Form 8-K MAXIMUS INC For: May 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report: May 9, 2016

Date of earliest event reported: May 5, 2016

___________

MAXIMUS, INC.

(Exact name of registrant as specified in its charter)

Virginia (State or other jurisdiction of incorporation) | 1-12997 (Commission File Number) | 54‑1000588 (I.R.S. Employer Identification No.) | |

1891 Metro Center Drive, Reston, Virginia (Address of principal executive offices) | 20190-5207 (Zip Code) | ||

Registrant’s telephone number, including area code: (703) 251-8500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On May 5, 2016, the Company issued a press release announcing its financial results for the quarter ended March 31, 2016. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference into this Item 2.02.

On May 5, 2016, the Company held a conference call with respect to these financial results. The conference call was open to the public. The transcript and slide presentation that accompanied the call are furnished as Exhibit 99.2 to this Current Report on Form 8-K and incorporated by reference into this Item 2.02.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are being furnished pursuant to Item 2.02 above.

Exhibit No. | Description |

99.1 | Press release dated May 5, 2016 |

99.2 | Conference call transcript and slide presentation for Earnings Call - May 5, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

MAXIMUS, Inc. | ||||

Date: May 9, 2016 | By: | /s/ David R. Francis | ||

David R. Francis | ||||

General Counsel and Secretary | ||||

EXHIBIT INDEX

Exhibit No. | Description |

99.1 | Press release dated May 5, 2016 |

99.2 | Conference call transcript and slide presentation for Earnings Call - May 5, 2016 |

FOR IMMEDIATE RELEASE | CONTACT: | Lisa Miles 703.251.8637 | |

Date: May 5, 2016 | |||

MAXIMUS Reports Second Quarter Results for Fiscal Year 2016

- The Company Narrows Earnings Guidance Range for Fiscal 2016 -

(RESTON, Va. - May 5, 2016) - MAXIMUS (NYSE: MMS), a leading provider of government services worldwide, today reported financial results for the three and six months ended March 31, 2016.

Highlights for the second quarter of fiscal year 2016 include:

• | Revenue growth of 26% (including organic growth of 13%) to $606.5 million compared to the same period last year |

• | Diluted earnings per share of $0.74, which included a benefit of approximately $0.08 of diluted earnings per share related to contract modifications from the United Kingdom Health Assessment Advisory Service (HAAS) contract |

• | Year-to-date signed contract awards of $1.1 billion and new contracts pending (awarded but unsigned) of $143 million at March 31, 2016 |

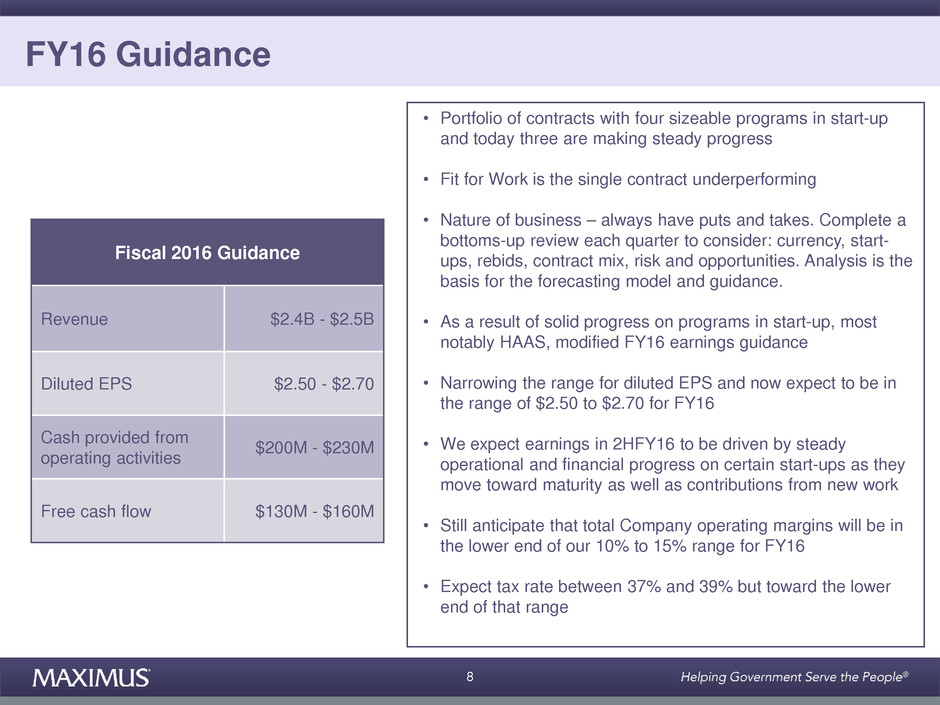

• | An update to earnings guidance with diluted earnings per share now expected to range between $2.50 and $2.70 for fiscal 2016 |

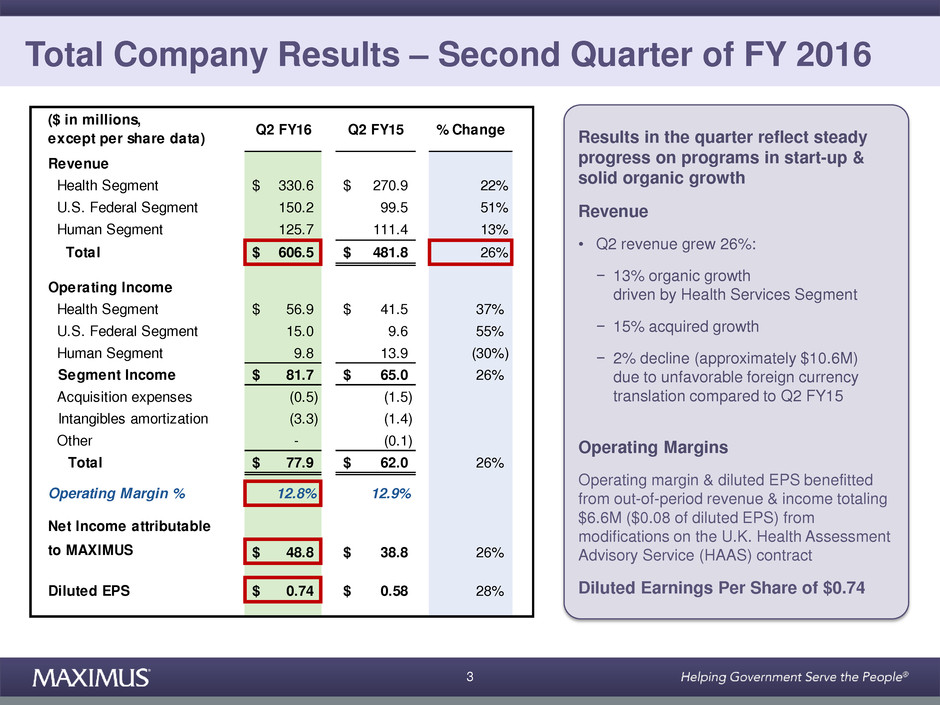

For the second quarter of fiscal 2016, revenue increased 26% to $606.5 million compared to $481.8 million reported for the same period last year. The increase in revenue was attributable to acquisitions that accounted for growth of 15% and organic growth of 13%, principally from the Health Services Segment. The increase in revenue was partially offset by a 2% decline from unfavorable foreign currency translation.

For the second quarter of fiscal 2016, net income attributable to MAXIMUS totaled $48.8 million, or $0.74 of diluted earnings per share. This compares to diluted earnings per share of $0.58 for the second quarter of fiscal 2015. The second quarter of fiscal 2016 received the benefit of out-of-period revenue and income of approximately $6.6 million, or approximately $0.08 of diluted earnings per share, resulting from contract modifications on the HAAS contract in the U.K.

Total Company operating margin for the second quarter of fiscal 2016 was 12.8%.

“Our financial results for the quarter demonstrate that overall, we have made solid progress on start-up projects, particularly the HAAS contract. Our current trends confirm that we are on track to hit full productivity on this contract by the end of the summer and we have an increased level of confidence that we are on a path to achieve our long-term operational and financial goals over the life of the contract,” commented MAXIMUS CEO Richard A. Montoni.

1891 METRO CENTER DRIVE | RESTON, VIRGINIA 20190 | 703.251.8500 | 703.251.8240 FAX | MAXIMUS.COM

Page 1

Health Services Segment

Health Services Segment revenue for the second quarter of fiscal 2016 increased 22% to $330.6 million compared to $270.9 million reported for the same period last year.

The year-over-year increase in revenue was nearly all organic and principally driven by the U.K. HAAS contract and, to a lesser extent, new work and expansion on existing contracts in the U.S. health business. The Ascend acquisition, which occurred in the quarter, accounted for less than 1% of Segment growth in the quarter. Health Segment growth was offset by a 2% decline from unfavorable foreign currency translation.

