Form 8-K KEYCORP /NEW/ For: Oct 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 15, 2015

(Exact name of registrant as specified in charter)

| Ohio |

001-11302 |

34-6542451 | ||

| (State or other jurisdiction of incorporation) |

Commission File Number |

(I.R.S. Employer Identification No.) | ||

| 127 Public Square, Cleveland, Ohio |

44114-1306 | |||

| (Address of principal executive offices) | (Zip Code) | |||

(216) 689-3000

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operations and Financial Condition. |

On October 15, 2015, KeyCorp issued a press release announcing its financial results for the three- and nine-month periods ended September 30, 2015 (the “Press Release”), and posted on its website its third quarter 2015 Supplemental Information Package (the “Supplemental Information Package”). The Press Release and Supplemental Information Package are being furnished as Exhibit 99.1 and Exhibit 99.2, respectively.

The information in the preceding paragraph, as well as Exhibit 99.1 and Exhibit 99.2 referenced therein, shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”).

KeyCorp’s Consolidated Balance Sheets and Consolidated Statements of Income (collectively, the “Financial Statements”), included as part of the Press Release, are filed as Exhibit 99.3 to this report. Exhibit 99.3 is deemed “filed” for purposes of Section 18 of the Exchange Act and, therefore, may be incorporated by reference in filings under the Securities Act.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits |

The following exhibits are furnished, or filed in the case of Exhibit 99.3, herewith:

| 99.1 | Press Release, dated October 15, 2015, announcing financial results for the three- and nine-month periods ended September 30, 2015. |

| 99.2 | Supplemental Information Package reviewed during the conference call and webcast. |

| 99.3 | Financial Statements. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| KEYCORP | ||||||

| (Registrant) | ||||||

| Date: October 15, 2015 | /s/ Douglas M. Schosser | |||||

| By: | Douglas M. Schosser | |||||

| Chief Accounting Officer | ||||||

Exhibit 99.1

|

NEWS |

FOR IMMEDIATE RELEASE

KEYCORP REPORTS THIRD QUARTER 2015

NET INCOME OF $216 MILLION, OR $.26 PER COMMON SHARE

Positive operating leverage from prior year

Revenue up 7% from prior year, reflecting growth in net interest income

and noninterest income

Average loans up 6% from prior year, driven by a

15% increase in commercial, financial and agricultural loans

Expenses include a $19 million pension settlement charge

Credit quality remains strong, with net charge-offs to average loans of .27%

Disciplined capital management with common share repurchases of $123 million

CLEVELAND, October 15, 2015 — KeyCorp (NYSE: KEY) today announced third quarter net income from continuing operations attributable to Key common shareholders of $216 million, or $.26 per common share, compared to $230 million, or $.27 per common share, for the second quarter of 2015, and $197 million, or $.23 per common share, for the third quarter of 2014. During the third quarter of 2015, Key incurred $19 million, or $.01 per common share, of costs related to a pension settlement charge, compared to $20 million, or $.01 per common share, during the third quarter of 2014.

For the nine months ended September 30, 2015, net income from continuing operations attributable to Key common shareholders was $668 million, or $.78 per common share, compared to $671 million, or $.76 per common share, for the same period one year ago.

“Key’s third quarter results reflect our continued success in growing our business, managing expenses and maintaining strong credit quality,” said Chairman and Chief Executive Officer Beth Mooney.

“We generated positive operating leverage relative to the same period last year, driven by a 7% increase in revenue along with well-managed expenses. Revenue trends reflect growth in new and expanded relationships across our company, which drove higher net interest income, as well as continued momentum in our fee-based businesses,” continued Mooney. “We saw good loan growth again this quarter, with average balances up 6% from the prior year, driven by a 15% increase in commercial, financial and agricultural loans. Loan balances increased in both the Community Bank and Corporate Bank.”

“Results compared with the prior quarter reflect higher net interest income and variability in capital markets revenues, which declined relative to our record second quarter,” said Mooney. “Expenses, excluding the pension settlement charge, were lower than the previous quarter.”

“Additionally, credit quality remains strong, with net charge-offs to average loans of .27%, which is below our targeted range,” added Mooney.

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 2

THIRD QUARTER 2015 FINANCIAL RESULTS, from continuing operations

Compared to Third Quarter of 2014

| • | Average loans up 6%, driven by 15% growth in commercial, financial and agricultural loans |

| • | Average deposits, excluding deposits in foreign office, up 3% due to continued growth in commercial mortgage servicing and inflows from commercial and consumer clients |

| • | Net interest income (taxable-equivalent) up $17 million, as higher earning asset balances offset lower earning asset yields |

| • | Noninterest income up $53 million due to strength in Key’s core fee-based businesses, which included a full-quarter impact of the September 2014 Pacific Crest Securities acquisition |

| • | Noninterest expense up $18 million primarily attributable to higher performance-based compensation and a full-quarter impact of the September 2014 Pacific Crest Securities acquisition |

| • | Asset quality remained strong, with net loan charge-offs to average loans of .27% |

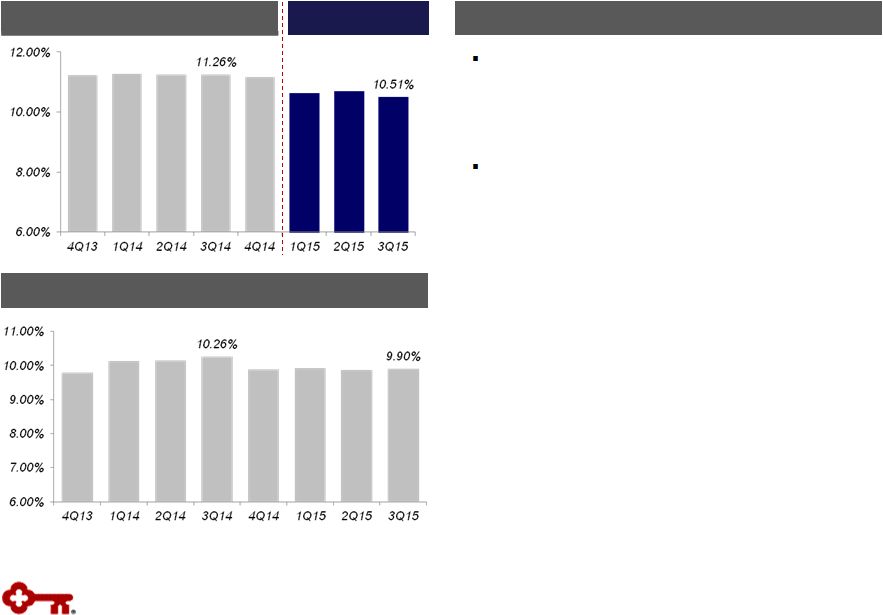

| • | Disciplined capital management, repurchasing $123 million of common shares during the third quarter of 2015 and maintaining a solid capital position with an estimated Common Equity Tier 1 ratio of 10.51% |

Compared to Second Quarter of 2015

| • | Average loans up 2%, primarily driven by a 5% increase in commercial, financial and agricultural loans |

| • | Average deposits, excluding deposits in foreign office, down slightly reflecting a decline in short-term noninterest-bearing deposit balances from commercial clients and lower certificates of deposit |

| • | Net interest income (taxable-equivalent) up $7 million attributable to improvement in the earning asset mix, partly offset by slightly lower earning asset yields and loan fees |

| • | Noninterest income down $18 million, primarily due to lower investment banking and debt placement fees partially offset by growth in other fee-based businesses |

| • | Noninterest expense up $13 million, driven by a $19 million pension settlement charge in the third quarter |

| • | Strong asset quality, with net loan charge-offs to average loans remaining below our targeted range of 40-60 basis points |

Selected Financial Highlights

| dollars in millions, except per share data | Change 3Q15 vs. | |||||||||||||||||||

| 3Q15 | 2Q15 | 3Q14 | 2Q15 | 3Q14 | ||||||||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders |

$ | 216 | $ | 230 | $ | 197 | (6.1 | )% | 9.6 | % | ||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders per common share — assuming dilution |

