Form 8-K JETBLUE AIRWAYS CORP For: Dec 13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 13, 2016

JETBLUE AIRWAYS CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | 000-49728 | 87-0617894 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

27-01 Queens Plaza North, Long Island City, New York (Address of principal executive offices) | 11101 (Zip Code) | |

(718) 286-7900 (Registrant’s telephone number, including area code) | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Item 7.01. Regulation FD Disclosure.

Executives of JetBlue Airways Corporation ("JetBlue" or the "Company") will present today at the Company's previously announced Investor Day. Materials to be used in conjunction with the presentation are furnished as Exhibit 99.1 to this Form 8-K.

The information in this report (including the exhibits) that is being furnished pursuant to Item 7.01 of Form 8−K shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), except as expressly set forth in such filing. This report will not be deemed an admission as to the materiality of any information in the report that is required to be disclosed solely by Regulation FD.

Statements in this Form 8-K and the attached exhibits that are not historical facts, including statements regarding our estimates, expectations, beliefs, intentions, projections or strategies for the future, may be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act. All forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the estimates, expectations, beliefs, intentions, projections and strategies reflected in or suggested by the forward-looking statements. When used in this document and in documents incorporated herein by reference, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or lease financing or to raise funds through debt or equity issuances; volatility in fuel prices, maintenance costs and interest rates; our ability to implement our growth strategy; our significant fixed obligations and substantial indebtedness; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on high daily aircraft utilization; our dependence on the New York and Boston metropolitan markets and the effect of increased congestion in these markets; our reliance on automated systems and technology; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; our reliance on a limited number of suppliers; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches or cyber-attacks; changes in or additional government regulation; changes in our industry due to other airlines' financial condition; acts of war or terrorist attacks; global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for domestic and business air travel; the spread of infectious diseases; adverse weather conditions or natural disasters; and external geopolitical events and conditions. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs and assumptions upon which we base our expectations may change prior to the end of each quarter or year and you should not place undue reliance on these statements. Further information concerning these and other factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to, the Company's 2015 Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. In light of these risks and uncertainties, the forward-looking events discussed in this presentation might not occur. We undertake no obligation to update any forward-looking statements to reflect events or circumstances that may arise after the date of this presentation.

The following presentation also includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. We refer you to the reconciliations made available in our Quarterly Report on Form 10-Q for the third quarter of 2016 (available on our website at jetblue.com and at sec.gov), which reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit 99.1 Investor Day Presentation*

*Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

JETBLUE AIRWAYS CORPORATION | |

By: /s/ Alexander Chatkewitz | |

Alexander Chatkewitz | |

Vice President, Controller and Chief Accounting Officer (principal accounting officer) | |

Date: December 13, 2016

EXHIBIT INDEX

Exhibit Number | Description |

99.1 | Investor Day Presentation* |

*Furnished herewith.

JETBLUE INVESTOR DAY

DECEMBER 13, 2016

SAFE HARBOR

2

ROBIN HAYES | PRESIDENT

WHY INVEST IN JETBLUE?

ROBIN HAYES

PRESIDENT & CEO

3

WHY INVEST IN JETBLUE?

