Form 8-K Lumos Networks Corp. For: Nov 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 12, 2015

Lumos Networks Corp.

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-35180 | 80-0697274 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

One Lumos Plaza, P.O. Box 1068, Waynesboro, Virginia 22980

(Address of Principal Executive Offices) (Zip Code)

(540) 946-2000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure. |

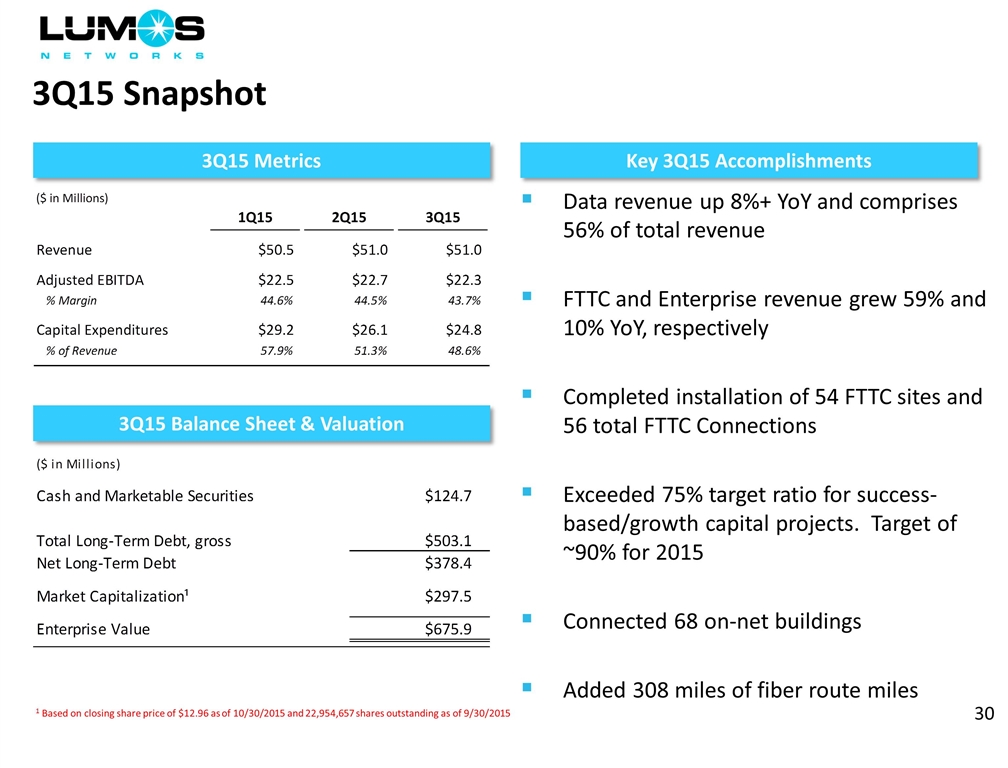

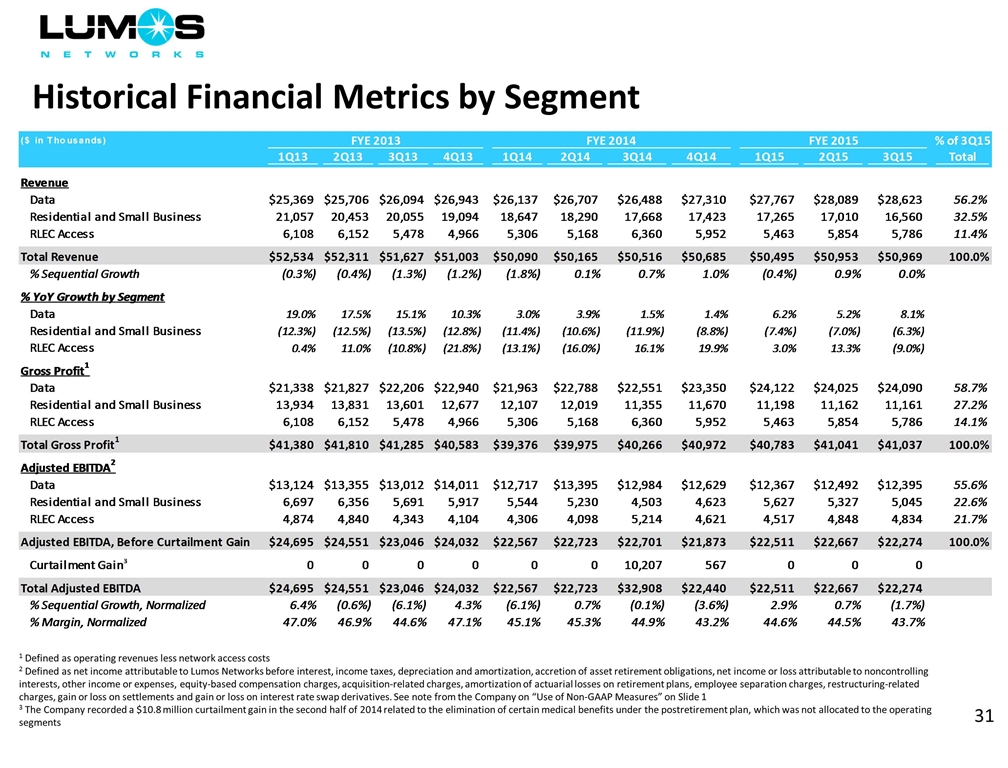

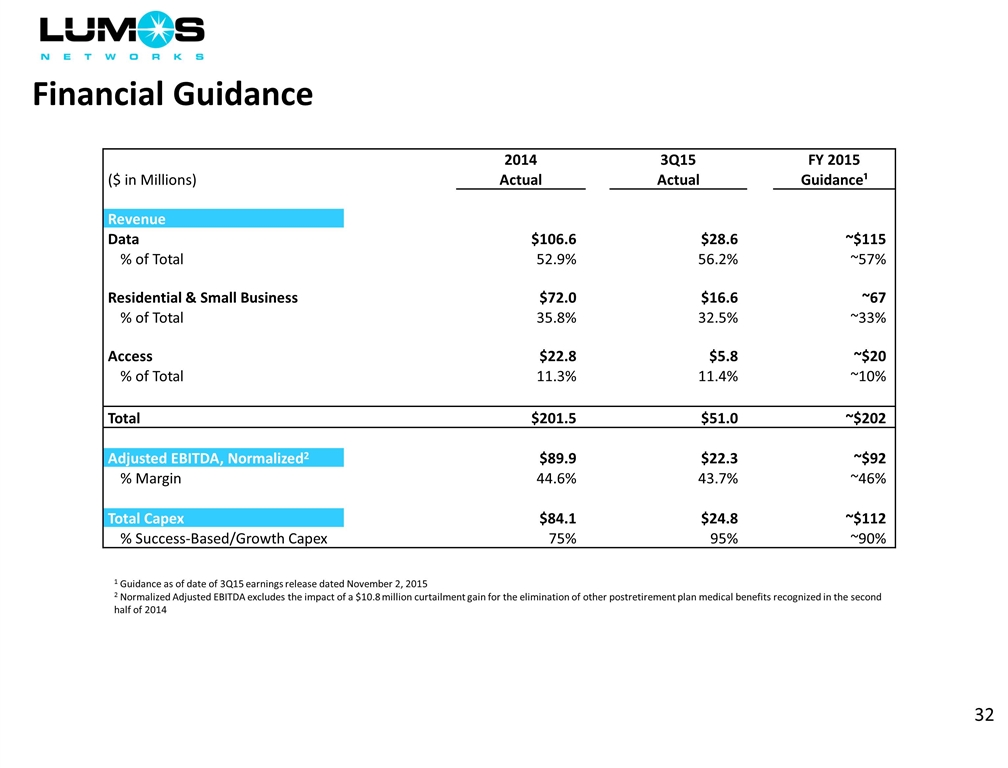

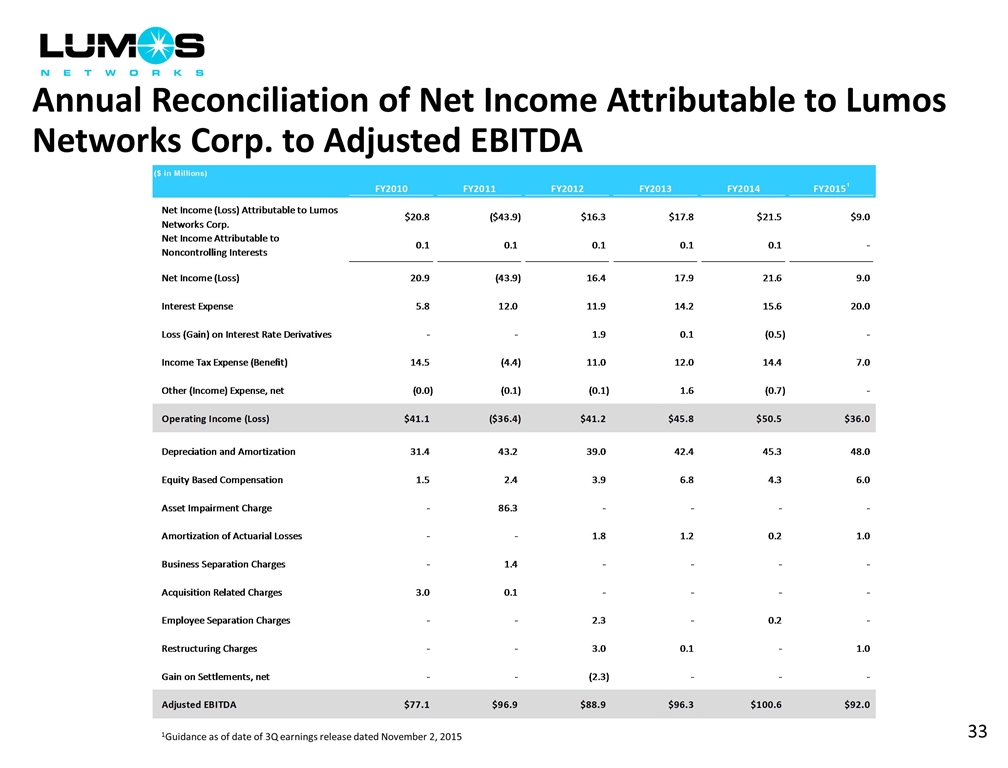

A revised copy of the Company Presentation that Lumos Networks Corp. will present in connection with upcoming presentations to investors is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The only changes to the Company Presentation filed with the Current Report on Form 8-K dated November 2, 2015 are to revise certain 2015 estimated amounts on slide 33 in the annual reconciliation of net income attributable to Lumos Networks Corp. to Adjusted EBITDA guidance. No change is made to Adjusted EBITDA guidance itself.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. The information in this Report will not be deemed as an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits |

| Exhibit |

Description | |

| 99.1 | Company Presentation – Third Quarter 2015 Update (Revised November 11, 2015) | |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 12, 2015

| LUMOS NETWORKS CORP. | ||

| By: | /s/ Johan G. Broekhuysen | |

| Johan G. Broekhuysen Executive Vice President, Chief Financial Officer and Chief Accounting Officer | ||

3

EXHIBIT INDEX

| Exhibit No. |

Description | |

| 99.1 | Company Presentation – Third Quarter 2015 Update (Revised November 11, 2015) | |

4

Company Presentation November 2015 Exhibit 99.1

Use of Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures that are not determined in accordance with US generally accepted accounting principles. These financial performance measures are not indicative of cash provided or used by operating activities and exclude the effects of certain operating, capital and financing costs and may differ from comparable information provided by other companies, and they should not be considered in isolation, as an alternative to, or more meaningful than measures of financial performance determined in accordance with US generally accepted accounting principles. These financial performance measures are commonly used in the industry and are presented because Lumos Networks Corp. believes they provide relevant and useful information to investors. The Company utilizes these financial performance measures to assess its ability to meet future capital expenditure and working capital requirements, to incur indebtedness if necessary, and to fund continued growth. Lumos Networks Corp. also uses these financial performance measures to evaluate the performance of its business, for budget planning purposes and as factors in its employee compensation programs. Special Note Regarding Forward-Looking Statements Any statements contained in this presentation that are not statements of historical fact, including statements about our beliefs and expectations, are forward-looking statements and should be evaluated as such. The words “anticipates,” “believes,” “expects,” “intends,” “plans,” “estimates,” “targets,” “projects,” “should,” “may,” “will” and similar words and expressions are intended to identify forward-looking statements. Such forward-looking statements reflect, among other things, our current expectations, plans and strategies, and anticipated financial results, all of which are subject to known and unknown risks, uncertainties and factors that may cause our actual results to differ materially from those expressed or implied by these forward-looking statements. Many of these risks are beyond our ability to control or predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. Furthermore, forward-looking statements speak only as of the date they are made. We do not undertake any obligation to update or review any forward-looking information, whether as a result of new information, future events or otherwise. Important factors with respect to any such forward-looking statements, including certain risks and uncertainties that could cause actual results to differ from those contained in the forward-looking statements, include, but are not limited to: rapid development and intense competition in the telecommunications and high speed data transport industry; our ability to offset expected revenue declines in legacy voice and access products related to the recent regulatory actions, wireless substitution, technology changes and other factors; our ability to effectively allocate capital and implement our network expansion plans in a timely manner; our ability to complete customer installations in a timely manner; adverse economic conditions; operating and financial restrictions imposed by our senior credit facility and our unsecured debt obligations; our cash and capital requirements; declining prices for our services; our ability to maintain and enhance our network; the potential to experience a high rate of customer turnover; federal and state regulatory fees, requirements and developments; our reliance on certain suppliers and vendors; and other unforeseen difficulties that may occur. These risks and uncertainties are not intended to represent a complete list of all risks and uncertainties inherent in our business, and should be read in conjunction with the more detailed cautionary statements and risk factors included in our SEC filings, including our Annual Report filed on Form 10-K.

