Form 8-K JPMORGAN CHASE & CO For: Mar 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): March 5, 2015

JPMorgan Chase & Co.

(Exact name of registrant as specified in its charter)

Delaware | 1-5805 | 13-2624428 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. employer identification no.) |

270 Park Avenue, New York, New York | 10017 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (212) 270-6000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Item 7.01 Regulation FD Disclosure.

JPMorgan Chase & Co. (“JPMorgan Chase” or the “Firm”) announced on March 5, 2015, that it had released the results of its “company-run” 2015 Dodd-Frank Act Stress Test (“DFAST”) for JPMorgan Chase & Co. and certain select subsidiaries that are subject to the DFAST rules. A copy of that information is attached as Exhibit 99.2.

The “company-run” 2015 Annual Stress Test Disclosure, and press release, are being furnished pursuant to Item 7.01, and the information contained therein shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities under that Section. Furthermore, the information contained in Exhibits 99.1 and 99.2 shall not be deemed to be incorporated by reference into the filings of the Firm under the Securities Act of 1933.

The DFAST results reflect the hypothetical economic scenario and market shock assumptions provided by the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”) in the supervisory severely adverse scenario which are available on the Federal Reserve Board's website (http://www.federalreserve.gov/bankinforeg/ccar.htm). The furnishing of the stress test information by JPMorgan Chase should not be taken as an indication of the Federal Reserve Board’s judgment or analysis regarding JPMorgan Chase’s proposed capital actions. Investors are cautioned not to draw any inferences from this information about the Federal Reserve Board's determination with respect to the Firm’s capital plan and proposed capital actions. Among other things, that determination will be based on qualitative, as well as quantitative, factors. The Federal Reserve Board has indicated that it will publicly disclose on March 11, 2015, the results of the 2015 Comprehensive Capital Analysis and Review (“CCAR”), and whether or not it has objected to the Firm’s proposed capital plan and proposed capital actions.

This Current Report on Form 8-K (including the Exhibits hereto) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase’s Annual Report on Form 10-K for the year ended December 31, 2014, which has been filed with the Securities and Exchange Commission and is available on JPMorgan Chase's website (http://investor.shareholder.com/jpmorganchase) and on the Securities and Exchange Commission's website (www.sec.gov). JPMorgan Chase does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. | Description of Exhibit | |

99.1 | JPMorgan Chase & Co. press release dated March 5, 2015 | |

99.2 | 2015 Annual Stress Test Disclosure | |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

JPMorgan Chase & Co. |

(Registrant) |

By: | /s/ Neila B. Radin |

Neila B. Radin | |

Senior Vice President | |

Dated: | March 5, 2015 |

3

INDEX TO EXHIBITS

Exhibit No. | Description of Exhibit | |

99.1 | JPMorgan Chase & Co. press release dated March 5, 2015 | |

99.2 | 2015 Annual Stress Test Disclosure | |

4

JPMorgan Chase & Co. 270 Park Avenue, New York, NY 10017-2070 NYSE symbol: JPM www.jpmorganchase.com |  |

News release: IMMEDIATE RELEASE

JPMorgan Chase Announces Release of its 2015 Dodd-Frank Act Stress Test Results

New York, March 5, 2015 – JPMorgan Chase & Co. (NYSE: JPM) announced today that it has released the results of its “company-run” 2015 Dodd-Frank Act Stress Test for JPMorgan Chase & Co. and certain select subsidiaries that are subject to the DFAST rules.

The information is available on the Firm's website at www.jpmorganchase.com under Investor Relations, Investor Presentations. JPMorgan Chase & Co. (NYSE: JPM) is a leading global financial services firm with assets of $2.6 trillion and operations worldwide. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management. A component of the Dow Jones Industrial Average, JPMorgan Chase & Co. serves millions of consumers in the United States and many of the world's most prominent corporate, institutional and government clients under its J.P. Morgan and Chase brands. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com.

Investor Contact: Sarah Youngwood (212) 270-7325 | Media Contact: Joe Evangelisti (212) 270-7438 |

March 5, 2015 2 0 1 5 A N N U A L S T R E S S T E S T D I S C L O S U R E Dodd-Frank Act Stress Test Results Supervisory Severely Adverse Scenario

Agenda Page 2 0 1 5 A N N U A L S T R E S S T E S T D I S C L O S U R E 1 2015 Supervisory Severely Adverse Scenario Results 1 Capital Adequacy Assessment Processes and Risk Methodologies 8 2015 Supervisory Severely Adverse Scenario Design and Description 22 DFAST Results – In-scope Bank Entities 24 Notes 29 Forward-looking Statements 31

2 0 1 5 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O R E S U L T S Overview The 2015 Annual Stress Test Disclosure presents results of the annual stress test conducted by JPMorgan Chase & Co. (“JPMorgan Chase” or the “Firm”) in accordance with the Dodd-Frank Act Stress Test (“DFAST”) requirements. The results reflect certain forecasted financial measures for the nine-quarter period Q4 2014 through Q4 2016 under the Supervisory Severely Adverse scenario prescribed by the Board of Governors of the Federal Reserve System (“Federal Reserve”). The stress test has been executed in accordance with the Comprehensive Capital Analysis and Review (“CCAR”) 2015 Summary Instructions and Guidance published by the Federal Reserve on October 17, 2014 (“2015 CCAR Instructions”). The results presented were calculated using forecasting models and methodologies developed and employed by JPMorgan Chase. The Federal Reserve conducts stress testing of financial institutions, including JPMorgan Chase, based on models and methodologies the Federal Reserve employs. Because of the different models and methodologies employed by the Federal Reserve, results published by the Federal Reserve may vary from those disclosed herein; JPMorgan Chase may not be able to explain the differences between the results published in this report and the results published by the Federal Reserve. The results presented reflect specific assumptions regarding planned capital actions as prescribed by the DFAST rule starting with the second quarter of the projection period (“DFAST capital actions”)1: Common stock dividend payments are assumed to continue at the same dollar amount as the average of the prior-four quarters (Q1 2014 – Q4 2014) Scheduled dividend, interest or principal payments for other capital instruments are assumed to be paid Repurchases of common stock and redemptions of other capital instruments are assumed to be zero Issuance of new common stock, preferred stock, or other capital instruments are assumed to be zero, except for common stock issuance associated with employee compensation Even though the Firm became subject to the Basel III capital rules effective January 1, 2014, the results presented include both the tier 1 common ratio calculated using the methodology in the Basel I capital rules and the common equity tier 1 (“CET1”) capital ratio using the Basel III capital framework, as required under Regulation Y (12 CFR Part 225).2 The results presented represent hypothetical estimates under the Supervisory Severely Adverse scenario prescribed by the Federal Reserve that reflects an economic outcome that is more adverse than expected, and do not represent JPMorgan Chase's forecasts of expected losses, revenue, net income before taxes, capital, risk-weighted assets (“RWA”), or capital ratios. 1 The first quarter of the projection period (Q4 2014) reflects actual capital actions (e.g., common stock dividends and repurchases, issuances and redemptions of other capital instruments) 2 See Federal Register Vol. 79, No. 207 (October 27, 2014) 2

