Form 8-K MGIC INVESTMENT CORP For: Apr 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): | April 15, 2016 | |

MGIC Investment Corporation

__________________________________________

(Exact name of registrant as specified in its charter)

Wisconsin | 1-10816 | 39-1486475 |

_____________________ (State or other jurisdiction | _____________ (Commission | ______________ (I.R.S. Employer |

of incorporation) | File Number) | Identification No.) |

250 E. Kilbourn Avenue, Milwaukee, Wisconsin | 53202 | |

_________________________________ (Address of principal executive offices) | ___________ (Zip Code) | |

Registrant’s telephone number, including area code: | 414-347-6480 | |

Not Applicable

_____________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure.

We have changed the presentation of the information provided in the Quarterly Portfolio Supplement that was posted on our website, www.mtg.mgic.com, on January 21, 2016, and the Additional Information that was contained in our January 21, 2016 Fourth Quarter 2015 Earnings Release. The attached Exhibits present the changed presentation of the Additional Information disclosures for the periods Q3 2014 through Q4 2015 and the Quarterly Portfolio Supplement for the period ending December 31, 2015. The earnings release and quarterly portfolio supplement for First Quarter 2016 will present the information as of March 31, 2016 in the same manner.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

MGIC INVESTMENT CORPORATION | ||

Date: | April 15, 2016 | By: \s\ Julie K. Sperber |

Julie K. Sperber | ||

Vice President, Controller and Chief Accounting Officer | ||

Exhibit Index

Exhibit No. | Description | |

99 | Revised presentation of the Additional Information for the quarterly periods Q3 2014 through Q4 2015. (Pursuant to General Instruction B.2 to Form 8-K, this information is furnished and is not filed.) | |

99.1 | Revised presentation of the Quarterly Portfolio Supplement for the period ending December 31, 2015. (Pursuant to General Instruction B.2 to Form 8-K, this information is furnished and is not filed.) | |

Exhibit 99

Additional Information | ||||||||||||||||||||||||||||||

Q4 2015 | Q3 2015 | Q2 2015 | Q1 2015 | Q4 2014 | Q3 2014 | |||||||||||||||||||||||||

New primary insurance written (NIW) (billions) | $ | 9.8 | $ | 12.4 | $ | 11.8 | $ | 9.0 | $ | 9.5 | $ | 10.4 | ||||||||||||||||||

Monthly premium plans (1) | 7.7 | 10.2 | 9.5 | 6.9 | 7.9 | 8.8 | ||||||||||||||||||||||||

Single premium plans | 2.1 | 2.2 | 2.3 | 2.1 | 1.6 | 1.6 | ||||||||||||||||||||||||

Direct average premium rate (bps) | ||||||||||||||||||||||||||||||

Monthly (1) | 64.6 | 63.0 | 63.1 | 63.6 | 65.5 | 63.8 | ||||||||||||||||||||||||

Singles | 159.8 | 176.1 | 168.5 | 168.2 | 189.7 | 196.0 | ||||||||||||||||||||||||

New primary risk written (billions) | $ | 2.5 | $ | 3.2 | $ | 3.0 | $ | 2.2 | $ | 2.4 | $ | 2.7 | ||||||||||||||||||

Product mix as a % of primary flow NIW | ||||||||||||||||||||||||||||||

>95% LTVs | 5 | % | 5 | % | 5 | % | 3 | % | 2 | % | 2 | % | ||||||||||||||||||

Singles | 22 | % | 18 | % | 20 | % | 23 | % | 17 | % | 15 | % | ||||||||||||||||||

Refinances | 17 | % | 12 | % | 20 | % | 29 | % | 17 | % | 12 | % | ||||||||||||||||||

Primary Insurance In Force (IIF) (billions) | $ | 174.5 | $ | 172.7 | $ | 168.8 | $ | 166.1 | $ | 164.9 | $ | 162.4 | ||||||||||||||||||

Flow only | $ | 164.0 | $ | 161.8 | $ | 157.5 | $ | 154.5 | $ | 153.0 | $ | 150.2 | ||||||||||||||||||

Annual Persistency | 79.7 | % | 80.0 | % | 80.4 | % | 81.6 | % | 82.8 | % | 82.8 | % | ||||||||||||||||||

Primary Risk In Force (RIF) (billions) | $ | 45.5 | $ | 45.0 | $ | 44.0 | $ | 43.2 | $ | 42.9 | $ | 42.3 | ||||||||||||||||||

Flow only | $ | 42.5 | $ | 41.9 | $ | 40.8 | $ | 40.0 | $ | 39.6 | $ | 38.8 | ||||||||||||||||||

Total Primary RIF by FICO (%) (6) | ||||||||||||||||||||||||||||||

FICO 740 & > | 47 | % | 47 | % | 46 | % | 46 | % | 46 | % | 45 | % | ||||||||||||||||||

FICO 700-739 | 24 | % | 24 | % | 24 | % | 23 | % | 23 | % | 23 | % | ||||||||||||||||||

FICO 660-699 | 16 | % | 16 | % | 16 | % | 16 | % | 16 | % | 16 | % | ||||||||||||||||||

FICO 659 & < | 13 | % | 13 | % | 14 | % | 15 | % | 15 | % | 16 | % | ||||||||||||||||||

Average Coverage Ratio (RIF/IIF) | 26.1 | % | 26.1 | % | 26.0 | % | 26.0 | % | 26.0 | % | 26.0 | % | ||||||||||||||||||

