Form 8-K KEMPER Corp For: Sep 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 20, 2016

Kemper Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 001-18298

DE | 95-4255452 | |

(State or other jurisdiction of incorporation) | (IRS Employer Identification No.) | |

One East Wacker Drive, Chicago, IL 60601

(Address of principal executive offices, including zip code)

312-661-4600

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2.below):

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 7. – Regulation FD

Item 7.01. Regulation FD Disclosure.

Exhibit 99.1 is a set of slides to be presented during a conference call being hosted by Kemper Corporation (“Kemper”) to share its strategic update for investors. The conference call will be held on Wednesday, September 21, 2016 at 3:00 p.m. Eastern (2:00 p.m. Central) and will be accessible by telephone at 866.393.1565 or via webcast on Kemper’s website. To listen via webcast, register online at the investor section on kemper.com at least 15 minutes prior to the webcast to install any necessary software and to download the presentation materials.

The information contained in this report is furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, or incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, except as expressly stated in such filing.

This report may contain or incorporate by reference information that includes or is based on forward-looking statements within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events, and can be identified by the fact that they relate to future actions, performance or results rather than strictly to historical or current facts.

Any or all forward-looking statements may turn out to be wrong, and, accordingly, readers are cautioned not to place undue reliance on such statements, which speak only as of the date of this report. Forward-looking statements involve a number of risks and uncertainties that are difficult to predict, and are not guarantees of future performance. Among the general factors that could cause actual results and financial condition to differ materially from estimated results and financial condition are those listed in periodic reports filed by Kemper with the Securities Exchange Commission (the “SEC”). No assurances can be given that the results and financial condition contemplated in any forward-looking statements will be achieved or will be achieved in any particular timetable. Kemper assumes no obligation to publicly correct or update any forward-looking statements as a result of events or developments subsequent to the date of this report. The reader is advised, however, to consult any further disclosures Kemper makes on related subjects in its filings with the SEC.

Section 9. – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 Presentation materials for Kemper’s Strategic Update for Investors call on September 21, 2016.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Kemper Corporation | ||||

Date: | September 21, 2016 | /s/ Richard Roeske | ||

Richard Roeske | ||||

Vice President and Chief Accounting Officer | ||||

Exhibit Index

99.1 | Presentation materials for Kemper’s Strategic Update for Investors call on September 21, 2016. | ||

Strategic Update

for Investors

September 21, 2016

2 Strategic Update for Investors – September 21, 2016

Caution Regarding Forward-looking Statements

This presentation may contain or incorporate by reference information that includes or is based on

forward-looking statements within the meaning of the safe-harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts

of future events, and can be identified by the fact that they relate to future actions, performance or

results rather than strictly to historical or current facts.

Any or all forward-looking statements may turn out to be wrong, and, accordingly, Kemper cautions

readers not to place undue reliance on such statements. Kemper bases these statements on current

expectations and the current economic environment as of the date of this presentation. They

involve a number of risks and uncertainties that are difficult to predict. These statements are not

guarantees of future performance; actual results could differ materially from those expressed or

implied in the forward-looking statements. Forward-looking statements can be affected by

inaccurate assumptions or by known or unknown risks and uncertainties that may be important in

determining the company’s actual future results and financial condition. Kemper assumes no

obligation to publicly correct or update any forward-looking statements as a result of events or

developments subsequent to the date of this presentation. Kemper advises the reader to consult

any further disclosures Kemper makes on related subjects in its filings with the SEC.

This presentation contains non-GAAP financial measures that the company believes are meaningful

to investors. Non-GAAP financial measures are defined and reconciled to the most comparable

GAAP financial measure at the end of this report.

Data in this presentation is as of and for the period ending June 30, 2016 unless otherwise stated

3 Strategic Update for Investors – September 21, 2016

Strategy Outline

• Current State

• Resetting the Table

– Strategic focus

– Senior executive team

– Our businesses

• Our Path Forward

• Progress Made in 2016

• The Case for Kemper

4 Strategic Update for Investors – September 21, 2016

Baseline: Year End 2015

• Unclear strategic framework & focus

– Limited external focus

– Constrained analytical curiosity

• Financial underperformance

– Low earnings & ROE

– Declining revenue

– Heavy expense base

• Significant “deferred maintenance”

– Aging IT infrastructure

– Dated processes

• Culture of complacency

– Diffusion of accountability

– Collaboration impeded

1 See Non-GAAP Financial Measures in Appendix

2 Source: SNL Financial

Average Normalized Earnings from 2011-20151

Price to Book Value versus ROE-20152

G

ro

w

th

Legacy Non-

Standard Auto

Alliance United

Preferred Home and Auto

Life & Health

Bubble sized with avg. of

Earned Premium from

2011-2015

(AU last 12 months)

Normalized

Earnings

-20%

-10%

0%

10%

20%

30%

25 75

A

vg.

