Form 8-K PARAGON OFFSHORE PLC For: Dec 08

�

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

�

�

FORM 8-K

�

�

CURRENT REPORT

Pursuant to Section�13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): December�8, 2014

�

�

PARAGON OFFSHORE plc

(Exact name of Registrant as specified in its charter)

�

�

�

| England and Wales | � | 001-36465 | � | 98-1146017 |

| (State�or�other�jurisdiction�of incorporation or organization) |

� | (Commission file number) |

� | (I.R.S. employer identification number) |

�

| 3151 Briarpark Drive, Suite 700 Houston, Texas |

� | 77042 |

| (Address of principal executive offices) | � | (Zip code) |

Registrant�s telephone number, including area code: +44 20 330 2300

�

�

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

�

| � | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

�

| � | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

�

| � | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

�

| � | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

�

�

�

| Item�7.01 | Regulation FD Disclosure |

Investor Presentation

On December�8, 2014, Randall D. Stilley, President, Chief Executive Officer and Director of Paragon Offshore plc (�Paragon�), will attend the 2014 Wells Fargo Energy Symposium Conference in New York City, New York. The event will not be webcast. However, presentation slides used during investor meetings will be available on December�8, 2014 on Paragon�s website at www.paragonoffshore.com, under �Events�& Presentations� in the �Investor Relations� section of the website. The presentation slides are also included as Exhibit 99.1 to this Current Report on Form 8-K and are incorporated herein by reference.

The information presented in Item�7.01 to this Current Report on Form 8-K is being furnished in accordance with Rule 101(e)(1) under Regulation FD and shall not be deemed to be �filed� for purposes of Section�18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any registration statement filed under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated by reference.

Forward Looking Statements

Certain statements in this current report constitute �forward-looking statements� within the meaning of the U.S. federal securities laws. These statements reflect management�s current expectations regarding future events and speak only as of the date of this current report. Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance and will not necessarily be accurate indications of whether or not, or the times at or by which, events will occur. Actual performance may differ materially from that expressed or implied in such statements. Although the forward-looking statements contained in this current report are based upon what are believed to be reasonable assumptions, investors cannot be assured that actual results will be consistent with these forward-looking statements, and the differences may be material. These forward-looking statements are made as of the date of this current report and, except as expressly required by applicable law, the Company assumes no obligation to update or revise them to reflect new events or circumstances.

�

| Item�9.01 | Financial Statements and Exhibits. |

�

| � | (d) | Exhibits. |

�

| EXHIBIT |

�� | � | �� | DESCRIPTION |

| 99.1 | �� | � | �� | Slide presentation of Paragon to be used at the 2014 Wells Fargo Energy Symposium Conference on December�8, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

�

| � | � | Paragon Offshore plc, a public limited company incorporated under the laws of England and Wales | ||||

| Date: December 8, 2014 | � | � | � | |||

| � | � | By: | � | /s/ Steven A. Manz | ||

| � | � | Name: | � | Steven A. Manz | ||

| � | � | Title: | � | Senior Vice President and Chief Financial Officer | ||

INDEX TO EXHIBITS

�

| EXHIBIT |

�� | � | �� | DESCRIPTION |

| 99.1 | �� | � | �� | Slide presentation of Paragon to be used at the 2014 Wells Fargo Energy Symposium Conference on December�8, 2014. |

Exhibit 99.1

�

PARAGON

OFFSHORE

2014 Wells Fargo Energy Symposium

Presentation for 1x1 Meetings

December 8-9, 2014

New York, NY

www.paragonoffshore.com

Safe Harbor Statement

PARAGON

OFFSHORE

This material contains statements that are �forward-looking statements� about Paragon�s business and financial performance. These statements can be identified by the

fact that they do relate strictly to current or historical facts. Each future projection is a forward-looking statement that involves certain risks, uncertainties and assumptions. These include but are not

limited to operational risks, actions by regulatory authorities or other third parties, costs and difficulties related to the separation, market conditions, financial results and performance, tax rates, ability to repay debt and timing thereof,

actions by customers and other third parties, factors affecting the level of activity in the oil and gas industry, supply and demand of drilling rigs, factors affecting the duration of contracts, the actual amount of downtime, factors that reduce

applicable dayrates, violations of anticorruption laws, the future price of oil and gas, statements related to the anticipated mandatory tender offer for Prospector, the time frame in which it is expected to occur, the expected benefits of the

proposed acquisition, the future financial performance of the assets after the proposed acquisition, and the contract backlog, revenue, condition or performance, contract commitments, dayrates, contract commencements, contract extensions or renewals

of Prospector�s fleet, and other factors including those detailed in Paragon�s filings with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those indicated. Paragon disclaims any duty to update the information presented here.

www.paragonoffshore.com 2

Agenda

PARAGON

OFFSHORE

Introducing Paragon

Offshore

Paragon�s Acquisition of

Prospector Offshore

Market Considerations

Conclusion

Paragon C461

www.paragonoffshore.com 3

Overview of Paragon Offshore

PARAGON

OFFSHORE

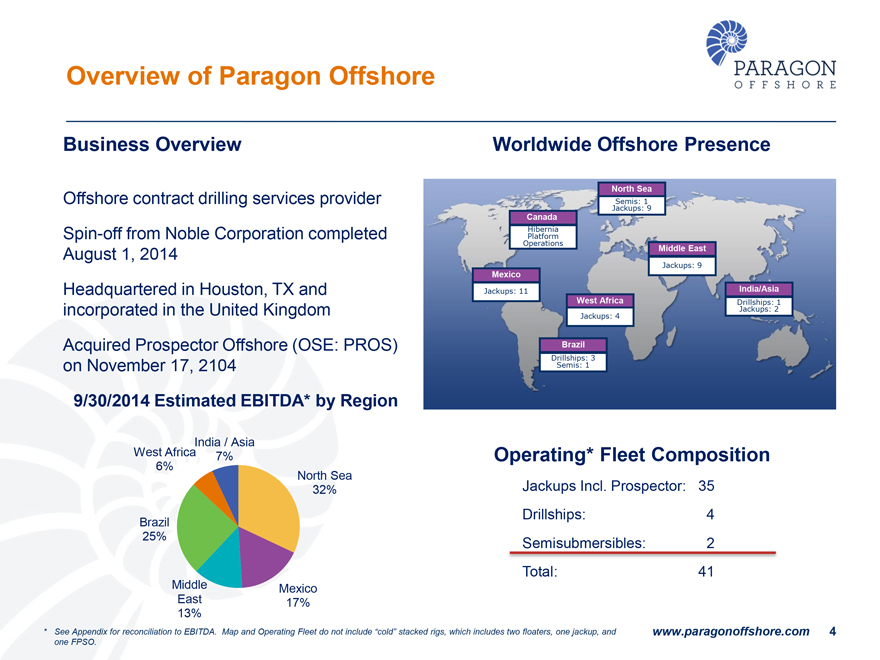

Business Overview

Offshore contract drilling services provider

Spin-off from Noble Corporation completed August 1, 2014

Headquartered in Houston, TX and

incorporated in the United Kingdom

Acquired Prospector Offshore (OSE: PROS) on November 17, 2104

9/30/2014 Estimated EBITDA* by Region

India / Asia

7%

West Africa

6%

North Sea

32%

Brazil

25%

Middle

East

13%

Mexico

17%

Worldwide Offshore Presence

North Sea

Semis: 1

Jackups: 9

Canada

Hibernia

Platform

Operations

Middle East

Jackups: 9

Mexico

Jackups: 11

India/Asia

Drillships: 1

Jackups: 2

West Africa

Jackups: 4

Brazil

Drillships: 3

Semis: 1

Operating* Fleet Composition

Jackups Incl. Prospector: 35

Drillships: 4

Semisubmersibles: 2

Total: 41

* See Appendix for reconciliation to EBITDA. Map and Operating Fleet do not include

�cold� stacked rigs, which includes two floaters, one jackup, and one FPSO.