.26 | .27 | .23 | (3.7 | ) | 13.0 | ||||||||||||||

| Return on average total assets from continuing operations |

.95 | % | 1.03 | % | .92 | % | N/A | N/A | ||||||||||||

| Common Equity Tier 1 (a), (b) |

10.51 | 10.71 | N/A | N/A | N/A | |||||||||||||||

| Tier 1 common equity (a) |

N/A | N/A | 11.26 | % | N/A | N/A | ||||||||||||||

| Book value at period end |

$ | 12.47 | $ | 12.21 | $ | 11.74 | 2.1 | % | 6.2 | % | ||||||||||

| Net interest margin (TE) from continuing operations |

2.87 | % | 2.88 | % | 2.96 | % | N/A | N/A | ||||||||||||

| (a) | The table entitled “GAAP to Non-GAAP Reconciliations” in the attached financial supplement presents the computations of certain financial measures related to “Common Equity Tier 1” (compliance date of January 1, 2015, under the Regulatory Capital Rules) and “Tier 1 common equity” (prior to January 1, 2015). The table reconciles the GAAP performance measures to the corresponding non-GAAP measures, which provides a basis for period-to-period comparisons. For further information on the Regulatory Capital Rules, see the “Capital” section of this release. |

| (b) | 9-30-15 ratio is estimated. |

TE = Taxable Equivalent, N/A = Not Applicable

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 3

INCOME STATEMENT HIGHLIGHTS

Revenue

| dollars in millions | Change 3Q15 vs. | |||||||||||||||||||

| 3Q15 | 2Q15 | 3Q14 | 2Q15 | 3Q14 | ||||||||||||||||

| Net interest income (TE) |

$ | 598 | $ | 591 | $ | 581 | 1.2 | % | 2.9 | % | ||||||||||

| Noninterest income |

470 | 488 | 417 | (3.7 | ) | 12.7 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

$ | 1,068 | $ | 1,079 | $ | 998 | (1.0 | )% | 7.0 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

TE = Taxable Equivalent

Taxable-equivalent net interest income was $598 million for the third quarter of 2015, and the net interest margin was 2.87%. These results compare to taxable-equivalent net interest income of $581 million and a net interest margin of 2.96% for the third quarter of 2014. The increase in net interest income reflects higher earning asset balances moderated by lower earning asset yields, which also drove the decline in the net interest margin.

Compared to the second quarter of 2015, taxable-equivalent net interest income increased by $7 million, and the net interest margin was essentially unchanged. The increase in net interest income and the relatively stable net interest margin were primarily attributable to improvement in the earning asset mix, partly offset by slightly lower earning asset yields and loan fees. One additional day in the third quarter of 2015 also contributed to the increase in net interest income compared to the prior quarter.

Noninterest Income

| dollars in millions | Change 3Q15 vs. | |||||||||||||||||||

| 3Q15 | 2Q15 | 3Q14 | 2Q15 | 3Q14 | ||||||||||||||||

| Trust and investment services income |

$ | 108 | $ | 111 | $ | 99 | (2.7 | )% | 9.1 | % | ||||||||||

| Investment banking and debt placement fees |

109 | 141 | 88 | (22.7 | ) | 23.9 | ||||||||||||||

| Service charges on deposit accounts |

68 | 63 | 68 | 7.9 | — | |||||||||||||||

| Operating lease income and other leasing gains |

15 | 24 | 17 | (37.5 | ) | (11.8 | ) | |||||||||||||

| Corporate services income |

57 | 43 | 42 | 32.6 | 35.7 | |||||||||||||||

| Cards and payments income |

47 | 47 | 42 | — | 11.9 | |||||||||||||||

| Corporate-owned life insurance income |

30 | 30 | 26 | — | 15.4 | |||||||||||||||

| Consumer mortgage income |

3 | 4 | 3 | (25.0 | ) | — | ||||||||||||||

| Mortgage servicing fees |

11 | 9 | 9 | 22.2 | 22.2 | |||||||||||||||

| Net gains (losses) from principal investing |

11 | 11 | 9 | — | 22.2 | |||||||||||||||

| Other income |

11 | 5 | 14 | 120.0 | (21.4 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest income |

$ | 470 | $ | 488 | $ | 417 | (3.7 | )% | 12.7 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

Key’s noninterest income was $470 million for the third quarter of 2015, compared to $417 million for the year-ago quarter. The increase from the prior year was primarily attributable to strength in Key’s core fee-based businesses, which included a full-quarter impact of the September 2014 acquisition of Pacific Crest Securities. The third quarter of 2015 included $21 million of higher investment banking and debt placement fees, $15 million of increased corporate services income, and $9 million of higher trust and investment services income. Additionally, cards and payments income increased $5 million due to higher revenue from credit card and merchant fees.

Compared to the second quarter of 2015, noninterest income decreased by $18 million. The primary cause for the decline was $32 million in lower investment banking and debt placement fees, reflecting the variability of the business. Additionally, operating lease income and other leasing gains decreased $9 million. These decreases were partially offset by $14 million in higher corporate services income due to increased derivative income and loan commitment fees, a $6 million increase in other income and $5 million of higher service charges on deposit accounts.

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 4

Noninterest Expense

| dollars in millions | Change 3Q15 vs. | |||||||||||||||||||

| 3Q15 | 2Q15 | 3Q14 | 2Q15 | 3Q14 | ||||||||||||||||

| Personnel expense |

$ | 426 | $ | 408 | $ | 405 | 4.4 | % | 5.2 | % | ||||||||||

| Nonpersonnel expense |

298 | 303 | 301 | (1.7 | ) | (1.0 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest expense |

$ | 724 | $ | 711 | $ | 706 | 1.8 | % | 2.5 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

Key’s noninterest expense was $724 million for the third quarter of 2015, compared to $706 million in the third quarter of last year. Personnel costs increased $21 million year-over-year primarily due to increased performance-based compensation related to a strong capital markets business performance, along with a full-quarter impact of the September 2014 acquisition of Pacific Crest Securities. Nonpersonnel expense remained relatively stable as lower occupancy costs offset an increase in business services and professional fees.

Compared to the second quarter of 2015, noninterest expense increased by $13 million. This increase was primarily driven by a pension settlement charge of $19 million and partially offset by $5 million in lower nonpersonnel expense, largely related to lower occupancy costs.

BALANCE SHEET HIGHLIGHTS

In the third quarter of 2015, Key had average assets of $94.8 billion compared to $91.3 billion in the third quarter of 2014 and $93.9 billion in the second quarter of 2015.

Average Loans

| dollars in millions | Change 9-30-15 vs. | |||||||||||||||||||

| 9-30-15 | 6-30-15 | 9-30-14 | 6-30-15 | 9-30-14 | ||||||||||||||||

| Commercial, financial and agricultural (a) |

$ | 30,374 | $ | 29,017 | $ | 26,456 | 4.7 | % | 14.8 | % | ||||||||||

| Other commercial loans |

13,098 | 13,161 | 13,317 | (.5 | ) | (1.6 | ) | |||||||||||||

| Total home equity loans |

10,510 | 10,510 | 10,658 | — | (1.4 | ) | ||||||||||||||

| Other consumer loans |

5,299 | 5,290 | 5,365 | .2 | (1.2 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans |

$ | 59,281 | $ | 57,978 | $ | 55,796 | 2.2 | % | 6.2 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| (a) | Commercial, financial and agricultural average loan balances include $88 million, $88 million, and $92 million of assets from commercial credit cards at September 30, 2015, June 30, 2015, and September 30, 2014, respectively. |

Average loans were $59.3 billion for the third quarter of 2015, an increase of $3.5 billion compared to the third quarter of 2014. The loan growth occurred primarily in the commercial, financial and agricultural portfolio, which increased $3.9 billion and was broad-based across Key’s commercial lines of business. Consumer loans declined $214 million as a result of the run-off in Key’s consumer exit portfolios. Key’s core consumer loan portfolio remained relatively stable to the year-ago quarter.

Compared to the second quarter of 2015, average loans increased by $1.3 billion, driven by commercial, financial and agricultural loans, which grew $1.8 billion on a period-end basis.

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 5

Average Deposits

| dollars in millions | Change 9-30-15 vs. | |||||||||||||||||||

| 9-30-15 | 6-30-15 | 9-30-14 | 6-30-15 | 9-30-14 | ||||||||||||||||

| Non-time deposits (a) |

$ | 64,928 | $ | 65,109 | $ | 61,699 | (.3 | )% | 5.2 | % | ||||||||||

| Certificates of deposit ($100,000 or more) |

1,985 | 2,010 | 2,629 | (1.2 | ) | (24.5 | ) | |||||||||||||

| Other time deposits |

3,064 | 3,136 | 3,413 | (2.3 | ) | (10.2 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

$ | 69,977 | $ | 70,255 | $ | 67,741 | (.4 | )% | 3.3 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Cost of total deposits (a) |

.15 | % | .15 | % | .16 | % | N/A | N/A | ||||||||||||

| (a) | Excludes deposits in foreign office. |

N/A = Not Applicable

Average deposits, excluding deposits in foreign office, totaled $70 billion for the third quarter of 2015, an increase of $2.2 billion compared to the year-ago quarter. NOW and money market deposit accounts increased by $2.3 billion, and noninterest-bearing deposits increased by $966 million, reflecting continued growth in the commercial mortgage servicing business and inflows from commercial and consumer clients. These increases were partially offset by a decline in certificates of deposit.

Compared to the second quarter of 2015, average deposits, excluding deposits in foreign office, decreased by $278 million. The decrease was driven by a decline in short-term noninterest-bearing deposit balances from commercial clients and lower certificates of deposit. These decreases were partly offset by increases in NOW and money market deposit accounts.

