Form 8-K MRC GLOBAL INC. For: Nov 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2015

MRC GLOBAL INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-35479 | 20-5956993 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

2 Houston Center, 909 Fannin, Suite 3100,

Houston, TX 77010

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (877) 294-7574

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure. |

MRC Global Inc. (“MRC Global”) executive management will make presentations from time to time to current and potential investors, lenders, creditors, insurers, vendors, customers, employees and others with an interest in MRC Global and its business regarding, among other things, MRC Global’s operations and performance. A copy of the materials to be used at the presentations (the “Presentation Materials”) is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in the Presentation Materials is summary information that should be considered in the context of MRC Global’s filings with the Securities and Exchange Commission and other public announcements that MRC Global may make by press release or otherwise from time to time. The Presentation Materials speak as of the date of this Current Report on Form 8-K. While MRC Global may elect to update the Presentation Materials in the future or reflect events and circumstances occurring or existing after the date of this Current Report on Form 8-K, MRC Global specifically disclaims any obligation to do so. The Presentation Materials will also be posted in the Investor Relations section of MRC Global’s website, http://www.mrcglobal.com, for 90 days.

The information referenced under Item 7.01 (including Exhibit 99.1 referenced under Item 9.01 below) of this Current Report on Form 8-K is being “furnished” under “Item 7.01. Regulation FD Disclosure” and, as such, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information set forth in this Current Report on Form 8-K (including Exhibit 99.1 referenced under Item 9.01 below) shall not be incorporated by reference into any registration statement, report or other document filed by MRC Global pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| 99.1 | Investor Presentation, dated November 9, 2015 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 9, 2015

| MRC GLOBAL INC. | ||

| By: | /s/ James E. Braun | |

| James E. Braun | ||

| Executive Vice President and Chief Financial Officer | ||

3

INDEX TO EXHIBITS

| Exhibit No. |

Description | |

| 99.1 | Investor Presentation, dated November 9, 2015 | |

4

Investor Presentation November 9, 2015 Exhibit 99.1

Forward Looking Statements and Non-GAAP Disclaimer This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Words such as “will,” “expect,” “expected”, “looking forward”, “guidance” and similar expressions are intended to identify forward-looking statements. Statements about the company’s business, including its strategy, the impact of changes in oil prices and customer spending, its industry, the company’s future profitability, the company’s guidance on its sales, adjusted EBITDA, adjusted gross profit, tax rate, capital expenditures and cash flow, the company’s expectations regarding the pay down of its debt, growth in the company’s various markets and the company’s expectations, beliefs, plans, strategies, objectives, prospects and assumptions are not guarantees of future performance. These statements are based on management’s expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors, most of which are difficult to predict and many of which are beyond our control, including the factors described in the company’s SEC filings that may cause our actual results and performance to be materially different from any future results or performance expressed or implied by these forward-looking statements. For a discussion of key risk factors, please see the risk factors disclosed in the company’s SEC filings, which are available on the SEC’s website at www.sec.gov and on the company’s website, www.mrcglobal.com. Our filings and other important information are also available on the Investor Relations page of our website at www.mrcglobal.com. Undue reliance should not be placed on the company’s forward-looking statements. Although forward-looking statements reflect the company’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause the company’s actual results, performance or achievements or future events to differ materially from anticipated future results, performance or achievements or future events expressed or implied by such forward-looking statements. The company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except to the extent required by law.

Projects 28% U.S. 75% Market Leader in North America and Worldwide $5.1B TTM Sales $303M TTM Adjusted EBITDA Key Role in Global Supply Chains of Leading Energy Companies Create value for customers and suppliers Closely integrated into customer supply chains Volume purchasing savings and capital efficiencies for customer Differentiated Global Capabilities Unparalleled footprint, with 400+ locations in 22 countries Enhanced capabilities to evaluate suppliers, source material and provide outstanding customer service Serve broad PVF needs making it convenient & efficient for customers Attractive and Diversified Business Mix Focus on maintenance, repair and operations (MRO) contracts Balanced portfolio across upstream, midstream and downstream sectors Growing international and project business Global Leader in PVF Distribution Note: Sales and Adjusted EBITDA for the twelve months ended September 30, 2015

