Form 8-K Mueller Water Products, For: May 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): May 9, 2016

MUELLER WATER PRODUCTS, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware | 0001-32892 | 20-3547095 |

(State or Other Jurisdiction of Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

1200 Abernathy Road, Suite 1200

Atlanta, Georgia 30328

(Address of Principal Executive Offices)

(770) 206-4200

(Registrant's telephone number, including area code)

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240-14d-2(b)) | |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c)) | |

Item 7.01. Regulation FD Disclosure.

An updated version of an investor presentation used by representatives of Mueller Water Products, Inc. (the "Company") is attached as Exhibit 99.1. The presentation will be accessible online through the Investors section of the Company’s website located at www.muellerwaterproducts.com. The information on our website is not a part of this Form 8-K.

The information provided pursuant to this Item 7.01, including Exhibit 99.1 in Item 9.01, is “furnished” and shall not be deemed to be “filed” with the Securities and Exchange Commission or incorporated by reference in any filing under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in any such filings.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1 Investor presentation, dated May 10, 2016

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: May 9, 2016 | MUELLER WATER PRODUCTS, INC. | ||

By: | /s/ Evan L. Hart | ||

Evan L. Hart | |||

Senior Vice President and Chief Financial Officer | |||

Where Intelligence Meets Infrastructure® Oppenheimer 11th Annual Industrial Growth Conference May 10, 2016

NON-GAAP FINANCIAL MEASURES The Company reports its financial results under accounting principles generally accepted in the United States (“GAAP”), as well as through the use of non-GAAP measures. The Company presents adjusted operating income, adjusted operating margin, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, free cash flow, net debt and net debt leverage as non-GAAP measures. Adjusted operating income represents operating income excluding restructuring. This amount divided by net sales is adjusted operating margin. Adjusted EBITDA represents operating income excluding restructuring, depreciation and amortization. This amount divided by net sales is adjusted EBITDA margin. The Company presents adjusted operating income, adjusted operating margin, adjusted EBITDA and adjusted EBITDA margin because these are measures management believes are frequently used by securities analysts, investors and other interested parties in the evaluation of financial performance. Adjusted net income and adjusted net income per diluted share exclude, on an after-tax basis, restructuring. Restructuring is excluded because it is not considered indicative of recurring operations. Free cash flow represents cash flows from operating activities less capital expenditures. It is presented as a measurement of cash flows because management believes it is commonly used by the investment community. Net debt represents total debt less cash and cash equivalents. Net debt leverage represents net debt divided by trailing 12 months adjusted EBITDA. Net debt and net debt leverage are commonly used by the investment community as measures of indebtedness. These non-GAAP measures have limitations as analytical tools, and securities analysts, investors and other interested parties should not consider any of these non- GAAP measures in isolation or as a substitute for analysis of the Company's results as reported under GAAP. These non-GAAP measures may not be comparable to similarly titled measures used by other companies. A reconciliation of GAAP to non-GAAP results is included as an attachment to this presentation and has been posted online at www.muellerwaterproducts.com. PAGE 2

FORWARD-LOOKING STATEMENTS This presentation contains certain statements that may be deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements that address activities, events or developments that we intend, expect, plan, project, believe or anticipate will or may occur in the future are forward-looking statements. Examples of forward- looking statements include, but are not limited to, statements we make regarding our expectations for growth in our key end markets, anticipated stronger operating leverage, and 2016 full year earnings per share. Forward-looking statements are based on certain assumptions and assessments made by us in light of our experience and perception of historical trends, current conditions and expected future developments. Actual results and the timing of events may differ materially from those contemplated by the forward- looking statements due to a number of factors, including regional, national or global political, economic, business, competitive, market and regulatory conditions and the other factors that are described in the section entitled “RISK FACTORS” in Item 1A of our most recent Annual Report on Form 10-K and any subsequent quarterly reports on Form 10-Q. Undue reliance should not be placed on any forward-looking statements. We do not intend to update forward-looking statements, except as required by law. PAGE 3

OUR BUSINESS AND PRIMARY END MARKETS PORTFOLIO Fire Hydrants Valves Metering Systems Piping Component Systems Leak Detection and Pipe Condition Assessment 70% Repair and replacement of municipal water distribution and treatment systems 25% Residential construction* 85% Non-residential construction 10% Oil & gas 5% Natural gas utilities 5% Power/high pressure * Driven primarily by new community development FY2015 NET SALES: $1.2 BILLION Net sales: $702mm Net sales: $371mm 100% Municipal spending Net sales: $91mm PAGE 4

Leading provider of water infrastructure and flow control products and services in North America INVESTMENT HIGHLIGHTS Improved results driven by strong incremental operating leverage as end markets recover Leveraging Mueller brand and relationships to expand intelligent water technology offerings Leading brands in water infrastructure and one of the largest installed bases of iron gate valves and fire hydrants in the U.S. Increasing investment and improved operating efficiencies are needed in water infrastructure industry Transformed Company by acquiring or developing new technologies, adjusting portfolio and improving processes Strengthened Company’s balance sheet through debt restructuring and ongoing focus on free cash flow Industry-leading adjusted operating margins associated with Mueller Co. core products PAGE 5