ASSET QUALITY

| dollars in millions | Change 3Q15 vs. | |||||||||||||||||||

| 3Q15 | 2Q15 | 3Q14 | 2Q15 | 3Q14 | ||||||||||||||||

| Net loan charge-offs |

$ | 41 | $ | 36 | $ | 31 | 13.9 | % | 32.3 | % | ||||||||||

| Net loan charge-offs to average total loans |

.27 | % | .25 | % | .22 | % | N/A | N/A | ||||||||||||

| Nonperforming loans at period end (a) |

$ | 400 | $ | 419 | $ | 401 | (4.5 | )% | (.2 | )% | ||||||||||

| Nonperforming assets at period end |

417 | 440 | 418 | (5.2 | ) | (.2 | ) | |||||||||||||

| Allowance for loan and lease losses |

790 | 796 | 804 | (.8 | ) | (1.7 | ) | |||||||||||||

| Allowance for loan and lease losses to nonperforming loans |

197.5 | % | 190.0 | % | 200.5 | % | N/A | N/A | ||||||||||||

| Provision for credit losses |

$ | 45 | $ | 41 | $ | 19 | 9.8 | % | 136.8 | % | ||||||||||

| (a) | Loan balances exclude $12 million, $12 million, and $14 million of purchased credit impaired loans at September 30, 2015, June 30, 2015, and September 30, 2014, respectively. |

N/A = Not Applicable

Key’s provision for credit losses was $45 million for the third quarter of 2015, compared to $19 million for the third quarter of 2014 and $41 million for the second quarter of 2015. Key’s allowance for loan and lease losses was $790 million, or 1.31% of total period-end loans, at September 30, 2015, compared to 1.43% at September 30, 2014, and 1.37% at June 30, 2015.

Net loan charge-offs for the third quarter of 2015 totaled $41 million, or .27% of average total loans. These results compare to $31 million, or .22%, for the third quarter of 2014, and $36 million, or .25%, for the second quarter of 2015.

At September 30, 2015, Key’s nonperforming loans totaled $400 million and represented .67% of period-end portfolio loans, compared to .71% at September 30, 2014, and .72% at June 30, 2015. Nonperforming assets at September 30, 2015 totaled $417 million and represented .69% of period-end portfolio loans and OREO and other nonperforming assets, compared to .74% at September 30, 2014, and .75% at June 30, 2015.

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 6

CAPITAL

Key’s estimated risk-based capital ratios included in the following table continued to exceed all “well-capitalized” regulatory benchmarks at September 30, 2015.

Capital Ratios

| 9-30-15 | 6-30-15 | 9-30-14 | ||||||||||

| Common Equity Tier 1 (a), (b) |

10.51 | % | 10.71 | % | N/A | |||||||

| Tier 1 common equity (b) |

N/A | N/A | 11.26 | % | ||||||||

| Tier 1 risk-based capital (a) |

10.90 | % | 11.11 | % | 12.01 | |||||||

| Total risk based capital (a) |

12.51 | 12.66 | 14.10 | |||||||||

| Tangible common equity to tangible assets (b) |

9.90 | 9.86 | 10.26 | |||||||||

| Leverage (a) |

10.67 | 10.74 | 11.15 | |||||||||

| (a) | 9-30-15 ratio is estimated. |

| (b) | The table entitled “GAAP to Non-GAAP Reconciliations” in the attached financial supplement presents the computations of certain financial measures related to “Common Equity Tier 1” (compliance date of January 1, 2015, under the Regulatory Capital Rules) and “Tier 1 common equity” (prior to January 1, 2015). The table reconciles the GAAP performance measures to the corresponding non-GAAP measures, which provides a basis for period-to-period comparisons. See below for further information on the Regulatory Capital Rules. |

As shown in the preceding table, at September 30, 2015, Key’s estimated Common Equity Tier 1 and Tier 1 risk-based capital ratios stood at 10.51% and 10.90%, respectively. In addition, the tangible common equity ratio was 9.90% at September 30, 2015.

In October 2013, federal banking regulators published the final Basel III capital framework for U.S. banking organizations (the “Regulatory Capital Rules”). The mandatory compliance date for Key as a “standardized approach” banking organization began on January 1, 2015, subject to transitional provisions extending to January 1, 2019. Key’s estimated Common Equity Tier 1 ratio as calculated under the fully phased-in Regulatory Capital Rules was 10.41% at September 30, 2015. This estimate exceeds the fully phased-in required minimum Common Equity Tier 1 and Capital Conservation Buffer of 7.00%.

Summary of Changes in Common Shares Outstanding

| in thousands | Change 3Q15 vs. | |||||||||||||||||||

| 3Q15 | 2Q15 | 3Q14 | 2Q15 | 3Q14 | ||||||||||||||||

| Shares outstanding at beginning of period |

843,608 | 850,920 | 876,823 | (.9 | )% | (3.8 | )% | |||||||||||||

| Common shares repurchased |

(8,386 | ) | (8,794 | ) | (8,830 | ) | (4.6 | ) | (5.0 | ) | ||||||||||

| Shares reissued (returned) under employee benefit plans |

63 | 1,482 | 484 | (95.7 | ) | (87.0 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Shares outstanding at end of period |

835,285 | 843,608 | 868,477 | (1.0 | )% | (3.8 | )% | |||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

As previously reported, Key’s 2015 capital plan includes common share repurchases of up to $725 million, which are expected to be executed through the second quarter of 2016. During the third quarter of 2015, Key completed $123 million of common share repurchases, including repurchases to offset issuances of common shares under employee compensation plans.

LINE OF BUSINESS RESULTS

The following table shows the contribution made by each major business segment to Key’s taxable-equivalent revenue from continuing operations and income (loss) from continuing operations attributable to Key for the periods presented. For more detailed financial information pertaining to each business segment, see the tables at the end of this release.

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 7

In the third quarter of 2015, Key enhanced the approach used to determine the commercial reserve factors used in estimating the quantitative component of the commercial allowance for loan and lease losses. In addition, Key began utilizing an enhanced framework to quantify commercial allowance for loan and lease loss adjustments resulting from qualitative factors not fully captured within the statistical analysis of expected loss. The impact of these changes was largely neutral to the total allowance for loan and lease losses at September 30, 2015. However, because the quantitative reserve is allocated to the business segments at a loan level, while the qualitative portion is allocated at the portfolio level, the impact of the methodology enhancements on the allowance for each business segment and each portfolio caused the business segment and commercial portfolio reserves to increase or decrease accordingly. While the impact of the increases and decreases on the business segment and commercial portfolio reserves was not significant, the current quarter provision for credit losses within each business segment is not comparable to prior period amounts as a result of these methodology enhancements.

Major Business Segments

| dollars in millions | Change 3Q15 vs. | |||||||||||||||||||

| 3Q15 | 2Q15 | 3Q14 | 2Q15 | 3Q14 | ||||||||||||||||

| Revenue from continuing operations (TE) |

||||||||||||||||||||

| Key Community Bank |

$ | 579 | $ | 560 | $ | 558 | 3.4 | % | 3.8 | % | ||||||||||

| Key Corporate Bank |

454 | 477 | 400 | (4.8 | ) | 13.5 | ||||||||||||||

| Other Segments |

35 | 44 | 44 | (20.5 | ) | (20.5 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total segments |

1,068 | 1,081 | 1,002 | (1.2 | ) | 6.6 | ||||||||||||||

| Reconciling Items |

— | (2 | ) | (4 | ) | N/M | N/M | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 1,068 | $ | 1,079 | $ | 998 | (1.0 | )% | 7.0 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) from continuing operations attributable to Key |

||||||||||||||||||||

| Key Community Bank |

$ | 71 | $ | 67 | $ | 60 | 6.0 | % | 18.3 | % | ||||||||||

| Key Corporate Bank |

138 | 133 | 134 | 3.8 | 3.0 | |||||||||||||||

| Other Segments |

26 | 31 | 27 | (16.1 | ) | (3.7 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total segments |

235 | 231 | 221 | 1.7 | 6.3 | |||||||||||||||

| Reconciling Items |

(13 | ) | 4 | (18 | ) | N/M | N/M | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 222 | $ | 235 | $ | 203 | (5.5 | )% | 9.4 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

TE = Taxable Equivalent, N/M = Not Meaningful

Key Community Bank

| dollars in millions | Change 3Q15 vs. | |||||||||||||||||||

| 3Q15 | 2Q15 | 3Q14 | 2Q15 | 3Q14 | ||||||||||||||||

| Summary of operations |

||||||||||||||||||||

| Net interest income (TE) |

$ | 379 | $ | 362 | $ | 359 | 4.7 | % | 5.6 | % | ||||||||||

| Noninterest income |

200 | 198 | 199 | 1.0 | .5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue (TE) |

