Form 8-K JOHNSON CONTROLS INC For: Jul 24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): | July 24, 2015 | |

JOHNSON CONTROLS, INC.

__________________________________________

(Exact name of registrant as specified in its charter)

__________________________________________

(Exact name of registrant as specified in its charter)

Wisconsin | 1-5097 | 39-0380010 |

______________________________________ (State or other jurisdiction | ____________________ (Commission | ____________________________ (I.R.S. Employer |

of incorporation) | File Number) | Identification No.) |

5757 North Green Bay Avenue Milwaukee Wisconsin | 53209 | |

_____________________________________________________________ (Address of principal executive offices) | __________________ (Zip Code) | |

Registrant’s telephone number, including area code: | 414-524-1200 | |

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On July 24, 2015, Johnson Controls, Inc. (the "Company") issued a press release containing information about the Company’s results of operations for the three and nine months ended June 30, 2015. A copy of this press release is incorporated herein by reference as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure

Attached and incorporated herein by reference as Exhibit 99.1 is a copy of the press release dated July 24, 2015 reporting the results of operations for the three and nine months ended June 30, 2015 issued by the registrant on

July 24, 2015.

Attached and incorporated herein by reference as Exhibit 99.2 is a copy of the slide presentation for the fiscal year 2015 third quarter quarterly update conference call issued by the registrant on July 24, 2015.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

99.1 | Press release issued by Johnson Controls, Inc., dated July 24, 2015. |

99.2 | Slide presentation for the fiscal year 2015 third quarter quarterly update conference call issued by Johnson Controls, Inc., dated July 24, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

JOHNSON CONTROLS, INC.

July 24, 2015 | By: | /s/ Suzanne M. Vincent | |||

Name: | Suzanne M. Vincent | ||||

Title: | Vice President and Corporate Controller | ||||

|  |

FOR IMMEDIATE RELEASE

Exhibit 99.1

CONTACT: | Glen L. Ponczak (Investors) (414) 524-2375 Fraser Engerman (Media) (414) 524-2733 | July 24, 2015 |

Johnson Controls reports record fiscal third quarter earnings from continuing operations;

Announces planned tax-free spin-off of its Automotive Experience business

MILWAUKEE, July 24, 2015 . . . . For the third quarter of fiscal 2015, Johnson Controls, Inc., a global multi-industrial company, reported net income from continuing operations of $503 million, or $0.76 per share, on $9.6 billion in revenues. Adjusted non-GAAP diluted earnings per share from continuing operations for the quarter were $0.91. As a result of the previously announced sale of its Global Workplace Solutions (GWS) business, the Company has reclassified GWS results to discontinued operations. Prior year financial statements have been revised accordingly.

Excluding transaction / integration costs and non-recurring items in the third quarter, continuing operations highlights include:

• | Net revenues of $9.6 billion versus $9.8 billion in Q3 2014. Excluding the impact of foreign exchange, sales increased 5 percent |

• | Income from business segment continuing operations of $848 million compared with $745 million a year ago, up 14 percent (up 19 percent excluding foreign exchange) |

• | Segment income margins increased 120 basis points vs. the 2014 third quarter |

• | Diluted earnings per share of $0.91 versus $0.79 in the same quarter last year, up 15 percent |

• | Reduced Euro headwind offset by higher diesel costs and certain currencies |

Non-recurring items in third quarter earnings from continuing operations include:

Fiscal 2015 third quarter

• | A non-cash tax charge of $75 million related to the future repatriation of foreign cash associated with the Interiors joint venture transaction |

• | Transaction / integration costs of $26 million ($23 million after-tax) |

Page 1

|  |

Fiscal 2014 third quarter

• | Pre-tax restructuring charges of $162 million primarily related to the Automotive Interiors business ($151 million after-tax) |

• | Pre-tax losses from divested businesses and other transaction-related costs of $115 million ($149 million after-tax) |

“Our Automotive and Power businesses delivered significant margin improvements, while Building Efficiency saw higher revenues, backlog and orders. The Building Efficiency backlog increase was the biggest quarterly year on year improvement since 2012,” said Alex Molinaroli, Johnson Controls chairman and chief executive officer. “We continued to see growing demand across our global markets and are realizing the benefits from our Johnson Controls Operating System efforts.”

Business results (Excluding transaction / integration costs and non-recurring items)

Automotive Experience revenues from continuing operations in the fiscal third quarter of 2015 were $5.4 billion, down 6 percent compared to the 2014 quarter, as slightly higher global automotive production was more than offset by the impact of foreign currency. Excluding foreign currency, revenues increased 3 percent. Automotive industry production in the quarter increased 2 percent in North America and China and was level versus last year in Europe. Revenues in China, which are primarily related to Seating and generated through non-consolidated joint ventures, increased 10 percent to $1.9 billion, reflecting market share gains.

Automotive Experience segment income from continuing operations of $342 million was up 19 percent (25 percent excluding currency) compared to $288 million in the third quarter of 2014. The increase reflects profitability improvements in both the company’s Seating and Interiors businesses due to the higher volumes and the benefits of restructuring initiatives.

