Form 8-K HeartWare International, For: Nov 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): November 5, 2015

HEARTWARE INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-34256 | 26-3636023 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

500 Old Connecticut Path

Framingham, MA 01701

(Address of principal executive offices)

Registrant’s telephone number, including area code:

508.739.0950

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 8.01. | Other Events. |

As previously announced, on November 5, 2015, HeartWare International, Inc. (“HeartWare”) held an analyst and investor meeting with the management of HeartWare and Valtech Cardio, Ltd. (“Valtech”) to discuss HeartWare’s business outlook and provide commentary on HeartWare’s announced acquisition of Valtech. A link to the webcast can be found on HeartWare’s investor relations website (ir.heartware.com). Further, the slide presentation used at the meeting is attached to this report as Exhibit 99.1 and is hereby incorporated by reference.

HeartWare intends to acquire Valtech as set forth in that certain Business Combination Agreement, dated as of September 1, 2015, by and among HeartWare, Valtech, HW Global, Inc., a Delaware corporation and a direct wholly owned subsidiary of HeartWare (“Holdco”), HW Merger Sub, Inc., a Delaware corporation and a direct wholly owned subsidiary of Holdco (“US Merger Sub”), Valor Merger Sub Ltd., a private company incorporated under the laws of Israel and a direct wholly owned subsidiary of Holdco (“ISR Merger Sub”) and Valor Shareholder Representative, LLC, a Delaware limited liability company, pursuant to which, subject to satisfaction or waiver of the conditions therein, HeartWare and Valtech will effect a strategic combination of their respective businesses under Holdco wherein (a) US Merger Sub shall merge with and into HeartWare, with HeartWare surviving the merger as a wholly owned subsidiary of Holdco (the “US Merger”), and (b) ISR Merger Sub shall merge with and into Valtech, with Valtech surviving the merger as a subsidiary of Holdco (the “ISR Merger,” together with the US Merger and the other transactions contemplated by the Business Combination Agreement, the “Transactions”).

Additional information concerning the proposed Transaction is included in the preliminary proxy statement/prospectus, which was filed by Holdco with the Securities and Exchange Commission on October 16, 2015.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

Description | |

| 99.1 | November 5, 2015 HeartWare Analyst and Investor Meeting Slide Presentation. | |

Important Information

Additional Information about the Transactions and Where to Find It

In connection with the proposed Transactions, Holdco has filed a Registration Statement on Form S-4 that contains a preliminary proxy statement/prospectus, which is not yet final and will be amended. Holdco intends to file a final prospectus and other relevant materials and HeartWare intends to file a definitive proxy statement and other relevant materials with the SEC in connection with the proposed Transactions. Investors and security holders of HeartWare and Valtech are urged to read these materials when they become available because they will contain important information about HeartWare, Valtech and the Transactions. The proxy statement/prospectus and other relevant materials (when they become available), and any other documents filed by Holdco or HeartWare with the SEC, may be obtained free of charge at the SEC website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by Holdco or HeartWare by directing a written request to HeartWare’s investor relations department at HeartWare International, Inc., 500 Old Connecticut Path, Framingham, MA 01701, Attention: Investor Relations. Investors and security holders are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the Transactions.

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Participants in the Solicitation

HeartWare, Valtech and their respective directors, executive officers, certain members of management and certain employees may be deemed to be participants in the solicitation of proxies from the stockholders of HeartWare and Valtech in connection with the proposed transaction. Information regarding the special interests of HeartWare’s directors and executive officers in the transaction is included in the proxy statement/prospectus referred to above. Additional information regarding the directors and executive officers of HeartWare is also included in the HeartWare Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on March 2, 2015. This document is available free of charge at the SEC website (www.sec.gov) and from Investor Relations at HeartWare at the address described above.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements, including, but not limited to, the ability of the parties to consummate the proposed Transactions; satisfaction of closing conditions to the consummation of the proposed Transactions; and such other risks and uncertainties pertaining to HeartWare’s business as detailed in its filings with the SEC on Forms 10-K and 10-Q, which are available on the SEC’s website at www.sec.gov. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date thereof. HeartWare assumes no obligation to update any forward-looking statement contained in this document.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| HeartWare International, Inc. | ||||||||

| Date: November 5, 2015 | By: | /s/ Lawrence J. Knopf | ||||||

| Name: | Lawrence J. Knopf | |||||||

| Title: | Senior Vice President, General Counsel and Secretary | |||||||

INDEX TO EXHIBITS

| Exhibit |

Description | |

| 99.1 | November 5, 2015 HeartWare Analyst and Investor Meeting Slide Presentation. | |

Exhibit 99.1

|

|

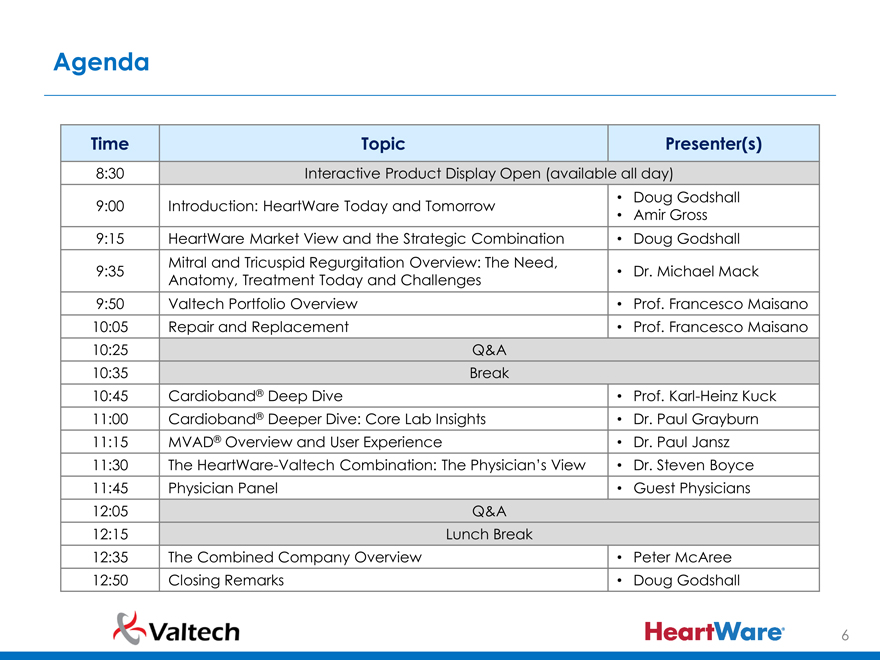

Agenda

Thursday, November 5, 2015

| 8:30 a.m. – 9:00 a.m. | Interactive Product Display Open (available all day) | |

| 9:00 a.m. – 9:15 a.m. | Introduction: HeartWare Today and Tomorrow | |

| Doug Godshall, CEO, HeartWare International, Inc. | ||

| Amir Gross, CEO, Valtech Cardio, Ltd. | ||

| 9:15 a.m. – 9:35 a.m. | HeartWare Market View and the Strategic Combination | |

| Doug Godshall | ||

| 9:35 a.m. – 9:50 a.m. | Mitral and Tricuspid Regurgitation Overview: The Need, Anatomy, | |

| Treatment Today and Challenges | ||

| Michael Mack, M.D., Baylor Health Care System | ||

| 9:50 a.m. – 10:05 a.m. | Valtech Portfolio Overview | |

| Prof. Francesco Maisano, M.D., University Hospital of Zurich | ||

| 10:05 a.m. – 10:25 a.m. | Repair and Replacement | |

| Prof. Francesco Maisano, M.D. | ||

| 10:25 a.m. – 10:35 a.m. | Q&A | |

| 10:35 a.m. – 10:45 a.m. | Break | |

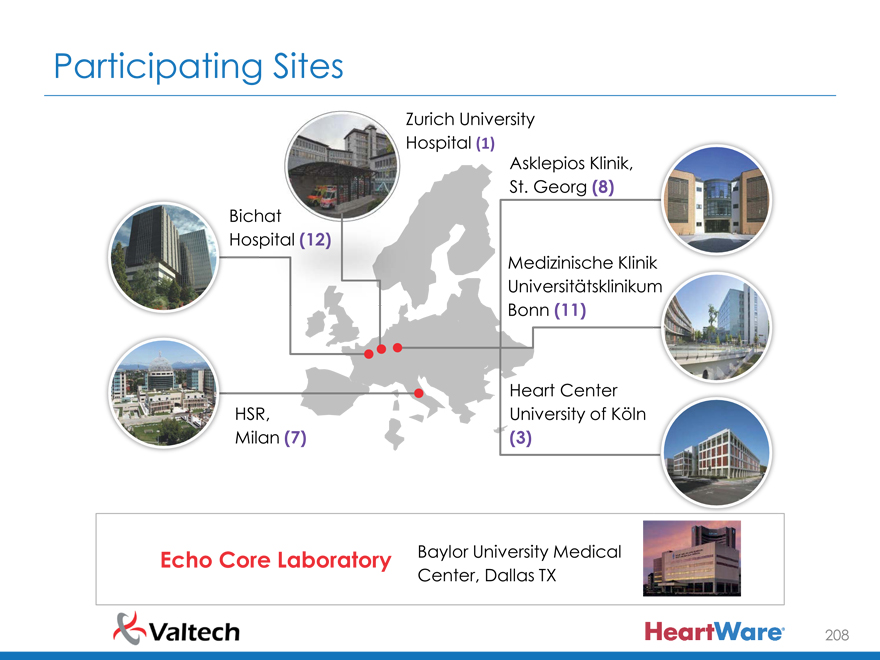

| 10:45 a.m. – 11:00 a.m. | Cardioband® Deep Dive | |

| Prof. Karl-Heinz Kuck, M.D., Ph.D., Asklepios Klinik St. Georg | ||

| 11:00 a.m. – 11:15 a.m. | Cardioband® Deeper Dive: Core Lab Insights | |

| Paul Grayburn, M.D., Baylor University Medical Center | ||

| 11:15 a.m. – 11:30 a.m. |

MVAD® Overview and User Experience | |

| Paul Jansz, M.D., St. Vincent’s Hospital | ||

| 11:30 a.m. – 11:45 a.m. | The HeartWare-Valtech Combination: The Physician’s View | |

| Steven Boyce, M.D., MedStar Washington Hospital | ||

| 11:45 a.m. – 12:05 p.m. | Physician Panel – Moderated by Dr. Michael Mack | |

| 12:05 p.m. – 12:15 p.m. | Q&A | |

| 12:15 p.m. – 12:35 p.m. | Lunch Break | |

| 12:35 p.m. – 12:50 p.m. | The Combined Company Overview | |

| Peter McAree, CFO, HeartWare International, Inc. | ||

| 12:50 p.m. – 1:00 p.m. | Closing Remarks | |

| Doug Godshall | ||

Doug Godshall

President and Chief Executive Officer, HeartWare

Mr. Godshall has been President and Chief Executive Officer of HeartWare since September 2006 and became a director in October 2006. Prior to joining HeartWare, Mr. Godshall served in various executive and managerial positions at Boston Scientific Corporation, where he had been employed since 1990, including as a member of Boston Scientific’s Operating Committee and as President, Vascular Surgery since January 2005. Prior to that, he spent five years as Vice President, Business Development at Boston Scientific, where he focused on acquisition strategies for the cardiology, electrophysiology, neuroradiology and vascular surgery divisions. Mr. Godshall has a Bachelor of Arts degree in business from Lafayette College and an M.B.A. from Northeastern University.

Amir Gross

Founder and Chief Executive Officer, Valtech Cardio

|

Mr. Gross founded Valtech Cardio in March 2005 to design and develop solutions for percutaneous mitral valve repair technology. Prior to founding Valtech, Mr. Gross gained broad experience in the medical device space as part of Rainbow Medical, and held various positions in a series of Israeli medical device startups, including EarlySense, BetaStim, GluSense and BioControl. He holds an LLB degree in medicine and ethics from the University of Manchester. At Valtech, Mr. Gross has overall responsibility for the company’s strategy and vision and is responsible for building the Valtech culture and overseeing all company functions, including operations, marketing, finance, human resources, compliance with safety regulations and public relations. |

1

Michael Mack, M.D., FACC

Dr. Mack has practiced cardiothoracic surgery in Dallas, Texas since 1982. He is board-certified in internal medicine, general surgery, and thoracic surgery and is currently the Director of Cardiovascular Surgery for Baylor Scott & White Health, Chair of the Baylor Scott & White Health Cardiovascular Governance Council and Director of Cardiovascular Research at The Heart Hospital Baylor Plano. He also co-founded and is Chair of the Board of Cardiopulmonary Research Science and Technology Institute (CRSTI). He has more than 450 peer-reviewed medical publications.

Dr. Mack was President of the Society of Thoracic Surgeons (STS) in 2011 and is Past President of the Thoracic Surgery Foundation for Research and Education (TSFRE) 2009-2011, the Southern Thoracic Surgical Association (STSA) 2009, and the International Society for Minimally Invasive Cardiothoracic Surgery (ISMICS) 2000.

He has served on the Board of Directors of the STS and is currently on the Board of Directors of CTSNet, and is a member of the American College of Cardiology Foundation (ACCF) Board of Trustees and the ACC Interventional Scientific Council, the ACC National Cardiovascular Data Registry (NCDR) Management Board and the ACC Governance Task Force. He is an honorary Fellow of the German Society for Thoracic and Cardiovascular Surgery and the Indian Association of Cardiothoracic Surgery. He was the first Chair of the STS/ACC National Transcatheter Valve Therapy (TVT) Registry Steering Committee and is the liaison to the TVT Registry from the ACCF NCDR Management Board and is on the Steering Committee of the Cardiothoracic Surgery Network (CTSN) of the NIH. He is a member of the FDA MDEpiNet Advisory and Research and Publications Committees, and the Brookings Institute National Medical Device Postmarket Surveillance System Planning Board.

| 2 |

Francesco Maisano, M.D., FESC

Professor Maisano is the Chair of Cardiovascular Surgery at the University Hospital of Zurich. Earlier in his career, Professor Maisano served as Senior Staff Heart Surgeon at San Raffaele University Hospital in Milan, where he developed significant expertise in the surgical and endovascular treatment of cardiovascular diseases. He has held several international academic roles, has served as a scientific advisor, and serves on professional, review and editorial boards.

Professor Maisano’s main area of focus is on heart valve treatment and innovative technologies, which he was able to extend from the surgical to the catheter-based pathway, training on interventional approaches. He was instrumental in initiating and advancing the Transcatheter Valve Treatment program at San Raffaele Hospital.

In 2013, he held the same position at the Division of Cardiovascular Surgery of the University Hospital in Zurich, where, in 2014, he was appointed Full Professor and Chair of Cardiovascular Surgery. Professor Maisano has extended his vision of the Heart Team approach into clinical practice, leading the full spectrum of multidisciplinary cardiovascular therapies and research programs, from heart failure to valvular therapies. From 2008 to 2013, Dr. Maisano was Chief Medical Officer of Valtech Cardio, and helped pioneer the Cardioband® procedure.

Professor Maisano qualified in medicine at the University La Sapienza in Rome in 1990, completed a postgraduate fellowship at the University of Alabama at Birmingham in 1994, and earned a master’s specialization in cardiac surgery in 1995 at Catholic University in Rome.

| 3 |

Karl-Heinz Kuck, M.D., Ph.D.

Professor Kuck is the current President of the European Heart Rhythm Association (EHRA) and Head of the Second Medical Department (Cardiology) at St. Georg Hospital in Hamburg, Germany. He has built a global reputation as a scientist, cardiologist and electrophysiologist, authoring more than 450 scientific papers – many related to his specialization in catheter ablation. He also leads cardiology at one of Europe’s largest hospital groups in Hamburg, Germany. Professor Kuck serves as a reviewer for multiple medical journals, including European Heart Journal, Europace, Heart Rhythm, Journal of Clinical Electrophysiology, JACC and Circulation Arrhythmia and Electrophysiology. He received his Doctor of Medicine degree from the University of Cologne.

Paul Grayburn, M.D., FACC

Dr. Grayburn is the Director of Cardiology Research at Baylor Heart and Vascular Institute in Dallas, Texas. Dr. Grayburn also holds faculty positions at Johns Hopkins, Mayo Clinic, Vanderbilt, UT Southwestern and the University of Maryland. Earlier in his career, Dr. Grayburn served as Assistant and Associate Professor of Medicine at UT Southwestern Medical School.

|

Dr. Grayburn has served on multiple editorial boards and boards of directors of publications and professional medical associations. He currently serves on the editorial boards of Circulation, American Journal of Cardiology, Heart and JACC: Cardiovascular Imaging. He is also Associate Editor of the American Journal of Cardiology. Dr. Grayburn has participated as an investigator in multiple clinical trials and has authored numerous peer-reviewed publications.

Dr. Grayburn earned his Bachelor of Arts degree from Texas A&M University and his degree in medicine from the University of Texas Medical Branch. He received further training in internal medicine, cardiology and interventional cardiology from St. Paul Medical Center in Dallas and from the University of Kentucky. |

4

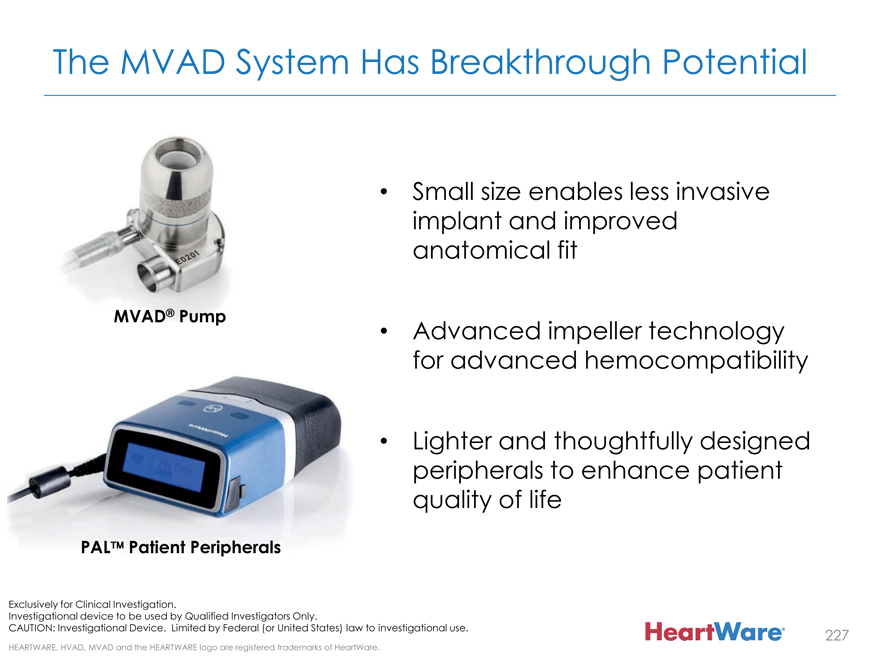

Paul Jansz, BMed, FRACS, Ph.D.

Dr. Jansz is Consultant Cardiothoracic and Transplant Surgeon at St. Vincent’s Hospital in Sydney, Australia and previously held a similar position at Papworth Hospital in the United Kingdom. Dr. Jansz’s clinical research experience encompasses multiple trials within advanced heart failure research. Among these, he served as a lead investigator in HeartWare’s HVAD® System clinical trial and was also a sub-investigator in a clinical trial of an investigational mitral valve implant and for the MitraClip® System. He is also an investigator in HeartWare’s clinical trial of the MVAD® System. Dr. Jansz received a Bachelor of Medicine degree from the University of Newcastle, is a Fellow of the Royal Australasian College of Surgeons and earned his Doctor of Philosophy degree from the University of New South Wales.

Steven Boyce, M.D.

Dr. Boyce, surgical director of the advanced heart failure program at MedStar Washington Hospital Center, is an internationally known cardiothoracic surgeon and one of the busiest in the country, performing over 425 heart surgeries per year.

|

|

Dr. Boyce received his undergraduate degree at Johns Hopkins, his medical degree from the University of Maryland, and completed his internship and residency in surgery at the University of California, San Francisco. He completed his chief residency in cardiothoracic surgery and fellowship in cardiac transplantation at UCLA. Following a faculty appointment at Harvard Medical School, he moved to Washington, D.C. |

| 5 |

Dr. Boyce has been instrumental in the development of the field of mechanical circulatory assist devices, in particular mini left ventricular assist devices, also known as LVADs. He has been an investigator in more than 60 clinical trials, including HeartWare’s ADVANCE and ENDURANCE trials. He has authored over 100 peer-reviewed papers. He is also the Founder of MyLVAD.com. For many years, Dr. Boyce has been named one of the “Best Doctors in America,” “America’s Top Surgeons” and a Washingtonian “Top Doctor.”

Peter McAree

Senior Vice President, Chief Financial Officer and Treasurer, HeartWare

Mr. McAree joined HeartWare in July 2012 as Chief Financial Officer with overall responsibility for the strategy and operations of the company’s accounting and finance functions, as well as oversight of the Information Technology department. Mr. McAree has more than 25 years of financial management and public accounting experience, serving most recently as Senior Vice President and Chief Financial Officer of Caliper Life Sciences prior to its acquisition by PerkinElmer in November 2011. Before that, he served as Chief Financial Officer of Zymark Corporation prior to the company’s merger with Caliper in 2003. Mr. McAree is a Certified Public Accountant in Massachusetts and holds a degree from Bentley University.

| 6 |

|

|

HeartWare ®

|

|

November 5, 2015

A MEETING WITH HEARTWARE AND VALTECH MANAGEMENT

2

|

|

Safe Harbor Statement

Forward-Looking Statements

This announcement contains forward-looking statements that are based on management’s beliefs, assumptions and expectations and on information currently available to management. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements, including without limitation our expectations with respect to the: commercialization of the HeartWare HVAD System and introduction of the MVAD System; timing, progress and outcomes of clinical trials; regulatory and quality compliance; research and development activities; consummation of our proposed acquisition of Valtech and our ability to take advantage of acquired and pipeline technology. Management believes that these forward-looking statements are reasonable as and when made. However, you should not place undue reliance on forward-looking statements because they speak only as of the date when made. HeartWare does not assume any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by federal securities laws and the rules and regulations of the Securities and Exchange Commission. HeartWare may not actually achieve the plans, projections or expectations disclosed in forward-looking statements, and actual results, developments or events could differ materially from those disclosed in the forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, including without limitation those described in Part I, Item 1A. “Risk Factors” in HeartWare’s Annual Report on Form 10-K filed with the Securities and Exchange Commission. HeartWare may update risk factors from time to time in Part II, Item 1A. “Risk Factors” in Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, or other filings with the Securities and Exchange Commission.

3

|

|

Additional Shareholder Information

Participants in the Solicitation

HeartWare, Valtech and their respective directors, executive officers, certain members of management and certain employees may be deemed to be participants in the solicitation of proxies in connection with the proposed acquisition of Valtech Cardio, Ltd. A description of the interests in HeartWare of its directors and executive officers is set forth in HeartWare’s proxy statement for its 2015 Annual Meeting of Shareholders, which was filed with the Securities and Exchange Commission (the “SEC”) on April 30, 2015. Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the proposed transaction, and a description of their direct and indirect interests in the proposed transaction, which may differ from the interests of HeartWare stockholders or Valtech shareholders generally, are set forth in a preliminary proxy statement/prospectus filed with the SEC on October 16, 2015.

Additional Information and Where To Find It

In connection with the proposed transactions, HW Global, Inc. (“Holdco”), has filed a Registration Statement on Form S-4 that contains a preliminary proxy statement/prospectus, which is not yet final and will be amended. Holdco intends to file a final prospectus and other relevant materials and HeartWare intends to file a definitive proxy statement and other relevant materials with the SEC in connection with the proposed transactions. Investors and security holders of HeartWare and Valtech are urged to read these materials (when they become available) before making any voting or investment decision with respect to the transactions because they will contain important information about HeartWare, Valtech and the transactions. The proxy statement/prospectus and other relevant materials, and any other documents filed by Holdco or HeartWare with the SEC, may be obtained free of charge at the SEC website at www.sec.gov. In addition, investors and security holders may obtain free copies of these documents by directing a written request to HeartWare’s investor relations department at HeartWare International, Inc., 500 Old Connecticut Path, Framingham, MA 01701, Attention: Investor Relations.

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”).

4

|

|

HeartWare Today and Tomorrow

Doug Godshall

President and CEO, HeartWare International

5

|

|

Agenda

Time Topic Presenter(s)

8:30 Interactive Product Display Open (available all day)

Doug Godshall

9:00 Introduction: HeartWare Today and Tomorrow Amir Gross

9:15 HeartWare Market View and the Strategic Combination Doug Godshall

Mitral and Tricuspid Regurgitation Overview: The Need,

9:35 Dr. Michael Mack

Anatomy, Treatment Today and Challenges

9:50 Valtech Portfolio Overview Prof. Francesco Maisano

10:05 Repair and Replacement Prof. Francesco Maisano

10:25 Q&A

10:35 Break

10:45 Cardioband® Deep Dive Prof. Karl-Heinz Kuck

11:00 Cardioband® Deeper Dive: Core Lab Insights Dr. Paul Grayburn

11:15 MVAD® Overview and User Experience Dr. Paul Jansz

11:30 The HeartWare-Valtech Combination: The Physician’s View Dr. Steven Boyce

11:45 Physician Panel Guest Physicians

12:05 Q&A

12:15 Lunch Break

12:35 The Combined Company Overview Peter McAree

12:50 Closing Remarks Doug Godshall

6

|

|

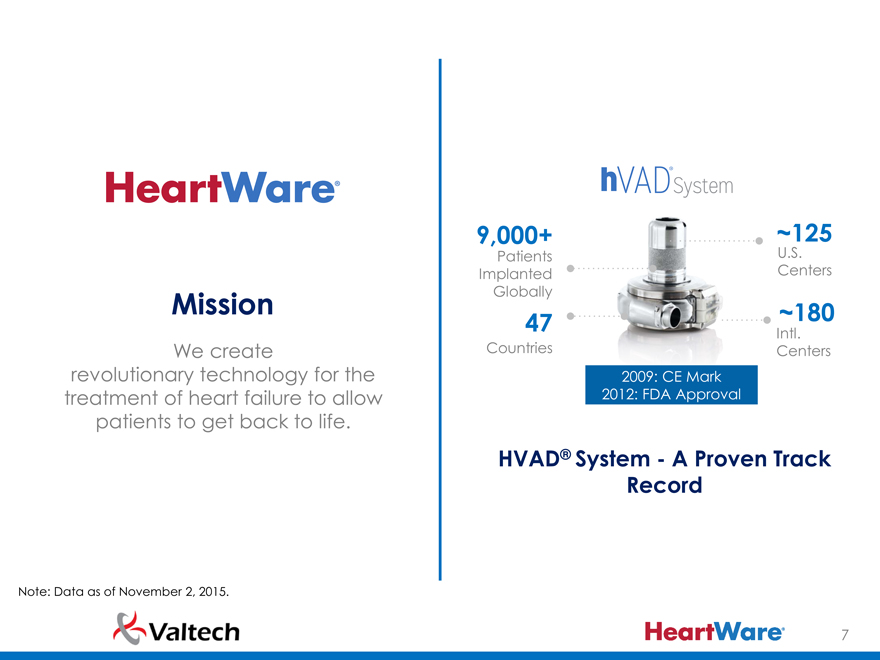

Mission

We create revolutionary technology for the treatment of heart failure to allow patients to get back to life.

9,000+ ~125

Patients U.S.

Implanted Centers

Globally

47 ~180

Intl.

Countries Centers

2009: CE Mark

2012: FDA Approval

HVAD® System—A Proven Track Record

Note: Data as of November 2, 2015.

