orientation, advanced inverters, etc.) • Experience with utility-owned DG from Flagstaff Community Power Project, launched in 2010 − 1.5 MW of distributed energy from solar panels owned by APS, spread across 125 residential rooftops, schools and Community solar APS SOLAR INNOVATION Partnering with Arizona installers APS Solar Partner Program • APS is conducting home rate study to implement and study various technology configurations (solar, storage, smart inverters, load control, etc.) and demand rates − 75 homes will have APS-owned systems with various configurations − Up to 125 homes will have customer- owned systems Solar Innovation Study

Powering Growth, Delivering Value12 Regional Haze / BART (SCR) Mercury and Other Hazardous Air Pollutants (ACI + Baghouse) Coal Combustion Residuals Cooling Water Intake Structures – CWA 316(b) EPA Ruling Announced in 1999, with site-specific requirements announced more recently MATS compliance by April 2015, with potential for one-year extension Announced on December 19, 2014 (Subtitle D) Announced in May 2014 Four Corners 4-5 Approximately $400M for SCRs in 2015-2017 (does not include CAPEX related to El Paso’s 7% interest) $0 APS estimates that is share of incremental costs to comply with the CCR rule for Four Corners is approximately $15 million, and its share of incremental costs for Cholla is approximately $85 million. APS expects to incur certain of these costs during 2015-2017 timeframe. $20M or less Cholla 2-3 On September 11, 2014, APS announced a proposal to close Unit 2 by April 2016 and stop burning coal at the other APS-owned units (1 and 3) by the mid-2020’s. On September 11, 2015, APS announced it would retire Unit 2 on October 1, 2015. $0 Navajo 1-3 Up to ~$200M for SCRs and baghouses On July 28, 2014, EPA issued the final BART rule incorporating the better-than-BART alternative proposed by SRP and others SRP, the operating agent, is evaluating compliance options Approximately $1 million To be determined ENVIRONMENTAL PLAN Regional Haze compliance is the biggest driver of environmental spend over the next few years Clean Power Plan: On August 3, 2015, the U.S. EPA issued its final rules to reduce carbon dioxide emissions from fossil fuel-fired power plants including those on Tribal lands. APS is reviewing the rules, while working closely with other utilities, the Arizona Department of Environmental Quality, the ACC, tribal officials and other impacted stakeholders to determine how best to proceed. Note: Dollars shown at ownership. Estimates as of June 30, 2015. • Cholla Unit 1 is not BART-eligible. Cholla Unit 4 is owned by PacifiCorp. • SO2 NAAQS and greenhouse gas-related costs will be determined based upon EPA rule makings, with no spend occurring before 2016. • ACI = Activated Carbon Injection; NAAQS = National Ambient Air Quality Standard; SCR = Selective catalytic reduction control technology

Powering Growth, Delivering Value13 Emissions • Four Corners: 2013 transaction to purchase Southern California Edison’s ownership in Units 4 and 5 and close units 1, 2 & 3 leads to expected reductions of emissions: particulates are expected to decline by 43%, NOx by 36%, CO2 by 30%, mercury by 61% and SO2 by 24% • Cholla Power Plant: Closure of Unit 2 (effective October 1, 2015) will reduce mercury emissions by 51%, particulates by 34%, NOx by 32%, and CO2 and SO2 by 23% each. We also announced plans to work with the U.S. EPA to stop burning coal at our remaining Cholla units by the mid-2020s • Navajo Generating Station: Plan proposed by a group of stakeholders, including SRP, the operating agent, was approved by the EPA in 2014. The plan will achieve even greater NOx emission reductions than the EPA’s proposal • Participated in Carbon Disclosure Project since 2006 COAL FLEET STRATEGY APS’s proactive approach to reducing emissions leads to coal’s expected share of the energy mix being reduced to 17% 28% 18% 35% 17% 20% 35% 10% 15% 7% 15% 2014 2029 P e r c e n t o f P o r t f o l i o M W h EE/DR Renewable Energy Natural Gas Coal Nuclear Source: Data shown is based on 2014 IRP Supplement filed September 14, 2014.