P

rice

t

o

B

o

o

k

V

al

u

e

-

2

0

1

5

ALL

CINF

HIG HMN KMPR

MCY

NGHC

PGR

SIGI

STFC

THG

TRV

50%

150%

250%

0% 5% 10% 15% 20%

2015 Return on Equity

5 Strategic Update for Investors – September 21, 2016

Current State

Strong capital position

• More than $200MM of excess capital

• Steady capital creation from life businesses

Distinguished brand

• Recognized in market

• Positive impression yet undefined

Flexible regulatory foundation

• Broadly licensed (multiple products) in 50 states

Broad business portfolio

• Diversified product platforms

• Non-correlated risks

• Leverageable growth opportunities

Strong Investments function

• Outperform similarly sized peers

Proven senior executive team

• Broad experience

• Track record of results

Poor execution

Limited strategic focus

• Overall and within specific businesses

Culture of complacency

Financial underperformance

• Declining revenues

• Heavy expense base

Weak technology infrastructure

• Aging platforms

• Dated and slow processes to update and maintain

• Lack of agility

Tangible Strengths

Tremendous unrealized potential

Fixable Weaknesses

Resetting the Table

7 Strategic Update for Investors – September 21, 2016

Strategic Focus

• Focus on consumer-related businesses with niche opportunities that:

– Target underserved markets

– Have limited, weak or unfocused competition

– Require unique expertise (underwriting, claim, distribution, other)

• Build and leverage key core capabilities:

– Nimble—ability to take advantage of opportunities quickly

– Execution excellence

– Disciplined underwriting and risk management

– Business intelligence and analytics expertise

– Efficient expense structure

– Optimal technology utilization

• Create value organically and through M&A

• Produce high single-digit/low double-digit ROE and grow BVPS consistently

Utilize scale and nimbleness as advantage

8 Strategic Update for Investors – September 21, 2016

Senior Executive Team

Experienced leadership team with proven history of delivering results

Joe Lacher

President and

Chief Executive Officer

• 20+ years of insurance industry experience

• Joined Kemper in 2015; Track record of turning around under-

performing businesses to realize their full potential

• Previous experience: Allstate, Travelers

John Boschelli

Chief Investment Officer

• 25+ years of insurance industry experience; Rejoined Kemper in 1997

• Held various investment, finance and accounting positions

Charles Brooks

Chief Information Officer

• 25+ years of IT and operations experience; Joined Kemper in 2016

• Previous experience: ACE Group, Travelers and Accenture

Chip Dufala

President, Property & Casualty

• 20+ years of insurance industry experience; Joined Kemper in 2016

• Previous experience: Senior sales and operational roles at Erie Ins.

Tom Evans

Secretary & General Counsel

• 30+ years of legal experience, majority in the insurance industry

• Joined Kemper in 1992; served in various legal roles

Mark Green

President, Life & Health

• 25+ years of insurance industry experience; Joined Kemper in 2016

• Previous experience: Allstate, AIX Group, Wells Fargo Ins., Chubb

Jim McKinney

Chief Financial Officer

• 14+ years of finance experience; Joining Kemper in November

• Previous experience: Banc of California, AerCap, RBS Citizens, KPMG

Christine Mullins

Chief Human Resources Officer

• 25+ years of human resources experience; Joining Kemper in October

• Previous experience: CEO.works, Zurich, Motorola

9 Strategic Update for Investors – September 21, 2016

Life & Health

Our Results

Market & consumer focus

• Modest income consumers

• Simple “final expense” type life product

• Limited, diffused, smaller competition

• Consistently profitable segment

Keys to success

• Efficient and consistent pricing, underwriting and claim functions

• Strong and cost-conscious distribution

Priorities

• Finalize the replacement of policy administration system

• Expand current distribution model; evaluate new distribution sources

• Move beyond DMF issue

Life Insurance

Market & consumer focus

• Indemnity medical supplemental products

• Rural and dissatisfied ACA consumers

• Limited larger or sophisticated players

Keys to success

• Being opportunistic and nimble when addressing market gaps

• Efficient distribution of product

Priorities

• Evaluate new products to take advantage of market disruption

• Higher-yielding distribution capabilities

Health Insurance

1 See Non-GAAP Financial Measures in Appendix

² 2015 normalized for deferred premium adjustment

0

50

100

2011 2012 2013 2014 2015 1H16

Normalized Earnings¹

(10)%

(5)%

0%

5%

2011 2012 2013 2014 2015 1H16

Growth Rate²

($MM)