4

IMPROVE THE JETBLUE

EXPERIENCE

5

FOCUS ON EXECUTION

6

BUILD ON STRENGTH

LA Basin

San Juan

Boston New York

Fort Lauderdale

Orlando

7

DEVELOPING OUR TOOLKIT

MARTY ST. GEORGE

EVP COMMERCIAL AND PLANNING

8

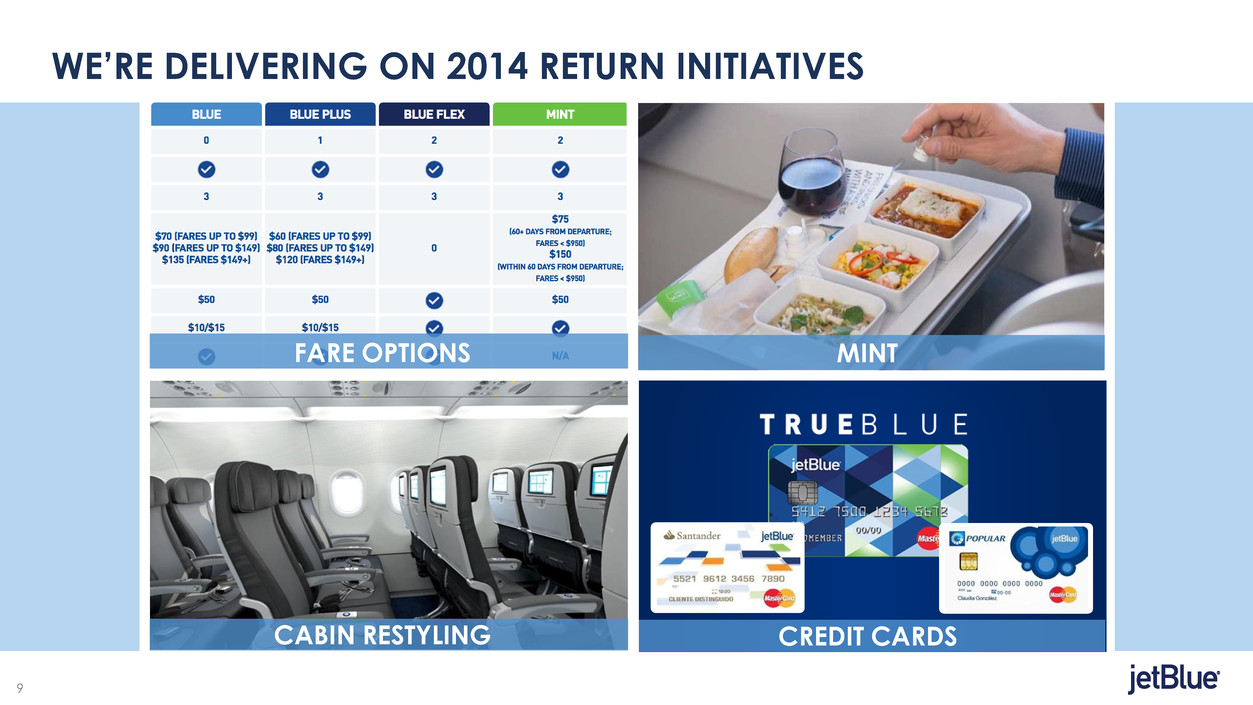

WE’RE DELIVERING ON 2014 RETURN INITIATIVES

CABIN RESTYLING

FARE OPTIONS MINT

CREDIT CARDS

9

FARE OPTIONS EXCEEDING ORIGINAL EXPECTATIONS

[VALUE]m

[VALUE]m

[VALUE]m

[VALUE]m

2015 2016E 2017E

2014 Expectations ($m) Actual (2015) & Current Expectations ($m)

$280m+

FARE OPTIONS EARNINGS BENEFIT

Opportunity to evolve Fare

Options further through pricing

and bundled offerings

10

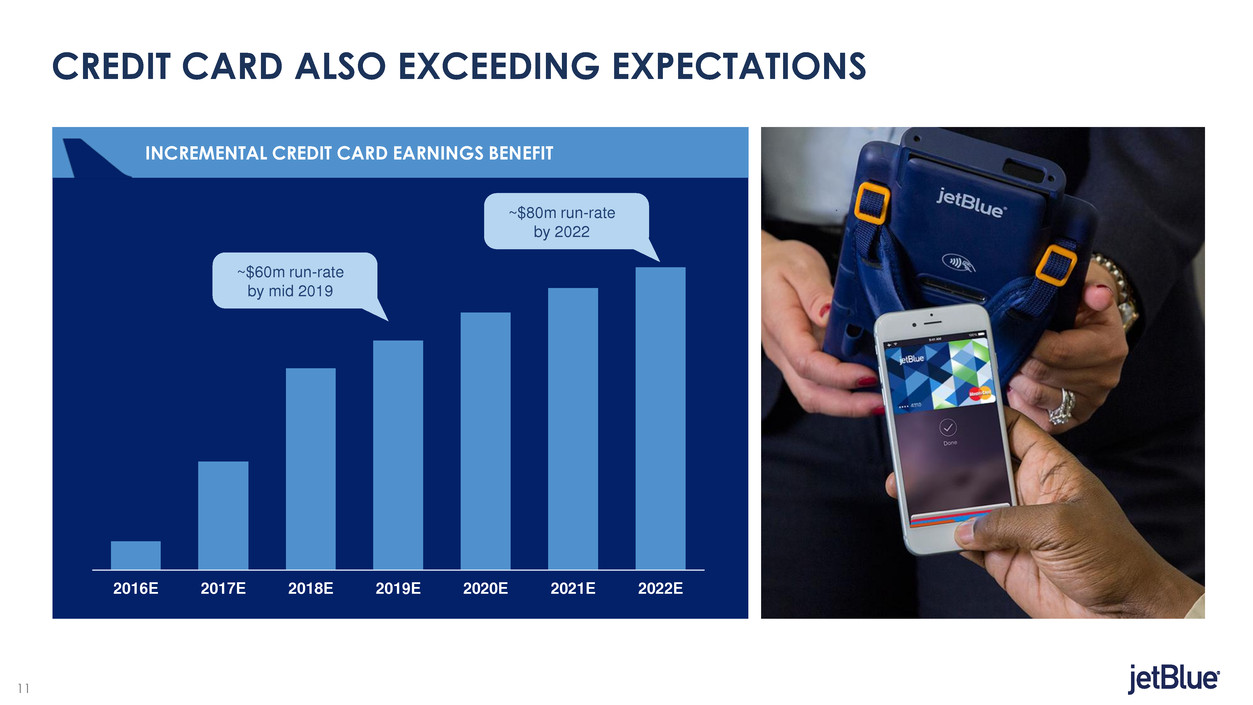

CREDIT CARD ALSO EXCEEDING EXPECTATIONS

INCREMENTAL CREDIT CARD EARNINGS BENEFIT

2016E 2017E 2018E 2019E 2020E 2021E 2022E

~$60m run-rate

by mid 2019

~$80m run-rate

by 2022

11

GROWING TRUEBLUE PARTNERSHIPS

12

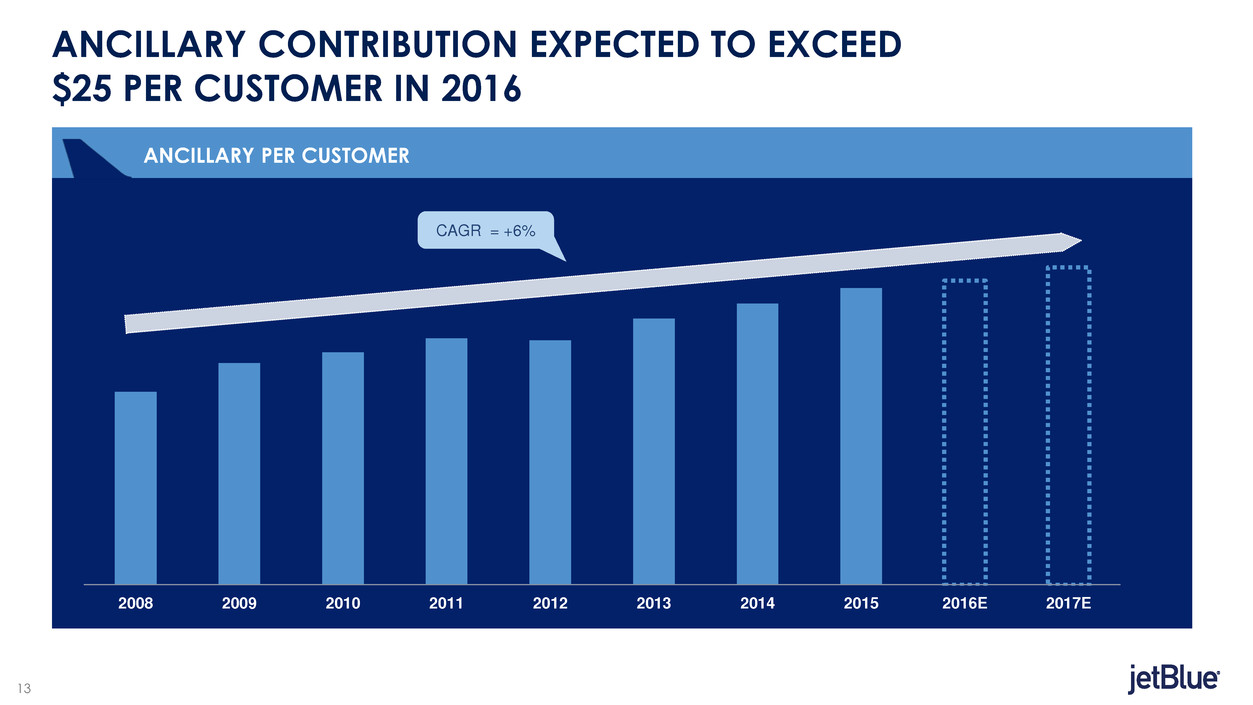

2008 2009 2010 2011 2012 2013 2014 2015 2016E 2017E

ANCILLARY CONTRIBUTION EXPECTED TO EXCEED

$25 PER CUSTOMER IN 2016

ANCILLARY PER CUSTOMER