2 0 1 5 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O R E S U L T S Firm-calculated projected stressed capital ratios (Q4 2014 – Q4 2016) Firm-calculated projected Q4 2016 risk-weighted assets DFAST results under the Supervisory Severely Adverse scenario Capital and RWA projections – JPMorgan Chase & Co. 1 See note 1 on page 30 2 Stressed capital ratios are calculated using capital action assumptions prescribed by the Dodd-Frank Act stress test rule. These projections represent hypothetical estimates that involve an economic outcome that is more adverse than expected. These estimates are not forecasts of JPMorgan Chase expected losses, revenues, net income before taxes, capital, RWA, or capital ratios. The minimum capital ratio presented is for the period Q4 2014 to Q4 2016. Calculations do not include the impact of JPMorgan Chase’s 2015 CCAR capital actions request 3 Stressed capital ratios are calculated in accordance with the Federal Reserve’s CCAR 2015 Summary Instructions and Guidance, published October 17, 2014. The tier 1 common ratio is calculated using the definition of tier 1 capital and total risk-weighted assets in 12 CFR 225, appendix A. All other ratios are calculated using the definitions of tier 1 capital and approaches to risk-weighting assets that are in effect during a particular planning horizon quarter. See Fed. Reg. Vol. 79, 13498 (March 11, 2014) 4 JPMorgan Chase, as an advanced approaches bank holding company (“BHC”), is subject to the CET1 ratio for each quarter commencing Q3 2014 through Q4 2016 1 For each quarter in 2014, risk-weighted assets are calculated using the Basel III standardized transitional approach, which reflects Basel I plus 2.5 market risk rules. Beginning Q1 2015 through Q4 2016, risk-weighted assets are calculated using the Basel III approach in effect during a particular planning horizon quarter, except for the tier 1 common ratio which uses Basel I plus 2.5 market risk rules. For additional information on the standardized approach, see Regulatory Capital on pages 146–153 of JPMorgan Chase’s Annual Report on Form 10-K (“2014 Form 10-K”) Q4 2014 2015 2016 Q4 2016 Minimum Tier 1 common ratio (%) 10.9% 5.0% 5.0% 5.0% 8.7% 7.5% Common equity tier 1 capital ratio (%)4 11.1% 4.0% 4.5% 4.5% 8.0% 6.9% Tier 1 risk-based capital ratio (%) 12.6% 5.5% 6.0% 6.0% 9.1% 8.1% Total risk-based capital ratio (%) 15.0% 8.0% 8.0% 8.0% 11.1% 10.2% Tier 1 leverage ratio (%) 7.6% 4.0% 4.0% 4.0% 6.5% 6.0% 2015 CCAR / Regulatory Minimums Actual Q3 20141 Stressed capital ratios2,3 General approach (Basel I with 2.5) Basel III Standardized Risk-weighted assets (billions of dollars)1 $1,455 $1,477 $1,640 Actual Q3 2014 General approach (Basel I with 2.5) Projected Q4 2016 3

2 0 1 5 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O R E S U L T S DFAST results under the Supervisory Severely Adverse scenario Profit & Loss projections – JPMorgan Chase & Co. Firm-calculated 9-quarter cumulative projected losses, revenues, net income before taxes, and other comprehensive income (Q4 2014 – Q4 2016) 1 Average assets is the nine-quarter average of total assets (from Q4 2014 through Q4 2016) 2 Pre-provision net revenue includes losses from operational-risk events, mortgage repurchase expenses, and other real estate owned (“OREO”) costs 3 Other revenue includes one-time income and (expense) items not included in pre-provision net revenue 4 Trading and counterparty losses include mark-to-market (“MTM”) and credit valuation adjustments (“CVA”) losses resulting from the assumed instantaneous global market shock, and losses arising from the counterparty default scenario component applied to derivatives, securities lending, and repurchase agreement activities 5 Other losses/gains includes projected change in fair value of loans held for sale and loans held for investment measured under the fair value option 6 Other comprehensive income (“OCI”) includes incremental unrealized losses/gains on available-for-sale (“AFS”) securities and on any held-to- maturity (“HTM”) securities that have experienced other than temporary impairment; the amount shown is on a pretax basis 7 JPMorgan Chase, as an advanced approaches BHC, is required to transition AOCI related to AFS securities, as well as for pension and other postretirement employee benefit plans, into projected regulatory capital. Those transitions are 20 percent included in projected capital for 2014, 40 percent included in projected capital for 2015, and 60 percent included in projected capital for 2016 Billions of dollars Percent of average assets1 Pre-provision net revenue2 $49.5 2.0% Other revenue3 0.0 less Provision for loan and lease losses 48.5 Realized losses/(gains) on securities (AFS/HTM) 1.3 Trading and counterparty losses4 25.1 Other losses/(gains)5 4.9 equals Net income (losses) before taxes ($30.3) (1.2%) M mo items Other comprehensive income 6 ($16.0) Other effects on capital Actual Q3 2014 Q4 2016 Accumulated other comprehensive income ("AOCI") in capital (billions of dollars) 7 $0.5 ($4.0) 4

2 0 1 5 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O R E S U L T S DFAST results under the Supervisory Severely Adverse scenario Loan loss projections – JPMorgan Chase & Co. Firm-calculated 9-quarter cumulative projected loan losses, by type of loan (Q4 2014 – Q4 2016) For purposes of this disclosure, loan losses and loss rates are calculated to be consistent with the Federal Reserve’s methodology5, which includes impairments in the purchased credit-impaired (“PCI”) portfolios as part of loan losses (rather than being included as part of loan loss reserves) 1 Average loan balances used to calculate portfolio loss rates exclude loans held-for-sale and loans held-for-investment under the fair value option, and are calculated over nine quarters 2 Commercial and industrial loans include small- and medium-enterprise loans and corporate cards 3 Other consumer loans include student loans and automobile loans 4 Other loans include loans to financial institutions 5 As described in the Federal Reserve’s Dodd-Frank Act Stress Test 2014: Supervisory Stress Test Methodology and Results published on March 24, 2014 Billions of dollars Portfolio loss rates (%)1 Loan losses $37.4 5.0% First-lien mortgages, domestic 6.3 4.6 J nior liens and HELOCs, domestic 6.8 11.7 Commercial and industrial2 4.6 3.3 Commercial real estate, domestic 2.4 3.1 Credit cards 13.7 11.8 Other consumer3 1.8 2.8 Other loans4 1.8 1.1 5

2 0 1 5 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O R E S U L T S Key drivers of JPMorgan Chase’s 2015 DFAST pro forma CET1 ratio Firm-calculated CET1 ratio calculated under Supervisory Severely Adverse scenario (billions of dollars, except where noted) 1 Q3 2014 and Q4 2016 reflect end-of-period amounts. Other amounts represent the cumulative nine-quarter impact 2 2015 DFAST launch point CET1 RWA and ratio adjusted to reflect Basel III standardized risk weights 3 Represents other items, including income taxes, securities losses/gains, and goodwill & intangibles net of related deferred tax liabilities 4 Net capital distributions in the first quarter of the projection period (Q4 2014) reflects actual capital actions (e.g., actual amount of common stock dividends and repurchases, issuances, and redemptions of other capital instruments); the second through ninth quarters (Q1 2015 – Q4 2016) assume no common stock repurchases, common stock dividends are held flat to the average of the prior four quarters (Q1 2014 – Q4 2014), and no issuances or redemptions of other capital instruments, except for common stock issuance associated with employee compensation 10.5% $163 8.0% $130 3.2% 3.1% 1.6% 0.3% 0.3% 0.6% 1.0% 0.8% Launch Point 2015 DFAST (Q3 2014) Pretax PPNR (incl. op. losses) Pretax Provisions for Loans and Lease Losses Pretax Trading and Counterparty Losses Pretax Other Losses AOCI RWA Other Net Capital Distributions End Point 2015 DFAST (Q4 2016) 2015 CCAR Regulatory Minimum: 4.5% CET1 impact ($B) RWA ($T)2 1.5 1.6 (4) (49) 50 (13) 13 (25) (5) 1,2 3 4 1 6

