Form 8-K Houston Wire & Cable CO For: Oct 01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 1, 2015

HOUSTON WIRE & CABLE COMPANY

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-52046

|

36-4151663

|

||

|

(State of Incorporation)

|

(Commission File Number)

|

(IRS employer identification no.)

|

|

10201 North Loop East

|

||

|

Houston, TX

|

77029

|

|

|

(Address of principal executive offices)

|

(Zip code)

|

Registrant’s telephone number, including area code: (713) 609-2100

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01. Entry into a Material Definitive Agreement.

On October 1, 2015, (i) HWC Wire & Cable Company (the “Subsidiary”), a wholly-owned subsidiary of Houston Wire & Cable Company (the “Company”), entered into the Fourth Amended and Restated Loan and Security Agreement dated as of October 1, 2015 (the “2015 Loan Agreement”), among the Subsidiary, as borrower, the lenders named therein and Bank of America, N.A., as agent, and (ii) the Company executed a Third Amended and Restated Guaranty, dated as of October 1, 2015 (the “Guaranty”), whereby it guarantees the obligations of the Subsidiary under the 2015 Loan Agreement.

The 2015 Loan Agreement amends and restates the Subsidiary’s existing loan and security agreement. The 2015 Loan Agreement provides a $100 million revolving credit facility, including a $10 million subline for letters of credit. Under certain circumstances, the Subsidiary could request an increase to the revolving commitment of up to an additional $50 million. Availability under the 2015 Loan Agreement is limited to a borrowing base equal to 85% of the value of eligible accounts receivable, plus the lesser of 70% of the value of eligible inventory or 90% of the net orderly liquidation value percentage of the value of eligible inventory, in each case less certain reserves. The 2015 Loan Agreement expires on September 30, 2020. Borrowings under the 2015 Loan Agreement bear interest at the British Bankers Association LIBOR Rate plus 100 to 150 basis points based on availability, if a LIBOR loan, or at a fluctuating rate equal to the greatest of the agent’s prime rate, the federal funds rate plus 50 basis points, or LIBOR for a 30-day interest period plus 150 basis points, if a Base Rate loan. The unused commitment fee is 25 basis points. The 2015 Loan Agreement is secured by a lien on substantially all the property of the Company, other than real estate.

The Guaranty sets forth the Company’s unconditional, irrevocable guaranty with respect to all obligations of the borrowers under the 2015 Loan Agreement.

Copies of the 2015 Loan Agreement and the Guaranty are filed as Exhibits 10.1 and 10.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference. A copy of the Company’s press release dated October 1, 2015 announcing its entering into the 2015 Credit Agreement is filed as Exhibit 10.3 to this Current Report on Form 8-K.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information in Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 2.03 by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

Description

|

|

|

Fourth Amended and Restated Loan and Security Agreement dated as of October 1, 2015, among HWC Wire & Cable Company, as borrower, the lenders named therein and Bank of America, N.A., as agent.

|

||

|

Third Amended and Restated Guaranty of Houston Wire & Cable Company, dated as of October 1, 2015.

|

||

|

Press release dated October 1, 2015.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: October 2, 2015

|

Houston Wire & Cable Company

|

||

|

By:

|

/s/ Nicol G. Graham

|

||

|

Name:

|

Nicol G. Graham

|

||

|

Title:

|

Vice President and

|

||

|

Chief Financial Officer

|

|||

HOUSTON WIRE & CABLE COMPANY,

as Guarantor

and

HWC WIRE & CABLE COMPANY,

as Borrower

FOURTH AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT

Dated as of October 1, 2015

$100,000,000

CERTAIN FINANCIAL INSTITUTIONS,

as Lenders

and

BANK OF AMERICA, N.A.,

as Agent

TABLE OF CONTENTS

| Page | ||

|

Section 1.

|

Definitions; Rules of Construction

|

1

|

|

1.1

|

Definitions

|

1

|

|

1.2

|

Accounting Terms

|

27

|

|

1.3

|

Uniform Commercial Code

|

27

|

|

1.4

|

Certain Matters of Construction

|

27

|

|

Section 2.

|

Credit Facilities

|

28

|

|

2.1

|

Revolver Commitment

|

28

|

|

2.2

|

Reserved

|

30

|

|

2.3

|

Letter of Credit Facility

|

30

|

|

Section 3.

|

Interest, Fees and Charges

|

33

|

|

3.1

|

Interest

|

33

|

|

3.2

|

Fees

|

35

|

|

3.3

|

Computation of Interest, Fees, Yield Protection

|

36

|

|

3.4

|

Reimbursement Obligations

|

36

|

|

3.5

|

Illegality

|

36

|

|

3.6

|

Inability to Determine Rates

|

37

|

|

3.7

|

Increased Costs; Capital Adequacy

|

37

|

|

3.8

|

Mitigation

|

38

|

|

3.9

|

Funding Losses

|

39

|

|

3.1

|

Maximum Interest

|

39

|

|

Section 4.

|

Loan Administration

|

39

|

|

4.1

|

Manner of Borrowing and Funding Revolver Loans

|

39

|

|

4.2

|

Defaulting Lender

|

41

|

|

4.3

|

Number and Amount of LIBOR Loans; Determination of Rate

|

42

|

|

4.4

|

Borrower Agent

|

43

|

|

4.5

|

One Obligation

|

43

|

|

4.6

|

Effect of Termination

|

43

|

|

Section 5.

|

Payments

|

44

|

|

5.1

|

General Payment Provisions

|

44

|

|

5.2

|

Repayment of Revolver Loans

|

44

|

|

5.3

|

Other Mandatory Prepayments

|

44

|

|

5.4

|

Payment of Other Obligations

|

45

|

|

5.5

|

Marshaling; Payments Set Aside

|

45

|

|

5.6

|

Post-Default Allocation of Payments

|

45

|

|

5.7

|

Application of Payments

|

46

|

|

5.8

|

Loan Account; Account Stated

|

46

|

|

5.9

|

Taxes

|

47

|

|

5.1

|

Lender Tax Information

|

49

|

|

5.11

|

Nature and Extent of Each Borrower’s Liability

|

51

|

|

Section 6.

|

Conditions Precedent

|

53

|

|

6.1

|

Documentation

|

53

|

|

6.2

|

No Default

|

53

|

|

6.3

|

Conditions Precedent to All Credit Extensions

|

53

|

|

Section 7.

|

Collateral

|

53

|

|

7.1

|

Grant of Security Interest

|

53

|

|

7.2

|

Lien on Deposit Accounts; Cash Collateral

|

53

|

|

7.3

|

Other Collateral

|

53

|

|

7.4

|

No Assumption of Liability

|

53

|

|

7.5

|

Further Assurances

|

53

|

|

7.6

|

Foreign Subsidiary Stock

|

53

|

|

Section 8.

|

Collateral Administration

|

53

|

|

8.1

|

Borrowing Base Certificates

|

53

|

|

8.2

|

Administration of Accounts

|

53

|

|

8.3

|

Administration of Inventory

|

53

|

|

8.4

|

Administration of Equipment

|

53

|

|

8.5

|

Administration of Deposit Accounts

|

53

|

|

8.6

|

General Provisions

|

53

|

|

8.7

|

Power of Attorney

|

53

|

|

Section 9.

|

Representations and Warranties

|

53

|

|

9.1

|

General Representations and Warranties

|

53

|

|

9.2

|

Complete Disclosure

|

53

|

|

Section 10.

|

Covenants and Continuing Agreements

|

53

|

|

10.1

|

Affirmative Covenants

|

53

|

|

10.2

|

Negative Covenants

|

53

|

|

10.3

|

Financial Covenants

|

53

|

|

Section 11.

|

Events of Default; Remedies On Default

|

53

|

|

11.1

|

Events of Default

|

53

|

|

11.2

|

Remedies upon Default

|

53

|

|

11.3

|

License

|

53

|

|

11.4

|

Setoff

|

53

|

|

11.5

|

Remedies Cumulative; No Waiver

|

53

|

|

Section 12.

|

Agent

|

53

|

|

12.1

|

Appointment, Authority and Duties of Agent

|

53

|

|

12.2

|

Agreements Regarding Collateral and Field Examination Reports

|

53

|

|

12.3

|

Reliance By Agent

|

53

|

|

12.4

|

Action Upon Default

|

53

|

|

12.5

|

Ratable Sharing

|

53

|

|

12.6

|

Indemnification of Agent Indemnitees

|

53

|

|

12.7

|

Limitation on Responsibilities of Agent

|

53

|

|

12.8

|

Successor Agent and Co-Agents

|

53

|

|

12.9

|

Due Diligence and Non-Reliance

|

53

|

|

12.1

|

Replacement of Certain Lenders

|

53

|

|

12.11

|

Remittance of Payments and Collections

|

53

|

|

12.12

|

Agent in its Individual Capacity

|

53

|

|

12.13

|

Agent Titles

|

53

|

|

12.14

|

No Third Party Beneficiaries

|

53

|

|

Section 13.