www.paragonoffshore.com 4

PARAGON

OFFSHORE

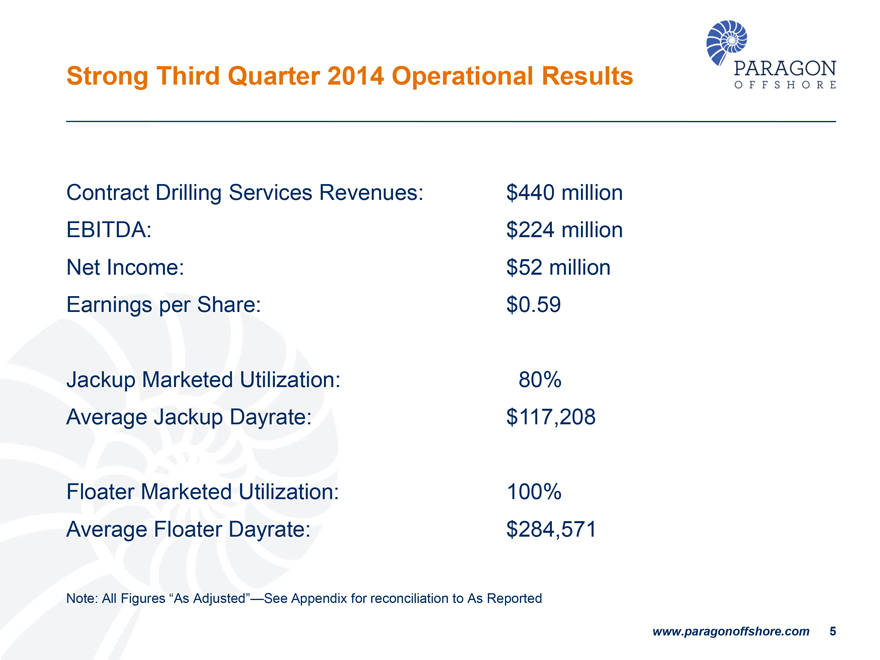

Strong Third Quarter 2014 Operational Results

Contract Drilling Services

Revenues: $440 million

EBITDA: $224 million

Net Income: $52 million

Earnings per Share: $0.59

Jackup Marketed Utilization: 80%

Average Jackup Dayrate: $117,208

Floater Marketed Utilization: 100%

Average Floater Dayrate: $284,571

Note: All Figures �As Adjusted��See Appendix

for reconciliation to As Reported

www.paragonoffshore.com 5

PARAGON

OFFSHORE

Paragon�s Strategy

Deliver reliable, safe, cost-efficient operations

Match our assets to customers in fit- for-purpose applications while maintaining industry-leading utilization

Manage our costs to preserve flexibility in changing dayrate environments

Practice disciplined

capital allocation in terms of fleet maintenance, fleet renewal and returns to shareholders

Paragon DPDS2

www.paragonoffshore.com 6

PARAGON

OFFSHORE

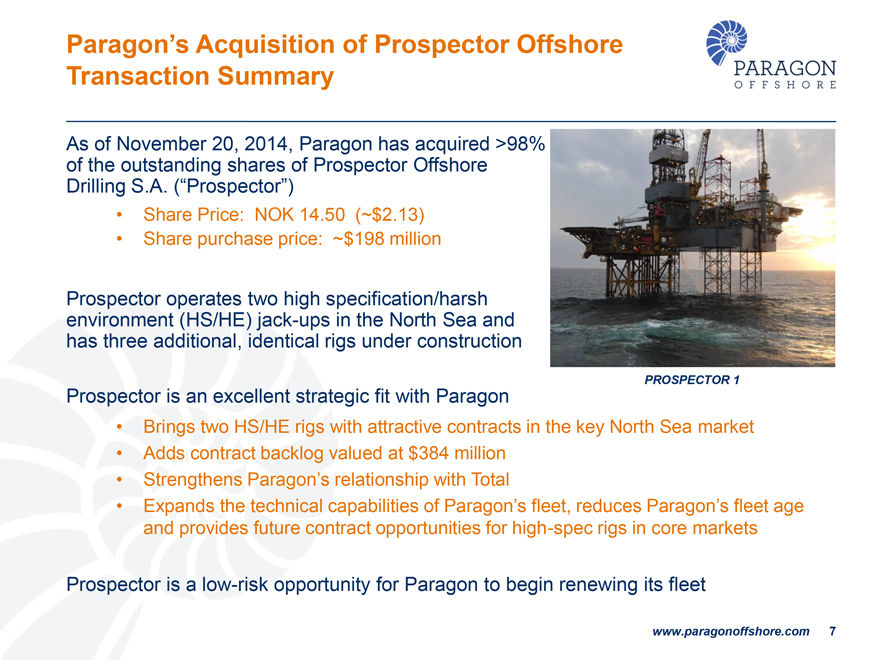

Paragon�s Acquisition of Prospector Offshore

Transaction Summary

As of November�20, 2014, Paragon has acquired >98% of the outstanding shares of Prospector Offshore Drilling S.A. (�Prospector�)

Share Price: NOK 14.50 (~$2.13)

Share purchase price: ~$198 million

Prospector operates two high specification/harsh environment (HS/HE) jack-ups in the North Sea and has three additional, identical rigs under construction

Prospector is an excellent strategic fit with Paragon

Brings two HS/HE rigs with attractive

contracts in the key North Sea market

Adds contract backlog valued at $384 million

Strengthens Paragon�s relationship with Total

Expands the technical capabilities of

Paragon�s fleet, reduces Paragon�s fleet age and provides future contract opportunities for high-spec rigs in core markets

Prospector is a low-risk

opportunity for Paragon to begin renewing its fleet

PROSPECTOR 1

www.paragonoffshore.com 7

PARAGON

OFFSHORE

Contract Overview and Delivery Schedule of

Propsector Offshore�s Rigs

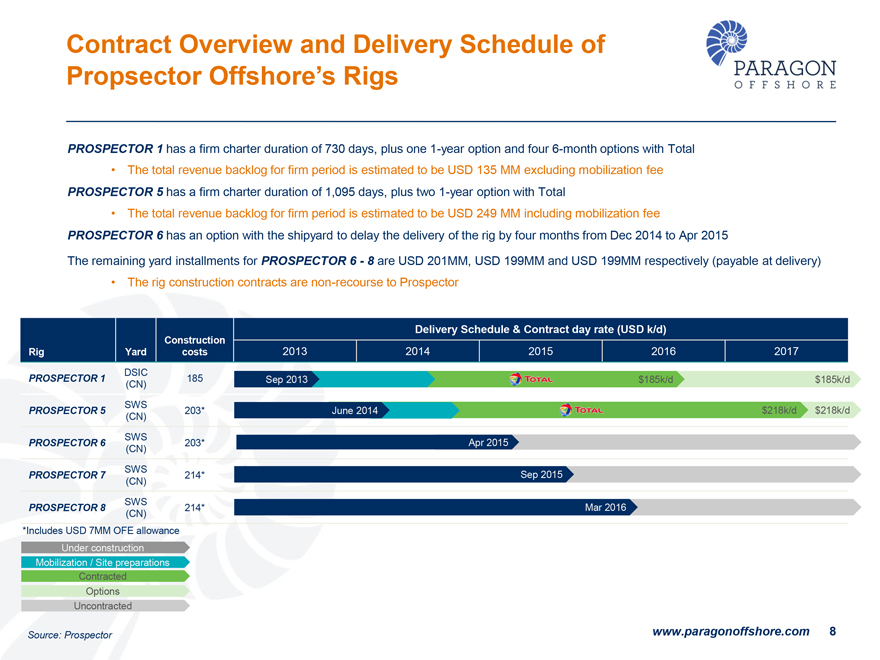

PROSPECTOR 1 has a firm charter duration of 730 days, plus one 1-year option and four 6-month options with Total

The total revenue backlog for firm period is estimated to be USD 135 MM excluding mobilization fee

PROSPECTOR 5 has a firm charter duration of 1,095 days, plus two 1-year option with Total

The

total revenue backlog for firm period is estimated to be USD 249 MM including mobilization fee

PROSPECTOR 6 has an option with the shipyard to delay the delivery

of the rig by four months from Dec 2014 to Apr 2015

The remaining yard installments for PROSPECTOR 6 - 8 are USD 201MM, USD 199MM and USD 199MM respectively

(payable at delivery)

The rig construction contracts are non-recourse to Prospector

Delivery Schedule & Contract day rate (USD k/d)

