Form 8-K ManpowerGroup Inc. For: Oct 21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 21, 2016

MANPOWERGROUP INC.

(Exact name of registrant as specified in its charter)

Wisconsin | 1-10686 | 39-1672779 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

100 Manpower Place | |

Milwaukee, Wisconsin | 53212 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (414) 961-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Securities Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

The information in this Item 2.02, including exhibit 99.1 attached hereto, is furnished solely pursuant to Item 2.02 of Form 8-K. Consequently, such information is not deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section. Further, the information in this Item 2.02, including exhibit 99.1, shall not be deemed to be incorporated by reference into the filings of the registrant under the Securities Act of 1933.

On October 21, 2016, we issued a press release announcing our results of operations for the three- and nine-month periods ended September 30, 2016. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Exhibits.

Exhibit No. | Description |

99.1 | Press Release dated October 21, 2016 |

99.2 | Presentation materials for October 21, 2016 conference call |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

MANPOWERGROUP INC. | ||||

Dated: October 21, 2016 | By: | /s/ John T. McGinnis | ||

John T. McGinnis Executive Vice President and Chief Financial Officer | ||||

EXHIBIT INDEX

Exhibit No. | Description |

99.1 | Press Release dated October 21, 2016 |

99.2 | Presentation materials for October 21, 2016 conference call |

Exhibit 99.1

FOR IMMEDIATE RELEASE Contact:

Mike Van Handel

+1.414.906.6305

ManpowerGroup Reports 3rd Quarter 2016 Results

MILWAUKEE, October 21, 2016 -- ManpowerGroup (NYSE: MAN) today reported that net earnings per diluted share for the three months ended September 30, 2016 were $1.87 compared to $1.61 in the prior year period. Net earnings in the quarter were $129.2 million compared to $123.9 million a year earlier. Revenues for the third quarter were $5.1 billion, an increase of 2% from the year earlier period.

Financial results in the quarter were impacted by the stronger U.S. dollar relative to several foreign currencies compared to the prior year period. On a constant currency basis, revenues increased 4% and net earnings per diluted share increased 18%. Earnings per share in the quarter were negatively impacted 3 cents by changes in foreign currencies compared to the prior year.

Jonas Prising, ManpowerGroup Chairman & CEO, said, “We executed well in the third quarter despite continued soft and uneven market conditions globally. This slow growth environment results in our services and solutions becoming increasingly more attractive to companies that need operational and strategic flexibility. We have seen this translate into continued strong growth in our permanent recruitment and market leading workforce solutions offerings. As we look to the fourth quarter we are well placed to seize further opportunities across all our brands.

“We are anticipating the fourth quarter of 2016 diluted net earnings per share to be in the range of $1.65 to $1.73, which includes an estimated unfavorable currency impact of 2 cents,” Prising stated.

Earnings per diluted share for the nine months ended September 30, 2016 were $4.42 compared to $3.75 per diluted share in 2015. Net earnings were $316.3 million compared to $295.3 million in the prior year. Revenues for the nine-month period were $14.7 billion, an increase of 2% from the prior year in reported U.S. dollars or an increase of 4% in constant currency. Foreign currency exchange rates had an unfavorable impact of 8 cents per share for the nine-month period in 2016. On a constant currency basis, net earnings per diluted share were up 20% for the nine

month period.

In conjunction with its third quarter earnings release, ManpowerGroup will broadcast its conference call live over the Internet on October 21, 2016 at 7:30 a.m. CDT (8:30 a.m. EDT). Interested parties are invited to listen to the webcast and view the presentation by logging on to http://www.investor.manpower.com.

Supplemental financial information referenced in the conference call can be found at http://www.investor.manpower.com.

About ManpowerGroup

ManpowerGroup® (NYSE: MAN) is the world’s workforce expert, creating innovative workforce solutions for nearly 70 years. As workforce experts, we connect more than 600,000 people to meaningful work across a wide range of skills and industries every day. Through our ManpowerGroup family of brands - Manpower®, Experis®, Right Management® and ManpowerGroup® Solutions - we help more than 400,000 clients in 80 countries and territories address their critical talent needs, providing comprehensive solutions to resource, manage and develop talent. In 2016, ManpowerGroup was named one of the World’s Most Ethical Companies for the sixth consecutive year and one of Fortune’s Most Admired Companies, confirming our position as the most trusted and admired brand in the industry. See how ManpowerGroup makes powering the world of work humanly possible: www.manpowergroup.com.

Forward-Looking Statements

This news release contains statements, including earnings projections, that are forward-looking in nature and, accordingly, are subject to risks and uncertainties regarding the Company’s expected future results. The Company’s actual results may differ materially from those described or contemplated in the forward-looking statements. Factors that may cause the Company’s actual results to differ materially from those contained in the forward-looking statements can be found in the Company’s reports filed with the SEC, including the information under the heading ‘Risk Factors’ in its Annual Report on Form 10-K for the year ended December 31, 2015, which information is incorporated herein by reference.

###

ManpowerGroup | |||||||||||||

Results of Operations | |||||||||||||

(In millions, except per share data) | |||||||||||||

Three Months Ended September 30 | |||||||||||||

% Variance | |||||||||||||

Amount | Constant | ||||||||||||

2016 | 2015 | Reported | Currency | ||||||||||

(Unaudited) | |||||||||||||

Revenues from services (a) | $ | 5,088.2 | $ | 4,972.5 | 2.3 | % | 3.8 | % | |||||