10 Strategic Update for Investors – September 21, 2016

Property & Casualty

Market & consumer focus

• Regional independent agency player

• Main Street consumer focus

• Historically leveraged package product strength

Keys to success

• Product/pricing sophistication

• Claims effectiveness

• Ease of doing business

Priorities

• Finish program to replace policy administration and agency

interface systems

• Overhaul claim capabilities

• Expand homeowners capability

• Lead with homeowners strength; deliver auto at parity

• Intensify business intelligence and analytics competency

1 Includes Preferred Personal Automobile, Homeowners and Other Personal Lines Insurance

2 See Non-GAAP Financial Measures in Appendix

Preferred Personal Lines1 Our Results

80%

95%

110%

2011 2012 2013 2014 2015 1H16

Normalized Combined Ratio²

(15)%

(10)%

(5)%

0%

2011 2012 2013 2014 2015 1H16

Written Premium Growth Rate

11 Strategic Update for Investors – September 21, 2016

75%

95%

115%

2011 2012 2013 2014 2015⁴ 1H16

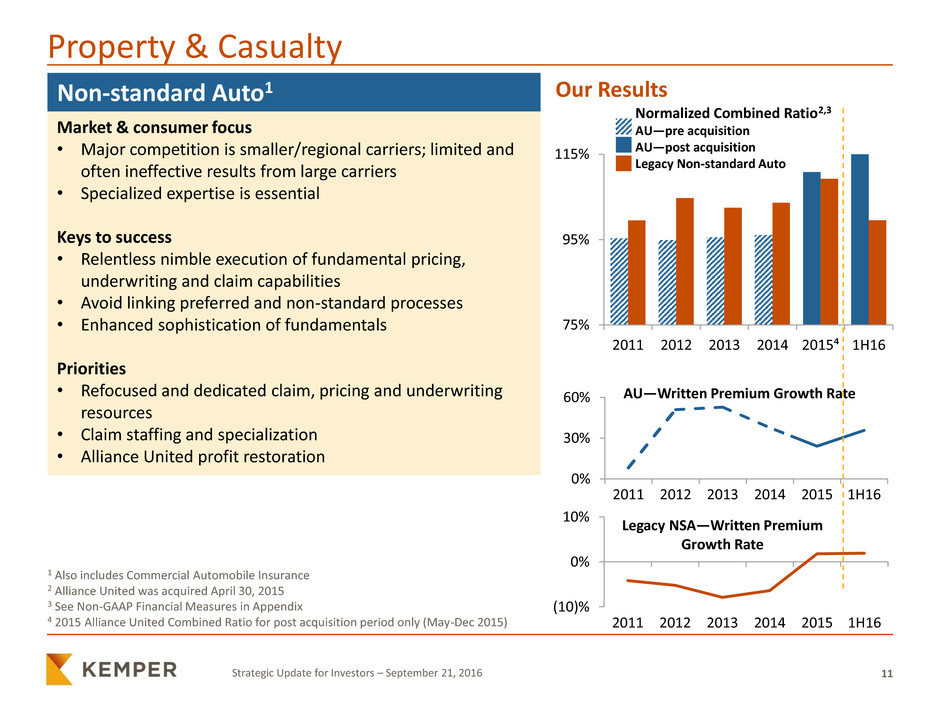

Property & Casualty

Market & consumer focus

• Major competition is smaller/regional carriers; limited and

often ineffective results from large carriers

• Specialized expertise is essential

Keys to success

• Relentless nimble execution of fundamental pricing,

underwriting and claim capabilities

• Avoid linking preferred and non-standard processes

• Enhanced sophistication of fundamentals

Priorities

• Refocused and dedicated claim, pricing and underwriting

resources

• Claim staffing and specialization

• Alliance United profit restoration

Non-standard Auto1

1 Also includes Commercial Automobile Insurance

2 Alliance United was acquired April 30, 2015

3 See Non-GAAP Financial Measures in Appendix

4 2015 Alliance United Combined Ratio for post acquisition period only (May-Dec 2015)

