Form 8-K OXFORD INDUSTRIES INC For: Jan 09

�

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

�

FORM�8-K

�

CURRENT REPORT

Pursuant to Section�13 or 15(d)�of the Securities Exchange Act of 1934

�

Date of Report (Date of earliest event reported):����January 12, 2015

Oxford Industries,�Inc.

(Exact name of registrant as specified in its charter)

�

Georgia | 001-04365 | 58-0831862 | ||

(State or other jurisdiction | (Commission | (IRS Employer | ||

of incorporation) | File Number) | Identification No.) | ||

999 Peachtree Street, N.E., Ste. 688, Atlanta, GA | 30309 | |||

(Address of principal executive offices) | (Zip Code) | |||

�

Registrants telephone number, including area code:����(404) 659-2424

�

Not Applicable�

(Former name or former address, if changed since last report)

�

Check the appropriate box below if the Form�8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

�

o��Written communications pursuant to Rule�425 under the Securities Act (17 CFR 230.425)

�

o��Soliciting material pursuant to Rule�14a-12 under the Exchange Act (17 CFR 240.14a-12)

�

o��Pre-commencement communications pursuant to Rule�14d-2(b)�under the Exchange Act (17 CFR 240.14d-2(b))

�

o��Pre-commencement communications pursuant to Rule�13e-4(c)�under the Exchange Act (17 CFR 240.13e-4(c))

�

�

�

Item 7.01. Regulation FD Disclosure.

In this Current Report on Form 8-K, Oxford Industries, Inc. (the

Company

) is furnishing materials which the Company will use during its presentation at the 17th Annual ICR XChange Conference on January 12, 2015, as well as in related meetings with analysts and investors. The presentation materials are attached hereto as Exhibit 99.1.

As announced by the Company in its press release on December 30, 2014, the Companys presentation at the conference is scheduled to begin at 2:00 p.m., Eastern time, on January 12, 2015 and will be broadcast on the Internet. The broadcast can be accessed from the Companys website at www.oxfordinc.com.

The information contained in this Form 8-K (including Exhibit 99.1) shall not be deemed

filed

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

Exchange Act

), or otherwise be subject to the liabilities of that section, nor shall it be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. | Description |

99.1 | Investor Presentation, dated January 12, 2015 |

�

SIGNATURE

�

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

�

� OXFORD INDUSTRIES,�INC. | ||

Date: January 12, 2015 | By | /s/ Thomas E. Campbell |

Name: Thomas E. Campbell | ||

Title: Executive Vice President-Law and Administration, General Counsel and Secretary | ||

�

EXHIBIT INDEX

�

Exhibit No. | Description |

99.1 | Investor Presentation, dated January 12, 2015 |

NYSE: OXM

�

Cautionary Statements Regarding Forward-Looking Statements This presentation may include statements that are forward-looking statements within the meaning of the federal securities laws. Generally, the words

believe,

expect,

intend,

estimate,

anticipate,

project,

will

and similar expressions identify forward-looking statements, which generally are not historical in nature. We intend for all forward-looking statements contained herein or on our website, and all subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf, to be covered by the safe harbor provisions for forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (which Sections were adopted as part of the Private Securities Litigation Reform Act of 1995). Important assumptions relating to these forward-looking statements include, among others, assumptions regarding the impact of economic conditions on consumer demand and spending, particularly in light of general economic uncertainty that continues to prevail, demand for our products, timing of shipments requested by our wholesale customers, labor disputes at key shipping ports, expected pricing levels, competitive conditions, retention of and disciplined execution by key management, the timing and cost of store openings and of planned capital expenditures, weather, costs of products as well as the raw materials used in those products, costs of labor, acquisition and disposition activities, expected outcomes of pending or potential litigation and regulatory actions, access to capital and/or credit markets and the impact of foreign losses on our effective tax rate. Forward-looking statements reflect our current expectations, based on currently available information, and are not guarantees of performance. Although we believe that the expectations reflected in such forward-looking statements are reasonable, these expectations could prove inaccurate as such statements involve risks and uncertainties, many of which are beyond our ability to control or predict. Should one or more of these risks or uncertainties, or other risks or uncertainties not currently known to us or that we currently deem to be immaterial, materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. Important factors relating to these risks and uncertainties include, but are not limited to, those described in Part I, Item 1A. contained in our Annual Report on Form 10-K for the period ended February 1, 2014 under the heading

