Form 8-K NORFOLK SOUTHERN CORP For: Apr 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 29, 2016 (April 29, 2016)

________________________________

NORFOLK SOUTHERN CORPORATION

(Exact name of registrant as specified in its charter)

________________________________

Virginia | 1-8339 | 52-1188014 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

Three Commercial Place | 757-629-2680 | |

Norfolk, Virginia 23510-9241 | (Registrant's telephone number, including area code) | |

(Address of principal executive offices) | ||

No Change

(Former name or former address, if changed since last report)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[X] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

(17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

(17 CFR 240.13e-4(c))

Item 8.01. Other Events.

On April 29, 2016, Norfolk Southern Corporation posted to its corporate website, www.nscorp.com, a presentation for investors. A copy of that presentation is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibit is filed as part of this Current Report on Form 8-K:

Exhibit Number | Description |

99.1 | Investor Presentation |

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

SIGNATURES

NORFOLK SOUTHERN CORPORATION

(Registrant)

/s/ Denise W. Hutson

Name: Denise W. Hutson

Title: Corporate Secretary

Title: Corporate Secretary

Date: April 29, 2016

EXHIBIT INDEX

Exhibit Number | Description |

99.1 | Investor Presentation |

Investor Presentation April 29, 2016 1

Certain statements in this presentation are forward-looking statements within the meaning of the safe harbor provision of the Private Securities Litigation Reform Act of 1995, as amended. These statements relate to future events or Norfolk Southern Corporation’s (NYSE: NSC) (“Norfolk Southern,” “NS” or the “Company”) future financial performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results, levels of activity, performance or achievements of the Company or its industry to be materially different from those expressed or implied by any forward-looking statements. In some cases, forward-looking statements may be identified by the use of words like “believe,” “expect,” “anticipate,” “estimate,” “plan,” “consider,” “project,” and similar references to the future. The Company has based these forward-looking statements on management’s current expectations, assumptions, estimates, beliefs and projections. While the Company believes these expectations, assumptions, estimates, and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which involve factors or circumstances that are beyond the Company’s control. These and other important factors, including those discussed under “Risk Factors” in the Annual Report on Form 10-K for the year ended December 31, 2015, filed with the Securities and Exchange Commission (the “SEC”) on February 8, 2016, as well as the Company’s subsequent filings with the SEC, may cause our actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. Forward-looking statements are not, and should not be relied upon as, a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at or by which any such performance or results will be achieved. As a result, actual outcomes and results may differ materially from those expressed in forward-looking statements. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, the occurrence of certain events or otherwise, unless otherwise required by applicable securities law. 2 Forward-Looking Statements

Overview of Norfolk Southern 3 Norfolk Southern’s network interfaces with: 74% of U.S. population 66% of U.S. manufacturing 55% of total energy consumption in the U.S. Estimated 50M+ long-haul (1) truck shipments in our service area Extensive port access Note: (1) Over 550 miles Strong Network Supports Future Growth Intermodal 52% Coal 14% General Merchandise 34% Volume Mix (trailing 12-months 3/31) ~20,000 Route Miles of Track 22 States Served by Network 43 Ports Served by Network

Norfolk Southern’s Strategic Plan 4 Since Jim Squires was named CEO in June 2015, Norfolk Southern’s Board has worked closely with management to develop the strategic plan − Robust review of customer expectations, plant-level forecasts and market expectations − Extensive evaluation by highly qualified and independent Board of Directors − New management team in place to drive execution with Board ensuring accountability Norfolk Southern is already successfully implementing new plan to increase profitability and deliver enhanced value to shareholders Strategic plan will deliver significant long-term shareholder value by balancing cost savings, growth and capital return with investment Revenue Plan Optimize pricing Growth of service-sensitive traffic Conservative pricing and volume forecasts Cost Plan Service recovery allows Norfolk Southern to capitalize on cost initiatives Dynamic plan with flexibility to address market headwinds and opportunities On track to achieve more than $650 million of cost savings and an operating ratio of less than 65 by 2020 Superior service levels restored Reduced 2015 and 2016 capital spending Consolidated headquarters and reduced G&A Operating region and division consolidation Triple Crown restructuring Line / terminal rationalizations Delaware & Hudson line acquisition extended the network

Driving Increased Shareholder Value Increase asset utilization Optimize revenue – both pricing and volume Double-digit compound annual EPS growth Improve productivity to deliver efficient and superior service Reward shareholders with significant return of capital Operating Ratio < 70 Focus capital investment to support long-term value creation ~$2.0bn of CapEx Key Focus Areas Key Financial Targets Operating Ratio < 65 Dividend payout target of ~33% over the longer term and continuation of dividend growth and significant share repurchases CapEx ~17% of revenue 2016E 2020E Disciplined pricing increases above rail inflation 5 Intensely focused on executing initiatives to drive long-term shareholder value

