Form 8-K PINNACLE WEST CAPITAL For: May 01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 1, 2015

Commission File Number | Exact Name of Registrant as Specified in Charter; State of Incorporation; Address and Telephone Number | IRS Employer Identification Number |

1-8962 | Pinnacle West Capital Corporation (an Arizona corporation) 400 North Fifth Street, P.O. Box 53999 Phoenix, AZ 85072-3999 (602) 250-1000 | 86-0512431 |

1-4473 | Arizona Public Service Company (an Arizona corporation) 400 North Fifth Street, P.O. Box 53999 Phoenix, AZ 85072-3999 (602) 250-1000 | 86-0011170 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

This combined Form 8-K is separately filed or furnished by Pinnacle West Capital Corporation and Arizona Public Service Company. Each registrant is filing or furnishing on its own behalf all of the information contained in this Form 8-K that relates to such registrant and, where required, its subsidiaries. Except as stated in the preceding sentence, neither registrant is filing or furnishing any information that does not relate to such registrant, and therefore makes no representation as to any such information.

Item 2.02. Results of Operations and Financial Condition.

Item 7.01. Regulation FD Disclosure.

The following information is furnished pursuant to both Item 2.02 and 7.01.

On May 1, 2015, Pinnacle West Capital Corporation (the “Company” or “Pinnacle West”) issued a press release regarding its financial results for the fiscal quarter ended March 31, 2015 and its earnings outlook for 2015. A copy of the press release is attached hereto as Exhibit 99.1.

The Company is providing a quarterly consolidated statistical summary and a copy of the slide presentation made in connection with the quarterly earnings conference call on May 1, 2015. This information contains Company operating results for the fiscal quarter ended March 31, 2015 and is attached hereto as Exhibits 99.2 and 99.3. The statistical summary and slide presentation are concurrently being posted to the Company’s website at www.pinnaclewest.com, which also contains a glossary of relevant terms.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. | Registrant(s) | Description |

99.1 | Pinnacle West APS | Earnings News Release issued on May 1, 2015. |

99.2 | Pinnacle West APS | Pinnacle West Capital Corporation quarterly consolidated statistical summary for the three-month periods ended March 31, 2015 and 2014. |

99.3 | Pinnacle West APS | Pinnacle West Capital Corporation 1st Quarter 2015 Results slide presentation accompanying May 1, 2015 conference call. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PINNACLE WEST CAPITAL CORPORATION | ||

(Registrant) | ||

Dated: May 1, 2015 | By: /s/ James R. Hatfield | |

James R. Hatfield | ||

Executive Vice President and | ||

Chief Financial Officer | ||

ARIZONA PUBLIC SERVICE COMPANY | ||

(Registrant) | ||

Dated: May 1, 2015 | By: /s/ James R. Hatfield | |

James R. Hatfield | ||

Executive Vice President and | ||

Chief Financial Officer | ||

Exhibit Index

Exhibit No. | Registrant(s) | Description |

99.1 | Pinnacle West APS | Earnings News Release issued on May 1, 2015. |

99.2 | Pinnacle West APS | Pinnacle West Capital Corporation quarterly consolidated statistical summary for the three-month periods ended March 31, 2015 and 2014. |

99.3 | Pinnacle West APS | Pinnacle West Capital Corporation 1st Quarter 2015 Results slide presentation accompanying May 1, 2015 conference call. |

FOR IMMEDIATE RELEASE | May 1, 2015 | |

Media Contact: Analyst Contact: | Alan Bunnell, (602) 250-3376 Paul Mountain, (602) 250-4952 | |

Website: | pinnaclewest.com | |

PINNACLE WEST REPORTS 2015 FIRST-QUARTER RESULTS

• | Results in line with expectations; full-year 2015 earnings guidance affirmed |

• | Revenue adjustors help offset mild weather as Company readies its fossil plants for summer demand |

• | Company continues growing its solar energy portfolio |

PHOENIX – Pinnacle West Capital Corp. (NYSE: PNW) today reported consolidated net income attributable to common shareholders of $16.1 million, or $0.14 per diluted share of common stock, for the quarter ended March 31, 2015. This result compares with $15.8 million, or $0.14 per diluted share, for the same period in 2014. For both the 2015 and 2014 first-quarter periods, net income is the same as on-going earnings.

“We are off to another solid start this year despite seasonal weather patterns that remained unfavorable compared to historical averages, as well as an increase in fossil power plant maintenance designed to ensure our generation fleet operates reliably during Arizona’s upcoming hot summer months,” said Pinnacle West Chairman, President and Chief Executive Officer Don Brandt.

Brandt said the Company also continues to grow an already diverse energy portfolio with the addition of two more APS-owned solar plants scheduled to come on line this summer. The two new facilities will each produce 10 megawatts of solar energy, enough power to supply 5,000 homes. “In addition,” he said, “as part of our innovative Solar Partner Program, we will begin installing solar panels this quarter on the rooftops of 1,500 residential customers.”

The 2015 first-quarter results comparison was positively impacted by the following major factors:

• | Revenue adjustors improved earnings by $0.08 per share compared to the 2014 first quarter. These adjustors included a Jan. 1, 2015, rate change reflecting acquisition of Southern California Edison’s interest in Units 4 and 5 of the Four Corners Power Plant; higher retail transmission revenues; and higher lost fixed cost recovery (LFCR). |

• | The effects of weather variations improved results by $0.04 per share compared to the year-ago period despite temperatures that remained less favorable than normal. While residential heating degree-days (a measure of the effects of weather) were 6 percent higher than last year’s first quarter, heating degree-days were 51 percent below normal 10-year averages. As a result, weather impacted 2015 first-quarter earnings negatively by $0.06 per share compared with historically normal conditions. |

These positive factors were offset by the following items:

• | Increased operations and maintenance expenses decreased results by $0.03 per share compared with the prior-year period. The expense increase was comprised of higher fossil plant maintenance costs largely as a result of more planned work being completed in the 2015 first quarter compared with the 2014 first quarter. |

The O&M variance excludes costs associated with renewable energy, demand side management and similar regulatory programs, which are offset by comparable amounts of operating revenues.

