Form 8-K Manitex International, For: Aug 04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of the earliest event reported) August 4, 2016

MANITEX INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Michigan | 001-32401 | 42-1628978 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

| 9725 Industrial Drive, Bridgeview, Illinois | 60455 | |||

| (Address of Principal Executive Offices) | (Zip Code) | |||

(708) 430-7500

(Registrant’s Telephone Number, Including Area Code)

9725 Industrial Drive, Bridgeview, Illinois

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operations and Financial Condition. |

On August 4, 2016, Manitex International, Inc. (the “Company”) issued a press release announcing its unaudited financial results for the second quarter ended June 30, 2016 (the “Press Release”). The full text of the Press Release is being furnished as Exhibit 99.1 to this Current Report. The Company also posted presentation slides (Exhibit 99.2) that will be referenced during the conference call and webcast which will take place today August 4, 2016 at 4:30 pm eastern time to discuss the second quarter 2016 results. Both Exhibits can be accessed from the Investor Relations section of the Company’s website at www.ManitexInternational.com.

The information in this Current Report (including Exhibit 99.1 and 99.2) is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

The Company references certain non-GAAP financial measures. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached Press Release. Disclosures regarding definitions of these financial measures used by the Company and why the Company’s management believes these financial measures provide useful information to investors is also included in the Press Release.

| Item 9.01 | Financial Statements and Exhibits. |

(a) Financial Statements of Businesses Acquired.

Not applicable.

(b) Pro Forma Financial Information.

Not applicable.

(c) Shell Company Transactions.

Not applicable.

(d) Exhibits.

See the Exhibit Index set forth below for a list of exhibits included with this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned thereunder duly authorized.

| MANITEX INTERNATIONAL, INC. | ||

| By: | /s/ DAVID GRANSEE | |

| Name: | David Gransee | |

| Title: | VP and CFO | |

Date: August 4, 2016

EXHIBIT INDEX

| Exhibit |

Description | |

| 99.1 | Press release dated August 4, 2016 | |

| 99.2 | Webcast presentation slides dated August 4, 2016 | |

Exhibit 99.1

Manitex International, Inc. Reports Second Quarter 2016 Results

Bridgeview, IL, August 4th, 2016 — Manitex International, Inc. (Nasdaq: MNTX), a leading international provider of cranes and specialized material and container handling equipment, today announced Second Quarter 2016 results.

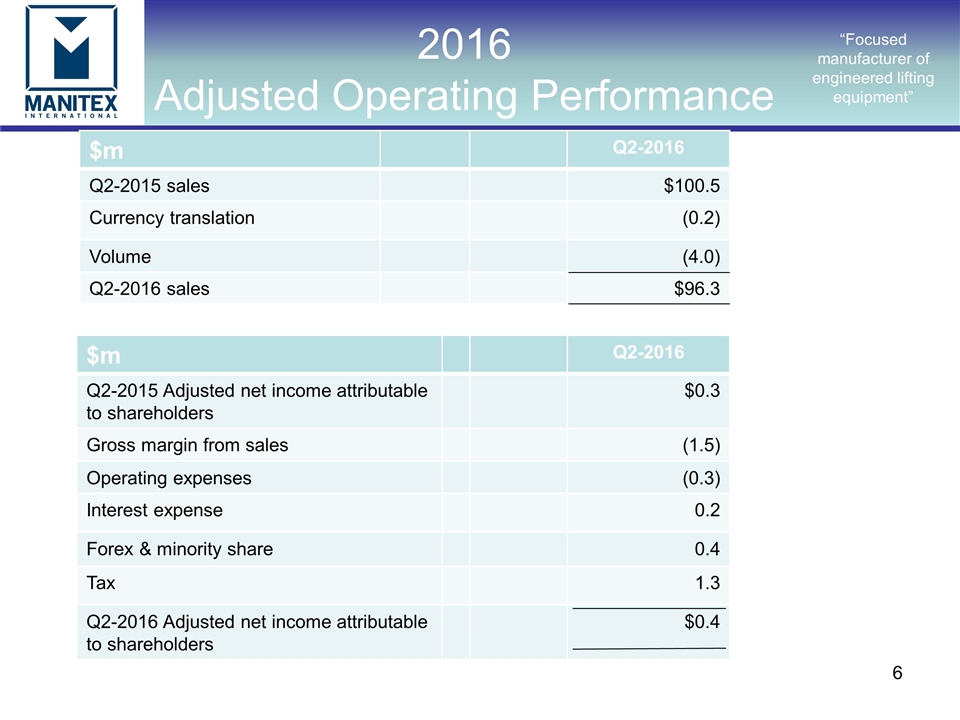

For the three months ended June 30, 2016, the Company reported net loss attributable to shareholders of Manitex International of $(1.8) million or $(0.11) per share, on net revenues of $96.3 million, compared to net income of $0.1 million or $0.01 per share on sales of $100.5 million for the three months ended June 30, 2015. Net income attributable to shareholders of Manitex International adjusted for transaction related and restructuring related items for the three months ended June 30, 2016 was $0.4 million or $0.02 per share, compared to $0.3 million or $0.02 per share for the three months ended June 30 2015. (The Glossary at the end of this press release contains further details regarding these adjustments).

Second Quarter 2016 Financial Highlights:

| • | Net revenues of $96.3 million representing a year-over-year decrease of 4.2% from $100.5 million. |

| • | Gross margin of 17.5% compared to 18.8% in the second quarter of 2015. Adjusted gross margin* for the second quarter 2016 was 18.3% compared to 19.1% in second quarter of 2015. |

| • | Continued progress on strategic restructuring, with net costs of $2.1 million in the quarter, resulting from charges related the entry into our new North American credit facility and the consolidation of two manufacturing facilities. |

| • | Completed new North American $45 million revolving credit facility with lower interest rate of 4%. |

| • | Debt reduction of $7.1 million in the quarter, including term debt reduction of $3.0 million. |

| • | Cost reductions of $2.9 million achieved in the quarter and $5.1 million year to date equal to 92% of 2016 target. |

| • | Adjusted EBITDA* of $6.2 million or 6.4% of sales compared to adjusted EBITDA of $7.9 million or 7.8% of sales for the second quarter of 2015. |

| • | Consolidated backlog was $63.6 million at June 30, 2016, compared to $82.5 million at December 31, 2015. |

Chairman and Chief Executive Officer, David Langevin commented, “As anticipated, the second quarter financial performance reflects continued softness in our markets although it also reflects well on our organization’s focus on controlling what we can control and on the execution of our strategic objectives for the year. During the second quarter, much as we did in the first quarter, we achieved solid gross margins considering the reduced level of demand in our markets. And, while we made good progress during the quarter in reducing our debt and working capital levels we expect to accelerate our debt reduction throughout the end of this year. Sales of non-strategic businesses, when combined with other incremental working capital and operating cash flow, may enable us to exceed our previously stated target of $45 million in debt reduction for calendar year 2016.”

“We have seen improvement in ASV with a 110 basis point expansion in adjusted operating margin compared to the same quarter in 2015, along with the continued emphasis on reactivating their independent dealer network. Our PM knuckle boom crane product continues as our highest margin product with sales growth in Europe and North America offset by weakness in Latin America and the rest of the world. The straight mast market continues to run at historically low levels with a further shift in market demand to lower tonnage cranes. However, even with these headwinds we are seeing our market share for these type of products expand.

“We operate in cyclical businesses and while the timing of the recovery is impossible to predict we remain confident that the measures we continue to take to rationalize production, lower our costs, strengthen our balance sheet, and add to our leadership position in our served markets, will provide our shareholders an excellent foundation for future growth.”

