Form 8-K Orexigen Therapeutics, For: Mar 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 15, 2016

OREXIGEN THERAPEUTICS, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 001-33415 | 65-1178822 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

| 3344 N. Torrey Pines Ct., Suite 200, La Jolla, CA | 92037 | |||

| (Address of Principal Executive Offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (858) 875-8600

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 | Entry into a Material Definitive Agreement. |

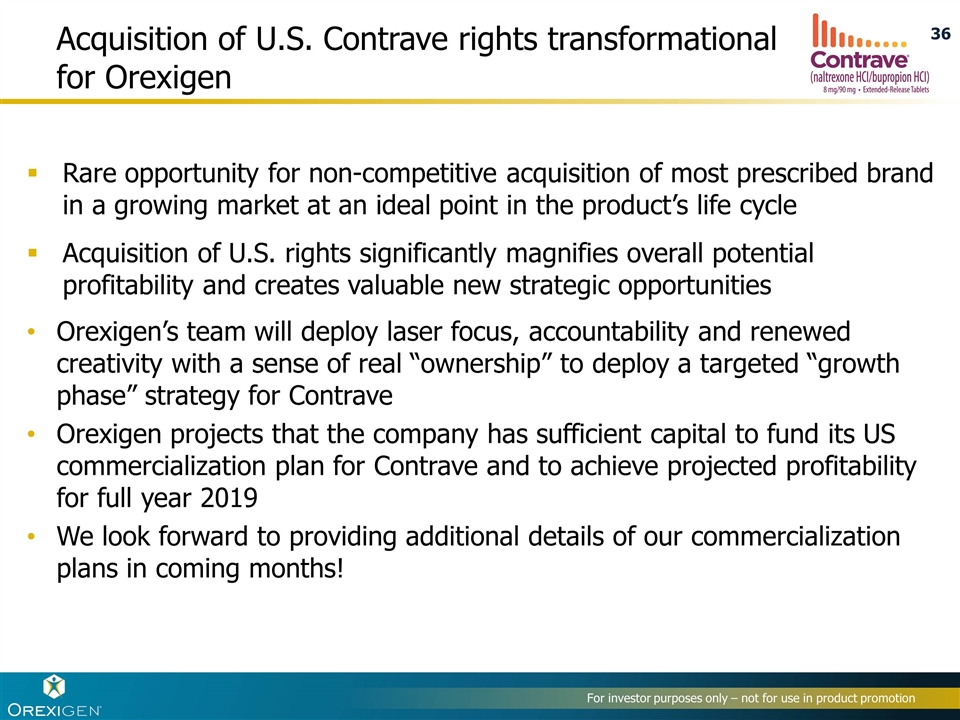

Takeda Separation Agreement

On March 15, 2016, Orexigen Therapeutics, Inc. (the “Company”) entered into a Separation Agreement (the “Separation Agreement”) with Takeda Pharmaceutical Company Limited (“Takeda”), which terminates the Amended and Restated Collaboration Agreement between the Company and Takeda, dated July 31, 2015 (the “Collaboration Agreement”), and the Manufacturing Services Agreement between the Company and Takeda, dated September 2, 2014 (the “Manufacturing Agreement”), effective automatically upon the end of a transition period, which will be the earlier of (i) the date that is 180 days after the closing of the transactions contemplated by the Separation Agreement, (ii) September 30, 2016, (iii) the date of first commercial sale of Contrave® by the Company in the United States or (iv) the effective date of the Company’s notice to Takeda that it is terminating the transition period under the Separation Agreement. In general, the obligations of the parties under the Collaboration Agreement continue until the end of the transition period. The Separation Agreement provides for the transfer of certain rights and assets to the Company and provides for the transition of activities under the Collaboration Agreement from Takeda to the Company during the transition period. The obligations of the parties under the Separation Agreement are conditioned upon (i) the expiration of any waiting period under the Hart-Scott-Rodino Antitrust Improvement Act, as amended, (ii) the payment by the Company to Takeda of the $60 million initial payment and (iii) the execution of certain related agreements, including a transition services agreement and amendments to certain other agreements between the parties. The Company will pay Takeda an additional $15 million in January 2017 provided that Takeda substantially performs its obligations under the Separation Agreement and related agreements, including certain specified activities. The Company may also be obligated to pay Takeda milestone payments of $10 million, $20 million, $30 million and $50 million, based on the achievement of annual Contrave® net sales milestones of $200 million, $300 million $400 million and $600 million, respectively, in any year following the end of the transition period. Each such milestone payment shall be payable only once but more than one may be payable with respect to net sales in a single year. The Separation Agreement is not terminable by the parties except that either party may terminate the Separation Agreement if the closing has not occurred within sixty (60) days after the date of the Separation Agreement.

The foregoing description of the Separation Agreement does not purport to be complete and is qualified in its entirety by the Separation Agreement, a copy of which the Company intends to file with its Quarterly Report on Form 10-Q for the quarter ending March 31, 2016, requesting confidential treatment for certain portions.

Convertible Note Financing

On March 15, 2016, the Company entered into a securities purchase agreement (the “Purchase Agreement”), with various purchasers (collectively, the “Purchasers”) for the sale of $165,000,000 aggregate principal amount of the Company’s 0% Convertible Senior Secured Notes due 2020 (the “Notes”) and related warrants (“Warrants”) to purchase up to 220,000,000 shares of the Company’s common stock, par value $0.001 per share (“Common Stock”), and 220,000 shares of preferred stock, par value $0.001 per share (together with the Notes, Warrants and Common Stock underlying the Notes and Warrants, the “Securities”) to qualified institutional buyers and accredited investors (the “Offering”). The Offering is being led by funds managed by The Baupost Group, L.L.C. (collectively, “Baupost”), a holder of approximately 18.1% of the Company’s outstanding Common Stock, and is expected to close on March 21, 2016, subject to the satisfaction of the closing conditions set forth in the Purchase Agreement. The Company intends to use the net proceeds from the Offering, after the placement agents’ fees and offering expenses, of approximately $158.5 million for general corporate purposes, including development and commercialization activities, clinical trials, including post-marketing studies, and working capital.

The Notes, Warrants and Shares will be sold at a price equal to 100% of the principal amount thereof. Following the Trigger Date (as defined below), the Notes and Warrants can be settled in cash until the Company obtains the requisite approval (“Stockholder Approval”) from its shareholders to (a) amend the Company’s Amended and Restated Certificate of Incorporation, as amended, to increase the total number of authorized but unissued shares of Common Stock to an amount sufficient to permit the conversion of all outstanding Notes and Warrants into shares of Common Stock at the then applicable Conversion Rate (as defined below) or exercise price; (b) approve the sale and issuance of the maximum number of shares of Common Stock upon conversion of the Notes and exercise of the Warrants, based on the then applicable Conversion Price or exercise price, as applicable, as required by Nasdaq Rule 5365; and (c) approve the sale and issuance of the shares of Common Stock upon conversion of Notes and exercise of the Warrants to Baupost that may result in a change of control (as interpreted by The Nasdaq Stock Market LLC) of the Company as required by Nasdaq Rule 5365(b). From and after the date that is six months following the closing date (“Trigger Date”) and if Stockholder Approval has not been obtained, all or any portion of the aggregate principal amount of the Notes shall be convertible, at any time, in the sole discretion of the holder, into an amount of cash determined by multiplying (i) the Conversion Rate by (ii) the average of the volume weighted average price per share during a 5-day observation period (the “Average Daily VWAP”); in addition, if the Company does not receive Stockholder Approval by the Trigger Date, the Notes held by qualifying Purchasers will bear interest at a rate of 8.0% per annum and the Conversion Rate shall be increased by 20% until Stockholder Approval is obtained. From and after the date that the Company obtains Stockholder Approval, the Notes shall only be convertible (without regard to the Trigger Date) into a number of shares of Common Stock of the Company at the Conversion Rate. In the event of a change of control transaction at any time and without regard to the Trigger Date or whether Stockholder Approval is obtained, the Notes will be convertible for a period beginning on the closing of such change of control transaction and ending 35 days after the closing of such transaction.

The Conversion Rate will be approximately 1,333.33 shares of Common Stock for each $1,000 principal amount of Notes, which represents an initial conversion price of $0.75 per share of Common Stock. The Conversion Rate and the corresponding conversion price will be subject to adjustment for certain events, but will not be adjusted for accrued and unpaid interest.

The Notes will be issued pursuant to an indenture to be entered into between the Company and U.S. Bank National Association as trustee and collateral agent thereunder (the “Indenture”), dated as of the date of the closing of the Offering. The Notes will be secured by a perfected first-priority security interest in substantially all of the Company’s current and future assets, subject to customary exclusions specified by a Security Agreement, dated as of the closing date of the Offering, by and between the Company and the Collateral Agent. The security interests shall be released once less than 25% of the original principal amount of Notes issued on the date of the Indenture remains outstanding. Upon the occurrence of certain fundamental changes or adverse events related to the regulatory approval for, commercialization of, and net sales of Contrave®, as described in the Indenture, holders of the Notes will, at their option, have the right to require the Company to repurchase for cash all or a portion of their Notes at a repurchase price equal to 100% of the aggregate principal amount of Notes. The Notes will not be redeemable by the Company, in whole or in part, prior to the receipt of Stockholder Approval. From and after receipt of Stockholder Approval, the Notes will not be redeemable by the Company, in whole or in part, without the consent of the holders of not less than 70% in aggregate principal amount of the Notes at the time outstanding.

The Purchasers will receive Warrants exercisable for a number of shares of Common Stock equal to the aggregate principal amount of the Notes acquired by the Purchasers, multiplied by the Conversion Rate. The exercise price of the Warrants is $1.50 (the “Exercise Price”) and the Warrants have a 10-year term. From and after the Trigger Date and if Stockholder Approval has not been obtained, all or any portion of the Warrants will be exercisable, at any time, in the sole discretion of the holder, into an amount of cash determined by multiplying the number of Warrants exercised by the sum of: (i) the Average Daily VWAP minus (ii) the Exercise Price. From and after the date that the Company obtains Stockholder Approval, the Warrants shall only be exercisable (without regard to the Trigger Date) for a number of shares of Common Stock of the Company at the Exercise Price. In the event of a change of control transaction at any time and without regard to the Trigger Date or whether Stockholder Approval is obtained, the Warrants will be exercisable for a period beginning on closing of such change of control transaction and ending 35 days after such transaction.

The sale of the Securities is being made only to accredited investors and qualified institutional buyers pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Regulation D promulgated thereunder. None of the Securities or any shares of our Common Stock issuable upon conversion of the

Notes or exercise of the Warrants have been or are expected to be registered under the Securities Act or under any state securities laws and, unless so registered, may not be offered or sold in the United States or to U.S. persons except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws. This Current Report on Form 8-K does not constitute an offer to sell, or the solicitation of an offer to buy, these Securities, nor will there be any sale of these Securities in any state or other jurisdiction in which such offer, solicitation or sale is not permitted.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Investor Rights Agreement

On March 15, 2016, the Company entered into an investor rights agreement (the “Investor Rights Agreement”) with Baupost and the other Purchasers (collectively, the “Investors”) party thereto in connection with the Offering. Pursuant and subject to the terms of the Investor Rights Agreement, the Investors are entitled to customary demand and piggyback registration rights. Baupost shall have an unlimited number of demands (including with respect to underwritten offerings, shelf registrations and takedowns), except that Baupost shall have no more than one demand right underwritten offering in any six-month period with minimum anticipated proceeds in any such underwritten offering of $20.0 million. The other Purchasers shall have no more than two demands for underwritten offerings, provided that no such Purchaser shall be entitled to demand more than one underwritten offering in any one-year period with minimum anticipated proceeds in any such underwritten offering of $20.0 million. The Investor Rights Agreement also includes customary indemnification and expense reimbursement obligations in connection with registrations conducted pursuant to the Investor Rights Agreement.

In connection with the Offering and pursuant to the Investor Rights Agreement, Baupost is entitled to designate two directors for so long as it and its affiliates hold at least 20% of the Company’s outstanding Common Stock and one director for so long as it and its affiliates hold at least 10% but less than 20% of the Company’s outstanding Common Stock and is entitled to have a representative serve as a non-voting board observer until the date Baupost or its affiliates have ownership of less than 10% of the Company’s outstanding Common Stock. The Company has agreed to increase the size of the Board from eight to ten directors at such time as Baupost appoints such directors.

The foregoing description of the Investor Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the Investor Rights Agreement, a copy of which is attached hereto as Exhibit 10.2 and incorporated herein by reference.

| Item 1.02 | Termination of a Material Definitive Agreement. |

On March 15, 2016, the Company entered into the Separation Agreement which terminates the Collaboration Agreement and Manufacturing Agreement, effective automatically upon the end of a transition period set forth in the Separation Agreement. Reference is made to the disclosure set forth in Item 1.01 of this Current Report on Form 8-K.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off- Balance Sheet Arrangement of a Registrant. |

The information required to be reported under this Item 2.03 is incorporated by reference to Item 1.01 of this Current Report on Form 8-K.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information required to be reported under this Item 3.02 is incorporated by reference to Item 1.01 of this Current Report on Form 8-K.

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws. |

In connection with the approval of the Purchase Agreement, the Board approved a Certificate of Designations, Preferences and Rights of Series Z Non-Convertible, Non-Voting Preferred Stock (the “Certificate of Designations”). The Certificate of Designations will be filed with the Secretary of State of the State of Delaware. The Certificate of Designations designates 220,000 shares of the Company’s authorized preferred stock as Series Z Non-Convertible, Non-Voting Preferred Stock and sets forth the rights, powers and preferences of the Series Z Non-Convertible, Non-Voting Preferred Stock. The Company will file the Certificate of Designations immediately prior to the closing of the Offering, which is expected to occur on March 21, 2016.

