Form 8-K Lumos Networks Corp. For: Mar 04

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

FORM 8-K

|

|

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 4, 2015

|

|

Lumos Networks Corp.

(Exact Name of Registrant as Specified in Charter)

|

|

|

Delaware (State or Other Jurisdiction of Incorporation) |

001-35180 (Commission File Number) |

80-0697274 (IRS Employer Identification No.) |

One Lumos Plaza, P.O. Box 1068, Waynesboro, Virginia 22980

(Address of Principal Executive Offices) (Zip Code)

(540) 946-2000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02Results of Operations and Financial Condition.

On March 4, 2015, Lumos Networks Corp. issued a press release announcing its results of operations and financial condition for the three and twelve months ended December 31, 2014. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01Regulation FD Disclosure.

A copy of the materials that Lumos Networks Corp. will present in connection with upcoming presentations to investors is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. The information in this Report will not be deemed as an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

Item 8.01Other Events.

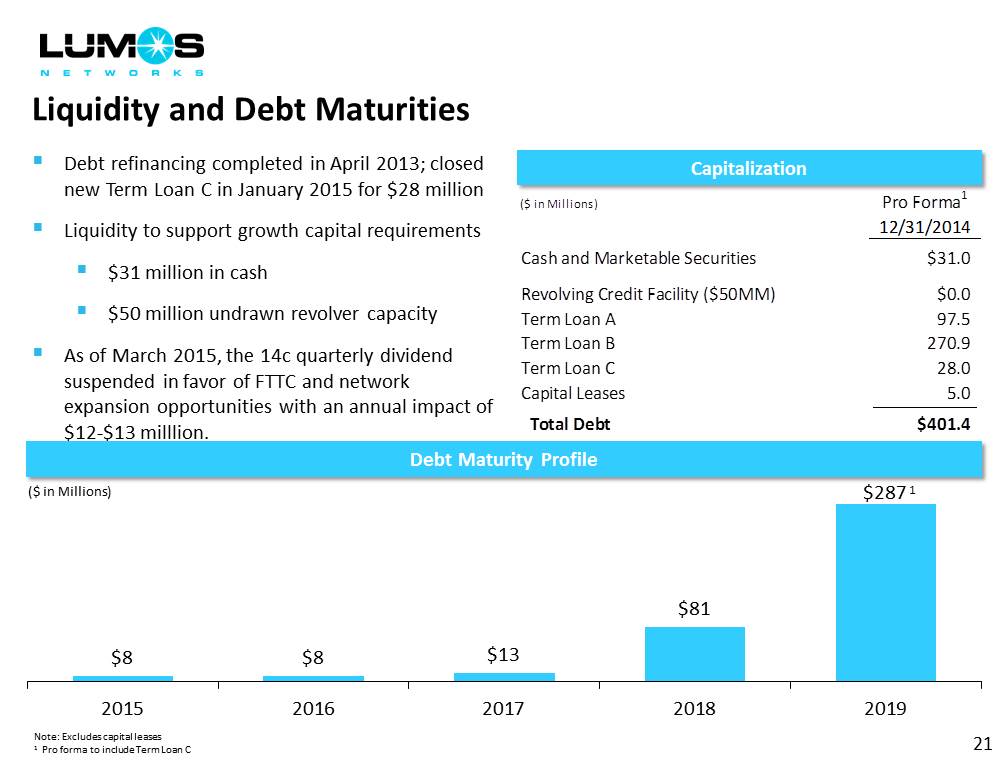

On March 4, 2015, the Company’s Board of Directors suspended the Company’s quarterly dividend in favor of allocating capital to growth opportunities.

Item 9.01Financial Statements and Exhibits.

(d)Exhibits

|

Exhibit No. |

|

Description |

|

|

99.1 |

|

Press release issued by Lumos Networks Corp. dated March 4, 2015 |

|

|

99.2 |

|

Company Presentation – Fourth Quarter 2014 Update |

|

1

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 4, 2015

|

LUMOS NETWORKS CORP. |

|

|

|

|

|

By: |

/s/ Johan G. Broekhuysen |

|

|

Johan G. Broekhuysen Executive Vice President, Chief Financial Officer and Chief Accounting Officer |

2

Exhibit Index

Exhibit No.Description

99.1Press release issued by Lumos Networks Corp. dated March 4, 2015

99.2Company Presentation – Fourth Quarter 2014 Update

3

Contact:Will Davis

Vice President of Investor Relations and Chief of Staff

Phone: (c) 917-519-6994

Email: [email protected]

Lumos Networks Corp. Reports Fourth Quarter and Annual 2014 Financial Results

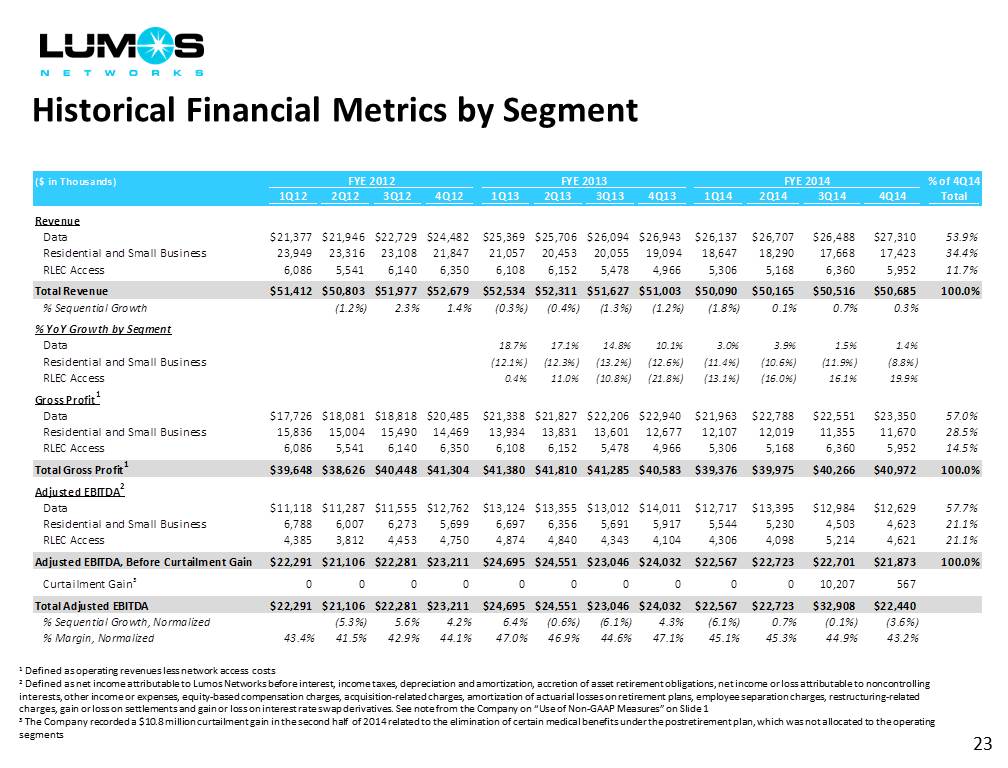

Delivers 2014 Revenue of $201.5 Million and Adjusted EBITDA of $100.6 Million, which includes a $10.8 Million Benefit Plan Curtailment Gain

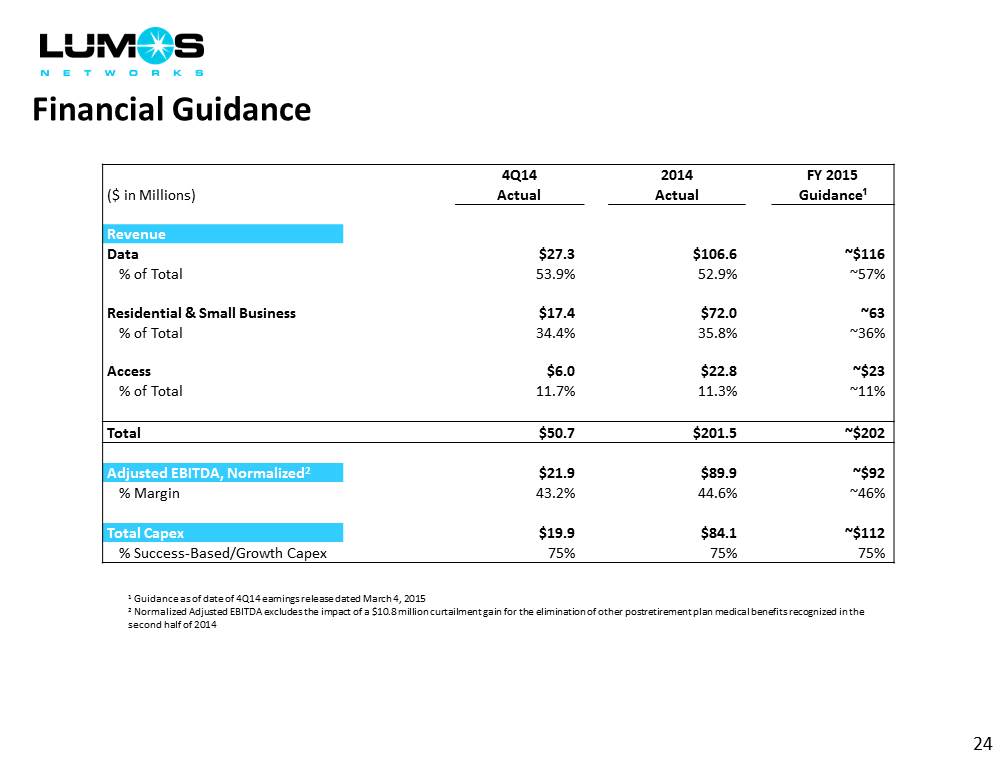

Provides 2015 Revenue and Adjusted EBITDA Guidance of Approximately $202 Million and $92 Million