|

Benefit of Agreement; Assignments and Participations

|

53

|

|

13.1

|

Successors and Assigns

|

53

|

|

13.2

|

Participations

|

53

|

|

13.3

|

Assignments

|

53

|

|

Section 14.

|

Miscellaneous

|

53

|

|

14.1

|

Consents, Amendments and Waivers

|

53

|

|

14.2

|

Indemnity

|

53

|

|

14.3

|

Notices and Communications

|

53

|

|

14.4

|

Performance of Borrowers’ Obligations

|

53

|

|

14.5

|

Credit Inquiries

|

53

|

|

14.6

|

Severability

|

53

|

|

14.7

|

Cumulative Effect; Conflict of Terms

|

53

|

|

14.8

|

Counterparts; Facsimile Signatures

|

53

|

|

14.9

|

Entire Agreement

|

53

|

|

14.1

|

No Control; No Advisory or Fiduciary Responsibility

|

53

|

|

14.11

|

Obligations of Lenders

|

53

|

|

14.12

|

No Advisory or Fiduciary Responsibility

|

53

|

|

14.13

|

Confidentiality

|

53

|

|

14.14

|

GOVERNING LAW

|

53

|

|

14.15

|

Consent to Forum

|

53

|

|

14.16

|

Waivers by Borrowers

|

53

|

|

14.17

|

Patriot Act Notice

|

53

|

|

14.18

|

NO ORAL AGREEMENT

|

53

|

|

14.19

|

No Novation

|

53

|

LIST OF EXHIBITS AND SCHEDULES

|

Exhibit A

|

Revolver Note

|

|

Exhibit B

|

Reserved

|

|

Exhibit C

|

Assignment and Acceptance

|

|

Exhibit D

|

Assignment Notice

|

|

Schedule 1.1

|

Commitments of Lenders

|

|

Schedule 6.1

|

Schedule of Documents

|

|

Schedule 8.5

|

Deposit Accounts

|

|

Schedule 8.6.1

|

Business Locations

|

|

Schedule 9.1.4

|

Names and Capital Structure

|

|

Schedule 9.1.8

|

Surety Obligations

|

|

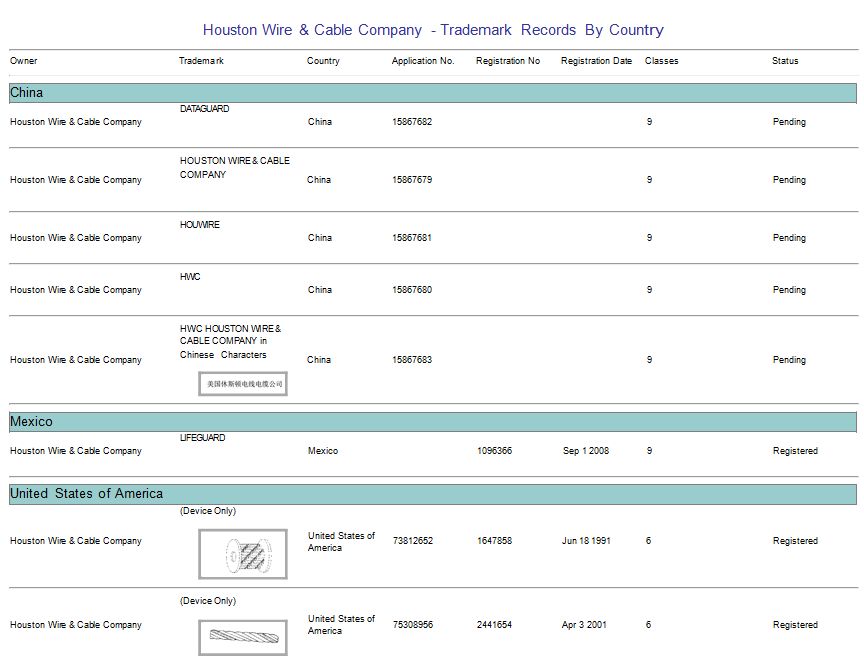

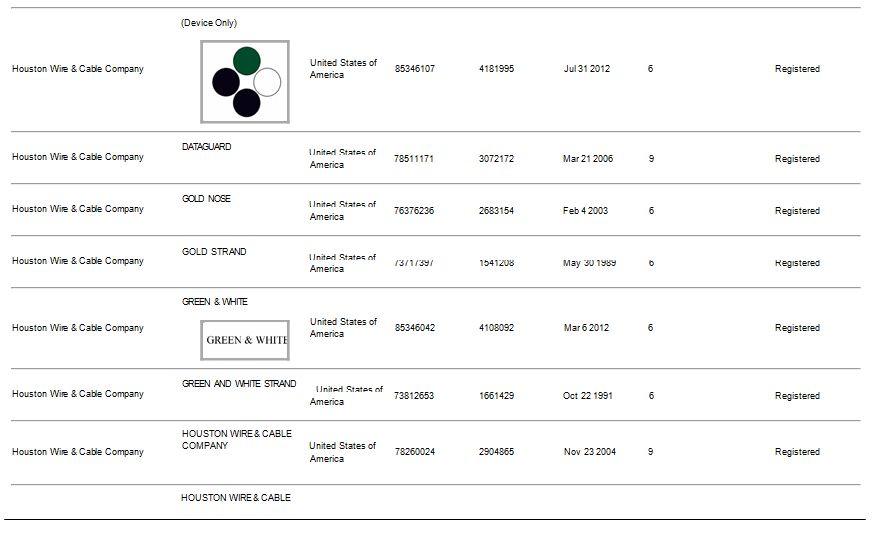

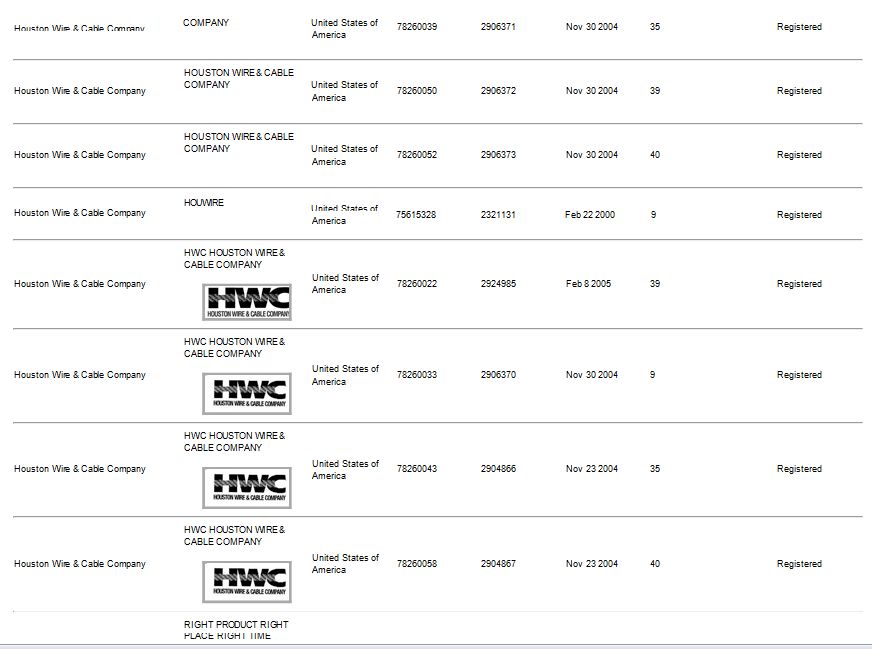

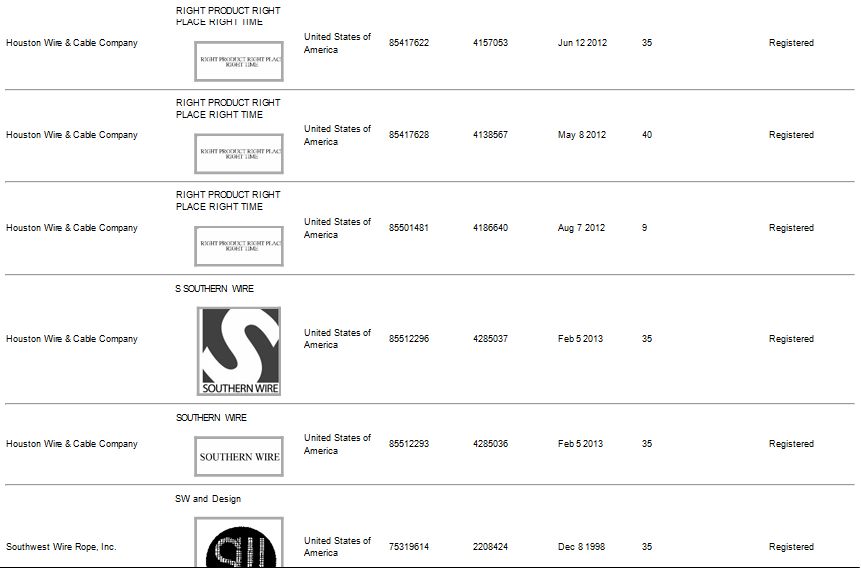

Schedule 9.1.11

|

Patents, Trademarks, Copyrights and Licenses

|

|

Schedule 9.1.14

|

Environmental Matters

|

|

Schedule 9.1.15

|

Restrictive Agreements

|

|

Schedule 9.1.16

|

Litigation

|

|

Schedule 9.1.18

|

Pension Plan Disclosures

|

|

Schedule 10.2.2

|

Existing Liens

|

|

Schedule 10.2.17

|

Existing Affiliate Transactions

|

(Signature Page to Fourth Amended and Restated Loan and Security Agreement)