The foregoing description of the Certificate of Designations does not purport to be complete and is qualified in its entirety by reference to the Certificate of Designations, a copy of which is attached hereto as Exhibit 3.1 and incorporated herein by reference.

| Item 7.01 | Regulation FD Disclosure. |

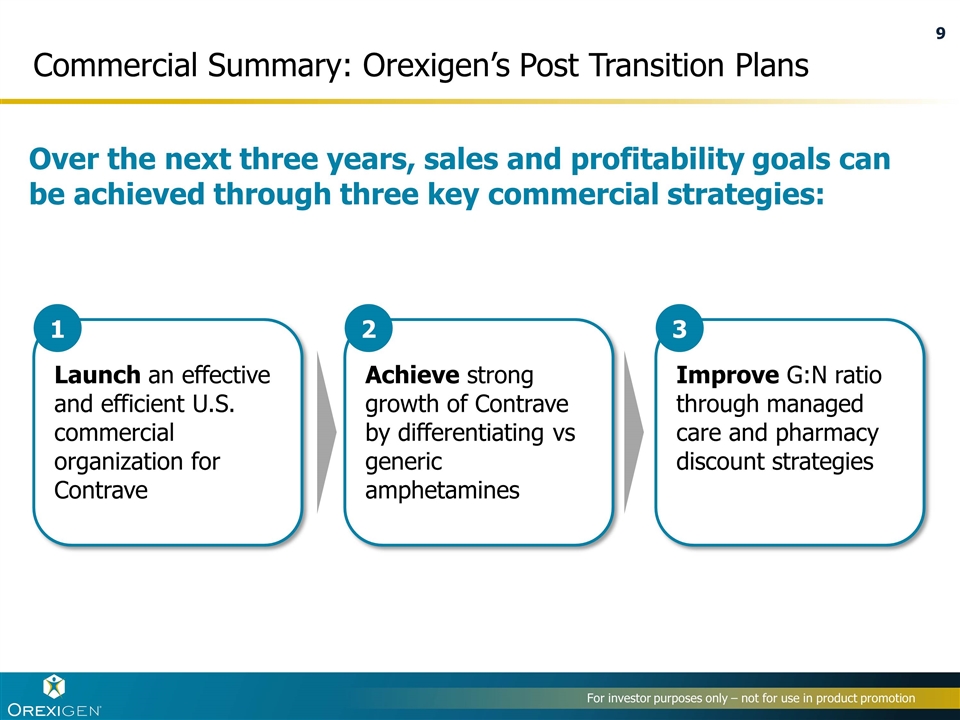

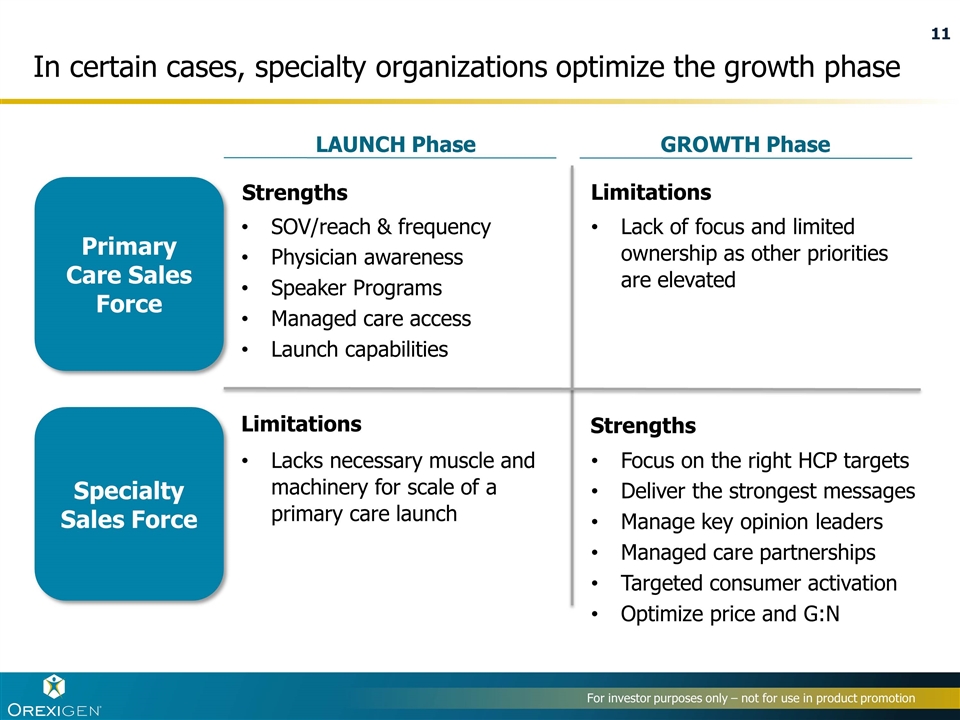

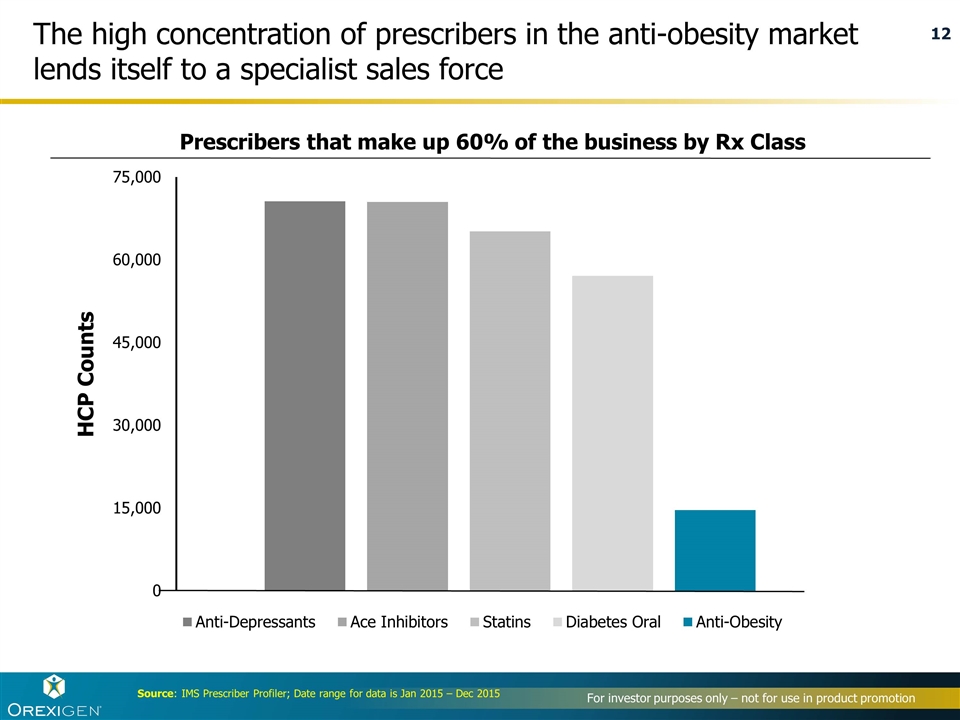

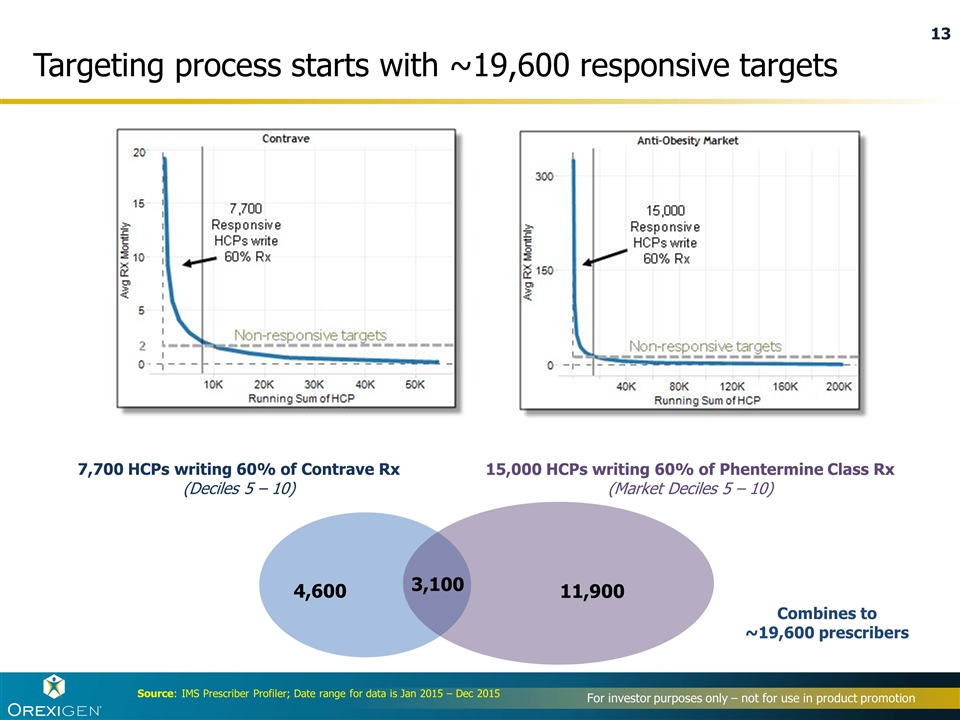

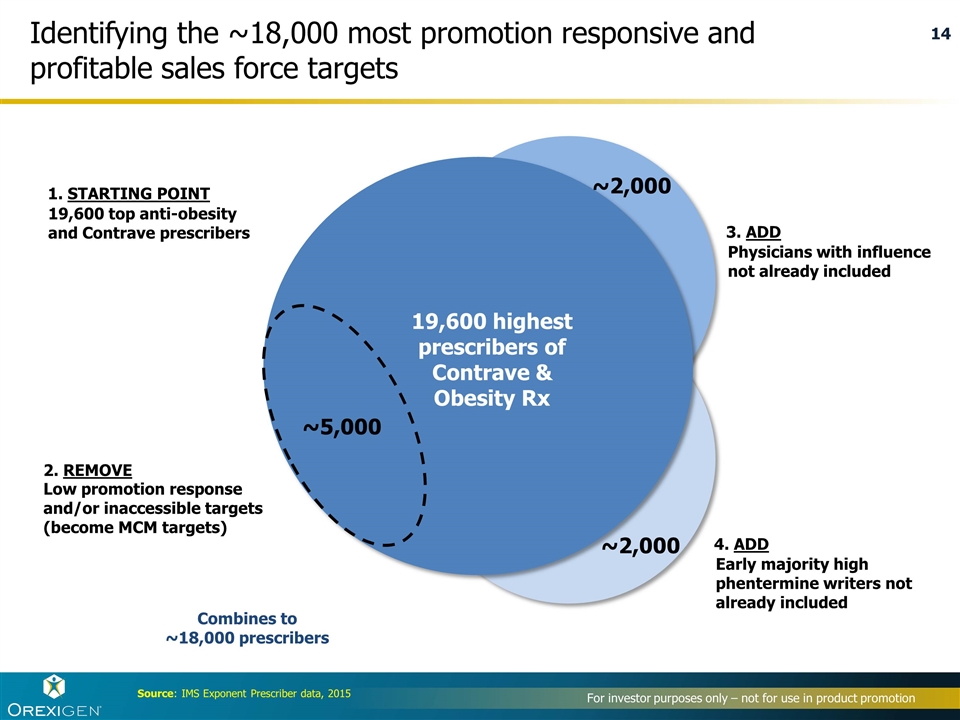

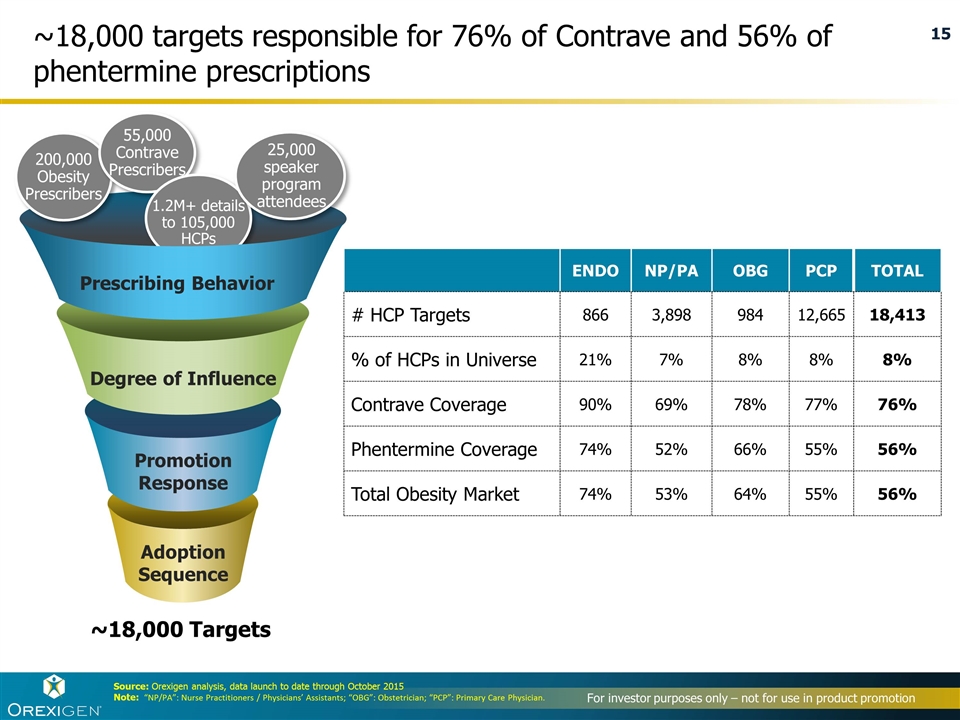

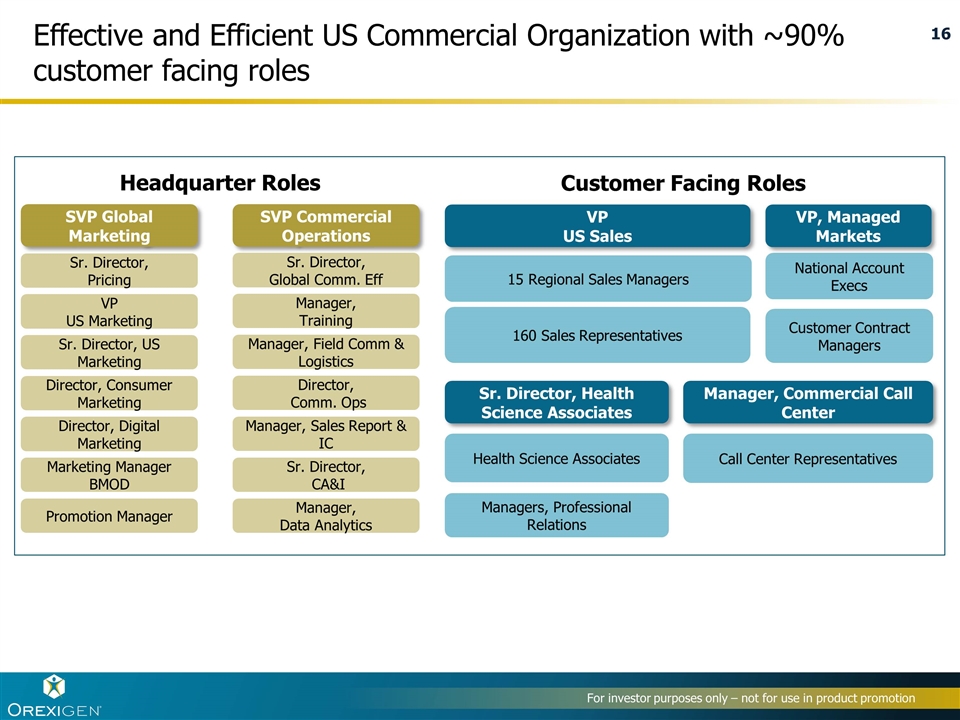

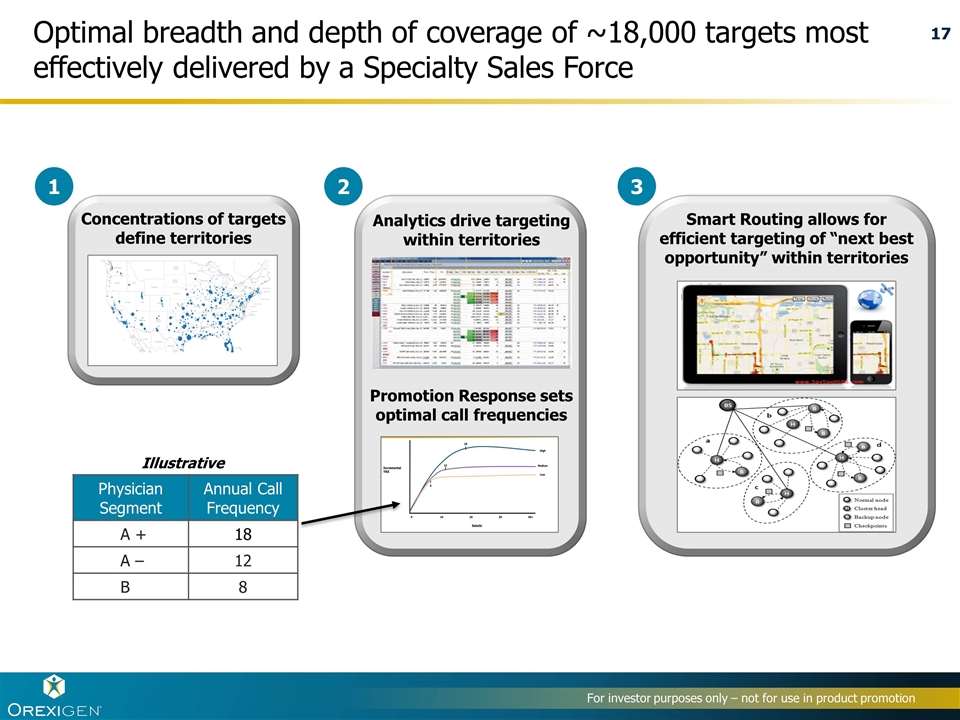

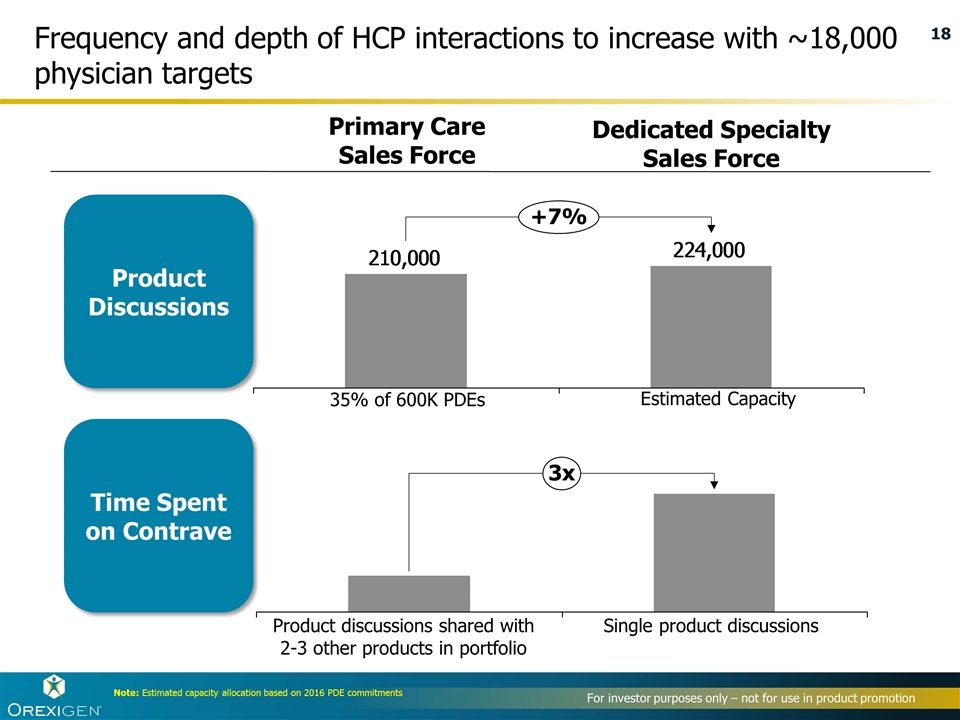

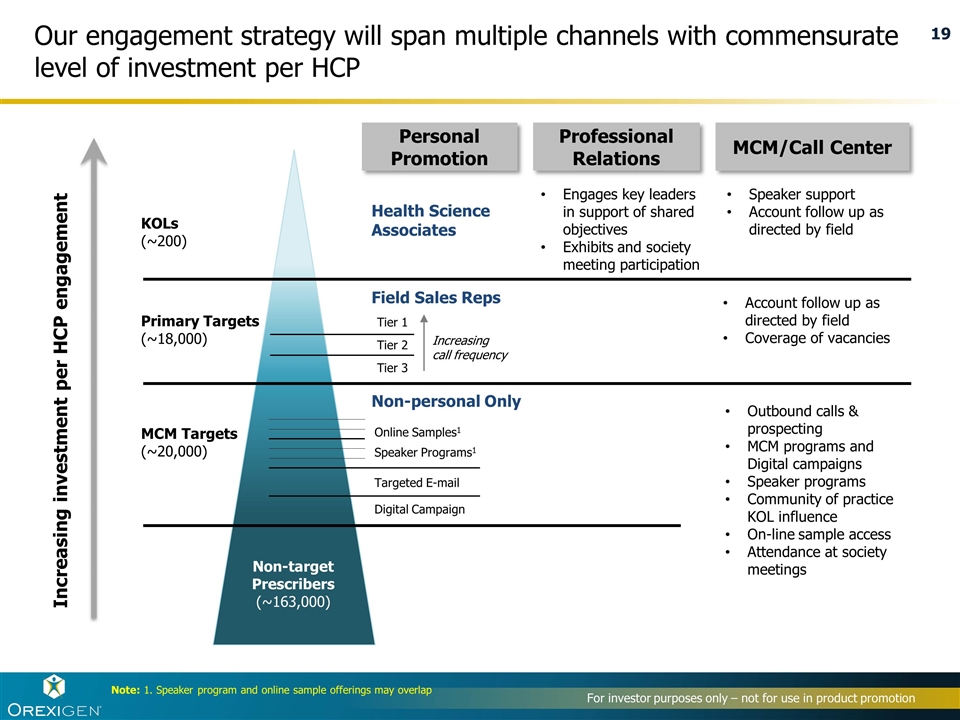

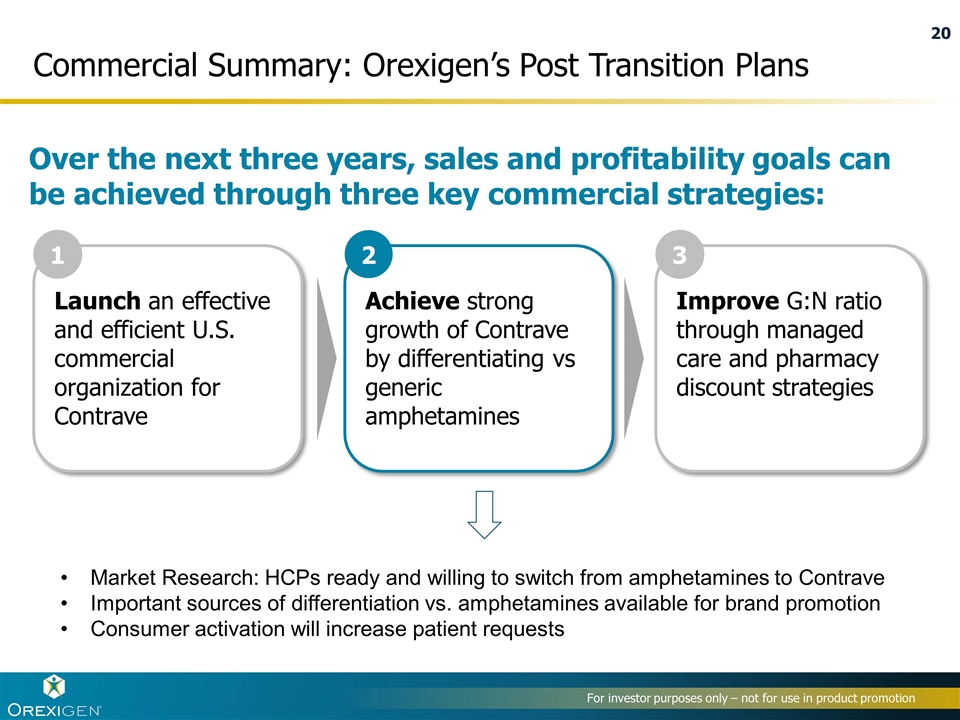

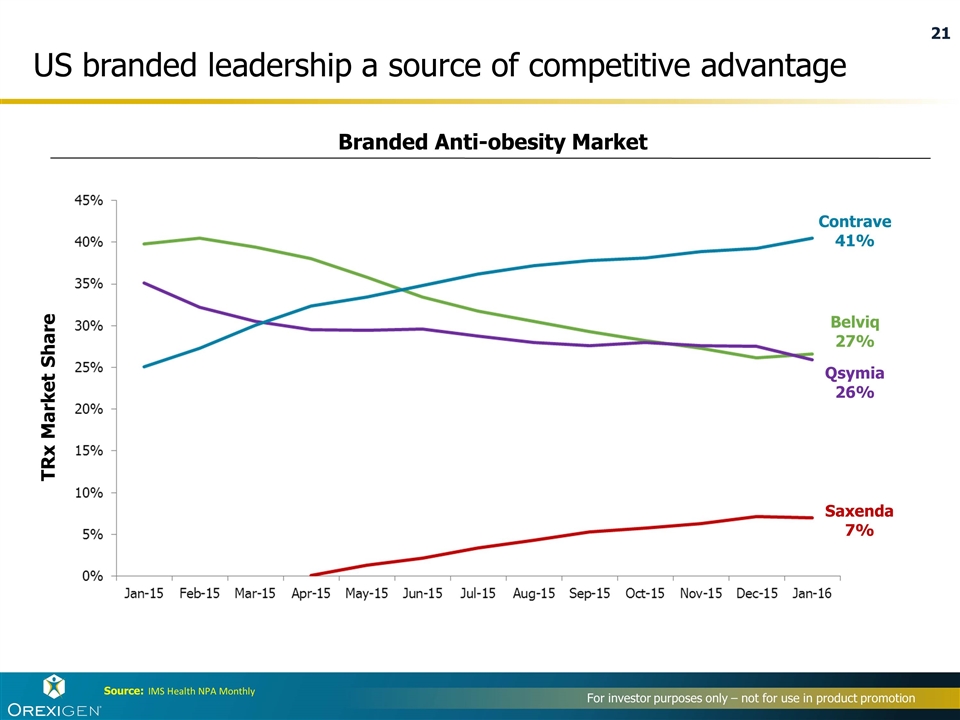

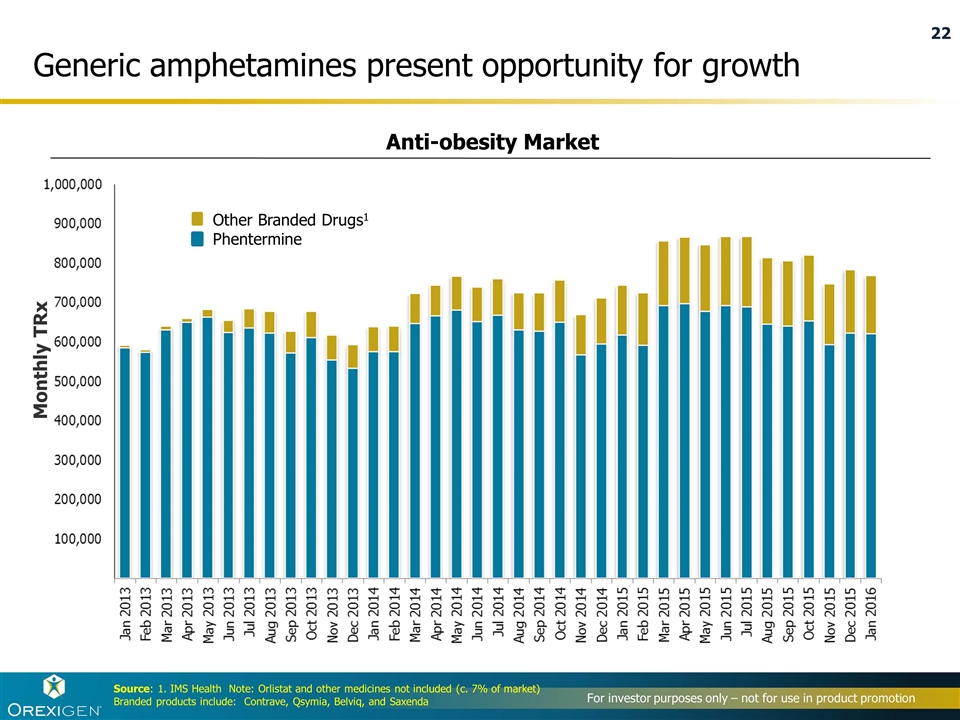

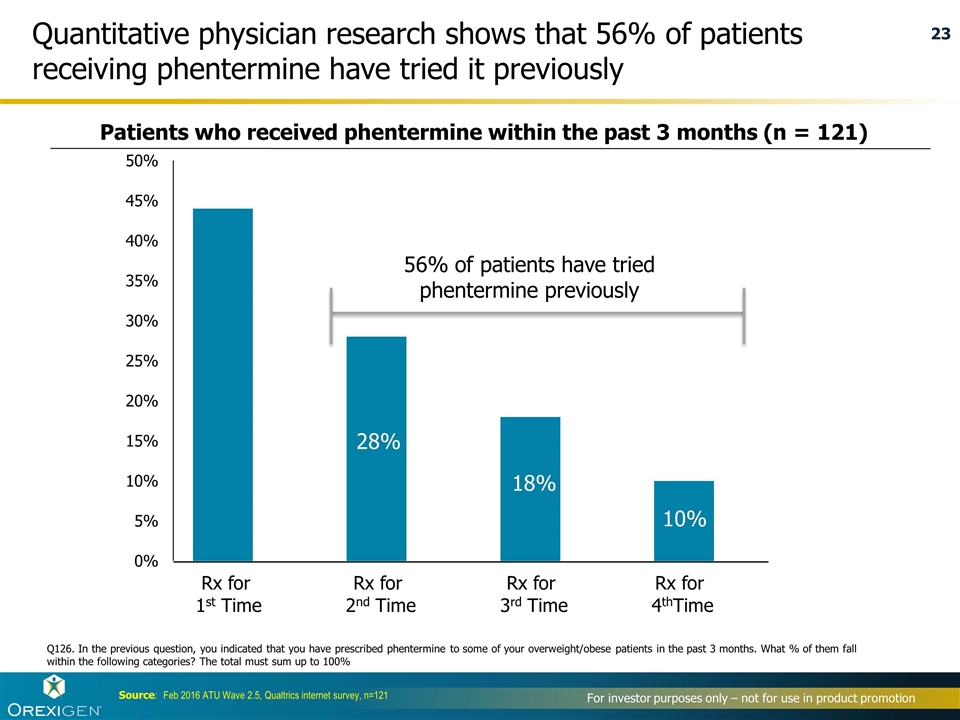

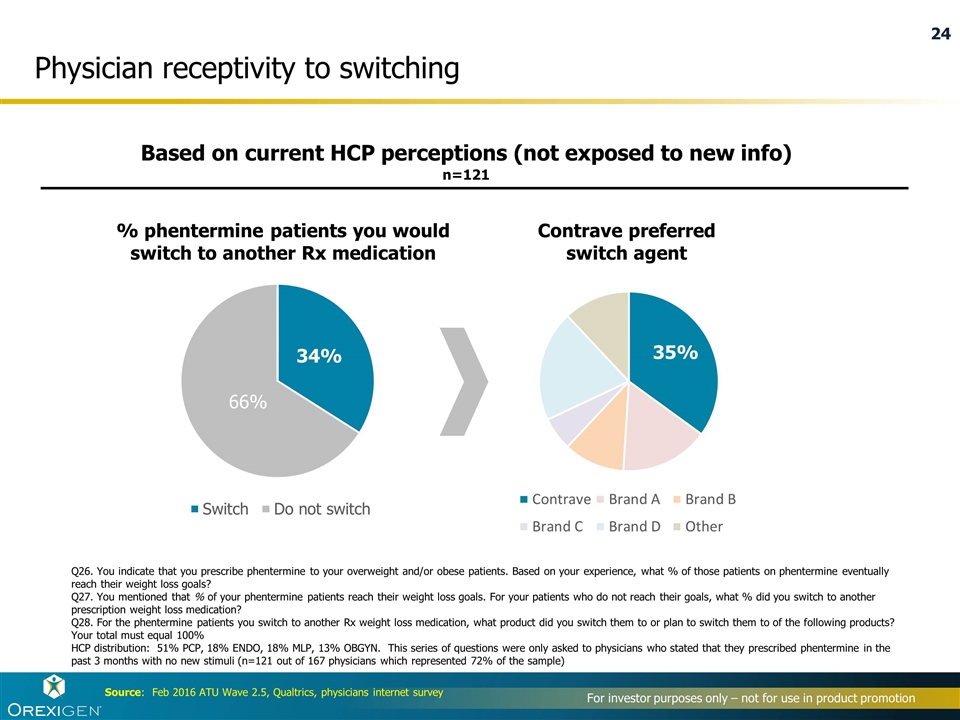

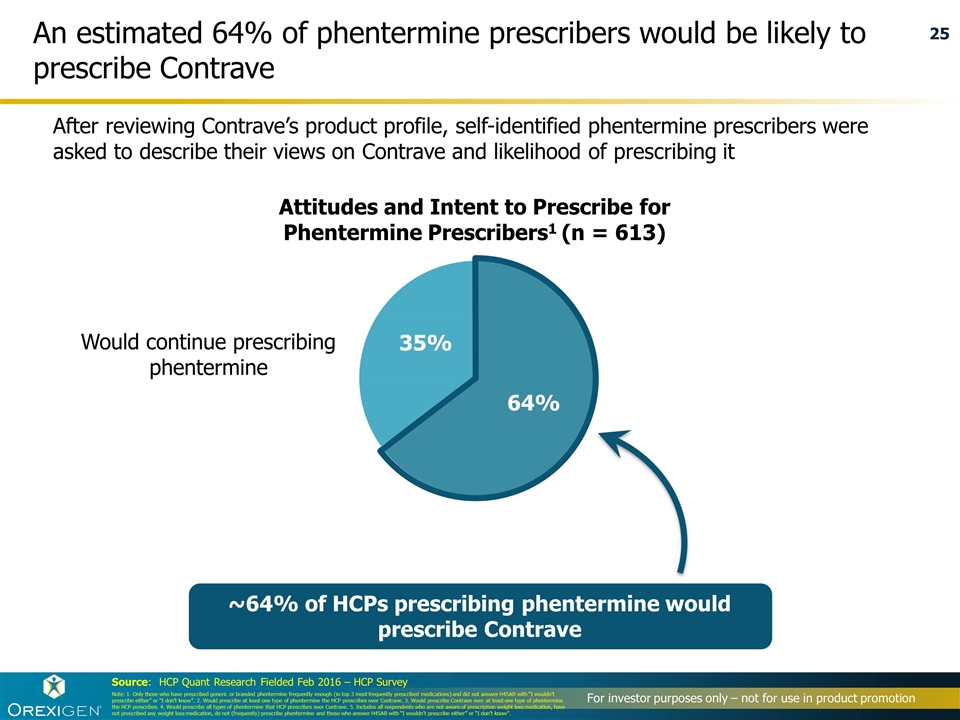

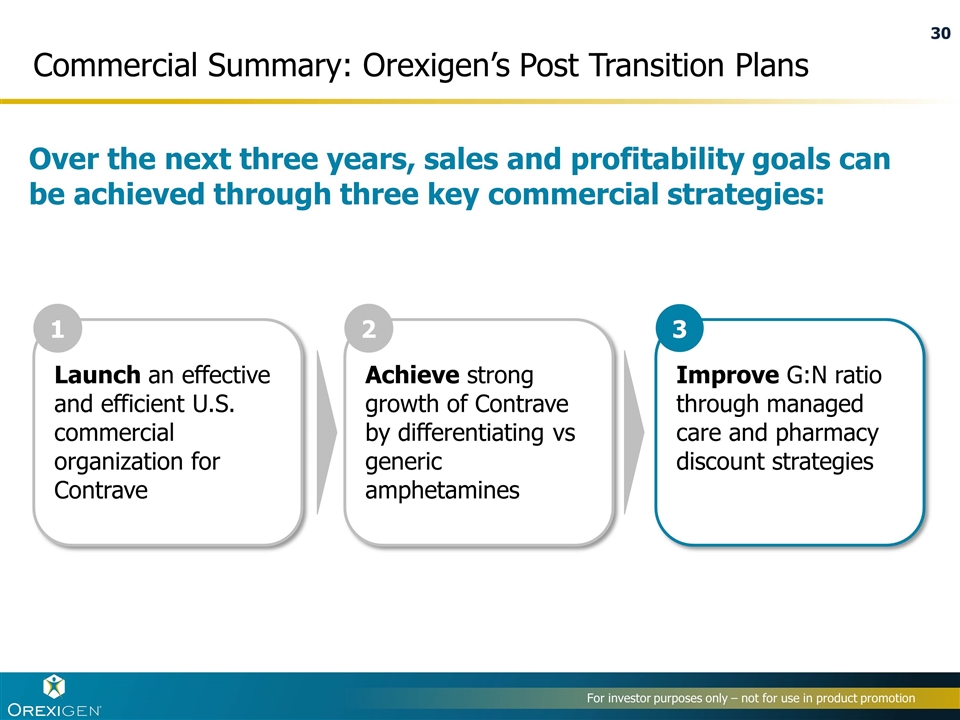

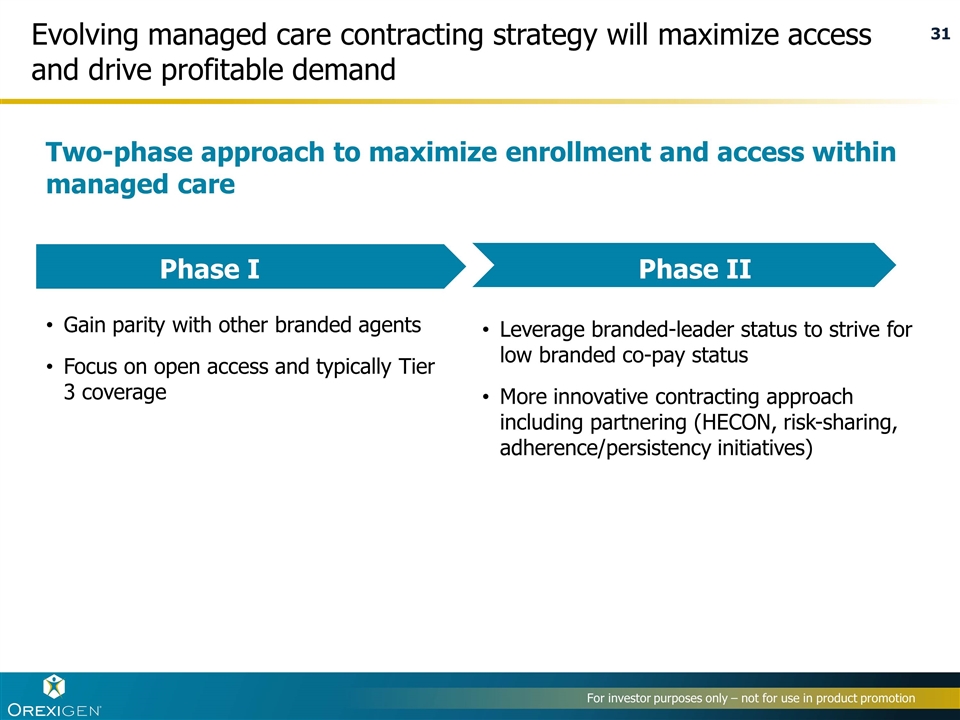

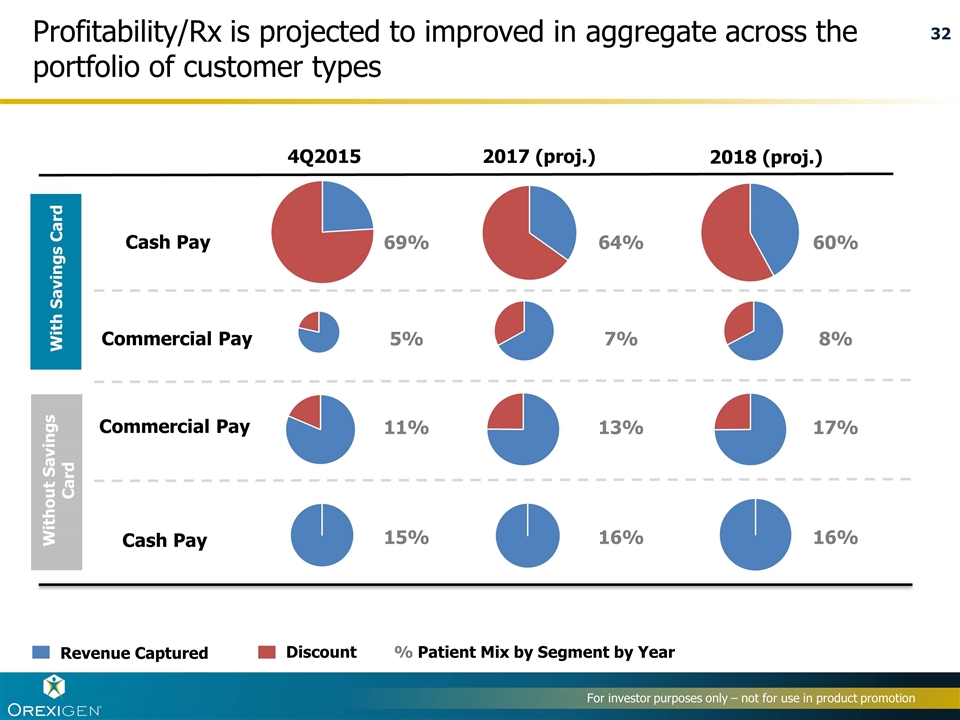

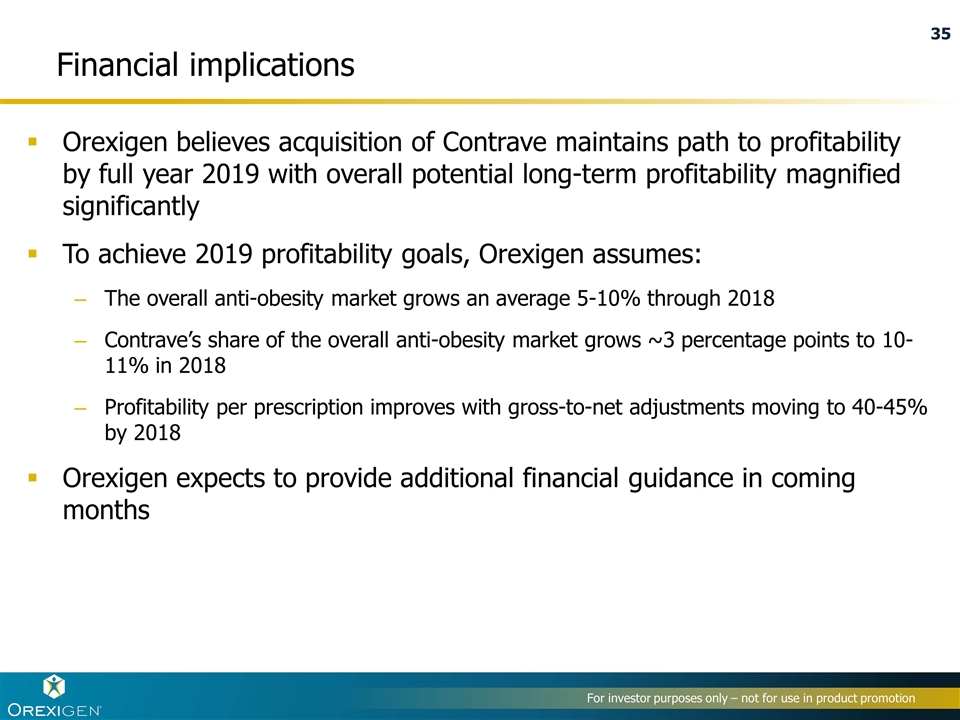

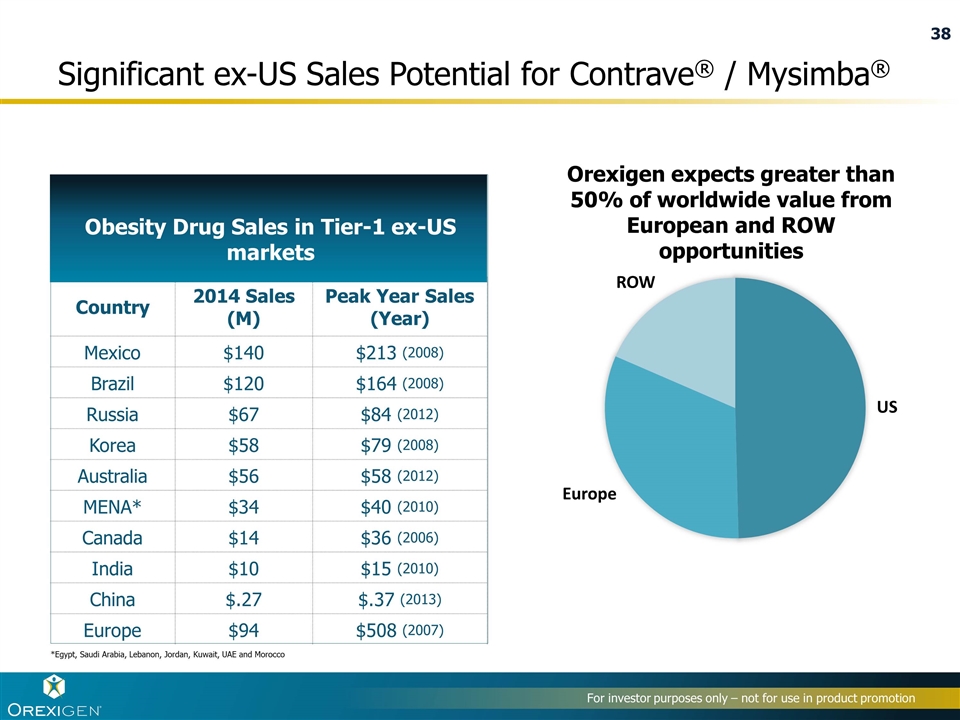

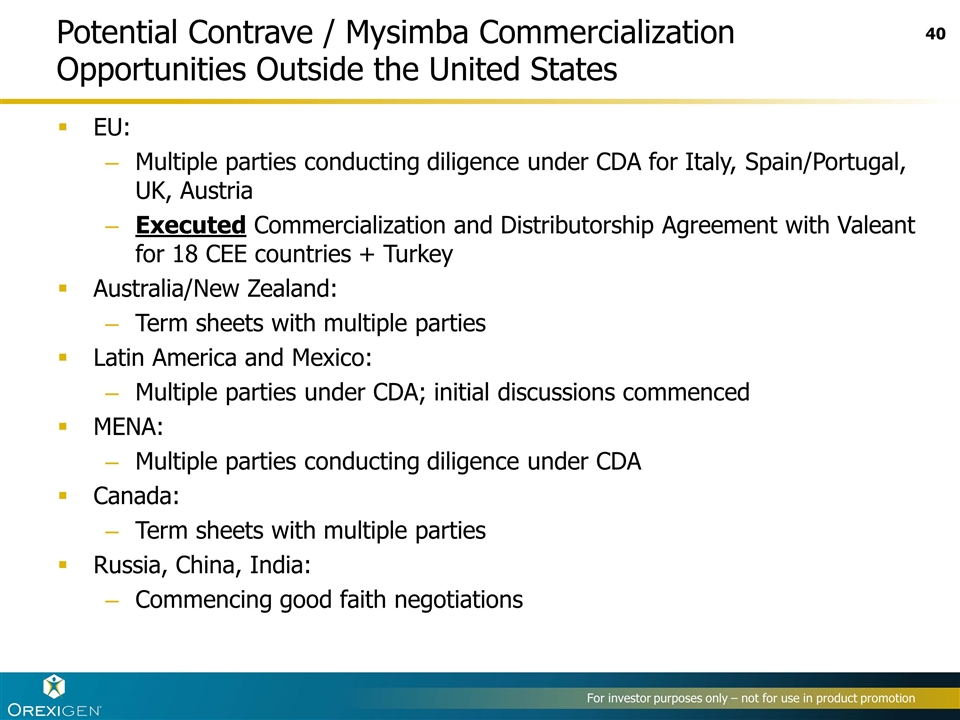

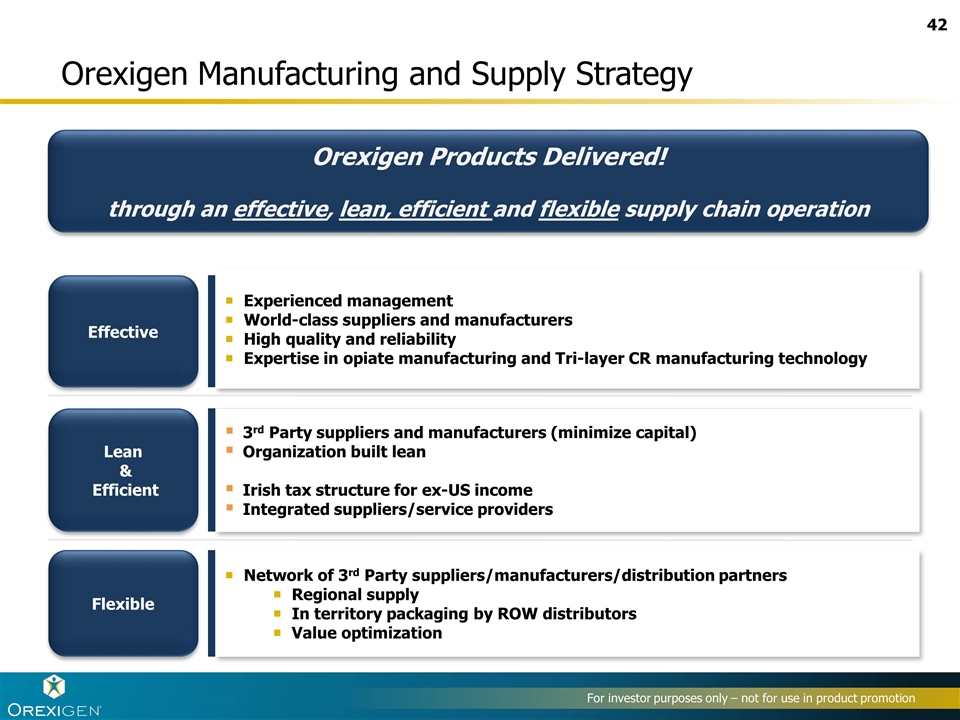

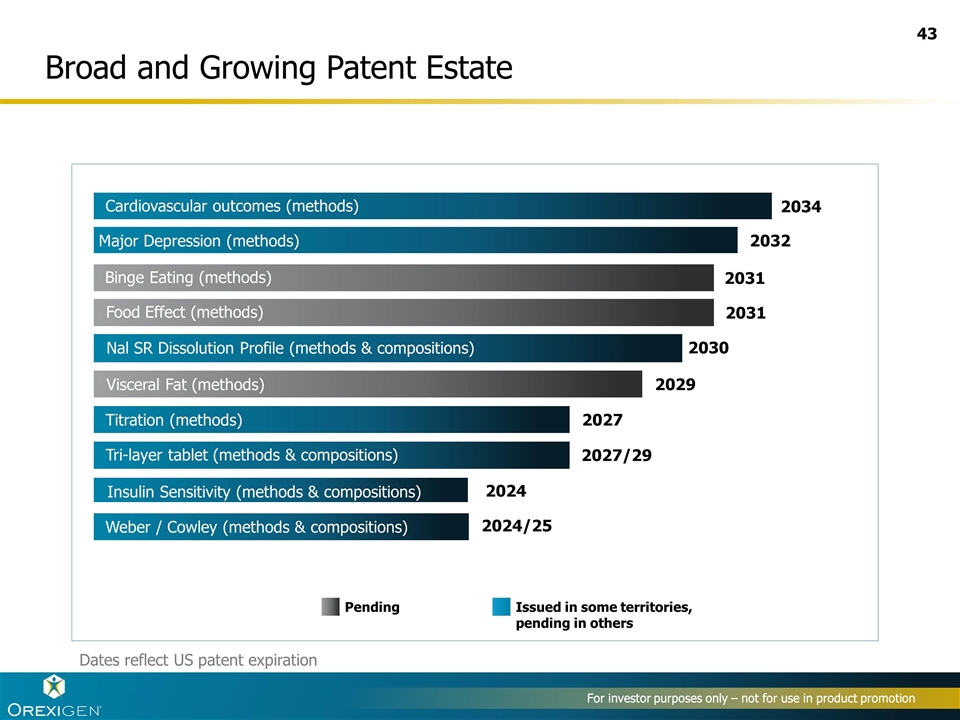

The Company has updated its corporate presentation that it uses when meeting with investors. The Company’s updated corporate presentation is attached hereto as Exhibit 99.2.