Cost of services | 4,229.9 | 4,120.4 | 2.7 | % | 4.1 | % | |||||||

Gross profit | 858.3 | 852.1 | 0.7 | % | 1.9 | % | |||||||

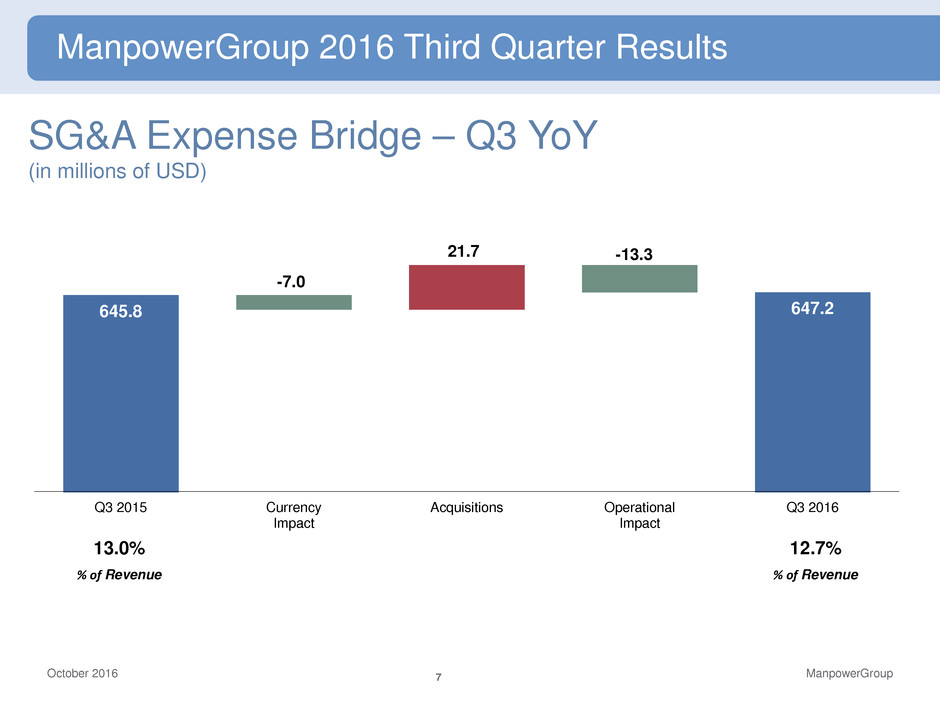

Selling and administrative expenses | 647.2 | 645.8 | 0.2 | % | 1.3 | % | |||||||

Operating profit | 211.1 | 206.3 | 2.3 | % | 3.7 | % | |||||||

Interest and other expenses | 11.4 | 9.4 | 21.4 | % | |||||||||

Earnings before income taxes | 199.7 | 196.9 | 1.4 | % | 2.9 | % | |||||||

Provision for income taxes | 70.5 | 73.0 | -3.5 | % | |||||||||

Net earnings | $ | 129.2 | $ | 123.9 | 4.3 | % | 6.0 | % | |||||

Net earnings per share - basic | $ | 1.89 | $ | 1.63 | 16.0 | % | |||||||

Net earnings per share - diluted | $ | 1.87 | $ | 1.61 | 16.1 | % | 18.0 | % | |||||

Weighted average shares - basic | 68.4 | 76.1 | -10.1 | % | |||||||||

Weighted average shares - diluted | 69.0 | 77.0 | -10.3 | % | |||||||||

(a) Revenues from services include fees received from our franchise offices of $6.3 million and $6.6 million for the three months ended September 30, 2016 and 2015, respectively. These fees are primarily based on revenues generated by the franchise offices, which were $273.1 million and $286.4 million for the three months ended September 30, 2016 and 2015, respectively. | |||||||||||||

ManpowerGroup | |||||||||||||

Operating Unit Results | |||||||||||||

(In millions) | |||||||||||||

Three Months Ended September 30 | |||||||||||||

% Variance | |||||||||||||

Amount | Constant | ||||||||||||

2016 | 2015 | Reported | Currency | ||||||||||

(Unaudited) | |||||||||||||

Revenues from Services: | |||||||||||||

Americas: | |||||||||||||

United States (a) | $ | 723.7 | $ | 769.6 | -6.0 | % | -6.0 | % | |||||

Other Americas | 383.7 | 367.0 | 4.5 | % | 15.7 | % | |||||||

1,107.4 | 1,136.6 | -2.6 | % | 1.0 | % | ||||||||

Southern Europe: | |||||||||||||

France | 1,277.8 | 1,242.5 | 2.8 | % | 2.5 | % | |||||||

Italy | 299.0 | 324.4 | -7.8 | % | -8.1 | % | |||||||

Other Southern Europe | 389.5 | 364.4 | 6.9 | % | 6.6 | % | |||||||

1,966.3 | 1,931.3 | 1.8 | % | 1.5 | % | ||||||||

Northern Europe | 1,300.1 | 1,267.5 | 2.6 | % | 8.8 | % | |||||||

APME | 650.9 | 570.2 | 14.1 | % | 6.5 | % | |||||||

Right Management | 63.5 | 66.9 | -5.0 | % | -3.7 | % | |||||||

$ | 5,088.2 | $ | 4,972.5 | 2.3 | % | 3.8 | % | ||||||

Operating Unit Profit: | |||||||||||||

Americas: | |||||||||||||

United States | $ | 41.0 | $ | 45.5 | -9.9 | % | -9.9 | % | |||||

Other Americas | 14.0 | 13.2 | 5.5 | % | 17.1 | % | |||||||

55.0 | 58.7 | -6.5 | % | -3.8 | % | ||||||||

Southern Europe: | |||||||||||||

France | 68.9 | 74.9 | -8.1 | % | -8.3 | % | |||||||

Italy | 18.4 | 17.5 | 5.1 | % | 4.8 | % | |||||||

Other Southern Europe | 13.7 | 13.1 | 4.9 | % | 4.6 | % | |||||||

101.0 | 105.5 | -4.3 | % | -4.5 | % | ||||||||

Northern Europe | 53.9 | 44.5 | 21.1 | % | 28.4 | % | |||||||

APME | 25.3 | 23.9 | 6.5 | % | 0.3 | % | |||||||

Right Management | 8.8 | 10.7 | -17.8 | % | -18.3 | % | |||||||

244.0 | 243.3 | ||||||||||||

Corporate expenses | (23.9 | ) | (28.9 | ) | |||||||||

Intangible asset amortization expense | (9.0 | ) | (8.1 | ) | |||||||||

Operating profit | 211.1 | 206.3 | 2.3 | % | 3.7 | % | |||||||

Interest and other expenses (b) | (11.4 | ) | (9.4 | ) | |||||||||

Earnings before income taxes | $ | 199.7 | $ | 196.9 | |||||||||

(a) In the United States, revenues from services include fees received from our franchise offices of $4.1 million and $4.2 million for the three months ended September 30, 2016 and 2015, respectively. These fees are primarily based on revenues generated by the franchise offices, which were $179.8 million and $186.3 million for the three months ended September 30, 2016 and 2015, respectively. | |||||||||||||