7

|

|

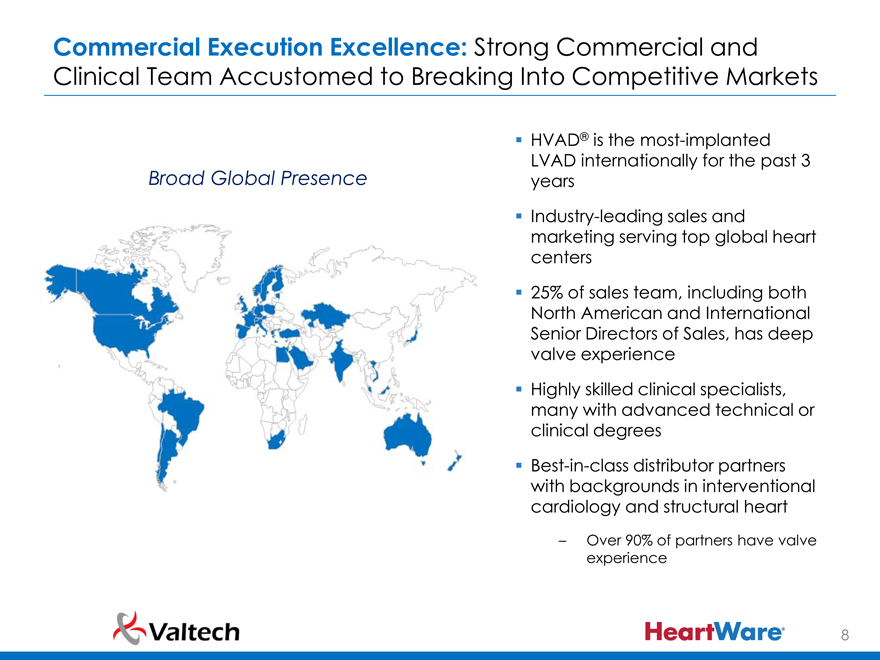

Commercial Execution Excellence: Strong Commercial and Clinical Team Accustomed to Breaking Into Competitive Markets

Broad Global Presence

HVAD® is the most-implanted LVAD internationally for the past 3 years Industry-leading sales and marketing serving top global heart centers 25% of sales team, including both North American and International Senior Directors of Sales, has deep valve experience Highly skilled clinical specialists, many with advanced technical or clinical degrees Best-in-class distributor partners with backgrounds in interventional cardiology and structural heart

– Over 90% of partners have valve experience

8

|

|

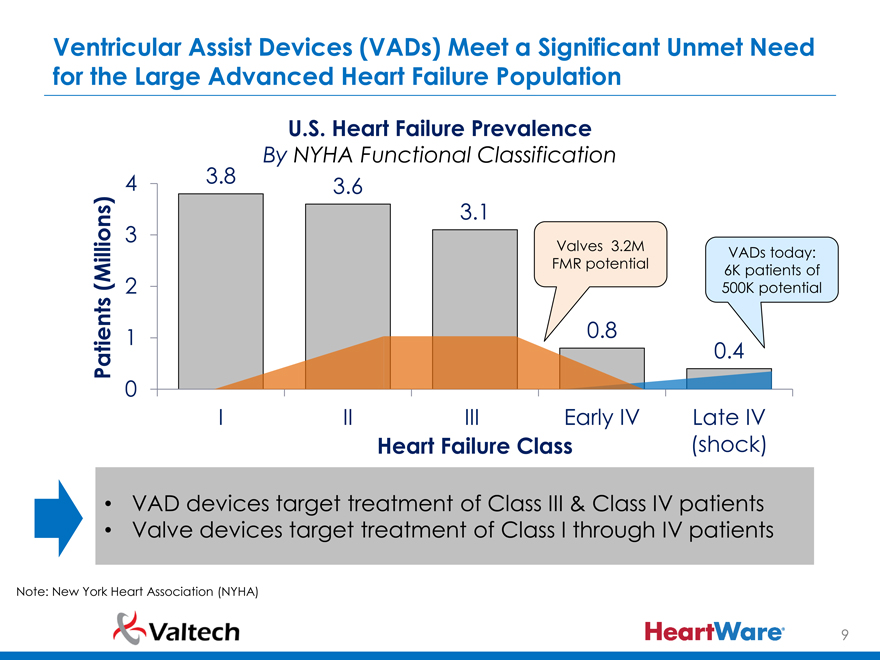

Ventricular Assist Devices (VADs) Meet a Significant Unmet Need for the Large Advanced Heart Failure Population

U.S. Heart Failure Prevalence

By NYHA Functional Classification

4 3.8 3.6

3.1

3

Valves 3.2M VADs today:

(Millions) FMR potential 6K patients of

2 500K potential

Patients 1 0.8 0.4

0

I II III Early IV Late IV

Heart Failure Class(shock)

VAD devices target treatment of Class III & Class IV patients Valve devices target treatment of Class I through IV patients

Note: New York Heart Association (NYHA)

9

|

|

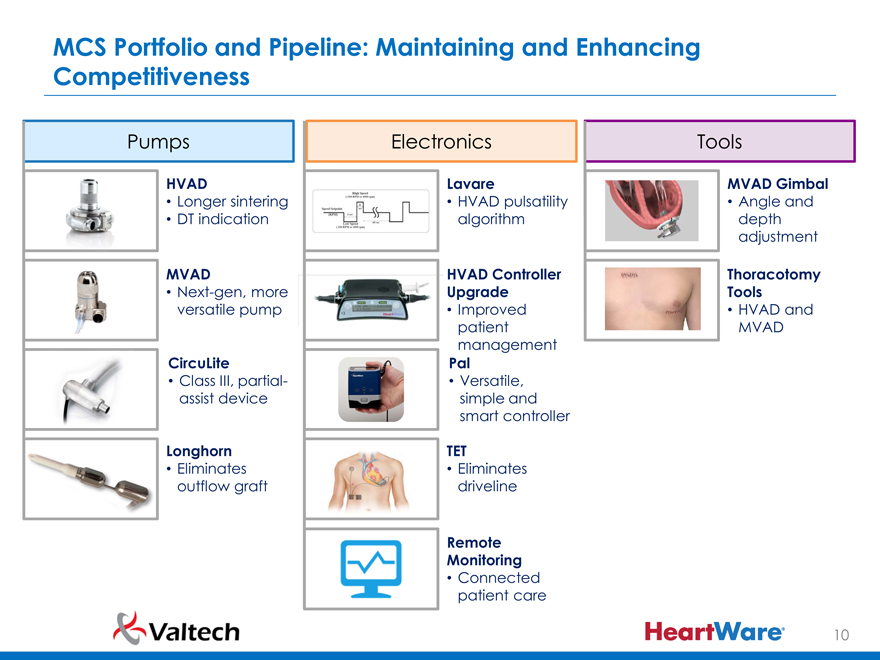

MCS Portfolio and Pipeline: Maintaining and Enhancing Competitiveness

Pumps

HVAD

Longer sintering

DT indication

MVAD

Next-gen, more

versatile pump

CircuLite

Class III, partial-

assist device

Longhorn

Eliminates

outflow graft

Electronics

Lavare

HVAD pulsatility

algorithm

HVAD Controller

Upgrade

Improved

patient

management

Pal

Versatile,

simple and

smart controller

TET

Eliminates

driveline

Remote

Monitoring

Connected

patient care

Tools

MVAD Gimbal

Angle and

depth

adjustment

Thoracotomy

Tools

HVAD and

MVAD

10

|

|

MVAD System Commentary

Controller assembly fix complete, software patch progressing towards submission efficiently Investigation continues with no anticipated design modifications Narrowing our focus to specific areas within our manufacturing process, which we may elect to further tighten up Working with investigators to review status and develop restart plan Finalizing decision tree for return to the clinic

11

|

|

HeartWare Leadership Team Here Today

Doug Godshall Peter McAree Mark Strong Jeff LaRose

President & CEO SVP, CFO SVP, Research & Executive VP, Chief

Development and Scientific Officer

Quality

Jim Schuermann Larry Knopf Chris Taylor Stuart Logan

SVP, Sales and SVP, General VP, Corporate Director, New Business

Marketing Counsel and Communications and Development and

Secretary Investor Relations Strategic Planning

12

|

|

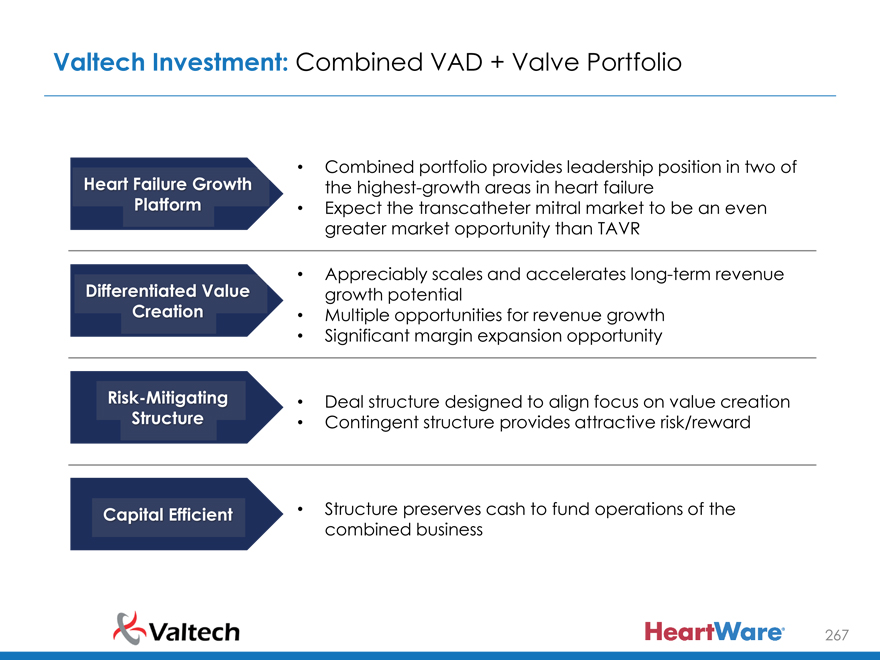

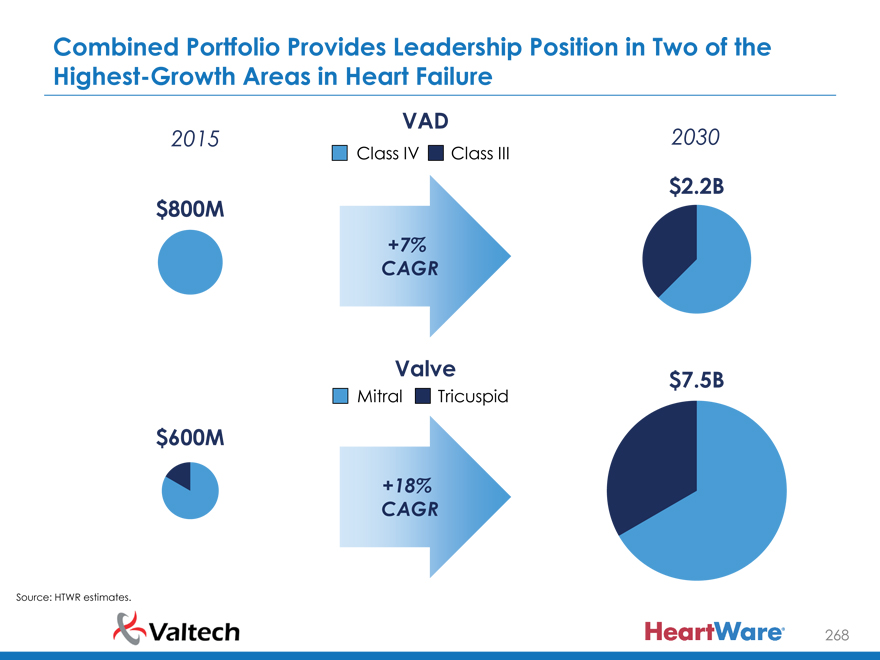

Why Mitral and Why Valtech? Because We Can Win BIG

Heart Failure Cardioband is a leading interventional MR technology, and

Leadership Valtech offers technology leadership throughout its pipeline

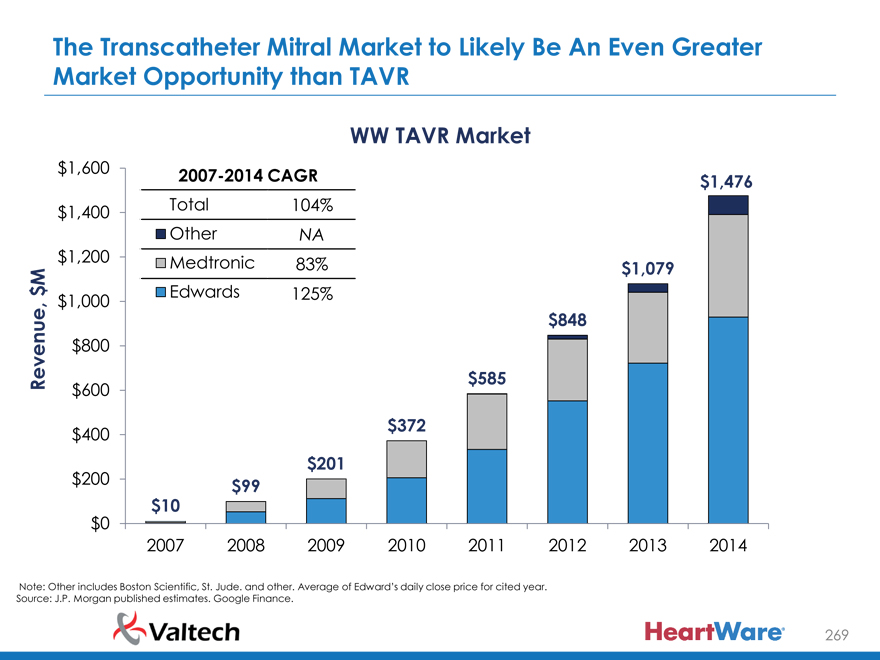

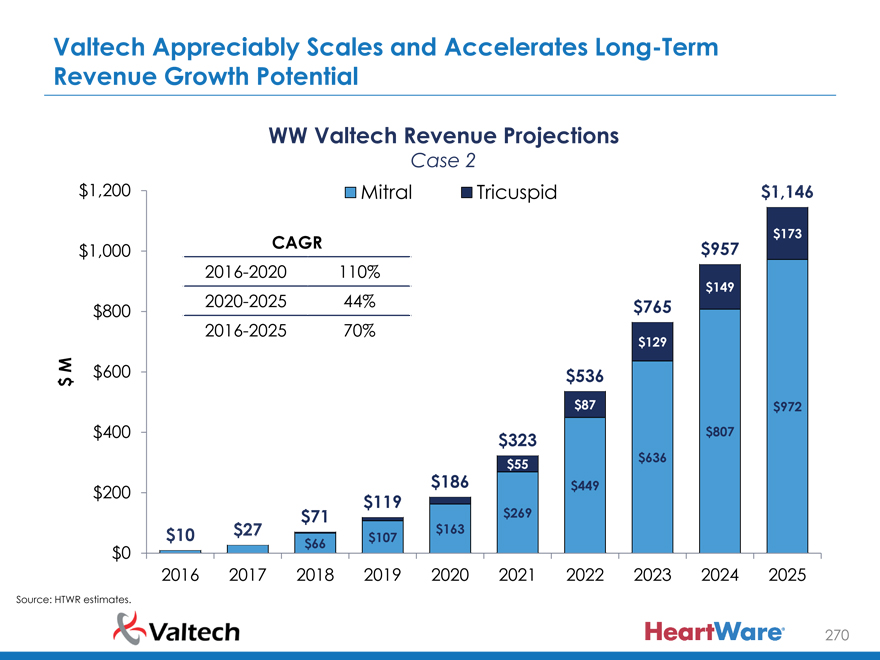

Significant Market Mitral market likely > TAVR

Only 1 significant mitral repair competitor today, replacement

Opportunity years away

Better Meet Our Mitral regurgitation is either secondary to HF or leads to HF

Patients’ Needs Tricuspid and mitral regurgitation are common in VAD patients

Concentrated customer base with significant VAD center overlap

Service Our Heart Increasing involvement of Heart Team in VAD and with HTWR

Team Customer HTWR becomes a more sophisticated clinical partner with

meaningful cross-selling and market development synergies

Attractive Growth Better gross margin and accelerated growth

Goal is to build a $1B+ revenue company – Valtech a key

Platform contributor

13

|

|

Valtech Overview

Larry Best

Executive Chairman, Valtech Cardio

Amir Gross

Founder and CEO, Valtech Cardio

14

|

|

Why HeartWare?

Strategic fit

Size and stage

Management, track record and culture

Stock vs. cash

Risk / reward

Valtech commitment

15

|

|

Valtech: Valve Expertise Has Yielded Best-in-Class Repair and Replacement Portfolio for Mitral and Tricuspid Valves

Products

Leveraging proven surgical solutions

– Annuloplasty

– Chord repair

– Valve replacement

Near-term revenue generation

– Multiple commercial-stage products

over next few years

Serving multiple large, untapped markets

– Portfolio potentially serving – and

expanding – current mitral and tricuspid

markets

Team

Experienced

– 62 deep; broad functional experience

– Exceptional R&D; significant valve and

transcatheter delivery experience

Proven execution

– Since 2010: 4 FIM (>120 patients

treated), 2 CE Mark products

16

|

|

Valtech Cardio Leadership Team Here Today

Amir Gross Nitza Shoham, Ph.D. Tal Sheps Ilia Hariton, Ph.D.

Founder & CEO VP, Clinical & VP, Cardioband VP, Research &

Regulatory Affairs Development

17

|

|

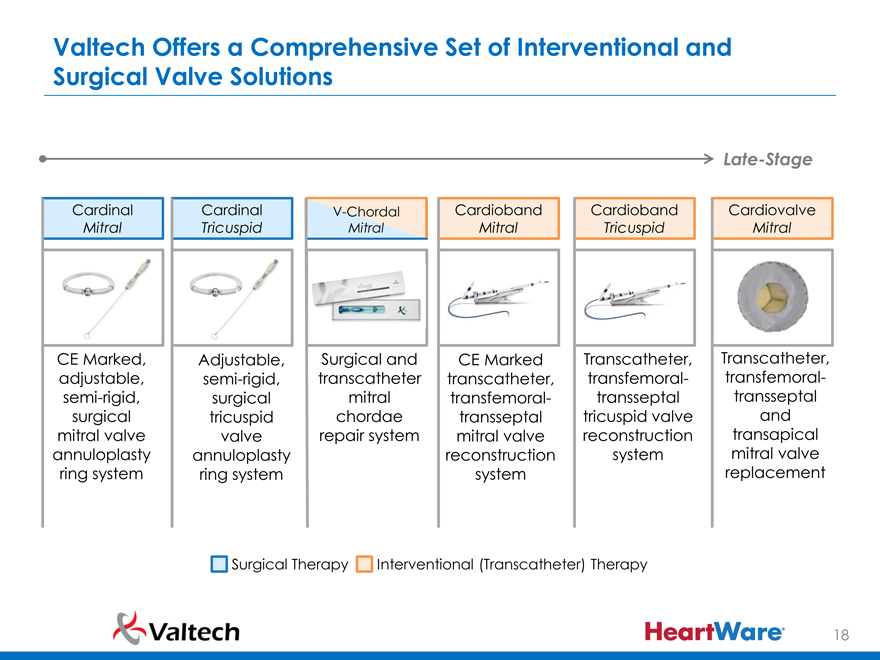

Valtech Offers a Comprehensive Set of Interventional and Surgical Valve Solutions

Late-Stage

Cardinal Cardinal V-Chordal Cardioband Cardioband Cardiovalve

Mitral Tricuspid Mitral Mitral Tricuspid Mitral

d

CE Marked, Adjustable, Surgical and CE Marked Transcatheter, Transcatheter,

adjustable, semi-rigid, transcatheter transcatheter, transfemoral- transfemoral-

semi-rigid, surgical mitral transfemoral- transseptal transseptal

surgical tricuspid chordae transseptal tricuspid valve and

mitral valve valve repair system mitral valve reconstruction transapical

annuloplasty annuloplasty reconstruction system mitral valve

ring system ring system system replacement

Surgical Therapy Interventional (Transcatheter) Therapy

18

|

|

Valtech Management’s Perspective

Early HeartWare investment enabled creation of a strong partnership

Appreciation for HeartWare’s achievements with VADs and its proven commercial execution

Strong alignment of cultures and shared vision; we have watched HeartWare for 8 years

We want to develop technologies and evaluate them clinically; we want an aggressive partner to commercialize them

With HeartWare, we will be able to continue our mission; we chose the best partner

Stock transaction further aligns interests and allows for employees to participate in long-term success; structure is highly motivating to the team

19

|

|

HeartWare Market View and the Strategic Combination

Doug Godshall

President and CEO, HeartWare International

20

|

|

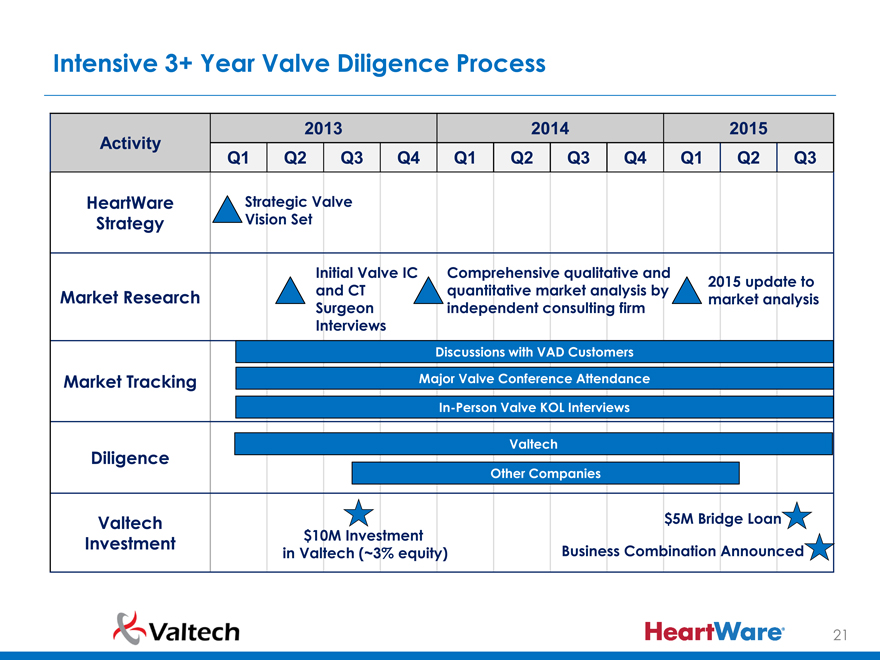

Intensive 3+ Year Valve Diligence Process

Activity

HeartWare

Strategy

Market Research

Market Tracking

Diligence

Valtech

Investment

2013

2014

2015

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Strategic Valve Vision Set

Initial Valve IC

Comprehensive qualitative and

and CT

quantitative market analysis by

2015 update to

Surgeon

independent consulting firm

market analysis

Interviews

Discussions with VAD Customers

Major Valve Conference Attendance

In-Person Valve KOL Interviews

Valtech

Other Companies

$5M Bridge Loan

$10M Investment

in Valtech (~3% equity)

Business Combination Announced

21

|

|

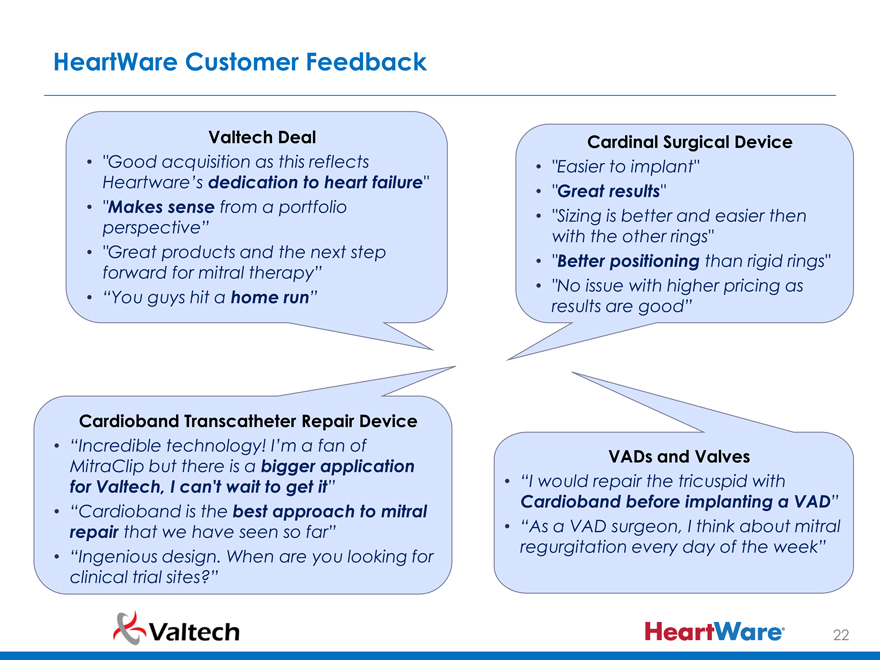

HeartWare Customer Feedback

Valtech Deal

“Good acquisition as this reflects

Heartware’s dedication to heart failure”

“Makes sense from a portfolio perspective”

“Great products and the next step forward for mitral therapy”

“You guys hit a home run”

Cardinal Surgical Device

“Easier to implant”

“Great results”

“Sizing is better and easier then with the other rings”

“Better positioning than rigid rings”

“No issue with higher pricing as results are good”

Cardioband Transcatheter Repair Device

“Incredible technology! I’m a fan of MitraClip but there is a bigger application for Valtech, I can’t wait to get it”

“Cardioband is the best approach to mitral repair that we have seen so far”

“Ingenious design. When are you looking for clinical trial sites?”

VADs and Valves

“I would repair the tricuspid with

Cardioband before implanting a VAD”

“As a VAD surgeon, I think about mitral regurgitation every day of the week”

22

|

|

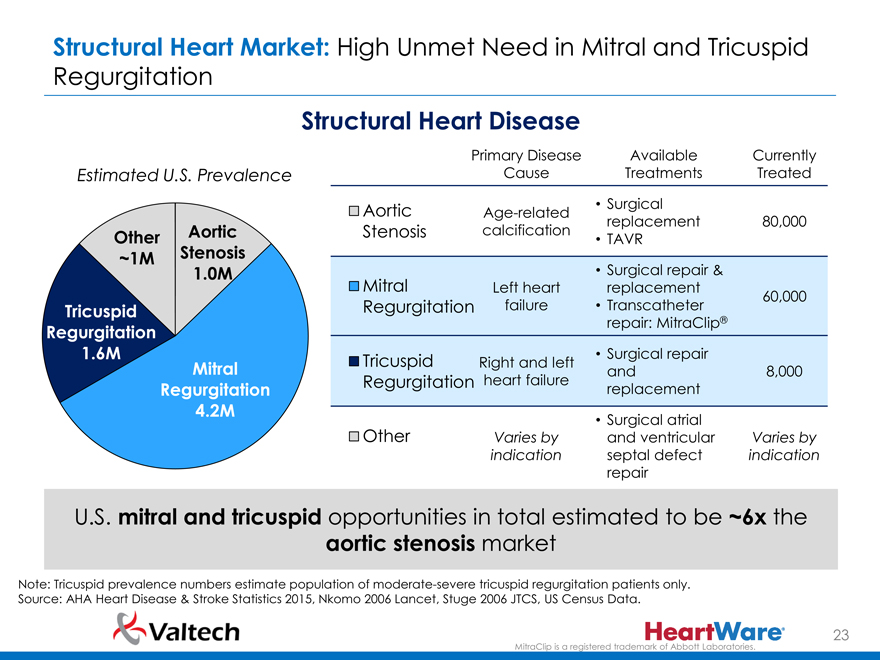

Structural Heart Market: High Unmet Need in Mitral and Tricuspid Regurgitation

Structural Heart Disease

Estimated U.S. Prevalence

Other Aortic

~1M Stenosis

1.0M

Tricuspid

Regurgitation

1.6M

Mitral

Regurgitation

4.2M

Primary Disease Available Currently

Cause Treatments Treated

Aortic Age-related Surgical

replacement 80,000

Stenosis calcification TAVR

Surgical repair &

Mitral Left heart replacement

Regurgitation failure Transcatheter 60,000

repair: MitraClip®

Tricuspid Right and left Surgical repair

and 8,000

Regurgitation heart failure replacement

Surgical atrial

Other Varies by and ventricular Varies by

indication septal defect indication

repair

U.S. mitral and tricuspid opportunities in total estimated to be ~6x the aortic stenosis market

Note: Tricuspid prevalence numbers estimate population of moderate-severe tricuspid regurgitation patients only. Source: AHA Heart Disease & Stroke Statistics 2015, Nkomo 2006 Lancet, Stuge 2006 JTCS, US Census Data.

MitraClip is a registered trademark of Abbott Laboratories.