CAGR = +6%

13

CABIN RESTYLING: EXPANDING NEW CORE PRODUCT TO THE A320

14a

CABIN RESTYLING: EXPANDING NEW CORE PRODUCT TO THE A320

14b

0%

20%

40%

60%

80%

100%

Year 1 Year 2 Year 3 Year 4

CABIN RESTYLING: $100M EARNINGS BENEFIT

A320 PROGRAM ADDS TO 2017 A321 BENEFIT

PERCENT OF A320 FLEET CONVERTED ILLUSTRATIVE A320 ASM IMPACT - Y/Y GROWTH*

Expected start

to ‘Year 1’ is

Fall 2017

* Assumes capacity growth, reflecting only A320 fleet modifications and does not include any typical adjustments to fleet utilization or network.

Conversions currently

expected to take ~36 months

-2%

-1%

0%

1%

2%

3%

4%

5%

Year 1 Year 2 Year 3 Year 4

15

MINT: SURPRISING & DELIGHTING

16

+17

June 2014 TTM June 2015 TTM June 2016 TTM

+18

October 2014 TTM October 2015 TTM October 2016 TTM

MINT: ORIGINALLY DESIGNED TO SOLVE A SPECIFIC NETWORK PROBLEM

Mint Launch Mint Launch

JFK-LAX MARGIN VS. SYSTEM (pre and post Mint Launch) JFK-SFO MARGIN VS. SYSTEM (pre and post Mint Launch)

17

JFK-LAX FREQUENCY AND MARGIN

5 5

7

10

Q3 2013 Q3 2014 Q3 2015 Q3 2016

Core Daily Margin (gap to system)