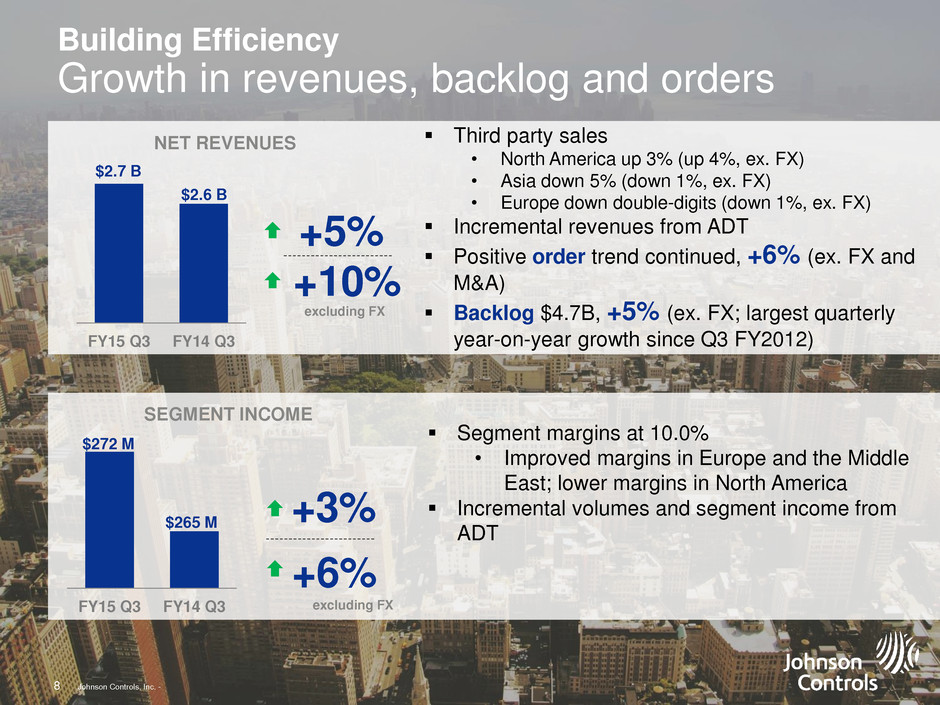

Building Efficiency sales in the fiscal third quarter of 2015 were $2.7 billion, 5 percent higher than the prior year due to incremental revenues from a 2014 acquisition and higher demand for systems and services in North America. Excluding foreign currency, revenues increased 10 percent.

Page 2

|  |

Adjusted for currency, backlog was 5 percent higher than the prior year quarter, the largest quarterly year over year increase since third quarter fiscal 2012. Improvements were driven by North America, Asia and the Middle East, partially offset by lower backlog in Europe and Latin America. Adjusted for acquisitions and currency, third quarter orders were six percent higher versus last year driven by higher demand in existing institutional buildings markets in North America.

Building Efficiency segment income of $272 million was up 3 percent (6 percent excluding currency) compared with $265 million in the 2014 third quarter, due primarily to the higher volumes and incremental income from the acquisition.

Power Solutions sales in the fiscal third quarter of 2015 were $1.5 billion, down 2 percent versus the 2014 quarter. Excluding the impact of foreign exchange, sales increased 6 percent. Global unit shipments increased 6 percent, with global shipments of AGM batteries for start-stop vehicles increasing 47 percent compared with the prior year. Power Solutions segment income was $234 million, up 22 percent (28 percent excluding currency), versus $192 million in the third quarter of 2014 due to improved product mix, higher volumes and operational efficiencies.

For the fourth quarter of 2015, the company expects earnings from continuing operations of $1.00 - $1.03 per share, up approximately 5 percent versus the 2014 fourth quarter, excluding any transaction-related costs and non-recurring items. The company also reaffirmed its full fiscal year expectations for segment margin improvements in all three of its businesses.

Portfolio Update

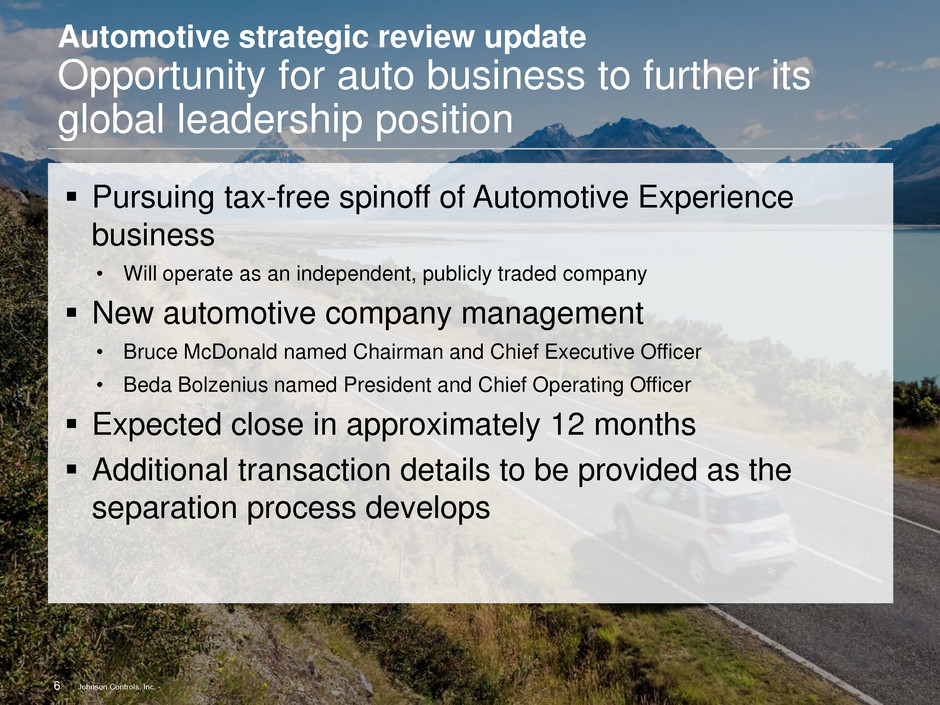

Johnson Controls announced today that it plans to pursue a tax-free spin-off of its Automotive Experience business. Following the separation, which is expected to close in approximately 12 months, the Automotive Experience business will operate as an independent, publicly traded company.

Once the transaction is completed, Bruce McDonald, Johnson Controls vice chairman and executive vice president, will serve as the chairman and CEO of the new company. Beda Bolzenius will serve as president and chief operating officer.

Page 3

|  |

The new automotive company will benefit from strong existing relationships with customers, well established positions in growth markets including China, and will generate strong cash flow. Automotive Experience reported $22 billion in revenue in 2014.

As part of the spin-off preparation, Johnson Controls is initiating a comprehensive cost savings program. Additional details of the transaction will be provided as the separation process develops.

“This is a great opportunity for our Automotive Experience business to further its position as the global leader in automotive seating and interiors,” said Alex Molinaroli, chairman and CEO of Johnson Controls. “At the same time, Johnson Controls will move forward with our multi-industrial strategies and make investments in our core growth platforms around buildings and energy storage.”

Johnson Controls noted that on July 2, 2015, it completed the transaction to form a joint venture related to its automotive interiors business. The Yanfeng Automotive Interiors joint venture is the largest automotive interiors company in the world with annual revenues of approximately $8.5 billion. Beginning in the fiscal 2015 fourth quarter, the company will no longer consolidate the majority of the Automotive Interiors business and will report its share of the profits from the new joint venture as equity income.

The company also said it continues to expect the sale of its GWS business to CBRE to close in the fiscal 2015 fourth quarter, subject to final regulatory approvals. Completion of the HVAC joint venture with Hitachi is now expected in the fiscal 2016 first quarter.

