Form 8-K MEDIFAST INC For: Jan 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 10, 2017

MEDIFAST, INC.

(Exact name of registrant as specified in its Charter)

| Delaware | 001-31573 | 13-3714405 | ||

| (State or other jurisdiction | (Commission file number) | (IRS Employer | ||

| of incorporation) | Identification No.) |

3600 Crondall Lane, Owings Mills, Maryland 21117

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (410)-581-8042

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. | Regulation FD Disclosure. |

On January 10, 2017 at 12:00 p.m. EST, Daniel R. Chard, Chief Executive Officer and Timothy G. Robinson, Chief Financial Officer of Medifast, Inc. (the “Company”) conducted a presentation at the 19th Annual ICR Conference in Orlando, Florida. The presentation will be archived online on the Investor Relations section of the Company’s website at https://ir.medifastnow.com/ through January 24, 2017.

The slides used during the presentation are furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| 99.1 | Investor Presentation dated January 10, 2017. |

| - 2 - |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| MEDIFAST, INC. | ||

| By: | /s/ Jason L. Groves | |

|

Jason L. Groves, Esq. Executive Vice President and General Counsel | ||

| Dated: January 10, 2017 | ||

| - 3 - |

EXHIBIT INDEX

| No. | Description |

| 99.1 | Investor Presentation dated January 10, 2017. |

| - 4 - |

Investor Presentation January 2017 Exhibit 99.1

Certain information included in this presentation may constitute forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, Section 21 E of the Securities Exchange Act of 1934 , as amended, and the Private Securities Litigation Reform Act of 1995 . These forward - looking statements generally can be identified by use of phrases or terminology such as "intend" or other similar words or the negative of such terminology . Similarly, descriptions of Medifast's objectives, strategies, plans, goals or targets contained herein are also considered forward - looking statements . Medifast believes this presentation should be read in conjunction with all of its filings with the United States Securities and Exchange Commission and cautions its readers that these forward - looking statements are subject to certain events, risks, uncertainties, and other factors . Some of these factors include, among others, Medifast's inability to attract and retain independent Health Coaches and Members, stability in the pricing of print, TV and Direct Mail marketing initiatives affecting the cost to acquire customers, increases in competition, litigation, regulatory changes, and its planned growth into new domestic and international markets and new channels of distribution . Although Medifast believes that the expectations, statements, and assumptions reflected in these forward - looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward - looking statement in this presentation, as well as those set forth in its latest Annual Report on Form 10 - K, and other filings filed with the United States Securities and Exchange Commission, including its current reports on Form 8 - K . Safe Harbor Statement 2

Daniel R. Chard Chief Executive Officer Timothy Robinson Chief Financial Officer 3 Today’s Presenters & Agenda Presenters Agenda Company Highlights 1 Focus On Execution… Medifast Business Evolution 2 Weight Loss & Weight Maintenance Options for Success 3 Financial Highlights 4 Well Positioned for Future Growth 5

4 COMPANY HIGHLIGHTS

Medifast Today Weight Management & Healthy Living Company Compelling Distribution Delivery Business Model Vertically Integrated Manufacturing In - house Innovation and Food Science Industry - Leading Margins Strong Balance Sheet Share Repurchase Program Quarterly Dividend of $0.32 per share Over 35 years of Empowering people with the right opportunities to enjoy the healthy life they deserve 5

Well Positioned for Future Growth Large , addressable and growing market Differentiated scientific approach to weight loss Highly efficacious product portfolio validated by customer referrals Network of Coach, Center and Physician distribution partners Low cost vertically integrated business model with state - of - the - art manufacturing infrastructure Highly variable cost base limiting downside Strong balance sheet and consistent cash flow generation Experienced management team 6 x X x X x X x X x X x X x X x X

Served Market Market Opportunity Total Market 1.5% Medifast share of served market $ 18 B Served Market ‣ Diet Foods/Meals ‣ Weight Loss Centers ‣ Low Calories Programs ‣ Medical Plans & Surgery ‣ Books & Videos Unserved Market ‣ Diet Soft Drinks ‣ Artificial Sweeteners ‣ Health Club Revenues Sources: U.S. Census Data, CDC Data, IBIS World, MarketData $ 47 B $ 65 B 7