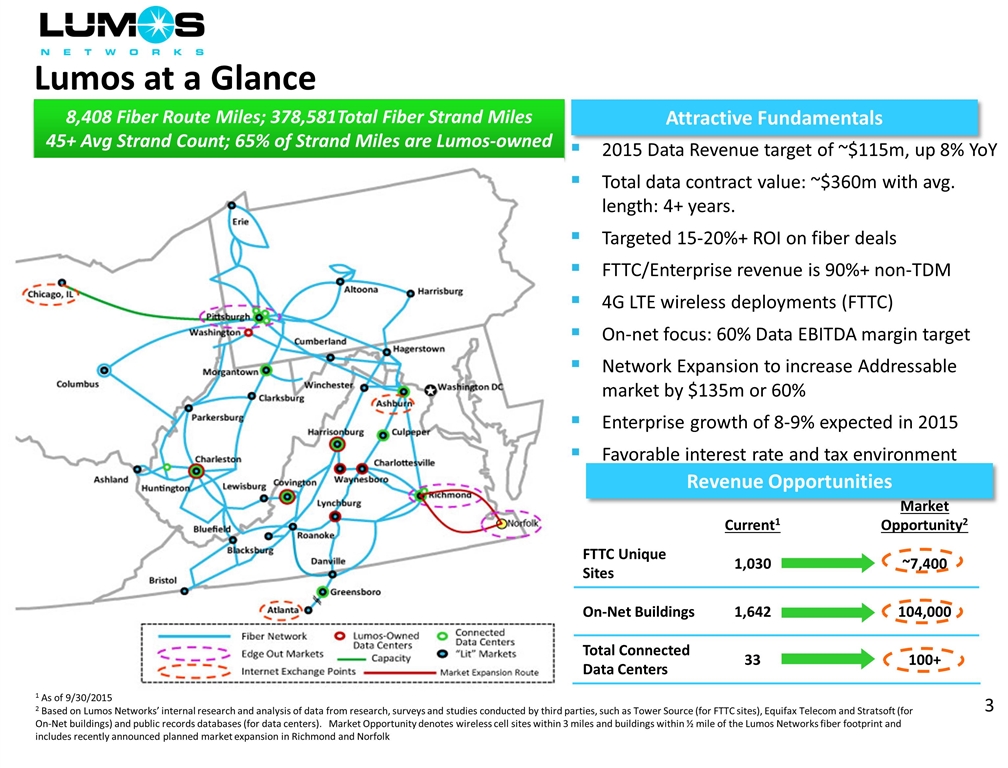

Advanced Fiber Network Driving Value for Our Customers

Lumos at a Glance Attractive Fundamentals 2015 Data Revenue target of ~$115m, up 8% YoY Total data contract value: ~$360m with avg. length: 4+ years. Targeted 15-20%+ ROI on fiber deals FTTC/Enterprise revenue is 90%+ non-TDM 4G LTE wireless deployments (FTTC) On-net focus: 60% Data EBITDA margin target Network Expansion to increase Addressable market by $135m or 60% Enterprise growth of 8-9% expected in 2015 Favorable interest rate and tax environment 1 As of 9/30/2015 2 Based on Lumos Networks’ internal research and analysis of data from research, surveys and studies conducted by third parties, such as Tower Source (for FTTC sites), Equifax Telecom and Stratsoft (for On-Net buildings) and public records databases (for data centers). Market Opportunity denotes wireless cell sites within 3 miles and buildings within ½ mile of the Lumos Networks fiber footprint and includes recently announced planned market expansion in Richmond and Norfolk Current1 Market Opportunity2 FTTC Unique Sites 1,030 ~7,400 On-Net Buildings 1,642 104,000 Total Connected Data Centers 33 100+ 8,408 Fiber Route Miles; 378,581Total Fiber Strand Miles 45+ Avg Strand Count; 65% of Strand Miles are Lumos-owned Revenue Opportunities

Strategic Financial Partnership with Pamplona Capital On August 6, 2015, Lumos closed on a $150 Million cash investment from Pamplona Capital, a Private Equity Fund with over $8 billion in total capital commitments Strategic Partnership to Accelerate the Transformation of Lumos Networks to a Pure-Play Fiber Bandwidth Infrastructure Company Use of Proceeds Approximately $50m used to pay down existing senior bank debt and related deal costs Approximately $100m for general corporate purposes. Provides the company with additional capital to pursue organic and inorganic growth opportunities in the fiber and data center space. Interest payable on the notes issued in connection with Pamplona’s investment accrues at an annual rate of 8%, paid quarterly either in cash or in kind. The warrants issued entitle Pamplona to purchase up to 5.5 million shares of common stock at an exercise price equal to $13.99, the closing price immediately prior to the closing of the transaction. Pamplona holds two seats on the Lumos Board of Directors William Pruellage, Partner at Pamplona Capital (based in New York City) Peter Aquino, former Executive Chairman of Primus Telecommunications Group and former President and CEO of RCN Corporation

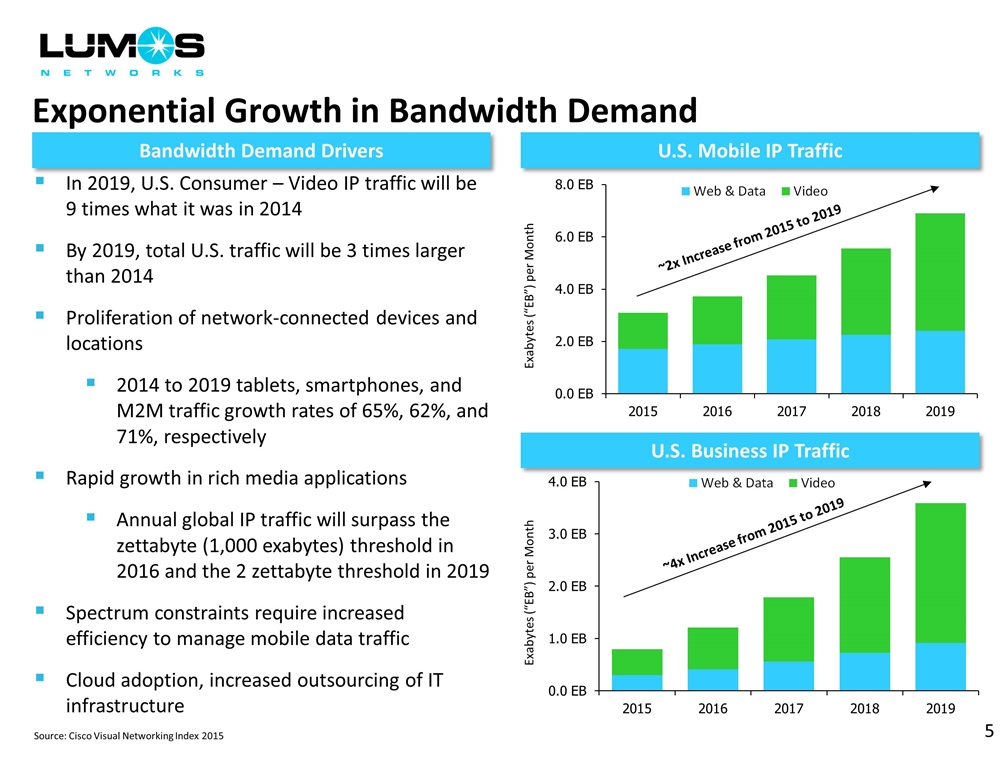

Exponential Growth in Bandwidth Demand Bandwidth Demand Drivers U.S. Mobile IP Traffic Exabytes (“EB”) per Month ~2x Increase from 2015 to 2019 Source: Cisco Visual Networking Index 2015 U.S. Business IP Traffic ~4x Increase from 2015 to 2019 Exabytes (“EB”) per Month In 2019, U.S. Consumer – Video IP traffic will be 9 times what it was in 2014 By 2019, total U.S. traffic will be 3 times larger than 2014 Proliferation of network-connected devices and locations 2014 to 2019 tablets, smartphones, and M2M traffic growth rates of 65%, 62%, and 71%, respectively Rapid growth in rich media applications Annual global IP traffic will surpass the zettabyte (1,000 exabytes) threshold in 2016 and the 2 zettabyte threshold in 2019 Spectrum constraints require increased efficiency to manage mobile data traffic Cloud adoption, increased outsourcing of IT infrastructure

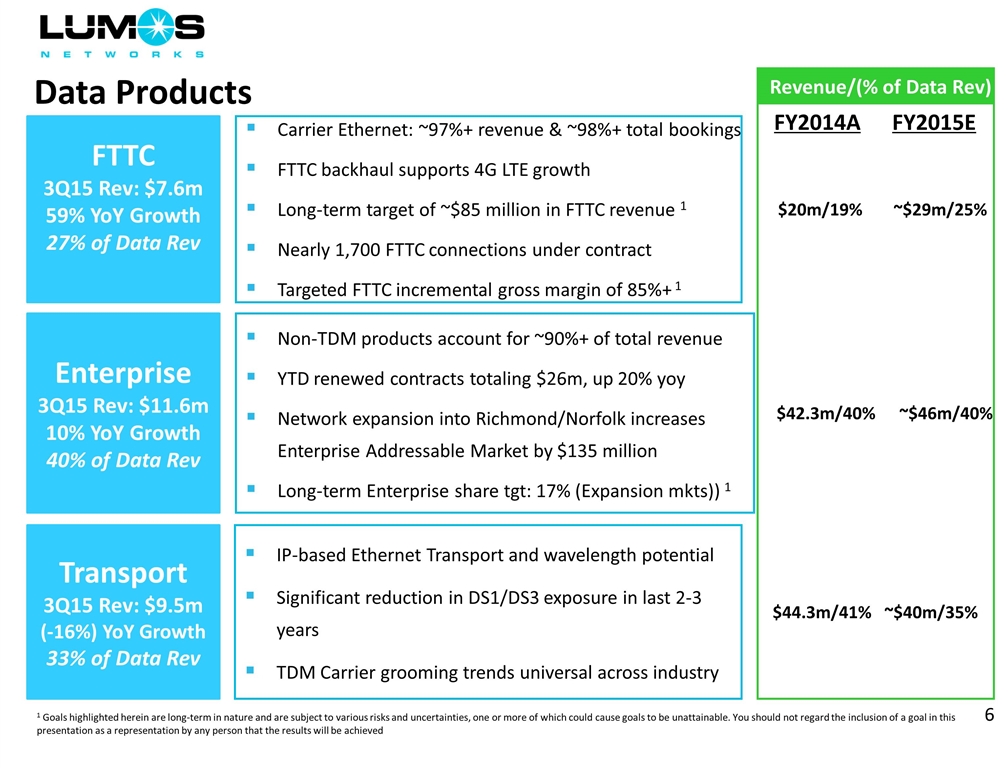

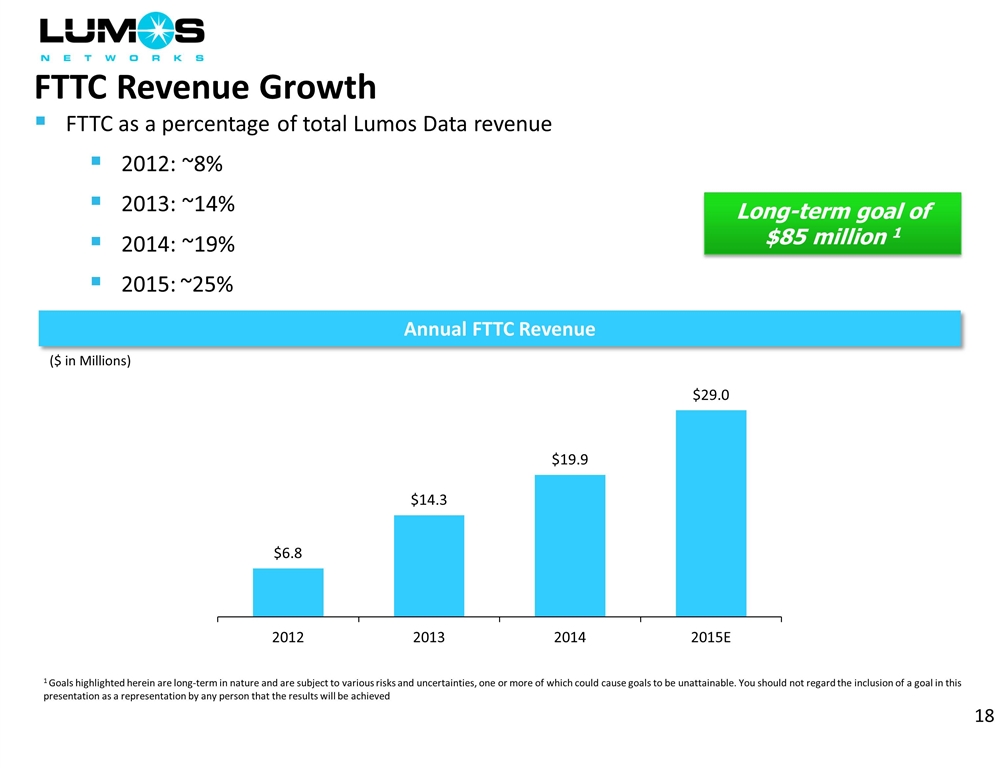

Data Products 1 Goals highlighted herein are long-term in nature and are subject to various risks and uncertainties, one or more of which could cause goals to be unattainable. You should not regard the inclusion of a goal in this presentation as a representation by any person that the results will be achieved Enterprise 3Q15 Rev: $11.6m 10% YoY Growth 40% of Data Rev Non-TDM products account for ~90%+ of total revenue YTD renewed contracts totaling $26m, up 20% yoy Network expansion into Richmond/Norfolk increases Enterprise Addressable Market by $135 million Long-term Enterprise share tgt: 17% (Expansion mkts)) 1 Transport 3Q15 Rev: $9.5m (-16%) YoY Growth 33% of Data Rev IP-based Ethernet Transport and wavelength potential Significant reduction in DS1/DS3 exposure in last 2-3 years TDM Carrier grooming trends universal across industry FTTC 3Q15 Rev: $7.6m 59% YoY Growth 27% of Data Rev Carrier Ethernet: ~97%+ revenue & ~98%+ total bookings FTTC backhaul supports 4G LTE growth Long-term target of ~$85 million in FTTC revenue 1 Nearly 1,700 FTTC connections under contract Targeted FTTC incremental gross margin of 85%+ 1 FY2014A FY2015E $20m/19% ~$29m/25% $42.3m/40% ~$46m/40% $44.3m/41% ~$40m/35% Revenue/(% of Data Rev)

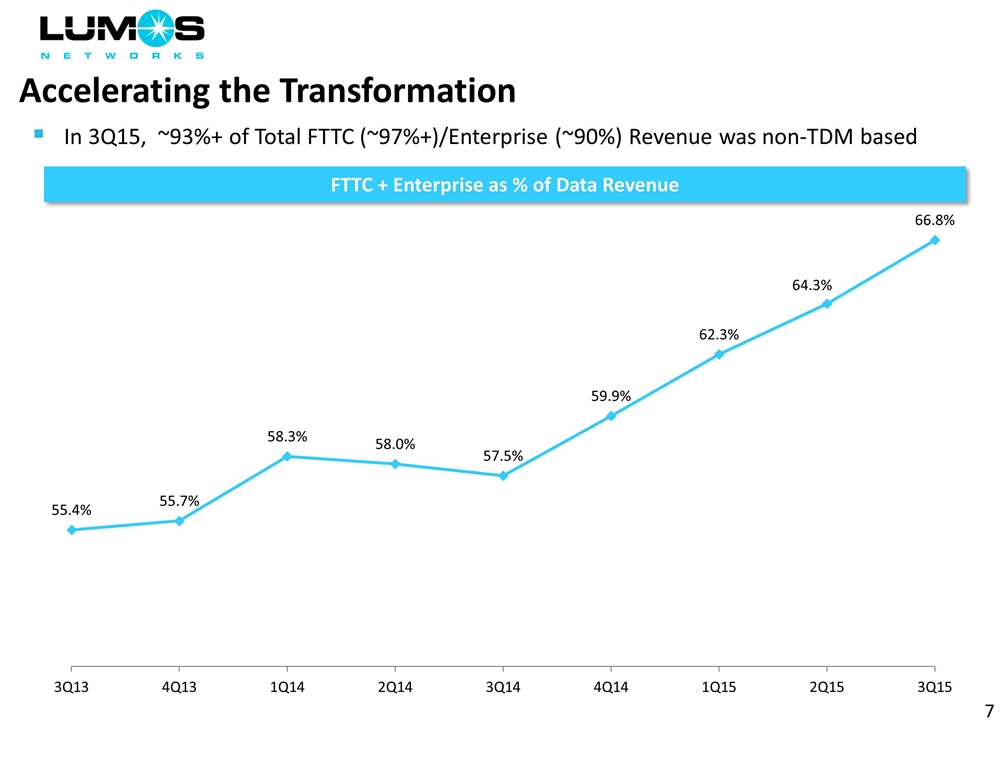

Accelerating the Transformation FTTC + Enterprise as % of Data Revenue In 3Q15, ~93%+ of Total FTTC (~97%+)/Enterprise (~90%) Revenue was non-TDM based