Rig Yard Construction costs 2013 2014 2015

2016 2017

PROSPECTOR 1 DSIC 185 Sep 2013 TOTAL $185k/d $185k/d

(CN)

PROSPECTOR 5 SWS 203* June 2014 TOTAL $218k/d $218k/d

(CN)

203* Apr 2015

PROSPECTOR 6 SWS

(CN)

214* Sep 2015

SWS

PROSPECTOR 7

(CN)

214* Mar 2016

PROSPECTOR 8 SWS

(CN)

*Includes USD 7MM OFE allowance

Under construction Mobilization

/ Site preparations Contracted

Options

Uncontracted

Source: Prospector

www.paragonoffshore.com 8

PARAGON

OFFSHORE

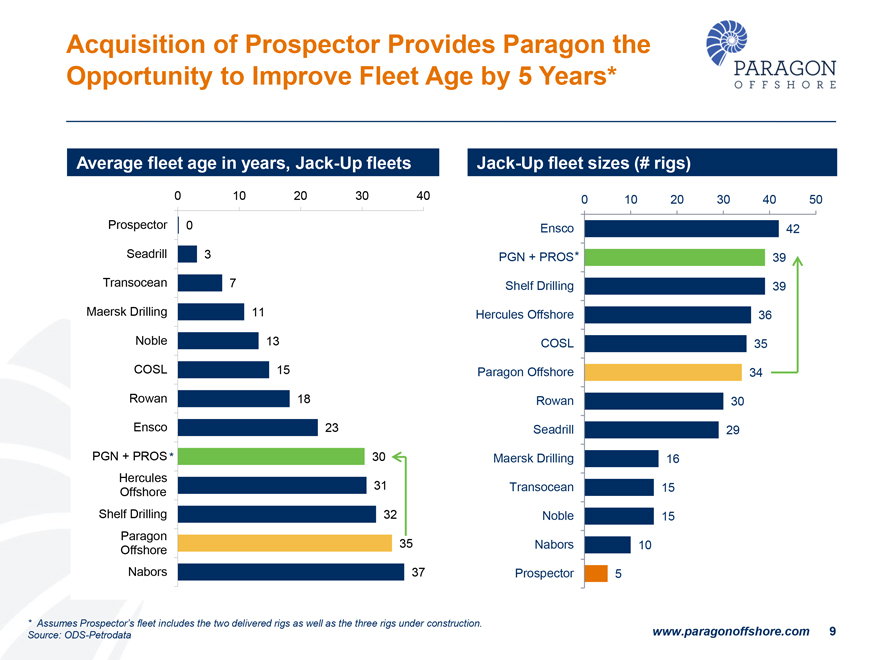

Acquisition of Prospector Provides Paragon the

Opportunity to Improve Fleet

Age by 5 Years*

Average fleet age in years, Jack-Up fleets

0 10 20 30 40

Prospector 0

Seadrill 3

Transocean 7

Maersk Drilling 11

Noble 13

COSL 15

Rowan 18

Ensco 23

PGN + PROS * 30

Hercules 31

Offshore

Shelf Drilling 32

Paragon

Offshore 35

Nabors 37

Jack-Up fleet sizes (# rigs)

0 10 20 30 40 50

Ensco 42

PGN + PROS* 39

Shelf Drilling 39

Hercules Offshore 36

COSL 35

Paragon Offshore 34

Rowan 30

Seadrill 29

Maersk Drilling 16

Transocean 15

Noble 15

Nabors 10

Prospector 5

* Assumes Prospector�s fleet includes the two delivered rigs as well as the three rigs under construction.

Source: ODS-Petrodata

www.paragonoffshore.com 9

PARAGON

OFFSHORE

Prospector Transaction Next Steps

Commence a mandatory tender offer for the

remaining outstanding shares in Prospector within four weeks with the intent to require all remaining shares

Continue discussions with Prospector�s bank

group on Prospector debt

Term Loan: $270 million (LIBOR

+ 350 bps)

Bond holders: $100 million (7.75%)

