Form 8-K LEUCADIA NATIONAL CORP For: Mar 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 2, 2015

LEUCADIA NATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

| New York | 1-5721 | 13-2615557 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 520 Madison Avenue, New York, New York | 10022 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 212-460-1900

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 8.01. | Other Events. |

We posted the attached letter to shareholders on our website. The letter to shareholders is incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

The following exhibit is filed with this report:

| Number |

Exhibit | |

| 99 | 2015 Letter to Shareholders. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| LEUCADIA NATIONAL CORPORATION | ||||||

| Date: March 2, 2015 | /s/ Roland T. Kelly | |||||

| Roland T. Kelly | ||||||

| Assistant Secretary and Associate General Counsel | ||||||

Exhibit Index

| Number |

Exhibit | |

| 99 | Letter to Shareholders. | |

Exhibit 99

Dear Fellow Shareholders,

We and our entire team have been working diligently to position Leucadia to achieve our number one goal: long-term value creation. We aim to achieve this goal by operating a merchant and investment banking platform that creates, acquires and operates a diversified group of businesses. We want Leucadia to be focused, diversified, driven and transparent. We will only invest where we see value and opportunity that fits our investment profile. We have instilled throughout Leucadia and its businesses a sense of urgency, as well as a constant drive to make things better and more valuable.

We have accomplished much, occasionally been frustrated and learned something new every day. In this letter, we will share with you our experiences to date and our rationale for many of the decisions we have made. By sharing specific ideas and examples we hope to provide insight into our thought process, how we view the world and where we hope to steer Leucadia over time. We also will give an update on each of our businesses.

Our First Two Years

Leucadia has realized $2.5 billion in cash from asset sales since the period surrounding our combination. These were generally good businesses, but were ones where either we had too little influence or ability to add value, were not scalable, or were highly illiquid and too big for a company with $10.3 billion of shareholders’ equity.

We have eliminated long-term endeavors we felt were “quasi venture capital” and would have required meaningful further investment with a likelihood of satisfactory returns lower than we would like. In 2013, we closed Sangart, a biotechnology company that had been nurtured for years by Leucadia. This past year, we stopped investing in Lake Charles Clean Energy after it became apparent that our team’s heroic effort could not overcome the challenge of obtaining an acceptable fixed price construction contract. We are continuing to pursue our Oregon LNG terminal project, but the change in energy dynamics, combined with the bureaucratic and political permitting process, are challenging. The burn rate here is modest (single digit millions per year), particularly compared to the two projects we stopped, but we will continue to monitor this closely.

We have also been hard at work looking to deploy fresh capital in smart ways, while operating in an environment where value can be elusive. Since March 1, 2013, we have invested or committed an aggregate of almost $2.2 billion to new investments that have followed two overriding themes:

| • | Finding unique value opportunities where our entry terms afford us a favorable risk-reward tradeoff — so far, Harbinger Group (NYSE:HRG), FXCM (NASDAQ:FXCM) and Golden Queen; and |

| • | Building businesses with great managers one asset at a time and thereby creating enterprise value — so far, the various Leucadia Asset Management businesses (LAM), Juneau Energy and Vitesse Energy. |

Harbinger, the LAM businesses and FXCM all originated from relationships developed at Jefferies, while Vitesse, Juneau and Golden Queen emanated from relationships of the Leucadia deal team.

We and the rest of the Leucadia deal team are also spending much time with our existing businesses. We saw several opportunities to drive growth in these companies, investing a further $534 million over the past two years in Garcadia, Linkem, Conwed, Foursight and HomeFed (OTC:HOFD), including transferring Leucadia’s historic one-off real estate assets valued at $216 million into HomeFed for more shares. We also raised $4.4 billion of long-term capital over these past two years across our businesses at attractive rates.

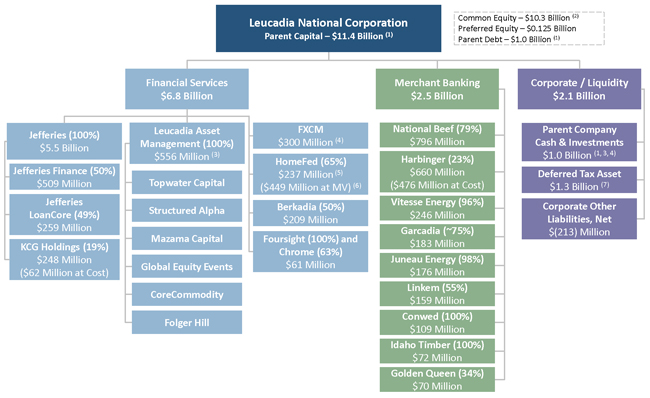

We own businesses and investments in financial services and a diverse array of other industries (the latter group comprising what we call our “merchant banking” effort). We also maintain meaningful liquidity and have a significant tax NOL we expect to monetize substantially before the end of this decade. The chart below illustrates how we think about and manage Leucadia today (amounts as of 12/31/14, with some pro forma adjustments noted):

Note: Dollar amounts are Leucadia’s net carrying amount as of 12/31/14 for each investment, for consolidated subsidiaries equal to their assets less liabilities.