— more —

Continuing Operations: Segment Results

| As Reported | As Adjusted* | |||||||||||||||

| Three Months Ended June 30 | Three Months Ended June 30 | |||||||||||||||

| $000 | 2016 | 2015 | 2016 | 2015 | ||||||||||||

| Consolidated |

||||||||||||||||

| Net Revenues |

96,277 | 100,513 | 96,277 | 100,513 | ||||||||||||

| Operating Income |

1,884 | 4,508 | 3,037 | 4,869 | ||||||||||||

| Operating Margin % |

2.0 | % | 4.5 | % | 3.1 | % | 4.8 | % | ||||||||

| Lifting Segment |

||||||||||||||||

| Net Revenues |

67,065 | 65,776 | 67,065 | 65,776 | ||||||||||||

| Operating Income |

2,677 | 4,141 | 3,565 | 4,314 | ||||||||||||

| Operating Margin % |

4.0 | % | 6.3 | % | 5.3 | % | 6.6 | % | ||||||||

| ASV Segment |

||||||||||||||||

| Net Revenues |

27,273 | 32,202 | 27,273 | 32,202 | ||||||||||||

| Operating Income |

2,057 | 1,974 | 2,057 | 2,065 | ||||||||||||

| Operating Margin % |

7.5 | % | 6.1 | % | 7.5 | % | 6.4 | % | ||||||||

| Equipment Distribution Segment |

||||||||||||||||

| Net Revenues |

3,498 | 3,920 | 3,498 | 3,920 | ||||||||||||

| Operating Income |

(902 | ) | 211 | (652 | ) | 211 | ||||||||||

| Operating Margin % |

-25.8 | % | 5.4 | % | -18.6 | % | 5.4 | % | ||||||||

| Corporate & Eliminations |

||||||||||||||||

| Revenue eliminations |

1,559 | 1,385 | 1,559 | 1,385 | ||||||||||||

| Corporate charges & inter segment profit in inventory |

1,948 | 1,818 | 1,933 | 1,721 | ||||||||||||

| * | (The Glossary at the end of this press release contains further details regarding As Adjusted items). The segment commentary below refers to “As adjusted” results. |

Lifting Segment Results

| • | Net revenues increased 2% or $1.3 million to $67.1 million for the quarter from $65.8 million in the year ago quarter. Sales of Manitex straight mast and industrial cranes were down year over year by approximately $0.9 million but with sales skewed to lower capacity units. PM knuckle boom crane sales were flat overall, with growth in North America, Italy and Western Europe offset by lower sales in South America and the Middle East. Sales of material handling equipment increased year over year with increased military and container handling equipment shipments being partially offset by lower volumes of other products. |

| • | Operating income on an adjusted basis was $3.6 million or 5.3% of sales compared to $4.3 million or 6.6% of sales in the comparative period, with the shortfall almost entirely from lower gross margin as operating expenses were in line year over year. Gross profit for the three months ended June 30, 2016 was adversely affected by higher sales of lower capacity straight mast cranes and chassis which was partially offset by stronger margins on military sales. |

ASV Segment Results

| • | Net revenues of $27.3 million were $4.9 million lower than the $32.2 million in the second quarter of 2015, with the shortfall in revenues principally resulting from a $4.4 million reduction in demand for undercarriages and parts. Undercarriage sales in the second quarter of 2015 were elevated due to acceleration of orders by the customer to accommodate their production schedules. Sales of machines in total were down 12.9% but showed an improved mix, as sales of tracked machines were up year over year and comprised over 90% of machine sales in the quarter. ASV branded product sales increased 23% on a quarter over quarter basis. |

| • | Despite lower sales, gross margin improved year over year on both a dollar basis and as a percent of sales, resulting from the favorable mix of machine sales and lower manufacturing costs. Operating income of $2.1 million or 7.5% of sales compared to $2.1 million or 6.4% of sales, with the percentage improvement of 110 basis points over the year ago period driven by the improved gross margin and lower SG&A costs. |

Equipment Distribution Segment Results

| • | Net revenues decreased $0.4 million to $3.5 million for the quarter ended June 30 2016 compared to the quarter ending June 30 2015. Sales of new and remarketed equipment were lower than the comparative period, reflecting the continuing soft demand for equipment. This was partially offset by improved parts, service and rental revenues. Operating loss on an adjusted basis was ($0.7 million) in the quarter with reduced gross margin from lower equipment sales and higher operating expenses from costs related to the expansion of the rental fleet operations. |

Other Profit / Loss Items

| • | Interest expense related to write-off of debt issuance costs. Costs of $1.4 million charged in the current period were related to the expensing of deferred financing fees resulting from the change to a new long-term North American revolving credit facility |

| • | Other income in the second quarter of 2016 was $0.7 million compared with zero in the second quarter of 2015 principally arising from the reassessment of a contingent liability valuation in the Lifting segment. |

| • | Income tax benefit of $1.1 million in the second quarter of 2016 compared to expense of $0.1 million in the year ago period. The tax benefit reflects the benefit of the full year expected tax including valuation allowance against US deferred tax assets during the quarter. |

Andrew Rooke, Manitex International President and Chief Operating Officer, commented, “We made further progress during the quarter through a focus on restructuring our debt and strengthening the operations. We completed a new credit facility for North America at reduced interest cost and completed the consolidation of two facilities with excess capacity to improve our cost base. In addition, relating to our debt reduction initiative, we have made term debt repayments of $3.0 million in the quarter and $9.7 million year to date, totally eliminating our recourse Term Debt. We expect to continue making progress with debt reduction, and as expected, we saw a reduction in our working capital from March 31, 2016, with an improvement of $3.2 million in the quarter. We are

seeing strong results from our cost reduction program despite lower levels of activity in our served markets, with expense reduction initiatives for the year-to-date resulting in 92% of the $5.5 million in savings we targeted for the full year. Such aggressive cost reduction has enabled us to achieve adjusted gross margin for the quarter of 18.3%, a good performance when considering the relatively high proportion of lower capacity crane sales in our current mix.”

Conference Call:

Management will host a conference call at 4:30 PM Eastern Time today to discuss the results with the investment community. Anyone interested in participating in the call should dial 888-203-7667 if calling within the United States or 719-457-2552 if calling internationally. A replay will be available until August 11, 2016 which can be accessed by dialing 877-870-5176 if calling within the United States or 858-384-5517 if calling internationally. Please use passcode 2049972 to access the replay. The call will additionally be broadcast live and archived for 90 days over the internet with accompanying slides, accessible at the investor relations portion of the Company’s corporate website, www.manitexinternational.com/eventspresentations.aspx.

About Manitex International, Inc.

Manitex International, Inc. is a leading worldwide provider of highly engineered specialized equipment including boom truck, truck and knuckle boom cranes, container handling equipment and reach stackers, rough terrain forklifts, and other related equipment. Our products, which are manufactured in facilities located in the USA, Canada, and Italy, are targeted to selected niche markets where their unique designs and engineering excellence fill the needs of our customers and provide a competitive advantage. We have consistently added to our portfolio of branded products and equipment both through internal development and focused acquisitions to diversify and expand our sales and profit base while remaining committed to our niche market strategy. Our brands include Manitex, PM, O&S, CVS Ferrari, Badger, Liftking, Sabre, and Valla. ASV, our venture with Terex Corporation, manufactures and sells a line of high quality compact track and skid steer loaders.