Normalized Combined Ratio2,3

AU—pre acquisition

AU—post acquisition

Legacy Non-standard Auto

Our Results

0%

30%

60%

2011 2012 2013 2014 2015 1H16

AU—Written Premium Growth Rate

(10)%

0%

10%

2011 2012 2013 2014 2015 1H16

Legacy NSA—Written Premium

Growth Rate

12 Strategic Update for Investors – September 21, 2016

Investments

Goal

Balance risk and return to maximize investment portfolio’s

after-tax yield and total return

Approach to Investment Management

• Take advantage of multi-line businesses allowing for greater

optimization and asset diversification

• Collaborate within the group and among our internal and

external partners

• Combine top-down and bottom-up analyses with an emphasis

on risk management

• Encourage proactive and innovative problem-solving

• Adapt quickly to the constantly evolving investment landscape

• Execute strategy opportunistically and efficiently using our

size to our advantage

Track Record

Returns (yields & total return) have been strong relative to the

industry while maintaining a similar risk profile

4,542

542

365

295

532

441

2Q16

Investment Portfolio

Total Investments: $6,717MM

3,033

1,647

294

110

2Q16

Fixed Maturity Portfolio

Total Fixed Maturities: $5,084MM

Other1

Alternative Inv.2

Equities3

Non-Inv. Grade FM

Inv. Grade FM

Short-term

Other

Muni’s

Corporate Bonds &

Notes

US Gov’t & Agencies

($MM)

($MM)

1 Includes $291MM of policyholder loans, $145MM of Real Estate and $5MM of other investments

2 Includes $134MM of Fair Value Option Investments, $183MM of Equity Method Limited Liability

Investments and $215MM of Other Equity Interests at Fair Value

3 Excludes $215MM of Other Equity Interests at Fair Value

13 Strategic Update for Investors – September 21, 2016

Path Forward to Unlock Embedded Value

W

or

k /

E

ff

or

t

• Assemble top quality leadership team

• Resolve DMF/UCP issue

• Refocus & strengthen Non-standard Auto

competency

• Restore Alliance United profitability

Broader

• Reinvigorate culture

• Focus on relentlessly delivering execution excellence

• Expand and fully leverage business intelligence & analytics capabilities

Phase 1—Key Elements:

Grow

Build &

Leverage,

Rebuild

Phase 1 Phase 2 Phase 3

Incubate

• Redesign P&C claim service delivery model

• Complete IT re-platforming in P&C and Life

• Reset expense base & ongoing expense

management

Specific

14 Strategic Update for Investors – September 21, 2016

Life Insurance Claims—DMF/Unclaimed Property Issue

• Some insurers used Social Security Death Master File (DMF) to halt annuities but

failed to see if person also had life policy—had notice of death but did not pay claim

• Kemper was not one of those companies

• Officials imposed penalties and reforms on the offending companies

• Consensus among states on proper DMF use for non-offending companies never

materialized

• Social Security Administration admits DMF is flawed—urges data verification

• Some officials took simplistic approaches to a complex issue in new laws and

regulations

Background

• Kemper voluntarily implementing a process to use DMF and other databases to

identify and investigate instances where beneficiary may have failed to file claim