Powering Growth, Delivering Value14 WATER STRATEGY APS, and Palo Verde in particular, has provided national and international leadership on the use of reclaimed water for power generation Vision: To secure and maintain a sustainable and cost-effective supply of water to enable reliable energy production for APS customers Mission: To develop and implement a strategic water resource management program that will provide APS timely and reliable information to manage APS’s water resources portfolio in support of the safe and efficient generation of electricity for the long-term Water intensity metric: Introduced in 2014 for power provided to APS customers – includes annual goals and is reported on monthly 68% 17% 15% Reclaimed Water Groundwater Surface Water APS Fleet Water Use by Source Type Each APS power plant has unique water strategies, developed to promote efficient and sustainable use of water • APS has identified both primary water supplies and contingencies for each plant in order to ensure reliable long-term operation, even in times of possible shortage, such as extended drought • Palo Verde is the only nuclear plant in the world that does not sit on a large body of water, instead it uses treated effluent from several area municipalities, recycling approximately 20 billion gallons of wastewater each year

Powering Growth, Delivering Value15 2015 KEY DATES ACC Key Dates Docket # Q1 Q2 Q3 Q4 Key Recurring Regulatory Filings Lost Fixed Cost Recovery E-01345A-11-0224 Jan 15 Net Metering – Quarterly Installation Filings E-01345A-13-0248 Jan 15 Apr 15 Jul 15 Oct 15 Transmission Cost Adjustor E-01345A-11-0224 May 15 Renewable Energy Surcharge E-01345A-15-0241 Jul 1 2014 Integrated Resource Plan (Biennial) and Cholla Unit 2 Retirement Proposal E-00000V-13-0070 Apr 14: ACC Review Resource Planning and Procurement in 2015 and 2016 E-00000V-15-0094 Sept: ACC adopted revised IRP schedule Grid Access Charge Filing E-01345A-13-0248 Apr 2 ALJ ROO and ACC meeting TBD ACC Open Meetings - ACC Open Meetings Held Monthly Other Key Dockets Docket # Ocotillo Modernization Project L-00000D-14-0292-00169 Inquiry into Solar DG business models and practices (Generic Docket) E-00000J-14-0415 ROO = Recommended Opinion and Order

Powering Growth, Delivering Value APPENDIX

Powering Growth, Delivering Value17 LEADERSHIP TEAM Our top executives have more than 100 combined years of creating shareholder value in the energy industry Don Brandt Chairman & Chief Executive Officer Mark Schiavoni EVP & Chief Operating Officer Jeff Guldner SVP Public Policy Randy Edington EVP & Chief Nuclear Officer Jim Hatfield EVP & Chief Financial Officer

Powering Growth, Delivering Value18 ARIZONA CORPORATION COMMISSION * Term limited - elected to four-year terms (limited to two consecutive) Bob Stump (R)* Tom Forese (R) Doug Little (R) Terms to January 2019Terms to January 2017 Susan Bitter Smith (R) Chairman Bob Burns (R) Other State Utility Officials ACC Staff Director - Thomas Broderick RUCO Director - David Tenney (R)