• | Expiration of a long-term wholesale contract at the end of 2014 reduced earnings by $0.02 per share. |

• | Tax-related items decreased quarter-over-quarter earnings by $0.02 per share. |

• | Higher other operating costs impacted earnings by $0.01 per share, largely due to higher depreciation and amortization expenses associated with the Four Corners transaction. Helping offset the increased depreciation and amortization costs were lower interest expense and reduced property taxes. |

The depreciation and amortization variance excludes costs associated with the Palo Verde lease extensions which are offset in net income attributable to noncontrolling interests.

• | Slightly lower retail electricity sales – excluding the effects of weather variations, but including the effects of customer conservation, energy efficiency programs and distributed renewable generation – reduced earnings $0.01 per share. Compared to the same quarter a year ago, weather-normalized sales decreased 0.8 percent, while total customer growth improved 1.2 percent quarter-over-quarter. |

• | The net effect of miscellaneous items decreased earnings $0.03 per share. |

Financial Outlook

For 2015, the Company continues to expect its on-going consolidated earnings will be within a range of $3.75 to $3.95 per diluted share. Longer-term, the Company’s goal is to achieve a consolidated earned return on average common equity of more than 9.5 percent annually through 2016.

Key factors and assumptions underlying the 2015 outlook can be found in the first-quarter 2015 earnings presentation slides on the Company’s website at pinnaclewest.com/investors.

Conference Call and Webcast

Pinnacle West invites interested parties to listen to the live webcast of management’s conference call to discuss the Company’s 2015 first-quarter results, as well as recent developments, at 12 noon ET (9 a.m. AZ time) today, May 1. The webcast can be accessed at pinnaclewest.com/presentations and will be available for replay on the website for 30 days. To access the live conference call by telephone, dial (877) 407-8035 or (201) 689-8035 for international callers. A replay of the call also will be available until 11:59 p.m. (ET), Friday, May 8, 2015, by calling (877) 660-6853 in the U.S. and Canada or (201) 612-7415 internationally and entering conference ID number 13606144.

General Information

Pinnacle West Capital Corp., an energy holding company based in Phoenix, has consolidated assets of about $14 billion, more than 6,400 megawatts of generating capacity and about 6,400 employees in Arizona and New Mexico. Through its principal subsidiary, Arizona Public Service, the Company provides retail electricity service to nearly 1.2 million Arizona homes and businesses. For more information about Pinnacle West, visit the Company’s website at pinnaclewest.com.

Dollar amounts in this news release are after income taxes. Earnings per share amounts are based on average diluted common shares outstanding. For more information on Pinnacle West’s operating statistics and earnings, please visit pinnaclewest.com/investors.

NON-GAAP FINANCIAL INFORMATION

In this press release, we refer to “on-going earnings.” On-going earnings is a “non-GAAP financial measure,” as defined in accordance with SEC rules. We believe on-going earnings and the information provided in the reconciliation provide investors with useful indicators of our results that are comparable among periods because they exclude the effects of unusual items that may occur on an irregular basis. Investors should note that these non-GAAP financial measures involve judgments by management, including whether an item is classified as an unusual item. We use on-going earnings, or similar concepts, to measure our performance internally in reports for management.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements based on our current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume” and similar words. Because actual results may differ materially from expectations, we caution readers not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to:

• | our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels; |

• | variations in demand for electricity, including those due to weather, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation; |

• | power plant and transmission system performance and outages; |

• | competition in retail and wholesale power markets; |

• | regulatory and judicial decisions, developments and proceedings; |

• | new legislation or regulation including those relating to environmental requirements, nuclear plant operations and potential deregulation of retail electric markets; |

• | fuel and water supply availability; |

• | our ability to achieve timely and adequate rate recovery of our costs, including returns on debt and equity capital; |

• | our ability to meet renewable energy and energy efficiency mandates and recover related costs; |

• | risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; |

• | current and future economic conditions in Arizona, particularly in real estate markets; |

• | the development of new technologies which may affect electric sales or delivery; |

• | the cost of debt and equity capital and the ability to access capital markets when required; |

• | environmental and other concerns surrounding coal-fired generation; |

• | volatile fuel and purchased power costs; |

• | the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; |

• | the liquidity of wholesale power markets and the use of derivative contracts in our business; |

• | potential shortfalls in insurance coverage; |

• | new accounting requirements or new interpretations of existing requirements; |

• | generation, transmission and distribution facility and system conditions and operating costs; |

• | the ability to meet the anticipated future need for additional baseload generation and associated transmission facilities in our region; |

• | the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant operations; and |

• | restrictions on dividends or other provisions in our credit agreements and Arizona Corporation Commission orders. |

These and other factors are discussed in Risk Factors described in Part 1, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2014, which readers should review carefully before placing any reliance on our financial statements or disclosures. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law.

# # #

PINNACLE WEST CAPITAL CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

(dollars and shares in thousands, except per share amounts)