Operating margin for the second quarter of fiscal 2016 increased to 17.2% compared to 15.3% reported in the prior-year period. Operating margin in the second quarter benefitted from out-of-period revenue and income related to: 1) a previously disclosed contract change order that was recognized in the second quarter, and 2) modifications on the HAAS contract. Excluding the benefit of out-of-period revenue and income related to contract modifications in the second quarter of 2016, operating margin would have been 13.2% in the quarter.

U.S. Federal Services Segment

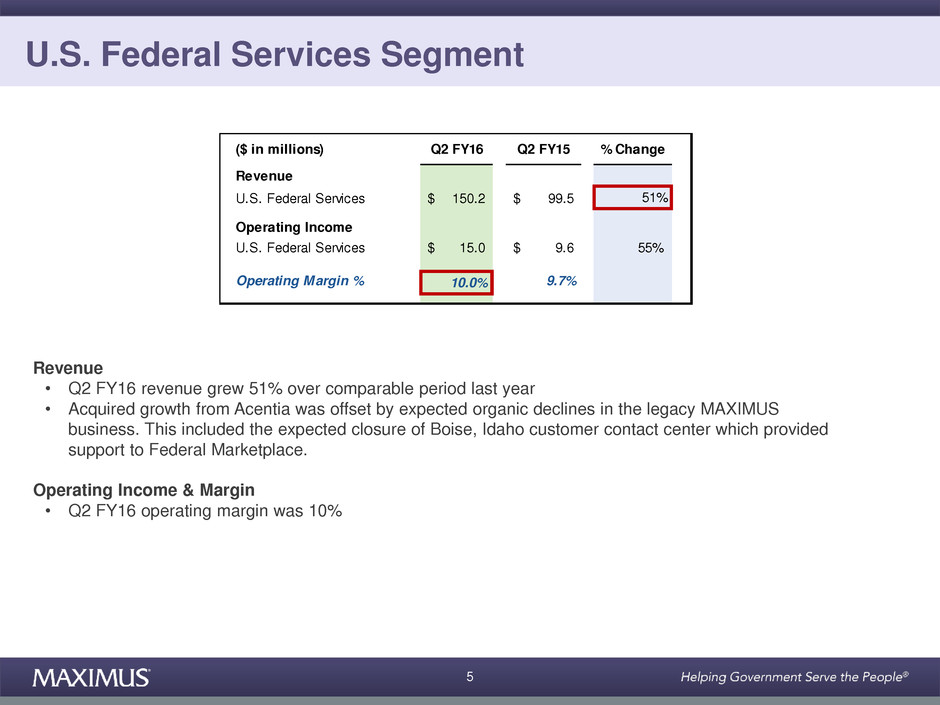

U.S. Federal Services Segment revenue for the second quarter of fiscal 2016 increased 51% to $150.2 million compared to $99.5 million reported for the same period last year. All growth in the quarter was acquired and partially offset by expected reductions from the closure of one of the Company’s customer contact centers tied to the Federal Marketplace.

Operating margin for the second quarter was 10.0% compared to 9.7% reported for the prior-year period.

Human Services Segment

Human Services Segment revenue for the second quarter of fiscal 2016 increased 13% to $125.7 million compared to $111.4 million for the same period last year. Year-over-year revenue growth was principally driven by acquisitions. The Segment was unfavorably impacted by a 5% decline in foreign currency translation.

Operating margin for the second quarter was 7.8% compared to 12.5% for the same period last year. The anticipated reduction in margin was principally due to the ongoing ramp up of the new jobactive contract in Australia. The Company now expects that the jobactive contract will operate at the lower end of its target operating margin range of 10-15% in the second half of fiscal 2016 as a result of lower-than-expected volumes in the near term.

Sales and Pipeline

Year-to-date signed contract awards at March 31, 2016 totaled $1.1 billion. New contracts pending (awarded but unsigned) totaled $143.2 million.

The sales pipeline at March 31, 2016 increased to $3.2 billion (comprised of approximately $543 million in proposals pending, $261 million in proposals in preparation, and $2.4 billion in opportunities tracking). The pipeline includes opportunities across all Segments and geographies. This compares to a pipeline of $2.6 billion for the same period last year. Of the $3.2 billion in pipeline at March 31, 2016, more than half is associated with new work.

The Company’s reported pipeline only reflects those opportunities where MAXIMUS expects that the request for proposal will be released within the next six months.

Balance Sheet and Cash Flows

Cash and cash equivalents at March 31, 2016 totaled $60.8 million. For the three-months ended March 31, 2016, cash provided by operating activities totaled $20.5 million, with free cash flow of $11.3 million.

1891 METRO CENTER DRIVE | RESTON, VIRGINIA 20190 | 703.251.8500 | 703.251.8240 FAX | MAXIMUS.COM

Page 2

At March 31, 2016, Days Sales Outstanding (DSOs) were within the Company’s expected range at 70 days, and lower sequentially by five days compared to DSOs of 75 days in the first quarter.

On February 29, 2016, MAXIMUS paid a quarterly cash dividend of $0.045 per share. On April 19, 2016, the Company announced a $0.045 per share cash dividend, payable on May 31, 2016 to shareholders of record on May 13, 2016.

During the second quarter of fiscal 2016, MAXIMUS did not repurchase any common stock. At March 31, 2016, MAXIMUS had $139.4 million available for repurchases under its Board-authorized share repurchase program.

Outlook

The Company still expects revenue to range between $2.4 billion and $2.5 billion for fiscal 2016. MAXIMUS is narrowing its earnings guidance and now expects GAAP diluted earnings per share to range between $2.50 and $2.70 for fiscal 2016. This compares to the Company’s prior range of $2.40 to $2.70 of GAAP diluted earnings per share. Fiscal year 2016 earnings guidance assumes that certain contracts in start-up will continue to mature and provide increasing contributions in the second half of the year, coupled with the addition of new work. The Company’s guidance does not include any future acquisitions or significant legal expenses or recoveries.

Website Presentation, Conference Call and Webcast Information

MAXIMUS will host a conference call this morning, May 5, 2016, at 9:00 a.m. (ET). The call is open to the public and can be accessed under the Investor Relations page of the Company’s website at http://investor.maximus.com or by calling:

877.407.8289 (Domestic)/+1.201.689.8341 (International)

For those unable to listen to the live call, a replay will be available through May 19, 2016. Callers can access the replay by calling:

877.660.6853 (Domestic)/+1.201.612.7415 (International)

Replay conference ID number: 13636167

About MAXIMUS

Since 1975, MAXIMUS has operated under its founding mission of Helping Government Serve the People®, enabling citizens around the globe to successfully engage with their governments at all levels and across a variety of health and human services programs. MAXIMUS delivers innovative business process management and technology solutions that contribute to improved outcomes for citizens and higher levels of productivity, accuracy, accountability and efficiency of government-sponsored programs. With more than 16,000 employees worldwide, MAXIMUS is a proud partner to government agencies in the United States, Australia, Canada, New Zealand, Saudi Arabia and the United Kingdom. For more information, visit maximus.com.

Non-GAAP Measures

We utilize non-GAAP measures where we believe it will assist the user of our financial statements in understanding our business. The presentation of these measures is meant to complement, and not replace, other financial measures in this document. The presentation of non-GAAP numbers is not meant to be considered in isolation, nor as alternatives to revenue growth, cash flows from operations or net income as measures of performance. These non-GAAP measures, as determined and presented by us, may not be comparable to related or similarly titled measures presented by other companies.

1891 METRO CENTER DRIVE | RESTON, VIRGINIA 20190 | 703.251.8500 | 703.251.8240 FAX | MAXIMUS.COM

Page 3

During the past twelve months, we have acquired Acentia, Ascend, Assessments Australia and Remploy. We believe users of our financial statements wish to evaluate the performance of our underlying business, excluding changes that have arisen due to businesses acquired. We provide organic revenue growth as a useful basis for assessing this. To calculate organic revenue growth, we compare current year revenue less revenue from these acquisitions to our prior year revenue.

In the first six months of fiscal year 2016, 29% of our business has been generated outside the United States. We believe that users of our financial statements wish to understand the performance of our foreign operations using a methodology which excludes the effect of year-over-year exchange rate fluctuations. We provide constant currency revenue movement as a useful basis for assessing this. To calculate constant currency revenue movement, we determine the current year’s revenue for all foreign businesses using the exchange rates in the prior year.

In order to sustain our cash flows from operations, we require regular refreshing of our fixed assets and technology. We believe that users of our financial statements wish to understand the cash flows that directly correspond with our operations and the investments we must make in those operations using a methodology which combines operating cash flows and capital expenditures. We provide free cash flow to complement our statement of cash flows. Free cash flow shows the effects of the Company’s operations and routine capital expenditure and excludes the cash flow effects of acquisitions, share repurchases, dividend payments and other financing transactions. We have provided a reconciliation of free cash flow to cash provided by operating activities.