Forward-Looking Statement

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This release contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company’s future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company’s filings with the Securities and Exchange Commission and statements in this release should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

| Company Contact | ||

| Manitex International, Inc. | Darrow Associates Inc. | |

| David Langevin | Peter Seltzberg, Managing Director | |

| Chairman and Chief Executive Officer | Investor Relations | |

| (708) 237-2060 | (516) 419-9915 | |

| [email protected] | [email protected] | |

MANITEX INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except for share and per share amounts)

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Unaudited | Unaudited | Unaudited | Unaudited | |||||||||||||

| Net revenues |

$ | 96,277 | $ | 100,513 | $ | 198,638 | $ | 201,555 | ||||||||

| Cost of sales |

79,432 | 81,603 | 163,348 | 164,643 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

16,845 | 18,910 | 35,290 | 36,912 | ||||||||||||

| Operating expenses |

||||||||||||||||

| Research and development costs |

1,364 | 1,901 | 2,853 | 3,002 | ||||||||||||

| Selling, general and administrative expenses |

13,597 | 12,501 | 27,196 | 27,352 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

14,961 | 14,402 | 30,049 | 30,354 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

1,884 | 4,508 | 5,241 | 6,558 | ||||||||||||

| Other income (expense) |

||||||||||||||||

| Interest expense: |

||||||||||||||||

| Interest expense |

(3,627 | ) | (3,814 | ) | (6,740 | ) | (6,658 | ) | ||||||||

| Interest expense related to write off of debt issuance costs (Note 13) |

(1,439 | ) | — | (1,439 | ) | — | ||||||||||

| Foreign currency transaction gain (loss) |

60 | (266 | ) | (477 | ) | 679 | ||||||||||

| Other (expense) income |

650 | 11 | 2,832 | (7 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other expense |

(4,356 | ) | (4,069 | ) | (5,824 | ) | (5,986 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss) income before income taxes and loss in non-marketable equity interest from continuing operations |

(2,472 | ) | 439 | (583 | ) | 572 | ||||||||||

| Income tax (benefit) expense from continuing operations |

(1,125 | ) | 121 | (608 | ) | 152 | ||||||||||

| Loss in non-marketable equity interest, net of taxes |

(40 | ) | (40 | ) | (79 | ) | (79 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net (loss) income from continuing operations |

(1,387 | ) | 278 | (54 | ) | 341 | ||||||||||

| Discontinued operations |

||||||||||||||||

| Income from operations of discontinued operations |

— | 51 | — | 61 | ||||||||||||

| Income tax expense |

— | 13 | — | 16 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income on discontinued operations |

— | 38 | — | 45 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net (loss) income |

(1,387 | ) | 316 | (54 | ) | 386 | ||||||||||

| Net (income) attributable to noncontrolling interests |

(399 | ) | (178 | ) | (272 | ) | (472 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net (loss) income attributable to shareholders of Manitex International, Inc. |

$ | (1,786 | ) | $ | 138 | $ | (326 | ) | $ | (86 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings (loss) Per Share |

||||||||||||||||

| Basic |

||||||||||||||||

| (Loss) earnings from continuing operations attributable to shareholders of Manitex International, Inc. |

$ | (0.11 | ) | $ | 0.01 | $ | (0.02 | ) | $ | (0.01 | ) | |||||

| Income (loss) from discontinued operations attributable to shareholders of Manitex International, Inc. |

$ | — | $ | — | $ | — | $ | — | ||||||||

| (Loss) earnings attributable to shareholders of Manitex International, Inc. |

$ | (0.11 | ) | $ | 0.01 | $ | (0.02 | ) | $ | (0.01 | ) | |||||

| Diluted |

||||||||||||||||

| (Loss) earnings from continuing operations attributable to shareholders of Manitex International, Inc. |

$ | (0.11 | ) | $ | 0.01 | $ | (0.02 | ) | $ | (0.01 | ) | |||||

| Income (loss) from discontinued operations attributable to shareholders of Manitex International, Inc. |

$ | — | $ | — | $ | — | $ | — | ||||||||

| (Loss) earnings attributable to shareholders of Manitex International, Inc. |

$ | (0.11 | ) | $ | 0.01 | $ | (0.02 | ) | $ | (0.01 | ) | |||||

| Weighted average common shares outstanding |

||||||||||||||||

| Basic |

16,125,788 | 16,014,059 | 16,115,695 | 15,925,241 | ||||||||||||

| Diluted |

16,125,788 | 16,031,011 | 16,115,695 | 15,925,241 | ||||||||||||

MANITEX INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

| June 30, 2016 |

December 31, 2015 |

|||||||

| Unaudited | Unaudited | |||||||

| ASSETS | ||||||||

| Current assets |

||||||||

| Cash |

$ | 9,896 | $ | 8,578 | ||||

| Trade receivables (net) |

74,973 | 63,388 | ||||||

| Accounts receivable from related party |

461 | 388 | ||||||

| Other receivables |

3,824 | 3,254 | ||||||

| Inventory (net) |

114,977 | 119,269 | ||||||

| Deferred tax asset |

2,951 | 2,951 | ||||||

| Prepaid expense and other |

5,139 | 4,872 | ||||||

|

|

|

|

|

|||||

| Total current assets |

212,221 | 202,700 | ||||||

|

|

|

|

|

|||||

| Total fixed assets (net) |

40,627 | 41,985 | ||||||

| Intangible assets (net) |

67,560 | 70,629 | ||||||

| Goodwill |

80,298 | 80,089 | ||||||

| Other long-term assets |

1,444 | 3,003 | ||||||

| Non-marketable equity investment |

5,673 | 5,752 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 407,823 | $ | 404,158 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND EQUITY | ||||||||

| Current liabilities |

||||||||

| Notes payable—short term |

$ | 39,174 | $ | 30,323 | ||||

| Revolving credit facilities |

1,527 | 1,795 | ||||||

| Current portion of capital lease obligations |

848 | 1,004 | ||||||

| Accounts payable |

60,539 | 62,137 | ||||||

| Accounts payable related parties |

1,965 | 1,611 | ||||||

| Accrued expenses |

19,652 | 21,053 | ||||||

| Other current liabilities |

3,032 | 2,113 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

126,737 | 120,036 | ||||||

|

|

|

|

|

|||||

| Long-term liabilities |

||||||||

| Revolving term credit facilities |

47,706 | 46,097 | ||||||

| Notes payable (net) |

60,237 | 67,639 | ||||||

| Capital lease obligations |

5,684 | 5,850 | ||||||

| Convertible note related party (net) |

6,802 | 6,737 | ||||||

| Convertible note (net) |

14,022 | 13,923 | ||||||

| Deferred gain on sale of property |

1,116 | 1,288 | ||||||

| Deferred tax liability |

4,270 | 4,525 | ||||||

| Other long-term liabilities |

6,792 | 7,763 | ||||||

|

|

|

|

|

|||||

| Total long-term liabilities |

146,629 | 153,822 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

273,366 | 273,858 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies |

||||||||

| Equity |

||||||||

| Preferred Stock—Authorized 150,000 shares, no shares issued or outstanding at June 30, 2016 and December 31, 2015 |

— | — | ||||||

| Common Stock—no par value 25,000,000 shares authorized, 16,126,106 and 16,072,100 shares issued and outstanding at June 30, 2016 and December 31, 2015, respectively |