THREE MONTHS ENDED | ||||

MARCH 31, | ||||

2015 | 2014 | |||

Operating Revenues | $ 671,219 | $ 686,251 | ||

Operating Expenses | ||||

Fuel and purchased power | 223,237 | 249,786 | ||

Operations and maintenance | 214,944 | 212,882 | ||

Depreciation and amortization | 120,949 | 101,772 | ||

Taxes other than income taxes | 43,216 | 45,845 | ||

Other expenses | 1,189 | 796 | ||

Total | 603,535 | 611,081 | ||

Operating Income | 67,684 | 75,170 | ||

Other Income (Deductions) | ||||

Allowance for equity funds used during construction | 9,224 | 7,442 | ||

Other income | 235 | 2,367 | ||

Other expense | (4,286) | (4,684) | ||

Total | 5,173 | 5,125 | ||

Interest Expense | ||||

Interest charges | 48,399 | 52,969 | ||

Allowance for borrowed funds used during construction | (4,216) | (3,770) | ||

Total | 44,183 | 49,199 | ||

Income Before Income Taxes | 28,674 | 31,096 | ||

Income Taxes | 7,947 | 6,405 | ||

Net Income | 20,727 | 24,691 | ||

Less: Net income attributable to noncontrolling interests | 4,605 | 8,925 | ||

Net Income Attributable To Common Shareholders | $ 16,122 | $ 15,766 | ||

Weighted-Average Common Shares Outstanding - Basic | 110,916 | 110,257 | ||

Weighted-Average Common Shares Outstanding - Diluted | 111,377 | 110,888 | ||

Earnings Per Weighted-Average Common Share Outstanding | ||||

Net income attributable to common shareholders - basic | $ 0.15 | $ 0.14 | ||

Net income attributable to common shareholders - diluted | $ 0.14 | $ 0.14 | ||

Last Updated 5/1/2015 Line 2015 2014 Incr (Decr) EARNINGS CONTRIBUTION BY SUBSIDIARY (Dollars in Millions) 1 Arizona Public Service 24$ 28$ (4)$ 2 Parent Company (3) (3) - 3 Net Income 21 25 (4) 4 Less: Net Income Attributable to Noncontrolling Interests 5 9 (4) 5 Net Income Attributable to Common Shareholders 16$ 16$ -$ EARNINGS PER SHARE BY SUBSIDIARY - DILUTED 6 Arizona Public Service 0.22$ 0.26$ (0.04)$ 7 Parent Company (0.04) (0.04) - 8 Net Income 0.18 0.22 (0.04) 9 Less: Net Income Attributable to Noncontrolling Interests 0.04 0.08 (0.04) 10 Net Income Attributable to Common Shareholders 0.14$ 0.14$ -$ 11 BOOK VALUE PER SHARE 39.70$ 38.27$ 1.43$ COMMON SHARES OUTSTANDING (Thousands) 12 Average - Diluted 111,377 110,888 489 13 End of Period - Basic 110,748 110,354 394 Pinnacle West Capital Corporation Quarterly Consolidated Statistical Summary Periods Ended March 31, 2015 and 2014 Page 1 of 4

Last Updated 5/1/2015 Line 2015 2014 Incr (Decr) ELECTRIC OPERATING REVENUES (Dollars in Millions) Retail 14 Residential 294$ 282$ 12$ 15 Business 336 329 7 16 Total retail 630 611 19 Wholesale revenue on delivered electricity 17 Traditional contracts 2 11 (9) 18 Off-system sales 23 49 (26) 19 Native load hedge liquidation - - - 20 Total wholesale 25 60 (35) 21 Transmission for others 8 8 - 22 Other miscellaneous services 8 7 1 23 Total electric operating revenues 671$ 686$ (15)$ ELECTRIC SALES (GWH) Retail sales 24 Residential 2,417 2,383 34 25 Business 3,260 3,229 31 26 Total retail 5,677 5,612 65 Wholesale electricity delivered 27 Traditional contracts 40 144 (104) 28 Off-system sales 1,010 1,103 (93) 29 Retail load hedge management - - - 30 Total wholesale 1,050 1,247 (197) 31 Total electric sales 6,727 6,859 (132) Pinnacle West Capital Corporation 3 Months Ended March 31, Quarterly Consolidated Statistical Summary Periods Ended March 31, 2015 and 2014 Page 2 of 4

Last Updated 5/1/2015 Line 2015 2014 Incr (Decr) AVERAGE ELECTRIC CUSTOMERS Retail customers 32 Residential 1,048,954 1,036,013 12,941 33 Business 130,152 128,833 1,319 34 Total retail 1,179,106 1,164,846 14,260 35 Wholesale customers 45 57 (12) 36 Total customers 1,179,151 1,164,903 14,248 37 Total customer growth (% over prior year) 1.2% 1.3% (0.1)% RETAIL SALES (GWH) - WEATHER NORMALIZED 38 Residential 2,636 2,666 (30) 39 Business 3,207 3,224 (17) 40 Total 5,843 5,890 (47) 41 Retail Sales (GWH) (% over prior year) (0.8)% 1.2% (2.0)% RETAIL USAGE (KWh/Average Customer) 42 Residential 2,305 2,300 5 43 Business 25,046 25,064 (18) RETAIL USAGE - WEATHER NORMALIZED (KWh/Average Customer) 44 Residential 2,513 2,573 (60) 45 Business 24,646 25,029 (383) ELECTRICITY DEMAND (MW) 46 Native load peak demand 4,244 3,978 266 WEATHER INDICATORS - RESIDENTIAL Actual 47 Cooling degree-days - - - 48 Heating degree-days 253 239 14 49 Average humidity - - - 10-Year Averages 50 Cooling degree-days - - - 51 Heating degree-days 514 514 - 52 Average humidity - - - 3 Months Ended March 31, Periods Ended March 31, 2015 and 2014 Quarterly Consolidated Statistical Summary Pinnacle West Capital Corporation Page 3 of 4

Last Updated 5/1/2015 Line 2015 2014 Incr (Decr) ENERGY SOURCES (GWH) Generation production 53 Nuclear 2,510 2,511 (1) 54 Coal 2,274 2,796 (522) 55 Gas, oil and other 992 1,126 (134) 56 Total generation production 5,776 6,433 (657) Purchased power 57 Firm load 1,254 856 398 58 Marketing and trading 83 113 (30) 59 Total purchased power 1,337 969 368 60 Total energy sources 7,113 7,402 (289) POWER PLANT PERFORMANCE Capacity Factors 61 Nuclear 101% 101% - 62 Coal 54% 67% (13)% 63 Gas, oil and other 18% 14% 4% 64 System average 42% 46% (4)% ECONOMIC INDICATORS Building Permits (a) 65 Metro Phoenix 4,463 5,413 (950) Arizona Job Growth (b) 66 Payroll job growth (% over prior year) 2.6% 2.0% 0.6% 67 Unemployment rate (%, seasonally adjusted) 6.4% 7.1% (0.7)% Sources: (a) U.S. Census Bureau (b) Arizona Department of Economic Security 3 Months Ended March 31, Pinnacle West Capital Corporation Quarterly Consolidated Statistical Summary Periods Ended March 31, 2015 and 2014 Page 4 of 4