2 0 1 5 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O R E S U L T S Key drivers of JPMorgan Chase’s 2015 DFAST pro forma Tier 1 Leverage ratio 1 Q3 2014 and Q4 2016 reflect end-of-period amounts. Other amounts represent the cumulative nine-quarter impact 2 Represents other items, including income taxes, securities losses/gains, goodwill & intangibles net of related deferred tax liabilities, and the impact of the phase-out of non-qualifying trust preferred securities 3 Net capital distributions in the first quarter of the projection period (Q4 2014) reflects actual capital actions (e.g., actual amount of common stock dividends and repurchases, issuances, and redemptions of other capital instruments); the second through ninth quarters (Q1 2015 – Q4 2016) assume no common stock repurchases, common stock dividends are held flat to the average of the prior four quarters (Q1 2014 – Q4 2014), and no issuances or redemptions of other capital instruments, except for common stock issuance associated with employee compensation Firm-calculated Tier 1 Leverage ratio calculated under Supervisory Severely Adverse scenario (billions of dollars, except where noted) 7.6% $184 6.5% $150 2.1% 2.1% 1.0% 0.2% 0.2% 0.2% 0.6% 0.5% Launch Point 2015 DFAST (Q3 2014) Pretax PPNR (incl. op. losses) Pretax Provisions for Loans and Lease Losses Pretax Trading and Counterparty Losses Pretax Other Losses AOCI Leverage Assets Other Net Capital Distributions End Point 2015 DFAST (Q4 2016) 2015 CCAR Regulatory Minimum: 4.0% Tier 1 Leverage impact ($B) Leverage Assets ($T) 2.4 2.3 (4) (49) 50 (13) 12 (25) (5) 1 2 3 1 7

Agenda Page 2 0 1 5 A N N U A L S T R E S S T E S T D I S C L O S U R E 8 Capital Adequacy Assessment Processes and Risk Methodologies 8 2015 Supervisory Severely Adverse Scenario Results 1 2015 Supervisory Severely Adverse Scenario Design and Description 22 DFAST Results – In-scope Bank Entities 24 Notes 29 Forward-looking Statements 31

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S Both CCAR and DFAST Mid-Cycle stress tests are components of the Firm’s Internal Capital Adequacy Assessment Process (“ICAAP”) Capital adequacy assessment processes are used to evaluate the Firm’s capital adequacy by providing management with a view of the impact of severe and unexpected events on earnings, balance sheet positions, reserves, and capital Assesses a broad range of macroeconomic factors, interest rate sensitivities, market stresses, and idiosyncratic risks and events Measures the full impact of these factors on the Firm’s earnings, balance sheet positions, reserves, and capital Results are assessed relative to internal capital management policies and regulatory capital requirements, and are used in capital and risk management decisions Semi-annual process Centrally-defined economic scenarios applied uniformly across the Firm DFAST Mid-Cycle company-run: 3 scenarios defined by JPMorgan Chase’s economists CCAR: 3 scenarios defined by the Federal Reserve, and at least 1 stress scenario defined by JPMorgan Chase’s economists Granular approach; forecasts and projections developed at the portfolio or line of business (“LOB”) level Forecasting approaches and results independently assessed by the Central Challenger Team within the Firm’s Regulatory Capital Management Office (“RCMO”) Models independently reviewed and validated by the Firm’s Model Risk and Development unit Results projected over 2+ year time horizon Key Features Draws on the collective expertise and resources of the Firm (e.g., people, systems, technology and control functions) Leverages ~3,000 employees across LOBs and Firmwide functions, many of whom carry out ICAAP processes as part of their core responsibilities Centrally coordinated and supervised by Corporate Capital Stress Testing Team Key Resources Overall results reviewed with the Firm’s Capital Governance Committee and Board of Directors Overview of capital adequacy assessment processes 9