| (1) | Adjusted for assumed maturity of 2015 8.125% Sr. Notes using Parent Company Cash. |

| (2) | Includes $2.7 billion of goodwill and intangibles. |

| (3) | Adjusted for $400 million investment in Folger Hill. In addition, Parent Company Cash & Investments includes $273 million for Mazama Capital, $101 million for Structured Alpha and $25 million for Global Equity Events, all of which are available for sale immediately. |

| (4) | Adjusted for the January 2015 senior secured loan to FXCM. |

| (5) | Carrying amount is net of deferred gain on real estate sale. |

| (6) | Market value as of 12/31/14. |

| (7) | Excludes Jefferies Net Deferred Tax Asset of $400 million. |

Leucadia National Corporation 2

We believe this chart illustrates the diverse platform we are building that can take advantage of further opportunities as they arise. It also demonstrates the breadth of our effort, where our capital is allocated, and our ample liquidity and dry powder. We believe the foundation is now set for us to optimize the capabilities of our existing businesses, continue to deploy our cash judiciously and grow our book value per share, which we believe is the yardstick by which we should be measured.

We will talk more about all these businesses throughout this letter.

What We Have Learned and How We View the World

We Want to Be “The One Who Gets the Call”

Particularly in a world where value is so hard to find, we believe it is a huge advantage to be “the one who gets the call.” Unique value opportunities tend to arise when there is some problem, uncertainty, complexity or urgency impacting a business, and a rapid and creative solution is necessary. In some cases, absent this solution, a good business will be either incredibly impaired or, in some cases, doomed. We are increasingly being recognized as one of the first groups to call in these circumstances. In 2012, we restored Knight Capital’s equity and, more recently, we invested in FXCM to replenish its regulatory capital, allowing the Company to avoid bankruptcy. Even when there isn’t a circumstance that changes the outlook of a company, but rather a new opportunity that is developing, getting “the call” is just as important. This was the reality that led to our becoming the largest shareholder of Harbinger and our investing in the Golden Queen mining project, where the ownership group in each case sought out our partnership. In all these companies, our investment became a catalyst for change and created a significant opportunity to drive long-term value for all stakeholders.

We believe there are a number of factors that increase the likelihood of being the “one who gets the call.” First, you must have the expertise instantly accessible in-house to quickly understand and assess the situation. Second, you must be able to mobilize rapidly, typically in days or hours, and sometimes even in minutes. Third, you must have the reputation with many constituencies that you are trustworthy and will do what you say you will do. Fourth, it helps when you can convey with confidence that you are a long-term investor and able to add meaningful value beyond capital. Finally, you must be able to make a decision quickly and wire the funds!

The best way we know to increase the likelihood that we get “the call” is to have real long-term relationships with as many quality people across as many industries and specialties as is humanly possible. The combination of Leucadia and Jefferies is no doubt a big part of this equation, as management teams and Boards of Directors recognize the uniqueness and power of our combined merchant and investment banking platform.

The Jefferies Platform Is Very Valuable As a Source of Unique Opportunities and Added Value

Some people ask us if it is complicated, cumbersome or distracting to have Jefferies and Leucadia under the same roof. The reality could not be further from the truth. Both platforms provide consistent, real and unique operating leverage and the activities of both companies are massively complementary. Aside from being a very valuable long-term source of what we believe will be growing earnings, Jefferies is a tremendous resource in helping us find unique long-term investment opportunities. In a typical week, Jefferies trades many billions of dollars of securities in many different markets and provides clients with valuable liquidity. We also help clients buy and sell businesses, raise capital around the globe and

Leucadia National Corporation 3

restructure companies facing challenges. These are all “regular way” transactions that serve our clients’ goals. Given this trading and transaction flow, countless relationships and diverse industry expertise, a small handful of times each year, we hopefully will get “the call” that presents an opportunity distinctly for Leucadia. Sometimes, the party on the other end of the phone wants to work exclusively with us as principal, and sometimes there is the opportunity to share these potential deals with others. Here are four examples of opportunities sourced by Jefferies:

Knight Capital. Knight Capital was an example prior to the Leucadia-Jefferies combination where Jefferies helped KCG avoid shutdown by injecting its capital (and also bringing in some partners) on attractive terms. Since that initial transaction, Jefferies has served as adviser in connection with KCG’s merger with GETCO, completed several capital raises totaling $840 million, and recently advised KCG on a major subsidiary sale. In the 18 months since KCG and GETCO merged, KCG has become a leaner, more focused organization, selling non-core assets, exiting tertiary businesses and paying down debt arising from the merger. Having integrated and rationalized the platform, we believe that what is now called KCG (NYSE:KCG) will have the opportunity to capitalize on its scale and expertise in order to deliver solid ongoing returns for shareholders. Jefferies invested $125 million in KCG shares in August 2012 and a further $129.5 million through the open market in 2013 and 2014, has realized $192 million in cash and continues to own 22.5 million shares (about 19% of KCG) with a current value of about $280 million.