“We are making significant changes to our multi-industry portfolio to drive future growth and increased shareholder value. We see considerable opportunities for growth in our buildings and energy storage businesses, and expect increasing bottom-line benefits from the Johnson Controls Operating System as we leverage our scale and expertise across the businesses,” said Molinaroli. “Even in this time of change, however, our top priority remains operational excellence and consistent execution with a strong focus on our customers. We expect to complete fiscal 2015 with record results, providing strong momentum as we enter fiscal 2016.”

###

Page 4

|  |

FORWARD-LOOKING STATEMENTS

Johnson Controls, Inc. has made statements in this document that are forward-looking and, therefore, are subject to risks and uncertainties. All statements in this document other than statements of historical fact are statements that are, or could be, deemed "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In this document, statements regarding future financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels and plans, objectives, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identify forward-looking statements. Johnson Controls cautions that these statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond Johnson Controls’ control, that could cause Johnson Controls’ actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include potential impacts of the planned separation of the Automotive Experience business on business operations, assets or results, required regulatory approvals that are material conditions for proposed transactions to close, the strength of the U.S. or other economies, automotive vehicle production levels, mix and schedules, energy and commodity prices, availability of raw materials and component products, currency exchange rates, and cancellation of or changes to commercial contracts, as well as other factors discussed in Item 1A of Part I of Johnson Controls’ most recent Annual Report on Form 10-K for the year ended September 30, 2014. Shareholders, potential investors and others should consider these factors in evaluating the forward-looking statements and should not place undue reliance on such statements. The forward-looking statements included in this document are only made as of the date of this document, and Johnson Controls assumes no obligation, and disclaims any obligation, to update forward-looking statements to reflect events or circumstances occurring after the date of this document.

###

ABOUT JOHNSON CONTROLS

Johnson Controls is a global diversified technology and industrial leader serving customers in more than 150 countries. Our 170,000 employees create quality products, services and solutions to optimize energy and operational efficiencies of buildings; lead-acid automotive batteries and advanced batteries for hybrid and electric vehicles; and interior systems for automobiles. Our commitment to sustainability dates back to our roots in 1885, with the invention of the first electric room thermostat. Through our growth strategies and by increasing market share we are committed to delivering value to shareholders and making our customers successful. In 2015, Corporate Responsibility Magazine recognized Johnson Controls as the #14 company in its annual “100 Best Corporate Citizens” list. For additional information, please visit http://www.johnsoncontrols.com. Follow Johnson Controls Investor Relations on Twitter at www.twitter.com/JCI_IR.

###

Page 5

July 24, 2015 Page 6 JOHNSON CONTROLS, INC. CONDENSED CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share data; unaudited) | |||||||||

Three Months Ended June 30, | |||||||||

2015 | 2014 | ||||||||

Net sales | $ | 9,608 | $ | 9,833 | |||||

Cost of sales | 7,902 | 8,253 | |||||||

Gross profit | 1,706 | 1,580 | |||||||

Selling, general and administrative expenses | (975 | ) | (943 | ) | |||||

Loss on business divestitures | — | (95 | ) | ||||||

Restructuring and impairment costs | — | (162 | ) | ||||||

Net financing charges | (75 | ) | (67 | ) | |||||

Equity income | 91 | 88 | |||||||

Income from continuing operations before income taxes | 747 | 401 | |||||||

Income tax provision | 215 | 154 | |||||||

Net income from continuing operations | 532 | 247 | |||||||

Loss from discontinued operations, net of tax | (325 | ) | (48 | ) | |||||

Net income | 207 | 199 | |||||||

Less: Income from continuing operations attributable to noncontrolling interests | 29 | 17 | |||||||

Less: Income from discontinued operations attributable to noncontrolling interests | — | 6 | |||||||

Net income attributable to JCI | $ | 178 | $ | 176 | |||||

Income from continuing operations | $ | 503 | $ | 230 | |||||

Loss from discontinued operations | (325 | ) | (54 | ) | |||||

Net income attributable to JCI | $ | 178 | $ | 176 | |||||

Diluted earnings per share from continuing operations | $ | 0.76 | $ | 0.34 | |||||

Diluted loss per share from discontinued operations | (0.49 | ) | (0.08 | ) | |||||

Diluted earnings per share | $ | 0.27 | $ | 0.26 | |||||

Diluted weighted average shares | 661.4 | 672.3 | |||||||

Shares outstanding at period end | 654.1 | 666.1 | |||||||

July 24, 2015 Page 7 JOHNSON CONTROLS, INC. CONDENSED CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share data; unaudited) | |||||||||

Nine Months Ended June 30, | |||||||||

2015 | 2014 | ||||||||

Net sales | $ | 28,430 | $ | 28,797 | |||||

Cost of sales | 23,542 | 24,239 | |||||||

Gross profit | 4,888 | 4,558 | |||||||

Selling, general and administrative expenses | (2,955 | ) | (2,901 | ) | |||||

Loss on business divestitures | — | (86 | ) | ||||||

Restructuring and impairment costs | — | (162 | ) | ||||||

Net financing charges | (215 | ) | (178 | ) | |||||

Equity income | 275 | 273 | |||||||

Income from continuing operations before income taxes | 1,993 | 1,504 | |||||||

Income tax provision | 465 | 358 | |||||||

Net income from continuing operations | 1,528 | 1,146 | |||||||

Loss from discontinued operations, net of tax | (218 | ) | (149 | ) | |||||

Net income | 1,310 | 997 | |||||||

Less: Income from continuing operations attributable to noncontrolling interests | 92 | 73 | |||||||

Less: Income from discontinued operations attributable to noncontrolling interests | 4 | 18 | |||||||

Net income attributable to JCI | $ | 1,214 | $ | 906 | |||||

Income from continuing operations | $ | 1,436 | $ | 1,073 | |||||

Loss from discontinued operations | (222 | ) | (167 | ) | |||||

Net income attributable to JCI | $ | 1,214 | $ | 906 | |||||

Diluted earnings per share from continuing operations | $ | 2.16 | $ | 1.59 | |||||

Diluted loss per share from discontinued operations | (0.33 | ) | (0.25 | ) | |||||

Diluted earnings per share | $ | 1.83 | $ | 1.34 | |||||

Diluted weighted average shares | 663.6 | 675.4 | |||||||

Shares outstanding at period end | 654.1 | 666.1 | |||||||

July 24, 2015 Page 8 JOHNSON CONTROLS, INC. CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (in millions; unaudited) | ||||||||||||