First Quarter 2015 FIRST QUARTER 2015 RESULTS May 1, 2015

First Quarter 20152 FORWARD LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume” and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels; variations in demand for electricity, including those due to weather, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation or regulation, including those relating to environmental requirements, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs, including returns on debt and equity capital; our ability to meet renewable energy and energy efficiency mandates and recover related costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona, particularly in real estate markets; the development of new technologies which may affect electric sales or delivery; the cost of debt and equity capital and the ability to access capital markets when required; environmental and other concerns surrounding coal-fired generation; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional baseload generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2014 which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law. In this presentation, references to net income and earnings per share (EPS) refer to amounts attributable to common shareholders. We present “gross margin” per diluted share of common stock. Gross margin refers to operating revenues less fuel and purchased power expenses. Gross margin is a “non-GAAP financial measure,” as defined in accordance with SEC rules. The appendix contains a reconciliation of this non-GAAP financial measure to the referenced revenue and expense line items on our Consolidated Statements of Income, which are the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles in the United States of America (GAAP). We view gross margin as an important performance measure of the core profitability of our operations. We refer to “on-going earnings” in this presentation, which is also a non-GAAP financial measure. We also provide a reconciliation to show impacts of our noncontrolling interests for the Palo Verde lease extensions. We believe on-going earnings and the information provided in the reconciliation provide investors with useful indicators of our results that are comparable among periods because they exclude the effects of unusual items that may occur on an irregular basis. Investors should note that these non-GAAP financial measures may involve judgments by management, including whether an item is classified as an unusual item. These measures are key components of our internal financial reporting and are used by our management in analyzing the operations of our business. We believe that investors benefit from having access to the same financial measures that management uses.

First Quarter 20153 CEO • Regulatory Update • Solar Investments • Ocotillo Modernization Project • Transmission Investments AGENDA CFO • 1st Quarter 2015 Results • Arizona Economic Outlook • Financial Outlook

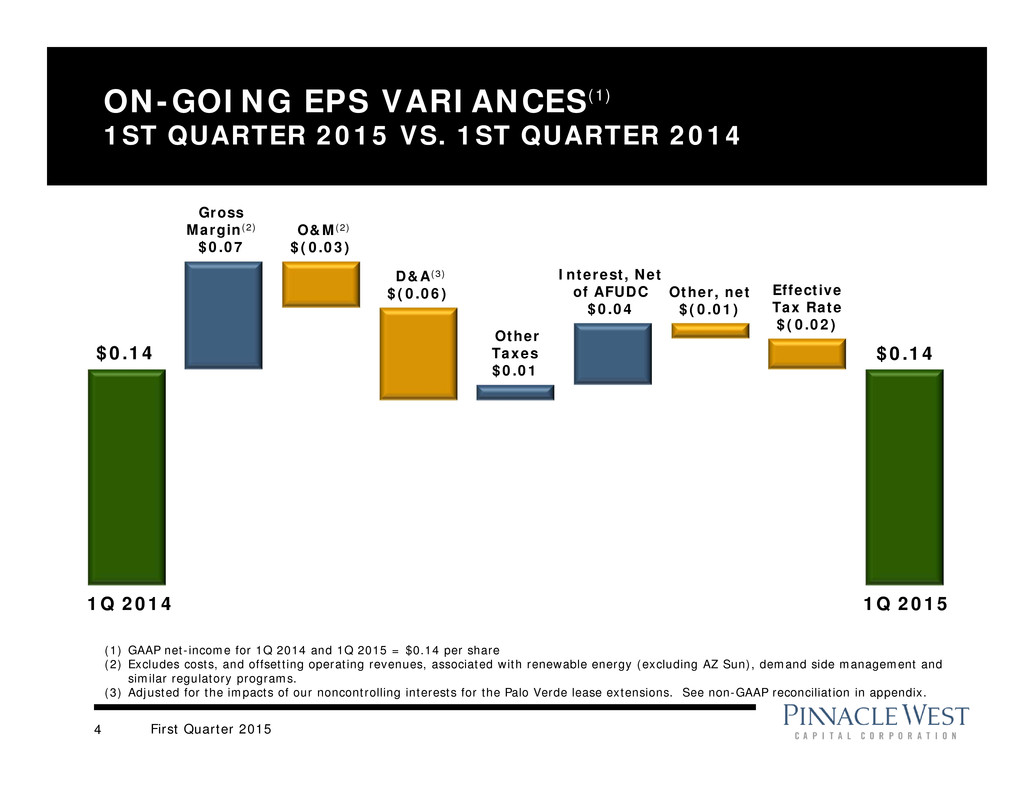

First Quarter 20154 Gross Margin(2) $0.07 ON-GOING EPS VARIANCES(1) 1ST QUARTER 2015 VS. 1ST QUARTER 2014 O&M(2) $(0.03) Other Taxes $0.01 Effective Tax Rate $(0.02) Other, net $(0.01) Interest, Net of AFUDC $0.04 $0.14 $0.14 1Q 2014 1Q 2015 (1) GAAP net-income for 1Q 2014 and 1Q 2015 = $0.14 per share (2) Excludes costs, and offsetting operating revenues, associated with renewable energy (excluding AZ Sun), demand side management and similar regulatory programs. (3) Adjusted for the impacts of our noncontrolling interests for the Palo Verde lease extensions. See non-GAAP reconciliation in appendix. D&A(3) $(0.06)

First Quarter 20155 GROSS MARGIN EPS DRIVERS 1ST QUARTER 2015 VS. 1ST QUARTER 2014 Lost Fixed Cost Recovery Mechanism $0.01 = Net Increase $0.07 Retail Transmission Revenue $0.01 See non-GAAP reconciliation for gross margin in appendix. Other, Net $(0.02) Lower Retail kWh Sales $(0.01) Weather $0.04 Four Corners Rate Change $0.06 Wholesale Contract $(0.02)