All of the information furnished in this Item 7.01 and Item 9.01 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference in any filing under the Securities Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing to this item of this report.

| Item 8.01 | Other Events. |

On March 15, 2016, the Company issued a press release announcing the Separation Agreement. A copy of the press release is being filed as Exhibit 99.2 hereto and is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit |

Description | |

| 3.1 | Certificate of Designations, Preferences and Rights of Series Z Non-Convertible, Non-Voting Preferred Stock. | |

| 10.1 | Securities Purchase Agreement, dated as of March 15, 2016, by and among the Company and each purchaser party thereto. | |

| 10.2 | Investor Rights Agreement, dated as of March 15, 2016, by and among the Company, Baupost, and the other investors party thereto. | |

| 10.3 | Form of Indenture to be entered into between the Company and U.S. Bank National Association, as trustee and collateral agent. | |

| 10.4 | Form of Warrant. | |

| 10.5 | Form of Note. | |

| 10.6 | Form of Security Agreement. | |

| 99.1 | Press Release, dated March 15, 2016. | |

| 99.2 | Corporate Presentation. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| OREXIGEN THERAPEUTICS, INC. | ||||||

| Date: March 15, 2016 | By: | /s/ Michael A. Narachi | ||||

| Name: | Michael A. Narachi | |||||