June 30, 2015 | September 30, 2014 | June 30, 2014 | ||||||||||

ASSETS | ||||||||||||

Cash and cash equivalents | $ | 213 | $ | 409 | $ | 160 | ||||||

Accounts receivable - net | 5,597 | 5,871 | 6,710 | |||||||||

Inventories | 2,489 | 2,477 | 2,591 | |||||||||

Assets held for sale | 2,090 | 2,157 | 1,575 | |||||||||

Other current assets | 2,553 | 2,193 | 2,411 | |||||||||

Current assets | 12,942 | 13,107 | 13,447 | |||||||||

Property, plant and equipment - net | 5,922 | 6,314 | 6,260 | |||||||||

Goodwill | 6,850 | 7,127 | 7,658 | |||||||||

Other intangible assets - net | 1,545 | 1,639 | 1,669 | |||||||||

Investments in partially-owned affiliates | 1,339 | 1,018 | 966 | |||||||||

Noncurrent assets held for sale | 710 | 630 | 628 | |||||||||

Other noncurrent assets | 2,660 | 2,969 | 2,446 | |||||||||

Total assets | $ | 31,968 | $ | 32,804 | $ | 33,074 | ||||||

LIABILITIES AND EQUITY | ||||||||||||

Short-term debt and current portion of long-term debt | $ | 1,801 | $ | 323 | $ | 1,071 | ||||||

Accounts payable and accrued expenses | 5,760 | 6,394 | 6,701 | |||||||||

Liabilities held for sale | 1,610 | 1,801 | 994 | |||||||||

Other current liabilities | 2,962 | 3,176 | 3,377 | |||||||||

Current liabilities | 12,133 | 11,694 | 12,143 | |||||||||

Long-term debt | 5,734 | 6,357 | 6,416 | |||||||||

Other noncurrent liabilities | 3,041 | 2,997 | 2,236 | |||||||||

Redeemable noncontrolling interests | 220 | 194 | 184 | |||||||||

Shareholders' equity attributable to JCI | 10,655 | 11,311 | 11,815 | |||||||||

Noncontrolling interests | 185 | 251 | 280 | |||||||||

Total liabilities and equity | $ | 31,968 | $ | 32,804 | $ | 33,074 | ||||||

July 24, 2015 Page 9 JOHNSON CONTROLS, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions; unaudited) | |||||||||||||

Three Months Ended June 30, | |||||||||||||

2015 | 2014 | ||||||||||||

Operating Activities | |||||||||||||

Net income attributable to JCI | $ | 178 | $ | 176 | |||||||||

Income from continuing operations attributable to noncontrolling interests | 29 | 17 | |||||||||||

Income from discontinued operations attributable to noncontrolling interests | — | 6 | |||||||||||

Net income | 207 | 199 | |||||||||||

Adjustments to reconcile net income to cash provided by operating activities: | |||||||||||||

Depreciation and amortization | 218 | 240 | |||||||||||

Pension and postretirement benefit expense (income) | (1 | ) | 9 | ||||||||||

Pension and postretirement contributions | (25 | ) | (12 | ) | |||||||||

Equity in earnings of partially-owned affiliates, net of dividends received | (70 | ) | 49 | ||||||||||

Deferred income taxes | 400 | (7 | ) | ||||||||||

Non-cash restructuring and impairment costs | — | 88 | |||||||||||

Loss on business divestitures | — | 120 | |||||||||||

Other - net | 27 | 23 | |||||||||||

Changes in assets and liabilities, excluding acquisitions and divestitures: | |||||||||||||

Receivables | (167 | ) | 10 | ||||||||||

Inventories | (72 | ) | (152 | ) | |||||||||

Restructuring reserves | (37 | ) | 76 | ||||||||||

Accounts payable and accrued liabilities | 267 | 191 | |||||||||||

Other assets and liabilities | (84 | ) | (120 | ) | |||||||||

Cash provided by operating activities | 663 | 714 | |||||||||||

Investing Activities | |||||||||||||

Capital expenditures | (264 | ) | (274 | ) | |||||||||

Sale of property, plant and equipment | 8 | 12 | |||||||||||

Acquisition of businesses, net of cash acquired | — | (1,589 | ) | ||||||||||

Business divestitures, net of cash divested | — | (54 | ) | ||||||||||

Other - net | 8 | 1 | |||||||||||

Cash used by investing activities | (248 | ) | (1,904 | ) | |||||||||

Financing Activities | |||||||||||||

Increase (decrease) in short and long-term debt - net | (51 | ) | 1,240 | ||||||||||

Stock repurchases | (190 | ) | — | ||||||||||

Payment of cash dividends | (170 | ) | (146 | ) | |||||||||

Proceeds from the exercise of stock options | 69 | 56 | |||||||||||

Other - net | (18 | ) | (6 | ) | |||||||||

Cash provided (used) by financing activities | (360 | ) | 1,144 | ||||||||||

Effect of exchange rate changes on cash and cash equivalents | (6 | ) | 24 | ||||||||||

Cash held for sale | — | (27 | ) | ||||||||||

Increase (decrease) in cash and cash equivalents | $ | 49 | $ | (49 | ) | ||||||||

July 24, 2015 Page 10 JOHNSON CONTROLS, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions; unaudited) | |||||||||||||

Nine Months Ended June 30, | |||||||||||||

2015 | 2014 | ||||||||||||

Operating Activities | |||||||||||||

Net income attributable to JCI | $ | 1,214 | $ | 906 | |||||||||

Income from continuing operations attributable to noncontrolling interests | 92 | 73 | |||||||||||

Income from discontinued operations attributable to noncontrolling interests | 4 | 18 | |||||||||||

Net income | 1,310 | 997 | |||||||||||

Adjustments to reconcile net income to cash provided by operating activities: | |||||||||||||

Depreciation and amortization | 647 | 731 | |||||||||||

Pension and postretirement benefit expense (income) | (16 | ) | 25 | ||||||||||

Pension and postretirement contributions | (77 | ) | (59 | ) | |||||||||

Equity in earnings of partially-owned affiliates, net of dividends received | (239 | ) | (96 | ) | |||||||||