(b) The components of interest and other expenses were: | |||||||||||||

2016 | 2015 | ||||||||||||

Interest expense | $ | 9.2 | $ | 9.2 | |||||||||

Interest income | (1.0 | ) | (0.7 | ) | |||||||||

Foreign exchange gain | — | (0.2 | ) | ||||||||||

Miscellaneous expenses, net | 3.2 | 1.1 | |||||||||||

$ | 11.4 | $ | 9.4 | ||||||||||

ManpowerGroup | |||||||||||||

Results of Operations | |||||||||||||

(In millions, except per share data) | |||||||||||||

Nine Months Ended September 30 | |||||||||||||

% Variance | |||||||||||||

Amount | Constant | ||||||||||||

2016 | 2015 | Reported | Currency | ||||||||||

(Unaudited) | |||||||||||||

Revenues from services (a) | $ | 14,698.0 | $ | 14,376.0 | 2.2 | % | 4.5 | % | |||||

Cost of services | 12,205.2 | 11,931.3 | 2.3 | % | 4.6 | % | |||||||

Gross profit | 2,492.8 | 2,444.7 | 2.0 | % | 3.8 | % | |||||||

Selling and administrative expenses | 1,954.0 | 1,936.9 | 0.9 | % | 2.7 | % | |||||||

Operating profit | 538.8 | 507.8 | 6.1 | % | 7.9 | % | |||||||

Interest and other expenses | 34.4 | 27.2 | 26.3 | % | |||||||||

Earnings before income taxes | 504.4 | 480.6 | 4.9 | % | 6.7 | % | |||||||

Provision for income taxes | 188.1 | 185.3 | 1.5 | % | |||||||||

Net earnings | $ | 316.3 | $ | 295.3 | 7.1 | % | 9.1 | % | |||||

Net earnings per share - basic | $ | 4.46 | $ | 3.80 | 17.4 | % | |||||||

Net earnings per share - diluted | $ | 4.42 | $ | 3.75 | 17.9 | % | 20.0 | % | |||||

Weighted average shares - basic | 70.9 | 77.7 | -8.7 | % | |||||||||

Weighted average shares - diluted | 71.6 | 78.7 | -9.0 | % | |||||||||

(a) Revenues from services include fees received from our franchise offices of $17.2 million and $18.1 million for the nine months ended September 30, 2016 and 2015, respectively. These fees are primarily based on revenues generated by the franchise offices, which were $762.1 million and $812.6 million for the nine months ended September 30, 2016 and 2015, respectively. | |||||||||||||

ManpowerGroup | |||||||||||||

Operating Unit Results | |||||||||||||

(In millions) | |||||||||||||

Nine Months Ended September 30 | |||||||||||||

% Variance | |||||||||||||

Amount | Constant | ||||||||||||

2016 | 2015 | Reported | Currency | ||||||||||

(Unaudited) | |||||||||||||

Revenues from Services: | |||||||||||||

Americas: | |||||||||||||

United States (a) | $ | 2,152.1 | $ | 2,257.3 | -4.7 | % | -4.7 | % | |||||

Other Americas | 1,082.2 | 1,094.4 | -1.1 | % | 16.2 | % | |||||||

3,234.3 | 3,351.7 | -3.5 | % | 2.1 | % | ||||||||

Southern Europe: | |||||||||||||

France | 3,608.8 | 3,485.9 | 3.5 | % | 3.3 | % | |||||||

Italy | 861.9 | 913.8 | -5.7 | % | -5.8 | % | |||||||

Other Southern Europe | 1,114.7 | 1,044.3 | 6.8 | % | 6.6 | % | |||||||

5,585.4 | 5,444.0 | 2.6 | % | 2.4 | % | ||||||||

Northern Europe | 3,836.3 | 3,717.0 | 3.2 | % | 7.6 | % | |||||||

APME | 1,841.7 | 1,659.9 | 10.9 | % | 9.3 | % | |||||||

Right Management | 200.3 | 203.4 | -1.5 | % | 0.4 | % | |||||||

$ | 14,698.0 | $ | 14,376.0 | 2.2 | % | 4.5 | % | ||||||

Operating Unit Profit: | |||||||||||||

Americas: | |||||||||||||

United States | $ | 103.8 | $ | 104.6 | -0.8 | % | -0.8 | % | |||||

Other Americas | 39.4 | 40.5 | -2.7 | % | 13.9 | % | |||||||

143.2 | 145.1 | -1.4 | % | 3.3 | % | ||||||||

Southern Europe: | |||||||||||||

France | 183.6 | 192.1 | -4.4 | % | -5.0 | % | |||||||

Italy | 57.3 | 51.3 | 11.7 | % | 11.2 | % | |||||||

Other Southern Europe | 34.1 | 29.1 | 17.1 | % | 16.6 | % | |||||||

275.0 | 272.5 | 0.9 | % | 0.4 | % | ||||||||

Northern Europe | 124.2 | 108.6 | 14.3 | % | 18.8 | % | |||||||

APME | 66.8 | 61.2 | 9.5 | % | 7.7 | % | |||||||

Right Management | 32.8 | 28.0 | 16.9 | % | 18.1 | % | |||||||

642.0 | 615.4 | ||||||||||||

Corporate expenses | (76.2 | ) | (84.5 | ) | |||||||||

Intangible asset amortization expense | (27.0 | ) | (23.1 | ) | |||||||||

Operating profit | 538.8 | 507.8 | 6.1 | % | 7.9 | % | |||||||

Interest and other expenses (b) | (34.4 | ) | (27.2 | ) | |||||||||

Earnings before income taxes | $ | 504.4 | $ | 480.6 | |||||||||

(a) In the United States, revenues from services include fees received from our franchise offices of $11.1 million and $11.5 million for the nine months ended September 30, 2016 and 2015, respectively. These fees are primarily based on revenues generated by the franchise offices, which were $511.5 million and $539.6 million for the nine months ended September 30, 2016 and 2015, respectively. | |||||||||||||