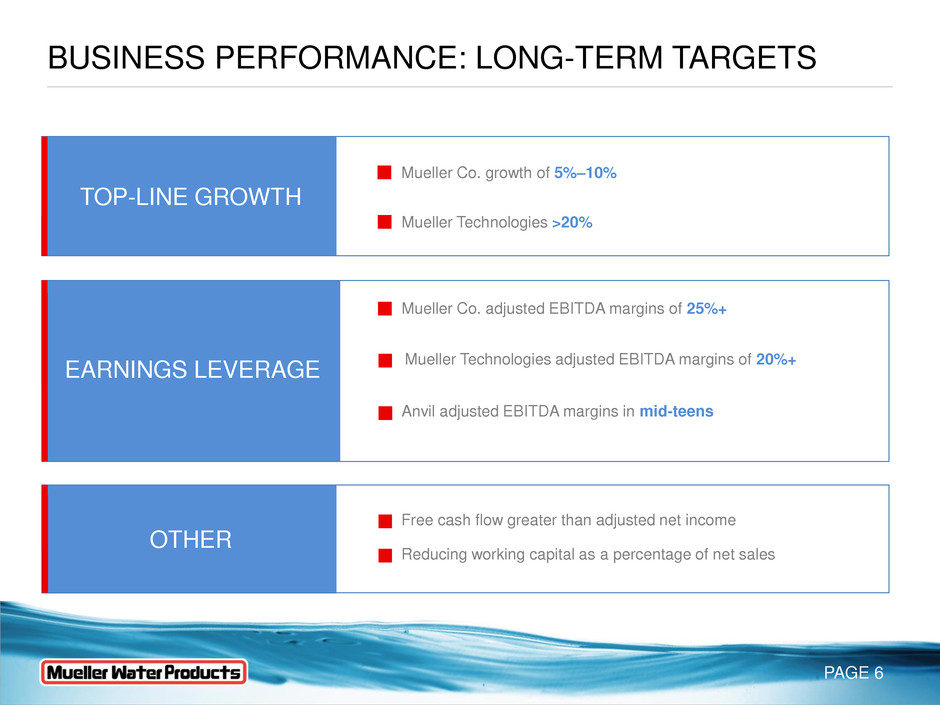

BUSINESS PERFORMANCE: LONG-TERM TARGETS TOP-LINE GROWTH Mueller Co. growth of 5%–10% Mueller Technologies >20% EARNINGS LEVERAGE Mueller Co. adjusted EBITDA margins of 25%+ Mueller Technologies adjusted EBITDA margins of 20%+ Anvil adjusted EBITDA margins in mid-teens OTHER Free cash flow greater than adjusted net income Reducing working capital as a percentage of net sales PAGE 6

BROAD PRODUCT PORTFOLIO Note: All statistics are LTM ended March 31, 2016 (1) Mueller Co. adjusted operating income and adjusted EBITDA exclude restructuring and pension settlement expenses totaling $0.9. Anvil adjusted operating income and adjusted EBITDA exclude restructuring and pension settlement expenses totaling $1.1. Mueller Technologies adjusted operating loss and adjusted EBITDA exclude structuring expenses totaling $0.5. Net Sales Adjusted Operating Income(Loss)(1) Depreciation & Amortization Adjusted EBITDA(1) Product and Services Portfolio $ 706.7 151.7 36.4 188.1 Fire Hydrants Iron Gate Valves Butterfly, Ball & Plug Valves $ 348.9 28.3 14.1 42.4 Cast Iron Fittings Pipe Nipples Fittings & Couplings Hangers & Supports Metering Systems Leak Detection and Pipe Condition Assessment (8.9) 4.6 (13.5) $ 83.1 $ in millions PAGE 7

INTELLIGENT WATER TECHNOLOGY™ Mueller Water Products manufactures and markets products and offers services used in the transmission, distribution and measurement of safe, clean drinking water and in water treatment facilities. These products and services help utilities actively diagnose, monitor and control the delivery of safe, clean drinking water. PAGE 8

WATER INFRASTRUCTURE LANDSCAPE Company estimates based on internal analysis and information from trade associations and distributor networks, where available. #1 PRODUCT POSITION #1 PRODUCT POSITION #1 PRODUCT POSITION #2 PRODUCT POSITION PAGE 9