579 | 560 | 558 | 3.4 | 3.8 | |||||||||||||||

| Provision for credit losses |

18 | 3 | 21 | 500.0 | (14.3 | ) | ||||||||||||||

| Noninterest expense |

448 | 450 | 441 | (.4 | ) | 1.6 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes (TE) |

113 | 107 | 96 | 5.6 | 17.7 | |||||||||||||||

| Allocated income taxes (benefit) and TE adjustments |

42 | 40 | 36 | 5.0 | 16.7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to Key |

$ | 71 | $ | 67 | $ | 60 | 6.0 | % | 18.3 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Average balances |

||||||||||||||||||||

| Loans and leases |

$ | 31,039 | $ | 30,707 | $ | 30,103 | 1.1 | % | 3.1 | % | ||||||||||

| Total assets |

33,090 | 32,753 | 32,173 | 1.0 | 2.9 | |||||||||||||||

| Deposits |

51,234 | 50,766 | 50,303 | .9 | 1.9 | |||||||||||||||

| Assets under management at period end |

$ | 35,158 | $ | 38,399 | $ | 39,249 | (8.4 | )% | (10.4 | )% | ||||||||||

TE = Taxable Equivalent

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 8

Additional Key Community Bank Data

| dollars in millions | Change 3Q15 vs. | |||||||||||||||||||

| 3Q15 | 2Q15 | 3Q14 | 2Q15 | 3Q14 | ||||||||||||||||

| Noninterest income |

|

|||||||||||||||||||

| Trust and investment services income |

$ | 73 | $ | 76 | $ | 73 | (3.9 | )% | — | |||||||||||

| Service charges on deposit accounts |

56 | 52 | 57 | 7.7 | (1.8 | )% | ||||||||||||||

| Cards and payments income |

43 | 43 | 39 | — | 10.3 | |||||||||||||||

| Other noninterest income |

28 | 27 | 30 | 3.7 | (6.7 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest income |

$ | 200 | $ | 198 | $ | 199 | 1.0 | % | .5 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Average deposit balances |

||||||||||||||||||||

| NOW and money market deposit accounts |

$ | 28,568 | $ | 28,284 | $ | 27,403 | 1.0 | % | 4.3 | % | ||||||||||

| Savings deposits |

2,362 | 2,385 | 2,419 | (1.0 | ) | (2.4 | ) | |||||||||||||

| Certificates of deposit ($100,000 or more) |

1,560 | 1,547 | 2,072 | .8 | (24.7 | ) | ||||||||||||||

| Other time deposits |

3,061 | 3,132 | 3,406 | (2.3 | ) | (10.1 | ) | |||||||||||||

| Deposits in foreign office |

271 | 299 | 320 | (9.4 | ) | (15.3 | ) | |||||||||||||

| Noninterest-bearing deposits |

15,412 | 15,119 | 14,683 | 1.9 | 5.0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

$ | 51,234 | $ | 50,766 | $ | 50,303 | .9 | % | 1.9 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Home equity loans |

||||||||||||||||||||

| Average balance |

$ | 10,281 | $ | 10,266 | $ | 10,368 | ||||||||||||||

| Weighted-average loan-to-value ratio (at date of origination) |

71 | % | 71 | % | 71 | % | ||||||||||||||

| Percent first lien positions |

60 | 60 | 59 | |||||||||||||||||

| Other data |

||||||||||||||||||||

| Branches |

972 | 989 | 997 | |||||||||||||||||

| Automated teller machines |

1,259 | 1,280 | 1,290 | |||||||||||||||||

Key Community Bank Summary of Operations

| • | Positive operating leverage from prior year |

| • | Net income increased to $71 million, up 18.3% from prior year |

| • | Commercial, financial and agricultural loan growth of $1 billion, or 8.7% from prior year |

| • | Average deposits up $931 million, or 1.9% from the prior year |

Key Community Bank recorded net income attributable to Key of $71 million for the third quarter of 2015, compared to net income attributable to Key of $60 million for the year-ago quarter.

Taxable-equivalent net interest income increased by $20 million, or 5.6%, from the third quarter of 2014 due to an increase in average loans and leases of 3.1%, including commercial, financial and agricultural loans, which grew by $1 billion, or 8.7%, from the prior year. Average deposits increased 1.9% from one year ago.

Noninterest income remained relatively stable from the year-ago quarter. Core revenue continues to improve, driven by growth in cards and payments income of $4 million, mostly offset by lower service charges on deposit accounts and a decrease in other income.

The provision for credit losses decreased by $3 million, or 14.3%, from the third quarter of 2014, due to the enhancements to the approach utilized to determine the allowance for loan and lease losses discussed above.

Noninterest expense increased by $7 million, or 1.6%, from the year-ago quarter. Personnel expense increased $1 million while nonpersonnel expense increased by $6 million.

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 9

Key Corporate Bank

| dollars in millions | Change 3Q15 vs. | |||||||||||||||||||

| 3Q15 | 2Q15 | 3Q14 | 2Q15 | 3Q14 | ||||||||||||||||

| Summary of operations |

|

|||||||||||||||||||

| Net interest income (TE) |

$ | 220 | $ | 227 | $ | 215 | (3.1 | )% | 2.3 | % | ||||||||||

| Noninterest income |

234 | 250 | 185 | (6.4 | ) | 26.5 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue (TE) |

454 | 477 | 400 | (4.8 | ) | 13.5 | ||||||||||||||

| Provision for credit losses |

30 | 41 | 2 | (26.8 | ) | N/M | ||||||||||||||

| Noninterest expense |

246 | 252 | 213 | (2.4 | ) | 15.5 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes (TE) |

178 | 184 | 185 | (3.3 | ) | (3.8 | ) | |||||||||||||

| Allocated income taxes and TE adjustments |

42 | 51 | 51 | (17.6 | ) | (17.6 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

136 | 133 | 134 | 2.3 | 1.5 | |||||||||||||||

| Less: Net income (loss) attributable to noncontrolling interests |

(2 | ) | — | — | N/M | N/M | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to Key |

$ | 138 | $ | 133 | $ | 134 | 3.8 | % | 3.0 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Average balances |

||||||||||||||||||||

| Loans and leases |

$ | 26,425 | $ | 25,298 | $ | 23,215 | 4.5 | % | 13.8 | % | ||||||||||

| Loans held for sale |

918 | 1,234 | 481 | (25.6 | ) | 90.9 | ||||||||||||||

| Total assets |

32,163 | 31,228 | 28,268 | 3.0 | 13.8 | |||||||||||||||

| Deposits |

18,809 | 19,708 | 17,599 | (4.6 | ) | 6.9 | ||||||||||||||

| Assets under management at period end |

— | — | $ | 34 | N/M | N/M | ||||||||||||||

TE = Taxable Equivalent, N/M = Not Meaningful

Additional Key Corporate Bank Data

| dollars in millions | Change 3Q15 vs. | |||||||||||||||||||

| 3Q15 | 2Q15 | 3Q14 | 2Q15 | 3Q14 | ||||||||||||||||

| Noninterest income |

|

|||||||||||||||||||

| Trust and investment services income |

$ | 35 | $ | 35 | $ | 26 | — | 34.6 | % | |||||||||||

| Investment banking and debt placement fees |

108 | 139 | 86 | (22.3 | )% | 25.6 | ||||||||||||||

| Operating lease income and other leasing gains |

16 | 18 | 14 | (11.1 | ) | 14.3 | ||||||||||||||

| Corporate services income |

46 | 33 | 30 | 39.4 | 53.3 | |||||||||||||||

| Service charges on deposit accounts |

11 | 11 | 11 | — | — | |||||||||||||||

| Cards and payments income |

4 | 4 | 3 | — | 33.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Payments and services income |

61 | 48 | 44 | 27.1 | 38.6 | |||||||||||||||

| Mortgage servicing fees |

11 | 9 | 9 | 22.2 | 22.2 | |||||||||||||||

| Other noninterest income |

3 | 1 | 6 | 200.0 | (50.0 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest income |

$ | 234 | $ | 250 | $ | 185 | (6.4 | )% | 26.5 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

N/M = Not Meaningful

Key Corporate Bank Summary of Operations

| • | Investment banking and debt placement fees up 25.6% from the prior year |

| • | Revenue up 13.5% from the prior year |

| • | Average loan and lease balances up 13.8% from the prior year |

Key Corporate Bank recorded net income attributable to Key of $138 million for the third quarter of 2015, an increase of $4 million, or 3%, from the same period one year ago.

Taxable-equivalent net interest income increased by $5 million, or 2.3%, compared to the third quarter of 2014. Average earning assets increased $3 billion, or 12.2%, from the year-ago quarter, primarily driven by growth in commercial, financial and agricultural loans. Average deposit balances increased $1.2 billion, or 6.9%, from the year-ago quarter, driven by commercial mortgage servicing deposits and other commercial client inflows.