| Title: | President and Chief Executive Officer | |||||

| Exhibit |

Description | |

| 3.1 | Certificate of Designations, Preferences and Rights of Series Z Non-Convertible, Non-Voting Preferred Stock. | |

| 10.1 | Securities Purchase Agreement, dated as of March 15, 2016, by and among the Company and each purchaser party thereto. | |

| 10.2 | Investor Rights Agreement, dated as of March 15, 2016, by and among the Company, Baupost, and the other investors party thereto. | |

| 10.3 | Form of Indenture to be entered into between the Company and U.S. Bank National Association, as trustee and collateral agent. | |

| 10.4 | Form of Warrant. | |

| 10.5 | Form of Note. | |

| 10.6 | Form of Security Agreement. | |

| 99.1 | Press Release, dated March 15, 2016. | |

| 99.2 | Corporate Presentation. | |

Exhibit 3.1

OREXIGEN THERAPEUTICS, INC.

CERTIFICATE OF DESIGNATIONS, PREFERENCES AND RIGHTS

OF

SERIES Z NON-CONVERTIBLE, NON-VOTING PREFERRED STOCK

Orexigen Therapeutics, Inc. (the “Company”), a corporation organized and existing under the General Corporation Law of the State of Delaware (the “DGCL”), does hereby certify that, pursuant to authority conferred upon the Company’s Board of Directors (the “Board”) by the Company’s Amended and Restated Certificate of Incorporation, as amended (the “Charter”) and pursuant to Section 151 of the DGCL, the Board adopted resolutions (i) authorizing a new series of the Company’s previously authorized preferred stock, par value $0.001 per share (the “Preferred Stock”), and (ii) providing for the designations, preferences, and relative, optional or other rights, and the qualifications, limitations or restrictions thereof, of 220,000 shares of Series Z Non-Convertible Non-Voting Preferred Stock of the Company, as follows:

RESOLVED, that the Company is authorized to issue up to 220,000 shares of Series Z Non-Convertible Non-Voting Preferred Stock, par value $0.001 per share, which shall have the following terms, designations, preferences and other special rights:

Series Z Preferred Stock

(1) DESIGNATION AND NUMBER. A series of Preferred Stock, designated the “Series Z Non-Convertible Non-Voting Preferred Stock” (the “Series Z Preferred Stock”), is hereby established. The total number of authorized shares of Series Z Preferred Stock shall be 220,000.

(2) RANK. The Series Z Preferred Stock shall, with respect to dividend and redemption rights and rights upon liquidation, dissolution or winding up of the Company, rank senior to all classes or series of shares of common stock of the Company, par value $0.001 per share (“Common Stock”) of the Company and to all other equity securities issued by the Company from time to time (together with the Common Stock, the “Junior Securities”). The term “equity securities” shall not include convertible debt securities unless and until such securities are converted into equity securities of the Company.