Deferred income taxes | 648 | (60 | ) | ||||||||||

Non-cash restructuring and impairment costs | — | 88 | |||||||||||

Loss (gain) on business divestitures | (200 | ) | 111 | ||||||||||

Fair value adjustment of equity investment | — | (19 | ) | ||||||||||

Other - net | 72 | 57 | |||||||||||

Changes in assets and liabilities, excluding acquisitions and divestitures: | |||||||||||||

Receivables | (56 | ) | 203 | ||||||||||

Inventories | (173 | ) | (313 | ) | |||||||||

Restructuring reserves | (182 | ) | (48 | ) | |||||||||

Accounts payable and accrued liabilities | (189 | ) | (189 | ) | |||||||||

Other assets and liabilities | (682 | ) | (265 | ) | |||||||||

Cash provided by operating activities | 863 | 1,163 | |||||||||||

Investing Activities | |||||||||||||

Capital expenditures | (820 | ) | (876 | ) | |||||||||

Sale of property, plant and equipment | 25 | 61 | |||||||||||

Acquisition of businesses, net of cash acquired | (22 | ) | (1,717 | ) | |||||||||

Business divestitures, net of cash divested | 141 | (41 | ) | ||||||||||

Other - net | (26 | ) | 16 | ||||||||||

Cash used by investing activities | (702 | ) | (2,557 | ) | |||||||||

Financing Activities | |||||||||||||

Increase in short and long-term debt - net | 974 | 1,985 | |||||||||||

Stock repurchases | (1,000 | ) | (1,199 | ) | |||||||||

Payment of cash dividends | (487 | ) | (422 | ) | |||||||||

Proceeds from the exercise of stock options | 231 | 173 | |||||||||||

Other - net | (71 | ) | 3 | ||||||||||

Cash provided (used) by financing activities | (353 | ) | 540 | ||||||||||

Effect of exchange rate changes on cash and cash equivalents | (24 | ) | (15 | ) | |||||||||

Cash held for sale | 20 | (26 | ) | ||||||||||

Decrease in cash and cash equivalents | $ | (196 | ) | $ | (895 | ) | |||||||

July 24, 2015

Page 11

FOOTNOTES

1. Business Unit Summary

In the second quarter of fiscal 2015, the Company began reporting its Global Workplace Solutions (GWS) business as a discontinued operation, which required retrospective application to previously reported financial information. As a result, the segment income amounts shown below are for continuing operations and exclude the GWS business segment income of $24 million for the fiscal 2014 third quarter and $89 million for fiscal 2014 year-to-date.

(in millions) | Three Months Ended June 30, | Nine Months Ended June 30, | |||||||||||||||||||

2015 | 2014 (Revised) | % | 2015 | 2014 (Revised) | % | ||||||||||||||||

(unaudited) | (unaudited) | ||||||||||||||||||||

Net Sales | |||||||||||||||||||||

Building Efficiency | $ | 2,733 | $ | 2,597 | 5 | % | $ | 7,607 | $ | 7,181 | 6 | % | |||||||||

Automotive Experience | 5,402 | 5,730 | -6 | % | 15,918 | 16,774 | -5 | % | |||||||||||||

Power Solutions | 1,473 | 1,506 | -2 | % | 4,905 | 4,842 | 1 | % | |||||||||||||

Net Sales | $ | 9,608 | $ | 9,833 | $ | 28,430 | $ | 28,797 | |||||||||||||

Segment Income (1) | |||||||||||||||||||||

Building Efficiency | $ | 260 | $ | 245 | 6 | % | $ | 583 | $ | 497 | 17 | % | |||||||||

Automotive Experience | 328 | 193 | 70 | % | 812 | 615 | 32 | % | |||||||||||||

Power Solutions | 234 | 192 | 22 | % | 813 | 732 | 11 | % | |||||||||||||

Segment Income | $ | 822 | (2) | $ | 630 | (2) | $ | 2,208 | (3) | $ | 1,844 | (3) | |||||||||

Restructuring and impairment costs | — | (162 | ) | — | (162 | ) | |||||||||||||||

Net financing charges | (75 | ) | (67 | ) | (215 | ) | (178 | ) | |||||||||||||

Income from continuing operations before income taxes | $ | 747 | $ | 401 | $ | 1,993 | $ | 1,504 | |||||||||||||

Net Sales | |||||||||||||||||||||

Products and systems | $ | 8,872 | $ | 8,903 | 0 | % | $ | 26,108 | $ | 26,066 | 0 | % | |||||||||

Services | 736 | 930 | -21 | % | 2,322 | 2,731 | -15 | % | |||||||||||||

$ | 9,608 | $ | 9,833 | $ | 28,430 | $ | 28,797 | ||||||||||||||

Cost of Sales | |||||||||||||||||||||

Products and systems | $ | 7,380 | $ | 7,623 | -3 | % | $ | 21,951 | $ | 22,406 | -2 | % | |||||||||

Services | 522 | 630 | -17 | % | 1,591 | 1,833 | -13 | % | |||||||||||||

$ | 7,902 | $ | 8,253 | $ | 23,542 | $ | 24,239 | ||||||||||||||

(1) Management evaluates the performance of the business units based primarily on segment income, which represents income from continuing operations before income taxes and noncontrolling interests, excluding net financing charges, significant restructuring and impairment costs, and the net mark-to-market adjustments related to pension and postretirement plans.

Building Efficiency - Provides facility systems and services including comfort, energy and security management for the non-residential buildings market and provides heating, ventilating, and air conditioning products and services for the residential and non-residential building markets.

Automotive Experience - Designs and manufactures interior systems and products for passenger cars and light trucks, including vans, pick-up trucks and sport/crossover utility vehicles.

Power Solutions - Services both automotive original equipment manufacturers and the battery aftermarket by providing advanced battery technology, coupled with systems engineering, marketing and service expertise.