Average Loan Size (thousands) | $ | 175.89 | $ | 174.58 | $ | 172.37 | $ | 171.05 | $ | 170.24 | $ | 169.05 | ||||||||||||||||||

Flow only | $ | 178.03 | $ | 176.61 | $ | 174.23 | $ | 172.88 | $ | 172.07 | $ | 170.74 | ||||||||||||||||||

Primary IIF - # of loans | 992,188 | 989,020 | 979,202 | 970,931 | 968,748 | 960,849 | ||||||||||||||||||||||||

Flow only | 921,166 | 916,230 | 904,055 | 893,461 | 889,479 | 879,654 | ||||||||||||||||||||||||

Primary IIF - Default Roll Forward - # of Loans | ||||||||||||||||||||||||||||||

Beginning Default Inventory | 64,642 | 66,357 | 72,236 | 79,901 | 83,154 | 85,416 | ||||||||||||||||||||||||

New Notices | 18,459 | 19,509 | 17,451 | 18,896 | 21,393 | 22,927 | ||||||||||||||||||||||||

Cures | (16,910 | ) | (17,036 | ) | (17,897 | ) | (21,767 | ) | (19,196 | ) | (19,582 | ) | ||||||||||||||||||

Paids (including those charged to a deductible or captive) | (3,333 | ) | (3,958 | ) | (4,140 | ) | (4,573 | ) | (5,074 | ) | (5,288 | ) | ||||||||||||||||||

Rescissions and denials | (225 | ) | (230 | ) | (172 | ) | (221 | ) | (183 | ) | (319 | ) | ||||||||||||||||||

Items removed from inventory | — | — | (1,121 | ) | — | (193 | ) | — | ||||||||||||||||||||||

Ending Default Inventory | 62,633 | 64,642 | 66,357 | 72,236 | 79,901 | 83,154 | ||||||||||||||||||||||||

Exhibit 99

Additional Information | ||||||||||||||||||||||||||||||

Q4 2015 | Q3 2015 | Q2 2015 | Q1 2015 | Q4 2014 | Q3 2014 | |||||||||||||||||||||||||

Primary claim received inventory included in ending default inventory | 2,769 | 2,982 | 3,440 | 4,448 | 4,746 | 5,194 | ||||||||||||||||||||||||

Composition of Cures | ||||||||||||||||||||||||||||||

Reported delinquent and cured intraquarter | 5,110 | 5,185 | 4,620 | 6,887 | 5,674 | 6,205 | ||||||||||||||||||||||||

Number of payments delinquent prior to cure | ||||||||||||||||||||||||||||||

3 payments or less | 7,714 | 7,146 | 7,721 | 9,516 | 8,420 | 7,989 | ||||||||||||||||||||||||

4-11 payments | 2,836 | 3,005 | 3,789 | 3,688 | 3,463 | 3,651 | ||||||||||||||||||||||||

12 payments or more | 1,250 | 1,700 | 1,767 | 1,676 | 1,639 | 1,737 | ||||||||||||||||||||||||

Total Cures in Quarter | 16,910 | 17,036 | 17,897 | 21,767 | 19,196 | 19,582 | ||||||||||||||||||||||||

Composition of Paids | ||||||||||||||||||||||||||||||

Number of payments delinquent at time of claim payment | ||||||||||||||||||||||||||||||

3 payments or less | 18 | 20 | 16 | 12 | 11 | 25 | ||||||||||||||||||||||||

4-11 payments | 304 | 374 | 435 | 550 | 528 | 550 | ||||||||||||||||||||||||

12 payments or more | 3,011 | 3,564 | 3,689 | 4,011 | 4,535 | 4,713 | ||||||||||||||||||||||||

Total Paids in Quarter | 3,333 | 3,958 | 4,140 | 4,573 | 5,074 | 5,288 | ||||||||||||||||||||||||

Aging of Primary Default Inventory | ||||||||||||||||||||||||||||||

Consecutive months in default | ||||||||||||||||||||||||||||||

3 months or less | 13,053 | 21 | % | 13,991 | 22 | % | 12,545 | 19 | % | 11,604 | 16 | % | 15,319 | 19 | % | 16,209 | 19 | % | ||||||||||||

4-11 months | 15,763 | 25 | % | 14,703 | 23 | % | 15,487 | 23 | % | 18,940 | 26 | % | 19,710 | 25 | % | 18,890 | 23 | % | ||||||||||||

12 months or more | 33,817 | 54 | % | 35,948 | 55 | % | 38,325 | 58 | % | 41,692 | 58 | % | 44,872 | 56 | % | 48,055 | 58 | % | ||||||||||||