FOURTH AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT

THIS FOURTH AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT (“Agreement”) is dated as of October 1, 2015, among HWC WIRE & CABLE COMPANY, a Delaware corporation (“Borrower Agent”) with its chief executive office and principal place of business at 10201 North Loop East, Houston, Texas 77029, each of the Domestic Subsidiaries of Borrower Agent that are or become borrower parties thereto (including Borrower Agent, individually a “Borrower” and collectively, “Borrowers”), the financial institutions party to this Agreement from time to time as lenders (collectively, “Lenders”), and BANK OF AMERICA, N.A., a national banking association, as agent for the Lenders (“Agent”).

R E C I T A L S:

WHEREAS, Borrower Agent, the lender signatories thereto and Bank of America, N.A. as agent for such lenders, entered into a certain Third Amended and Restated Loan and Security Agreement dated as of September 30, 2011 (said Third Amended and Restated Loan and Security Agreement as amended from time to time, the “2011 Loan Agreement”); and

WHEREAS, Borrower Agent, Lenders and Agent desire to amend and restate the 2011 Loan Agreement pursuant to the terms and conditions hereof.

NOW, THEREFORE, for valuable consideration hereby acknowledged, the parties agree as follows:

SECTION 1. DEFINITIONS; RULES OF CONSTRUCTION

1.1 Definitions. As used herein, the following terms have the meanings set forth below:

Account: as defined in the UCC, including all rights to payment for goods sold or leased, or for services rendered.

Account Debtor: a Person who is obligated under an Account, Chattel Paper or General Intangible.

Accounts Formula Amount: the sum of (x) 85% of the Value of Eligible Accounts, plus (y) 85% of the Value of Eligible Foreign Accounts, provided that the Value of Eligible Foreign Accounts shall not exceed $1,500,000.

Affiliate: with respect to any Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified. “Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise. “Controlling” and “Controlled” have correlative meanings.

Agent Indemnitees: Agent and its officers, directors, employees, Affiliates, agents and attorneys.

Agent Professionals: attorneys, accountants, appraisers, auditors, business valuation experts, environmental engineers or consultants, turnaround consultants, and other professionals and experts retained by Agent.

Allocable Amount: as defined in Section 5.11.3.

Anti-Terrorism Laws: any laws relating to terrorism or money laundering, including the Patriot Act.

Applicable Law: all laws, rules, regulations and governmental guidelines applicable to the Person, conduct, transaction, agreement or matter in question, including all applicable statutory law, common law and equitable principles, and all provisions of constitutions, treaties, statutes, rules, regulations, orders and decrees of Governmental Authorities.

Applicable Margin: with respect to any Type of Loan, the margin set forth below, as determined by average Availability for the most recently ended Fiscal Quarter:

|

Level

|

Availability

|

Base Rate Revolver Loans

|

LIBOR Revolver Loans

|

|

I

|

> $40,000,000

|

0.00%

|

1.00%

|

|

II

|

< $40,000,000, but > $25,000,000

|

0.00%

|

1.25%

|

|

III

|

< $25,000,000

|

0.00%

|

1.50%

|

Until March 31, 2017, margins shall be determined based on the lesser of actual Availability or Level II. Thereafter, the margins shall be subject to increase or decrease to Levels I, II or III, as applicable, upon the first day of each Fiscal Quarter.

Approved Fund: any Person (other than a natural person) that is engaged in making, purchasing, holding or otherwise investing in commercial loans and similar extensions of credit in its ordinary course of activities, and is administered or managed by a Lender, an entity that administers or manages a Lender, or an Affiliate of either.

Asset Disposition: a sale, lease, license, consignment, transfer or other disposition of Property of an Obligor, including a disposition of Property in connection with a sale-leaseback transaction or synthetic lease.

Assignment and Acceptance: an assignment agreement between a Lender and Eligible Assignee, in the form of Exhibit C.

Availability: the Borrowing Base minus the principal balance of all Revolver Loans.

Availability Reserve: the sum (without duplication) of (a) the Inventory Reserve; (b) the Rent and Charges Reserve; (c) the LC Reserve; (d) the Bank Product Reserve; (e) the aggregate amount of liabilities secured by Liens upon Collateral that are senior to Agent’s Liens (but imposition of any such reserve shall not waive an Event of Default arising therefrom) and (f) such additional reserves, in such amounts and with respect to such matters, as Agent in its reasonable credit judgment may elect to impose from time to time.

Bank of America: Bank of America, N.A., a national banking association, and its successors and assigns.

Bank of America Indemnitees: Bank of America and its officers, directors, employees, Affiliates, agents and attorneys.

Bank Product: any of the following products, services or facilities extended to any Borrower or Subsidiary by any Lender or any of its Affiliates: (a) Cash Management Services; (b) products under Hedging Agreements; (c) commercial credit card and merchant card services; and (d) leases and other banking products or services as may be requested by any Borrower or Subsidiary, other than Letters of Credit; provided, however, that for any of the foregoing to be included as an “Obligation” for purposes of a distribution under Section 5.6.1, the applicable Secured Party and Obligor must have previously provided written notice to Agent of (i) the existence of such Bank Product, (ii) the maximum dollar amount of obligations arising thereunder to be included as a Bank Product Reserve (“Bank Product Amount”), and (iii) the methodology to be used by such parties in determining the Bank Product Debt owing from time to time. The Bank Product Amount may be changed from time to time upon written notice to Agent by the Secured Party and Obligor. No Bank Product Amount may be established or increased at any time that a Default or Event of Default exists, or if a reserve in such amount would cause an Overadvance.

Bank Product Amount: as defined in the definition of Bank Product.

Bank Product Debt: Debt and other obligations of an Obligor relating to Bank Products, provided that Bank Product Debt of an Obligor shall not include its Excluded Swap Obligations.

Bank Product Reserve: the aggregate amount of reserves established by Agent from time to time in its reasonable discretion in respect of Bank Product Debt, which shall be at least equal to the sum of all Bank Product Amounts.

Bankruptcy Code: Title 11 of the United States Code.

Base Rate: for any day, a per annum rate equal to the greater of (a) the Prime Rate for such day; (b) the Federal Funds Rate for such day, plus 0.50%; or (c) LIBOR for a 30 day interest period as determined on such day, plus 1.50%.

Base Rate Revolver Loan: a Revolver Loan that bears interest based on the Base Rate.

Board of Governors: the Board of Governors of the Federal Reserve System.

Borrowed Money: with respect to any Obligor, without duplication, its (a) Debt that (i) arises from the lending of money by any Person to such Obligor, (ii) is evidenced by notes, drafts, bonds, debentures, credit documents or similar instruments, (iii) accrues interest or is a type upon which interest charges are customarily paid (excluding trade payables owing in the Ordinary Course of Business), or (iv) was issued or assumed as full or partial payment for Property; (b) Capital Leases; (c) reimbursement obligations with respect to letters of credit; and (d) guaranties of any Debt of the foregoing types owing by another Person.

Borrower Agent: as defined in Section 4.4.

Borrower Materials: Borrowing Base Certificates, Compliance Certificates and other information, reports, financial statements and other materials delivered by Borrowers hereunder, as well as other Reports and information provided by Agent to Lenders.

Borrowing: a group of Loans of one Type that are made on the same day or are converted into Loans of one Type on the same day.

Borrowing Base: on any date of determination, an amount equal to the lesser of (a) the aggregate amount of Revolver Commitments, minus the LC Reserve; or (b) the sum of the Accounts Formula Amount, plus the Inventory Formula Amount, minus the Availability Reserve.

Borrowing Base Certificate: a certificate, in form and substance satisfactory to Agent, by which Borrowers certify calculation of the Borrowing Base.

Business Day: any day other than a Saturday, Sunday or other day on which commercial banks are authorized to close under the laws of, or are in fact closed in, North Carolina and Illinois, and if such day relates to a LIBOR Loan, any such day on which dealings in Dollar deposits are conducted between banks in the London interbank Eurodollar market.