MINT: MARGIN BENEFITS EXTEND BEYOND MINT SEATS

JFK-LAX

Mint Launch

18

Q2-14 Q1-15 Q4-15 Q3-16

BOS MINT ROUTES PERFORMANCE: TTM MARGIN GAP TO SYSTEM

MINT: BOSTON MARKETS FOLLOWING NYC SUCCESS

BOS-SFO Mint Launch

BOS-LAX Mint Launch

Margin vs. System

improved 11 points

19

BOS

JFK

LAX

SFO

MINT: WITH ROOM TO GROW

Current

20a

BOS

JFK

LAX

SFO

MINT: WITH ROOM TO GROW

Current

2017 Start

SAN

FLL

20b

BOS

JFK

LAX

SFO

MINT: WITH ROOM TO GROW

Current

2017 Start

Announced

SAN

LAS

SEA

FLL

20c

WE’RE DELIVERING ON 2014 RETURN INITIATIVES

CABIN RESTYLING

FARE OPTIONS MINT

CREDIT CARDS

21

GROWING OUR NETWORK

SCOTT LAURENCE

SVP AIRLINE PLANNING

22

APPLYING OUR TOOLKIT

23

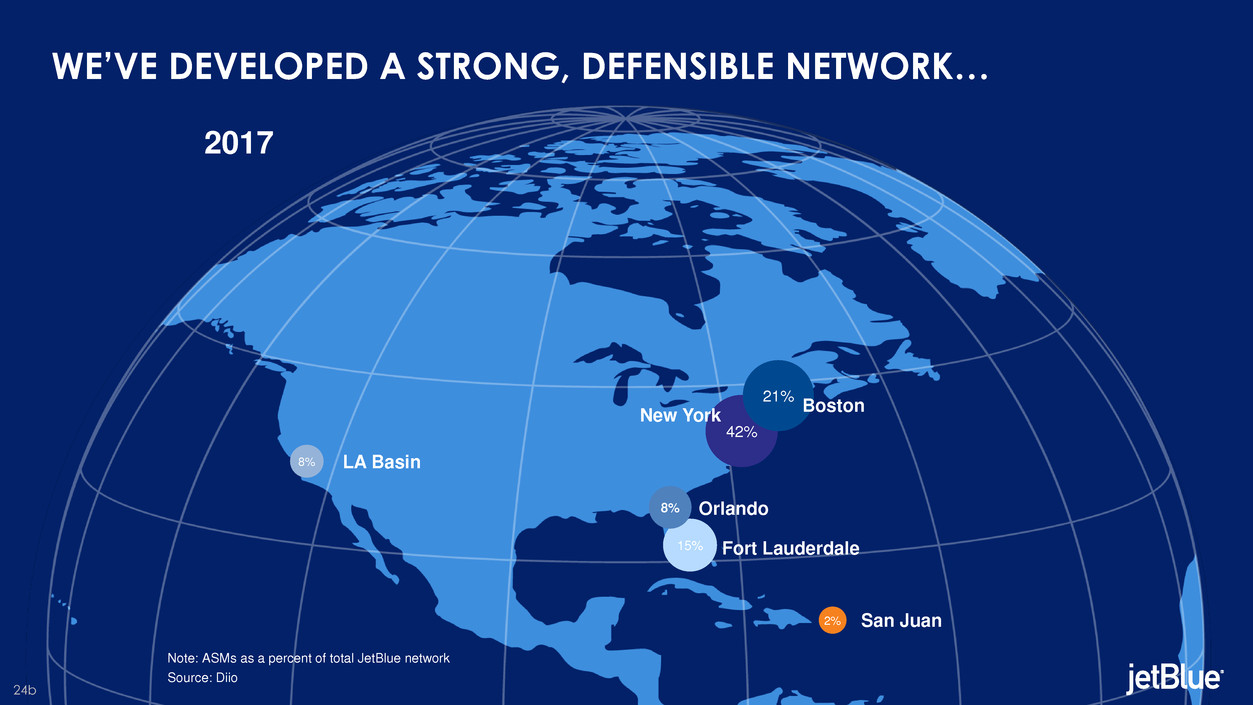

WE’VE DEVELOPED A STRONG, DEFENSIBLE NETWORK…

Fort Lauderdale

LA Basin

Orlando

San Juan

2007

7%

6%

8%

2% 4

11

Source: Diio

Note: ASMs as a percent of total JetBlue network

24a

56%

New York

14% Boston

WE’VE DEVELOPED A STRONG, DEFENSIBLE NETWORK…

Fort Lauderdale

LA Basin

Orlando

San Juan

2017

42%

New York

14% 21% Boston

7% 15%

6% 8

8%

2%

Source: Diio

Note: ASMs as a percent of total JetBlue network

24b

+ 24 pts + 34 pts

+ 10 pts

+ 15 pts + 24 pts + 28pts

NYC BOS FLL MCO SJU LA Basin

MARGIN BY FOCUS CITY: THEN AND NOW

…THAT GENERATES STRONG MARGINS IN EACH FOCUS CITY

Q3 2006 TTM Q3 2016 TTM

Boston Fort Lauderdale Orlando San Juan New York

25

DIFFERENTIATED BY OUR FOCUS ON LARGE ‘LOCAL’ MARKETS

0%

10%

20%

30%

40%

50%

60%

70%

System Domestic International

PERCENT CONNECTING TRAFFIC

JBLU “Big 3” LUV

Source: US DOT OD1B, T100

26

JFK-FLL JFK-MCO

5

10

500

1,000

1,500

2013 2014 2015 2016

5

10

500

1,000

1,500

2013 2014 2015 2016

TOOLKIT ALSO INCLUDES 200-SEAT A321

Frees up 1 JFK

slot pair

Frees up 2 JFK

slot pairs

Seats/Day JFK Slots Seats/Day JFK Slots

27

0%

20%

40%

60%

80%

100%

¹ Based on 2015 seat share by carrier

BOSTON: AMPLE OPPORTUNITY REMAINS

SEAT SHARE IN TOP 20 US METRO AREAS

#1 seat share carrier #2 seat share carrier #3 seat share carrier

Source: Diio

28

(9.0)

(6.0)

(3.0)

0.0

3.0

6.0

9.0

12.0

15.0

($300)

($200)

($100)

$100

$200

$300

$400

$500

Q2 08 Q2 09 Q2 10 Q2 11 Q2 12 Q2 13 Q2 14 Q2 15 Q2 16

Gap to System P&L (M)

31 32 35 42 45 48 51 58 61

BOSTON: MARGINS HAVE IMPROVED AS WE’VE GROWN RELEVANCE

Nonstop Markets:

TTM Profit BOS vs System (ex-BOS)