1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 America Striving to Be Healthy 2014 OBESITY as BMI% 1985 Diagnosed Diabetes Rate 2.9% 6.2% 8 Sources: CDC Behavioral Risk Factor Surveillance System (1985 to 2014 comparison subject to methodology changes in 2011) and Diabetes Surveillance System (Age Adjusted Rates)

9 Proven Products and Programs Over 20,000 Over Customers 1,000,000 Doctors have recommended Medifast products & programs Since 1980

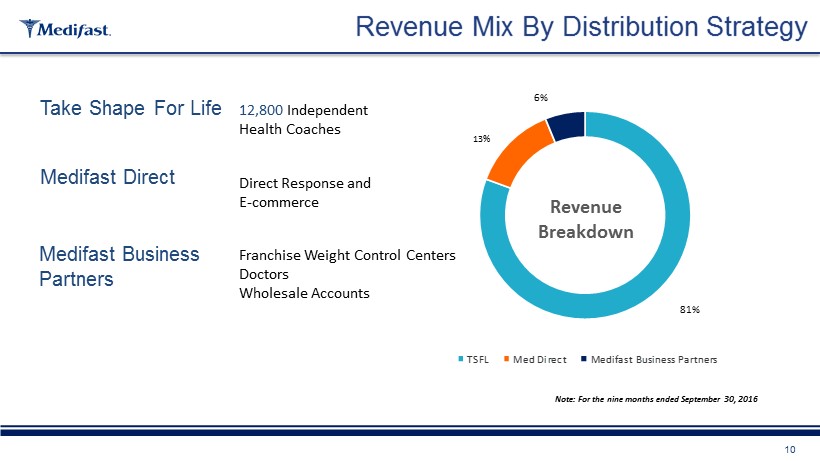

10 Revenue Mix By Distribution Strategy Direct Response and E - commerce 81% 13% 6% TSFL Med Direct Medifast Business Partners Revenue Breakdown 12,800 Independent Health Coaches Note: For the nine months ended September 30, 2016 13% Take Shape For Life Medifast Direct Medifast Business Partners Franchise Weight Control Centers Doctors Wholesale Accounts

11 FOCUS ON EXECUTION… MEDIFAST BUSINESS EVOLUTION

Areas of Execution in 2016 2 MAINTAINED PROFIT FOCUS Financial Discipline in all areas of the company to drive overall performance Continued to improve Supply Chain efficiencies while developing a new line of Optavia products in 2016. 3 CREATED VALUE Maintained strong balance sheet and cash flows Initiated quarterly dividend in 4Q15 and increased it by 28% in 4Q16 Drove significant s hare price appreciation 12 1 DELIVERED ON STRATEGIC PLAN Initiated Channel differentiation and exclusivity to enable new strategies Strengthened Coach network Direct r esponse analytics, test & measure capabilities

13 Strategic Business Evolution 2011 2012 2014 2015 Beyond 2013 2016 Focus on MWCC Growth – Corporate: + 48 Centers – Franchise: + 14 Centers “One Medifast” Strategy – Internally created shared service model and technology platform to support all channels with independent strategies – Standardized products, offers, pricing and systems – Externally introduced opportunity for e - commerce customer to choose a sales channel for support MWCC Center Transition – Corporate: - 87 Centers • Sold: 41 Centers • Closed: 46 Centers – Franchise: +38 Centers Product Launches – Largest new product introduction year in 2014 – Entered new categories, including healthy living Cost base reductions – Supply Chain Enhancements – Expense Reductions Complement of Products & Brands for Effective Distribution Delivery – Redefined brand , product & price strategy – Tested products beyond weight loss Restructured Executive team to create focus future growth path OPTA VIA ™ – Introduced a new, exclusive lifestyle brand for Take Shape For Life division Industry Expertise including Dan Chard, CEO effective 10/3/16 – S easoned executive who possesses extensive direct selling industry and consumer products experience One Medifast “blurred” the lines of differentiation Heightened focus on sustainable profitability Defining Path to Growth