• Good customer service suggests reasonable use of DMF even if solid legal

arguments support other viewpoint

• Process will result in estimated after-tax charge of $50 million in 3Q16

Kemper’s Go-Forward Approach

15 Strategic Update for Investors – September 21, 2016

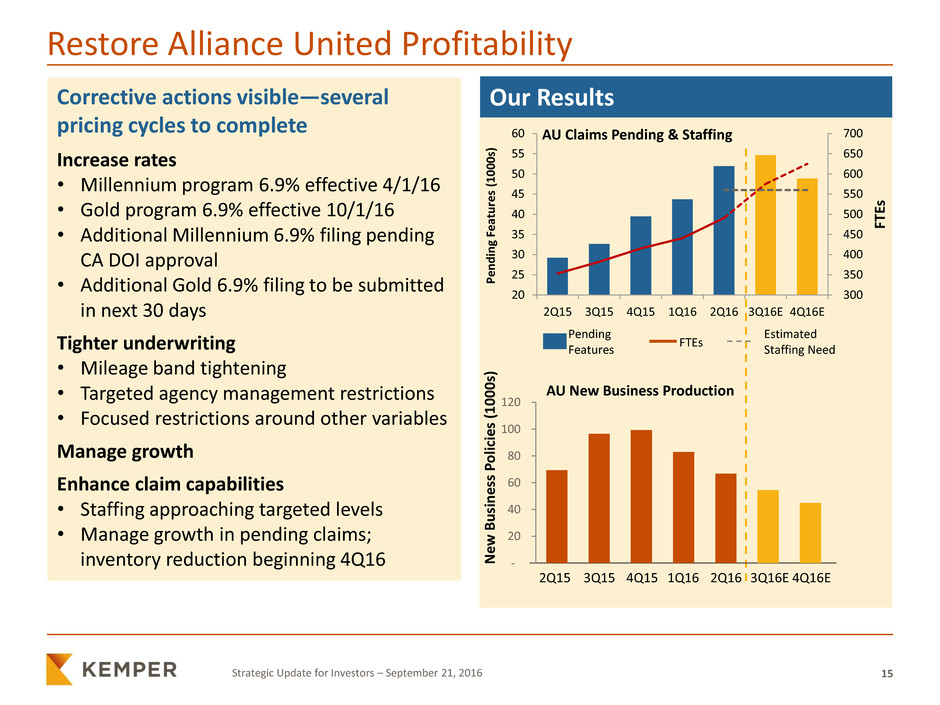

Restore Alliance United Profitability

Corrective actions visible—several

pricing cycles to complete

Increase rates

• Millennium program 6.9% effective 4/1/16

• Gold program 6.9% effective 10/1/16

• Additional Millennium 6.9% filing pending

CA DOI approval

• Additional Gold 6.9% filing to be submitted

in next 30 days

Tighter underwriting

• Mileage band tightening

• Targeted agency management restrictions

• Focused restrictions around other variables

Manage growth

Enhance claim capabilities

• Staffing approaching targeted levels

• Manage growth in pending claims;

inventory reduction beginning 4Q16

Our Results

AU Claims Pending & Staffing

AU New Business Production

Ne

w

Bu

si

n

ess

P

o

lic

ie

s

(1

0

0

0

s)

2Q15 3Q15 4Q15 1Q16 2Q16 3Q16E 4Q16E

Pending

Features

FTEs

Estimated

Staffing Need

-

20

40

60

80

100

120

300

350

400

450

500

550

600

650

700

20

25

30

35

40

45

50

55

60

2Q15 3Q15 4Q15 1Q16 2Q16 3Q16E 4Q16E

FT

Es

Pe

n

d

in

g F

e

at

u

re

s

(1000

s)

16 Strategic Update for Investors – September 21, 2016

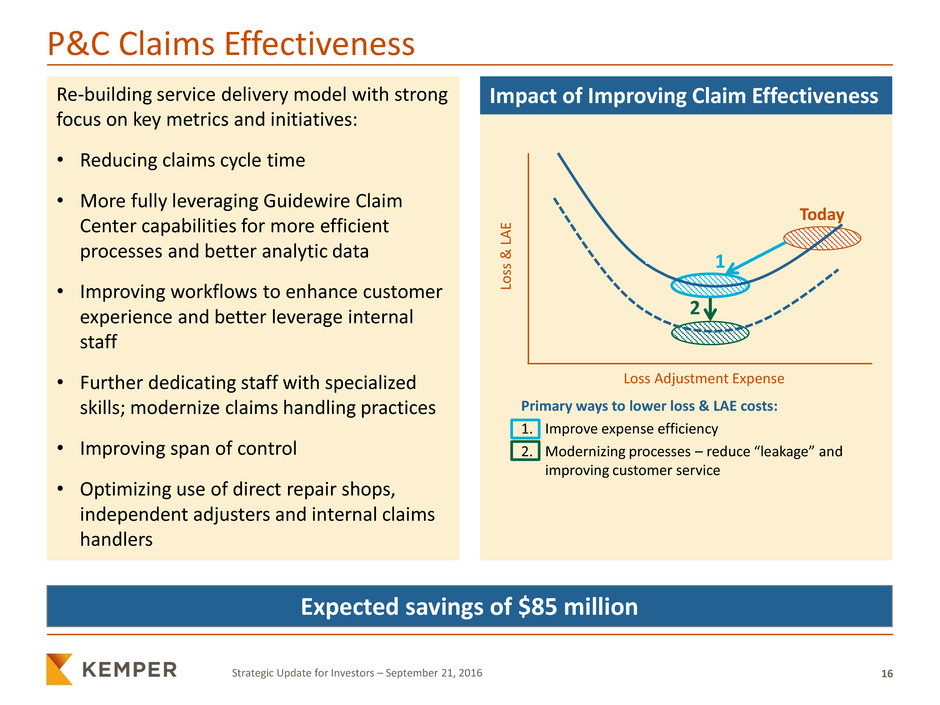

P&C Claims Effectiveness

Re-building service delivery model with strong

focus on key metrics and initiatives:

• Reducing claims cycle time

• More fully leveraging Guidewire Claim

Center capabilities for more efficient

processes and better analytic data

• Improving workflows to enhance customer

experience and better leverage internal

staff

• Further dedicating staff with specialized

skills; modernize claims handling practices

• Improving span of control

• Optimizing use of direct repair shops,

independent adjusters and internal claims

handlers

Expected savings of $85 million

Primary ways to lower loss & LAE costs:

1. Improve expense efficiency

2. Modernizing processes – reduce “leakage” and

improving customer service

Loss Adjustment Expense

Loss

&

LA

E

1

2

Today

Impact of Improving Claim Effectiveness

17 Strategic Update for Investors – September 21, 2016

Property & Casualty—Key Technology Investments

• Multi-year effort to upgrade key

components of core legacy systems

• Enterprise claims system upgrade

completed—in process of being fully

leveraged

• Finished 2 of 4 development phases of new

Preferred platform

• Initial phase of new Non-standard Auto

platform under development

• Remaining components of core systems

architecture are currently adequate

• New platforms will:

– Enable more sophisticated products

– Reduce operational costs

– Be scalable for organic/inorganic growth

Policy

Administration

Sales

CRM

Data

Warehouse

Billing Rating

Claims

P

Scope of

current

project

AgencyPort

Guidewire

Enhancing current

Agency Front End Policyholder Experience

P Complete

P&C Technology Framework

18 Strategic Update for Investors – September 21, 2016

Expense Management

Goal:

Reduce expenses $50MM - $65MM by YE18

Competitively priced products require further expense discipline

Expenses1

Initiatives:

• Increase utilization of shared services &

outsourcing

• Increase automation and consolidate

activities

• Improved vendor management

• Increased span of control

2016-2017 Actions

Realization of Net Expense Savings

$20MM Actions already taken

$20MM - $25MM Savings to be realized by YE17

$10MM - $20MM Savings to be realized by YE18

$50MM - $65MM Savings

1 Includes General Expenses and Interest and Other

420 405 50 355 505 490

50

440

350 300

235-250

50-65

0

200

400

2015 1H16

Annualized

Initiatives Pro Forma

Expenses Savings($MM)