Capital Expenditures: all liabilities incurred or expenditures made by a Borrower or Subsidiary for the acquisition of fixed assets, or any improvements, replacements, substitutions or additions thereto with a useful life of more than one year.

Capital Lease: any lease that is required to be capitalized for financial reporting purposes in accordance with GAAP.

Cash Collateral: cash, and any interest or other income earned thereon, that is delivered to Agent to Cash Collateralize any Obligations.

Cash Collateral Account: a demand deposit, money market or other account established by Agent at such financial institution as Agent may select in its reasonable discretion, which account shall be subject to Agent’s Liens for the benefit of Secured Parties.

Cash Collateralize: the delivery of cash to Agent, as security for the payment of Obligations, in an amount equal to (a) with respect to LC Obligations, 105% of the aggregate LC Obligations, and (b) with respect to any inchoate, contingent or other Obligations (including Obligations arising under Bank Products), Agent’s good faith estimate of the amount due or to become due, including all fees and other amounts relating to such Obligations. “Cash Collateralization” has a correlative meaning.

Cash Equivalents: (a) marketable obligations issued or unconditionally guaranteed by, and backed by the full faith and credit of, the United States government, maturing within 12 months of the date of acquisition; (b) certificates of deposit, time deposits and bankers’ acceptances maturing within 12 months of the date of acquisition, and overnight bank deposits, in each case which are issued by a commercial bank organized under the laws of the United States or any state or district thereof, rated A-1 (or better) by S&P or P-1 (or better) by Moody’s at the time of acquisition, and (unless issued by a Lender) not subject to offset rights; (c) repurchase obligations with a term of not more than 30 days for underlying investments of the types described in clauses (a) and (b) entered into with any bank meeting the qualifications specified in clause (b); (d) commercial paper rated A-1 (or better) by S&P or P-1 (or better) by Moody’s, and maturing within nine months of the date of acquisition; and (e) shares of any money market fund that has substantially all of its assets invested continuously in the types of investments referred to above, has net assets of at least $500,000,000 and has the highest rating obtainable from either Moody’s or S&P.

Cash Management Services: any services provided from time to time by any Lender or any of its Affiliates to any Borrower or Subsidiary in connection with operating, collections, payroll, trust, or other depository or disbursement accounts, including automated clearinghouse, e-payable, electronic funds transfer, wire transfer, controlled disbursement, overdraft, depository, information reporting, lockbox and stop payment services.

CERCLA: the Comprehensive Environmental Response Compensation and Liability Act (42 U.S.C. § 9601 et seq.).

Change in Law: the occurrence, after the date hereof, of (a) the adoption or taking effect of any law, rule, regulation or treaty; (b) any change in any law, rule, regulation or treaty or in the administration, interpretation or application thereof by any Governmental Authority; or (c) the making or issuance of any request, guideline or directive (whether or not having the force of law) by any Governmental Authority.

Change of Control: an event or series of events by which:

(a) any “person” or “group” (as such terms are used in Sections 13(d) and 14(d) of the Exchange Act), other than any such “person” or “group” existing as of the Closing Date, becomes the “beneficial owner” (as defined in Rules 13d-3 and 13d-5 under the Exchange Act, provided that a person shall be deemed to have “beneficial ownership” of all Securities that such person has the right to acquire, whether such right is exercisable immediately or only after the passage of time), directly or indirectly, of forty percent (40%) or more of the combined voting power of Guarantor’s outstanding Equity Interests ordinarily having the right to vote at an election of directors; or

(b) the majority of the board of directors (or comparable governing body) of Guarantor fails to consist of Continuing Directors or other substitutes therefor reasonably acceptable to Agent.

Claims: all liabilities, obligations, losses, damages, penalties, judgments, proceedings, interest, costs and expenses of any kind (including remedial response costs, reasonable attorneys’ fees and Extraordinary Expenses) at any time (including after Full Payment of the Obligations, resignation or replacement of Agent, or replacement of any Lender) incurred by or asserted against any Indemnitee in any way relating to (a) any Loans, Letters of Credit, Loan Documents, or the use thereof or transactions relating thereto, (b) any action taken or omitted to be taken by any Indemnitee in connection with any Loan Documents, (c) the existence or perfection of any Liens, or realization upon any Collateral, (d) the exercise of any rights or remedies under any Loan Documents or Applicable Law, or (e) the failure by any Obligor to perform or observe any terms of any Loan Document, in each case including all costs and expenses relating to any investigation, litigation, arbitration or other proceeding (including an Insolvency Proceeding or appellate proceedings), whether or not the applicable Indemnitee is a party thereto.

Closing Date: as defined in Section 6.

Code: the Internal Revenue Code of 1986.

Collateral: all Property described in Section 7.1, all Property described in any Security Documents as security for any Obligations, and all other Property that now or hereafter secures (or is intended to secure) any Obligations.

Commitment: for any Lender, the aggregate amount of such Lender’s Revolver Commitment. “Commitments” means the aggregate amount of all Revolver Commitments.

Commitment Termination Date: the earliest to occur of (a) the Revolver Termination Date; (b) the date on which Borrowers terminate the Revolver Commitments pursuant to Section 2.1.6; or (c) the date on which the Revolver Commitments are terminated pursuant to Section 11.2.

Commodity Exchange Act: the Commodity Exchange Act (7 U.S.C. § 1 et seq.).

Compliance Certificate: a certificate, in form and substance satisfactory to Agent, by which Borrowers certify compliance with Section 10.2.3 and calculate the applicable Level for the Applicable Margin.

Consolidated Net Income: with respect to any fiscal period of Guarantor determined in accordance with GAAP on a consolidated basis; provided, however, Consolidated Net Income shall not include (a) the income (or loss) of any Person (other than a subsidiary of Guarantor) in which Guarantor or any of its wholly-owned subsidiaries had an ownership interest unless received in a cash distribution or requiring the payment of cash; (b) the income (or loss) of any Person accrued prior to the date it became a subsidiary of Guarantor or is merged into or consolidated with Guarantor; (c) all amounts included in determining net income (or loss) in respect of the write-up of assets on or after the Closing Date, including the subsequent amortization or expensing of the written-up portion of the assets; (d) extraordinary gains as defined under GAAP and extraordinary non-cash losses and (e) gains (or losses) from asset dispositions (other than sales of inventory).

Contingent Obligation: any obligation of a Person arising from a guaranty, indemnity or other assurance of payment or performance of any Debt, lease, dividend or other obligation (“primary obligation”) of another obligor (“primary obligor”) in any manner, whether directly or indirectly, including any obligation of such Person under any (a) guaranty, endorsement, co-making or sale with recourse of an obligation of a primary obligor; (b) obligation to make take-or-pay or similar payments regardless of nonperformance by any other party to an agreement; and (c) arrangement (i) to purchase any primary obligation or security therefor, (ii) to supply funds for the purchase or payment of any primary obligation, (iii) to maintain or assure working capital, equity capital, net worth or solvency of the primary obligor, (iv) to purchase Property or services for the purpose of assuring the ability of the primary obligor to perform a primary obligation, or (v) otherwise to assure or hold harmless the holder of any primary obligation against loss in respect thereof. The amount of any Contingent Obligation shall be deemed to be the stated or determinable amount of the primary obligation (or, if less, the maximum amount for which such Person may be liable under the instrument evidencing the Contingent Obligation) or, if not stated or determinable, the maximum reasonably anticipated liability with respect thereto.

Continuing Director: with respect to any Person as of any date of determination, any member of the board of directors of such Person, who (a) was a member of such board of directors on the date of this Agreement, or (b) was nominated for election or elected to such board of directors with the recommendation or approval of a majority of the Continuing Directors who were members of such board at the time of such nomination or election.

CWA: the Clean Water Act (33 U.S.C. §§ 1251 et seq.).

Debt: as applied to any Person, without duplication, (a) all items that would be included as liabilities on a balance sheet in accordance with GAAP, including Capital Leases, but excluding trade payables incurred and being paid in the Ordinary Course of Business; (b) all Contingent Obligations; (c) all reimbursement obligations in connection with letters of credit issued for the account of such Person; and (d) in the case of a Borrower, the Obligations. The Debt of a Person shall include any recourse Debt of any partnership in which such Person is a general partner or joint venturer.

Default: an event or condition that, with the lapse of time or giving of notice, would constitute an Event of Default.

Default Rate: for any Obligation (including, to the extent permitted by law, interest not paid when due), 2% plus the interest rate otherwise applicable thereto.

Defaulting Lender: any Lender that (a) fails to make any payment or provide funds to Agent or any Borrower as required hereunder or fails to perform its obligations under any Loan Document, and such failure is not cured within one Business Day, or (b) is the subject of any Insolvency Proceeding.