(b) The components of interest and other expenses were: | |||||||||||||

2016 | 2015 | ||||||||||||

Interest expense | $ | 27.9 | $ | 25.4 | |||||||||

Interest income | (2.5 | ) | (1.9 | ) | |||||||||

Foreign exchange losses | 1.6 | 0.5 | |||||||||||

Miscellaneous expenses, net | 7.4 | 3.2 | |||||||||||

$ | 34.4 | $ | 27.2 | ||||||||||

ManpowerGroup | |||||||

Consolidated Balance Sheets | |||||||

(In millions) | |||||||

Sep. 30 | Dec. 31 | ||||||

2016 | 2015 | ||||||

(Unaudited) | |||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 503.1 | $ | 730.5 | |||

Accounts receivable, net | 4,581.9 | 4,243.0 | |||||

Prepaid expenses and other assets | 112.1 | 119.0 | |||||

Total current assets | 5,197.1 | 5,092.5 | |||||

Other assets: | |||||||

Goodwill | 1,284.1 | 1,257.4 | |||||

Intangible assets, net | 309.1 | 326.5 | |||||

Other assets | 776.6 | 694.0 | |||||

Total other assets | 2,369.8 | 2,277.9 | |||||

Property and equipment: | |||||||

Land, buildings, leasehold improvements and equipment | 612.2 | 585.4 | |||||

Less: accumulated depreciation and amortization | 458.7 | 438.3 | |||||

Net property and equipment | 153.5 | 147.1 | |||||

Total assets | $ | 7,720.4 | $ | 7,517.5 | |||

LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 1,945.0 | $ | 1,659.2 | |||

Employee compensation payable | 216.3 | 211.4 | |||||

Accrued liabilities | 434.3 | 483.7 | |||||

Accrued payroll taxes and insurance | 620.6 | 613.8 | |||||

Value added taxes payable | 479.1 | 438.7 | |||||

Short-term borrowings and current maturities of long-term debt | 36.0 | 44.2 | |||||

Total current liabilities | 3,731.3 | 3,451.0 | |||||

Other liabilities: | |||||||

Long-term debt | 839.7 | 810.9 | |||||

Other long-term liabilities | 676.6 | 563.1 | |||||

Total other liabilities | 1,516.3 | 1,374.0 | |||||

Shareholders' equity: | |||||||

ManpowerGroup shareholders' equity | |||||||

Common stock | 1.2 | 1.2 | |||||

Capital in excess of par value | 3,206.5 | 3,186.7 | |||||

Retained earnings | 2,221.5 | 1,966.0 | |||||

Accumulated other comprehensive loss | (324.7 | ) | (286.0 | ) | |||

Treasury stock, at cost | (2,712.5 | ) | (2,243.2 | ) | |||

Total ManpowerGroup shareholders' equity | 2,392.0 | 2,624.7 | |||||

Noncontrolling interests | 80.8 | 67.8 | |||||

Total shareholders' equity | 2,472.8 | 2,692.5 | |||||

Total liabilities and shareholders' equity | $ | 7,720.4 | $ | 7,517.5 | |||

ManpowerGroup | |||||||

Consolidated Statements of Cash Flows | |||||||

(In millions) | |||||||

Nine Months Ended | |||||||

September 30 | |||||||

2016 | 2015 | ||||||

(Unaudited) | |||||||

Cash Flows from Operating Activities: | |||||||

Net earnings | $ | 316.3 | $ | 295.3 | |||

Adjustments to reconcile net earnings to net cash provided by operating activities: | |||||||

Depreciation and amortization | 64.0 | 57.1 | |||||

Deferred income taxes | 36.4 | 72.6 | |||||

Provision for doubtful accounts | 14.5 | 13.2 | |||||

Share-based compensation | 21.0 | 22.9 | |||||

Excess tax benefit on exercise of share-based awards | (0.1 | ) | (4.8 | ) | |||

Changes in operating assets and liabilities, excluding the impact of acquisitions: | |||||||

Accounts receivable | (277.3 | ) | (331.7 | ) | |||

Other assets | (54.1 | ) | (10.3 | ) | |||

Other liabilities | 281.8 | 168.5 | |||||

Cash provided by operating activities | 402.5 | 282.8 | |||||

Cash Flows from Investing Activities: | |||||||

Capital expenditures | (42.6 | ) | (33.3 | ) | |||

Acquisitions of businesses, net of cash acquired | (56.9 | ) | (240.7 | ) | |||

Proceeds from sales of investments, property and equipment | 3.5 | 4.8 | |||||

Cash used in investing activities | (96.0 | ) | (269.2 | ) | |||

Cash Flows from Financing Activities: | |||||||

Net change in short-term borrowings | (3.9 | ) | (2.3 | ) | |||

Proceeds from long-term debt | — | 453.9 | |||||

Repayments of long-term debt | (6.3 | ) | (1.9 | ) | |||

Payments for debt issuance costs | — | (2.5 | ) | ||||

Payments of contingent consideration for acquisitions | (2.9 | ) | — | ||||

Proceeds from share-based awards and other equity transactions | 5.5 | 99.8 | |||||

Other share-based award transactions | (6.6 | ) | (1.4 | ) | |||

Repurchases of common stock | (462.6 | ) | (523.2 | ) | |||

Dividends paid | (60.8 | ) | (62.1 | ) | |||

Cash used in financing activities | (537.6 | ) | (39.7 | ) | |||

Effect of exchange rate changes on cash | 3.7 | (20.6 | ) | ||||

Change in cash and cash equivalents | (227.4 | ) | (46.7 | ) | |||

Cash and cash equivalents, beginning of period | 730.5 | 699.2 | |||||

Cash and cash equivalents, end of period | $ | 503.1 | $ | 652.5 | |||

ManpowerGroup Third Quarter Results

October 21, 2016

Exhibit 99.2

FORWARD-LOOKING STATEMENT

This presentation includes forward-looking statements

which are subject to known and unknown risks and

uncertainties. Actual results might differ materially from

those projected in the forward-looking statements.