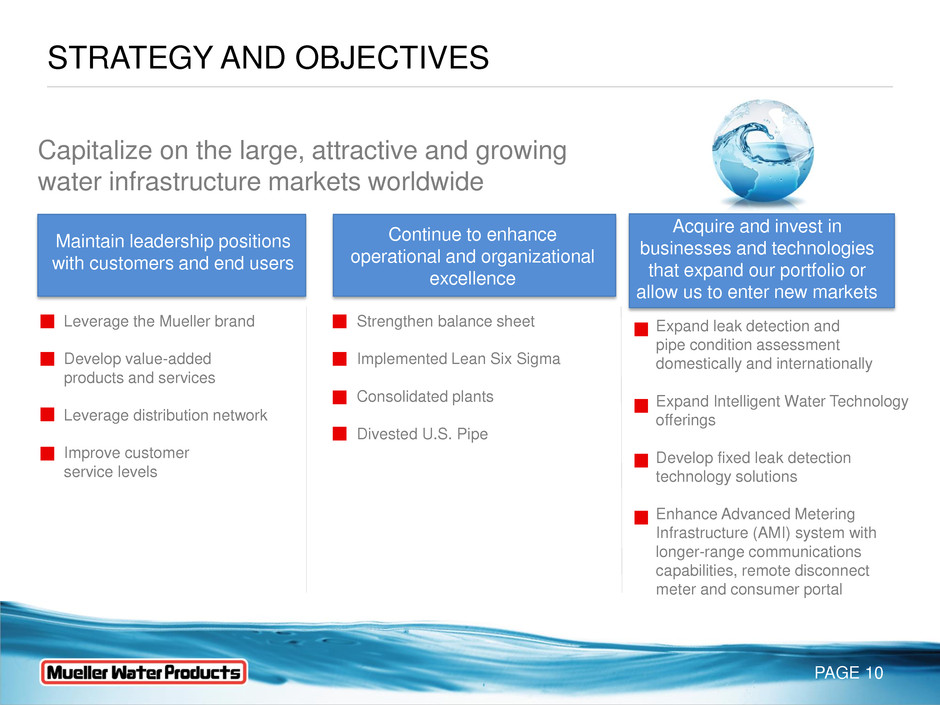

STRATEGY AND OBJECTIVES Maintain leadership positions with customers and end users Leverage the Mueller brand Develop value-added products and services Leverage distribution network Improve customer service levels Continue to enhance operational and organizational excellence Strengthen balance sheet Implemented Lean Six Sigma Consolidated plants Divested U.S. Pipe Acquire and invest in businesses and technologies that expand our portfolio or allow us to enter new markets Expand leak detection and pipe condition assessment domestically and internationally Expand Intelligent Water Technology offerings Develop fixed leak detection technology solutions Enhance Advanced Metering Infrastructure (AMI) system with longer-range communications capabilities, remote disconnect meter and consumer portal Capitalize on the large, attractive and growing water infrastructure markets worldwide PAGE 10

Significant Market Opportunities

0 500 1,000 1,500 2,000 2,500 3,000 1 9 5 9 1 9 6 2 1 9 6 5 1 9 6 8 1 9 7 1 1 9 7 4 1 9 7 7 1 9 8 0 1 9 8 3 1 9 8 6 1 9 8 9 1 9 9 2 1 9 9 5 1 9 9 8 2 0 0 1 2 0 0 4 2 0 0 7 2 0 1 0 2 0 1 3 2 0 1 6 2 0 1 9 Source: U.S. Census Bureau MARKET DRIVER: HOUSING STARTS Homebuilders’ confidence is one driver of housing starts, and confidence could increase due to improving job growth in a key demographic for household formation: Millennials Source: NAHB, April 2016 Forecast: Blue Chip Economic Indicators, April 2016 NAHB Housing Market Index - National (1987 – April 2016) Seasonally Adjusted Annualized Historical Housing Starts (1959 – April 2016) Seasonally Adjusted Annualized Rates-Units in 000’s 1959 to 2015: Average 1,443 Bottom of prior cycle April 2009 – lowest starts (499) since Census Bureau began keeping record in 1959 2017 Blue Chip Consensus forecast of 1,350 PAGE 12 0 10 20 30 40 50 60 70 80 90 100 A pr -8 7 A pr -8 9 A pr -9 1 A pr -9 3 A pr -9 5 A pr -9 7 A pr -9 9 A pr -0 1 A pr -0 3 A pr -0 5 A pr -0 7 A pr -0 9 A pr -1 1 A pr -1 3 A p r- 1 5

THE MARKET OPPORTUNITY IS SIGNIFICANT AND GROWING Valves and fire hydrants are typically replaced at the same time as pipes ASCE graded drinking water infrastructure a D(1) At least 40 cities under consent decrees: Atlanta, Washington, D.C., Suburban Washington, D.C. (WSSC), New Orleans (1) ASCE: 2013 Report Card for America’s Infrastructure (2) The EPA Clean Water and Drinking Water Infrastructure Gap Analysis 2002 (3) EPA 2013 Drinking Water Needs Survey and Assessment PAGE 13

FUNDING WATER INFRASTRUCTURE REPAIR (1) Bureau of Labor Statistics (2) 2014 Strategic Directions: U.S. Water Industry – Black & Veatch (3) American Water Works Association 2014 Water and Wastewater Rate Survey (4) EPA Clean Water and Drinking Water Infrastructure HISTORICAL WATER RATES COMPARED TO OTHER UTILITIES(1) Long-term trends in consumer prices (CPI) for utilities (1953-2016) TOP FIVE WATER INDUSTRY ISSUES(2) UTILITY SOURCES OF FUNDING Majority of utilities have service connection fees and/or capital recovery charges, with median fees of about $5,800(3) CPI for water and sewage maintenance increased 4.3% for 12 months ended March 2016(1) 90% funded at local level(4) Aging water and sewer infrastructure Justifying capital improvement programs/rate requirements Ability to fund capital programs Managing capital costs Managing operational costs CPI Utilities (NSA 1982-1984 = 100) PAGE 14 -50 50 150 250 350 450 550 1 9 5 3 1 9 5 6 1 9 5 9 1 9 6 2 1 9 6 5 1 9 6 8 1 9 7 1 1 9 7 4 1 9 7 7 1 9 8 0 1 9 8 3 1 9 8 6 1 9 8 9 1 9 9 2 1 9 9 5 1 9 9 8 2 0 0 1 2 0 0 4 2 0 0 7 2 0 1 0 2 0 1 3 2 0 1 6 CPI Water CPI Nat Gas CPI Postage CPI Electricity CPI All Items