Harbinger Group. Harbinger is an example of a company not under duress, but where the major shareholder was committed to unlocking long-term value and made “the call” to us to be his partner. We will give more details later, but the short of it is that HRG owns substantial interests in two very attractive public companies (59% of Spectrum Brands (NYSE: SPB) and 80% of Fidelity & Guarantee Life (NYSE:FGL)). The sum-of-the-parts valuation of HRG was then around $13.50 per share, while the stock was trading around $10.00 per share. Jefferies had been an active and consistent adviser to the Company and its subsidiaries for many years. We bought our initial stake in HRG in September 2013, increased our stake considerably in 2014 and then began to work actively with HRG’s management. We have two representatives on HRG’s Board, including our own Joe Steinberg as Chairman and Andrew Whittaker. We will spend 2015 and beyond continuing to work with management to maximize the value embedded in HRG. Leucadia owns 23% of HRG, with a mark-to-market gain of $119 million.

Folger Hill. We knew Sol Kumin for many years as a client of Jefferies. We have seen him in action and agreed with those who know him that he is a high energy, smart, talented, honest and driven business executive. Our history and experience with Sol led him to seek us out to partner with him to create Folger Hill, a multi-manager hedge fund platform.

In 2014, we committed $400 million in investment from Leucadia in Folger Hill and are launching what we believe will soon be an over $1 billion hedge fund, with great prospects for substantial further growth. Sol has hired a world class operating management team, eleven portfolio management teams focused in an array of sectors, and has opened offices in New York City and Boston. This will be a long-term and methodical build. Consistent with our value mind-set, we are focused on helping Sol and his team build this business with proper risk management of our downside and the potential for disproportionate upside. We prefer to build with people whom we have reason to trust and back, versus to buy and pay for goodwill. We would rather deploy our own capital in strategies we believe in, creating equity value in the management company if and when a strategy succeeds. In addition to our commitment to Folger Hill, we have invested additional capital using the same “build” thesis in a variety of asset management businesses that we hope will scale over time. It is relationships built over time at Jefferies that are allowing us to build Leucadia Asset Management, which we hope will be an important next leg for Leucadia.

Leucadia National Corporation 4

FXCM. On the morning of January 15, 2015, world markets were stunned to wake up to the Swiss National Bank scrapping its over three-year old peg of 1.20 Swiss francs per euro, despite a bank official having reaffirmed its commitment to the policy just two days before. The franc quickly soared by around 30%, an incredibly large gap move that was unprecedented in currency markets since the U.S. abandoned the Bretton Woods agreement in 1971. Fortunately, Leucadia and Jefferies had no meaningful direct exposure to this event. Around 2 P.M. that afternoon, Alex Yavorsky, one of our terrific investment bankers, received “the call” from the management team at FXCM (whom he had known for years), outlining the fact that its customers experienced significant losses as a result of the Swiss National Bank’s action, generating customer debit balances owed to FXCM of well over $200 million and creating a severe risk of FXCM being shut down due to its inability to meet the regulatory capital requirements attendant to the unpaid customer receivables. FXCM and its peers were well known and understood by the relevant team at Jefferies and we ourselves had taken a close look at this sector years ago. The two of us, the Jefferies team and our lawyers spent the next 24 hours doing due diligence, crafting a financing solution, documenting it, conducting a full Leucadia Board meeting, and closing the deal and wiring the funds at 3:00 P.M. on January 16. Remarkably, the day prior to the Swiss National Bank’s action, FXCM was an industry leader with a $1.5 billion capitalization. The Company has a strong management team and, absent this extraordinary event, a solid platform for ongoing growth. We believe that, with time and performance, FXCM will regain its position in the global markets.

Leucadia now holds $300 million in principal amount of a two-year secured term loan with an initial interest rate of 10% per annum, increasing by 1.5% per annum each quarter for so long as the loan is outstanding. Leucadia is also entitled to a deferred financing fee of $10 million, with an additional fee of up to $30 million becoming payable in the event the aggregate principal amount of the term loan outstanding on April 16, 2015 is greater than $250 million or the $10 million fee has not been paid on or before that date. We expect to have received back over a quarter of our investment in repayment of principal and fees within three months of closing and that repayment in fact has already started.

FXCM has also agreed to pay Leucadia in cash a percentage of the proceeds received in connection with any sale of assets, any dividend or distribution or the sale or indirect sale of FXCM’s business according to the following schedule:

| • | first, 100% of the principal amounts and fees due under the term loan; |

| • | second, of the next $350 million, 50% to Leucadia; |

| • | third, of the next amount equal to two times the balance outstanding on the term loan and fees as of April 16, 2015 (but not less than $500 million or more than $680 million), 90% to Leucadia; and |

| • | finally, of all aggregate amounts thereafter, 60% to Leucadia. |

Diversification Is Good

We were both long-term shareholders of Jefferies and now, after our all-stock combination, we are “all in” at Leucadia. We believe shareholders are best-served when senior management is “all in” and we are big fans of alignment. In fact, aside from tax payments and charitable donations, neither of us has sold even one share in our respective 25 and 14 years with Jefferies and Leucadia. We have seen incredible volatility in our careers and it’s rare that something isn’t going wrong somewhere. We have seen companies arrive, and we have seen companies disappear. Everything in life is fragile, whether it is health, personal relationships or businesses. Consistent with our being “all in,” our philosophy is to continue to strive to bullet proof our

Leucadia National Corporation 5

company over time. The best way we know to do this is to continue to diversify Leucadia. We have done this at Jefferies, moving our platform from one that a long time ago was exclusively agency cash equity trading to what today is a diversified global investment banking firm.