Risk Factors

and those described from time to time in our future reports filed with the SEC. Comparable Store Sales Our disclosures about comparable store sales include sales from our full-price stores and e-commerce sites, excluding sales associated with e-commerce flash clearance sales. Definitions and calculations of comparable store sales differ among companies in the retail industry, and therefore comparable store metrics disclosed by us may not be comparable to the metrics disclosed by other companies. Non-GAAP Disclosures Reconciliations of GAAP to adjusted results are included in the March 29, 2011, March 27, 2012, April 2, 2013, March 27, 2014 and December 10, 2014 press releases available on our website at www.oxfordinc.com. OXM: ICR XChange January 12, 2015

�

Oxfords Strategy To own, develop and use powerful, emotional brands to drive sustained, profitable growth. OXM: ICR XChange January 12, 2015

�

Solid Sales Growth Approaching $1 Billion in Fiscal 2014 OXM: ICR XChange January 12, 2015 500 550 600 650 700 750 800 850 900 950 1000 2010 2011 2012 2013 2014 (est.) Net Sales (in millions) Continuing operations

�

Operating Income Expansion While Investing in Our Brands (in millions) OXM: ICR XChange January 12, 2015 10 20 30 40 50 60 70 80 90 2010 2011 2012 2013 2014 (est.) Cap Ex Adjusted Operating Income Continuing operations

�

Revenue Dominated by Lifestyle Brands OXM: ICR XChange January 12, 2015 Estimated Fiscal 2014

�

�

�

Our Lifestyle Brands are Ideally Suited to Succeed They offer an emotional connection based on their unique brand position. Supported by: " A+ Product " A+ Distribution " A+ Communication

�

Our Brands Establish an Authentic Emotional Connection

�

Our Brands Establish an Authentic Emotional Connection

�

A+ Product Our Brands are Design-Led " Tommy Bahama and Lilly Pulitzer are design-led, commercially informed businesses " They earn business on the strength of their brand message and compelling, differentiated product OXM: ICR XChange January 12-13, 2015

�

A+ Product Our Brands are Full-Price, Premium Brands

�

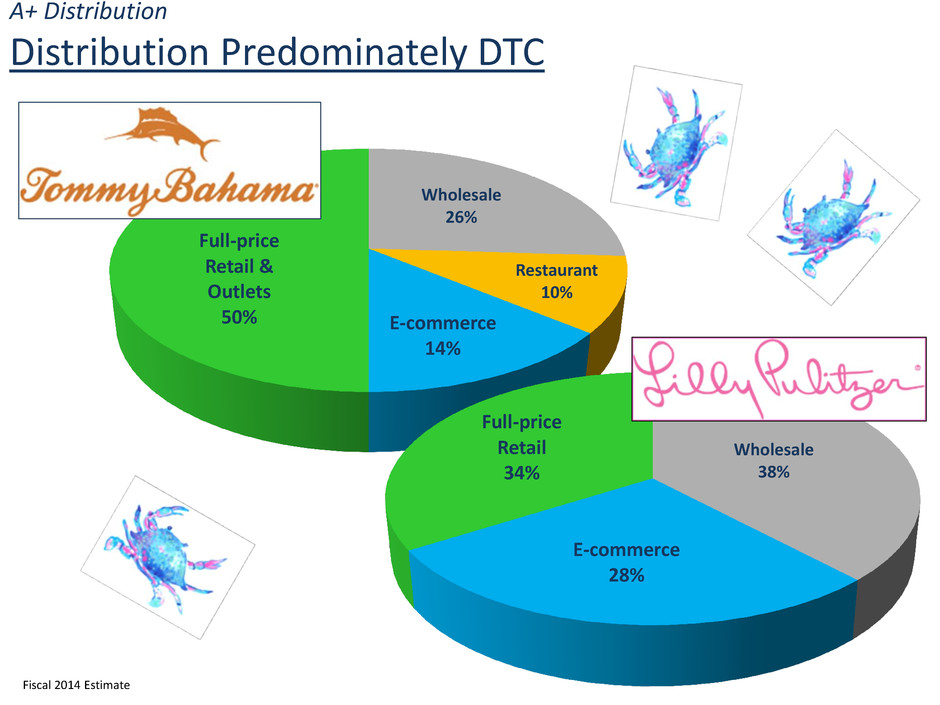

A+ Distribution Distribution Predominately DTC Wholesale 26% Restaurant 10% E-commerce 14% Full-price Retail & Outlets 50% Wholesale 38% E-commerce 28% Full-price Retail 34% Fiscal 2014 Estimate