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 10

Noninterest income was up $49 million, or 26.5% from the prior year. Investment banking and debt placement fees increased $22 million, or 25.6%, driven by strength in syndications, debt underwriting, and financial advisory fees. Corporate services income increased $16 million, or 53.3%, due to higher derivatives income and loan commitment fees. Trust and investment services income increased $9 million, or 34.6%, primarily due to the September 2014 acquisition of Pacific Crest Securities.

The provision for credit losses increased $28 million from the same period one year ago, primarily due to the enhancements to the approach utilized to determine the allowance for loan and lease losses discussed above, as well as a 13.8% increase in average loan balances.

Noninterest expense increased by $33 million, or 15.5%, from the third quarter of 2014. This increase was driven primarily by higher personnel expense, from increased performance-based compensation related to a strong capital markets business performance, along with a full quarter impact of the September 2014 acquisition of Pacific Crest Securities.

Other Segments

Other Segments consist of Corporate Treasury, Key’s Principal Investing unit and various exit portfolios. Other Segments generated net income attributable to Key of $26 million for the third quarter of 2015, essentially unchanged compared to net income attributable to Key of $27 million for the same period last year.

*****

KeyCorp was organized more than 160 years ago and is headquartered in Cleveland, Ohio. One of the nation’s largest bank-based financial services companies, Key had assets of approximately $95.4 billion at September 30, 2015.

Key provides deposit, lending, cash management and investment services to individuals and small and mid-sized businesses in 12 states under the name KeyBank National Association. Key also provides a broad range of sophisticated corporate and investment banking products, such as merger and acquisition advice, public and private debt and equity, syndications and derivatives to middle market companies in selected industries throughout the United States under the KeyBanc Capital Markets trade name. For more information, visit https://www.key.com/. KeyBank is Member FDIC.

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 11

CONTACTS:

| ANALYSTS Vernon L. Patterson 216.689.0520

Melanie S. Misconish 216.689.4545 |

MEDIA Jack Sparks 720.904.4554 Twitter: @keybank_news |

| INVESTOR RELATIONS: www.key.com/ir |

KEY MEDIA NEWSROOM: www.key.com/newsroom |

This earnings release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements do not relate strictly to historical or current facts. Forward-looking statements usually can be identified by the use of words such as “goal,” “objective,” “plan,” “expect,” “assume,” “anticipate,” “intend,” “project,” “believe,” “estimate,” or other words of similar meaning. Forward-looking statements provide our current expectations or forecasts of future events, circumstances, results, or aspirations. Forward-looking statements, by their nature, are subject to assumptions, risks and uncertainties, many of which are outside of our control. Our actual results may differ materially from those set forth in our forward-looking statements. There is no assurance that any list of risks and uncertainties or risk factors is complete. Factors that could cause Key’s actual results to differ from those described in the forward-looking statements can be found in KeyCorp’s Form 10-K for the year ended December 31, 2014, as well as in KeyCorp’s subsequent SEC filings, all of which have been filed with the Securities and Exchange Commission (the “SEC”) and are available on Key’s website (www.key.com/ir) and on the SEC’s website (www.sec.gov). These factors may include, among others: deterioration of commercial real estate market fundamentals, adverse changes in credit quality trends, declining asset prices, a reversal of the U.S. economic recovery due to financial, political, or other shocks, and the extensive and increasing regulation of the U.S. financial services industry. Any forward-looking statements made by us or on our behalf speak only as of the date they are made and we do not undertake any obligation to update any forward-looking statement to reflect the impact of subsequent events or circumstances.

Notes to Editors:

A live Internet broadcast of KeyCorp’s conference call to discuss quarterly results and currently anticipated earnings trends and to answer analysts’ questions can be accessed through the Investor Relations section at https://www.key.com/ir at 9:00 a.m. ET, on Thursday, October 15, 2015. An audio replay of the call will be available through October 22, 2015.

For up-to-date company information, media contacts, and facts and figures about Key’s lines of business, visit our Media Newsroom at https://www.key.com/newsroom.

*****

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 12

KeyCorp

Third Quarter 2015

Financial Supplement

Page

| 13 | Financial Highlights |

| 15 | GAAP to Non-GAAP Reconciliation |

| 18 | Consolidated Balance Sheets |

| 19 | Consolidated Statements of Income |

| 20 | Consolidated Average Balance Sheets, and Net Interest Income and Yields/Rates From Continuing Operations |

| 22 | Noninterest Expense |

| 22 | Personnel Expense |

| 23 | Loan Composition |

| 23 | Loans Held for Sale Composition |

| 23 | Summary of Changes in Loans Held for Sale |

| 24 | Exit Loan Portfolio From Continuing Operations |

| 24 | Asset Quality Statistics From Continuing Operations |

| 25 | Summary of Loan and Lease Loss Experience From Continuing Operations |

| 26 | Summary of Nonperforming Assets and Past Due Loans From Continuing Operations |

| 27 | Summary of Changes in Nonperforming Loans From Continuing Operations |

| 27 | Summary of Changes in Other Real Estate Owned, Net of Allowance, From Continuing Operations |

| 28 | Line of Business Results |

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 13

Financial Highlights

(dollars in millions, except per share amounts)

| Three months ended | ||||||||||||

| 9-30-15 | 6-30-15 | 9-30-14 | ||||||||||

| Summary of operations |

||||||||||||

| Net interest income (TE) |

$ | 598 | $ | 591 | $ | 581 | ||||||

| Noninterest income |

470 | 488 | 417 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total revenue (TE) |

1,068 | 1,079 | 998 | |||||||||

| Provision for credit losses |

45 | 41 | 19 | |||||||||

| Noninterest expense |

724 | 711 | 706 | |||||||||

| Income (loss) from continuing operations attributable to Key |

222 | 235 | 203 | |||||||||

| Income (loss) from discontinued operations, net of taxes (a) |

(3 | ) | 3 | (17 | ) | |||||||

| Net income (loss) attributable to Key |

219 | 238 | 186 | |||||||||

| Income (loss) from continuing operations attributable to Key common shareholders |

$ | 216 | $ | 230 | $ | 197 | ||||||

| Income (loss) from discontinued operations, net of taxes (a) |

(3 | ) | 3 | (17 | ) | |||||||

| Net income (loss) attributable to Key common shareholders |

213 | 233 | 180 | |||||||||

| Per common share |

||||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders |

$ | .26 | $ | .27 | $ | .23 | ||||||

| Income (loss) from discontinued operations, net of taxes (a) |

— | — | (.02 | ) | ||||||||

| Net income (loss) attributable to Key common shareholders (b) |

.26 | .28 | .21 | |||||||||

| Income (loss) from continuing operations attributable to Key common shareholders — assuming dilution |

.26 | .27 | .23 | |||||||||

| Income (loss) from discontinued operations, net of taxes — assuming dilution (a) |

— | — | (.02 | ) | ||||||||

| Net income (loss) attributable to Key common shareholders — assuming dilution (b) |