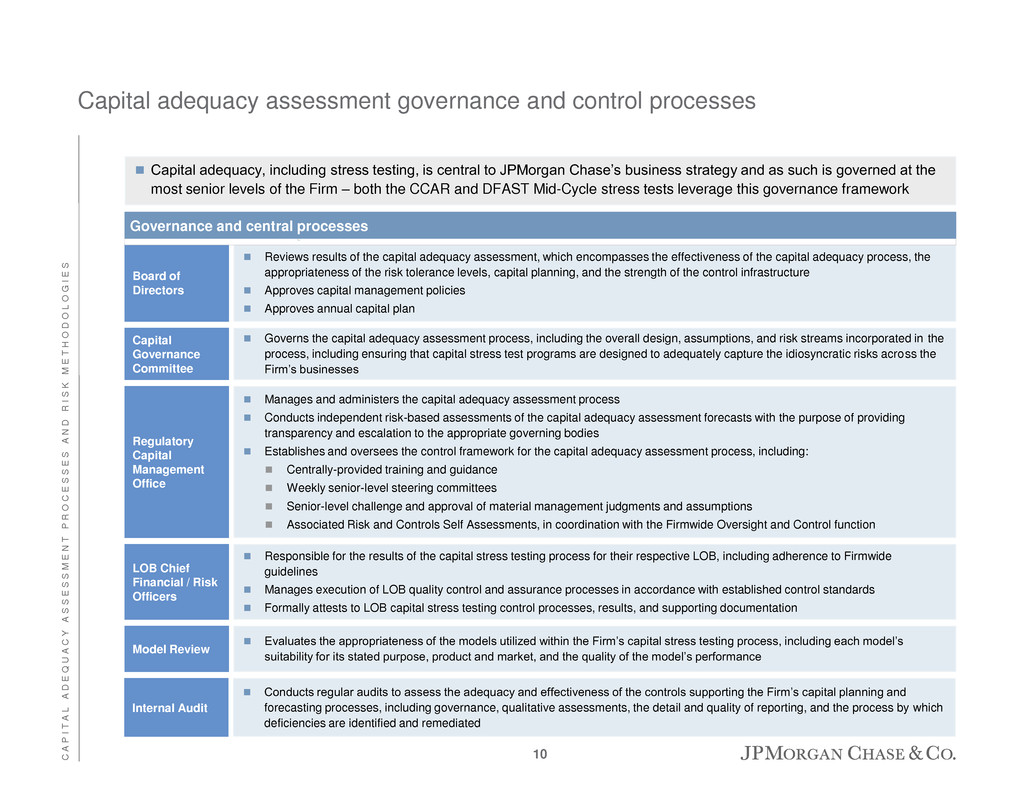

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S Capital adequacy assessment governance and control processes Board of Directors Reviews results of the capital adequacy assessment, which encompasses the effectiveness of the capital adequacy process, the appropriateness of the risk tolerance levels, capital planning, and the strength of the control infrastructure Approves capital management policies Approves annual capital plan Capital Governance Committee Governs the capital adequacy assessment process, including the overall design, assumptions, and risk streams incorporated in the process, including ensuring that capital stress test programs are designed to adequately capture the idiosyncratic risks across the Firm’s businesses LOB Chief Financial / Risk Officers Responsible for the results of the capital stress testing process for their respective LOB, including adherence to Firmwide guidelines Manages execution of LOB quality control and assurance processes in accordance with established control standards Formally attests to LOB capital stress testing control processes, results, and supporting documentation Regulatory Capital Management Office Manages and administers the capital adequacy assessment process Conducts independent risk-based assessments of the capital adequacy assessment forecasts with the purpose of providing transparency and escalation to the appropriate governing bodies Establishes and oversees the control framework for the capital adequacy assessment process, including: Centrally-provided training and guidance Weekly senior-level steering committees Senior-level challenge and approval of material management judgments and assumptions Associated Risk and Controls Self Assessments, in coordination with the Firmwide Oversight and Control function Capital adequacy, including stress testing, is central to JPMorgan Chase’s business strategy and as such is governed at the most senior levels of the Firm – both the CCAR and DFAST Mid-Cycle stress tests leverage this governance framework Governance and central processes Model Review Evaluates the appropriateness of the models utilized within the Firm’s capital stress testing process, including each model’s suitability for its stated purpose, product and market, and the quality of the model’s performance Internal Audit Conducts regular audits to assess the adequacy and effectiveness of the controls supporting the Firm’s capital planning and forecasting processes, including governance, qualitative assessments, the detail and quality of reporting, and the process by which deficiencies are identified and remediated 10

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S Capital management objectives and assessment of results Cover all material risks underlying the Firm’s business activities; Maintain “well-capitalized” status under regulatory requirements at the holding company level and at banking subsidiaries; Maintain debt ratings that enable the Firm to optimize its funding mix and liquidity sources while minimizing costs; Retain flexibility to take advantage of future investment opportunities; Continue to build and invest in its businesses through-the-cycle and in stressed environments; and Distribute excess capital to shareholders while balancing other stated objectives JPMorgan Chase’s capital management objectives are to hold capital sufficient to: Firmwide capital ratios are assessed relative to: Applicable regulatory standards CCAR guidelines established by the Federal Reserve Internal capital management policies Capital management decisions: Through-the-cycle business growth and investment Sustainable, upward-trending dividends Issuance/redemption plans across capital structure Balance sheet management and strategy Results inform 11

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S Key risks captured in capital adequacy assessment projections Capital The risk the Firm has an insufficient level and composition of capital to support the Firm’s business activities and associated risks during normal economic environments and stressed conditions Compliance The risk of fines or sanctions or of financial damage or loss due to the failure to comply with laws, rules, and regulations Country The risk that a sovereign event or action alters the value or terms of contractual obligations of obligors, counterparties and issuers or adversely affects markets related to a particular country Credit The risk of loss arising from the default of a customer, client or counterparty Fiduciary The risk of a failure to exercise the applicable high standard of care, to act in the best interests of clients or to treat clients fairly, as required under applicable law or regulation Legal The risk of loss or imposition of damages, fines, penalties or other liability arising from failure to comply with a contractual obligation or to comply with laws or regulations to which the Firm is subject Liquidity The risk that the Firm will not have the appropriate amount, composition and tenor of funding and liquidity in support of its assets, and that the Firm will be unable to meet its contractual and contingent obligations through normal economic cycles and market stress events Market The risk of loss arising from potential adverse changes in the value of the Firm’s assets and liabilities resulting from changes in market variables such as interest rates, foreign exchange rates, equity prices, commodity prices, implied volatilities or credit spreads Model The risk of the potential for adverse consequences from decisions based on incorrect or misused model outputs and reports Non-USD FX The risk arising from capital investments, forecasted expense and revenue, investment securities portfolio or debt denominated in currencies other than the U.S. dollar Operational The risk of loss resulting from inadequate or failed processes or systems or due to external events that are neither market nor credit- related Principal The risk of an adverse change in the value of privately-held financial assets and instruments, typically representing an ownership or junior capital position. These positions have unique risks due to their illiquidity or for which there is less observable market or valuation data Reputation The risk that an action, transaction, investment or event will reduce the trust that clients, shareholders, employees or the broader public has in the Firm’s integrity or competence Structural Interest Rate The risk resulting from the Firm’s traditional banking activities (both on- and off-balance sheet positions) arising from the extension of loans and credit facilities, taking deposits and issuing debt (collectively referred to as “non-trading activities”), and also the impact from the Chief Investment Office (“CIO”) investment securities portfolio and other related CIO and Treasury activities Source – Enterprise-Wide Risk Management on page 106 of JPMorgan Chase & Co. 2014 Form 10-K The below key risks are those inherent in JPMorgan Chase’s business activities. The results of the Firm’s capital stress tests reflect the majority of these risks: 12

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S Key risks by business activity captured in capital adequacy assessment projections Business activities Key risks1 Consumer & Community Banking Consumer & Business Banking Consumer Banking Business Banking Chase Wealth Management Mortgage Banking Mortgage Production Mortgage Servicing Real Estate Portfolios Card, Merchant Services & Auto Credit Liquidity Market Operational, legal, compliance, and fiduciary Principal Structural interest rate2 Corporate & Investment Bank Banking Investment Banking Treasury Services Lending Markets & Investor Services Fixed Income / Equity Markets Securities Services Credit Adjustments & Other Market Credit Liquidity Principal Operational, legal, compliance, and fiduciary Structural interest rate2 Commercial Banking Middle Market Banking Corporate Client Banking Commercial Term Lending Real Estate Banking Credit Liquidity Market Operational, legal, and compliance Principal Structural interest rate2 Asset Management Global Investment Management Global Wealth Management Market Operational, legal, compliance, and fiduciary Credit Liquidity Principal Structural interest rate2 Corporate Private Equity Treasury and CIO Other Corporate Liquidity Market Principal Credit Operational, legal, compliance, and fiduciary Structural interest rate2 1 Reputation risk is less quantifiable. Actual losses from historical events that may have caused reputation risk are captured through the Firm’s operational loss forecasting framework; however, the entirety of the reputation risk impact may not be quantifiable 2 The Firm's structural interest rate risk arises from activities undertaken by its four major reportable business segments and is centrally managed by Treasury and CIO within Corporate 13