23

|

|

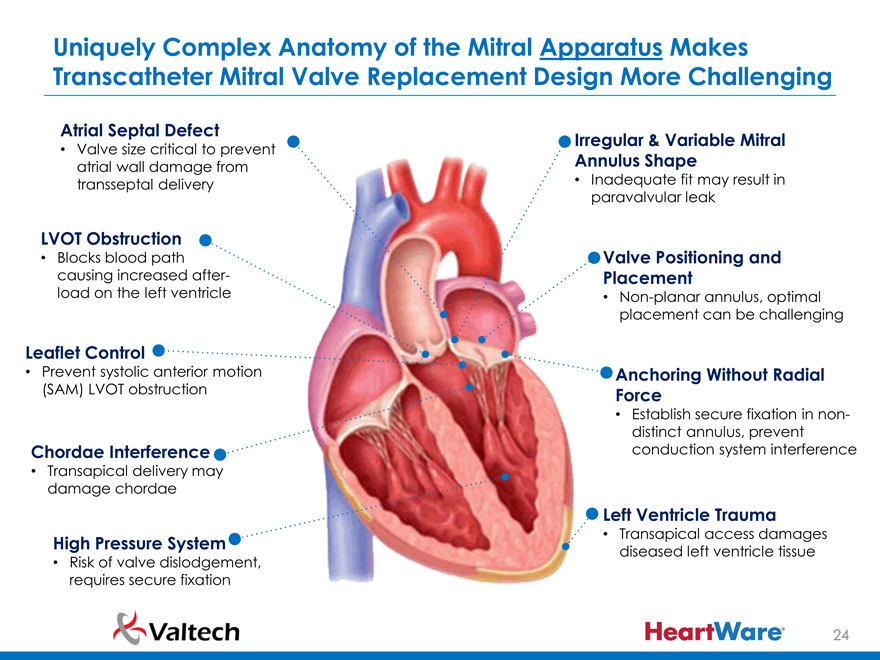

Uniquely Complex Anatomy of the Mitral Apparatus Makes Transcatheter Mitral Valve Replacement Design More Challenging

Atrial Septal Defect

Valve size critical to prevent atrial wall damage from transseptal delivery

LVOT Obstruction

Blocks blood path causing increased after-load on the left ventricle

Leaflet Control

Prevent systolic anterior motion (SAM) LVOT obstruction

Chordae Interference

Transapical delivery may damage chordae

High Pressure System

Risk of valve dislodgement, requires secure fixation

Irregular & Variable Mitral Annulus Shape

Inadequate fit may result in paravalvular leak

Valve Positioning and Placement

Non-planar annulus, optimal placement can be challenging

Anchoring Without Radial Force

Establish secure fixation in non-distinct annulus, prevent conduction system interference

Left Ventricle Trauma

Transapical access damages diseased left ventricle tissue

24

|

|

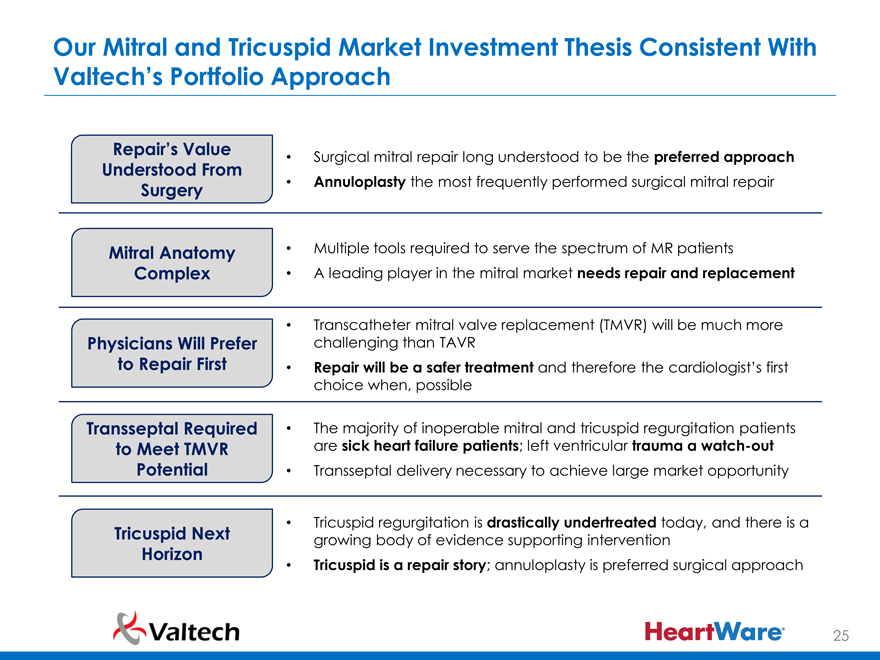

Our Mitral and Tricuspid Market Investment Thesis Consistent With Valtech’s Portfolio Approach

Repair’s Value Surgical mitral repair long understood to be the preferred approach

Understood From

Surgery Annuloplasty the most frequently performed surgical mitral repair

Mitral Anatomy Multiple tools required to serve the spectrum of MR patients

Complex A leading player in the mitral market needs repair and replacement

Transcatheter mitral valve replacement (TMVR) will be much more

Physicians Will Prefer challenging than TAVR

to Repair First Repair will be a safer treatment and therefore the cardiologist’s first

choice when, possible

Transseptal Required The majority of inoperable mitral and tricuspid regurgitation patients

to Meet TMVR are sick heart failure patients; left ventricular trauma a watch-out

Potential Transseptal delivery necessary to achieve large market opportunity

Tricuspid regurgitation is drastically undertreated today, and there is a

Tricuspid Next growing body of evidence supporting intervention

Horizon Tricuspid is a repair story; annuloplasty is preferred surgical approach

25

|

|

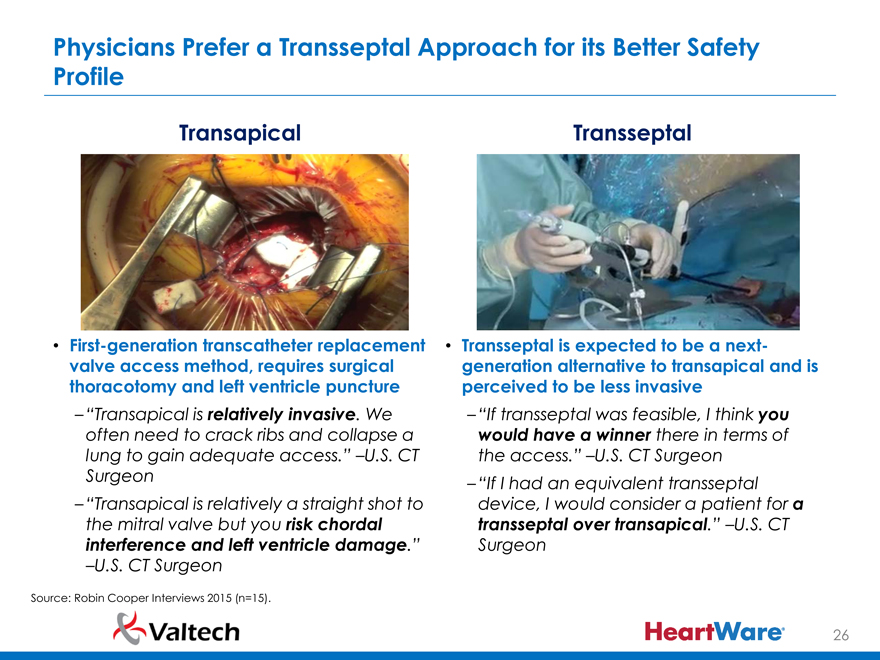

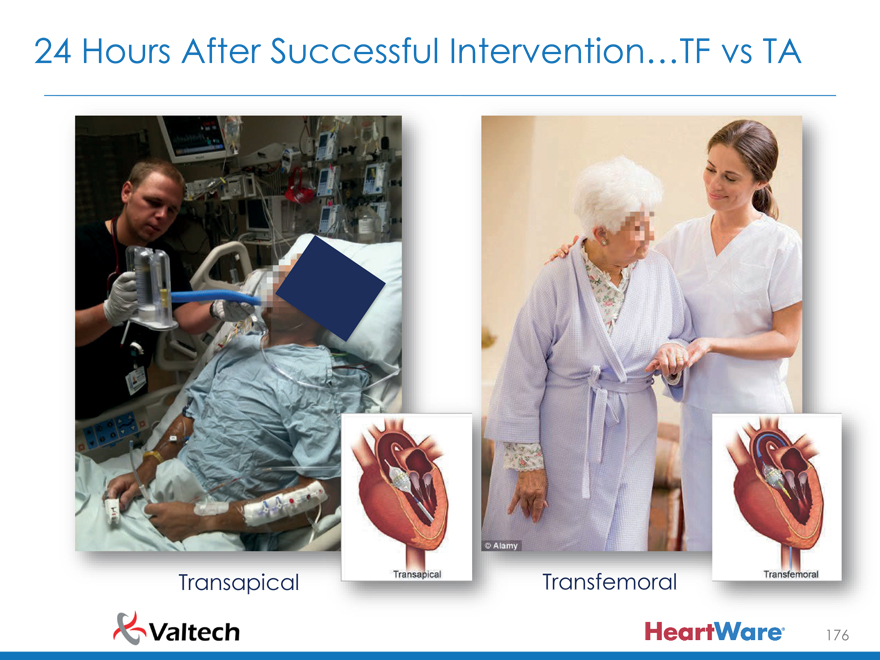

Physicians Prefer a Transseptal Approach for its Better Safety Profile

Transapical

First-generation transcatheter replacement valve access method, requires surgical thoracotomy and left ventricle puncture

“Transapical is relatively invasive. We often need to crack ribs and collapse a lung to gain adequate access.” –U.S. CT

Surgeon

“Transapical is relatively a straight shot to the mitral valve but you risk chordal interference and left ventricle damage.”

–U.S. CT Surgeon

Transseptal

Transseptal is expected to be a next- generation alternative to transapical and is perceived to be less invasive

“If transseptal was feasible, I think you would have a winner there in terms of the access.” –U.S. CT Surgeon

“If I had an equivalent transseptal device, I would consider a patient for a transseptal over transapical.” –U.S. CT

Surgeon

Source: Robin Cooper Interviews 2015 (n=15).

26

|

|

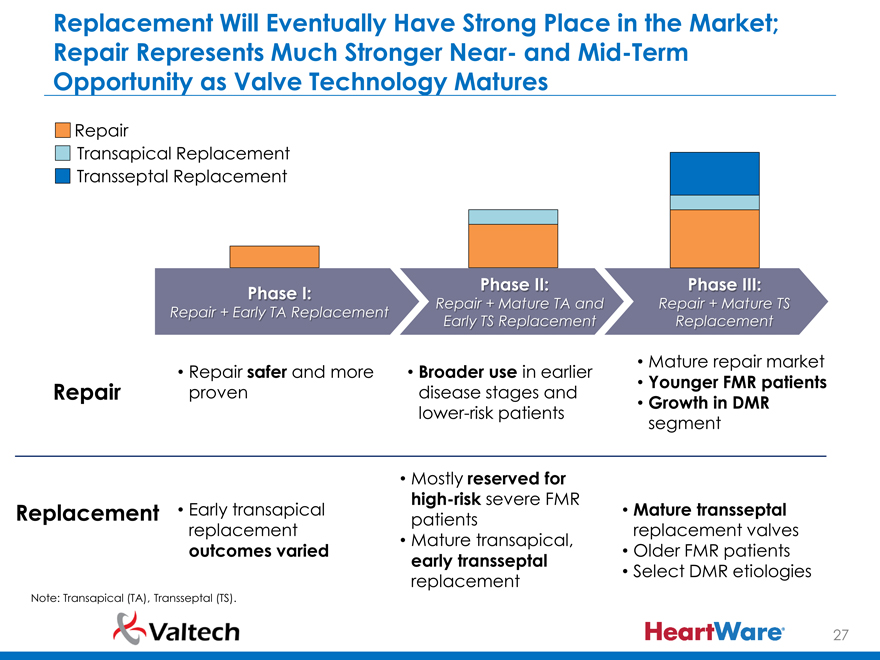

Replacement Will Eventually Have Strong Place in the Market; Repair Represents Much Stronger Near- and Mid-Term Opportunity as Valve Technology Matures

Repair

Transapical Replacement Transseptal Replacement

Phase I

Phase II

Phase III

Repair + Early TA Replacement

Repair + Mature TA and Early TS Replacement

Repair + Mature TS Replacement

Mature repair market

Repair proven Repair safer and more disease Broader stages use in earlier and Younger FMR patients

Growth in DMR

lower-risk patients segment

Mostly reserved for

high-risk severe FMR

Replacement Early transapical patients Mature transseptal

replacement replacement valves

Mature transapical,

outcomes varied Older FMR patients

early transseptal

replacement Select DMR etiologies

Note: Transapical (TA), Transseptal (TS).

27

|

|

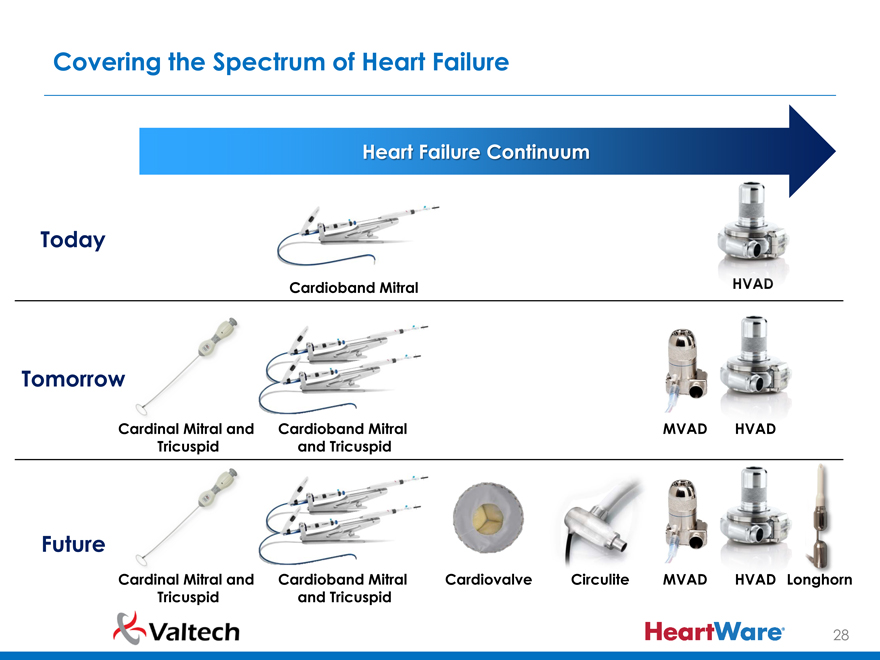

Covering the Spectrum of Heart Failure

Heart Failure Continuum

Today

Cardioband Mitral

Tomorrow

Cardinal Mitral and Cardioband Mitral MVAD HVAD

Tricuspid and Tricuspid

Future

Cardinal Mitral and Cardioband Mitral Cardiovalve Circulite MVAD HVAD Longhorn

Tricuspid and Tricuspid

28

|

|

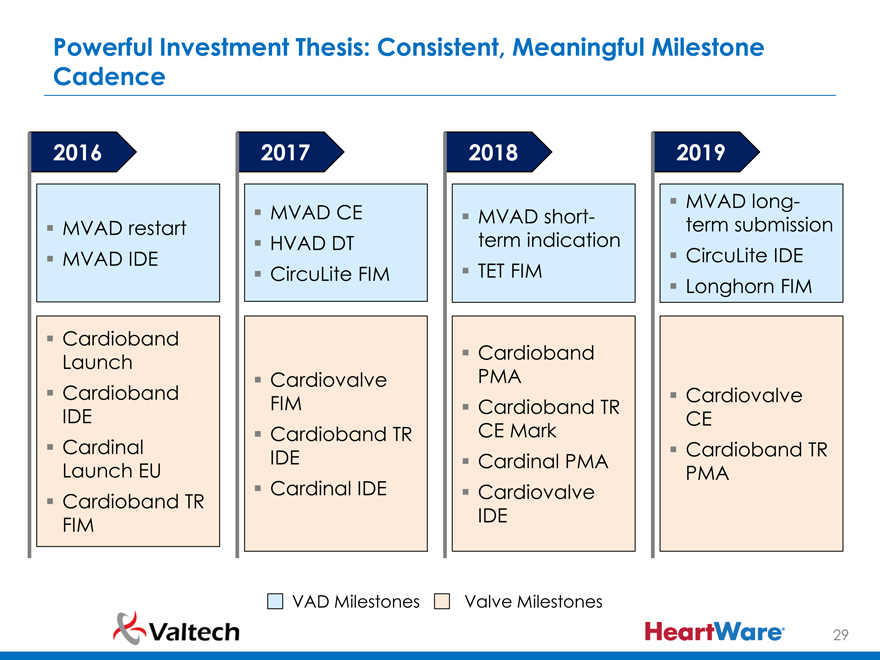

Powerful Investment Thesis: Consistent, Meaningful Milestone Cadence

2016 2017 2018 2019

MVAD CE MVAD long-

MVAD restart MVAD short- term submission

HVAD DT term indication

MVAD IDE CircuLite IDE

CircuLite FIM TET FIM Longhorn FIM

Cardioband

Launch Cardioband

Cardiovalve PMA

Cardioband FIM Cardioband TR Cardiovalve

IDE CE

Cardioband TR CE Mark

Cardinal IDE Cardinal PMA Cardioband TR

Launch EU PMA

Cardioband TR Cardinal IDE Cardiovalve

FIM IDE

VAD Milestones Valve Milestones

29

|

|

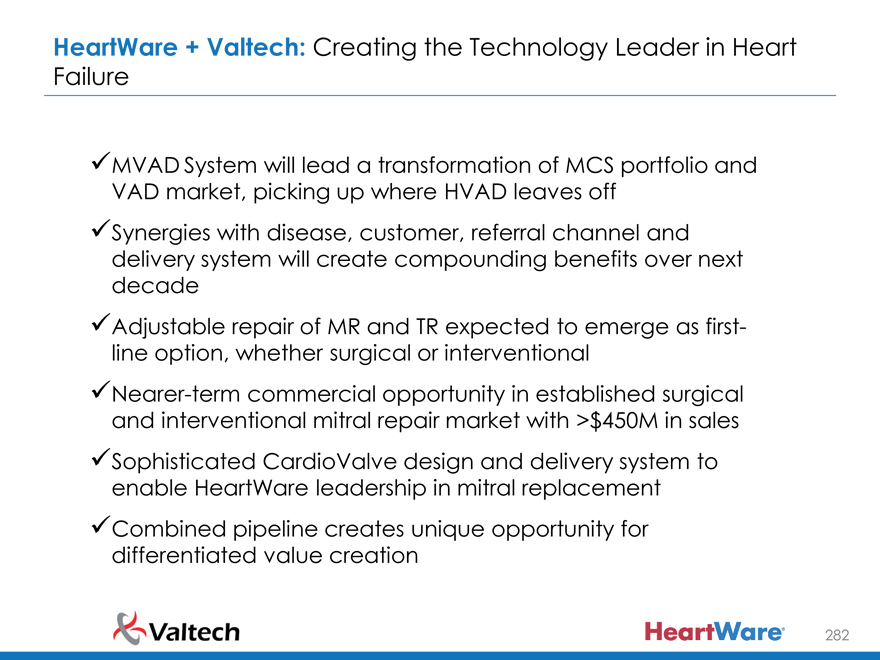

HeartWare + Valtech: Creating the Technology Leader in Advanced Heart Failure

MVAD System will lead a transformation of MCS portfolio and

VAD market, picking up where HVAD leaves off

Synergies with disease, customer, referral channel and

delivery system will create compounding benefits over next

decade

Adjustable repair of MR and TR expected to emerge as first-

line option, whether surgical or interventional

Nearer-term commercial opportunity in established surgical

and interventional mitral repair market with >$450M in sales

Sophisticated Cardiovalve design and delivery system to

enable HeartWare leadership in mitral replacement

Combined pipeline creates unique opportunity for

differentiated value creation

30

|

|

Welcome to Our Guest Clinicians

Michael Mack, M.D., FACC Prof. Francesco Maisano, M.D., FESC

Director of Cardiovascular Surgery Chair of Cardiovascular Surgery

Baylor Scott & White Health University Hospital of Zurich

Prof. Karl-Heinz Kuck, M.D., Ph.D. Paul Grayburn, M.D., FACC

Head of Cardiology Director of Cardiology Research

St. Georg Hospital Hamburg Baylor Heart and Vascular Institute

Paul Jansz, BMed, FRACS, Ph.D. Steven Boyce, M.D.

Deputy Director of Heart & Lung Director of the Advanced Heart

Transplant Program, Surgical Director MCS Failure Program

St. Vincent’s Hospital MedStar Washington Hospital

31

|

|

Mitral and Tricuspid Regurgitation Overview:

The Need, Anatomy, Treatment Today and Challenges

Michael Mack, M.D., FACC

Baylor Scott & White Health

32

|

|

Conflict of Interest Disclosure

Co-PI- COAPT Trial- Abbott Vascular Sponsor

– Uncompensated

33

|

|

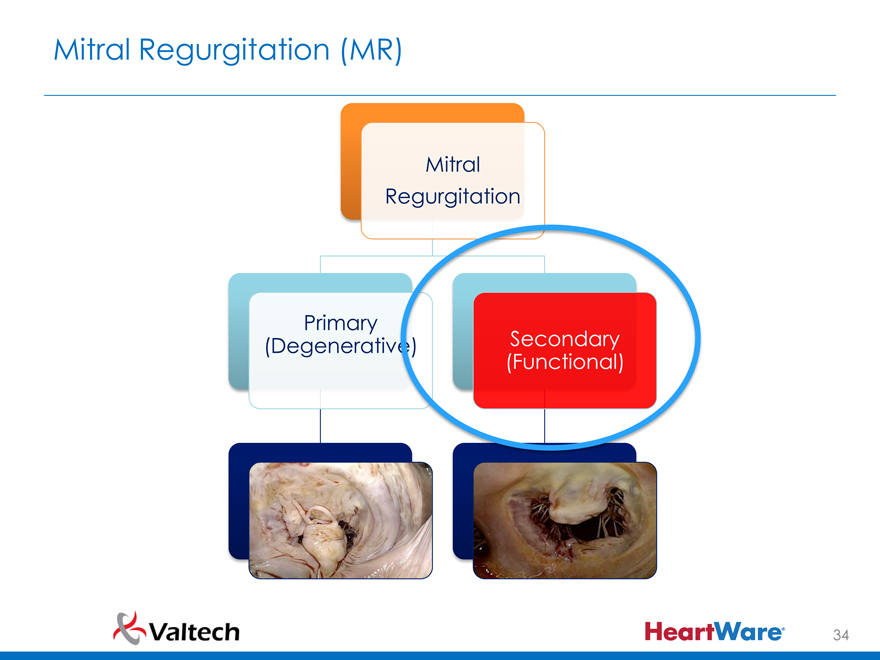

Mitral Regurgitation (MR)

Mitral

Regurgitation

Primary

(Degenerative)

34

|

|

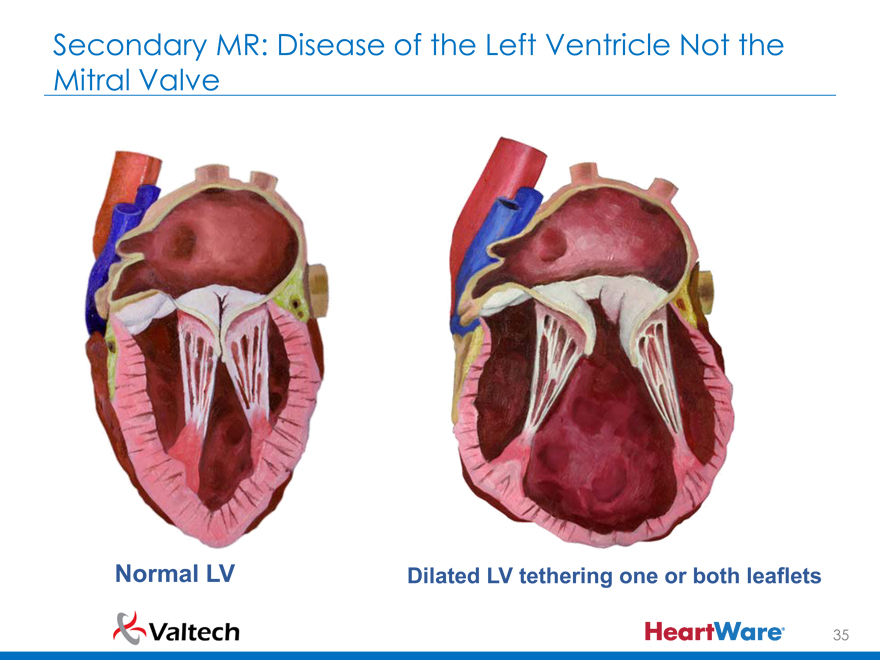

Secondary MR: Disease of the Left Ventricle Not the Mitral Valve

Normal LV Dilated LV tethering one or both leaflets

35

|

|

Why Do We Care About Secondary MR?

It is Associated with Advanced CHF !

36

|

|

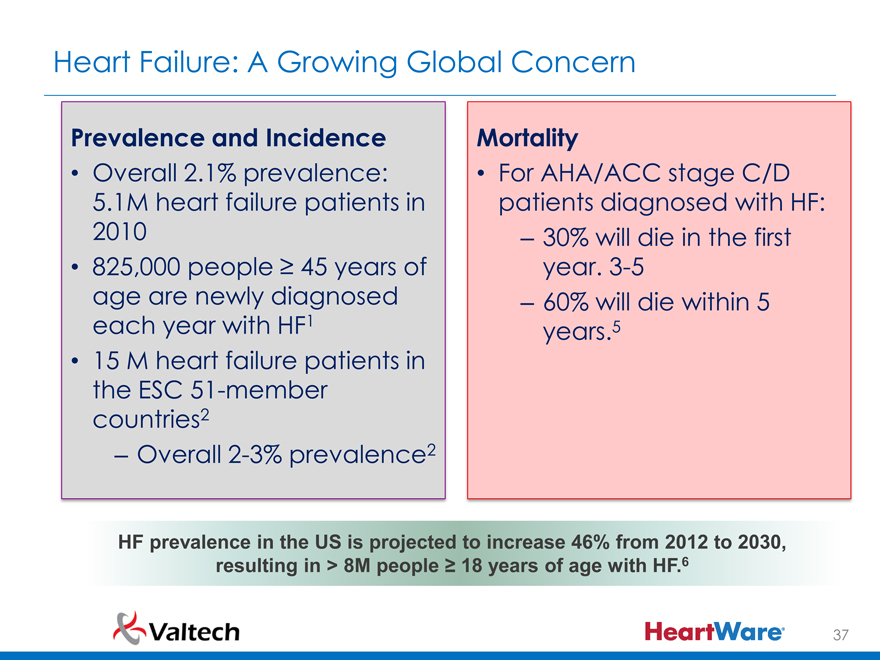

Heart Failure: A Growing Global Concern

Prevalence and Incidence Mortality

Overall 2.1% prevalence: For AHA/ACC stage C/D

5.1M heart failure patients in patients diagnosed with HF:

2010 – 30% will die in the first

825,000 people ? 45 years of year. 3-5

age are newly diagnosed – 60% will die within 5

each year with HF1 years.5

15 M heart failure patients in

the ESC 51-member

countries2

– Overall 2-3% prevalence2

HF prevalence in the US is projected to increase 46% from 2012 to 2030, resulting in > 8M people ? 18 years of age with HF.6

37

|

|

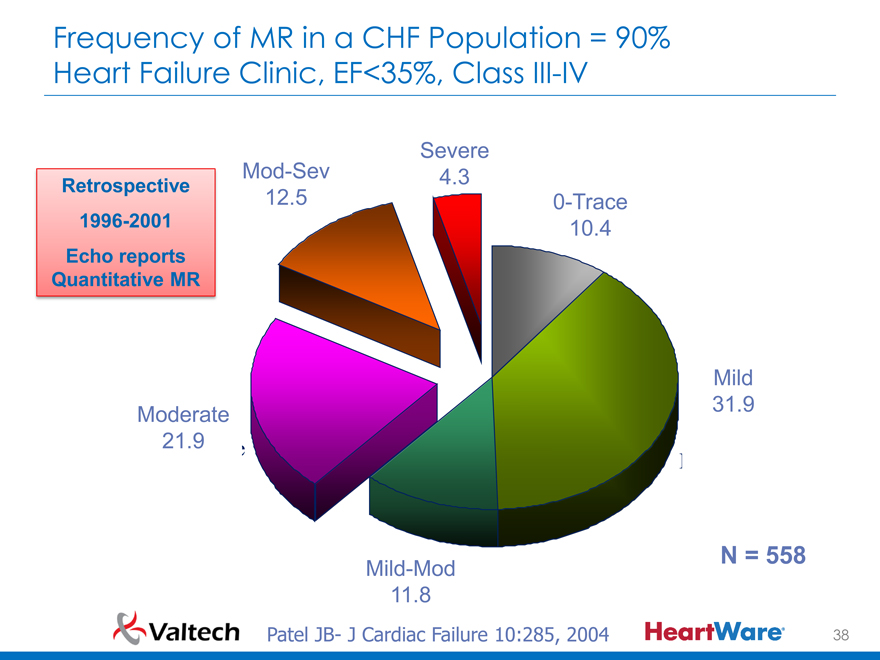

Frequency of MR in a CHF Population = 90% Heart Failure Clinic, EF<35%, Class III-IV

Severe

Retrospective Mod-Sev 4.3

12.5 0-Trace

1996-2001 10.4

Echo reports

Quantitative MR

Mild

Moderate 31.9

21.9

Mild-Mod N = 558

11.8

Patel JB- J Cardiac Failure 10:285, 2004

38

|

|

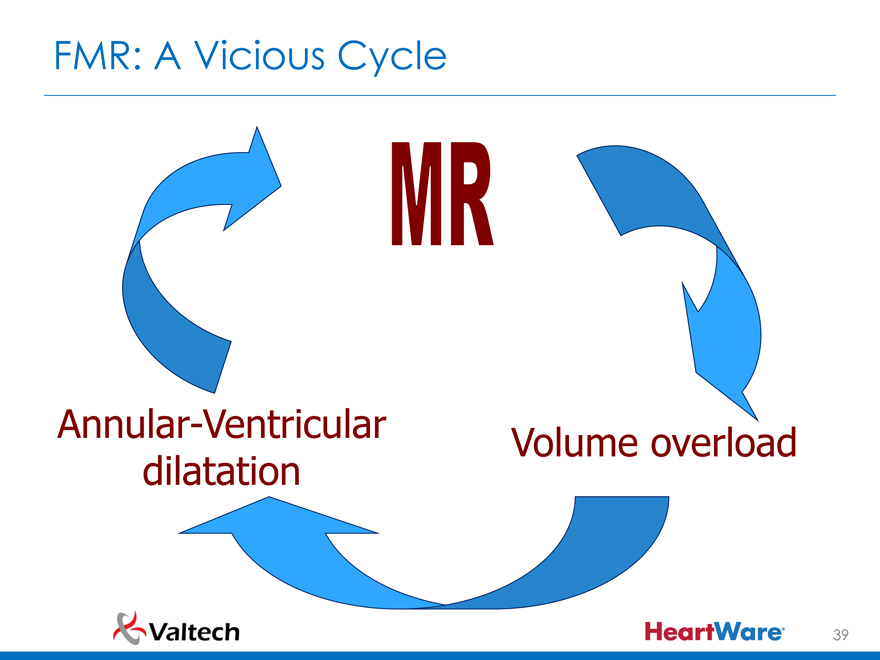

FMR: A Vicious Cycle

MR

Annular-Ventricular Volume overload

dilatation

39

|

|

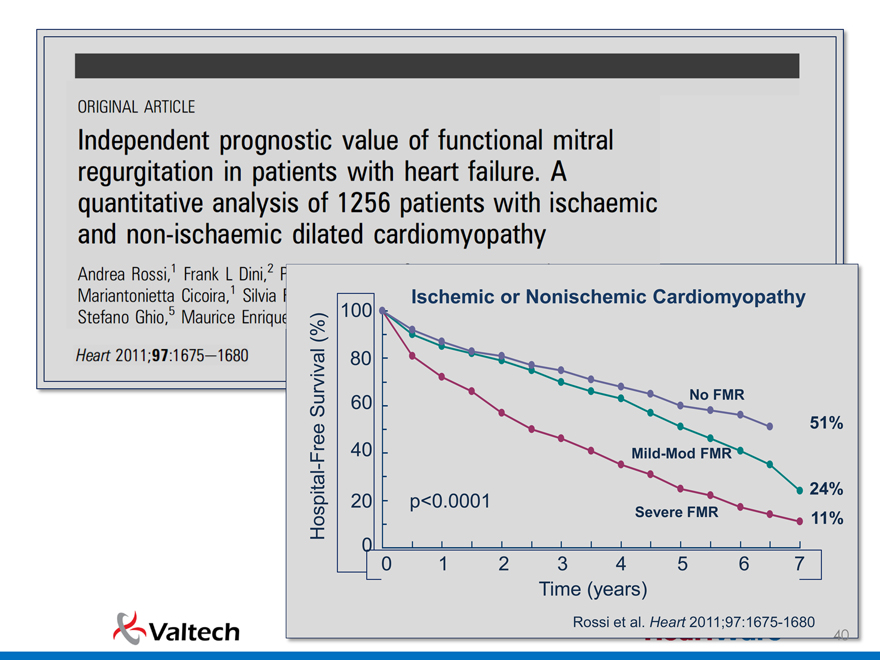

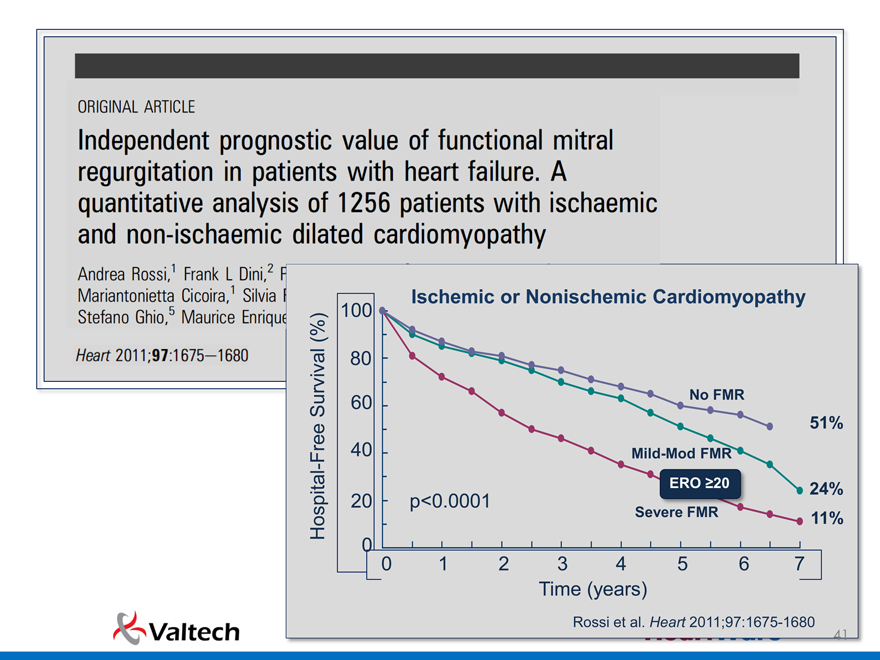

100 Ischemic or Nonischemic Cardiomyopathy

(%)