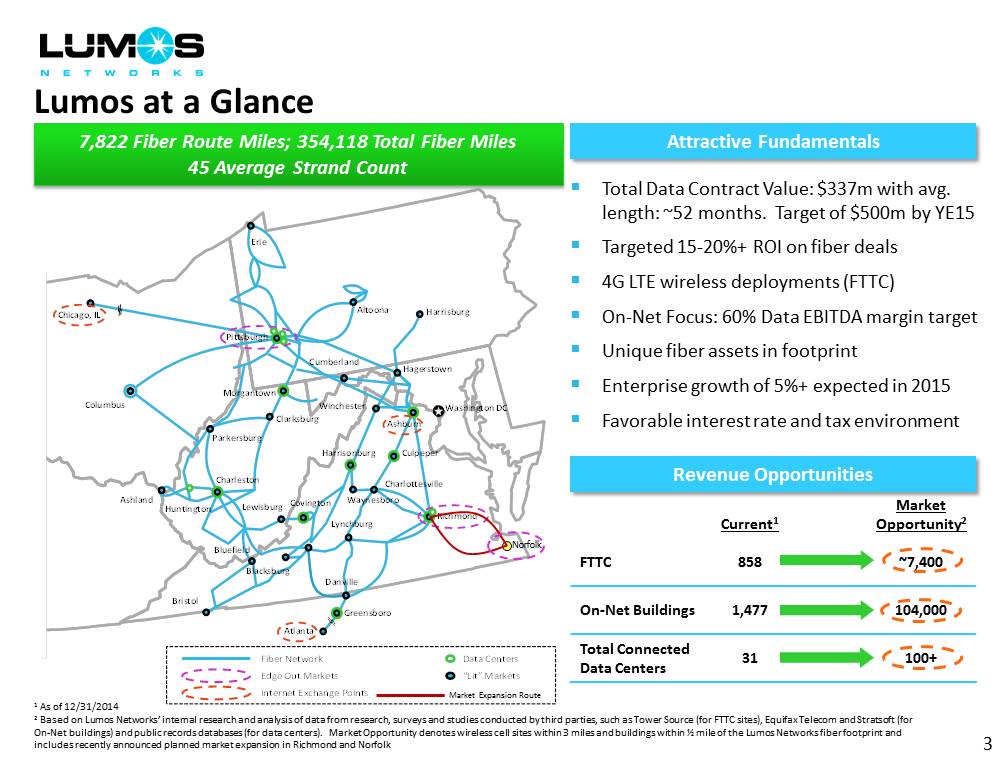

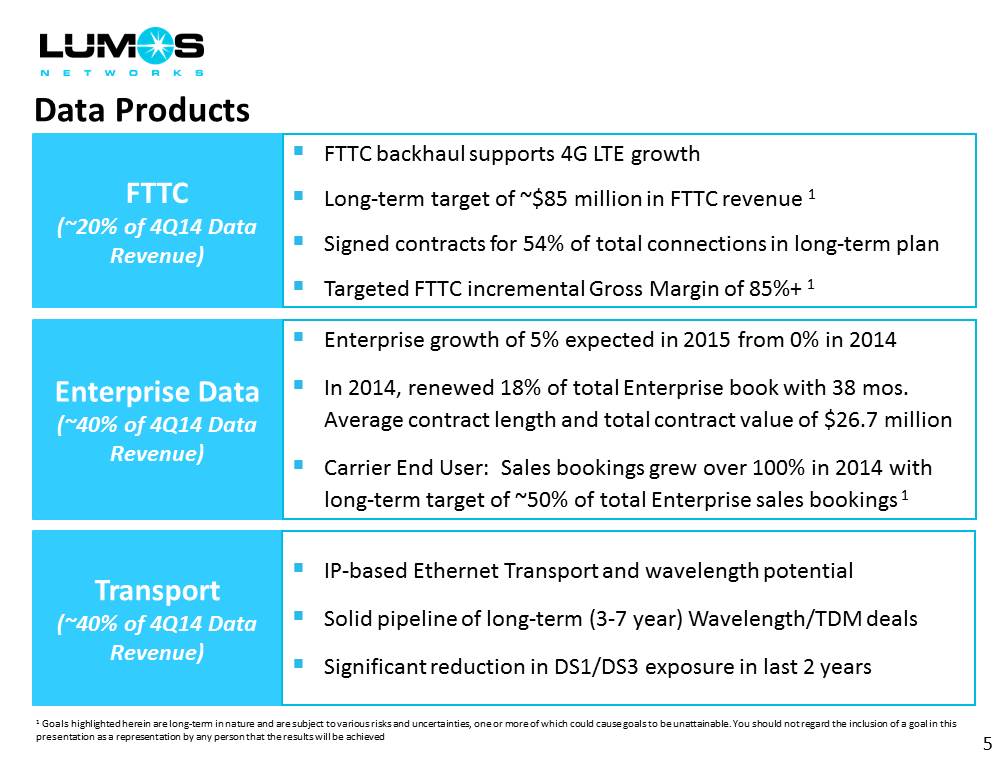

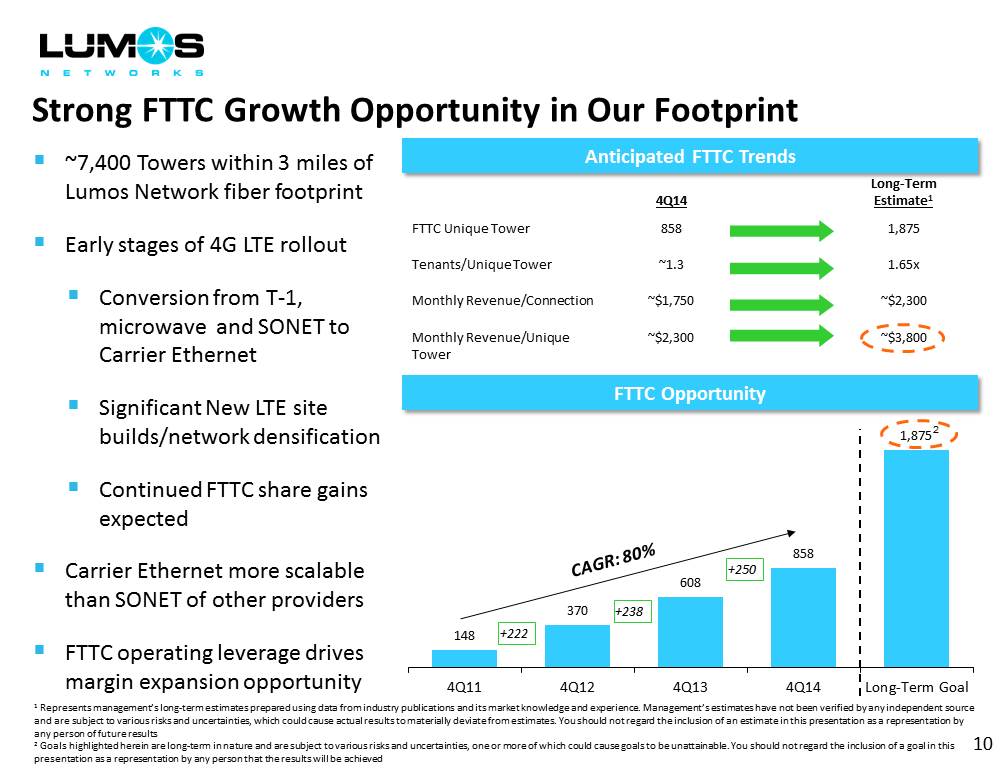

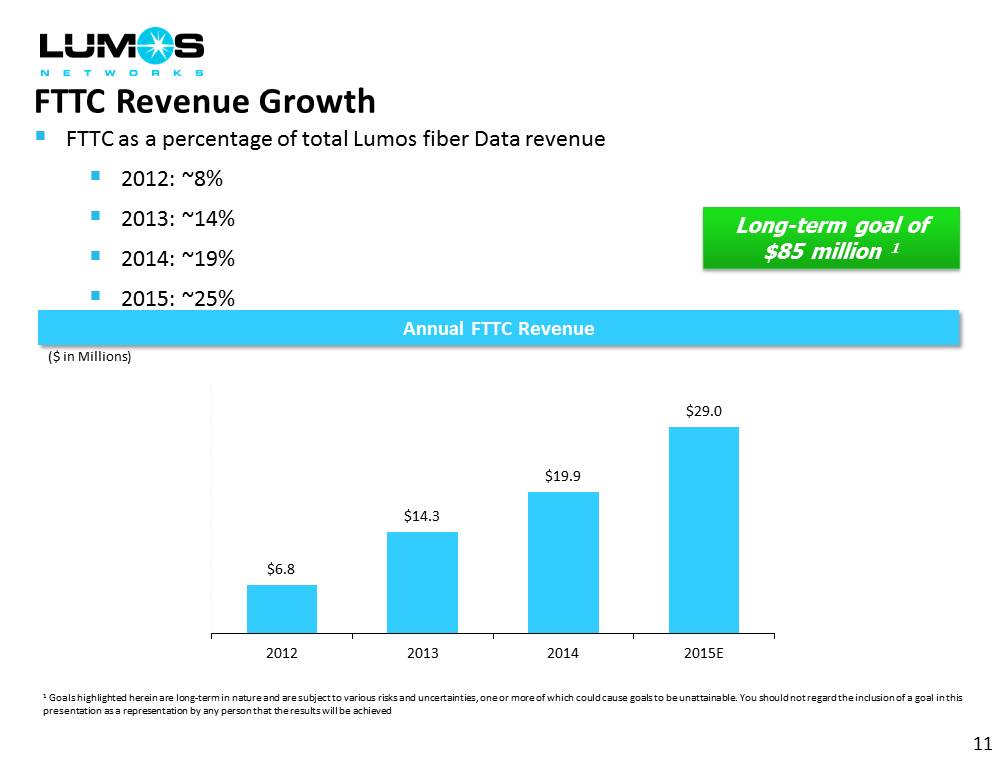

Achieves 2014 Fiber to the Cell (“FTTC”) Revenue of Nearly $20 Million, 858 Unique FTTC Sites at YE 2014

Targeting 2015 Data Revenue of $116 Million, up 9% Year-over-Year

Targets total FTTC Installed Connections of 1,700 by YE 2015

Expects 6% Enterprise Revenue growth in 2015

Board of Directors Approves Suspension of Quarterly Dividend

WAYNESBORO, VA – March 4, 2015 – Lumos Networks Corp. (“Lumos Networks”, “Lumos” or the “Company”) (Nasdaq: LMOS), a fiber-based service provider of data, voice and IP-based telecommunication services in the Mid-Atlantic region, today announced financial results for the fourth quarter of 2014 and full-year 2014.

