Form 8-K NCR CORP For: Apr 28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 28, 2015

NCR CORPORATION

(Exact name of registrant as specified in its charter)

Commission File Number 001-00395

Maryland | 31-0387920 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3097 Satellite Boulevard

Duluth, Georgia 30096

(Address of principal executive offices and zip code)

Registrant's telephone number, including area code: (937) 445-5000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On April 28, 2015, the Company issued a press release setting forth its first quarter 2015 financial results along with its fiscal year 2015 financial outlook and its second quarter 2015 financial outlook. A copy of the press release is attached hereto as Exhibit 99.1 and hereby incorporated by reference.

Item 7.01. Regulation FD Disclosure.

On April 28, 2015, the Company will hold its previously announced conference call to discuss its first quarter 2015 results, its fiscal year 2015 financial outlook and its second quarter 2015 financial outlook. A copy of supplementary materials that will be referred to in the conference call, and which were posted to the Company’s website, is attached hereto as Exhibit 99.2.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

The following exhibits are attached with this current report on Form 8-K:

Exhibit No. | Description |

99.1 | Press Release issued by the Company, dated April 28, 2015 |

99.2 | Supplemental materials, dated April 28, 2015 |

- 2 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

NCR Corporation | ||

By: | /s/ Robert Fishman | |

Robert Fishman | ||

Senior Vice President and Chief Financial Officer | ||

Date: April 28, 2015

- 3 -

Index to Exhibits

The following exhibits are attached with this current report on Form 8-K:

Exhibit No. Description

99.1 Press Release issued by the Company, dated April 28, 2015

99.2 Supplemental materials, dated April 28, 2015

- 4 -

| NEWS RELEASE | |

April 28, 2015

NCR Announces First Quarter 2015 Results

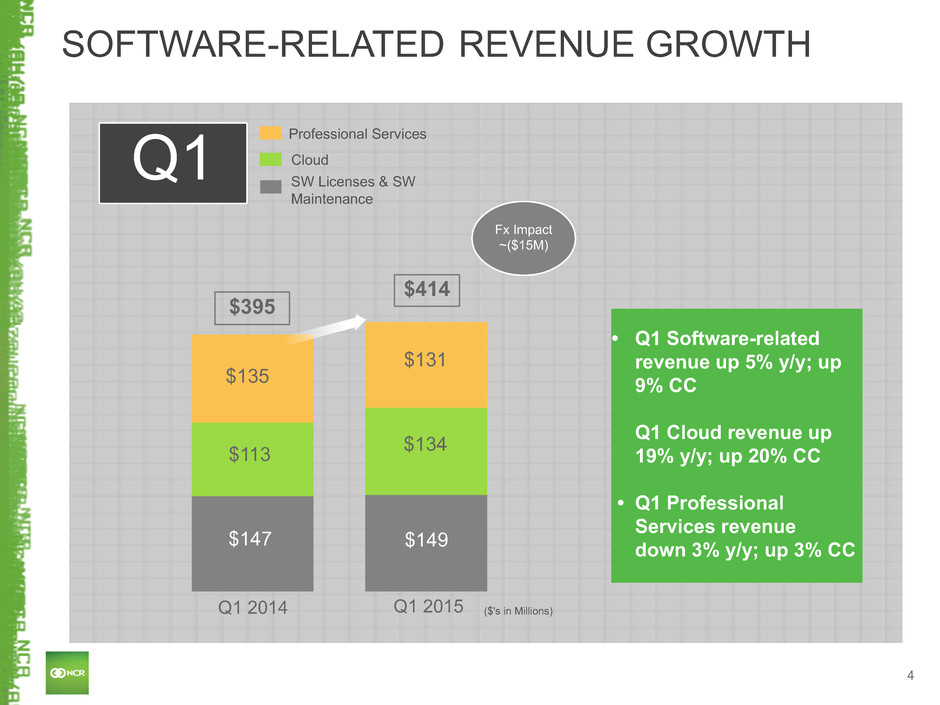

• | Revenue of $1.48 billion, down 3% as reported, up 3% constant currency; Growth in software-related revenue to $414 million, up 9% constant currency, and growth in cloud revenue to $134 million, up 20% constant currency growth |

• | Non-pension operating income (NPOI) of $146 million, down 6% as reported, up 6% constant currency; GAAP income from operations decreased 12% to $95 million, primarily due to restructuring and foreign currency impacts |

• | Non-GAAP diluted EPS of $0.43, GAAP diluted EPS of $0.23 |

• | Free cash flow improvement of $75 million; net cash provided by operating activities of $79 million |

• | 2015 full year as reported guidance reaffirmed despite additional unfavorable FX impacts |

DULUTH, Georgia - NCR Corporation (NYSE: NCR) reported financial results today for the three months ended March 31, 2015.

"We are off to a good start in 2015. Our first quarter results were in-line with our expectations and we improved execution across our organization,” said Chairman and CEO Bill Nuti. “Our constant currency growth was driven primarily by the impact of our omni-channel solutions in Financial Services. In Retail Solutions, we are beginning to see investment priorities shifting from security back towards omni-channel and customer experience solutions and while we are not pleased with the operating results in Retail Solutions in the first quarter, we continue to forecast improvement in the second half of the year. We expanded our total software revenues during the quarter, including strong cloud revenue growth, and further advanced our sales and services transformation initiatives as we work to build a stronger NCR. We are excited about the opportunities ahead of us this year and are focused on continuing to deliver innovation, value and leading omni-channel solutions to our customers."

Q1 Financial Summary

First Quarter | |||||||

$ in millions, except per share amounts | 2015 | 2014 | As Reported | Constant Currency | |||

Revenue | $1,476 | $1,518 | (3)% | 3% | |||

Income from operations * | $95 | $108 | (12)% | ||||

Non-pension operating income (NPOI) | $146 | $155 | (6)% | 6% ** | |||

Diluted earnings per share *** | $0.23 | $0.31 | (26)% | ||||

Non-GAAP diluted earnings per share | $0.43 | $0.50 | (14)% | 2% ** | |||

* | Income from operations in the first quarter of 2015 includes a $16 million charge related to the ongoing restructuring plan. |

** | NPOI includes approximately $18 million and non-GAAP diluted earnings per share includes approximately $0.08 of unfavorable foreign currency impacts. |

*** | Diluted earnings per share in the first quarter of 2015 includes $0.07 related to the ongoing restructuring plan. |

In this release, we use the non-GAAP measures non-pension operating income (NPOI), non-GAAP diluted earnings per share and free cash flow, and we present certain measures on a constant currency basis. These non-GAAP measures are described and reconciled to their most directly comparable GAAP measures elsewhere in this release.

Q1 Supplemental Revenue Information

First Quarter | |||||||||||||

$ in millions | 2015 | 2014 | % Change | % Change Constant Currency | |||||||||

Cloud * | $ | 134 | $ | 113 | 19 | % | 20 | % | |||||

Software License/Software Maintenance | 149 | 147 | 1 | % | 6 | % | |||||||

Professional Services | 131 | 135 | (3 | %) | 3 | % | |||||||

Total Software-Related Revenue | 414 | 395 | 5 | % | 9 | % | |||||||

Hardware | 539 | 570 | (5 | %) | 2 | % | |||||||

Other Services | 523 | 553 | (5 | %) | 2 | % | |||||||

Total Revenue | $ | 1,476 | $ | 1,518 | (3 | %) | 3 | % | |||||

* Referred to as Software-as-a-Service or SaaS in prior Company earnings releases.

Software-related revenue increased 5% in the first quarter and increased 9% on a constant currency basis, including 19% growth in cloud revenue driven by Financial Services and Hospitality.