80

Survival 60 No FMR

51%

Free 40 Mild-Mod FMR

-

20 p<0.0001 24%

Hospital Severe FMR 11%

0 0 1 2 3 4 5 6 7

Time (years)

Rossi et al. Heart 2011;97:1675-1680

40

|

|

100 Ischemic or Nonischemic Cardiomyopathy

(%)

80

Survival 60 No FMR

51%

Free 40 Mild-Mod FMR

-

20 p<0.0001 ERO ?20 24%

Hospital Severe FMR 11%

0 0 1 2 3 4 5 6 7

Time (years)

Rossi et al. Heart 2011;97:1675-1680

41

|

|

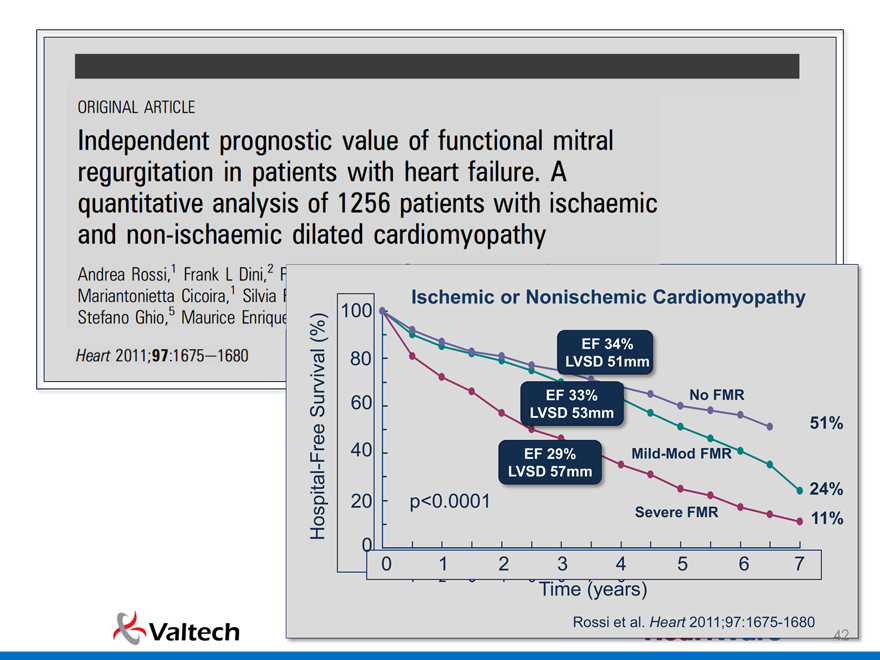

100 Ischemic or Nonischemic Cardiomyopathy

(%) EF 34%

80 LVSD 51mm

Survival 60 EF 33% No FMR

LVSD 53mm 51%

Free 40 EF 29% Mild-Mod FMR

—LVSD 57mm

20 p<0.0001 24%

Hospital Severe FMR 11%

0 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8

Time (years)

Rossi et al. Heart 2011;97:1675-1680

42

|

|

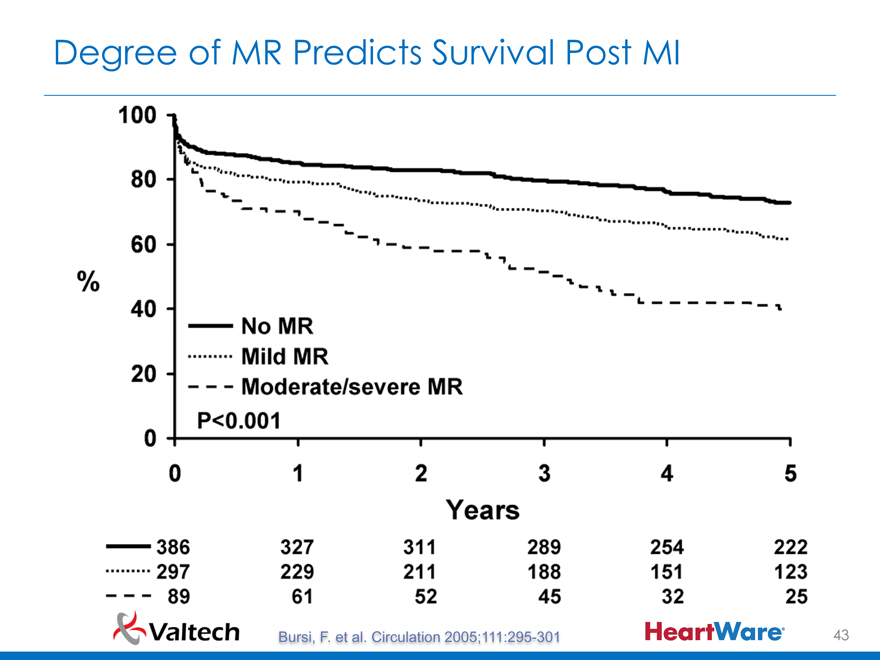

Degree of MR Predicts Survival Post MI

Bursi, F. et al. Circulation 2005;111:295-301

43

|

|

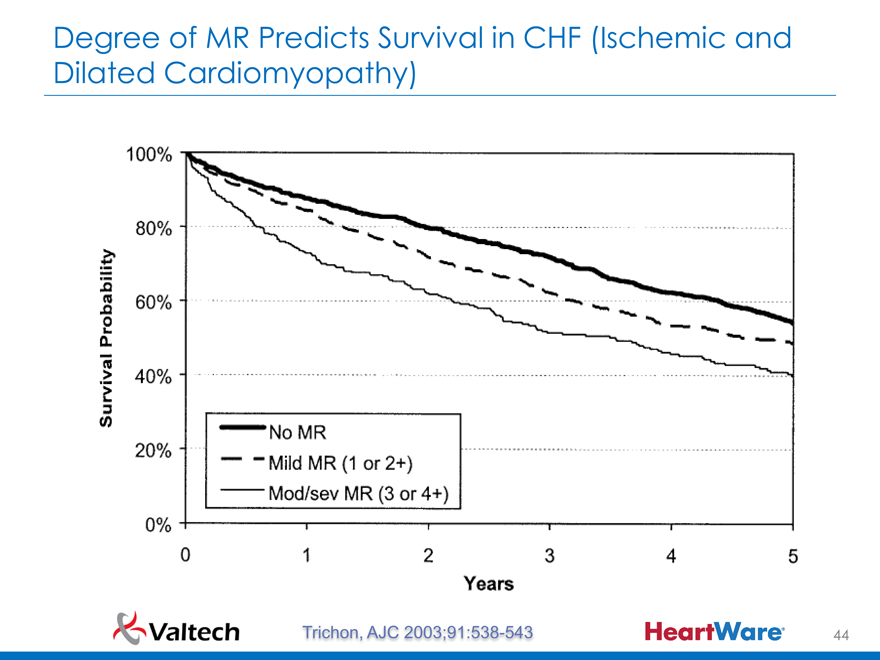

Degree of MR Predicts Survival in CHF (Ischemic and Dilated Cardiomyopathy)

Trichon, AJC 2003;91:538-543

44

|

|

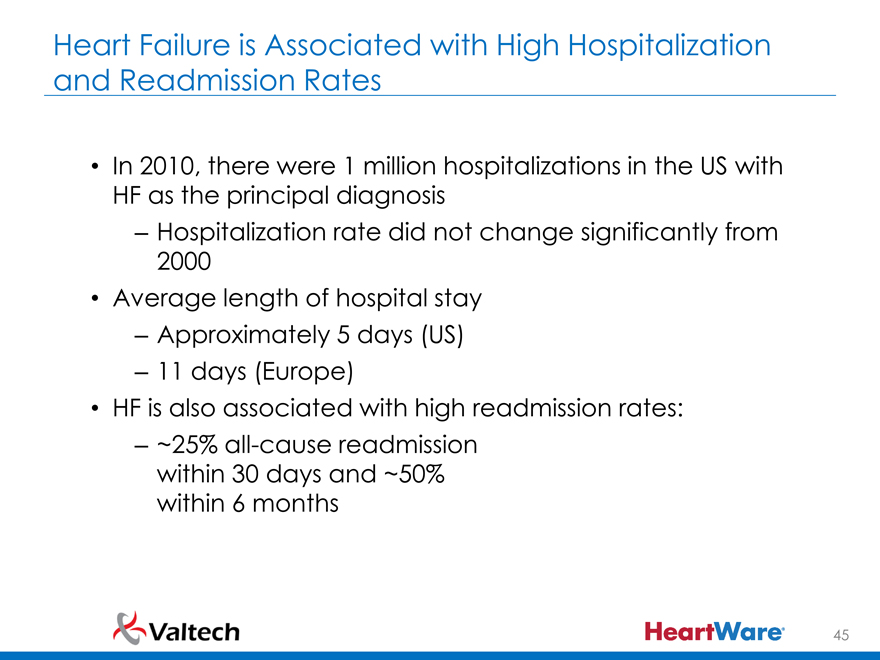

Heart Failure is Associated with High Hospitalization and Readmission Rates

In 2010, there were 1 million hospitalizations in the US with HF as the principal diagnosis

Hospitalization rate did not change significantly from 2000

Average length of hospital stay

Approximately 5 days (US)

11 days (Europe)

HF is also associated with high readmission rates:

~25% all-cause readmission within 30 days and ~50% within 6 months

45

|

|

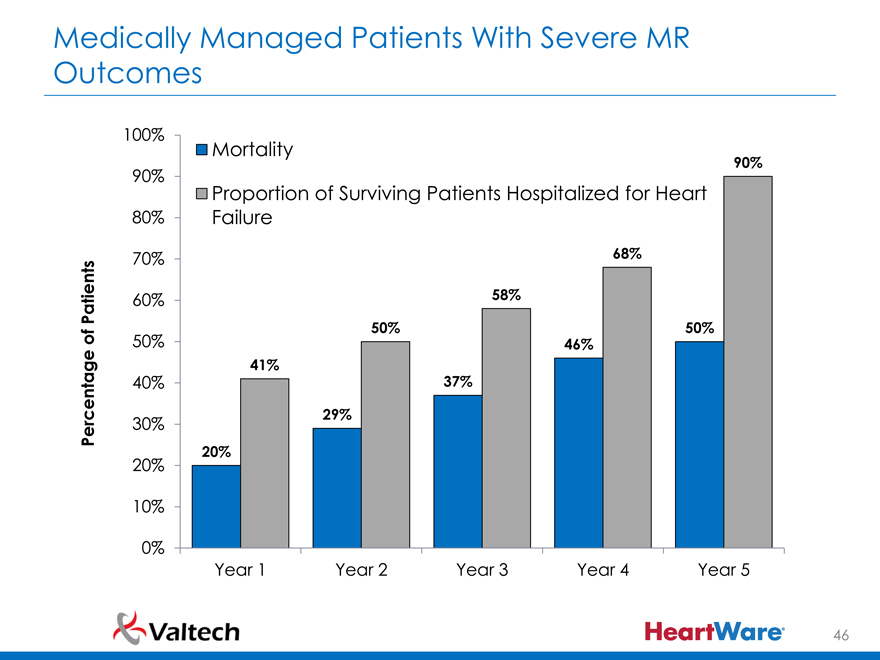

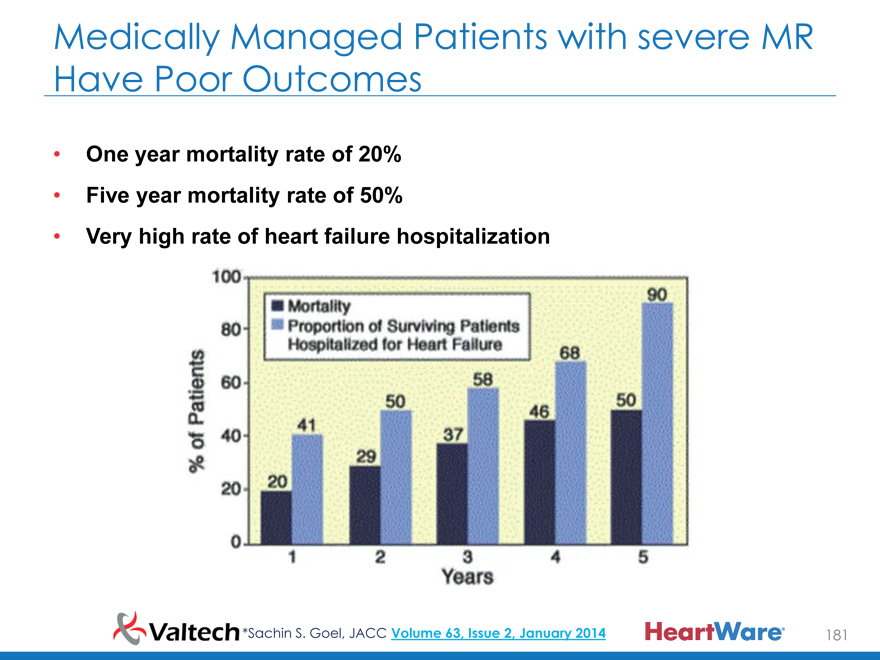

Medically Managed Patients With Severe MR Outcomes

100%

Mortality

90%

90%

Proportion of Surviving Patients Hospitalized for Heart

80% Failure

70% 68%

Patients 60% 58%

50% 50%

of 50% 46%

41%

40% 37%

Percentage 30% 29%

20%

20%

10%

0%

Year 1 Year 2 Year 3 Year 4 Year 5

46

|

|

Chronic Severe Secondary Mitral Regurgitation: Intervention

Recommendations COR LOE

MV surgery is reasonable for patients with chronic severe

secondary MR (stages C and D) who are undergoing CABG or IIa C

AVR

MV repair may be considered for patients with chronic

moderate secondary MR (stage B) who are undergoing other IIb C

cardiac surgery

Repair or Replacement not stipulated

47

|

|

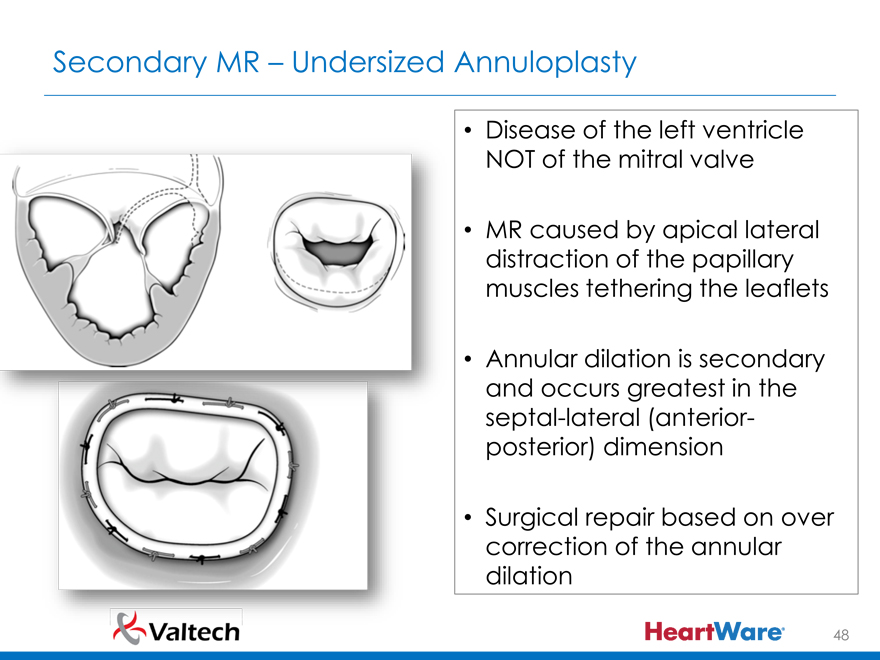

Secondary MR – Undersized Annuloplasty

Disease of the left ventricle NOT of the mitral valve

MR caused by apical lateral distraction of the papillary muscles tethering the leaflets

Annular dilation is secondary and occurs greatest in the septal-lateral (anterior-posterior) dimension

Surgical repair based on over correction of the annular dilation

48

|

|

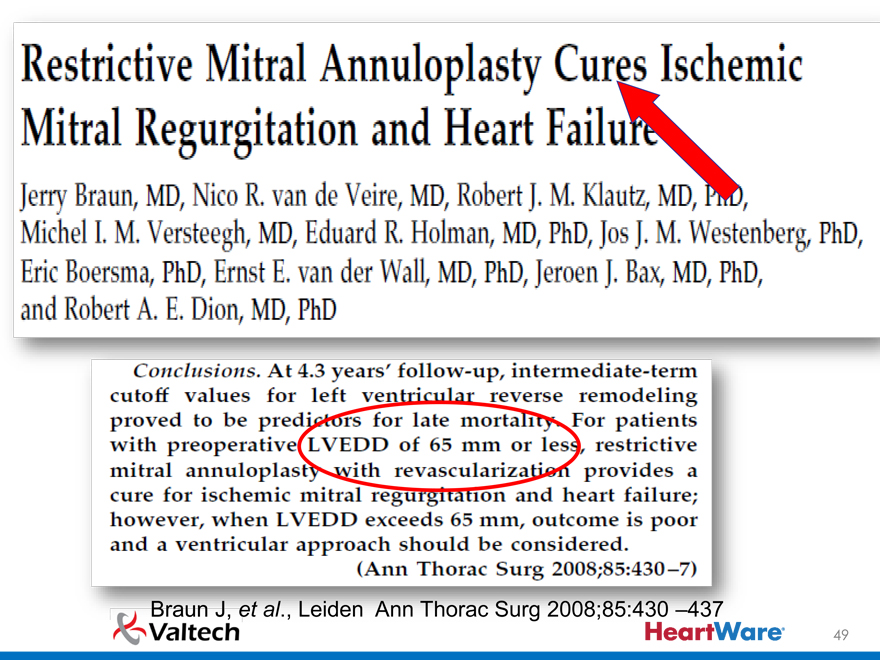

Braun J, et al., Leiden Ann Thorac Surg 2008;85:430 –437

49

|

|

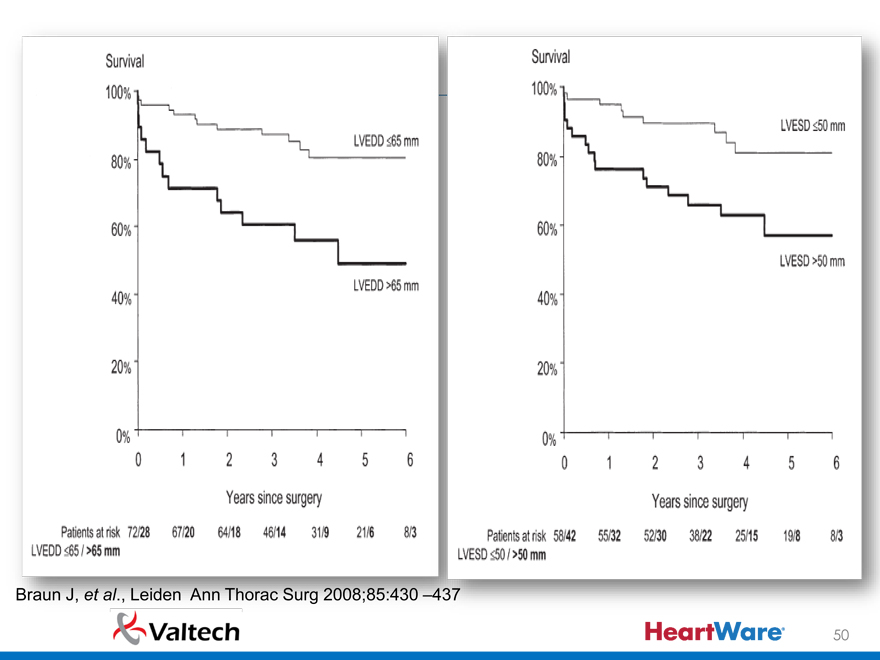

Braun J, et al., Leiden Ann Thorac Surg 2008;85:430 –437

50

|

|

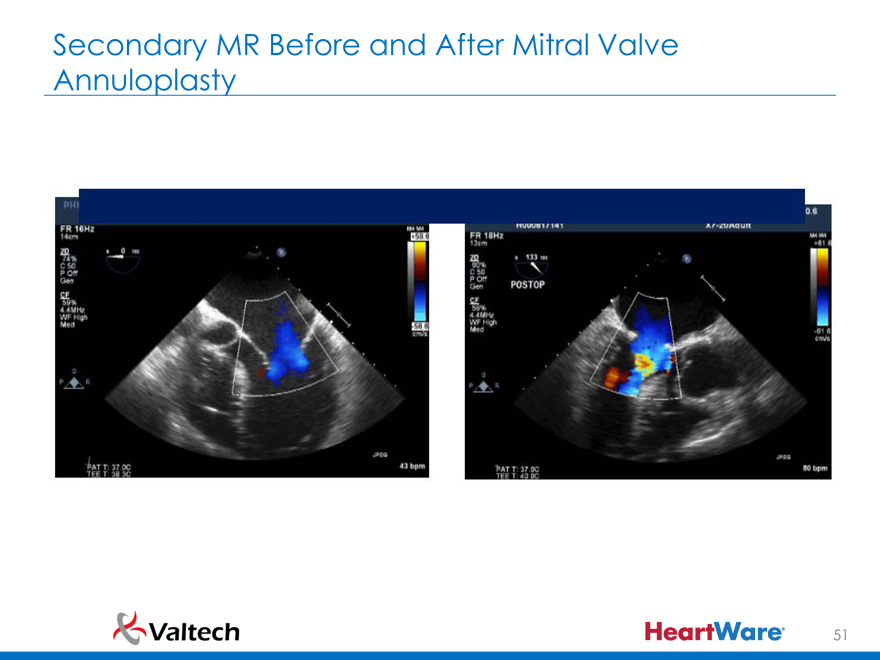

Secondary MR Before and After Mitral Valve Annuloplasty

51

|

|

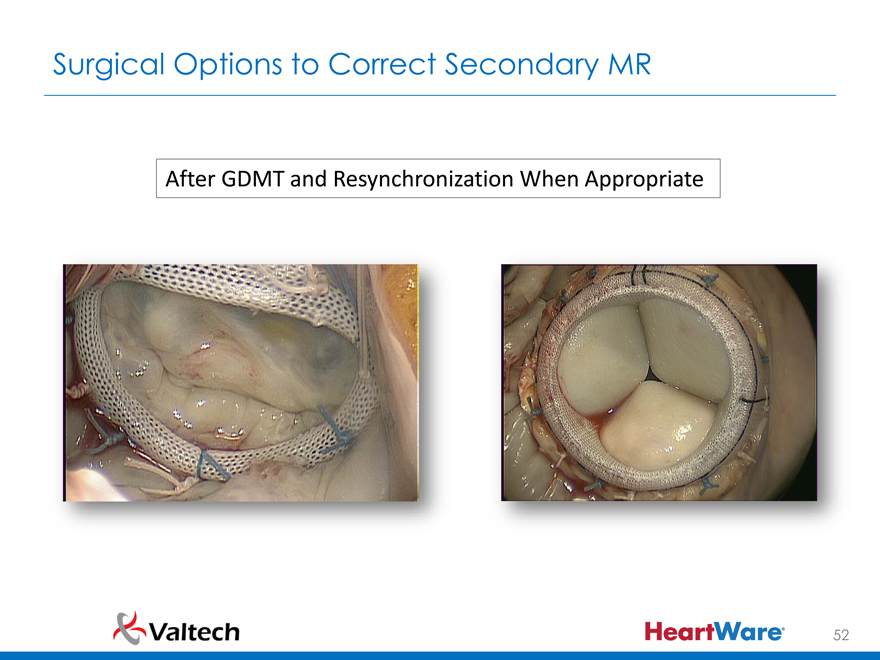

Surgical Options to Correct Secondary MR

After GDMT and Resynchronization When Appropriate

52

|

|

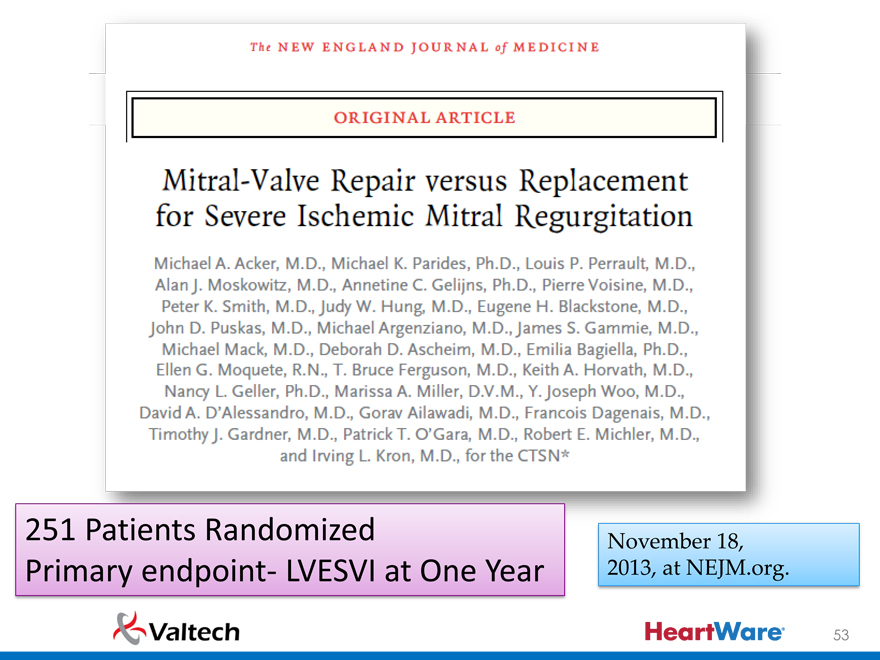

251 Patients Randomized November 18, Primary endpoint- LVESVI at One Year 2013, at NEJM.org.

53

|

|

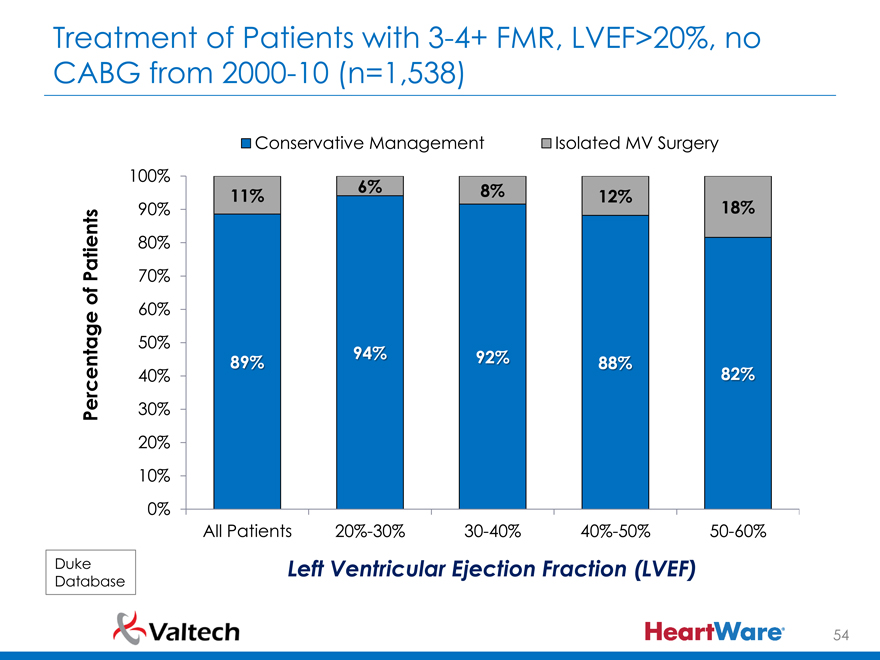

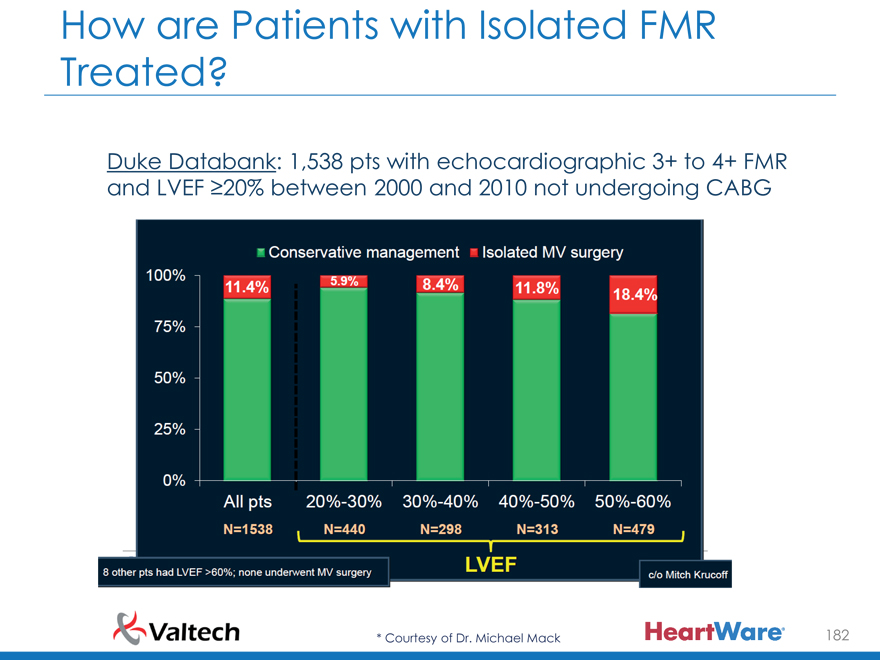

Treatment of Patients with 3-4+ FMR, LVEF>20%, no CABG from 2000-10 (n=1,538)