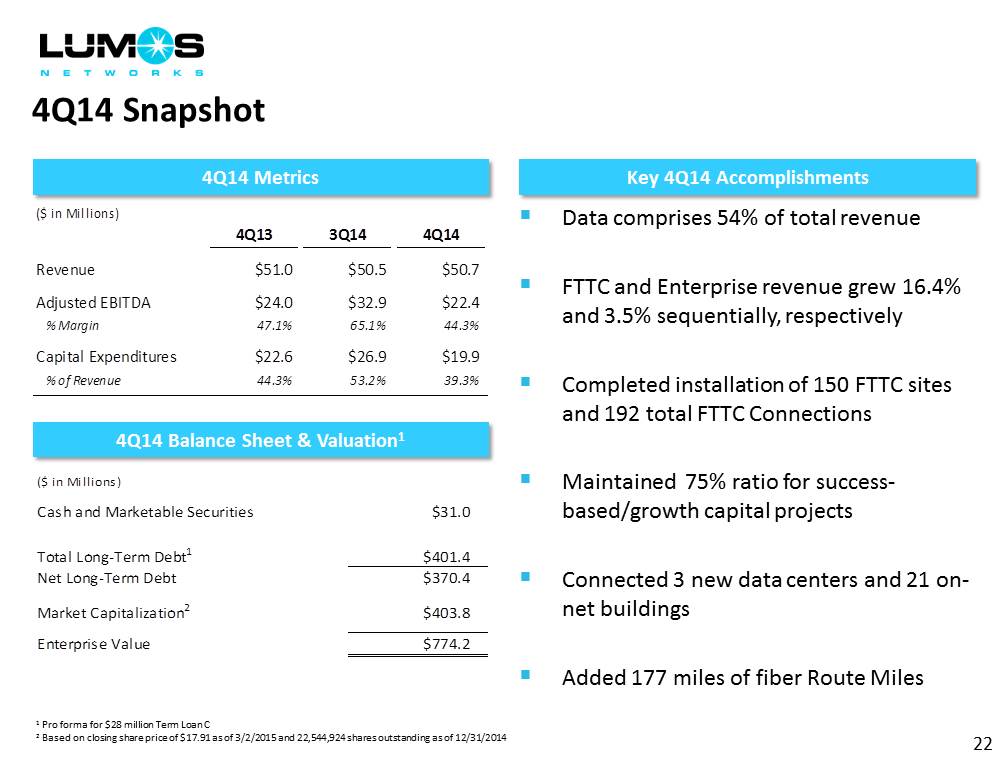

Total revenue in 2014 was $201.5 million down 3% from 2014. Total Adjusted EBITDA in 2014 was $89.9 million, excluding a one-time, non-cash gain of $10.8 million related to a reduction in our liability for certain postretirement medical benefits (the “OPEBs gain”), versus $96.3 million in 2013, or down 7%. In the fourth quarter of 2014, total revenue was $50.7 million and total Adjusted EBITDA was $21.9 million, excluding an OPEBs gain of $0.6 million.

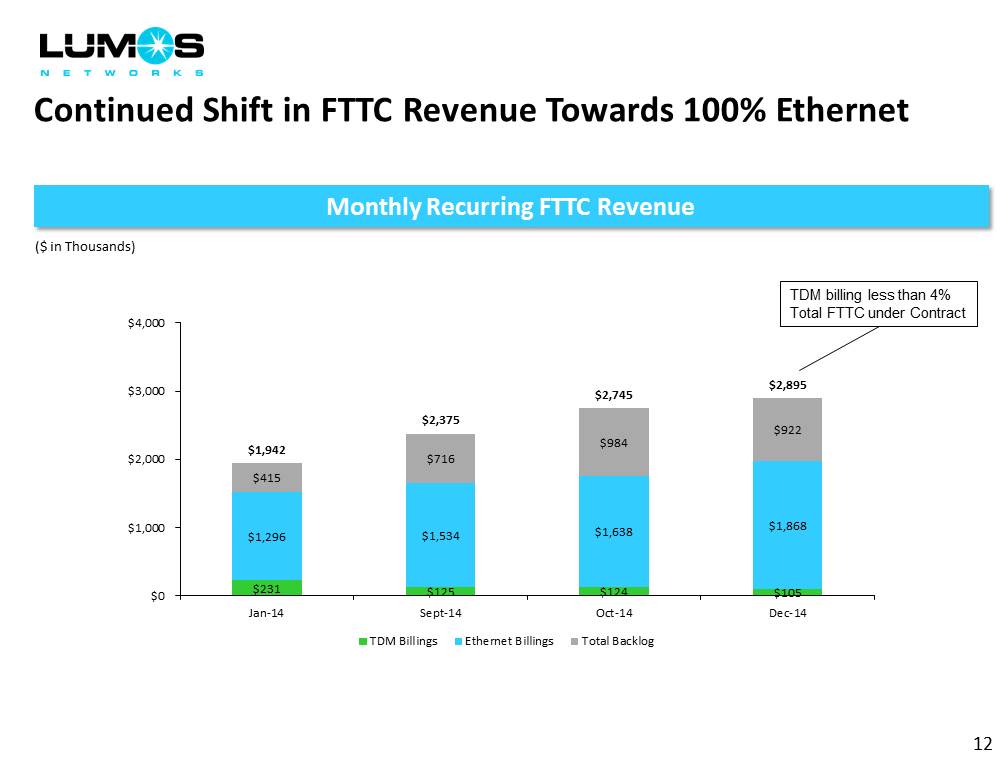

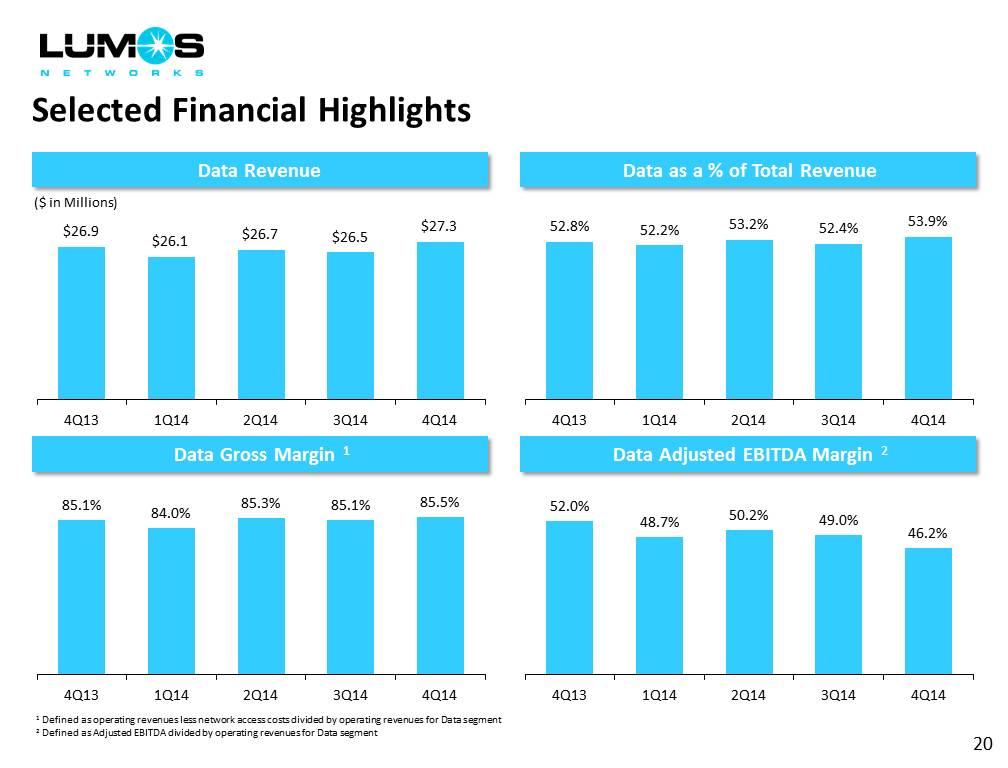

Total Data segment revenue in the fourth quarter of 2014 was $27.3 million, up approximately 3% sequentially, and constituted 54% of total revenue as compared to 53% in the prior year period. The Company posted over 16% sequential growth in Fiber to the Cell (“FTTC”) site revenue to $5.5 million and Enterprise revenue grew 3% sequentially and over 2% from the prior year.

“I am pleased to announce that Lumos Networks achieved its 2014 targets of approximately $200 million in revenue and $90 million in Adjusted EBITDA. We also hit our targets for 2014 FTTC revenue and surpassed our target for unique FTTC sites,“ said Lumos Networks President and CEO Timothy G. Biltz. “But even more importantly, our 2015 financial guidance demonstrates our expectations for continued solid execution of the Lumos strategy. In 2015, we expect that revenue and Adjusted EBITDA will grow, and we expect that our data segment revenue will grow approximately 9% to $116 million.”