BOSTON OPERATING MARGIN VS. SYSTEM

29

JFK

SAN

LAS

SEA

SFO

DEN

FLL RSW

MCO

TPA

PBI

RDU

CLT

PHX

PIT

RIC

SJU

AUS

IAD

BUF

CUN

AUA

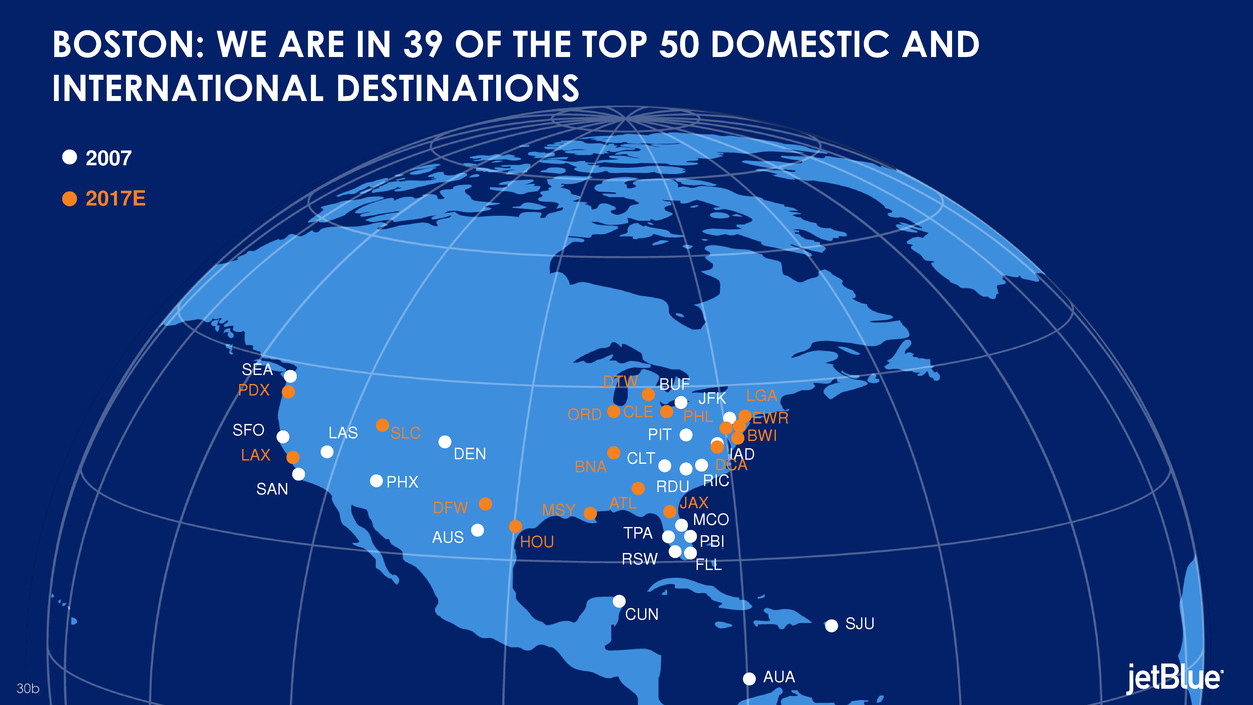

BOSTON: WE ARE IN 39 OF THE TOP 50 DOMESTIC AND

INTERNATIONAL DESTINATIONS

2007

30a

JFK

SAN

LAS

SEA

SFO

DEN

FLL RSW

MCO

TPA

PBI

RDU

CLT

PHX

PIT

RIC

SJU

AUS

IAD

BUF

CUN

AUA

BOSTON: WE ARE IN 39 OF THE TOP 50 DOMESTIC AND

INTERNATIONAL DESTINATIONS

2007

EWR CLE

MSY

LAX

ATL

ORD

SLC

DFW

DTW

BWI

DCA

PHL

LGA

BNA

PDX

HOU

JAX

2017E

30b

JFK

SAN

LAS

SEA

SFO

DEN

FLL RSW

MCO

TPA

PBI

RDU

CLT

PHX

PIT

RIC

SJU

AUS

IAD

BUF

CUN

AUA

BOSTON: WE ARE IN 39 OF THE TOP 50 DOMESTIC AND

INTERNATIONAL DESTINATIONS

2007

EWR CLE

MSY

LAX

ATL

ORD

SLC

DFW

DTW

BWI

DCA

PHL

LGA

BNA

PDX

HOU

JAX

2017E

Not Currently

Served

DUB

CDG

LHR

CMH

MSP

KEF

STL

IND

MCI

MKE YYZ

30c

¹ Based on 2015 seat share by carrier

SOUTH FLORIDA: AN UNDERSERVED MARKET

SEAT SHARE IN TOP 20 US METRO AREAS

Source: Diio

0%

20%

40%

60%

80%

100%

#1 seat share carrier #2 seat share carrier #3 seat share carrier

31

82%

75% 74%

39%

0%

20%

40%

60%

80%

100%

B6 WN NK AA (MIA)

RASM (top 3 carriers)

Source: US DOT OD1B, T100, Form 41 for YE2Q16

FORT LAUDERDALE: WE GENERATE A STRONG REVENUE PREMIUM

WITH A LOCAL FOCUS

PERCENT LOCAL TRAFFIC (top 3 carriers)

5.00

7.00

9.00

11.00

13.00

B6 WN NKJBLU LUV SAVE JBLU LUV SAVE AAL (MIA)

Note: Stage adjusted. Unshaded area reflects estimated ancillary revenue.

32

-10

-5

0

5

10

1 4 7 10 13 16 19 22 25 28 31 34

M

a

rgin

P

ts

v

s

Indu

s

tr

y

Growth Program Age (Quarters)

FORT LAUDERDALE: MARGINS AS EXPECTED FOR

THIS STAGE OF DEVELOPMENT

Boston Margins vs. Industry

Ft. Lauderdale Margins vs. Industry

FT. LAUDERDALE VS. BOSTON MARGINS BY QUARTER

Source: Company reports

33

EWR

JFK

HPN

LGA

BUF

2007

SOUTH FLORIDA: WE ARE IN 29 OF THE TOP 50

DOMESTIC AND INTERNATIONAL DESTINATIONS

34a

EWR

JFK

HPN

LGA

BUF

LIM

ORD

BOS

RDU

PIT

CLE

MSY

DTW

BWI DCA

PHL

BNA

LAS

SFO

LAX

BDL

PVD

BOG

MEX SJU

CUN PAP

SDQ

NAS

2007 2017E

SOUTH FLORIDA: WE ARE IN 29 OF THE TOP 50

DOMESTIC AND INTERNATIONAL DESTINATIONS

34b

EWR

JFK

HPN

LGA

BUF

LIM

ORD

BOS

RDU

PIT

CLE

MSY

DTW

BWI DCA

PHL

BNA

LAS

SFO

LAX

BDL

PVD

BOG

MEX SJU

CUN PAP

SDQ

NAS

2007 2017E Not Currently Served

SOUTH FLORIDA: WE ARE IN 29 OF THE TOP 50

DOMESTIC AND INTERNATIONAL DESTINATIONS

SEA

DEN

TPA

CLT

PHX

ATL DFW

MSP

STL

CVG ACY

HOU

GRU

EZE

LHR

YYZ

YUL

PTY

CCS

SCL

MAD

34c

2017 CAPACITY GUIDANCE

Region % of Total Capacity

ASMs

Low High

Transcon 30% 11.5% 13.5%

Latin 29% 4.5% 6.5%

Florida 28% 4.5% 6.5%

East 6% 17.5% 19.5%

Central 4% 4.5% 6.5%

West 3% 15.5% 17.5%

System 6.5% 8.5%

35

APPLYING OUR TOOLKIT

36

QUESTIONS

37

BREAK

38

ROBIN HAYES | PRESIDENT

IMPROVING THE JETBLUE EXPERIENCE

JOANNA GERAGHTY

EVP CUSTOMER EXPERIENCE

JEFF MARTIN

EVP OPERATIONS

39

PRODUCT & SERVICE MATTER

Source: DOT OD1B, T100

REVENUE PREMIUM

40

NPS VS. RELATIVE REVENUE PERFORMANCE

INVESTMENTS ALLOW US TO FOCUS ON CUSTOMER EXPERIENCE

41

IMPROVING OPERATIONAL PROCESS TO MATCH

PRODUCT AND FLEET EVOLUTION

JBLU

JBLU

42

ENHANCING RELIABILITY IN A HIGH UTILIZATION MODEL

Aircraft

Utilization

Technical

Dispatch

Reliability

*A321 YE aircraft totals: 2014 – 13; 2015 – 25; 2016 – 37

1 2016 YTD Aircraft Utilization data as of 10/31/2016

2 2016 YTD TDR data as of 11/14/2016

Note: “Aircraft Utilization” as publicly reported is calculated as Completed Block Hours divided by the daily number of aircraft in fleet, regardless of availability to operations.