First Quarter 20156 0% 5% 10% 15% 20% 25% '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Industrial ARIZONA ECONOMIC INDICATORS Nonresidential Building Vacancy – Metro Phoenix Single Family & Multifamily Housing Permits Maricopa County Home Prices – Metro Phoenix Value Relative to Jan ‘05 50 75 100 125 150 175 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Vacancy Rate Office Retail Job Growth (Total Nonfarm) - Arizona (10.0)% (5.0)% 0.0% 5.0% 10.0% '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 YoY Change E Q1Jan 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 '07 '08 '09 '10 '11 '12 '13 '14 '15 Single Family Multifamily Q1

First Quarter 20157 2015 ON-GOING EPS GUIDANCE Key Factors & Assumptions as of May 1, 2015 2015 Electricity gross margin* (operating revenues, net of fuel and purchased power expenses) $2.30 – $2.35 billion • Retail customer growth about 1.5-2.5% • Weather-normalized retail electricity sales volume about 0-1.0% to prior year taking into account effects of customer conservation, energy efficiency and distributed renewable generation initiatives • Assumes normal weather Operating and maintenance* $795 - $815 million Other operating expenses (depreciation and amortization, and taxes other than income taxes) $650 - $670 million Interest expense, net of allowance for borrowed and equity funds used during construction (Total AFUDC $40 million) $175 - $185 million Net income attributable to noncontrolling interests ~$20 million Effective tax rate 35% Average diluted common shares outstanding ~111.0 million On-Going EPS Guidance $3.75 - $3.95 * Excludes O&M of $115 million, and offsetting revenues, associated with renewable energy and demand side management programs.

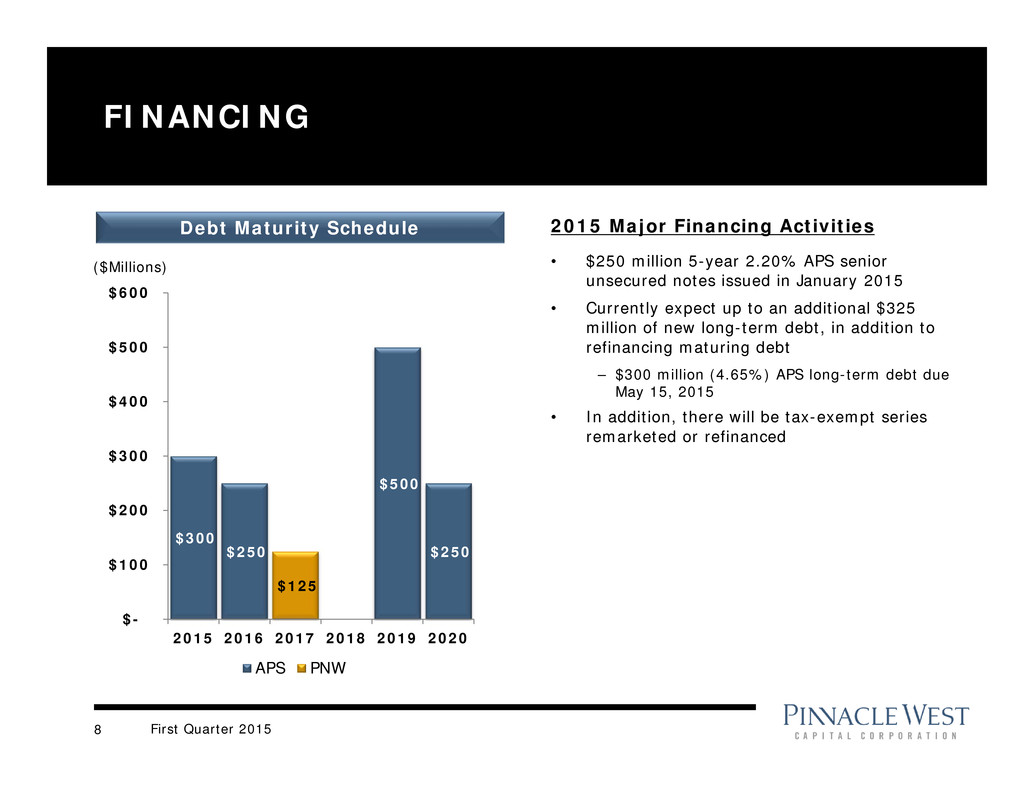

First Quarter 20158 FINANCING $300 $250 $500 $250 $125 $- $100 $200 $300 $400 $500 $600 2015 2016 2017 2018 2019 2020 APS PNW ($Millions) Debt Maturity Schedule 2015 Major Financing Activities • $250 million 5-year 2.20% APS senior unsecured notes issued in January 2015 • Currently expect up to an additional $325 million of new long-term debt, in addition to refinancing maturing debt – $300 million (4.65%) APS long-term debt due May 15, 2015 • In addition, there will be tax-exempt series remarketed or refinanced

First Quarter 2015 APPENDIX

First Quarter 201510 2015 KEY DATES Other Key Dates Docket # Q1 Q2 Q3 Q4 Arizona State Legislature n/a In Session Jan 12 – Apr 3 (Adjourned) Delaney Colorado River Transmission Line (California ISO) n/a Jan: Bidders posted Summer: Cal ISO selects winning bid ACC Key Dates Docket # Q1 Q2 Q3 Q4 Key Recurring Regulatory Filings Lost Fixed Cost Recovery E-01345A-11-0224 Jan 15 Net Metering – Quarterly Installation Filings E-01345A-13-0248 Jan 15 Apr 15 Jul 15 Oct 15 Transmission Cost Adjustor E-01345A-11-0224 May 15 Renewable Energy Surcharge TBD Jul 1 2014 Integrated Resource Plan (Biennial) and Cholla Unit 2 Retirement Proposal E-00000V-13-0070 Apr 14: ACC Review Ocotillo Modernization Project L-00000D-14-0292-00169 Jan – Q2: RFP Grid Access Charge Filing E-01345A-13-0248 Apr 2 Inquiry into Solar DG business models and practices (Generic Docket) E-00000J-14-0415 ACC to outline next steps ACC Open Meetings - ACC Open Meetings Held Monthly