Diversification doesn’t mean we won’t make meaningful investments that will move the dial, however, it simply means that we will avoid unduly large commitments. Bite sizes below $500 million fit our current capitalization and should allow us to take meaningful stakes, enjoy heavy influence (or, better yet, control), please our bondholders and build our shareholders’ equity. This is why we consolidated our various real estate holdings into a significant single entity, HomeFed. It is a reason why we are so excited about building a diversified asset management platform. It is also why we did not invest more in HRG, even though we thought our entry price was and remains very attractive. When we find something uniquely attractive, but larger than our bite size, we have a long list of wonderful partners we would be happy to work with (and we are always looking to expand that list).

Patience Is Essential – Almost Everything Is More Difficult Than It Appears and Takes Longer Than Expected

We are not happy that Jefferies had a disappointing fourth quarter after three strong quarters in a row. We are not happy that beef processing is just starting to come out of a cyclical low due to the drought and reduced cattle herd. We are not happy that, in our opinion, we did not grow book value per share enough last year. At the same time, we look forward with excitement, knowing the moves that have been made in combining Leucadia and Jefferies, shedding some investments, investing significant capital in new opportunities, and strengthening our many operating businesses, have put the combined company in a solid position. Both Jefferies and National Beef, while facing short term challenges, are valuable, scalable and unique operating businesses that will create long-term value. Berkadia, Garcadia, Linkem, HomeFed, Conwed, Idaho Timber and Foursight are all doing very well. We are pleased with our almost $2.2 billion of new investments and commitments. One of our biggest competitive advantages is our permanent capital base, complemented by our focus on the long-term, which is ingrained in the management teams and Boards of both Leucadia and Jefferies. It is a long race and we prefer an endurance contest to a sprint.

Stay Liquid for the Inevitable Rainy Day

During our 30+ year careers, the world has had dislocations of varying degrees every three to five years and this pattern did not start the day we entered the work force. If we work hard and smart, and do nothing arrogant or foolish during the good periods, we should be able to greatly enhance all of our operating businesses and create good entry points to new businesses when times become difficult. To the latter point, we need to make sure we have plenty of liquidity at our operating businesses and at Leucadia throughout the cycles. This will be a drag on short-term ROE, but we should more than make up for this as we deploy more and more capital and hopefully do it at the right time.

Be a Value Investor, and Preserve and Grow Tangible Book Value

While there may be occasional unique exceptions, we also are ingrained with a value mentality, regardless of whether the style is currently in or out of favor. Unfortunately, we do not see shortcuts in being a value investor. Patience and the ability to act quickly when the opportunity arises, as we have discussed, is deep in our chemistry. We believe you also have to be creative when the world is generally fairly valued. We really like Spectrum Brands and Fidelity & Guarantee Life, but the individual stocks did not afford us an attractive entry opportunity. Now, we have meaningful interests in both companies at a major discount to their trading levels by virtue of our investment in HRG. We invested directly into the gold mining assets of

Leucadia National Corporation 6

Golden Queen, versus buying the shares of its then parent, as that allowed us into the opportunity at a more attractive valuation and with no tax leakage. We believe we will make money so long as gold is above $800 an ounce. We are working with the management teams of Vitesse Energy and Juneau Energy to build two energy companies from scratch by buying and investing in assets one at a time, versus making a major acquisition. We were not smart enough to see oil dropping from $105 to $45 per barrel in a matter of months, but the right value entry point allows us both to make money even at current price levels, and retain our opportunity to build long-term value. The nature of value investing, particularly in direct investments such as the ones we make, is that results will be episodic and lumpy, but the amounts of gain can be sizeable.

Culture Matters Always

Lastly, but perhaps most importantly, we are strong believers that culture is the special sauce that is the final determinant of building long-term value throughout the Leucadia ecosystem. At all of Leucadia’s businesses, we strive for integrity, transparency, a lack of bureaucracy, a sense of urgency and always putting the client or customer first. At Berkadia, it was so important to us to protect the integrity and quality of the Berkadia brand that we recommended our own Justin Wheeler as full-time CEO, versus taking our chances on the outside where we had over 20 candidates clamoring for the job. The Berkadia team respects and trusts Justin, and so do we. We could talk about the cultures of Conwed, Idaho Timber, National Beef, Linkem, Foursight, Garcadia, Folger Hill, Topwater and all the others for pages. Suffice it to say that we demand and have honest leaders throughout these companies who lead by example, know their people, clients, and industries cold, and have a long-term value mentality. We also have tens of thousands of dedicated employees in these businesses whose effort and commitment we greatly value.

Our Leadership Team

We get asked from time to time about the depth of our senior leadership teams at Leucadia and Jefferies. At Leucadia’s holding company, we are supported by our special Chairman, Joe Steinberg, as well as a team of experienced executives who focus on our investee companies, as well as work with us in sourcing and culling new opportunities, and executing new deals. We are confident that the team we have assembled from Leucadia’s historic team and the team at Jefferies Capital Partners is both a strong group and well-suited to the enhancement and development of our non-Jefferies portfolio. Our relatively new CFO, Teri Gendron, has ably taken over from Joe Orlando, who served with distinction for twenty years as Leucadia’s CFO, and as a friend and counselor. Teri brings fresh perspective and her own set of experiences that we believe will enhance our internal efforts and our reporting. Tom Mara also retired at year-end after a long and successful career with Leucadia, and we thank him for his many contributions.

