Form 8-K Jazz Pharmaceuticals For: Jan 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

January 9, 2017

Date of Report (Date of earliest event reported)

JAZZ PHARMACEUTICALS PUBLIC LIMITED COMPANY

(Exact Name of Registrant as Specified in Charter)

| Ireland | 001-33500 | 98-1032470 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File No.) |

(IRS Employer Identification No.) |

Fourth Floor, Connaught House

1 Burlington Road, Dublin 4, Ireland

(Address of principal executive offices, including zip code)

011-353-1-634-7800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. | Results of Operations and Financial Condition. |

On January 9, 2017, at the J.P. Morgan Healthcare Conference in San Francisco, California, Jazz Pharmaceuticals plc (the “Company”) presented a corporate overview and financial update, which presentation included the Company’s current expectations with respect to certain operating results for the year ended December 31, 2016. The presentation was announced by a widely disseminated press release and was made available to the public by audio webcast, and the slides that accompanied the presentation were made available to the public on the Company’s website. A transcript of the relevant portion of the presentation relating to the aforementioned financial update is attached hereto as Exhibit 99.1, along with a copy of the relevant slides containing such information.

The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 to this Current Report on Form 8-K shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

| Item 9.01. | Financial Statements and Exhibits. |

Exhibits

| Exhibit |

Description | |

| 99.1 | Portion of transcript and related slides of presentation by Jazz Pharmaceuticals plc on January 9, 2017 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| JAZZ PHARMACEUTICALS PUBLIC LIMITED COMPANY | ||

| By: | /s/ Matthew P. Young | |

|

|

Matthew P. Young | |

|

|

Executive Vice President and Chief Financial Officer | |

Date: January 9, 2017

EXHIBIT INDEX

| Exhibit |

Description | |

| 99.1 | Portion of transcript and related slides of presentation by Jazz Pharmaceuticals plc on January 9, 2017 | |

Exhibit 99.1

Relevant portion of the transcript of the oral presentation by Jazz Pharmaceuticals plc at the J.P. Morgan Healthcare Conference in San Francisco, California on January 9, 2017:

Bruce Cozadd, Chairman & CEO, Jazz Pharmaceuticals plc

…

2016 was a very busy and productive year for Jazz Pharmaceuticals. On the commercial side, we had strong, double-digit top line growth, driven by volume growth in Xyrem and Defitelio.

…

I will make forward-looking statements today. Of course, actual results could differ and are subject to risks and uncertainties that we detail in our SEC filings.

…

Guidance that I refer to today was provided on November 8, 2016, and unless I expressly say otherwise, it’s as of that date.

…

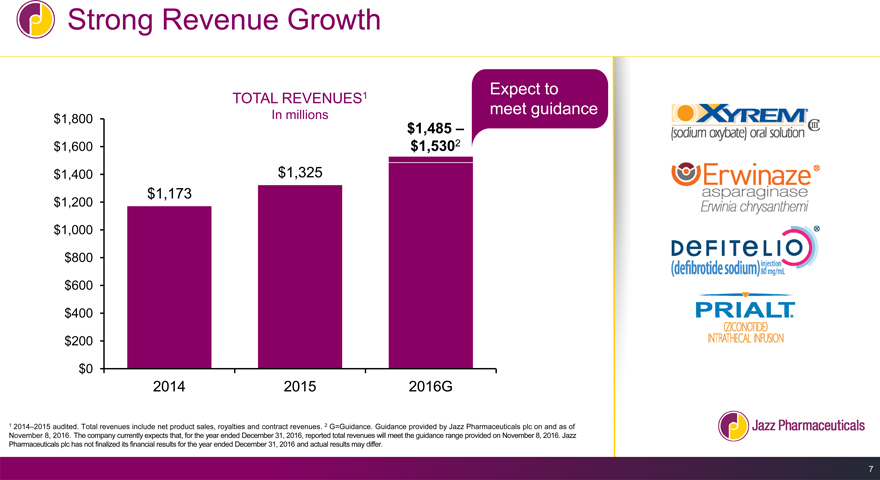

With reference to slide 7: We gave guidance for total revenues at approximately $1.5 billion, specifically a range of $1.485 to $1.53 billion. And I can tell you, based on our preliminary analysis, we expect to meet guidance for total revenues. I’ll also say at this time we do expect to meet guidance for each of our key products – Xyrem, Erwinaze and Defitelio. This revenue growth represents double-digit growth and, as I said earlier, reflects good volume growth on Xyrem and Defitelio, in particular.

