Form 8-K Oritani Financial Corp For: Mar 18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 18, 2016

Oritani Financial Corp.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-34786

|

30-0628335

|

||

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File No.)

|

(I.R.S. Employer

Identification No.)

|

|

370 Pascack Road, Township of Washington, New Jersey

|

7676

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (201) 664-5400

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

|

Item 7.01 Other Events

On March 18, 2016, Oritani Financial Corp. (the "Company") made available investor presentation materials to be used in upcoming investor presentations and meetings. A copy of the Company's investor presentation materials is attached as Exhibit 99.1 and is being furnished to the SEC and shall not be deemed "filed" for any purpose.

Item 9.01 Financial Statements and Exhibits

|

a.

|

No financial statements or businesses acquired are required.

|

|

b.

|

No pro forma financial information is required.

|

|

c.

|

Not applicable.

|

|

d.

|

Exhibits.

|

99.1 Investor Presentation

Investor InformationAs of December 31, 2015

* Forward-Looking Statements This presentation contains forward-looking statements, which can be identified by the use of words such as “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect” and words of similar meaning. These forward-looking statements include, but are not limited to: statements of our goals, intentions and expectations; statements regarding our business plans, prospects, growth and operating strategies; statements regarding the asset quality of our loan and investment portfolios; and estimates of our risks and future costs and benefits.These forward-looking statements are based on current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change.The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements:changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital requirements; general economic conditions, either nationally or in our market areas, that are worse than expected; estimates of our risks and future costs and benefits.competition among depository and other financial institutions; inflation and changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments;adverse changes in the securities markets; our ability to enter new markets successfully and capitalize on growth opportunities; our ability to successfully integrate acquired entities, if any; changes in consumer spending, borrowing and savings habits; changes in our organization, compensation and benefit plans;our ability to continue to increase and manage our commercial and residential real estate, multi-family, and commercial and industrial loans;possible impairments of securities held by us, including those issued by government entities and government sponsored enterprises;the level of future deposit premium assessments;the impact of the current recession on our loan portfolio (including cash flow and collateral values), investment portfolio, customers and capital market activities;changes in the financial performance and/or condition of our borrowers; andthe effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Securities and Exchange Commission, the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters.Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these forward-looking statements.

An Overview of Oritani * Oritani Bank is a New Jersey-chartered savings bank headquartered in the Township of Washington, New Jersey, with a longstanding history of community banking since 1911Focuses on organic growth of loan portfolio through commercial real estate and multifamily loan originationsGross loans have increased from $1.5 billion on June 30, 2010 to $2.9 billion as of December 31, 2015Operates 26 branches in demographically attractive Northern New JerseyThe Bank recently opened a branch in Westwood, NJOne of the largest community banking institutions in Northern New JerseyOritani ranks 9th in deposit market share in Bergen County with 18 branches; ranks 2nd among New Jersey based institutionsConverted to MHC structure on January 24th, 2007, raising $122 million of gross proceedsCompleted second-step conversion transaction on June 24th, 2010 raising $414 million of gross proceeds; experienced strong organic growth thereafter Source: SNL Financial. Deposit information as of June 30, 2015; New Jersey Franchise demographic information weighted by deposits by countyNote: Bergen County branch count shown pro forma for Westwood Branch expected to open in the first quarter of 2016

An Overview of Oritani (Con’t) * Note: Stockholder information based on a closing stock price of $16.61 on 03/16/2016

Financial Highlights * * Includes the impact of special dividends of $0.25 paid in December 2014 and $0.25 paid in December 2013; based on average stock price for each respective period** Includes the impact of special dividends of $0.50 paid in December 2015 and $0.25 paid in December 2014; based on average stock price for each respective period. Note: Financial data is presented for Oritani’s Fiscal Year Ended June 30 for each respective year