Additional information concerning factors that could

cause actual results to materially differ from those in the

forward-looking statements can be found in the

Company’s Annual Report on Form 10-K for the period

ended December 31, 2013. Forward-looking statements

can be identified by forward-looking words such as

“expect,” “anticipate,” “intend,” “plan,” “may,” “will,”

“believe,” “seek,” “estimate,” and similar expressions. In

this presentation, references to road map and journey to

4% are also intended to be forward-looking statements.

Please note that ManpowerGroup’s 2013 Annual report is

available online at www.manpowergroup.com in the

section titled “Investor Relations.”

contain statements, cluding financial

projections, that are forward-looki g in nature. These

stat me s are based on managements’ current

expectations or beliefs, and are subject to known and

unknown r sks and u certainties regarding expected

fut r res lts. Actual results might differ materially from

those projected in the forward-looking statements.

Additio al inform tion c ncerning factors tha could

cause actual results to materially differ from thos in the

forward-look ng statements is contained in the

ManpowerGrou Inc. A nual Report on Form 10-K dated

D c mber 31, 2015, which information is incorporated

herein by referenc , and such other factors as may be

described from tim to tim in the Company’s SEC

filings. Any forward-looking statements in this

pr sentation speak only as of the date hereof. The

Company assumes no obligation to update or revise any

forward-looking statements.

2 ManpowerGroup October 2016

October 2016 3 ManpowerGroup

As

Reported Q3 Financial Highlights

2%

Revenue $5.1B

4% CC

20 bps Gross Margin 16.9%

2%

Operating Profit $211M

4% CC

0 bps OP Margin 4.1%

16%

EPS $1.87

18% CC

Throughout this presentation, the difference between reported variances and Constant Currency (CC) variances represents the

impact of changes in currency on our financial results. Constant Currency is further explained in the Annual Report on our Web site.

Consolidated Financial Highlights

ManpowerGroup 2016 Third Quarter Results

October 2016 4 ManpowerGroup

EPS Bridge – Q3 vs. Guidance Midpoint

ManpowerGroup 2016 Third Quarter Results

$1.70

$1.87 +0.11

+0.02

+0.04

Q3 Guidance

Midpoint

Operational Performance Tax Rate

(35.3% vs 36.0%)

WAS Q3 Reported

October 2016 5 ManpowerGroup

Consolidated Gross Margin Change

ManpowerGroup 2016 Third Quarter Results

17.1%

16.9%

Q3 2015 Staffing/Interim Permanent

Recruitment

Acquisitions Q3 2016

-0.4%

+0.1%

+0.1%

October 2016 6 ManpowerGroup

Growth

Business Line Gross Profit – Q3 2016

█ Manpower █ Experis █ ManpowerGroup Solutions █ Right Management █ ManpowerGroup – Total

ManpowerGroup 2016 Third Quarter Results

-2%

-1% CC

6%

8% CC

12%

12% CC

-10%

-10% CC

1%

2% CC

$533M

62%

$178M

21%

$108M

12%

$39M

5%

$858M

October 2016 7 ManpowerGroup

SG&A Expense Bridge – Q3 YoY

(in millions of USD)

ManpowerGroup 2016 Third Quarter Results

645.8 647.2

Q3 2015 Currency

Impact

Acquisitions Operational

Impact

Q3 2016

-7.0

21.7 -13.3

13.0%

% of Revenue % of Revenue

12.7%

October 2016 8 ManpowerGroup

As

Reported Q3 Financial Highlights

3%

Revenue $1.1B

1% CC

6%

OUP $55M

4% CC

20 bps OUP Margin 5.0%

Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance. OUP is

equal to segment revenues less direct costs and branch and national headquarters operating costs.

Americas Segment

(22% of Revenue)

ManpowerGroup 2016 Third Quarter Results

October 2016 9 ManpowerGroup

Americas – Q3 Revenue Growth YoY

Revenue Growth - CC Revenue Growth

% of Segment

Revenue

(1) On an organic basis, Other revenue increased 17% (+16% in CC).

(1)

ManpowerGroup 2016 Third Quarter Results

-6%

-8%

-36%

30%

-6%

5%

4%

29%

US

Mexico

Argentina

Other

65%

11%

4%

20%

October 2016 10 ManpowerGroup

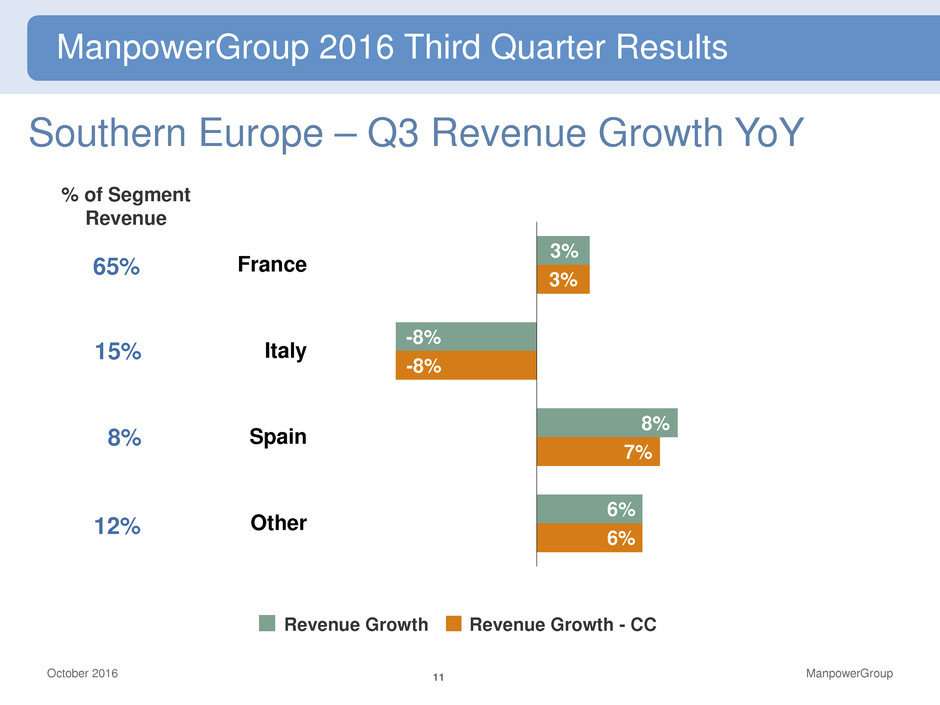

As

Reported Q3 Financial Highlights

2%

Revenue $2.0B

2% CC

4%

OUP $101M

5% CC

40 bps OUP Margin 5.1%

Southern Europe Segment

(39% of Revenue)