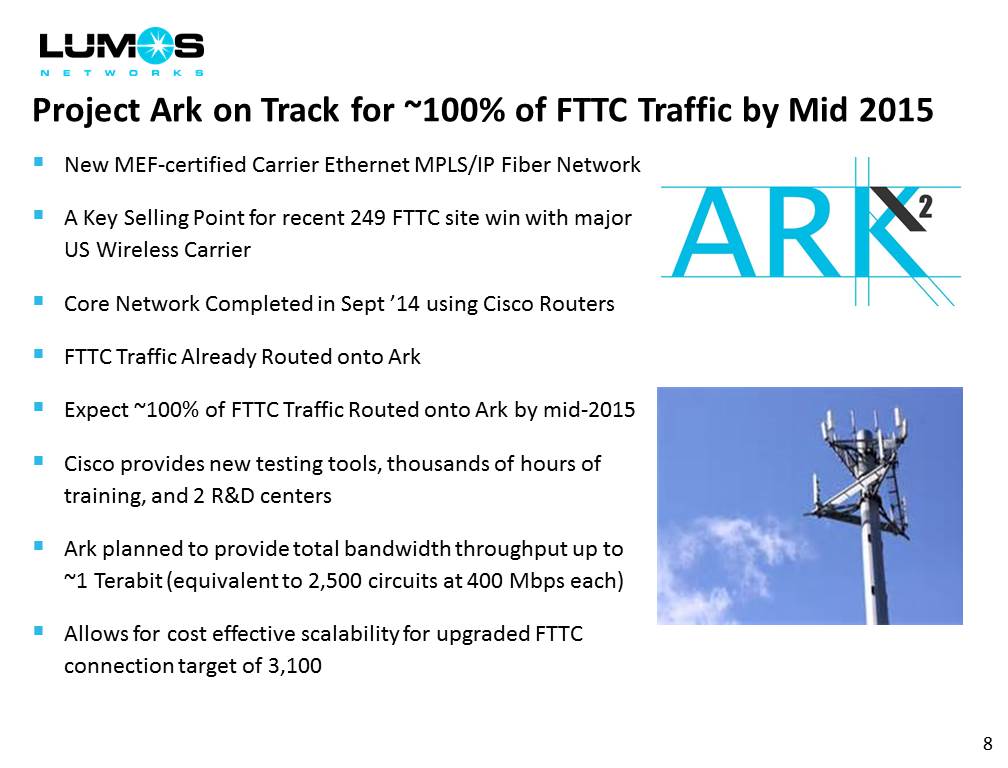

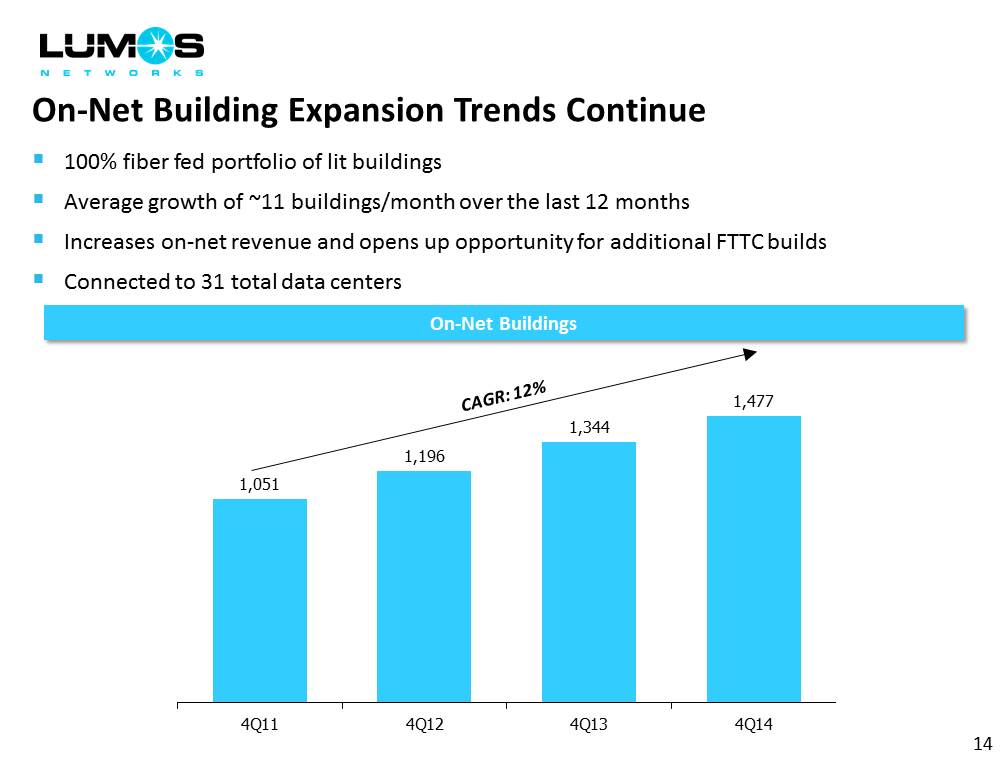

The Company remains focused on building valuable, dense fiber infrastructure underpinned by long-term Ethernet, MPLS and wavelength contracts. In 2014, the Company increased its FTTC connections by 375, added 250 unique FTTC connections, added 408 route miles of fiber, connected to an incremental 133 lit buildings and 7 data centers.