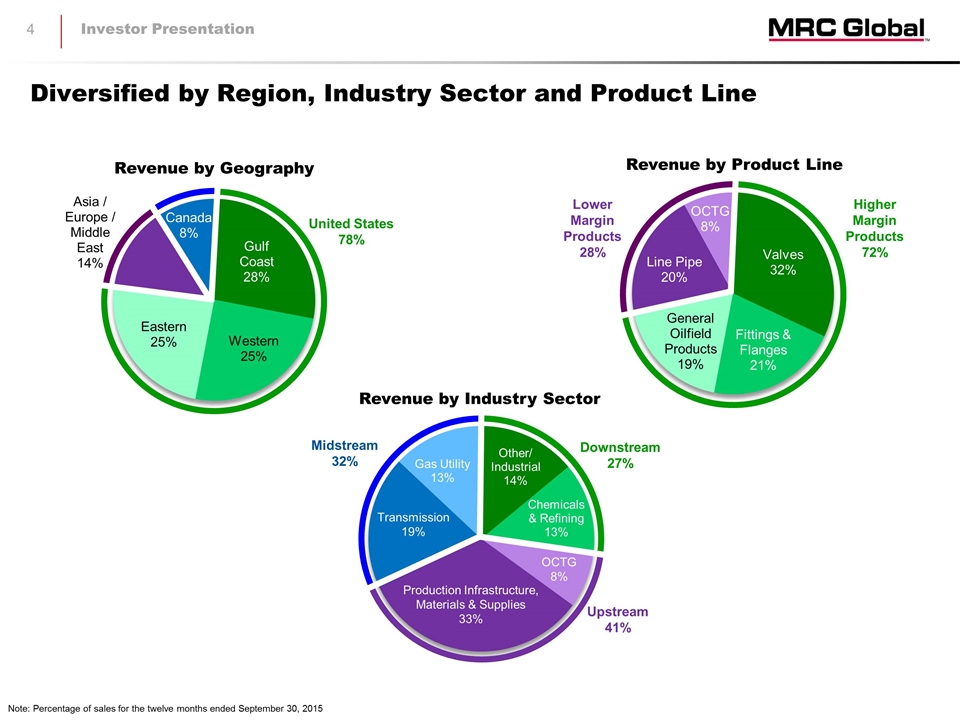

Revenue by Product Line Note: Percentage of sales for the twelve months ended September 30, 2015 Chemical 9% Gas Utility 9% Other / Industrial 9% United States 78% Chemical 9% Transmission 17% Gas Utility 9% Refining 9% Other / Industrial 9% Higher Margin Products 72% Lower Margin Products 28% Revenue by Geography Chemical 9% Transmission 17% Refining 9% Other / Industrial 9% Transmission 19% OCTG 8% Production Infrastructure, Materials & Supplies 33% Revenue by Industry Sector Downstream 27% Upstream 41% Midstream 32% Diversified by Region, Industry Sector and Product Line

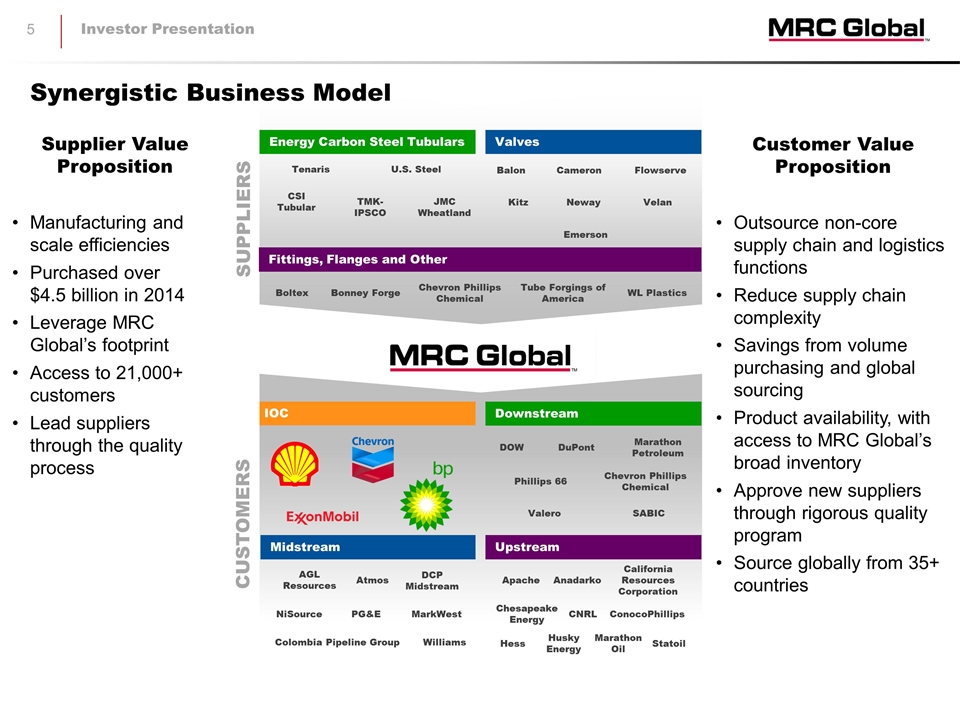

Synergistic Business Model CUSTOMERS SUPPLIERS IOC DOW DuPont Marathon Petroleum AGL Resources Atmos DCP Midstream NiSource PG&E MarkWest Chesapeake Energy CNRL ConocoPhillips Apache Anadarko California Resources Corporation Hess Husky Energy Marathon Oil Statoil CSI Tubular TMK-IPSCO JMC Wheatland Tenaris U.S. Steel Balon Cameron Flowserve Kitz Neway Velan Boltex Bonney Forge Chevron Phillips Chemical Tube Forgings of America WL Plastics Emerson Phillips 66 Chevron Phillips Chemical Colombia Pipeline Group Williams Energy Carbon Steel Tubulars Valves Fittings, Flanges and Other Downstream Midstream Upstream Valero SABIC Supplier Value Proposition Manufacturing and scale efficiencies Purchased over $4.5 billion in 2014 Leverage MRC Global’s footprint Access to 21,000+ customers Lead suppliers through the quality process Customer Value Proposition Outsource non-core supply chain and logistics functions Reduce supply chain complexity Savings from volume purchasing and global sourcing Product availability, with access to MRC Global’s broad inventory Approve new suppliers through rigorous quality program Source globally from 35+ countries