(3) FUNDAMENTAL CHANGE AMOUNT.

| (a) | If a Fundamental Change occurs at any time prior to the Expiration Date, (i) the holders of shares of Series Z Preferred Stock then outstanding shall be immediately paid, out of the assets of the Company or the proceeds of such Fundamental Change, as applicable, and legally available for distribution to its stockholders, an amount in cash equal to the Fundamental Change Amount per share of Series Z Preferred Stock, if any; and (ii) no distributions or payments shall be made in respect of any Junior Securities unless all Fundamental Change Amounts, if any, are first paid in full. |

| (b) | In the event that, upon any such Fundamental Change, the legally available assets of the Company and proceeds of such Fundamental Change are insufficient to pay the full amount of the Fundamental Change Amount on all outstanding shares of Series Z Preferred Stock, then the holders of the Series Z Preferred Stock shall share ratably in any such distribution of assets in proportion to the full Fundamental Change Amount to which they would otherwise be respectively entitled. |

| (c) | In furtherance of the foregoing, the Company shall take such actions as are necessary to give effect to the provisions of this Section 3 including, without limitation, (i) in the case of a Change in Control structured as a merger, consolidation or similar reorganization, causing the definitive agreement relating to such transaction to provide for a rate at which the shares of Series Z Preferred Stock are converted into or exchanged for cash or (ii) in the case of a Change in Control structured as an asset sale or a transfer of Capital Stock of the Company, as promptly as practicable following such transaction, either dissolving the Company and distributing the assets of the Company in accordance with applicable law or redeeming all outstanding shares of Series Z Preferred Stock and, in the case of both (i) and (ii), giving effect to the preferences and priorities set forth in this Section 3. |

| (d) | Except as limited by Section 3(b), to the extent the full amount required to be paid to the holders of Series Z Preferred Stock pursuant to Section 3(a) are not paid within sixty days of a Fundamental Change, any such unpaid Fundamental Change Amount shall increase by twenty-five percent (25%) each thirty days thereafter (pro rated for partial periods) until paid in full. |

| (e) | After payment of the full amount of the Fundamental Change Amount (subject to limitation pursuant to Section 3(b)), the holders of Series Z Preferred Stock will have no right or claim to any of the remaining assets of the Company. |

| (f) | Upon the Company’s provision of written notice as to the effective date of any Fundamental Change, accompanied by cash payment in the amount of the full Fundamental Change Amount to each record holder of the Series Z Preferred Stock, the Series Z Preferred Stock shall no longer be deemed outstanding shares of the Company and all rights of the holders of such shares will terminate. Such notice shall be given by first class mail, postage pre-paid, to each record holder of the Series Z Preferred Stock at the respective mailing addresses of such holders as the same shall appear on the share transfer records of the Company. |

(4) DEFINITIONS.

| (a) | “Affiliate” of any specified Person means any other Person directly or indirectly controlling or controlled by or under direct or indirect common control with such specified Person. For the purposes of this definition, “control,” when used with respect to any specified Person means the power to direct or cause the direction of the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; and the terms “controlling” and “controlled” have meanings correlative to the foregoing; provided that for purposes of the definition of “Baupost Related Purchasers,” “control” when used with respect to any specified Person, means the ownership of 50% or more of the Capital Stock of such Person. Notwithstanding anything to the contrary herein, the determination of whether one Person is an “Affiliate” of another Person for purposes of this Warrant shall be made based on the facts at the time such determination is made or required to be made, as the case may be, hereunder. “Affiliated Entities” means, with respect to any Holder, means (i) any Affiliate of such Holder, and (ii) any fund that is administered or managed by such Holder, any Affiliate of such Holder or any entity or an Affiliate of an entity that administers or manages such Holder. |

| (b) | “Baupost Related Purchaser” means (a) each affiliated investment entity and/or other Affiliate of Baupost Group Securities, L.L.C. or The Baupost Group, L.L.C. and (b) each fund, investor, entity or account that is |

2

| managed, sponsored or advised by The Baupost Group, L.L.C., Baupost Group Securities, L.L.C. or any of their respective Affiliates. |

| (c) | “Business Day” means any day other than (x) a Saturday, (y) a Sunday or (z) a day on which state or federally chartered banking institutions in New York, New York are not required to be open. |

| (d) | “Capital Stock” means, for any entity, any and all shares, interests, rights to purchase, warrants, options, participations or other equivalents of or interests in (however designated) stock issued by that entity; provided that “Capital Stock” shall not include any indebtedness that is convertible or exchangeable for Capital Stock. |

| (e) | A “Change in Control” shall be deemed to have occurred if any of the following occurs after the Original Issue Date: |

| (i) | any “person” or “group” (other than any Permitted Holders (as defined below)) within the meaning of Section 13(d) of the Securities Exchange Act of 1934, as amended and the rules and regulations promulgated thereunder (the “Exchange Act”) is or becomes the direct or indirect “beneficial owner,” as defined in Rule 13d-3 under the Exchange Act, of shares of the Company’s voting stock representing 50% or more of the total voting power of all outstanding classes of the Company’s voting stock entitled to vote generally in elections of directors; |

| (ii) | the consummation of (A) any recapitalization, reclassification or change of the Common Stock (other than changes resulting from a subdivision, combination or change in par value and any recapitalization, reclassification or change of the Common Stock pursuant to a transaction described in Clause (B) below) as a result of which the Common Stock would be converted into, or exchanged for, stock, other securities, other property or assets; (B) any share exchange, consolidation, merger or similar transaction involving the Company pursuant to which the Common Stock will be converted into, or exchanged for, cash, securities or other property; or (C) any sale, lease or other transfer in one transaction or a series of transactions of all or substantially all of the consolidated assets of the Company and its Subsidiaries, taken as a whole, to any Person other than one or more of the Company’s Wholly Owned Subsidiaries; provided that a transaction described in clause (A) or (B) above pursuant to which the Persons that “beneficially owned,” directly or indirectly, the shares of the Company’s voting stock immediately prior to such transaction “beneficially own,” directly or indirectly, shares of voting stock representing at least a majority of the total voting power of all outstanding classes of voting stock of the surviving or transferee Person and such holders’ proportional voting power immediately after such transaction vis-à-vis each other with respect to the securities they receive in such transaction shall be in substantially the same proportions as their respective voting power vis-à-vis each other immediately prior to such transaction shall not constitute a “Change in Control”; or |

3

| (iii) | the Board of Directors or holders of the Capital Stock of the Company approve any plan or proposal for the liquidation, dissolution or winding up of the Company; |

provided, however, that a Change in Control shall not be deemed to have occurred if at least 90% of the consideration received or to be received by the holders of the Common Stock in a transaction or transactions described under clause (ii) above, excluding cash payments for any fractional share and cash payments made pursuant to dissenters’ appraisal rights, consists of shares of common stock traded on The New York Stock Exchange, The Nasdaq Global Select Market or The Nasdaq Global Market (or any of their respective successors), or will be so traded immediately following such transaction. In addition, for purposes of this definition, a transaction or event described under both clause (i) and clause (ii) above (whether or not the exceptions in clause (ii) apply) shall be evaluated solely under clause (b) of this definition of Change in Control. If any transaction in which the Common Stock is replaced by, converted into or exchanged for property consisting of common equity of another entity, following the effective date of the related transaction that would have been a Fundamental Change but for the proviso immediately following clause (iii)(C) of this definition, references to the Company in this definition shall instead be references to such other entity.

| (f) | “Daily VWAP” means the per share volume-weighted average price of the Common Stock as displayed under the heading “Bloomberg VWAP” on Bloomberg page “OREX <equity> AQR” (or its equivalent successor if such page is not available) in respect of the period from the scheduled open of trading until the scheduled close of trading of the primary trading session on such Trading Day (or if such volume-weighted average price is unavailable, the market value of one share of the Common Stock on such Trading Day determined, using a volume-weighted average method, by a nationally recognized independent investment banking firm retained for this purpose by the Company). The “Daily VWAP” shall be determined without regard to after-hours trading or any other trading outside of the regular trading session trading hours. |

| (g) | “Fundamental Change” means the occurrence of a Change in Control or a Termination of Trading or a Fundamental Change (as defined under the Indenture, dated as of December 6, 2013, by and between the Company and Wilmington Trust, National Association, but excluding clause (1) thereof). |

| (h) | “Fundamental Change Maximum Amount” means $225. |

| (i) | “Fundamental Change Amount” means an amount equal to the lesser of (i) the amount by which the Fundamental Change Premium Amount exceeds the amount received by holders of each 1,000 shares of Common Stock (such number of shares of Common Stock to be proportionately increased to reflect any Common Stock split or Common Stock dividend or similar event payable on Common Stock after the Original Issue Date and proportionately decreased to reflect any Common Stock combination or Common Stock reverse split or similar event payable on Common Stock after the Original Issue Date) upon such Fundamental Change (the “Common Stock Amount”) and (ii) the Fundamental Change Maximum Amount; provided that, in the case the holders of Common Stock of the Company do not receive any amounts out of the assets of the Company or the proceeds of such Fundamental Change the “Common Stock |

4

| Amount” for purposes of clause (i) of this sentence shall be equal to 1,000 (such number to be proportionately increased to reflect any Common Stock split or Common Stock dividend or similar event payable on Common Stock after the Original Issue Date and proportionately decreased to reflect any Common Stock combination or Common Stock reverse split or similar event payable on Common Stock after the Original Issue Date) multiplied by the average of the Daily VWAP for the five (5) Trading Days immediately preceding the effective date of such Fundamental Change. For the avoidance of doubt, if the Fundamental Change Premium Amount does not exceed the Common Stock Amount, then the Fundamental Change Amount will be $0. |

| (j) | “Fundamental Change Premium Amount” means $975. |

| (k) | “Original Issue Date” means March 21, 2016. |

| (l) | “Person” means an individual, a corporation, a limited liability company, an association, a partnership, a joint venture, a joint stock company, a trust, an unincorporated organization or a government or an agency or a political subdivision thereof. |

| (m) | “Permitted Exchange” means any of The New York Stock Exchange, The Nasdaq Global Select Market, The Nasdaq Global Market, The Nasdaq Capital Market (or any of their respective successors). |

| (n) | “Permitted Holders” means Baupost Group Securities, L.L.C., any Baupost Related Purchaser and any of their Affiliated Entities and any group including any of the foregoing. |

| (o) | “Relevant Market” means, as of any day, The Nasdaq Global Select Market or, if the Common Stock is not listed on The Nasdaq Global Select Market on such day, the principal other U.S. national or regional securities exchange on which the Common Stock is then listed for trading. |

| (p) | “Subsidiary” means, with respect to the Company, any corporation, association, partnership or other business entity of which more than 50% of the total voting power of shares of Capital Stock or other interests (including partnership interests) entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers, general partners or trustees thereof is at the time owned or controlled, directly or indirectly, by (i) the Company; (ii) the Company and one or more Subsidiaries of the Company; or (iii) one or more Subsidiaries of the Company. |

| (q) | “Termination of Trading” means the Common Stock (or other capital stock for which the Common Stock was exchanged) ceases to be listed or quoted on a Permitted Exchange, or the announcement by any Permitted Exchange on which the Common Stock (or such other common stock) is trading that the Common Stock (or such other common stock) has been delisted (or admission has been revoked) and will not be immediately relisted or readmitted for trading on any Permitted Exchange. |

| (r) | “Trading Day” means a day on which (i) the Relevant Market is open for trading with a scheduled closing time of 4:00 p.m. (New York City time) or the then- |

5

| standard closing time for regular trading on the Relevant Market and (ii) a Closing Sale Price for the Common Stock is available on the Relevant Market; provided that if the Common Stock is not listed on a Relevant Market, “Trading Day” means a Business Day. |

| (s) | “Wholly Owned Subsidiary” means, with respect to any Person, any Subsidiary of such Person, except that, solely for purposes of this definition, the reference to “50%” in the definition of “Subsidiary” shall be deemed replaced by a reference to “100%” (other than directors’ qualifying shares and shares issued to foreign nationals as required under applicable law). |

(5) LIMITATIONS ON REDEMPTION. Unless the full Fundamental Change Amount on all shares of Series Z Preferred Stock shall have been paid, no shares of Series Z Preferred Stock shall be redeemed or otherwise acquired, directly or indirectly, by the Company unless all outstanding shares of Series Z Preferred Stock are simultaneously redeemed or acquired, and the Company shall not purchase or otherwise acquire, directly or indirectly, any shares of any Junior Securities of the Company (except by exchange for shares of Junior Securities); provided, however, that the foregoing shall not prevent the purchase or acquisition of shares of Series Z Preferred Stock pursuant to a purchase or exchange offer made on the same terms to holders of all outstanding shares of Series Z Preferred Stock.

(6) VOTING RIGHTS. Except as provided in this Section, the holders of the Series Z Preferred Stock shall not be entitled to vote on any matter submitted to the stockholders of the Company for a vote. Notwithstanding the foregoing, the Company shall not (and shall not have the power to), by merger, consolidation, reclassification, amendment or otherwise without first obtaining the consent of the holders of at least seventy percent (70%) of the outstanding shares of Series Z Preferred Stock, voting as a separate class, directly or indirectly, take or permit any of the following: (a) the authorization or issuance of any equity security senior to or on a parity with the Series Z Preferred Stock with respect to payments on a Fundamental Change, (b) any amendment to the Company’s Charter or bylaws which effects the rights, preferences or privileges of the Series Z Preferred Stock in a manner that is adverse and disproportionate to the effect of such amendment on the rights, preferences or privileges of the other authorized classes or series of capital stock of the Company or which increases the number of authorized or issued shares of Series Z Preferred Stock, (c) any amendment to this Certificate of Designation which adversely affects the rights, preferences or privileges of the Series Z Preferred Stock, (d) reclassification of any Series Z Preferred Stock, or (e) the consummation of any Fundamental Change unless each holder of Series Z Preferred Stock receives in cash upon the occurrence of the Fundamental Change the amount provided for in Section 3.

(7) CONVERSION. The shares of Series Z Preferred Stock are not convertible into or exchangeable for any other property or securities of the Company.

(8) TERM. Any outstanding shares of Series Z Preferred Stock shall expire on the earlier to occur of (a) December 31, 2020 or (b) upon receipt of the consent of the holders of at least seventy percent (70%) of the outstanding shares of Series Z Preferred Stock, voting as a separate class (such earlier date, the “Expiration Date”) and shall no longer be deemed outstanding shares of the Company and all rights of the holders of such shares will terminate; provided, there if a Fundamental Change occurs prior to December 31, 2020, the Expiration Date shall be extended until the holders of Series Z Preferred Stock receives in cash upon the occurrence of the Fundamental Change, the amount provided for in Section 3. Any shares of Series Z Preferred Stock that have expired, or shall at any time have been redeemed or otherwise

6

acquired by the Company, shall, after such expiration, redemption or acquisition, have the status of authorized but unissued shares of Preferred Stock which may be issued by the Board from time to time at its discretion.

