Form 8-K OCEANFIRST FINANCIAL For: May 06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 6, 2015

OCEANFIRST FINANCIAL CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 001-11713 | 22-3412577 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File No.) |

(IRS Employer Identification No.) |

975 HOOPER AVENUE, TOMS RIVER, NEW JERSEY 08753

(Address of principal executive offices, including zip code)

(732) 240-4500

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 140.13e-4(c)) |

| ITEM 7.01 | REGULATION FD DISCLOSURE |

On May 6, 2014 OceanFirst Financial Corp. (the “Company”) will make a presentation at its Annual Meeting of Stockholders. Attached as Exhibit 99.1 of this Form 8-K is a copy of the presentation which OceanFirst Financial Corp. will make available at the Annual Meeting of Stockholders on May 6, 2015 and will post on its website at www.oceanfirst.com. This report is being furnished to the SEC and shall not be deemed “filed” for any purpose.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

| (d) | EXHIBITS |

| 99.1 | Presentation to be made at the Company’s Annual Meeting of Shareholders on May 6, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| OCEANFIRST FINANCIAL CORP. |

| /s/ Michael Fitzpatrick |

| Michael Fitzpatrick |

| Executive Vice President and |

| Chief Financial Officer |

Dated: May 6, 2015

Exhibit Index

| Exhibit |

Description | |

| 99.1 | Presentation to be made at the Company’s Annual Meeting of Shareholders on May 6, 2015. | |

Christopher D. Maher

President & Chief Executive Officer

May 6, 2015

OceanFirst Financial Corp.

OceanFirst Financial Corp.

2015 Annual Meeting

2015 Annual Meeting

Of Shareholders

Of Shareholders

Exhibit 99.1 |

OceanFirst Financial Corp.

2

Forward Looking Statements:

This

presentation

contains

certain

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Reform

Act

of

1995

which

are

based

on

certain

assumptions

and

describe

future

plans,

strategies

and

expectations

of

the

Company.

These

forward-looking

statements

are

generally

identified

by

use

of

the

words

"believe,"

"expect,"

"intend,"

"anticipate,"

"estimate,"

"project,"

"will,"

"should,"

"may,"

"view,"

"opportunity,"

"potential,"

or

similar

expressions

or

expressions

of

confidence.

The

Company's

ability

to

predict

results

or

the

actual

effect

of

future

plans

or

strategies

is

inherently

uncertain.

Factors

which

could

have

a

material

adverse

effect

on

the

operations

of

the

Company

and

its

subsidiaries

include,

but

are

not

limited

to,

changes

in

interest

rates,

general

economic

conditions,

levels

of

unemployment

in

the

Bank’s

lending

area,

real

estate

market

values

in

the

Bank’s

lending

area,

future

natural

disasters

and

increases

to

flood

insurance

premiums,

the

level

of

prepayments

on

loans

and

mortgage-backed

securities,

legislative/

regulatory

changes,

monetary

and

fiscal

policies

of

the

U.S.

Government

including

policies

of

the

U.S.

Treasury

and

the

Board

of

Governors

of

the

Federal

Reserve

System,

the

quality

or

composition

of

the

loan

or

investment

portfolios,

demand

for

loan

products,

deposit

flows,

competition,

demand

for

financial

services

in

the

Company's

market

area

and

accounting

principles

and

guidelines.

These

risks

and

uncertainties

are

further

discussed

in

the

Company’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2014

and

subsequent

securities

filings

and

should

be

considered

in

evaluating

forward-

looking

statements

and

undue

reliance

should

not

be

placed

on

such

statements.

The

Company

does

not

undertake,

and

specifically

disclaims

any

obligation,

to

publicly

release

the

result

of

any

revisions

which

may

be

made

to

any

forward-looking

statements

to

reflect

events

or

circumstances

after

the

date

of

such

statements

or

to

reflect

the

occurrence

of

anticipated

or

unanticipated

events. |

Discussion Topics

•

2014 Highlights

•

2015 First Quarter Highlights

•

Areas of Strategic Focus

•

Questions and Answers

3 |

2014 Highlights

4

•

Increased dividend 8% to $0.13 per quarter in October 2014

•

Repurchased 551,291 common shares

•

Demonstrated earnings strength of $1.19 per share; 9.18% ROE &

0.86% ROA

•

Stabilized net interest margin at 3.31%

•

Maintained tangible common equity at 9.26% of total assets

•

Grew commercial loan portfolio $144.4 million

•

Announced the addition of a new commercial lending team to be

located in Mercer County, New Jersey |

2014 Highlights –

Risk Management

5

For the year ended December 31, 2014:

•

Interest Rate Risk Management

Extended

$144

million

of

FHLB

advances

into

3

–

5

year

terms

$72 million of retail checking migrated to non-interest bearing

Core

deposits

(1)

are

88.0%

of

total

deposits,

a

significant

benefit

in

a

rising

rate

environment

•

Asset Quality Improvements

Non-performing loans decreased by 60%, or $27.1 million, to $18.3 million at

December 31, 2014

Credit metrics improved as non-performing loans as a percent of total loans

receivable

decreased

to

1.06%

from

2.88%,

and

Allowance

for

Loan

Losses

as

a

percent of total non-performing loans increased to 89.13% from 46.14%

(1)

Core deposits are all deposits except time deposits |

2015 Highlights –

First Quarter

6

•

Announced a merger agreement with Colonial American Bank. Colonial operates two

full service banking centers in Middletown and Shrewsbury, New Jersey, with

total assets of $143.7 million •

Grew

commercial

loan

portfolio

$41.3

million,

22.5%

annualized;

7

th

consecutive

quarter

of

double

digit percentage

growth

A new commercial lending team located in Mercer County, New Jersey, began

operations and provided strong support for the commercial loan growth

The Bank’s conservative credit culture was further enhanced with the addition

of a highly experienced Chief Credit Officer

•

Deposit growth totaled $80.8 million which included $73.7 million of core deposits

(all deposits except time deposits)

•

Earnings per share of $0.32; 9.6% ROE & 0.89% ROA annualized

Net interest margin relatively stable at 3.24%

Expense discipline led to reductions in operating expenses of 4.6%, as compared to

the prior linked quarter and 2.6%, as compared to the same prior year

quarter. •

Tangible common equity of 9.2% of assets |

Areas of Strategic Focus

•

Continued Emphasis on Commercial Banking

•

Renewed Focus on Deposit Gathering and Branching

•

Acquisition of Colonial American

•

Geographic Expansion via Mercer Loan Production Office

7 |

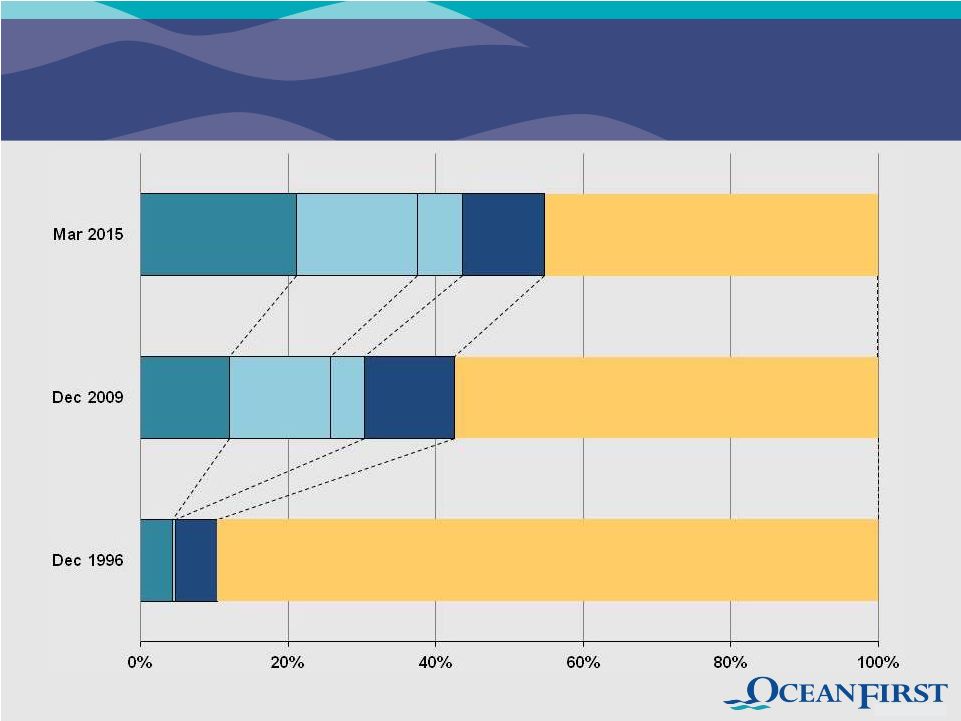

Strategic Loan Composition Transition

8

C&I

(1)

(1)

Commercial loan (CRE and C&I) duration of 3.2 years

(45.2%)

Residential R.E.