Q1 Operating Segment Results

First Quarter | |||||||||||

$ in millions | 2015 | 2014 | % Change | % Change Constant Currency | |||||||

Revenue by segment | |||||||||||

Financial Services | $ | 798 | $ | 794 | 1% | 9% | |||||

Retail Solutions | 445 | 490 | (9)% | (4)% | |||||||

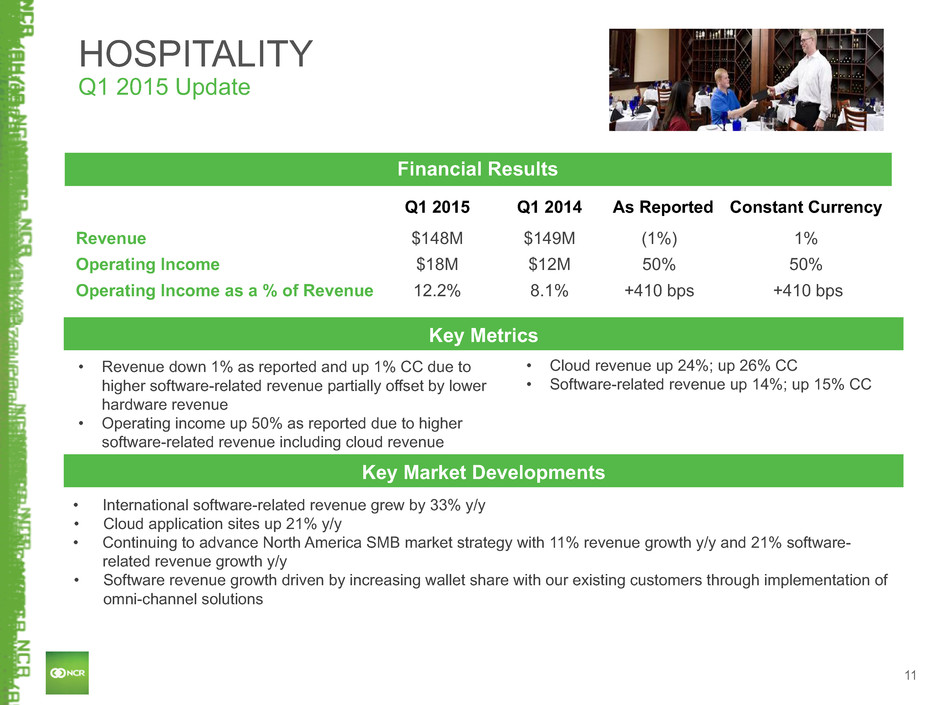

Hospitality | 148 | 149 | (1)% | 1% | |||||||

Emerging Industries | 85 | 85 | —% | 8% | |||||||

Total Revenue | $ | 1,476 | $ | 1,518 | (3)% | 3% | |||||

Operating income by segment | |||||||||||

Financial Services | $ | 105 | $ | 103 | |||||||

% of Financial Services Revenue | 13.2 | % | 13.0 | % | |||||||

Retail Solutions | 16 | 36 | |||||||||

% of Retail Solutions Revenue | 3.6 | % | 7.3 | % | |||||||

Hospitality | 18 | 12 | |||||||||

% of Hospitality Revenue | 12.2 | % | 8.1 | % | |||||||

Emerging Industries | 7 | 4 | |||||||||

% of Emerging Industries Revenue | 8.2 | % | 4.7 | % | |||||||

Segment operating income | $ | 146 | $ | 155 | |||||||

% of Total Revenue | 9.9 | % | 10.2 | % | |||||||

Revenue was down 3% as reported and was up 3% on a constant currency basis. Financial Services' constant currency growth was driven by improvements in software-related revenue in the Americas, Europe and Middle East Africa. Emerging Industries' constant currency growth was driven by improvements in our Telecom & Technology business. Hospitality's constant currency growth was driven by higher software-related revenue, partially offset by lower hardware

2

revenue. Retail Solutions constant currency revenue results were negatively impacted by reduced spending by retailers, which we expect to improve in the second half of 2015.

Segment operating income was stronger in Financial Services driven by a higher mix of omni-channel solutions. Segment operating income was also stronger in Hospitality driven by higher software-related revenue including cloud revenue, and stronger in Emerging Industries due to higher services margins. Retail solutions operating income was down due to lower volume and a less favorable mix of software-related revenue.

Free Cash Flow

First Quarter | |||||||

$ in millions | 2015 | 2014 | |||||

Net cash provided by operating activities | $ | 79 | $ | 31 | |||

Total capital expenditures | (51 | ) | (66 | ) | |||

Net cash provided by (used in) discontinued operations | (4 | ) | (16 | ) | |||

Free cash flow | $ | 24 | $ | (51 | ) | ||

Free cash flow improved by $75 million in the first quarter of 2015 as compared to the first quarter of 2014 driven by improvements in cash from operations, lower capital expenditures, and discontinued operations.

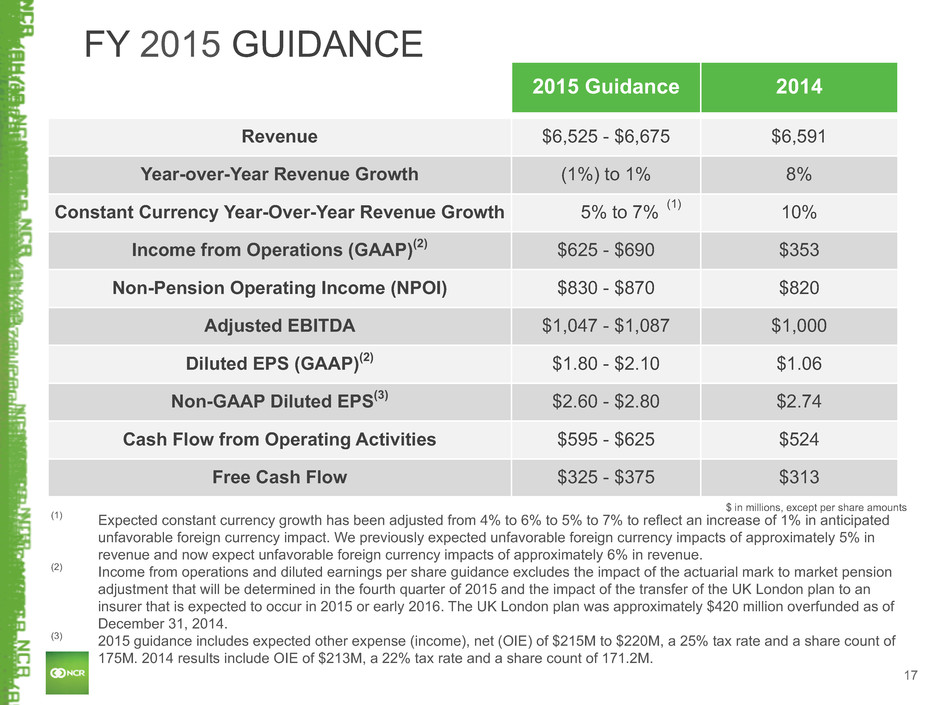

2015 Outlook

We are reaffirming our 2015 as reported guidance despite an increase in anticipated unfavorable foreign exchange impacts from our prior expectations. We previously expected unfavorable foreign currency impacts of 5% in revenue, $50 million in NPOI and $0.20 per share in non-GAAP diluted EPS. We now expect unfavorable foreign currency impacts of 6% in revenue, $75 million in NPOI and $0.30 per share in non-GAAP diluted EPS.

$ in millions, except per share amounts | 2015 Guidance | 2014 Actual | ||||

Revenue | $6,525 - $6,675 | $6,591 | ||||

Year-over-year revenue growth | (1%) to 1% | 8% | ||||

Constant currency revenue growth | 5% to 7% | (1) | 10% | |||

Income from operations (GAAP) | $625 - $690 | (2) | $353 | (2) | ||

Non-pension operating income (NPOI) | $830 - $870 | $820 | ||||

Diluted earnings per share (GAAP) | $1.80 - $2.10 | (2) | $1.06 | (2) | ||

Non-GAAP Diluted EPS | $2.60 - $2.80 | (3) | $2.74 | |||

Net cash provided by operating activities | $595 - $625 | $524 | ||||

Free cash flow | $325 - $375 | $313 | ||||

(1) | Expected constant currency growth has been adjusted from 4% to 6% to 5% to 7% to reflect an increase of 1% in anticipated unfavorable foreign currency impact. We previously expected unfavorable foreign currency impacts of approximately 5% in revenue and now expect unfavorable foreign currency impacts of approximately 6% in revenue. |

(2) | For 2014, actuarial mark-to-market pension adjustment is included; 2015 guidance does not include actuarial mark-to-market pension adjustments, which will be determined in Q4 2015. The impact of the transfer of the UK London pension plan to an insurer expected to occur in 2015 or early 2016 is excluded from the 2015 guidance. The UK London pension plan was approximately $420 million overfunded as of December 31, 2014. |

(3) | NCR expects approximately $215 million to $220 million of other expense, net including interest expense in 2015 and that its full-year 2015 effective income tax rate will be approximately 25% compared to 22% in 2014. |

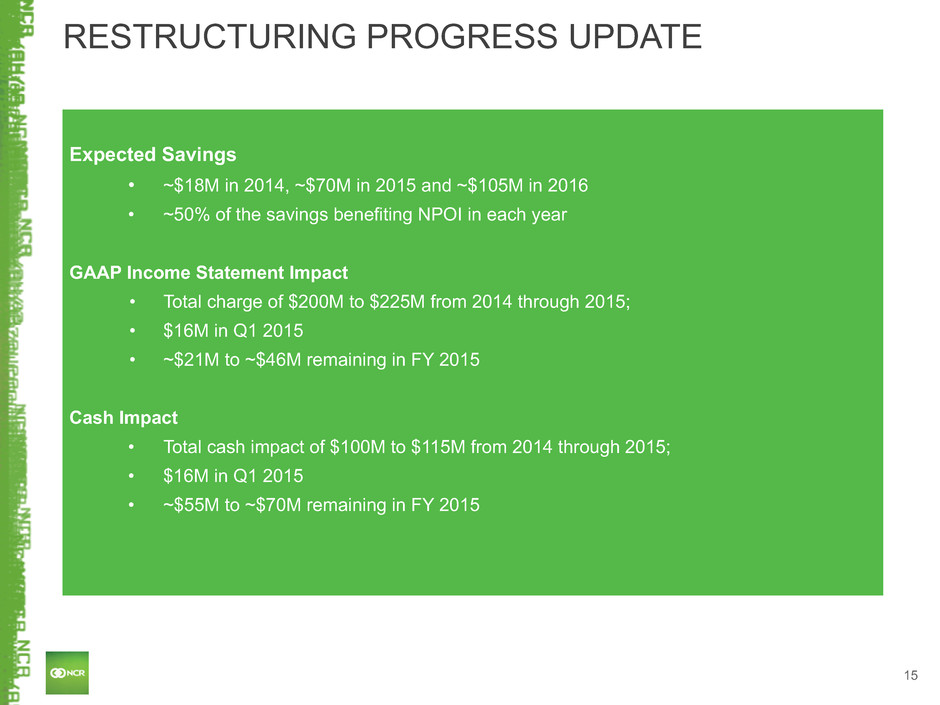

The Company is on track with progress to date with the restructuring plan. In 2015, NCR expects to incur a pre-tax charge of approximately $39 million to $64 million with $16 million recorded during Q1 2015. Cash payments in 2015

3

are expected to be approximately $71 million to $86 million with $16 million paid during Q1 2015. Savings are in line with previous expectations with approximately $18 million in 2014, $70 million in 2015 and $105 million in 2016, with about 50% of the savings benefiting NPOI.