…

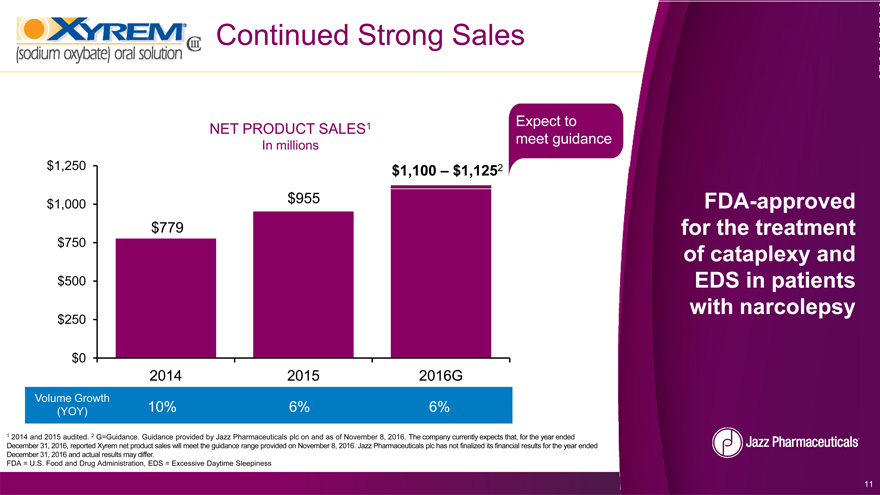

With reference to slide 11: Starting with Xyrem…2016 represented our first year with over a billion dollars in sales. As I said earlier, we do expect to meet our prior guidance here. Shown in the blue bar, volume growth for the full year was 6%. And for those of you that followed us over the year, we had first half over first half growth in volume of 4%, so we were very pleased to see the second half come in at a strong 7% volume growth.

…

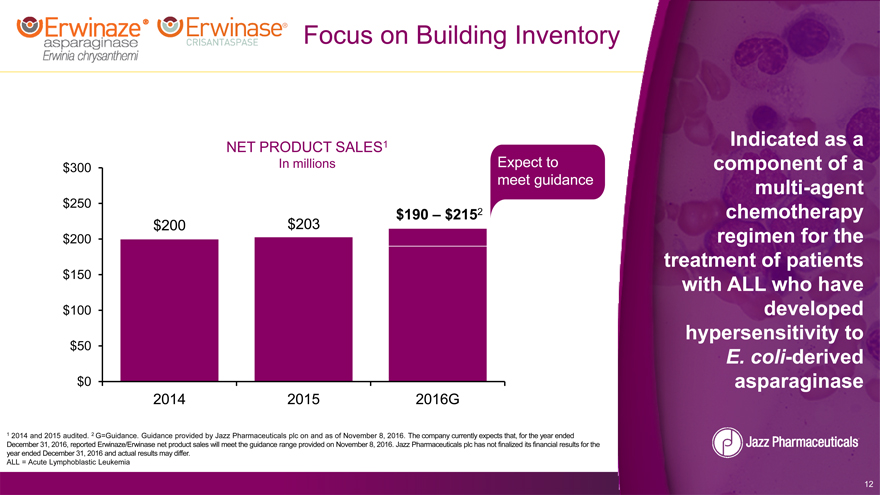

With reference to slide 12: Erwinaze growth has been limited by supply challenges during 2016.