At Jefferies, we have patiently and methodically strengthened our leadership team, particularly since 2007. Our three core businesses, Equities, Fixed Income and Investment Banking, are led by Pete Forlenza, Fred Orlan and Ben Lorello, respectively, outstanding individuals with deep experience and relationships. Similarly, Peg Broadbent and Mike Sharp, Jefferies’ CFO and general counsel respectively, add unique perspective and a distinct breadth of knowledge consistent with the trajectory we anticipate for Jefferies’ business. In each of Leucadia’s other subsidiaries and investee companies, we work closely with the leadership teams, are personally familiar with all the key leaders, and focus on leadership development and succession needs.

Leucadia National Corporation 7

Looking Forward

The two of us think and act as shareholders first, second and third — stock price in 5, 10 and 15 years is what we care about. It does not mean that we do not have a keen sense of urgency and feel the responsibilities entrusted to us on a daily basis. We believe we have made tremendous progress and are uniquely positioned as a permanent capital company that is a diversified investment holding company anchored by a global investment banking firm and a diversified merchant bank. We remain highly liquid and with very little leverage at our parent company ($1 billion of 10 and 30-year debt underpinned by over $10 billion of shareholders’ equity). We are supported by a strong deal team at Leucadia, excellent managers at our operating businesses and a fully engaged Board of Directors. We have much work ahead of us, but are energized and eager for the challenge.

Although we intend to continue to follow Leucadia’s historic practice of letting our actions and results be our primary voice, we remind you that the two of us look forward to answering your questions at our upcoming Annual Meeting on May 21, 2015 in New York, and we also will hold a combined Leucadia and Jefferies Investor Day on October 8, 2015 in New York, at which you will have the opportunity to hear directly from the senior leaders of the major Leucadia businesses, including Jefferies.

Our Businesses

Jefferies

Despite good results in Investment Banking and Equities, Jefferies overall results, excluding its Bache business, were relatively flat to the prior two years due to weak results in Fixed Income, as well as the absence of unique mark to market gains such as were recorded in 2012 (Knight Capital) and 2013 (KCG and HRG). After three strong quarters in a row, Jefferies fourth quarter was very challenging. While Jefferies fourth quarter reflected Fixed Income trading losses driven by heightened market volatility, the first quarter of 2015 can best be described as slow, with Fixed Income results constrained by clients’ reduced risk appetite and with subdued leverage finance capital markets activity. We anticipate Jefferies first quarter net revenues will be modestly better than those of its fourth quarter. While market conditions constantly change, we expect improvement at Jefferies in coming periods.

As a result of the growth and margin challenges we have recently faced in the Bache business we acquired in mid-2011, we are pursuing strategic alternatives for this business, and are in advanced discussions with three parties in this regard. Eliminating Bache’s drag on Jefferies’ overall results should be meaningfully accretive.

We intend to drive market share, margin expansion and earnings growth at Jefferies by focusing on increasing productivity, broadening our client coverage, deepening our relationships with our clients, and leveraging our global platform and momentum in Europe and Asia. At the same time, we will continue to prudently build a leading, independent global investment banking firm in an environment that we believe favors our business model. Jefferies is in an exceptional position to benefit as its large bank holding company competitors continue to adapt their business models in ways that create growth opportunities for us.

In 2014, Jefferies Finance, Jefferies’ corporate lending joint venture with Massachusetts Mutual Life Insurance Company, arranged a record $23 billion of loans and generated net earnings of $139 million (50% to Jefferies – please keep in mind that this is essentially a pre-tax number as Jefferies Finance is treated as a partnership for tax reporting purposes and is generally not subject to income taxes directly). In an era of

Leucadia National Corporation 8

shrinking bank balance sheets, Jefferies Finance’s capital markets-focused business model continues to fill an increasingly important need for our corporate borrower clients. We believe Jefferies Finance has the momentum and market penetration to deliver ongoing growth and solid returns over the long-term. Above all, our management team has retained a vigilant and disciplined approach to risk, consistent with the prudent approach that has served and protected us well over the ten years since we founded this business with MassMutual.

Jefferies LoanCore, Jefferies’ commercial real estate lending joint venture with GIC Private Limited (formerly known as the Government of Singapore Investment Corporation), experienced a slow 2014, following two-years of strong results. Markedly slower market conditions, combined with an increasingly competitive CMBS origination environment, led to net earnings of $38 million (48.5% to Jefferies – this too is essentially a pre-tax number). Despite this challenging year, the refinancing opportunity in commercial real estate lending remains significant, and we have been working actively with management to drive performance in 2015 and beyond.

Leucadia Asset Management

Leucadia Asset Management brings together under one umbrella Jefferies’ various historic investment management efforts, as well as Topwater Capital, which we acquired in 2013, Mazama Capital Management, with which we became associated in 2014, and Folger Hill, which we discussed above and will launch its flagship fund in the next month. LAM identifies, seeds and develops focused funds managed by distinct management teams.