Number of payments delinquent | ||||||||||||||||||||||||||||||

3 payments or less | 20,360 | 33 | % | 20,637 | 32 | % | 19,274 | 29 | % | 19,159 | 27 | % | 23,253 | 29 | % | 23,769 | 28 | % | ||||||||||||

4-11 payments | 15,092 | 24 | % | 14,890 | 23 | % | 15,710 | 24 | % | 18,372 | 25 | % | 19,427 | 24 | % | 18,985 | 23 | % | ||||||||||||

12 payments or more | 27,181 | 43 | % | 29,115 | 45 | % | 31,373 | 47 | % | 34,705 | 48 | % | 37,221 | 47 | % | 40,400 | 49 | % | ||||||||||||

Primary IIF - # of Delinquent Loans | 62,633 | 64,642 | 66,357 | 72,236 | 79,901 | 83,154 | ||||||||||||||||||||||||

Flow only | 47,088 | 48,436 | 49,507 | 53,390 | 59,111 | 61,323 | ||||||||||||||||||||||||

Primary IIF Default Rates | 6.31 | % | 6.54 | % | 6.78 | % | 7.44 | % | 8.25 | % | 8.65 | % | ||||||||||||||||||

Flow only | 5.11 | % | 5.29 | % | 5.48 | % | 5.98 | % | 6.65 | % | 6.97 | % | ||||||||||||||||||

Exhibit 99

Additional Information | ||||||||||||||||||||||||||||||

Q4 2015 | Q3 2015 | Q2 2015 | Q1 2015 | Q4 2014 | Q3 2014 | |||||||||||||||||||||||||

Reserves | ||||||||||||||||||||||||||||||

Primary | ||||||||||||||||||||||||||||||

Direct Loss Reserves (millions) | $ | 1,807 | $ | 1,877 | $ | 1,993 | $ | 2,112 | $ | 2,246 | $ | 2,362 | ||||||||||||||||||

Average Direct Reserve Per Default | $ | 28,859 | $ | 29,032 | $ | 30,033 | $ | 29,233 | $ | 28,107 | $ | 28,404 | ||||||||||||||||||

Pool | ||||||||||||||||||||||||||||||

Direct loss reserves (millions) | $ | 43 | $ | 49 | $ | 52 | $ | 57 | $ | 65 | $ | 69 | ||||||||||||||||||

Ending default inventory | 2,739 | 2,950 | 3,129 | 3,350 | 3,797 | 4,525 | ||||||||||||||||||||||||

Pool claim received inventory included in ending default inventory | 60 | 75 | 97 | 88 | 99 | 86 | ||||||||||||||||||||||||

Reserves related to Freddie Mac settlement (millions) | $ | 42 | $ | 52 | $ | 63 | $ | 73 | $ | 84 | $ | 94 | ||||||||||||||||||

Other Gross Reserves (millions) (3) | $ | 1 | $ | 2 | $ | 3 | $ | 3 | $ | 2 | $ | 3 | ||||||||||||||||||

Net Paid Claims (millions) (4) | $ | 188 | $ | 207 | $ | 222 | $ | 232 | $ | 248 | $ | 263 | ||||||||||||||||||

Total primary (excluding settlements) | $ | 164 | $ | 190 | $ | 196 | $ | 217 | $ | 225 | $ | 242 | ||||||||||||||||||

Settlements | $ | — | $ | — | $ | 10 | — | $ | 6 | — | ||||||||||||||||||||

Pool - with aggregate loss limits | $ | 4 | $ | 3 | $ | 5 | $ | 4 | $ | 3 | $ | 6 | ||||||||||||||||||

Pool - without aggregate loss limits | $ | 2 | $ | 3 | $ | 3 | $ | 2 | $ | 3 | $ | 3 | ||||||||||||||||||

Pool - Freddie Mac settlement | $ | 10 | $ | 11 | $ | 10 | $ | 11 | $ | 10 | $ | 11 | ||||||||||||||||||

Reinsurance | $ | (2 | ) | $ | (5 | ) | $ | (8 | ) | $ | (8 | ) | $ | (7 | ) | $ | (7 | ) | ||||||||||||

Other (3) | $ | 10 | $ | 5 | $ | 6 | $ | 6 | $ | 8 | $ | 8 | ||||||||||||||||||

Reinsurance terminations (4) | $ | — | $ | (15 | ) | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||

Primary Average Claim Payment (thousands) | $ | 49.1 | $ | 48.2 | $ | 48.6 | $ | 47.4 | $ | 45.0 | $ | 45.8 | ||||||||||||||||||

Flow only | $ | 45.6 | $ | 44.8 | $ | 45.1 | $ | 44.2 | $ | 44.6 | $ | 43.5 | ||||||||||||||||||

Reinsurance excluding captives | ||||||||||||||||||||||||||||||

% insurance inforce subject to reinsurance | 72.9 | % | 71.9 | % | 59.5 | % | 57.1 | % | 56.0 | % | 54.3 | % | ||||||||||||||||||