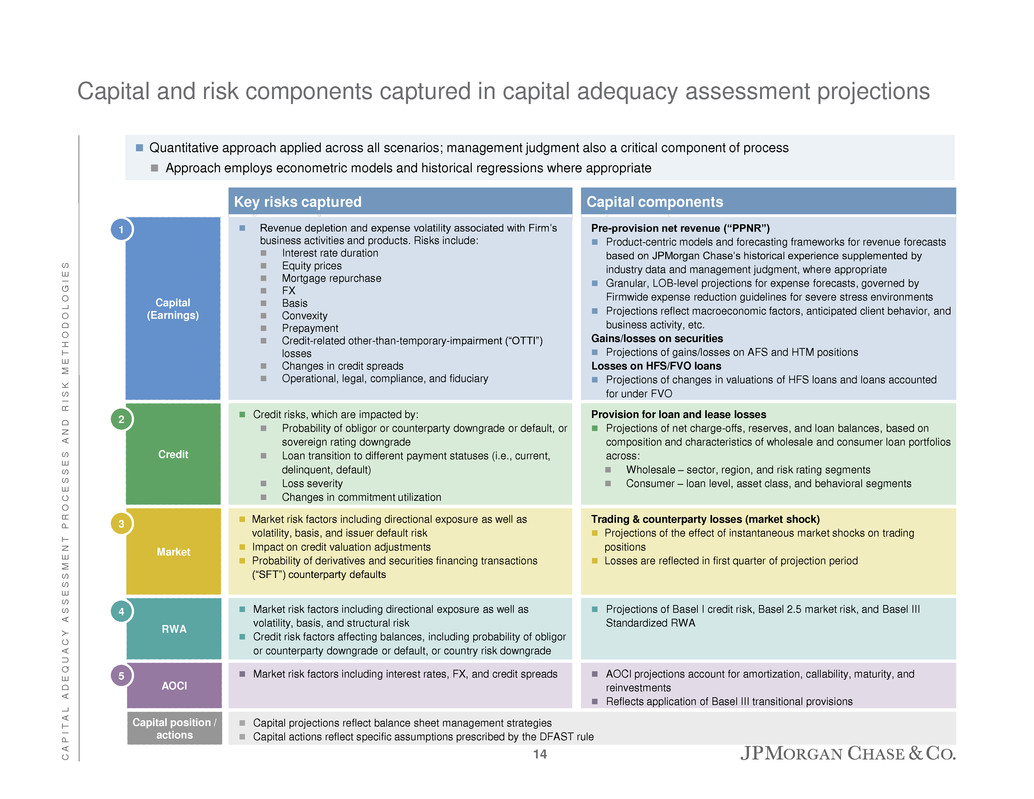

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S Capital and risk components captured in capital adequacy assessment projections Quantitative approach applied across all scenarios; management judgment also a critical component of process Approach employs econometric models and historical regressions where appropriate Capital components Key risks captured Provision for loan and lease losses Projections of net charge-offs, reserves, and loan balances, based on composition and characteristics of wholesale and consumer loan portfolios across: Wholesale – sector, region, and risk rating segments Consumer – loan level, asset class, and behavioral segments Credit Credit risks, which are impacted by: Probability of obligor or counterparty downgrade or default, or sovereign rating downgrade Loan transition to different payment statuses (i.e., current, delinquent, default) Loss severity Changes in commitment utilization 2 Trading & counterparty losses (market shock) Projections of the effect of instantaneous market shocks on trading positions Losses are reflected in first quarter of projection period Market Market risk factors including directional exposure as well as volatility, basis, and issuer default risk Impact on credit valuation adjustments Probability of derivatives and securities financing transactions (“SFT”) counterparty defaults 3 Capital (Earnings) Pre-provision net revenue (“PPNR”) Product-centric models and forecasting frameworks for revenue forecasts based on JPMorgan Chase’s historical experience supplemented by industry data and management judgment, where appropriate Granular, LOB-level projections for expense forecasts, governed by Firmwide expense reduction guidelines for severe stress environments Projections reflect macroeconomic factors, anticipated client behavior, and business activity, etc. Gains/losses on securities Projections of gains/losses on AFS and HTM positions Losses on HFS/FVO loans Projections of changes in valuations of HFS loans and loans accounted for under FVO Revenue depletion and expense volatility associated with Firm’s business activities and products. Risks include: Interest rate duration Equity prices Mortgage repurchase FX Basis Convexity Prepayment Credit-related other-than-temporary-impairment (“OTTI”) losses Changes in credit spreads Operational, legal, compliance, and fiduciary 1 Capital position / actions Capital projections reflect balance sheet management strategies Capital actions reflect specific assumptions prescribed by the DFAST rule RWA Projections of Basel I credit risk, Basel 2.5 market risk, and Basel III Standardized RWA Market risk factors including directional exposure as well as volatility, basis, and structural risk Credit risk factors affecting balances, including probability of obligor or counterparty downgrade or default, or country risk downgrade 4 AOCI AOCI projections account for amortization, callability, maturity, and reinvestments Reflects application of Basel III transitional provisions Market risk factors including interest rates, FX, and credit spreads 5 14