93,683 | 93,186 | ||||||

| Paid in capital |

2,805 | 2,630 | ||||||

| Retained earnings |

16,262 | 16,588 | ||||||

| Accumulated other comprehensive loss |

(4,304 | ) | (5,392 | ) | ||||

|

|

|

|

|

|||||

| Equity attributable to shareholders of Manitex International, Inc. |

108,446 | 107,012 | ||||||

| Equity attributable to noncontrolling interests |

26,011 | 23,288 | ||||||

|

|

|

|

|

|||||

| Total equity |

134,457 | 130,300 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 407,823 | $ | 404,158 | ||||

|

|

|

|

|

|||||

MANITEX INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS\

(in thousands)

| Six Months Ended June 30, |

||||||||

| 2016 | 2015 | |||||||

| Unaudited | Unaudited | |||||||

| Cash flows from operating activities: |

||||||||

| Net (loss) income |

$ | (54 | ) | $ | 386 | |||

| Adjustments to reconcile net income to cash used for operating activities: |

||||||||

| Depreciation and amortization |

6,243 | 5,812 | ||||||

| Changes in allowances for doubtful accounts |

118 | (94 | ) | |||||

| Changes in inventory reserves |

655 | 204 | ||||||

| Revaluation of contingent acquisition liability |

(915 | ) | — | |||||

| Write down of goodwill |

275 | — | ||||||

| Deferred income taxes |

(283 | ) | 71 | |||||

| Amortization and write off of deferred debt issuance costs (Note 13) |

2,105 | 614 | ||||||

| Amortization of debt discount |

286 | 341 | ||||||

| Change in value of interest rate swaps |

(373 | ) | (357 | ) | ||||

| Loss in non-marketable equity interest |

79 | 79 | ||||||

| Share-based compensation |

565 | 866 | ||||||

| Adjustment to deferred gain on sales and lease back |

(118 | ) | — | |||||

| Gain on disposal of assets |

(2,244 | ) | (98 | ) | ||||

| Reserves for uncertain tax provisions |

32 | 8 | ||||||

| Changes in operating assets and liabilities: |

||||||||

| (Increase) decrease in accounts receivable |

(11,678 | ) | 11,387 | |||||

| (Increase) decrease in inventory |

862 | (6,931 | ) | |||||

| (Increase) decrease in prepaid expenses |

(250 | ) | (3,229 | ) | ||||

| (Increase) decrease in other assets |

182 | (25 | ) | |||||

| Increase (decrease) in accounts payable |

(1,882 | ) | 608 | |||||

| Increase (decrease) in accrued expense |

(1,593 | ) | (2,956 | ) | ||||

| Increase (decrease) in income tax payable on ASV conversion |

— | (16,500 | ) | |||||

| Increase (decrease) in other current liabilities |

894 | 1,252 | ||||||

| Increase (decrease) in other long-term liabilities |

(157 | ) | 1,004 | |||||

| Discontinued operations - cash used for operating activities |

— | (851 | ) | |||||

|

|

|

|

|

|||||

| Net cash used for operating activities |

(7,251 | ) | (8,409 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Acquisition of business, net of cash acquired |

— | (13,747 | ) | |||||

| Proceeds from the sale of fixed assets |

187 | 167 | ||||||

| Proceeds from the sale of intellectual property (Note 17) |

2,205 | — | ||||||

| Purchase of property and equipment |

(1,275 | ) | (1,351 | ) | ||||

| Investment in intangibles other than goodwill |

(55 | ) | (173 | ) | ||||

| Investment received from noncontrolling interest (Note 17) |

2,450 | — | ||||||

| Discontinued operations - cash used for investing activities |

— | |||||||

| Discontinued operations - cash used for investing activities |

— | (33 | ) | |||||

|

|

|

|

|

|||||

| Net cash provided by (used for) investing activities |

3,512 | (15,137 | ) | |||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Borrowing on revolving term credit facilities |

698 | 6,594 | ||||||

| Net borrowings on working capital facilities |

9,996 | (2,941 | ) | |||||

| New borrowings—convertible notes |

— | 15,000 | ||||||

| New borrowings—term loan |

— | 14,000 | ||||||

| New borrowings—other |

749 | 4,667 | ||||||

| Debt issuance costs incurred |

(501 | ) | (1,074 | ) | ||||

| Note payments |

(9,924 | ) | (8,853 | ) | ||||

| Shares repurchased for income tax withholding on share-based compensation |

(43 | ) | (3 | ) | ||||

| Proceeds from sale and lease back (Note 13) |

4,080 | — | ||||||

| Payments on capital lease obligations |

(322 | ) | (1,011 | ) | ||||

| Discontinued operations - cash used for financing activities |

— | (59 | ) | |||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

4,733 | 26,320 | ||||||

|

|

|

|

|

|||||

| Net increase (decrease) in cash and cash equivalents |

994 | 2,774 | ||||||

| Effect of exchange rate changes on cash |

324 | (836 | ) | |||||

| Cash and cash equivalents at the beginning of the year |

8,578 | 4,370 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 9,896 | $ | 6,308 | ||||

|

|

|

|

|

|||||

Supplemental Information

In an effort to provide investors with additional information regarding the Company’s results, Manitex International refers to various non-GAAP (U.S. generally accepted accounting principles) financial measures which management believes provides useful information to investors. These non-GAAP measures may not be comparable to similarly titled measures being disclosed by other companies. In addition, the Company believes that non-GAAP financial measures should be considered in addition to, and not in lieu of, GAAP financial measures. Manitex International believes that this information is useful to understanding its operating results and the ongoing performance of its underlying businesses. Management of Manitex International uses both GAAP and non–GAAP financial measures to establish internal budgets and targets and to evaluate the Company’s financial performance against such budgets and targets. The amounts described below are unaudited, are reported in thousands of U.S. dollars, and are as of, or for the three month period ended June 30, 2016, unless otherwise indicated.

Non-GAAP Financial Measures

This press release includes the following non-GAAP financial measures: “Adjusted EBITDA” (GAAP Operating Income adjusted for acquisition transaction related expense, restructuring and related expense, and Foreign exchange and other, and depreciation and amortization) and Adjusted Net Income (net income attributable to Manitex shareholders adjusted for acquisition transaction related and restructuring and related expense, net of tax, and change in net income attributable to noncontrolling interest). These non-GAAP terms, as defined by the Company, may not be comparable to similarly titled measures used by other companies. Neither Adjusted Net Income nor Adjusted EBITDA are a measure of financial performance under generally accepted accounting principles. Items excluded from Adjusted EBITDA and Adjusted Net Income are significant components in understanding and assessing financial performance. Adjusted EBITDA and Adjusted Net Income should not be considered in isolation or as a substitute for net earnings, operating income and other consolidated earnings data prepared in accordance with GAAP or as a measure of our profitability. A reconciliation of Operating Income to Adjusted EBITDA and Adjusted Net Income is provided below.

The Company’s management believes that Adjusted EBITDA and Adjusted EBITDA as a percentage of sales and Adjusted Net Income represent key operating metrics for its business. GAAP Operating Income adjusted for acquisition transaction related expense, restructuring and related expense, Foreign exchange and other, and depreciation and amortization (Adjusted EBITDA), and Adjusted Net Income, GAAP net income adjusted for acquisition transaction and restructuring related expense are a key indicator used by management to evaluate operating performance. While Adjusted EBITDA and Adjusted Net Income are not intended to replace any presentation included in our consolidated financial statements under generally accepted accounting principles (GAAP) and should not be considered an alternative to operating performance or an alternative to cash flow as a measure of liquidity, we believe these measures are useful to investors in assessing our operating results, capital expenditure and working capital requirements and the ongoing performance of its underlying businesses. These calculations may differ in method of calculation from similarly titled measures used by other companies. A reconciliation of Adjusted EBITDA and Adjusted Net Income to GAAP financial measures for the three month periods ended June 30, 2015 and 2016 is included with this press release below and with the Company’s related Form 8-K.