19 Strategic Update for Investors – September 21, 2016

Capital Deployment Priorities

1. Fund profitable organic growth—improve margins in all lines

2. Strategic acquisitions:

• Bolt-on Non-standard Auto and Preferred opportunities

• Leverage scale in Life operations

• Other niche specialized businesses

3. Return capital to shareholders:

• Maintain competitive dividends

• Repurchase shares

20 Strategic Update for Investors – September 21, 2016

Significant Progress Made During 2016

• Senior leadership team established

• Life & Health

– DMF/UCP resolution defined and being executed

– IT system upgrade reset and on track

• Preferred Personal Lines

– New business production and retention stabilized

– IT system re-platforming on track

• Redesign of P&C Claim service delivery model initiated

• Alliance United

– 1st round of rate increases implemented; 2nd round in process

– Claim staffing approaching target level

– Claim pending file growth slowed; reductions beginning in 4Q16

– New business growth tempered

• Expense base reset underway; actions to-date improve FY17 run rate by

$20 million pre-tax

21 Strategic Update for Investors – September 21, 2016

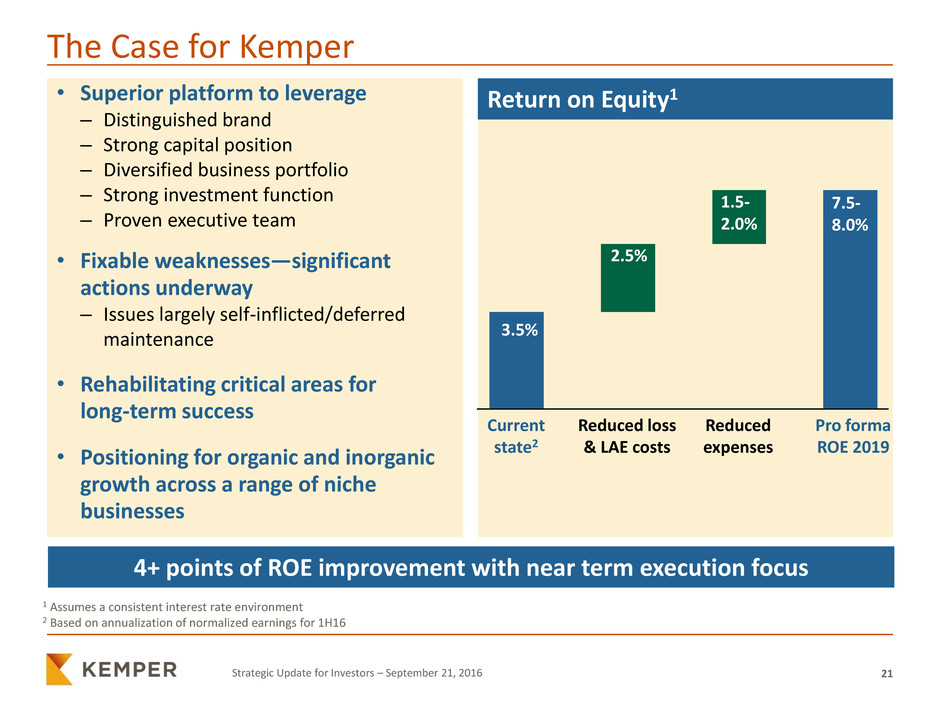

The Case for Kemper

• Superior platform to leverage

– Distinguished brand

– Strong capital position

– Diversified business portfolio

– Strong investment function

– Proven executive team

• Fixable weaknesses—significant

actions underway

– Issues largely self-inflicted/deferred

maintenance

• Rehabilitating critical areas for

long-term success

• Positioning for organic and inorganic

growth across a range of niche

businesses

Return on Equity1

5.0

9.0

Current

state2

Reduced loss

& LAE costs

Reduced

expenses

Pro forma

ROE 2019

3.5%

2.5%

1.5-

2.0%

7.5-

8.0%

4+ points of ROE improvement with near term execution focus

1 Assumes a consistent interest rate environment

2 Based on annualization of normalized earnings for 1H16

22 Strategic Update for Investors – September 21, 2016

Appendix

24 Strategic Update for Investors – September 21, 2016

Non-GAAP Financial Measures

Normalized Earnings is an after-tax, non-GAAP financial measure that is most directly comparable to the GAAP financial measure of

Segment or Product Line Net Operating Income. For the company’s Life & Health business, Normalized Earnings is calculated by 1)

normalizing catastrophe losses and LAE by removing the GAAP-reported amounts (including development) and including the

Company’s planned load for catastrophe losses and LAE, 2) excluding investment income in 2014 from one company that had sold

substantially all of its operations and 3) excluding an adjustment recorded in 2015 to correct deferred premium reserves on certain

limited pay life insurance policies. For the company’s Preferred Personal Lines and Legacy Non-standard Auto businesses, Normalized

Earnings is computed by normalizing catastrophe losses and LAE by removing the GAAP-reported amounts (including development)

and including the Company’s planned load for catastrophe losses and LAE. No adjustments were necessary to compute Normalized

Earnings for the Alliance United business. The Preferred Personal Lines business consists of Preferred Personal Automobile Insurance,

Homeowners Insurance and Other Personal Insurance product lines. The Legacy Non-standard Auto business consists of Non-

standard Personal Automobile Insurance, excluding Alliance United, and Commercial Automobile Insurance product lines.

Six Months

Ended

(Dollars in Millions) 2011 2012 2013 2014 2015 1H 2016

Life & Health

Net Operating Income 98.9$ 90.8$ 89.3$ 91.8$ 71.7$ 36.7$

Adjustments, After-tax:

Normalize Catastrophe Losses and LAE:

Rem ve: Catastrophe Losses and LAE

I l i g Development, as Reported 4.9 4.0 1.0 2.0 2.5 2.1

A : Catastrophe Losses and LAE at

Pla ned Load (3.6) (2.7) (2.3) (1.8) (1.8) (0.1)

Remove: Special Dividend From One Investment - - - (13.9) - -

Remove: Deferred Premium Reserve Adjustment - - - - 4.9 -

Total Adjustments, After-tax 1.3 1.3 (1.3) (13.7) 5.6 2.0

Normalized Earnings 100.2$ 92.1$ 88.0$ 78.1$ 77.3$ 38.7$

Year Ended December 31,

25 Strategic Update for Investors – September 21, 2016

Non-GAAP Financial Measures

Normalized Earnings (continued)

Six Months

Ended

(Dollars in Millions) 2011 2012 2013 2014 2015 1H 2016

Preferred Personal Lines

Net Operating Income (Loss) (45.1)$ (12.1)$ 90.4$ 57.3$ 55.2$ (6.2)$

Adjustments, After-Tax:

Normalize Catastrophe Losses and LAE:

Remove: Catastrophe Losses and LAE

Including Development, as Reported 94.8 69.7 20.1 50.1 34.3 45.3

Add: Catastrophe Losses and LAE at

Planned Load (33.9) (35.9) (43.0) (40.3) (35.0) (15.1)

Total Adjustments, After-tax 60.9 33.8 (22.9) 9.8 (0.7) 30.2

Normalized Earnings 15.8$ 21.7$ 67.5$ 67.1$ 54.5$ 24.0$

Legacy Non-standard Auto

Net Operating Income (Loss) 19.8$ 1.2$ 10.4$ 3.1$ (9.1)$ 4.6$

Adjustments, After-Tax:

Normalize Catastrophe Losses and LAE:

Remove: Catastrophe Losses and LAE

Including Development, as Reported 2.5 3.2 2.4 2.4 2.5 2.9

Add: Catastrophe Losses and LAE at

Planned Load (1.8) (1.8) (2.4) (2.1) (2.1) (1.5)