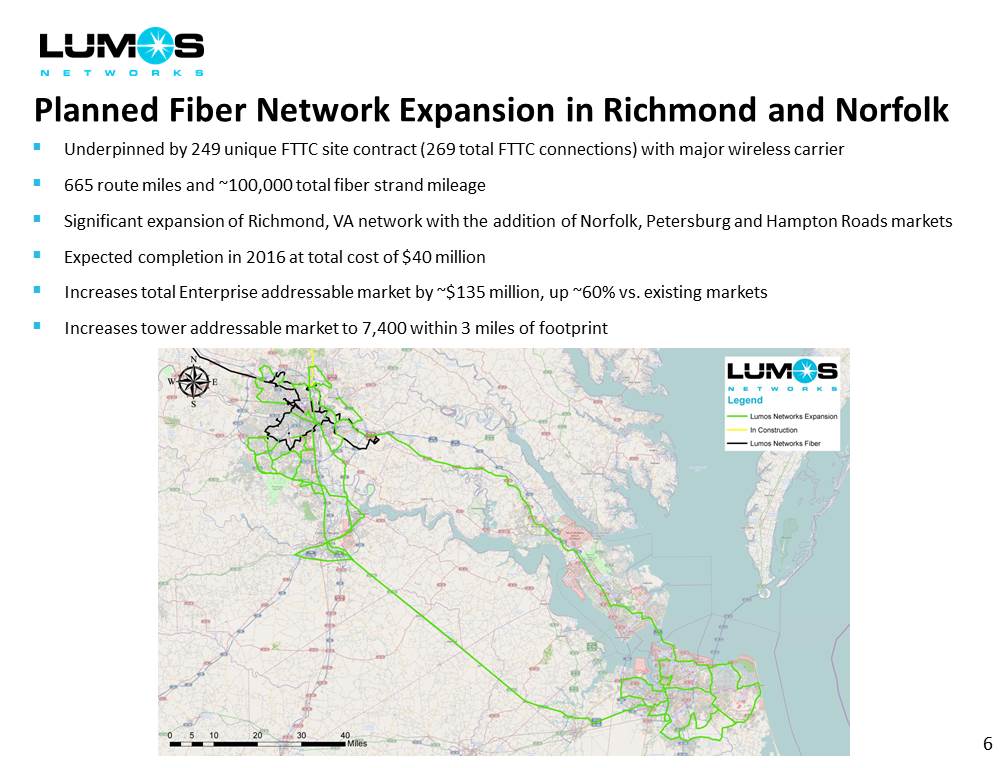

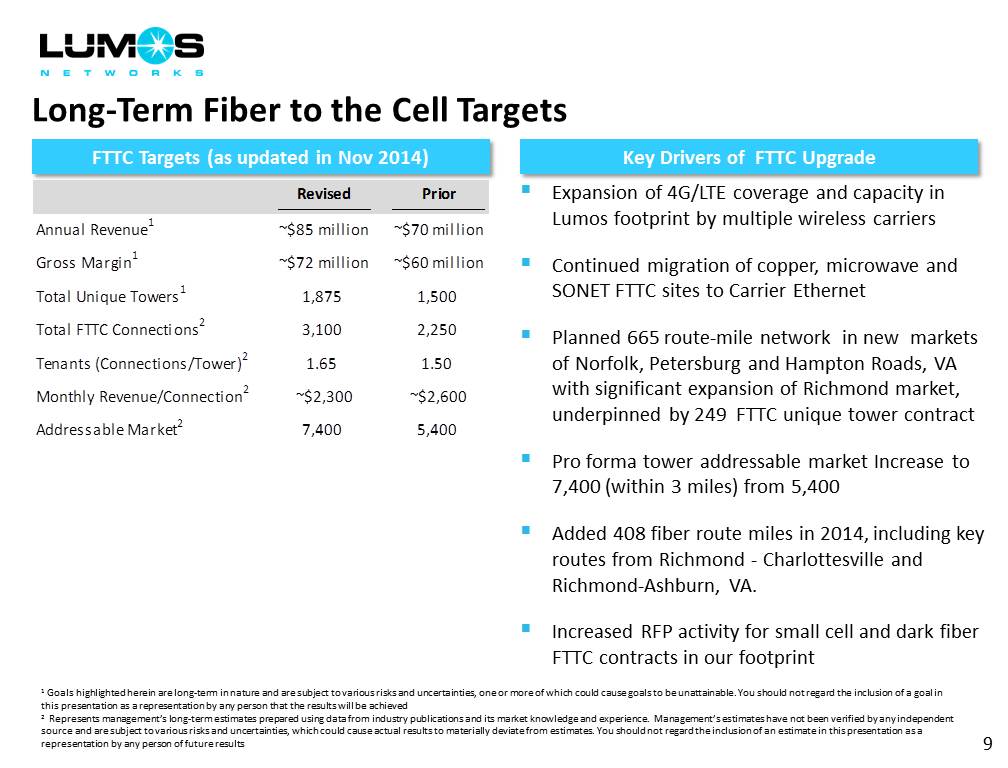

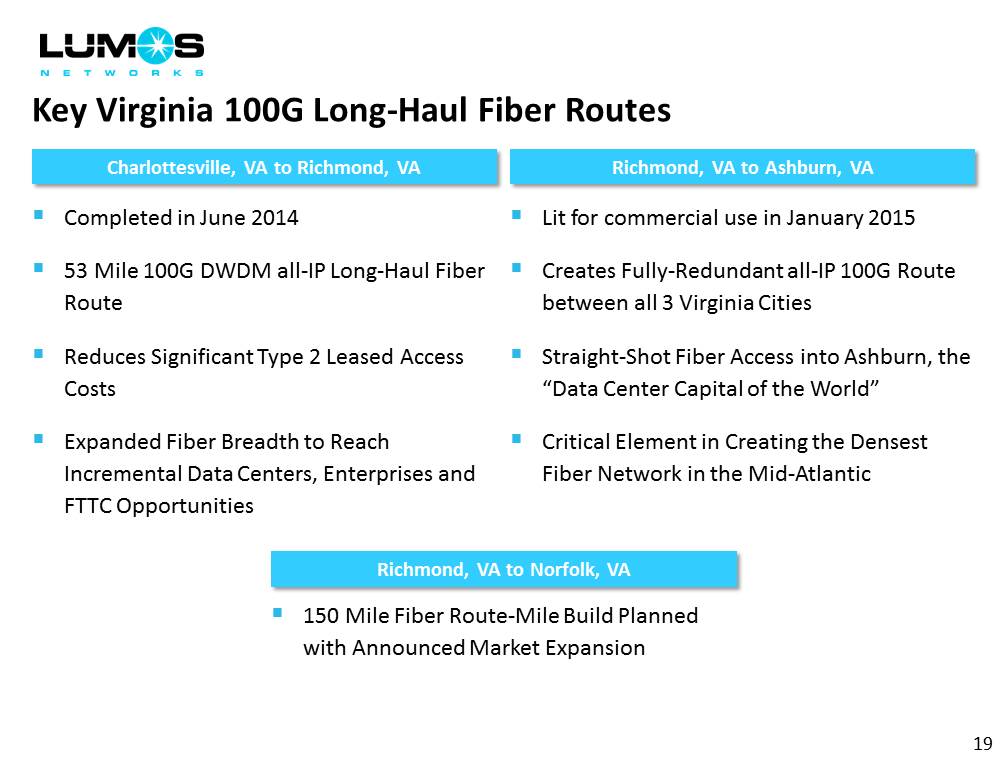

“We expect to accelerate these fiber investments in 2015 as we install our $1.3 million backlog of monthly recurring revenue of high-value data products and complete our investment on Project Ark, our all-IP network overlay focused on FTTC traffic,” Mr. Biltz continued, “We expect to end 2015 with 1,700 FTTC connections, an increase of nearly 550, which would represent around $35 million in annualized FTTC revenue, once installed. Additionally, we are accelerating the completion of our previously announced 665 fiber route mile network expansion in Richmond, Hampton Roads, Petersburg and Norfolk, Virginia to the first half of 2016 from our original plan of the second half of 2016. To this end, we expect total capital expenditures to be approximately $112 million in 2015.”

1

Highlights

|

• |

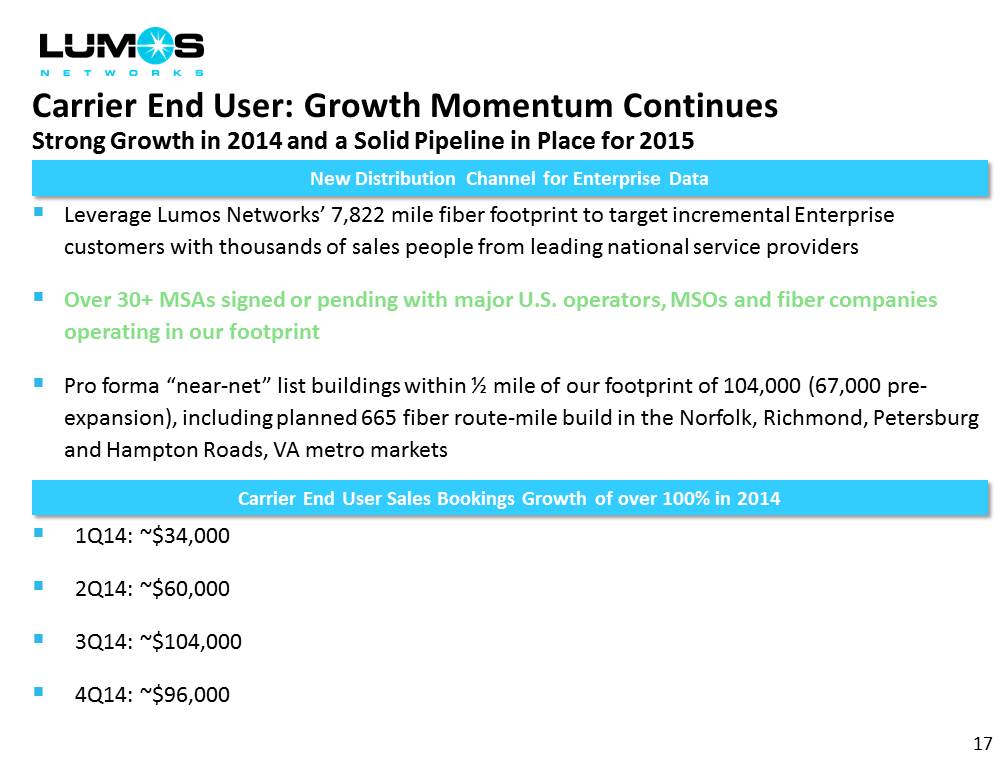

Lumos Networks achieved total data sales bookings of over $2.5 million in monthly recurring revenue in 2014, up over 30% versus 2013. The vast majority of 2014 sales involved advanced data products like carrier Ethernet, MPLS and wavelengths. FTTC and Carrier End User sales grew over 100% in 2014. Lumos sold 735 FTTC connections in 2014 versus guidance of 500-700. |

|

• |

The Company’s previously announced 665 fiber route mile network expansion is expected over time to increase the Company’s Addressable Market of cell sites to 7,400 and increase its Enterprise Addressable Market by $135 million, an increase of 60% versus the Company’s core markets. |

|

• |

The Company ended 2014 with 858 connected FTTC sites, up 150 sequentially, representing a year-over-year increase in total FTTC sites of approximately 41%. Total 2014 FTTC revenue of $19.9 million grew 40% year-over-year. As of year-end 2014, the Company had 1,153 total FTTC connections, up 48% from the prior year, representing annualized FTTC revenue of approximately $24 million. |

|

• |

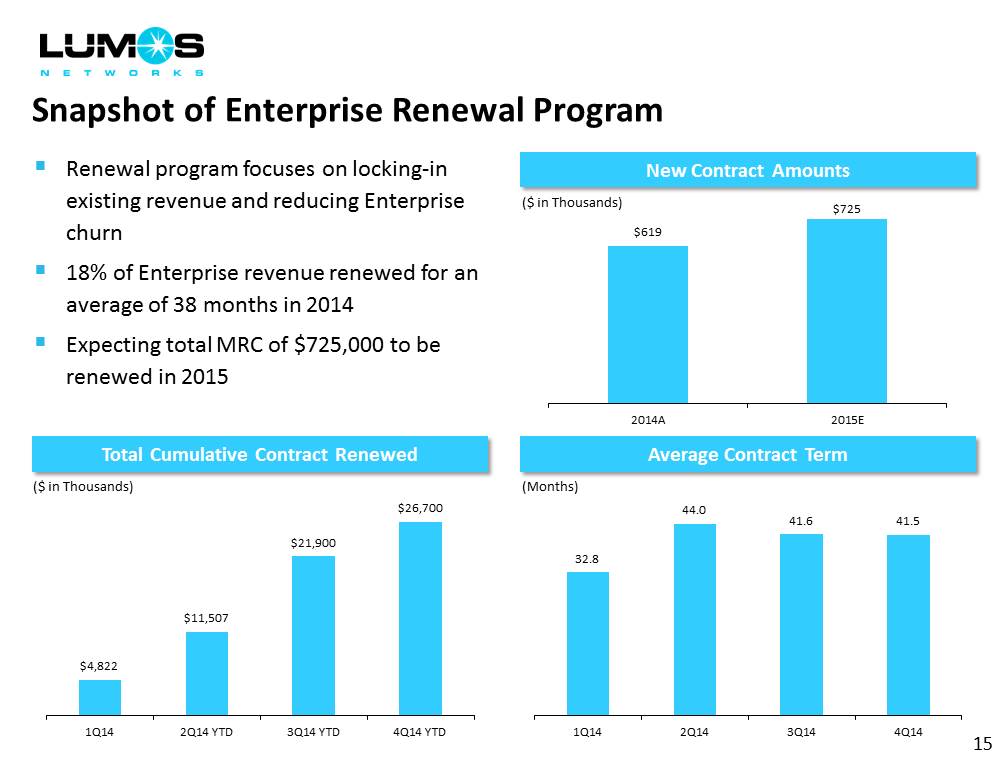

In 2014, Lumos renewed Enterprise accounts worth nearly $619,000 in monthly recurring revenue, or approximately 18% of the total Enterprise base, with an average contract length of 38 months. These renewal efforts produced a total contract value of nearly $27 million. |

|

• |

On March 4, 2015, the Board of Directors of Lumos Networks suspended the quarterly dividend, with an annual cash impact of $12 to $13 million, in favor of FTTC and network expansion opportunities. |

Business Outlook

For the full year 2015, the Company initiates financial guidance for revenue of approximately $202 million, Adjusted EBITDA of approximately $92 million and capital expenditures of approximately $112 million.