Deposit Account Control Agreements: the Deposit Account control agreements to be executed by each institution maintaining a Deposit Account for a Borrower, in favor of Agent, for the benefit of Secured Parties, as security for the Obligations.

Designated Jurisdiction: a country or territory that is the subject of a Sanction.

Distribution: any declaration or payment of a distribution, interest or dividend on any Equity Interest (other than payment-in-kind); any distribution, advance or repayment of Debt to a holder of Equity Interests; or any purchase, redemption, or other acquisition or retirement for value of any Equity Interest.

Dollars: lawful money of the United States.

Domestic Subsidiary: any Subsidiary that is not a Foreign Subsidiary.

Dominion Account: a special account established by Borrowers at Bank of America or another bank reasonably acceptable to Agent, over which, during any Trigger Period, Agent has exclusive control for withdrawal purposes.

EBITDA: Consolidated Net Income for Guarantor and its Subsidiaries calculated before interest expense, provision for income taxes, depreciation, amortization expense and other non-cash write-offs or impairment of goodwill and other intangible assets (in each case, to the extent included in determining net income).

Eligible Account: an Account owing to a Borrower that arises in the Ordinary Course of Business from the sale of goods or rendition of services, is payable in Dollars and is deemed by Agent, in its reasonable credit judgment, to be an Eligible Account. Without limiting the foregoing, no Account shall be an Eligible Account if (a) it is unpaid for more than 120 days after the original invoice date; (b) 25% or more of the Accounts owing by the Account Debtor are not Eligible Accounts under the foregoing clause; (c) when aggregated with other Accounts owing by the Account Debtor, it exceeds 20% of the aggregate Eligible Accounts (or such higher percentage as Agent may establish for the Account Debtor from time to time); (d) it does not conform with a covenant or representation herein; (e) it is owing by a creditor or supplier, or is otherwise subject to a potential offset, counterclaim, dispute, deduction, discount, recoupment, reserve, defense, chargeback, credit or allowance (but ineligibility shall be limited to the amount thereof); (f) an Insolvency Proceeding has been commenced by or against the Account Debtor; or the Account Debtor has failed, has suspended or ceased doing business, is liquidating, dissolving or winding up its affairs, or is not Solvent or is subject to any Sanction or any specifically designated nationals list maintained by OFAC; or Borrowers are not able to bring suit or enforce remedies against the Account Debtor through judicial process; (g) the Account Debtor is organized or has its principal offices or assets outside the United States or Canada; (h) it is owing by a Government Authority, unless the Account Debtor is the United States or any department, agency or instrumentality thereof and the Account has been assigned to Agent in compliance with the Assignment of Claims Act; (i) it is not subject to a duly perfected, first priority Lien in favor of Agent, or is subject to any other Lien; (j) the goods giving rise to it have not been delivered to and accepted by the Account Debtor, the services giving rise to it have not been accepted by the Account Debtor, or it otherwise does not represent a final sale; (k) it is evidenced by Chattel Paper or an Instrument of any kind, or has been reduced to judgment; (l) its payment has been extended, the Account Debtor has made a partial payment, or it arises from a sale on a cash-on-delivery basis; (m) it arises from a sale to an Affiliate, from a sale on a bill-and-hold, guaranteed sale, sale-or-return, sale-on-approval, consignment, or other repurchase or return basis, or from a sale to a Person for personal, family or household purposes; (n) it represents a progress billing or retainage, or relates to services for which a performance, surety or completion bond or similar assurance has been issued; or (o) it includes a billing for interest, fees or late charges, but ineligibility shall be limited to the extent thereof. In calculating delinquent portions of Accounts under clauses (a) and (b), credit balances more than 120 days old will be excluded.

Eligible Assignee: a Person that is (a) a Lender (other than a Defaulting Lender), U.S.-based Affiliate of a Lender (other than a Defaulting Lender) or Approved Fund; (b) any other financial institution approved by Agent and Borrower Agent (which approval by Borrower Agent shall not be unreasonably withheld or delayed, and shall be deemed given if no objection is made within two Business Days after notice of the proposed assignment), that is organized under the laws of the United States or any state or district thereof, has total assets in excess of $5 billion, extends asset-based lending facilities in its ordinary course of business and whose becoming an assignee would not constitute a prohibited transaction under Section 4975 of the Code or any other Applicable Law; and (c) during any Event of Default, any Person acceptable to Agent in its discretion.

Eligible Foreign Account: an Account that would be an Eligible Account but for the failure of such Account to satisfy the requirements of clause (g) of the definition of Eligible Account.

Eligible In-Transit Inventory: Inventory owned by a Borrower that would be Eligible Inventory if it were not subject to a Document and in transit from a foreign location to a location of the Borrower within the United States, and that Agent, in its reasonable credit judgment, deems to be Eligible In-Transit Inventory. Without limiting the foregoing, no Inventory shall be Eligible In-Transit Inventory unless it (a) is subject to a negotiable Document showing Agent (or, with the consent of Agent, the applicable Borrower) as consignee, which Document is in the possession of Agent or such other Person as Agent shall approve; (b) is fully insured in a manner satisfactory to Agent; (c) has been identified to the applicable sales contract and title has passed to the Borrower; (d) is not sold by a vendor that has a right to reclaim, divert shipment of, repossess, stop delivery, claim any reservation of title or otherwise assert Lien rights against the Inventory, or with respect to whom any Borrower is in default of any obligations; (e) is subject to purchase orders and other sale documentation satisfactory to Agent; (f) is shipped by a common carrier that is not affiliated with the vendor and is not subject to any Sanction or on the specifically designated nationals list maintained by OFAC; and (g) is being handled by a customs broker, freight-forwarder or other handler that has delivered a Lien Waiver.

Eligible Inventory: Inventory owned by a Borrower that Agent, in its reasonable credit judgment, deems to be Eligible Inventory. Without limiting the foregoing, no Inventory shall be Eligible Inventory unless it (a) is finished goods or raw materials, and not work-in-process, packaging or shipping materials, labels, samples, display items, bags, replacement parts or manufacturing supplies; (b) is not held on consignment, nor subject to any deposit or downpayment; (c) is in new and saleable condition and is not damaged, defective, shopworn or otherwise unfit for sale; (d) is not slow-moving (based on Inventory with supply in excess of 36 months), obsolete or unmerchantable, and does not constitute returned or repossessed goods; (e) meets all standards imposed by any Governmental Authority, has not been acquired from a Person subject to any Sanction or any specifically designated nationals list maintained by OFAC and does not constitute hazardous materials under any Environmental Law; (f) conforms with the covenants and representations herein; (g) is subject to Agent’s duly perfected, first priority Lien, and no other Lien; (h) is within the continental United States or Canada, is not in transit except between locations of Borrowers, and is not consigned to any Person; (i) is not subject to any warehouse receipt or negotiable Document; (j) is not subject to any License or other arrangement that restricts such Borrower’s or Agent’s right to dispose of such Inventory, unless Agent has received an appropriate Lien Waiver; and (k) is not located on leased premises or in the possession of a warehouseman, processor, repairman, mechanic, shipper, freight forwarder or other Person, unless the lessor or such Person has delivered a Lien Waiver or an appropriate Rent and Charges Reserve has been established.

Enforcement Action: any action to enforce any Obligations or Loan Documents or to realize upon any Collateral (whether by judicial action, self-help, notification of Account Debtors, exercise of setoff or recoupment, or otherwise).

Environmental Laws: all Applicable Laws (including all programs, permits and guidance promulgated by regulatory agencies), relating to public health (but excluding occupational safety and health, to the extent regulated by OSHA) or the protection or pollution of the environment, including CERCLA, RCRA and CWA.

Environmental Notice: a notice (whether written or oral) from any Governmental Authority or other Person of any possible noncompliance with, investigation of a possible violation of, litigation relating to, or potential fine or liability under any Environmental Law, or with respect to any Environmental Release, environmental pollution or hazardous materials, including any complaint, summons, citation, order, claim, demand or request for correction, remediation or otherwise.

Environmental Release: a release as defined in CERCLA or under any other Environmental Law.

Equity Interest: the interest of any (a) shareholder in a corporation; (b) partner in a partnership (whether general, limited, limited liability or joint venture); (c) member in a limited liability company; or (d) other Person having any other form of equity security or ownership interest.

ERISA: the Employee Retirement Income Security Act of 1974.

ERISA Affiliate: any trade or business (whether or not incorporated) under common control with an Obligor within the meaning of Section 414(b) or (c) of the Code (and Sections 414(m) and (o) of the Code for purposes of provisions relating to Section 412 of the Code).

