Form 8-K ORACLE CORP For: Jul 16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 16, 2015

Oracle Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 001-35992 | 54-2185193 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

500 Oracle Parkway, Redwood City, California 94065

(Address of principal executive offices) (Zip Code)

(650) 506-7000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 7 – Regulation FD

Item 7.01 Regulation FD Disclosure

Certain information not previously made publicly available is set forth in the presentation furnished herewith and is being made available to investors.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| Exhibit No. |

Description | |

| 99.1 |

Investor Presentation dated July 2015 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ORACLE CORPORATION | ||||||||||

| Dated: July 16, 2015 | By: | /s/ Dorian Daley | ||||||||

| Name: | Dorian Daley | |||||||||

| Title: | Executive Vice President, General Counsel and Secretary | |||||||||

EXHIBIT LIST

| Exhibit No. |

Description | |

| 99.1 |

Investor Presentation dated July 2015 | |

Investor Presentation

July 2015 Exhibit 99.1 |

Oracle: Business and Performance Overview

US$38.2 billion total GAAP revenue in FY 2015

100% of the Fortune 100 are customers

Over 400,000 customers in 145+ countries

Invested $5.5 billion in R&D in FY 2015

Approximately 132,000 employees

#1 provider of enterprise software worldwide and leading provider of hardware and services for Oracle database and middleware software, application software, cloud infrastructure, and hardware systems

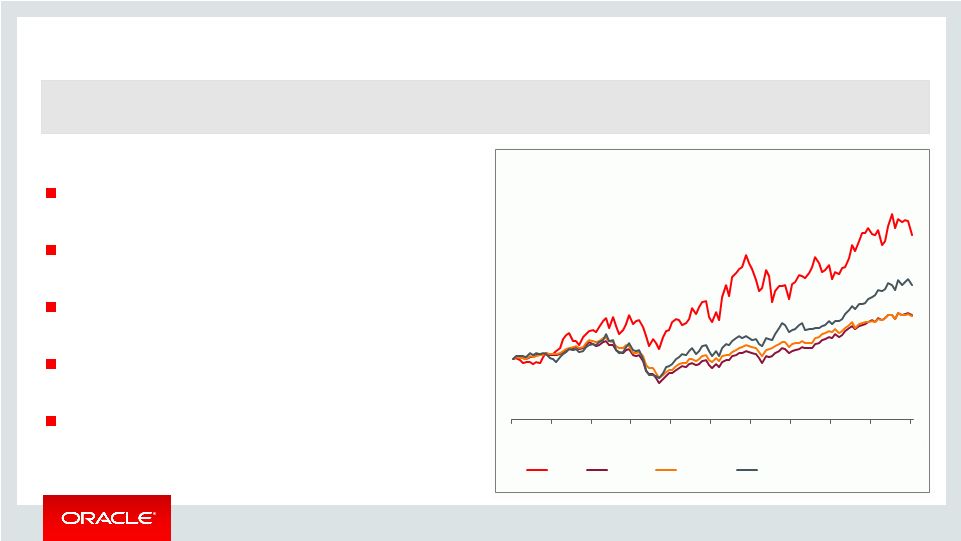

Stock chart: FactSet Research. Prices for the last 10 years were indexed (6/05 – 6/15) 2 Oracle Stock has Outperformed Copyright © 2015, Oracle and/or its affiliates. All rights reserved. 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Oracle S&P 500 Dow Jones S&P Information Technology |

Copyright © 2015,

Oracle and/or its affiliates. All rights reserved.