To sustain our operations, our principal source of financing comes from receiving payments from our customers. We believe that users of our financial statements wish to evaluate our efficiency in converting revenue into cash receipts. Accordingly, we provide days sales outstanding, or DSO. We calculate DSO by dividing billed and unbilled receivable balances at the end of each quarter by revenue per day for the period. Revenue per day for a quarter is determined by dividing total revenue by 91 days.

Statements that are not historical facts, including statements about the Company’s confidence and strategies and the Company’s expectations about revenues, results of operations, profitability, future contracts, market opportunities, market demand or acceptance of the Company’s products are forward-looking statements that involve risks and uncertainties. These uncertainties could cause the Company’s actual results to differ materially from those indicated by such forward-looking statements and include reliance on government clients; risks associated with government contracting; risks involved in managing government projects; legislative changes and political developments; opposition from government unions; challenges resulting from growth; adverse publicity; and legal, economic, and other risks detailed in Exhibit 99.1 to the Company’s most recent Annual Report filed with the Securities and Exchange Commission, found on maximus.com.

1891 METRO CENTER DRIVE | RESTON, VIRGINIA 20190 | 703.251.8500 | 703.251.8240 FAX | MAXIMUS.COM

Page 4

MAXIMUS, Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except per share data)

(Unaudited)

Three Months Ended March 31, | Six Months Ended March 31, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

Revenue | $ | 606,453 | $ | 481,794 | $ | 1,163,175 | $ | 948,837 | |||||||

Cost of revenue | 458,786 | 357,449 | 905,293 | 705,225 | |||||||||||

Gross profit | 147,667 | 124,345 | 257,882 | 243,612 | |||||||||||

Selling, general and administrative expenses | 65,976 | 59,392 | 130,210 | 111,353 | |||||||||||

Amortization of intangible assets | 3,262 | 1,432 | 6,411 | 2,907 | |||||||||||

Acquisition-related expenses | 529 | 1,514 | 575 | 2,114 | |||||||||||

Operating income | 77,900 | 62,007 | 120,686 | 127,238 | |||||||||||

Interest expense | 1,273 | — | 2,262 | — | |||||||||||

Other income, net | 2,209 | 219 | 3,340 | 1,120 | |||||||||||

Income before income taxes | 78,836 | 62,226 | 121,764 | 128,358 | |||||||||||

Provision for income taxes | 29,495 | 23,198 | 45,541 | 46,980 | |||||||||||

Net income | 49,341 | 39,028 | 76,223 | 81,378 | |||||||||||

Income attributable to noncontrolling interests | 556 | 220 | 829 | 709 | |||||||||||

Net income attributable to MAXIMUS | $ | 48,785 | $ | 38,808 | $ | 75,394 | $ | 80,669 | |||||||

Basic earnings per share attributable to MAXIMUS | $ | 0.74 | $ | 0.59 | $ | 1.14 | $ | 1.22 | |||||||

Diluted earnings per share attributable to MAXIMUS | $ | 0.74 | $ | 0.58 | $ | 1.14 | $ | 1.20 | |||||||

Dividends paid per share | $ | 0.045 | $ | 0.045 | $ | 0.09 | $ | 0.09 | |||||||

Weighted average shares outstanding: | |||||||||||||||

Basic | 65,760 | 65,862 | 65,872 | 65,899 | |||||||||||

Diluted | 66,079 | 66,987 | 66,196 | 66,947 | |||||||||||

1891 METRO CENTER DRIVE | RESTON, VIRGINIA 20190 | 703.251.8500 | 703.251.8240 FAX | MAXIMUS.COM

Page 5

MAXIMUS, Inc.

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

March 31, 2016 | September 30, 2015 | ||||||

(unaudited) | |||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 60,783 | $ | 74,672 | |||

Accounts receivable - billed and billable, net of reserves of $5,080 and $3,385 | 433,228 | 396,177 | |||||

Accounts receivable - unbilled | 35,777 | 30,929 | |||||

Income taxes receivable | 21,124 | 7,310 | |||||

Prepaid expenses and other current assets | 49,351 | 52,819 | |||||

Total current assets | 600,263 | 561,907 | |||||

Property and equipment, net | 137,493 | 137,830 | |||||

Capitalized software, net | 31,033 | 32,483 | |||||

Goodwill | 401,152 | 376,302 | |||||

Intangible assets, net | 117,732 | 102,358 | |||||

Deferred contract costs, net | 17,782 | 19,126 | |||||

Deferred compensation plan assets | 21,519 | 19,310 | |||||

Deferred income taxes | 5,204 | 11,058 | |||||

Other assets | 10,635 | 11,184 | |||||

Total assets | $ | 1,342,813 | $ | 1,271,558 | |||

LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable and accrued liabilities | $ | 135,704 | $ | 155,411 | |||

Accrued compensation and benefits | 74,975 | 99,700 | |||||

Deferred revenue | 80,429 | 77,642 | |||||

Income taxes payable | 2,577 | 11,709 | |||||

Long-term debt, current portion | 329 | 356 | |||||

Other liabilities | 13,343 | 11,562 | |||||

Total current liabilities | 307,357 | 356,380 | |||||

Deferred revenue, less current portion | 47,873 | 52,954 | |||||

Deferred income taxes | 7,347 | 6,546 | |||||

Long-term debt | 286,017 | 210,618 | |||||

Deferred compensation plan liabilities, less current portion | 21,575 | 20,635 | |||||

Other liabilities | 9,203 | 8,726 | |||||

Total liabilities | 679,372 | 655,859 | |||||

Shareholders’ equity: | |||||||

Common stock, no par value; 100,000 shares authorized; 64,906 and 65,437 shares issued and outstanding at March 31, 2016 and September 30, 2015, at stated amount, respectively | 455,441 | 446,132 | |||||

Accumulated other comprehensive income/(loss) | (24,984 | ) | (22,365 | ) | |||

Retained earnings | 228,834 | 188,611 | |||||

Total MAXIMUS shareholders’ equity | 659,291 | 612,378 | |||||

Noncontrolling interests | 4,150 | 3,321 | |||||

Total equity | 663,441 | 615,699 | |||||

Total liabilities and equity | $ | 1,342,813 | $ | 1,271,558 | |||

1891 METRO CENTER DRIVE | RESTON, VIRGINIA 20190 | 703.251.8500 | 703.251.8240 FAX | MAXIMUS.COM

Page 6

MAXIMUS, Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited)

Three Months Ended March 31, | Six Months Ended March 31, | |||||||||||||||

2016 | 2015 | 2016 | 2015 | |||||||||||||

Cash flows from operating activities: | ||||||||||||||||

Net income | $ | 49,341 | $ | 39,028 | $ | 76,223 | $ | 81,378 | ||||||||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||||||||||

Depreciation and amortization of property, equipment and capitalized software | 12,912 | 12,739 | 25,859 | 23,706 | ||||||||||||

Amortization of intangible assets | 3,262 | 1,432 | 6,411 | 2,907 | ||||||||||||

Deferred income taxes | 172 | (9,209 | ) | (327 | ) | (10,134 | ) | |||||||||

Non-cash equity based compensation | 4,819 | 4,470 | 9,151 | 8,436 | ||||||||||||

Change in assets and liabilities: | ||||||||||||||||

Accounts receivable - billed | (5,304 | ) | (76,641 | ) | (35,051 | ) | (80,883 | ) | ||||||||

Accounts receivable - unbilled | (2,998 | ) | 2,003 | (4,851 | ) | (2,311 | ) | |||||||||

Prepaid expenses and other current assets | 127 | (5,822 | ) | 5,443 | (6,043 | ) | ||||||||||

Deferred contract costs | 46 | (3,651 | ) | 810 | (7,105 | ) | ||||||||||

Accounts payable and accrued liabilities | (28,137 | ) | 13,833 | (19,949 | ) | 27,274 | ||||||||||

Accrued compensation and benefits | 7,172 | 11,638 | (14,211 | ) | (12,263 | ) | ||||||||||

Deferred revenue | 877 | 18,248 | (2,009 | ) | 21,858 | |||||||||||

Income taxes | (19,554 | ) | 747 | (22,597 | ) | 19,583 | ||||||||||

Other assets and liabilities | (2,237 | ) | (3,343 | ) | (3,038 | ) | (4,337 | ) | ||||||||

Cash provided by operating activities | 20,498 | 5,472 | 21,864 | 62,066 | ||||||||||||

