Form 8-K MIX 1 LIFE, INC. For: Oct 07

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 12, 2016 (October 7, 2016)

MIX 1 LIFE, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | 333-170091 | 68-0678499 | ||

(State or other jurisdiction | (Commission | (IRS Employer | ||

of Incorporation) | File Number) | Identification Number) |

16000 N. 80th Street, Suite E

Scottsdale, AZ 85260

Tel. (480) 371-1100

(Address and Telephone Number of Principal Executive Offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

MIX 1 LIFE, INC.

Form 8-K

Current Report

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On October 7, 2016, Mix 1 Life, Inc., a Nevada corporation (the “Company”) and BrandMark Products, Inc., a Delaware corporation (“BMP”), entered into an amended Letter of Intent (“Amended LOI”) to acquire One Hundred Percent (100%) of BMP’s interest in their brand assets, including all of BMP’s distribution and manufacturing contracts, for an aggregate purchase price of Two Million Five Hundred Thousand (2,500,000) restricted shares of common stock of the Company (the “Purchase Price”).

BrandMark Products Inc. (BrandMark) focuses on the purchase of distribution rights of major brands. The BrandMark business model is to build a diverse portfolio of high quality, competitively priced brands with annualized target revenues between $25 million and $50 million for “each brand”. The business strategy is “Brand Distribution”, (collectively, shall be referred to hereinafter as the "Brand Assets").

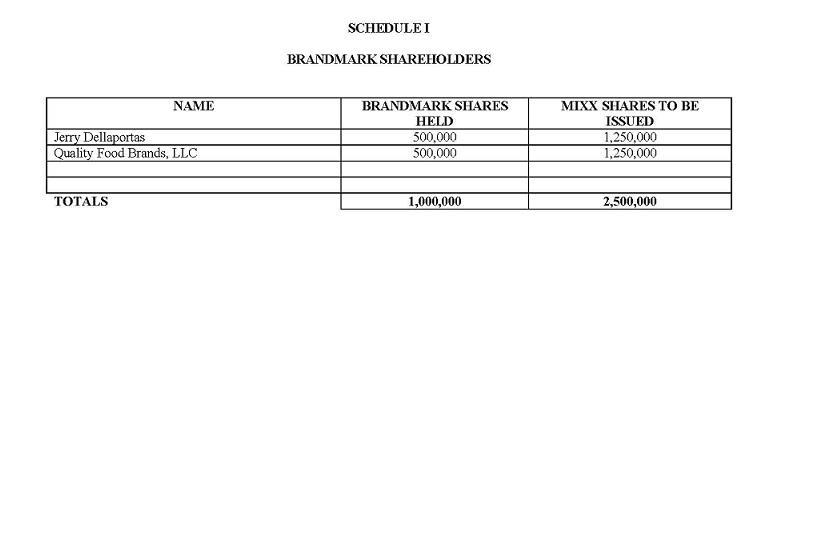

The Company will acquire One Hundred Percent (100%) of BMP’s interest in the Brand Assets for an aggregate purchase price of Two Million Five Hundred Thousand (2,500,000) restricted shares of common stock of the Company (the “Purchase Price”). The Company will purchase all rights to distribute and commercialize the Brand Assets globally. The Share Exchange Agreement closed on October 7, 2016.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

The information provided in Item 1.01 of this Current Report on Form 8-K related to the aforementioned Share Exchange Agreement is incorporated by reference into this Item 2.01.

As of the date of the closing of the Share Exchange Agreement, there were no material relationships between the Company and BMP or between the Company and any of BMP’s respective affiliates, directors, or officers, or associates thereof, other than in respect of the Purchase Agreement.

ITEM 3.02 UNREGISTERED SALES OF EQUITY SECURITIES.

The information provided in Item 1.01 of this Current Report on Form 8-K related to the aforementioned Purchase Agreement is incorporated by reference into this Item 3.02.

Concurrent with the Closing Date of the Share Exchange Agreement referred to in Item 1.01 above, and as a condition to the Closing of the Share Exchange Agreement, the Company issued 2,500,000 restricted shares of the Company’s common stock to the BMP shareholders.