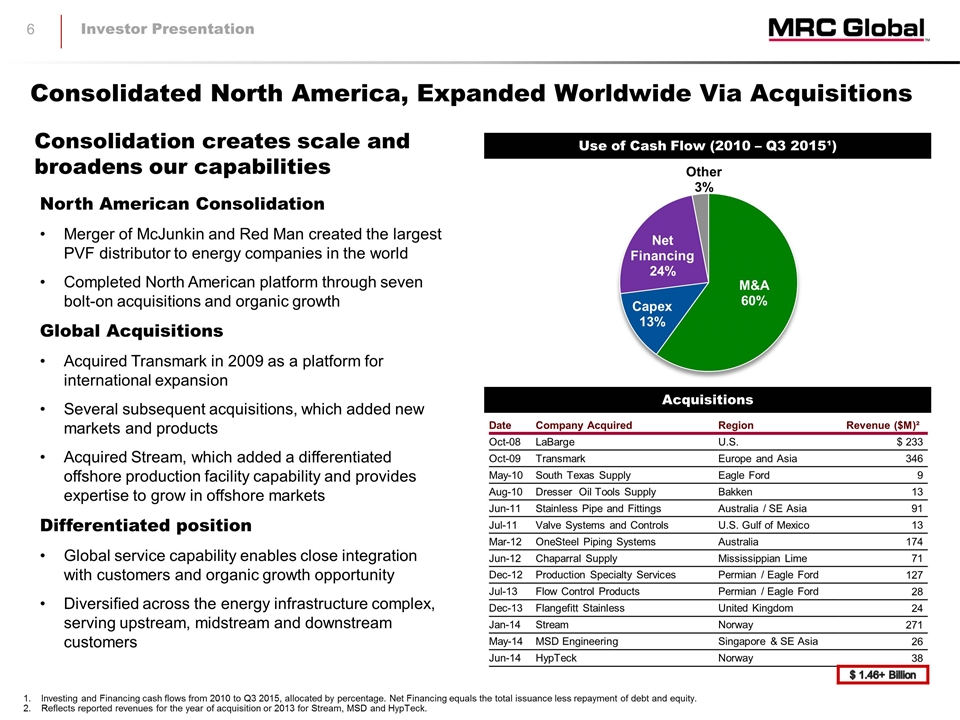

Investing and Financing cash flows from 2010 to Q3 2015, allocated by percentage. Net Financing equals the total issuance less repayment of debt and equity. Reflects reported revenues for the year of acquisition or 2013 for Stream, MSD and HypTeck. Other / Industrial 9% Use of Cash Flow (2010 – Q3 2015¹) North American Consolidation Merger of McJunkin and Red Man created the largest PVF distributor to energy companies in the world Completed North American platform through seven bolt-on acquisitions and organic growth Global Acquisitions Acquired Transmark in 2009 as a platform for international expansion Several subsequent acquisitions, which added new markets and products Acquired Stream, which added a differentiated offshore production facility capability and provides expertise to grow in offshore markets Differentiated position Global service capability enables close integration with customers and organic growth opportunity Diversified across the energy infrastructure complex, serving upstream, midstream and downstream customers Acquisitions Date Company Acquired Region Revenue ($M)² Oct-08 LaBarge U.S. $ 233 Oct-09 Transmark Europe and Asia 346 May-10 South Texas Supply Eagle Ford 9 Aug-10 Dresser Oil Tools Supply Bakken 13 Jun-11 Stainless Pipe and Fittings Australia / SE Asia 91 Jul-11 Valve Systems and Controls U.S. Gulf of Mexico 13 Mar-12 OneSteel Piping Systems Australia 174 Jun-12 Chaparral Supply Mississippian Lime 71 Dec-12 Production Specialty Services Permian / Eagle Ford 127 Jul-13 Flow Control Products Permian / Eagle Ford 28 Dec-13 Flangefitt Stainless United Kingdom 24 Jan-14 Stream Norway 271 May-14 MSD Engineering Singapore & SE Asia 26 Jun-14 HypTeck Norway 38 $ 1.46+ Billion Consolidation creates scale and broadens our capabilities Consolidated North America, Expanded Worldwide Via Acquisitions