Cash flows from investing activities: | ||||||||||||||||

Purchases of property and equipment and capitalized software costs | (9,151 | ) | (33,363 | ) | (19,836 | ) | (47,473 | ) | ||||||||

Acquisition of business | (39,206 | ) | — | (41,812 | ) | — | ||||||||||

Other | 126 | 122 | 210 | 282 | ||||||||||||

Cash used in investing activities | (48,231 | ) | (33,241 | ) | (61,438 | ) | (47,191 | ) | ||||||||

Cash flows from financing activities: | ||||||||||||||||

Cash dividends paid | (2,919 | ) | (2,966 | ) | (5,860 | ) | (5,928 | ) | ||||||||

Repurchases of common stock | — | — | (31,138 | ) | (32,616 | ) | ||||||||||

Tax withholding related to RSU vesting and option exercises | (44 | ) | (116 | ) | (11,597 | ) | (12,453 | ) | ||||||||

Expansion of credit facility | — | (1,444 | ) | — | (1,444 | ) | ||||||||||

Borrowings under credit facility | 83,493 | — | 130,563 | — | ||||||||||||

Repayment of credit facility and other long-term debt | (42,498 | ) | (35 | ) | (55,219 | ) | (74 | ) | ||||||||

Cash provided by/(used in) financing activities | 38,032 | (4,561 | ) | 26,749 | (52,515 | ) | ||||||||||

Effect of exchange rate changes on cash and cash equivalents | (474 | ) | (2,331 | ) | (1,064 | ) | (5,937 | ) | ||||||||

Net increase/(decrease) in cash and cash equivalents | 9,825 | (34,661 | ) | (13,889 | ) | (43,577 | ) | |||||||||

Cash and cash equivalents, beginning of period | 50,958 | 149,196 | 74,672 | 158,112 | ||||||||||||

Cash and cash equivalents, end of period | $ | 60,783 | $ | 114,535 | $ | 60,783 | $ | 114,535 | ||||||||

1891 METRO CENTER DRIVE | RESTON, VIRGINIA 20190 | 703.251.8500 | 703.251.8240 FAX | MAXIMUS.COM

Page 7

MAXIMUS, Inc.

SEGMENT INFORMATION

(Amounts in thousands)

(Unaudited)

Three Months Ended March 31, | Six Months Ended March 31, | |||||||||||||||||||||||||||

2016 | % (1) | 2015 | % (1) | 2016 | % (1) | 2015 | % (1) | |||||||||||||||||||||

Revenue: | ||||||||||||||||||||||||||||

Health Services | $ | 330,567 | 100 | % | $ | 270,918 | 100 | % | $ | 622,470 | 100 | % | $ | 514,488 | 100 | % | ||||||||||||

U.S. Federal Services | 150,191 | 100 | % | 99,465 | 100 | % | 295,476 | 100 | % | 207,194 | 100 | % | ||||||||||||||||

Human Services | 125,695 | 100 | % | 111,411 | 100 | % | 245,229 | 100 | % | 227,155 | 100 | % | ||||||||||||||||

Total | $ | 606,453 | 100 | % | $ | 481,794 | 100 | % | $ | 1,163,175 | 100 | % | $ | 948,837 | 100 | % | ||||||||||||

Gross profit: | ||||||||||||||||||||||||||||

Health Services | $ | 82,717 | 25.0 | % | $ | 69,873 | 25.8 | % | $ | 134,689 | 21.6 | % | $ | 129,720 | 25.2 | % | ||||||||||||

U.S. Federal Services | 33,421 | 22.3 | % | 22,014 | 22.1 | % | 61,659 | 20.9 | % | 47,582 | 23.0 | % | ||||||||||||||||

Human Services | 31,529 | 25.1 | % | 32,458 | 29.1 | % | 61,534 | 25.1 | % | 66,310 | 29.2 | % | ||||||||||||||||

Total | $ | 147,667 | 24.3 | % | $ | 124,345 | 25.8 | % | $ | 257,882 | 22.2 | % | $ | 243,612 | 25.7 | % | ||||||||||||

Selling, general and administrative expense: | ||||||||||||||||||||||||||||

Health Services | $ | 25,803 | 7.8 | % | $ | 28,397 | 10.5 | % | $ | 50,967 | 8.2 | % | $ | 50,404 | 9.8 | % | ||||||||||||

U.S. Federal Services | 18,438 | 12.3 | % | 12,377 | 12.4 | % | 35,960 | 12.2 | % | 24,627 | 11.9 | % | ||||||||||||||||

Human Services | 21,735 | 17.3 | % | 18,523 | 16.6 | % | 42,633 | 17.4 | % | 36,222 | 15.9 | % | ||||||||||||||||

Other | — | NM | 95 | NM | 650 | NM | 100 | NM | ||||||||||||||||||||

Total | $ | 65,976 | 10.9 | % | $ | 59,392 | 12.3 | % | $ | 130,210 | 11.2 | % | $ | 111,353 | 11.7 | % | ||||||||||||

Operating income: | ||||||||||||||||||||||||||||

Health Services | $ | 56,914 | 17.2 | % | $ | 41,476 | 15.3 | % | $ | 83,722 | 13.4 | % | $ | 79,316 | 15.4 | % | ||||||||||||

U.S. Federal Services | 14,983 | 10.0 | % | 9,637 | 9.7 | % | 25,699 | 8.7 | % | 22,955 | 11.1 | % | ||||||||||||||||

Human Services | 9,794 | 7.8 | % | 13,935 | 12.5 | % | 18,901 | 7.7 | % | 30,088 | 13.2 | % | ||||||||||||||||

Amortization of intangible assets | (3,262 | ) | NM | (1,432 | ) | NM | (6,411 | ) | NM | (2,907 | ) | NM | ||||||||||||||||

Acquisition-related expenses (2) | (529 | ) | NM | (1,514 | ) | NM | (575 | ) | NM | (2,114 | ) | NM | ||||||||||||||||

Other | — | NM | (95 | ) | NM | (650 | ) | NM | (100 | ) | NM | |||||||||||||||||

Total | $ | 77,900 | 12.8 | % | $ | 62,007 | 12.9 | % | $ | 120,686 | 10.4 | % | $ | 127,238 | 13.4 | % | ||||||||||||

(1) Percentage of respective segment revenue. Percentages not considered meaningful are marked “NM.”

(2) | Acquisition-related expenses are costs directly incurred from the purchase of Assessments Australia in the first quarter of fiscal year 2016 and the purchase of Acentia in fiscal year 2015, as well as other transaction-related activity. |

1891 METRO CENTER DRIVE | RESTON, VIRGINIA 20190 | 703.251.8500 | 703.251.8240 FAX | MAXIMUS.COM

Page 8

MAXIMUS, Inc.

FREE CASH FLOW

(Non-GAAP measure)

(Amounts in thousands)

(Unaudited)

Three Months Ended March 31, | Six Months Ended March 31, | |||||||||||||||

2016 | 2015 | 2016 | 2015 | |||||||||||||

Cash provided by operating activities | $ | 20,498 | $ | 5,472 | $ | 21,864 | $ | 62,066 | ||||||||

Purchases of property and equipment and capitalized software costs | (9,151 | ) | (33,363 | ) | (19,836 | ) | (47,473 | ) | ||||||||

Free cash flow | $ | 11,347 | $ | (27,891 | ) | $ | 2,028 | $ | 14,593 | |||||||

-XXX-

1891 METRO CENTER DRIVE | RESTON, VIRGINIA 20190 | 703.251.8500 | 703.251.8240 FAX | MAXIMUS.COM

Page 9

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 1 Operator: Greeting, and welcome to the MAXIMUS Fiscal 2016 Second Quarter Conference Call. At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. If anyone should require operator assistance during the conference, please press star, zero on your telephone keypad. As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Lisa Miles, Senior Vice President of Investor Relations for MAXIMUS. Thank you, Ms. Miles. You may begin. Ms. Lisa Miles: Good Morning, and thank you for joining us. With me today is Rich Montoni, CEO, Bruce Caswell, President, and Rick Nadeau, CFO. I'd like to remind everyone that a number of statements being made today will be forward- looking in nature. Please remember that such statements are only predictions and actual events and results may differ from materially as the result of risks we face including those discussed in exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC. The company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. Today’s presentation may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful periods to period comparisons. For reconciliation of the non-GAAP measures presented in this document, please see the company’s most recent quarterly earnings press release. And with that I’ll hand the call over to Rick. Mr. Rick Nadeau: Thanks, Lisa.