Powering Growth, Delivering Value19 Mechanism Adopted / Last Adjusted Description Power Supply Adjustor (“PSA”) April 2005 / February 2015 • Recovers variance between actual fuel and purchased power costs and base fuel rate • Includes forward-looking, historical and transition components Renewable Energy Surcharge (“RES”) May 2008 / January 2015 • Recovers costs related to renewable initiatives • Collects projected dollars to meet RES targets • Provides incentives to customers to install distributed renewable energy Demand-Side Management Adjustment Clause (“DSMAC”) April 2005 / March 2015 • Recovers costs related to energy efficiency and DSM programs above $10 million in base rates • Provides performance incentive to APS for net benefits achieved • Provides conservation education, rebates and other incentives to participating customers Environmental Improvement Surcharge (“EIS”) July 2007 / April 2015 • Allows recovery of certain carrying costs for government-mandated environmental capital projects • Capped at $5 million annually Transmission Cost Adjustor (“TCA”) April 2005 / June 2015 • Recovers FERC-approved transmission costs related to retail customers • Resets annually as result of FERC Formula Rate process (see below) FERC Formula Rates 2008 / June 2015 • Recovers transmission costs based on historical costs per FERC Form 1 and certain projected data Lost Fixed Cost Recovery (“LFCR”) July 2012 / March 2015 • Mitigates loss of portion of fixed costs related to ACC-approved energy efficiency and distributed renewable generation programs REGULATORY MECHANISMS We have achieved a more supportive regulatory structure and improvements in cost recovery timing

Powering Growth, Delivering Value20 2015 2016 2017 RETAIL SALES IMPACT FROM ENERGY EFFICIENCY AND DISTRIBUTED GENERATION YoY Retail Sales Before Customer Programs Energy Efficiency & Customer Conservation Distributed Generation Distributed Generation (DG) Impact • DG makes up 0.5% or less of the negative impact to retail sales growth as shown in the chart • Average residential rooftop solar system produces 10,000 – 12,000 KWh per year (average metro-Phoenix customer’s usage is nearly 15,000 KWh) The difference between customer growth and weather-normalized retail sales, mostly driven by EE and DG, has ranged from (1)-(2)%, in line with guidance, despite some larger quarterly variances. • 2015 (thru Q2): (1.4)% • 2014: (1.4)% • 2013: (1.8)% • 2012: (1.0)% Annual Retail Sales Growth %

Powering Growth, Delivering Value21 • Cumulative savings from energy efficiency programs must be equivalent to 22% of annual retail sales by 2020 • Annual milestones in place to measure progress toward cumulative 2020 goal – 9.5% by 2015 – 22% by 2020 ARIZONA’S RENEWABLE RESOURCE AND ENERGY EFFICIENCY STANDARDS • Portion of retail sales to be supplied by renewable resources – 5% by 2015* – 15% by 2025 • Distributed energy component – 30% of total requirement Energy Efficiency RequirementsRenewable Energy (RES) Requirements APS on track to double 2015 requirement* APS on track to meet target * In APS’s 2009 retail rate case settlement agreement, APS committed to have 1,700 GWh of new renewable resources in service by year-end 2015 in addition to its 2008 renewable resource commitments.

Powering Growth, Delivering Value22 250 364 346 450 637 728 654 803 1276 878 969 545 863 517 719 862 757 1,203 1,237 1,490 0 28 33 83 41 45 62 64 84 85 63 94 34 69 112 108 62 97 105 90 64 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 RESIDENTIAL PV APPLICATIONS As of August 31, 2015, over 35,000 residential grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, equivalent to 248 MW. *Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Solar water heaters can also be found on the site, but are not included in the above chart. 2014 Applications* 2014 Canceled Apps 2015 Applications* 2015 Canceled Apps Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 15 19 23 44 51 57 2009 2010 2011 2012 2013 2014 Residential DG (MW) Annual Additions

Powering Growth, Delivering Value23 • Customers with rooftop solar systems do not pay for all of the electric services they use (i.e. rooftop customers still need support from the grid 24 hours a day) • These unpaid costs are then paid, through higher rates, by non-rooftop solar customers • The issue will get bigger over time as applications and installs continue to increase NET METERING Rooftop solar customers still use the grid 24 hours a day TYPICAL GRID INTERACTION FOR ROOFTOP SOLAR