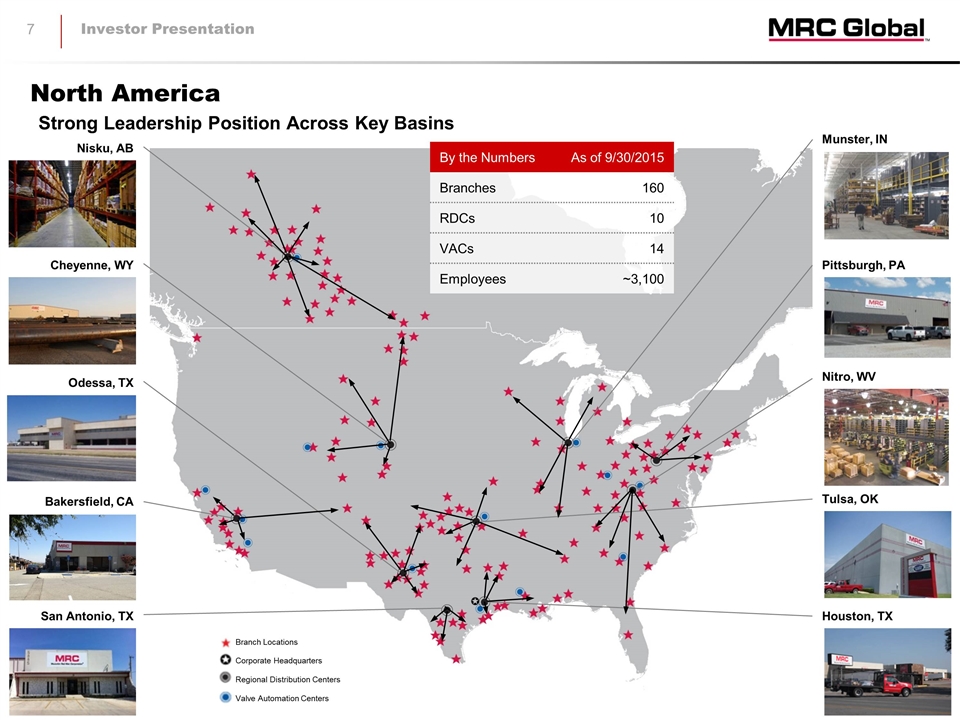

Munster, IN Nitro, WV Tulsa, OK Houston, TX Nisku, AB Cheyenne, WY Odessa, TX Bakersfield, CA San Antonio, TX Regional Distribution Centers Corporate Headquarters Valve Automation Centers Branch Locations By the Numbers As of 9/30/2015 Branches 160 RDCs 10 VACs 14 Employees ~3,100 Pittsburgh, PA Strong Leadership Position Across Key Basins North America

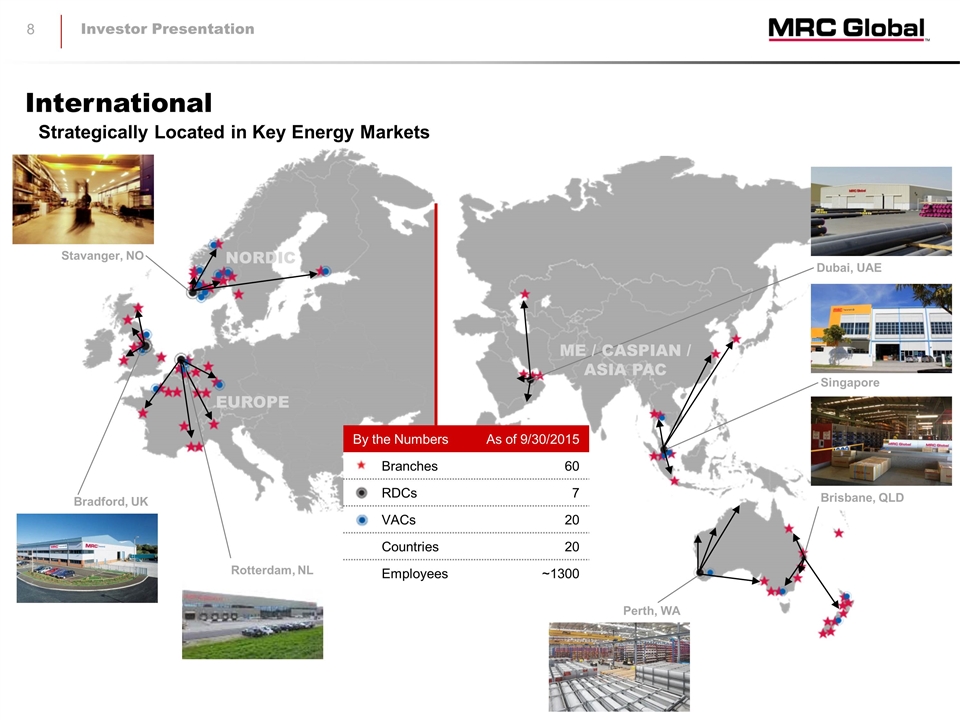

International Stavanger, NO EUROPE Bradford, UK By the Numbers As of 9/30/2015 Branches 60 RDCs 7 VACs 20 Countries 20 Employees ~1300 NORDIC Brisbane, QLD Singapore Dubai, UAE ME / CASPIAN / ASIA PAC Perth, WA Rotterdam, NL Strategically Located in Key Energy Markets