(2) The third quarter reported segment income numbers include transaction/integration costs and other non-recurring/unusual items. The pre-tax impacts are reported as follows:

Building Efficiency | Automotive Experience | Power Solutions | Consolidated JCI | |||||||||||||||||||||||||||||

2015 | 2014 (Revised) | 2015 | 2014 (Revised) | 2015 | 2014 (Revised) | 2015 | 2014 (Revised) | |||||||||||||||||||||||||

Segment income, as reported | $ | 260 | $ | 245 | $ | 328 | $ | 193 | $ | 234 | $ | 192 | $ | 822 | $ | 630 | ||||||||||||||||

Non-recurring/unusual items: | ||||||||||||||||||||||||||||||||

Transaction/integration costs | 12 | 20 | 14 | — | — | — | 26 | 20 | ||||||||||||||||||||||||

Loss on business divestiture | — | — | — | 95 | — | — | — | 95 | ||||||||||||||||||||||||

Segment income, excluding non-recurring/unusual items | $ | 272 | $ | 265 | $ | 342 | $ | 288 | $ | 234 | $ | 192 | $ | 848 | $ | 745 | ||||||||||||||||

(3) The year-to-date reported segment income numbers include transaction/integration costs and other non-recurring/unusual items. The pre-tax impacts are reported as follows:

Building Efficiency | Automotive Experience | Power Solutions | Consolidated JCI | |||||||||||||||||||||||||||||

2015 | 2014 (Revised) | 2015 | 2014 (Revised) | 2015 | 2014 (Revised) | 2015 | 2014 (Revised) | |||||||||||||||||||||||||

Segment income, as reported | $ | 583 | $ | 497 | $ | 812 | $ | 615 | $ | 813 | $ | 732 | $ | 2,208 | $ | 1,844 | ||||||||||||||||

Non-recurring/unusual items: | ||||||||||||||||||||||||||||||||

Transaction/integration costs | 26 | 20 | 31 | — | — | — | 57 | 20 | ||||||||||||||||||||||||

Loss on business divestiture | — | — | — | 95 | — | — | — | 95 | ||||||||||||||||||||||||

Segment income, excluding non-recurring/unusual items | $ | 609 | $ | 517 | $ | 843 | $ | 710 | $ | 813 | $ | 732 | $ | 2,265 | $ | 1,959 | ||||||||||||||||

July 24, 2015

Page 12

2. Earnings Per Share Reconciliation

A reconciliation of earnings per share, as reported, to earnings per share, excluding non-recurring/unusual items and transaction/integration costs, for the respective quarters and year-to-date periods is shown below:

Net Income Attributable to JCI | Net Income Attributable to JCI from Continuing Operations | ||||||||||||||

Three Months Ended | Three Months Ended | ||||||||||||||

June 30, | June 30, | ||||||||||||||

2015 | 2014 (Revised) | 2015 | 2014 (Revised) | ||||||||||||

(unaudited) | (unaudited) | ||||||||||||||

Earnings per share, as reported | $ | 0.27 | $ | 0.26 | $ | 0.76 | $ | 0.34 | |||||||

Non-recurring/unusual items, net of tax: | |||||||||||||||

Transaction/integration costs | 0.06 | 0.02 | 0.03 | 0.02 | |||||||||||

Loss on business divestitures | — | 0.34 | — | 0.20 | |||||||||||

Restructuring and impairment costs | — | 0.22 | — | 0.22 | |||||||||||

Foreign earnings repatriation provision | 0.62 | — | 0.11 | — | |||||||||||

Earnings per share, excluding non-recurring/unusual items* | $ | 0.95 | $ | 0.85 | $ | 0.91 | $ | 0.79 | |||||||

Net Income Attributable to JCI | Net Income Attributable to JCI from Continuing Operations | ||||||||||||||

Nine Months Ended | Nine Months Ended | ||||||||||||||

June 30, | June 30, | ||||||||||||||

2015 | 2014 (Revised) | 2015 | 2014 (Revised) | ||||||||||||

(unaudited) | (unaudited) | ||||||||||||||

Earnings per share, as reported | $ | 1.83 | $ | 1.34 | $ | 2.16 | $ | 1.59 | |||||||

Non-recurring/unusual items, net of tax: | |||||||||||||||

Transaction/integration costs | 0.12 | 0.02 | 0.08 | 0.02 | |||||||||||

(Gain) loss on business divestitures | (0.19 | ) | 0.34 | — | 0.20 | ||||||||||

Restructuring and impairment costs | — | 0.22 | — | 0.22 | |||||||||||

Foreign earnings repatriation provision and other tax items | 0.74 | 0.27 | 0.14 | — | |||||||||||

Earnings per share, excluding non-recurring/unusual items* | $ | 2.51 | $ | 2.20 | $ | 2.38 | $ | 2.03 | |||||||

* May not sum due to rounding.

3. Income Taxes

The Company's total effective tax rate before consideration of non-cash tax charges, restructuring and impairment costs, and other non-recurring items for the third quarter of fiscal 2015 and fiscal 2014 is approximately 19 percent. The fiscal 2015 third quarter includes a non-cash tax charge of $335 million ($0.51) related to the future repatriation of foreign cash associated with the GWS divestiture and a $75 million ($0.11) non-cash tax charge related to the future repatriation of foreign cash associated with the Interiors joint venture transaction.

4. Share Repurchase Program

In November 2013, the Company's Board of Directors authorized a $3 billion increase in the share repurchase program bringing the total authorized amount under the repurchase program to $3.65 billion. The share repurchase program does not have an expiration date and may be amended or terminated by the Board of Directors at any time without prior notice. During fiscal 2015, the Company has repurchased approximately $1.0 billion of its shares.

5. Divestitures

As disclosed in the second quarter of fiscal 2015, the Company has signed a definitive agreement to sell its GWS business to CBRE Group, Inc. for $1.475 billion. The GWS business met the criteria to be classified as a discontinued operation and the condensed consolidated statements of income have been revised for all periods presented. The GWS business is included within assets held for sale and liabilities held for sale in the accompanying condensed consolidated statements of financial position as of June 30, 2015 and September 30, 2014.

On June 10, 2015, the Company announced its intention to explore strategic options for the separation of its automotive business.

Only July 2, 2015, the Company completed its global automotive interiors joint venture with Yanfeng Automotive Trim Systems. The Company holds a 30 percent equity interest in the joint venture. As disclosed in the third quarter of fiscal 2014, the majority of the Automotive Interiors business met the reporting requirements for held for sale classification and is reported as such in the accompanying condensed consolidated statements of financial position as of June 30, 2015, September 30, 2014 and June 30, 2014.