14 WEIGHT LOSS & WEIGHT MAINTENANCE OPTIONS FOR SUCCESS

Unique Direct Selling Model 12,800 i ndependent h ealth coaches 81% of total revenue Healthy lifestyle f ocus 92% of orders go directly to clients, and 8% for coach’s own use Coaches do not purchase at a discount Coaches do not hold inventory All commissions based on product sales Attractive business opportunity 15 Take Shape For Life

16 Introducing OPTA VIA™

17 Introducing OPTA VIA™ Launch – Convention July 2016 Brand Introduction – July 2016 – > July 2017 Fully exclusive lifestyle brand and product offering that is only available to our Take Shape For Life family of Health C oaches and clients Well positioned f or growth across the U.S. and opportunity for future international expansion

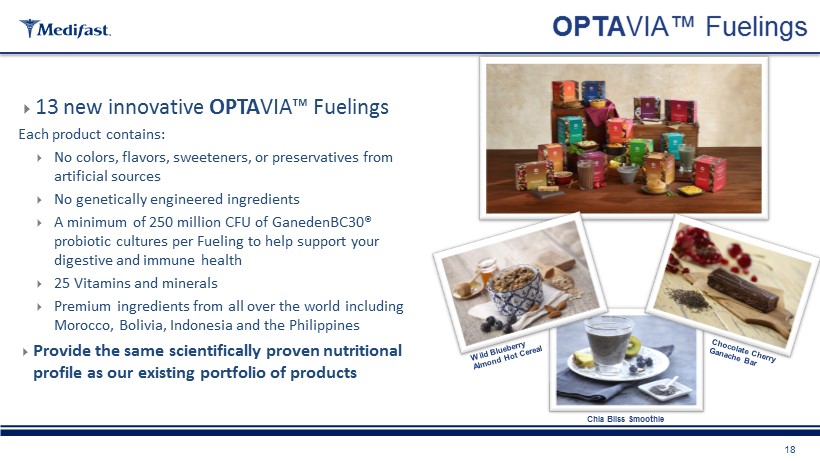

18 OPTA VIA™ Fuelings 13 new innovative OPTA VIA™ Fuelings Each product contains : No colors, flavors, sweeteners, or preservatives from artificial sources No genetically engineered ingredients A minimum of 250 million CFU of GanedenBC30® probiotic cultures per Fueling to help support your digestive and immune health 25 Vitamins and minerals Premium ingredients from all over the world including Morocco, Bolivia, Indonesia and the Philippines Provide the same scientifically proven nutritional profile as our existing portfolio of products Chia Bliss Smoothie

19 Re - energized Coach Network Convention 2016 largest event in the company's history - with more than 3,400 registered attendees, >20% growth y/y

Take Shape For Life – Strengthening Network For Growth 12% 13% 20% 20% 12% 10% 1% (0%) (4%) (12%) (11%) (12%) (9%) (3%) (0%) 5% 9% 10% 13% Q1 12 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16 20 Executed on key Initiatives – Focus on New Coach Sponsorship - Each One Reach One – Unified & Simplified Training and Tools – Leadership Development – Helping leaders achieve more success – Price and Program differentiation. Strengthening the Coach value proposition. Leading indicators show continued strengthening of Coach network – New Coach Sponsorship – Coach Activity Rates – New Clients Net Sales Y/Y% Seventh consecutive quarter of improvement in revenue trend y/y

21 Direct Response Business Model 13% of Revenue E - commerce Platform Self - Directed Program Driven by Advertising/Promotion Continuity Options for the Customer and Incentives to S tay on P lan

22 Local C enters for 1 - to - 1 Counseling Supervised Medifast Programs Onsite Product Purchasing 55 Franchise Centers in the U.S. 6% of Total Revenue As of 9/30/2016

2017 - Increased Focus 23 Align the organization around top priorities tied to revenue and profit generation objectives Leverage the knowledge gained from previous efforts in Mexico with Medix and in Sports Nutrition in the Collegiate markets to enable future growth in new markets.