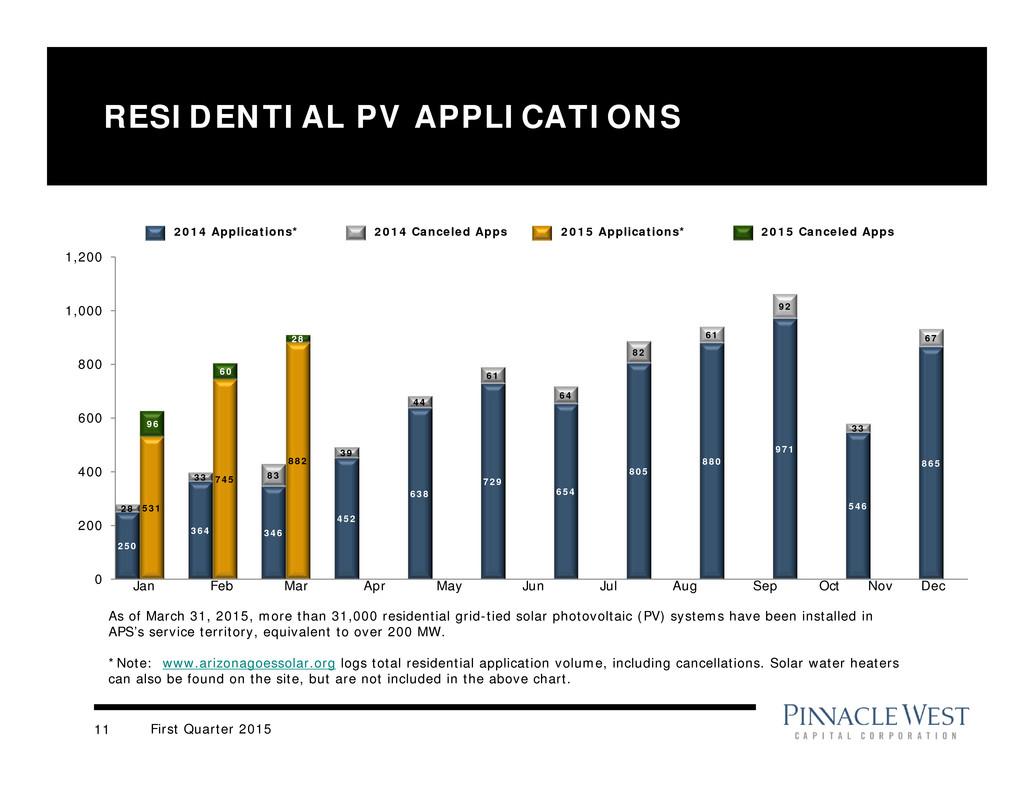

First Quarter 201511 As of March 31, 2015, more than 31,000 residential grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, equivalent to over 200 MW. *Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Solar water heaters can also be found on the site, but are not included in the above chart. 880 971 546 865 250 531 364 745 346 882 452 638 729 654 805 61 92 33 67 28 96 33 60 83 28 39 44 61 64 82 0 200 400 600 800 1,000 1,200 14-Jan 15-Jan2 14-Feb 15-Feb 14-Mar2 15-Mar 14-Apr3 15-Apr 14-May3 15-May Column2 14-Jun3 15-Jun 14-Jul3 15-Jul 14-Aug3 15-Aug Column3 14-Sep3 15-Sep Column4 14-Oct3 15-Oct Column5 14-Nov3 15-Nov Column6 14-Dec3 15-Dec RESIDENTIAL PV APPLICATIONS 2014 Applications* 2014 Canceled Apps Jan Feb Mar A r M y Jun Jul Aug Sep Oct Nov D c 2015 Applications* 2015 Canceled Apps

First Quarter 201512 FINANCIAL OUTLOOK Key Factors & Assumptions as of May 1, 2015 Assumption Impact Retail customer growth • Expected to average about 2-3% annually • Modestly improving Arizona and U.S. economic conditions Weather-normalized retail electricity sales volume growth • About 0.5-1.5% after customer conservation and energy efficiency and distributed renewable generation initiatives Assumption Impact AZ Sun Program • Additions to flow through RES until next base rate case • First 50 MW of AZ Sun is recovered through base rates Lost Fixed Cost Recovery (LFCR) • Offsets 30-40% of revenues lost due to ACC-mandated energy efficiency and distributed renewable generation initiatives Environmental Improvement Surcharge (EIS) • Assumed to recover up to $5 million annually of carrying costs for government- mandated environmental capital expenditures Power Supply Adjustor (PSA) • 100% recovery as of July 1, 2012 Transmission Cost Adjustor (TCA) • TCA is filed each May and automatically goes into rates effective June 1 • Beginning July 1, 2012 following conclusion of the regulatory settlement, transmission revenue is accrued each month as it is earned. Four Corners Acquisition • Four Corners rate increase effective January 1, 2015 Potential Property Tax Deferrals (2012 retail rate settlement): Assume 60% of property tax increases relate to tax rates, therefore, will be eligible for deferrals (Deferral rates: 50% in 2013; 75% in 2014 and thereafter) Gross Margin – Customer Growth and Weather (2015-2017) Gross Margin – Related to 2012 Retail Rate Settlement Outlook Through 2016: Goal of earning more than 9.5% Return on Equity (earned Return on Equity based on average Total Shareholder’s Equity for PNW consolidated, weather-normalized)