Q2 2015 Outlook

For the second quarter of 2015, the Company expects non-pension operating income (NPOI) to be in the range of $190 million to $200 million, compared to $210 million in the second quarter of 2014, and income from operations to be in the range of $140 million to $150 million, compared to $169 million in the second quarter of 2014. The unfavorable foreign currency impact on NPOI is expected to be approximately $20 million in the second quarter of 2015. NCR expects its second quarter 2015 effective income tax rate to be approximately 28% and other expense, net including interest expense to be approximately $55 million.

2015 First Quarter Earnings Conference Call

A conference call is scheduled for today at 4:30 p.m. (EDT) to discuss the first quarter 2015 results and guidance for second quarter and full-year 2015. Access to the conference call and accompanying slides, as well as a replay of the call, are available on NCR's web site at http://investor.ncr.com/. Additionally, the live call can be accessed by dialing 866-409-1555 and entering the participant passcode 6680678.

More information on NCR’s Q1 2015 earnings, including additional financial information and analysis, is available on NCR’s Investor Relations website at http://investor.ncr.com/.

About NCR Corporation

NCR Corporation (NYSE: NCR) is the global leader in consumer transaction technologies, turning everyday interactions with businesses into exceptional experiences. With its software, hardware, and portfolio of services, NCR enables nearly 550 million transactions daily across the financial, retail, hospitality, travel, telecom and technology industries. NCR solutions run the everyday transactions that make your life easier.

NCR is headquartered in Duluth, Georgia with over 30,000 employees and does business in 180 countries. NCR is a trademark of NCR Corporation in the United States and other countries. NCR encourages investors to visit its web site which is updated regularly with financial and other important information about NCR.

Web site: www.ncr.com

Twitter: @NCRCorporation

Facebook: www.facebook.com/ncrcorp

LinkedIn: http://linkd.in/ncrgroup

YouTube: www.youtube.com/user/ncrcorporation

News Media Contact

Lou Casale

NCR Corporation

212.589.8415

Investor Contact

Gavin Bell

NCR Corporation

212.589.8468

4

Note to Investors This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements use words such as “expect,” “anticipate,” “outlook,” “intend,” “believe,” “will,” “should,” “would,” “could” and words of similar meaning. Statements that describe or relate to NCR’s future plans, goals, intentions, strategies or financial outlook, and statements that do not relate to historical or current fact, are examples of forward-looking statements. The forward-looking statements in this release include statements about expected industry investment trends, and market and economic conditions affecting NCR and its business; expectations regarding foreign currency fluctuations and their impact on NCR's results; expectations for NCR's growth; NCR's ongoing restructuring plan and its costs, expected benefits and results; and NCR's 2015 financial outlook (including in the sections entitled “2015 Outlook” and “Q2 2015 Outlook”). Forward-looking statements are based on our current beliefs, expectations and assumptions, which may not prove to be accurate, and involve a number of known and unknown risks and uncertainties, many of which are out of NCR's control. Forward-looking statements are not guarantees of future performance, and there are a number of important factors that could cause actual outcomes and results to differ materially from the results contemplated by such forward-looking statements, including those factors relating to: domestic and global economic and credit conditions including, in particular, market conditions and spending trends in the retail industry; the impact of our indebtedness and its terms on our financial and operating activities; foreign currency fluctuations; our ability to successfully introduce new solutions and compete in the information technology industry; the transformation of our business model and our ability to sell higher-margin software and services; our ability to improve execution in our sales and services organizations; defects or errors in our products; manufacturing disruptions; the historical seasonality of our sales; compliance with data privacy and protection requirements; the availability and success of acquisitions, divestitures and alliances, including the acquisition of Digital Insight; our pension strategy and underfunded pension obligation; the success of our ongoing restructuring plan; tax rates; reliance on third party suppliers; development and protection of intellectual property; workforce turnover and the ability to attract and retain skilled employees; environmental exposures from our historical and ongoing manufacturing activities; and uncertainties with regard to regulations, lawsuits, claims and other matters across various jurisdictions. Additional information concerning these and other factors can be found in the Company's filings with the U.S. Securities and Exchange Commission, including the Company’s most recent annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Any forward-looking statement speaks only as of the date on which it is made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures While NCR reports its results in accordance with Generally Accepted Accounting Principles in the United States, or GAAP, in this release NCR also uses the non-GAAP measures listed and described below.

Non-Pension Operating Income and Non-GAAP Diluted Earnings Per Share. NCR’s non-pension operating income and non-GAAP diluted earnings per share are determined by excluding pension expense and special items, including amortization of acquisition related intangibles, from NCR’s GAAP income (loss) from operations. Due to the significant change in its pension expense from year to year and the non-operational nature of pension expense and these special items, NCR's management uses non-pension operating income and non-GAAP diluted earnings per share to evaluate year-over-year operating performance, to manage and determine the effectiveness of its business managers and as a basis for incentive compensation. NCR believes these measures are useful for investors because they provide a more complete understanding of NCR's underlying operational performance, as well as consistency and comparability with NCR's past reports of financial results.

Free Cash Flow. NCR defines free cash flow as net cash provided by/used in operating activities and cash flow provided by/used in discontinued operations less capital expenditures for property, plant and equipment, additions to capitalized software, discretionary pension contributions and settlements. NCR's management uses free cash flow to assess the financial performance of the Company and believes it is useful for investors because it relates the operating cash flow of the Company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures which can be used for, among other things, investment in the Company's existing businesses, strategic acquisitions, strengthening the Company's balance sheet, repurchase of Company stock and repayment of the Company's debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure. Free cash flow does not have a uniform definition under GAAP and, therefore, NCR's definition may differ from other companies' definitions of this measure.

Constant Currency. NCR presents certain measures, such as period-over-period revenue growth, on a constant currency basis, which excludes the effects of foreign currency translation. Due to the continuing strengthening of the U.S. dollar against foreign currencies and the overall variability of foreign exchange rates from period to period, NCR’s management uses these measures on a constant currency basis to evaluate period-over-period operating performance. Measures presented on a constant currency basis are calculated by translating current period results at prior period monthly average exchange rates.

NCR's definitions and calculations of these non-GAAP measures may differ from similarly-titled measures reported by other companies and cannot, therefore, be compared with similarly-titled measures of other companies. These non-GAAP measures should not be considered as substitutes for, or superior to, results determined in accordance with GAAP. These non-GAAP measures are

5

reconciled to their most directly comparable GAAP measures in the tables below or, in the case of quarterly free cash flow, in the body of this release.

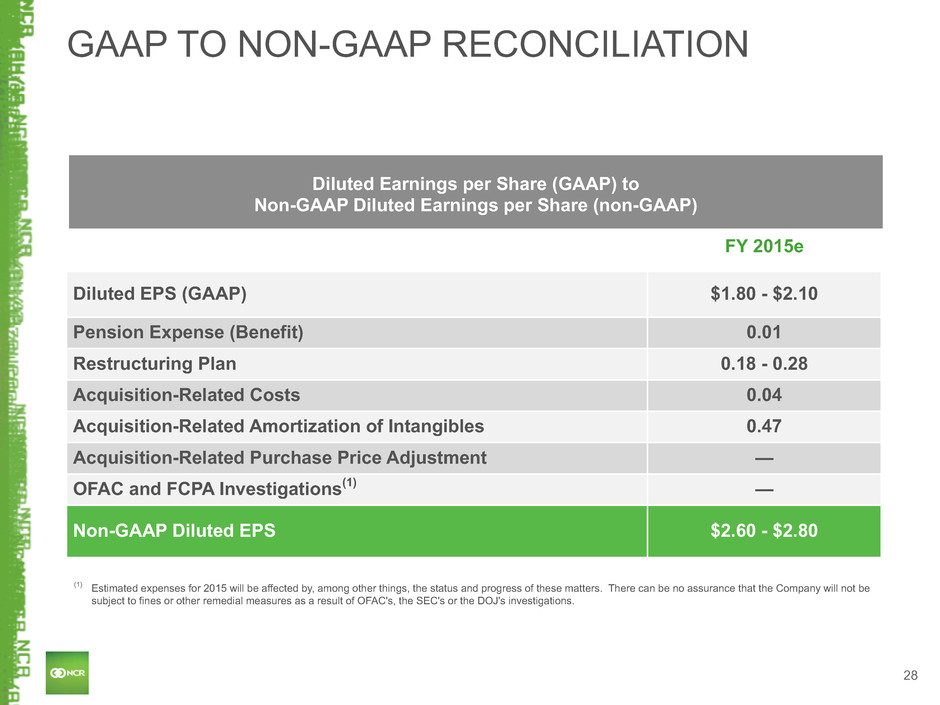

Reconciliation of Diluted Earnings Per Share (GAAP) to Non-GAAP Diluted Earnings Per Share (non-GAAP)

Q1 2015 Actual | Q1 2014 Actual | 2015 Guidance | 2014 Actual | |||||||||||

Diluted EPS (GAAP) | $ | 0.23 | $ | 0.31 | $1.80 - $2.10 | $ | 1.06 | |||||||

Pension (benefit) expense | — | — | 0.01 | 0.38 | ||||||||||

Restructuring plan | 0.07 | — | 0.18 - 0.28 | 0.68 | ||||||||||

Acquisition-related costs | 0.01 | 0.06 | 0.04 | 0.12 | ||||||||||

Acquisition-related amortization of intangibles | 0.12 | 0.11 | 0.47 | 0.47 | ||||||||||

Acquisition-related purchase price adjustments | — | 0.01 | — | 0.02 | ||||||||||