(9) LEGEND. In the event the Board determines that the shares of Series Z Preferred Stock shall be certificated, the Company shall include on such certificates any legends that the Board determines to be necessary or appropriate.

(10) DEFINITIONS. Capitalized terms used herein without definition shall have the same meanings given to such terms in the Charter.

[SIGNATURE PAGE FOLLOWS]

7

IN WITNESS WHEREOF, the Company has caused this Certificate of Designation, Preferences and Rights to be duly executed in its name and on its behalf on this [●] day of March, 2016.

| OREXIGEN THERAPEUTICS, INC. | ||||

| By: |

| |||

| Name: |

| |||

| Title: |

| |||

[Signature Page – Orexigen Therapeutics, Inc. Certificate of Designation]

Exhibit 10.1

SECURITIES PURCHASE AGREEMENT

This SECURITIES PURCHASE AGREEMENT (this “Agreement”), dated as of March 15, 2016, is made by and among OREXIGEN THERAPEUTICS, INC., a Delaware corporation (the “Company”), and the Purchasers listed on Exhibit A hereto, together with their permitted transferees (each, a “Purchaser” and collectively, the “Purchasers”).

RECITALS:

A. The Company and the Purchasers are executing and delivering this Agreement in reliance upon the exemption from securities registration afforded by Section 4(a)(2) of the Securities Act.

B. The Purchasers desire to purchase from the Company and the Company desires to issue and to sell to the Purchasers, upon the terms and conditions stated in this Agreement and pursuant to an indenture to be dated on or about March 21, 2016 (in such capacity, the “Indenture”), by and among the Company, U.S. Bank National Association, as trustee (the “Trustee”) and as collateral agent (in such capacity, the “Collateral Agent”) in substantially the form of Exhibit F attached hereto, with such changes as the Trustee may reasonably request, securities of the Company as more fully described in this Agreement and set forth on Exhibit A hereto.

C. The capitalized terms used herein and not otherwise defined have the meanings given them in Article 7.

AGREEMENT

In consideration of the foregoing and the mutual promises and covenants contained herein and agreements of the parties hereto, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company and the Purchasers (severally and not jointly) hereby agree as follows:

ARTICLE 1

PURCHASE AND SALE OF SECURITIES

1.1 Purchase and Sale of Securities. At the Closing, upon the terms and subject to the conditions set forth herein, the Company will issue and sell to each Purchaser, and each Purchaser will, severally and not jointly, purchase from the Company (i) the aggregate principal amount of 0% Senior Secured Convertible Notes due 2020 (the “Notes”), (ii) the number of shares of the Company’s Series Z Non-Convertible, Non-Voting Preferred Stock (the “Shares”) and (iii) the number of warrants substantially in the form attached as Exhibit B hereto (the “Warrants”) to purchase shares of Common Stock in the respective amounts set forth opposite such Purchaser’s name on Exhibit A hereto for the aggregate purchase price set forth opposite such Purchaser’s name on Exhibit A hereto. The Notes, Shares and the Warrants are referred to collectively as the “Securities.” For each $0.75 of principal amount of Notes purchased by a Purchaser, such Purchaser shall receive a Warrant to purchase one share of Common Stock at an exercise price per share equal to $1.50 and 0.001 Share. Each Purchaser’s aggregate purchase price for the Securities purchased by such Purchaser hereunder is referred to as the “Aggregate Purchase Price.” As soon as reasonably practicable after the Closing Date, the parties agree that

the Aggregate Purchase Price paid by each Purchaser for the Securities shall be allocated among the Warrants, Shares and Notes and the Company will cooperate with Baupost in determining the allocation, provided that the Company and its advisors shall determine the final allocation.

1.2 Payment. At the Closing, subject to the terms and conditions herein, each Purchaser will pay the Aggregate Purchase Price set forth opposite its name on Exhibit A hereto by wire transfer of immediately available funds in accordance with wire instructions provided by the Company to the Purchasers prior to the Closing. At the Closing, the Company will (i) deliver to the each Purchaser one or more certificates, in substantially the form of Exhibit E attached hereto, representing such Purchaser’s respective Notes, as the case may be, registered in such names and denominations as the Purchaser may request, duly authorized by the Trustee (ii) deliver to each Purchaser the number of Shares set forth on Exhibit A, registered in such names and denominations as the Purchaser may request, and (iii) deliver the applicable Warrants to purchase the Warrant Shares to each applicable Purchaser, registered in such names and denominations as the Purchaser may request, against payment by such Purchaser of its respective Aggregate Purchase Price on the Closing Date. All Securities purchased by a Purchaser hereunder will be delivered to it at the address listed therein.

1.3 Closing Date. The closing of the transaction contemplated by this Agreement will take place on

March 21, 2016 (the “Closing Date”) and the closing (the “Closing”) will be held at the offices of Cooley LLP, 101 California Street, 5th Floor, San Francisco, CA 94111-5800

or at such other date and place as shall be agreed upon by the Company and the Purchasers with a right to acquire hereunder at least 70% in interest of the Securities.

ARTICLE 2

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

Except as specifically contemplated by this Agreement, the Company hereby represents and warrants to the Purchasers that:

2.1 Organization and Qualification.

(a) Subsidiaries. The Company owns, directly or indirectly, all of the capital stock or other equity interests of each of its subsidiaries free and clear of any Liens, and all of the issued and outstanding shares of capital stock of each subsidiary are validly issued and are fully paid, non-assessable and free of preemptive and similar rights to subscribe for or purchase securities. Other than the subsidiaries, the Company does not control, directly or indirectly, through one or more intermediaries, any other Person.

(b) The Company is duly incorporated, validly existing and in good standing under the laws of the State of Delaware, with full corporate power and authority to conduct its business as currently conducted as disclosed in the SEC Documents (as defined in Section 2.6), and to own or lease its properties and assets. The Company is duly qualified to do business and is in good standing in every jurisdiction in which the

2

nature of the business conducted by it or property owned by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, would not reasonably be expected to have a Material Adverse Effect. Each subsidiary of the Company has been duly formed and is validly existing as a corporation, limited liability company or limited partnership, as the case may be, in good standing under the laws of the jurisdiction in which it is chartered or organized with full power and authority (corporate or other) to conduct its business as currently conducted and to own or lease its properties and assets, except as would not reasonably be expected to have a Material Adverse Effect, and is duly qualified to do business as a foreign corporation, limited liability company or limited partnership, as the case may be, and is in good standing under the laws of each jurisdiction which requires such qualification, except where the failure to be so qualified would not reasonably be expected to have a Material Adverse Effect.

2.2 Authorization; Enforcement. The Company has all requisite corporate power and authority to enter into and to perform its obligations under the Transaction Agreements (defined in Section 8.7 below), to consummate the transactions contemplated thereby, to issue the Securities in accordance with the terms thereof and otherwise to carry out its obligations thereunder. The execution, delivery and performance of the Transaction Agreements by the Company and the consummation by it of the transactions contemplated thereby (including the issuance of the Securities) have been duly authorized by the Company’s Board of Directors and no further action, consent or authorization is required by the Company, its officers, directors or stockholders in connection therewith, other than the Stockholder Approval. The Transaction Agreements have been duly executed and delivered by the Company, and constitute the legal, valid and binding obligations of the Company enforceable against the Company in accordance with their terms, except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, or moratorium or similar laws affecting creditors’ and contracting parties’ rights generally and except as enforceability may be subject to general principles of equity and except as rights to indemnity and contribution may be limited by state or federal securities laws or public policy underlying such laws (collectively, the “Enforceability Exceptions”). The Notes, when duly executed, authenticated, issued and delivered against payment therefor as provided herein and in the Indenture, will be duly and validly issued, fully paid and nonassessable and will constitute valid and legally binding obligations of the Company enforceable against the Company in accordance with their terms, subject to the Enforceability Exceptions, and will be entitled to the benefits of the Indenture free and clear of any Lien and will conform to the description thereof in the Indenture.

2.3 Capitalization. The authorized capital stock of the Company, as of February 26, 2016, consisted of 300,000,000 shares of Common Stock, $0.001 par value per share, of which 145,564,920 shares were issued and outstanding and 10,000,000 shares of Preferred Stock, $0.001 par value per share, none of which were designated or issued. All of the issued and outstanding shares of Common Stock have been duly authorized, validly issued, fully paid, and nonassessable. 25,749,902 shares of Common Stock were subject to outstanding options and performance stock unit awards outstanding as of February 26, 2016. Except as disclosed in or contemplated by the SEC Documents, the Company does not have outstanding any options to purchase, or any preemptive rights or other rights to subscribe for or to purchase, any securities

3

or obligations convertible into, or any contracts or commitments to issue or sell, shares of its capital stock or any such options, rights, convertible securities or obligations other than options granted under the Company’s stock option plans and its employee stock purchase plan and shares of common stock issuable upon exercise of the Company’s 2.75% Convertible Senior Notes due 2020. The Company’s Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”), as in effect on the date hereof, and the Company’s Amended and Restated Bylaws, as amended (the “Bylaws”) as in effect on the date hereof, are each filed as exhibits to the SEC Documents.

2.4 Issuance of Securities. The Shares have been duly and validly authorized and, upon issuance in accordance with the terms of the Transaction Agreements, will be validly issued, fully paid and non-assessable and will not be subject to preemptive rights or other similar rights of stockholders of the Company or any of its subsidiaries. The Warrants have been duly and validly authorized and when executed, issued and delivered by the Company pursuant to the Transaction Agreements, will constitute legal, valid and binding obligations of the Company, enforceable in accordance with their terms. Subject to receipt of Stockholder Approval, (i) the shares of Common Stock issuable upon conversion of the Notes (“Note Shares”) and the shares of Common Stock issuable upon exercise of the Warrants (the “Warrant Shares”), will have been duly authorized and validly reserved for issuance pursuant to the terms of the Notes and Warrants, and (ii) upon conversion of the Notes and exercise of the Warrants in accordance with their terms, the Note Shares and Warrant Shares issuable thereupon will be validly issued, fully paid and non-assessable and will not be subject to preemptive rights or other similar rights of stockholders of the Company or any of its subsidiaries and will be free of any voting or transfer restrictions pursuant to the Company’s Certificate of Incorporation or Bylaws or any agreement or other instrument to which the Company or any of its subsidiaries is a party that have not been validly waived (other than as provided in the Transaction Agreements). The certificates for such Note Shares or Warrant Shares will be in due and proper form. The issuance of the Securities is not subject to any preemptive or similar rights that have not been waived.

2.5 No Conflicts; Government Consents and Permits.

(a) The execution, delivery and performance of the Transaction Agreements by the Company and the consummation by the Company of the transactions contemplated hereby (including the issuance and sale of the Securities, and subject to the provisions therein, the conversion of the Notes and the exercise of the Warrants) will not (i) conflict with or result in a violation of any provision of its Certificate of Incorporation or Bylaws or other organizational or charter documents or require the approval of the Company’s stockholders, (ii) violate or conflict with, or result in a breach of any provision of, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, result in the creation of any Lien upon any of the properties or assets of the Company or any Subsidiary, or give to others any rights of termination, amendment, acceleration or cancellation (with or without notice, lapse of time or both) of, any agreement, indenture, or instrument to which the Company or any of its subsidiaries is a party, (iii) result in a violation of any law, rule, regulation, order, judgment or decree (including United States federal and state securities laws and regulations and regulations of any self-regulatory organizations to which the Company or any of its subsidiaries or its

4

securities are subject) applicable to the Company, or (iv) violate or conflict with, or result in a breach of any provision of, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, result in the creation of any Lien upon any of the properties or assets of the Company or any subsidiary, or give to others any rights of termination, amendment, acceleration or cancellation (with or without notice, lapse of time or both) of, any employment agreement or employment arrangement to which the Company or any of its subsidiaries is a party, except in the case of clauses (ii) and (iii) only, for such conflicts, breaches, defaults, and violations as would not reasonably be expected to have a Material Adverse Effect, and except in the case of clauses (ii) and (iv) only, Liens created by the Collateral Documents (as defined in the Indenture).

(b) Except as provided for elsewhere in this Agreement, neither the Company nor any of its subsidiaries is required to obtain any consent, authorization or order of, or make any filing or registration with, any court or governmental authority, agency or any regulatory or self regulatory agency in order for it to execute, deliver or perform any of its obligations under the Transaction Agreements in accordance with the terms thereof, or to issue and sell the Securities in accordance with the terms thereof other than such as have been made or obtained, and except for receipt of the Stockholder Approval, the registration of the Shares and the Warrant Shares under the Securities Act pursuant to the Investor Rights Agreement, any filings required to be made under federal or state securities laws, and any required filings or notifications regarding the issuance or listing of additional shares with Nasdaq.

(c) The Company and its subsidiaries have all franchises, permits, licenses, and any similar authority necessary for the conduct of their business and are otherwise in compliance with all laws, rules and regulations applicable to them and their business, in each case now being conducted by them and as currently proposed to be conducted as disclosed in the SEC Documents, except for such franchise, permit, license or similar authority, the lack of which, or which compliance failure, would not reasonably be expected to have a Material Adverse Effect. Neither the Company nor any of its subsidiaries has received any actual notice of any proceeding relating to revocation or modification of any such franchise, permit, license, or similar authority except where such revocation or modification would not reasonably be expected to have a Material Adverse Effect.