…

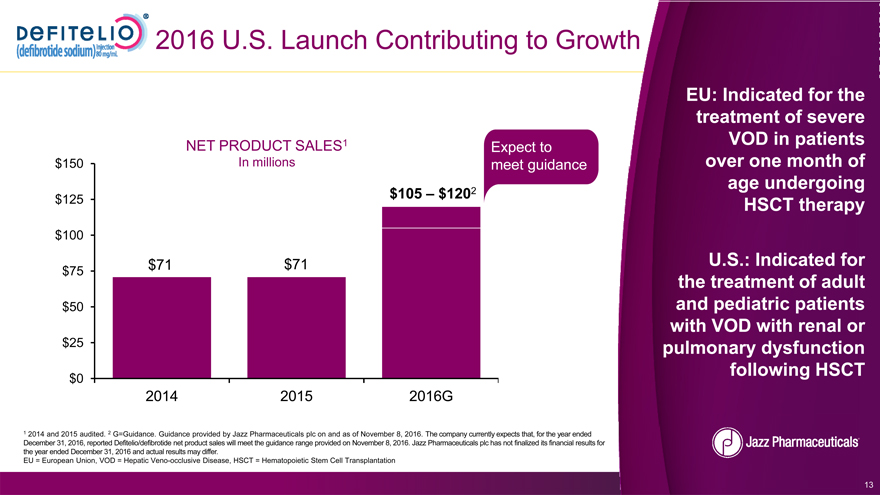

With reference to slide 13: Defitelio had a big year with our U.S. launch in April of 2016. You can see here growth north of 50% in revenues for the year.

…

| Relevant slides from Jazz Pharmaceuticals plc’s presentation at the J.P. Morgan Healthcare Conference in San Francisco, California on January 9, 2017:

|

35th Annual

J.P. Morgan Healthcare Conference

Bruce Cozadd | Chairman and CEO January 9, 2017

© Copyright 2017 Jazz Pharmaceuticals. All rights reserved.

|

|

Forward-Looking Statements

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995

This slide deck and the accompanying oral presentation contain forward-looking statements, including, but not limited to, statements related to Jazz Pharmaceuticals’ growth strategies and initiatives; corporate development efforts; expected financial and operating results, including 2016 financial guidance; future product sales and volume; ongoing and future clinical trials and other product development activities, including expected regulatory submissions and other events; expected U.S. commercial launch of Vyxeos™; 2017 goals (financial and otherwise); the timing of such events and activities; and other statements that are not historical facts. These forward-looking statements are based on the company’s current plans, objectives, estimates, expectations and intentions and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties associated with maintaining or increasing sales of and revenue from Xyrem® (sodium oxybate) oral solution, such as the potential introduction of generic competition or other competitive products, regulatory restrictions and requirements applicable to Xyrem and ongoing patent litigation and related proceedings; effectively commercializing the company’s other products and product candidates; the inherent uncertainty associated with the regulatory approval process; protecting and enhancing the company’s intellectual property rights; delays or problems in the supply or manufacture of the company’s products and product candidates; complying with applicable U.S. and non-U.S. regulatory requirements; obtaining and maintaining appropriate pricing and reimbursement for the company’s products; the difficulty and uncertainty of pharmaceutical product development and the uncertainty of clinical success; identifying and acquiring, in-licensing or developing additional products or product candidates, financing these transactions and successfully integrating acquired businesses; potential restrictions on the company’s ability and flexibility to pursue future strategic opportunities as a result of its substantial outstanding debt obligations; the ability to achieve expected future financial performance and results; and other risks and uncertainties, including those described from time to time under the caption “Risk Factors” and elsewhere in Jazz Pharmaceuticals plc’s Securities and Exchange Commission filings and reports (Commission File No. 001-33500), including the company’s most recent Quarterly Report on Form 10-Q for the quarter ended September 30, 2016 and future filings and reports by the company. Other risks and uncertainties of which the company is not currently aware may also affect the company’s forward-looking statements and may cause actual results and timing of events to differ materially from those anticipated. The forward-looking statements made in this slide deck and the accompanying oral presentation are made only as of January 9, 2017 or as of the dates indicated in the forward-looking statements, even if they are subsequently made available by the company on its website or otherwise. The company undertakes no obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made.