% Quarterly NIW subject to reinsurance | 89.5 | % | 90.6 | % | 97.9 | % | 85.2 | % | 87.4 | % | 90.1 | % | ||||||||||||||||||

Ceded premium written (millions) | $ | 30.0 | $ | (46.8 | ) | (5 | ) | $ | 30.9 | $ | 27.1 | $ | 27.6 | $ | 27.7 | |||||||||||||||

Ceded premium earned (millions) | $ | 30.0 | $ | 11.0 | (5 | ) | $ | 23.0 | $ | 24.6 | $ | 24.2 | $ | 23.7 | ||||||||||||||||

Ceded losses incurred (millions) | $ | 7.2 | $ | 4.2 | $ | 1.2 | $ | 4.9 | $ | 4.8 | $ | 4.7 | ||||||||||||||||||

Ceding commissions (millions) (included in underwriting and other expenses) | $ | 11.4 | $ | (2.4 | ) | (5 | ) | $ | 11.7 | $ | 10.1 | $ | 10.0 | $ | 9.9 | |||||||||||||||

Profit commission (millions) (included in ceded premiums) | $ | 27.0 | $ | 34.9 | (5 | ) | $ | 27.5 | $ | 23.5 | $ | 22.5 | $ | 21.9 | ||||||||||||||||

Direct Pool RIF (millions) | ||||||||||||||||||||||||||||||

With aggregate loss limits | $ | 271 | $ | 279 | $ | 282 | $ | 287 | $ | 303 | $ | 331 | ||||||||||||||||||

Without aggregate loss limits | $ | 388 | $ | 418 | $ | 456 | $ | 479 | $ | 505 | $ | 536 | ||||||||||||||||||

Exhibit 99

Additional Information | ||||||||||||||||||||||||||||||

Q4 2015 | Q3 2015 | Q2 2015 | Q1 2015 | Q4 2014 | Q3 2014 | |||||||||||||||||||||||||

Bulk Primary Insurance Statistics | ||||||||||||||||||||||||||||||

Insurance in force (billions) | $ | 10.5 | $ | 10.9 | $ | 11.3 | $ | 11.6 | $ | 11.9 | $ | 12.2 | ||||||||||||||||||

Risk in force (billions) | $ | 3.0 | $ | 3.1 | $ | 3.2 | $ | 3.2 | $ | 3.3 | $ | 3.5 | ||||||||||||||||||

Average loan size (thousands) | $ | 148.15 | $ | 149.00 | $ | 149.93 | $ | 149.90 | $ | 149.75 | $ | 150.77 | ||||||||||||||||||

Number of delinquent loans | 15,545 | 16,206 | 16,850 | 18,846 | 20,790 | 21,831 | ||||||||||||||||||||||||

Default rate | 21.89 | % | 22.26 | % | 22.42 | % | 24.33 | % | 26.23 | % | 26.89 | % | ||||||||||||||||||

Primary paid claims (millions) | $ | 39 | $ | 47 | $ | 46 | $ | 50 | $ | 36 | $ | 46 | ||||||||||||||||||

Average claim payment (thousands) | $ | 65.7 | $ | 62.2 | $ | 63.3 | $ | 61.8 | $ | 47.3 | $ | 59.2 | ||||||||||||||||||

Mortgage Guaranty Insurance Corporation - Risk to Capital | 12.1:1 | 12.3:1 | 13.2:1 | 13.7:1 | 14.6:1 | 15.0:1 | ||||||||||||||||||||||||

Combined Insurance Companies - Risk to Capital | 13.6:1 | 13.6:1 | 14.8:1 | 15.4:1 | 16.4:1 | 17.0:1 | ||||||||||||||||||||||||

GAAP loss ratio (insurance operations only) | 42.0 | % | 32.0 | % | (2 | ) | 42.3 | % | (2 | ) | 37.6 | % | (2 | ) | 54.8 | % | (2 | ) | 55.1 | % | (2 | ) | ||||||||

GAAP underwriting expense ratio (insurance operations only) | 13.9 | % | 14.4 | % | 15.0 | % | 16.4 | % | 13.9 | % | 14.9 | % | ||||||||||||||||||

Note: The FICO credit score for a loan with multiple borrowers is the lowest of the borrowers’ “decision FICO scores.” A borrower’s “decision FICO score” is determined as follows: if there are three FICO scores available, the middle FICO score is used; if two FICO scores are available, the lower of the two is used; if only one FICO score is available, it is used.

Note: Average claim paid may vary from period to period due to amounts associated with mitigation efforts.

(1) Includes loans with annual and split payments.

(2) As calculated, does not reflect any effects due to premium deficiency.

(3) Includes Australian operations.

(4) Net paid claims, as presented, does not include amounts received in conjunction with terminations or commutations of reinsurance agreements.

(5) In the third quarter of 2015, the April 2013 quota share reinsurance agreement was restructured via a commutation and new agreement. The effects of the new agreement for the third quarter of 2015 were as follows (in millions):

Ceded premium written | $ | 22.6 | |

Ceded premium earned | $ | 22.6 | |

Ceding commissions | $ | 9.2 | |

Profit commissions | $ | 23.3 | |

(6) Unknown FICO scores are reported in the "659 and <" FICO category.