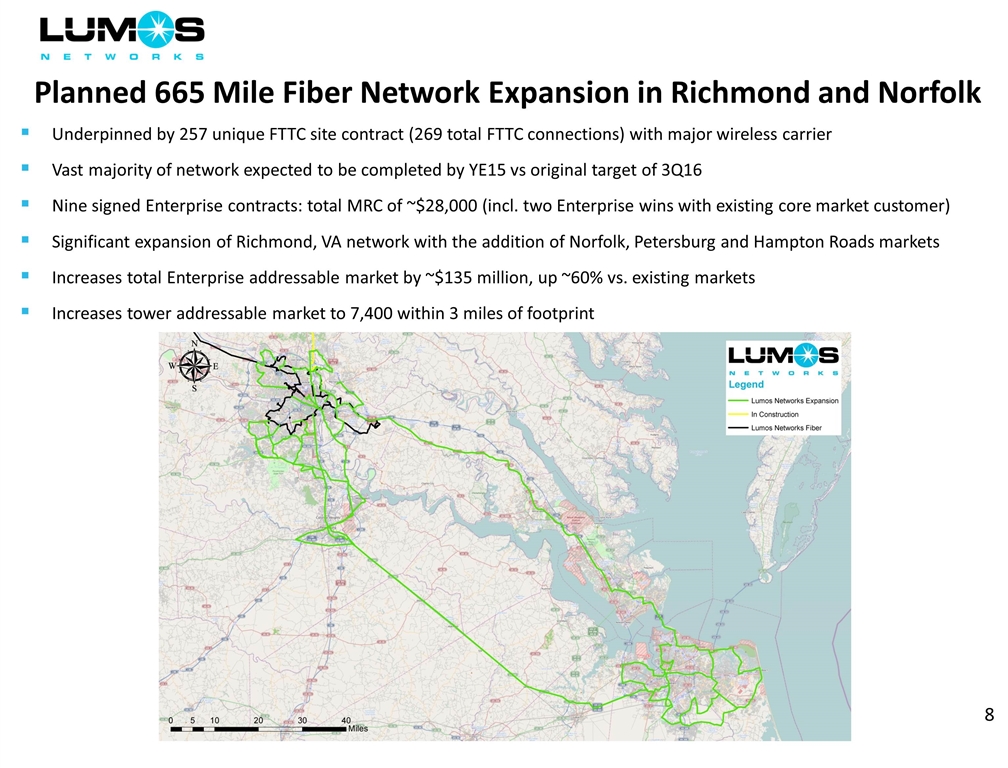

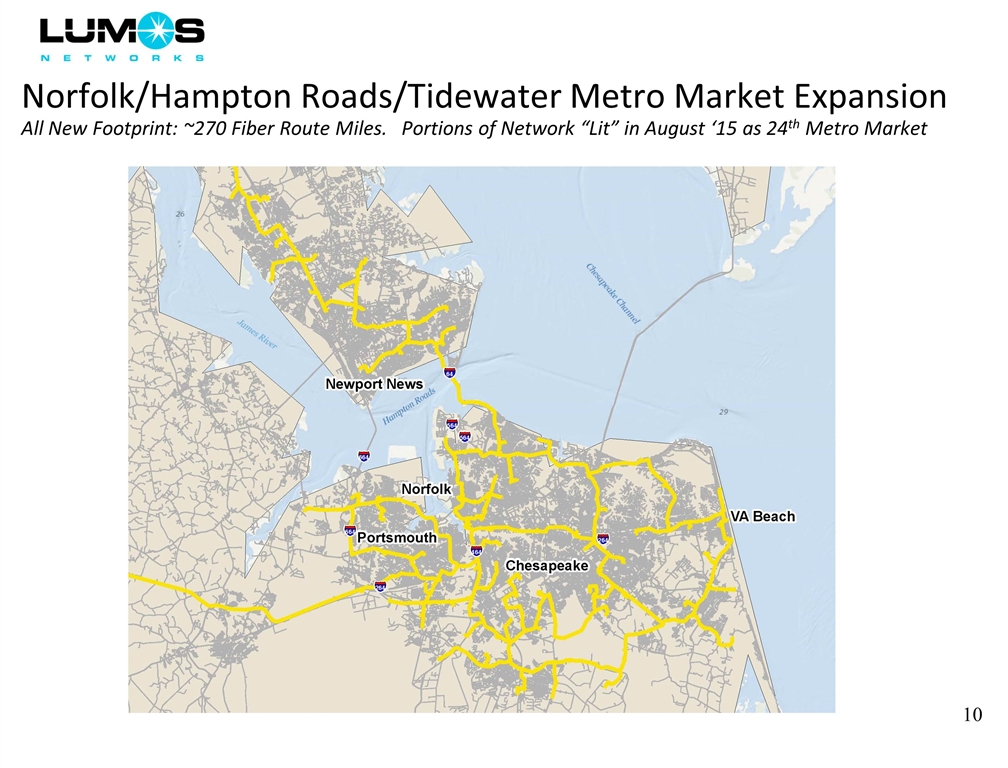

Planned 665 Mile Fiber Network Expansion in Richmond and Norfolk Underpinned by 257 unique FTTC site contract (269 total FTTC connections) with major wireless carrier Vast majority of network expected to be completed by YE15 vs original target of 3Q16 Nine signed Enterprise contracts: total MRC of ~$28,000 (incl. two Enterprise wins with existing core market customer) Significant expansion of Richmond, VA network with the addition of Norfolk, Petersburg and Hampton Roads markets Increases total Enterprise addressable market by ~$135 million, up ~60% vs. existing markets Increases tower addressable market to 7,400 within 3 miles of footprint

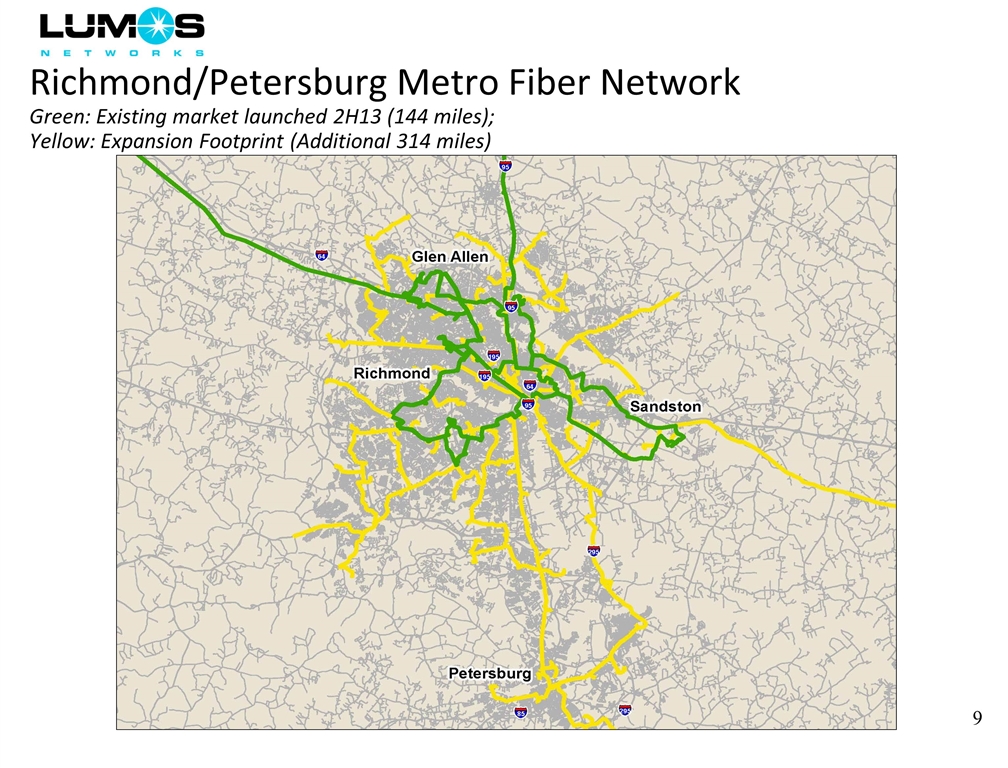

Richmond/Petersburg Metro Fiber Network Green: Existing market launched 2H13 (144 miles); Yellow: Expansion Footprint (Additional 314 miles)

Norfolk/Hampton Roads/Tidewater Metro Market Expansion All New Footprint: ~270 Fiber Route Miles. Portions of Network “Lit” in August ‘15 as 24th Metro Market

First Significant Enterprise Dark Fiber Win New contract: $12k in monthly revenue, providing fiber connectivity and co-location services to a financial institution Targeting a Growing Number of RFPs in our Footprint: Macro Fiber to the Cell Backhaul/Small Cell Fronthaul Large Enterprises: Healthcare, Education/Gov’t, Financial Data Centers Relatively limited dark fiber deployments in our footprint (by any fiber provider), but industry dark fiber network activity should increase in 2015 and beyond Lumos Dark Fiber Product has standardized Monthly Recurring Charge (MRC) and Non-Recurring Charge (NRC) pricing Lumos provides dark fiber cable and customer supplies equipment and resources to manage their bandwidth service Lumos has $1m+ in annual Dark Fiber revenue, mostly derived from Allegheny Energy assets purchased in 2009

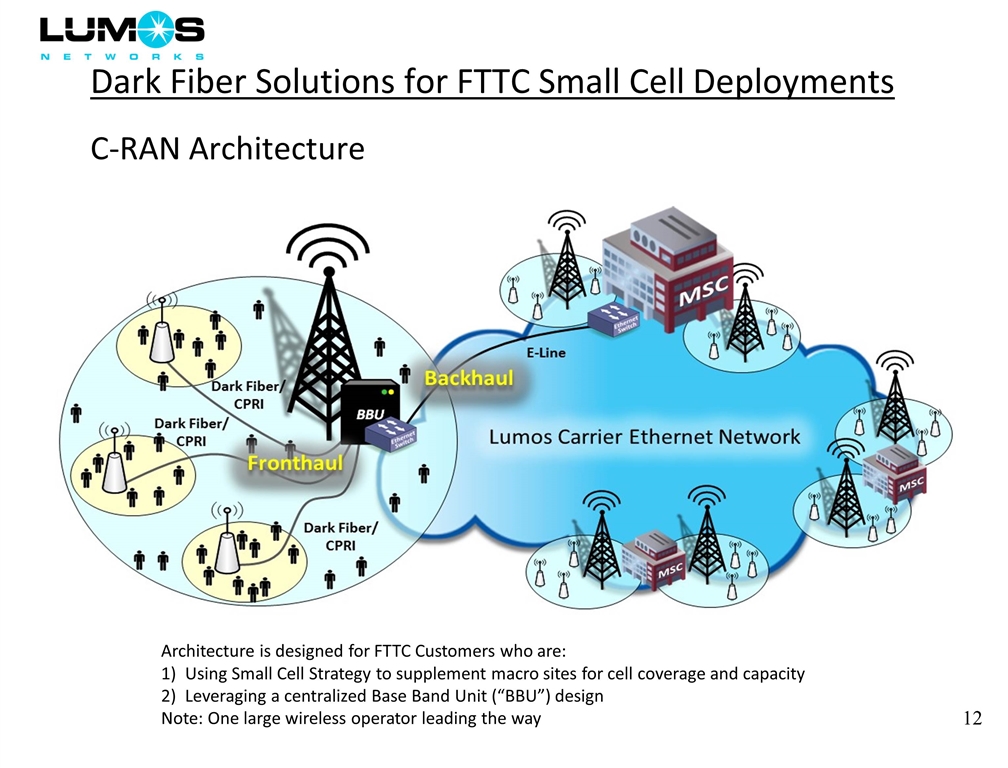

Dark Fiber Solutions for FTTC Small Cell Deployments C-RAN Architecture Architecture is designed for FTTC Customers who are: Using Small Cell Strategy to supplement macro sites for cell coverage and capacity Leveraging a centralized Base Band Unit (“BBU”) design Note: One large wireless operator leading the way

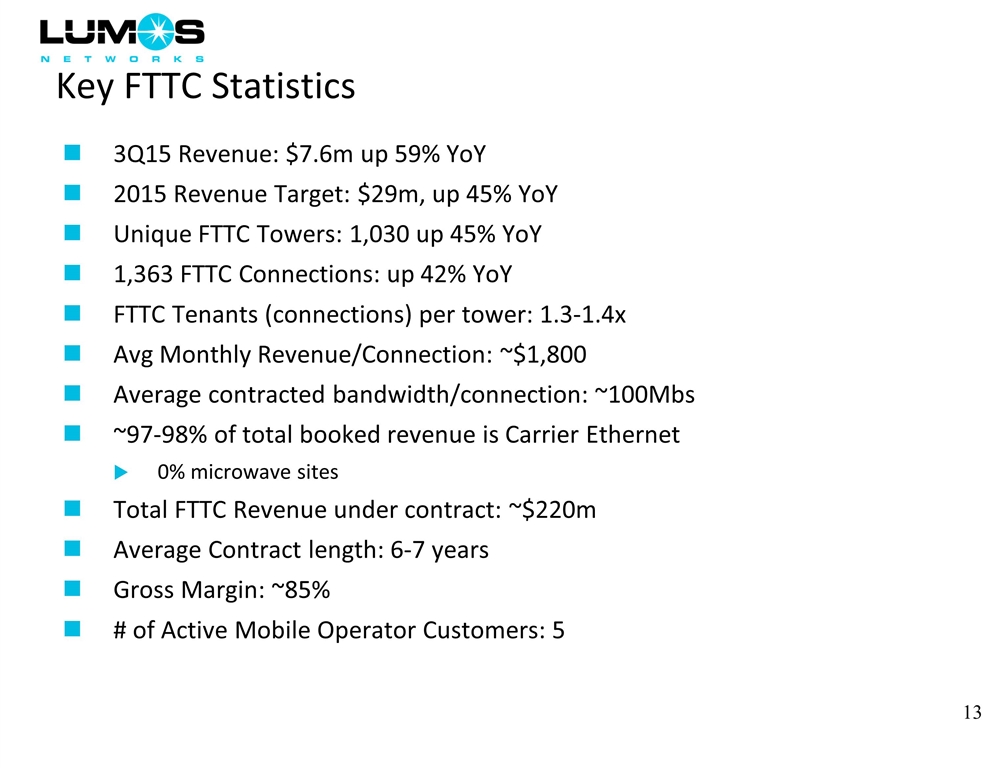

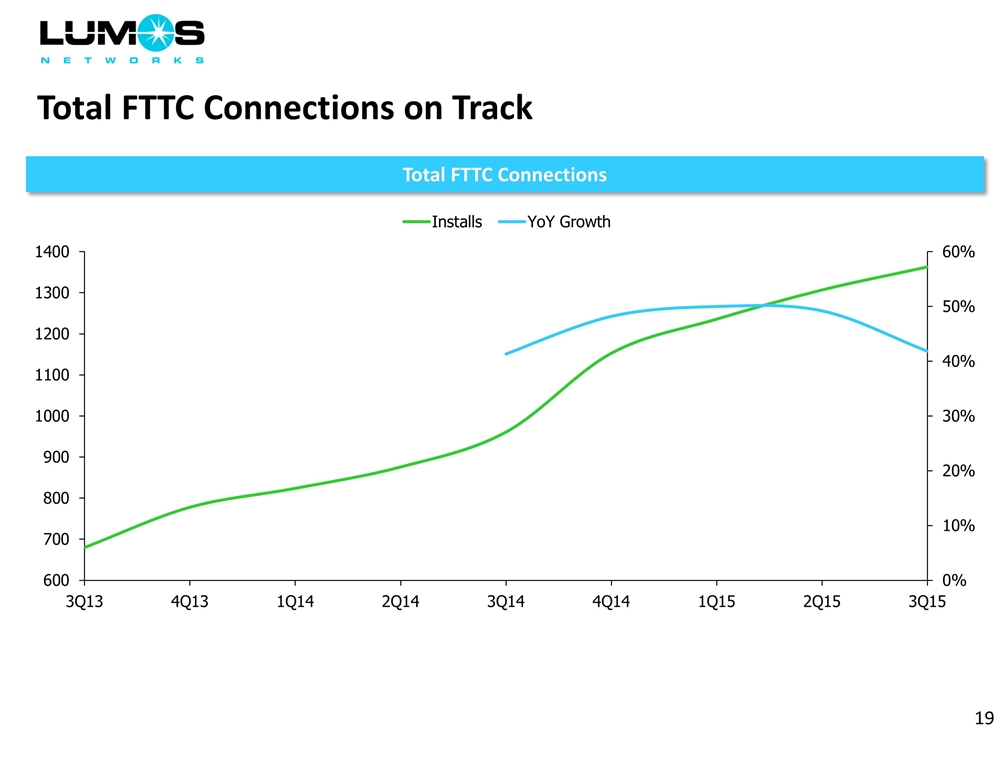

Key FTTC Statistics 3Q15 Revenue: $7.6m up 59% YoY 2015 Revenue Target: $29m, up 45% YoY Unique FTTC Towers: 1,030 up 45% YoY 1,363 FTTC Connections: up 42% YoY FTTC Tenants (connections) per tower: 1.3-1.4x Avg Monthly Revenue/Connection: ~$1,800 Average contracted bandwidth/connection: ~100Mbs ~97-98% of total booked revenue is Carrier Ethernet 0% microwave sites Total FTTC Revenue under contract: ~$220m Average Contract length: 6-7 years Gross Margin: ~85% # of Active Mobile Operator Customers: 5