Transformation to the Cloud Accelerates

Oracle’s primary area of focus over the next few years is becoming the #1

company in cloud computing’s

two most profitable segments –

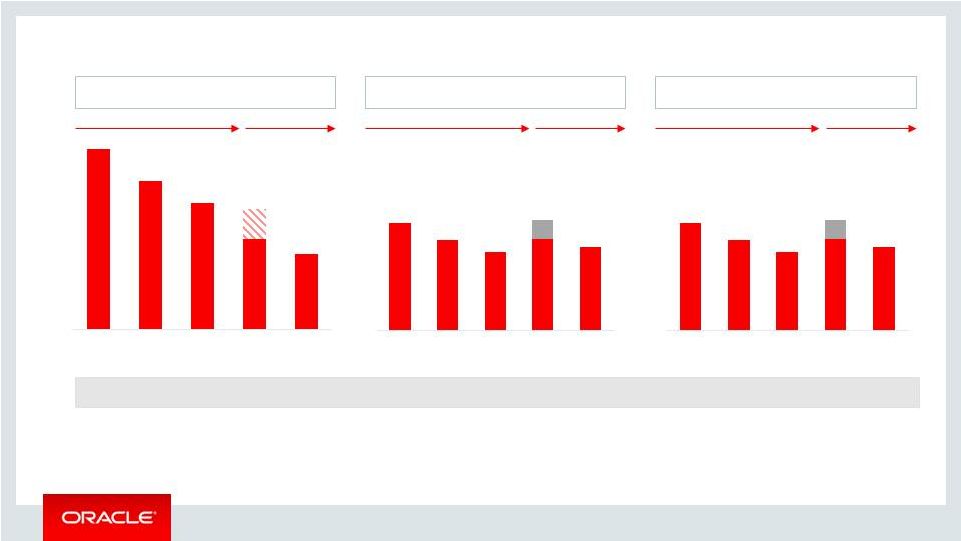

SaaS and PaaS Software and Cloud Revenue Cloud Revenue Unrelenting Growth in Cloud 3 Cloud business growing at a $2.3 billion run rate Q4 SaaS/PaaS bookings grew 200% - 3 rd consecutive quarter of 100% growth - Bookings – leading indicator of revenue growth SaaS/PaaS revenue up 29% in Q4; up 32% in FY15 0 5 10 15 20 25 30 FY10 FY11 FY12 FY13 FY14 FY15 Software and Cloud FY10 FY11 FY12 FY13 FY14 FY15 0.0 0.5 1.0 1.5 2.0 2.5 IaaS SaaS/PaaS 1 Year CAGR +32% +33% 5 Year CAGR +75% +16% 1 Year CAGR +1% 5 Year CAGR +7% |

Copyright © 2015,

Oracle and/or its affiliates. All rights reserved.

Disciplined Allocation of Capital, With Emphasis on

Returning Capital to Shareholders

In the Last 5 Years:

Over $44 billion of capital returned to

shareholders 68% of cumulative free cash flow (85% over last 3 years) 25% of current market capitalization Quarterly dividends per share increased 200% 4 (US$ in Billions) 2011 2012 2013 2014 2015 Capital Expenditures Acquisitions Dividends Share Repurchases $0.5 $0.6 $0.7 $0.6 $1.4 $1.8 $4.7 $3.3 $3.5 $6.2 $1.1 $1.2 $1.4 $2.2 $2.3 $1.2 $5.9 $11.0 $9.8 $8.1 FY |

Copyright © 2015,

Oracle and/or its affiliates. All rights reserved.

Summary of Shareholder Feedback

Oracle continues to expand the scope and improve the quality of its engagement with shareholders – in the last fiscal year: – The company’s senior executives and directors (including Compensation Committee members)

engaged with 13 of the top-20 shareholders holding 27% of unaffiliated

shares on the topics of compensation and governance

– Focused on increasing the scope and depth of our engagement In conversations with shareholders, we heard a focus on the following key areas regarding compensation:

1) Introduced performance-based (relative and absolute) metrics to our at-risk equity components

2) Increased the duration of long-term incentives 3) Reduction in the quantum of pay In the past year we have transitioned a significant portion of compensation to long-term, performance- based PSUs, and have

taken a number of steps to reduce the overall quantum of compensation The Board and Compensation Committee made improvements to our compensation program and increased the scope and depth of engagement with our shareholders 5 |

Copyright © 2015,

Oracle and/or its affiliates. All rights reserved.