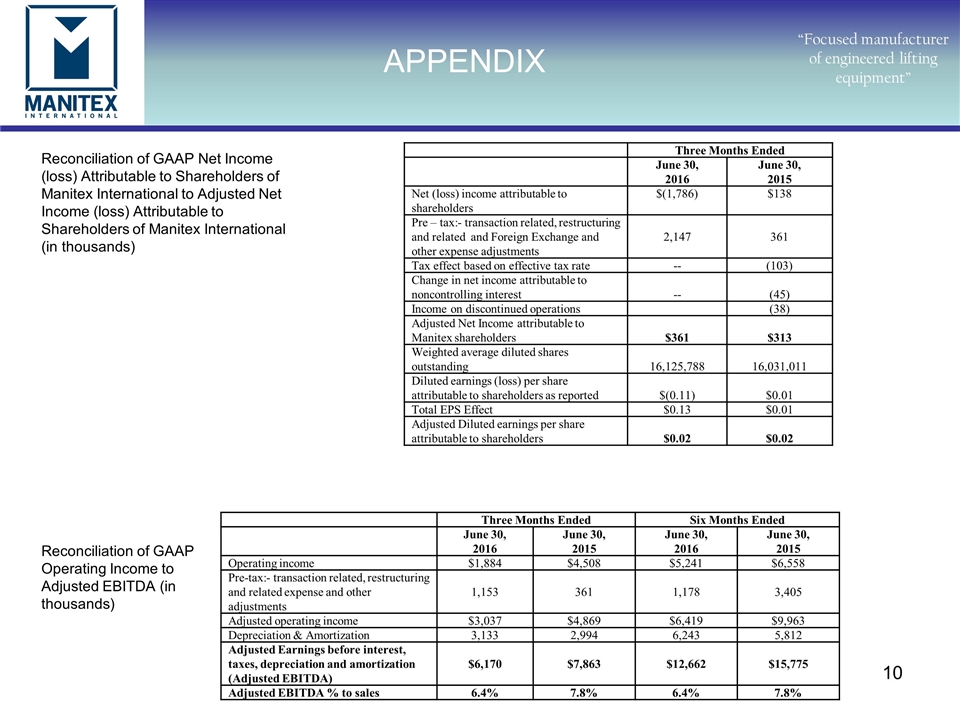

Reconciliation of GAAP Operating Income to Adjusted EBITDA (in thousands)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2016 |

June 30, 2015 |

June 30, 2016 |

June 30, 2015 |

|||||||||||||

| Operating income |

$ | 1,884 | $ | 4,508 | $ | 5,241 | $ | 6,558 | ||||||||

| Pre-tax:- transaction related, restructuring and related expense and foreign exchange and other adjustments |

1,153 | 361 | 1,178 | 3,405 | ||||||||||||

| Adjusted operating income |

$ | 3,037 | $ | 4,869 | $ | 6,419 | $ | 9,963 | ||||||||

| Depreciation & Amortization |

3,133 | 2,994 | 6,243 | 5,812 | ||||||||||||

| Adjusted Earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) |

$ | 6,170 | $ | 7,863 | $ | 12,662 | $ | 15,775 | ||||||||

| Adjusted EBITDA % to sales |

6.4 | % | 7.8 | % | 6.4 | % | 7.8 | % | ||||||||

Reconciliation of GAAP Net Income (loss) Attributable to Shareholders of Manitex International to Adjusted Net Income (loss) Attributable to Shareholders of Manitex International (in thousands)

| Three Months Ended | ||||||||

| June 30, 2016 |

June 30, 2015 |

|||||||

| Net (loss) income attributable to shareholders |

$ | (1,786 | ) | $ | 138 | |||

| Pre – tax:- transaction related, restructuring and related and Foreign Exchange and other expense adjustments |

2,147 | 361 | ||||||

| Tax effect based on effective tax rate |

— | (103 | ) | |||||

| Change in net income attributable to noncontrolling interest |

— | (45 | ) | |||||

| Income on discontinued operations |

(38 | ) | ||||||

| Adjusted Net Income attributable to Manitex shareholders |

$ | 361 | $ | 313 | ||||

| Weighted average diluted shares outstanding |

16,125,788 | 16,031,011 | ||||||

| Diluted earnings (loss) per share attributable to shareholders as reported |

$ | (0.11 | ) | $ | 0.01 | |||

| Total EPS Effect |

$ | 0.13 | $ | 0.01 | ||||

| Adjusted Diluted earnings per share attributable to shareholders |

$ | 0.02 | $ | 0.02 | ||||

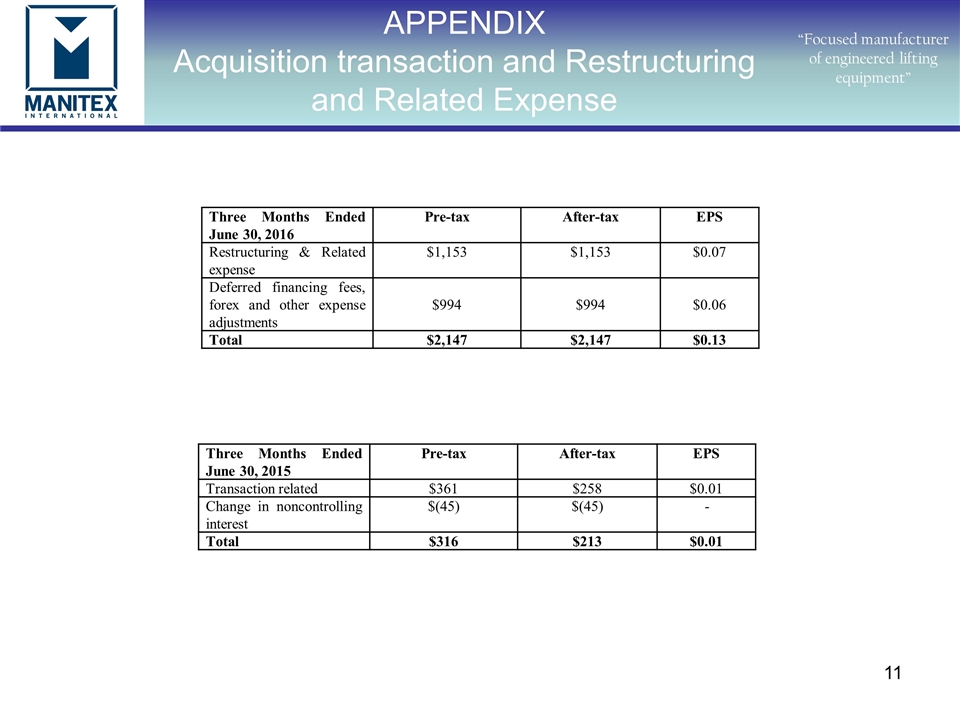

Transaction and restructuring related expense

After tax expense and per share amounts (Adjusted Net Income) are calculated using pre-tax amounts, applying a tax rate based on the effective tax rate to arrive at an after-tax amount. This number is divided by the weighted average diluted shares to provide the impact on earnings per share. The company assesses the impact of these items because when discussing earnings per share, the Company adjusts for items it believes are not reflective of operating activities in the periods.