2017 Take Shape For Life Strategy to Accelerate Growth 24 Deliver sustained v alue t hrough o ur b rand e xperience Enable digital as a growth d river Develop existing m arkets and prepare for expansion Explore new g rowth i nitiatives and exploiting p roven ‘winners ’

2017 Medifast Direct Strategy to Stabilize 25 Focus on proven, efficient methods of acquiring customers Maintain strong average order value and retention metrics Capitalize on the launch of new programs – Medifast Flex and Medifast Go Launch new e - commerce platform to improve the customer experience Leverage direct marketing and direct response expertise across the company Expand on our digital strategy as a growth Driver

26 Experienced Management Team Name Title Years of Experience Previous Experience Michael C. MacDonald Executive Chairman of the Board of Directors 40+ Daniel R. Chard Chief Executive Officer 25+ Timothy G. Robinson Chief Financial Officer 25+ Brian Kagen Executive Vice President & Chief Marketing Officer 20+ Bill Baker EVP Information Technology 20+ Mona Ameli President of Take Shape for Life 20+ Recent Addition to Leadership Team: Jeremy Redd VP of Take Shape for Life Sales & Field Development 15+

27 FINANCIAL OVERVIEW

P ositive Momentum in 2016 3Q16 Financial Highlights x R evenue of $68.6 million exceeding prior guidance of $64 million to $67 million x Earnings per diluted share from continuing operations was $0.51 which was above expectations of $ 0.43 to $ 0.46 x 2016 annual guidance: narrowed revenue guidance to $275 million to $ 278 million, raised earnings per share to $1.45 - $1.48 from $1.38 - $1.43 and adjusted earnings per share to $ 1.86 - $ 1.89 from $1.79 - $1.84 x Expect annual savings of $2.2 million associated with corporate restructuring 28 Financial Highlights - Revenue from continuing operations - 2016 guidance for Non - GAAP EPS excludes $ 1 . 2 million of first - quarter 2016 restructuring costs, associated with separation payments for several senior executives and excludes a $ 6 . 1 million charge for the asset abandonment that occurred in 2 Q 16 - Restructuring excludes $ 1 . 2 million of anticipated restructuring costs associated with separation agreements for several senior executives realized in 1 Q 16

29 2011 - 2015 Revenue - Revenue from continuing operations . 2011 2012 2013 2014 2015 FY16 Guidance $ in millions $273 $319 $324 $285 $273 $275 to $278 $0 $50 $100 $150 $200 $250 $300 $350

30 2011 - 2015 EPS - EPS from continuing operations . 2011 2012 2013 2014 2015 FY16 Guidance $1.60 $1.34 $1.96 $1.65 $1.62 $1.45 to $1.48

31 2011 - 2015 Adjusted EPS - EPS from continuing operations . - 2012 Non - GAAP EPS excludes two non - recurring items, including a FTC settlement recorded in the second quarter and a sales tax accrual in the fourth quarter . Reported EPS $ 1 . 34 . - 2014 Non - GAAP EPS excludes the net of tax items of $ 1 . 3 million accrual for franchise loan default guaranteed by Medifast and the $ 1 . 8 million in extraordinary legal and advisory expenses resulting from 13 D filings . Reported EPS $ 1 . 65 . - 2015 Non - GAAP EPS excludes $ 1 . 4 million in extraordinary legal and advisory expenses resulting from 13 D filings . Reported EPS $ 1 . 62 - 2016 guidance for Non - GAAP EPS excludes $ 1 . 2 million of restructuring costs associated with separation agreements with several senior executives and a $ 6 . 1 million noncash asset impairment expense 2011 2012 2013 2014 2015 FY16 Guidance $1.60 $1.75 $1.96 $1.89 $1.73 $1.86 to $1.89

32 Strong Cash & Balance Sheet $ 82.1M Cash & Investments No Long - Term Debt Low Working Capital Levels Minimal CAPEX Requirements Strong Free Cash Flows Existing Stock Repurchase Program Increased Quarterly Cash Dividend 28% to $0.32 per share Note: Cash and Investments as well as debt position as of 9 /30/2016

Well Positioned for Future Growth 33

34 Q&A

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- SumUp Doubles Down on ESG Initiatives for 2024, Announces the Creation of the 'SumUp Forest' in Peru

- With New Hire, FeganScott Expands Footprint to Include Nation’s Capital

- Jeff Martin Auctioneers to Manage Sale of Sabine Mining Company Assets for North American Coal

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share