Form 8-K MEDIFAST INC For: May 25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 25, 2016

MEDIFAST, INC.

(Exact name of registrant as specified in its Charter)

| Delaware | 001-31573 | 13-3714405 | ||

| (State or other jurisdiction | (Commission file number) | (IRS Employer | ||

| of incorporation) | Identification No.) |

3600 Crondall Lane, Owings Mills, Maryland 21117

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (410)-581-8042

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. | Regulation FD Disclosure. |

On May 25, 2016 at 4:00 p.m. EST, Timothy G. Robinson, Chief Financial Officer of Medifast, Inc. (the “Company”) conducted a presentation at the 17th Annual B. Riley & Co. Investor Conference in Hollywood, California. The presentation will be archived online on the Investor Relations section of the Company’s website at https://ir.medifastnow.com/ through June 8, 2016.

The slides used during the presentation are furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| 99.1 | Investor Presentation dated May 25, 2016. |

| - 2 - |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| MEDIFAST, INC. | ||

| By: | /s/ Jason L. Groves | |

|

Jason L. Groves, Esq. Executive Vice President and General Counsel | ||

| Dated: May 25, 2016 | ||

| - 3 - |

EXHIBIT INDEX

| No. | Description |

| 99.1 | Investor Presentation dated May 25, 2016. |

| - 4 - |

Investor Presentation May 2016 Exhibit 99.1

Certain information included in this presentation may constitute forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, Section 21 E of the Securities Exchange Act of 1934 , as amended, and the Private Securities Litigation Reform Act of 1995 . These forward - looking statements generally can be identified by use of phrases or terminology such as "intend" or other similar words or the negative of such terminology . Similarly, descriptions of Medifast's objectives, strategies, plans, goals or targets contained herein are also considered forward - looking statements . Medifast believes this presentation should be read in conjunction with all of its filings with the United States Securities and Exchange Commission and cautions its readers that these forward - looking statements are subject to certain events, risks, uncertainties, and other factors . Some of these factors include, among others, Medifast's inability to attract and retain independent Health Coaches and Members, stability in the pricing of print, TV and Direct Mail marketing initiatives affecting the cost to acquire customers, increases in competition, litigation, regulatory changes, and its planned growth into new domestic and international markets and new channels of distribution . Although Medifast believes that the expectations, statements, and assumptions reflected in these forward - looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward - looking statement in this presentation, as well as those set forth in its latest Annual Report on Form 10 - K, and other filings filed with the United States Securities and Exchange Commission, including its current reports on Form 8 - K . Safe Harbor Statement 2

Medifast Today Weight Management & Healthy Living Products Company Founded in 1980 Four Business Units to Reach Customers Vertically Integrated Manufacturing In - house Innovation and Food Science Industry - Leading Margins Strong Balance Sheet Share Repurchase Program Quarterly Dividend of $0.25 per share Empowering people with the right opportunities to enjoy the healthy life they deserve 3

Areas of Execution in 2015 2 MAINTAINED PROFIT FOCUS Completed Weight Control Center transition Exercised cost discipline and manufacturing efficiencies 3 CREATED VALUE Maintained strong balance sheet and cash flows Repurchased stock Initiated quarterly dividend in 4Q15 4 1 DELIVERED ON STRATEGIC PLAN Initiated Channel differentiation and exclusivity to enable independent strategies Strengthened Coach network Enhanced Direct Response capabilities Supported Weight Control Center Franchisees through transition away from Company owned locations

Well Positioned for Future Growth Large , addressable and growing market Differentiated scientific approach to weight loss Highly efficacious product portfolio validated by customer referrals Diversified sales channels meeting distinct customer needs Low cost vertically integrated business model with state - of - the - art manufacturing infrastructure Highly variable cost base limiting downside Strong balance sheet and consistent cash flow generation Experienced management team 5

Served Market Market Size Total Market 1.5% Medifast share of served market $ 18 Bn Served Market ‣ Diet Foods/Meals ‣ Weight Loss Centers ‣ Low Calories Programs ‣ Medical Plans & Surgery ‣ Books & Videos Unserved Market: ‣ Diet Soft Drinks ‣ Artificial Sweeteners ‣ Health Club Revenues Sources: U.S. Census Data, CDC Data, IBIS World, MarketData $ 47 Bn $ 65 Bn 6

1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 America Striving to Be Healthy 2014 OBESITY as BMI% 1985 Diagnosed Diabetes Rate 2.9% 6.2% 7 Sources: CDC Behavioral Risk Factor Surveillance System (1985 to 2014 comparison subject to methodology changes in 2011) and Diabetes Surveillance System (Age Adjusted Rates)