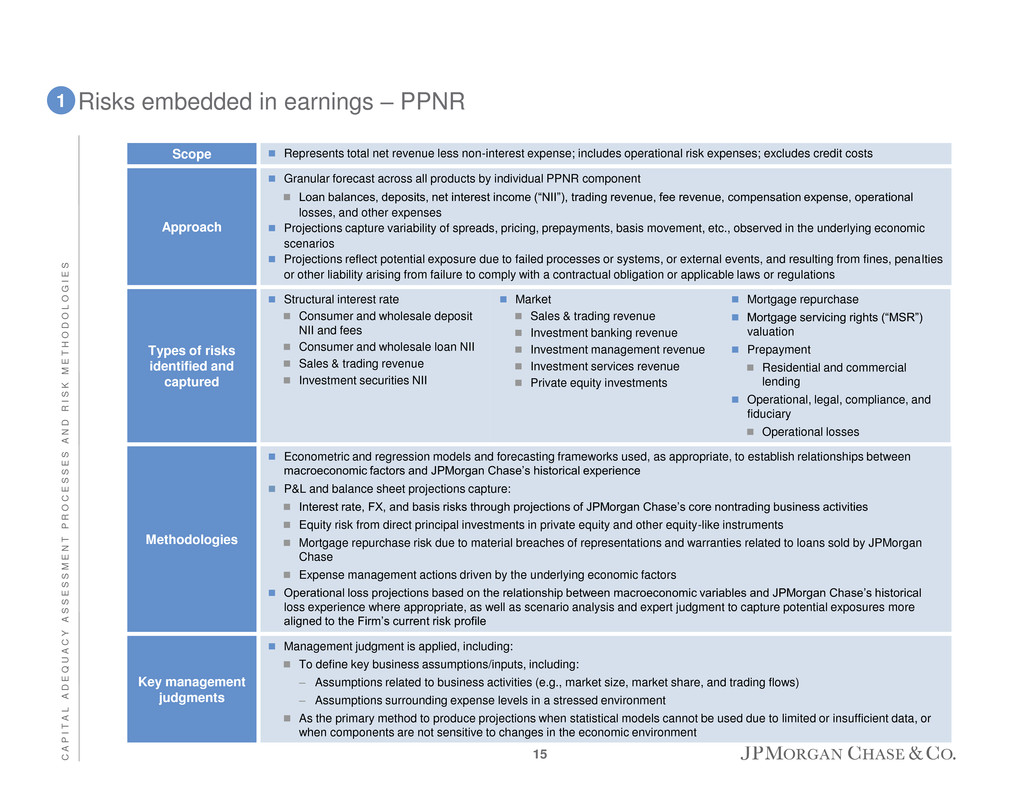

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S Risks embedded in earnings – PPNR 1 Scope Represents total net revenue less non-interest expense; includes operational risk expenses; excludes credit costs Approach Granular forecast across all products by individual PPNR component Loan balances, deposits, net interest income (“NII”), trading revenue, fee revenue, compensation expense, operational losses, and other expenses Projections capture variability of spreads, pricing, prepayments, basis movement, etc., observed in the underlying economic scenarios Projections reflect potential exposure due to failed processes or systems, or external events, and resulting from fines, penalties or other liability arising from failure to comply with a contractual obligation or applicable laws or regulations Types of risks identified and captured Structural interest rate Consumer and wholesale deposit NII and fees Consumer and wholesale loan NII Sales & trading revenue Investment securities NII Market Sales & trading revenue Investment banking revenue Investment management revenue Investment services revenue Private equity investments Mortgage repurchase Mortgage servicing rights (“MSR”) valuation Prepayment Residential and commercial lending Operational, legal, compliance, and fiduciary Operational losses Methodologies Econometric and regression models and forecasting frameworks used, as appropriate, to establish relationships between macroeconomic factors and JPMorgan Chase’s historical experience P&L and balance sheet projections capture: Interest rate, FX, and basis risks through projections of JPMorgan Chase’s core nontrading business activities Equity risk from direct principal investments in private equity and other equity-like instruments Mortgage repurchase risk due to material breaches of representations and warranties related to loans sold by JPMorgan Chase Expense management actions driven by the underlying economic factors Operational loss projections based on the relationship between macroeconomic variables and JPMorgan Chase’s historical loss experience where appropriate, as well as scenario analysis and expert judgment to capture potential exposures more aligned to the Firm’s current risk profile Key management judgments Management judgment is applied, including: To define key business assumptions/inputs, including: – Assumptions related to business activities (e.g., market size, market share, and trading flows) – Assumptions surrounding expense levels in a stressed environment As the primary method to produce projections when statistical models cannot be used due to limited or insufficient data, or when components are not sensitive to changes in the economic environment 15

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S Risks embedded in earnings – Gains/losses on AFS & HTM securities Scope Represents OTTI on the investment securities portfolio Approach Investment securities are assessed for OTTI, and OTTI is recognized when the Firm determines that it does not expect to recover the entire amortized cost of an investment security Separate methodologies developed for individual asset classes Assumes no securities are sold throughout the forecast period Types of risks identified and captured Potential credit-related OTTI Credit risks, which are impacted by probability of default estimated, loss given default, and prepayment assumptions Methodologies The methodologies used to assess the portfolio include the following: Issuer credit migrations for non-securitized products (e.g.,corporate debt, non-U.S. government debt, and municipal bonds) – Impairment is assumed on investment securities that migrate from investment-grade Cash flow model-based methodology used for securitized products – Cash flows are projected to identify any principal shortfalls Key management judgments Management judgment is applied to determine key inputs/assumptions used in the projection of OTTI in lieu of statistical models or where there is limited or insufficient data for certain securities, including: Default rates; Recovery rates; and Prepayment rates for certain securitized products 1 16

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S Risks embedded in earnings – Losses on held-for-sale loans and loans accounted for under the fair-value-option Scope Represents changes in valuation of HFS loans and pending syndicate commitments as well as loans accounted for under FVO in the Firm’s wholesale loan portfolio Approach Projections are based on the estimated change in value of loans and commitments (i.e., lower of cost or fair value for HFS loans, and fair value for FVO loans) Types of risks identified and captured Market risk resulting from changes in credit spreads Methodologies Projections capture the Firm’s exposure to changes in the fair value of HFS/FVO loans primarily due to credit spreads based on facility rating Key management judgments Management judgment is applied, including: To determine which credit spread to apply to each loan based on the facility risk rating To estimate the timing of pending sales over the nine-quarter forecast horizon 1 17

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S Credit risk – Provision for loan and lease losses 2 Scope Represents losses inherent in the Firm’s retained loan portfolios and related commitments Approach Provision projections based on composition and characteristics of wholesale and consumer loan portfolios across all asset classes and customer segments Considers estimated delinquencies, charge-offs/recoveries, and changes in reserves Risks assessed on a risk-rated basis for the wholesale portfolio and on a scored basis for the consumer portfolio Types of risks identified and captured Credit risk impacted by: Probability of obligor or counterparty downgrade or default, or sovereign rating downgrades Loan transition to different payment statuses (i.e., current, delinquent, default) Loss severity Changes in utilization of commitments Methodologies Model-based approach, which captures the inherent, idiosyncratic risks that are unique to the Firm’s portfolios Reflects credit migration and changes in delinquency trends, driven by the underlying economic factors (e.g., U.S. gross domestic product (“GDP”), unemployment rate, house price index (“HPI”), etc.), which influence the frequency and severity of potential losses Considers characteristics such as credit rating, geographic distribution, product and industry mix, and collateral type Leverages loss experience data relevant to the Firm’s asset classes and portfolios, rather than relying on banking industry averages Reflects reserve levels calculated in accordance with accounting principles generally accepted in the U.S. (“U.S. GAAP”), regulatory guidelines, and the Firm’s internal accounting policies and procedures Key management judgments Management judgment is applied, including: To define key business assumptions/inputs, including credit quality of new originations To determine the timing of recognition of loan loss reserves builds/releases 18

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S Market risk – Trading & counterparty losses (market shock) 3 Scope Represents an instantaneous global market shock applied to trading and counterparty positions as of October 9, 20141 Approach Instantaneous P&L impact with no re-hedging and no recovery assumed over the forecast period Types of risks identified and captured Market risks on trading, private equity, and other assets carried at fair value Market risk factors including directional exposure as well as volatility and basis risks Counterparty credit risk (“CCR”) CVA captures valuation changes which reflect the credit risk of derivative counterparties Counterparty default captures assumes an instantaneous and unexpected default of the counterparty which would result in the largest loss across derivatives and SFT activities after the market shock Trading incremental default risk (“IDR”) captures additional projected losses from the default of underlying issuers (i.e., obligors) on the Firm’s trading and counterparty positions Methodologies Results measure the Firm’s exposure to changes in the fair value of financial instruments primarily due to movements in: Interest rates FX rates Equity prices Credit spreads Commodity prices Leverages the existing Firmwide stress framework and methodologies across all LOBs that carry market risk Trading IDR calculation leverages existing models used for business-as-usual risk management Trade-level results, reflecting the instantaneous impact of the shock, are aggregated for all counterparties to produce the stressed MTM, CVA, and other credit metrics Key management judgments No significant management judgment applied 1 As prescribed in the Federal Reserve’s CCAR 2015 Summary Instructions and Guidance published on October 17, 2014, the as-of date for the global market shock was required to fall during the business week October 6, 2014 to October 10, 2014 19

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S RWA 4 Scope Projections of RWA under Basel I and Basel III Standardized for credit risk and Basel 2.5 for market risk Approach Credit risk RWA Projections leverage forecasted loan and securities balances Market risk RWA Projections based on historically observed relationships between RWA and key macroeconomic drivers Types of risks identified and captured Credit risk factors that affect the projections of underlying balances (see Gains/losses on AFS & HTM securities, Losses on held-for-sale loans and loans accounted for under the fair-value-option and Provision for loan and lease losses on pages 16, 17 and 18 respectively) Market risk factors including directional exposure as well as volatility, basis, and structural risks Impact of country risk classification downgrade by the Organisation for Economic Co-operation and Development (“OECD”) Methodologies Credit risk RWA Risk weights as prescribed by regulatory rules are applied to projected balances Regression model used to establish relationships between macroeconomic factors and historical country risk classification trends Market risk RWA Econometric and regression models and forecasting frameworks used, as appropriate, to establish relationships between macroeconomic factors and key RWA components, including Value-at-risk (“VaR”), incremental risk charge and comprehensive risk measure Key management judgments No significant management judgment applied 20