In August 2013, we launched a “first loss” fund called Topwater Partners with Bryan Borgia and Travis Taylor. We seeded that fund with $100 million from Leucadia and have raised additional third party capital. Starting in 2004, Topwater pioneered the first-loss model of investing, which we feel offers a unique risk-reward trade-off for investors and a prudent way for hedge fund managers to run a managed account on attractive terms. Topwater is a multi-strategy, multi-manager investment partnership where each underlying investment manager contributes 10% of their own capital as a first loss layer, shielding Topwater’s investors from losses up to 10%. This unique structure provides a strong layer of principal protection, while aiming to produce equity-like returns. Targeting low volatility and positive returns in all market environments, Topwater now has a solid almost ten-year performance track record, including a return to investors in 2014 of 7.72%, with no negative months and with a 0.24 correlation to the S&P 500 since inception. This compares to the HFRI Fund Weighted Composite Index return for 2014 of 3.33%. We are encouraged by the early results and the strong pipeline of investment managers seeking to join the platform. As of the end of December 2014, Topwater has funded more than 22 portfolio managers, with an average allocation of $56 million. We have confidence that we will continue to grow this business prudently, while maximizing returns for Topwater’s investors.

LAM also includes the Structured Alpha Fund, which is a continuation of a trading strategy developed at Jefferies beginning in 2006 by a team led by Vlad Portnoy. Structured Alpha uses statistical models to generate systematic alpha through short-term trading (but generally not “high frequency trading”) of global equities and futures, with a view to delivering consistent positive returns that beat absolute return benchmarks with low correlation to the S&P 500. Third party assets under management in Structured Alpha and associated efforts are currently about $700 million. Mazama, led by Ron Sauer, has an over 20-year track record of long-only growth equity investing. With historically strong returns on an absolute basis and relative to its benchmark indices, Mazama is working to grow its assets under management on the back of our investment in its strategies.

Leucadia National Corporation 9

We believe we are early in the development of LAM, which over time will afford us a broad exposure in investment management and hopefully a valuable business developed on an attractive risk-reward basis.

Berkadia Commercial Mortgage

Berkadia, our 50/50 joint venture with Berkshire Hathaway, had another strong year in 2014. Despite a slow first quarter, Berkadia originated $12.8 billion in new financing for its clients, up nearly 23% over 2013. For 2014, Berkadia was the single largest originator for HUD ($1.5 billion), the second largest Freddie Mac originator ($4.4 billion) and the third largest originator for FNMA ($2.7 billion). Although Berkadia’s $4.1 billion of investment sales in 2014 were flat versus 2013, significant progress was made in the integration of the mortgage banking and investment sales teams. The combination of these capabilities allows us to better serve our clients and we expect it will lead to accelerated growth for the entire enterprise. With a large commercial real estate refinancing wave coming in 2015 and 2016, expectations are high for the future of Berkadia. Our relationship with Berkshire Hathaway remains outstanding and we look forward to continued success together. We also look forward to working with Justin and the Berkadia senior leadership team as they continue to grow Berkadia into the best full service mortgage banking firm in the industry.

HomeFed

In 2014, Leucadia sold substantially all of its direct real estate assets to California-based HomeFed. The transaction was valued at $216 million and increased our ownership in HomeFed from 31% to 65%. It also enhanced HomeFed’s geographic presence by adding land and commercial real estate assets in New York, Florida, Maine, and South Carolina. With the closing of the transaction, Brian joined HomeFed’s Board of Directors, where Joe has served as Chairman for many years. As a result of the acquisition, HomeFed’s lot inventory increased to approximately 10,200 entitled lots, with more than 6,200 of those lots located in entitlement-constrained California, where HomeFed’s management team has substantial experience and an established history of success. HomeFed also owns approximately 5,000 acres of unentitled land in California, currently in the entitlement process. The additional land holdings provide the necessary land supply and diversification for future land and lot sales, as well as increased home deliveries. With integration and transition completed, we are confident in CEO Paul Borden and HomeFed’s entire management team’s ability to create value.

Vehicle Finance – Foursight Capital and Chrome Capital

In October 2012, we partnered with an experienced management team in the indirect auto finance market to start Foursight Capital. Foursight purchases automobile installment contracts originated by franchised dealerships in conjunction with the sale of new and used automobiles and services these loans throughout their life cycle. While Foursight was initially jump started by deal flow from Garcadia, it has quickly grown to fund loans for car buyers at nearly 300 third party dealerships as well. In 2014, Foursight originated $141.9 million in auto loans, up from $55.8 million in 2013. Foursight’s loan portfolio has an average credit score of 640 and it has performed as expected in terms of delinquencies and losses. This strong performance enabled Foursight to achieve a major milestone in September when it completed its first securitization of $112.7 million. We will continue to grow originations at Foursight, while keeping a close eye on the performance of our paper.