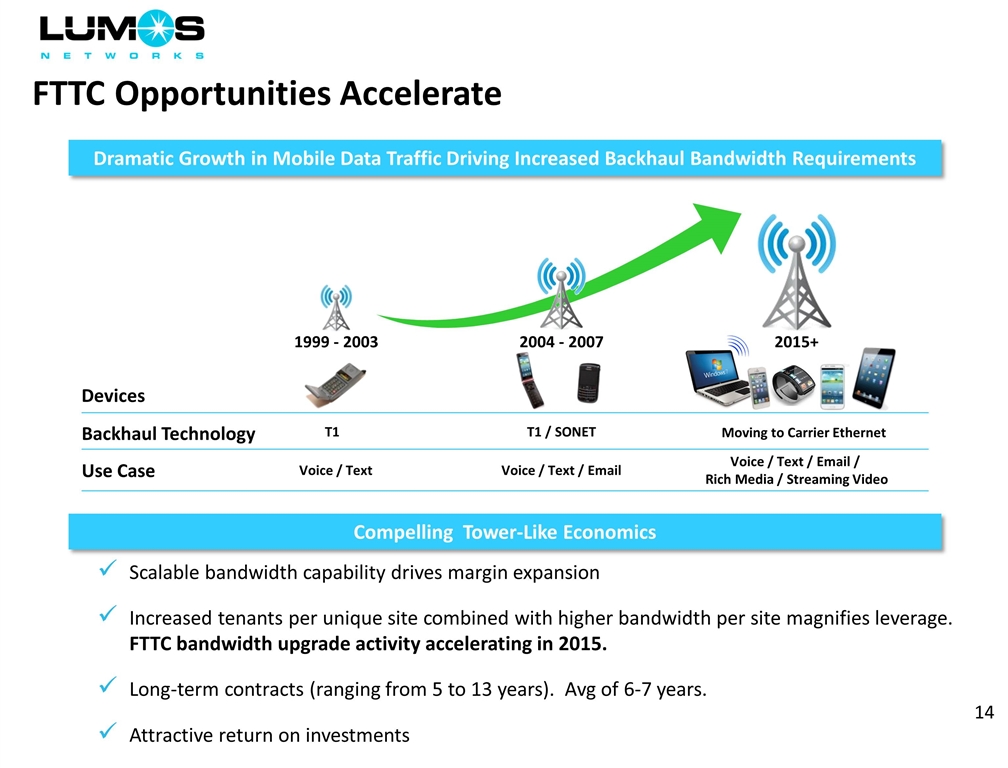

FTTC Opportunities Accelerate Dramatic Growth in Mobile Data Traffic Driving Increased Backhaul Bandwidth Requirements Compelling Tower-Like Economics Scalable bandwidth capability drives margin expansion Increased tenants per unique site combined with higher bandwidth per site magnifies leverage. FTTC bandwidth upgrade activity accelerating in 2015. Long-term contracts (ranging from 5 to 13 years). Avg of 6-7 years. Attractive return on investments Devices Use Case Backhaul Technology Voice / Text / Email / Rich Media / Streaming Video Moving to Carrier Ethernet 2015+ Voice / Text / Email T1 / SONET 2004 - 2007 Voice / Text T1 1999 - 2003

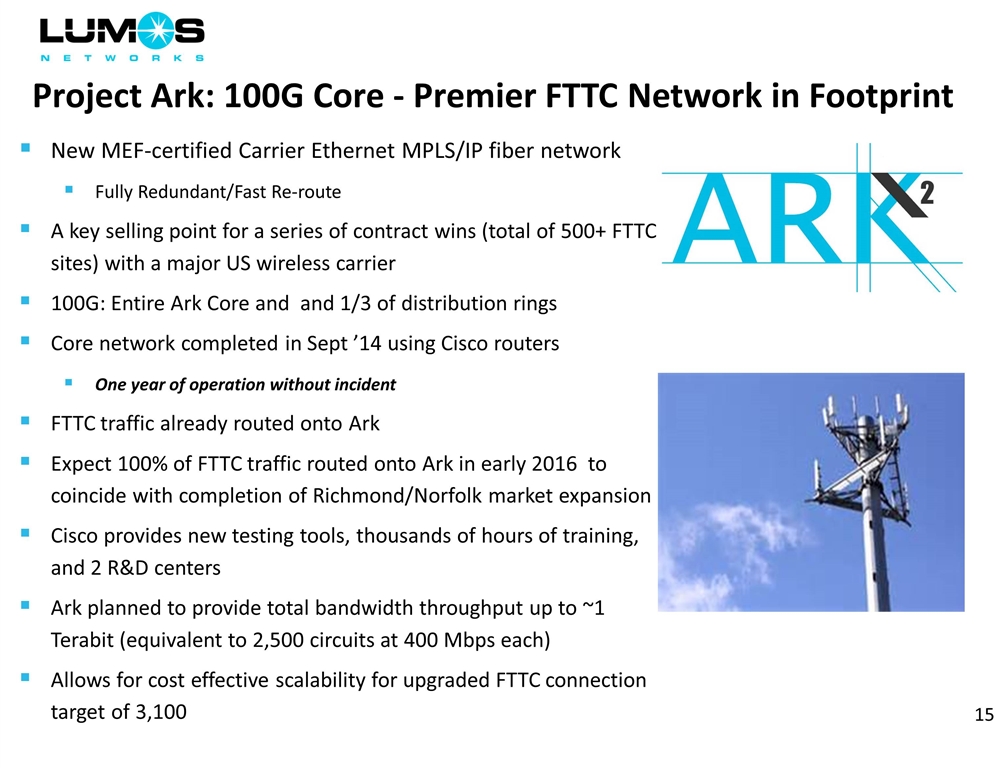

Project Ark: 100G Core - Premier FTTC Network in Footprint New MEF-certified Carrier Ethernet MPLS/IP fiber network Fully Redundant/Fast Re-route A key selling point for a series of contract wins (total of 500+ FTTC sites) with a major US wireless carrier 100G: Entire Ark Core and and 1/3 of distribution rings Core network completed in Sept ’14 using Cisco routers One year of operation without incident FTTC traffic already routed onto Ark Expect 100% of FTTC traffic routed onto Ark in early 2016 to coincide with completion of Richmond/Norfolk market expansion Cisco provides new testing tools, thousands of hours of training, and 2 R&D centers Ark planned to provide total bandwidth throughput up to ~1 Terabit (equivalent to 2,500 circuits at 400 Mbps each) Allows for cost effective scalability for upgraded FTTC connection target of 3,100