GROWTH OPPORTUNITIES: SMART WATER FACTORS AFFECTING MUNICIPAL WATER SYSTEMS Water Conservation • 15% of U.S. experiencing drought conditions(1) • 240,000 water main breaks per year(2) • Up to 30% of treated water is lost or unaccounted for(3) • 1.7 trillion gallons lost per year at a national cost of $2.6 billion per year(4) • Budget constraints • Capital spending prioritization (1) U.S. Drought Monitor – May 2016 (2) EPA Aging Water Infrastructure Research Program (3) Navigant Research (4) National Geological Survey Operational Efficiencies Non-Revenue Water Customer Service Focus • Awareness/education • Ongoing monitoring • Sustainability Mi.Data Consumer Portal PAGE 15

MUELLER TECHNOLOGIES: SOLUTIONS FOR TODAY & TOMORROW Smart Metering Leak Detection and Pipe Condition Assessment “A critical component of an integrated water loss management approach is leak detection… The challenge for utilities is identifying, locating and focusing on the more impactful leaks with the limited capital infrastructure budget that exists.” – Black & Veatch 2014 Strategic Directions in the U.S. Water Industry Mueller Systems’ National Operations Center INTELLIGENT WATER TECHNOLOGY™ • Longer-range AMI systems • Remote Disconnect Meter (RDM) • Leak detection • Consumer portal • Fixed transmission and distribution main leak detection / monitoring • Condition assessment 420 RDM Echologics’ acoustic fixed leak detection Utilize Existing Infrastructure PAGE 16

Leading domestic manufacturer of piping system components Significant FY2015 net sales from #1 or #2 product positions Customer service capabilities focused on quick delivery Domestically manufactured and domestically and internationally sourced products Network of over 1,000 distributors and 4,000 distributor locations Track record of solid adjusted EBITDA margins PAGE 17

ANVIL KEY MARKETS Non-Residential Construction Oil & Gas Power/High Pressure Mechanical, Industrial & Fire Protection Oil & Gas Production Power Need Development 85% 10% 5% Mechanical and Industrial: Grooved, Iron/Steel Fittings, Staple Hangers, Pipe Nipples, Bull Plugs Fire Protection: O-Lets, Grooved Fittings and Couplings, Iron Fittings, Staple Hangers, Pipe Nipples Hammer Union, Swages and Bull Plugs, Forged Steel Fittings, Pipe Nipples, Iron/Steel Fittings Engineered Hangers Victaulic, Ward, Erico, Bonney Forge, Westbrook Victaulic, Ward, Tolco, Ceirco, Tyco Kemper, C&C, Westbrook, Bonney Forge, Ward, Phoenix Capital Lisega, Piping Tech, Bergen KEY MARKETS % FY2015 NET SALES MARKET DRIVERS PRODUCTS KEY COMPETITORS PAGE 18

MARKET DRIVER: NON-RESIDENTIAL CONSTRUCTION The non-residential construction market is showing improvement Source: IHS Data as of April 2016 Source: American Institute of Architects Data as of March 2016 Non-Residential Construction (Real $ in Billions) AIA Architectural Billing Index Diffusion Index (> 50 = expansion) PAGE 19 $ 2 9 1 $ 3 2 7 $ 3 3 7 $ 2 8 7 $ 2 3 6 $ 2 2 3 $ 2 2 3 $ 2 1 5 $ 2 1 8 $ 2 3 6 $ 2 5 0 $ 2 6 1 $ 2 6 5 $ 2 6 7 $0 $50 $100 $150 $200 $250 $300 $350 $400 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 30 35 40 45 50 55 60 65 M a r- 9 6 M a r- 9 8 M a r- 0 0 M a r- 0 2 M a r- 0 4 M a r- 0 6 M a r- 0 8 M a r- 1 0 M a r- 1 2 M a r- 1 4 M a r- 1 6

0 500 1,000 1,500 2,000 2,500 A pr -9 0 A pr -9 2 A pr -9 4 A pr -9 6 A pr -9 8 A pr -0 0 A pr -0 2 A pr -0 4 A p r- 0 6 A pr -0 8 A pr -1 0 A pr -1 2 A pr -1 4 A pr -1 6 $0 $20 $40 $60 $80 $100 $120 $140 $160 A pr -9 2 A pr -9 4 A pr -9 6 A pr -9 8 A pr -0 0 A pr -0 2 A pr -0 4 A pr -0 6 A pr -0 8 A pr -1 0 A pr -1 2 A pr -1 4 A pr -1 6 MARKET DRIVER: OIL & GAS Sales to the oil & gas market represented about 10% of Anvil’s FY2015 net sales Source: Baker Hughes Data as of April 2016 Source: FactSet Data as of April 2016 U.S. Land Based Rig Count Oil Price - WTI ($/bbl) PAGE 20