Financial Highlights - Trends * Balance sheet strategies have had a significant positive impact on earningsImproved overall credit quality and decreasing provision for loan losses Strong profitability driven by one of the lowest efficiency ratios in the countryOperating at one of the highest ROAs in the countryStrategic sales of real estate investments and joint venturesStrong deposit growthSpecial dividends enhanced robust dividend yieldActive repurchase authorization

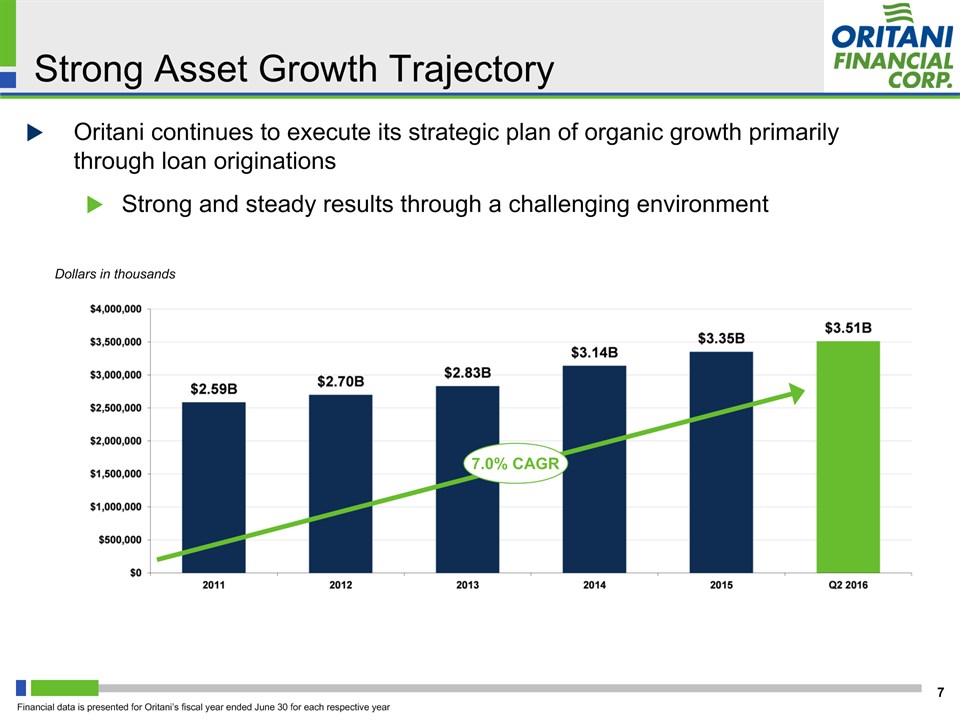

Strong Asset Growth Trajectory * Oritani continues to execute its strategic plan of organic growth primarily through loan originations Strong and steady results through a challenging environment Dollars in thousands Financial data is presented for Oritani’s fiscal year ended June 30 for each respective year 7.0% CAGR

Double Digit Loan Growth * Oritani’s focus on commercial real estate and multifamily loans has been a source of strength Dollars in thousands 13.0% CAGR Financial data is presented for Oritani’s fiscal year ended June 30 for each respective year

Loan Geography * Oritani’s loan portfolio is concentrated in New Jersey and New York, and primarily within a 150 mile radius from our headquarters in Bergen County Financial data is presented for Oritani’s fiscal year ended June 30 for each respective year