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 2 This morning MAXIMUS reported financial results for the second quarter of fiscal year 2016. Results in the quarter reflected steady progress on our programs in start-up as well as solid organic growth. For the second quarter of fiscal year 2016, total company revenue grew 26% to $606.5 million compared to the same period last year. This was comprised of organic revenue growth of 13% which was driven by the Health Services Segment, acquired revenue growth of 15%, and total company revenue was unfavorably impacted by approximately $10.6 million (or 2 percent) from the effects of foreign currency translation as compared to the second quarter of fiscal year 2015. Operating margin for the second quarter was 12.8 percent compared to 12.9 percent in the prior year. Operating margin in the second quarter of fiscal year 2016 benefitted from out-of-period revenue and pre-tax income of approximately $6.6 million from modifications to the U.K. Health Assessment Advisory Service contract – or HAAS. For the second quarter of fiscal year 2016, net income attributable to MAXIMUS was $48.8 million and diluted earnings per share totaled $0.74. This includes approximately $0.08 of diluted earnings per share from the aforementioned modifications on the HAAS contract. Now I will speak to segment results, starting with Health Services. Health Services Segment revenue increased 22 percent. Nearly all growth in the Segment was organic. Revenue growth was driven principally by the U.K. HAAS contract and, to a lesser extent, new work and expansion on existing contracts in the U.S. This was offset by unfavorable foreign currency translation of 2 percent so that on a constant currency basis, revenue growth would have been 24 percent. We completed the Ascend acquisition in the second quarter which accounts for less than 1% of revenue growth. Let me focus my Health Segment commentary today on our HAAS contract where we have completed several contract modifications. Some of the HAAS modifications were normal-course clean up items that can be required at the end of a contract year, and in this case contract year one, which ended on February 29th. These modifications included changes to certain performance benchmarks specified in the contract. The contract was modified to put a greater

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 3 emphasis on carrying out face-to-face assessments at a reduced level. This will achieve DWP’s services goals while at the same time achieving greater value for money overall. The financial impact from the HAAS contract modifications had an immediate pick-up of $6.6 million of out-of-period revenue and income that was recognized in the second quarter of fiscal year 2016. These modifications are expected to lower our future revenue run rates in contract years two and three. As you may recall, the contract years straddle our fiscal year, and as a result, we now expect revenue from the HAAS contract to contribute approximately $225 million in fiscal 2016. This compares to our original November guidance of revenue from the HAAS contract in the range of $230 to $280 million for fiscal year 2016. While our revenue expectations are lower, we have made tremendous operational progress and we believe that we have achieved a stabilized level of operations. We are confident that this program will be profitable for fiscal year 2016, with an estimated margin in the mid-single digits for the full fiscal year. We believe that this contract will yield operating income margins in our typical range of 10 to 15 percent in future years. Rich will provide a brief update on the ongoing operations of this contract. Let me speak now to the U.S. Federal Services Segment. Second quarter revenue for the Federal Segment increased 51% compared to the prior year. Acquired revenue growth from Acentia was offset by expected organic declines in the legacy MAXIMUS business. As we mentioned last quarter, this included the expected closure of a customer contact center in Boise, Idaho where we provided support for the Federal Marketplace. Second quarter operating margin for the Federal Segment was 10 percent. Let me finish the operations discussions with the financial results for the Human Services Segment. For the second quarter, revenue increased 13 percent compared to last year, driven principally by the Remploy acquisition. The Segment was unfavorably impacted by a 5 decline from foreign currency translation.

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 4 As expected, operating margin in the second quarter was lower compared to the prior year and was 7.8 percent. The expected reduction in margin was a result of the ongoing start-up of the new jobactive contract in Australia. We still expect that the new contract will achieve an operating margin in our target range of 10 to 15 percent sometime in the second half of fiscal year 2016. However, overall volumes in the new contract have been lower than both the client and vendors anticipated. This means that while our start-up is progressing well and this is a desirable, contributing contract, the revenue and operating income will not be at the level initially anticipated. Let me move on to discuss cash flow and balance sheet items. Days Sales Outstanding were lower on a sequential basis and were 70 days at March 31st. This is in line with our targeted range of 65 to 80 days. Subsequent to quarter close, we collected some significant past due receivables from one state which was responsible for DSOs of three days at March 31st. During the quarter, we completed the acquisition of Ascend using cash of approximately $39 million. For the second quarter, cash provided by operating activities totaled $20.5 million, with free cash flow of $11.3 million. For the remainder of the year, we would expect solid net income, improved cash collections, and benefits from the timing of tax and other disbursements to drive an increase in cash from operating activities. At March 31st, we had cash and cash equivalents totaling $60.8 million with most of our cash held outside of the United States. We did not repurchase any shares during the second quarter. At March 31st, we had an estimated $139.4 million remaining under our Board-authorized program. We maintain adequate liquidity with our available line of credit and we continue to have a range of flexibility in our capital deployment plans. The management team remains focused on the most prudent and sensible uses of cash in support of our longer-term strategic growth plans. And lastly, guidance. MAXIMUS operates a portfolio of contracts which includes a number of programs in start-up. Coming into this fiscal year, we had four sizeable programs in the start-up

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 5 phase. This includes the Department of Education contract, the jobactive contract in Australia as well as the HAAS and Fit for Work contracts in the U.K. Today, three of the four start-ups are making steady forward progress. Fit for Work is the single contract that is under-performing. The nature of the business is that we will always have puts and takes in the overall model and some programs will over deliver compared to initial plan and others may under deliver. Each quarter, we complete a bottoms-up review. We consider the effects of currency, start-ups, rebids and contract mix, risks and opportunities. This analysis is the basis for our forecasting model and guidance each quarter. As a result of the overall solid progress on our programs in start-up, most notably HAAS, we have modified our fiscal year 2016 guidance. We are maintaining our revenue guidance and still expect to be in the range of $2.4 to $2.5 billion. On the bottom-line, we are tightening the range for fiscal year 2016. We are bringing up the lower end from $2.40 to $2.50, so that, we now expecting diluted earnings per share to range between $2.50 and $2.70 for fiscal year 2016. As a reminder, income and earnings in the second half of fiscal year 2016 are expected to be driven by the steady operational and financial progress of certain programs in start-up as they move towards maturity as well as the contributions from new work. We still expect that total Company operating margins for fiscal year 2016 will be in the lower- end of the 10 to 15 percent range. We still expect our tax rate to run between 37 and 39 percent but more towards the lower end of that range. Our cash flow guidance remains unchanged. We expect strong cash flow generation in the back half of fiscal year 2016 and stable CAPEX spending. We still expect cash provided by operating activities to be in the range of $200 to $230 million for fiscal year 2016. We expect free cash flow to range between $130 and $160 million. Thanks for your continued interest, and now I will turn the call over to Rich.

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 6 Mr. Richard Montoni: Thank you Rick, and good morning all. I’m pleased with our quarterly results and our ability to narrow our earnings guidance range for fiscal 2016. We’ve made meaningful advancements in the first half of fiscal 2016 to shore-up and mitigate the risks of certain projects in start-up mode. As always, we remain focused on delivering on our promises and contractual obligations to our government clients. Our number one goal is solid service delivery in the programs we operate to ensure that citizens are able to seamlessly access critical government programs and services. Let’s start off with an update on our U.K. Health Assessment Advisory Service contract, also known as HAAS. As Rick mentioned, certain features of the HAAS contract have been modified to better align with the client’s programmatic objectives. At the same time, our current trends confirm that we are on track to hit full productivity by the end of the summer. This positive contractual change, coupled with the progress we have made in the past several months, provides us with an increased level of confidence that we are on a path to achieve our long-term operational and financial goals. We have also continued to receive many questions related to specific performance indicators under the HAAS contract. Unlike last quarter, when we were able to provide a full update due to the timing of the Public Accounts Committee hearing the day prior, we are unable to provide specific statistical updates on a regular basis. The release of this information is managed through a very formal process by our client, the Department for Work and Pensions. Qualitatively, what I can say is that we are making meaningful progress on the contract on all key factors. Our productivity continues to improve as more of our health care professionals mature in their roles and others continue to receive accreditation. This means that we can complete an increasing number of assessments. Equally as important, we are continuing to see steady improvements in the quality of our assessment reports. There has also been speculation within the investment community that the HAAS contract was under review for cancellation or significant changes. I want to dispel that myth today. We maintain a collaborative working relationship with our client. To this end, we have had personal