| Three Months Ended March 31, 2016 |

Pre-tax | After-tax | EPS | |||||||||

| Restructuring & Related expense |

$ | 1,153 | $ | 1,153 | $ | 0.07 | ||||||

| Deferred financing fees, foreign exchange and other expense adjustments |

$ | 994 | $ | 994 | $ | 0.06 | ||||||

| Total |

$ | 2,147 | $ | 2,147 | $ | 0.13 | ||||||

| Three Months Ended June 30, 2015 |

Pre-tax | After-tax | EPS | |||||||||

| Transaction related |

$ | 361 | $ | 258 | $ | 0.01 | ||||||

| Change in noncontrolling interest |

$ | (45 | ) | $ | (45 | ) | — | |||||

| Total |

$ | 316 | $ | 213 | $ | 0.01 | ||||||

Backlog

Backlog is defined as purchase orders that have been received by the Company. The disclosure of backlog aids in the analysis the Company’s customers’ demand for product, as well as the ability of the Company to meet that demand. Backlog is not necessarily indicative of sales to be recognized in a specified future period.

| June 30, 2016 | December 31, 2015 | |||||||

| Backlog |

$ | 63,612 | $ | 82,522 | ||||

| 6/30/2016 Decrease v prior periods |

(22.9 | %) | ||||||

Current Ratio is calculated by dividing current assets by current liabilities.

| June 30, 2016 | December 31, 2015 | |||||||

| Current Assets |

$ | 212,221 | $ | 202,700 | ||||

| Current Liabilities |

126,737 | $ | 120,036 | |||||

| Current Ratio |

1.7 | 1.7 | ||||||

Days Sales Outstanding, (DSO), is calculated by taking the sum of net trade and related party receivables divided by annualized sales per day (sales for the quarter, multiplied by 4, and the sum divided by 365).

Days Payables Outstanding, (DPO), is calculated by taking the sum of net trade and related party payables divided by annualized cost of sales per day (cost of goods sold for the quarter, multiplied by 4, and the sum divided by 365).

Debt is calculated using the Condensed Consolidated Balance Sheet amounts for current and long term portion of long term debt, capital lease obligations, notes payable, convertible notes and revolving credit facilities. Debt to Adjusted EBITDA ratio is calculated by dividing total debt at the balance sheet date by trailing twelve month Adjusted EBITDA.

| June 30, 2016 | December 31, 2015 | |||||||

| Current portion of long term debt |

39,174 | 30,323 | ||||||

| Current portion of capital lease obligations |

848 | 1,004 | ||||||

| Revolving credit facilities |

1,527 | 1,795 | ||||||

| Revolving term credit facilities |

47,706 | 46,097 | ||||||

| Notes payable – long term |

60,237 | 67,639 | ||||||

| Capital lease obligations |

5,684 | 5,850 | ||||||

| Convertible Notes |

20,824 | 20,660 | ||||||

|

|

|

|

|

|||||

| Debt |

$ | 176,000 | $ | 173,368 | ||||

|

|

|

|

|

|||||

| Adjusted EBITDA (TTM) |

$ | 22,670 | $ | 25,775 | ||||

| Debt to Adjusted EBITDA Ratio |

7.8 | 6.7 | ||||||

Interest Cover is calculated by dividing Adjusted EBITDA (GAAP Operating Income adjusted for acquisition transaction expense and restructuring related expense and other exceptional costs and depreciation and amortization) for the trailing twelve month period by interest expense as reported in the Consolidated Statement of Income for the same period.

| 12 Month Period July 1, 2015 to June 30, 2016 |

12 Month Period January 1 2015 to December 31 2015 |

|||||||

| Adjusted EBITDA |

$ | 22,670 | $ | 25,775 | ||||

| Interest Expense |

13,066 | 12,984 | ||||||

| Interest Cover Ratio |

1.7 | 2.0 | ||||||

Inventory turns are calculated by multiplying cost of goods sold for the referenced three month period by 4 and dividing that figure by inventory as at the referenced period.

Operating Working Capital is calculated using the Consolidated Balance Sheet amounts for Trade receivables (net of allowance) plus inventories, less Accounts payable. The Company considers excessive working capital as an inefficient use of resources, and seeks to minimize the level of investment without adversely impacting the ongoing operations of the business.

| June 30, 2016 |

December 31, 2015 |

|||||||

| Trade receivables (net) |

$ | 74,973 | $ | 63,388 | ||||

| Inventory (net) |

114,977 | 119,269 | ||||||

| Less: Accounts payable |

60,539 | 62,137 | ||||||

| Total Operating Working Capital |

$ | 129,411 | $ | 120,520 | ||||

| % of Trailing Three Month Annualized Net Sales |

33.6 | % | 32.2 | % | ||||

Trailing Three Month Annualized Net Sales is calculated using the net sales for quarter, multiplied by four.

| Three Months Ended | ||||||||||||

| June 30, 2016 |

December 31, 2015 |

June 30, 2015 |

||||||||||

| Net sales |

$ | 96,277 | $ | 93,491 | $ | 100,513 | ||||||

| Multiplied by 4 |

4 | 4 | 4 | |||||||||

| Trailing Three Month Annualized Net Sales |

$ | 385,108 | $ | 373,964 | $ | 402,052 | ||||||

Working capital is calculated as total current assets less total current liabilities

| June 30, 2016 | December 31, 2015 | |||||||

| Total Current Assets |

$ | 212,221 | $ | 202,700 | ||||

| Less: Total Current Liabilities |

126,737 | 120,036 | ||||||

| Working Capital |

$ | 85,484 | $ | 82,664 | ||||

Exhibit 99.2 “Focused manufacturer of engineered lifting equipment” Manitex International, Inc. (NASDAQ: MNTX) Conference Call Second Quarter 2016 August 4th, 2016

Forward Looking Statements & Non GAAP Measures “Focused manufacturer of engineered lifting equipment” Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Non-GAAP Measures: Manitex International from time to time refers to various non-GAAP (generally accepted accounting principles) financial measures in this presentation. Manitex believes that this information is useful to understanding its operating results without the impact of special items. See Manitex’s Second Quarter 2016 Earnings Release on the Investor Relations section of our website www.manitexinternational.com for a description and/or reconciliation of these measures.

Summary “Focused manufacturer of engineered lifting equipment” Our objectives moving into 2016 Cost reduction program to include plant consolidations Continue program of strategic rationalization to drive growth in highest margin products and operating units Cash generation to continue debt reduction by a similar amount as in 2015 Implementation and execution of integration of PM strategy Expand ASV through new distribution

“Focused manufacturer of engineered lifting equipment” Commercial Overview Q2 market conditions little change from Q1-2016 Oil and gas demand very low adversely impacting yoy comparisons for core crane products. North American general construction demand steady in the quarter and increasingly price competitive. Straight mast market maintaining low levels of activity and preference for lower capacity equipment. Knuckle boom crane market in contrast growing in absolute terms and in certain geographies eg North America. European markets modest improvement. Significant activity and interest related to our new acquisition products PM sales strength in Q2-2016 in Italy & West Europe, and N America. ASV controlled distribution channels gaining momentum. ASV branded product at over 60% of quarterly machine shipments in Q2. New ASV dealer sign-ups at approximately 119 locations. 6/30/16 Backlog of $63.6 million (12/31/15, $82.5 million, 3/31/16, $78.6 million) Broad based order book: ASV 16%, PM 19% All other 65%.