ERISA Event: (a) a Reportable Event with respect to a Pension Plan (for which the 30-day notice is not waived); (b) a withdrawal by any Obligor or ERISA Affiliate from a Pension Plan subject to Section 4063 of ERISA during a plan year in which it was a substantial employer (as defined in Section 4001(a)(2) of ERISA) or a cessation of operations that is treated as such a withdrawal under Section 4062(e) of ERISA; (c) a complete or partial withdrawal by any Obligor or ERISA Affiliate from a Multiemployer Plan or notification that a Multiemployer Plan is in reorganization; (d) the filing of a notice of intent to terminate, the treatment of a Plan amendment as a termination under Section 4041 or 4041A of ERISA, or the commencement of proceedings by the PBGC to terminate a Pension Plan or Multiemployer Plan; (e) any Obligor or ERISA Affiliate fails to meet any funding obligations with respect to any Pension Plan or Multiemployer Plan, or requests a minimum funding waiver; (f) an event or condition which constitutes grounds under Section 4042 of ERISA for the termination of, or the appointment of a trustee to administer, any Pension Plan or Multiemployer Plan; or (g) the imposition of any liability under Title IV of ERISA, other than for PBGC premiums due but not delinquent under Section 4007 of ERISA, upon any Obligor or ERISA Affiliate.

Event of Default: as defined in Section 11.1.

Exchange Act: the Securities Exchange Act of 1934, as amended from time to time.

Excluded Swap Obligation: with respect to an Obligor, each Swap Obligation as to which, and only to the extent that, such Obligor’s guaranty of or grant of a Lien as security for such Swap Obligation is or becomes illegal under the Commodity Exchange Act because the Obligor does not constitute an “eligible contract participant” as defined in the act (determined after giving effect to any keepwell, support or other agreement for the benefit of such Obligor and all guarantees of Swap Obligations by other Obligors) when such guaranty or grant of Lien becomes effective with respect to the Swap Obligation. If a Hedging Agreement governs more than one Swap Obligation, only the Swap Obligation(s) or portions thereof described in the foregoing sentence shall be Excluded Swap Obligation(s) for the applicable Obligor.

Excluded Tax: any of the following Taxes imposed on or with respect to any Recipient or required to be withheld or deducted from a payment to a Recipient, (a) Taxes imposed on or measured by net income (however denominated), franchise Taxes, and branch profits Taxes, in each case, (i) imposed as a result of such Recipient being organized under the laws of, or having its principal office or, in the case of any Lender, its Lending Office located in, the jurisdiction imposing such Tax (or any political subdivision thereof) or (ii) that are Other Connection Taxes, (b) in the case of a Lender, U.S. federal withholding Taxes imposed on amounts payable to or for the account of such Lender with respect to an applicable interest in a Loan or Commitment pursuant to a law in effect on the date on which (i) such Lender acquires such interest in the Loan or Commitment or (ii) such Lender changes its Lending Office, except in each case to the extent that, pursuant to Section 5.9, amounts with respect to such Taxes were payable either to such Lender’s assignor immediately before such Lender became a party hereto or to such Lender immediately before it changed its Lending Office, (c) Taxes attributable to such Recipient’s failure to comply with Section 5.10 and (d) any U.S. federal withholding Taxes imposed under FATCA.

Extraordinary Expenses: all costs, expenses or advances that Agent may incur during a Default or Event of Default, or during the pendency of an Insolvency Proceeding of an Obligor, including those relating to (a) any audit, inspection, repossession, storage, repair, appraisal, insurance, manufacture, preparation or advertising for sale, sale, collection, or other preservation of or realization upon any Collateral; (b) any action, arbitration or other proceeding (whether instituted by or against Agent, any Lender, any Obligor, any representative of creditors of an Obligor or any other Person) in any way relating to any Collateral (including the validity, perfection, priority or avoidability of Agent’s Liens with respect to any Collateral), Loan Documents, Letters of Credit or Obligations, including any lender liability or other Claims; (c) the exercise, protection or enforcement of any rights or remedies of Agent in, or the monitoring of, any Insolvency Proceeding; (d) settlement or satisfaction of any taxes, charges or Liens with respect to any Collateral; (e) any Enforcement Action; (f) negotiation and documentation of any modification, waiver, workout, restructuring or forbearance with respect to any Loan Documents or Obligations; and (g) Protective Advances. Such costs, expenses and advances include transfer fees, Other Taxes, storage fees, insurance costs, permit fees, utility reservation and standby fees, legal fees, appraisal fees, brokers’ fees and commissions, auctioneers’ fees and commissions, accountants’ fees, environmental study fees, wages and salaries paid to employees of any Obligor or independent contractors in liquidating any Collateral, and travel expenses.

FATCA: Sections 1471 through 1474 of the Code (including any amended or successor version if substantively comparable and not materially more onerous to comply with), and any agreements entered into pursuant to Section 1471(b)(1) of the Code.

Federal Funds Rate: (a) the weighted average of interest rates on overnight federal funds transactions with members of the Federal Reserve System arranged by federal funds brokers on the applicable Business Day (or on the preceding Business Day, if the applicable day is not a Business Day), as published by the Federal Reserve Bank of New York on the next Business Day; or (b) if no such rate is published on the next Business Day, the average rate (rounded up, if necessary, to the nearest 1/8 of 1%) charged to Agent on the applicable day on such transactions, as determined by Agent.

Fee Letter: the fee letter agreement between Agent and Borrower Agent.

Fiscal Quarter: each period of three months, commencing on the first day of a Fiscal Year.

Fiscal Year: the fiscal year of Borrowers and Subsidiaries for accounting and tax purposes, ending on December 31 of each year.

Fixed Charge Coverage Ratio: with respect to any period of determination, the ratio of (a) the remainder of EBITDA for such period less cash taxes paid within such period, less non-financed Capital Expenditures to (b) Fixed Charges.

Fixed Charges: for any period of determination, the sum of (a) scheduled principal payments on Borrowed Money (including the principal portion of scheduled payments of Capital Lease Obligations), (b) Interest Expense included in the determination of Consolidated Net Income, but excluding any interest paid in kind, with respect to Borrowed Money and (c) Distributions paid in cash within such period.

FLSA: the Fair Labor Standards Act of 1938.

Foreign Lender: any Lender that is organized under the laws of a jurisdiction other than the laws of the United States, or any state or district thereof.

Foreign Plan: any employee benefit plan or arrangement (a) maintained or contributed to by any Obligor or Subsidiary that is not subject to the laws of the United States; or (b) mandated by a government other than the United States for employees of any Obligor or Subsidiary.

Foreign Subsidiary: a Subsidiary that is a “controlled foreign corporation” under Section 957 of the Code, such that a guaranty by such Subsidiary of the Obligations or a Lien on the assets of such Subsidiary to secure the Obligations would result in material tax liability to Borrowers.

Fronting Exposure: a Defaulting Lender’s interest in LC Obligations, Swingline Loans, Overadvances and Protective Advances, except to the extent Cash Collateralized by the Defaulting Lender or allocated to other Lenders hereunder.

Full Payment: with respect to any Obligations, (a) the full and indefeasible cash payment thereof, including any interest, fees and other charges accruing during an Insolvency Proceeding (whether or not allowed in the proceeding); (b) if such Obligations are LC Obligations or inchoate or contingent in nature, Cash Collateralization thereof (or delivery of a standby letter of credit acceptable to Agent in its discretion, in the amount of required Cash Collateral); and (c) a release of any Claims of Obligors against Agent, Lenders and Issuing Bank arising on or before the payment date. No Loans shall be deemed to have been paid in full until all Commitments related to such Loans have expired or been terminated.

GAAP: generally accepted accounting principles in effect in the United States from time to time.

Governmental Approvals: all authorizations, consents, approvals, licenses and exemptions of, registrations and filings with, and required reports to, all Governmental Authorities.

Governmental Authority: any federal, state, municipal, foreign or other governmental department, agency, commission, board, bureau, court, tribunal, instrumentality, political subdivision, or other entity or officer exercising executive, legislative, judicial, regulatory or administrative functions for or pertaining to any government or court, in each case whether associated with the United States, a state, district or territory thereof, or a foreign entity or government.

Guarantor Payment: as defined in Section 5.11.3.

Guarantor: Houston Wire & Cable Company, a Delaware corporation.

Guaranty: the Third Amended and Restated Guaranty which is to be executed by Guarantor in form and substance satisfactory to Agent.

Hedging Agreement: an agreement relating to any swap, cap, floor, collar, option, forward, cross right or obligation, or combination thereof or similar transaction, with respect to interest rate, foreign exchange, currency, commodity, credit or equity risk.

Indemnified Taxes: (a) Taxes, other than Excluded Taxes, imposed on or with respect to any payment made by or on account of any obligation of an Obligor under any Loan Document and (b) to the extent not otherwise described in (a) above, Other Taxes.

Indemnitees: Agent Indemnitees, Lender Indemnitees, Issuing Bank Indemnitees and Bank of America Indemnitees.