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 7 reassurances from DWP that the Secretary of State has not expressed concern over the continuity of the HAAS contract. Further, there is no current plan on making substantial changes or terminating the HAAS contract. Some of the modifications that were made to our contract were done in parallel with the government’s spending review. These changes were done to better align contract year two and three volumes to the client’s needs and circumstances. This is commonplace. As a result, we’ve lowered our revenue expectations on the contract and at the same time reduced costs for the client. Above all, we remain fully committed to the contract and our focus continues to be delivery of high-quality assessment services. Even with these changes, this contract is a positive contributor today and when fully mature will fall within our targeted portfolio range. Separately, DWP has confirmed with us that the Secretary of State is focused on potential changes to the Fit for Work contract. This is consistent with information provided in our 8K filing on April 7th. It’s important to put this in context. The Fit for Work program is not achieving its intended goals as the volumes simply have not materialized. As a reminder, this is a voluntary program that’s free to businesses and their employees. The program provides access to occupational health services for those employees who are out sick for more than four weeks so that a return-to-work plan can be developed. The program is not mandated by law and also requires a referral from a general practitioner. As we disclosed in our last quarterly filing in February, the Fit for Work project is losing money and we are moving forward with changes. We have been actively working with DWP on a number of fronts as it relates to the Fit for Work project. At this point in time, it’s fair to say that all options are on the table. Our discussions with the client are ongoing and we are optimistic that we will achieve a solution that is beneficial to both parties. Moving on to the U.S. health business, just last week the Centers for Medicare & Medicaid Services finalized managed care regulations and federal standards for the Medicaid and Children’s Health Insurance programs. This is the first update since 2002 and much has

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 8 changed. Not only has the Medicaid program grown substantially, but now more than 80 percent of enrollees are in managed care plans. While our teams are still dissecting the fourteen-hundred-page release, CMS has clearly outlined its long-term goals. Our read of the rules is that there will be a continued effort on enhancing support for consumers, including improving health care delivery and quality of care, providing greater access to health care and ensuring a modern set of rules that better align with the Marketplace and Medicare Advantage plans. The new rules reinforce the ongoing efforts to modernize and streamline the enrollment process and the continued value of independent choice counseling both of which are core competencies of MAXIMUS. Other services that MAXIMUS currently deploys to our customers, such as document processing, data collection and analysis, and customer support centers, can help States meet the administrative and Managed Care oversight responsibilities which are also included in the new rules. As Medicaid programs continue to modernize, states are taking greater leadership in managing provider networks, including quality and access to providers. They are also evaluating new approaches to delivering long-term care services to the most vulnerable of Medicaid populations. We have had good success in creating an expanding list of qualifications in both of these growing areas. Let me start with provider services. Here in the U.S., Medicaid providers must undergo a rigorous credentialing on a state-by-state basis. Many states are choosing to manage this important process and MAXIMUS has played an integral role for supporting these efforts. Our work in provider credentialing started more than a decade ago. Our portfolio has since grown to include six contracts along with a healthy pipeline of additional opportunities. While each of these individual contracts is small, together they comprise a nice portfolio of strategic contracts built of our core business demonstrating our land and expand strategy.

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 9 The same can be said for our entrance into the long-term services and supports market – also known as LTSS. Many governments are looking for innovative solutions to best deliver public benefits and services to diverse populations and address demographic challenges. One of these challenges is supporting the increasingly complex disabled and elderly populations, which includes a rise in the number of elderly people who face functional and cognitive limitations. A general trend in LTSS has been to ensure that individuals are in the right setting and receiving the right level of support and care. Most individuals would rather receive care at home or in a community-based settings, rather than institutional facilities. Therefore, providing LTSS has been increasingly directed to community-based settings. In response, MAXIMUS provides governments with solutions for their LTSS programs that combine technology, enhanced customer service and workforce strategies. We offer states conflict-free, independent assessment and review services to help states connect the right set of services to the right beneficiaries. The new Medicaid regulations further strengthen the importance of independence in these programs. We recently broadened our LTSS capabilities through the acquisition of Ascend. Based in Tennessee, Ascend is one of the largest health assessment providers on behalf of U.S. government agencies and offers conflict-free assessment services to assist them in determining the most appropriate placement and health care services for program beneficiaries. Ascend provides a broad array of services including Preadmission Screening and Resident Review, Supports Intensity Scale, Inventory for Client and Agency planning, Utilization Reviews, and other specialty and standardized assessments. While the U.S. LTSS market is largely still in its infancy, we continue to see a growing interest around the world for independent assessments and appeals. In December 2015, MAXIMUS established another foothold in this emerging market with the acquisition of Assessments Australia. Assessments Australia delivers assessments as a means to identify what support services may be required in order to make individuals successful in a community environment. Their client base includes government, non-government and private organizations who are

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 10 trying to make informed decisions about patients’ needs. This acquisition has been integrated into our Human Services Segment. I am pleased to share that the acquisition of Assessments Australia has already generated a small, but strategic win in the disability services market. MAXIMUS will be providing information gathering services for the majority of the trial regions across Australia through phone and face- to-face interviews of individuals with disabilities. By taking a core capability and applying it to different government programs and new populations, MAXIMUS continues to build a strong portfolio and expand the business. Moving on to our new awards and the pipeline. We had solid awards in the second quarter, with year-to-date signed contracts at March 31st of $1.1 billion. We also had an additional $143 million in new awarded, unsigned contracts. Our sales pipeline at March 31st was $3.2 billion compared to a pipeline of $2.6 billion for the same period last year. On a sequential basis, the pipeline is up from $2.8 billion reported in the first quarter of fiscal 2016. As part of our long-term growth strategy, we monitor a much broader pipeline that lays out our opportunities over the next three to five years and that will drive fiscal 2018 and beyond. In closing, our longer-term outlook remains very positive. We continue to see favorable trends as demonstrated by the strength of our pipeline, which contains new opportunities across the segments and in all of our existing geographies. We will continue to deploy capital in a prudent fashion and look for strategic acquisitions, like Ascend, which further strengthen our foothold in the emerging global assessments and appeals markets. Above all, the management team is working hard every day to deliver long-term shareholder value. So, while it’s too soon to speak specifically to fiscal 2017, we remain confident of our continued growth prospects given the favorable macro and demand trends that we see in the market. And with that, let’s open it up for questions. Operator?

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 11 Operator: Thank you. We will now be conducting a question and answer session. Please limit to one question and one follow up question. If you wish to ask additional questions, you may reenter the queue. If you would like to ask a question, please press star, one on your telephone keypad. A confirmation tone will indicate your line is in the question queue. You may press star, two if you would like to remove your question from the queue. For participants using speaker equipment, it may be necessary to pick up your handset before pressing the star key. One moment, please while we poll for questions. Our first question is from Dave Styblo from Jefferies; please proceed with your question. Mr. Dave Styblo: I good morning, and thanks for the questions. Wanted to start out on HAAS and just a get a little bit more insight about, about first of all, the eight sense. Was any of that assumed in guidance? In other words, was that pulled forward from quarters that were, that you were expecting that to benefit, or was that just something catch up from year one, and then as we think about years two and three and I know you talked about a lower revenue trajectory. Can you be a little bit more specific, perhaps, about what you were thinking? I guess the revenue came down 10 percent versus your expectations, but what sort of, what was sort of the expected ramp of revenue for next year, or is there not really going to be a ramp and revenue now that there’s new modifications on the contract? Mr. Richard Montoni: Okay. Good morning, Dave, and I think you’ve put forth two questions. One is to give you a little bit of insight in terms of the eight cents in the quarter relative to HAAS and with the reduced anticipated revenue, what’s it means to fiscal ’17? I'm going to ask Rick Nadeau, our CFO to field both those questions. Mr. Rick Nadeau: Yes. Thank you. Our revenue projection is approximately $225 million, and our operating income is expected to be in the mid-single digits for fiscal year 2016. As I mentioned in the prepared comments, we expect this contract to perform in our normal targeted operating range of 10 to 15 percent in future years, and the revenue for, for fiscal year ’17 we would expect it to be similar to what FY16 is, around $225 million.

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 12 I think, as Rich said, that, that new target for contract year two creates a straightforward path for us to achieving, you know, the targeted volumes and the targeting operating margins. So, you know, in other words, the new targets reduce the risks that we have and increase the likelihood of us achieving the contract volume targets. And as I, we mentioned in the prepared remarks, this provides us with an increased level of confidence that we are on target to make our financial goals on this program. Ms. Lisa Miles: Thanks, Dave. Next question, please. Operator: Our next question is from Richard Close from Canaccord Genuity. Mr. Richard Close: Great. Thank you. Congratulations on a good second quarter here. My question surrounds Fit for Work and I have two or three combined into one here. Can you just give us what the original revenue guidance was for fiscal ’16 on Fit for Work, and now what are you expecting Fit for Work in your updated guidance. And then you say all options are on the table. You know, what do you really mean by that? Could you agree to terminate this contract? Just more clarification there. And then, finally, on Fit for Work, what is the profit drag so far through the first half of the year? Mr. Richard Montoni: Okay. Well, let me take the all options on the table piece first, and then, Rick Nadeau can pick up in terms of revenue expectations for fiscal ’16 versus or current versus original and then the profit drag. On the all options on the table, I think that the appropriate backdrop is to appreciate that when we work with our clients, we really strive to develop a partnership. So, we are very sensitive to their needs, their desired outcomes, social outcomes, and the real drivers behind even the creation of the program, and oftentimes, that’ll flow down in terms of the number of expected cases, the volumes, etc., and it’s not uncommon to, as these programs, especially those that are more novel in nature as Fit for Work is, to get the point where they require some sort of adjustment.