Please see the schedules accompanying this release for additional financial guidance, including reconciliations of non-GAAP measures to GAAP results.

Statements made are based on management’s current expectations. These statements are forward-looking and actual results may differ materially. Please see “Special Note from the Company Regarding Forward-Looking Statements.”

Conference Call

A conference call and simultaneous webcast, hosted by Timothy G. Biltz, CEO, Johan Broekhuysen, CFO, and Will Davis, Vice President of Investor Relations and Chief of Staff, to review these financial and operational results and financial guidance will be held at 8:30 A.M. (ET) on March 5, 2015.

The webcast may be accessed via the Internet at http://ir.lumosnetworks.com/ and the live call (“Lumos Networks Fourth Quarter Earnings Conference Call”) may be accessed with the following numbers:

Domestic: 1-877-510-3772

International: 1-412-902-4135

Canada: 1-855-669-9657

The conference call will be archived and available for replay through March 20, 2015 and may be accessed with the following numbers:

Domestic: 1-877-344-7529

International: 1-412-317-0088

Canada: 1-855-669-9658

Replay pass codes: Conference ID: 10060806

The webcast will also be archived and the replay may be accessed at http://ir.lumosnetworks.com/.

2

About Lumos Networks

Lumos Networks is a fiber-based provider in the Mid-Atlantic region serving Carrier and Enterprise customers offering end to end connectivity in 23 markets in Virginia, Pennsylvania, West Virginia, Maryland, Ohio and Kentucky. With a fiber network of 7,822 fiber route miles, Lumos Networks connects to 858 Fiber to the Cell sites, 31 data centers and 1,477 on-net buildings. In 2014, Lumos Networks generated over $106 million in Data Revenue over its fiber network. Detailed information about Lumos Networks is available at www.lumosnetworks.com.

Non-GAAP Measures

Adjusted EBITDA is defined as net income attributable to Lumos Networks before interest, income taxes, depreciation and amortization, accretion of asset retirement obligations, net income or loss attributable to noncontrolling interests, other income or expenses, equity-based compensation charges, acquisition-related charges, amortization of actuarial losses on retirement plans, employee separation charges, restructuring-related charges, gain or loss on settlements and gain or loss on interest rate swap derivatives. Adjusted EBITDA margin is calculated as the ratio of Adjusted EBITDA, as defined, to operating revenues.

Adjusted EBITDA is a non-GAAP financial performance measure. It should not be considered in isolation or as an alternative to measures determined in accordance with GAAP. Please refer to the schedules herein and our SEC filings for a reconciliation of these non-GAAP financial performance measures to the most comparable measures reported in accordance with GAAP and for a discussion of the presentation, comparability and use of such financial performance measures.

SPECIAL NOTE FROM THE COMPANY REGARDING FORWARD-LOOKING STATEMENTS

Any statements contained in this presentation that are not statements of historical fact, including statements about our beliefs and expectations, are forward-looking statements and should be evaluated as such. The words “anticipates,” “believes,” “expects,” “intends,” “plans,” “estimates,” “targets,” “projects,” “should,” “may,” “will” and similar words and expressions are intended to identify forward-looking statements. Such forward-looking statements reflect, among other things, our current expectations, plans and strategies, and anticipated financial results, all of which are subject to known and unknown risks, uncertainties and factors that may cause our actual results to differ materially from those expressed or implied by these forward-looking statements. Many of these risks are beyond our ability to control or predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. Furthermore, forward-looking statements speak only as of the date they are made. We do not undertake any obligation to update or review any forward-looking information, whether as a result of new information, future events or otherwise. Important factors with respect to any such forward-looking statements, including certain risks and uncertainties that could cause actual results to differ from those contained in the forward-looking statements, include, but are not limited to: rapid development and intense competition in the telecommunications and high speed data transport industry; our ability to offset expected revenue declines in legacy voice and access products related to the recent regulatory actions, wireless substitution, technology changes and other factors; our ability to effectively allocate capital and implement our “edge-out” expansion plans in a timely manner; our ability to complete customer installations in a timely manner; adverse economic conditions; operating and financial restrictions imposed by our senior credit facility; our cash and capital requirements; declining prices for our services; our ability to maintain and enhance our network; the potential to experience a high rate of customer turnover; federal and state regulatory fees, requirements and developments; our reliance on certain suppliers and vendors; and other unforeseen difficulties that may occur. These risks and uncertainties are not intended to represent a complete list of all risks and uncertainties inherent in our business, and should be read in conjunction with the more detailed cautionary statements and risk factors included in our SEC filings, including our Annual Report filed on Form 10-K.

Exhibits:

|

• |

Condensed Consolidated Balance Sheets |

|

• |

Condensed Consolidated Statements of Income |

|

• |

Condensed Consolidated Statements of Cash Flows |

|

• |

Summary of Operating Results, Customer and Network Statistics |

|

• |

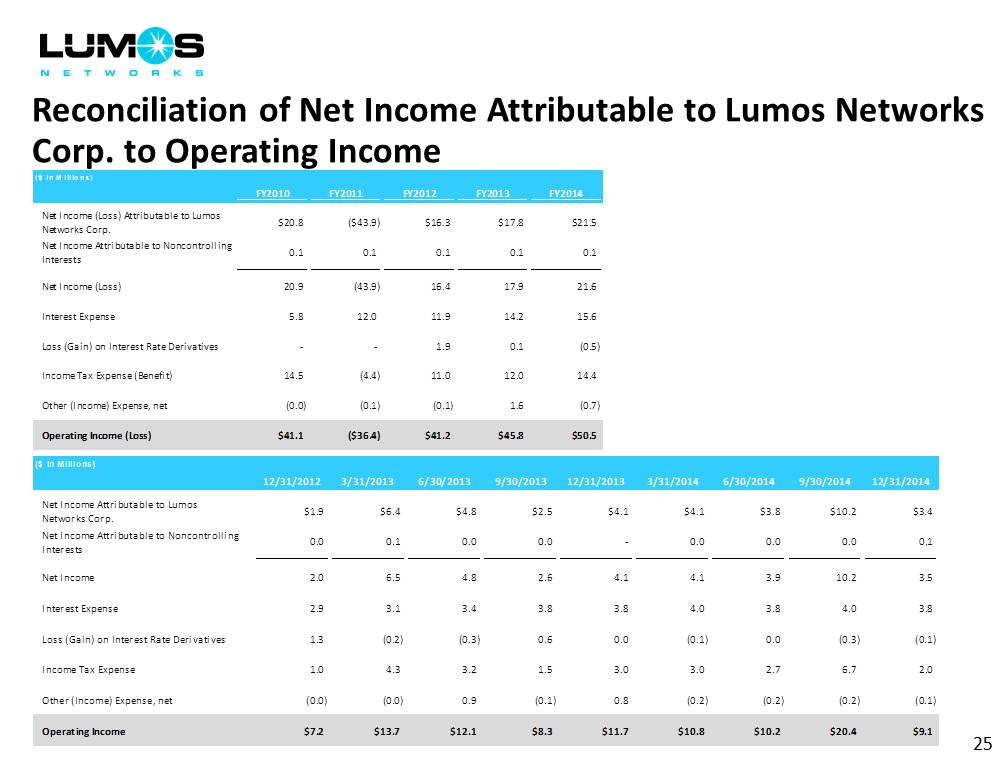

Reconciliation of Net Income Attributable to Lumos Networks Corp. to Operating Income |