Significant Compensation Program Improvements

Introduced Performance Stock Units (“PSUs”)

PSUs are earned based on relative performance depending on each NEO’s

position

PSUs are long-term (4 year term with multiple performance periods, the

longest of which is 3 years), performance based, and subject to

robust metrics tailored to business

responsibilities Mr. Ellison’s compensation reduced to

reflect transition from CEO to Executive Chairman & Chief

Technology Officer roles Performance-based

compensation

Long-term performance periods

Quantum of pay and equity dilution

Significant changes in ORCL compensation…

…are consistent with investor perspectives

Significantly reduced number of shares subject to stock options granted to

Mr. Ellison, Ms. Catz and Mr. Hurd

Option awards reduced to 5 year terms (from 10 years), significantly reducing

value; maintain long-term vest (4 years)

Continuing to award equity in the form of PSUs

FY15 FY16 6 |

Copyright © 2015,

Oracle and/or its affiliates. All rights reserved.

A Structure that Pays for Performance

Annual performance-based cash bonuses for Mr. Ellison, Ms. Catz and Mr. Hurd are tied to the key driver of shareholder value – our ability to grow Oracle’s non-GAAP pre-tax profits year-over-year

– In years where no growth in non-GAAP pre-tax profits is achieved, no performance-based cash bonuses are awarded

– FY 2015 bonuses are expected to be paid out at $0 to Mr.

Ellison, Ms. Catz and Mr. Hurd* – In FY 2014 bonuses paid out at 16% of target (~$741,000 for Mr. Ellison and ~$456,000 for Ms. Catz and Mr. Hurd) For Mr. Ellison, Ms. Catz and Mr. Hurd, PSU payouts are based on Oracle’s revenue growth and operating cash flow growth relative to select peer company performances – 25% of PSUs are tied to each of 4 separate performance periods (representing a transition to a 3-year performance period);

earned shares vest at the end of each period

• Tranche 1: year 1 performance • Tranche 2: weighted average performance for combined years 1 and 2 • Tranche 3: weighted average performance for combined years 1, 2 and 3 • Tranche 4: weighted average performance for combined years 2, 3 and 4 Aggregate Target PSUs Eligible to Vest Grant Date Value¹ % of Target PSUs Vesting Actual PSUs Vesting Illustrative Value of Vested PSUs² % Reduction From Grant Date Value Mr. Ellison 140,625 $5,691,094 60.7% 85,358 $3,429,684 (39.7%) Ms. Catz 171,875 $6,955,781 104,327 $4,191,859 Mr. Hurd 171,875 $6,955,781 104,327 $4,191,859 *The corporate bonus for other executive and non-executive Oracle employees for FY 2015 will be determined and paid in due course

consistent with past practice 1

Based on Oracle’s closing share price on July 24, 2014 of

$40.47 2

Based on Oracle’s closing share price on July 9, 2015 of

$40.18 7 |

Disciplined Reduction in Overall Compensation

Since 2012, total compensation has decreased year-over-year for Mr.

Ellison Mr. Ellison

Ms. Catz Mr. Hurd 1 In connection with the management transition, the Compensation Committee cancelled 1.5 million equity equivalent shares (750,000 options and 187,500 PSUs) of Mr. Ellison’s FY 2015 equity award 2 In FY 2015, Ms. Catz and Mr. Hurd each received a one-time promotional grant of 1 million equity equivalent shares (500,000 options

and 125,000 PSUs) in connection with their promotions to CEOs

3 2016E reflects only the grant date value of equity awards; equity awards have historically represented >95% of overall compensation for these executives 8 Copyright © 2015, Oracle and/or its affiliates. All rights reserved. $96 $80 $67 $48 $41 2012 2013 2014 2015 2016E $52 $44 $38 $44 $41 2012 2013 2014 2015 2016E $52 $44 $38 $44 $41 2012 2013 2014 2015 2016E $16 $64 FY 1 2 2 3 3 3 $9 $9 $53 $53 (US$ in Millions) CTO President & CFO CEO President CEO CEO |

Copyright © 2015,

Oracle and/or its affiliates. All rights reserved.

Actively Engaged and Responsive Board

“As directors, we are in an oversight role, but we strive to be exposed

to the day-to-day business, which helps us to make more

informed decisions on what is right for the company and ultimately shareholders. Directors regularly participate in key customer events including Oracle OpenWorld and Oracle President

Council Forums.”