Total Adjustments, After-tax 0.7 1.4 - 0.3 0.4 1.4

Normalized Earnings 20.5$ 2.6$ 10.4$ 3.4$ (8.7)$ 6.0$

Year Ended December 31,

26 Strategic Update for Investors – September 21, 2016

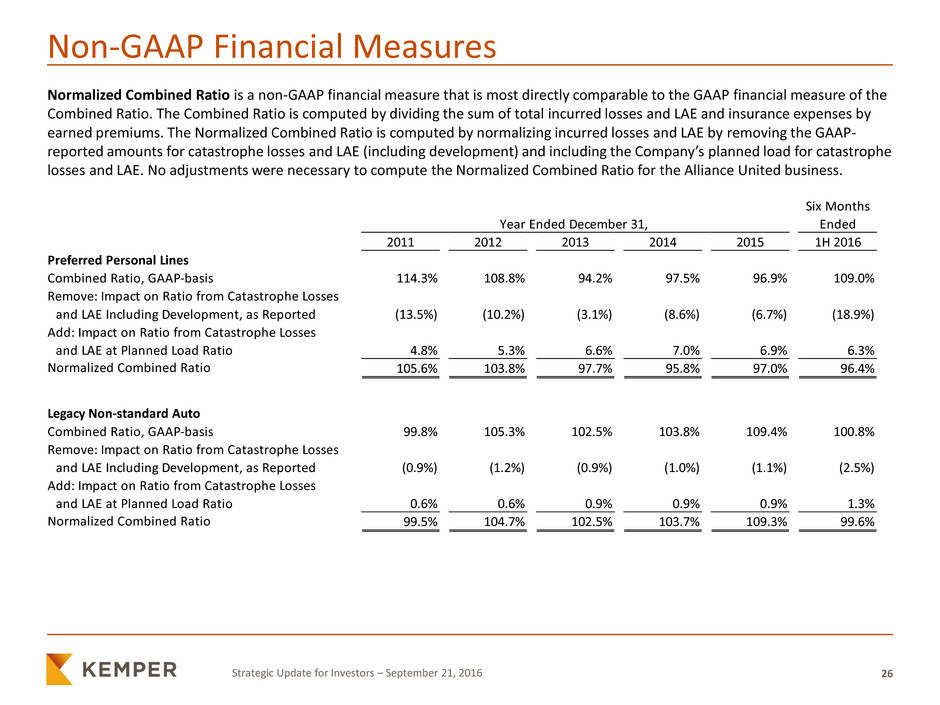

Non-GAAP Financial Measures

Normalized Combined Ratio is a non-GAAP financial measure that is most directly comparable to the GAAP financial measure of the

Combined Ratio. The Combined Ratio is computed by dividing the sum of total incurred losses and LAE and insurance expenses by

earned premiums. The Normalized Combined Ratio is computed by normalizing incurred losses and LAE by removing the GAAP-

reported amounts for catastrophe losses and LAE (including development) and including the Company’s planned load for catastrophe

losses and LAE. No adjustments were necessary to compute the Normalized Combined Ratio for the Alliance United business.

Six Months

Ended

2011 2012 2013 2014 2015 1H 2016

Preferred Personal Lines

Combined Ratio, GAAP-basis 114.3% 108.8% 94.2% 97.5% 96.9% 109.0%

Remove: Impact on Ratio from Catastrophe Losses

and LAE Including Development, as Reported (13.5%) (10.2%) (3.1%) (8.6%) (6.7%) (18.9%)

Add: Impact on Ratio from Catastrophe Losses

and LAE at Planned Load Ratio 4.8% 5.3% 6.6% 7.0% 6.9% 6.3%

Normalized Combined Ratio 105.6% 103.8% 97.7% 95.8% 97.0% 96.4%

C mb ne Ra io, GAAP-basis 99.8% 105.3% 102.5% 103.8% 109.4% 100.8%

Remove: Impact on Ratio from Catastrophe Losses

and LAE Including Development, as Reported (0.9%) (1.2%) (0.9%) (1.0%) (1.1%) (2.5%)

Add: Impact on Ratio from Catastrophe Losses

and LAE at Planned Load Ratio 0.6% 0.6% 0.9% 0.9% 0.9% 1.3%

Normalized Combined Ratio 99.5% 104.7% 102.5% 103.7% 109.3% 99.6%

Year Ended December 31,

Legacy Non-standard Auto

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Kemper Announces First Quarter Preliminary Results and Schedule for Earnings Release

- Dime Community Bancshares Declares Quarterly Cash Dividend for Series A Preferred Stock

- USCB Financial Holdings, Inc. Reports Diluted EPS of $0.23 for Q1 2024 and Announces Adoption of New 500,000 Share Repurchase Program

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share