Norfolk Southern Actions and Strategic Plan Already Showing Results 6 Norfolk Southern continues to demonstrate its ability to deliver shareholder value Record first quarter operating ratio Double digit earnings per share growth Service improvements provided a solid foundation Norfolk Southern is on track to achieve its 2016 objectives 70.1% operating ratio 630-basis point, or 8%, improvement EPS increased 29% to $1.29 Composite service performance increased 23% Train speed improved 15% Terminal dwell reduced by 14% Productivity savings ~ $200 million Operating ratio below 70% First Quarter 2016 Highlights

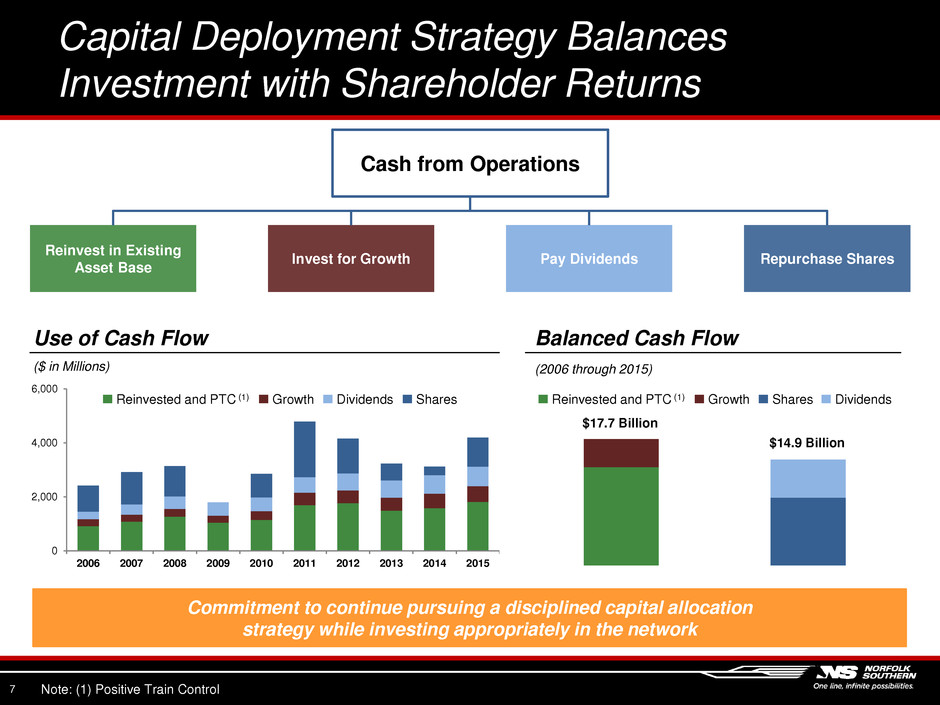

Capital Deployment Strategy Balances Investment with Shareholder Returns 0 2,000 4,000 6,000 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Balanced Cash Flow (2006 through 2015) Use of Cash Flow ($ in Millions) $17.7 Billion $14.9 Billion Cash from Operations Reinvest in Existing Asset Base Invest for Growth Pay Dividends Repurchase Shares 7 Commitment to continue pursuing a disciplined capital allocation strategy while investing appropriately in the network Note: (1) Positive Train Control Reinvested and PTC (1) Growth Dividends Shares Reinvested and PTC (1) Growth Dividends Shares

Norfolk Southern’s New Leadership Team 8 23 years of experience at Norfolk Southern Previously served as Chief Financial Officer, Executive Vice President Administration and Senior Vice President Law Jim Squires Chairman, President & CEO Appointed CEO in June 2015 30 years of experience at Norfolk Southern Previously served as Vice President Engineering and Vice President Transportation Mike Wheeler Executive Vice President & COO Appointed COO in Feb. 2016 30 years of experience at Norfolk Southern Previously served as Vice President Human Resources, Vice President IT and Executive Vice President Administration Cindy Earhart Executive Vice President & CIO Appointed CIO in Sep. 2015 22 years of experience at Norfolk Southern Previously served as Vice President Intermodal Operations, Vice President Chemicals and Vice President Coal Marketing Alan Shaw Executive Vice President & CMO Appointed CMO in May 2015 Marta Stewart Executive Vice President & CFO Appointed CFO in Sep. 2013 32 years of experience at Norfolk Southern Previously served as Controller and Principal Accounting Officer and Vice President Treasurer • Triple Crown restructuring complete • Roanoke closure complete • Service levels restored to record levels • Reduced capital spending by $100M+ in 2015 • Completed Delaware & Hudson line acquisition • Began line rationalizations, division consolidation • Downsized more than 20 terminals • Focusing on strong service levels • Managing coal-related headcount • Streamlining switching yards and terminals • Reducing secondary main line network • Optimizing investment in locomotives • Improving fuel efficiency Ongoing initiatives to Drive Long-Term Value Creation Actions Taken to Establish Foundation for Success