First Quarter 201513 OPERATIONS & MAINTENANCE OUTLOOK Targeting to be top quartile in peer benchmarking for staffing $749 $754 $761 $788 $805 $121 $150 $124 $137 $103 $115 2010 2011 2012 2013 2014 2015E PNW Consolidated RES/DSM* *Renewable energy and demand side management expenses are offset by revenue adjustors. $795 - $815 ($ Millions) 2015+ Outlook • Goal is to keep O&M per kWh flat • Complete documentation of over 1,800 policies, processes and procedures, including more than 275 process improvements to drive additional efficiencies • Execute targeted initiatives to address specific gaps and inefficiencies

First Quarter 201514 $289 $322 $397 $457 $24 $35 $181 $173 $63 $87 $1 $2 $192 $207 $101 $191 $242 $323 $316 $439 $73 $82 $68 $70 2014 2015 2016 2017 CAPITAL EXPENDITURES 70% of capital expenditures are recovered through rate adjustors (30%) and depreciation cash flow (40%) ($ Millions) $883 $1,056 $1,064 Other Distribution Transmission Renewable Generation Environmental Traditional Generation Projected $1,332 • The table does not include capital expenditures related to El Paso's 7% interest in Four Corners Units 4 and 5 of $2 million in 2015, $24 million in 2016 and $24 million in 2017. • 2015 – 2017 as disclosed in First Quarter 2015 Form 10-Q.

First Quarter 201515 RATE BASE APS’s revenues come from a regulated retail rate base and meaningful transmission business $5.9 $7.8 $1.4 $2.0 2014 2015 2016 2017 2018 APS Rate Base Growth Year-End ACC FERC $7.0 Billion Total Approved Rate Base Projected Most Recent Rate Decisions ACC FERC Rate Effective Date 7/1/2012 6/1/2014 Test Year Ended 12/31/2010* 12/31/2013 Rate Base $5.7B $1.3B Equity Layer 54% 58% Allowed ROE 10.00% 10.75% *Adjusted to include post test-year plant in service through 3/31/2012 83% 17% Generation & Distribution Transmission Rate base $ in billions, rounded

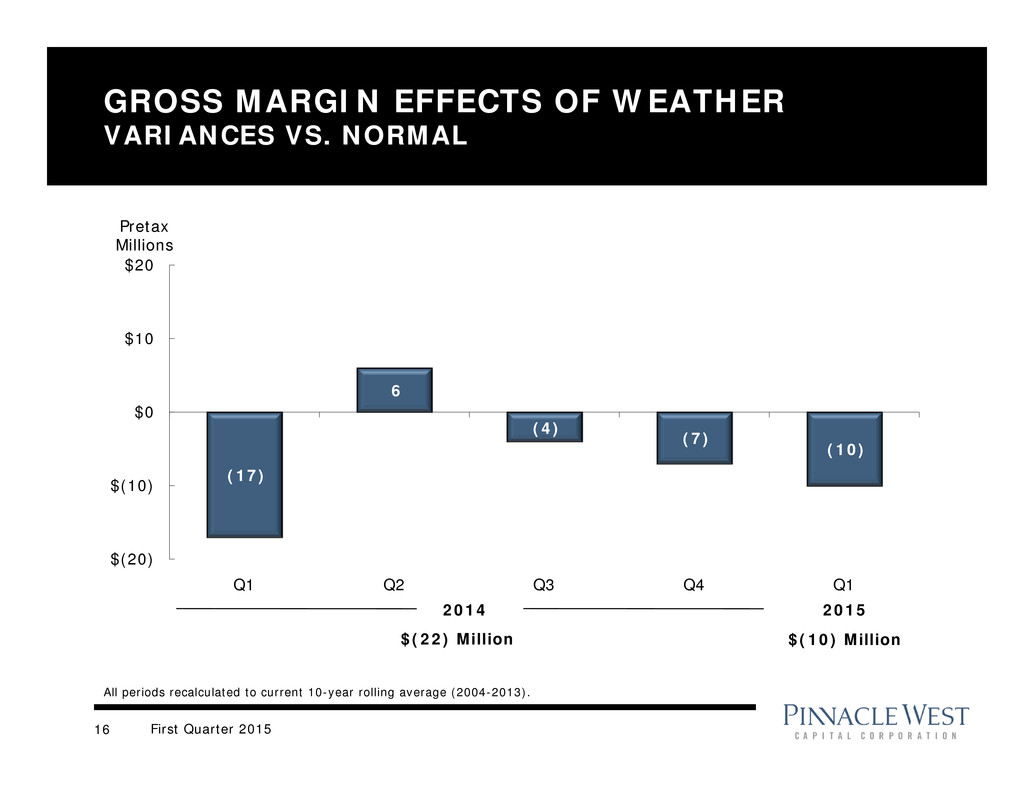

First Quarter 201516 (17) 6 (4) (7) (10) $(20) $(10) $0 $10 $20 Q1 Q2 Q3 Q4 Q1 GROSS MARGIN EFFECTS OF WEATHER VARIANCES VS. NORMAL Pretax Millions 2014 $(22) Million 2015 $(10) Million All periods recalculated to current 10-year rolling average (2004-2013).