Conservative Management Isolated MV Surgery 100%

6% 8%

11% 12%

90% 18% 80%

Patients 70% of

60% 50%

% %

% %

40% %

Percentage 30% 20% 10% 0%

All Patients 20%-30% 30-40% 40%-50% 50-60%

Duke Left Ventricular Ejection Fraction (LVEF)

Database

54

|

|

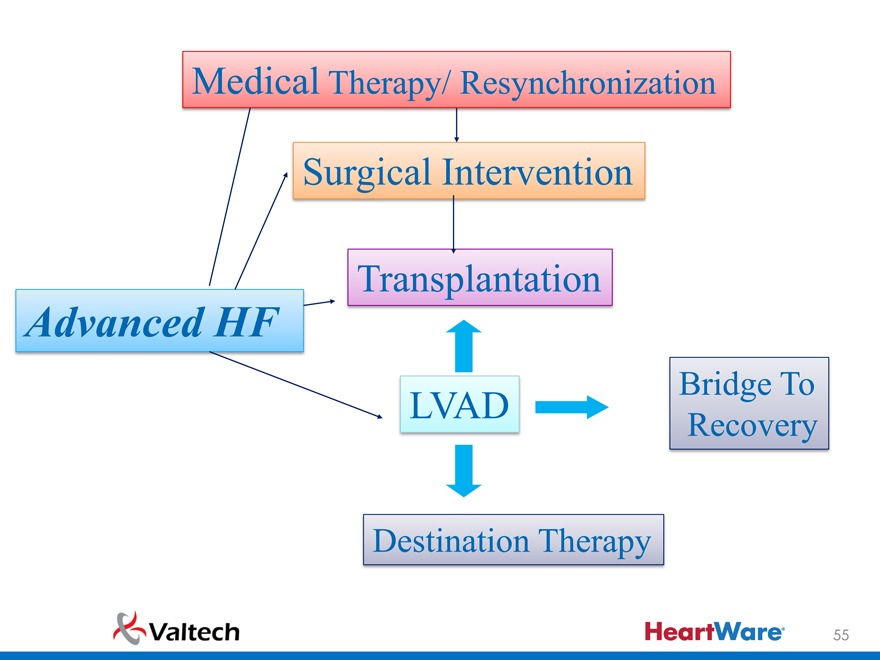

Medical Therapy/ Resynchronization

Surgical Intervention

Advanced HF Transplantation

Bridge To

LVAD

Recovery

Destination Therapy

55

|

|

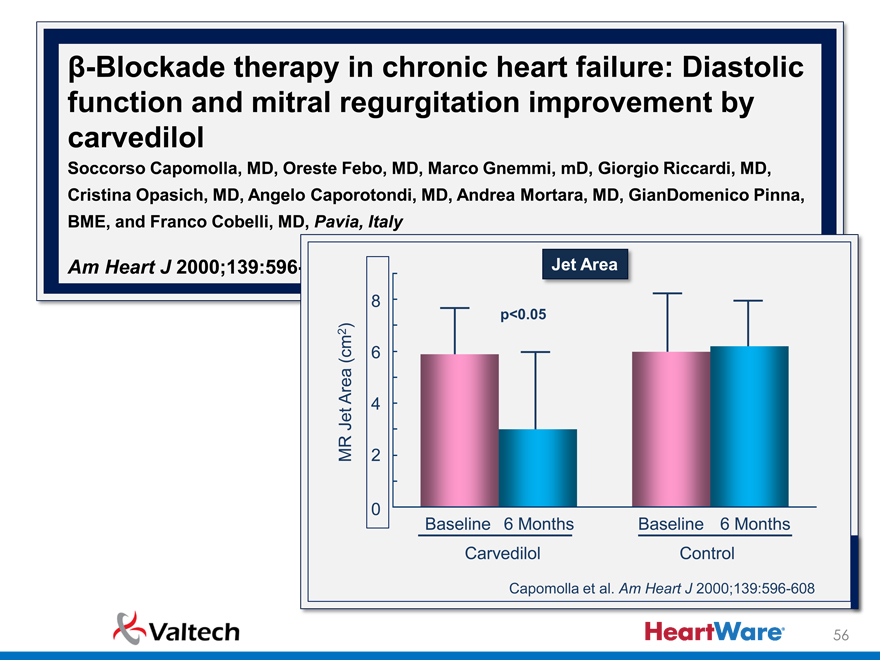

â-Blockade therapy in chronic heart failure: Diastolic function and mitral regurgitation improvement by carvedilol

Soccorso Capomolla, MD, Oreste Febo, MD, Marco Gnemmi, mD, Giorgio Riccardi, MD, Cristina Opasich, MD, Angelo Caporotondi, MD, Andrea Mortara, MD, GianDomenico Pinna, BME, and Franco Cobelli, MD, Pavia, Italy

Am Heart J 2000;139:596 Jet Area

9

88 p<0.05

) 2 7 (cm 66 Area 5 Jet 44

3

MR 22 1

00 Baseline 6 Months Baseline 6 Months Carvedilol Control

Capomolla et al. Am Heart J 2000;139:596-608

56

|

|

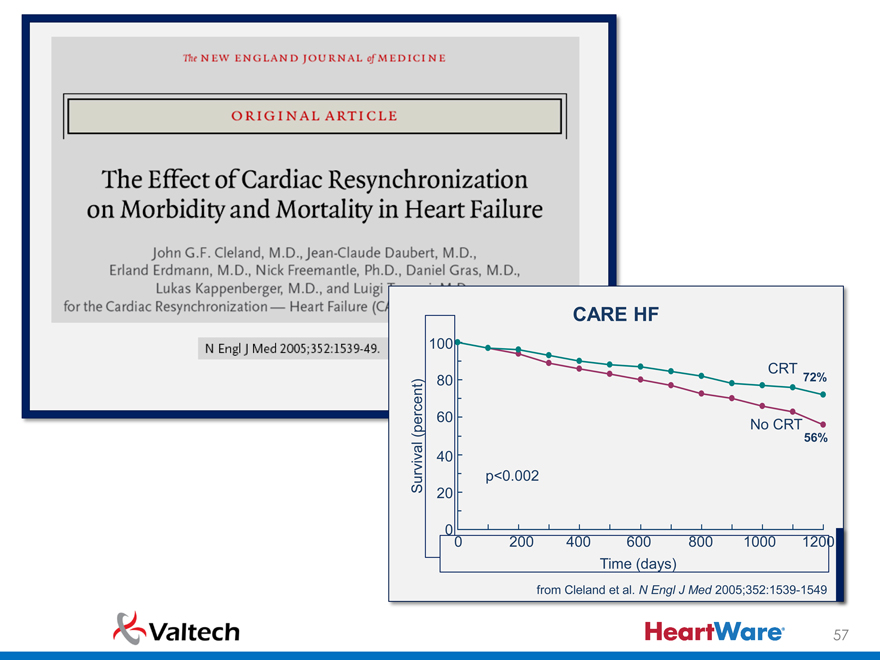

CARE HF

100

CRT

880 72%

(percent) 660 No CRT

56%

440

Survival p<0.002

220

00

0 200 400 600 800 1000 1200

0 1 2 3 4 5 6 7 8

Time (days)

from Cleland et al. N Engl J Med 2005;352:1539-1549

57

|

|

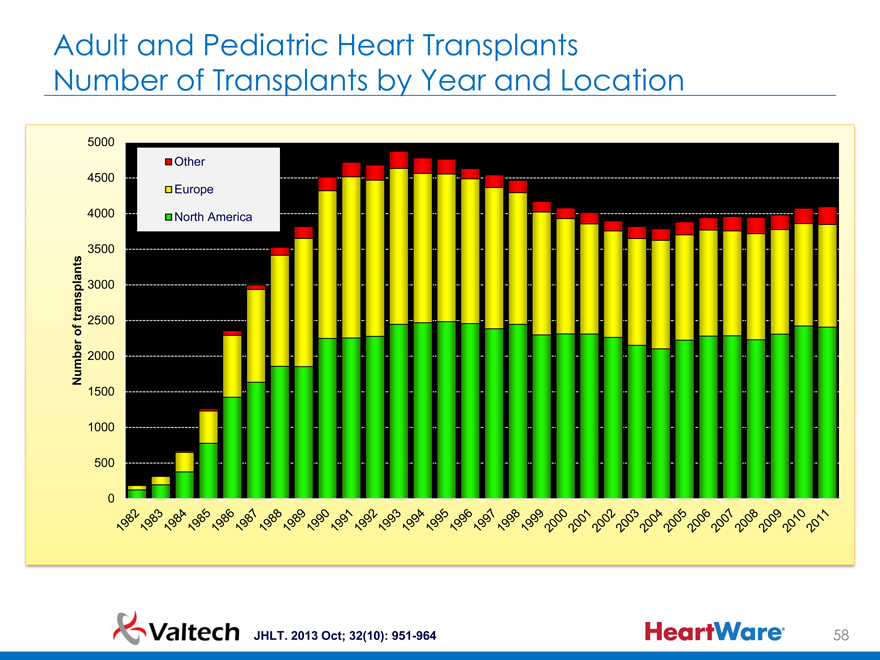

Adult and Pediatric Heart Transplants Number of Transplants by Year and Location

5000

Other 4500 Europe 4000 North America 3500 transplants 3000 of 2500

Number 2000 1500

1000 500 0

JHLT. 2013 Oct; 32(10): 951-964 58

|

|

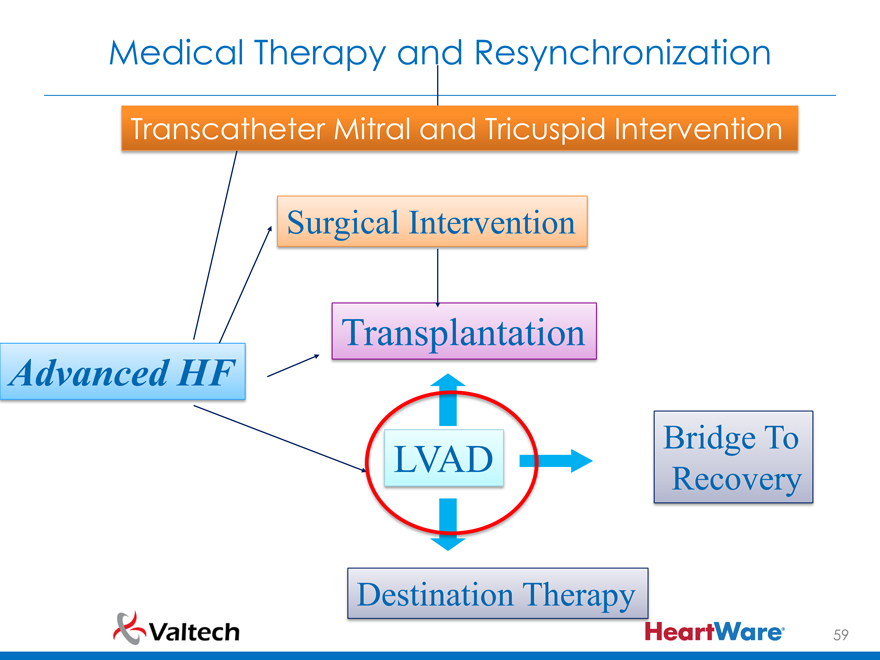

Medical Therapy and Resynchronization

Transcatheter Mitral and Tricuspid Intervention

Surgical Intervention

Advanced HF Transplantation

Bridge To Recovery

Destination Therapy

59

|

|

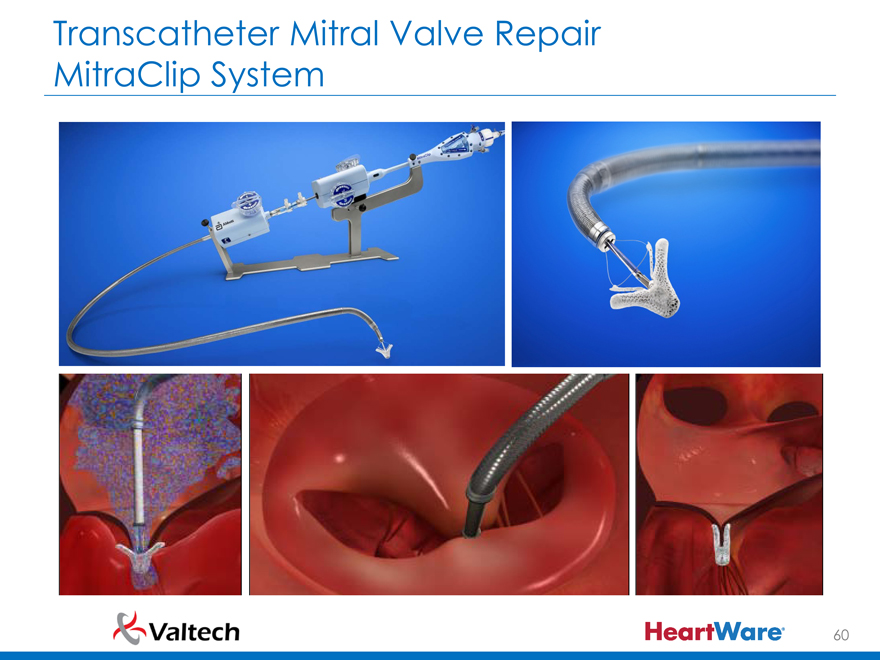

Transcatheter Mitral Valve Repair MitraClip System

60

|

|

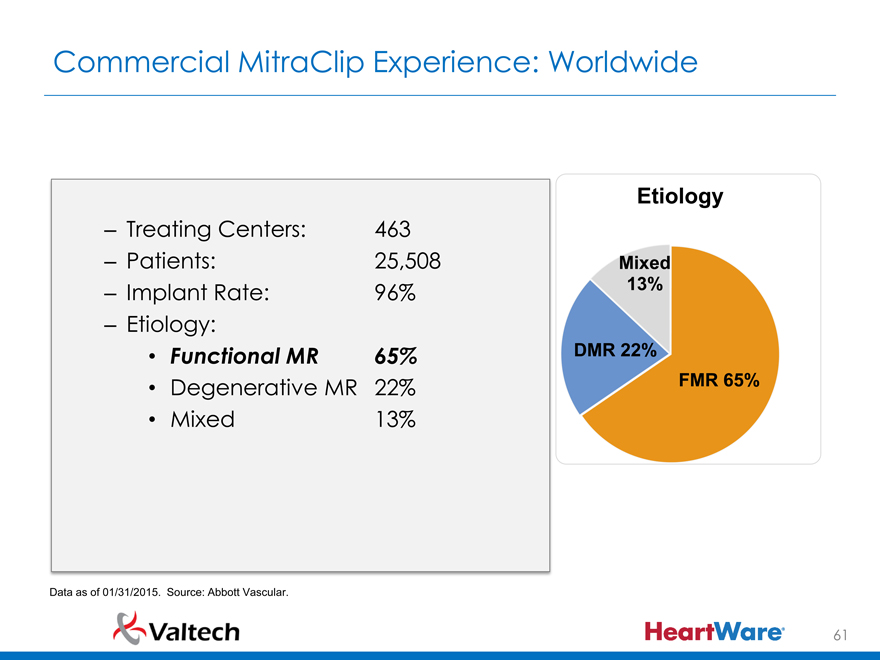

Commercial MitraClip Experience: Worldwide

– Treating Centers:

Patients:

Implant Rate:

Etiology:

Functional MR

Etiology

463

25,508 Mixed 96% 13%

65% DMR 22%

Degenerative MR 22% FMR 65%

Mixed 13%

Data as of 01/31/2015. Source: Abbott Vascular.

61

|

|

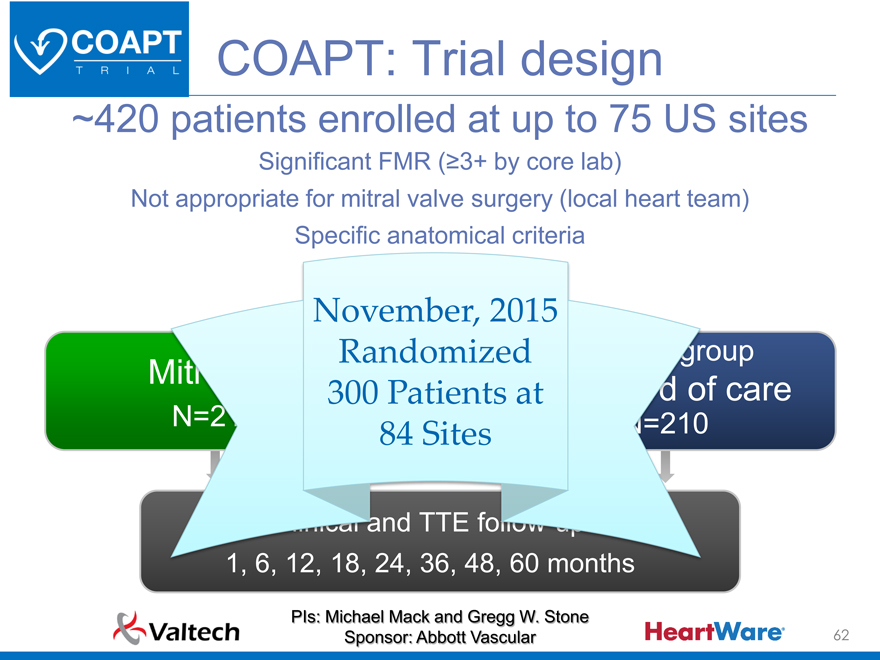

COAPT: Trial design

~420 patients enrolled at up to 75 US sites

Significant FMR (?3+ by core lab)

Not appropriate for mitral valve surgery (local heart team) Specific anatomical criteria

November, 2015

Randomized oup

M care

300 Patients at

84 Sites

PIs: Michael Mack and Gregg W. Stone

Sponsor: Abbott Vascular 62

|

|

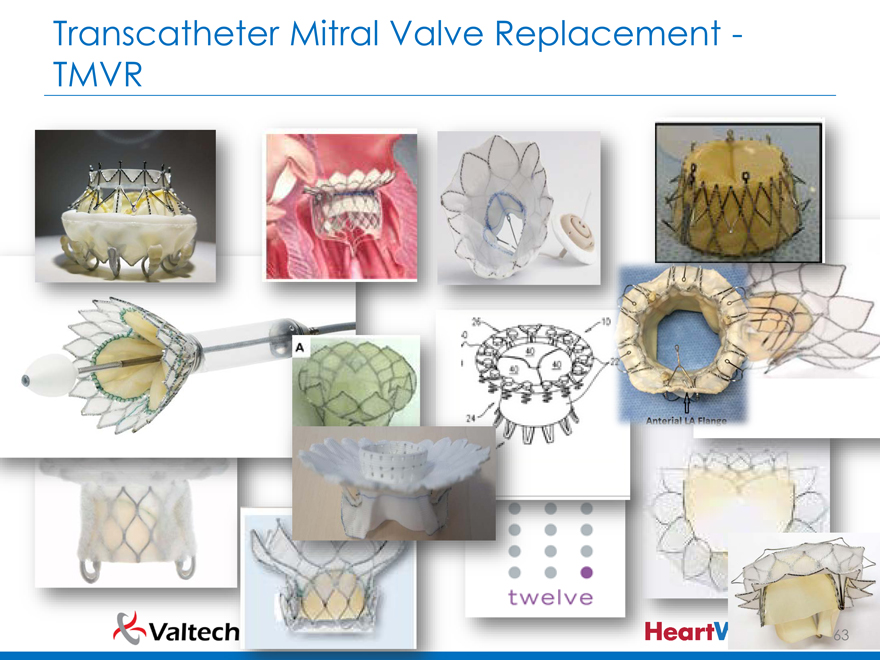

Transcatheter Mitral Valve Replacement -TMVR

63

|

|

64

|

|

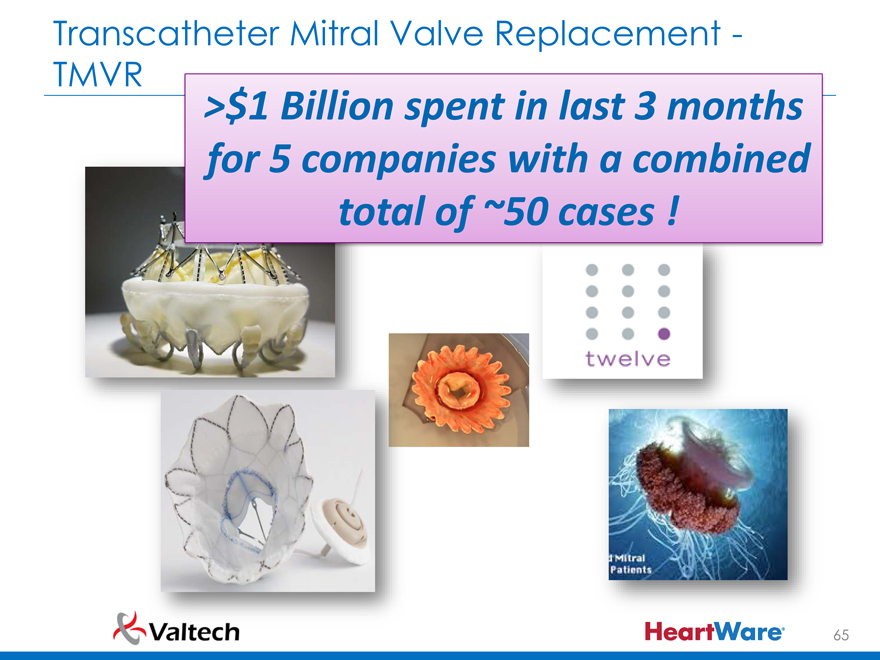

Transcatheter Mitral Valve Replacement -TMVR

>$1 Billion spent in last 3 months for 5 companies with a combined total of ~50 cases !

65

|

|

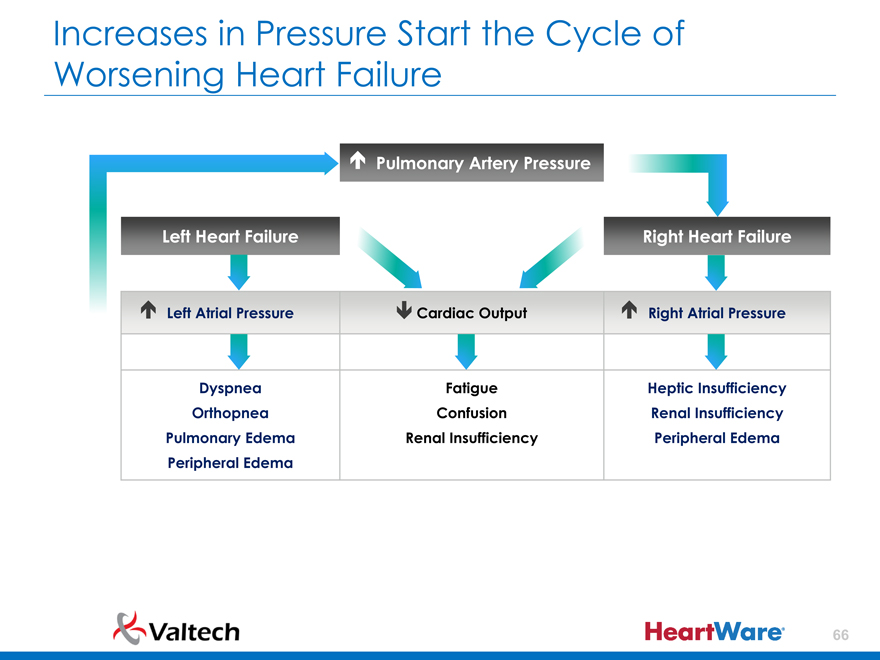

Increases in Pressure Start the Cycle of Worsening Heart Failure

Pulmonary Artery Pressure

Left Heart Failure

Right Heart Failure

Left Atrial Pressure Cardiac Output Right Atrial Pressure

Dyspnea Fatigue Heptic Insufficiency

Orthopnea Confusion Renal Insufficiency

Pulmonary Edema Renal Insufficiency Peripheral Edema

Peripheral Edema

66

|

|

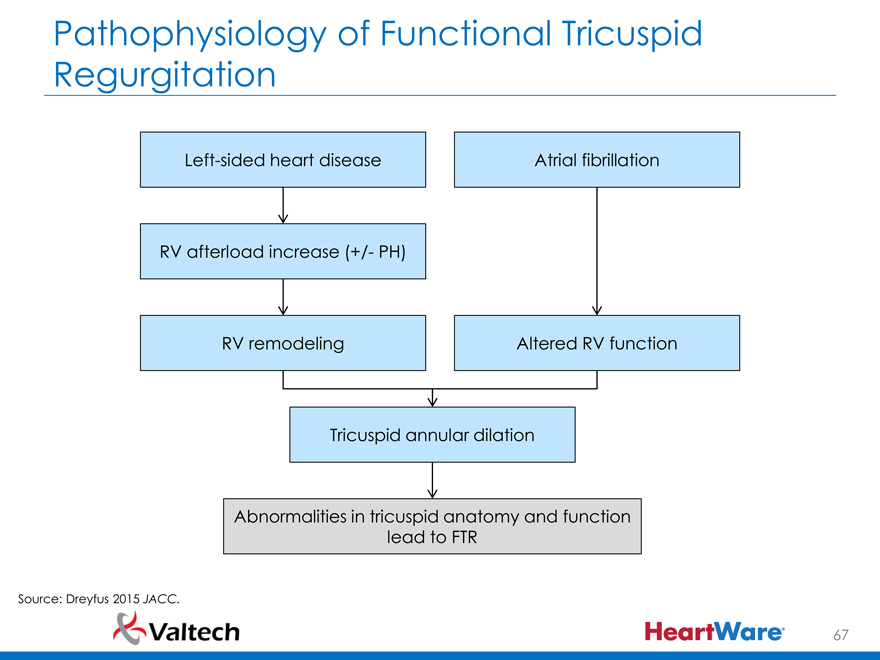

Pathophysiology of Functional Tricuspid Regurgitation

Left-sided heart disease

Atrial fibrillation

RV afterload increase (+/- PH)

RV remodeling

Altered RV function

Tricuspid annular dilation

Abnormalities in tricuspid anatomy and function lead to FTR

Source: Dreyfus 2015 JACC.