Actions & Business Results

MANAGEMENT ACTIONS / INITIATIVES Reduce costs and improve operating leverage Divested U.S. Pipe Divested three non-core assets of Anvil Implemented Lean Six Sigma and other manufacturing improvements: • Increased production capacity without footprint expansion • Lowered labor costs Closed seven plants Consolidated distribution centers and smaller manufacturing facilities at Anvil Manage working capital and capital expenditures to generate free cash flow Generated free cash flow of $50.3mm in FY2015 and $110.7mm in 2014 Reduced debt by about $600mm from September 30, 2008 through March 31, 2016 Pursue strategic growth opportunities by leveraging the Mueller brand Acquired leak detection and pipe condition assessment technologies Developed fixed leak detection technology capabilities Acquired and invested in AMI technology Enhanced Smart Water offering with remote disconnect meter, integrated leak detection and longer-range communications capabilities PAGE 22

HISTORY OF STRONG FINANCIAL PERFORMANCE Net Sales Adjusted EBITDA and Adjusted EBITDA Margin (1) Fiscal year ended September 30. Reflects inventory step-up costs of $52.9 in 2006; restructuring charges of $2.0 in 2009; goodwill and other intangible assets impairment charges of $818.7 in 2009; restructuring charges of $0.1 in 2010; restructuring charges of $1.4 in 2011; restructuring charges of $2.5 in 2012; restructuring charges of $1.5 in 2013; restructuring charges of $2.1 in 2014 and restructuring charges and pension settlement charges totaling $8.4 in 2015. (2) Fiscal year ended September 30. Excludes inventory step-up costs of $17.3 in 2006; restructuring costs of $4.0 in 2009; goodwill impairment charges of $92.7 in 2009; restructuring charges of $0.5 in 2010; restructuring charges of $1.2 in 2011; restructuring charges of $0.3 in 2012; restructuring charges of $0.1 in 2013; restructuring charges of $0.9 in 2014 and restructuring and pension settlement charges totaling $0.7 in 2015. (1) (2) $ 5 0 9 $ 5 3 6 $ 6 1 8 $ 6 6 4 $ 8 0 4 $ 7 5 6 $ 7 1 8 $ 5 4 7 $ 6 1 3 $ 6 0 6 $ 6 5 2 $ 6 3 2 $ 6 7 9 $ 7 0 2 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 $ 3 9 3 $ 3 8 7 $ 4 3 1 $ 4 8 5 $ 5 3 5 $ 5 5 6 $ 5 9 5 $ 4 7 0 $ 3 4 7 $ 3 5 9 $ 3 7 2 $ 3 9 1 $ 4 0 1 $ 3 7 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 $131 $139 $167 $190 $248 $207 $179 $101 $131 $103 $106 $140 $167 $184 25.7% 25.9% 27.0% 28.6% 30.8% 27.3% 24.9% 18.5% 21.3% 17.0% 16.2% 22.2% 24.6% 26.2% 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 $48 $38 $47 $62 $73 $81 $94 $61 $38 $48 $52 $55 $56 $45 12.2% 9.8% 10.9% 12.8% 13.6% 14.6% 15.8% 13.0% 11.0% 13.2% 14.0% 13.9% 14.1% 12.2% 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 Note: Mueller Co. 2002-2012 net sales and adjusted EBITDA include Mueller Technologies in these years PAGE 23 ($ in millions)

CONSOLIDATED Q2 2016 NON-GAAP RESULTS Overall, second quarter's results came in about as expected. Adjusted operating income increased 14.8 percent, despite slightly lower net sales, and adjusted net income per diluted share for the quarter was $0.10 versus $0.08 a year ago. Mueller Co. had a 9.0 percent increase in adjusted operating income and a 110 basis point improvement in adjusted operating margin. Anvil's adjusted operating income increased 14.9 percent, despite overall net sales declining $4.7 million to $86.4 million. Anvil sales increased 3.3% year-over-year, excluding sales to the oil & gas market. Mueller Technologies remains focused on growing sales of its higher-margin AMI and leak detection technologies, and on improving operating performance over the course of the year. Backlog and projects awarded at both Mueller Systems and Echologics continued to be up substantially on a year- over-year basis at the end of the quarter. 2Q16 adjustments were restructuring expenses ($0.9M, $0.6M net of tax) 2Q15 adjustments were restructuring expenses ($0.7M, $0.4M net of tax) PAGE 24 Second Quarter 2016 2015 Net sales $283.6 $290.3 Adj. operating income $30.2 $26.3 Adj. operating margin 10.6% 9.1% Adj. net income per diluted share $0.10 $0.08 Adj. EBITDA $43.3 $40.7 Adj. EBITDA margin 15.3% 14.0% $ in millions except per share amounts