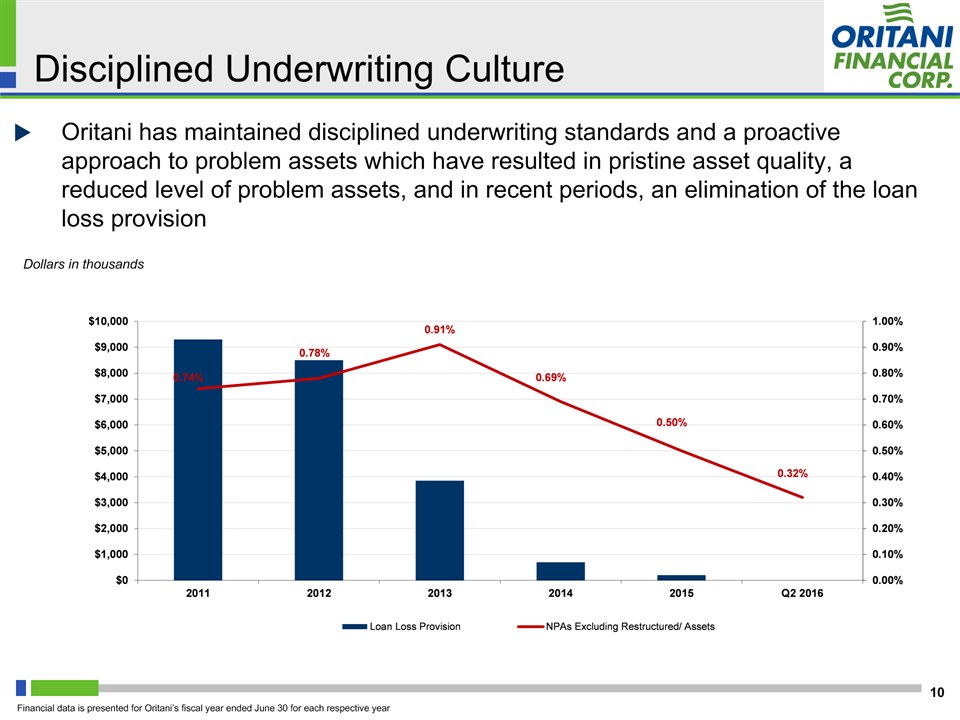

Disciplined Underwriting Culture * Oritani has maintained disciplined underwriting standards and a proactive approach to problem assets which have resulted in pristine asset quality, a reduced level of problem assets, and in recent periods, an elimination of the loan loss provision Dollars in thousands Financial data is presented for Oritani’s fiscal year ended June 30 for each respective year

Continued Focus on Deposit Growth * Oritani’s deposit gathering efforts, particularly for core deposits, have resulted in improved funding costs for the Company and significant increases in core depositsThe cost of deposits in Q2 2016 was impacted by a new interest rate swap in which deposits were hedged. The cost of the swap is now reflected in the cost of deposits. The pro forma cost for Q2 2016 excluding this item was 76 basis points.Compounded annual growth rate of 13.9% for core deposits and 10.0% for total deposits since 2011 Dollars in thousands Financial data is presented for Oritani’s fiscal year ended June 30 for each respective year

Net Interest Margin Contributes to Strong Net Interest Income * Despite operating in an environment that places significant pressure on spread and margin, Oritani’s margin has been strong and has significantly contributed to profitability. Both Oritani and its peers have experienced margin decline recently. Oritani has been able to largely offset this decline through growth of interest-earning assets. Oritani prepaid various high cost FHLB advances in the second quarter of fiscal 2016 as part of a balance sheet restructure. This restructure will ease some of the pressure on net interest margin. Financial data is presented for Oritani’s fiscal year ended June 30. Peer group detailed on page 21. Dollars in thousands

Loan Originations by Reprice / Maturity Date * Oritani has remained disciplined in this period of contracting margins and has been unwilling to underwrite loans with undue interest rate risk