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 13 And I will say that, by the way, we do this very, very often with our clients and have adjustments. Usually, it’s to the upside, but in this particular case, given the novel nature of this program, these volumes just have not materialized. And, accordingly, it’s appropriate to adjust the program in consultation, in partnership with our client to the right level, and we’re having active discussions. From my perspective, I say all options are on the table. It could be right sizing. So we take down the variable cost to the appropriate level to serve the current level, and it could be a wind down of the program, and it could be a termination of the program. Rick, on the financial aspects. Mr. Rick Nadeau: Sure. As a result of all of that, we are only forecasting around $5 million of revenue from this contract for fiscal year 2016 which is well below our initial expectations, and at this point, built into our full guidance for fiscal year ’16, we are presently forecasting that we will lose approximately $3 million more than what we had projected when we did our original guidance. Mr. Richard Montoni: Next question, please. Operator: Our next question is from Charlie Strauzer from CJS Securities. Mr. Charlie Strauzer: Hi. Good morning. Just to expand a little bit more on the HAAS contract. I know you talked a little bit more about the profitability, but, you know, maybe Rich, you know. Talk a little bit more about, some more color there, on what exactly, kind of, changed there if you can expand on that. And then, my second question as a follow up would be that the Medicaid opportunities that could be emerging from, you know, the--in your prepared remarks talking about the changes in Medicaid. You know, what potential positive opportunities could there be down the road? Thank you. Mr. Richard Montoni: All right, Charlie. I’ll field the first question, and Bruce Caswell, our President is here with us today, and Bruce, as you would imagine, has been immersed in these

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 14 new Medicaid rules and Bruce is going to give us a highlight in terms of what it means, what they are and what it means to MAXIMUS more specifically. On the HAAS contract, I think I just mentioned the driver behind it that we work with our client to adjust these programs accordingly. In the HAAS situation, this really emanated from a client’s routine annual evaluation of programs and their budget and their programmatic needs. I do think there has been, behind the situation, a need for UK to do a spending review on all of its budget, and they came back and simply said given--and I think part of it is the reduction in backlog, but we think the volumes won’t be quite as high in demand for the programming years two and three. So, in partnership and negotiation with our client, the volumes were adjusted. At the end of the day, again, as we work with our clients, I think we ended up with a better risk profile. I mean, the other--the prior volumes were very, very were very challenging in some regards, so with the reduced volumes, I view it as a better risk profile. We really do have a more stable footing for both the client and MAXIMUS with these revisions. Bruce? Mr. Bruce Caswell: Great. Thanks. And I might just add one other comment to the HAAS answer, and that is that we, as part of those discussions and negotiations with the client, if I might, we’re able to adjust some of the performance benchmarks. And you think about that program. You ask, kind of, Charlie, what are the things that are different now? What are the things that have been improving, and we've made some adjustments to things like customer call waiting times that are required and call center waiting times, and those are, those are metrics that, you know, while there’s still challenging, we feel they’re very much achievable. So, we’re pleased with the improvements that we’ve seen in productivity as more of our employees have graduated and become accredited. We talked, probably, in prior discussions with you about how even when you're training employees, you're pulling other employees off the line to help train and mentor them. So, consequently, you get the benefit of those folks returning to the line. So across the board, productivity capability improves, quality improves, as Rich mentioned.

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 15 So, you know, to summarize, as Rich said, we feel quite good about the footing that we’re on. Turning now to your question about the Medicaid rules. Rich is right. We've--many of us have been immersed, I think is the right word, in the 1425 pages that dropped from CMS. It’s still early days, and a lot of folks are still really trying to dissect them and understand what that potential impacts are going to be, and, quite honestly, it could be some time before the states, you know, themselves digest them and figure out how they’re going to operationalize the rules. We did hold a webinar two days ago, and I was really proud that we’re, kind of, first to market in that regard with a very comprehensive webinar held in conjunction with some consultants that we worked with from Health Management Associates, and you're welcome to go to our website and review the transcript from that and the materials from that webinar. Our early read is that there are many things in the new rules where MAXIMUS can provide additional support to our state clients, and Rich mentioned several in his prepared remarks. I would lump them largely into four categories. One is the area of beneficiary support services and the fact that the rule really does emphasize the importance of choice counseling for beneficiaries, assistance for enrollees in understanding managed care. And that, all that be done in a conflict free and independent fashion. The second category would be really new standards and requirements for Medicaid long-term services and supports, and Rich spoke to a number of those. We’re encouraged that the concept of beneficiary support services really extends now to the Medicaid long-term services and supports community. So, there’s much more of a requirement to ensure that there’s a single point of entry, for example, for choice counseling. That there’s independence and freedom, or freedom from conflict in that choice counseling process. Similarly, you know, the very, the process that we've discussed in terms of getting beneficiaries into the appropriate level of care and the work that we now do with our new colleagues from Ascend will become more important in that domain. The third area is provider credentialing and enrollment. A greater burden has really fallen on the states to address that and MAXIMUS is well positioned to continue to grow on the six states that where we do that presently.

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 16 And the fourth area probably worth considering is quality measures. As you're well familiar, quality measures are now going to be important aspect of plan selection and enrollment through that rule. I'd also, maybe, make one final comment on the rule, and that is that it creates a new requirement for the medical loss ratio to be at 85 percent for Medicaid plans across the states, and from our point of view, the states are already overburdened with a lot of administrative task, and they’re going to look at ways that they can continue to off load some of the, that work so that their staff can focus on higher level work. There is an opportunity, as plans look a their MLRs to say, hey look it. There may be some administrative tasks that are quite common across all plans, like the creation of member handbooks and notices and so forth that could be shifted back on the state side, centralized, and provided as a shared service. So, I hope that gives you a little bit of color. We think, overall, the rule creates a lot of good opportunity for MAXIMUS well into the future. Ms. Lisa Miles: Thanks, Charlie. Next question, please. Operator: Our next question is from Stephen Lynch from Wells Fargo. Mr. Stephen Lynch: Hey, guys. Thanks for taking the questions. Maybe for Rick. I was wondering if you could walk us through some of the assumptions underpinning the new EPS guidance range. Maybe, you know, the volumes and margins for different contracts whether it’s HAAS and jobactive that would support the low and the high end of the range. Mr. Rick Nadeau: Well, you know, we don’t really call out specific contracts. We did that one time with respect to HAAS because of the size of that contract, but let me, let me try as follows. You know, I think it’s really important that we focus on the fact that we do have a portfolio of contracts and that these contracts are really in different stages of maturity and different types of cost structures and contract structures that you have. There really are many things that drive our guidance and that we put into there when we consider that. We’re making good strides on a

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 17 lot of the key elements of the portfolio, particularly the startups. But they’re all kinds of different headwinds and tailwinds inside that. The startups are an important component of our organic growth this year. I think that as you go forward and you look into future years, I think you would see a better operating income margin than you see this year because of those, those start-ups. And so, you know, I think when people think about start-ups, they’re really an important component of our organic growth. They’re really advantageous to us, and they’re critical in our development of long-term shareholder value. That’s really what allows us to drive in some years’ double digit organic growth. It’s those start-ups. But then what you have in that circumstance is you have revenue that lags the earnings which is really a normal course kind of event. So, you would tend to see this year being the year that you have revenue--. Mr. Richard Montoni: --Earnings lag revenue. Mr. Rick Nadeau: Earnings--I'm sorry. Earnings lag revenue. I say that backwards? Sorry. Earnings lag revenue, and I think you will see that normalize itself on the back half of the year and as you go into FY17. But, obviously, the big storyline this year, I mean this quarter, is, is HAAS, and, and that does create a situation where, where we feel like we’ve stabilized that contract and we have a better feeling of confidence with respect to FY16 guidance, and that’s why we were able to really manage it, manage the bottom end of our guidance up and effectively raise the midpoint. Mr. Richard Montoni: Did that answer your question? Mr. Stephen Lynch: I think. Ms. Lisa Miles: Stephen, do you have another follow up? Mr. Stephen Lynch: No. I’ll hop back in the queue for now.