OFAC and FCPA Investigations (1) | — | 0.01 | — | 0.01 | ||||||||||

Non- GAAP Diluted EPS | $ | 0.43 | $ | 0.50 | $2.60 - $2.80 | $ | 2.74 | |||||||

Reconciliation of Income from Operations (GAAP) to Non-pension Operating Income (non-GAAP)

$ in millions | Q1 2015 Actual | Q1 2014 Actual | 2015 Guidance | 2014 Actual | Q2 2015 Guidance | Q2 2014 Actual | |||||||||||||||

Income from Operations (GAAP) | $ | 95 | $ | 108 | $625 - $690 | $ | 353 | $140 - $150 | $ | 169 | |||||||||||

Pension (benefit) expense | — | (1 | ) | 3 | 152 | 1 | 2 | ||||||||||||||

Restructuring plan | 16 | — | 39 - 64 | 160 | 14 | — | |||||||||||||||

Acquisition-related costs | 2 | 14 | 10 | 27 | 3 | 6 | |||||||||||||||

Acquisition-related amortization of intangibles | 32 | 30 | 127 | 119 | 32 | 30 | |||||||||||||||

Acquisition-related purchase price adjustments | — | 3 | — | 6 | — | 2 | |||||||||||||||

OFAC and FCPA Investigations (1) | 1 | 1 | 1 | 3 | — | 1 | |||||||||||||||

Non-pension Operating Income (non-GAAP) | $ | 146 | $ | 155 | $830 - $870 | $ | 820 | $190 - $200 | $ | 210 | |||||||||||

Reconciliation of Net Cash Provided by Operating Activities (GAAP) to Free Cash Flow (non-GAAP)

$ in millions | 2015 Guidance |

Net cash provided by operating activities | $595 - $625 |

Total capital expenditures | (215) - (235) |

Net cash provided by (used in) discontinued operations | (35) |

Free cash flow | $325 - $375 |

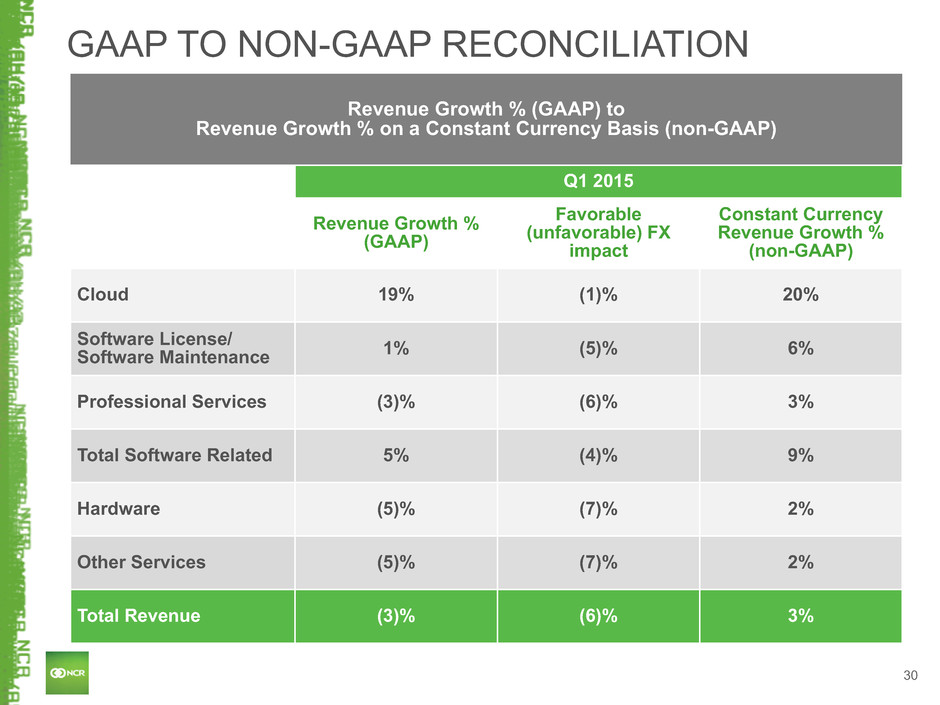

Reconciliation of Revenue Growth (GAAP) to Revenue Growth on a Constant Currency Basis (non-GAAP)

Revenue Growth % (GAAP) | Favorable (unfavorable) FX impact | Constant Currency Revenue Growth % (non-GAAP) | |||

Financial Services | 1% | (8)% | 9% | ||

Retail Solutions | (9)% | (5)% | (4)% | ||

Hospitality | (1)% | (2)% | 1% | ||

Emerging Industries | —% | (8)% | 8% | ||

Total Revenue | (3)% | (6)% | 3% | ||

6

Revenue Growth % (GAAP) | Favorable (unfavorable) FX impact | Constant Currency Revenue Growth % (non-GAAP) | ||||||

Cloud | 19 | % | (1 | )% | 20 | % | ||

Software License/Software Maintenance | 1 | % | (5 | )% | 6 | % | ||

Professional Services | (3 | )% | (6 | )% | 3 | % | ||

Total Software-Related Revenue | 5 | % | (4 | )% | 9 | % | ||

Hardware | (5 | )% | (7 | )% | 2 | % | ||

Other Services | (5 | )% | (7 | )% | 2 | % | ||

Total Revenue | (3 | )% | (6 | )% | 3 | % | ||

(1) Estimated expenses for 2015 will be affected by, among other things, the status and progress of these matters. There can be no assurance that the Company will not be subject to fines or other remedial measures as a result of OFAC’s, the SEC’s or the DOJ’s investigations.

7

| NCR CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) (in millions, except per share amounts) | Schedule A |

For the Periods Ended March 31 | |||||||

Three Months | |||||||

2015 | 2014 | ||||||

Revenue | |||||||

Products | $ | 604 | $ | 634 | |||

Services | 872 | 884 | |||||

Total Revenue | 1,476 | 1,518 | |||||

Cost of products | 483 | 476 | |||||

Cost of services | 603 | 626 | |||||

Total gross margin | 390 | 416 | |||||

% of Revenue | 26.4 | % | 27.4 | % | |||

Selling, general and administrative expenses | 225 | 245 | |||||

Research and development expenses | 55 | 63 | |||||

Restructuring-related charges | 15 | — | |||||

Income from operations | 95 | 108 | |||||

% of Revenue | 6.4 | % | 7.1 | % | |||

Interest expense | (44 | ) | (43 | ) | |||

Other (expense), net | (7 | ) | (7 | ) | |||

Total other (expense), net | (51 | ) | (50 | ) | |||

Income before income taxes and discontinued operations | 44 | 58 | |||||

% of Revenue | 3.0 | % | 3.8 | % | |||

Income tax expense | 2 | 4 | |||||

Income from continuing operations | 42 | 54 | |||||

Income from discontinued operations, net of tax | — | — | |||||

Net Income | 42 | 54 | |||||

Net income attributable to noncontrolling interests | 2 | 1 | |||||

Net income attributable to NCR | $ | 40 | $ | 53 | |||

Amounts attributable to NCR common stockholders: | |||||||

Income from continuing operations | $ | 40 | $ | 53 | |||

Income from discontinued operations, net of tax | — | — | |||||

Net income | $ | 40 | $ | 53 | |||

Net income per share attributable to NCR common stockholders: | |||||||

Net income per common share from continuing operations | |||||||

Basic | $ | 0.24 | $ | 0.32 | |||

Diluted | $ | 0.23 | $ | 0.31 | |||

Net income per common share | |||||||

Basic | $ | 0.24 | $ | 0.32 | |||

Diluted | $ | 0.23 | $ | 0.31 | |||

Weighted average common shares outstanding | |||||||

Basic | 169.0 | 167.1 | |||||

Diluted | 171.6 | 171.0 | |||||

8

| NCR CORPORATION REVENUE AND OPERATING INCOME SUMMARY (Unaudited) (in millions) | Schedule B |

For the Periods Ended March 31 | |||||||||||||

Three Months | |||||||||||||

2015 | 2014 | % Change | % Change Constant Currency | ||||||||||

Revenue by segment | |||||||||||||

Financial Services | $ | 798 | $ | 794 | 1 | % | 9 | % | |||||

Retail Solutions | 445 | 490 | (9 | )% | (4 | )% | |||||||

Hospitality | 148 | 149 | (1 | )% | 1 | % | |||||||

Emerging Industries | 85 | 85 | — | % | 8 | % | |||||||

Total Revenue | $ | 1,476 | $ | 1,518 | (3 | )% | 3 | % | |||||

Operating income by segment | |||||||||||||

Financial Services | $ | 105 | $ | 103 | |||||||||

% of Revenue | 13.2 | % | 13.0 | % | |||||||||

Retail Solutions | 16 | 36 | |||||||||||

% of Revenue | 3.6 | % | 7.3 | % | |||||||||

Hospitality | 18 | 12 | |||||||||||

% of Revenue | 12.2 | % | 8.1 | % | |||||||||

Emerging Industries | 7 | 4 | |||||||||||

% of Revenue | 8.2 | % | 4.7 | % | |||||||||

Subtotal-segment operating income | $ | 146 | $ | 155 | |||||||||

% of Revenue | 9.9 | % | 10.2 | % | |||||||||

Pension expense (benefit) | — | (1 | ) | ||||||||||

Other adjustments (1) | 51 | 48 | |||||||||||

Total income from operations | $ | 95 | $ | 108 | |||||||||

(1) | The following table presents the other adjustments for NCR: |

For the Periods Ended March 31 | ||||||||

Three months | ||||||||

In millions | 2015 | 2014 | ||||||

Restructuring plan | $ | 16 | $ | — | ||||

Acquisition-related amortization of intangible assets | 32 | 30 | ||||||

Acquisition-related costs | 2 | 14 | ||||||

Acquisition-related purchase price adjustments | — | 3 | ||||||

OFAC and FCPA investigations | 1 | 1 | ||||||

Total other adjustments | $ | 51 | $ | 48 | ||||

9

| NCR CORPORATION CONSOLIDATED BALANCE SHEETS (Unaudited) (in millions, except per share amounts) | Schedule C |