Examine refinancing opportunities / requirements

Begin integration of Prospector into Paragon

Focus on marketing opportunities for Prospector 6

www.paragonoffshore.com 10

PARAGON

OFFSHORE

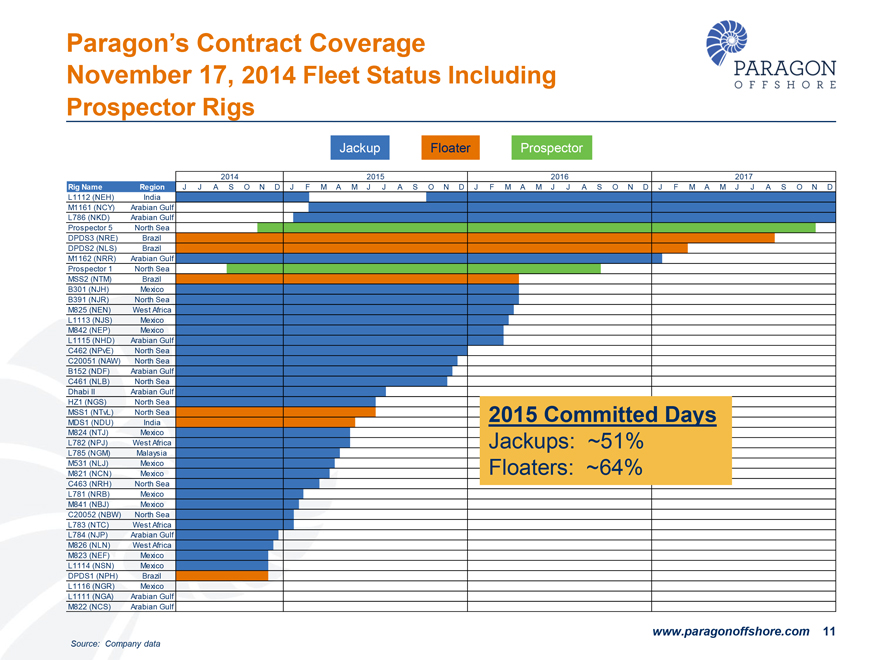

Paragon�s Contract Coverage

November�17, 2014 Fleet Status

Including

Prospector Rigs

Jackup Floater Prospector

2014 2015 2016 2017

Rig Name Region J J A S O N D J F M A M J J A S O N D J F M A M J J A S O

N D J F M A M J J A S O N D

L1112 (NEH) India

M1161 (NCY) Arabian Gulf

L786 (NKD) Arabian Gulf

Prospector 5 North Sea

DPDS3 (NRE) Brazil

DPDS2 (NLS) Brazil

M1162 (NRR) Arabian Gulf

Prospector 1 North Sea

MSS2 (NTM) Brazil

B301 (NJH) Mexico

B391 (NJR) North Sea

M825 (NEN) West Africa

L1113 (NJS) Mexico

M842 (NEP) Mexico

L1115 (NHD) Arabian Gulf

C462 (NPvE) North Sea

C20051 (NAW) North Sea

B152 (NDF) Arabian Gulf

C461 (NLB) North Sea

Dhabi II Arabian Gulf

HZ1 (NGS) North Sea

MSS1 (NTvL) North Sea 2015 Committed Days

MDS1 (NDU) India

M824 (NTJ) Mexico

L782 (NPJ) West Africa Jackups: ~51%

L785 (NGM) Malaysia

M531 (NLJ) Mexico Floaters: ~64%

M821 (NCN) Mexico

C463 (NRH) North Sea

L781 (NRB) Mexico

M841 (NBJ) Mexico

C20052 (NBW) North Sea

L783 (NTC) West Africa

L784 (NJP) Arabian Gulf

M826 (NLN) West Africa

M823 (NEF) Mexico

L1114 (NSN) Mexico

DPDS1 (NPH) Brazil

L1116 (NGR) Mexico

L1111 (NGA) Arabian Gulf

M822 (NCS) Arabian Gulf

www.paragonoffshore.com 11

Source: Company data

PARAGON

OFFSHORE

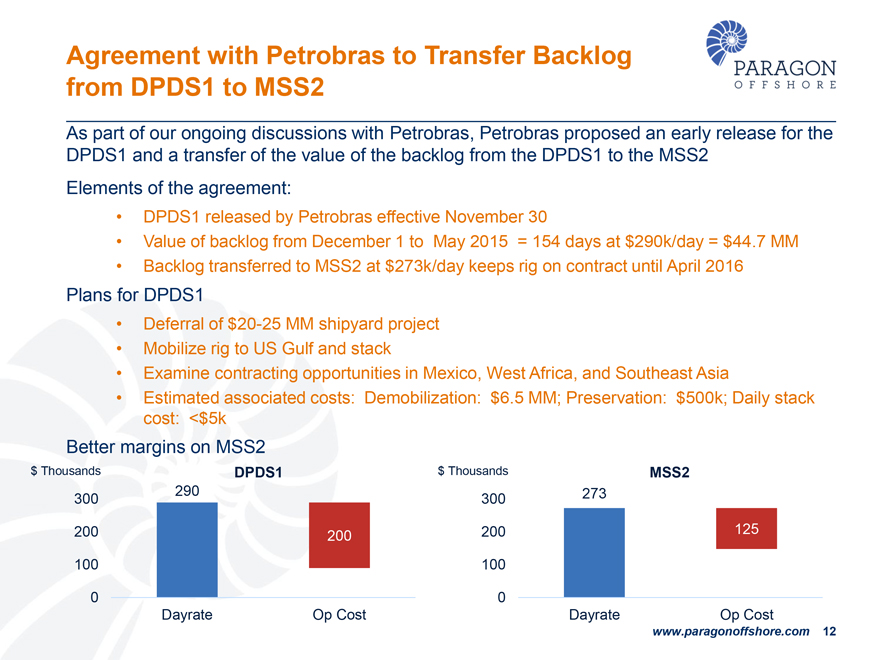

Agreement with Petrobras to Transfer Backlog from DPDS1 to MSS2

As part of

our ongoing discussions with Petrobras, Petrobras proposed an early release for the

DPDS1 and a transfer of the value of the backlog from the DPDS1 to the MSS2

Elements of the agreement:

DPDS1 released by Petrobras effective

November�30

Value of backlog from December�1 to May 2015 = 154 days at $290k/day = $44.7 MM

Backlog transferred to MSS2 at $273k/day keeps rig on contract until April 2016

Plans for

DPDS1

Deferral of $20-25 MM shipyard project

Mobilize rig to US Gulf and

stack

Examine contracting opportunities in Mexico, West Africa, and Southeast Asia

Estimated associated costs: Demobilization: $6.5 MM; Preservation: $500k; Daily stack cost: <$5k

Better margins on MSS2

$ Thousands DPDS1 $ Thousands MSS2

290 273

300 300

200 200 200 125

100 100

0 0

Dayrate Op Cost Dayrate Op Cost

www.paragonoffshore.com 12

PARAGON

OFFSHORE

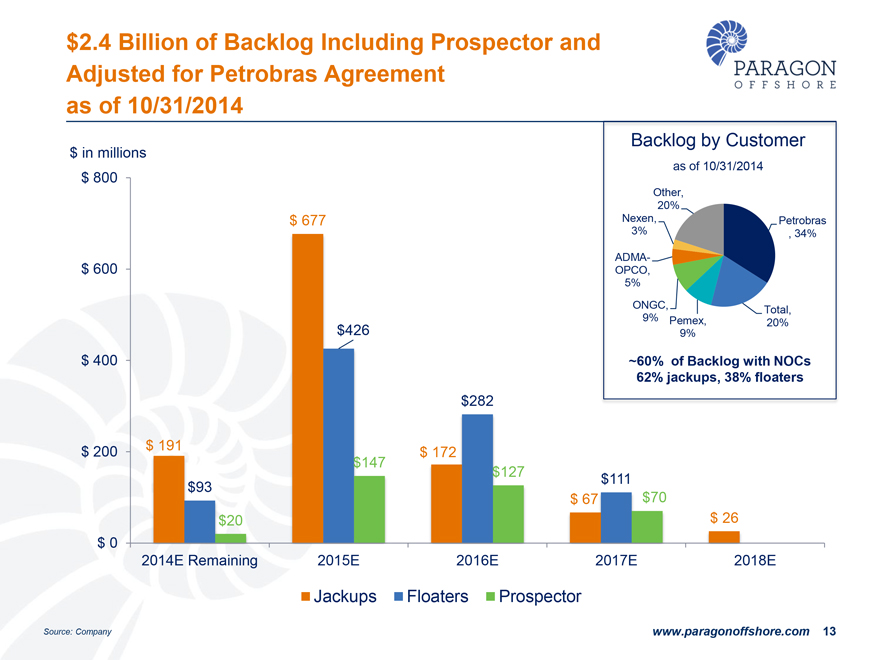

$2.4 Billion of Backlog Including Prospector and

Adjusted for Petrobras

Agreement as of 10/31/2014

Backlog by Customer

as of 10/31/2014

Other,

20%

Nexen, Petrobras

3% ,34%

ADMA-

OPCO,

5%

ONGC,�Total,

9% Pemex, 20%

9%

~60% of Backlog with NOCs

62% jackups, 38% floaters

$ in millions

$ 800

$ 677

$ 600

$426

$ 400

$282

$ 191

$ 200 $ 172

$147

$127

$111

$93

$ 67 $70

$20 $ 26

$ 0

2014E Remaining 2015E 2016E 2017E 2018E

Jackups Floaters Prospector

www.paragonoffshore.com 13

Source: Company data

PARAGON

OFFSHORE

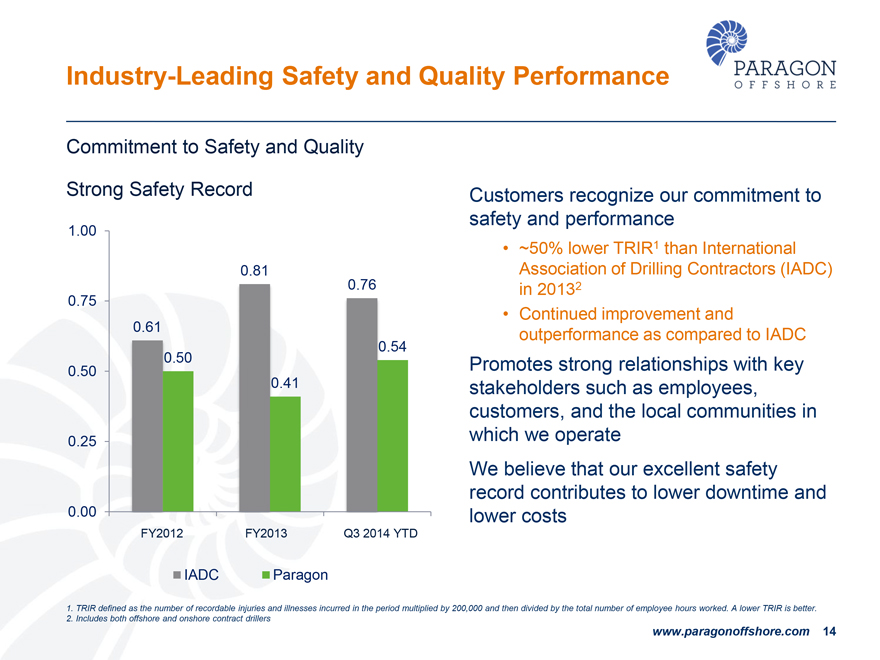

Industry-Leading Safety and Quality Performance

Commitment to Safety and

Quality

Strong Safety Record

1.00

0.81

0.76

0.75

0.61

0.54

0.50

0.50

0.41

0.25

0.00

FY2012 FY2013 Q3 2014 YTD

IADC Paragon

Customers recognize our commitment to safety and performance

~50% lower TRIR1 than

International Association of Drilling Contractors (IADC) in 20132

Continued improvement and outperformance as compared to IADC

Promotes strong relationships with key stakeholders such as employees, customers, and the local communities in which we operate We believe that our excellent safety record

contributes to lower downtime and lower costs

1. TRIR defined as the number of recordable injuries and illnesses incurred in the period multiplied by 200,000 and

then divided by the total number of employee hours worked. A lower TRIR is better.