The information in this document does not include our Australian operations, which are immaterial. Exhibit 99.1 Portfolio Supplement Q4 2015 (Revised Presentation) NYSE: MTG

Summary of Loan Modification and HARP Activity Risk in Force Total Primary Book HARP/RTM: 13% HAMP: 7% Other Mods: 4% % Current at 12/31/2015 (# of loans) HARP/RTM HAMP Other Mod 97.7% 77.0% 71.4% Risk in Force Flow Primary Book Risk in Force 2007 Flow Primary Book HARP/RTM: 13% HAMP: 5% Other Mods: 2% HARP/ RTM: 40% HAMP: 19% Other Mods: 8% % Current at 12/31/2015 (# of loans) HARP/RTM HAMP Other Mod 97.7% 76.8% 73.4% % Current at 12/31/2015 (# of loans) HARP/RTM HAMP Other Mod 97.2% 76.0% 73.4% 2

Primary Risk in Force December 31, 0% 50% 100% 2015 2014 1.5% 1.8% 4.5% 4.6% 29.8% 30.4% 48.0% 44.5% 16.2% 18.7% Note: Charts may not add to 100% due to rounding. 3 Total 80 and < 80.01-85 85.01-90 90.01-95 95.01-100 0% 50% 100% 2015 2014 3.8% 3.7% 29.8% 30.4% 50.1% 46.9% 16.2% 19.0% Flow Original LTV

Primary Risk in Force December 31, 0% 50% 100% 2015 2014 13.2% 15.2% 15.8% 16.0% 23.8% 23.2% 47.2% 45.6% Note: Charts may not add to 100% due to rounding. 4 Total 659 and < 660 - 699 700 - 739 740 and > 0% 50% 100% 2015 2014 9.7% 11.1% 15.7% 16.0% 24.8% 24.3% 49.8% 48.6% Flow Original FICO Refer to pages 13 and 14 of this supplement for Original FICO by Origination Year information. The percentage of primary risk in force previously displayed in the "Not Reported" category is now included in the "659 and <" Original FICO category. "Not Reported" is less than 1% for Total and Flow in both periods presented.

Primary Risk in Force December 31, 0% 50% 100% 2015 2014 7.0% 7.9% 33.9% 35.3% 30.7% 29.9% 26.1% 22.6% 2.3% Note: Charts may not add to 100% due to rounding. 5 Total 100k and < 101 - 200k 201 - 300k 301k - Conf Conf - 500k 500k and > 0% 50% 100% 2015 2014 6.6% 7.5% 34.0% 35.6% 31.2% 30.5% 26.7% 23.2% Flow Loan Amount 1.2% 2.0% 1.6% 1.7%

Primary Risk in Force December 31, 0% 50% 100% 2015 2014 95.0% 93.8% 2.0% 2.3% Note: Charts may not add to 100% due to rounding. FRM includes ARMs with initial reset periods of greater than 5 years, ARM I/O includes all ARMs regardless of reset period. 6 Total FRM FRM I/O ARM I/O* Option ARM* ARM* 0% 50% 100% 2015 2014 96.8% 95.9% 1.6% 1.9% Flow Loan Type *ARM I/O, Option ARM, and ARM are each individually less than 2% for Total and Flow in both periods presented.

Primary Risk in Force December 31, 0% 50% 100% 2015 2014 79.2% 76.8% 14.5% 15.4% 6.4% 7.8% Note: Charts may not add to 100% due to rounding. 7 Total Purchase Refinance Refinance Equity 0% 50% 100% 2015 2014 82.1% 80.2% 14.9% 16.1% 2.9% 3.7% Flow Loan Purpose

Primary Risk in Force December 31, 0% 50% 100% 2015 2014 87.4% 87.0% 11.9% 12.3% Note: Charts may not add to 100% due to rounding. 8 Total Single Family Detached Condo/Townhouse/Other Attached Coop/Other (1% or less) 0% 50% 100% 2015 2014 87.3% 87.0% 12.0% 12.3% Flow Property Type

Primary Risk in Force December 31, 0% 50% 100% 2015 2014 96.8% 96.4% 2.2% 2.3% Note: Charts may not add to 100% due to rounding. 9 Total Owner 2nd Home Investor (2% or less) 0% 50% 100% 2015 2014 96.9% 96.6% 2.2% 2.3% Flow Occupancy

Primary Risk in Force December 31, 0% 50% 100% 2015 2014 96.1% 95.2% 3.1% 3.8% 10 Total Full Stated No Doc (1% or less) 0% 50% 100% 2015 2014 97.9% 97.3% 1.5% 1.9% Flow Documentation Note: Charts may not add to 100% due to rounding. In accordance with industry practice, loans approved by GSE and other automated underwriting (AU) systems under "doc waiver" programs that do not require verification of borrower income are classified by MGIC as "full doc." Based in part on information provide by the GSEs, MGIC estimates full doc loans of this type were approximately 4% of 2007 NIW. Information for other periods is not available. MGIC understands these AU systems grant such doc waivers for loans they judge to have higher credit quality. MGIC also understands that the GSEs terminated their "doc waiver" programs in the second half of 2008.