67

|

|

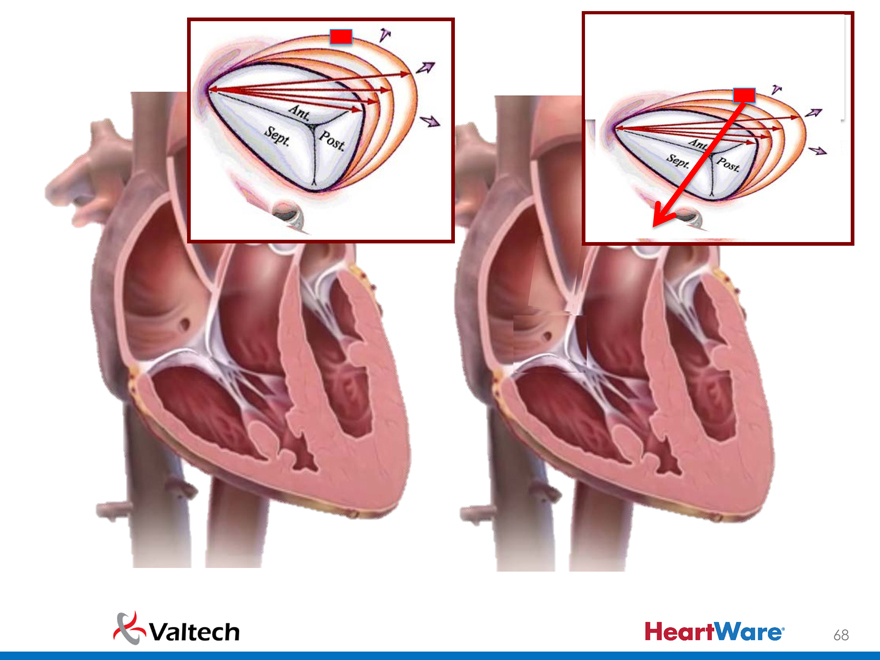

68

|

|

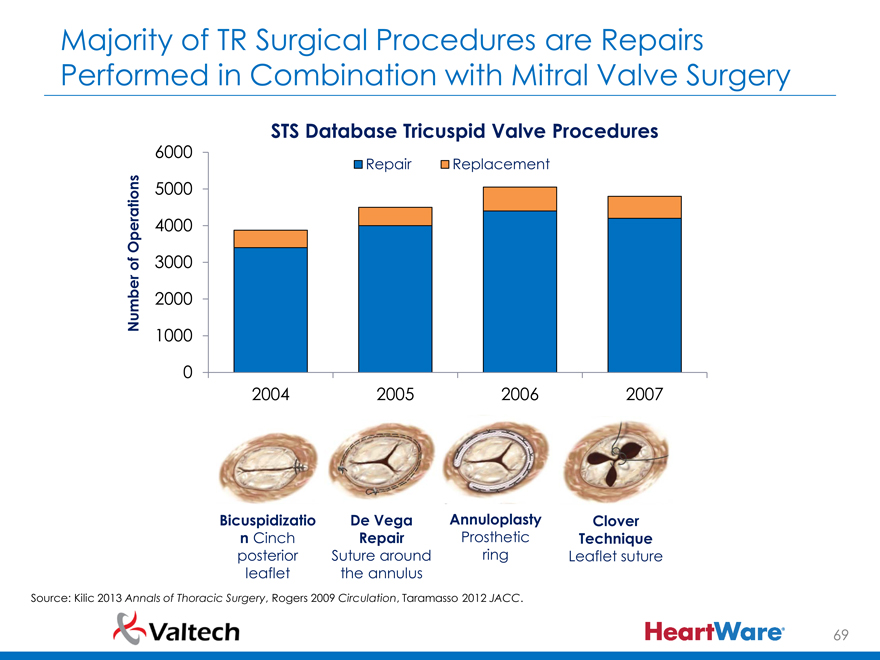

Majority of TR Surgical Procedures are Repairs Performed in Combination with Mitral Valve Surgery

STS Database Tricuspid Valve Procedures

6000

Repair Replacement

5000

Operations 4000

of 3000

Number 2000

1000

0

2004 2005 2006 2007

Bicuspidizatio De Vega Annuloplasty Clover

n Cinch Repair Prosthetic Technique

posterior Suture around ring Leaflet suture

leaflet the annulus

Source: Kilic 2013 Annals of Thoracic Surgery, Rogers 2009 Circulation, Taramasso 2012 JACC.

69

|

|

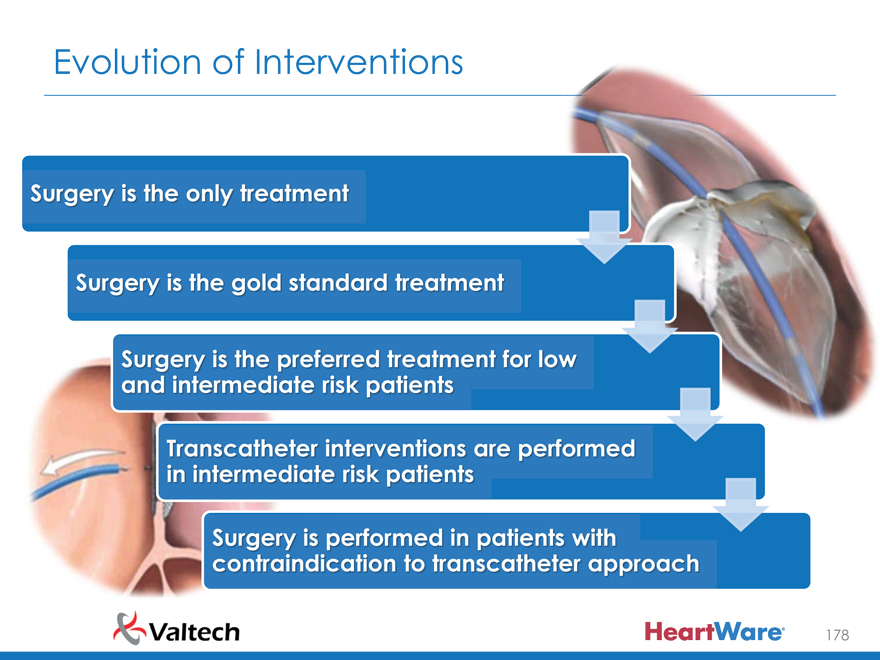

FMR / FTR Summary

Advanced CHF is a growing problem with significant mortality and repeat hospitalization

Most patients with CHF have FMR and in very advanced stages FTR

GDMT and resynchronization therapy work

Surgery is seldom used

Transcatheter therapy and MCS are major opportunities

A vertically integrated device company capable of managing different stages of CHF disease state makes total sense

70

|

|

Valtech Portfolio Overview

Prof. Francesco Maisano, M.D., FESC

University Hospital of Zurich

71

|

|

Valtech Cardio Portfolio:

A Journey from Valve Surgery to Interventions

FRANCESCO MAISANO, MD

72

|

|

73

|

|

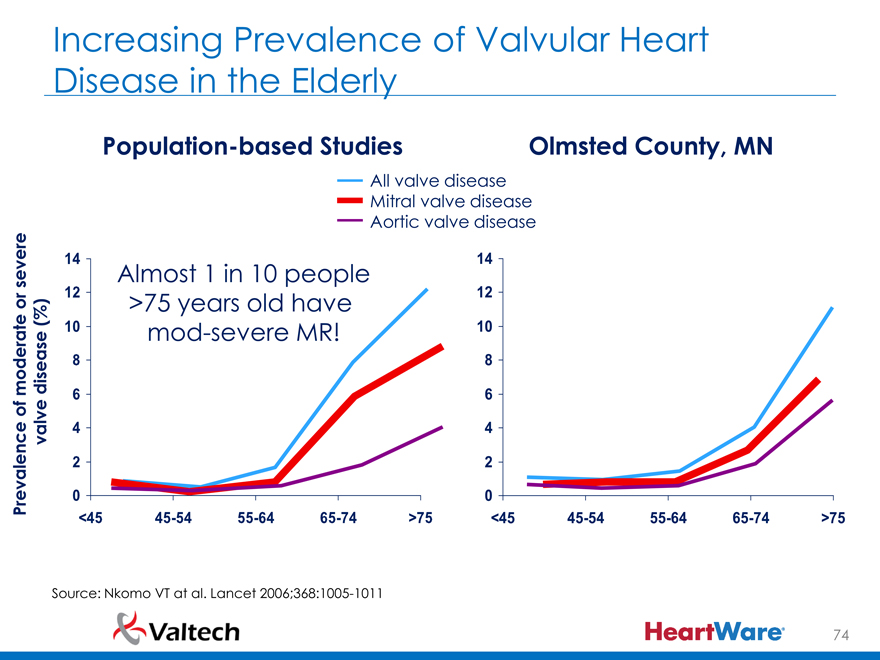

Increasing Prevalence of Valvular Heart Disease in the Elderly

Population-based Studies Olmsted County, MN

All valve disease Mitral valve disease Aortic valve disease

14 14

severe Almost 1 in 10 people or 12 >75 years old have 12

(%)

10 mod-severe MR! 10

moderate disease 8 8

6 6 of valve 4 4

2 2

Prevalence 0 0

<45 45-54 55-64 65-74 >75 <45 45-54 55-64 65-74 >75

Source: Nkomo VT at al. Lancet 2006;368:1005-1011

74

|

|

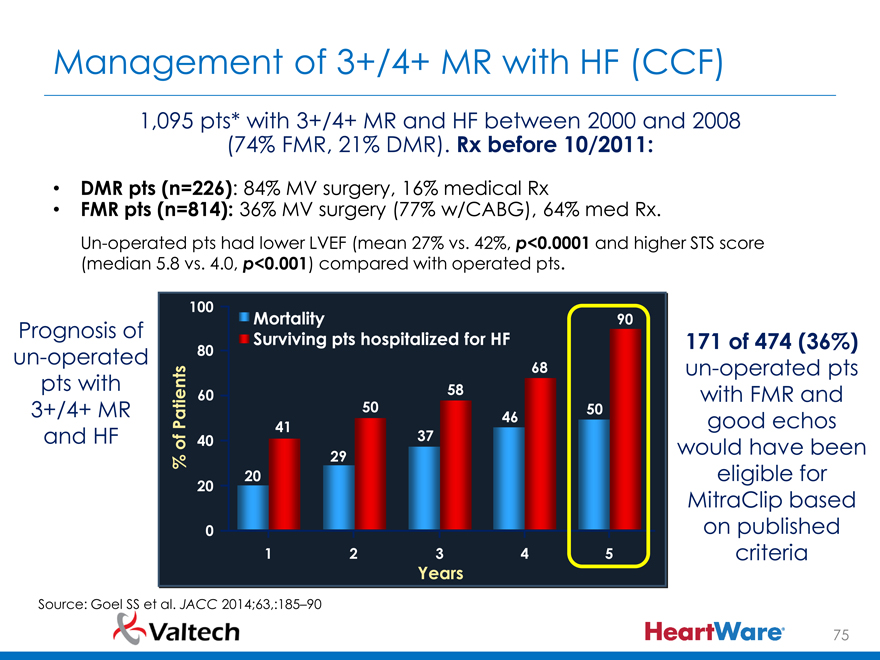

Management of 3+/4+ MR with HF (CCF)

1,095 pts* with 3+/4+ MR and HF between 2000 and 2008 (74% FMR, 21% DMR). Rx before 10/2011:

DMR pts (n=226): 84% MV surgery, 16% medical Rx

FMR pts (n=814): 36% MV surgery (77% w/CABG), 64% med Rx.

Un-operated pts had lower LVEF (mean 27% vs. 42%, p<0.0001 and higher STS score (median 5.8 vs. 4.0, p<0.001) compared with operated pts.

100

Prognosis of Mortality 90

Surviving pts hospitalized for HF 171 of 474 (36%)

un-operated 80

68 un-operated pts pts with 58 60 with FMR and 3+/4+ MR 50 50 Patients 46 good echos

41

and HF 40 37 of would have been

29

% eligible for

20 20

MitraClip based 0 on published

1 2 3 4 5 criteria

Years

Source: Goel SS et al. JACC 2014;63,:185–90

75

|

|

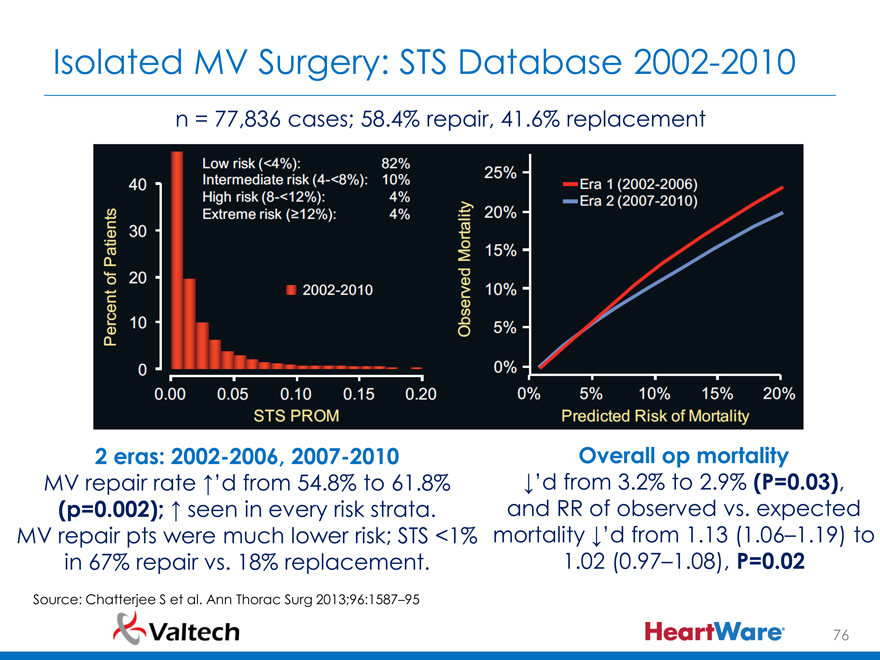

Isolated MV Surgery: STS Database 2002-2010

n = 77,836 cases; 58.4% repair, 41.6% replacement

2 eras: 2002-2006, 2007-2010 Overall op mortality

MV repair rate ’d from 54.8% to 61.8% ?’d from 3.2% to 2.9% (P=0.03),

(p=0.002); seen in every risk strata. and RR of observed vs. expected

MV repair pts were much lower risk; STS <1% mortality ?’d from 1.13 (1.06–1.19) to

in 67% repair vs. 18% replacement. 1.02 (0.97–1.08), P=0.02

Source: Chatterjee S et al. Ann Thorac Surg 2013;96:1587–95

76

|

|

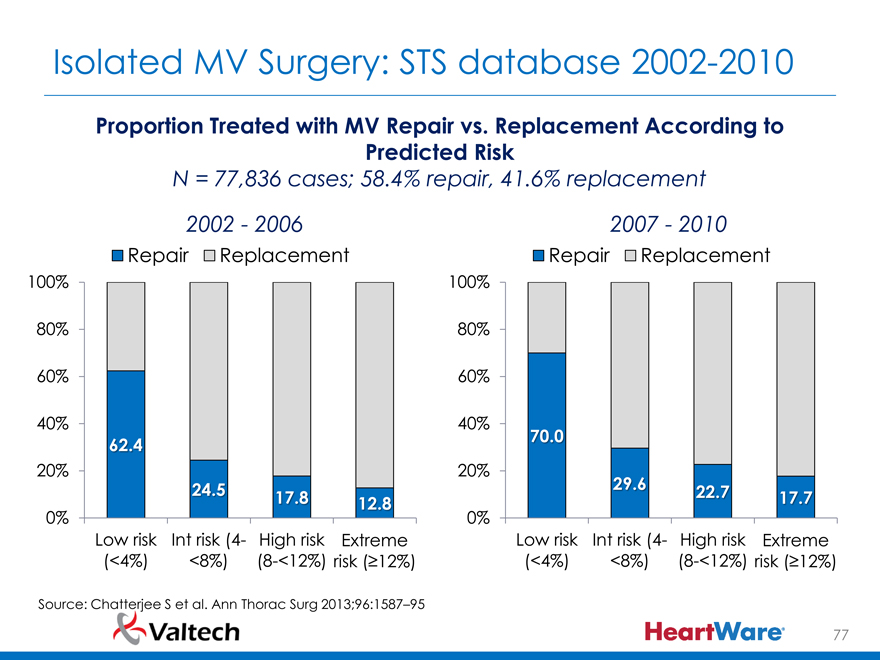

Isolated MV Surgery: STS database 2002-2010

Proportion Treated with MV Repair vs. Replacement According to Predicted Risk

N = 77,836 cases; 58.4% repair, 41.6% replacement

2002—2006 2007—2010

Repair Replacement Repair Replacement

100% 100% 80% 80% 60% 60%

40% 40%

70.0

62.4

20% 20%

24.5 29.6 22.7

17.8 12.8 17.7

0% 0%

Low risk Int risk (4- High risk Extreme Low risk Int risk (4- High risk Extreme (<4%) <8%) (8-<12%) risk (?12%) (<4%) <8%) (8-<12%) risk (?12%)

Source: Chatterjee S et al. Ann Thorac Surg 2013;96:1587–95

77

|

|

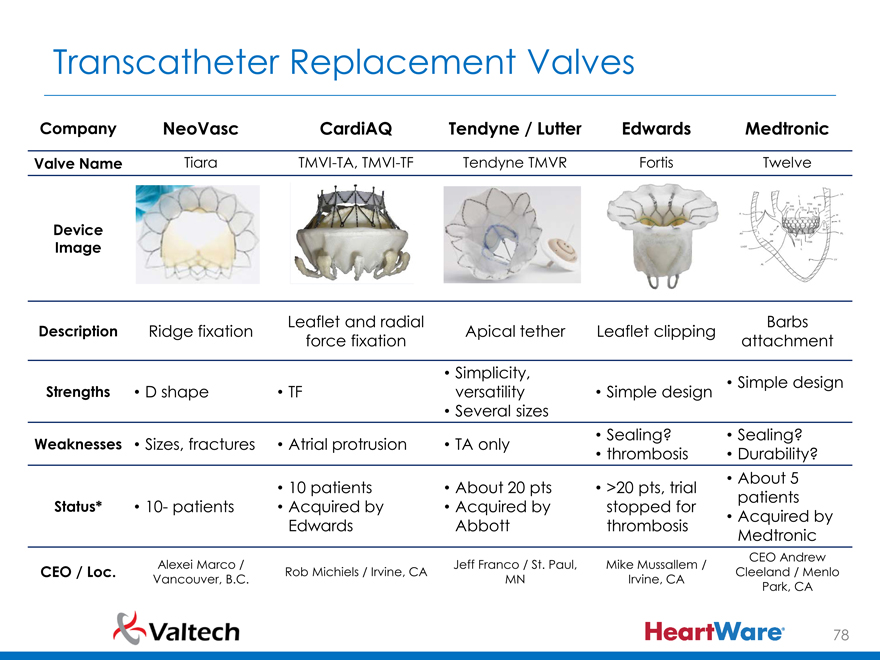

Transcatheter Replacement Valves

Company NeoVasc CardiAQ Tendyne / Lutter Edwards Medtronic

Valve Name Tiara TMVI-TA, TMVI-TF Tendyne TMVR Fortis Twelve

Device

Image

Leaflet and radial Barbs

Description Ridge fixation Apical tether Leaflet clipping

force fixation attachment

Simplicity,

Strengths D shape TF versatility Simple design Simple design

Several sizes

Sealing? Sealing?

Weaknesses Sizes, fractures Atrial protrusion TA only thrombosis Durability?

10 patients About 20 pts >20 pts, trial About 5

Status* 10- patients Acquired by Acquired by stopped for patients

Edwards Abbott thrombosis Acquired by

Medtronic

Alexei Marco / Jeff Franco / St. Paul, Mike Mussallem / CEO Andrew

CEO / Loc. Rob Michiels / Irvine, CA Cleeland / Menlo

Vancouver, B.C. MN Irvine, CA Park, CA

78

|

|

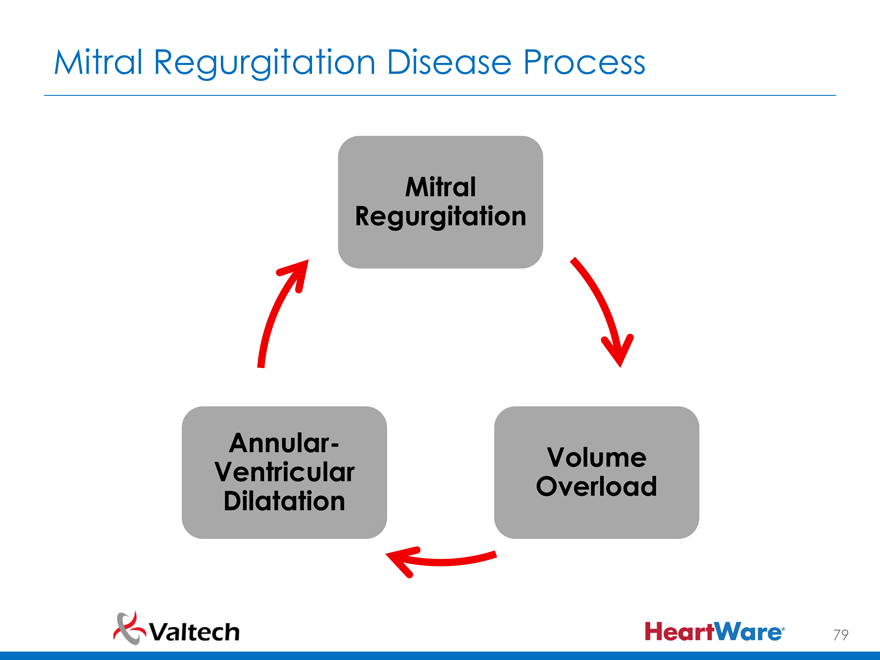

Mitral Regurgitation Disease Process

Mitral

Regurgitation

Annular- Volume

Ventricular Overload

Dilatation

79

|

|

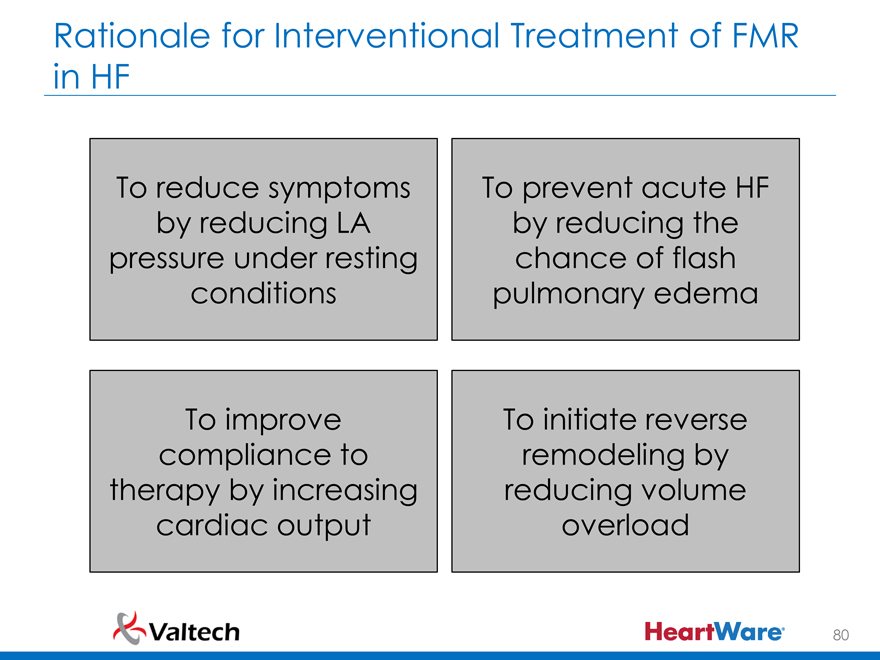

Rationale for Interventional Treatment of FMR in HF

To reduce symptoms To prevent acute HF

by reducing LA by reducing the

pressure under resting chance of flash

conditions pulmonary edema

To improve To initiate reverse

compliance to remodeling by

therapy by increasing reducing volume

cardiac output overload

80

|

|

LA pressure acute reduction in a HF patient undergoing adjustable transcatheter mitral annuloplasty

81

|

|

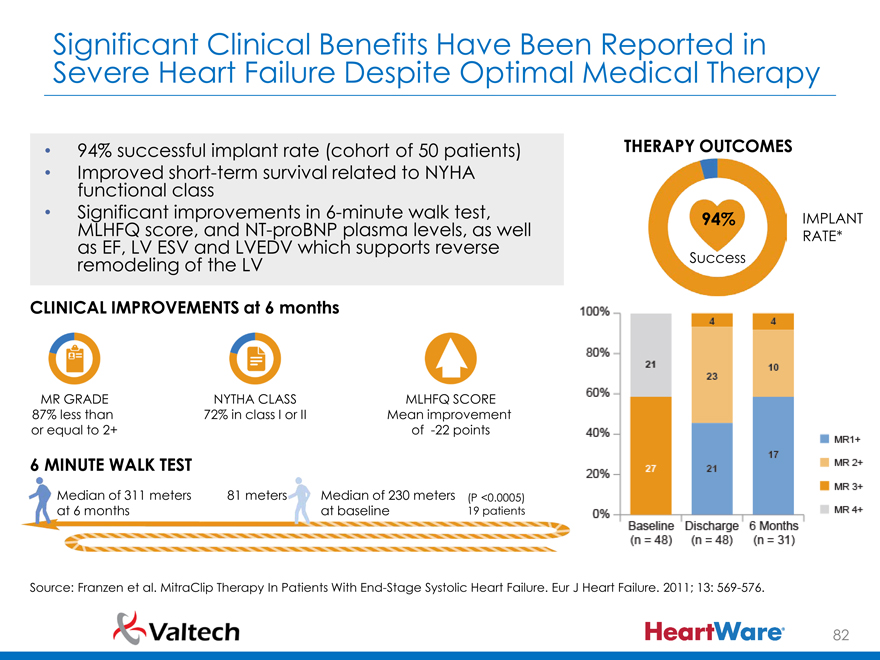

Significant Clinical Benefits Have Been Reported in Severe Heart Failure Despite Optimal Medical Therapy

94% successful implant rate (cohort of 50 patients) THERAPY OUTCOMES

Improved short-term survival related to NYHA

functional class

Significant improvements in 6-minute walk test, 94% IMPLANT

MLHFQ score, and NT-proBNP plasma levels, as well RATE*

as EF, LV ESV and LVEDV which supports reverse

remodeling of the LV Success

CLINICAL IMPROVEMENTS at 6 months

MR GRADE NYTHA CLASS MLHFQ SCORE

87% less than 72% in class I or II Mean improvement

or equal to 2+ of -22 points

6 MINUTE WALK TEST

Median of 311 meters 81 meters Median of 230 meters(P <0.0005)

at 6 months at baseline 19 patients

Source: Franzen et al. MitraClip Therapy In Patients With End-Stage Systolic Heart Failure. Eur J Heart Failure. 2011; 13: 569-576.

82

|

|

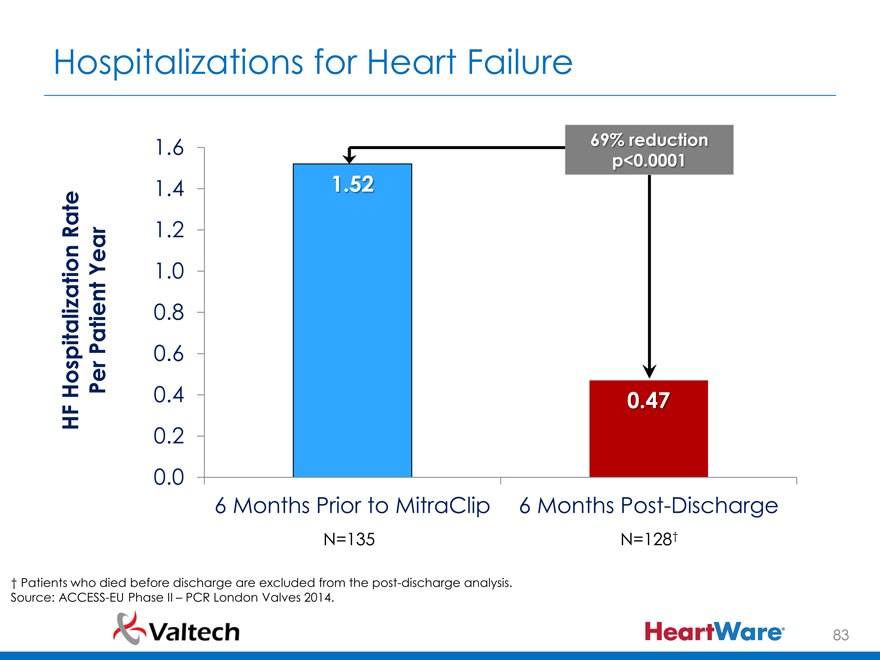

Hospitalizations for Heart Failure

1.6 % reduction 0.0001

1.4 1.52 Rate 1.2 Year

1.0

Patient 0.8 Hospitalization Per 0.6

0.4 0.47 HF

0.2 0.0

6 Months Prior to MitraClip 6 Months Post-Discharge

N=135 N=128†

† Patients who died before discharge are excluded from the post-discharge analysis.

Source: ACCESS-EU Phase II – PCR London Valves 2014.