2. Includes both offshore and onshore contract drillers

www.paragonoffshore.com 14

PARAGON

OFFSHORE

Market Considerations

Returns for industry players have been negatively

impacted in recent years by a variety of factors

Jackup market capacity additions create potential challenges for drilling contractors

Challenges and opportunities in the short-term

Breakeven oil prices for various play types

Paragon DPDS3

www.paragonoffshore.com 15

PARAGON

OFFSHORE

Key Issues Impacting Returns in Recent Years

For Operators

Financial crisis and resulting host government responses

Macondo incident and impact on

ultradeepwater activity and project costs

Rise of North American shale plays

Reduced conventional exploration success

Increased pressure from investors to

return cash to shareholders

For the Drilling industry

Rising labor costs and

competition for crews

Increasing regulation

Increasing local content

requirements

Increasing number of national drilling contractors

Increasing

rig supply

Increasing industry fragmentation

A changing environment for both

Operators and Contractors

www.paragonoffshore.com 16

PARAGON

OFFSHORE

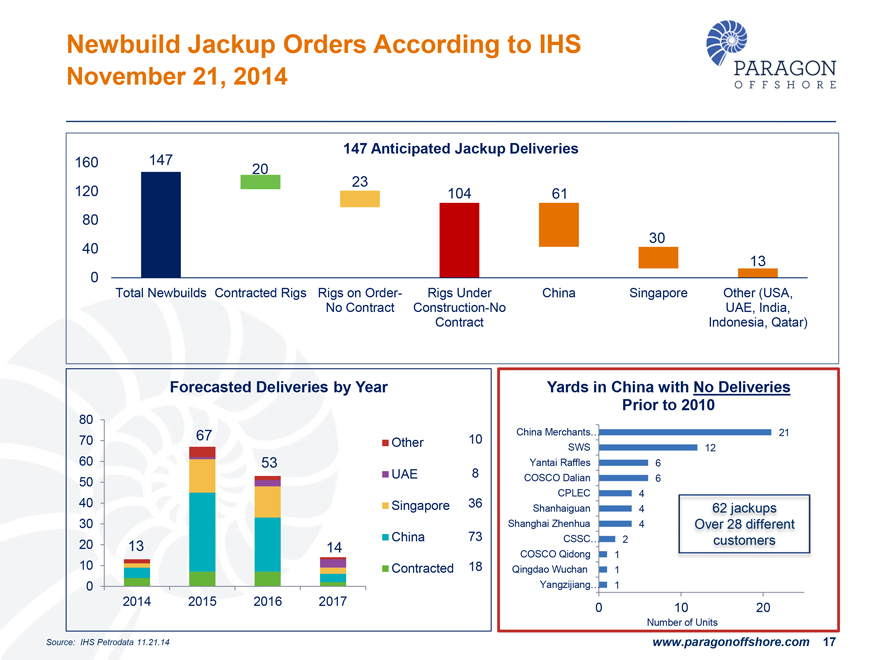

Newbuild Jackup Orders According to IHS

November�21, 2014

147 Anticipated Jackup Deliveries

160 120 80 40 0

147 20 23 104 61 30 13

Total Newbuilds Contracted Rigs Rigs on Order-No Contract Rigs Under

Construction-No Contract China Singapore Other (USA, UAE, India, Indonesia, Qatar)

Forecasted Deliveries by Year

80 70 60 50 40 30 20 10 0

13 67 53 14

2014 2015 2016 2017

Other

UAE

Singapore

China

Contracted

10 8 36 73 18

Yards in China with No Deliveries

Prior to 2010

China Merchants...

SWS

Yantai Raffles

COSCO Dalian

CPLEC

Shanhaiguan

Shanghai Zhenhua

CSSC...

COSCO Qidong

Qingdao Wuchan

Yangzijiang...

0 10 20

Number of Units

62 jackups Over 28 different customers

21

12

6

6

4

4

4

2

1

1

1

Source: IHS Petrodata 11.21.14

www.paragonoffshore.com 17

PARAGON

OFFSHORE

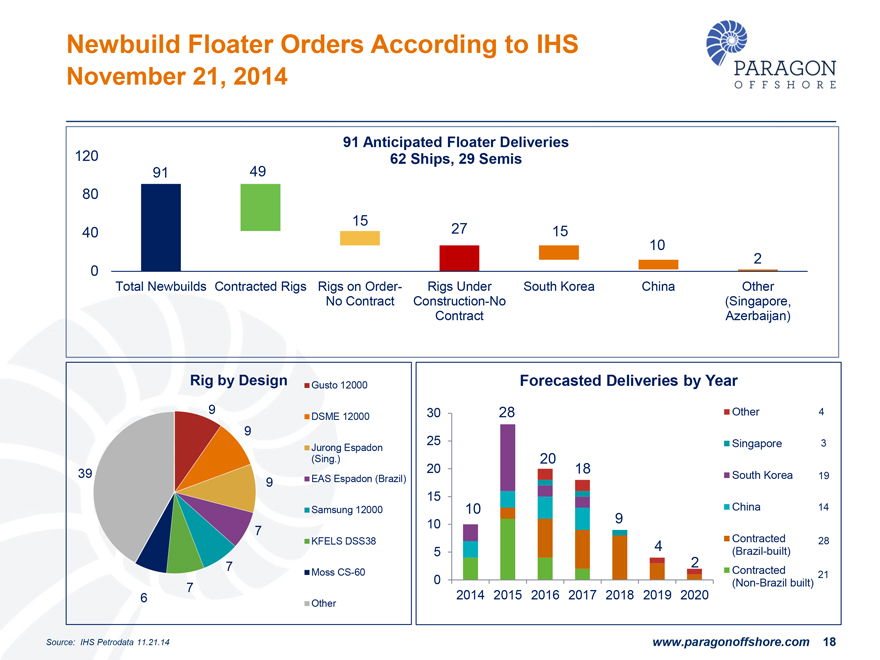

Newbuild Floater Orders According to IHS

November�21, 2014

91 Anticipated Floater Deliveries

62 Ships, 29 Semis

120 80 40 0

91 49 15 27 15 10 2

Total Newbuilds

Contracted Rigs

Rigs on Order-No Contract

Rigs Under Construction-No Contract

South Korea

China

Other (Singapore, Azerbaijan)

Rig by Design

39 9 9 9 7 7 7 6

Gusto 12000

DSME 12000

Jurong Espadon (Sing.)

EAS Espadon (Brazil)

Samsung 12000

KFELS DSS38

Moss CS-60

Other

Forecasted Deliveries by Year

30

25

20

15

10

5

0

2014

2015

2016

2017

2018

2019

2020

10 28 20 18 9 4 2

Other

Singapore

South Korea

China

Contracted (Brazil-built)

Contracted (Non-Brazil built)

4

3

19

14

28

21

Source: IHS Petrodata 11.21.14

www.paragonoffshore.com 18

PARAGON

OFFSHORE

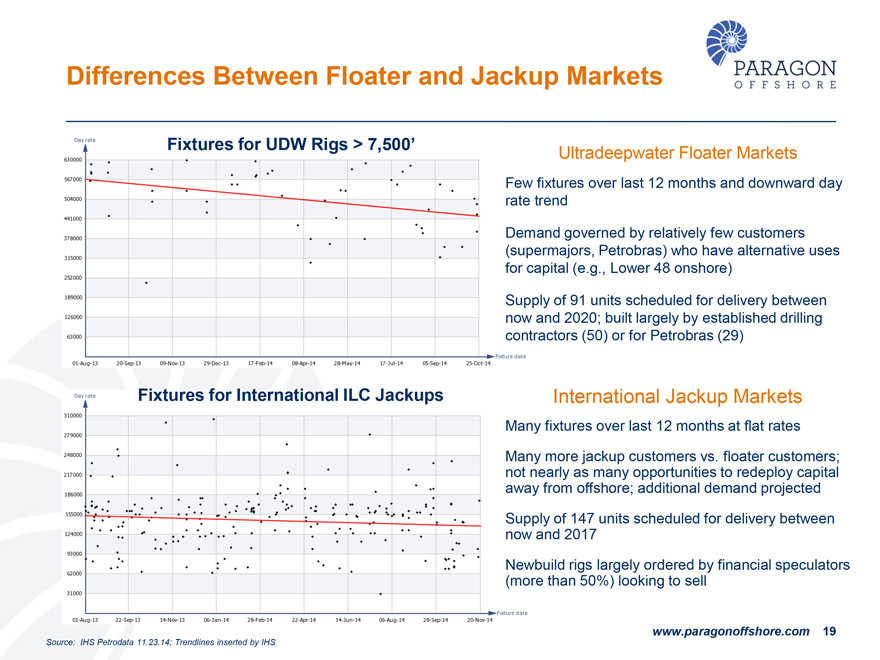

Differences Between Floater and Jackup Markets

Fixtures for UDW Rigs >

7,500�

Day rate

630000

567000

504000

441000

378000

315000

252000

189000

126000

63000 Fixture date

01-Aug-13 20-Sep-13 09-Nov-13 29-Dec-13 17-Feb-14 08-Apr-14 28-May-14

17-Jul-14 05-Sep-14 25-Oct-14

Ultradeepwater Floater Markets

Few fixtures

over last 12 months and downward day rate trend

Demand governed by relatively few customers (supermajors, Petrobras) who have alternative uses for capital (e.g.,