3

|

|

Strong Revenue Growth

TOTAL REVENUES1Expect to

meet guidance

$1,800 In millions

$1,485 –

$1,600 $1,5302

$1,400 $1,325

$1,200 $1,173

$1,000

$800

$600

$400

$200

$0

2014 20152016G

1 2014–2015 audited. Total revenues include net product sales, royalties and contract revenues. 2 G=Guidance. Guidance provided by Jazz Pharmaceuticals plc on and as of November 8, 2016. The company currently expects that, for the year ended December 31, 2016, reported total revenues will meet the guidance range provided on November 8, 2016. Jazz Pharmaceuticals plc has not finalized its financial results for the year ended December 31, 2016 and actual results may differ.

7

|

|

Continued Strong Sales

NET PRODUCT SALES1Expect to

In millionsmeet guidance

$1,250 $1,100 – $1 ,1252

$1,000 $955FDA-approved

$779 for the treatment

$750 of cataplexy and

$500 EDS in patients

with narcolepsy

$250

$0

2014 20152016G

Volume Growth

(YOY) 10% 6%6%

1 2014 and 2015 audited. 2 G=Guidance. Guidance provided by Jazz Pharmaceuticals plc on and as of November 8, 2016. The company currently expects that, for the year ended December 31, 2016, reported Xyrem net product sales will meet the guidance range provided on November 8, 2016. Jazz Pharmaceuticals plc has not finalized its financial results for the year ended December 31, 2016 and actual results may differ.

FDA = U.S. Food and Drug Administration, EDS = Excessive Daytime Sleepiness

11

|

|

Focus on Building Inventory

NET PRODUCT SALES1 Indicated as a

$300 In millions Expect tocomponent of a

meet guidancemulti-agent

$250

$190 – $215 2chemotherapy

$200 $203

$200 regimen for the

treatment of patients

$150 with ALL who have

$100 developed

hypersensitivity to

$50 E. coli-derived

$0 asparaginase

2014 2015 2016G

1 2014 and 2015 audited. 2 G=Guidance. Guidance provided by Jazz Pharmaceuticals plc on and as of November 8, 2016. The company currently expects that, for the year ended December 31, 2016, reported Erwinaze/Erwinase net product sales will meet the guidance range provided on November 8, 2016. Jazz Pharmaceuticals plc has not finalized its financial results for the year ended December 31, 2016 and actual results may differ.

ALL = Acute Lymphoblastic Leukemia

12

|

|

2016 U.S. Launch Contributing to Growth

EU: Indicated for the

treatment of severe

NET PRODUCT SALES1 Expect to VOD in patients

$150 In millions meet guidanceover one month of

age undergoing

$125 $105 – $120 2HSCT therapy

$100

$71 $71 U.S.: Indicated for

$75

the treatment of adult

$50 and pediatric patients

with VOD with renal or

$25 pulmonary dysfunction

$0 following HSCT

2014 2015 2016G

1 2014 and 2015 audited. 2 G=Guidance. Guidance provided by Jazz Pharmaceuticals plc on and as of November 8, 2016. The company currently expects that, for the year ended December 31, 2016, reported Defitelio/defibrotide net product sales will meet the guidance range provided on November 8, 2016. Jazz Pharmaceuticals plc has not finalized its financial results for the year ended December 31, 2016 and actual results may differ.

EU = European Union, VOD = Hepatic Veno-occlusive Disease, HSCT = Hematopoietic Stem Cell Transplantation

13

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Jazz Pharmaceuticals to Present Data Across Growing Oncology Pipeline and Portfolio at ASCO 2024

- Pre-Investor Call Presentation available to shareholders

- Sobi Q1 2024 report: Strong sales reflecting the strength of the portfolio

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share