6. Earnings Per Share

The following table reconciles the numerators and denominators used to calculate basic and diluted earnings per share (in millions):

Three Months Ended | Nine Months Ended | ||||||||||||||

June 30, | June 30, | ||||||||||||||

2015 | 2014 (Revised) | 2015 | 2014 (Revised) | ||||||||||||

(unaudited) | (unaudited) | ||||||||||||||

Income Available to Common Shareholders | |||||||||||||||

Income from continuing operations | $ | 503 | $ | 230 | $ | 1,436 | $ | 1,073 | |||||||

Loss from discontinued operations | (325 | ) | (54 | ) | (222 | ) | (167 | ) | |||||||

Basic and diluted income available to common shareholders | $ | 178 | $ | 176 | $ | 1,214 | $ | 906 | |||||||

Weighted Average Shares Outstanding | |||||||||||||||

Basic weighted average shares outstanding | 654.9 | 664.4 | 656.9 | 667.5 | |||||||||||

Effect of dilutive securities: | |||||||||||||||

Stock options and unvested restricted stock | 6.5 | 7.9 | 6.7 | 7.9 | |||||||||||

Diluted weighted average shares outstanding | 661.4 | 672.3 | 663.6 | 675.4 | |||||||||||

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Quarterly update FY 2015 third quarter July 24, 2015 Exhibit 99.2

Johnson Controls, Inc. — 2 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Forward-Looking Statements Johnson Controls, Inc. has made statements in this document that are forward-looking and, therefore, are subject to risks and uncertainties. All statements in this document other than statements of historical fact are statements that are, or could be, deemed "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In this document, statements regarding future financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels and plans, objectives, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identify forward-looking statements. Johnson Controls cautions that these statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond Johnson Controls’ control, that could cause Johnson Controls’ actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include potential impacts of the planned separation of the Automotive Experience business on business operations, assets or results, required regulatory approvals that are material conditions for proposed transactions to close, currency exchange rates, strength of the U.S. or other economies, automotive vehicle production levels, mix and schedules, energy and commodity prices, availability of raw materials and component products, and cancellation of or changes to commercial contracts, as well as other factors discussed in Item 1A of Part I of Johnson Controls’ most recent Annual Report on Form 10-K for the year ended September 30, 2014. Shareholders, potential investors and others should consider these factors in evaluating the forward-looking statements and should not place undue reliance on such statements. The forward-looking statements included in this document are only made as of the date of this document, and Johnson Controls assumes no obligation, and disclaims any obligation, to update forward- looking statements to reflect events or circumstances occurring after the date of this document.

Johnson Controls, Inc. — 3 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Agenda Automotive update and third quarter highlights Alex Molinaroli, Chairman and Chief Executive Officer Introduction Glen Ponczak, Vice President, Global Investor Relations Business results Bruce McDonald, Vice Chairman and Executive Vice President Financial review Brian Stief, Executive Vice President and Chief Financial Officer Q&A 2 3 4 5 1

1/6 2/6 4/6 5/6 1/4 3/4 1/2 FY2015 third quarter highlights* Executing well • Record third-quarter earnings from continuing operations • Gross margin up 170 bps year-over-year; segment margins up 120 bps • Johnson Controls Operating System delivering increasing benefits Markets supporting continued growth • Global automotive markets strong despite slowing production in China; Europe improving • Revenue, backlog and order improvements in Building Efficiency (ex. FX) ― Strength in North America institutional buildings markets • Good OE and aftermarket battery demand; AGM growth accelerating Substantial progress on key portfolio initiatives • Yanfeng Automotive Interiors JV closed July 2nd - equity accounting going forward • GWS sale expected to close Q4 fiscal 2015 • Hitachi JV formation expected to close in early Q1 fiscal 2016 4 Johnson Controls, Inc. - * Excluding transaction / integration costs and non-recurring items

1/6 2/6 4/6 5/6 1/4 3/4 1/2 5 Johnson Controls, Inc. - Power Solutions • 2014 – 2020 battery industry CAGR 8-9% • Rapidly growing aftermarket • Strong future AGM growth • JCI ― Q3 aftermarket shipments +58% vs. p/y Q3 ― Received new order for 1.4 million units / year Automotive Experience • Q3 passenger car production +7% (2016 production expectation +6%) • JCI Q3 revenues (including JVs at 100%) +10% ― Benefitting from growth in premium and SUV segments Building Efficiency • Q3 HVAC markets +3% ― Controls: strong demand ― VRF: +10% • JCI Q3 Orders: HVAC +12%, Controls +43%, Service +16% China Update Johnson Controls outperforming the market

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Automotive strategic review update Opportunity for auto business to further its global leadership position Pursuing tax-free spinoff of Automotive Experience business • Will operate as an independent, publicly traded company New automotive company management • Bruce McDonald named Chairman and Chief Executive Officer • Beda Bolzenius named President and Chief Operating Officer Expected close in approximately 12 months Additional transaction details to be provided as the separation process develops 6 Johnson Controls, Inc. -

Johnson Controls, Inc. — 7 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Segment margin Record FY15 Q3 earnings from continuing operations* excluding FX -2% +5% FY15 Q3 FY14 Q3 $9.6 B $9.8 B NET REVENUES FY15 Q3 FY14 Q3 $848 M $745 M SEGMENT INCOME +14% +120 bps +15% DILUTED EPS FY15 Q3 FY14 Q3 $0.91 $0.79 * Excluding transaction / integration costs and non-recurring items +19% excluding FX

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Building Efficiency Growth in revenues, backlog and orders Third party sales • North America up 3% (up 4%, ex. FX) • Asia down 5% (down 1%, ex. FX) • Europe down double-digits (down 1%, ex. FX) Incremental revenues from ADT Positive order trend continued, +6% (ex. FX and M&A) Backlog $4.7B, +5% (ex. FX; largest quarterly year-on-year growth since Q3 FY2012) Segment margins at 10.0% • Improved margins in Europe and the Middle East; lower margins in North America Incremental volumes and segment income from ADT +5% +10% FY15 Q3 FY14 Q3 $2.7 B $2.6 B NET REVENUES excluding FX +3% FY15 Q3 FY14 Q3 $272 M $265 M SEGMENT INCOME +6% excluding FX 8 Johnson Controls, Inc. -

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Power Solutions Strong operational performance and profitability Improved aftermarket and OE volumes in Europe and Asia • Europe up 22% • Asia up 8% AGM units up 47% Segment margin at 15.9% Higher volumes Improved mix Operational improvements -2% +6% FY15 Q3 FY14 Q3 $1.5 B $1.5 B NET REVENUES excluding FX +22% FY15 Q3 FY14 Q3 $234 M $192 M SEGMENT INCOME +28% excluding FX 9 Johnson Controls, Inc. - +320 bps