Lower 48 onshore)

Supply of 91 units scheduled for delivery between now and 2020; built largely by established drilling contractors (50)�or for Petrobras

(29)

Fixtures for International ILC Jackups

Day rate

310000

279000

248000

217000

186000

155000

124000

93000

62000

31000 Fixture date

01-Aug-13 22-Sep-13 14-Nov-13 06-Jan-14 28-Feb-14 22-Apr-14 14-Jun-14 06-Aug-14 28-Sep-14 20-Nov-14

International Jackup Markets

Many fixtures over last 12 months at flat rates

Many more jackup customers vs. floater customers; not nearly as many opportunities to redeploy capital away from offshore; additional demand projected

Supply of 147 units scheduled for delivery between now and 2017

Newbuild rigs largely ordered

by financial speculators (more than 50%) looking to sell

www.paragonoffshore.com 19

Source: IHS Petrodata 11.23.14; Trendlines inserted by IHS

PARAGON

OFFSHORE

People�A Key Ingredient for Success and an

Advantage for Paragon

With 147 jackups and 93 floaters under construction, the industry needs to add a significant number of people to crew these units

At an average of 100 people per rig, we could need more than 20,000 new employees to crew these rigs if all are incremental to current supply.

Although rig stacking and retirements will likely make crews available for some newbuilds, a large proportion of the workforce is past the age of 50, which means that the

�great crew change� is coming

Many safety and downtime incidents can be traced to human error�those contractors with the most experienced crews and

best training programs, like Paragon, are best positioned for success

www.paragonoffshore.com 20

PARAGON

OFFSHORE

Where Are We Headed?

Short-term: More Challenges Than Opportunities

Challenges

Near-term lower oil price environment

2015 E&P capital budgets reduced for some oil companies

Customer focus on project cost

reduction

Speculative rig construction continues

Absorption of new rigs into

the industry�crews and safety

Increasing nationalism

Opportunities

Consolidation

Fleet renewal

Re-setting cost bases

New country openings

www.paragonoffshore.com 21

PARAGON

OFFSHORE

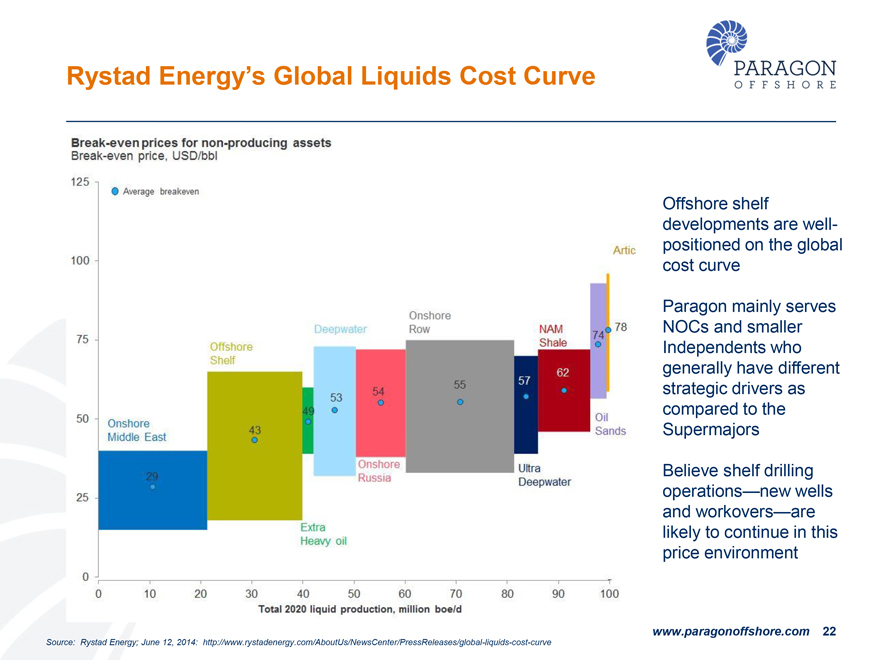

Rystad Energy�s Global Liquids Cost Curve

Break-even prices for

non-producing assets

Break-even price, USD/bbl

125 100 75 50 25 0

Average breakeven

Onshore Middle East

Offshore Shelf

Deepwater

Onshore Row

Extra Heavy oil

Onshore Russia

NAM Shale

Ultra Deepwater

Arctic

Oil Sands

29 43 49 53 54 55 57 62 74 78

0 10 20 30 40 50 60 70 80 90 100

Total 2020 liquid production, million boe/d

Offshore shelf developments are well-positioned on the global cost curve

Paragon mainly serves

NOCs and smaller Independents who generally have different strategic drivers as compared to the Supermajors

Believe shelf drilling operations�new wells and

workovers�are likely to continue in this price environment

Source: Rystad Energy; June�12, 2014:

http://www.rystadenergy.com/AboutUs/NewsCenter/PressReleases/global-liquids-cost-curve

www.paragonoffshore.com 22

PARAGON

OFFSHORE

Conclusion

www.paragonoffshore.com 23

PARAGON

OFFSHORE

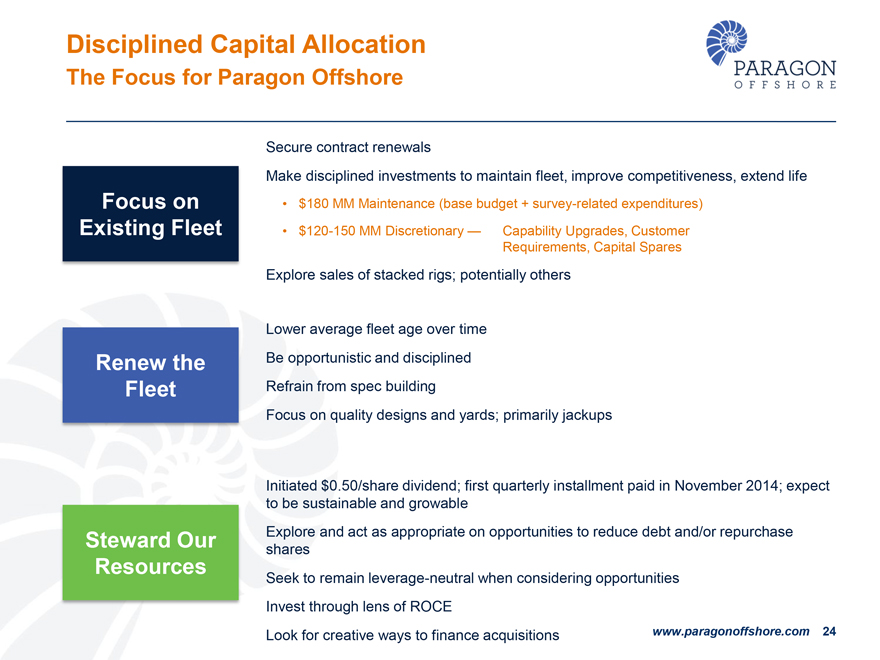

Disciplined Capital Allocation

The Focus for Paragon Offshore

Focus on Existing Fleet

Secure contract renewals

Make disciplined investments to maintain fleet, improve competitiveness, extend life

�

$180 MM Maintenance (base budget + survey-related expenditures)

� $120-150 MM Discretionary � Capability Upgrades, Customer

Requirements, Capital Spares

Explore sales of stacked rigs; potentially others

Renew the Fleet

Lower average fleet age over time

Be opportunistic and disciplined

Refrain from spec building

Focus on quality designs and yards; primarily jackups

Steward Our Resources

Initiated $0.50/share dividend; first quarterly installment paid in November 2014; expect to be sustainable and growable

shares Explore and act as appropriate on opportunities to reduce debt and/or repurchase

Seek

to remain leverage-neutral when considering opportunities

Invest through lens of ROCE

Look for creative ways to finance acquisitions

www.paragonoffshore.com 24

PARAGON

OFFSHORE

Why Paragon Offshore?