Insolvency Proceeding: any case or proceeding commenced by or against a Person under any state, federal or foreign law for, or any agreement of such Person to, (a) the entry of an order for relief under the Bankruptcy Code, or any other insolvency, debtor relief or debt adjustment law; (b) the appointment of a receiver, trustee, liquidator, administrator, conservator or other custodian for such Person or any part of its Property; or (c) an assignment or trust mortgage for the benefit of creditors.

Intellectual Property: all intellectual and similar Property of a Person, including inventions, designs, patents, copyrights, trademarks, service marks, trade names, trade secrets, confidential or proprietary information, customer lists, know-how, software and databases; all embodiments or fixations thereof and all related documentation, applications, registrations and franchises; all licenses or other rights to use any of the foregoing; and all books and records relating to the foregoing.

Intellectual Property Claim: any claim or assertion (whether in writing, by suit or otherwise) that a Borrower’s or Subsidiary’s ownership, use, marketing, sale or distribution of any Inventory, Equipment, Intellectual Property or other Property violates another Person’s Intellectual Property.

Interest Expense: with respect to any fiscal period, the interest expense incurred for such period as determined in accordance with GAAP.

Interest Period: as defined in Section 3.1.3.

Inventory: as defined in the UCC, including all goods intended for sale, lease, display or demonstration; all work in process; and all raw materials, and other materials and supplies of any kind that are or could be used in connection with the manufacture, printing, packing, shipping, advertising, sale, lease or furnishing of such goods, or otherwise used or consumed in a Borrower’s business (but excluding Equipment).

Inventory Formula Amount: the sum of (x) the lesser of (i) 70% of the Value of Eligible Inventory; or (ii) 90% of the NOLV Percentage of the Value of Eligible Inventory, plus (y) the lesser of (i) 70% of the Value of Eligible In-Transit Inventory or (ii) 90% of the NOLV Percentage of the Value of Eligible In-Transit Inventory.

Inventory Reserve: reserves established by Agent to reflect factors that may negatively impact the Value of Inventory, including change in salability, obsolescence, seasonality, theft, shrinkage, imbalance, change in composition or mix, markdowns and vendor chargebacks.

Investment: any acquisition of all or substantially all assets of a Person; any acquisition of record or beneficial ownership of any Equity Interests of a Person; or any advance or capital contribution to or other investment in a Person.

IRS: the United States Internal Revenue Service.

Issuing Bank: Bank of America or an Affiliate of Bank of America.

Issuing Bank Indemnitees: Issuing Bank and its officers, directors, employees, Affiliates, agents and attorneys.

LC Application: an application by Borrower Agent to Issuing Bank for issuance of a Letter of Credit, in form and substance satisfactory to Issuing Bank.

LC Conditions: the following conditions necessary for issuance of a Letter of Credit: (a) each of the conditions set forth in Section 6; (b) after giving effect to such issuance, total LC Obligations do not exceed the Letter of Credit Subline, no Overadvance exists and, if no Revolver Loans are outstanding, the LC Obligations do not exceed the Borrowing Base (without giving effect to the LC Reserve for purposes of this calculation); (c) the expiration date of such Letter of Credit is (i) no more than 365 days from issuance, in the case of standby Letters of Credit, (ii) no more than 120 days from issuance, in the case of documentary Letters of Credit, and (iii) at least 20 Business Days prior to the Revolver Termination Date; (d) the Letter of Credit and payments thereunder are denominated in Dollars; and (e) the purpose and form of the proposed Letter of Credit is satisfactory to Agent and Issuing Bank in their reasonable discretion.

LC Documents: all documents, instruments and agreements (including LC Requests and LC Applications) delivered by Borrowers or any other Person to Issuing Bank or Agent in connection with issuance, amendment or renewal of, or payment under, any Letter of Credit.

LC Obligations: the sum (without duplication) of (a) all amounts owing by Borrowers for any drawings under Letters of Credit; (b) the stated amount of all outstanding Letters of Credit; and (c) all fees and other amounts owing with respect to Letters of Credit.

LC Request: a request for issuance of a Letter of Credit, to be provided by Borrower Agent to Issuing Bank, in form satisfactory to Agent and Issuing Bank.

LC Reserve: the aggregate of all LC Obligations, other than (a) those that have been Cash Collateralized; and (b) if no Default or Event of Default exists, those constituting charges owing to Agent.

Lender Indemnitees: Lenders and their officers, directors, employees, Affiliates, agents and attorneys.

Lenders: as defined in the preamble to this Agreement, including Agent in its capacity as a provider of Swingline Loans and any other Person who hereafter becomes a “Lender” pursuant to an Assignment and Acceptance.

Lending Office: the office designated as such by the applicable Lender at the time it becomes party to this Agreement or thereafter by notice to Agent and Borrower Agent.

Letter of Credit: any standby or documentary letter of credit issued by Issuing Bank for the account of a Borrower, or any indemnity, guarantee, exposure transmittal memorandum or similar form of credit support issued by Agent or Issuing Bank for the benefit of a Borrower.

Letter of Credit Subline: $10,000,000.

LIBOR: the per annum rate of interest (rounded up, if necessary, to the nearest 1/8th of 1% and in no event less than zero) determined by Agent at or about 11:00 a.m. (London time) two Business Days prior to an interest period, for a term equivalent to such period, equal to the London Interbank Offered Rate, or comparable or successor rate approved by Agent, as published on the applicable Reuters screen page (or other commercially available source designated by Agent from time to time); provided, that any comparable or successor rate shall be applied by Agent, if administratively feasible, in a manner consistent with market practice.

LIBOR Loan: each set of LIBOR Revolver Loans having a common length and commencement of Interest Period.

LIBOR Revolver Loan: a Revolver Loan that bears interest based on LIBOR.

License: any license or agreement under which an Obligor is authorized to use Intellectual Property in connection with any manufacture, marketing, distribution or disposition of Collateral, any use of Property or any other conduct of its business.

Licensor: any Person from whom an Obligor obtains the right to use any Intellectual Property.

Lien: any Person’s interest in Property securing an obligation owed to, or a claim by, such Person, whether such interest is based on common law, statute or contract, including liens, security interests, pledges, hypothecations, statutory trusts, reservations, exceptions, encroachments, easements, rights-of-way, covenants, conditions, restrictions, leases, and other title exceptions and encumbrances affecting Property.

Lien Waiver: an agreement, in form and substance satisfactory to Agent, by which (a) for any material Collateral located on leased premises, the lessor waives or subordinates any Lien it may have on the Collateral, and agrees to permit Agent to enter upon the premises and remove the Collateral or to use the premises to store or dispose of the Collateral; (b) for any Collateral held by a warehouseman, processor, shipper, customs broker or freight forwarder, such Person waives or subordinates any Lien it may have on the Collateral, agrees to hold any Documents in its possession relating to the Collateral as agent for Agent, and agrees to deliver the Collateral to Agent upon request; (c) for any Collateral held by a repairman, mechanic or bailee, such Person acknowledges Agent’s Lien, waives or subordinates any Lien it may have on the Collateral, and agrees to deliver the Collateral to Agent upon request; and (d) for any Collateral subject to a Licensor’s Intellectual Property rights, the Licensor grants to Agent the right, vis-à-vis such Licensor, to enforce Agent’s Liens with respect to the Collateral, including the right to dispose of it with the benefit of the Intellectual Property, whether or not a default exists under any applicable License.

Loan: a Revolver Loan.

Loan Account: the loan account established by each Lender on its books pursuant to Section 5.8.

Loan Documents: this Agreement, Other Agreements and Security Documents.

Loan Year: each 12 month period commencing on the Closing Date and on each anniversary of the Closing Date.

Margin Stock: as defined in Regulation U of the Board of Governors.

Material Adverse Effect: the effect of any event or circumstance that, taken alone or in conjunction with other events or circumstances, (a) has or could be reasonably expected to have a material adverse effect on the business, operations, Properties, or financial condition of any Obligor, on the value of any material Collateral, on the enforceability of any Loan Documents, or on the validity or priority of Agent’s Liens on any Collateral; (b) impairs the ability of any Obligor to perform any obligations under the Loan Documents, including repayment of any Obligations; or (c) otherwise impairs the ability of Agent or any Lender to enforce or collect any Obligations or to realize upon any Collateral.

Material Contract: any agreement or arrangement to which a Borrower or Subsidiary is party (other than the Loan Documents) (a) that is deemed to be a material contract under any securities law applicable to such Obligor, including the Securities Act of 1933; (b) for which breach, termination, nonperformance or failure to renew could reasonably be expected to have a Material Adverse Effect; or (c) that relates to Subordinated Debt, or Debt in an aggregate amount of $150,000 or more.

Moody’s: Moody’s Investors Service, Inc., and its successors.

Multiemployer Plan: any employee benefit plan of the type described in Section 4001(a)(3) of ERISA, to which any Obligor or ERISA Affiliate makes or is obligated to make contributions, or during the preceding five plan years, has made or been obligated to make contributions.