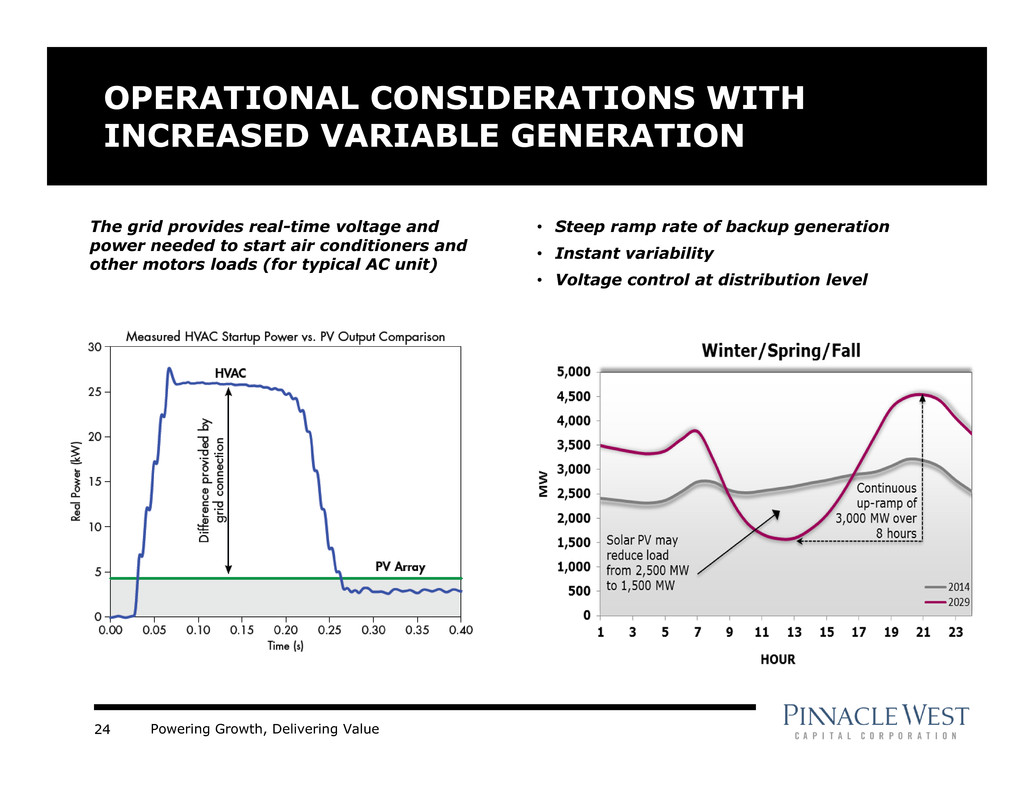

Powering Growth, Delivering Value24 OPERATIONAL CONSIDERATIONS WITH INCREASED VARIABLE GENERATION The grid provides real-time voltage and power needed to start air conditioners and other motors loads (for typical AC unit) • Steep ramp rate of backup generation • Instant variability • Voltage control at distribution level