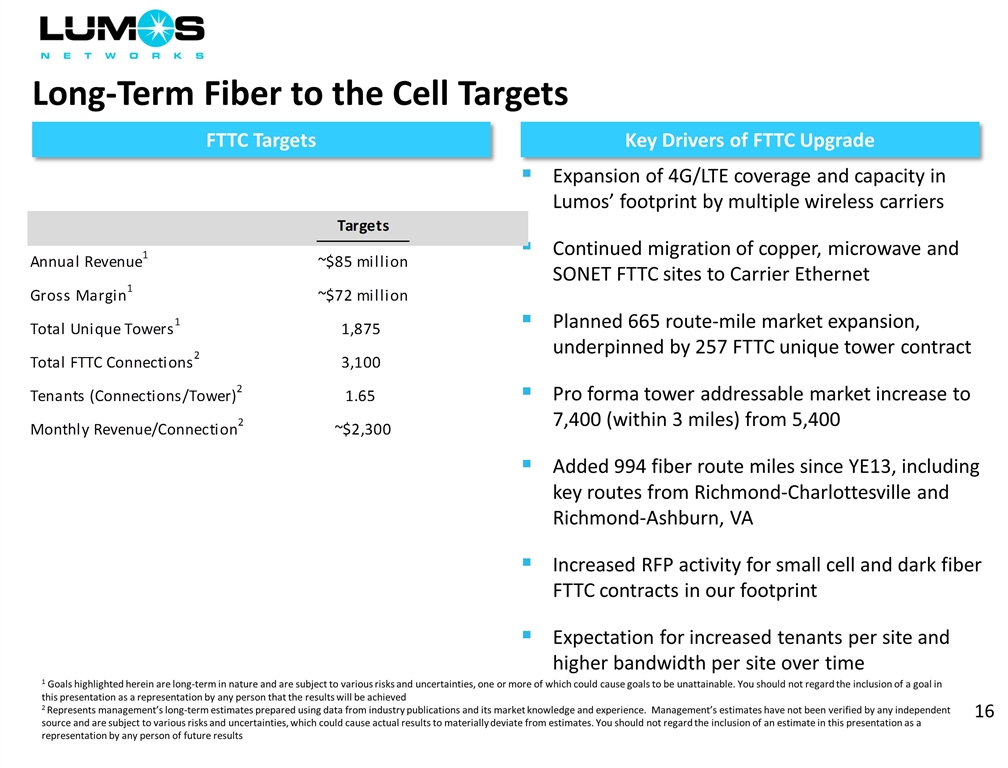

1 Goals highlighted herein are long-term in nature and are subject to various risks and uncertainties, one or more of which could cause goals to be unattainable. You should not regard the inclusion of a goal in this presentation as a representation by any person that the results will be achieved 2 Represents management’s long-term estimates prepared using data from industry publications and its market knowledge and experience. Management’s estimates have not been verified by any independent source and are subject to various risks and uncertainties, which could cause actual results to materially deviate from estimates. You should not regard the inclusion of an estimate in this presentation as a representation by any person of future results Long-Term Fiber to the Cell Targets FTTC Targets Key Drivers of FTTC Upgrade Expansion of 4G/LTE coverage and capacity in Lumos’ footprint by multiple wireless carriers Continued migration of copper, microwave and SONET FTTC sites to Carrier Ethernet Planned 665 route-mile market expansion, underpinned by 257 FTTC unique tower contract Pro forma tower addressable market increase to 7,400 (within 3 miles) from 5,400 Added 994 fiber route miles since YE13, including key routes from Richmond-Charlottesville and Richmond-Ashburn, VA Increased RFP activity for small cell and dark fiber FTTC contracts in our footprint Expectation for increased tenants per site and higher bandwidth per site over time LUMOS NETWORKS Selected Fiancial Highlights FY 2012 FY 2013 FY 2014 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Total Revenue $51.411999999999999 $50.802999999999997 $51.977000000000004 $52.679000000000002 $52.533999999999999 $52.311 $51.627000000000002 $51.003000000000007 $50.089999999999996 $50.164999999999999 $50.515999999999998 $50.684999999999995 Data Segment: Revenue $21.321999999999999 $21.882999999999999 $22.664000000000001 $24.423999999999999 $25.369 $25.706 $26.094000000000001 $26.943000000000001 $26.137 $26.707000000000001 $26.488 $27.31 % Total Revenue 0.41472807904769315 0.4307422789992717 0.43603901725763317 0.46363826192600466 0.48290630829558001 0.49140716101775916 0.50543320355627874 0.52826304335039109 0.52180075863445807 0.53238313565234729 0.52434872119724441 0.53881819078622872 Gross Profit $17.670999999999999 $18.016999999999999 $18.753 $20.428000000000001 $21.338000000000001 $21.827000000000002 $22.206 $22.94 $21.963000000000001 $22.788 $22.550999999999998 $23.35 Gross Margin 0.82876840821686526 0.8233331810080885 0.82743558065654776 0.83639043563707838 0.84110528597895073 0.84910137711040234 0.85100022993791669 0.85142708681290136 0.84030301870910973 0.8532594450893024 0.85136665659921473 0.85499816916880278 EBTIDA $11.118 $11.287000000000001 $11.555 $12.762 $13.124000000000001 $13.355 $13.012 $14.010999999999999 $12.717000000000001 $13.395 $12.984 $12.629 % Margin 0.52143326142012947 0.51578851163003248 0.50983939286974933 0.52251883393383558 0.51732429342898811 0.51952851474363959 0.49865869548555225 0.52002375385072186 0.48655163178635652 0.50155389972666342 0.49018423437028091 0.46243134383009887 LUMOS NETWORKS Historical Financial Metrics by Segment ($ in Thousands) FYE 2011 FYE 2012 FYE 2013 FYE 2014 % of 4Q14 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Total Revenue Data $21,322 $21,883 $22,664 $24,424 $25,369 $25,369 $25,706 $26,094 $26,943 $26,137 $26,707 $26,488 $27,310 0.53881819078622861 Residential and Small Business 24004 23379 23173 21905 21057 21057 20453 20055 19094 18647 18290 17668 17423 0.34375061655322087 RLEC Access 6086 5541 6140 6350 6108 6108 6152 5478 4966 5306 5168 6360 5952 0.11743119266055047 Total Revenue $0 $0 $0 $0 $51,412 $50,803 $51,977 $52,679 $52,534 $52,311 $51,627 $51,003 $50,090 $50,165 $50,516 $50,685 100.0000000000% % YoY Growth #DIV/0! #DIV/0! #DIV/0! #DIV/0! 2.1823698747% 2.968328642% -0.6733747619% -3.1815334384% -4.6522252256% -4.1023876431% -2.1519747419% -0.6234927357% % Sequential Growth -1.1845483545% 2.3108871523% 1.3505973796% -0.2752519979% -0.4244869989% -1.3075643746% -1.208669882% -1.790090779% .1497304851% .6996910196% 1.3657928835% % YoY Growth by Segment Data 0.189803958352875 0.17470182333318096 0.1513413342746206 0.10313625941696691 3.2731680397% 3.8940325216% 1.5099256534% 1.3621348773% Residential and Small Business -0.12277120479920012 -0.12515505368065361 -0.13455314374487548 -0.1283268660123259 -0.11445125136534173 -0.10575465701853026 -0.11902268760907508 -8.751440243% RLEC Access .3614853763% 0.11026890452986815 -0.10781758957654719 -0.21795275590551177 -0.13130320890635228 -0.15994798439531854 0.1610076670317635 0.19855014095851797 Gross Profit1 Data $17,671 $18,017 $18,753 $20,428 $21,338 $21,827 $22,206 $22,940 $21,963 $22,788 $22,551 $23,350 0.56990139607536849 Residential and Small Business 15891 15068 15555 14526 13934 13831 13601 12677 12107 12019 11355 11670 0.2848286634774968 RLEC Access 6086 5541 6140 6350 6108 6152 5478 4966 5306 5168 6360 5952 0.14526994044713462 0.0000000000% Total Gross Profit1 $0 $0 $0 $0 $39,648 $38,626 $40,448 $41,304 $41,380 $41,810 $41,285 $40,583 $39,376 $39,975 $40,266 $40,972 0.99999999999999989 Adjusted EBITDA2 Data $11,118 $11,287 $11,555 $12,762 $13,124 $13,355 $13,012 $14,011 $12,717 $13,395 $12,984 $12,629 0.57737850317743333 Residential and Small Business 6788 6007 6273 5699 6697 6356 5691 5917 5544 5230 4503 4623 0.2113564668769716 RLEC Access 4385 3812 4453 4750 4874 4840 4343 4104 4306 4098 5214 4621 0.21126502994559501 Adjusted EBITDA, Before Curtailment Gain $0 $0 $0 $0 $22,291 $21,106 $22,281 $23,211 $24,695 $24,551 $23,046 $24,032 $22,567 $22,723 $22,701 $21,873 100.0000000000% Curtailment Gain3 0 0 0 0 0 0 0 0 0 0 0 10207 567 Total Adjusted EBITDA $0 $0 $0 $0 $22,291 $21,106 $22,281 $23,211 $24,695 $24,551 $23,046 $24,032 $22,567 $22,723 $32,908 $22,440 % QoQ Growth #DIV/0! #DIV/0! #DIV/0! #DIV/0! 0.10784621596159893 0.16322372784990047 3.4334186078% 3.5371160226% -8.6171289735% -7.445725225% 0.42792675518528167 -6.6245006658% % Sequential Growth, Normalized -5.316046835% 5.5671373069% 4.1739598761% 6.3935203136% -0.5831139907% -6.1300965337% 4.2783997223% -6.9603861518% .6912748704% .0968182018% -3.6474164134% % Margin, Normalized #DIV/0! #DIV/0! #DIV/0! #DIV/0! 0.43357581887497082 0.41544790661968783 0.42867037343440367 0.44061200858026917 0.47007652187154986 0.46932767486761867 0.44639432854901506 0.47118796933513712 0.45052904771411462 0.45296521479118906 0.44938237390133817 0.43154779520568215 Capital Expenditures Data $11.8 $9.8000000000000007 $10.1 $12.1 $10.3 $10 $13 $14.7 $11.3372303 0.62577674851543796 Residential and Small Business 3 2.1 1.6 1.2 1.6 1.5 1.3 2.2999999999999998 2.38821532 0.13182140418408508 RLEC Access 0.307 6.8000000000000005E-2 0.156 6.5999999999999948E-2 0.16900000000000001 0.45400000000000001 0.78 0.22799999999999998 0 0.0000000000% Corporate / Unallocated 2.2509999999999999 -0.34100000000000003 3.02 2.66 2.9620000000000002 -0.29599999999999999 3.9289999999999998 5.327 4.3916070300000003 0.24240184730047687 Total Capital Expenditures $17.358000000000001 $11.627000000000001 $14.875999999999999 $16.026 $15.031000000000001 $11.658000000000001 $19.009 $22.555 $18.117052650000002 $0 $0 $0 100.0000000000% (In thousands) % of Total 1Q 2012 2Q 2012 3Q 2012 4Q 2012 FY 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 FY 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 FY 2014 FY 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Revenue: Data 21,322 21,883 22,664 24,424 90,293 25,369 25,706 26,094 26,943 ,104,112 26,137 26,707 26,488 27,310 ,106,642 0.50180503675141586 0.52180075863445796 0.53238313565234729 0.52434872119724441 0.53881819078622861 R&SB 24,004 23,379 23,173 21,905 92,461 21,057 20,453 20,055 19,094 80,659 18,647 18,290 17,668 17,423 72,028 0.38876491143511266 0.37226991415452187 0.36459683045948371 0.34975057407554044 0.34375061655322087 RLEC Access 6,086 5,541 6,140 6,350 24,117 6,108 6,152 5,478 4,966 22,704 5,306 5,168 6,360 5,952 22,786 0.1094300518134715 0.10592932721102016 0.10302003388816904 0.12590070472721515 0.11743119266055047 Total 51,412 50,803 51,977 52,679 ,206,871 52,534 52,311 51,627 51,003 ,207,475 50,090 50,165 50,516 50,685 ,201,456 100.000000000000% 100.000000000000% 100.000000000000% 100.000000000000% 100.000000000000% Gross Profit: Data 17,671 18,017 18,753 20,428 74,869 21,338 21,827 22,206 22,940 88,311 21,963 22,788 22,551 23,350 90,652 R&SB 15,891 15,068 15,555 14,526 61,040 13,934 13,831 13,601 12,677 54,043 12,107 12,019 11,355 11,670 47,151 RLEC Access 6,086 5,541 6,140 6,350 24,117 6,108 6,152 5,478 4,966 22,704 5,306 5,168 6,360 5,952 22,786 Total 39,648 38,626 40,448 41,304 ,160,026 41,380 41,810 41,285 40,583 ,165,058 39,376 39,975 40,266 40,972 ,160,589 Gross Margin: Data 0.82876840821686526 0.8233331810080885 0.82743558065654788 0.83639043563707827 0.82917834162116666 0.84110528597895073 0.84910137711040223 0.8510002299379168 0.85142708681290136 0.84823075149838634 0.84030301870910973 0.8532594450893024 0.85136665659921473 0.85499816916880267 0.85005907616136234 R&SB 0.66201466422262956 0.64451003036913468 0.67125534026668965 0.66313627025793198 0.66017023393647056 0.66172769150401289 0.67623331540605292 0.67818499127399656 0.66392584057819215 0.67001822487261187 0.64927334155628247 0.65713504647348275 0.64268734435136976 0.66980428169660788 0.6546204253901261 RLEC Access 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Total 0.77118182525480428 0.7603094305454402 0.77819035342555365 0.78406955333244743 0.77355453398494711 0.78768035938630221 0.79925828219686113 0.79967846281984234 0.79569829225731825 0.79555609109531267 0.78610501098023555 0.79687032791787105 0.79709399002296299 0.80836539410081876 0.79714180764037801 Adjusted EBITDA: Data 11,118 11,287 11,555 12,762 46,722 13,124 13,355 13,012 14,011 53,502 12,717 13,395 12,984 12,629 51,725 0.55543789709729663 0.56352195683963313 0.58949082427496369 0.39455451561930227 0.56278966131907304 R&SB 6,788 6,007 6,273 5,699 24,767 6,697 6,356 5,691 5,917 24,661 5,544 5,230 4,503 4,623 19,900 0.25602134462854531 0.24566845393716488 0.23016327069489065 0.13683602771362588 0.20601604278074867 RLEC Access 4,385 3,812 4,453 4,750 17,400 4,874 4,840 4,343 4,104 18,161 4,306 4,098 5,214 4,621 18,239 0.18854075827415806 0.19080958922320201 0.18034590503014566 0.15844171629998785 0.20592691622103387 Curtailment Gain 0 0 0 0 0 0 0 0 0 0 0 0 10,207 567 10,774 0.310167740367084 2.526737967914% Total 22,291 21,106 22,281 23,211 88,889 24,695 24,551 23,046 24,032 96,324 22,567 22,723 32,908 22,440 ,100,638 100.000000000000% 100.000000000000% 100.000000000000% 100.000000000000% 100.000000000000% Adjusted EBITDA Margin: Data 0.52143326142012947 0.51578851163003248 0.50983939286974933 0.52251883393383558 0.51744875017996961 0.51732429342898811 0.51952851474363959 0.49865869548555225 0.52002375385072186 0.51388888888888884 0.48655163178635652 0.50155389972666342 0.49018423437028086 0.46243134383009887 0.48503403912154686 R&SB 0.28278620229961671 0.2569399888789084 0.27070297328787812 0.26016891120748686 0.26786428872713902 0.31804150638742462 0.31076125751723466 0.28376963350785339 0.30988792290771972 0.30574393434086711 0.2973132407357752 0.28594860579551667 0.25486755716549692 0.26533891981863056 0.27628144610429278 RLEC Access 0.72050607952678281 0.68796246164952179 0.72524429967426707 0.74803149606299213 0.7214827714889912 0.79796987557301902 0.78673602080624183 0.7928075940124133 0.82641965364478454 0.79990310077519378 0.81153411232566908 0.79295665634674928 0.81981132075471697 0.776377688172043 0.80044764328973927 Total 0.43357581887497082 0.41544790661968783 0.42867037343440367 0.44061200858026917 0.42968323254588608 0.47007652187154986 0.46932767486761867 0.44639432854901506 0.47118796933513712 0.46426798409446923 0.45052904771411462 0.45296521479118906 0.65143716842188615 0.44273453684522046 0.49955325232308789 % Sequential Revenue Growth: Data 2.6% 3.6% 7.8% 3.9% 1.3% 1.5% 3.3% -2.9915005752885721 2.2% -0.8% 3.1% R&SB -2.6% -0.9% -5.5% -3.9% -2.9% -1.9% -4.8% -2.3% -1.9% -3.4% -1.4% RLEC Access -8.9549786395004924 0.10810323046381519 3.4% -3.8% .7% -0.10955786736020806 -9.3% 6.8% -2.6% 0.23065015479876161 -6.4% Total -1.2% 2.3% 1.4% -0.3% -0.4% -1.3% -1.2% -1.8% .1% .7% .3% % YoY Revenue Growth: Data 0.18980395835287497 0.17470182333318102 0.15134133427462054 0.10313625941696691 3.3% 3.9% 1.5% 1.4% R&SB -0.12277120479920013 -0.12515505368065358 -0.13455314374487551 -0.12832686601232596 -0.11445125136534169 -0.10575465701853029 -0.11902268760907504 -8.8% RLEC Access .4% 0.11026890452986826 -0.10781758957654723 -0.2179527559055118 -0.13130320890635233 -0.1599479843953186 0.16100766703176342 0.19855014095851792 Total 2.2% 2.96832864200933 -0.7% -3.2% -4.7% -4.1% -2.2% -0.6% % YoY Adjusted EBITDA Growth: Data 0.18042813455657492 0.18321963320634357 0.12609260060579836 9.8% -3.1% .3% -0.2% -9.9% R&SB -1.3% 5.8% -9.3% 3.8% -0.17216664177990146 -0.17715544367526748 -0.20875065893516079 -0.21869190468142641 RLEC Access 0.11151653363740023 0.26967471143756561 -2.5% -0.13600000000000001 -0.11653672548215019 -0.15330578512396695 0.20055261340087496 0.12597465886939571 Total 0.10784621596159885 0.1632237278499005 3.4% 3.5% -8.6% -7.4% 0.42792675518528162 -6.6% LUMOS NETWORKS Operating Metrics X Fiber Network Statistics 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Fiber Route-Miles N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/M N/M N/M 7414 7467 7548 7645 7822 Fiber Markets N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 22 23 23 23 23 23 23 23 Fiber to the Cell Sites 57 57 63 71 91 109 132 148 155 178 261 370 405 465 540 608 633 673 708 858 On-Network Buildings 647 687 705 752 830 903 949 1051 1066 1091 1150 1196 1235 1273 1303 1344 1387 1420 1456 1477 Data Centers N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 12 12 12 24 25 26 28 31 Enterprise Customers N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 1379 1365 R&SB Statistics Competitive Voice Connections 134071 129734 127561 125500 122046 117965 114930 112709 110261 105695 102189 98296 95730 92440 88941 85683 83406 Video Subscribers 2849 2997 3152 3439 3734 4019 4192 4390 4549 4666 4767 4975 5034 5073 5155 5309 5352 RLEC Access Lines 35422 34920 34489 33840 33193 32676 32272 31708 31203 30643 30129 29518 28886 28381 28081 28081 27257 X 4Q11 4Q12 4Q13 4Q14 CAGR On-Net Buildings 1051 1196 1344 1477 0.12010635118952084 LTM Avg per Month: 11.083333333333334 Change 145 148 133 X 4Q11 4Q12 4Q13 4Q14 Long-Term Goal CAGR FTTC Sites 148 370 608 858 1875 0.79642265815376367 Change 222 238 250 ($ in Millions) 3Q13 Financials 2013E Financials Actual WFS Est. Guidance WFS Est. Strategic Data Revenue $30.385000000000002 $30.6 $121 - $122 $122 Total Revenue $51.627000000000002 $51.4 $208 $208 Adjusted EBITDA $23.045999999999999 $24.1 $97 $96.7 % Margin 0.44639432854901501 0.46887159533073935 0.46634615384615385 0.46490384615384617 Targets Annual Revenue1 ~$85 million Gross Margin1 ~$72 million Total Unique Towers1 1875 Total FTTC Connections2 3100 Tenants (Connections/Tower)2 1.65 Monthly Revenue/Connection2 ~$2,300 Addressable Market2 7400 PROJECT LATTICE Transaction Overview Issuer: Lumos Networks Corp. Ticker (Exchange): LMOS (NASDAQ) Shelf Filing Date: [March 15, 2013] Targeted Launch Date: [November 4, 2013 (After Market Close)] Expected Pricing Date: [November 5, 2013 (After Market Close)] Shares Offered: Approximately [2.8] million (100% Secondary) Estimated Offering Size: [$66] million 1 Security: Common Stock Offering Structure: 100% Secondary Selling Shareholder: Quadrangle Capital Partners LP Over-allotment: 15% of Base Offering Size ([100% Secondary]) Selling Shareholder(s): [Quadrangle Capital Partners LP] Lock-up: 90 days Bookrunners: Wells Fargo Securities / Cowen and Company Co-Managers: TBD Stabilization Agent: Wells Fargo Securities Company Counsel: Troutman Sanders LLP Selling Shareholder Counsel: Paul, Weiss, Rifkind, Wharton & Garrison LLP Underwriters' Counsel: Latham & Watkins LLP Company Auditor: KPMG LLP ¹ Based on LMOS stock price of [$23.40] as of [10/22/2013] x LUMOS NETWORKS Source: Cisco VNI, February 2014 U.S. Business IP Traffic Website: http://ciscovni.com/forecast-widget/advanced.html Business IP Mobile Traffic Web & Data Video File Sharing Total Consumer Video Consumer Web & Data Consumer File Sharing Business Video Business Web & Data Business File Sharing Total 2012 2013 1291.5999999999999 892.2 82.6 2266.4 162.6 107.8 9.9 38.200000000000003 39.5 2 359.99999999999994 2014 1456 1232.4000000000001 99 2787.4 273.2 159.5 18.899999999999999 62.5 59.3 3.7 577.09999999999991 2015 1599.7 1648.8 113.5 3362 441.3 228.8 30.5 99.9 87.2 5.9 893.6 2016 1755.7 2183.3000000000002 125.8 4064.8 688.3 321.10000000000002 38.299999999999997 157.19999999999999 126.1 7.4 1,338.4 2017 1924.2 2811.9 135.5 4871.6000000000004 1,029.999999999999 432.6 45.2 239.2 176.4 8.9 1,931.4 0.52192212822473083 Web & Data Video File Sharing Total Web & Data Video File Sharing 2012 2013 1.2915999999999999 0.89219999999999999 8.2599999999999993E-2 2.2663999999999995 0.14730000000000001 0.20080000000000001 1.1900000000000001E-2 0.36000000000000004 2014 1.456 1.2324000000000002 9.9000000000000005E-2 2.7874000000000003 0.21880000000000002 0.3357 2.2599999999999999E-2 0.57709999999999995 2015 1.5997000000000001 1.6488 0.1135 3.3620000000000001 0.316 0.54120000000000001 3.6400000000000002E-2 0.89359999999999995 2016 1.7557 2.1833 0.1258 4.0648 0.44720000000000004 0.84550000000000003 4.5699999999999998E-2 1.3384 2017 1.9242000000000001 2.8119000000000001 0.13550000000000001 4.8716000000000008 0.60899999999999999 1.2683 5.4100000000000002E-2 1.9314 2.1494881750794219 5.3649999999999993 U.S. Business IP Traffic U.S. Mobile IP Traffic LUMOS NETWORKS 1000 Historical Financial Metrics by Segment ($ in Millions) FYE 2011 FYE 2012 FYE 2013 FYE 2014 % of 3Q14 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Total Revenue Data $21.321999999999999 $21.882999999999999 $22.664000000000001 $24.423999999999999 $25.369 $25.706 $26.094000000000001 $26.943000000000001 $26.137 $26.707000000000001 $26.488 $27.31 0.53881819078622872 Residential and Small Business 24.004000000000001 23.379000000000001 23.172999999999998 21.905000000000001 21.056999999999999 20.452999999999999 20.055 19.094000000000001 18.646999999999998 18.29 17.667999999999999 17.422999999999998 0.34375061655322087 RLEC Access 6.0860000000000003 5.5410000000000004 6.14 6.35 6.1079999999999997 6.1520000000000001 5.4779999999999998 4.9660000000000002 5.306 5.1680000000000001 6.36 5.952 0.11743119266055047 Total Revenue $0 $0 $0 $0 $51.411999999999999 $50.802999999999997 $51.977000000000004 $52.679000000000002 $52.533999999999999 $52.311 $51.627000000000002 $51.003000000000007 $50.089999999999996 $50.164999999999999 $50.515999999999998 $50.684999999999995 100.0000000000% % YoY Growth #DIV/0! #DIV/0! #DIV/0! #DIV/0! 