C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S AOCI 5 Scope Represents AOCI on the investment securities portfolio Approach Projections are based on the estimated change in value of the existing book and the forecasted reinvestment portfolio Types of risks identified and captured Market risk factors including interest rates, FX, and credit spreads Methodologies The forecasting methodologies used vary depending on the type of security to appropriately stress the underlying risks: Agency mortgage backed securities (“MBS”), municipal bonds, and U.S. Treasuries are based on a full revaluation approach Other securities and FAS 133 swap hedges leverage a sensitivity-based approach Key management judgments Management judgment is applied to determine the appropriate parameters for producing spread forecasts for credit sensitive assets 21

Agenda Page 2 0 1 5 A N N U A L S T R E S S T E S T D I S C L O S U R E 22 2015 Supervisory Severely Adverse Scenario Design and Description 22 2015 Supervisory Severely Adverse Scenario Results 1 Capital Adequacy Assessment Processes and Risk Methodologies 8 DFAST Results – In-scope Bank Entities 24 Notes 29 Forward-looking Statements 31

2 0 1 5 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O D E S I G N A N D D E S C R I P T I O N 2015 DFAST Annual Supervisory Severely Adverse scenario – Overview Supervisory Severely Adverse scenario, as constructed and prescribed by the Federal Reserve, assumes a substantially weakened global economic environment, accompanied by large reductions in asset prices Results are forecasted over a nine-quarter planning horizon Results capture the impact of stressed economic and market conditions on capital and risk-weighted assets, including: Potential losses (due to credit risk, market risk, legal risk, severe interest rate movements, and operational and other risks) on all on- and off-balance sheet positions Pre-provision net revenue Accumulated other comprehensive income Key economic variables from Supervisory Severely Adverse scenario prescribed by the Federal Reserve1 U.S. real GDP – GDP declines 4.6% between the third quarter of 2014 and its trough in the fourth quarter of 2015 U.S. inflation rate – Higher oil prices cause the annualized rate of change in the Consumer Price Index (“CPI”) to reach 4.3% in the fourth quarter of 2014, before subsequently falling back to 1.1% in the fourth quarter of 2015 and ending the forecast period at 1.9% U.S. unemployment rate – Unemployment increases by 4 percentage points from its level in the third quarter of 2014, peaking at 10.1% in the second quarter of 2016 HPI – House prices decline by approximately 25% during the forecast period relative to their level in the third quarter of 2014 Equity markets – Equity prices fall by approximately 60% from the third quarter of 2014 through the trough in the fourth quarter of 2015, and equity market volatility increases sharply Short-term and long-term rates – Short-term interest rates remain near zero through 2016; long-term Treasury yields drop to 0.9% in the fourth quarter of 2014 and then edge up slowly over the remainder of the forecast period; the 30-year mortgage rate increases 90 basis points from the third quarter of 2014 to its peak of 5.0% in the third quarter of 2015 Credit spreads – Spreads on investment-grade corporate bonds jump from approximately 170 basis points to 500 basis points at their peak in the third quarter of 2015 International – The international component of the Supervisory Severely Adverse scenario features severe recessions in the Euro area, the United Kingdom, and Japan, and below-trend growth in developing Asia 1 For full scenario description and complete set of economic variables provided by the Federal Reserve, see Board of Governors of the Federal Reserve System “2015 Supervisory Scenarios for Annual Stress Tests Required under the Dodd-Frank Act Stress Testing Rules and the Capital Plan Rule” (October 23, 2014) 23

Agenda Page 2 0 1 5 A N N U A L S T R E S S T E S T D I S C L O S U R E 24 DFAST Results – In-scope Bank Entities 24 2015 Supervisory Severely Adverse Scenario Results 1 Capital Adequacy Assessment Processes and Risk Methodologies 8 2015 Supervisory Severely Adverse Scenario Design and Description 22 Notes 29 Forward-looking Statements 31

D F A S T R E S U L T S – I N - S C O P E B A N K E N T I T I E S DFAST results under the Supervisory Severely Adverse scenario Capital projections – JPMorgan Chase Bank, N.A. Process, including models, forecasting frameworks, governance and controls, for conducting stress test consistent with the JPMorgan Chase Firmwide process Calculations based on bottom-up, stand-alone projections for JPMorgan Chase Bank, N.A. JPMorgan Chase Bank, N.A.-calculated projected stressed capital ratios (Q4 2014 – Q4 2016) 1 See note 1 on page 30 2 Stressed capital ratios are calculated using capital action assumptions provided within the Dodd-Frank Act stress test rule. These projections represent hypothetical estimates under the Supervisory Severely Adverse scenario prescribed by the Office of the Comptroller of the Currency (“OCC”) that reflects an economic outcome that is more adverse than expected, and does not represent JPMorgan Chase Bank, N.A.'s forecasts of expected losses, revenue, net income before taxes, capital, RWA, or capital ratios. The minimum capital ratio presented is for the period Q4 2014 to Q4 2016. For the 2015 Dodd- Frank Act Stress Test, the Supervisory Severely Adverse scenario was consistent with that prescribed by the Federal Reserve 3 Stressed capital ratios are calculated in accordance with the OCC’s Annual Stress Test rule requirements (12 CFR Part 46). See 77 Fed. Reg. 61238 (October 9, 2012) 4 JPMorgan Chase Bank, N.A. as a wholly-owned subsidiary of JPMorgan Chase & Co., which is an advanced approaches BHC, is subject to a Basel III CET1 ratio of 4.0% for Q4 2014 and 4.5% for each quarter in 2015 and 2016 Q4 2016 Minimum Tier 1 common ratio (%) 12.3% 10.2% 9.4% Common equity tier 1 capital ratio (%)4 12.4% 9.4% 8.5% Tier 1 risk-based capital ratio (%) 12.4% 9.4% 8.5% Total risk-based capital ratio (%) 13.8% 10.5% 9.7% Tier 1 leverage ratio (%) 8.0% 6.9% 6.6% Actual Q3 20141 Stressed capital ratios2, 3 25