.25 | .27 | .21 | |||||||||

| Cash dividends paid |

.075 | .075 | .065 | |||||||||

| Book value at period end |

12.47 | 12.21 | 11.74 | |||||||||

| Tangible book value at period end |

11.17 | 10.92 | 10.47 | |||||||||

| Market price at period end |

13.01 | 15.02 | 13.33 | |||||||||

| Performance ratios |

||||||||||||

| From continuing operations: |

||||||||||||

| Return on average total assets |

.95 | % | 1.03 | % | .92 | % | ||||||

| Return on average common equity |

8.30 | 8.96 | 7.68 | |||||||||

| Return on average tangible common equity (c) |

9.27 | 10.01 | 8.55 | |||||||||

| Net interest margin (TE) |

2.87 | 2.88 | 2.96 | |||||||||

| Cash efficiency ratio (c) |

66.9 | 65.1 | 69.7 | |||||||||

| From consolidated operations: |

|

|||||||||||

| Return on average total assets |

.92 | % | 1.02 | % | .81 | % | ||||||

| Return on average common equity |

8.19 | 9.07 | 7.01 | |||||||||

| Return on average tangible common equity (c) |

9.14 | 10.14 | 7.81 | |||||||||

| Net interest margin (TE) |

2.84 | 2.85 | 2.94 | |||||||||

| Loan to deposit (d) |

89.3 | 87.3 | 87.4 | |||||||||

| Capital ratios at period end |

||||||||||||

| Key shareholders’ equity to assets |

11.22 | % | 11.19 | % | 11.68 | % | ||||||

| Key common shareholders’ equity to assets |

10.91 | 10.89 | 11.36 | |||||||||

| Tangible common equity to tangible assets (c) |

9.90 | 9.86 | 10.26 | |||||||||

| Common Equity Tier 1 (c), (e) |

10.51 | 10.71 | N/A | |||||||||

| Tier 1 common equity (c) |

N/A | N/A | 11.26 | |||||||||

| Tier 1 risk-based capital (e) |

10.90 | 11.11 | 12.01 | |||||||||

| Total risk-based capital (e) |

12.51 | 12.66 | 14.10 | |||||||||

| Leverage (e) |

10.67 | 10.74 | 11.15 | |||||||||

| Asset quality — from continuing operations |

||||||||||||

| Net loan charge-offs |

$ | 41 | $ | 36 | $ | 31 | ||||||

| Net loan charge-offs to average loans |

.27 | % | .25 | % | .22 | % | ||||||

| Allowance for loan and lease losses |

$ | 790 | $ | 796 | $ | 804 | ||||||

| Allowance for credit losses |

844 | 841 | 839 | |||||||||

| Allowance for loan and lease losses to period-end loans |

1.31 | % | 1.37 | % | 1.43 | % | ||||||

| Allowance for credit losses to period-end loans |

1.40 | 1.44 | 1.49 | |||||||||

| Allowance for loan and lease losses to nonperforming loans |

197.5 | 190.0 | 200.5 | |||||||||

| Allowance for credit losses to nonperforming loans |

211.0 | 200.7 | 209.2 | |||||||||

| Nonperforming loans at period end (f) |

$ | 400 | $ | 419 | $ | 401 | ||||||

| Nonperforming assets at period end |

417 | 440 | 418 | |||||||||

| Nonperforming loans to period-end portfolio loans |

.67 | % | .72 | % | .71 | % | ||||||

| Nonperforming assets to period-end portfolio loans plus OREO and other nonperforming assets |

.69 | .75 | .74 | |||||||||

| Trust and brokerage assets |

||||||||||||

| Assets under management |

$ | 35,158 | $ | 38,399 | $ | 39,283 | ||||||

| Nonmanaged and brokerage assets |

46,796 | 48,789 | 48,273 | |||||||||

| Other data |

||||||||||||

| Average full-time equivalent employees |

13,555 | 13,455 | 13,905 | |||||||||

| Branches |

972 | 989 | 997 | |||||||||

| Taxable-equivalent adjustment |

$ | 7 | $ | 7 | $ | 6 | ||||||

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 14

Financial Highlights (continued)

(dollars in millions, except per share amounts)

| Nine months ended | ||||||||

| 9-30-15 | 9-30-14 | |||||||

| Summary of operations |

||||||||

| Net interest income (TE) |

$ | 1,766 | $ | 1,729 | ||||

| Noninterest income |

1,395 | 1,307 | ||||||

|

|

|

|

|

|||||

| Total revenue (TE) |

3,161 | 3,036 | ||||||

| Provision for credit losses |

121 | 35 | ||||||

| Noninterest expense |

2,104 | 2,057 | ||||||

| Income (loss) from continuing operations attributable to Key |

685 | 688 | ||||||

| Income (loss) from discontinued operations, net of taxes (a) |

5 | (41 | ) | |||||

| Net income (loss) attributable to Key |

690 | 647 | ||||||

| Income (loss) from continuing operations attributable to Key common shareholders |

$ | 668 | $ | 671 | ||||

| Income (loss) from discontinued operations, net of taxes (a) |

5 | (41 | ) | |||||

| Net income (loss) attributable to Key common shareholders |

673 | 630 | ||||||

| Per common share |

||||||||

| Income (loss) from continuing operations attributable to Key common shareholders |

$ | .79 | $ | .77 | ||||

| Income (loss) from discontinued operations, net of taxes (a) |

.01 | (.05 | ) | |||||

| Net income (loss) attributable to Key common shareholders (b) |

.80 | .72 | ||||||

| Income (loss) from continuing operations attributable to Key common shareholders — assuming dilution |

.78 | .76 | ||||||

| Income (loss) from discontinued operations, net of taxes — assuming dilution (a) |

.01 | (.05 | ) | |||||

| Net income (loss) attributable to Key common shareholders — assuming dilution (b) |

.79 | .71 | ||||||

| Cash dividends paid |

.215 | .185 | ||||||

| Performance ratios |

||||||||

| From continuing operations: |

||||||||

| Return on average total assets |

1.00 | % | 1.06 | % | ||||

| Return on average common equity |

8.67 | 8.84 | ||||||

| Return on average tangible common equity (c) |

9.69 | 9.83 | ||||||

| Net interest margin (TE) |

2.88 | 2.98 | ||||||

| Cash efficiency ratio (c) |

65.7 | 66.7 | ||||||

| From consolidated operations: |

||||||||

| Return on average total assets |

.99 | % | .95 | % | ||||

| Return on average common equity |

8.74 | 8.30 | ||||||

| Return on average tangible common equity (c) |

9.76 | 9.23 | ||||||

| Net interest margin (TE) |

2.85 | 2.94 | ||||||

| Asset quality — from continuing operations |

||||||||

| Net loan charge-offs |

$ | 105 | $ | 81 | ||||

| Net loan charge-offs to average total loans |

.24 | % | .20 | % | ||||

| Other data |

||||||||

| Average full-time equivalent employees |

13,525 | 13,942 | ||||||

| Taxable-equivalent adjustment |

$ | 20 | $ | 18 | ||||

| (a) | In April 2009, management decided to wind down the operations of Austin Capital Management, Ltd., a subsidiary that specialized in managing hedge fund investments for institutional customers. In September 2009, management decided to discontinue the education lending business conducted through Key Education Resources, the education payment and financing unit of KeyBank National Association. In February 2013, Key decided to sell its investment subsidiary, Victory Capital Management, and its broker-dealer affiliate, Victory Capital Advisors, to a private equity fund. As a result of these decisions, Key has accounted for these businesses as discontinued operations. |

| (b) | Earnings per share may not foot due to rounding. |

| (c) | The following table entitled “GAAP to Non-GAAP Reconciliations” presents the computations of certain financial measures related to “tangible common equity,” “Common Equity Tier 1” (compliance date of January 1, 2015, under the Regulatory Capital Rules) “Tier 1 common equity” (prior to January 1, 2015), and “cash efficiency.” The table reconciles the GAAP performance measures to the corresponding non-GAAP measures, which provides a basis for period-to-period comparisons. For further information on the Regulatory Capital Rules, see the “Capital” section of this release. |

| (d) | Represents period-end consolidated total loans and loans held for sale (excluding education loans in the securitization trusts for periods prior to September 30, 2014) divided by period-end consolidated total deposits (excluding deposits in foreign office). |

| (e) | 9-30-15 ratio is estimated. |

| (f) | Loan balances exclude $12 million, $12 million, and $14 million of purchased credit impaired loans at September 30, 2015, June 30, 2015, and September 30, 2014, respectively. |

TE = Taxable Equivalent, GAAP = U.S. generally accepted accounting principles

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 15

GAAP to Non-GAAP Reconciliations

(dollars in millions)

The table below presents certain non-GAAP financial measures related to “tangible common equity,” “return on tangible common equity,” “Common Equity Tier 1,” “Tier 1 common equity,” “pre-provision net revenue,” and “cash efficiency ratio.”

The tangible common equity ratio and the return on tangible common equity ratio have been a focus for some investors, and management believes these ratios may assist investors in analyzing Key’s capital position without regard to the effects of intangible assets and preferred stock. Traditionally, the banking regulators have assessed bank and bank holding company capital adequacy based on both the amount and the composition of capital, the calculation of which is prescribed in federal banking regulations. In October 2013, the federal banking regulators published the final Basel III capital framework for U.S. banking organizations (the “Regulatory Capital Rules”). The Regulatory Capital Rules require higher and better-quality capital and introduces a new capital measure, “Common Equity Tier 1,” a non-GAAP financial measure. The mandatory compliance date for Key as a “standardized approach” banking organization began on January 1, 2015, subject to transitional provisions extending to January 1, 2019. Prior to January 1, 2015, the Federal Reserve focused its assessment of capital adequacy on a component of Tier 1 risk-based capital known as Tier 1 common equity, also a non-GAAP financial measure.

Common Equity Tier 1 is not formally defined by GAAP and is considered to be a non-GAAP financial measure. Since analysts and banking regulators may assess Key’s capital adequacy using tangible common equity and Common Equity Tier 1, management believes it is useful to enable investors to assess Key’s capital adequacy on these same bases. The table also reconciles the GAAP performance measures to the corresponding non-GAAP measures.

The table also shows the computation for pre-provision net revenue, which is not formally defined by GAAP. Management believes that eliminating the effects of the provision for loan and lease losses makes it easier to analyze the results by presenting them on a more comparable basis.