2.1823698747% 2.968328642% -0.6733747619% -3.1815334384% -4.6522252256% -4.1023876431% -2.1519747419% -0.6234927357% % Sequential Growth -1.1845483545% 2.3108871523% 1.3505973796% -0.2752519979% -0.4244869989% -1.3075643746% -1.208669882% -1.790090779% .1497304851% .8504691555% 1.3657928835% % YoY Growth by Segment Data 0.189803958352875 0.17470182333318096 0.1513413342746206 0.10313625941696691 3.2731680397% 3.8940325216% 1.5099256534% 1.3621348773% Residential and Small Business -0.12277120479920023 -0.12515505368065361 -0.13455314374487548 -0.1283268660123259 -0.11445125136534173 -0.10575465701853026 -0.11902268760907508 -8.751440243% RLEC Access .3614853763% 0.11026890452986815 -0.10781758957654719 -0.21795275590551177 -0.13130320890635228 -0.15994798439531854 0.1610076670317635 0.19855014095851797 Adjusted EBITDA Data $11.118 $11.287000000000001 $11.555 $12.762 $13.124000000000001 $13.355 $13.012 $14.010999999999999 $12.717000000000001 $13.395 $12.984 $12.629 0.56278966131907315 Residential and Small Business 6.7880000000000003 6.0069999999999997 6.2729999999999997 5.6989999999999998 6.6970000000000001 6.3559999999999999 5.6909999999999998 5.9169999999999998 5.5439999999999996 5.23 4.5030000000000001 4.6230000000000002 0.2060160427807487 RLEC Access 4.3849999999999998 3.8119999999999998 4.4530000000000003 4.75 4.8739999999999997 4.84 4.343 4.1040000000000001 4.306 4.0979999999999999 5.2140000000000004 4.6210000000000004 0.2059269162210339 Curtailment Gain 0 0 0 0 0 0 0 0 0 0 10.207000000000001 0.56699999999999995 2.5267379679% Total Adjusted EBITDA $0 $0 $0 $0 $22.290999999999997 $21.106000000000002 $22.280999999999999 $23.210999999999999 $24.695 $24.550999999999998 $23.045999999999999 $24.031999999999996 $22.567 $22.722999999999999 $32.908000000000001 $22.439999999999998 100.0000000000% % QoQ Growth #DIV/0! #DIV/0! #DIV/0! #DIV/0! 0.10784621596159893 0.16322372784990025 3.4334186078% 3.5371160226% -8.6171289735% -7.445725225% 0.42792675518528167 -6.6245006658% % Sequential Growth -5.316046835% 5.5671373069% 4.1739598761% 6.3935203136% -0.5831139907% -6.1300965337% 4.2783997223% -6.9603861518% .6912748704% 0.44822426616203859 -0.31809894250638149 % Margin #DIV/0! #DIV/0! #DIV/0! #DIV/0! 0.43357581887497076 0.41544790661968789 0.42867037343440362 0.44061200858026911 0.47007652187154986 0.46932767486761862 0.44639432854901501 0.47118796933513701 0.45052904771411462 0.45296521479118906 0.65143716842188615 0.44273453684522046 Capital Expenditures Data 0 Residential and Small Business 0 RLEC Access 0 Corporate / Unallocated 0 Total Capital Expenditures $0 $0 $0 $0 $0 $0 $18.997 $22.613 $18.117000000000001 $19.170999999999999 $26.863 $20.443999999999999 1 LUMOS NETWORKS Adjusted EBITDA Reconciliation Source 41182 41274 41364 41455 41547 41639 41912 FY2010 FY2011 ($ in Millions) Three Months Ended ($ in Millions) Year Ended 40999 41090 41182 41274 41364 41455 41547 41639 41729 41820 41912 42004 FY2010 FY2011 FY2012 FY2013 FY2014 Operating Income (Loss) $11.585000000000001 $9.0150000000000006 $13.349 $7.2469999999999999 $13.726000000000001 $12.085000000000001 $8.3439999999999994 $11.68 $10.757999999999999 $10.247999999999999 $20.391000000000002 $9.0589999999999993 Operating Income (Loss) $41.128999999999998 $-36.372999999999998 $41.195999999999998 $45.835000000000001 $50.456000000000003 Depreciation and Amortization 9.25 8.8339999999999996 9.6820000000000004 11.242000000000001 9.5939999999999994 10.829000000000001 11.2 10.801 10.686 11.24 11.31 12.093999999999999 Depreciation and Amortization 31.376000000000001 43.206000000000003 39.007999999999996 42.423999999999999 45.330000000000005 Equity Based Compensation 1.0109999999999999 0.77700000000000002 1.099 1.0249999999999999 1.0249999999999999 1.3280000000000001 3.1829999999999998 1.242 0.83399999999999996 1.1519999999999999 1.123 1.2310000000000001 Equity Based Compensation 1.5289999999999999 2.383 3.9119999999999995 6.7779999999999996 4.34 Asset Impairment Charge 0 0 0 0 0 0 0 0 0 0 0 0 Asset Impairment Charge 0 86.295000000000002 0 0 0 Amortization of Actuarial Losses 0.44500000000000001 0.44500000000000001 0.44600000000000001 0.44500000000000001 0.31 0.309 0.309 0.309 6.4000000000000001E-2 6.4000000000000001E-2 6.4000000000000001E-2 0 Amortization of Actuarial Losses 0 0 1.7810000000000001 1.2369999999999999 0.192 Business Separation Charges 0 0 0 0 0 0 0 0 0 0 0 0 Business Separation Charges 0 1.3580000000000001 0 0 0 Acquisition Related Charges 0 0 0 0 0 0 0 0 0 0 0 0 Acquisition Related Charges 3.02 7.0999999999999994E-2 0 0 0 Employee Separation Charges 0 2.0350000000000001 0.04 0.27100000000000002 0 0 0 0 0.22500000000000001 1.9E-2 0 0 Employee Separation Charges 0 0 2.3460000000000001 0 0.24399999999999999 Restructuring Charges 0 0 0 2.9809999999999999 0.04 0 0.01 0 0 0 0 0 Restructuring Charges 0 0 2.9809999999999999 0.05 0 Gain on Settlements, net 0 0 -2.335 0 0 0 0 0 0 0 0 0 Gain on Settlements, net 0 0 -2.335 0 0 Adjusted EBITDA $22.291 $21.106000000000002 $22.280999999999999 $23.210999999999999 $24.694999999999997 $24.551000000000002 $23.045999999999999 $24.032000000000004 $22.567 $22.722999999999999 $32.887999999999998 $22.384 Adjusted EBITDA $77.053999999999988 $96.940000000000012 $88.88900000000001 $96.323999999999998 $100.562 Check 0 0 0 0 0 0 0 0 0 0 -2.0000000000003126E-2 0 0 0 -7.6000000000007617E-2 96.94 88.888999999999996 96.323999999999998 100.63800000000001 PROJECT LATTICE Capital Structure and Debt Maturity Schedule ($ in Millions) As of 42004 Cash and Marketable Securities $36.522000000000006 Revolving Credit Facility ($50MM) $0 Term Loan A 98.75 Term Loan B 270.875 -1250 Capital Leases 5.8509999999999991 -687.5 Total Debt $375.476 2015 2016 2017 2018 2019 Term Loan A $4.9375 $4.9375 $9.875 $79 $0 Term Loan B $2.75 $2.75 $2.75 $2.75 $259.875 Total $7.6875 $7.6875 $12.625 $81.75 $259.875 1Q 2011 2Q 2011 3Q 2011 4Q 2011 FY 2011 1Q 2012 2Q 2012 3Q 2012 4Q 2012 FY 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 FY 2013 1Q 2014 Revenue: 4/24/14: THIS ENTIRE TAB UPDATED BASED ON "QUARTERLY SEGMENT TREND" FILE FROM LUMOS Data 21,960 22,838 23,704 25,047 93,549 21,322 21,884 22,663 24,424 90,293 25,369 25,706 26,094 26,942 ,104,111 26,137 R&SB 20,032 19,212 18,619 17,785 75,648 24,004 23,379 23,173 21,905 92,461 21,057 20,453 20,055 19,094 80,659 18,647 RLEC Access 10,652 10,011 9,278 8,275 38,216 6,086 5,541 6,140 6,350 24,117 6,108 6,152 5,478 4,966 22,704 5,306 Total 52,644 52,061 51,601 51,107 ,207,413 51,412 50,804 51,976 52,679 ,206,871 52,534 52,311 51,627 51,002 ,207,474 50,090 Gross Profit: Data 17,801 18,522 19,142 20,042 75,507 17,669 18,018 18,753 20,428 74,868 21,339 21,828 22,209 22,942 88,318 21,963 R&SB 12,456 12,118 11,913 11,088 47,575 15,891 15,068 15,555 14,526 61,040 13,934 13,831 13,601 12,677 54,043 12,107 RLEC Access 10,227 9,577 8,904 7,909 36,617 6,086 5,541 6,140 6,350 24,117 6,108 6,152 5,478 4,966 22,704 5,306 Total 40,484 40,217 39,959 39,039 ,159,699 39,646 38,627 40,448 41,304 ,160,025 41,381 41,811 41,288 40,585 ,165,065 39,376 Gross Margin: Data 0.81061020036429876 0.8110167265084508 0.80754303071211608 0.80017566974088716 0.80713850495462269 0.82867460838570495 0.82334125388411628 0.82747209107355602 0.83639043563707827 0.82916726656551454 0.84114470416650244 0.84914027853419438 0.85111519889629805 0.85153292257441915 0.84830613479843631 0.84030301870910973 R&SB 0.62180511182108622 0.6307516135748491 0.63983028089585903 0.62344672476806295 0.62889964043993229 0.66201466422262956 0.64451003036913468 0.67125534026668965 0.66313627025793198 0.66017023393647056 0.66172769150401289 0.67623331540605292 0.67818499127399656 0.66392584057819215 0.67001822487261187 0.64927334155628247 RLEC Access 0.96010138941043932 0.95664768754370189 0.95968958827333473 0.95577039274924469 0.95815888633033286 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Total 0.76901451257503228 0.77249764699102974 0.77438421736012863 0.76386796329269968 0.76995656009989732 0.77114292383101224 0.76031414849224466 0.77820532553486221 0.78406955333244743 0.77354970005462342 0.78769939467773253 0.79927739863508629 0.79973657194878645 0.79575310772126584 0.79559366474835402 0.78610501098023555 Adjusted EBITDA: Data 10,911 11,872 12,136 12,290 47,209 11,117 11,293 11,549 12,761 46,720 13,125 13,355 13,014 14,014 53,508 12,717 R&SB 5,418 5,626 5,565 4,684 21,293 6,788 6,007 6,273 5,699 24,767 6,697 6,356 5,691 5,917 24,661 5,544 RLEC Access 7,935 7,531 6,946 6,026 28,438 4,385 3,812 4,453 4,750 17,400 4,874 4,840 4,343 4,104 18,161 4,306 Total 24,264 25,029 24,647 23,000 96,940 22,290 21,112 22,275 23,210 88,887 24,696 24,551 23,048 24,035 96,330 22,567 Adjusted EBITDA Margin: Data 0.49685792349726776 0.51983536211577197 0.5119811002362471 0.49067752625064875 0.5046446247421138 0.52138636150454931 0.51603911533540481 0.50959714071393902 0.52247789059941041 0.51742660006866537 0.51736371161653982 0.51952851474363959 0.4987353414578064 0.52015440576052263 0.51395145565790357 0.48655163178635652 R&SB 0.27046725239616615 0.29283780970226941 0.29888823245072238 0.26336800674725891 0.2814747250423012 0.28278620229961671 0.2569399888789084 0.27070297328787812 0.26016891120748686 0.26786428872713902 0.31804150638742462 0.31076125751723466 0.28376963350785339 0.30988792290771972 0.30574393434086711 0.2973132407357752 RLEC Access 0.74493052947803229 0.75227250024972525 0.74865272688079332 0.72821752265861028 0.74413858069918359 0.72050607952678281 0.68796246164952179 0.72524429967426707 0.74803149606299213 0.7214827714889912 0.79796987557301902 0.78673602080624183 0.7928075940124133 0.82641965364478454 0.79990310077519378 0.81153411232566908 Total 0.46090722589468885 0.48076295115345458 0.47764578205848723 0.45003619856379751 0.46737668323586273 0.43355636816307475 0.41555783009211872 0.42856318300754193 0.44059302568385883 0.42967356468523865 0.47009555716298018 0.46932767486761867 0.44643306796831117 0.47125602917532644 0.46429914109719772 0.45052904771411462 % Sequential Revenue Growth: Data 3.998178506375228 3.8% 5.7% -0.14872040563740169 2.6% 3.6% 7.8% 3.9% 1.3% 1.5% 3.2% -2.9878999331898151 R&SB -4.9% -3.9% -4.5% 0.34967669384312622 -2.6% -0.9% -5.5% -3.9% -2.9% -1.9% -4.8% -2.3% RLEC Access -6.2% -7.3% -0.10810519508514767 -0.26453172205438069 -8.9549786395004924 0.10810323046381519 3.4% -3.8% .7% -0.10955786736020806 -9.3% 6.8% Total -1.1% -0.9% -0.95734578787232804 .6% -1.2% 2.3% 1.4% -0.3% -0.4% -1.3% -1.2% -1.8% % YoY Revenue Growth: Data -2.9% -4.2% -4.4% -2.5% 0.18980395835287497 0.17464814476329737 0.15139213696333231 0.10309531608254176 3.3% R&SB 0.19828274760383385 0.21689569019362898 0.24458886084107631 0.23165588979477086 -0.12277120479920013 -0.12515505368065358 -0.13455314374487551 -0.12832686601232596 -0.11445125136534169 RLEC Access -0.42865189635749157 -0.44650884027569676 -0.33821944384565639 -0.23262839879154079 .4% 0.11026890452986826 -0.10781758957654723 -0.2179527559055118 -0.13130320890635233 Total -2.3% -2.4% .7% 3.8% 2.2% 2.9663018659948037 -0.7% -3.2% -4.7% % YoY Adjusted EBITDA Growth: Strategic Data 1.9% -4.9% -4.8% 3.8% 0.18062426913735721 0.18259098556628001 0.12685080959390424 9.8% -3.1% Legacy Voice 0.25286083425618311 6.8% 0.12722371967654986 0.21669513236549956 -1.3% 5.8% -9.3% 3.8% -0.17216664177990146 Access -0.44738500315059859 -0.49382552117912626 -0.35891160380074866 -0.21174908728841685 0.11151653363740023 0.26967471143756561 -2.5% -0.13600000000000001 -0.11653672548215019 Total -8.1% -0.15649846178433019 -9.6% .9% 0.10794078061911171 0.16289314134141719 3.5% 3.6% -8.6% LUMOS NETWORKS Snapshot X ($ in Millions) 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Revenue $52.533999999999999 $52.311 $51.627000000000002 $51.003000000000007 $50.089999999999996 $50.164999999999999 $50.515999999999998 $50.684999999999995 Adjusted EBITDA $24.695 $24.550999999999998 $23.045999999999999 $24.031999999999996 $22.567 $22.722999999999999 $32.908000000000001 $22.439999999999998 % Margin 0.47007652187154986 0.46932767486761862 0.44639432854901501 0.47118796933513701 0.45052904771411462 0.45296521479118906 0.65143716842188615 0.44273453684522046 Capital Expenditures $0 $0 $18.997 $22.613 $18.117000000000001 $19.170999999999999 $26.863 $20.443999999999999 % of Revenue 0.000000000000% 0.000000000000% 0.36796637418405098 0.44336607650530352 0.36168895987223004 0.3821588757101565 0.53177211180616046 0.40335404952155474 X ($ in Millions) Cash and Marketable Securities $36.522000000000006 Total Long-Term Debt $375.476 Net Long-Term Debt $338.95400000000001 Market Capitalization¹ #NAME? Enterprise Value #NAME? Dividend Yield #NAME? Ticker LMOS Date 41940 Shares Outstanding 22.413101999999999 Current Share Price #NAME? Dividend $0.56000000000000005 LTM Dividend 0.56000000000000005 3Q14 0.14000000000000001 2013 0.56000000000000005 3Q13 0.14000000000000001 LUMOS NETWORKS Operating Income Reconciliation 41912 ($ in Millions) Three Months Ended ($ in Millions) Year Ended 40999 41090 41182 41274 41364 41455 41547 41639 41729 41820 41912 42004 FY2008 FY2009 FY2010 FY2011 FY2012 FY2013 FY2014 Net Income (Loss) Attributable to Lumos Networks Corp. $5.2869999999999999 $2.7749999999999999 $6.3419999999999996 $1.9359999999999999 $6.4089999999999998 $4.7619999999999996 $2.5369999999999999 $4.0650000000000004 $4.0620000000000003 $3.8460000000000001 $10.199999999999999 $3.4129999999999998 Net Income (Loss) Attributable to Lumos Networks Corp. $22.736999999999998 $23.358000000000001 $20.824000000000002 $-43.93 $16.34 $17.773 $21.521000000000001 Net Income Attributable to Noncontrolling Interests 2.1999999999999999E-2 -5.7000000000000002E-2 0.115 2.8000000000000001E-2 6.9000000000000006E-2 3.5999999999999997E-2 1.6E-2 0 3.3000000000000002E-2 3.3000000000000002E-2 3.0000000000000001E-3 5.0999999999999997E-2 Net Income Attributable to Noncontrolling Interests 4.8000000000000001E-2 3.9E-2 0.11899999999999999 5.1999999999999998E-2 0.108 0.12100000000000001 0.12 Net Income (Loss) 5.3090000000000002 2.718 6.4569999999999999 1.964 6.4779999999999998 4.7979999999999992 2.5529999999999999 4.0650000000000004 4.0950000000000006 3.879 10.202999999999999 3.464 Net Income (Loss) 22.784999999999997 23.397000000000002 20.943000000000001 -43.878 16.448 17.893999999999998 21.641000000000002 Interest Expense 2.9870000000000001 2.9289999999999998 3.0640000000000001 2.9409999999999998 3.1280000000000001 3.4060000000000001 3.8410000000000002 3.8159999999999998 3.9740000000000002 3.8119999999999998 3.9689999999999999 3.82 Interest Expense 1.393 1.478 5.7519999999999998 11.993 11.920999999999999 14.190999999999999 15.574999999999999 Loss on Interest Rate Derivatives -0.14599999999999999 0.438 0.26300000000000001 1.343 -0.187 -0.26700000000000002 0.56399999999999995 3.4000000000000002E-2 -0.109 1.6E-2 -0.30199999999999999 -9.7000000000000003E-2 Loss on Interest Rate Derivatives 0 0 0 0 1.8980000000000001 0.14399999999999993 -0.49199999999999999 Income Tax Expense (Benefit) 3.4430000000000001 2.9529999999999998 3.589 1.0249999999999999 4.3319999999999999 3.2410000000000001 1.464 2.9820000000000002 2.9780000000000002 2.7109999999999999 6.7 2.0070000000000001 Income Tax Expense (Benefit) 14.887 15.768000000000001 14.477 -4.383 11.01 12.019000000000002 14.395999999999999 Other (Income) Expense, net -8.0000000000000002E-3 -2.3E-2 -2.4E-2 -2.5999999999999999E-2 -2.5000000000000001E-2 0.90700000000000003 -7.8E-2 0.78300000000000003 -0.18 -0.17 -0.17899999999999999 -0.13500000000000001 Other (Income) Expense, net -9.7000000000000003E-2 -0.105 -4.2999999999999997E-2 -0.105 -8.1000000000000003E-2 1.5870000000000002 -0.66399999999999992 Operating Income (Loss) $11.584999999999999 $9.0150000000000006 $13.349000000000002 $7.2469999999999999 $13.726000000000001 $12.084999999999999 $8.3440000000000012 $11.68 $10.758000000000001 $10.247999999999999 $20.391000000000002 $9.0589999999999993 Operating Income (Loss) $38.967999999999996 $40.538000000000004 $41.128999999999998 $-36.372999999999998 $41.195999999999998 $45.834999999999994 $50.456000000000003 Spread 11.585000000000001 9.0150000000000006 13.349 7.2469999999999999 13.726000000000001 12.085000000000001 8.3439999999999994 11.68 10.757999999999999 38.968000000000004 40.537999999999997 41.128999999999998 -36.372999999999998 41.195999999999998 45.835000000000001 50.475999999999999 Check 0 0 0 0 0 0 0 0 0 -10.247999999999999 -20.391000000000002 0 0 0 0 0 0 1.9999999999996021E-2

