Form 8-K MOSAIC CO For: Sep 19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 19, 2016

THE MOSAIC COMPANY

(Exact name of registrant as specified in its charter)

Delaware | 001-32327 | 20-1026454 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

3033 Campus Drive Suite E490 Plymouth, Minnesota | 55441 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (800) 918-8270

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation FD Disclosure.

The following information is being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing:

Furnished herewith as Exhibit 99.1 and incorporated by reference herein is a copy of a presentation being made by The Mosaic Company on September 20, 2016 at the Scotiabank Fertilizer and Chemicals Conference in Toronto, Ontario.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Reference is made to the Exhibit Index hereto with respect to the exhibit furnished herewith. The exhibit listed in the Exhibit Index hereto is being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

THE MOSAIC COMPANY | ||||||

Date: September 19, 2016 | By: | /s/ Mark J. Isaacson | ||||

Name: | Mark J. Isaacson | |||||

Title: | Senior Vice President, General Counsel | |||||

and Corporate Secretary | ||||||

EXHIBIT INDEX

Exhibit No. | Description | |

99.1 | Presentation being made by The Mosaic Company on September 20, 2016 at the Scotiabank Fertilizer and Chemicals Conference in Toronto, Ontario | |

Scotiabank Fertilizer &

Chemicals Conference

Rich Mack, Executive Vice President and Chief Financial Officer

September 20, 2016

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such

statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as MWSPC) and other

proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements

are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and

uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of MWSPC to obtain

additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of

production facilities in the Kingdom of Saudi Arabia, the future success of current plans for MWSPC and any future changes in those plans;

difficulties with realization of the benefits of our long term natural gas based pricing ammonia supply agreement with CF Industries, Inc.,

including the risk that the cost savings initially anticipated from the agreement may not be fully realized over its term or that the price of natural

gas or ammonia during the term are at levels at which the pricing is disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s

decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer,

raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market

conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new

technologies on demand for our products; changes in foreign currency and exchange rates; international trade risks and other risks associated

with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural

resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other

governmental regulation, including expansion of the types and extent of water resources regulated under federal law, greenhouse gas

regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow

of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative

proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or

delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance

requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse

weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and

including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current

estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian

resources taxes and royalties, or the costs of the MWSPC, its existing or future funding and Mosaic’s commitments in support of such funding;

reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund

financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash

shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events,

sinkholes or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other

risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission.

Actual results may differ from those set forth in the forward-looking statements.

2

Safe Harbor Statement

Background on New Wales Incident

3

Background:

• In August, Mosaic experienced a process water loss in its New Wales

phosphogypsum stack, caused by a sinkhole

• Incident was reported to federal, state and local officials immediately

• Little to no impact to production at New Wales

Next Steps:

• Pump out process water and continue monitoring water quality

• Advance investigation of sinkhole and develop repair estimates:

preliminary range $20-50M

• Continue to coordinate with government officials

• Local community outreach

Increase competitiveness

Mosaic’s Competitive Positioning

4

Potash: Long Life, Low Cost Assets

5

46%

54%

Potash Sales

2012-15

North

America Offshore

Corporate Headquarters

Business Unit Office

Deep Shaft Mine

Solution Mine

Export Terminal and Shipping

Potash Shipments

2012 - 2015

4

Potash: Long Life, Low Cost Assets

6

*Production costs are reflective of actual costs, excluding realized mark‐to‐market gains and

losses. These costs are captured in inventory and are not necessarily reflective of costs

included in costs of goods sold for the period.

*Assumes 1.30: 1 CAD to USD.

$53

$71 $66

$26

$18

$‐

$10

$20

$30

$40

$50

$60

$70

$80

$90

Esterhazy Belle Plaine Enterprise

C

a

s

h

c

o

s

t

s

i

n

c

l

u

d

i

n

g

r

o

y

a

l

t

i

e

s

,

e

x

c

l

u

d

i

n

g

r

e

s

o

u

r

c

e

t

a

x

e

s

a

n

d

r

e

a

l

i

z

e

d

d

e

r

i

v

a

t

i

v

e

g

a

i

n

s

/

(

l

o

s

s

e

s

)

Cash Costs by Mine (95% Operating Rate)