E190

60 Aircraft

A320

130 Aircraft

A321

37 Aircraft*

9.7 9.9 9.7

7

8

9

10

2014 2015 2016 (YTD)1

12.7 12.7 12.8

11

12

13

14

2014 2015 2016 (YTD)1

12.1

12.9

13.5

11

12

13

14

2014 2015 2016 (YTD)1

97.645

98.205 98.344

96

97

98

99

100

2014 2015 2016 (YTD)2

97.664 97.639 97.654

96

97

98

99

100

2014 2015 2016 (YTD)2

97.862 97.947 97.946

96

97

98

99

100

2014 2015 2016 (YTD)2

*

*

43

WE OPERATE IN THE MOST COMPLEX U.S. AIRSPACE

0

5

10

0%

50%

100%

Ice Storm (Feb

'07)

Ice Storm (Dec

'10)

Sandy (Oct '12) Hercules (Jan '14) Matthew (Oct '16)

Major Storm Comparison

Completion Factor (lhs) # of Days impacting operations (rhs)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

JBLU UAL AAL DAL ALK LUV

% of Departures Scheduled in/out of SFO,

ORD, DCA, PHL, NYC Metro, BOS

Pct Flights Pct ASMs

Source: Diio

44

SAFETY: OUR NUMBER ONE VALUE

OJI "TOTAL RECORDABLE" CASE RATE PER

200,000 HOURS WORKED – YTD 3Q16

0

1

2

3

4

5

6

7

8

A4A-1 A4A-2 A4A-3 JBLU A4A-7

Total Recordable Case Rate Industry Average

OJI, on the job injury

Source: A4A. NOTE: Industry data provided by A4A, current through September 2016; A4A carriers: JetBlue, American Airlines, Atlas Air Worldwide,

United Airlines, UPS, Alaska Airlines, Southwest, Fedex, Hawaiian, Air Canada (Associate Member)

0.0 1.0 2.0 3.0 4.0 5.0

A4A-1

A4A-2

A4A-3

A4A-4

A4A-5

A4A-6

A4A-7

A4A-8

A4A-10

GROUND DAMAGE EVENT RATE PER 10,000

DEPARTURES – YTD 3Q16

JBLU

45

ROBIN HAYES | PRESIDENT

FINANCIAL SUMMARY & OUTLOOK

JIM LEDDY

SVP TREASURER & CHIEF FINANCIAL OFFICER (INTERIM)

46

JETBLUE APPROACH FINDING TRACTION, FOCUS ON

SUSTAINING RELATIVE MARGIN GAINS

RASM GROWTH VS. PEERS COST GROWTH VS. PEERS

Seat Miles (CAGR) RASM (CAGR) CASM ex-Fuel, P/S (CAGR)

0.4%

-2.4%

0.0%

[VALUE

]

2011-2016E 2014-2016E

7.5%

9.1%

1.9%

3.3%

2011-2016E 2014-2016E

2.4%

0.7%

1.7%

1.4%

2011-2016E 2014-2016E

CAPACITY GROWTH VS. PEERS

JBLU PEERS

Peers include AAL, ALK, DAL, LUV, SAVE, UAL and VA.