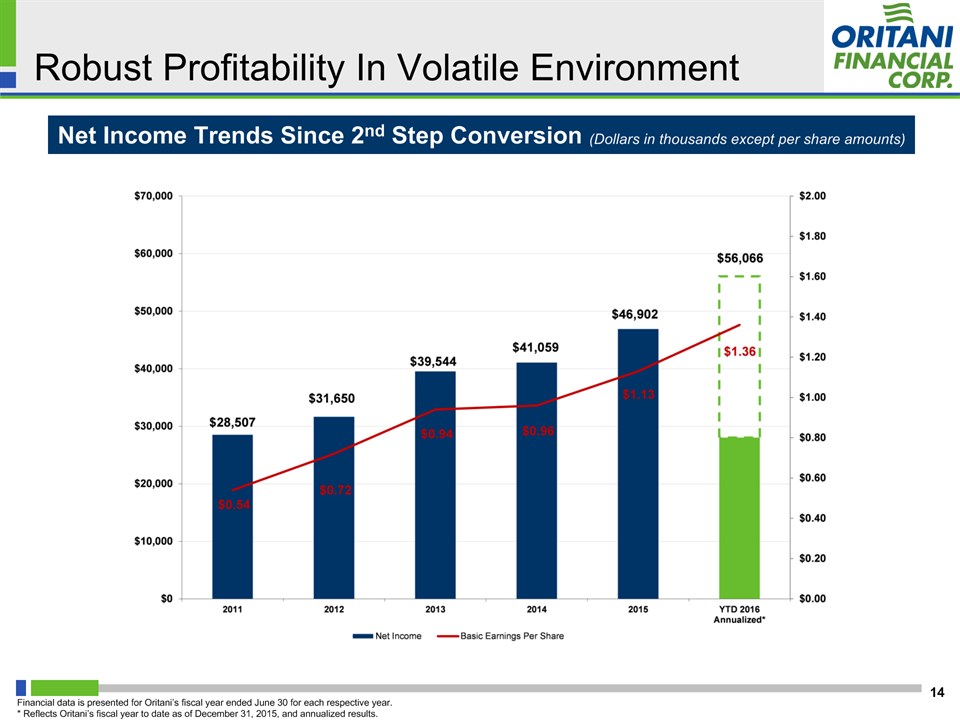

Robust Profitability In Volatile Environment * Net Income Trends Since 2nd Step Conversion (Dollars in thousands except per share amounts) Financial data is presented for Oritani’s fiscal year ended June 30 for each respective year. * Reflects Oritani’s fiscal year to date as of December 31, 2015, and annualized results.

Sales of Investments in Real Estate and Real Estate Joint Ventures * Oritani has strategically disposed of some of its investments in real estate and real estate joint ventures, generating significant gainsIn addition to the items detailed below, three properties have been sold in the quarter ending March 31, 2016 with a gain of approximately $2.0 million. One additional property is under contract and expected to be closed in the quarter ended June 30, 2016There are three properties / interests remaining in our investment in real estate and real estate joint venture portfolio. The strategic disposition of each of these proprieties is being pursued.