March 31, 2015 | December 31, 2014 | ||||||

Assets | |||||||

Current assets | |||||||

Cash and cash equivalents | $ | 462 | $ | 511 | |||

Accounts receivable, net | 1,415 | 1,404 | |||||

Inventories | 676 | 669 | |||||

Other current assets | 549 | 504 | |||||

Total current assets | 3,102 | 3,088 | |||||

Property, plant and equipment, net | 351 | 396 | |||||

Goodwill | 2,754 | 2,760 | |||||

Intangibles, net | 893 | 926 | |||||

Prepaid pension cost | 535 | 551 | |||||

Deferred income taxes | 344 | 349 | |||||

Other assets | 534 | 537 | |||||

Total assets | $ | 8,513 | $ | 8,607 | |||

Liabilities and stockholders’ equity | |||||||

Current liabilities | |||||||

Short-term borrowings | $ | 172 | $ | 187 | |||

Accounts payable | 642 | 712 | |||||

Payroll and benefits liabilities | 176 | 196 | |||||

Deferred service revenue and customer deposits | 588 | 494 | |||||

Other current liabilities | 446 | 481 | |||||

Total current liabilities | 2,024 | 2,070 | |||||

Long-term debt | 3,443 | 3,472 | |||||

Pension and indemnity plan liabilities | 676 | 705 | |||||

Postretirement and postemployment benefits liabilities | 174 | 170 | |||||

Income tax accruals | 175 | 181 | |||||

Environmental liabilities | 37 | 44 | |||||

Other liabilities | 64 | 67 | |||||

Total liabilities | 6,593 | 6,709 | |||||

Redeemable noncontrolling interests | 14 | 15 | |||||

Stockholders' equity | |||||||

NCR stockholders' equity: | |||||||

Preferred stock: par value $0.01 per share, 100.0 shares authorized, no shares issued and outstanding as of March 31, 2015 and December 31, 2014, respectively | — | — | |||||

Common stock: par value $0.01 per share, 500.0 shares authorized, 169.5 and 168.6 shares issued and outstanding as of March 31, 2015 and December 31, 2014, respectively | 2 | 2 | |||||

Paid-in capital | 447 | 442 | |||||

Retained earnings | 1,603 | 1,563 | |||||

Accumulated other comprehensive loss | (158 | ) | (136 | ) | |||

Total NCR stockholders' equity | 1,894 | 1,871 | |||||

Noncontrolling interests in subsidiaries | 12 | 12 | |||||

Total stockholders' equity | 1,906 | 1,883 | |||||

Total liabilities and stockholders' equity | $ | 8,513 | $ | 8,607 | |||

10

| NCR CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (in millions) | Schedule D |

For the Periods Ended March 31 | |||||||

Three Months | |||||||

2015 | 2014 | ||||||

Operating activities | |||||||

Net income | $ | 42 | $ | 54 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Loss from discontinued operations | — | — | |||||

Depreciation and amortization | 76 | 69 | |||||

Stock-based compensation expense | 9 | 10 | |||||

Deferred income taxes | 4 | 3 | |||||

Gain on sale of property, plant and equipment and other assets | (1 | ) | (1 | ) | |||

Impairment of long-lived and other assets | 14 | — | |||||

Changes in assets and liabilities: | |||||||

Receivables | (46 | ) | (66 | ) | |||

Inventories | (21 | ) | (30 | ) | |||

Current payables and accrued expenses | (83 | ) | — | ||||

Deferred service revenue and customer deposits | 110 | 59 | |||||

Employee benefit plans | (21 | ) | (21 | ) | |||

Other assets and liabilities | (4 | ) | (46 | ) | |||

Net cash provided by operating activities | 79 | 31 | |||||

Investing activities | |||||||

Expenditures for property, plant and equipment | (13 | ) | (32 | ) | |||

Additions to capitalized software | (38 | ) | (34 | ) | |||

Business acquisition, net | — | (1,642 | ) | ||||

Changes in restricted cash | — | 1,114 | |||||

Other investing activities, net | (6 | ) | (4 | ) | |||

Net cash used in investing activities | (57 | ) | (598 | ) | |||

Financing activities | |||||||

Short term borrowings, net | 2 | 6 | |||||

Payments on term credit facilities | (19 | ) | — | ||||

Borrowings on term credit facilities | — | 250 | |||||

Payments on revolving credit facilities | (273 | ) | (60 | ) | |||

Borrowings on revolving credit facilities | 248 | 400 | |||||

Debt issuance costs | — | (2 | ) | ||||

Proceeds from employee stock plans | 6 | 5 | |||||

Tax withholding payments on behalf of employees | (9 | ) | (22 | ) | |||

Other financing activities | — | (1 | ) | ||||

Net cash used in financing activities | (45 | ) | 576 | ||||

Cash flows from discontinued operations | |||||||

Net cash used in discontinued operations | (4 | ) | (16 | ) | |||

Effect of exchange rate changes on cash and cash equivalents | (22 | ) | (6 | ) | |||

Decrease in cash and cash equivalents | (49 | ) | (13 | ) | |||

Cash and cash equivalents at beginning of period | 511 | 528 | |||||

Cash and cash equivalents at end of period | $ | 462 | $ | 515 | |||

11

1 Q1 2015 EARNINGS CONFERENCE CALL BILL NUTI, CHAIRMAN AND CEO BOB FISHMAN, CFO April 28, 2015

2 NOTES TO INVESTORS FORWARD-LOOKING STATEMENTS. Comments made during this conference call and in these materials contain forward- looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that describe or relate to NCR's future plans, goals, intentions, strategies or financial outlook, and statements that do not relate to historical or current fact, are examples of forward-looking statements. The forward-looking statements in these materials include statements about the expected benefits of NCR's Kalpana ATM technology; industry investment trends and market conditions affecting NCR and its business; expectations for the growth of NCR's Retail Solutions business; expectations regarding the transformation of NCR's sales and services functions; the success of NCR's ongoing restructuring plan; foreign currency fluctuations and their impact on NCR's results and NCR's FY 2015 overall, FY 2015 segment and Q2 2015 financial outlook. Forward-looking statements are based on our current beliefs, expectations and assumptions, which may not prove to be accurate, and involve a number of known and unknown risks and uncertainties, many of which are out of NCR's control. Forward-looking statements are not guarantees of future performance, and there are a number of important factors that could cause actual outcomes and results to differ materially from the results contemplated by such forward-looking statements, including those factors listed in Item 1a "Risk Factors" of NCR's Annual Report on Form 10-K and those factors detailed from time to time in NCR's other SEC reports. These materials are dated April 28, 2015, and NCR does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. NON-GAAP MEASURES. While NCR reports its results in accordance with generally accepted accounting principles in the United States (GAAP), comments made during this conference call and these materials will include the following "non-GAAP" measures: non- pension operating income (NPOI), non-GAAP diluted earnings per share (non-GAAP diluted EPS), free cash flow (FCF), operational gross margin, operational gross margin rate, expenses (non-GAAP), adjusted EBITDA, effective tax rate, non-GAAP net income and selected measures expressed on a constant currency basis. These measures are included to provide additional useful information regarding NCR's financial results, and are not a substitute for their comparable GAAP measures. Explanations of these non-GAAP measures and reconciliations of these non-GAAP measures to their directly comparable GAAP measures are included in the accompanying "Supplementary Non-GAAP Materials" and are available on the Investor Relations page of NCR's website at www.ncr.com. Descriptions of many of these non-GAAP measures are also included in NCR's SEC reports. USE OF CERTAIN TERMS. As used in these materials, (i) the term "software-related revenue" includes software license, software maintenance, cloud, and professional services revenue associated with software delivery, (ii) the term "recurring revenue" means the sum of cloud, hardware maintenance and software maintenance revenue, (iii) the terms "cloud" and "cloud revenue" are used to describe NCR’s software-as-a-service offerings and the revenue associated therewith (prior earnings releases and presentation materials referred to these offerings and revenues as "SaaS" and "SaaS revenue") and (iv) the term "CC" means constant currency. These presentation materials and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together.