The cash efficiency ratio is a ratio of two non-GAAP performance measures. As such, there is no directly comparable GAAP performance measure. The cash efficiency ratio performance measure removes the impact of Key’s intangible asset amortization from the calculation. Management believes this ratio provides greater consistency and comparability between Key’s results and those of its peer banks. Additionally, this ratio is used by analysts and investors as they develop earnings forecasts and peer bank analysis.

Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied, and are not audited. Although these non-GAAP financial measures are frequently used by investors to evaluate a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP.

| Three months ended | ||||||||||||

| 9-30-15 | 6-30-15 | 9-30-14 | ||||||||||

| Tangible common equity to tangible assets at period end |

|

|||||||||||

| Key shareholders’ equity (GAAP) |

$ | 10,705 | $ | 10,590 | $ | 10,486 | ||||||

| Less: Intangible assets (a) |

1,084 | 1,085 | 1,105 | |||||||||

| Preferred Stock, Series A (b) |

281 | 281 | 282 | |||||||||

|

|

|

|

|

|

|

|||||||

| Tangible common equity (non-GAAP) |

$ | 9,340 | $ | 9,224 | $ | 9,099 | ||||||

|

|

|

|

|

|

|

|||||||

| Total assets (GAAP) |

$ | 95,422 | $ | 94,606 | $ | 89,784 | ||||||

| Less: Intangible assets (a) |

1,084 | 1,085 | 1,105 | |||||||||

|

|

|

|

|

|

|

|||||||

| Tangible assets (non-GAAP) |

$ | 94,338 | $ | 93,521 | $ | 88,679 | ||||||

|

|

|

|

|

|

|

|||||||

| Tangible common equity to tangible assets ratio (non-GAAP) |

9.90 | % | 9.86 | % | 10.26 | % | ||||||

| Common Equity Tier 1 at period end |

||||||||||||

| Key shareholders’ equity (GAAP) |

$ | 10,705 | $ | 10,590 | — | |||||||

| Less: Preferred Stock, Series A (b) |

281 | 281 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Common Equity Tier 1 capital before adjustments and deductions |

10,424 | 10,309 | — | |||||||||

| Less: Goodwill, net of deferred taxes |

1,037 | 1,034 | — | |||||||||

| Intangible assets, net of deferred taxes |

30 | 33 | — | |||||||||

| Deferred tax assets |

1 | 1 | — | |||||||||

| Net unrealized gains (losses) on

available-for-sale |

55 | — | — | |||||||||

| Accumulated gains (losses) on cash flow hedges, net

of |

20 | (20 | ) | — | ||||||||

| Amounts in accumulated other comprehensive

income |

(386 | ) | (361 | ) | — | |||||||

|

|

|

|

|

|

|

|||||||

| Total Common Equity Tier 1 capital (c) |

$ | 9,667 | $ | 9,622 | — | |||||||

|

|

|

|

|

|

|

|||||||

| Net risk-weighted assets (regulatory) (c) |

$ | 91,998 | $ | 89,851 | — | |||||||

| Common Equity Tier 1 ratio (non-GAAP) (c) |

10.51 | % | 10.71 | % | — | |||||||

| Tier 1 common equity at period end |

||||||||||||

| Key shareholders’ equity (GAAP) |

— | — | $ | 10,486 | ||||||||

| Qualifying capital securities |

— | — | 340 | |||||||||

| Less: Goodwill |

— | — | 1,051 | |||||||||

| Accumulated other comprehensive income (loss) (d) |

— | — | (366 | ) | ||||||||

| Other assets (e) |

— | — | 110 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Tier 1 capital (regulatory) |

— | — | 10,031 | |||||||||

| Less: Qualifying capital securities |

— | — | 340 | |||||||||

| Preferred Stock, Series A (b) |

— | — | 282 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Tier 1 common equity (non-GAAP) |

— | — | $ | 9,409 | ||||||||

|

|

|

|

|

|

|

|||||||

| Net risk-weighted assets (regulatory) |

— | — | $ | 83,547 | ||||||||

| Tier 1 common equity ratio (non-GAAP) |

— | — | 11.26 | % | ||||||||

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 16

GAAP to Non-GAAP Reconciliations (continued)

(dollars in millions)

| Three months ended | ||||||||||||

| 9-30-15 | 6-30-15 | 9-30-14 | ||||||||||

| Pre-provision net revenue |

|

|||||||||||

| Net interest income (GAAP) |

$ | 591 | $ | 584 | $ | 575 | ||||||

| Plus: Taxable-equivalent adjustment |

7 | 7 | 6 | |||||||||

| Noninterest income (GAAP) |

470 | 488 | 417 | |||||||||

| Less: Noninterest expense (GAAP) |

724 | 711 | 706 | |||||||||

|

|

|

|

|

|

|

|||||||

| Pre-provision net revenue from continuing operations (non-GAAP) |

$ | 344 | $ | 368 | $ | 292 | ||||||

|

|

|

|

|

|

|

|||||||

| Average tangible common equity |

||||||||||||

| Average Key shareholders’ equity (GAAP) |

$ | 10,614 | $ | 10,590 | $ | 10,473 | ||||||

| Less: Intangible assets (average) (f) |

1,083 | 1,086 | 1,037 | |||||||||

| Preferred Stock, Series A (average) |

290 | 290 | 291 | |||||||||

|

|

|

|

|

|

|

|||||||

| Average tangible common equity (non-GAAP) |

$ | 9,241 | $ | 9,214 | $ | 9,145 | ||||||

|

|

|

|

|

|

|

|||||||

| Return on average tangible common equity from continuing operations |

||||||||||||

| Net income (loss) from continuing operations attributable to Key common shareholders (GAAP) |

$ | 216 | $ | 230 | $ | 197 | ||||||

| Average tangible common equity (non-GAAP) |

9,241 | 9,214 | 9,145 | |||||||||

| Return on average tangible common equity from continuing operations (non-GAAP) |

9.27 | % | 10.01 | % | 8.55 | % | ||||||

| Return on average tangible common equity consolidated |

||||||||||||

| Net income (loss) attributable to Key common shareholders (GAAP) |

$ | 213 | $ | 233 | $ | 180 | ||||||

| Average tangible common equity (non-GAAP) |

9,241 | 9,214 | 9,145 | |||||||||

| Return on average tangible common equity consolidated (non-GAAP) |

9.14 | % | 10.14 | % | 7.81 | % | ||||||

| Cash efficiency ratio |

||||||||||||

| Noninterest expense (GAAP) |

$ | 724 | $ | 711 | $ | 706 | ||||||

| Less: Intangible asset amortization (GAAP) |

9 | 9 | 10 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted noninterest expense (non-GAAP) |

$ | 715 | $ | 702 | $ | 696 | ||||||

|

|

|

|

|

|

|

|||||||

| Net interest income (GAAP) |

$ | 591 | $ | 584 | $ | 575 | ||||||

| Plus: Taxable-equivalent adjustment |

7 | 7 | 6 | |||||||||

| Noninterest income (GAAP) |

470 | 488 | 417 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total taxable-equivalent revenue (non-GAAP) |

$ | 1,068 | $ | 1,079 | $ | 998 | ||||||

|

|

|

|

|

|

|

|||||||

| Cash efficiency ratio (non-GAAP) |

66.9 | % | 65.1 | % | 69.7 | % | ||||||

| Three months ended |

||||||||||||

| 9-30-15 | ||||||||||||

| Common Equity Tier 1 under the Regulatory Capital Rules (“RCR”) (estimates) |

||||||||||||

| Common Equity Tier 1 under current RCR |

$ | 9,667 | ||||||||||

| Adjustments from current RCR to the fully phased-in RCR: |

||||||||||||

| Deferred tax assets and other intangible assets (g) |

(45 | ) | ||||||||||

|

|

|

|||||||||||

| Common Equity Tier 1 anticipated under the fully phased-in RCR (h) |

$ | 9,622 | ||||||||||

|

|

|

|||||||||||

| Net risk-weighted assets under current RCR |

$ | 91,998 | ||||||||||

| Adjustments from current RCR to the fully phased-in RCR: |

||||||||||||

| Mortgage servicing assets (i) |

479 | |||||||||||

| All other assets (j) |

(10 | ) | ||||||||||

|

|

|

|||||||||||

| Total risk-weighted assets anticipated under the fully phased-in RCR (h) |

$ | 92,467 | ||||||||||

|

|

|

|||||||||||

| Common Equity Tier 1 ratio under the fully phased-in RCR (h) |

10.41 | % | ||||||||||

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 17

GAAP to Non-GAAP Reconciliations (continued)