Source: Company Financial Reports

JBLU PEERS JBLU PEERS

47

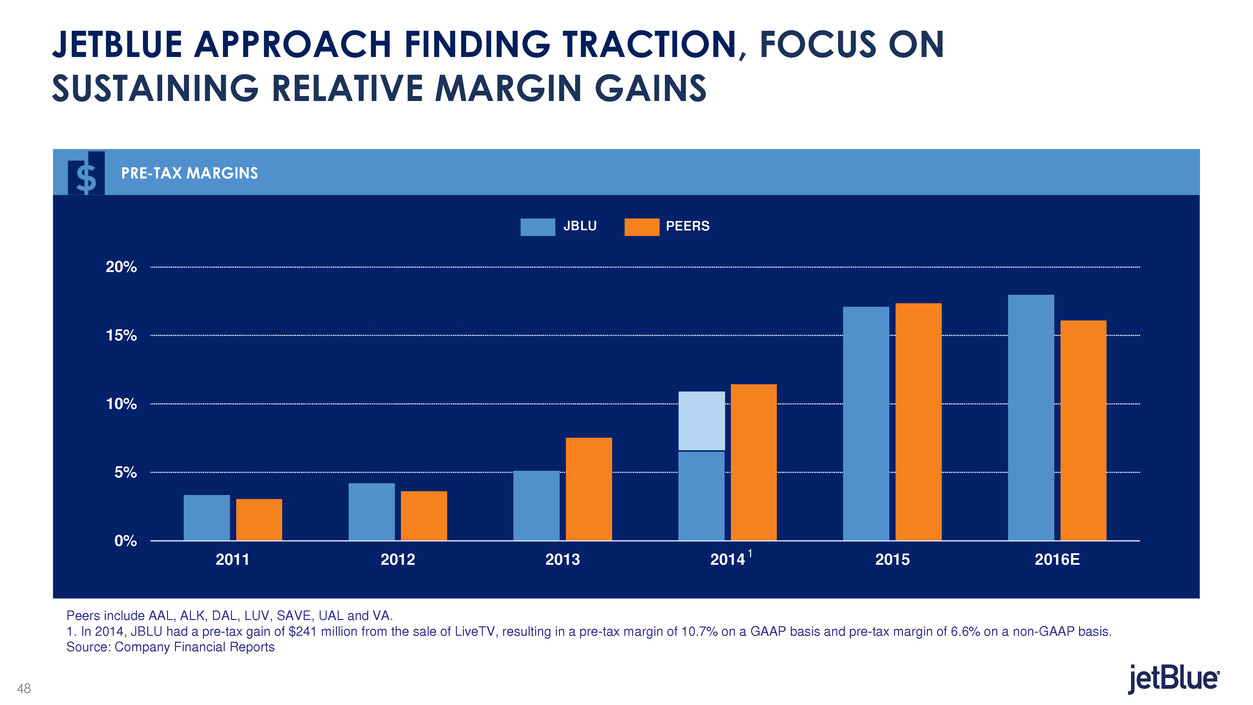

JETBLUE APPROACH FINDING TRACTION, FOCUS ON

SUSTAINING RELATIVE MARGIN GAINS

* Peers include: AAL, ALK, DAL, LUV, SAVE, UAL

0%

5%

10%

15%

20%

2011 2012 2013 2014 2015 2016E

PRE-TAX MARGINS

JBLU PEERS

Peers include AAL, ALK, DAL, LUV, SAVE, UAL and VA.

1. In 2014, JBLU had a pre-tax gain of $241 million from the sale of LiveTV, resulting in a pre-tax margin of 10.7% on a GAAP basis and pre-tax margin of 6.6% on a non-GAAP basis.

Source: Company Financial Reports

1

48

2017 GUIDANCE

Metric Guidance Range

Capacity 6.5 – 8.5%

CASM excluding fuel 1 – 3%

Capex (aircraft) $1.05bn - $1.2bn

Capex (non-aircraft) $150m – $200m

Other Income/(Expense) ($95m) – ($105m)

* Scheduled vs scheduled ASMs

Note: Detailed 2015 guidance will be provided in January 2015 on JetBlue’s fourth quarter and full year earnings call

49

STAGE LENGTH, LABOR AND MAINTENANCE ARE

PRIMARY CASM EX-FUEL PRESSURES

2017 CASM EX-FUEL HEADWINDS AND TAILWINDS

~1.5pts

~0.5pts

~0.0pts

2.0%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

Stage Length Salaries, Wages & Benefits,

MM&R and Profit Sharing

All Other 2017 (Midpoint of Guidance)

2

0

1

7

C

A

S

M

e

x

-Fue

l

Y

o

Y

%

50

MEDIUM TERM FINANCIAL GOALS

Metric 2017-2020

Capacity High Single Digit CAGR

CASM excluding fuel

1-3% in 2017

Flat to 1% CAGR 2018-2020

Capex Average of ~$1.3bn

51

ROBIN HAYES | PRESIDENT

STRUCTURAL COST INITIATIVES

STEVE PRIEST

VP STRUCTURAL PROGRAMS

52

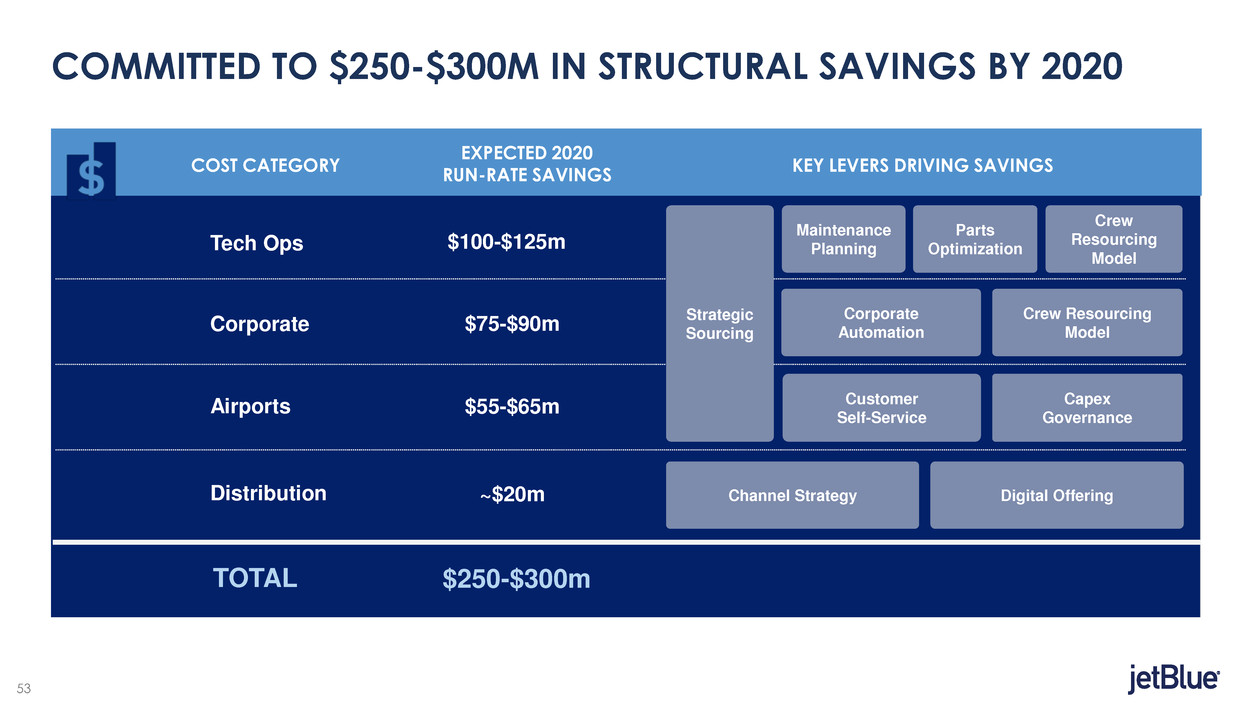

COMMITTED TO $250-$300M IN STRUCTURAL SAVINGS BY 2020

Maintenance

Planning

Crew

Resourcing

Model

Parts

Optimization

Crew Resourcing

Model

Corporate

Automation

Customer

Self-Service

Capex

Governance

Tech Ops

Airports

Corporate

TOTAL

Distribution Channel Strategy Digital Offering

COST CATEGORY

EXPECTED 2020

RUN-RATE SAVINGS

KEY LEVERS DRIVING SAVINGS

$100-$125m

$55-$65m

$75-$90m

~$20m

$250-$300m

Strategic

Sourcing

53

TECH OPS: $100-$125M OPPORTUNITY

54

CORPORATE: $75-$90M OPPORTUNITY

Source: XXXXX

55

AIRPORTS: $55-$65M OPPORTUNITY

56

DISTRIBUTION: ~$20M OPPORTUNITY

JBLU

57

COMMITTED TO $250-$300M IN STRUCTURAL SAVINGS BY 2020

AIRPORTS

TECH OPS CORPORATE

DISTRIBUTION

58

ROBIN HAYES | PRESIDENT

CAPITAL ALLOCATION

JIM LEDDY

SVP TREASURER & CHIEF FINANCIAL OFFICER (INTERIM)