Brine Cash costs including royalties, excluding resource taxes, brine and realized derivative gains/(losses)

average

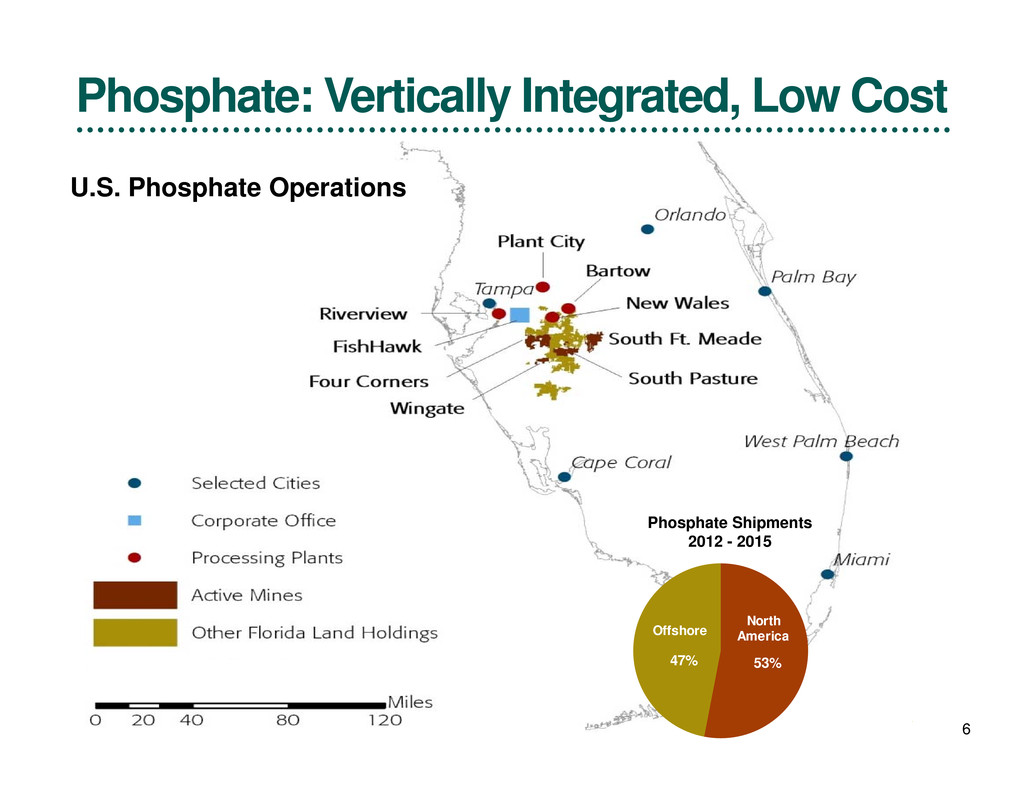

Phosphate: Vertically Integrated, Low Cost

7

U.S. Phosphate Operations

53%47%

Phosphate Sales

2012-15

North

America Offshore

Phosphate Shipments

2012 - 2015

6

Effective Capital Management

8

* 2013 through 2015

18%

13%

29%

40%

Capital Allocation: Three Year Summary*

Maintenance

Organic Growth

Investment Commitments

Return to Shareholders

(dividends & repurchases)

($ in billions)

Total:

$11.5 Billion

A Balanced Approach to Capital Allocation

Increase competitiveness

Opportunities We See

9

Managing Costs and Capital

10

• $500 million Expense Reduction

• +$75 million from Support Functions

• Asset Optimization

• Lower Capital Spending

Esterhazy K3: Transformational Impact

11

0

25

50

75

100

125

150

175

200

225

250

275

300

325

0 10 20 30 40 50 60 70

US$/Tonne

Million Tonnes

Future State: MOP Cost Curve fob Port (K3 Scenario)

Source: CRU and Mosaic Demand: ~70mmt

Notes:

‐ fob Port for exporting producers, fob Mine for

those serving a domestic market

‐ K3 Scenario: Full Esterhazy ore output from K3

Mosaic

Continue to Assess Trade-Offs:

Dividend, CAPEX, OPEX and Credit Rating

12

($ per share)

$1.10

$0.0

$0.2

$0.4

$0.6

$0.8

$1.0

$1.2

2011 2012 2013 2014 2015

Dividend per Share

Absolute Dividend Payout: Less than $400M

Cautiously Optimistic

13

Market

Environment

Mosaic’s

Actions

Capital

Stewardship

Mosaic is Well Positioned to Weather the Cycle

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Ecora Resources PLC Announces Transaction in Own Shares

- Man Group PLC : Form 8.3 - Barratt Developments plc

- AI HRMS Revolutionizes HR Management with a New Plan for Small Businesses

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share