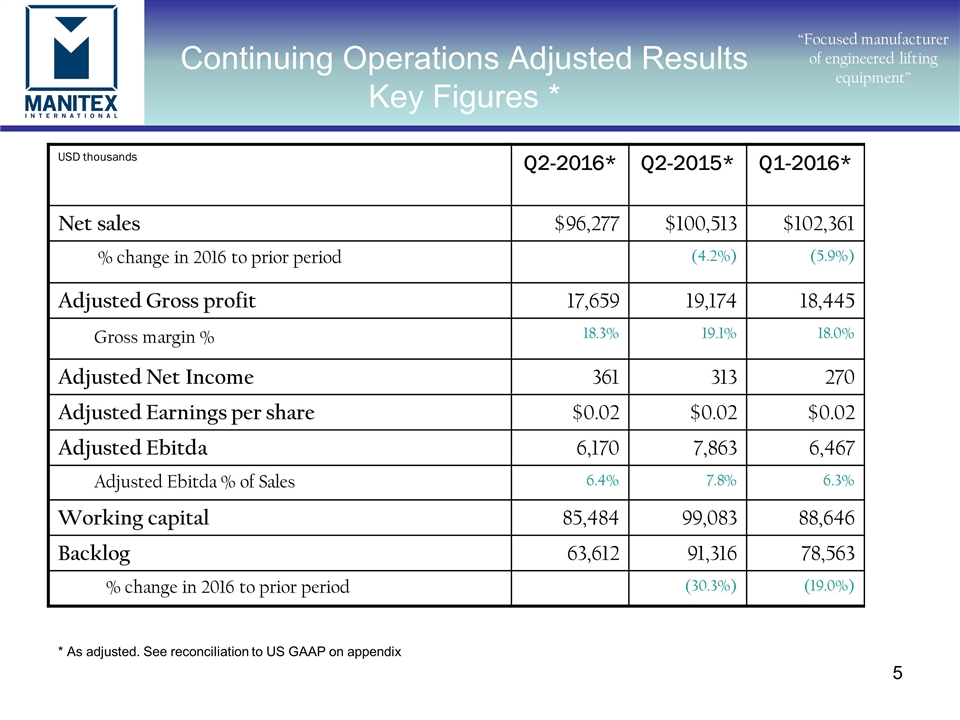

Continuing Operations Adjusted Results Key Figures * “Focused manufacturer of engineered lifting equipment” USD thousands Q2-2016* Q2-2015* Q1-2016* Net sales $96,277 $100,513 $102,361 % change in 2016 to prior period (4.2%) (5.9%) Adjusted Gross profit 17,659 19,174 18,445 Gross margin % 18.3% 19.1% 18.0% Adjusted Net Income 361 313 270 Adjusted Earnings per share $0.02 $0.02 $0.02 Adjusted Ebitda 6,170 7,863 6,467 Adjusted Ebitda % of Sales 6.4% 7.8% 6.3% Working capital 85,484 99,083 88,646 Backlog 63,612 91,316 78,563 % change in 2016 to prior period (30.3%) (19.0%) * As adjusted. See reconciliation to US GAAP on appendix

“Focused manufacturer of engineered lifting equipment” 2016 Adjusted Operating Performance $m Q2-2016 Q2-2015 sales $100.5 Currency translation (0.2) Volume (4.0) Q2-2016 sales $96.3 $m Q2-2016 Q2-2015 Adjusted net income attributable to shareholders $0.3 Gross margin from sales (1.5) Operating expenses (0.3) Interest expense 0.2 Forex & minority share 0.4 Tax 1.3 Q2-2016 Adjusted net income attributable to shareholders $0.4

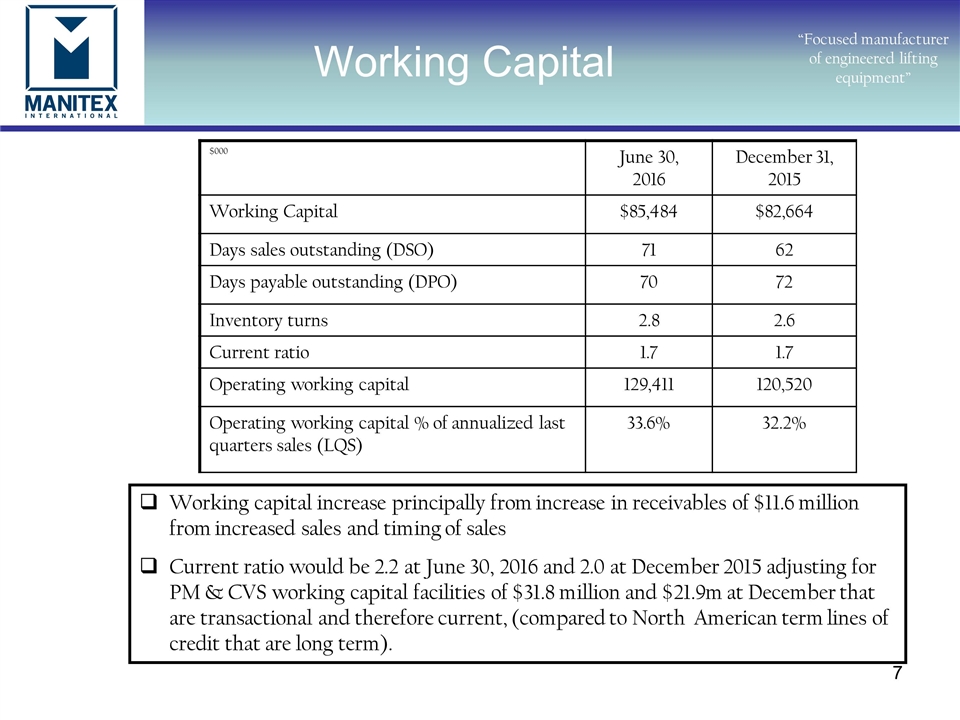

Working Capital “Focused manufacturer of engineered lifting equipment” $000 June 30, 2016 December 31, 2015 Working Capital $85,484 $82,664 Days sales outstanding (DSO) 71 62 Days payable outstanding (DPO) 70 72 Inventory turns 2.8 2.6 Current ratio 1.7 1.7 Operating working capital 129,411 120,520 Operating working capital % of annualized last quarters sales (LQS) 33.6% 32.2% Working capital increase principally from increase in receivables of $11.6 million from increased sales and timing of sales Current ratio would be 2.2 at June 30, 2016 and 2.0 at December 2015 adjusting for PM & CVS working capital facilities of $31.8 million and $21.9m at December that are transactional and therefore current, (compared to North American term lines of credit that are long term).