83

|

|

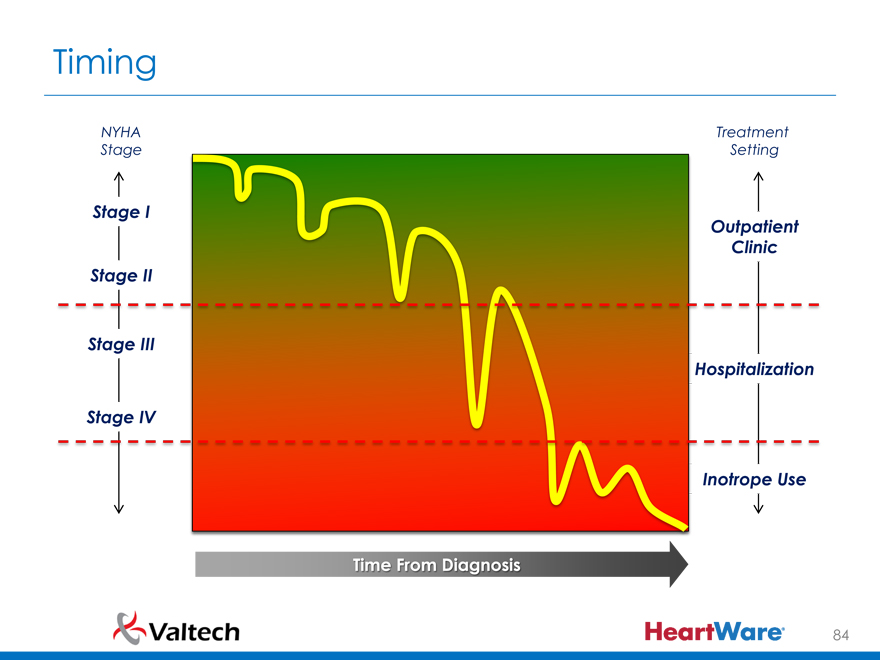

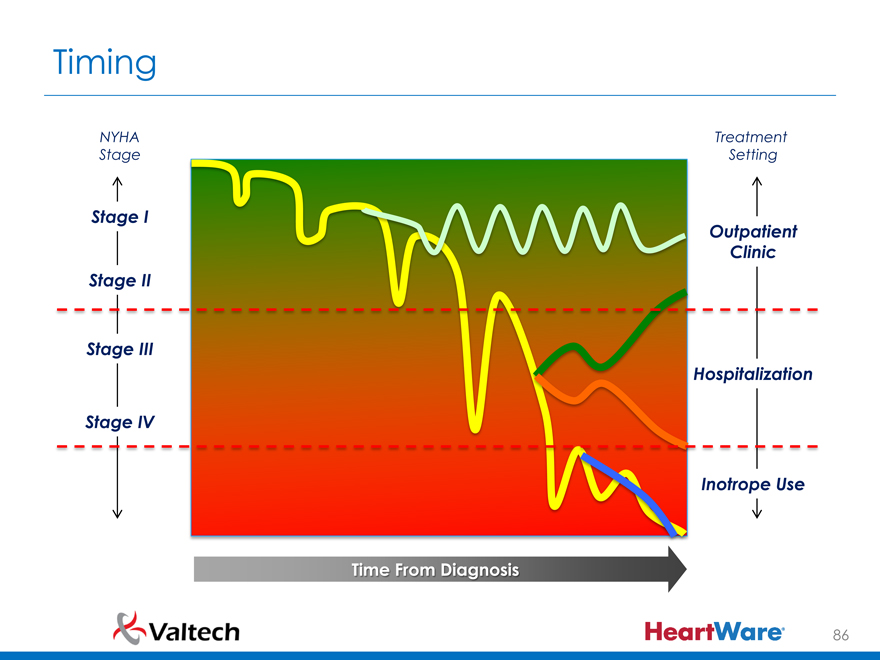

Timing

NYHA Treatment Stage Setting

Stage I

Outpatient Clinic Stage II

Stage III

Hospitalization

Stage IV

Inotrope Use

Time From Diagnosis

84

|

|

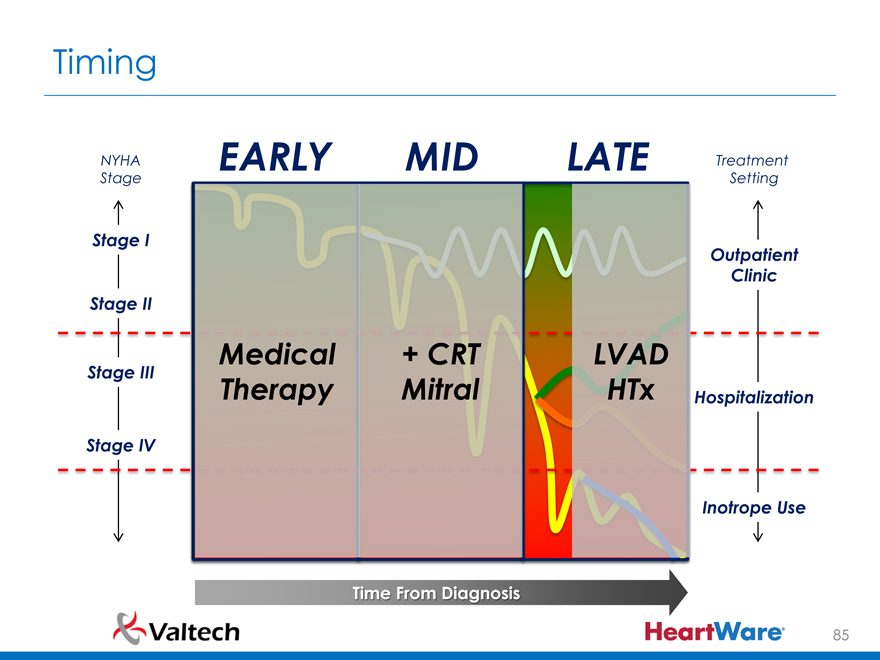

Timing

NYHA EARLY MID LATE Treatment Stage Setting

Stage I

Outpatient Clinic Stage II

Medical + CRT LVAD Stage III Therapy Mitral HTx

Hospitalization

Stage IV

Inotrope Use

Time From Diagnosis

85

|

|

Timing

NYHA Treatment Stage Setting

Stage I

Outpatient Clinic Stage II

Stage III

Hospitalization

Stage IV

Inotrope Use

Time From Diagnosis

86

|

|

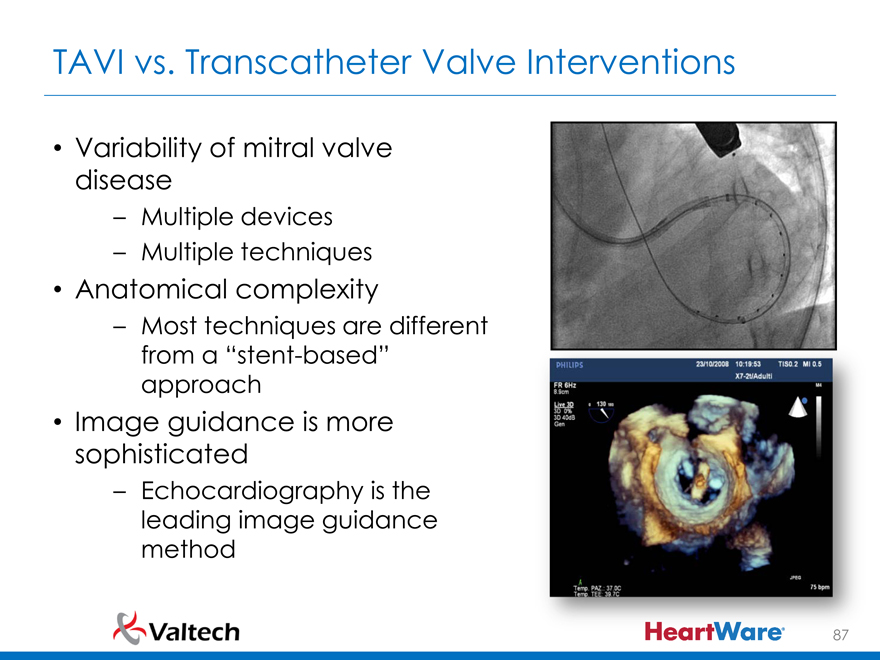

TAVI vs. Transcatheter Valve Interventions

Variability of mitral valve

disease

– Multiple devices

– Multiple techniques

Anatomical complexity

– Most techniques are different

from a “stent-based”

approach

Image guidance is more

sophisticated

– Echocardiography is the

leading image guidance

method

87

|

|

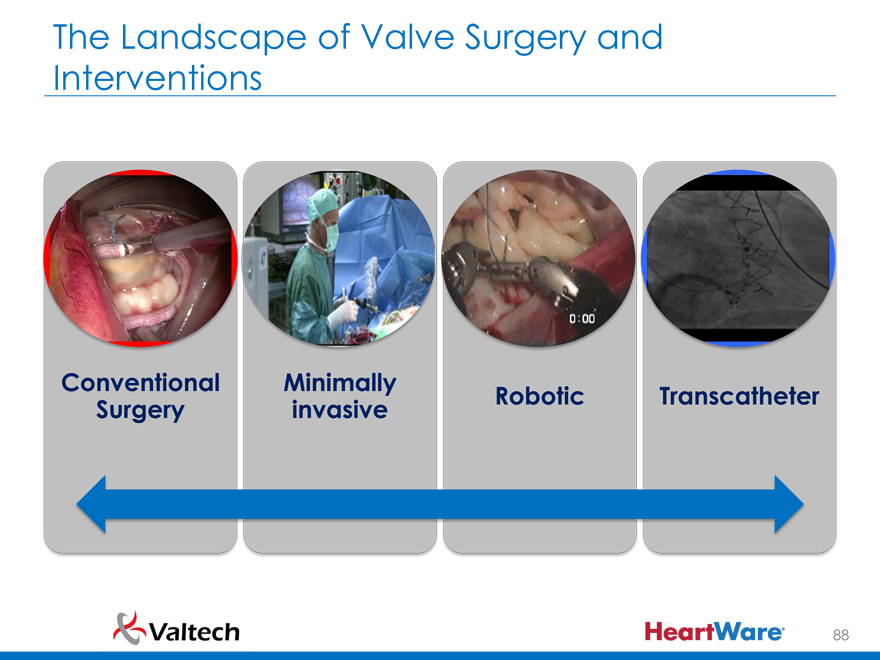

The Landscape of Valve Surgery and Interventions

Conventional Minimally

Robotic Transcatheter Surgery invasive

88

|

|

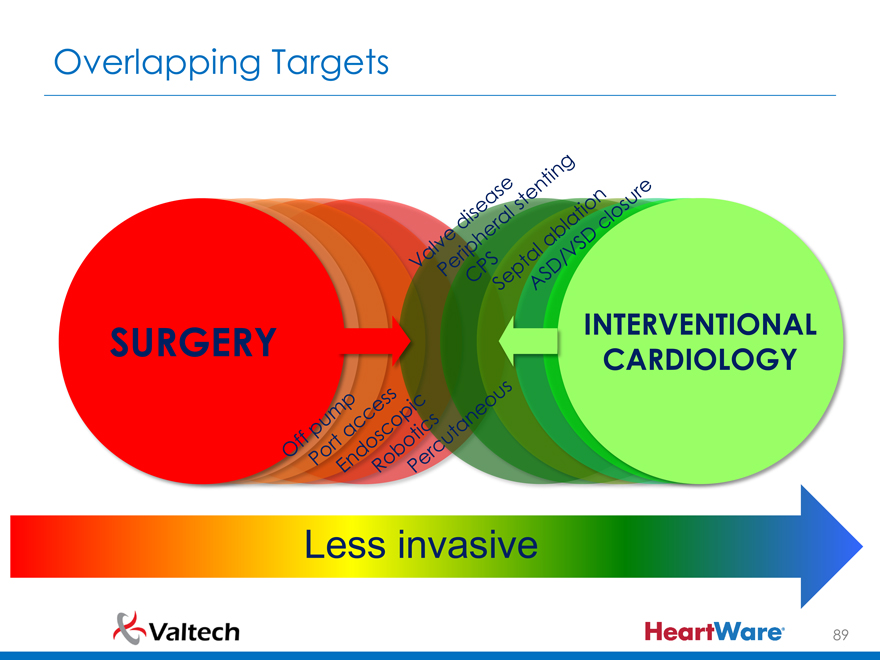

Overlapping Targets

SURGERY INTERVENTIONAL CARDIOLOGY

Less invasive

89

|

|

TEAMWORK

90

|

|

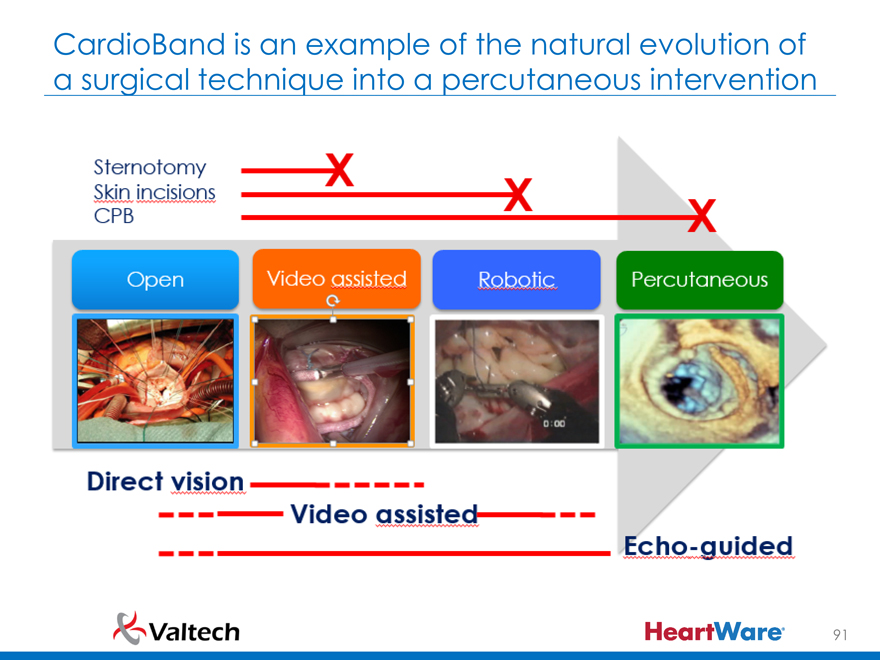

CardioBand is an example of the natural evolution of a surgical technique into a percutaneous intervention

91

|

|

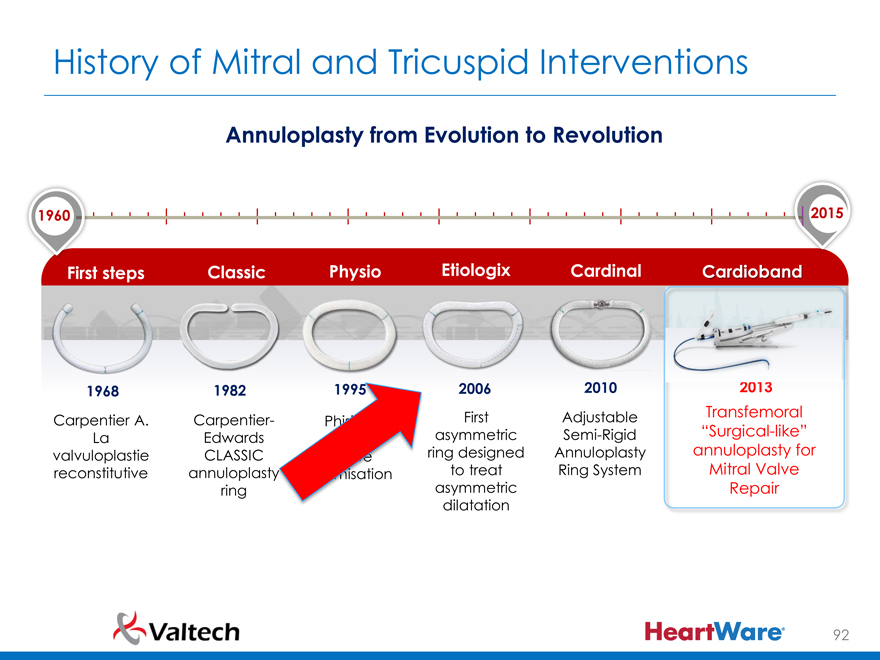

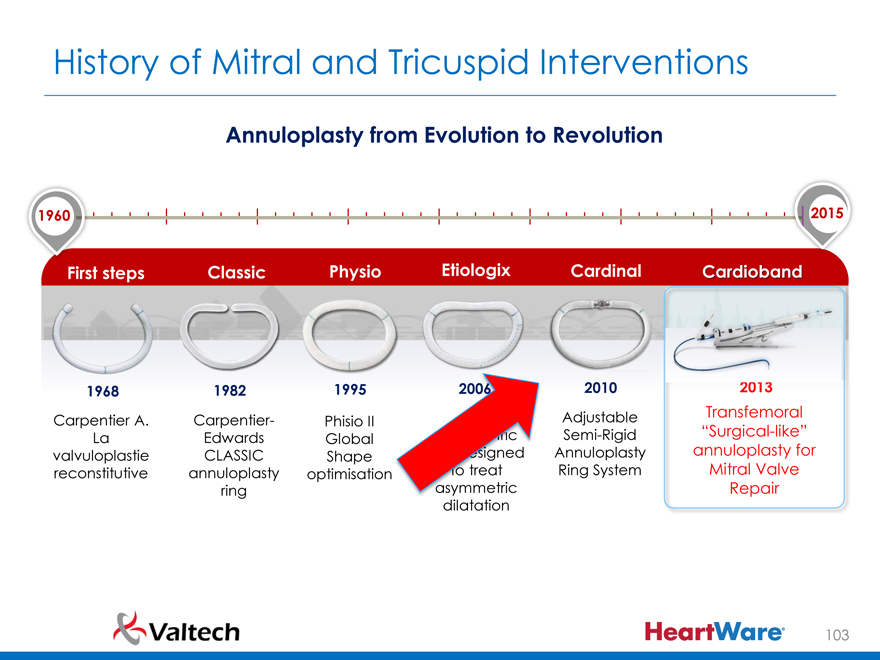

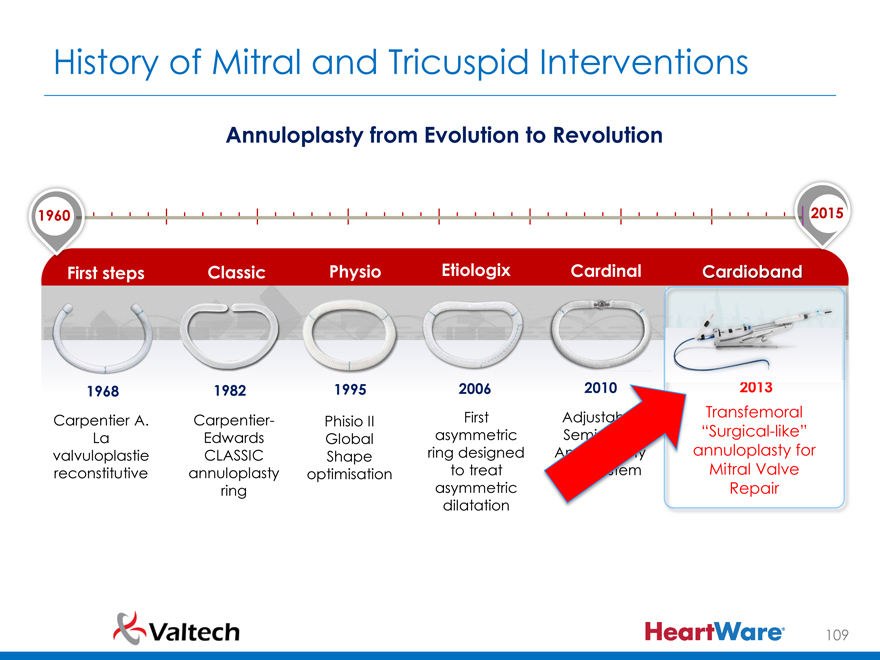

History of Mitral and Tricuspid Interventions

Annuloplasty from Evolution to Revolution

1960 2015

First steps Classic Physio Etiologix Cardinal Cardioband

1968 1982 2006 2010

Carpentier A. Carpentier- First Adjustable

La Edwards asymmetric Semi-Rigid

valvuloplastie CLASSIC ring designed Annuloplasty

reconstitutive annuloplast to treat Ring System

ring asymmetric

dilatation

92

|

|

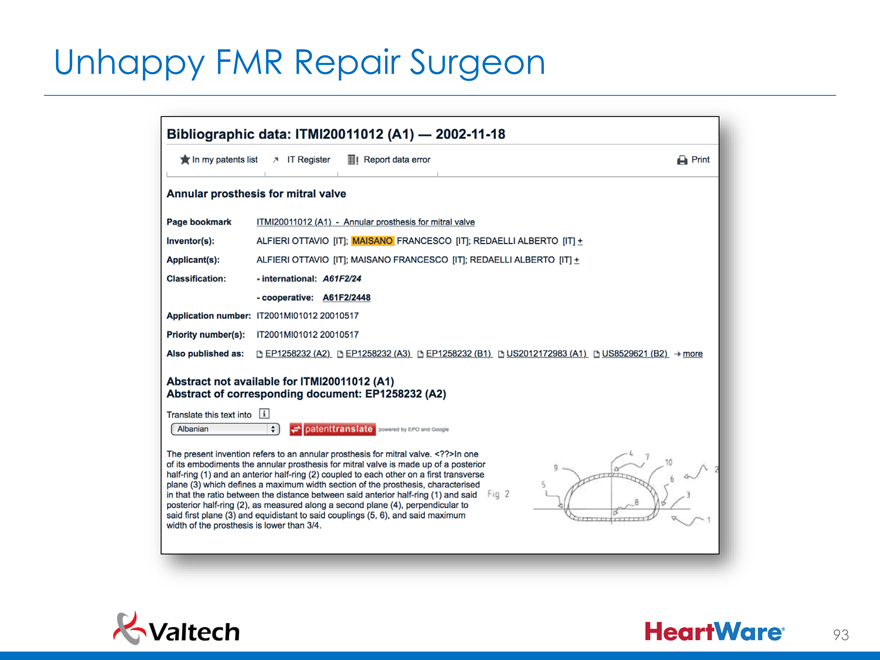

Unhappy FMR Repair Surgeon

93

|

|

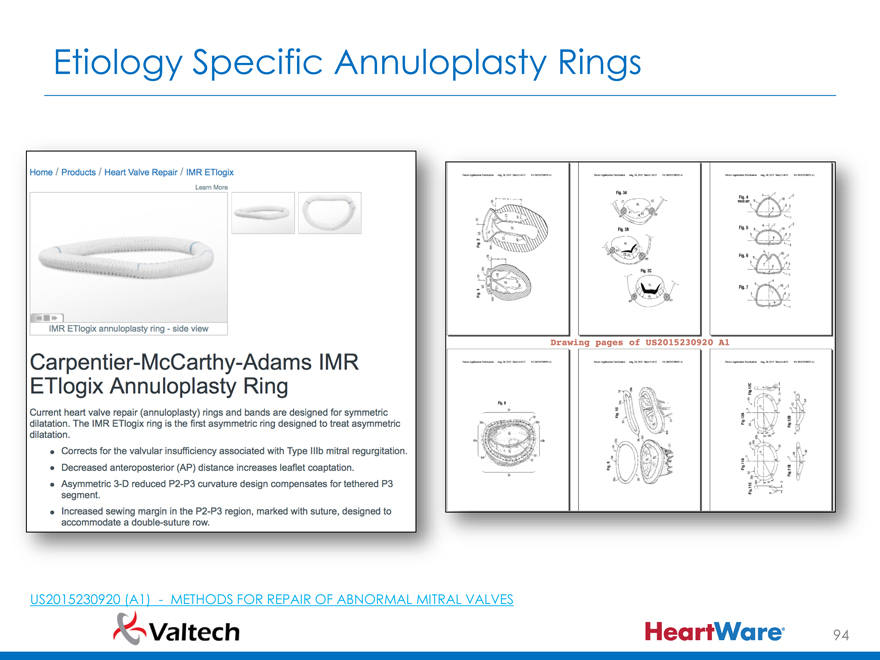

Etiology Specific Annuloplasty Rings

US2015230920 (A1)—METHODS FOR REPAIR OF ABNORMAL MITRAL VALVES

94

|

|

Maisano et al. J Am Coll Cardiol 2011;58: 2174–82

95

|

|

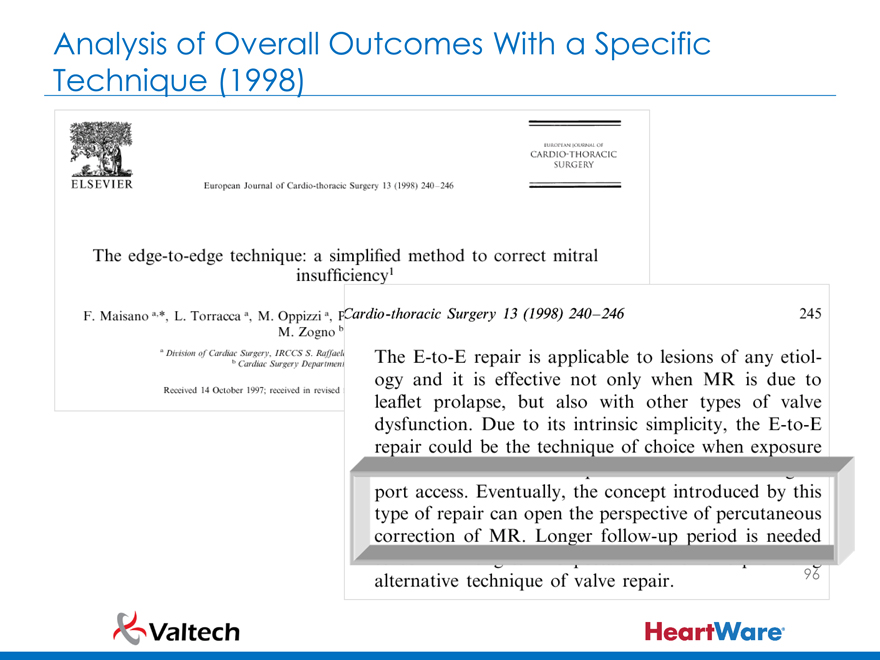

Analysis of Overall Outcomes With a Specific Technique (1998)

96

|

|

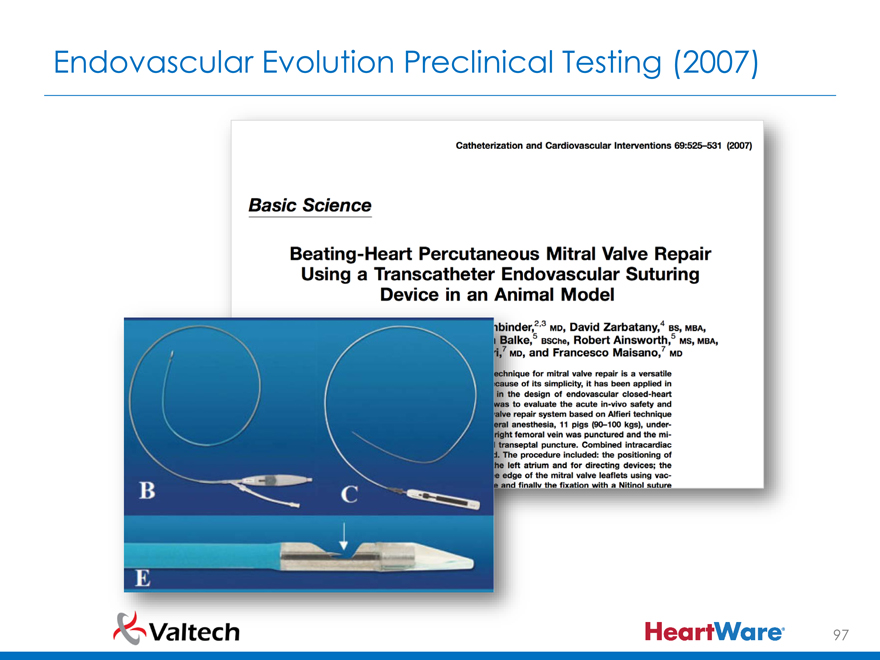

Endovascular Evolution Preclinical Testing (2007)

97

|

|

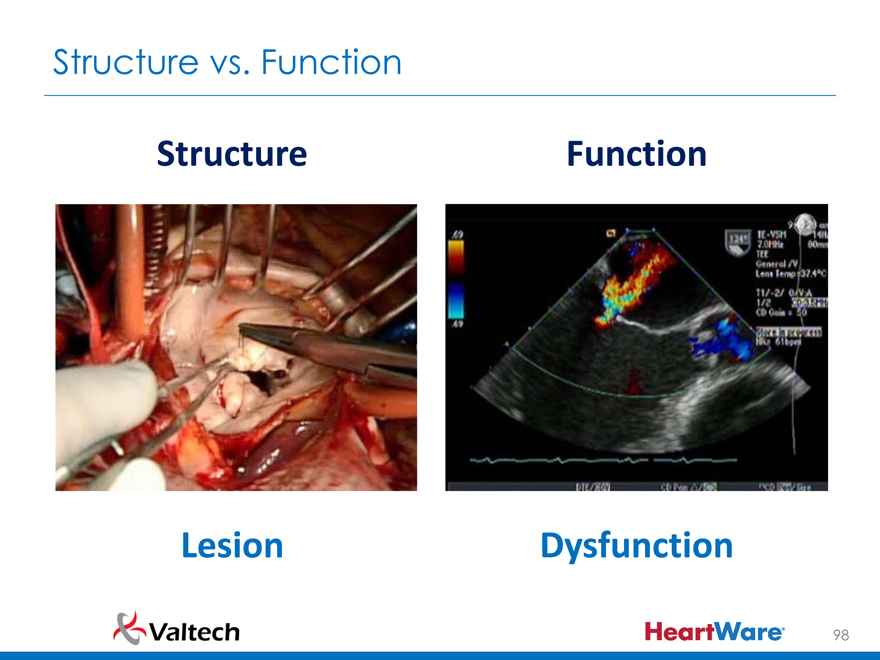

Structure vs. Function

Structure

Function

Lesion

Dysfunction

98

|

|

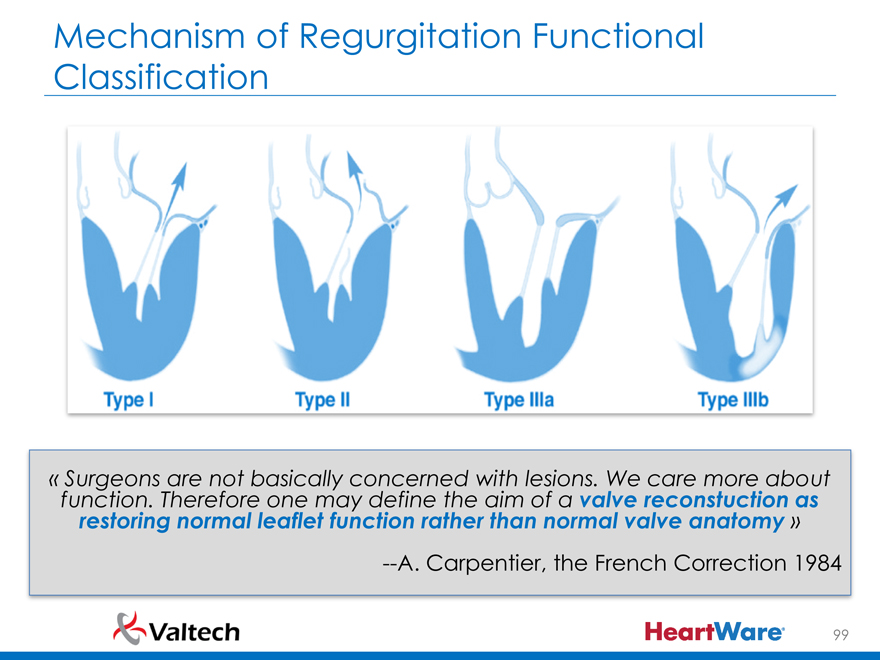

Mechanism of Regurgitation Functional Classification

« Surgeons are not basically concerned with lesions. We care more about function. Therefore one may define the aim of a valve reconstuction as restoring normal leaflet function rather than normal valve anatomy »