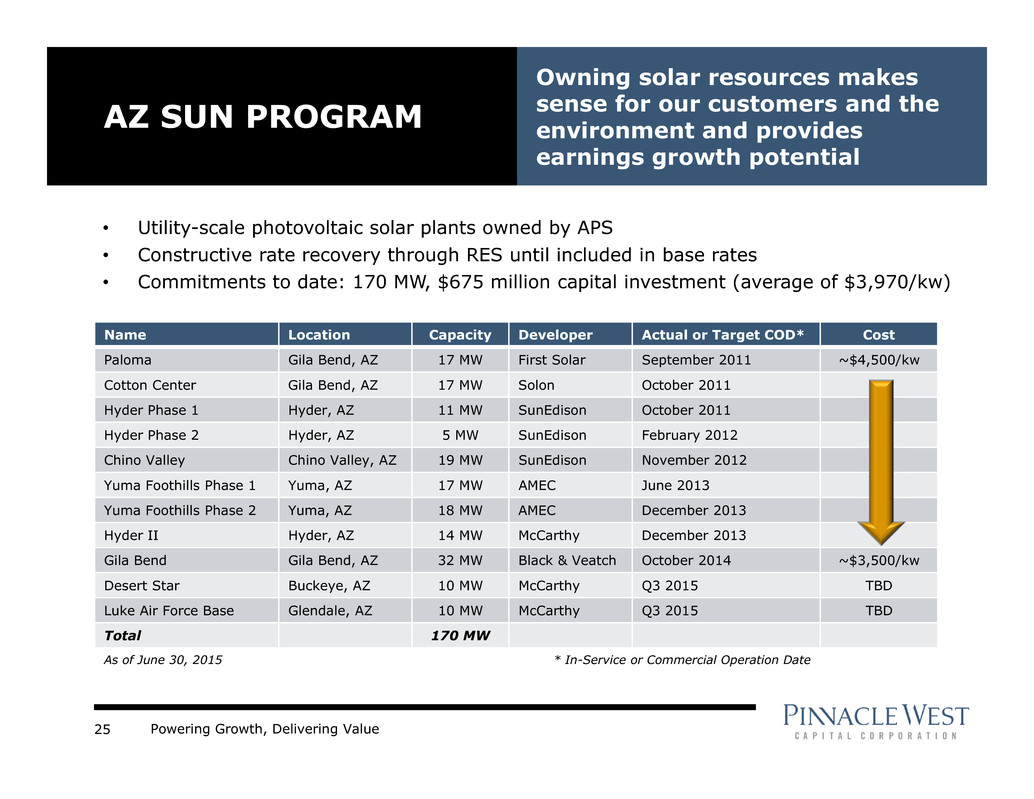

Powering Growth, Delivering Value25 • Utility-scale photovoltaic solar plants owned by APS • Constructive rate recovery through RES until included in base rates • Commitments to date: 170 MW, $675 million capital investment (average of $3,970/kw) AZ SUN PROGRAM Owning solar resources makes sense for our customers and the environment and provides earnings growth potential Name Location Capacity Developer Actual or Target COD* Cost Paloma Gila Bend, AZ 17 MW First Solar September 2011 ~$4,500/kw Cotton Center Gila Bend, AZ 17 MW Solon October 2011 Hyder Phase 1 Hyder, AZ 11 MW SunEdison October 2011 Hyder Phase 2 Hyder, AZ 5 MW SunEdison February 2012 Chino Valley Chino Valley, AZ 19 MW SunEdison November 2012 Yuma Foothills Phase 1 Yuma, AZ 17 MW AMEC June 2013 Yuma Foothills Phase 2 Yuma, AZ 18 MW AMEC December 2013 Hyder II Hyder, AZ 14 MW McCarthy December 2013 Gila Bend Gila Bend, AZ 32 MW Black & Veatch October 2014 ~$3,500/kw Desert Star Buckeye, AZ 10 MW McCarthy Q3 2015 TBD Luke Air Force Base Glendale, AZ 10 MW McCarthy Q3 2015 TBD Total 170 MW As of June 30, 2015 * In-Service or Commercial Operation Date

Powering Growth, Delivering Value26 • Benefits: – Maintains system reliability through retirement of aging steam units – Replacement units meet need for increased portfolio responsiveness – Aids integration of renewables • Estimated project cost of $500M • Expected timeline: – Early 2016: Planned start of construction – 2019: Project completion OCOTILLO POWER PLANT (TEMPE, AZ) Ocotillo modernization project will maintain valley grid reliability and increase APS’s generating capacity by 290 MW Site Capacity (MW) Current Future (2) Westinghouse 110 MW steam units - constructed 1960 220 Retire (2) Westinghouse 55 MW combustion turbines - constructed 1972/73 110 110 Install 5 GE 102 MW combustion turbines 0 510 Total 330 620 Net site capacity increased by 290 MW Existing New