D F A S T R E S U L T S – I N - S C O P E B A N K E N T I T I E S DFAST results under the Supervisory Severely Adverse scenario Profit & Loss projections – JPMorgan Chase Bank, N.A. Process, including models, forecasting frameworks, governance and controls, for conducting stress test consistent with the JPMorgan Chase Firmwide process Calculations based on bottom-up, stand-alone projections for JPMorgan Chase Bank, N.A. JPMorgan Chase Bank N.A.-calculated 9-quarter cumulative projected losses, revenues, net income before taxes, and other comprehensive income (Q4 2014 – Q4 2016) 1 Average assets is the nine-quarter average of total assets (from Q4 2014 to Q4 2016) 2 Pre-provision net revenue includes losses from operational-risk events, mortgage repurchase expenses, and OREO costs 3 Other revenue includes one-time income and (expense) items not included in pre-provision net revenue 4 Trading and counterparty losses include MTM and CVA losses resulting from the assumed instantaneous global market shock, and losses arising from the counterparty default scenario component applied to derivatives, securities lending, and repurchase agreement activities 5 Other losses/gains includes projected change in fair value of loans held-for-sale and loans held-for-investment measured under the fair value option 6 OCI includes incremental unrealized losses/gains on AFS securities and on any HTM securities that have experienced other than temporary impairment; the amount shown is on a pretax basis 7 JPMorgan Chase Bank N.A., as a wholly-owned subsidiary of an advanced approaches BHC, is required to transition AOCI related to AFS securities, as well as for pension and other postretirement employee benefit plans, into projected regulatory capital. Those transitions are 20 percent included in projected capital for 2014, 40 percent included in projected capital for 2015, and 60 percent included in projected capital for 2016 Billions of dollars Percent of average assets1 Pre-provision net revenue2 $41.6 2.1% Other revenue3 0.0 less Provision for loan and lease losses 34.5 Realized losses/(gains) on securities (AFS/HTM) 1.3 Trading and counterparty losses4 14.0 Other losses/(gains)5 4.9 equals Ne come (losses) before taxes ($13.1) (0.7%) mo it ms Other comprehensive income 6 ($10.4) Other effects on capital Actual Q3 2014 Q4 2016 Accumulated other comprehensive income in capital (billions of dollars) 7 $0.8 ($1.4) 26

D F A S T R E S U L T S – I N - S C O P E B A N K E N T I T I E S DFAST results under the Supervisory Severely Adverse Scenario Capital projections – Chase Bank USA, N.A. Process, including models, forecasting frameworks, governance and controls, for conducting stress test consistent with the JPMorgan Chase Firmwide process Calculations based on bottom-up, stand-alone projections for Chase Bank USA, N.A. 1 See note 1 on page 30 2 Stressed capital ratios are calculated using capital action assumptions provided within the Dodd-Frank Act stress test rule. These projections represent hypothetical estimates under the Supervisory Severely Adverse scenario prescribed by the OCC that reflects an economic outcome that is more adverse than expected, and does not represent Chase Bank USA, N.A.’s forecasts of expected losses, revenue, net income before taxes, capital, RWA, or capital ratios. The minimum capital ratio presented is for the period Q4 2014 to Q4 2016. For the 2015 Dodd-Frank Act Stress Test, the Supervisory Severely Adverse scenario was consistent with that prescribed by the Federal Reserve 3 Stressed capital ratios are calculated in accordance with the OCC’s Annual Stress Test rule requirements (12 CFR Part 46). See 77 Fed. Reg. 61238 (October 9, 2012) 4 Chase Bank USA, N.A. as a wholly-owned subsidiary of JPMorgan Chase & Co., which is an advanced approaches BHC, is subject to a Basel III CET1 ratio of 4.0% for Q4 2014 and 4.5% for each quarter in 2015 and 2016 Chase Bank USA, N.A.-calculated projected stressed capital ratios (Q4 2014 – Q4 2016) Q4 2016 Minimum Tier 1 common ratio (%) 15.0% 17.0% 15.2% Common equity tier 1 capital ratio (%)4 14.1% 15.1% 14.0% Tier 1 risk-based capital ratio (%) 14.1% 15.1% 14.0% Total risk-based capital ratio (%) 20.0% 21.1% 19.8% Tier 1 leverage ratio (%) 11.3% 13.7% 11.2% Actual Q3 20141 Stressed capital ratios2, 3 27

D F A S T R E S U L T S – I N - S C O P E B A N K E N T I T I E S DFAST results under the Supervisory Severely Adverse Scenario Profit & Loss projections – Chase Bank USA, N.A. Process, including models, forecasting frameworks, governance and controls, for conducting stress test consistent with the JPMorgan Chase Firmwide process Calculations based on bottom-up, stand-alone projections for Chase Bank USA, N.A. 1 Average assets is the nine-quarter average of total assets (from Q4 2014 to Q4 2016) 2 Pre-provision net revenue includes losses from operational-risk events, mortgage repurchase expenses, and OREO costs 3 Other revenue includes one-time income and (expense) items not included in pre-provision net revenue 4 Trading and counterparty losses include MTM and CVA losses resulting from the assumed instantaneous global market shock, and losses arising from the counterparty default scenario component applied to derivatives, securities lending, and repurchase agreement activities 5 Other losses/gains includes projected change in fair value of loans held-for-sale and loans held-for-investment measured under the fair value option 6 OCI includes incremental unrealized losses/gains on AFS securities and on any HTM securities that have experienced other than temporary impairment; the amount shown is on a pretax basis 7 Chase Bank USA, N.A., as a wholly-owned subsidiary of an advanced approaches BHC, is required to transition AOCI related to AFS securities, as well as for pension and other postretirement employee benefit plans, into projected regulatory capital. Those transitions are 20 percent included in projected capital for 2014, 40 percent included in projected capital for 2015, and 60 percent included in projected capital for 2016 Chase Bank USA, N.A.-calculated 9-quarter cumulative projected losses, revenues, net income before taxes, and other comprehensive income (Q4 2014 – Q4 2016) Billions of dollars Percent of average assets1 Pre-provision net revenue2 $15.0 11.6% Other revenue3 0.0 less Provision for loan and lease losses 13.8 Realized losses/(gains) on securities (AFS/HTM) 0.0 Trading and counterparty losses4 0.0 Other losses/(gains)5 0.0 equals Ne i come (losses) before taxes $1.2 0.9% M mo items Other comprehensive income 6 $0.0 Other effects on capital Actual Q3 2014 Q4 2016 Accumulated other comprehensive income in capital (billions of dollars) 7 $0.0 $0.0 28

Agenda Page 2 0 1 5 A N N U A L S T R E S S T E S T D I S C L O S U R E 29 Notes 29 2015 Supervisory Severely Adverse Scenario Results 1 Capital Adequacy Assessment Processes and Risk Methodologies 8 2015 Supervisory Severely Adverse Scenario Design and Description 22 DFAST Results – In-scope Bank Entities 24 Forward-looking Statements 31

N O T E S Notes on non-GAAP financial measures 1. Basel III rules became effective for the Firm on January 1, 2014. The tier 1 common ratio is based on Basel I, and it is a non-GAAP financial measure. The common equity tier 1 capital ratio, tier 1 risk-based capital ratio, total risk-based capital ratio, and tier 1 leverage ratio reflect Basel III standardized approach at September 30, 2014. For additional information on Basel III, see Regulatory Capital on pages 146-153 of JPMorgan Chase’s 2014 Form 10-K. 30

Agenda Page 2 0 1 5 A N N U A L S T R E S S T E S T D I S C L O S U R E 31 Forward-looking Statements 31 2015 Supervisory Severely Adverse Scenario Results 1 Capital Adequacy Assessment Processes and Risk Methodologies 8 2015 Supervisory Severely Adverse Scenario Design and Description 22 DFAST Results – In-scope Bank Entities 24 Notes 29

F O R W A R D - L O O K I N G S T A T E M E N T S Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2014, which has been filed with the Securities and Exchange Commission and is available on JPMorgan Chase & Co.'s website (http://investor.shareholder.com/jpmorganchase), and on the Securities and Exchange Commission's website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements. 32

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- T-Mobile (TMUS) and EQT Announce JV to Acquire Lumos

- JPMorgan Comments on TAL International (TAL) Earnings

- T-Mobile (TMUS) and EQT Announce JV to Acquire Lumos

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

JPMorganSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share