Primary Risk in Force December 31, Note: Charts may not add to 100% due to rounding. Year of origination as displayed is determined by the calendar date the insurance was effective. 12/31/2014 12/31/2015 (% labeled) Total 25% 20% 15% 10% 5% 0% 20 15 20 14 20 13 20 12 20 11 20 10 20 09 20 08 20 07 20 06 20 05 20 04 an d Pr io r Year of Origination 22.2% 16.1% 11.2% 7.3% 2.6% 1.7% 1.7% 7.2% 14.0% 6.8% 4.3% 4.9% 11 12/31/2014 12/31/2015 (% labeled) Flow 25% 20% 15% 10% 5% 0% 20 15 20 14 20 13 20 12 20 11 20 10 20 09 20 08 20 07 20 06 20 05 20 04 an d Pr io r Year of Origination 23.8% 17.3% 12.0% 7.8% 2.7% 1.8% 1.8% 7.6% 13.4% 5.2% 3.3% 3.3%

Primary Risk in Force December 31, 2015 Total 8% 6% 4% 2% 0% % R IF CA FL TX PA OH IL MI NY GA WA 7.8% 6.3% 6.3% 5.2% 4.8% 4.1% 3.7% 3.4% 3.3% 3.3% Flow 8% 6% 4% 2% 0% % R IF CA TX FL PA OH IL MI WA GA WI 7.4% 6.3% 5.8% 5.3% 4.9% 4.1% 3.8% 3.3% 3.3% 3.3% 12