ManpowerGroup 2016 Third Quarter Results

October 2016 11 ManpowerGroup

Southern Europe – Q3 Revenue Growth YoY

Revenue Growth - CC Revenue Growth

% of Segment

Revenue

ManpowerGroup 2016 Third Quarter Results

3%

-8%

8%

6%

3%

-8%

7%

6%

France

Italy

Spain

Other

65%

15%

8%

12%

October 2016 12 ManpowerGroup

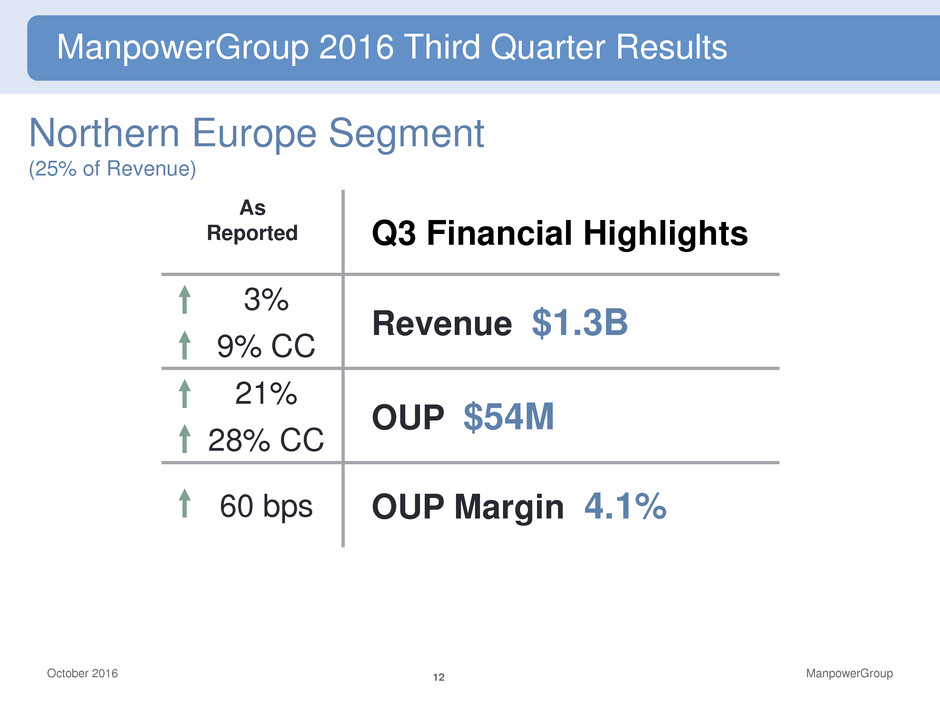

As

Reported Q3 Financial Highlights

3%

Revenue $1.3B

9% CC

21%

OUP $54M

28% CC

60 bps OUP Margin 4.1%

Northern Europe Segment

(25% of Revenue)

ManpowerGroup 2016 Third Quarter Results

October 2016 13 ManpowerGroup

Northern Europe – Q3 Revenue Growth YoY

Revenue Growth - CC Revenue Growth

% of Segment

Revenue

(1) On an organic basis, revenue for Germany increased 7% (+7% in CC), the Nordics decreased 2% (-2%

in CC), the Netherlands increased 22% (+22% in CC), and Belgium increased 18% (+17% in CC).

ManpowerGroup 2016 Third Quarter Results

(1)

(1)

(1)

(1)