$1,549 $1,127 $1,101 $1,096 $740 $692 $678 $623 $601 $546 $489 $0 $300 $600 $900 $1,200 $1,500 $1,800 DEBT STRUCTURE Net debt leverage of 2.1x and net debt of $393.3 million at March 31, 2016, down from a peak of more than 6x No significant required principal payments on outstanding debt before November 2021 No financial maintenance covenants with excess availability at the greater of $22.5 million or 10.0% of facility amount • $180 million of excess availability (as measured using March 31, 2016 data) DEBT STRUCTURE AT MARCH 31, 2016 $225 million ABL Agreement expires December 2017 $500 million Term Loan B LIBOR* + 325 bps due November 2021 * Subject to a floor of 75 bps Debt Maturity (at 3/31/2016) $ in millions Total Debt $ in millions $3 $5 $5 $5 $5 $5 $466 $0 $100 $200 $300 $400 $500 FY16 FY17 FY18 FY19 FY20 FY21 FY22 PAGE 25

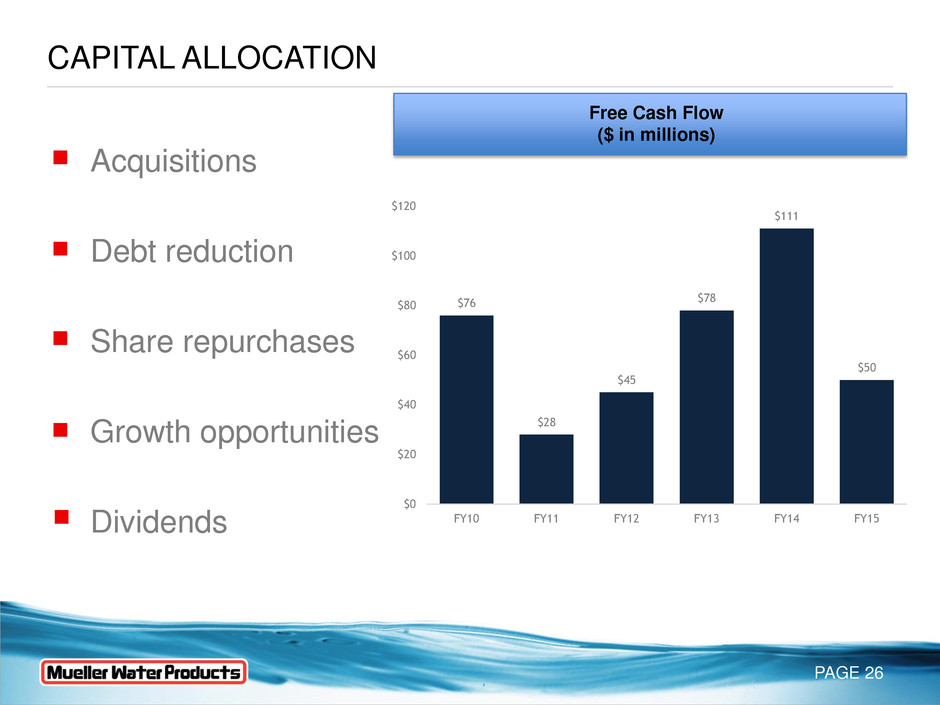

CAPITAL ALLOCATION Acquisitions Debt reduction Share repurchases Growth opportunities Dividends Free Cash Flow ($ in millions) $76 $28 $45 $78 $111 $50 $0 $20 $40 $60 $80 $100 $120 FY10 FY11 FY12 FY13 FY14 FY15 PAGE 26

WHY INVEST IN MWA? Water industry has fundamentally strong long-term dynamics Driven by need for new and upgraded infrastructure Limited number of suppliers to end markets Increasing public awareness of the importance of water infrastructure Strong competitive position Leading brand positions with large installed base Leading municipal specification positions Comprehensive distribution network and strong end-user relationships Low-cost manufacturing operations using lost foam process for valves and hydrants Strong operating leverage as end markets recover Recovery of residential construction market Increased municipal spending Operational excellence initiatives Leveraging strengths with emerging trends Develop Intelligent Water TechnologyTM solutions Grow proprietary fixed leak detection offerings domestically and internationally Expand smart metering Strategic acquisitions / partnerships PAGE 27