Exemption from Registration. The shares of common stock referenced herein were issued in reliance upon an exemption from registration afforded under Section 4(a)(2) of the Securities Act for transactions by an issuer not involving a public offering, or Regulation D promulgated thereunder, or Regulation S for offers and sales of securities outside the United States. The Share Exchange Agreement is an exempt transaction pursuant to Section 4(a)(2) of the Securities Act as the acquisition was a private transaction by the Company and did not involve any public offering. Additionally, we relied upon the exemption afforded by Rule 506 of Regulation D of the Securities Act which is a safe harbor for the private offering exemption of Section 4(a)(2) of the Securities Act whereby an issuer may sell its securities to an unlimited number of accredited investors, as that term is defined in Rule 501 of Regulation D. Further, we relied upon the safe harbor provision of Rule 903 of Regulation S of the Securities Act which permits offers or sales of securities by the Company outside of the United States that are not made to “U.S. persons” or for the account or benefit of a “U.S. person”, as that term is defined in Rule 902 of Regulation S.

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN DIRECTORS

On October 7, 2016, immediately prior to the Closing Date of the Share Exchange Agreement referred to in Item 1.01 above and as a condition to the Closing, Cameron Robb resigned as the Chief Executive Officer and as a member of the Board of Directors of the Company, and Chris Larson resigned as Chief Financial Officer and as a member of the Board of Directors of the Company.

| 2 |

Additionally, on October 7, 2016, immediately prior to the Closing Date of the Share Exchange Agreement and as a condition to the Closing, Jerry Dellaportas was appointed as Chief Executive Officer and as a member of the Board of Directors of the Company, Steve Staehr was appointed as Chief Financial Officer and Treasurer, and Michael Oxford was appointed as Secretary and as a member of the Board of Directors of the Company became effective.

Their biographies are set forth below:

Jerry Dellaportas (incoming)- 29- Co-founder of BrandMark. Jerry has over 5 years domestic and international experience in strategic brand marketing and corporate business development. His responsibilities include key account brand management for all Mix 1 blue chip branded accounts, from the conception of the product and category, manufacturing, branded sales plan and brand market message.

Michael Oxford (incoming)-57- Co-founder of BrandMark. Michael is founder and CEO of (OREP) and (OLP), began his career in the financial services industry in 1980. He has dedicated his professional life towards helping businesses and individuals realize their financial goals. Michael has conducted over one thousand educational financial seminars for audiences across the country educating them on the benefits of basic and complex planning strategies to protect and grow personal wealth.

Steven Staehr (incoming)-52- Mr. Staehr has over 30 years’ experience in the fields of public accounting, corporate finance, corporate management with experience in entrepreneurial ventures as well as private company and public company executive management and operational management experience. Mr. Staehr has a degree in accounting and is a licensed CPA in Nevada and California and gained his public accounting experience with the Big 4 firm of Deloitte and Touche, CPA’s. Mr. Staehr has worked for such notable Las Vegas gaming companies as Caesars World (Corporate Internal Audit and Finance), Wynn Resorts (Financial Controller) as well as Boyd Gaming Corporation (Controller Fremont Hotel, Corporate Controller). While with Boyd Gaming, Mr. Staehr assisted in all aspects of the company’s initial public offering (IPO) and listing on the NYSE. With 14 casino and hotel properties it was one of the largest IPO’s in the gaming industry. Mr. Staehr also served as CFO for the Encore Productions Inc. the leading Las Vegas based audio visual and event production company servicing the convention industry. While there the Encore was restored to profitability and its debt and equity structure went from a lender workout situation to regaining commercial bank financing. Mr. Staehr co-founded and served as CFO of Western Capital Resources a publicly traded consumer lending company operating in 14 states with over 75 branch operations. Mr. Staehr has recently consulted or worked directly for several public companies such as Cash Systems Inc., traded on the NASDAQ.

ITEM 7.01 REGULATION FD DISCLOSURE

Press Releases

On October 11, 2016, Mix 1 Life, Inc. (the “Company”) issued a press release regarding the closing of the Share Exchange Agreement (the “Share Exchange Agreement”) with BrandMark Products, Inc., a Delaware Corporation (“BMP”). A copy of the press release is furnished as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

Limitation on Incorporation by Reference.