Powering Growth, Delivering Value27 • 10-Year Transmission Plan filed January 2015 (115 kV and above) – 275 miles of new lines – Includes Hassayampa-North Gila (HANG2) • ~110 miles; 500kV • Construction started March 2013 • In-service May 2015 • Also includes other planned lines – Palm Valley-TS2-Trilby Wash 230kV (2015) – Delaney-Palo Verde 500kV (2016) – Delaney-Sun Valley 500kV (2016) – Sun Valley-Trilby Wash 230kV (2016) – Morgan-Sun Valley 500kV (2018) • Projects to deliver renewable energy approved by ACC • Transmission investment diversifies regulatory risk – Constructive regulatory treatment – FERC formula rates and retail adjustor APS TRANSMISSION Strategic transmission investment is essential to maintain reliability and deliver diversified resources to customers Legend Planned lines Existing lines Solar potential area Wind potential area Phoenix Flagstaff Tucson

Powering Growth, Delivering Value28 BRIGHT CANYON ENERGY – TRANSMISSION GROWTH TRANSCANYON A 50/50 Joint Venture formed with BHE U.S. Transmission, subsidiary of Berkshire Hathaway Energy, to pursue transmission opportunities in the western United States BRIGHT CANYON ENERGY Pinnacle West subsidiary formed to pursue new growth opportunities WECC WECC = Western Electricity Coordinating Council