(dollars in millions)

| Nine months ended | ||||||||

| 9-30-15 | 9-30-14 | |||||||

| Pre-provision net revenue |

|

|||||||

| Net interest income (GAAP) |

$ | 1,746 | $ | 1,711 | ||||

| Plus: Taxable-equivalent adjustment |

20 | 18 | ||||||

| Noninterest income (GAAP) |

1,395 | 1,307 | ||||||

| Less: Noninterest expense (GAAP) |

2,104 | 2,057 | ||||||

|

|

|

|

|

|||||

| Pre-provision net revenue from continuing operations (non-GAAP) |

$ | 1,057 | $ | 979 | ||||

|

|

|

|

|

|||||

| Average tangible common equity |

||||||||

| Average Key shareholders’ equity (GAAP) |

$ | 10,591 | $ | 10,435 | ||||

| Less: Intangible assets (average) (k) |

1,086 | 1,020 | ||||||

| Preferred Stock, Series A (average) |

290 | 291 | ||||||

|

|

|

|

|

|||||

| Average tangible common equity (non-GAAP) |

$ | 9,215 | $ | 9,124 | ||||

|

|

|

|

|

|||||

| Return on average tangible common equity from continuing operations |

||||||||

| Net income (loss) from continuing operations attributable to Key common shareholders (GAAP) |

$ | 668 | $ | 671 | ||||

| Average tangible common equity (non-GAAP) |

9,215 | 9,124 | ||||||

| Return on average tangible common equity from continuing operations (non-GAAP) |

9.69 | % | 9.83 | % | ||||

| Return on average tangible common equity consolidated |

||||||||

| Net income (loss) attributable to Key common shareholders (GAAP) |

$ | 673 | $ | 630 | ||||

| Average tangible common equity (non-GAAP) |

9,215 | 9,124 | ||||||

| Return on average tangible common equity consolidated (non-GAAP) |

9.76 | % | 9.23 | % | ||||

| Cash efficiency ratio |

||||||||

| Noninterest expense (GAAP) |

$ | 2,104 | $ | 2,057 | ||||

| Less: Intangible asset amortization (GAAP) |

27 | 29 | ||||||

|

|

|

|

|

|||||

| Adjusted noninterest expense (non-GAAP) |

$ | 2,077 | $ | 2,028 | ||||

|

|

|

|

|

|||||

| Net interest income (GAAP) |

$ | 1,746 | $ | 1,711 | ||||

| Plus: Taxable-equivalent adjustment |

20 | 18 | ||||||

| Noninterest income (GAAP) |

1,395 | 1,307 | ||||||

|

|

|

|

|

|||||

| Total taxable-equivalent revenue (non-GAAP) |

$ | 3,161 | $ | 3,036 | ||||

|

|

|

|

|

|||||

| Cash efficiency ratio (non-GAAP) |

65.7 | % | 66.8 | % | ||||

| (a) | For the three months ended September 30, 2015, June 30, 2015, and September 30, 2014, intangible assets exclude $50 million, $55 million, and $72 million, respectively, of period-end purchased credit card receivables. |

| (b) | Net of capital surplus. |

| (c) | 9-30-15 amount is estimated. |

| (d) | Includes net unrealized gains or losses on securities available for sale (except for net unrealized losses on marketable equity securities), net gains or losses on cash flow hedges, and amounts resulting from the application of the applicable accounting guidance for defined benefit and other postretirement plans. |

| (e) | Other assets deducted from Tier 1 capital and net risk-weighted assets consist of disallowed intangible assets (excluding goodwill) and deductible portions of nonfinancial equity investments. There were no disallowed deferred tax assets at September 30, 2014. |

| (f) | For the three months ended September 30, 2015, June 30, 2015, and September 30, 2014, average intangible assets exclude $52 million, $58 million, and $76 million, respectively, of average purchased credit card receivables. |

| (g) | Includes the deferred tax asset subject to future taxable income for realization, primarily tax credit carryforwards, as well as intangible assets (other than goodwill and mortgage servicing assets) subject to the transition provisions of the final rule. |

| (h) | The anticipated amount of regulatory capital and risk-weighted assets is based upon the federal banking agencies’ Regulatory Capital Rules (as fully phased-in on January 1, 2019); Key is subject to the Regulatory Capital Rules under the “standardized approach.” |

| (i) | Item is included in the 10%/15% exceptions bucket calculation and is risk-weighted at 250%. |

| (j) | Under the fully implemented rule, certain deferred tax assets and intangible assets subject to the transition provision are no longer required to be risk-weighted because they are deducted directly from capital. |

| (k) | For the nine months ended September 30, 2015, and September 30, 2014, average intangible assets exclude $58 million and $82 million, respectively, of average purchased credit card receivables. |

GAAP = U.S. generally accepted accounting principles

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 18

Consolidated Balance Sheets

(dollars in millions)

| 9-30-15 | 6-30-15 | 9-30-14 | ||||||||||

| Assets |

||||||||||||

| Loans |

$ | 60,085 | $ | 58,264 | $ | 56,155 | ||||||

| Loans held for sale |

916 | 835 | 784 | |||||||||

| Securities available for sale |

14,376 | 14,244 | 12,245 | |||||||||

| Held-to-maturity securities |

4,936 | 5,022 | 4,997 | |||||||||

| Trading account assets |

811 | 674 | 965 | |||||||||

| Short-term investments |

1,964 | 3,222 | 2,342 | |||||||||

| Other investments |

691 | 703 | 822 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total earning assets |

83,779 | 82,964 | 78,310 | |||||||||

| Allowance for loan and lease losses |

(790 | ) | (796 | ) | (804 | ) | ||||||

| Cash and due from banks |

470 | 693 | 651 | |||||||||

| Premises and equipment |

771 | 788 | 832 | |||||||||

| Operating lease assets |

315 | 296 | 304 | |||||||||

| Goodwill |

1,060 | 1,057 | 1,051 | |||||||||

| Other intangible assets |

74 | 83 | 126 | |||||||||

| Corporate-owned life insurance |

3,516 | 3,502 | 3,456 | |||||||||

| Derivative assets |

793 | 536 | 413 | |||||||||

| Accrued income and other assets |

3,348 | 3,314 | 3,024 | |||||||||

| Discontinued assets |

2,086 | 2,169 | 2,421 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total assets |

$ | 95,422 | $ | 94,606 | $ | 89,784 | ||||||

|

|

|

|

|

|

|

|||||||

| Liabilities |

||||||||||||

| Deposits in domestic offices: |

||||||||||||

| NOW and money market deposit accounts |

$ | 37,301 | $ | 36,024 | $ | 33,941 | ||||||

| Savings deposits |

2,338 | 2,370 | 2,390 | |||||||||

| Certificates of deposit ($100,000 or more) |

2,001 | 2,032 | 2,533 | |||||||||

| Other time deposits |

3,020 | 3,105 | 3,338 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total interest-bearing deposits |

44,660 | 43,531 | 42,202 | |||||||||

| Noninterest-bearing deposits |

25,985 | 26,640 | 25,697 | |||||||||

| Deposits in foreign office — interest-bearing |

428 | 498 | 557 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total deposits |

71,073 | 70,669 | 68,456 | |||||||||

| Federal funds purchased and securities sold under repurchase agreements |

407 | 444 | 657 | |||||||||

| Bank notes and other short-term borrowings |

677 | 528 | 996 | |||||||||

| Derivative liabilities |

676 | 560 | 384 | |||||||||

| Accrued expense and other liabilities |

1,562 | 1,537 | 1,613 | |||||||||

| Long-term debt |

10,310 | 10,267 | 7,172 | |||||||||

| Discontinued liabilities |

— | — | 3 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities |

84,705 | 84,005 | 79,281 | |||||||||

| Equity |

||||||||||||

| Preferred stock, Series A |

290 | 290 | 291 | |||||||||

| Common shares |

1,017 | 1,017 | 1,017 | |||||||||

| Capital surplus |

3,914 | 3,898 | 3,984 | |||||||||

| Retained earnings |

8,764 | 8,614 | 8,082 | |||||||||

| Treasury stock, at cost |

(3,008 | ) | (2,884 | ) | (2,563 | ) | ||||||

| Accumulated other comprehensive income (loss) |

(272 | ) | (345 | ) | (325 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Key shareholders’ equity |

10,705 | 10,590 | 10,486 | |||||||||

| Noncontrolling interests |

12 | 11 | 17 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total equity |

10,717 | 10,601 | 10,503 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities and equity |

$ | 95,422 | $ | 94,606 | $ | 89,784 | ||||||

|

|

|

|

|

|

|

|||||||

| Common shares outstanding (000) |

835,285 | 843,608 | 868,477 | |||||||||

KeyCorp Reports Third Quarter 2015 Profit

October 15, 2015

Page 19

Consolidated Statements of Income

(dollars in millions, except per share amounts)

| Three months ended | Nine months ended | |||||||||||||||||||

| 9-30-15 | 6-30-15 | 9-30-14 | 9-30-15 | 9-30-14 | ||||||||||||||||

| Interest income |

|

|||||||||||||||||||

| Loans |

$ | 542 | $ | 532 | $ | 531 | $ | 1,597 | $ | 1,576 | ||||||||||

| Loans held for sale |