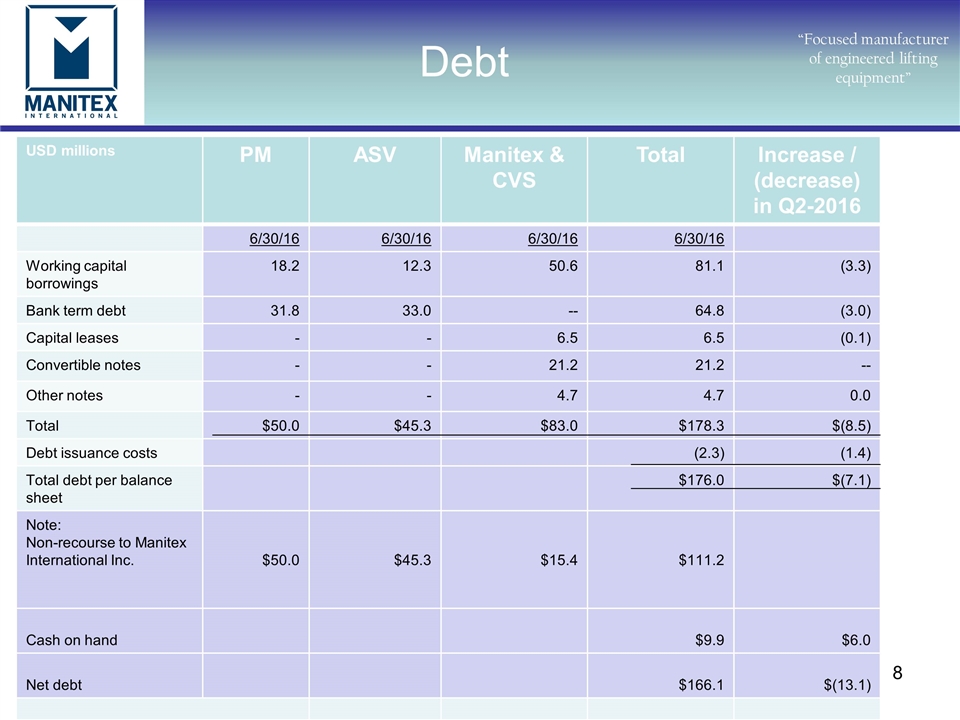

“Focused manufacturer of engineered lifting equipment” Debt USD millions PM ASV Manitex & CVS Total Increase / (decrease) in Q2-2016 6/30/16 6/30/16 6/30/16 6/30/16 Working capital borrowings 18.2 12.3 50.6 81.1 (3.3) Bank term debt 31.8 33.0 -- 64.8 (3.0) Capital leases - - 6.5 6.5 (0.1) Convertible notes - - 21.2 21.2 -- Other notes - - 4.7 4.7 0.0 Total $50.0 $45.3 $83.0 $178.3 $(8.5) Debt issuance costs (2.3) (1.4) Total debt per balance sheet $176.0 $(7.1) Note: Non-recourse to Manitex International Inc. $50.0 $45.3 $15.4 $111.2 Cash on hand $9.9 $6.0 Net debt $166.1 $(13.1)

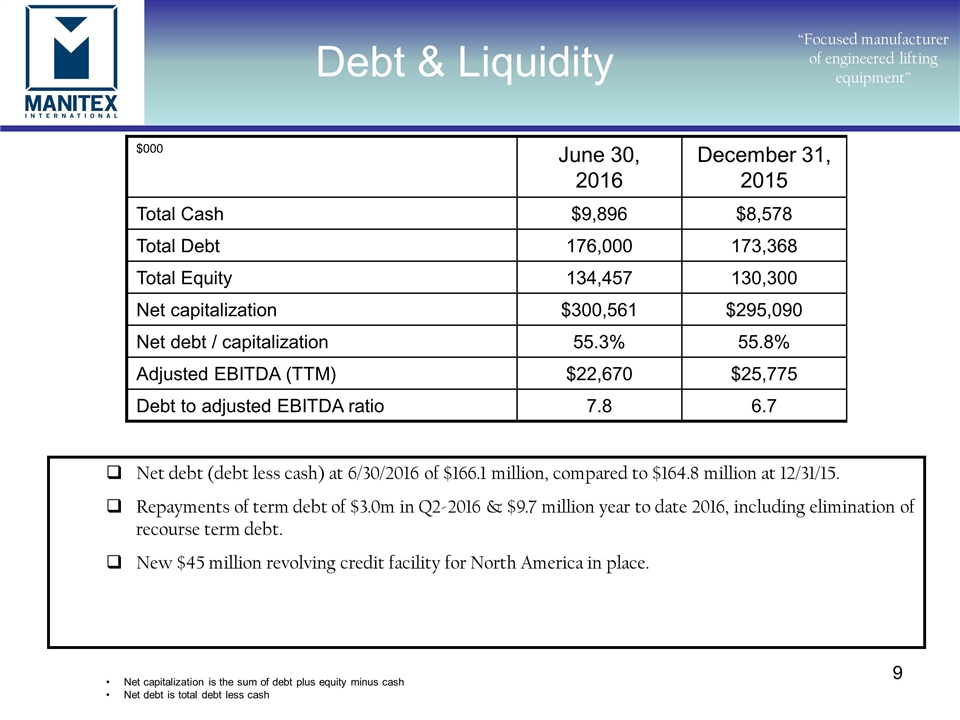

“Focused manufacturer of engineered lifting equipment” $000 June 30, 2016 December 31, 2015 Total Cash $9,896 $8,578 Total Debt 176,000 173,368 Total Equity 134,457 130,300 Net capitalization $300,561 $295,090 Net debt / capitalization 55.3% 55.8% Adjusted EBITDA (TTM) $22,670 $25,775 Debt to adjusted EBITDA ratio 7.8 6.7 Net debt (debt less cash) at 6/30/2016 of $166.1 million, compared to $164.8 million at 12/31/15. Repayments of term debt of $3.0m in Q2-2016 & $9.7 million year to date 2016, including elimination of recourse term debt. New $45 million revolving credit facility for North America in place. Debt & Liquidity Net capitalization is the sum of debt plus equity minus cash Net debt is total debt less cash

APPENDIX “Focused manufacturer of engineered lifting equipment” Reconciliation of GAAP Net Income (loss) Attributable to Shareholders of Manitex International to Adjusted Net Income (loss) Attributable to Shareholders of Manitex International (in thousands) Reconciliation of GAAP Operating Income to Adjusted EBITDA (in thousands) Three Months Ended June 30, 2016 June 30, 2015 Net (loss) income attributable to shareholders $(1,786) $138 Pre – tax:- transaction related, restructuring and related and Foreign Exchange and other expense adjustments 2,147 361 Tax effect based on effective tax rate -- (103) Change in net income attributable to noncontrolling interest -- (45) Income on discontinued operations (38) Adjusted Net Income attributable to Manitex shareholders $361 $313 Weighted average diluted shares outstanding 16,125,788 16,031,011 Diluted earnings (loss) per share attributable to shareholders as reported $(0.11) $0.01 Total EPS Effect $0.13 $0.01 Adjusted Diluted earnings per share attributable to shareholders $0.02 $0.02 Three Months Ended Six Months Ended June 30, 2016 June 30, 2015 June 30, 2016 June 30, 2015 Operating income $1,884 $4,508 $5,241 $6,558 Pre-tax:- transaction related, restructuring and related expense and other adjustments 1,153 361 1,178 3,405 Adjusted operating income $3,037 $4,869 $6,419 $9,963 Depreciation & Amortization 3,133 2,994 6,243 5,812 Adjusted Earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) $6,170 $7,863 $12,662 $15,775 Adjusted EBITDA % to sales 6.4% 7.8% 6.4% 7.8%

APPENDIX Acquisition transaction and Restructuring and Related Expense “Focused manufacturer of engineered lifting equipment” Three Months Ended June 30, 2016 Pre-tax After-tax EPS Restructuring & Related expense $1,153 $1,153 $0.07 Deferred financing fees, forex and other expense adjustments $994 $994 $0.06 Total $2,147 $2,147 $0.13 Three Months Ended June 30, 2015 Pre-tax After-tax EPS Transaction related $361 $258 $0.01 Change in noncontrolling interest $(45) $(45) - Total $316 $213 $0.01

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Aircraft MRO Market to Reach USD 120.77 Billion by 2031 Driven by Surge in Air Travel and Growing Economies

- CMUV Bancorp Announces 2024 1st Quarter Financial Results & Notice of Annual Shareholder Meeting

- Connected Toys Market is to Soar USD 41.5 billion by 2031, Propelled by Growing Demand for Interactive and Educational Toys

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share