Significant Scale, Size and Expertise

Low-cost Driller with Proven Record of Excellence

Strong Backlog and Established Diverse

Customer Base

Well-Maintained �Workhorse� Fleet of Rigs

Opportunistic Acquirer

Total Return Investment Vehicle

Paragon C20051

www.paragonoffshore.com 25

PARAGON

OFFSHORE

NYSE Listed: PGN

3151 Briarpark Drive

Houston, TX 77042

832.783.4000

For additional information, contact: Lee M. Ahlstrom

SVP-Investor Relations, Strategy &

Planning [email protected]

www.paragonoffshore.com

PARAGON

OFFSHORE

Appendix

www.paragonoffshore.com 27

PARAGON

OFFSHORE

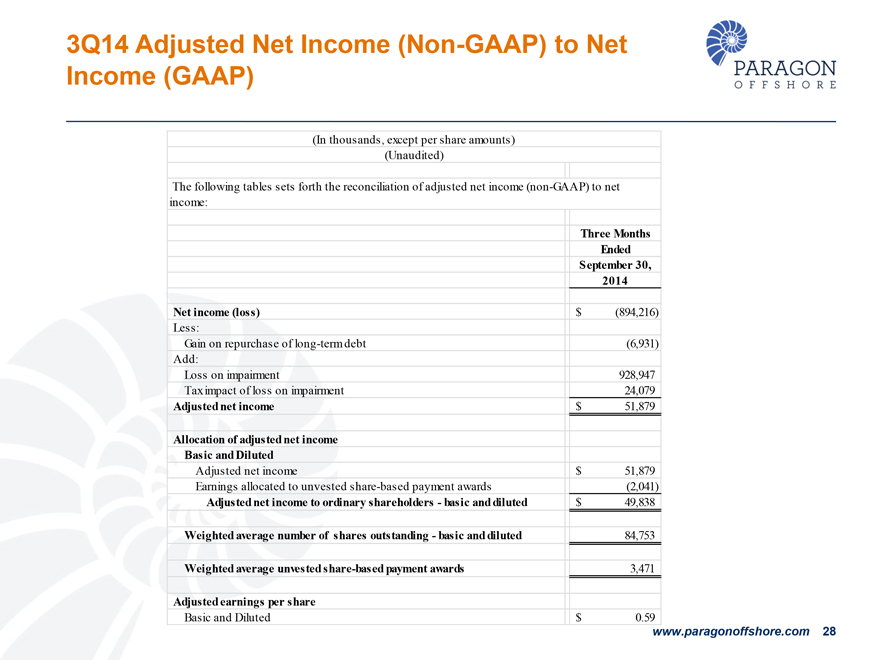

3Q14 Adjusted Net Income (Non-GAAP) to Net Income (GAAP)

(In thousands,

except per share amounts)

(Unaudited)

The following tables sets forth the

reconciliation of adjusted net income (non-GAAP) to net income:

Three Months Ended September�30, 2014

Net income (loss) $(894,216)

Less:

Gain on repurchase of long-term debt (6,931)

Add:

Loss on impairment 928,947

Tax impact of loss on impairment 24,079

Adjusted net income $51,879

Allocation of adjusted net income

Basic and Diluted

Adjusted net income $51,879

Earnings allocated to unvested share-based payment awards (2,041)

Adjusted net income to

ordinary shareholders - basic and diluted $49,838

Weighted average number of shares outstanding - basic and diluted 84,753

Weighted average unvested share-based payment awards 3,471

Adjusted earnings per share

Basic and Diluted $0.59

www.paragonoffshore.com 28

PARAGON

OFFSHORE

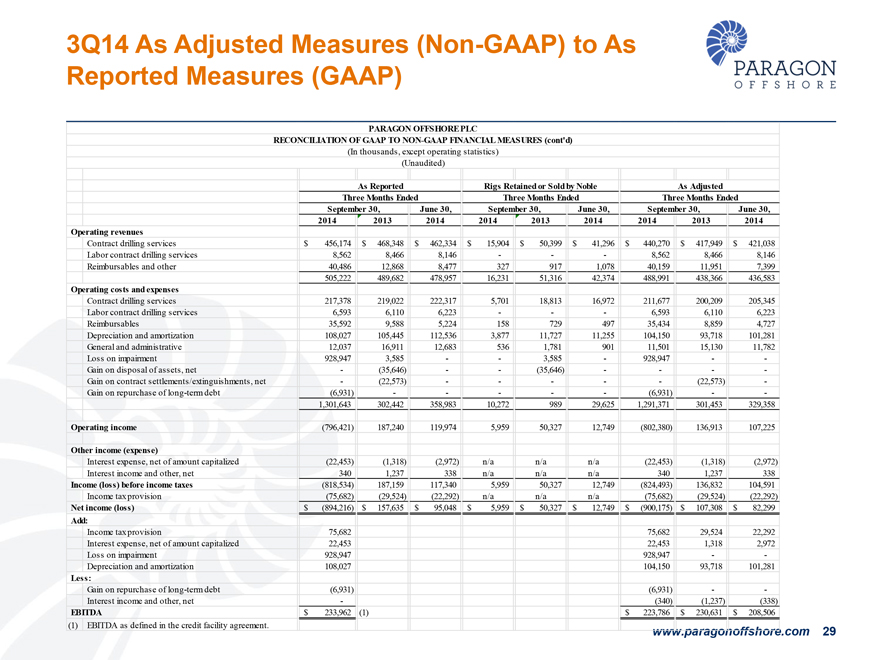

3Q14 As Adjusted Measures (Non-GAAP) to As Reported Measures (GAAP)

PARAGON

OFFSHORE PLC

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (cont�d)

(In thousands, except operating statistics )

(Unaudited)

As Reported Three Months Ended

Rigs Retained or Sold by Noble Three Months Ended

As Adjusted Three Months Ended

September 30,

June 30,

September 30,

June 30,

September 30,

June 30,

2014 2013 2014 2014 2013 2014 2014 2013 2014

Operating revenues

Contract drilling services

$456,174 $468,348 $462,334 $15,904 $50,399 $41,296 $440,270 $417,949 $421,038

Labor contract

drilling services

8,562 8,466 8,146 - - - 8,562 8,466 8,146

Reimbursables and

other

40,486 12,868 8,477 327 917 1,078 40,159 11,951 7,399

505,222 489,682

478,957 16,231 51,316 42,374 488,991 438,366 436,583

Operating costs and expenses

Contract drilling services

217,378 219,022 222,317 5,701 18,813 16,972 211,677 200,209 205,345

Labor contract drilling services

6,593 6,110 6,223 - - - 6,593 6,110 6,223

Reimbursables

35,592 9,588 5,224 158 729 497 35,434 8,859 4,727

Depreciation and amortization

108,027 105,445 112,536 3,877 11,727 11,255 104,150 93,718

101,281

General and administrative

12,037 16,911 12,683 536 1,781 901 11,501

15,130 11,782

Loss on impairment

928,947 3,585 - - 3,585 - 928,947 - -

Gain on disposal of assets, net

- (35,646) - - (35,646) - - - -

Gain on contract settlements/extinguishments, net

- (22,573) - - - - - (22,573) -

Gain on repurchase of long-term debt

(6,931) - - - - - (6,931) - -

1,301,643 302,442 358,983 10,272 989 29,625 1,291,371 301,453 329,358

Operating income

(796,421) 187,240 119,974 5,959 50,327 12,749 (802,380) 136,913 107,225

Other

income (expense)