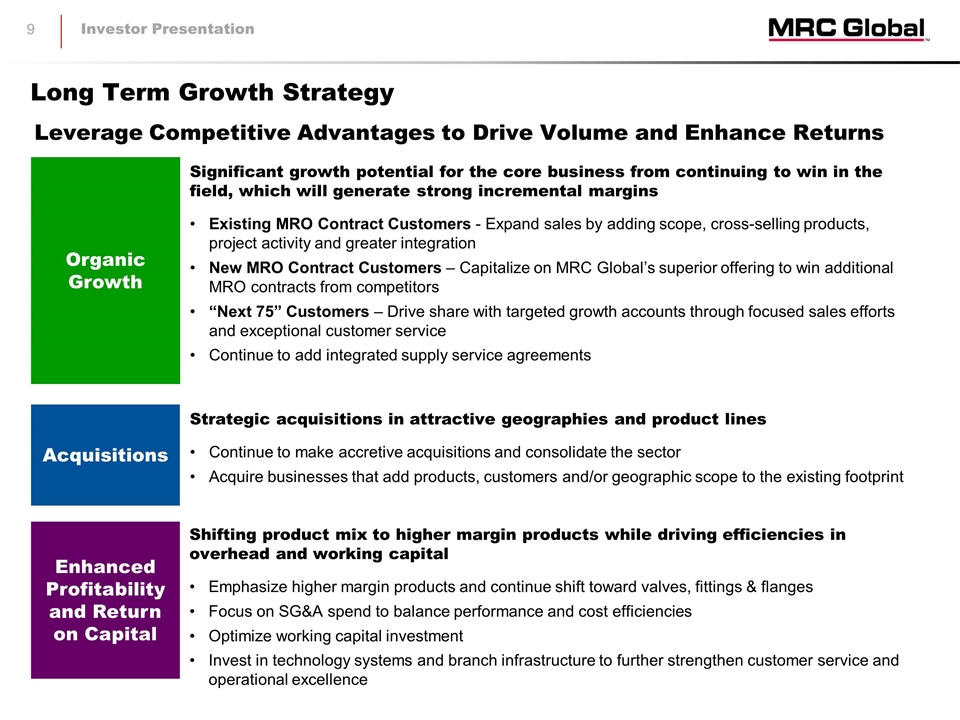

Organic Growth Acquisitions Enhanced Profitability and Return on Capital Leverage Competitive Advantages to Drive Volume and Enhance Returns Long Term Growth Strategy Significant growth potential for the core business from continuing to win in the field, which will generate strong incremental margins Existing MRO Contract Customers - Expand sales by adding scope, cross-selling products, project activity and greater integration New MRO Contract Customers – Capitalize on MRC Global’s superior offering to win additional MRO contracts from competitors “Next 75” Customers – Drive share with targeted growth accounts through focused sales efforts and exceptional customer service Continue to add integrated supply service agreements Strategic acquisitions in attractive geographies and product lines Continue to make accretive acquisitions and consolidate the sector Acquire businesses that add products, customers and/or geographic scope to the existing footprint Shifting product mix to higher margin products while driving efficiencies in overhead and working capital Emphasize higher margin products and continue shift toward valves, fittings & flanges Focus on SG&A spend to balance performance and cost efficiencies Optimize working capital investment Invest in technology systems and branch infrastructure to further strengthen customer service and operational excellence

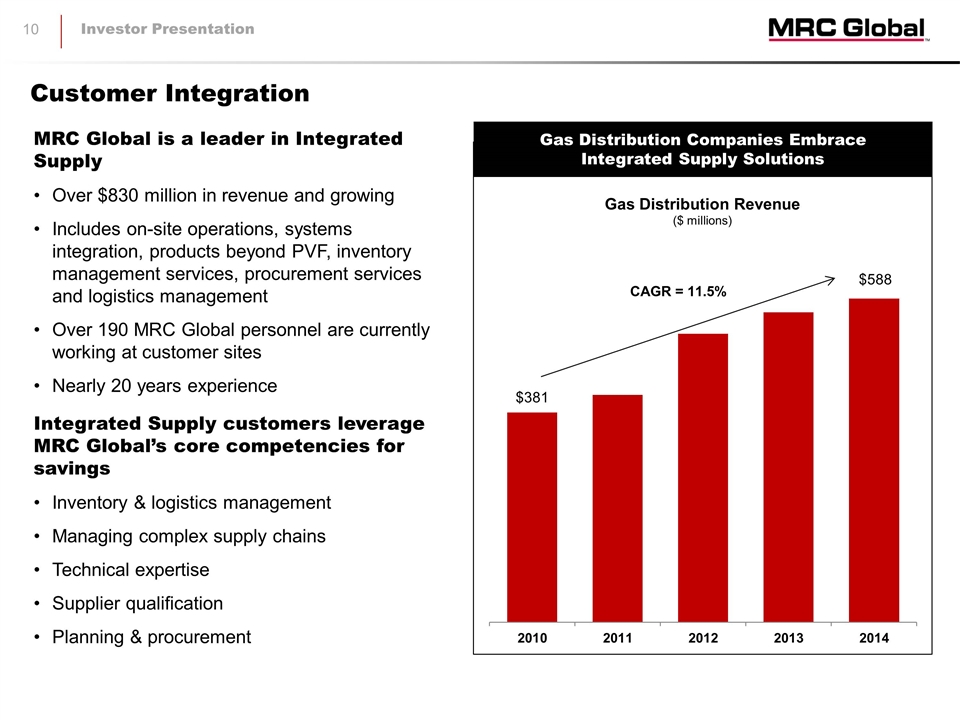

Customer Integration CAGR = 11.5% Gas Distribution Revenue ($ millions) MRC Global is a leader in Integrated Supply Over $830 million in revenue and growing Includes on-site operations, systems integration, products beyond PVF, inventory management services, procurement services and logistics management Over 190 MRC Global personnel are currently working at customer sites Nearly 20 years experience Integrated Supply customers leverage MRC Global’s core competencies for savings Inventory & logistics management Managing complex supply chains Technical expertise Supplier qualification Planning & procurement Gas Distribution Companies Embrace Integrated Supply Solutions

($ millions) International Segment Revenue 75% of our major IOC customers’ PVF Capex spend is outside of North America Build on North American customer and supplier relationships Attractive opportunities for growth Distribution channel is less penetrated than in North America Greater project spend MRC Global has presence in all key regions U.S., Canada, North Sea, Western Europe, Middle East, SE Asia and Australia Making headway on profitability Building scale to drive profitability Streamlining international management, SG&A after seven acquisitions International Expansion