�

A+ Distribution DTC Includes Significant E-commerce Restaurant 13% E-commerce 19% Full-price Retail & Outlets 68% E-commerce 45% Full-price Retail 55% Fiscal 2014 Estimate

�

A+ Distribution Our Brands Are Not Over-Stored Wholesale " Department stores: H 17% of total Tommy Bahama sales " Largest wholesale customer: H 7% of total Tommy Bahama sales Retail " 98 full-price stores in the US " H 40% mall-based

�

A+ Distribution Our Brands Are Not Over-Stored Wholesale " Department stores: H 10% of total Lilly Pulitzer sales " Largest wholesale customer: H 6% of total Lilly Pulitzer sales " Signature stores: H 20% of total Lilly Pulitzer sales Retail " 28 full-price stores in the US " H 50% mall-based

�

A+ Communication Our Websites

�

A+ Communication Social Media/Email

�

A+ Communication Direct Mail OXM: ICR XChange January 12-13, 2015

�

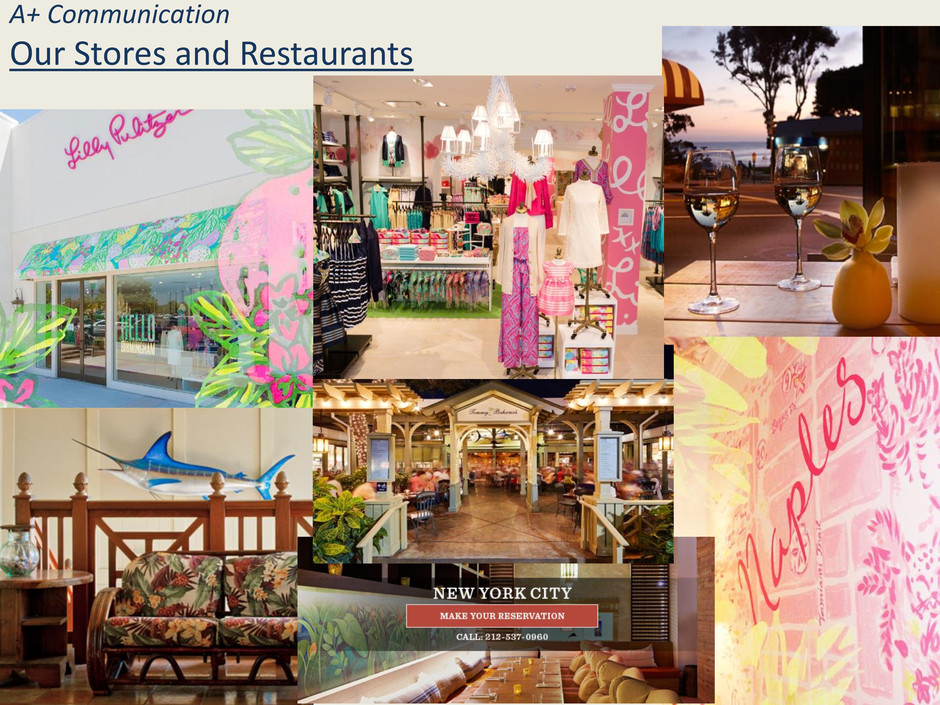

A+ Communication Our Stores and Restaurants

�

Financial underperformance Brand Strengths: " Worldwide recognition; in over 30 markets " Approaching 50% DTC " Clean wholesale distribution " Wide array of licensed product

Cash Cow

Market leader in tailored clothing " Kenneth Cole " Dockers " Geoffrey Beene " Large private label programs

�

OXM: ICR XChange January 12, 2015 Capital Structure to Support Growth Solid financial position to invest in growing our business: " Strong cash flow from operations funds cap ex, dividends and debt reduction " Good liquidity with over $85 million of availability under revolving lines of credit (at November 1, 2014)

�

Fourth Quarter Update: " We believe we will meet our previously issued guidance as Holiday sales and gross margin met our expectations and resort is performing well " Spring shipments scheduled for end of January are important to our fourth quarter plan

�

NYSE: OXM

�

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- AM Best Affirms Credit Ratings of Interamericana de Fianzas y Seguros, S.A.

- Hartford HealthCare hospitals make top 20% nationwide for safety, price transparency

- Marathon Digital Holdings Schedules Conference Call for First Quarter 2024 Financial Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share