Supplemental Data

SEGMENT RESULTS AND RECONCILIATION OF GAAP TO NON-GAAP PERFORMANCE MEASURES PAGE 29 Quarter ended March 31, 2016 Mueller Co. Anvil Mueller Technologies Corporate Total (in millions, except per share amounts) GAAP Results: Net sales $ 182.2 $ 86.4 $ 15.0 $ — $ 283.6 Gross profit $ 57.7 $ 25.6 $ 1.6 $ — $ 84.9 Selling, general and administrative expenses 22.4 17.1 6.5 8.7 54.7 Restructuring expense 0.4 0.5 — — 0.9 Operating income (loss) $ 34.9 $ 8.0 $ (4.9 ) $ (8.7 ) 29.3 Interest expense, net 5.9 Income tax expense 7.7 Net income $ 15.7 Net income per diluted share $ 0.10 Capital expenditures $ 5.2 $ 1.7 $ 2.1 $ — $ 9.0 Non-GAAP results: Adjusted operating income (loss) and EBITDA: Operating income (loss) $ 34.9 $ 8.0 $ (4.9 ) $ (8.7 ) $ 29.3 Restructuring expense 0.4 0.5 — — 0.9 Adjusted operating income (loss) 35.3 8.5 (4.9 ) (8.7 ) 30.2 Depreciation and amortization 8.6 3.2 1.2 0.1 13.1 Adjusted EBITDA $ 43.9 $ 11.7 $ (3.7 ) $ (8.6 ) $ 43.3 Adjusted operating margin 19.4 % 9.8 % (32.7 )% 10.6 % Adjusted EBITDA margin 24.1 % 13.5 % (24.7 )% 15.3 % Adjusted net income: Net income $ 15.7 Restructuring expense, net of tax 0.6 Adjusted net income $ 16.3 Adjusted net income per diluted share $ 0.10 Free cash flow: Net cash provided by operating activities $ 4.4 Less capital expenditures (9.0 ) Free cash flow $ (4.6 ) Net debt (end of period): Current portion of long-term debt $ 5.9 Long-term debt 481.0 Total debt 486.9 Less cash and cash equivalents (93.6 ) Net debt $ 393.3 Adjusted EBITDA: Current quarter $ 43.3 Three prior quarters 146.4 Adjusted EBITDA $ 189.7 Net debt leverage (net debt divided by adjusted EBITDA) 2.1x

SEGMENT RESULTS AND RECONCILIATION OF GAAP TO NON-GAAP PERFORMANCE MEASURES PAGE 30 Quarter ended March 31, 2015 Mueller Co. Anvil Mueller Technologies Corporate Total (in millions, except per share amounts) GAAP results: Net sales $ 177.3 $ 91.1 $ 21.9 $ — $ 290.3 Gross profit $ 54.1 $ 25.5 $ 2.5 $ — $ 82.1 Selling, general and administrative expenses 21.7 18.1 7.1 8.9 55.8 Restructuring expense — 0.2 0.1 0.4 0.7 Operating income (loss) $ 32.4 $ 7.2 $ (4.7 ) $ (9.3 ) 25.6 Interest expense, net 6.1 Income tax expense 7.2 Net income $ 12.3 Net income per diluted share $ 0.08 Capital expenditures $ 4.9 $ 3.4 $ 1.5 $ — $ 9.8 Non-GAAP results: Adjusted operating income (loss) and EBITDA: Operating income (loss) $ 32.4 $ 7.2 $ (4.7 ) $ (9.3 ) $ 25.6 Restructuring expense — 0.2 0.1 0.4 0.7 Adjusted operating income (loss) 32.4 7.4 (4.6 ) (8.9 ) 26.3 Depreciation and amortization 9.7 3.6 1.0 0.1 14.4 Adjusted EBITDA $ 42.1 $ 11.0 $ (3.6 ) $ (8.8 ) $ 40.7 Adjusted operating margin 18.3 % 8.1 % (21.0 )% 9.1 % Adjusted EBITDA margin 23.7 % 12.1 % (16.4 )% 14.0 % Adjusted net income: Net income $ 12.3 Restructuring expense, net of tax 0.4 Adjusted net income $ 12.7 Adjusted net income per diluted share $ 0.08 Free cash flow: =if(J39<0, "Net cash used in operating activities","Net cash provided by operating activities") $ (11.8 ) Less capital expenditures (9.8 ) Free cash flow $ (21.6 ) Net debt (end of period): Current portion of long-term debt $ 6.1 Long-term debt 499.4 Total debt 505.5 Less cash and cash equivalents (34.1 ) Net debt $ 471.4 Adjusted EBITDA: Current quarter $ 40.7 Three prior quarters 143.9 Adjusted EBITDA $ 184.6 Net debt leverage (net debt divided by adjusted EBITDA) 2.6x

SEGMENT RESULTS AND RECONCILIATION OF GAAP TO NON-GAAP PERFORMANCE MEASURES PAGE 31 Six months ended March 31, 2016 Mueller Co. Anvil Mueller Technologies Corporate Total (in millions, except per share amounts) GAAP Results: Net sales $ 326.9 $ 166.0 $ 33.4 $ — $ 526.3 Gross profit $ 101.7 $ 46.7 $ 5.2 $ — $ 153.6 Selling, general and administrative expenses 42.4 34.5 13.4 17.4 107.7 Restructuring expense 0.6 0.6 0.5 — 1.7 Operating income (loss) $ 58.7 $ 11.6 $ (8.7 ) $ (17.4 ) 44.2 Interest expense, net 12.0 Income tax expense 10.3 Net income $ 21.9 Net income per diluted share $ 0.13 Capital expenditures $ 8.8 $ 3.3 $ 3.1 $ 0.1 $ 15.3 Non-GAAP results: Adjusted operating income (loss) and EBITDA: Operating income (loss) $ 58.7 $ 11.6 $ (8.7 ) $ (17.4 ) $ 44.2 Restructuring expense 0.6 0.6 0.5 — 1.7 Adjusted operating income (loss) 59.3 12.2 (8.2 ) (17.4 ) 45.9 Depreciation and amortization 17.0 6.6 2.3 0.2 26.1 Adjusted EBITDA $ 76.3 $ 18.8 $ (5.9 ) $ (17.2 ) $ 72.0 Adjusted operating margin 18.1 % 7.3 % (24.6 )% 8.7 % Adjusted EBITDA margin 23.3 % 11.3 % (17.7 )% 13.7 % Adjusted net income: Net income $ 21.9 Restructuring expense, net of tax 1.1 $ 23.0 Adjusted net income per diluted share $ 0.14 Free cash flow: Net cash provided by operating activities $ 6.9 Less capital expenditures (15.3 ) Free cash flow $ (8.4 )