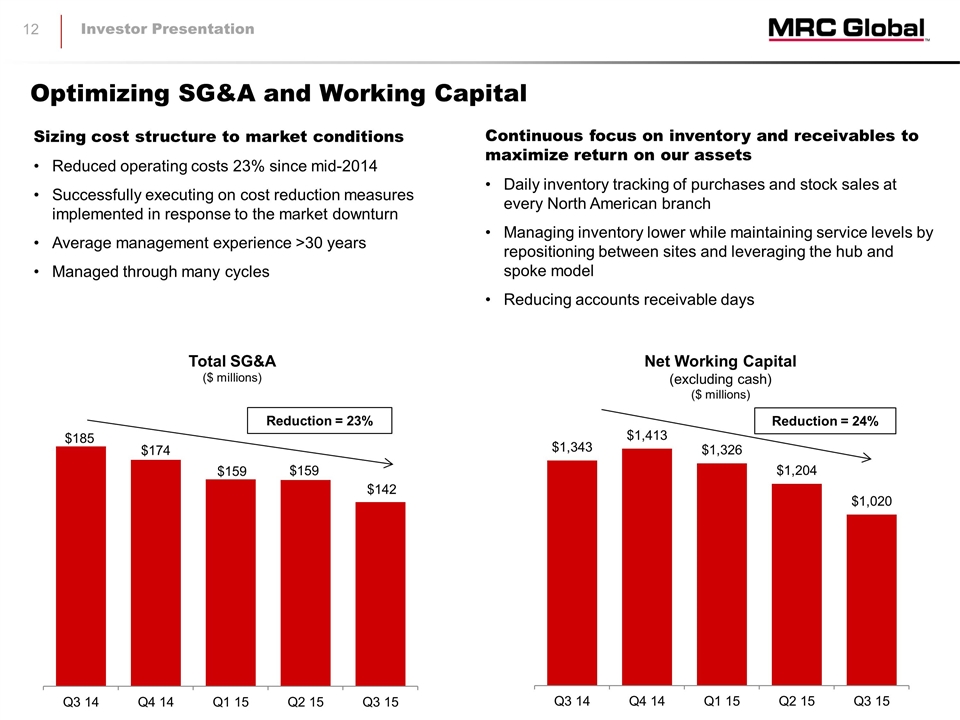

Optimizing SG&A and Working Capital Sizing cost structure to market conditions Reduced operating costs 23% since mid-2014 Successfully executing on cost reduction measures implemented in response to the market downturn Average management experience >30 years Managed through many cycles Total SG&A ($ millions) Reduction = 23% Net Working Capital (excluding cash) ($ millions) Reduction = 24% Continuous focus on inventory and receivables to maximize return on our assets Daily inventory tracking of purchases and stock sales at every North American branch Managing inventory lower while maintaining service levels by repositioning between sites and leveraging the hub and spoke model Reducing accounts receivable days

2015 Accomplishments In Spite of a Challenging Year Customer contract wins Continued success in winning and retaining customers reinforces MRC Global’s market leadership and positions MRC Global for a strong recovery Selected recent contract wins: Gained market share Outperforming competition in a highly challenging market Deleveraged balance sheet Utilized strong cash flow generation from working capital optimization and proceeds from an opportunistic capital raise to fortify the balance sheet Reduced debt by $790 million, a 54% reduction through the third quarter of 2015 Created financial flexibility to take advantage of current market Controlled operating costs Cost cutting initiatives have resulted in meaningful reductions in SG&A spend Customer Geography Term Customer Geography Term MarkWest U.S. 5 Years TECO Energy U.S. 5 Years Statoil Norway Project SABIC U.S., Europe & Saudi Arabia 5 Years Marathon Oil U.S. 5 Years Phillips 66 U.S. & Europe 5 Years California Resources U.S. 3 Years Canadian Natural Resources Canada 3 Years Selected Contract Wins Customer Geography Scope Term MarkWest U.S. Midstream MRO 5 Years Statoil Norway Instrumentation Project California Resources U.S. Integrated Supply 3 Years TECO Energy U.S. Integrated Supply 5 Years SABIC Saudi Arabia Valves 5 Years Customer A U.S. Down/Midstream MRO 5 Years Customer B U.S. Downstream MRO 5 Years Customer C Gulf of Mexico Upstream [ ] Customer D Middle East [ ] [ ]

Financial Model Countercyclical Operating Cash Flow Profile Low Capital Expenditure Requirements Economies of Scale Operating Leverage Flexible Capital Structure Disciplined Capital Allocation