|

• |

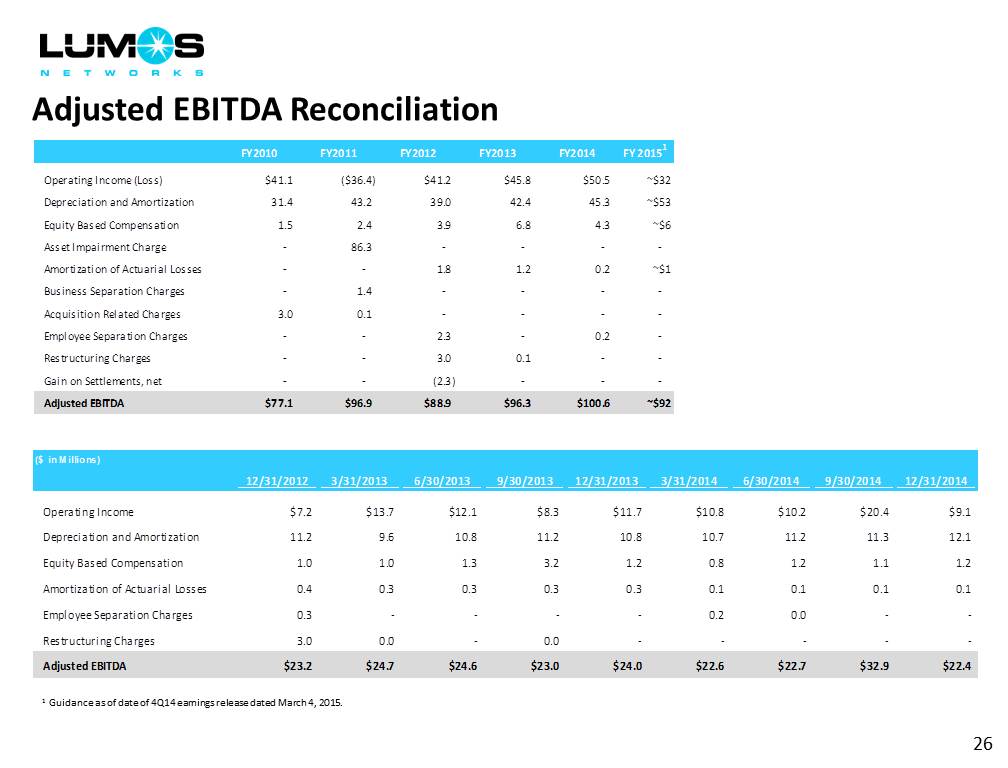

Reconciliation of Operating Income to Adjusted EBITDA |

|

• |

Business Outlook |

3

|

Lumos Networks Corp. |

|||||

|

Condensed Consolidated Balance Sheets |

|||||

|

December 31, 2014 |

December 31, 2013 |

||||

|

(In thousands) |

|||||

|

ASSETS |

|||||

|

Current Assets |

|||||

|

Cash and cash equivalents |

$ |

14,140 |

$ |

14,114 | |

|

Marketable securities |

16,870 | 38,480 | |||

|

Restricted cash 1 |

4,208 | 4,324 | |||

|

Accounts receivable, net |

22,925 | 22,917 | |||

|

Other receivables |

2,113 | 1,588 | |||

|

Income tax receivable |

172 | 1,116 | |||

|

Prepaid expenses and other |

4,321 | 3,960 | |||

|

Deferred income taxes |

5,601 | 7,289 | |||

|

Total Current Assets |

70,350 | 93,788 | |||

|

Securities and investments |

914 | 699 | |||

|

Property, plant and equipment, net |

429,451 | 378,723 | |||

|

Other Assets |

|||||

|

Goodwill |

100,297 | 100,297 | |||

|

Other intangibles, net |

15,884 | 25,071 | |||

|

Deferred charges and other assets |

5,718 | 7,722 | |||

|

Total Other Assets |

121,899 | 133,090 | |||

|

Total Assets |

$ |

622,614 |

$ |

606,300 | |

|

LIABILITIES AND EQUITY |

|||||

|

Current Liabilities |

|||||

|

Current portion of long-term debt |

$ |

10,227 |

$ |

6,688 | |

|

Accounts payable |

20,257 | 13,076 | |||

|

Dividends payable |

3,152 | 3,091 | |||

|

Advance billings and customer deposits |

14,029 | 13,502 | |||

|

Accrued compensation |

1,516 | 2,185 | |||

|

Accrued operating taxes |

4,618 | 4,375 | |||

|

Other accrued liabilities |

4,223 | 3,992 | |||

|

Total Current Liabilities |

58,022 | 46,909 | |||

|

Long-Term Liabilities |

|||||

|

Long-term debt, excluding current portion |

363,156 | 373,290 | |||

|

Retirement benefits |

18,257 | 16,848 | |||

|

Deferred income taxes |

87,864 | 79,087 | |||

|

Other long-term liabilities |

1,746 | 2,832 | |||

|

Income tax payable |

110 | 328 | |||

|

Total Long-term Liabilities |

471,133 | 472,385 | |||

|

Stockholders' Equity |

92,677 | 86,333 | |||

|

Noncontrolling Interests |

782 | 673 | |||

|

Total Equity |

93,459 | 87,006 | |||

|

Total Liabilities and Equity |

$ |

622,614 |

$ |

606,300 | |

|

1 During 2010, the Company received a Federal stimulus award providing 50% funding to bring broadband services and infrastructure to Alleghany County, Virginia. The Company was required to deposit 100% of its grant ($8.1 million) into pledged accounts in advance of any reimbursements, to be drawn down ratably following reimbursement approvals. |

|||||

4

|

Lumos Networks Corp. |

|||||||||||

|

Condensed Consolidated Statements of Income |

|||||||||||

|

Three months ended December 31, |

Twelve months ended December 31, |

||||||||||

|

(In thousands, except per share amounts) |

2014 |

2013 |

2014 |

2013 |

|||||||

|

Operating Revenues |

$ |

50,685 |

$ |

51,003 |

$ |

201,456 |

$ |

207,475 | |||

|

Operating Expenses |

|||||||||||

|

Network access costs |

9,714 | 10,420 | 40,868 | 42,417 | |||||||

|

Selling, general and administrative 1,2 |

19,818 | 18,102 | 64,782 | 76,749 | |||||||

|

Depreciation and amortization |

12,071 | 10,792 | 45,212 | 42,320 | |||||||

|

Accretion of asset retirement obligations |

23 | 9 | 118 | 104 | |||||||

|

Restructuring charges |

- |

- |

- |

50 | |||||||

|

Total Operating Expenses |

41,626 | 39,323 | 150,980 | 161,640 | |||||||

|

Operating Income |

9,059 | 11,680 | 50,476 | 45,835 | |||||||

|

Other Income (Expenses) |

|||||||||||

|

Interest expense |

(3,820) | (3,816) | (15,575) | (14,191) | |||||||

|

Gain (loss) on interest rate swap derivatives |

97 | (34) | 492 | (144) | |||||||

|

Other income (expenses), net |

135 | (783) | 664 | (1,587) | |||||||

|

Income Before Income Tax Expense |

5,471 | 7,047 | 36,057 | 29,913 | |||||||

|

Income Tax Expense |

2,007 | 2,982 | 14,409 | 12,019 | |||||||

|

Net Income |

3,464 | 4,065 | 21,648 | 17,894 | |||||||

|

Net Income Attributable to Noncontrolling Interests |

(51) |

- |

(120) | (121) | |||||||

|

Net Income Attributable to Lumos Networks Corp. |

$ |

3,413 |

$ |

4,065 |

$ |

21,528 |

$ |

17,773 | |||

|

Basic and Diluted Earnings per Common Share Attributable to Lumos Networks Corp. Stockholders: |

|||||||||||

|

Earnings per share - basic |

$ |

0.15 |

$ |

0.18 |

$ |

0.97 |

$ |

0.81 | |||

|

Earnings per share - diluted |

$ |

0.15 |

$ |

0.18 |

$ |

0.95 |

$ |

0.80 | |||

|

Cash Dividends Declared per Share - Common Stock |

$ |

0.14 |

$ |

0.14 |

$ |

0.56 |

$ |

0.56 | |||

|

1 Includes equity-based compensation expense related to all of the Company’s share-based awards and the Company’s 401(k) matching contributions of $1.2 million for each of the three months ended December 31, 2014 and 2013 and $4.3 million and $6.8 million for the twelve months ended December 31, 2014 and 2013, respectively. |

|||||||||||

|

2 Selling, general and administrative expenses for the three and twelve months ended December 31, 2014 includes $0.6 million and $10.8 million, respectively, of curtailment gain related to the elimination of certain medical benefits under the Company's postretirement plan. |