2.6 SEC Documents, Financial Statements. The Company has timely filed all reports, schedules, forms, statements and other documents required to be filed by it with the SEC since January 1, 2015, pursuant to the reporting requirements of the Exchange Act (all of the foregoing filed prior to the date hereof and all exhibits included therein and financial statements and schedules thereto and documents (other than exhibits) incorporated by reference therein, being hereinafter referred to herein as the “SEC Documents”). Except as otherwise expressly stated herein, all references in this Agreement to information disclosed or described in the SEC Documents shall include the disclosure set forth on Exhibit C hereto to the extent such disclosure is filed with the SEC on a Form 8-K on or before 9:00 a.m., New York local time, on March 15, 2016. The Company is eligible to register its Common Stock for resale using Form S-3

5

promulgated under the Securities Act as of the date of this Agreement. The Company has delivered to each Purchaser, or each Purchaser has had access to, true and complete copies of the SEC Documents. As of their respective dates, the SEC Documents complied in all material respects with the requirements of the Exchange Act or the Securities Act, as the case may be, and the rules and regulations of the SEC promulgated thereunder applicable to the SEC Documents, and none of the SEC Documents, at the time they were filed with the SEC, contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading. As of their respective dates, the Financial Statements and the related notes complied as to form in all material respects with applicable accounting requirements and the published rules and regulations of the SEC with respect thereto. The Financial Statements and the related notes have been prepared in accordance with accounting principles generally accepted in the United States, consistently applied, during the periods involved (except (i) as may be otherwise indicated in the Financial Statements or the notes thereto, or (ii) in the case of unaudited interim statements, to the extent they may not include footnotes, may be condensed or summary statements or may conform to the SEC’s rules and instructions for Reports on Form 10-Q) and fairly present in all material respects the consolidated financial position of the Company and its consolidated subsidiaries as of the dates thereof and the consolidated results of its operations and cash flows for the periods then ended (subject, in the case of unaudited statements, to normal and recurring year-end audit adjustments). All material agreements that were required to be filed as exhibits to the SEC Documents under Item 601 of Regulation S-K (collectively, the “Material Agreements”) to which the Company or any subsidiary of the Company is a party, or the property or assets of the Company or any subsidiary of the Company are subject, have been filed as exhibits to the SEC Documents. All Material Agreements are valid and enforceable against the Company in accordance with their respective terms, except (i) as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, or moratorium or similar laws affecting creditors’ and contracting parties’ rights generally, and (ii) as enforceability may be subject to general principles of equity and except as rights to indemnity and contribution may be limited by state or federal securities laws or public policy underlying such laws. The Company is not in breach of or default under any of the Material Agreements, and to the Company’s knowledge, no other party to a Material Agreement is in breach of or default under such Material Agreement, except in each case, for such breaches or defaults as would not reasonably be expected to have a Material Adverse Effect. The Company has not received a notice of termination nor is the Company otherwise aware of any threats to terminate any of the Material Agreements. Neither the Company nor its subsidiaries is a party to, or has any commitment to become a party to, (x) any off-balance sheet partnership or any similar contract or arrangement (including any contract or arrangement relating to any transaction or relationship between or among the Company and any subsidiary, on the one hand, and any unconsolidated Affiliate on the other hand), including any “off-balance sheet arrangement” (as defined in Item 303(a) of Regulation SK promulgated by the SEC); (y) any hedging, derivatives or similar contract or arrangement, in each case in an amount material to the Company and its subsidiaries, taken as a whole, or (z) any contract or arrangement pursuant to which the Company or any subsidiary is obligated to make any capital contribution or other investment in or loan to any Person (other than a subsidiary of the Company).

6

2.7 Disclosure Controls and Procedures. Except as disclosed in the SEC Documents, the Company has established and maintains disclosure controls and procedures (as such terms are defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) that are effective in all material respects to ensure that material information relating to the Company and its subsidiaries, including any consolidated subsidiaries, is made known to its chief executive officer and chief financial officer by others within those entities. The Company’s certifying officers have evaluated the effectiveness of the Company’s disclosure controls and procedures as of the end of the period covered by the most recently filed quarterly or annual periodic report under the Exchange Act (such date, the “Evaluation Date”). The Company presented in its most recently filed quarterly or annual periodic report under the Exchange Act the conclusions of the certifying officers about the effectiveness of the disclosure controls and procedures based on their evaluations as of the Evaluation Date. Since the Evaluation Date, there have been no significant changes in the Company’s internal control over financial reporting (as such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) or, to the Company’s knowledge, in other factors that could significantly affect the Company’s internal control over financial reporting.

2.8 Accounting Controls. Except as disclosed in the SEC Documents, the Company maintains a system of internal accounting controls sufficient to provide reasonable assurances that (i) transactions are executed in accordance with management’s general or specific authorization, (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with generally accepted accounting principles as applied in the United States and to maintain accountability for assets, (iii) access to assets is permitted only in accordance with management’s general or specific authorization, and (iv) the recorded accountability for assets is compared with existing assets at reasonable intervals and appropriate action is taken with respect to any differences.

2.9 Absence of Litigation. Except as disclosed in the SEC Documents, as of the date hereof, there is no action, suit, proceeding or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the Company’s knowledge, threatened against the Company or any of its subsidiaries, or any current or former director or officer of the Company, that if determined adversely to the Company or any of its subsidiaries or current or former directors or officers would reasonably be expected to have a Material Adverse Effect or would reasonably be expected to impair the ability of the Company to perform its obligations under the Transaction Agreements. Neither the Company, nor any director or officer thereof, nor any of its subsidiaries, is or has been the subject of any action involving a claim of violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty relating to the Company. The Company has not received any stop order or other order suspending the effectiveness of any Registration Statement filed by the Company under the Exchange Act or the Securities Act and, to the Company’s knowledge, the SEC has not issued any such order.

2.10 Intellectual Property Rights. The Company and its subsidiaries own, possess or can acquire on reasonable terms sufficient trademarks, trademark applications, service marks, service names, trade names, patents, patent applications, patent rights, inventions, know-how, copyrights, domain names, licenses, approvals, trade secrets and other similar rights reasonably necessary to conduct their businesses as now conducted and, to the knowledge of the Company,

7

as proposed to be conducted as described in the SEC Documents (the “Intellectual Property”); except to the extent failure to own, possess or acquire such Intellectual Property would not result in a Material Adverse Effect. To the Company’s knowledge, neither the Company nor any of its subsidiaries has infringed the intellectual property rights of third parties and no third party, to the Company’s knowledge, is infringing the Intellectual Property, in each case, which could reasonably be expected to result in a Material Adverse Effect. Except as disclosed in the SEC Documents, there are no material options, licenses or agreements relating to the Intellectual Property, nor is the Company, nor any subsidiary, bound by or a party to any material options, licenses or agreements relating to the patents, patent applications, patent rights, inventions, know-how, trade secrets, trademarks, trademark applications, service marks, service names, trade names or copyrights of any other person or entity. Except as described in the SEC Documents, there is no material claim or action or proceeding pending or, to the Company’s knowledge, threatened that challenges any of the rights of the Company or any subsidiary in or to, or otherwise with respect to, any Intellectual Property.

2.11 Placement Agents. The Company has taken no action that would give rise to any claim by any Person for

brokerage commissions, placement agent’s fees or similar payments relating to the Transaction Agreements or the transactions contemplated thereby other than to Leerink Partners LLC pursuant to the Letter Agreement dated March 11, 2016

between the Company and Leerink Partners LLC.

2.12 Investment Company. The Company is not and, after giving effect to the Offering and sale of the Securities, will not be an “investment company” as such term is defined in the Investment Company Act of 1940, as amended (the “Investment Company Act”). The Company shall conduct its business in a manner so that it will not become subject to the Investment Company Act.

2.13 No Material Adverse Change. Since the date of the latest audited financial statements included within the SEC Documents, except as described or referred to in the SEC Documents filed prior to the date hereof, the business of the Company and its subsidiaries has been conducted in the ordinary course of business consistent with past practices and, except for cash expenditures in the ordinary course of business, (i) there has not been any change in the assets, liabilities, business, properties, financial condition or results of operations of the Company and its subsidiaries that would reasonably be expected to have a Material Adverse Effect, (ii) there has not been any dividend or distribution of any kind declared, or any authorization of any dividend or distribution of any kind, set aside for payment, paid or made by the Company on any class of capital stock, (iii) neither the Company nor any of its subsidiaries has sustained any material loss or interference with its business from fire, explosion, flood or other calamity, whether or not covered by insurance, or from any labor disturbance or dispute or any action, order or decree of any court or arbitrator or governmental or regulatory authority, and (iv) neither the Company nor any of its subsidiaries has incurred any material liabilities except in the ordinary course of business.

2.14 The Nasdaq Global Market. The Company’s Common Stock is registered under Section 12 of the Exchange Act and is listed on The Nasdaq Global Market, and, except as

8

disclosed in the SEC Documents, to the Company’s knowledge, there are no proceedings to revoke or suspend such listing or the listing of the Shares and the Warrant Shares. Except as disclosed in the SEC Documents, and except that since February 26, 2016, the Company has had a bid price of less than $1.00 per share, the Company is in compliance with the requirements of Nasdaq for continued listing of the Common Stock thereon and any other Nasdaq listing and maintenance requirements. The Company has taken no action designed to terminate the registration of the Common Stock under the Exchange Act or remove from listing the Common Stock from Nasdaq, nor has the Company received any written notification that the SEC, Nasdaq or the Financial Industry Regulatory Authority, Inc. is contemplating terminating such registration or quotation.

2.15 Acknowledgment Regarding Purchasers’ Purchase of Securities. The Company acknowledges and agrees that each of the Purchasers is acting solely in the capacity of an arm’s length purchaser with respect to the Transaction Agreements and the transactions contemplated thereby. The Company further acknowledges that no Purchaser is acting as a financial advisor or fiduciary of the Company (or in any similar capacity with respect to the Company) with respect to the Transaction Agreements and the transactions contemplated thereby and any advice given by any Purchaser or any of their respective representatives or agents to the Company in connection with the Transaction Agreements and the transactions contemplated thereby is merely incidental to such Purchaser’s purchase of the Securities. The Company further represents to each Purchaser that the Company’s decision to enter into the Transaction Agreements has been based on the independent evaluation of the transactions contemplated thereby by the Company and its representatives.

2.16 Accountants. Ernst & Young LLP, who will have expressed or will express, as the case may be, their opinion with respect to the audited financial statements and schedules to be included as a part of any Registration Statement prior to the filing of any such Registration Statement, are independent accountants as required by the Securities Act.

2.17 Insurance. The Company and its subsidiaries are insured by insurers of recognized financial responsibility against such losses and risks and in such amounts as the Company believes are prudent and customary for a company (i) in the businesses and location in which the Company and its subsidiaries are engaged and present, (ii) with the resources of the Company, and (iii) at a similar stage of development as the Company and its subsidiaries. Neither the Company nor any of its subsidiaries have received any written notice that the Company or any subsidiary will not be able to renew its existing insurance coverage as and when such coverage expires. The Company believes it will be able to obtain similar coverage at reasonable cost from similar insurers as may be necessary to continue its business.

2.18 Foreign Corrupt Practices.

(a) The Company will not, directly or indirectly, use the proceeds of the Securities purchased hereunder, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other Person, for the purpose of funding (i) any activities of or business with any Person, or in any country or territory, that, at the time of such funding, is the subject of Sanctions (unless such activities or business are authorized pursuant to a license, license exception, an exemption or

9

exception, or other permit or authorization from a governmental authority) or (ii) any other transaction that will result in a violation by any Person (including any Person participating in the transaction, whether as underwriter, advisor, purchaser, investor, lender or otherwise) of Sanctions.

(b) The Companies will not use the proceeds of the Securities purchased hereunder directly, or, to the knowledge of the Company, indirectly, for any payments to any governmental official or employee, political party, official of a political party, candidate for political office, or anyone else acting in an official capacity, in order to obtain, retain or direct business or obtain any improper advantage, in violation of the United States Foreign Corrupt Practices Act of 1977, as amended (the “FCPA”).

(c) Except as could not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect, to the knowledge of the Company, the Company has not, in the past three years, committed a violation of applicable regulations of the United States Department of the Treasury’s Office of Foreign Assets Control (“OFAC”), Title III of the USA PATRIOT Act (the “Patriot Act”) or the FCPA.

(d) Neither the Company nor, to the knowledge of the Company, any director, officer, employee or agent thereof is an individual or entity currently on OFAC’s list of Specifically Designated Nationals and Blocked Persons.

2.19 Private Placement. Neither the Company nor any of its subsidiaries or any affiliates, nor any Person acting on its or their behalf, has, directly or indirectly, made any offers or sales of any security or solicited any offers to buy any security, under any circumstances that would require registration of the Securities under the Securities Act. Assuming the accuracy of the representations and warranties of the Purchasers contained in Article 3 hereof, the issuance of the Securities and the Warrant Shares are exempt from registration under the Securities Act.

2.20 No Registration Rights. No Person has the right to (i) prohibit the Company from filing a Registration Statement or (ii) other than as disclosed in the SEC Documents, require the Company to register any securities for sale under the Securities Act by reason of the filing of a Registration Statement except in the case of clause (ii) for rights which have been properly satisfied or waived. The granting and performance of the registration rights under the Transaction Agreements will not violate or conflict with, or result in a breach of any provision of, or constitute a default under, any agreement, indenture, or instrument to which the Company is a party.

2.21 Taxes. The Company and its subsidiaries have filed (or have obtained an extension of time within which to file) all necessary federal, state and foreign income and franchise tax returns and have paid all taxes required to be paid by them, except where the failure to so file or the failure to so pay would not reasonably be expected to have a Material Adverse Effect. The Company is not and has never been a U.S. real property holding corporation within the meaning of Section 897 of the Internal Revenue Code of 1986, as amended, and the Company shall so certify upon Purchaser’s request.

10

2.22 Real and Personal Property. The Company and its subsidiaries have good and marketable title to, or have valid rights to lease or otherwise use, all items of real and personal property that are material to the business of the Company and its subsidiaries, free and clear of all liens, encumbrances, claims and defects and imperfections of title except those that (i) do not materially interfere with the use of such property by the Company and its subsidiaries or (ii) would not reasonably be expected to have a Material Adverse Effect.

2.23 Application of Takeover Protections. The Company and its board of directors (the “Board”) have taken all necessary action, if any, in order to render inapplicable any control share acquisition law, business combination law, poison pill (including any distribution under a rights agreement) or other similar anti-takeover provision under the Company’s charter or the laws of its state of incorporation that is or could become applicable to the Purchasers as a result of the Purchasers and the Company fulfilling their respective obligations or exercising their respective rights under the Transaction Agreements, including, without limitation, as a result of the Company’s issuance of the Securities, Note Shares and Warrant Shares and the Purchasers’ acquisition and ownership of the Securities, Note Shares, and Warrant Shares.

2.24 No Manipulation of Stock. The Company has not, nor will it, (i) taken, directly or indirectly, any action designed to stabilize or manipulate the price of the Common Stock or any security of the Company to facilitate the sale or resale of any of the Securities, (ii) sold, bid for, purchased, or, paid any compensation for soliciting purchases of, any of the Securities, or (iii) paid or agreed to pay to any Person any compensation for soliciting another to purchase any other securities of the Company.