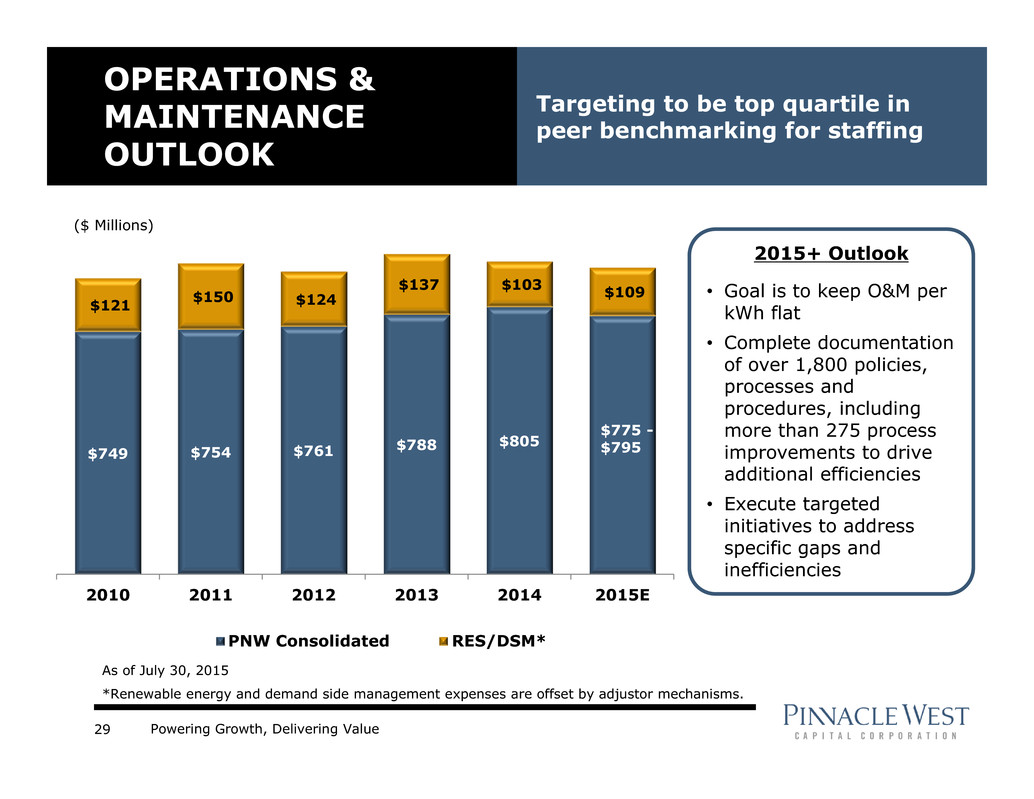

Powering Growth, Delivering Value29 OPERATIONS & MAINTENANCE OUTLOOK Targeting to be top quartile in peer benchmarking for staffing $749 $754 $761 $788 $805 $121 $150 $124 $137 $103 $109 2010 2011 2012 2013 2014 2015E PNW Consolidated RES/DSM* As of July 30, 2015 *Renewable energy and demand side management expenses are offset by adjustor mechanisms. $775 - $795 ($ Millions) 2015+ Outlook • Goal is to keep O&M per kWh flat • Complete documentation of over 1,800 policies, processes and procedures, including more than 275 process improvements to drive additional efficiencies • Execute targeted initiatives to address specific gaps and inefficiencies

Powering Growth, Delivering Value30 BALANCE SHEET STRENGTH $250 $50 $500 $250 $125 $- $100 $200 $300 $400 $500 2016 2017 2018 2019 2020 APS PNW ($Millions) Debt Maturity Schedule Credit Ratings • A- rating or better at S&P, Moody’s and Fitch • Moody’s and Fitch upgraded APS and PNW in Q2 2015 Major Financing Activities • $250 million 5-year 2.20% APS senior unsecured notes issued in January 2015 • $300 million 10-year 3.15% APS senior unsecured notes issued in May 2015 - proceeds used to refinance $300 million of 4.65% notes that matured May 15, 2015 • Currently expect up to an additional $300 million of new long-term debt We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds.

Powering Growth, Delivering Value31 2010 2011 2012 2013 2014 APS FFO / Debt 23.7% 23.6% 27.7% 31.5% 26.6% FFO / Interest 3.3x 4.2x 4.8x 5.6X 5.8x Debt / Capitalization 52.6% 52.9% 50.7% 47.7% 46.3% Pinnacle West FFO / Debt 22.3% 23.0% 26.7% 29.8% 23.6% FFO / Interest 3.1x 3.8x 4.4x 4.9X 5.6x Debt / Capitalization 54.6% 54.4% 52.1% 49.1% 47.7% CREDIT RATINGS AND METRICS Key credit metrics remain strong Source: Standard & Poor’s APS Parent Corporate Credit Ratings Moody’s A2 A3 S&P A- A- Fitch A- A- Senior Unsecured Moody’s A2 - S&P A- - Fitch A - Note: Moody’s, S&P, and Fitch all rate Outlook for APS and Parent as “Stable” We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds.

Powering Growth, Delivering Value32 GENERATION PORTFOLIO* Fuel/Plant Location Units Dispatch COD Ownership Interest1 Net Capacity (MW) NUCLEAR 1,146 MW Palo Verde Wintersburg, AZ 1-3 Base 1986-1989 29.1% 1,146 COAL 1,932 MW Cholla Joseph City, AZ 1-3 Base 1962-1980 100 647 Four Corners Farmington, NM 4, 5 Base 1969-1970 63 970 Navajo Page, AZ 1-3 Base 1974-1976 14 315 GAS/OIL COMBINED CYCLE 1,871 MW Redhawk Arlington, AZ 1, 2 Intermediate 2002 100 984 West Phoenix Phoenix, AZ 1-5 Intermediate 1976-2003 100 887 GAS/OIL STEAM TURBINES 220 MW Ocotillo Tempe, AZ 1, 2 Peaking 1960 100 220 GAS/OIL COMBUSTION TURBINES 1,088 MW Sundance Casa Grande, AZ 1-10 Peaking 2002 100 420 Yucca Yuma, AZ 1-6 Peaking 1971-2008 100 243 Saguaro Red Rock, AZ 1-3 Peaking 1972-2002 100 189 West Phoenix Phoenix, AZ 1, 2 Peaking 1972-1973 100 110 Ocotillo Tempe, AZ 1, 2 Peaking 1972-1973 100 110 Douglas Douglas, AZ 1 Peaking 1972 100 16 SOLAR 169 MW Hyder Hyder, AZ - As Available 2011-2012 100 16 Hyder II Hyder, AZ - As Available 2013 100 14 Paloma Gila Bend, AZ - As Available 2011 100 17 Cotton Center Gila Bend, AZ - As Available 2011 100 17 Chino Valley Chino Valley, AZ - As Available 2012 100 19 Yuma Foothills Yuma, AZ - As Available 2013 100 35 Distributed Energy Multiple AZ Facilities - As Available Various 100 15 Gila Bend Gila Bend, AZ - As Available 2015 100 32 Various Multiple AZ Facilities - As Available 1996-2006 100 4 Total Generation Capacity 6,426 MW 1 Includes leased generation plants * As disclosed in 2014 Form 10-K