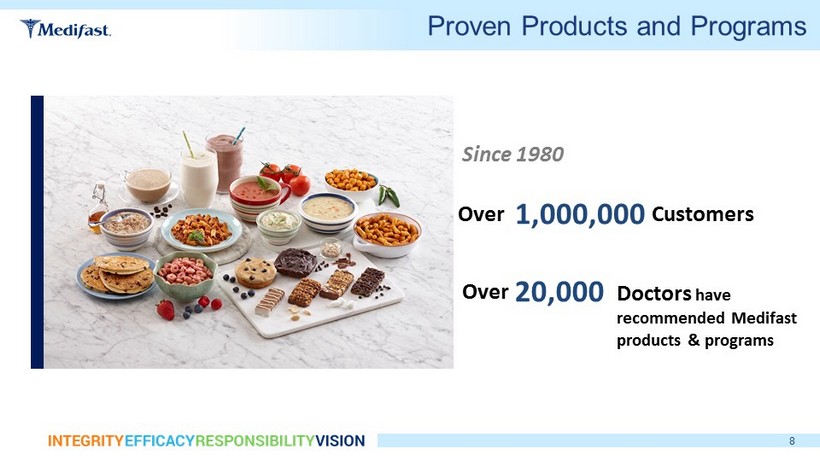

8 Proven Products and Programs Over 20,000 Over Customers 1,000,000 Doctors have recommended Medifast products & programs Since 1980

9 Four Business Models to Reach Clients 58 Franchise Locations Medical Provider & Wholesale Direct Response and E - commerce 78% 15% 6% 1% TSFL Med Direct Franchise MWCC Medifast Wholesale Revenue by Business Unit 12,600 Independent Health Coaches Note: 1Q16

10 Strategic Business Evolution 2011 2012 2014 2015 Beyond 2013 2016 Focus on MWCC Growth – Corporate: + 48 Centers – Franchise: + 14 Centers “One Medifast” Strategy – Internally created shared service model and technology platform to support all channels – Standardized products, offers, pricing and systems – Externally introduced opportunity for e - commerce customer to choose a sales channel for support MWCC Center Transition – Corporate: - 87 Centers • Sold: 41 Centers • Closed: 46 Centers – Franchise: +38 Centers Product Launches – Largest new product introduction year in 2014 – Entered new categories, including healthy living Business Unit Focus – Added channel expertise – Redefined brand , product & price d istinction Healthy Living – Enter markets beyond weight loss One Medifast “blurred” the lines of differentiation Heightened focus on sustainable profitability Redefined new forms of differentiation

Unique Direct Selling Model 12,600 i ndependent h ealth coaches 78% of total revenue Healthy lifestyle f ocus Supporting regional and n ational events 92% of orders go directly to clients, and 8% for coach’s own use Coaches do not hold inventory All commissions based on product sales Attractive business opportunity 11

12 Re - energized Coach Network 360 Regional events in 43 states with 8,000 attendees January 9, 2016! Annual Go Global event sold out in February ! Sundance Leadership Development Conference

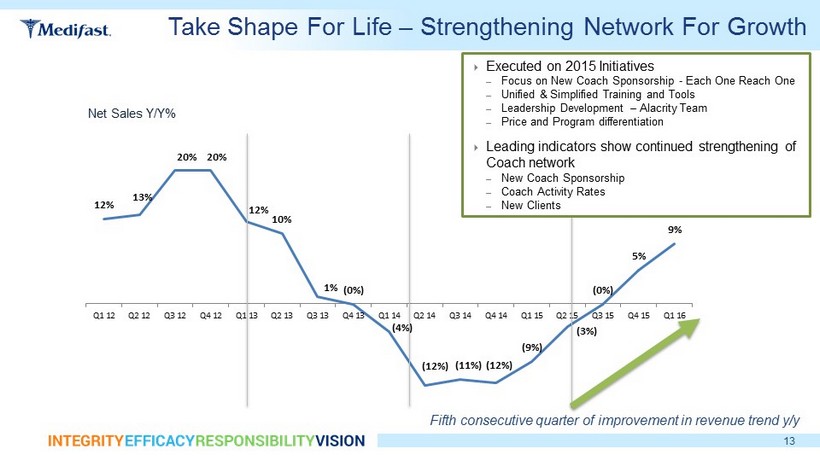

Take Shape For Life – Strengthening Network For Growth 12% 13% 20% 20% 12% 10% 1% (0%) (4%) (12%) (11%) (12%) (9%) (3%) (0%) 5% 9% Q1 12 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 13 Executed on 2015 Initiatives – Focus on New Coach Sponsorship - Each One Reach One – Unified & Simplified Training and Tools – Leadership Development – Alacrity Team – Price and Program differentiation Leading indicators show continued strengthening of Coach network – New Coach Sponsorship – Coach Activity Rates – New Clients Net Sales Y/Y% Fifth consecutive quarter of improvement in revenue trend y/y

14 Medifast Direct Direct Response Business Model 15% of Revenue E - commerce Platform Self - Directed Program Driven by Advertising/Promotion Transitioning to N ew Achieve P rogram Continuity Options for the Customer and Incentives to S tay on P lan

15 Medifast Weight Control Center Franchises Local C enters for 1 - to - 1 Counseling Supervised Medifast Programs Onsite Product Purchasing 58 Franchise Centers in the U.S. 6% of Total Revenue