In accordance with General Instruction B.2 of Form 8−K, the information in this Form 8−K furnished pursuant to Item 7.01 shall not be deemed to be "filed" for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Exchange Act or Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Forward-Looking Statements

This Current Report on Form 8-K includes statements that may constitute “forward-looking” statements, usually containing the words “believe”, “estimate”, “project”, “anticipate”, “expect” or similar expressions. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements.

| 3 |

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(a) Financial Statements.

(d) Exhibits. The following exhibits are either filed as a part hereof or are incorporated by reference. Exhibit numbers correspond to the numbering system in Item 601 of Regulation S-K.

Exhibit | ||

Number | Description of Exhibit | |

|

|

|

2.01 | Share Exchange Agreement by and among the Company and BrandMark Products, Inc., dated October 7, 2016 (1) | |

99.2 | Press Release dated October 11, 2016 (1) |

_________

(1) Filed herewith.

| 4 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

MIX 1 LIFE, INC. | |||

|

| ||

Date: October 12, 2016 | By: | /s/ Jerry Dellaportas | |

Jerry Dellaportas | |||

Chief Executive Officer | |||

5 |

EXHIBIT 2.01

|

EXHIBIT 99.2

FOR IMMEDIATE RELEASE

Mix 1 Life, Inc. acquires BrandMark Products, Inc.

Mix 1 Life, Inc. Announces acquisition of Scottsdale based BrandMark Products Inc.

SCOTTSDALE, AZ (October 11, 2016) –Mix 1 Life, Inc. (OTC: MIXX) announced today that it has acquired 100% of the shares of Scottsdale, AZ based BrandMark Products, Inc. BrandMark is an international distributor and sales agency of snack foods, beverage products and sports nutritional products. Its distribution and sales portfolio include world famous brands such as: Jim Beam Snacks, Sauza Tequila Snacks, Canadian Club Snacks, Lionel Messi Foot Bubble Products, Core Health Products and Disney “Superband” Product Line. The combined Company has contracts in place that will generate in excess of $100 million in distribution revenue over the next several years.

BrandMark President and CEO, Jerry Dellaportas said “We are thrilled with the acquisition of BrandMark by Mix 1 Life” Mr. Dellaportas went on to say “The synergies between our two companies target the fastest growing segments in the CPG industry and I look forward to serving our shareholders and employees as its new CEO” Mix 1 Life, Inc. outgoing Chief Executive Officer Cameron Robb said: “I am pleased to announce this acquisition. It has always been our strategy from the beginning to expand our product and distribution offering with blue chip signature brands. BrandMark Products and its management team were a perfect fit to help us continue to execute this strategy and push Mix forward.”

Full details of the transaction can be found in the subsequent 8k filing.

About Mix 1 Life, Inc.

Mix1 Life, Inc., ("MIXX" or "mix1"), is the innovator and distributor of mix1 natural nutritional products. Here at mix1 the philosophy is pretty simple: we only create products with natural, high-quality ingredients that are truly functional. We believe natural products are better than artificial ones and are the key to leading a healthy balanced life. As a company we want to improve people's lives by promoting active lifestyles and overall health. Mix1 has the perfect mix to fit your life and schedule. Never again will you miss getting the necessary nutrients because you were too busy to eat. We strive to help you make healthy choices during your busy day in order to help you feel your best not only today, but every day.

For additional information on Mix 1 Life Inc. please visit www.mix1life.com

Forward-Looking Statement

This press release may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are not guarantees of the Company’s future performance and are subject to risks, uncertainties and other important factors that could cause actual performance to be materially different from what is projected and planned. Investors are cautioned that such forward-looking statements involve risks and uncertainties, which include among others, the risk that information and data provided by third-parties is inaccurate, as the Company undertakes no obligation to independently verify such information or assure the timeliness of such information, the inherent uncertainties associated with smaller reporting companies, including without limitation, other risks detailed from time to time in the Company's periodic public disclosures filed with OTC Market Groups, Inc. and available online at www.otcmarkets.com.

Contact:

Mix 1 Life, Inc.

Sean Stephenson

480.344.7770

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- LS Cable & System Welcomes $99 Million Investment Tax Credit Under Section 48C of the Inflation Reduction Act

- TCTM Filed 2023 Annual Report on Form 20-F

- FendX Announces Corporate Update

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share