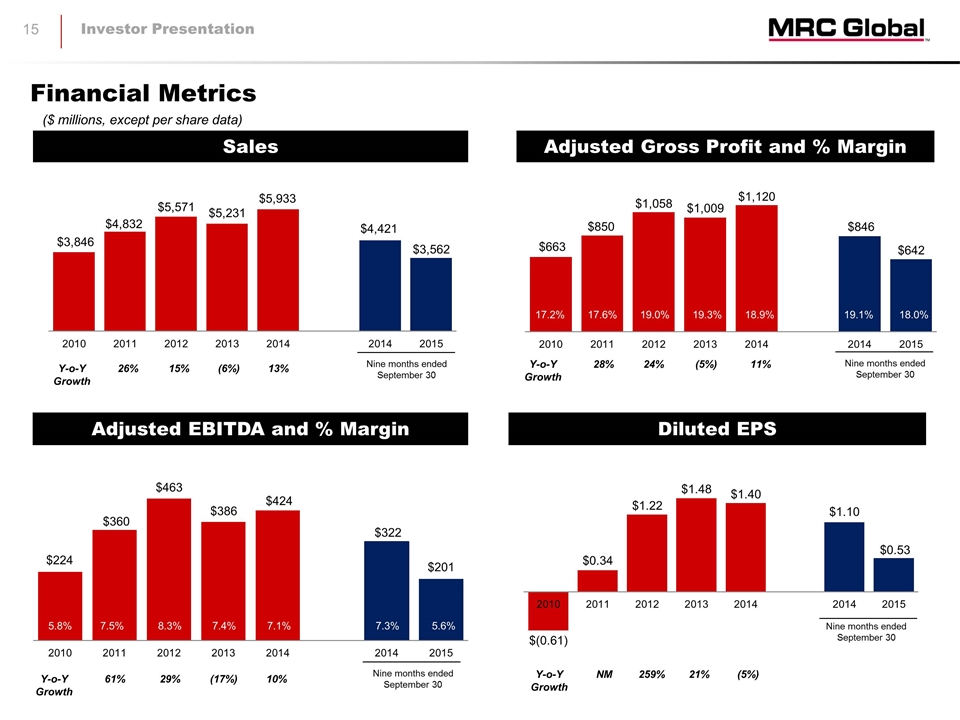

Sales Adjusted Gross Profit and % Margin Adjusted EBITDA and % Margin 7.0% 8.5% ($ millions, except per share data) Y-o-Y Growth 28% 24% (5%) 11% Y-o-Y Growth 61% 29% (17%) 10% 5.8% 7.5% 8.3% 7.4% 7.1% 7.3% 5.6% Y-o-Y Growth 26% 15% (6%) 13% Diluted EPS Y-o-Y Growth NM 259% 21% (5%) 17.2% 17.6% 19.0% 19.3% 18.9% 19.1% 18.0% Nine months ended September 30 Nine months ended September 30 Nine months ended September 30 Nine months ended September 30 Financial Metrics

Total Debt Capital Structure Cash Flow from Operations Net Leverage ($ millions) September 30, 2015 Cash and Cash Equivalents $ 33 Total Debt (including current portion): Term Loan B due 2019, net of discount 526 Global ABL Facility due 2019 138 Total Debt $ 664 Preferred stock 355 Common stockholders’ equity 1,375 Total Capitalization $ 2,394 Liquidity $ 649 Nine months ended September 30 Balance Sheet Metrics

Share Repurchase Program Summary Authorized up to $100 million share repurchase program for common stock Open market purchases at management’s discretion Expires December 31, 2017 Depending on market conditions and other factors, these repurchases may be commenced or suspended from time to time without prior notice Quarterly progress updates

Market Leader in PVF Distribution, Serving Critical Function to the Energy Industry Diversified Across Sectors, Regions and Customers Differentiated Global Platform Creates Customer Value Attractive Cash Flow Characteristics and Strong Balance Sheet Organic Growth Potential From Existing Business, Supported by Long-term Secular Growth Tailwind from Growth in Global Energy Use Industry Consolidator, With Proven Success in Acquiring and Integrating Businesses World-Class Management Team with Significant Distribution and Energy Experience Compelling Long-Term Investment