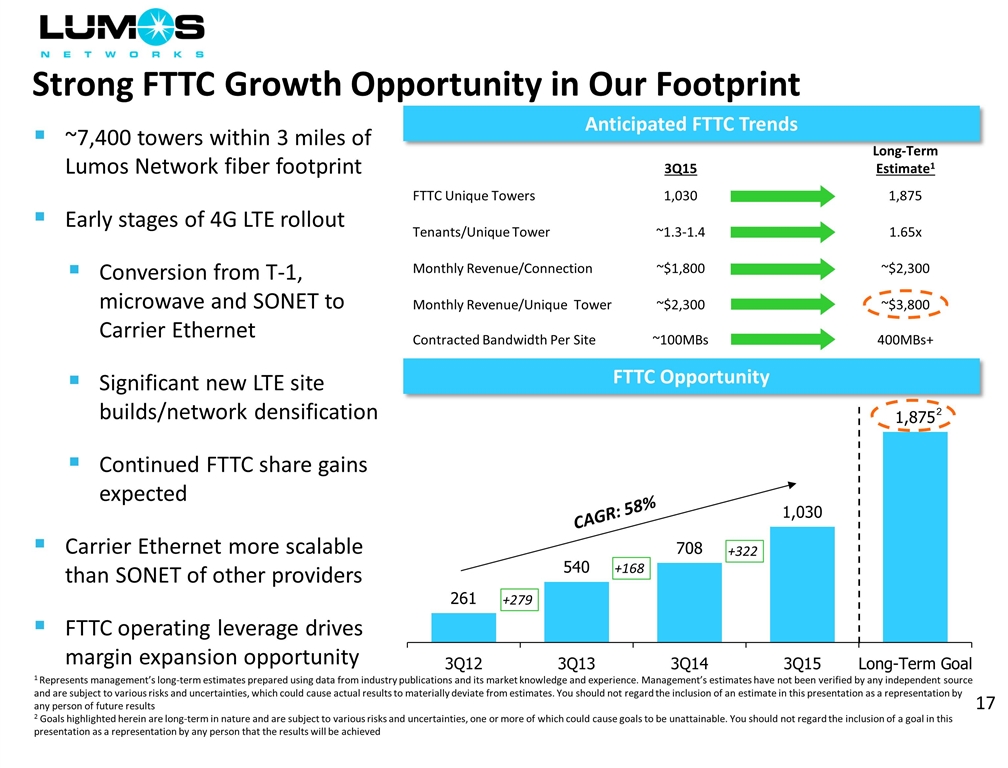

3Q15 Long-Term Estimate1 FTTC Unique Towers 1,030 1,875 Tenants/Unique Tower ~1.3-1.4 1.65x Monthly Revenue/Connection ~$1,800 ~$2,300 Monthly Revenue/Unique Tower Contracted Bandwidth Per Site ~$2,300 ~100MBs ~$3,800 400MBs+ ~7,400 towers within 3 miles of Lumos Network fiber footprint Early stages of 4G LTE rollout Conversion from T-1, microwave and SONET to Carrier Ethernet Significant new LTE site builds/network densification Continued FTTC share gains expected Carrier Ethernet more scalable than SONET of other providers FTTC operating leverage drives margin expansion opportunity Strong FTTC Growth Opportunity in Our Footprint CAGR: 58% Anticipated FTTC Trends +279 +168 +322 1 Represents management’s long-term estimates prepared using data from industry publications and its market knowledge and experience. Management’s estimates have not been verified by any independent source and are subject to various risks and uncertainties, which could cause actual results to materially deviate from estimates. You should not regard the inclusion of an estimate in this presentation as a representation by any person of future results 2 Goals highlighted herein are long-term in nature and are subject to various risks and uncertainties, one or more of which could cause goals to be unattainable. You should not regard the inclusion of a goal in this presentation as a representation by any person that the results will be achieved 2 FTTC Opportunity

FTTC as a percentage of total Lumos Data revenue 2012: ~8% 2013: ~14% 2014: ~19% 2015: ~25% Annual FTTC Revenue 1 Goals highlighted herein are long-term in nature and are subject to various risks and uncertainties, one or more of which could cause goals to be unattainable. You should not regard the inclusion of a goal in this presentation as a representation by any person that the results will be achieved FTTC Revenue Growth ($ in Millions) Long-term goal of $85 million 1

Total FTTC Connections on Track Total FTTC Connections

Key Enterprise Accounts

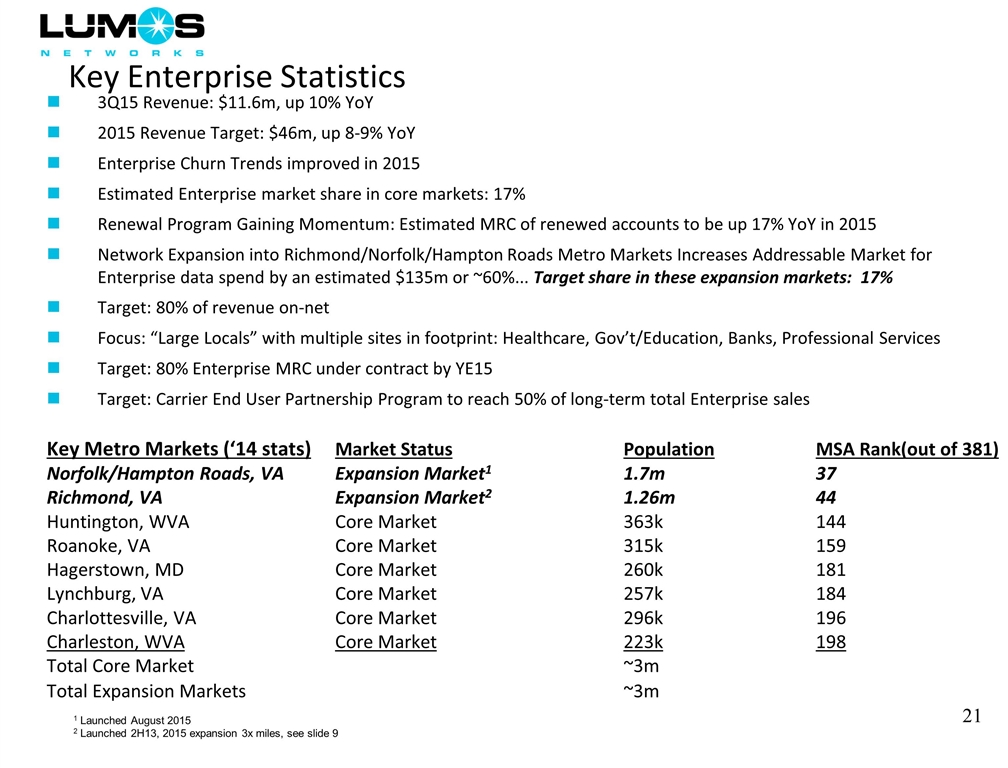

Key Enterprise Statistics 3Q15 Revenue: $11.6m, up 10% YoY 2015 Revenue Target: $46m, up 8-9% YoY Enterprise Churn Trends improved in 2015 Estimated Enterprise market share in core markets: 17% Renewal Program Gaining Momentum: Estimated MRC of renewed accounts to be up 17% YoY in 2015 Network Expansion into Richmond/Norfolk/Hampton Roads Metro Markets Increases Addressable Market for Enterprise data spend by an estimated $135m or ~60%... Target share in these expansion markets: 17% Target: 80% of revenue on-net Focus: “Large Locals” with multiple sites in footprint: Healthcare, Gov’t/Education, Banks, Professional Services Target: 80% Enterprise MRC under contract by YE15 Target: Carrier End User Partnership Program to reach 50% of long-term total Enterprise sales Key Metro Markets (‘14 stats) Market Status Population MSA Rank(out of 381) Norfolk/Hampton Roads, VAExpansion Market11.7m37 Richmond, VAExpansion Market2 1.26m44 Huntington, WVACore Market363k144 Roanoke, VACore Market315k159 Hagerstown, MDCore Market260k181 Lynchburg, VACore Market257k184 Charlottesville, VACore Market296k196 Charleston, WVA Core Market 223k 198 Total Core Market ~3m Total Expansion Markets~3m 1 Launched August 2015 2 Launched 2H13, 2015 expansion 3x miles, see slide 9

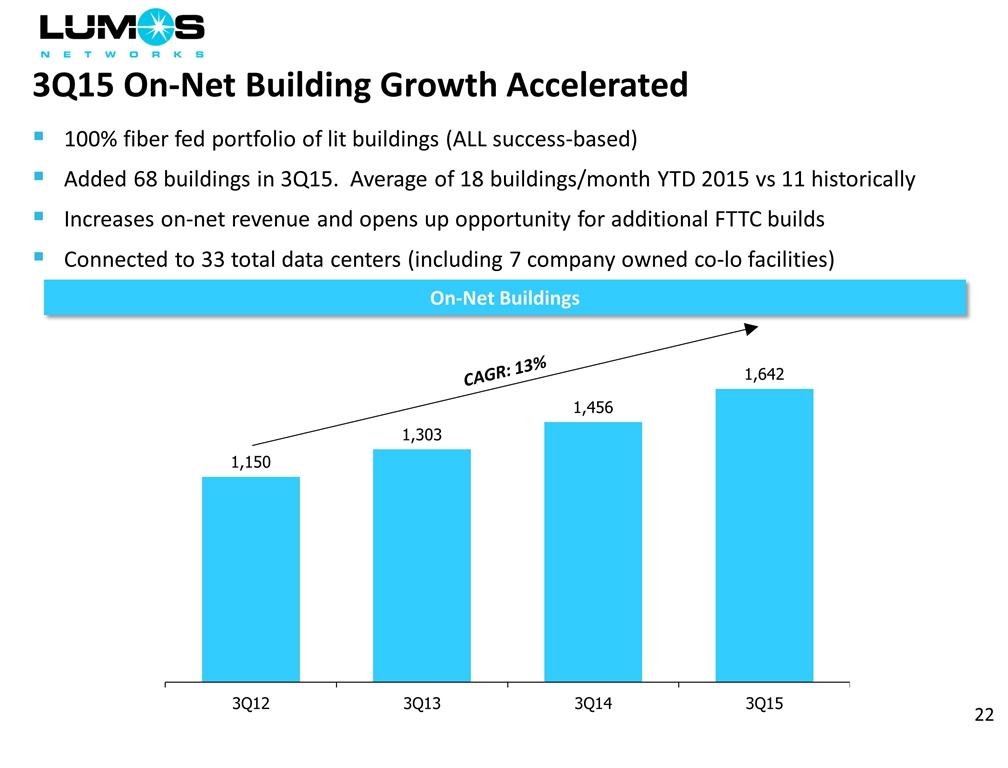

100% fiber fed portfolio of lit buildings (ALL success-based) Added 68 buildings in 3Q15. Average of 18 buildings/month YTD 2015 vs 11 historically Increases on-net revenue and opens up opportunity for additional FTTC builds Connected to 33 total data centers (including 7 company owned co-lo facilities) 3Q15 On-Net Building Growth Accelerated On-Net Buildings CAGR: 13%