Powering Growth, Delivering Value33 PURCHASED POWER CONTRACTS* Fuel/Contract Location Owner/Developer Status1 PPA Signed COD Term (Years) Net Capacity (MW) SOLAR 310 MW Solana Gila Bend, AZ Abengoa IO Feb-2008 2013 30 250 RE Ajo Ajo, AZ Duke Energy Gen Svcs IO Jan-2010 2011 25 5 Sun E AZ 1 Prescott, AZ SunEdison IO Feb-2010 2011 30 10 Saddle Mountain Tonopah, AZ SunEdison IO Jan - 2011 2012 30 15 Badger Tonopah, AZ PSEG IO Jan-2012 2013 30 15 Gillespie Maricopa County, AZ Recurrent Energy IO Jan-2012 2013 30 15 WIND 289 MW Aragonne Mesa Santa Rosa, NM Ingifen Asset Mgmt IO Dec-2005 2006 20 90 High Lonesome Mountainair, NM Foresight / EME IO Feb-2008 2009 30 100 Perrin Ranch Wind Williams, AZ NextEra Energy IO Jul-2010 2012 25 99 GEOTHERMAL 10 MW Salton Sea Imperial County, CA Cal Energy IO Jan-2006 2006 23 10 BIOMASS 14 MW Snowflake Snowflake, AZ Novo Power IO Sep-2005 2008 15 14 BIOGAS 6 MW Glendale Landfill Glendale, AZ Glendale Energy LLC IO Jul-2008 2010 20 3 NW Regional Landfill Surprise, AZ Waste Management IO Dec-2010 2012 20 3 INTER-UTILITY 540 MW PacifiCorp Seasonal Power Exchange - PacifiCorp IO Sep-1990 1991 30 480 Not Disclosed Not Disclosed Not Disclosed IO May-2009 2010 10 60 HEAT RATE OPTIONS 650 MW Call Option - Not Disclosed IO Nov-2005 2007 8-9 500 Call Option - Not Disclosed IO Oct-2005 2007 10 150 CONVENTIONAL TOLLING 1,074 MW CC Tolling Not Disclosed Not Disclosed IO Mar-2006 2007 10 514 CC Tolling Not Disclosed Not Disclosed IO Aug-2007 2010 10 560 DEMAND RESPONSE 25 MW Demand Response Not Disclosed Not Disclosed IO Sep-2008 2010 15 25 Total Contracted Capacity 2,918 MW 1 UD = Under Development; UC = Under Construction; IO = In Operation * As disclosed in 2014 Form 10-K

Powering Growth, Delivering Value34 INVESTOR RELATIONS CONTACTS Paul J. Mountain, CFA Director, Investor Relations Telephone: (602) 250-4952 E-mail: [email protected] Chalese Haraldsen Telephone: (602) 250-5643 E-mail: [email protected] Pinnacle West Capital Corporation P.O. Box 53999, Mail Station 9998 Phoenix, Arizona 85072-3999 Fax: (602) 250-2601 Visit us online at: www.pinnaclewest.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Pinnacle West Capital (PNW) Declares $0.88 Quarterly Dividend; 4.9% Yield

- Orosur Mining Inc Announces Results for Third Quarter Ended February 29, 2024

- Nidec Announces Financial Results for Fiscal Year Ended March 31, 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share