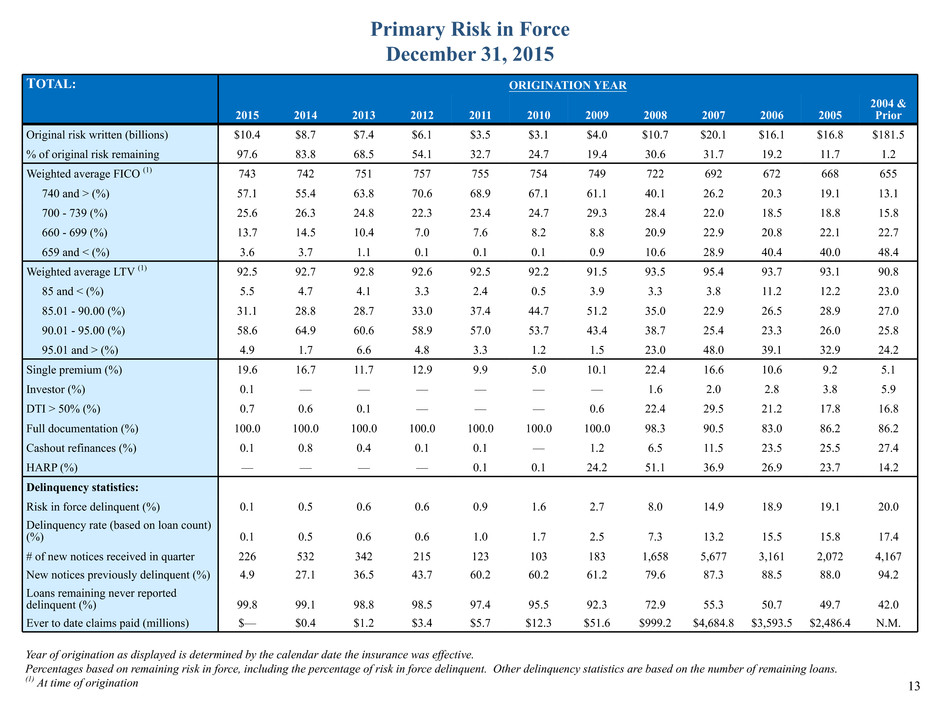

Primary Risk in Force December 31, 2015 TOTAL: ORIGINATION YEAR 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 & Prior Original risk written (billions) $10.4 $8.7 $7.4 $6.1 $3.5 $3.1 $4.0 $10.7 $20.1 $16.1 $16.8 $181.5 % of original risk remaining 97.6 83.8 68.5 54.1 32.7 24.7 19.4 30.6 31.7 19.2 11.7 1.2 Weighted average FICO (1) 743 742 751 757 755 754 749 722 692 672 668 655 740 and > (%) 57.1 55.4 63.8 70.6 68.9 67.1 61.1 40.1 26.2 20.3 19.1 13.1 700 - 739 (%) 25.6 26.3 24.8 22.3 23.4 24.7 29.3 28.4 22.0 18.5 18.8 15.8 660 - 699 (%) 13.7 14.5 10.4 7.0 7.6 8.2 8.8 20.9 22.9 20.8 22.1 22.7 659 and < (%) 3.6 3.7 1.1 0.1 0.1 0.1 0.9 10.6 28.9 40.4 40.0 48.4 Weighted average LTV (1) 92.5 92.7 92.8 92.6 92.5 92.2 91.5 93.5 95.4 93.7 93.1 90.8 85 and < (%) 5.5 4.7 4.1 3.3 2.4 0.5 3.9 3.3 3.8 11.2 12.2 23.0 85.01 - 90.00 (%) 31.1 28.8 28.7 33.0 37.4 44.7 51.2 35.0 22.9 26.5 28.9 27.0 90.01 - 95.00 (%) 58.6 64.9 60.6 58.9 57.0 53.7 43.4 38.7 25.4 23.3 26.0 25.8 95.01 and > (%) 4.9 1.7 6.6 4.8 3.3 1.2 1.5 23.0 48.0 39.1 32.9 24.2 Single premium (%) 19.6 16.7 11.7 12.9 9.9 5.0 10.1 22.4 16.6 10.6 9.2 5.1 Investor (%) 0.1 — — — — — — 1.6 2.0 2.8 3.8 5.9 DTI > 50% (%) 0.7 0.6 0.1 — — — 0.6 22.4 29.5 21.2 17.8 16.8 Full documentation (%) 100.0 100.0 100.0 100.0 100.0 100.0 100.0 98.3 90.5 83.0 86.2 86.2 Cashout refinances (%) 0.1 0.8 0.4 0.1 0.1 — 1.2 6.5 11.5 23.5 25.5 27.4 HARP (%) — — — — 0.1 0.1 24.2 51.1 36.9 26.9 23.7 14.2 Delinquency statistics: Risk in force delinquent (%) 0.1 0.5 0.6 0.6 0.9 1.6 2.7 8.0 14.9 18.9 19.1 20.0 Delinquency rate (based on loan count) (%) 0.1 0.5 0.6 0.6 1.0 1.7 2.5 7.3 13.2 15.5 15.8 17.4 # of new notices received in quarter 226 532 342 215 123 103 183 1,658 5,677 3,161 2,072 4,167 New notices previously delinquent (%) 4.9 27.1 36.5 43.7 60.2 60.2 61.2 79.6 87.3 88.5 88.0 94.2 Loans remaining never reported delinquent (%) 99.8 99.1 98.8 98.5 97.4 95.5 92.3 72.9 55.3 50.7 49.7 42.0 Ever to date claims paid (millions) $— $0.4 $1.2 $3.4 $5.7 $12.3 $51.6 $999.2 $4,684.8 $3,593.5 $2,486.4 N.M. 13 Year of origination as displayed is determined by the calendar date the insurance was effective. Percentages based on remaining risk in force, including the percentage of risk in force delinquent. Other delinquency statistics are based on the number of remaining loans. (1) At time of origination

Primary Risk in Force December 31, 2015 FLOW: ORIGINATION YEAR 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 & Prior Original risk written (billions) $10.4 $8.7 $7.4 $6.1 $3.5 $3.1 $4.0 $10.5 $18.1 $10.1 $10.2 $152.4 % of original risk remaining 97.7 83.8 68.5 54.1 32.8 24.9 19.3 30.9 31.5 21.9 13.8 0.9 Weighted average FICO (1) 743 742 751 757 755 754 749 722 694 688 684 668 740 and > (%) 57.1 55.4 63.8 70.6 68.9 67.1 61.1 39.9 26.2 25.7 25.2 17.8 700 - 739 (%) 25.6 26.3 24.8 22.3 23.4 24.7 29.3 28.4 22.6 22.6 23.3 20.0 660 - 699 (%) 13.7 14.5 10.4 7.0 7.6 8.2 8.8 21.1 23.8 23.3 24.2 25.8 659 and < (%) 3.6 3.7 1.1 0.1 0.1 0.1 0.9 10.6 27.4 28.6 27.4 36.4 Weighted average LTV (1) 92.5 92.7 92.8 92.6 92.5 92.2 91.5 93.5 95.7 95.5 95.3 94.7 85 and < (%) 5.5 4.7 4.1 3.3 2.4 0.5 3.9 3.3 2.3 2.2 2.0 3.2 85.01 - 90.00 (%) 31.1 28.8 28.7 33.0 37.4 44.7 51.2 35.1 22.8 24.8 25.1 24.7 90.01 - 95.00 (%) 58.6 64.9 60.6 58.9 57.0 53.7 43.4 39.0 25.7 24.8 29.5 35.1 95.01 and > (%) 4.9 1.7 6.6 4.8 3.3 1.2 1.5 22.5 49.3 48.2 43.4 37.0 Single premium (%) 19.6 16.7 11.7 12.9 9.9 5.0 10.1 22.6 13.9 13.7 12.8 8.0 Investor (%) 0.1 — — — — — — 1.6 2.1 2.5 3.7 5.9 DTI > 50% (%) 0.7 0.6 0.1 — — — 0.6 22.5 31.3 25.5 21.3 17.7 Full documentation (%) 100.0 100.0 100.0 100.0 100.0 100.0 100.0 98.3 92.4 90.8 92.6 92.8 Cashout refinances (%) 0.1 0.8 0.4 0.1 0.1 — 1.2 6.5 8.6 9.9 9.4 6.9 HARP (%) — — — — 0.1 0.1 24.2 51.5 40.4 37.3 32.8 22.4 Delinquency statistics: Risk in force delinquent (%) 0.1 0.5 0.6 0.6 0.9 1.6 2.7 8.0 14.1 14.5 14.2 18.3 Delinquency rate (based on loan count) (%) 0.1 0.5 0.6 0.6 1.0 1.7 2.5 7.4 12.8 12.9 12.8 15.6 # of new notices received in quarter 226 532 342 215 123 103 183 1,656 5,146 2,386 1,485 2,330 New notices previously delinquent (%) 4.9 27.1 36.5 43.7 60.2 60.2 61.2 79.6 86.7 86.6 85.9 94.1 Loans remaining never reported delinquent (%) 99.8 99.1 98.8 98.5 97.4 95.5 92.3 72.8 56.3 57.4 57.5 48.1 Ever to date claims paid (millions) $— $0.4 $1.2 $3.4 $5.7 $12.3 $51.6 $993.1 $4,151.5 $1,998.0 $1,398.5 N.M. 14 Year of origination as displayed is determined by the calendar date the insurance was effective. Percentages based on remaining risk in force, including the percentage of risk in force delinquent. Other delinquency statistics are based on the number of remaining loans. (1) At time of origination