3 Q1 2015 FINANCIAL RESULTS REVENUE Q1 2014 Q1 2015 $1.52 billion Revenue down 3% y/y, up 3% CC Recurring revenue down 2% y/y, up 4% CC, 45% of total OPERATIONAL GROSS MARGIN Q1 2014 Q1 2015 28.6% 27.6% Down 100 bps y/y, down ~75 bps CC NPOI NPOI down 6% y/y, up 6% CC Non-GAAP EPS down 14% y/y, up 2% CC FREE CASH FLOW FCF improvement driven by cash from operations, capital expenditures, and disc ops Q1 2014 Q1 2015 $155 million $146 million Q1 2014 Q1 2015 ($51) million $24 million $1.48 billion NON-GAAP EPS Q1 2014 Q1 2015 $0.43 $0.50 FX Impact ~($95M) FX Impact ~($0.08) FX Impact ~($18M) FX Impact ~(25 bps)

4 SOFTWARE-RELATED REVENUE GROWTH Q1 2015 Q1 2014 $113 Q1 • Q1 Software-related revenue up 5% y/y; up 9% CC Q1 Cloud revenue up 19% y/y; up 20% CC • Q1 Professional Services revenue down 3% y/y; up 3% CC $414 Cloud Professional Services SW Licenses & SW Maintenance $147 ($'s in Millions) $135 $131 $134 $149 $395 Fx Impact ~($15M)

5 NCR Kalpana is here! Making omni-channel a reality NCR Kalpana software enables the best consumer experience at the lowest cost to serve INTEGRATION SECURITY SPEED SAVINGS • Seamlessly integrates the experience across all channels • Enables institutions to run a combination of conventional ATMs and the tablet-like, ultra-thin client Cx110 • Delivers the world’s first ATM security certification to PCI 4.0, and is designed to eliminate malware • Controls and originates all software updates at the server level • Eliminates legacy PC architecture that is inefficient and complex • Runs ATMs remotely, enabling new customer services to be brought to market twice as fast as before • Cloud-driven creation, delivery and processing of transactions • Management of self- service channel moved to the cloud; eliminates costly onsite service visits • Reduces operating costs by up to 40%

6 Q1 2015 SUMMARY Q1 results in-line with expectations • Improving execution and metrics across NCR • Significant FX headwinds • Well positioned across end markets Financial Services – strong demand for omni-channel solutions Retail Solutions – investment priorities beginning to shift back to omni-channel and customer experience solutions; expect improvement in the second half of 2015 Hospitality – higher software and cloud revenue drive strong operating margin expansion Growth of software and cloud revenues • Total software-related revenue up 5%; up 9% CC • Cloud revenue up 19%; up 20% CC Building a stronger NCR • Sales and Services transformation gaining traction • Services margins improving in Q1 • Restructuring initiatives on track Free cash flow increased $75 million

7 For the Three Months Ended March 31 2015 2014 As Reported Constant Currency Revenue $1,476 $1,518 (3)% 3% Operational Gross Margin 407 434 (6)% 1% Operational Gross Margin Rate 27.6% 28.6% Expenses (non-GAAP) 261 279 (6)% (2)% % of Revenue 17.7% 18.4% NPOI 146 155 (6)% 6% % of Revenue 9.9% 10.2% -30 bps +30 bps Interest and other expense (51) (50) 2% 2% Non-GAAP Diluted EPS (1) $0.43 $0.50 (14)% 2% Q1 OPERATIONAL RESULTS (1) Effective tax rate of 21% in Q1 2015 and 17% in Q1 2014. $ millions, except per share amounts

8 For the Three Months Ended March 31 2015 2014 % Change Revenue $1,476 $1,518 (3)% Gross Margin 390 416 (6)% Gross Margin Rate 26.4% 27.4% Expenses 295 308 (4)% % of Revenue 20.0% 20.3% Income from Operations 95 108 (12)% % of Revenue 6.4% 7.1% Interest and other expense (51) (50) 2% GAAP Diluted EPS $0.23 $0.31 (26)% Q1 GAAP RESULTS $ millions, except per share amounts

9 FINANCIAL SERVICES Q1 2015 Update • Revenue up 1% as reported and up 9% CC: Growth in Americas, Europe and Middle East Africa driven by increased software-related revenue • Operating income up 2% as reported and up 15% CC due to a higher mix of omni-channel solutions ▪ Performance in key markets ▪ Growth in U.S., Middle East / Africa, Brazil and Western Europe ▪ Continued challenges in China and Russia • Key elements of solution portfolio • Branch Transformation and software license revenues were up significantly Y/Y ▪ Record end user growth in Digital banking ▪ Initial KalpanaTM win closed Key Market Developments Financial Results Q1 2015 Q1 2014 As Reported Constant Currency Revenue $798M $794M 1% 9% Operating Income $105M $103M 2% 15% Operating Income as a % of Revenue 13.2% 13.0% +20 bps +70 bps • Cloud revenue up 19%; up 19% CC • Software-related revenue up 10%; up 15% CC Key Metrics

10 RETAIL SOLUTIONS Q1 2015 Update • Revenue down 9% as reported and down 4% CC; Decline in all theaters due to reduced spending by retailers • Operating income down 56% as reported and down 44% CC due to lower volume and a less favorable mix of software-related revenue • As expected, challenging retail market impacting results in Q1 with improvement forecasted in the second half of 2015; Positive momentum in orders in Q1 • Improving demand for our omni-channel and self-checkout solutions in Greater China, Southeast Asia and Russia • Significant Services win in Q1 resulting from strong Customer Service execution Key Market Developments Financial Results Q1 2015 Q1 2014 As Reported Constant Currency Revenue $445M $490M (9%) (4%) Operating Income $16M $36M (56%) (44%) Operating Income as a % of Revenue 3.6% 7.3% -370 bps -300 bps • Cloud revenue flat; up 4% CC • Software-related revenue down 3%; up 1% CC Key Metrics

11 HOSPITALITY Q1 2015 Update • Revenue down 1% as reported and up 1% CC due to higher software-related revenue partially offset by lower hardware revenue • Operating income up 50% as reported due to higher software-related revenue including cloud revenue • International software-related revenue grew by 33% y/y • Cloud application sites up 21% y/y • Continuing to advance North America SMB market strategy with 11% revenue growth y/y and 21% software- related revenue growth y/y • Software revenue growth driven by increasing wallet share with our existing customers through implementation of omni-channel solutions Key Market Developments Financial Results Q1 2015 Q1 2014 As Reported Constant Currency Revenue $148M $149M (1%) 1% Operating Income $18M $12M 50% 50% Operating Income as a % of Revenue 12.2% 8.1% +410 bps +410 bps • Cloud revenue up 24%; up 26% CC • Software-related revenue up 14%; up 15% CC Key Metrics

12 EMERGING INDUSTRIES Q1 2015 Update • Revenue flat as reported and up 8% CC; Growth driven by Telecom & Technology revenue, up 6% Telecom & Technology ▪ Base expansion wins in new portfolios: Advanced and Managed Services ▪ Added two new Telecom expansion accounts Travel ▪ Delivered a record 40M mobile airline boarding passes in Q1 2015, up 172% y/y Small Business (NCR Silver) • Increased adoption of NCR Silver; Customer base up 11% over Q4 2014 and up 127% y/y Key Market Developments Financial Results Q1 2015 Q1 2014 As Reported Constant Currency Revenue $85M $85M —% 8% Operating Income $7M $4M 75% 125% Operating Income as a % of Revenue 8.2% 4.7% +350 bps +510 bps Key Metrics • Operating income up 75% as reported and up 125% CC due to higher services margins

13 Q1 SUPPLEMENTAL REVENUE INFORMATION For the Periods Ended March 31 Three Months 2015 2014 % Change % Change (Constant Currency) Cloud $134 $113 19% 20% Software License and Software Maintenance 149 147 1% 6% Professional Services 131 135 (3%) 3% Total Software-Related Revenue 414 395 5% 9% Hardware 539 570 (5%) 2% Other Services 523 553 (5%) 2% Total Revenue $1,476 $1,518 (3%) 3% $ millions

14 FREE CASH FLOW Q1 2015 Q1 2014 FY 2015e FY 2014 Cash Provided by Operating Activities (1) $79 $31 $595 - $625 $524 Net capital expenditures (51) (66) (215) - (235) (258) Cash used In Discontinued Operations (4) (16) (35) (1) Pension discretionary contributions and settlements — — — 48 Free Cash Flow $24 ($51) $325 - $375 $313 Free Cash Flow as a % of non-GAAP net income ~75% 67% $ millions, except metrics (1) Includes cash tax rate of 12% in FY 2014 and an expected cash tax rate of 13% in FY 2015.

15 RESTRUCTURING PROGRESS UPDATE Expected Savings • ~$18M in 2014, ~$70M in 2015 and ~$105M in 2016 • ~50% of the savings benefiting NPOI in each year GAAP Income Statement Impact • Total charge of $200M to $225M from 2014 through 2015; • $16M in Q1 2015 • ~$21M to ~$46M remaining in FY 2015 Cash Impact • Total cash impact of $100M to $115M from 2014 through 2015; • $16M in Q1 2015 • ~$55M to ~$70M remaining in FY 2015

16 NET DEBT & EBITDA METRICS Q1 2014 Q4 2014 Q1 2015 Debt $3,949 $3,659 $3,615 Cash 515 511 462 Net Debt $3,434 $3,148 $3,153 Adjusted EBITDA $904 (1) $1,000 $996 (1) Net Debt / Adjusted EBITDA 3.8x 3.1x 3.2x $ in millions, except metrics (1) Adjusted EBITDA for the trailing twelve-month period. Goal for Net Debt / Adjusted EBITDA under 3x in 2015

17 2015 Guidance 2014 Revenue $6,525 - $6,675 $6,591 Year-over-Year Revenue Growth (1%) to 1% 8% Constant Currency Year-Over-Year Revenue Growth 5% to 7% (1) 10% Income from Operations (GAAP)(2) $625 - $690 $353 Non-Pension Operating Income (NPOI) $830 - $870 $820 Adjusted EBITDA $1,047 - $1,087 $1,000 Diluted EPS (GAAP)(2) $1.80 - $2.10 $1.06 Non-GAAP Diluted EPS(3) $2.60 - $2.80 $2.74 Cash Flow from Operating Activities $595 - $625 $524 Free Cash Flow $325 - $375 $313 FY 2015 GUIDANCE $ in millions, except per share amounts (1) Expected constant currency growth has been adjusted from 4% to 6% to 5% to 7% to reflect an increase of 1% in anticipated unfavorable foreign currency impact. We previously expected unfavorable foreign currency impacts of approximately 5% in revenue and now expect unfavorable foreign currency impacts of approximately 6% in revenue. (2) Income from operations and diluted earnings per share guidance excludes the impact of the actuarial mark to market pension adjustment that will be determined in the fourth quarter of 2015 and the impact of the transfer of the UK London plan to an insurer that is expected to occur in 2015 or early 2016. The UK London plan was approximately $420 million overfunded as of December 31, 2014. (3) 2015 guidance includes expected other expense (income), net (OIE) of $215M to $220M, a 25% tax rate and a share count of 175M. 2014 results include OIE of $213M, a 22% tax rate and a share count of 171.2M.