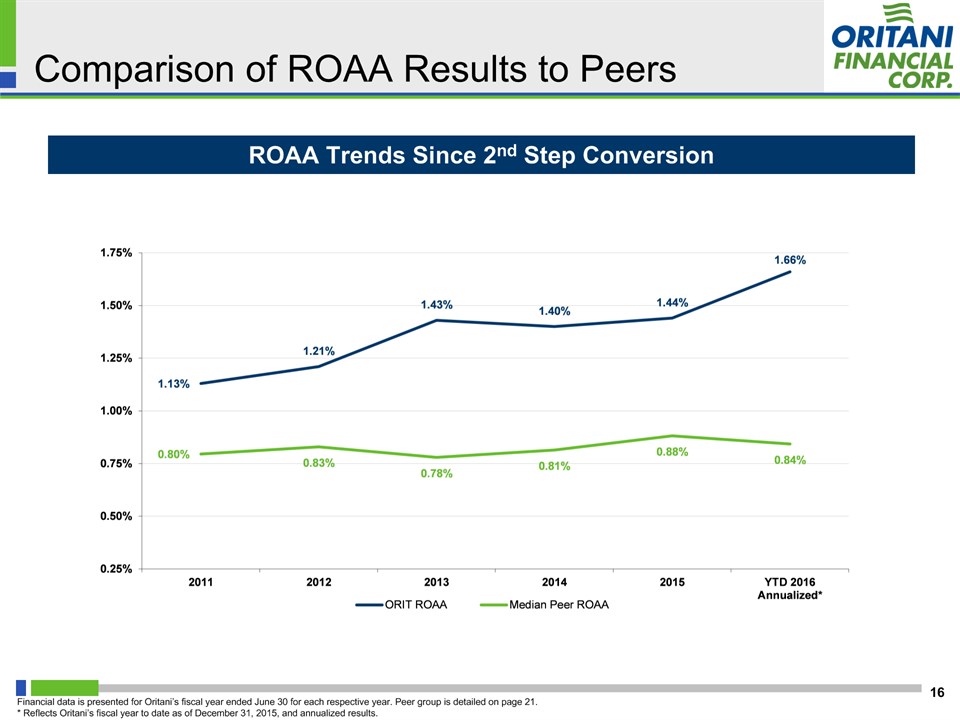

Comparison of ROAA Results to Peers * ROAA Trends Since 2nd Step Conversion Financial data is presented for Oritani’s fiscal year ended June 30 for each respective year. Peer group is detailed on page 21.* Reflects Oritani’s fiscal year to date as of December 31, 2015, and annualized results.

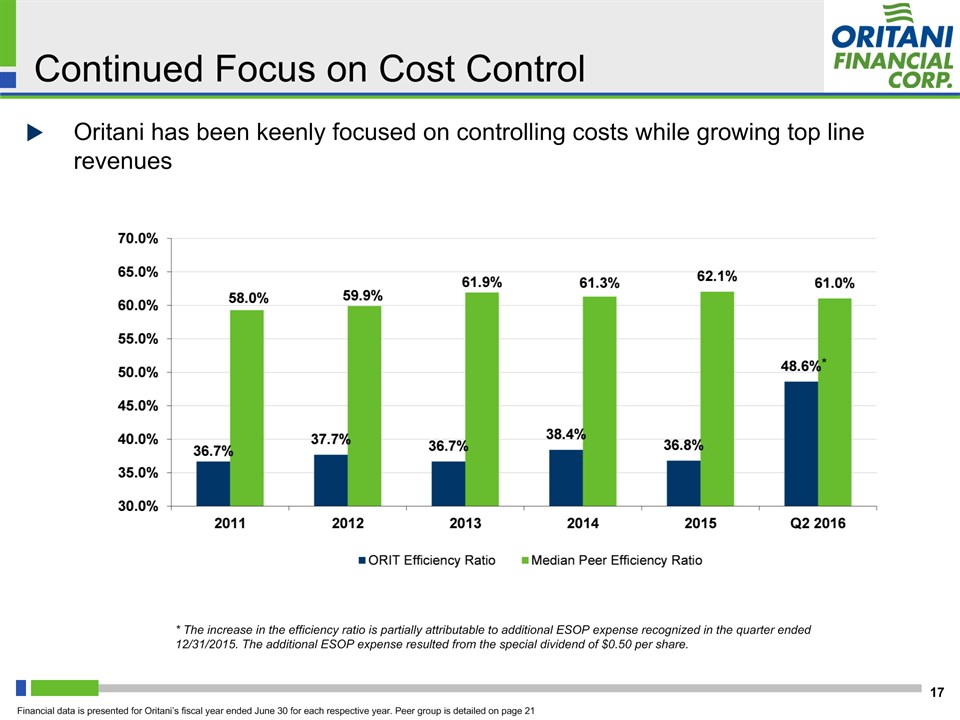

Continued Focus on Cost Control * Oritani has been keenly focused on controlling costs while growing top line revenues Financial data is presented for Oritani’s fiscal year ended June 30 for each respective year. Peer group is detailed on page 21 * * The increase in the efficiency ratio is partially attributable to additional ESOP expense recognized in the quarter ended 12/31/2015. The additional ESOP expense resulted from the special dividend of $0.50 per share.