|||||||||||

5

|

Lumos Networks Corp. |

|||||

|

Condensed Consolidated Statements of Cash Flows |

|||||

|

Twelve months ended December 31, |

|||||

|

(In thousands) |

2014 |

2013 |

|||

|

Cash Flows from Operating Activities: |

|||||

|

Net income |

$ |

21,648 |

$ |

17,894 | |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|||||

|

Depreciation |

36,025 | 32,496 | |||

|

Amortization |

9,187 | 9,824 | |||

|

Accretion of asset retirement obligations |

118 | 104 | |||

|

Deferred income taxes |

14,477 | 11,503 | |||

|

(Gain) loss on interest rate swap derivatives |

(492) | 144 | |||

|

Equity-based compensation expense |

4,340 | 6,778 | |||

|

Amortization of debt issuance costs |

1,461 | 1,280 | |||

|

Write off of unamortized debt issuance costs |

- |

890 | |||

|

Curtailment gain |

(10,774) |

- |

|||

|

Retirement benefits, net of cash contributions and distributions |

(1,628) | (330) | |||

|

Excess tax benefits from share-based compensation |

- |

(1,060) | |||

|

Other |

221 | (163) | |||

|

Changes in operating assets and liabilities, net |

5,226 | (5,106) | |||

|

Net Cash Provided by Operating Activities |

79,809 | 74,254 | |||

|

Cash Flows from Investing Activities: |

|||||

|

Purchases of property, plant and equipment |

(84,100) | (68,334) | |||

|

Broadband network expansion funded by stimulus grant |

(878) | (29) | |||

|

Purchases of available-for-sale marketable securities |

(19,516) | (38,560) | |||

|

Proceeds from sale or maturity of available-for-sale marketable securities |

40,679 |

- |

|||

|

Change in restricted cash |

116 | 979 | |||

|

Cash reimbursement received from broadband stimulus grant |

116 | 979 | |||

|

Other |

150 | 62 | |||

|

Net Cash Used in Investing Activities |

(63,433) | (104,903) | |||

|

Cash Flows from Financing Activities: |

|||||

|

Proceeds from issuance of long-term debt |

- |

375,000 | |||

|

Payment of debt issuance costs |

- |

(4,872) | |||

|

Principal payments on senior secured term loans |

(5,250) | (308,876) | |||

|

Borrowings from revolving credit facility |

- |

15,000 | |||

|

Principal payments on revolving credit facility |

- |

(18,521) | |||

|

Termination payments of interest rate swap derivatives |

- |

(858) | |||

|

Cash dividends paid on common stock |

(12,456) | (12,213) | |||

|

Principal payments under capital lease obligations |

(1,468) | (1,456) | |||

|

Proceeds from stock option exercises and employee stock purchase plan |

2,892 | 1,222 | |||

|

Excess tax benefits from share-based compensation |

- |

1,060 | |||

|

Other |

(68) | (725) | |||

|

Net Cash (Used in) Provided by Financing Activities |

(16,350) | 44,761 | |||

|

Increase in cash and cash equivalents |

26 | 14,112 | |||

|

Cash and cash equivalents: |

|||||

|

Beginning of Period |

14,114 | 2 | |||

|

End of Period |

$ |

14,140 |

$ |

14,114 | |

6

|

Lumos Networks Corp. |

|||||||||||||

|

Operating Results, Customer and Network Statistics |

|||||||||||||

|

(Dollars in thousands) |

Three months ended: |

Twelve months ended: |

|||||||||||

|

December 31, 2014 |

September 30, 2014 |

June 30, 2014 |

March 31, 2014 |

December 31, 2013 |

December 31, 2014 |

December 31, 2013 |

|||||||

|

Revenue, Gross Margin and Adjusted EBITDA |

|||||||||||||

|

Revenue |

|||||||||||||

|

Enterprise Data |

10,833 | 10,470 | 10,445 | 10,586 | 10,617 | 42,334 | 42,404 | ||||||

|

Transport |

10,962 | 11,279 | 11,225 | 10,907 | 11,927 | 44,373 | 47,434 | ||||||

|

FTTC |

5,515 | 4,739 | 5,037 | 4,644 | 4,399 | 19,935 | 14,274 | ||||||

|

Total Data |

27,310 | 26,488 | 26,707 | 26,137 | 26,943 | 106,642 | 104,112 | ||||||

|

Residential and Small Business |

17,423 | 17,668 | 18,290 | 18,647 | 19,094 | 72,028 | 80,659 | ||||||

|

RLEC Access |

5,952 | 6,360 | 5,168 | 5,306 | 4,966 | 22,786 | 22,704 | ||||||

|

Total Revenue |

50,685 | 50,516 | 50,165 | 50,090 | 51,003 | 201,456 | 207,475 | ||||||

|

Gross Margin |

|||||||||||||

|

Data |

85.5% | 85.1% | 85.3% | 84.0% | 85.1% | 85.0% | 84.8% | ||||||

|

Residential and Small Business |

67.0% | 64.3% | 65.7% | 64.9% | 66.4% | 65.5% | 67.0% | ||||||

|

Adjusted EBITDA1 |

|||||||||||||

|

Data |

12,629 | 12,984 | 13,395 | 12,717 | 14,012 | 51,725 | 53,504 | ||||||

|

Residential and Small Business |

4,623 | 4,503 | 5,230 | 5,544 | 5,916 | 19,900 | 24,659 | ||||||

|

RLEC Access |

4,621 | 5,214 | 4,098 | 4,306 | 4,104 | 18,239 | 18,161 | ||||||

|

Adjusted EBITDA before Curtailment Gain |

21,873 | 22,701 | 22,723 | 22,567 | 24,032 | 89,864 | 96,324 | ||||||

|

Curtailment Gain2 |

567 | 10,207 |

- |

- |

- |

10,774 |

- |

||||||

|

Total Adjusted EBITDA |

22,440 | 32,908 | 22,723 | 22,567 | 24,032 | 100,638 | 96,324 | ||||||

|

Adjusted EBITDA Margin1 |

|||||||||||||

|

Data |

46.2% | 49.0% | 50.2% | 48.7% | 52.0% | 48.5% | 51.4% | ||||||

|

Residential and Small Business |

26.5% | 25.5% | 28.6% | 29.7% | 31.0% | 27.6% | 30.6% | ||||||

|

RLEC Access |

77.6% | 82.0% | 79.3% | 81.2% | 82.6% | 80.0% | 80.0% | ||||||

|

Total Adjusted EBITDA Margin |

44.3% | 65.1% | 45.3% | 45.1% | 47.1% | 50.0% | 46.4% | ||||||

|

Capital Expenditures |

19,949 | 26,863 | 19,171 | 18,117 | 22,613 | 84,100 | 68,334 | ||||||

|

Adjusted EBITDA less Capital Expenditures |

2,491 | 6,045 | 3,552 | 4,450 | 1,419 | 16,538 | 27,990 | ||||||

|

Fiber Network Statistics |

|||||||||||||

|

Fiber Route-Miles |

7,822 | 7,645 | 7,548 | 7,467 | 7,414 | 7,822 | 7,414 | ||||||

|

Fiber Miles3 |

354,118 | 352,347 |

---- |

---- |

---- |

354,118 |

---- |

||||||

|

Fiber Markets |

23 | 23 | 23 | 23 | 23 | 23 | 23 | ||||||

|

FTTC Unique Towers |

858 | 708 | 673 | 633 | 608 | 858 | 608 | ||||||

|

FTTC Total Connections |

1,153 | 961 | 876 | 824 | 778 | 1,153 | 778 | ||||||

|

On-Network Buildings |

1,477 | 1,456 | 1,420 | 1,387 | 1,344 | 1,477 | 1,344 | ||||||

|

Data Centers4 |

31 | 28 | 26 | 25 | 24 | 31 | 24 | ||||||

|

R&SB Statistics |

|||||||||||||

|

Competitive Voice Connections |

83,406 | 85,683 | 88,941 | 92,440 | 95,730 | 83,406 | 95,730 | ||||||

|

Video Subscribers |

5,352 | 5,309 | 5,155 | 5,073 | 5,034 | 5,352 | 5,034 | ||||||

|

RLEC Access Lines |

27,257 | 27,716 | 28,081 | 28,381 | 28,886 | 27,257 | 28,886 | ||||||

|

1 Adjusted EBITDA is a non-GAAP measure. See definition on page 2 of this earnings release. Adjusted EBITDA margin is calculated as the ratio of Adjusted EBITDA, as defined, to Total Revenue. |

|||||||||||||

|

2 The Company recorded a gain totaling $10.8 million in the second half of 2014 related to the curtailment of medical benefits under the Company's postretirement plan, which was not allocated to the operating segments. |

|||||||||||||

|

3 Fiber miles are calculated as the fiber route miles multiplied by the number of fiber strands within each cable (represents an average of 45 fibers per route as of December 31, 2014) and are based on the results of the Company's conversion of its fiber records to a centralized fiber management system in the third quarter of 2014. |

|||||||||||||

|

4 During the third quarter of 2014, the Company revised its connected data center disclosures to include both commercial and private data centers and Company-owned facilities offering commercial data center services. Previously, the Company had only disclosed connections to third-party commercial data centers. Historical data center total for prior quarters have been revised to reflect the new measurement approach. |

|||||||||||||

|

Note: Certain prior period revenue and Adjusted EBITDA amounts have been reclassified to conform with the current year presentation. |

|||||||||||||

7

|

Lumos Networks Corp. |

|||||||||||

|

Reconciliation of Net Income Attributable to Lumos Networks Corp. to Operating Income |

|||||||||||

|

(In thousands) |

|||||||||||

|

Three months ended December 31, |

Twelve months ended December 31, |

||||||||||

|

2014 |

2013 |

2014 |

2013 |

||||||||

|

Net Income Attributable to Lumos Networks Corp. |

$ |

3,413 |

$ |

4,065 | 21,528 |

$ |

17,773 | ||||

|

Net Income Attributable to Noncontrolling Interests |

51 |

- |

120 | 121 | |||||||

|

Net Income |

3,464 | 4,065 | 21,648 | 17,894 | |||||||

|

Interest expense |

3,820 | 3,816 | 15,575 | 14,191 | |||||||

|

(Gain) loss on interest rate swap derivatives |

(97) | 34 | (492) | 144 | |||||||

|

Income tax expense |

2,007 | 2,982 | 14,409 | 12,019 | |||||||

|

Other (income) expenses, net |

(135) | 783 | (664) | 1,587 | |||||||

|

Operating Income |

$ |

9,059 |

$ |

11,680 |

$ |

50,476 |

$ |

45,835 | |||

8

|

Lumos Networks Corp. |

|||||

|

Reconciliation of Operating Income to Adjusted EBITDA |

|||||

|

(Dollars in thousands) |

2014 |

2013 |

|||

|

For The Three Months Ended December 31, |

|||||

|

Operating Income |

$ |

9,059 |

$ |

11,680 | |

|

Depreciation and amortization and accretion of asset retirement obligations |

12,094 | 10,801 | |||

|

Sub-total: |

21,153 | 22,481 | |||

|

Amortization of actuarial losses |

56 | 309 | |||

|

Equity-based compensation |

1,231 | 1,242 | |||

|

Adjusted EBITDA |

$ |

22,440 |

$ |

24,032 | |

|

Adjusted EBITDA Margin |

44.3% | 47.1% | |||

|

For The Twelve Months Ended December 31, |

|||||

|

Operating Income |

$ |

50,476 |

$ |

45,835 | |

|

Depreciation and amortization and accretion of asset retirement obligations |

45,330 | 42,424 | |||

|

Sub-total: |

95,806 | 88,259 | |||

|

Amortization of actuarial losses |

248 | 1,237 | |||

|

Equity-based compensation |

4,340 | 6,778 | |||

|

Restructuring charges |

- |

50 | |||

|

Employee separation charges |

244 |

- |

|||

|

Adjusted EBITDA |

$ |

100,638 |

$ |

96,324 | |

|

Adjusted EBITDA Margin |

50.0% | 46.4% | |||

9

|

Lumos Networks Corp. |

|||

|

Business Outlook 1 (as of March 4, 2015) |

|||

|

(In millions) |

2015 Annual |

||

|

Operating Revenues |

approximately $202 |

||

|

Adjusted EBITDA2 |

approximately $92 |

||

|

Capital Expenditures |

approximately $112 |

||

|

Cash, Cash Equivalents and Marketable Securities (at end of period) |

approximately $5 |

||

|

Reconciliation of Operating Income to Adjusted EBITDA |

|||

|

Operating Income |

approximately $32 |

||

|

Depreciation and amortization |

approximately $53 |

||

|

Equity-based compensation expense |

approximately $6 |

||

|

Amortization of actuarial losses |

approximately $1 |

||

|

Adjusted EBITDA |

approximately $92 |

||

|

1 These estimates are based on management’s current expectations. These estimates are forward-looking and actual results may differ materially. Please see “Special Note from the Company Regarding Forward-Looking Statements" in the Lumos Networks Corp. fourth quarter 2014 earnings release dated March 4, 2015. |

|||

10

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Actions Technology's Smartwatch Chip Powers HONOR Band 9 to Achieve 14-Day Long Battery Life

- Route1 Announces Q4 and Fiscal Year 2023 Financial Results

- Junshi Biosciences Announces NDA Acceptance in Hong Kong for Toripalimab

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share