James A. Squires President & CEO Chairman of the Board Steven F. Leer Lead Independent Director Former CEO and Chairman, Arch Coal 5 11 6 4 5 7 11 8 5 11 Transportation Strategic Planning Marketing Information Technology HR and Compensation Government Relations Governance/Board Finance and Accounting Environmental and Safety CEO/Senior Office Highly Engaged & Effective Board of Directors Our Directors’ Skills & Expertise Board Independence and Tenure Norfolk Southern Corporate Governance Best Practices Annually elected directors Extensive shareholder engagement Majority voting standard Lead independent director Shareholders right to call a special meeting Robust Enterprise Risk Management program 91% 9% Independent Insider 1 5 3 1 1 < 2 years 3 - 5 years 6 - 10 years > 10 years Independent Chairman / CEO Norfolk Southern’s Highly Independent and Experienced Board Nominees 9 Thomas D. Bell, Jr. Chairman, Mesa Capital Partners Erskine B. Bowles Senior Advisor and Non- Executive Vice Chairman, BDT Capital Partners Robert A. Bradway Chairman and CEO, Amgen Wesley G. Bush Chairman, CEO and President, Northrop Grumman Daniel A. Carp Former Chairman and CEO, Eastman Kodak Company Michael D. Lockhart Former Chairman, President and CEO, Armstrong World Industries Amy E. Miles CEO, Regal Entertainment Group Martin H. Nesbitt Co-Founder, The Vistria Group John R. Thompson Former Senior Vice President and General Manager, Best Buy.com Average Tenure: <6 Years

Norfolk Southern’s Board Is Focused on Driving Value for All Shareholders 10 Norfolk Southern’s Board is open to all alternatives to create shareholder value − The Board oversaw the development of Norfolk Southern’s new strategic plan that is driving significant improvement in operational and financial performance − In response to Canadian Pacific’s acquisition proposals, the Board led a thorough and objective process focused on value and certainty relative to Norfolk Southern’s strategic plan − The Board concluded that the proposals undervalued Norfolk Southern and created regulatory uncertainties that were highly unlikely to be overcome, and urged CP to pursue an STB declaratory order to address the regulatory concerns − Board’s concerns regarding the regulatory uncertainty of the proposal were echoed by a large number of prominent, independent constituencies, most recently the Department of Justice and the U.S. Army Shareholder feedback informed every step of the Board’s analysis of the strategic plan and CP’s proposals − Over the past six months, Norfolk Southern engaged with shareholders representing over 55% of shares held by institutional investors regarding its strategic plan and CP’s proposed business combination Independent Board will hold management team accountable for achievement of strategic plan − Our Board is highly-experienced, with a deep understanding of our business and markets − All directors other than CEO are independent, with balanced tenure that combines both fresh and long-term perspectives − Current Board was responsible for the senior leadership transition at Norfolk Southern over the past year – which has enabled the new strategic plan and has been a key driver of significant operational and financial improvements The Board believes that the Norfolk Southern strategic plan is the best alternative to drive shareholder value – and will hold the Norfolk Southern team accountable for execution of the plan