59

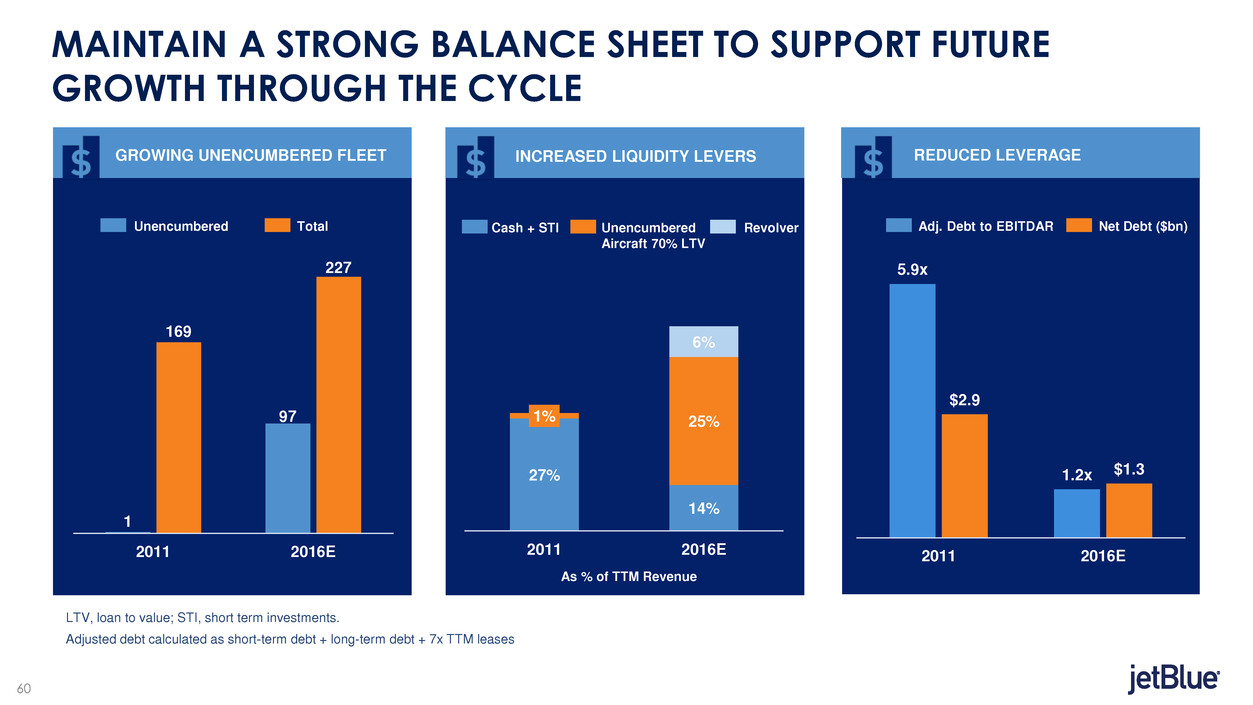

MAINTAIN A STRONG BALANCE SHEET TO SUPPORT FUTURE

GROWTH THROUGH THE CYCLE

1

97

169

227

2011 2016E

GROWING UNENCUMBERED FLEET

INCREASED LIQUIDITY LEVERS

REDUCED LEVERAGE

Unencumbered Total

27%

14%

1% 25%

6%

2011 2016E

Cash + STI Unencumbered

Aircraft 70% LTV

Revolver

As % of TTM Revenue

5.9x

1.2x

$2.9

$1.3

2011 2016E

Adj. Debt to EBITDAR Net Debt ($bn)

LTV, loan to value; STI, short term investments.

Adjusted debt calculated as short-term debt + long-term debt + 7x TTM leases

60

INVESTING IN NETWORK GROWTH WHILE SUPPLEMENTING WITH

‘ACCELERATOR CAPITAL’

CAPITAL EXPENDITURE

Aircraft Non-Aircraft

2017E

$1.2bn - $1.4bn

2018E

$1.1bn - $1.2bn Non-Aircraft Capital Efficiency

Focused Network Growth,

Mint & Aircraft Capital

Efficiency

IT Infrastructure

Tech Ops Planning

Customer Facing Tech

Self-Service

Cabin Restyling

NextGen

61

MATURING APPROACH TO CAPITAL ALLOCATION

AS LEVERAGE REACHES TARGET

Substantial progress in de-risking

balance sheet

• Targeting lower end of 30-40% range

Continuing to invest in the medium and

long term JetBlue vision and growth

Measured capital return to shareholders:

Increased authorization to $500M

deployment 2016-2019

• Commenced with 2016 $120M ASR YE17+

30-40%

3Q16

39%

YE15

46%

YE13

62%

YE11

70%

ADJUSTED DEBT TO CAPITALIZATION

62

QUESTIONS

63

ROBIN HAYES | PRESIDENT

BUILDING ON SUCCESS

ROBIN HAYES

PRESIDENT & CEO

64

HOW WE COMPETE

65

QUESTIONS

66

THANK YOU

67

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Midday movers: PepsiCo, JetBlue fall; GM, Danaher and UPS rise

- JetBlue Airways (JBLU) options active 93K contracts as share price up 3.7%

- Turtle Creek Asset Management Responds to Gildan Board’s Governance Charade

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share