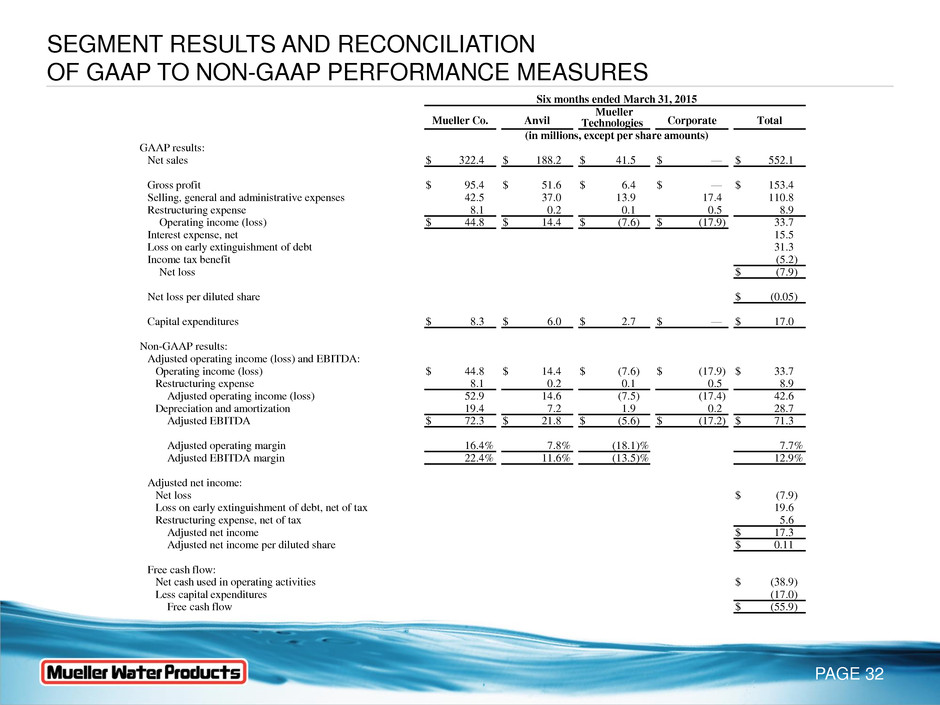

SEGMENT RESULTS AND RECONCILIATION OF GAAP TO NON-GAAP PERFORMANCE MEASURES PAGE 32 Six months ended March 31, 2015 Mueller Co. Anvil Mueller Technologies Corporate Total (in millions, except per share amounts) GAAP results: Net sales $ 322.4 $ 188.2 $ 41.5 $ — $ 552.1 Gross profit $ 95.4 $ 51.6 $ 6.4 $ — $ 153.4 Selling, general and administrative expenses 42.5 37.0 13.9 17.4 110.8 Restructuring expense 8.1 0.2 0.1 0.5 8.9 Operating income (loss) $ 44.8 $ 14.4 $ (7.6 ) $ (17.9 ) 33.7 Interest expense, net 15.5 Loss on early extinguishment of debt 31.3 Income tax benefit (5.2 ) Net loss $ (7.9 ) Net loss per diluted share $ (0.05 ) Capital expenditures $ 8.3 $ 6.0 $ 2.7 $ — $ 17.0 Non-GAAP results: Adjusted operating income (loss) and EBITDA: Operating income (loss) $ 44.8 $ 14.4 $ (7.6 ) $ (17.9 ) $ 33.7 Restructuring expense 8.1 0.2 0.1 0.5 8.9 Adjusted operating income (loss) 52.9 14.6 (7.5 ) (17.4 ) 42.6 Depreciation and amortization 19.4 7.2 1.9 0.2 28.7 Adjusted EBITDA $ 72.3 $ 21.8 $ (5.6 ) $ (17.2 ) $ 71.3 Adjusted operating margin 16.4 % 7.8 % (18.1 )% 7.7 % Adjusted EBITDA margin 22.4 % 11.6 % (13.5 )% 12.9 % Adjusted net income: Net loss $ (7.9 ) Loss on early extinguishment of debt, net of tax 19.6 Restructuring expense, net of tax 5.6 Adjusted net income $ 17.3 Adjusted net income per diluted share $ 0.11 Free cash flow: Net cash used in operating activities $ (38.9 ) Less capital expenditures (17.0 ) Free cash flow $ (55.9 )

Questions

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Mueller Water Products, Inc. (MWA) Declares $0.064 Quarterly Dividend; 1.6% Yield

- Orezone Intersects 18.41 g/t Gold Over 8.00m and 22.17 g/t Gold Over 4.00m in Ongoing Exploration

- TriCo Bancshares Reports First Quarter 2024 Net Income of $27.7 Million, Diluted EPS of $0.83

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share