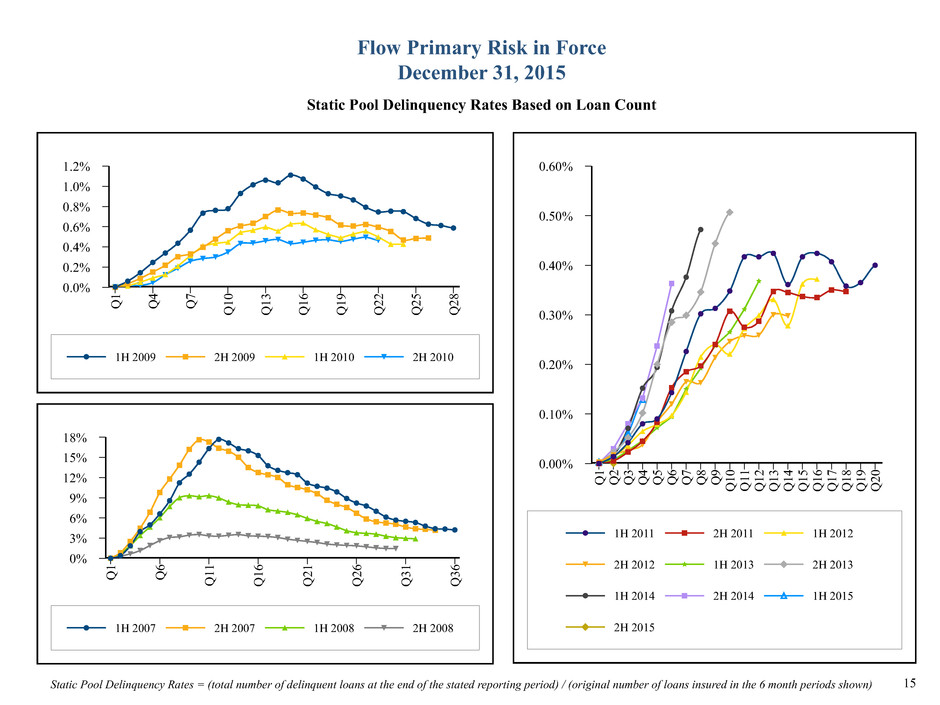

Flow Primary Risk in Force December 31, 2015 Static Pool Delinquency Rates Based on Loan Count 1H 2009 2H 2009 1H 2010 2H 2010 1.2% 1.0% 0.8% 0.6% 0.4% 0.2% 0.0% Q 1 Q 4 Q 7 Q 10 Q 13 Q 16 Q 19 Q 22 Q 25 Q 28 1H 2011 2H 2011 1H 2012 2H 2012 1H 2013 2H 2013 1H 2014 2H 2014 1H 2015 2H 2015 0.60% 0.50% 0.40% 0.30% 0.20% 0.10% 0.00% Q 1 Q 2 Q 3 Q 4 Q 5 Q 6 Q 7 Q 8 Q 9 Q 10 Q 11 Q 12 Q 13 Q 14 Q 15 Q 16 Q 17 Q 18 Q 19 Q 20 1H 2007 2H 2007 1H 2008 2H 2008 18% 15% 12% 9% 6% 3% 0% Q 1 Q 6 Q 11 Q 16 Q 21 Q 26 Q 31 Q 36 Static Pool Delinquency Rates = (total number of delinquent loans at the end of the stated reporting period) / (original number of loans insured in the 6 month periods shown) 15

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Prospera Energy Inc. 2024 Corporate Update

- i3 Energy PLC Announces 2024 Capital Budget and Production Guidance

- Sdiptech AB (publ) publishes interim report for the first quarter (January-March) 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share