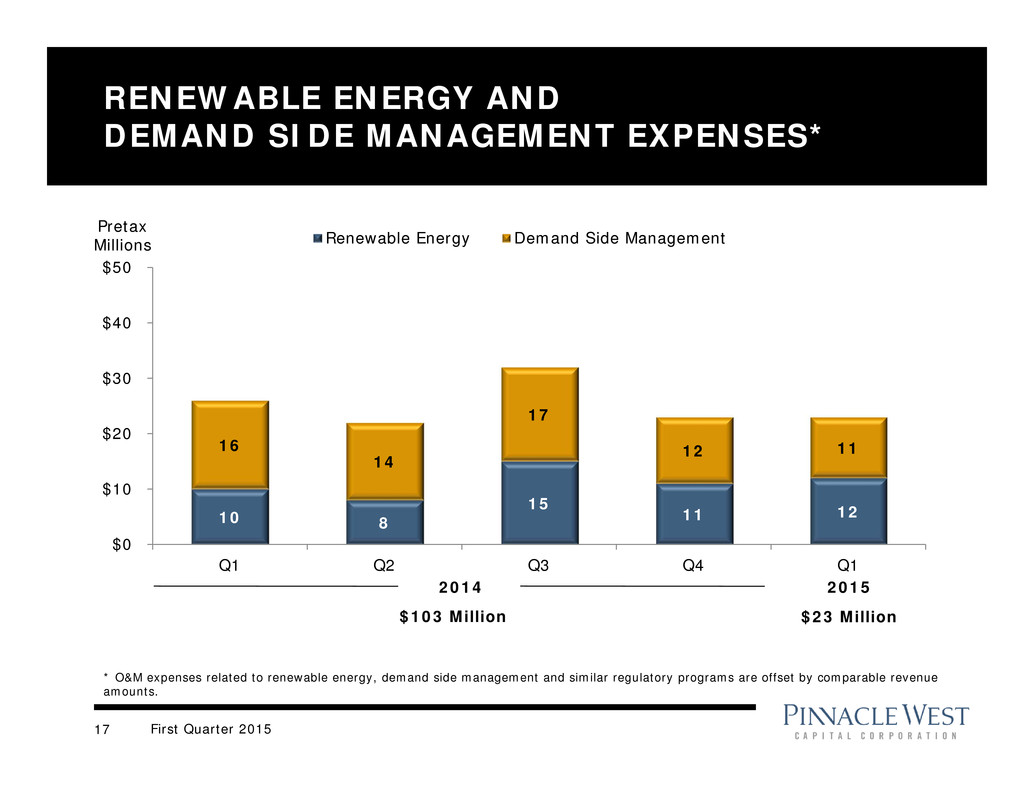

First Quarter 201517 10 8 15 11 12 16 14 17 12 11 $0 $10 $20 $30 $40 $50 Q1 Q2 Q3 Q4 Q1 Renewable Energy Demand Side Management RENEWABLE ENERGY AND DEMAND SIDE MANAGEMENT EXPENSES* * O&M expenses related to renewable energy, demand side management and similar regulatory programs are offset by comparable revenue amounts. Pretax Millions 2014 $103 Million 2015 $23 Million

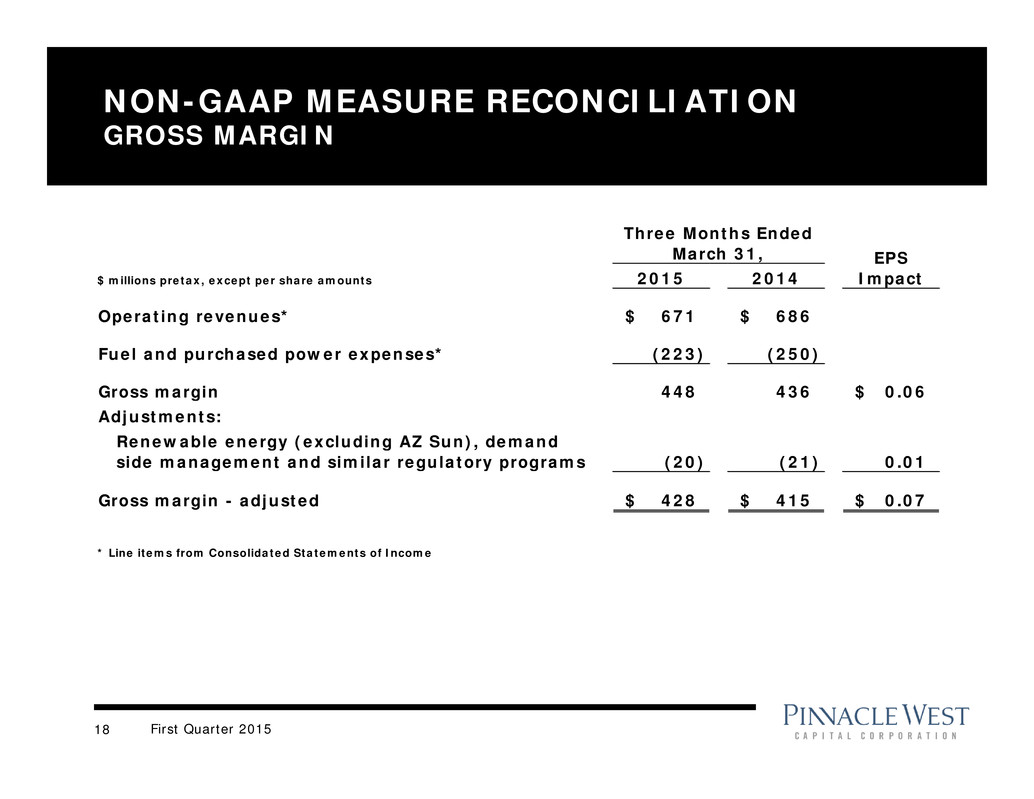

First Quarter 201518 NON-GAAP MEASURE RECONCILIATION GROSS MARGIN $ millions pretax, except per share amounts 2015 2014 Operating revenues* 671$ 686$ Fuel and purchased power expenses* (223) (250) Gross margin 448 436 0.06$ Adjustments: Renewable energy (excluding AZ Sun), demand side management and similar regulatory programs (20) (21) 0.01 Gross margin - adjusted 428$ 415$ 0.07$ * Line items from Consolidated Statements of Income Three Months Ended March 31, EPS Impact

First Quarter 201519 NON-GAAP MEASURE RECONCILIATION OTHER NON-GAAP $ millions pretax, except per share amounts 2015 Palo Verde Lease Extensions2 2015 Adjusted 2014 Depreciation and amortization1 121 (5) 116 102 (0.06)$ 4 5 9 9 N/A 1 Line items from Consolidated Statements of Income 2 Not tax effected EPS Impact Three Months Ended March 31, Net income attributable to noncontrolling interests1

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- CPKC announces results of director elections

- Hartford HealthCare hospitals make top 20% nationwide for safety, price transparency

- Airline Passengers Score Two Major Victories Following Two DOT Final Rules, Reports FlyersRights

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share