Consumer

& Other

C&I

Owner-

Occupied CRE

Investment CRE

Residential R.E.

Consumer

& Other

Investment

CRE

Owner-

Occupied CRE

Residential R.E.

Consumer

& Other

Investment

CRE |

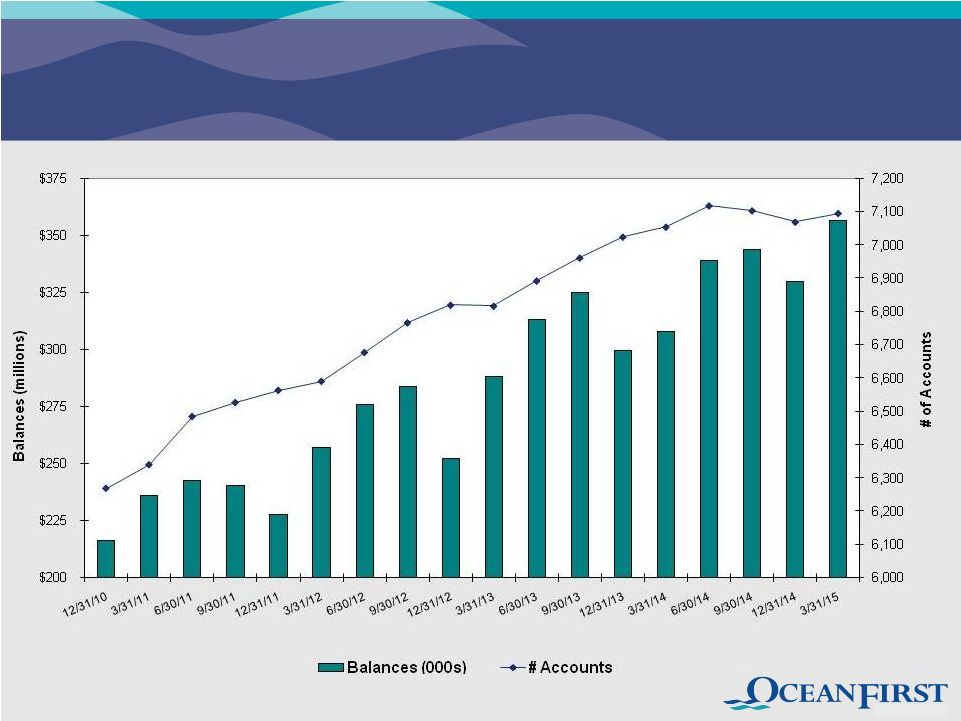

Deposit Transition Supported by Strategic Focus on

Business Checking

9 |

Deposit Driven Technology and Delivery Systems

Mobile Banking

Added mobile deposit capture

in 2013. More than 14,000

depositors use mobile, text or

smart phone apps monthly.

10

Online Banking & Bill Pay

In 2014, 42% of depositors used

online banking and an average of

34,000 bills were paid with online

bill pay service each month.

Check Card

Over 6 million transactions

processed in 2014, a 10.7%

increase from 2013. Rewards

program promotes usage.

ATM & Interactive Teller (ITM)

Invested $900,000 to upgrade ATM fleet

to intelligent terminals in 2014; self-

service

deposits

more

than

doubled.

First

ITM deployed in April 2014.

Commercial Cash Management

Added Remote Deposit Capture

(RDC)

in

2007.

In

2014,

88

clients

processed over 600,000 checks

using RDC. |

Colonial American Bank Acquisition

11

Supports

existing Red

Bank Financial

Center

•

Deal valued at $11.3 million

•

Favorable financial terms

•

Modest execution risk

•

Projected closing prior to year-

end 2015

•

Requires regulatory and CAB

shareholder approvals |

Additional Jackson Branch –

Second Quarter 2015

12

Second

Jackson Branch

Opening in

2015

•

Projected Opening June 2015

•

Strengthens Market Presence

•

Streamlined Operating Model |

Questions and Answers

Questions and Answers

13 |

THANK YOU

FOR ATTENDING THE

2015 ANNUAL MEETING

OF SHAREHOLDERS

14 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- OceanFirst Financial (OCFC) PT Lowered to $16 at DA Davidson

- Salesforge Gains Pre-Seed Funding of $500K to Create a Future-Proof AI Co-Pilot in B2B Sales

- Alvotech Announces Topline Results from a Confirmatory Clinical Study for AVT05, a Proposed Biosimilar for Simponi® (golimumab)

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share