Interest expense, net of amount capitalized

(22,453) (1,318)

(2,972) n/a n/a n/a (22,453) (1,318) (2,972)

Interest income and other, net

340 1,237 338 n/a n/a n/a 340 1,237 338

Income (loss) before income taxes

(818,534) 187,159 117,340 5,959 50,327 12,749 (824,493) 136,832 104,591

Income tax provision

(75,682) (29,524) (22,292) n/a n/a n/a (75,682) (29,524)

(22,292)

Net income (loss)

$(894,216) $157,635 $95,048 $5,959 $50,327 $12,749

$(900,175) $107,308 $82,299

Add:

Income tax provision

75,682 75,682 29,524 22,292

Interest expense, net of amount capitalized

22,453 22,453 1,318 2,972

Loss on impairment

928,947 928,947 - -

Depreciation and amortization

108,027 104,150 93,718 101,281

Less:

Gain on repurchase of long-term debt

(6,931) (6,931) - -

Interest income and other, net

- (340) (1,237) (338)

EBITDA

$233,962 (1) $223,786 $230,631 $208,506

(1) EBITDA as defined in the credit facility agreement.

www.paragonoffshore.com 29

PARAGON

OFFSHORE

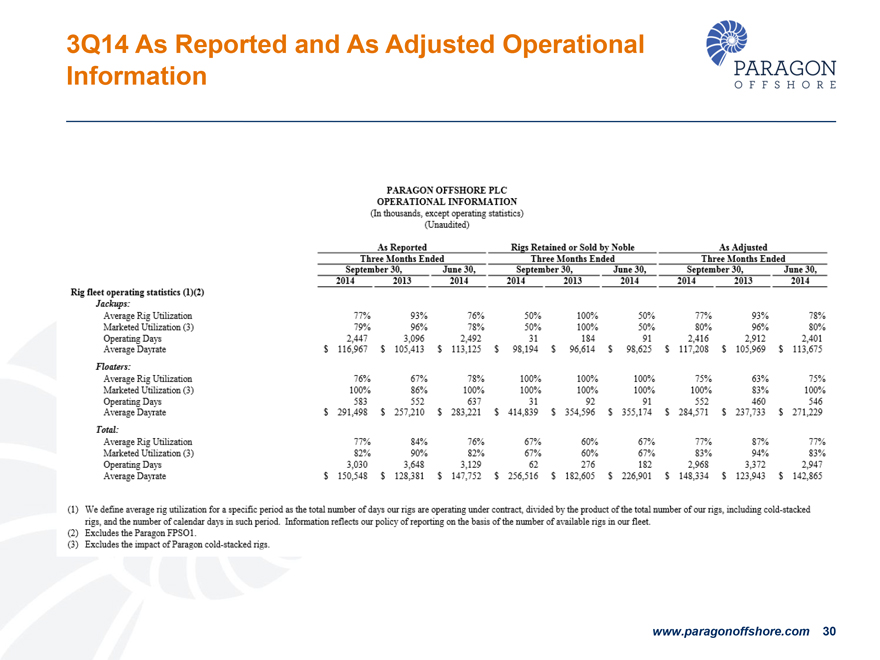

3Q14 As Reported and As Adjusted Operational

Information

PARAGON OFFSHORE PLC

OPERATIONAL INFORMATION

(In thousands, except operating statistics) (Unaudited)

As Reported Three Months Ended

Rigs Retained or Sold by Noble Three Months Ended

As Adjusted Three Months

Ended

September 30,

June 30,

September 30,

June 30,

September 30,

June 30,

2014 2013 2014 2014 2013 2014 2014 2013 2014

Rig fleet operating statistics (1)(2)

Jackups:

Average Rig Utilization 77% 93% 16% 50% 100% 50% 77% 93% 78%

Marketed Utilization (3) 79% 96% 78% 50% 100% 50% 80% 96% 80%

Operating Days 2,447 3,096 2,492

31 184 91 2,416 2,912 2,401

Average Dayrate $116,967 $105,413 $113,125 $98,194 $96,614 $98,625 $117,208 $105,969 $113,675

Floaters:

Average Rig Utilization 76% 67% 78% 100% 100% 100% 75% 63% 75%

Marketed Utilization (3) 100% 86% 100% 100% 100% 100% 100% 83% 100%

Operating Days 583 552 637

31 92 91 552 460 546

Average Dayrate $291,498 $257,210 $283,221 $414,839 $354,596 $355,174 $284,571 $237,733 $271,229

Total:

Average Rig Utilization 77% 84% 76% 67% 60% 67% 77% 87% 77%

Marketed Utilization (3) 82% 90% 82% 67% 60% 67% 83% 94% 83%

Operating Days 3,030 3,648 3,129

62 276 182 2,968 3,372 2,947

Average Dayrate $150,548 $128,381 $147,752 $256,516 $182,605 $226,901 $148,334 $123,943 $142,865

(l) We define average rig utilization for a specific period as the total number of days our rigs are operating under contract, divided by the product of the total number of our

rigs, including cold-stacked rigs, and the number of calendar days in such period. Information reflects our policy of reporting on the basis of the number of available rigs in our fleet.

(2) Excludes the Paragon FPSO1.

(3) Excludes the impact of Paragon cold-stacked rigs.

www.paragonoffshore.com 30

PARAGON

OFFSHORE

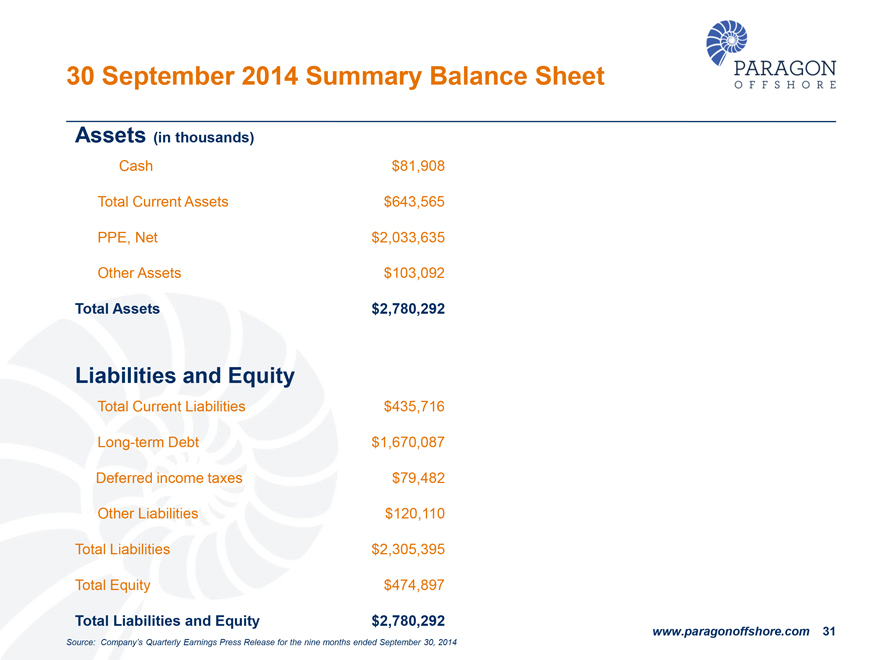

30 September 2014 Summary Balance Sheet

Assets (in thousands)

Cash

$81,908

Total Current Assets

$643,565

PPE, Net

$2,033,635

Other Assets

$103,092

Total Assets

$2,780,292

Liabilities and Equity

Total Current Liabilities

$435,716

Long-term Debt

$1,670,087

Deferred income taxes

$79,482

Other Liabilities

$120,110

Total Liabilities

$2,305,395

Total Equity

$474,897

Total Liabilities and Equity

$2,780,292

Source: Company�s Quarterly Earnings Press Release for the nine months ended

September 30, 2014

www.paragonoffshore.com 31

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Hillcrest's ZVS Technology Gains Traction in New Applications, Fuels Growth

- Inflation-Driven Price Hikes Vary Significantly Across 10 Popular U.S. Grocery Categories in Q1

- Vivid Seats Renews National Make-A-Wish® Partnership to Grant Live Event Experiences

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share