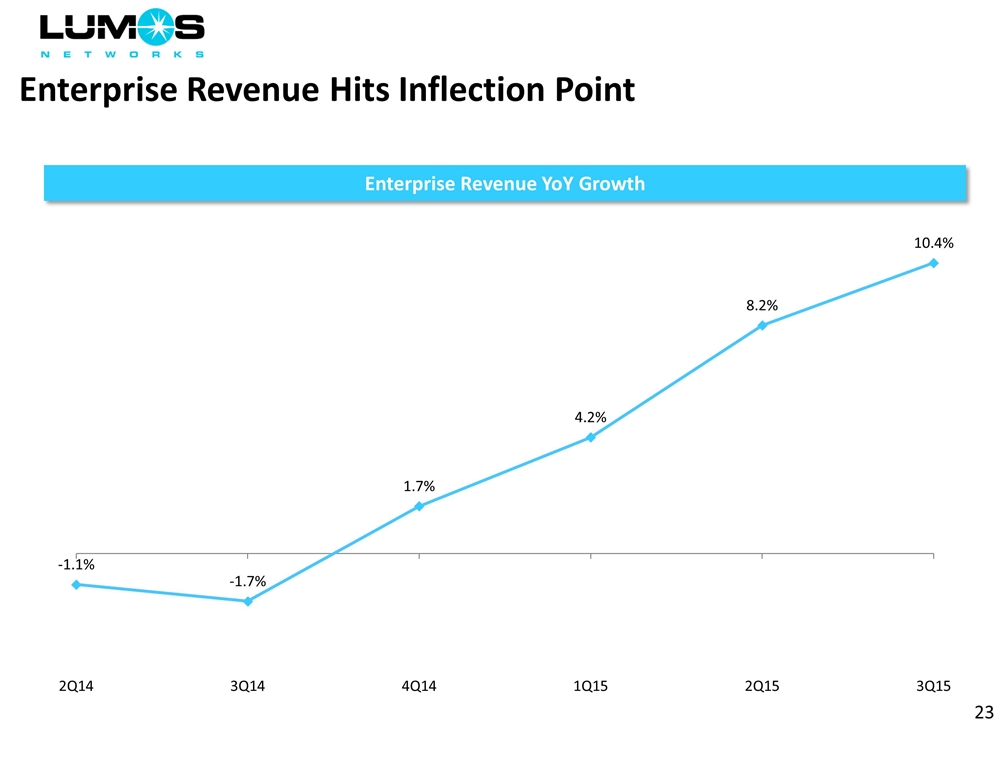

Enterprise Revenue Hits Inflection Point Enterprise Revenue YoY Growth

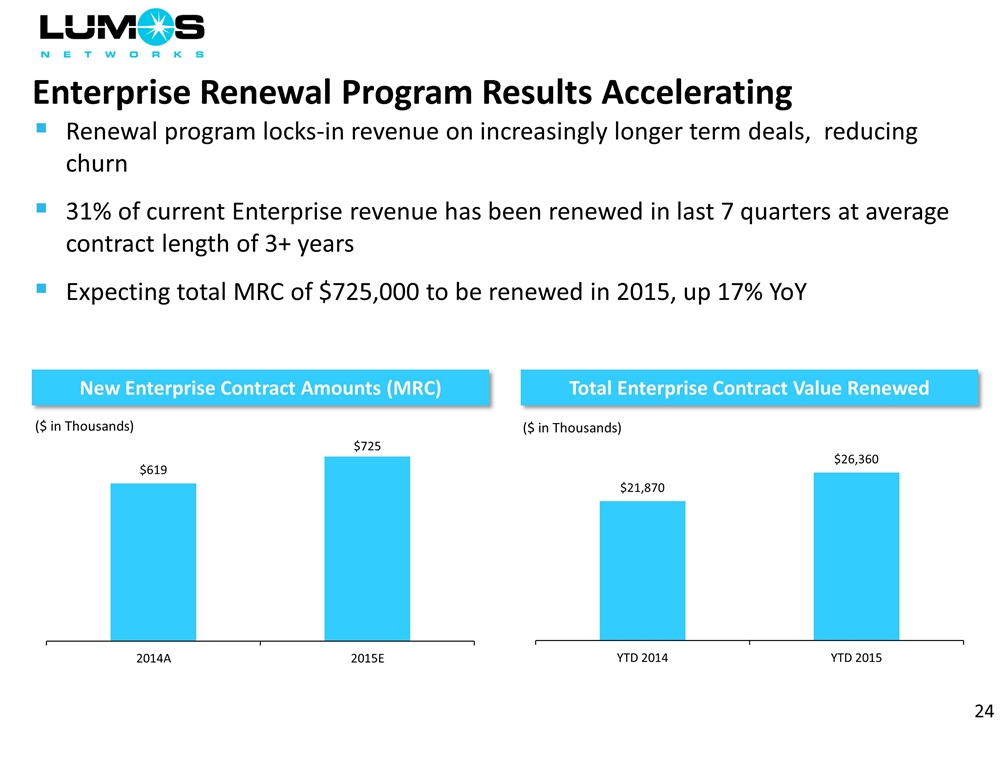

Enterprise Renewal Program Results Accelerating New Enterprise Contract Amounts (MRC) Total Enterprise Contract Value Renewed ($ in Thousands) Renewal program locks-in revenue on increasingly longer term deals, reducing churn 31% of current Enterprise revenue has been renewed in last 7 quarters at average contract length of 3+ years Expecting total MRC of $725,000 to be renewed in 2015, up 17% YoY ($ in Thousands)

Carrier End User Pipeline Building with Growing MSA Partners Solid Pipeline in Place for 2015 Leverage Lumos Networks’ 8,408 mile fiber footprint to target incremental Enterprise customers with thousands of sales people from leading national service providers 79 MSAs signed/pending with major U.S. operators, MSOs and fiber companies operating in our footprint Pro forma “near-net” list buildings within ½ mile of our footprint of 104,000 (67,000 pre-expansion), including planned 665 fiber route-mile expansion in the Norfolk, Richmond, Petersburg and Hampton Roads, VA metro markets Carrier End User Sales Grew Over 100% in 2014 2013: $77,000 2014: $294,000 2015 (target): ~$400,000 New Distribution Channel for Enterprise Data

33 total data center connections as of 3Q15 Includes 20 commercial, 6 private and 7 Lumos operated data centers Lumos Co-los: Washington PA, Waynesboro VA, Charlottesville VA, Covington VA, Harrisonburg VA, Lynchburg VA, Charleston WV Key data center relationships: Peak 10, Iron Mountain, QTS, DC Corp, Alpha Technologies Increasingly, Enterprise traffic moving to data centers with customers requesting secure, fiber bandwidth access to those locations ~100+ data center market opportunity within existing footprint Lumos is under-penetrated in data center connections relative to fiber peers. Data center connections represent promising fiber bandwidth revenue upside Data Center Fiber Connection Strategy 33 Total Data Center Connections

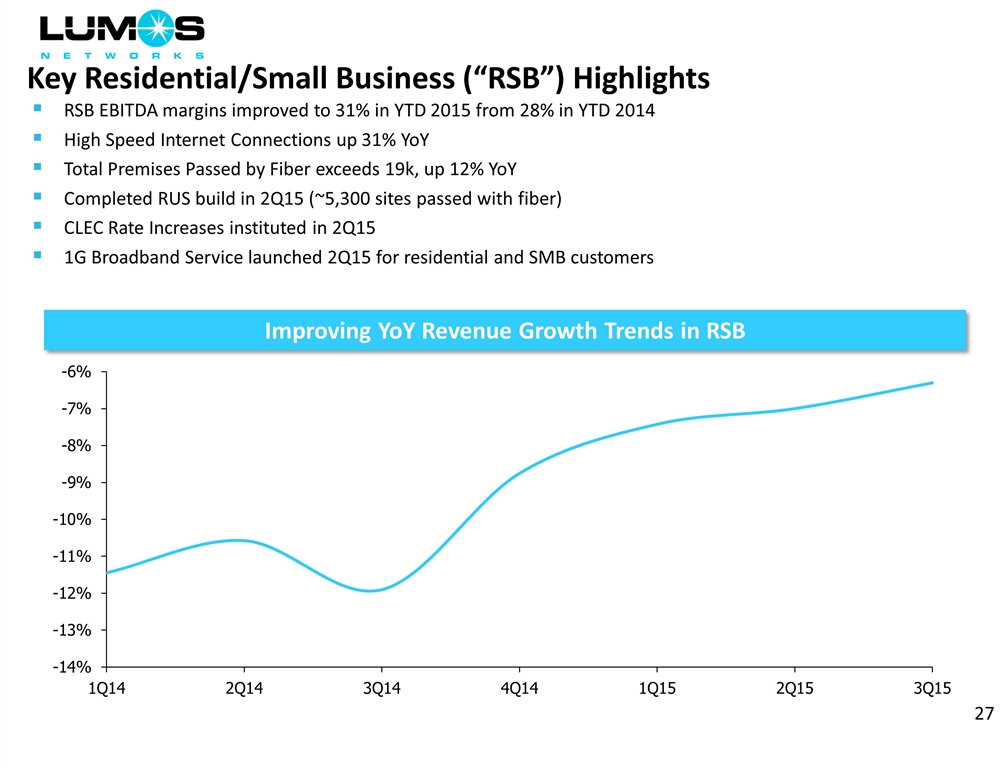

Key Residential/Small Business (“RSB”) Highlights RSB EBITDA margins improved to 31% in YTD 2015 from 28% in YTD 2014 High Speed Internet Connections up 31% YoY Total Premises Passed by Fiber exceeds 19k, up 12% YoY Completed RUS build in 2Q15 (~5,300 sites passed with fiber) CLEC Rate Increases instituted in 2Q15 1G Broadband Service launched 2Q15 for residential and SMB customers Improving YoY Revenue Growth Trends in RSB

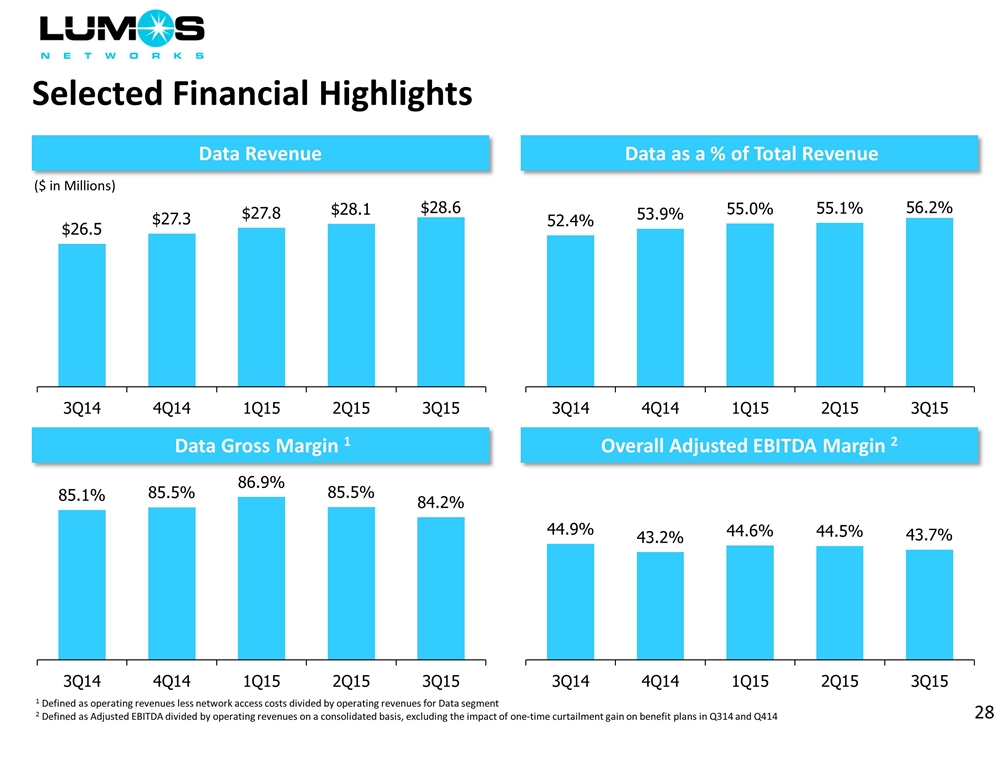

Selected Financial Highlights Data Revenue Data as a % of Total Revenue Data Gross Margin 1 Overall Adjusted EBITDA Margin 2 ($ in Millions) 1 Defined as operating revenues less network access costs divided by operating revenues for Data segment 2 Defined as Adjusted EBITDA divided by operating revenues on a consolidated basis, excluding the impact of one-time curtailment gain on benefit plans in Q314 and Q414

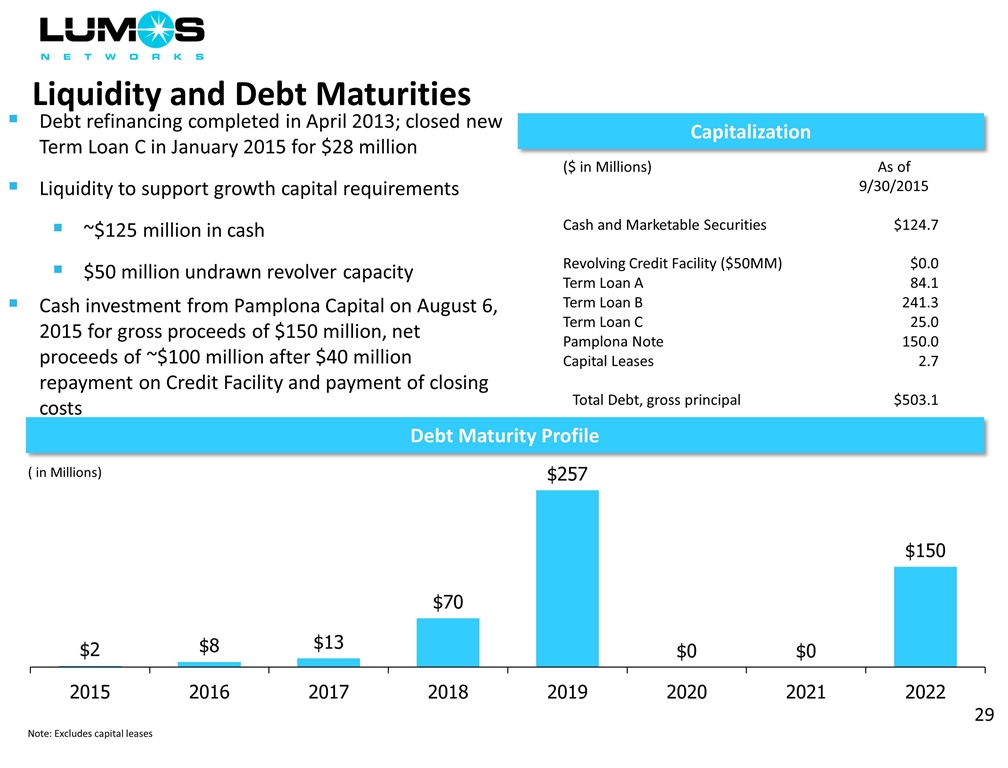

Liquidity and Debt Maturities Debt refinancing completed in April 2013; closed new Term Loan C in January 2015 for $28 million Liquidity to support growth capital requirements ~$125 million in cash $50 million undrawn revolver capacity Cash investment from Pamplona Capital on August 6, 2015 for gross proceeds of $150 million, net proceeds of ~$100 million after $40 million repayment on Credit Facility and payment of closing costs Debt Maturity Profile Capitalization Note: Excludes capital leases ( in Millions) ($ in Millions) As of 9/30/2015 Cash and Marketable Securities $124.7 Revolving Credit Facility ($50MM) $0.0 Term Loan A 84.1 Term Loan B 241.3 Term Loan C 25.0 Pamplona Note 150.0 Capital Leases 2.7 Total Debt, gross principal $503.1