Appendix

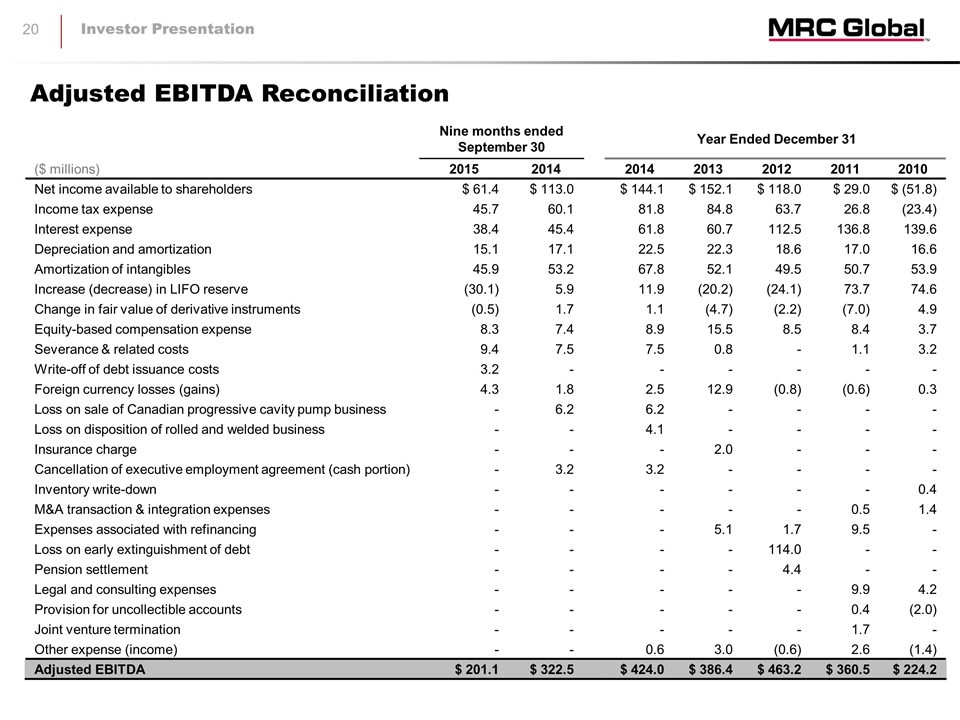

Adjusted EBITDA Reconciliation Nine months ended September 30 Year Ended December 31 ($ millions) 2015 2014 2014 2013 2012 2011 2010 Net income available to shareholders $ 61.4 $ 113.0 $ 144.1 $ 152.1 $ 118.0 $ 29.0 $ (51.8) Income tax expense 45.7 60.1 81.8 84.8 63.7 26.8 (23.4) Interest expense 38.4 45.4 61.8 60.7 112.5 136.8 139.6 Depreciation and amortization 15.1 17.1 22.5 22.3 18.6 17.0 16.6 Amortization of intangibles 45.9 53.2 67.8 52.1 49.5 50.7 53.9 Increase (decrease) in LIFO reserve (30.1) 5.9 11.9 (20.2) (24.1) 73.7 74.6 Change in fair value of derivative instruments (0.5) 1.7 1.1 (4.7) (2.2) (7.0) 4.9 Equity-based compensation expense 8.3 7.4 8.9 15.5 8.5 8.4 3.7 Severance & related costs 9.4 7.5 7.5 0.8 - 1.1 3.2 Write-off of debt issuance costs 3.2 - - - - - - Foreign currency losses (gains) 4.3 1.8 2.5 12.9 (0.8) (0.6) 0.3 Loss on sale of Canadian progressive cavity pump business - 6.2 6.2 - - - - Loss on disposition of rolled and welded business - - 4.1 - - - - Insurance charge - - - 2.0 - - - Cancellation of executive employment agreement (cash portion) - 3.2 3.2 - - - - Inventory write-down - - - - - - 0.4 M&A transaction & integration expenses - - - - - 0.5 1.4 Expenses associated with refinancing - - - 5.1 1.7 9.5 - Loss on early extinguishment of debt - - - - 114.0 - - Pension settlement - - - - 4.4 - - Legal and consulting expenses - - - - - 9.9 4.2 Provision for uncollectible accounts - - - - - 0.4 (2.0) Joint venture termination - - - - - 1.7 - Other expense (income) - - 0.6 3.0 (0.6) 2.6 (1.4) Adjusted EBITDA $ 201.1 $ 322.5 $ 424.0 $ 386.4 $ 463.2 $ 360.5 $ 224.2

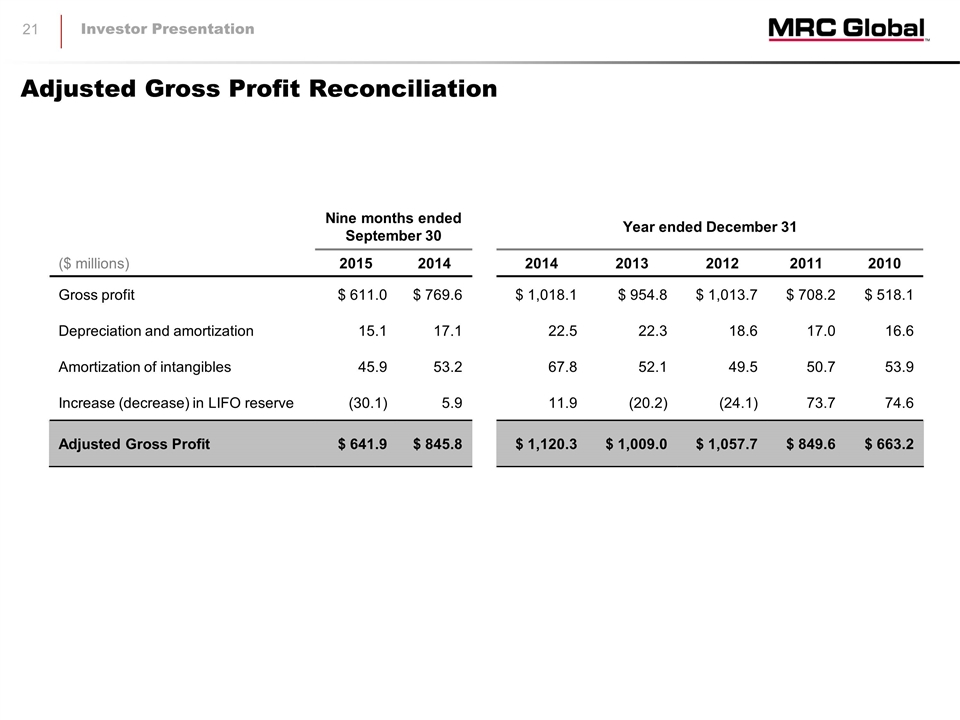

Adjusted Gross Profit Reconciliation Nine months ended September 30 Year ended December 31 ($ millions) 2015 2014 2014 2013 2012 2011 2010 Gross profit $ 611.0 $ 769.6 $ 1,018.1 $ 954.8 $ 1,013.7 $ 708.2 $ 518.1 Depreciation and amortization 15.1 17.1 22.5 22.3 18.6 17.0 16.6 Amortization of intangibles 45.9 53.2 67.8 52.1 49.5 50.7 53.9 Increase (decrease) in LIFO reserve (30.1) 5.9 11.9 (20.2) (24.1) 73.7 74.6 Adjusted Gross Profit $ 641.9 $ 845.8 $ 1,120.3 $ 1,009.0 $ 1,057.7 $ 849.6 $ 663.2

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Manhattan Associates Named a Leader in 2024 Gartner® Magic Quadrant™ for Transportation Management Systems for the Sixth Consecutive Year

- The 2024 Japan Prize Award Ceremony Is Held with Their Majesties the Emperor and Empress of Japan in Attendance

- Form 8.5 (EPT/RI) - Mattioli Woods

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share