To further build our consumer finance auto finance platform and leverage Foursight’s servicing capabilities, in March we made an investment in Chrome Capital. Chrome, which began operations in 2012, is the largest lessor of used Harley-Davidson motorcycles in the U.S. Through partnerships with 130 active new

Leucadia National Corporation 10

and used dealerships, Chrome provides two to four year leases on used Harleys. These leases provide first-time customers with the opportunity to “test ride” a Harley and loyal Harley enthusiasts the opportunity to try different bikes. Harley’s strong brand loyalty and low production volumes enable used Harleys to hold their value well and consistently, two important factors in any leasing business.

In 2014, Chrome originated $20.4 million of leases which are being serviced by Foursight. Although the initial reception for Chrome’s products from dealers and customers alike has been positive, the size of the used motorcycle leasing opportunity needs to be proven out by significant growth in originations in 2015 and beyond.

National Beef

2014 was a difficult year for National Beef, the fourth largest U.S. beef processor. The year began with the closure of the processing facility in Brawley, CA. The decision to close this plant was driven in large part by the inability to source sufficient quantities of high quality cattle. Availability of cattle, and the corresponding effects on the price for cattle, was the dominant theme affecting the results of National Beef in 2014. Cattle producers had culled the herd during the prolonged drought. In 2014, they took the confluence of largely better weather, less expensive feed and anticipated strong long-term demand for cattle as an opportunity to begin the multi-year process of rebuilding the herd, which is presently at an all-time low. This rebuilding led to less cattle available industry-wide for harvesting in 2014 and drove the price of cattle to historic highs. While resilient demand allowed for an increase in the overall price of beef, it was not sufficient to offset the decline in volume and the increase in costs.

For National Beef, this difficult margin environment was exacerbated by a number of other factors including capital improvements in one processing plant that led to short-term operating inefficiencies, the ramp-up of production at the new state-of-the-art tannery and the continued efforts to rebuild volume in the consumer-ready operations. While all of these elements were a drag on results in 2014, we believe they will lead to enhanced sales and margin opportunities in the future. We remain confident in the abilities of our management team led by Tim Klein and hopeful for a somewhat near-term improvement in results.

Harbinger Group

We own 23% of Harbinger for a total cost of $476 million (46.6 million shares at an average price of $10.21 per share). Although HRG is a diversified holding company with investments in consumer products, insurance, energy and asset management businesses, the vast majority of its value is represented by its ownership in two growing public companies. HRG owns 59% of Spectrum Brands, a diversified global branded consumer products company, which operates in segments including consumer batteries, hardware and home improvement, global pet supplies, and home and garden. Spectrum focuses on developing and acquiring products and brands that deliver better value (same performance at a lower price) to consumers. This focus has enabled Spectrum to consistently grow its adjusted EBITDA from $391 million in 2009 to $724 million in 2014, a 13% CAGR. HRG also owns 80% of Fidelity & Guaranty Life, a market leader in fixed indexed annuities and fixed indexed universal life insurance that focuses on middle-income Americans. Through its products, Fidelity helps approximately 700,000 customers prepare for retirement and unexpected loss. Fidelity’s expertise in and focus on the growing fixed indexed annuity market enabled the company to grow annuity sales to $2.2 billion in 2014, up 94% over the prior year. Despite the strength and growth of these two underlying assets, throughout 2014, HRG’s stock traded at a significant discount to the sum of the value of its shares in these publicly traded stocks combined with HRG’s other net assets. We believe significant upside potential remains to be realized by narrowing this valuation gap and supporting the continued growth of Spectrum and Fidelity.

Leucadia National Corporation 11

Garcadia

Garcadia, our auto dealership joint venture with the Ken Garff Group of Salt Lake City, grew substantially in 2014. Garcadia sold nearly 43,000 new units and 22,000 used units during the year. On a same store basis, this represented a 20% increase in new car sales, which strongly outperformed U.S. new sales growth of only 5.8%. In addition to this organic growth, we also acquired five new dealerships, bringing our total to 26 in four states. Two of the stores acquired were underperforming Nissan dealerships that we added to our Southern California platform and the other three were in the Detroit metro area (two Chrysler Jeep Dodge Ram stores and the largest Cadillac store in the world), representing our first entry into a new market since 2008. We also operate dealerships in Iowa and Texas. Although we will continue to look for acquisition opportunities, at this stage in the cycle we do so with heightened caution, emphasizing dealerships and groups where we believe performance improvement is available over time. Thank you to John Garff, Brett Hopkins and the entire Garcadia team for their on-going partnership.

Linkem

Linkem, our Italian fixed wireless broadband service provider, had a very encouraging 2014. Without growing its geographic footprint and with restrained marketing activities, Linkem increased its subscriber base by 46% to 240,000. This growth enabled Linkem to achieve its first quarter of positive EBITDA, improve its operating metrics and maintain excellent customer satisfaction. Linkem’s long awaited commercial LTE launch over its 3.5GHz spectrum occurred in December. 2015 will be a busy year for CEO Davide Rota and his team, with plans to meaningfully expand Linkem’s footprint, add capacity and take advantage of the migration to LTE. We are confident they will deliver.