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Automotive Experience Strong global volumes and profitability FY15 Q3 industry production • North America up 2% • Western Europe up 4% • China up 2% (passenger car up 7%) JCI China sales (mostly non-consolidated) up 10% to $1.9B Interiors JV closed July 2, 2015 - equity accounting going forward Higher global volumes Segment margins • Seating segment income margins 6.5% (+110 bps) • Interiors segment income margins 5.8% (+240 bps) -6% +3% FY15 Q3 FY14 Q3 $5.4 B $5.7 B NET REVENUES excluding FX +19% FY15 Q3 FY14 Q3 $342 M $288 M SEGMENT INCOME +25% excluding FX 10 Johnson Controls, Inc. - +130 bps

Johnson Controls, Inc. — 11 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) Gross margin Improvement of 170 bps includes improved product mix and JCOS benefits Operating margin Improvement of 120 bps reflects operational execution and cost management Third Quarter FY2015 i i li 1 Excluding Q3 2015 items: $26 million pre-tax transaction / integration-related costs ($23 million after tax) (in millions) 2015 1 2014 2 % Change 2015 (reported) 2014 (reported) Sales $9,608 $9,833 -2% $9,608 $9,833 Gross profit % of sales 1,706 17.8% 1,586 16.1% +8% 1,706 17.8% 1,580 16.1% SG&A expenses 949 929 +2% 975 943 Loss on divestiture - - - - 95 Equity income 91 88 +3% 91 88 Operating income $848 $745 +14% $822 $630 8.8% 7.6% 2 Excluding Q3 2014 items: $20 million pre-tax transaction / integration-related costs ($16 million after tax); $95 million pre-tax loss on business divestiture ($133 million after tax)

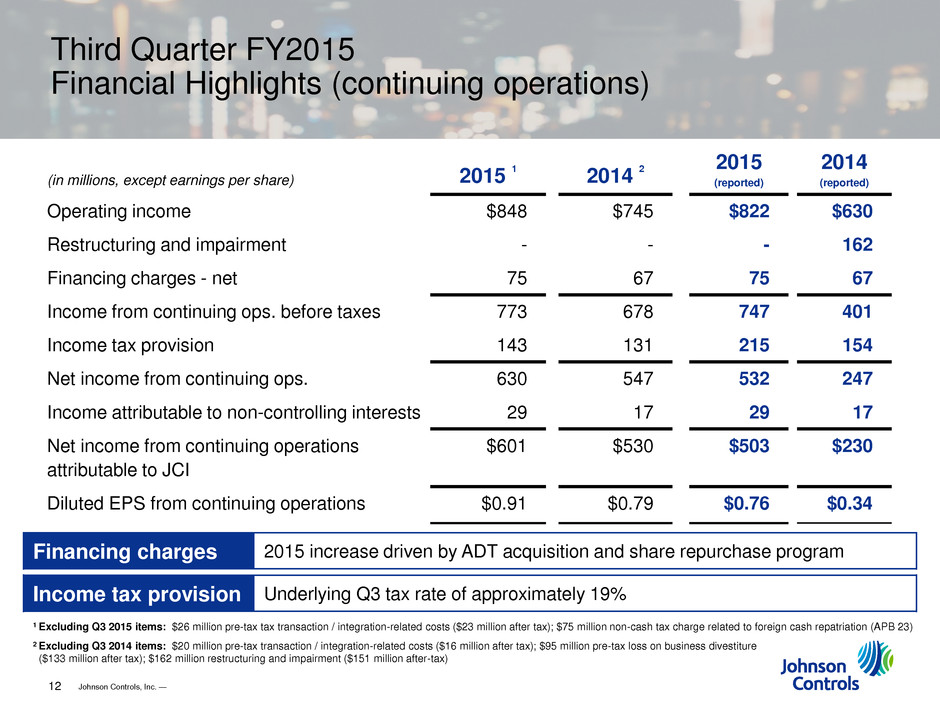

Johnson Controls, Inc. — 12 1/6 2/6 4/6 5/6 1/4 3/4 1/2 (in millions, except earnings per share) 2015 1 2014 2 2015 (reported) 2014 (reported) Operating income $848 $745 $822 $630 Restructuring and impairment - - - 162 Financing charges - net 75 67 75 67 Income from continuing ops. before taxes 773 678 747 401 Income tax provision 143 131 215 154 Net income from continuing ops. 630 547 532 247 Income attributable to non-controlling interests 29 17 29 17 Net income from continuing operations attributable to JCI $601 $530 $503 $230 Diluted EPS from continuing operations $0.91 $0.79 $0.76 $0.34 Second Quarter 2015 Financial Highlights (continuing operations) Third Quarter FY2015 i i li 1 Excluding Q3 2015 items: $26 million pre-tax tax transaction / integration-related costs ($23 million after tax); $75 million non-cash tax charge related to foreign cash repatriation (APB 23) Financing charges 2015 increase driven by ADT acquisition and share repurchase program Income tax provision Underlying Q3 tax rate of approximately 19% 2 Excluding Q3 2014 items: $20 million pre-tax transaction / integration-related costs ($16 million after tax); $95 million pre-tax loss on business divestiture ($133 million after tax); $162 million restructuring and impairment ($151 million after-tax)

Johnson Controls, Inc. — 13 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) Balance Sheet, Cash Flow and Guidance Q3 free cash flow of $399M impacted by timing of China JV dividends until Q4 ($170M) Capital spending in line with our expectations FY15 share repurchases to date of $1B Trade working capital at 8.6% of sales; down 110 bps** year-over-year Net debt to capitalization of 40.7% at 6/30/15, with target of low to mid 30’s by 9/30/15 Expect GWS divestiture net proceeds of approximately $1.3B in Q4 Continue to target $1.5B in FY15 free cash flow **Trade working capital as a % of sales (rolling 12 months), continuing operations; trade working capital defined as accounts receivable - net plus inventories less accounts payable. FY15 Q4 FY15 full year Diluted EPS $1.00 - $1.03* $3.38 – $3.41* *Excludes transaction / integration costs and non-recurring items Guidance

1/6 2/6 4/6 5/6 1/4 3/4 1/2 johnsoncontrols.com/investors @JCI_IR 14 Johnson Controls, Inc. -

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Johnson Controls (JCI) PT Raised to $71 at Oppenheimer

- 65,000 Ontario hospital workers awarded 6% wage increase, benefit improvements in new contract

- Johnson Controls (JCI) Prices $700M Notes Offering

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share