2016 Strategy 16 Continue to build direct response capabilities through new ecommerce technology platform and smart merchandising New efforts to stabilize customer acquisition trends Launch new advertising campaign: “Your Year” Build on 2015 Momentum Continue to enhance Coach experience through training and new systems Introduce exclusive products that focus on key consumer health and wellness trends Enhance and evolve the Take Shape For Life brand experience Support success of Franchisees Work with franchisees on center business model innovation Support local marketing efforts to assist with new client acquisition

Medifast Confidential 17 FINANCIAL OVERVIEW

Started 2016 with positive momentum • R evenue of $72.3 million above expectations of $68 million to $71 million • Adjusted earnings per diluted share were $ 0.42 above expectations of $0.30 to $0.33 • Raised 2016 annual guidance: Revenues of $275 million to $282 million and adjusted earnings per diluted share $1.75 to $1.80 • Expect annual savings of $2.2 million associated with corporate restructuring Expect Company to Return to Growth in 2016 18 First Quarter 2016 Financial Highlights - Revenue from continuing operations - 2016 guidance for Non - GAAP EPS excludes $ 1 . 2 million of first - quarter 2016 restructuring costs, associated with separation payments for several senior executives - Restructuring excludes $ 1 . 2 million of anticipated restructuring costs associated with separation agreements for several senior executives realized in 1 Q 16

19 2011 - 2015 Revenue - Revenue from continuing operations . 2011 2012 2013 2014 2015 FY16 Guidance $ in millions $273 $319 $324 $285 $273 $275 to $282 $0 $50 $100 $150 $200 $250 $300 $350

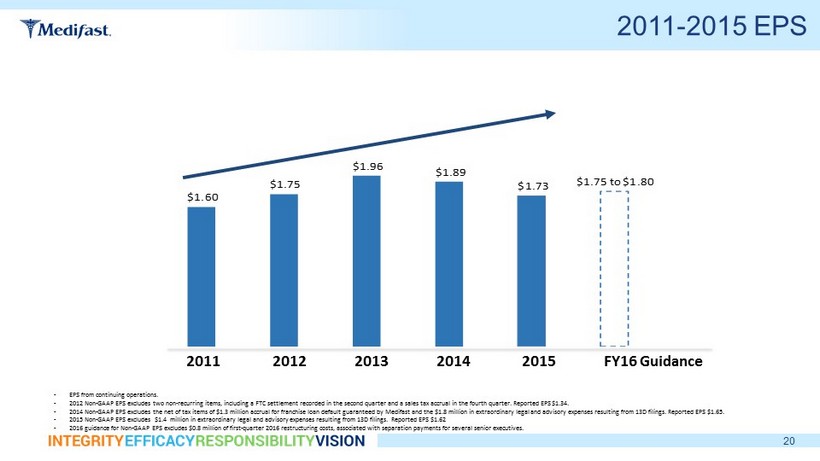

$1.60 $1.75 $1.96 $1.89 $1.73 $1.75 to $1.80 20 2011 - 2015 EPS - EPS from continuing operations . - 2012 Non - GAAP EPS excludes two non - recurring items, including a FTC settlement recorded in the second quarter and a sales tax accrual in the fourth quarter . Reported EPS $ 1 . 34 . - 2014 Non - GAAP EPS excludes the net of tax items of $ 1 . 3 million accrual for franchise loan default guaranteed by Medifast and the $ 1 . 8 million in extraordinary legal and advisory expenses resulting from 13 D filings . Reported EPS $ 1 . 65 . - 2015 Non - GAAP EPS excludes $ 1 . 4 million in extraordinary legal and advisory expenses resulting from 13 D filings . Reported EPS $ 1 . 62 - 2016 guidance for Non - GAAP EPS excludes $ 0 . 8 million of first - quarter 2016 restructuring costs, associated with separation payments for several senior executives . 2011 2012 2013 2014 2015 FY16 Guidance

21 Strong Cash & Balance Sheet $ 71.6M Cash & Investments No Long - Term Debt Low Working Capital Levels Minimal CAPEX Requirements Strong Free Cash Flows Existing Stock Repurchase Program Quarterly Cash Dividend of $0.25 per share Note: Cash and Investments as well as debt position as of 3/31/2016

Well Positioned for Future Growth Large , addressable and growing market Differentiated scientific approach to weight loss Highly efficacious product portfolio validated by customer referrals Diversified sales channels meeting distinct customer needs Low cost vertically integrated business model with state - of - the - art manufacturing infrastructure Highly variable cost base limiting downside Strong balance sheet and consistent cash flow generation Experienced management team 22

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Medifast to Announce Financial Results for the First Quarter Ended March 31, 2024

- Qualcomm Schedules Second Quarter Fiscal 2024 Earnings Release and Conference Call

- Safe & Green Holdings Corp Provides Update on Its Audit and Planned 10-K Filing for the Year Ended December 31, 2023

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share