18 2015 SEGMENT REVENUE GUIDANCE Segment 2015e 2015e Constant Currency FY 2014 Financial Services (2%) to 0% 4% to 6% $3,561 Retail Solutions (1%) to 1% 4% to 6% $2,008 Hospitality 3% to 7% 5% to 9% $659 Emerging Industries (6%) to (1%) 0% to 5% $363 Total (1%) to 1% 5% to 7% $6,591 $ in millions

19 Q2 2015 GUIDANCE Q2 2015e Q2 2014 Income from Operations (GAAP) $140 - $150 (1) $169 Non-Pension Operating Income (Non-GAAP) $190 - $200 (2) $210 Tax rate 28% 27% Other expense ~$55 $49 $ millions(1) Includes an estimated pre-tax charge of $14M in Q2 2015 related to the ongoing restructuring plan. (2) Includes an estimated unfavorable foreign currency impact of approximately $20M in NPOI in Q2 2015.

SUPPLEMENTARY NON-GAAP MATERIALS

21 NON-GAAP MEASURES While NCR reports its results in accordance with generally accepted accounting principles (GAAP) in the United States, comments made during this conference call and in these materials will include non-GAAP measures. These measures are included to provide additional useful information regarding NCR's financial results, and are not a substitute for their comparable GAAP measures. NPOI, Non-GAAP Diluted EPS, Operational Gross Margin, Operational Gross Margin Rate, Expenses (non-GAAP), Effective Tax Rate and Non-GAAP Net Income. NCR's non-pension operating income (NPOI), non-GAAP net income and non-GAAP diluted earnings per share (non-GAAP diluted EPS) are determined by excluding pension expense and special items, including amortization of acquisition related intangibles, from NCR's GAAP income (loss) from operations. NCR also determines operational gross margin, operational gross margin rate, expenses (non-GAAP) and effective tax rate (non-GAAP) by excluding pension expense and these special items from its GAAP gross margin, gross margin rate, expenses and effective tax rate. Due to the significant change in its pension expense from year to year and the non-operational nature of pension expense and these special items, NCR's management uses these non-GAAP measures to evaluate year-over-year operating performance. NCR also uses NPOI and non-GAAP diluted EPS to manage and determine the effectiveness of its business managers and as a basis for incentive compensation. NCR believes these measures are useful for investors because they provide a more complete understanding of NCR's underlying operational performance, as well as consistency and comparability with NCR's past reports of financial results. Free Cash Flow. NCR defines free cash flow as net cash provided by/used in operating activities and cash flow provided by/ used in discontinued operations less capital expenditures for property, plant and equipment, additions to capitalized software, discretionary pension contributions and settlements. NCR's management uses free cash flow to assess the financial performance of the Company and believes it is useful for investors because it relates the operating cash flow of the Company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures which can be used for, among other things, investment in the Company's existing businesses, strategic acquisitions, strengthening the Company's balance sheet, repurchase of Company stock and repayment of the Company's debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure. Free cash flow (FCF) do not have uniform definitions under GAAP and, therefore, NCR's definition may differ from other companies' definition of this measure.

22 NON-GAAP MEASURES Adjusted EBITDA. NCR believes that Adjusted EBITDA (adjusted earnings before interest, taxes, depreciation and amortization) provides useful information to investors because it is an indicator of the strength and performance of the Company's ongoing business operations, including its ability to fund discretionary spending such as capital expenditures, strategic acquisitions and other investments. NCR determines Adjusted EBITDA for a given period based on its GAAP income (loss) from continuing operations plus interest expense, net; plus income tax expense (benefit); plus depreciation and amortization; plus other income (expense); plus pension expense (benefit); and plus special items included in the definition of NPOI. NCR believes that its ratio of net debt to Adjusted EBITDA provides useful information to investors because it is an indicator of the company's ability to meet its future financial obligations. Constant Currency. NCR presents certain measures, such as period-over-period revenue growth, on a constant currency basis, which excludes the effects of foreign currency translation. Due to the continuing strengthening of the U.S. dollar against foreign currencies and the overall variability of foreign exchange rates from period to period, NCR's management uses these measures on a constant currency basis to evaluate period-over-period operating performance. Measures presented on a constant currency basis are calculated by translating current period results at prior period monthly average exchange rates. NCR management's definitions and calculations of these non-GAAP measures may differ from similarly-titled measures reported by other companies and cannot, therefore, be compared with similarly-titled measures of other companies. These non-GAAP measures should not be considered as substitutes for, or superior to, results determined in accordance with GAAP. These non- GAAP measures are reconciled to their corresponding GAAP measures in the following slides and elsewhere in these materials. These reconciliations and other information regarding these non-GAAP measures are also available on the Investor Relations page of NCR's website at www.ncr.com.

23 Income from Operations (GAAP) to Non-Pension Operating Income (non-GAAP) and Adjusted EBITDA (non-GAAP) in millions Q1 2014 LTM FY 2014 Q1 2015 LTM FY 2015e Q2 2015e Q2 2014 Income from Operations (GAAP) $689 $353 $340 $625 -$690 $140 - $150 $169 Pension Expense (Benefit) (86) 152 153 3 1 2 Restructuring Plan — 160 176 39 - 64 14 — Acquisition-Related Amortization of Intangibles 81 119 121 127 3 30 Acquisition-Related Costs 44 27 15 10 32 6 Acquisition-Related Purchase Price Adjustment 12 6 3 — — 2 OFAC and FCPA Investigations(1) 3 3 3 1 — 1 Non-Pension Operating Income (non-GAAP) $743 $820 $811 $830 -$870 $190 - $200 $210 Depreciation and Amortization 132 152 157 175 Ongoing Pension Expense (12) (3) (2) (3) Stock Compensation Expense 41 31 30 45 Adjusted EBITDA $904 $1,000 $996 $1,047 -$1,087 GAAP TO NON-GAAP RECONCILIATION (1) Estimated expenses for 2015 will be affected by, among other things, the status and progress of these matters. There can be no assurance that the Company will not be subject to fines or other remedial measures as a result of OFAC's, the SEC's or the DOJ's investigations.

24 in millions (except per share amounts) Q1 QTD 2015 GAAP Restructuring plan Acquisition- related amortization of intangibles Acquisition- related costs Acquisition- related purchase price adjustments OFAC and FCPA Investigations Pension (expense) benefit Q1 QTD 2015 non-GAAP Product revenue $604 $— $— $— $— $— $— $604 Service revenue 872 — — — — — — 872 Total revenue 1,476 — — — — — — 1,476 Cost of products 483 (1) (10) — — — — 472 Cost of services 603 — (6) — — — — 597 Gross margin 390 1 16 — — — — 407 Gross margin rate 26.4% 0.1% 1.1% —% —% —% —% 27.6% Selling, general and administrative expenses 225 — (16) (2) — (1) — 206 Research and development expenses 55 — — — — — — 55 Restructuring-related charges 15 (15) — — — — — — Total expenses 295 (15) (16) (2) — (1) — 261 Total expense as a % of revenue 20.0% (1)% (1.1)% (0.1)% —% (0.1)% —% 17.7% Income (loss) from operations 95 16 32 2 — 1 — 146 Income (loss) from operations as a % of revenue 6.4% 1.1% 2.2% 0.1% —% 0.1% —% 9.9% Interest and Other (expense) income, net (51) — — — — — — (51) Income (loss) from continuing operations before income taxes 44 16 32 2 — 1 — 95 Income tax expense (benefit) 2 5 11 1 — 1 — 20 Effective tax rate 5% 21% Income (loss) from continuing operations 42 11 21 1 — — — 75 Net income (loss) attributable to noncontrolling interests 2 — — — — — — 2 Income (loss) from continuing operations (attributable to NCR) $40 $11 $21 $1 $— $— $— $73 Diluted earnings per share $0.23 $0.07 $0.12 $0.01 $— $— $— $0.43 Diluted shares outstanding 171.6 171.6 GAAP TO NON-GAAP RECONCILIATION Q1 2015 QTD

25 in millions (except per share amounts) Q1 2014 GAAP Acquisition- related amortization of intangibles Acquisition- related costs Acquisition- related purchase price adjustments OFAC and FCPA Investigations Pension (expense) benefit Q1 2014 non-GAAP Product revenue $634 — — — — — $634 Service revenue 884 — — — — — 884 Total revenue 1,518 — — — — — 1,518 Cost of products 476 (10) — (2) — — 464 Cost of services 626 (6) — (1) — 1 620 Gross margin 416 16 — 3 — (1) 434 Gross margin rate 27.4% 1.1% —% 0.2% —% -0.1% 28.6% Selling, general and administrative expenses 245 (14) (14) — (1) — 216 Research and development expenses 63 — — — — — 63 Total expenses 308 (14) (14) — (1) — 279 Total expense as a % of revenue 20.3% (0.9)% (0.9)% —% (0.1)% —% 18.4% Income (loss) from operations 108 30 14 3 1 (1) 155 Income (loss) from operations as a % of revenue 7.1% 2.0% 0.9% 0.2% 0.1% (0.1)% 10.2% Interest and Other (expense) income, net (50) — — — — — (50) Income (loss) from continuing operations before income taxes 58 30 14 3 1 (1) 105 Income tax expense (benefit) 4 10 4 1 — (1) 18 Effective tax rate 7% 17% Income (loss) from continuing operations 54 20 10 2 1 — 87 Net income (loss) attributable to noncontrolling interests 1 — — — — — 1 Income (loss) from continuing operations (attributable to NCR) $53 $20 $10 $2 $1 $— $86 Diluted earnings per share $0.31 $0.11 $0.06 $0.01 $0.01 $— $0.50 Diluted shares outstanding 171.0 171.0 GAAP TO NON-GAAP RECONCILIATION Q1 2014 QTD