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 18 Mr. Richard Montoni: Okay. Good. Ms. Lisa Miles: Okay. Great. Next question, please. Operator: Our next question is from Frank Sparacino from First Analysis. Mr. Frank Sparacino: Hi. I was just hoping to get a little bit more color on the issues in Australia in terms of the volumes. Mr. Bruce Caswell: This is Bruce Caswell. Let me give you a little bit more color on that. You know, one of the things you, we always look at in situations like this is what the employment rate looks like in Australia, and I want to begin by saying that our understanding is that most, if not all vendors that are involved in this contract are experiencing similar volume related challenges. It’s not unusual in a contract like this to see fluctuations from the estimates that were first provided at the, as part of the tender process. It’s worth noting that the Australian unemployment rate is fairly low. It’s at 5.7 percent reported this past March. It hasn’t been that low since 2013. So, you know, while there are many factors that can ultimately factor into or play into the number of referrals that you get and the volumes that you're seeing. Some can be related to public policy. Other to, obviously, broader market trends. Could quite be here that it’s simply tied to the rates that were previously assumed at a tender time versus what we’re seeing today in terms of the employment environment. But I do want to note that, as we said, this program is profitable. It’s going to continue to improve in the back half of fiscal ’16 as this contract continues to mature, and we’re really focused now on really managing the margins of the contract because they, obviously, didn’t turn out to be as robust as we might have initially expected, but we've got a great team working on it. We expect it to continue to improve this year. Ms. Lisa Miles: Frank, do you have a follow up?

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 19 Mr. Frank Sparacino: I do not, Lisa. Thanks. Ms. Lisa Miles: Okay. Thank you, then. Next question, please. Operator: Our next question is from Brian Kinstlinger from Maxim Group. Mr. Brian Kinstlinger: Great. I missed the prepared remarks, but I just want to be clear that the HAAS contract was profitable before the unexpected $6.6 million in true ups, and based on the questions I heard from some of the analysts and I just want to be clear. The $6.6 million of benefits is completely separate from the $.08 change request that we all, that we all expected, right? Mr. Richard Montoni: Yes. With respect to the second question first. That $.08 that we had talked about in quarter one related to a domestic program that we had, and it was a change order that had, that we had in our hands, but it was not signed yet. So it was one that had been negotiated but had not been fully executed with the customer. The accounting rules not allowing us to record that revenue until we actually have the signed agreement. With respect to HAAS, yes. Without that $6.6, we still had a profit this quarter two in fiscal year ’16. Did that answer your question? Mr. Brian Kinstlinger: Thank you. And question I've got is, if I understand it correctly, the new change order which places some focus on face to face meetings is going to make it easier for MAXIMUS to achieve their productivity goals and, essentially your target profitability for that contract. Is that right? Mr. Rich Montoni: Yeah. And I don’t think it’s the fact that it’s a shift to face--more emphasis on face to face, Brian, but really the reduced volumes. Ms. Lisa Miles: Thanks, Brian. Next question, please. Operator: Our next question is from Allen Klee from Sidoti and Company.

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 20 Mr. Allen Klee: Yeah. Good morning. Question one is what was your previous revenue expectation for the HAAS contract for fiscal 2017, and then secondly, a bigger picture question. Since you mentioned that one of the factors for why the contract is reduced on volumes is the budget, just in general, thinking about operating in the UK, do you think that, given their, some of their budget issues there that that’s, how that could impact you in some other programs? Mr. Richard Montoni: Rick, why don’t you take the first one. I think the question was what’s our previous expectation for revenue on the HAAS contract. Was it, Allen, was that ’17 or ’16? Mr. Rick Nadeau: You said ’17, Allen. I’ll answer ’16. It was $230 million to $280 million was what our expectation was for revenue for HAAS for fiscal year 2016. Mr. Richard Montoni: So, hand sight, the revised expectation is really at the lower end being at $225 Ms. Lisa Miles: And we have not provided specific guidance relative to the HAAS contract in fiscal ’17. Mr. Rick Nadeau: Correct. Mr. Richard Montoni: The second part of Allen’s question, I think, was, given the decreased volume, really the amendments on this contract and UK situations in general, what is our expectation? My view is I don’t differentiate between the UK and other governments that we serve. They are, and we’ve said this to folks. It’s really intersection of these two drivers that sparks our growth, our long-term growth, and governments are dealing with the fact that they have to serve more people and more people are looking to their governments for some form of welfare. And, at the same time, they have budgetary pressures that they need to deal with. And the UK, and I think it’s a responsible thing, does go through and analyze each program and toggles or adjusts each program accordingly. So in some cases, we see downward adjustments. In other situations, we see upward adjustments.

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 21 I will say from a macro market perspective, we are seeing, in general, and this is in general, but a better employment rate, lower employment rates in many of the markets where we serve which, as you can appreciate, that means there’s fewer people looking for jobs, and that has an impact on our programs. On the other hand, what we are seeing is governments shift their emphasis from the classic just long term unemployed to those with disabilities and other challenging situations. So we’re seeing the market shift in terms of what they’re looking for in aggregate, I think it’s still a gross situation. I don’t think it’s a net reduction and a demand for what we do in that area. Ms. Lisa Miles: Thanks, Allen. Next question, please. Operator: Once again, as a reminder. If you’d like to ask a question please press star, one on your telephone keypad. Our next question is from Shane Svenpladsen from Avondale Partners. Mr. Shane Svenpladsen: Morning. With the new federal regulations mandating competitive bidding for one stop operators of workforce development centers in the U.S., are you seeing more RFP activity as a result of that, and has there been any changes to the competitive landscape? Mr. Richard Montoni: Bruce, why don’t you field that? Mr. Bruce Caswell: You know, I would say we’re beginning to see some changes in the competitive field there and some additional RFPs coming to market that we haven’t historically seen from clients that maybe haven’t even historically outsourced this function. And you’d expect the competitive landscape to include a, you know, kind of a broad composition of not just for profit vendors, but historically you’ve seen a lot of the smaller non-profits and community based type organizations locally providing services to workforce investment boards or [inaudible] that have been active in those types of programs.

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 22 So, yeah, it’s, I’d say it is a bit of a shift in the market. I wouldn’t call it a seismic shift at this point. Mr. Shane Svenpladsen: Okay. That’s helpful. Then--. Ms. Lisa Miles: Go ahead, Shane. Mr. Shane Svenpladsen: And then related to the new Work and Health Programme RFP that’s out, you know, other than a change in funding, are there any, you know, contract specific changes that are worth calling out? Mr. Bruce Caswell: Well, I might just provide a context, if that’s okay, Shane, on work and health. First of all, you know, as we’ve been talking about here, the UK’s experiencing really historically low unemployment. So as a result, as Rich mentioned, governments are shifting their focus to reducing the employment gap for people with disabilities and also focusing also on improving productivity and in work salary progression. So the work program historically was focused on long-term unemployed individuals, but that group interestingly has decreased by almost 75 percent since 2011. So while there was significantly more money allocated to the work program, none of the participants or vendors in the work program really ever achieved the funding levels that had been previously envisioned due to those decreased caseloads. So the government’s now shifted, and they’ve created a new, smaller program called Work and Health that’s expected to absorb both the work program and Work Choice, and that new program’s going to be focused on people with health conditions and disabilities and, as you probably well know and others, serving individuals with disabilities a core competency of Remploy, the organization with whom we combined last year. And so we feel like we’re very well positioned for that change. To give you just a sense of the economics because I know that would be top of mind for you. Combined the work performed by MAXIMUS and Remploy presently for both programs, Work

MAXIMUS Fiscal 2016 Second Quarter Conference Call May-05-2016 Confirmation #13636167 Page 23 Program and Work Choice Program, runs at about $80 to $85 million a year. But our profitability expectations for both of those programs are pretty low. In fact, comprising less than five cents per share in fiscal ’16. So any proposed reduction under this new Work and Health contract that we might see in overall funding would likely be a bigger hit to the top line and relatively immaterial to the bottom line. Ms. Lisa Miles: Thanks, Shane. Next question, please. Operator: Our next question comes from Richard Close from Canaccord Genuity. Mr. Richard Close: Yes. Just wanted to follow up on my Fit for Work questions. Rick, you didn’t give the original revenue guidance and the original operating loss. You gave us an update, but what is that compared to? Mr. Rick Nadeau: Richard, we don’t--go ahead. Mr. Richard Montoni: Go ahead. Mr. Rick Nadeau: Yeah. Richard, we don’t generally give that. We don’t call out specific programs. I will tell you that $5 million is substantially less than what we had projected for this coming year and that a $3 million loss is reasonably worse than what we had expected. Mr. Richard Close: And then my, I guess my final follow up is, you know, there’s some pretty strong positive commentary throughout your slide deck. Specifically, you talk about the long- term outlook being very positive and favorable trends. Seems like, you know, just reading your body language or your text here that you guys are pretty optimistic on your business. It sounds, you know, over the next couple year, and was wondering if you could just provide any additional commentary on, on that level of confidence. Mr. Richard Montoni: Richard, glad to do that. I think this, again, this is the nature of our business is multi-year. We’re dealing with governments and programs that take several years to