Conwed

Conwed, which manufactures extruded and oriented plastic netting, posted a 22% increase in revenues in 2014, driven by continued organic growth and two acquisitions: 80% of Filtrexx International in March and 100% of Weaver Express in August. Pre-tax profits, however, declined by 10% year over-year due to rising resin prices and the loss of a single customer which removed plastic netting from their product. Resin prices have since come down, due to declining oil prices, and we expect solid growth in results in 2015, driven by the full-year impact of the two acquisitions, continued organic growth and margin improvement due to lower resin costs. We recently celebrated the 30th anniversary of Leucadia’s ownership of Conwed, and thank Chris Hatzenbuhler and the entire team at Conwed for their outstanding drive and effort.

Idaho Timber

The U.S. housing industry continued its slow rebound from the depths of the recession, but thanks to the relentless efforts of Ted Ellis and his team at Idaho Timber, the company experienced a significant increase in profitability. A 19% increase in shipments, measured in board feet, increasingly efficient operations, lower log costs and an uptick in pricing led to a 60% improvement in EBITDA. The restart of an acquired sawmill in Coushatta, LA (which had been idle since 2008) contributed positive operating income in its first full year of operations. Idaho Timber weathered the housing downturn by focusing on streamlining its operations and meeting the needs of its customers, and is poised to continue to grow profits as the market improves.

Leucadia National Corporation 12

Golden Queen

In September, we entered into a joint venture with Golden Queen Mining Co. Ltd (TSX:GQM) and members of the Clay family, Golden Queen’s largest shareholder, to develop and operate the Soledad Mountain project. The project is a fully permitted, open pit, heap leach gold and silver project located just outside the town of Mojave in Kern County, California. Construction is in full swing and commissioning is planned for late 2015. Gold and silver mining operations are expected to run through 2027 and an ancillary business generating crushed stone for construction aggregate and concrete products could last up to 30 years. We appreciate and value our partnership with the Clay family and the Golden Queen team, and look forward to a long and lucrative relationship.

Juneau Energy

Juneau Energy’s largest acquisition in 2014 was its $60 million acquisition of acreage in the core area of the Eastern Eagle Ford in Brazos and Burleson counties in Texas. We now own over 20,000 acres in the Eastern Eagle Ford alongside key operators, including Anadarko, Halcon and Apache. Apache is the largest operator in the area and it has indicated that its Eastern Eagle Ford and Permian operations are its two ongoing focus areas in the U.S. Juneau has already met all of its modest development obligations on the acquired acreage and expects to defer drilling in 2015 in the Eastern Eagle Ford until a combination of falling drilling costs and higher oil prices make drilling on the acreage highly profitable. Despite falling oil prices, we believe the current value of the acquired acreage in Brazos and Burleson exceeds its acquisition price.

Juneau also owns 23,000 acres in Houston and Leon counties which has stacked resource potential that will eventually be developed through lower cost vertical wells. In Oklahoma, Juneau’s small development joint venture with a niche local developer has successfully drilled and completed eight wells, including four horizontal Mississippian oil wells in Alfalfa County which, even at current oil prices, are expected to generate good returns. Juneau’s assets have good value even in today’s environment and hold the promise of excellent returns over the cycle.

Vitesse Energy

Vitesse Energy acquired approximately $240 million of non-operated acreage and production in the core of the Bakken Field in 2014. The assets are primarily located in Williams, McKenzie and Mountrail counties of North Dakota. At year-end 2014 Vitesse was producing over 1,800 barrels of oil equivalent (BOE) per day, generating positive free cash flow and had operating costs (including lease operating expense, transportation and production taxes) of less than $14 per BOE. Falling oil prices have reduced the number of rigs drilling in the Bakken by almost 35% year over year, from approximately 200 down to less than 130 rigs running today. Operators are curtailing drilling in the marginal areas of the field, while development continues in the core areas as operators focus on reducing drilling costs and improving overall efficiencies in order to produce good returns. The falling Bakken rig count and Vitesse’s core acreage position suggest that Vitesse will participate in the development of new Bakken wells, but at a moderated pace in 2015. Rates of return in these newly drilled wells remain attractive. Again, lower oil prices have dampened our short-term returns, but the quality of Vitesse’s assets and low cost position give us confidence in the value creation potential.

Leucadia National Corporation 13

Oregon LNG

Since 2007, Leucadia has been working with the Federal Energy Regulatory Commission (“FERC”) and state and local authorities to permit an LNG facility site in Warrenton, Oregon and an 86 mile long natural gas pipeline to connect to the U.S. natural gas transmission grid. The process has proven to be agonizingly difficult, painfully slow and fraught with delay. While some progress was made in 2014 when we received our Department of Energy export authorization to Non-Free Trade Agreement countries, we had hoped and pushed for much more. The next major step towards achieving a fully permitted facility is for FERC to issue a Draft Environmental Impact Statement along with a Biological Assessment. We expect those to be issued in the first half of this year and will be closely monitoring the process.

* * *

Finally, we thank all of you — our clients and customers, our employees, our shareholders, our Board of Directors, our bondholders and all others associated with Leucadia and all our businesses — for your continued support.

| Sincerely, | ||||

|

|

|||

| Richard B. Handler | Brian P. Friedman | |||

| Chief Executive Officer | President | |||

Leucadi National Corporation 14

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Port Houston Regular Commission Meeting

- ContextLogic Completes Sale of Substantially All Operating Assets and Liabilities Associated with Wish to Qoo10

- Tocvan Provides Corporate Update

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share