Dividend Yield * Oritani has provided shareholders with a significantly higher dividend yield than its peers Source: SNL Financial. Peer group is detailed on page 21. Peer average excludes special dividendsBased on average stock price for each respective quarter 2.0% 4.3% 7.4%

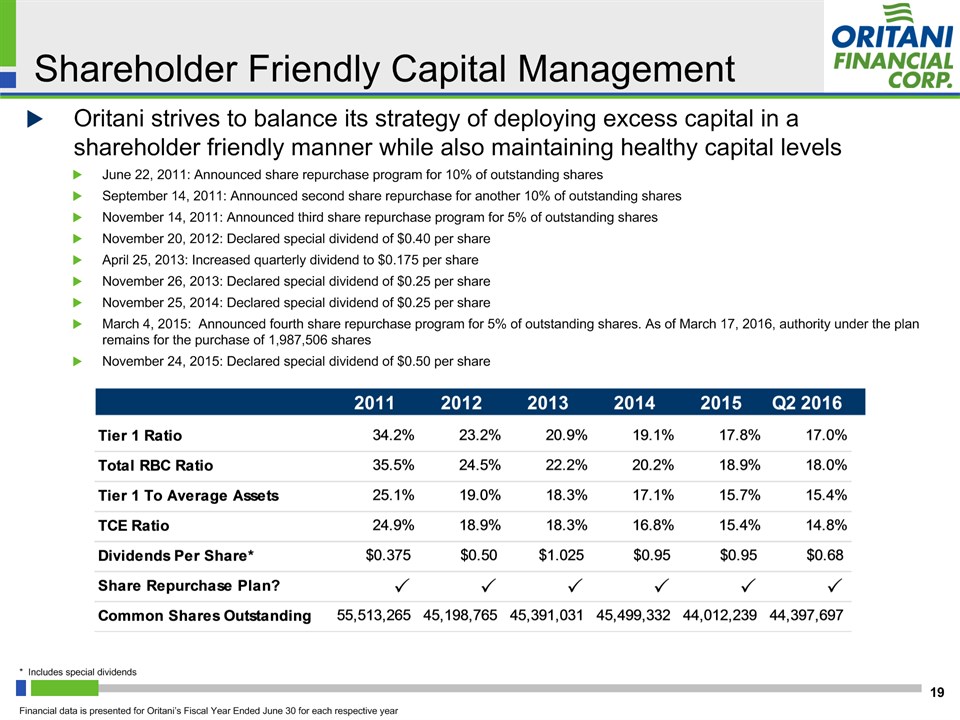

Shareholder Friendly Capital Management * Oritani strives to balance its strategy of deploying excess capital in a shareholder friendly manner while also maintaining healthy capital levelsJune 22, 2011: Announced share repurchase program for 10% of outstanding sharesSeptember 14, 2011: Announced second share repurchase for another 10% of outstanding sharesNovember 14, 2011: Announced third share repurchase program for 5% of outstanding sharesNovember 20, 2012: Declared special dividend of $0.40 per shareApril 25, 2013: Increased quarterly dividend to $0.175 per shareNovember 26, 2013: Declared special dividend of $0.25 per shareNovember 25, 2014: Declared special dividend of $0.25 per shareMarch 4, 2015: Announced fourth share repurchase program for 5% of outstanding shares. As of March 17, 2016, authority under the plan remains for the purchase of 1,987,506 sharesNovember 24, 2015: Declared special dividend of $0.50 per share Financial data is presented for Oritani’s Fiscal Year Ended June 30 for each respective year * Includes special dividends

QUESTIONS & ANSWERS

Appendix: Oritani Peer Data * Source: SNL Financial as of the most recent reported quarter

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- AUTODESK ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against Autodesk, Inc. and Encourages Investors to Contact the Firm

- Global CIOs geared up to scale AI but organizations aren’t as ready

- Junshi Biosciences Announces NDA Acceptance in Hong Kong for Toripalimab

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share