-17%

34%

-1%

37%

21%

-9%

-3%

34%

-1%

37%

21%

-7%

UK

Germany

Nordics

Netherlands

Belgium

Other

33%

21%

19%

13%

8%

6%

October 2016 14 ManpowerGroup

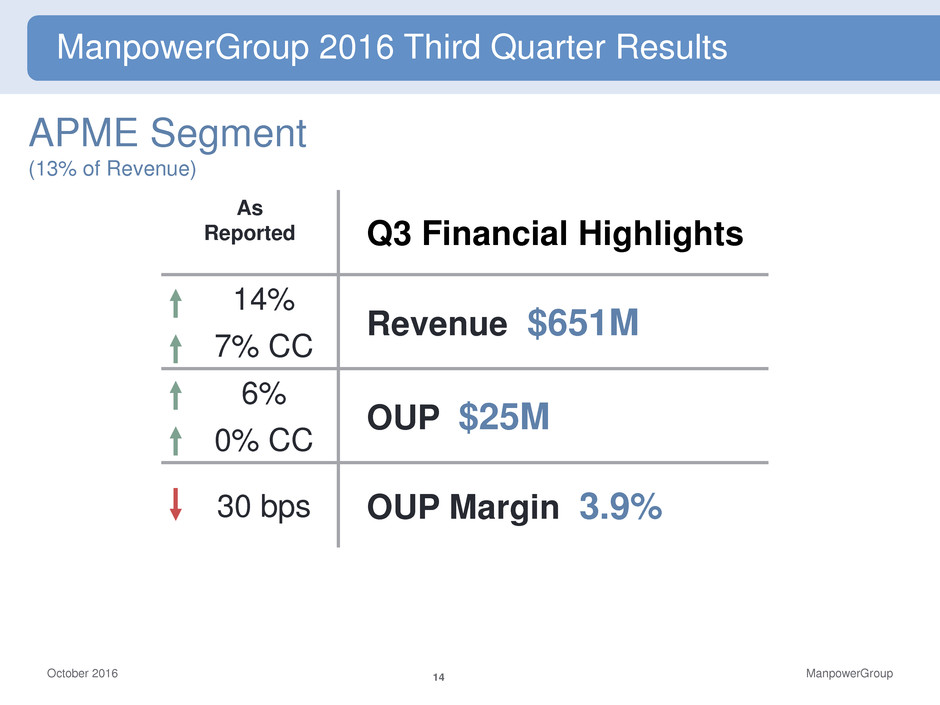

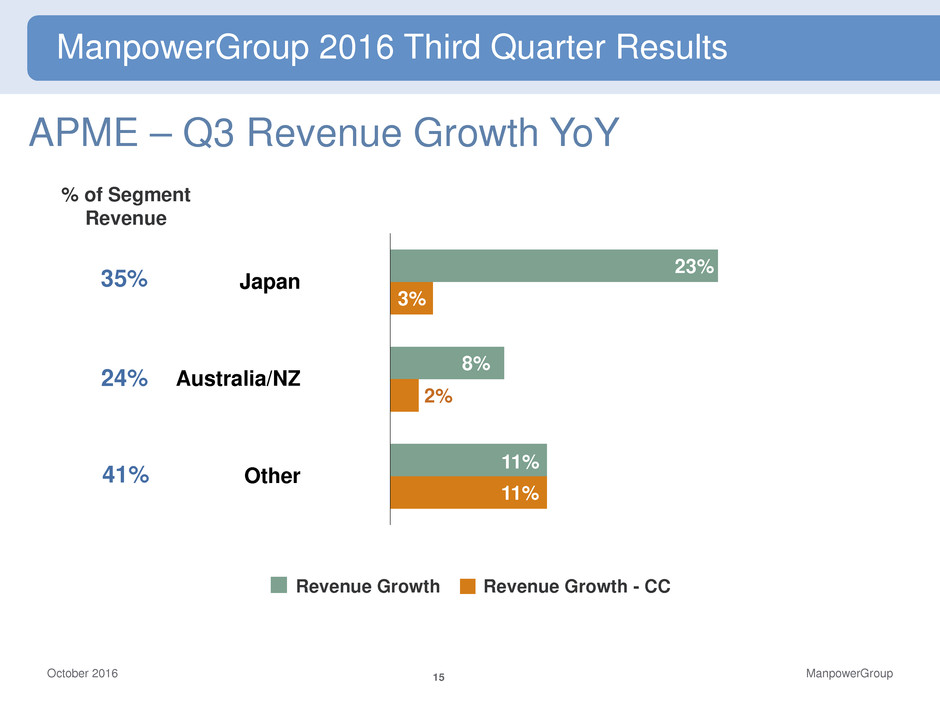

As

Reported Q3 Financial Highlights

14%

Revenue $651M

7% CC

6%

OUP $25M

0% CC

30 bps OUP Margin 3.9%

APME Segment

(13% of Revenue)

ManpowerGroup 2016 Third Quarter Results

October 2016 15 ManpowerGroup

APME – Q3 Revenue Growth YoY

Revenue Growth - CC Revenue Growth

% of Segment

Revenue

ManpowerGroup 2016 Third Quarter Results

23%

8%

11%

3%

2%

11%

Japan

Australia/NZ

Other

35%

24%

41%

October 2016 16 ManpowerGroup

As

Reported Q3 Financial Highlights

5%

Revenue $63M

4% CC

18%

OUP $9M

18% CC

210 bps OUP Margin 13.9%

Right Management Segment

(1% of Revenue)

ManpowerGroup 2016 Third Quarter Results

October 2016 17 ManpowerGroup

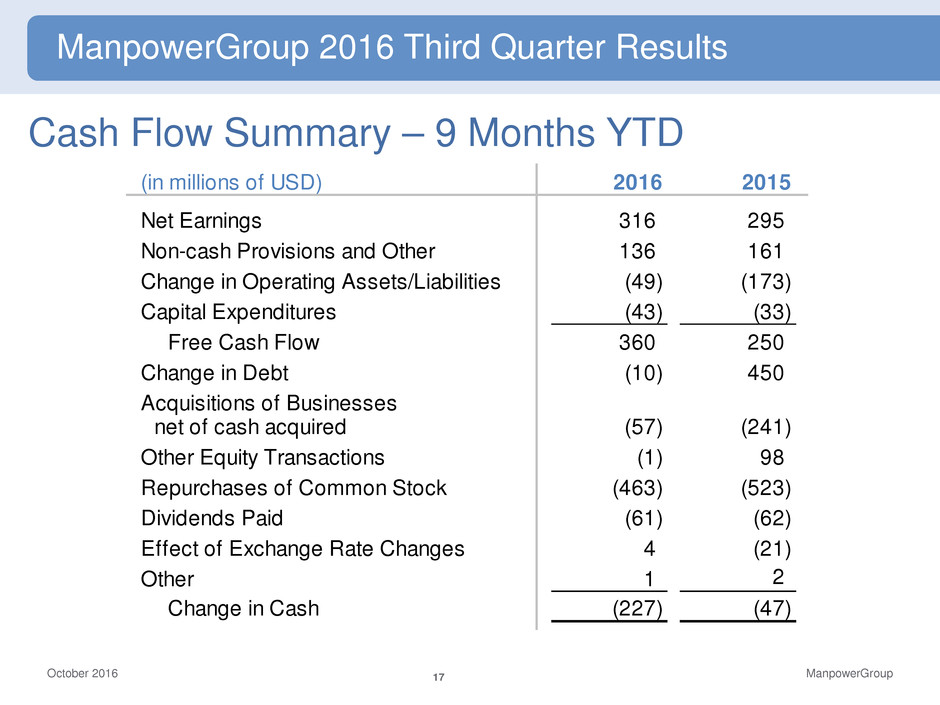

Cash Flow Summary – 9 Months YTD

ManpowerGroup 2016 Third Quarter Results

(in millions of USD) 2016 2015

Net Earnings 316 295

Non-cash Provisions and Other 136 161

Change in Operating Assets/Liabilities (49) (173)