Net Proceeds: with respect to an Asset Disposition, proceeds (including, when received, any deferred or escrowed payments) received by a Borrower or Subsidiary in cash from such disposition, net of (a) reasonable and customary costs and expenses actually incurred in connection therewith, including legal fees and sales commissions; (b) amounts applied to repayment of Debt secured by a Permitted Lien senior to Agent’s Liens on Collateral sold; (c) transfer or similar taxes; and (d) reserves for indemnities, until such reserves are no longer needed.

NOLV Percentage: the net orderly liquidation value of Inventory, expressed as a percentage, expected to be realized at an orderly, negotiated sale held within a reasonable period of time consistent with the provision for slow-moving Inventory contained in the definition of Eligible Inventory, net of all liquidation expenses, as determined from the most recent appraisal of Borrowers’ Inventory performed by an appraiser and on terms satisfactory to Agent.

Notes: each Revolver Note or other promissory note executed by a Borrower to evidence any Obligations.

Notice of Borrowing: a Notice of Borrowing to be provided by Borrower Agent to request a Borrowing of Revolver Loans, in form satisfactory to Agent.

Notice of Conversion/Continuation: a Notice of Conversion/Continuation to be provided by Borrower Agent to request a conversion or continuation of any Loans as LIBOR Loans, in form satisfactory to Agent.

Obligations: all (a) principal of and premium, if any, on the Loans, (b) LC Obligations and other obligations of Obligors with respect to Letters of Credit, (c) interest, expenses, fees and other sums payable by Obligors under the Loan Documents, (d) obligations of Obligors under any indemnity for Claims, (e) Extraordinary Expenses, (f) Bank Product Debt, and (g) other Debts, obligations and liabilities of any kind owing by Obligors pursuant to the Loan Documents, whether now existing or hereafter arising, whether evidenced by a note or other writing, whether allowed in any Insolvency Proceeding, whether arising from an extension of credit, issuance of a letter of credit, acceptance, loan, guaranty, indemnification or otherwise, and whether direct or indirect, absolute or contingent, due or to become due, primary or secondary, or joint or several; provided that the Obligations of an Obligor shall not include its Excluded Swap Obligations.

Obligor: each Borrower, Guarantor, or other Person that is liable for payment of any Obligations or that has granted a Lien in favor of Agent on its assets to secure any Obligations.

OFAC: Office of Foreign Assets Control of the U.S. Treasury Department.

Ordinary Course of Business: the ordinary course of business of any Borrower or Subsidiary, consistent with past practices and undertaken in good faith.

Organic Documents: with respect to any Person, its charter, certificate or articles of incorporation, bylaws, articles of organization, limited liability agreement, operating agreement, members agreement, shareholders agreement, partnership agreement, certificate of partnership, certificate of formation, voting trust agreement, or similar agreement or instrument governing the formation or operation of such Person.

OSHA: the Occupational Safety and Hazard Act of 1970.

Other Agreement: each Note; LC Document; Fee Letter; Lien Waiver; Borrowing Base Certificate, Compliance Certificate, financial statement or report delivered hereunder; or other document, instrument or agreement (other than this Agreement or a Security Document) now or hereafter delivered by an Obligor or other Person to Agent or a Lender in connection with any transactions relating hereto.

Other Connection Taxes: with respect to any Recipient, Taxes imposed as a result of a present or former connection between such Recipient and the jurisdiction imposing such Tax (other than connections arising solely from such Recipient having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, engaged in any other transaction pursuant to or enforced any Loan Document, or sold or assigned an interest in any Loan or Loan Document).

Other Taxes: all present or future stamp or documentary taxes or any other excise or property taxes, charges or similar levies arising from any payment made under any Loan Document or from the execution, delivery or enforcement of, or otherwise with respect to, any Loan Document.

Overadvance: as defined in Section 2.1.4.

Overadvance Loan: a Base Rate Revolver Loan made when an Overadvance exists or is caused by the funding thereof.

Participant: as defined in Section 13.2.

Patent Assignment: each patent collateral assignment agreement pursuant to which an Obligor assigns to Agent, for the benefit of Secured Parties, such Obligor’s interests in its patents, as security for the Obligations.

Patriot Act: the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Pub. L. No. 107-56, 115 Stat. 272 (2001).

Payment Item: each check, draft or other item of payment payable to a Borrower, including those constituting proceeds of any Collateral.

PBGC: the Pension Benefit Guaranty Corporation.

Pension Plan: any employee pension benefit plan (as such term is defined in Section 3(2) of ERISA), other than a Multiemployer Plan, that is subject to Title IV of ERISA and is sponsored or maintained by any Obligor or ERISA Affiliate or to which the Obligor or ERISA Affiliate contributes or has an obligation to contribute, or in the case of a multiple employer or other plan described in Section 4064(a) of ERISA, has made contributions at any time during the preceding five plan years.

Participating Lender: each Person who shall be granted the right by any Lender to participate in any of the Loans described in the Agreement and who shall have entered into a participation agreement in form and substance satisfactory to such Lender.

Permitted Acquisition(s): means any acquisition(s) by a Borrower of all or substantially all of the assets or outstanding capital stock or other ownership interests of a Person, or an operating division of a Person or a merger of a Person with a Borrower, which in either case, constitutes a business unit so long as each of the following conditions precedent (collectively, the “Acquisition Conditions”) have been fulfilled to the reasonable satisfaction of Agent: (i) no Default or Event of Default shall have occurred and be continuing at the time of such acquisition or would occur as a result thereof; (ii) the business unit being acquired (the “Target”) is primarily located in the United States of America and is in the same or related line of business as Borrower Agent; (iii) immediately after giving effect to any such Acquisition, Borrowers shall be in compliance with Section 10.1.9; (iv) either (A) both (x) the Fixed Charge Coverage Ratio shall be greater than or equal to 1.05 to 1 for the twelve-month period immediately preceding the making of such acquisition, and on a pro forma basis for the twelve-month period following the making of such acquisition, after giving effect to the making of such acquisition, such pro forma calculation to be demonstrated to Agent and to be reasonably acceptable to Agent based on projections prepared using reasonable assumptions by Borrower and (y) Availability was or will not be less than the greater of $12,500,000 and twelve and one-half percent (12.5%) of the Revolver Commitments at any time within the 30 days immediately prior to the date of the consummation of the proposed Acquisition or after giving effect to such Acquisition or (B) Availability was or will not be less than the greater of $17,500,000 and seventeen and one-half percent (17.5%) of the Revolver Commitments at any time within the 30 days immediately prior to the date of the consummation of proposed Acquisition or after giving effect to such Acquisition; (v) all conditions precedent to the consummation of the transactions under such acquisition shall have been satisfied in all material respects; and (vi) Agent shall have received a copy of the purchase agreement with respect to such Permitted Acquisition, certified as true and correct by Borrower Agent and such other agreements, documents, and instruments as Agent may reasonably request.

Permitted Asset Disposition: as long as no Default or Event of Default exists and, during a Trigger Period, all Net Proceeds are remitted to Agent, an Asset Disposition that is (a) a sale of Inventory in the Ordinary Course of Business; (b) a disposition of Equipment that, in the aggregate during any 12 month period, has a fair market or book value (whichever is more) of $100,000 or less; (c) a disposition of Inventory that is obsolete, unmerchantable or otherwise unsalable in the Ordinary Course of Business; (d) termination of a lease of real or personal Property that is not necessary for the Ordinary Course of Business, could not reasonably be expected to have a Material Adverse Effect and does not result from an Obligor’s default; or (e) approved in writing by Agent and Required Lenders.

Permitted Contingent Obligations: Contingent Obligations (a) arising from endorsements of Payment Items for collection or deposit in the Ordinary Course of Business; (b) arising from Hedging Agreements permitted hereunder; (c) existing on the Closing Date, and any extension or renewal thereof that does not increase the amount of such Contingent Obligation when extended or renewed; (d) incurred in the Ordinary Course of Business with respect to surety, appeal or performance bonds, or other similar obligations; (e) arising from customary indemnification obligations in favor of purchasers in connection with Permitted Asset Dispositions; or (f) arising under the Loan Documents.

Permitted Lien: as defined in Section 10.2.2.

Permitted Purchase Money Debt: Purchase Money Debt of Borrowers and Subsidiaries that is unsecured or secured only by a Purchase Money Lien, as long as the aggregate amount does not exceed $3,000,000 at any time and its incurrence does not violate Section 10.2.2.

Person: any individual, corporation, limited liability company, partnership, joint venture, joint stock company, land trust, business trust, unincorporated organization, Governmental Authority or other entity.

Plan: any employee benefit plan (as such term is defined in Section 3(3) of ERISA) established by an Obligor or, with respect to any such plan that is subject to Section 412 of the Code or Title IV of ERISA, an ERISA Affiliate.

Platform: as defined in Section 14.3.3.