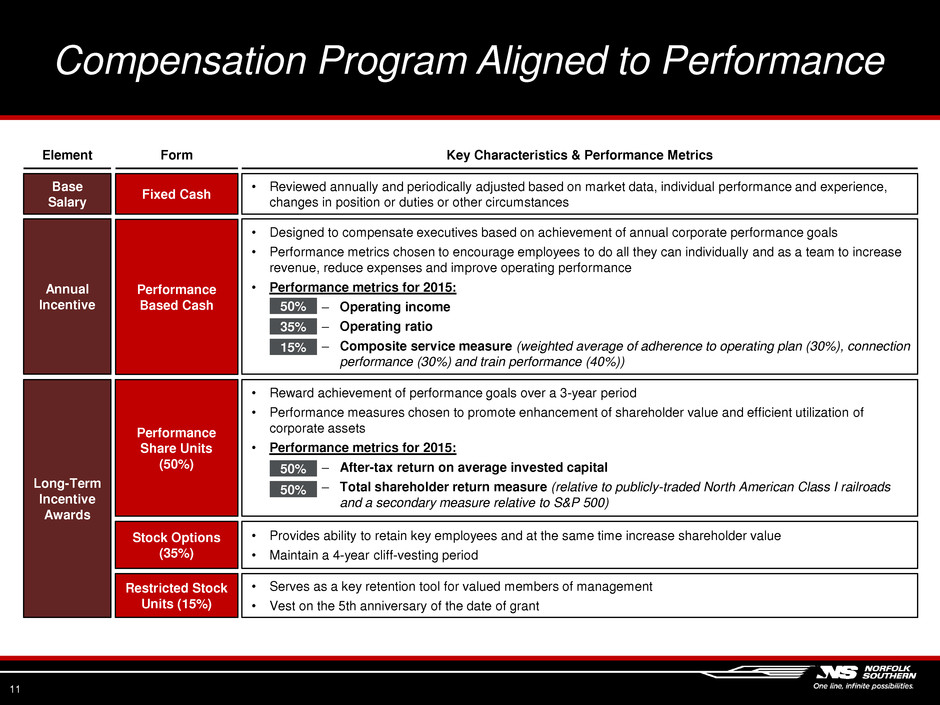

Compensation Program Aligned to Performance 11 Long-Term Incentive Awards Fixed Cash Performance Based Cash Performance Share Units (50%) • Reviewed annually and periodically adjusted based on market data, individual performance and experience, changes in position or duties or other circumstances Element Form Key Characteristics & Performance Metrics Annual Incentive Base Salary • Designed to compensate executives based on achievement of annual corporate performance goals • Performance metrics chosen to encourage employees to do all they can individually and as a team to increase revenue, reduce expenses and improve operating performance • Performance metrics for 2015: ‒ Operating income ‒ Operating ratio ‒ Composite service measure (weighted average of adherence to operating plan (30%), connection performance (30%) and train performance (40%)) 50% 35% • Reward achievement of performance goals over a 3-year period • Performance measures chosen to promote enhancement of shareholder value and efficient utilization of corporate assets • Performance metrics for 2015: ‒ After-tax return on average invested capital ‒ Total shareholder return measure (relative to publicly-traded North American Class I railroads and a secondary measure relative to S&P 500) 15% Stock Options (35%) Restricted Stock Units (15%) 50% 50% • Provides ability to retain key employees and at the same time increase shareholder value • Maintain a 4-year cliff-vesting period • Serves as a key retention tool for valued members of management • Vest on the 5th anniversary of the date of grant

80.0% 79.6% 2014 Target 2015 Target 69.9% 68.8% 2014 Target 2015 Target $3.44 $3.64 2014 Target 2015 Target Compensation Mix & Challenging 2015 Targets Align Executive Goals with Performance Goals 12 To align executive goals with the company’s performance goals, the Board set more challenging 2015 operating income & operating ratio annual incentive targets. 2016 compensation targets are aligned with the 2016 and long-term strategic plan goals. 58% 20% 22% 73% 16% 11% Long-Term Incentive Awards Annual Incentive Salary CEO Other Non-Executive Officers 2015 Target Total Compensation Mix Operating Income Targets Operating Ratio Targets Composite Service Measures Targets

Commitment to Strong Compensation Governance Practices 13 WE DO WE DON’T DO Stock Ownership Guidelines CEO – 5 times annual salary EVPs – 3 times annual salary Pledging or hedging of Norfolk Southern securities Clawback provisions in both annual and long-term incentives Stock option repricing, reloads or exchanges without shareholder approval Directly link the Corporation’s performance, including the Corporation’s stock-price performance, to pay outcomes Stock options granted below fair market value, as all stock options are priced during an open window period after the release of earnings Disclose metrics for annual and long-term incentives earned Tax gross-ups on perquisites or excise tax gross-ups on change-in-control benefits Independent compensation consultant that is hired by and reports directly to the Compensation Committee Individual employment agreements or individual supplemental retirement plans Annual Say-on-Pay vote Single trigger change-in-control agreements Our executive compensation program reflects leading governance principles and demonstrates our commitment to best practices in executive compensation

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Ancora Sends Important Letter to Fellow Shareholders on Norfolk Southern (NSC) Turnaround Plan

- Travel + Leisure Co. and Allegiant Announce Multi-Year Marketing Agreement

- Empire State Realty Trust Publishes 2023 Sustainability Report with Major Achievements, Key Goals, and Transparent Metrics

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share