Capital Expenditures (43) (33)

Free Cash Flow 360 250

Change in Debt (10) 450

Acquisitions of Businesses

net of cash acquired (57) (241)

Other Equity Transactions (1) 98

Repurchases of Common Stock (463) (523)

Dividends Paid (61) (62)

Effect of Exchange Rate Changes 4 (21)

Other 1 2

Change in Cash (227) (47)

October 2016 18 ManpowerGroup

Balance Sheet Highlights

Total Debt

(in millions of USD)

Total Debt to

Total Capitalization

Total Debt

Net Debt (Cash)

ManpowerGroup 2016 Third Quarter Results

120 -221 -231 125 132

308 373

768

516 468

855 880 854 876

-400

0

400

800

1,200

2012 2013 2014 2015 Q1 Q2 Q3

2016

23%

15% 14%

24% 25% 25% 26%

0%

10%

20%

30%

2012 2013 2014 2015 Q1 Q2 Q3

2016

October 2016 19 ManpowerGroup

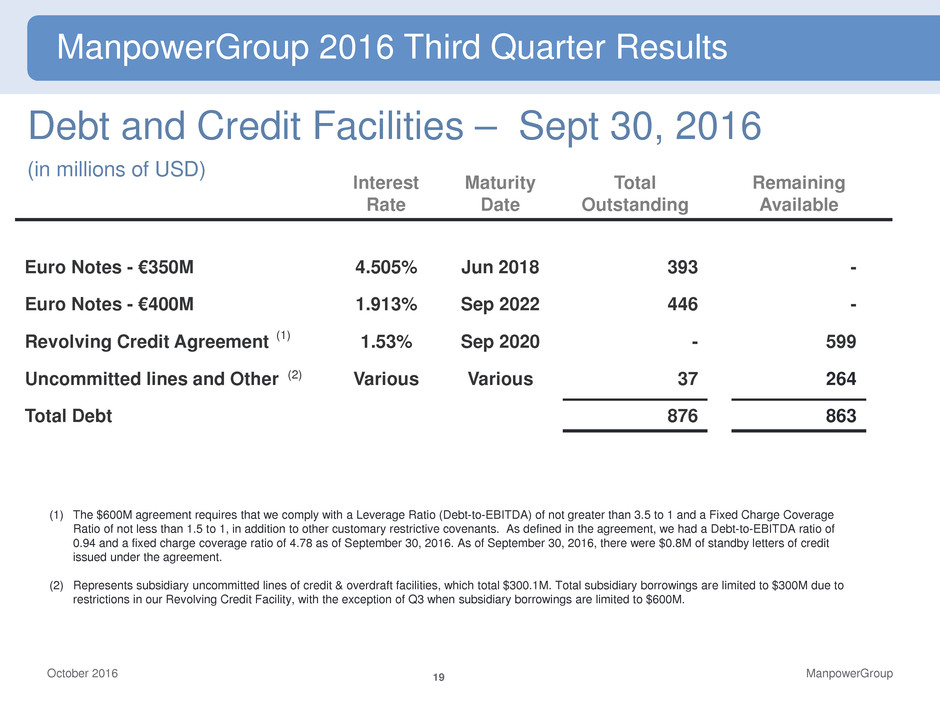

(1) The $600M agreement requires that we comply with a Leverage Ratio (Debt-to-EBITDA) of not greater than 3.5 to 1 and a Fixed Charge Coverage

Ratio of not less than 1.5 to 1, in addition to other customary restrictive covenants. As defined in the agreement, we had a Debt-to-EBITDA ratio of

0.94 and a fixed charge coverage ratio of 4.78 as of September 30, 2016. As of September 30, 2016, there were $0.8M of standby letters of credit

issued under the agreement.

(2) Represents subsidiary uncommitted lines of credit & overdraft facilities, which total $300.1M. Total subsidiary borrowings are limited to $300M due to

restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M.

Interest

Rate

Maturity

Date

Total

Outstanding

Remaining

Available

Euro Notes - €350M 4.505% Jun 2018 393 -

Euro Notes - €400M 1.913% Sep 2022 446 -

Revolving Credit Agreement 1.53% Sep 2020 - 599

Uncommitted lines and Other Various Various 37 264

Total Debt 876 863

Debt and Credit Facilities – Sept 30, 2016

(in millions of USD)

(2)

(1)

ManpowerGroup 2016 Third Quarter Results

October 2016 20 ManpowerGroup

Fourth Quarter Outlook

ManpowerGroup 2016 Third Quarter Results

Revenue Total Flat/Up 2% (Up 1-3% CC)

Americas Down 4-6% (Down/Up 1% CC)

Southern Europe Up 3-5% (Up 1-3% CC)

Northern Europe Down 3-5% (Up 2-4% CC)

APME Up 13-15% (Up 4-6% CC)

Right Management Down 5-7% (Down 4-6% CC)

Gross Profit Margin 16.8 – 17.0%

Operating Profit Margin 3.8 – 4.0%

Tax Rate 36.0%

EPS $1.65 – $1.73 (unfavorable $0.02 currency)

October 2016 21 ManpowerGroup

Key Take Aways

Continued slow growth environment, with improving trends in several European

markets; our geographic diversification and diversified business mix is helping us

offset weakness in some markets with strengths in others.

The current market conditions require a great focus on execution and operational

discipline; we will focus on driving revenue growth aligned with our strategies and

improving operational efficiency and productivity enhanced by technology.

With the added uncertainty in a slow growth environment, our clients are looking

for more flexibility and access to talent to execute their business plans. This is

precisely the reason we have diversified and strengthened our range of

workforce solutions and brands.

ManpowerGroup 2016 Third Quarter Results

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Argus on Manpower Inc. (MAN): 'The current dividend yield of 3.9% is attractive and safe, in our view'

- ManpowerGroup Reports 1st Quarter 2024 Results

- Manpower Inc. (MAN) PT Raised to $84 at BMO Capital

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share