- H. Raymond Bingham, Chairman of the Finance and Audit Committee “As a group, the Board understands the importance of shareholder engagement and we have made

extensive efforts to meet with investors in order to best understand their

views on executive compensation and other governance-related

topics. Through these engagements, we have discussed key areas of focus in the Boardroom and these insights have enriched our decision-making process.”

- Bruce Chizen, Chairman of the Compensation Committee “The Board is committed to bringing different substantive areas of expertise, varied perspectives and deep

institutional knowledge to the Boardroom. We continually evaluate our current

and future potential desired skills mix as the foundation for

building an effective Board. We added former Secretary of Defense, CIA Director and House Budget Committee Chairman Leon Panetta in January 2015.”

- Michael Boskin, Chairman of the Nominating and Governance Committee 9 |

Copyright © 2015,

Oracle and/or its affiliates. All rights reserved.

Appendix |

Copyright © 2015,

Oracle and/or its affiliates. All rights reserved.

Compensation Program Overview & Objectives

Our goal: Align the interests of executive officers with those of shareholders; provide incentives to executive officers for superior performance; and attract and retain highly talented and productive executive officers Compensation Element Designed to Reward Annual & Long-Term Incentive Metrics Performance- Based/ “At Risk” Base Salary Experience, industry knowledge, duties, scope of responsibility N/A Annual Performance-Based Cash Bonus Success in achieving annual results Bonus based on growth in non-GAAP Pre-Tax Profits during a fiscal year If non-GAAP pre-tax profits do not grow Y-o-Y, no bonus is paid Bonuses are expected to be paid out at $0 for the top 3 NEOs for FY 2015 In FY 2014, bonuses paid out at 16% of target Long-Term Incentive Compensation 50% target allocation to Stock Options and 50% target allocation to PSUs at grant date Success in achieving sustainable long-term results 50% of target PSUs are tied to relative growth in total consolidated revenues on a U.S. GAAP basis 50% of target PSUs are tied to relative growth in total consolidated operating cash flow (OCF) Objective relative performance metrics – both revenue and OCF growth requires relative performance above the weighted average of the peer group for target payout,

and performance in the bottom quartile of peer group results in zero payout 11 |

Copyright © 2015,

Oracle and/or its affiliates. All rights reserved.

Sound Compensation and Governance Practices

95%+ of executive compensation is “at risk” or

performance based

Strong historical pay-for-performance alignment

Strong ownership culture –

our executives and directors

hold 26% of Oracle stock and NEOs are subject to robust

ownership guidelines

Double trigger change-in-control benefits under equity

plan Clawback policy for executive officers Independent compensation consultant Commitment to improve dialogue with our shareholders – over the last year, representatives of the Board and/or management discussed executive compensation with 13 of the top-20 shareholders, representing approximately 27% of unaffiliated shares Annual director elections Shareholder ability to call a special meeting Shareholder ability to act by written consent Director majority voting policy Diverse and experienced Board with significant shareholder representation Independent Presiding Director 100% independent Committees Ongoing Board refreshment process, with new director added in 2015 Compensation Governance Practices Corporate Governance Practices 12 |

Copyright © 2015,

Oracle and/or its affiliates. All rights reserved.

"Safe Harbor" Statement: Statements in

this presentation relating to Oracle's future plans,

expectations, beliefs, intentions and prospects are "forward-looking statements" and are subject to material risks and uncertainties. A detailed discussion of these

factors and other risks that affect our business is contained in our SEC

filings, including our most recent reports on Form 10-K and

Form 10-Q, particularly under the heading "Risk

Factors." Copies of these filings are available online from the SEC or by contacting Oracle Corporation's Investor Relations Department at (650) 506-4073 or by clicking on

SEC Filings on Oracle’s Investor Relations website at

http://www.oracle.com/investor. All information set forth in this

presentation is current as of July 16, 2015. Oracle undertakes no

duty to update any statement in light of new information or future

events. Safe Harbor Statement 13 |

|

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Oppenheimer Starts Oracle (ORCL) at Perform, 'Improving Fundamentals Offset by a Less Efficient Cash Model'

- China's Top Tier in Heilongjiang

- Oracle (ORCL) to Invest More Than $8 Bln in Cloud Computing and AI in Japan

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share