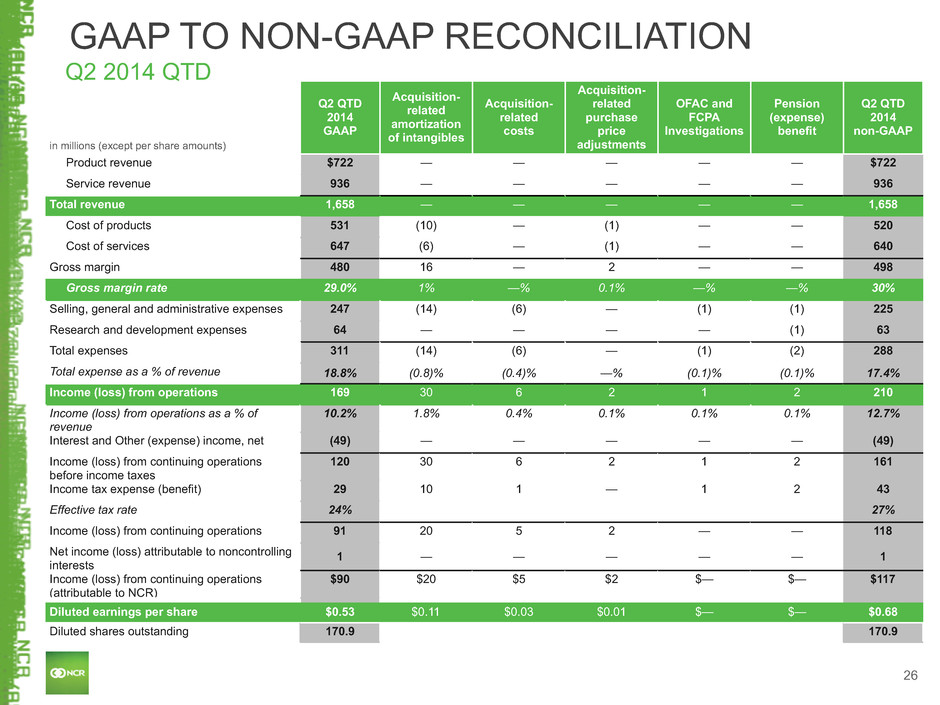

26 in millions (except per share amounts) Q2 QTD 2014 GAAP Acquisition- related amortization of intangibles Acquisition- related costs Acquisition- related purchase price adjustments OFAC and FCPA Investigations Pension (expense) benefit Q2 QTD 2014 non-GAAP Product revenue $722 — — — — — $722 Service revenue 936 — — — — — 936 Total revenue 1,658 — — — — — 1,658 Cost of products 531 (10) — (1) — — 520 Cost of services 647 (6) — (1) — — 640 Gross margin 480 16 — 2 — — 498 Gross margin rate 29.0% 1% —% 0.1% —% —% 30% Selling, general and administrative expenses 247 (14) (6) — (1) (1) 225 Research and development expenses 64 — — — — (1) 63 Total expenses 311 (14) (6) — (1) (2) 288 Total expense as a % of revenue 18.8% (0.8)% (0.4)% —% (0.1)% (0.1)% 17.4% Income (loss) from operations 169 30 6 2 1 2 210 Income (loss) from operations as a % of revenue 10.2% 1.8% 0.4% 0.1% 0.1% 0.1% 12.7% Interest and Other (expense) income, net (49) — — — — — (49) Income (loss) from continuing operations before income taxes 120 30 6 2 1 2 161 Income tax expense (benefit) 29 10 1 — 1 2 43 Effective tax rate 24% 27% Income (loss) from continuing operations 91 20 5 2 — — 118 Net income (loss) attributable to noncontrolling interests 1 — — — — — 1 Income (loss) from continuing operations (attributable to NCR) $90 $20 $5 $2 $— $— $117 Diluted earnings per share $0.53 $0.11 $0.03 $0.01 $— $— $0.68 Diluted shares outstanding 170.9 170.9 GAAP TO NON-GAAP RECONCILIATION Q2 2014 QTD

27 in millions (except per share amounts) FY 2014 GAAP Restructuring plan Acquisition- related amortization of intangibles Acquisition- related costs Acquisition- related purchase price adjustments OFAC and FCPA Investigations Pension (expense) benefit FY 2014 non-GAAP Product revenue $2,892 — — — — — — $2,892 Service revenue 3,699 — — — — — — 3,699 Total revenue 6,591 — — — — — — 6,591 Cost of products 2,153 (9) (39) — (4) — (3) 2,098 Cost of services 2,706 (47) (24) — (2) — (82) 2,551 Gross margin 1,732 56 63 — 6 — 85 1,942 Gross margin rate 26.3% 0.8% 1% —% 0.1% —% 1.3% 29.5% Selling, general and administrative expenses 1,012 — (56) (27) — (3) (48) 878 Research and development expenses 263 — — — — — (19) 244 Restructuring-related charges 104 (104) — — — — — — Total expenses 1,379 (104) (56) (27) — (3) (67) 1,122 Total expense as a % of revenue 20.9% (1.6)% (0.8)% (0.4)% —% —% (1.1)% 17% Income (loss) from operations 353 160 119 27 6 3 152 820 Income (loss) from operations as a % of revenue 5.4% 2.4% 1.8% 0.4% 0.1% —% 2.3% 12.4% Interest and Other (expense) income, net (216) 3 — — — — — (213) Income (loss) from continuing operations before income taxes 137 163 119 27 6 3 152 607 Income tax expense (benefit) (48) 45 39 7 2 1 86 132 Effective tax rate (35)% 22% Income (loss) from continuing operations 185 118 80 20 4 2 66 475 Net income (loss) attributable to noncontrolling interests 4 2 — — — — — 6 Income (loss) from continuing operations (attributable to NCR) $181 $116 $80 $20 $4 $2 $66 $469 Diluted earnings per share $1.06 $0.68 $0.47 $0.12 $0.02 $0.01 $0.38 $2.74 Diluted shares outstanding 171.2 171.2 GAAP TO NON-GAAP RECONCILIATION FY 2014

28 GAAP TO NON-GAAP RECONCILIATION FY 2015e Diluted EPS (GAAP) $1.80 - $2.10 Pension Expense (Benefit) 0.01 Restructuring Plan 0.18 - 0.28 Acquisition-Related Costs 0.04 Acquisition-Related Amortization of Intangibles 0.47 Acquisition-Related Purchase Price Adjustment — OFAC and FCPA Investigations(1) — Non-GAAP Diluted EPS $2.60 - $2.80 Diluted Earnings per Share (GAAP) to Non-GAAP Diluted Earnings per Share (non-GAAP) (1) Estimated expenses for 2015 will be affected by, among other things, the status and progress of these matters. There can be no assurance that the Company will not be subject to fines or other remedial measures as a result of OFAC's, the SEC's or the DOJ's investigations.

29 GAAP TO NON-GAAP RECONCILIATION Revenue Growth % (GAAP) to Revenue Growth % on a Constant Currency Basis (non-GAAP) Q1 2015 Revenue Growth % (GAAP) Favorable (unfavorable) FX impact Constant Currency Revenue Growth % (non-GAAP) Financial Services 1% (8)% 9% Retail Solutions (9)% (5)% (4)% Hospitality (1)% (2)% 1% Emerging Industries —% (8)% 8% Total Revenue (3)% (6)% 3%

30 GAAP TO NON-GAAP RECONCILIATION Revenue Growth % (GAAP) to Revenue Growth % on a Constant Currency Basis (non-GAAP) Q1 2015 Revenue Growth % (GAAP) Favorable (unfavorable) FX impact Constant Currency Revenue Growth % (non-GAAP) Cloud 19% (1)% 20% Software License/ Software Maintenance 1% (5)% 6% Professional Services (3)% (6)% 3% Total Software Related 5% (4)% 9% Hardware (5)% (7)% 2% Other Services (5)% (7)% 2% Total Revenue (3)% (6)% 3%

31 GAAP TO NON-GAAP RECONCILIATION Operating Income Growth % (GAAP) to Operating Income Growth % on a Constant Currency Basis (non-GAAP) Q1 2015 Operating Income Growth % Reported Favorable (unfavorable) FX impact Constant Currency Operating Income Growth % (non- GAAP) Financial Services 2% (13)% 15% Retail Solutions (56)% (12)% (44)% Hospitality 50% —% 50% Emerging Industries 75% (50)% 125% Total Operating Income (6)% (12)% 6%

32 GAAP TO NON-GAAP RECONCILIATION Operating Income Growth bps (GAAP) to Operating Income Growth bps on a Constant Currency Basis (non-GAAP) Q1 2015 Operating Income bps Growth Reported Favorable (unfavorable) FX impact Constant Currency Operating Income bps Growth (non- GAAP) Financial Services +20 bps -50 bps +70 bps Retail Solutions -370 bps -70 bps -300 bps Hospitality +410 bps — bps +410 bps Emerging Industries +350 bps -160 bps +510 bps Total Operating Income -30 bps -60 bps +30 bps

33

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Hillcrest's ZVS Technology Gains Traction in New Applications, Fuels Growth

- Eaton Awarded $26.6M in Federal Tax Credits Supporting U.S. Manufacturing and Workforce Training Programs Advancing Clean Energy Projects

- Supremex Announces Date of Its 2024 First Quarter Results Conference Call and Annual Meeting of Shareholders

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share