—A. Carpentier, the French Correction 1984

99

|

|

The Future of Valve Interventions

Cross-fertilization between surgical and interventional devices, will offer a better individualized treatment

Innovative solutions for the treatment of mitral valve disease should be simple, easy to use, reproducible, effective in the long term

To simplify minimally invasive approach, more sutureless devices should be developed

To optimize outcomes, fine tuning of devices under physiologic conditions are needed

100

|

|

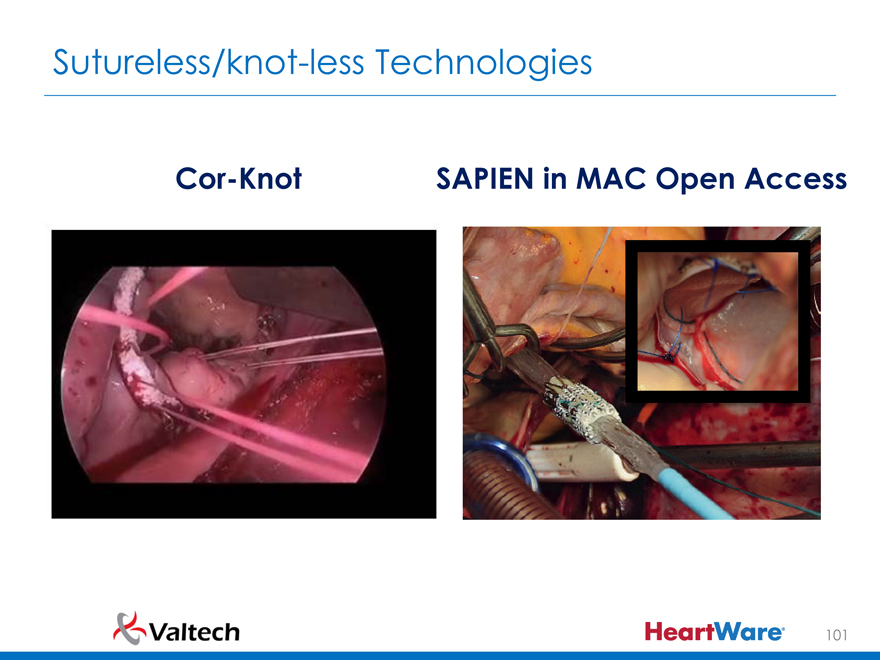

Sutureless/knot-less Technologies

Cor-Knot

SAPIEN in MAC Open Access

101

|

|

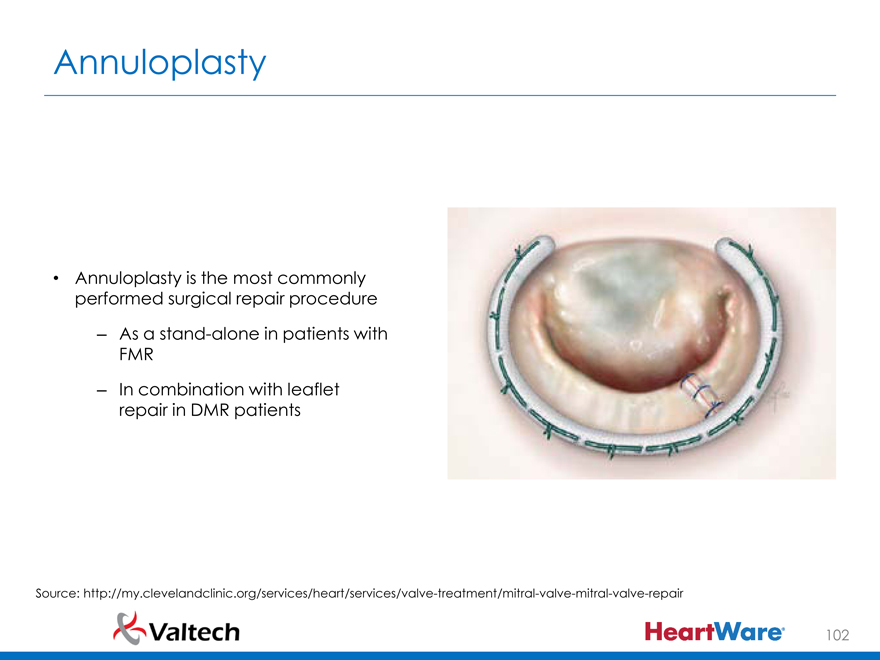

Annuloplasty

Annuloplasty is the most commonly performed surgical repair procedure

As a stand-alone in patients with FMR

In combination with leaflet repair in DMR patients

Source: http://my.clevelandclinic.org/services/heart/services/valve-treatment/mitral-valve-mitral-valve-repair

102

|

|

History of Mitral and Tricuspid Interventions

Annuloplasty from Evolution to Revolution

1960

2015

First steps

1968

Carpentier A. La valvuloplastie reconstitutive

Classic

1982

Carpentier-Edwards CLASSIC annuloplasty ring

Physio

1995

Phisio II Global Shape optimisation

Etiologix

dilatation

Cardinal

2010

Adjustable Semi-Rigid Annuloplasty Ring System

Cardioband

103

|

|

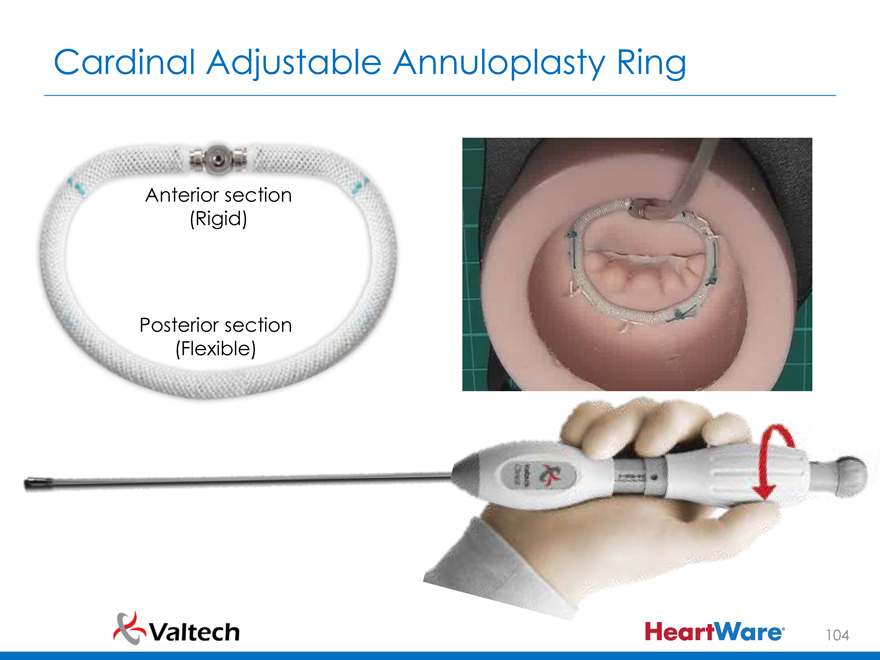

Cardinal Adjustable Annuloplasty Ring

104

|

|

Anterior section (Rigid)

Posterior section (Flexible)

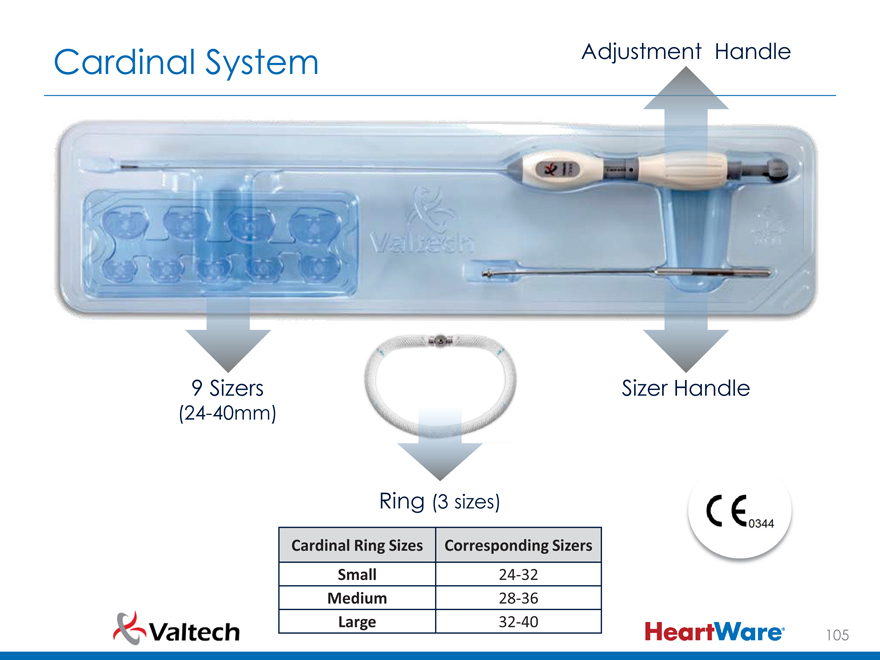

Cardinal System

Adjustment Handle

9 Sizers

(24-40mm)

Sizer Handle

Ring (3 sizes)

Cardinal Ring Sizes Corresponding Sizers

Small 24-32

Medium 28-36

Large 32-40

105

|

|

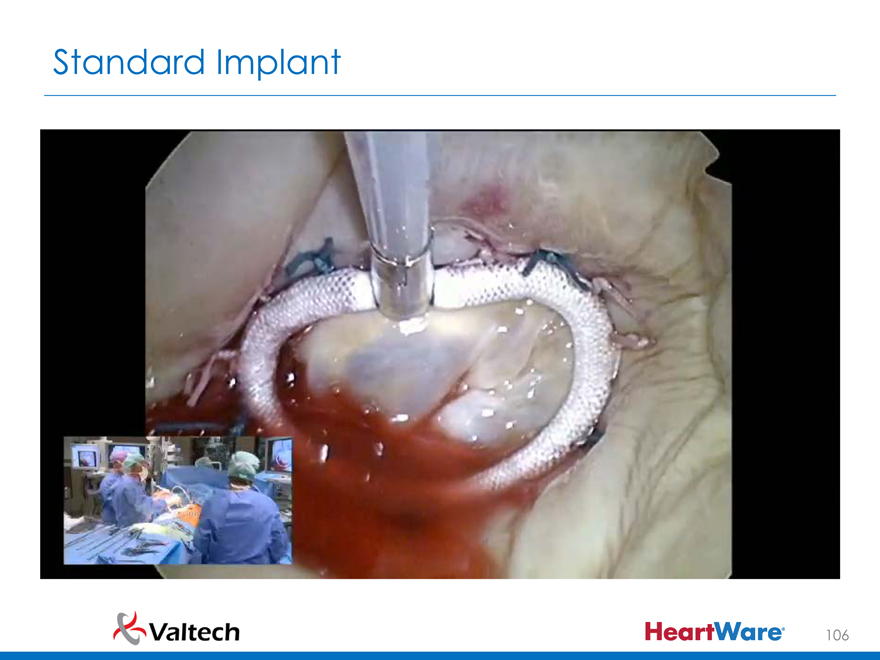

Standard Implant

106

|

|

Weaning from CPB

107

|

|

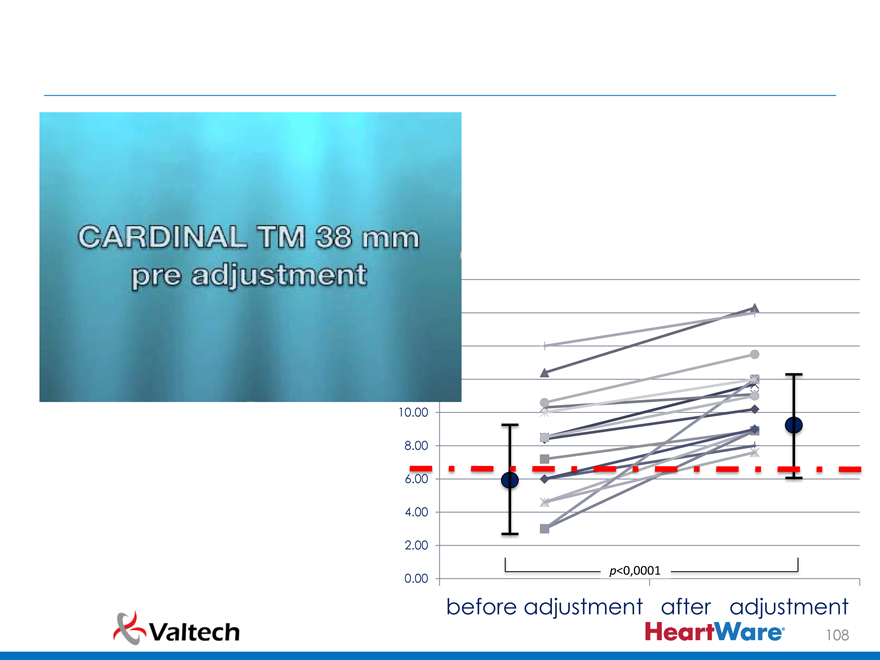

10.00

8.00

4.00

2.00 p<0,0001

0.00

before adjustment after adjustment

108

|

|

History of Mitral and Tricuspid Interventions

Annuloplasty from Evolution to Revolution

1960 2015

First steps

1968

Carpentier A. La valvuloplastie reconstitutive

Classic

1982

Carpentier-Edwards CLASSIC annuloplasty ring

Physio

1995

Phisio II Global Shape optimisation

Etiologix

2006

First asymmetric ring designed to treat asymmetric dilatation

Cardinal

Cardioband

109

|

|

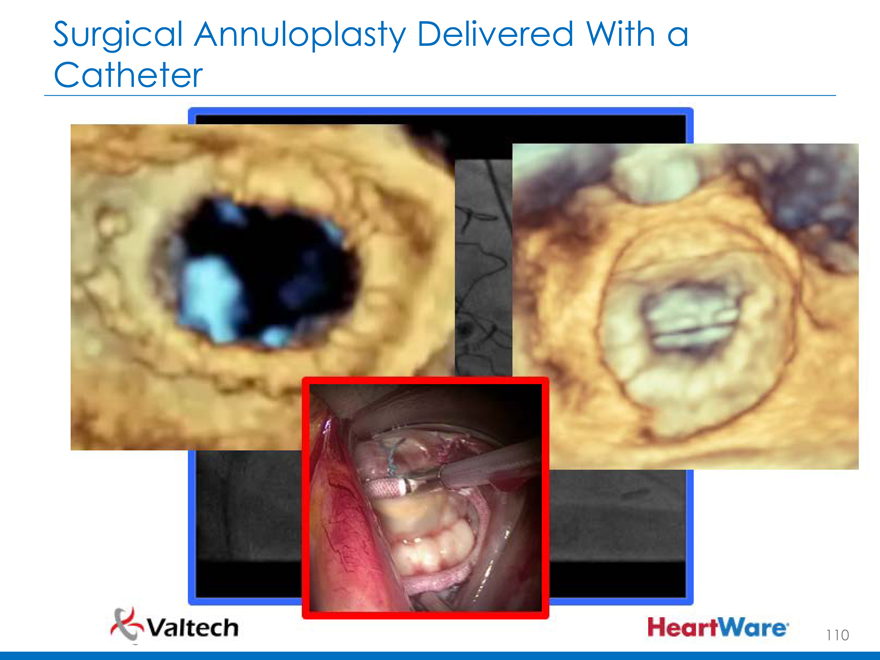

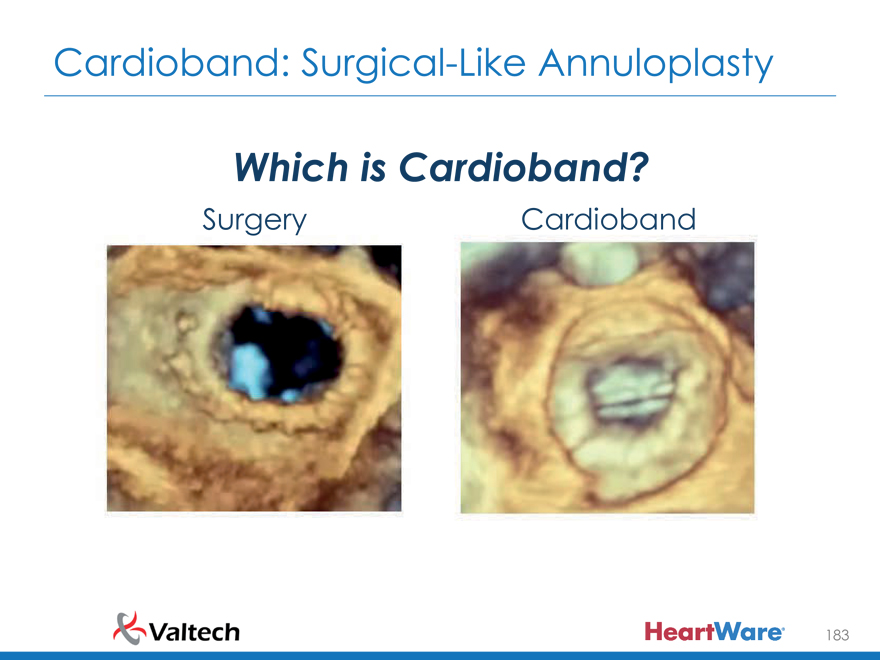

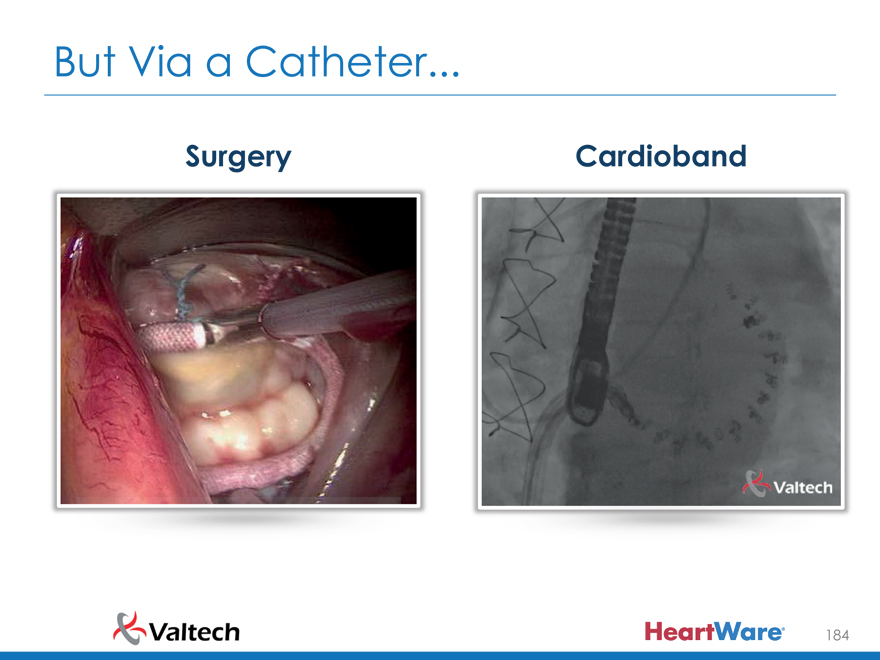

Surgical Annuloplasty Delivered With a Catheter

110

|

|

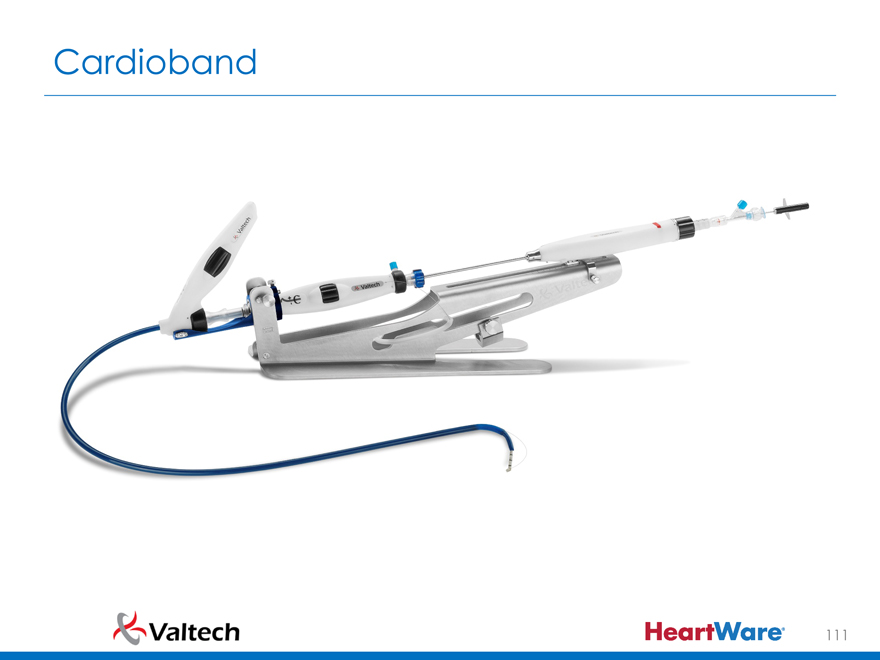

Cardioband

111

|

|

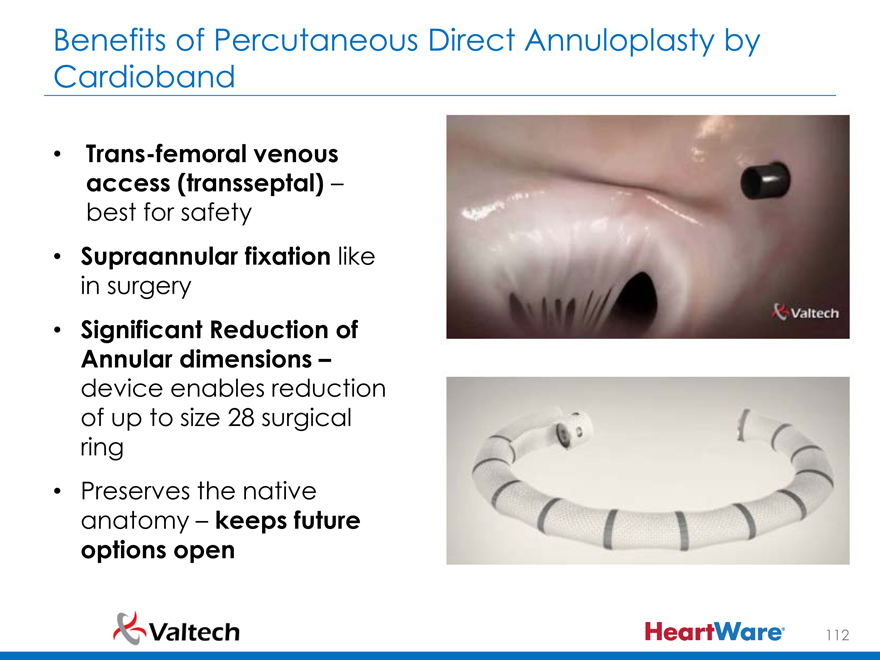

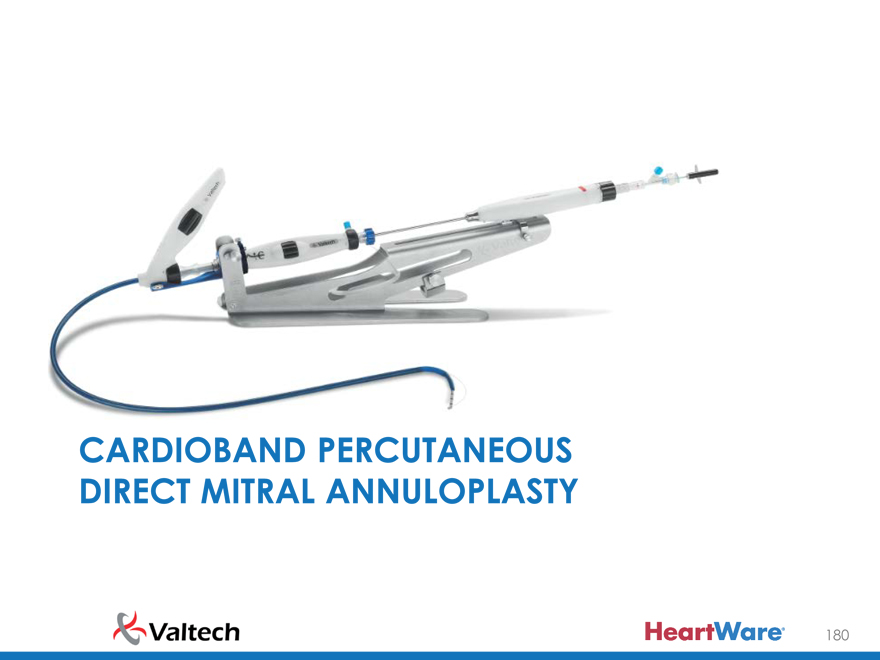

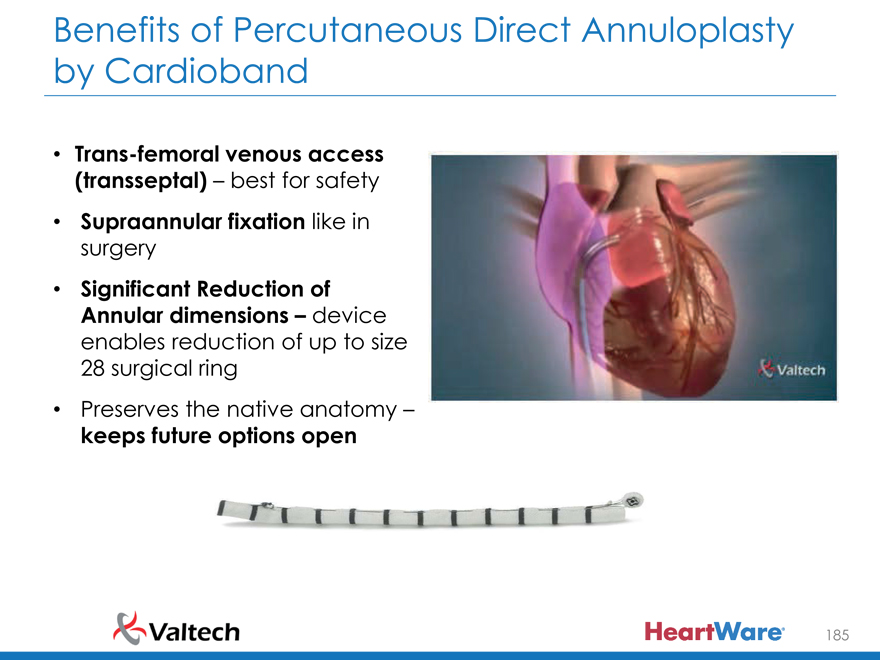

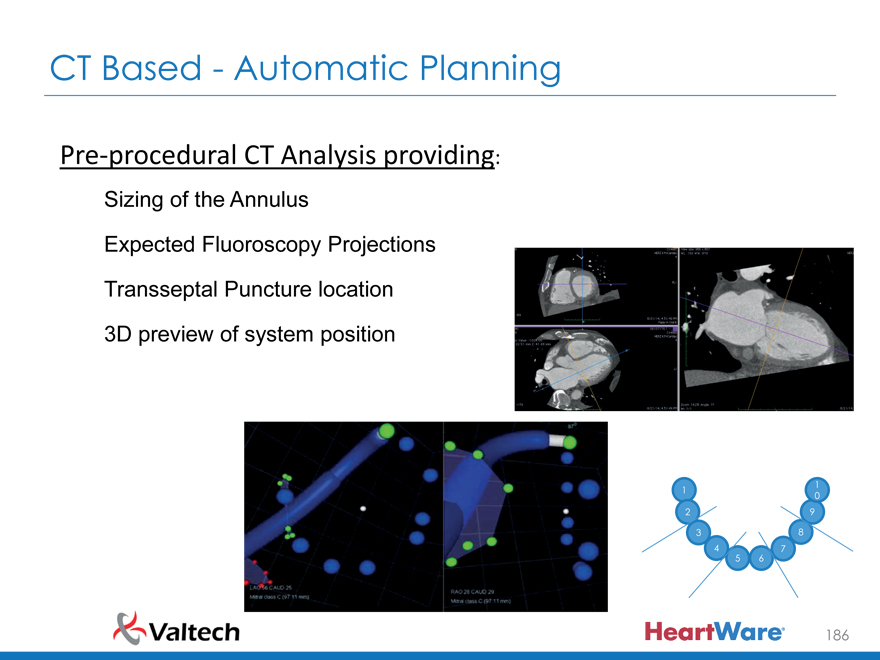

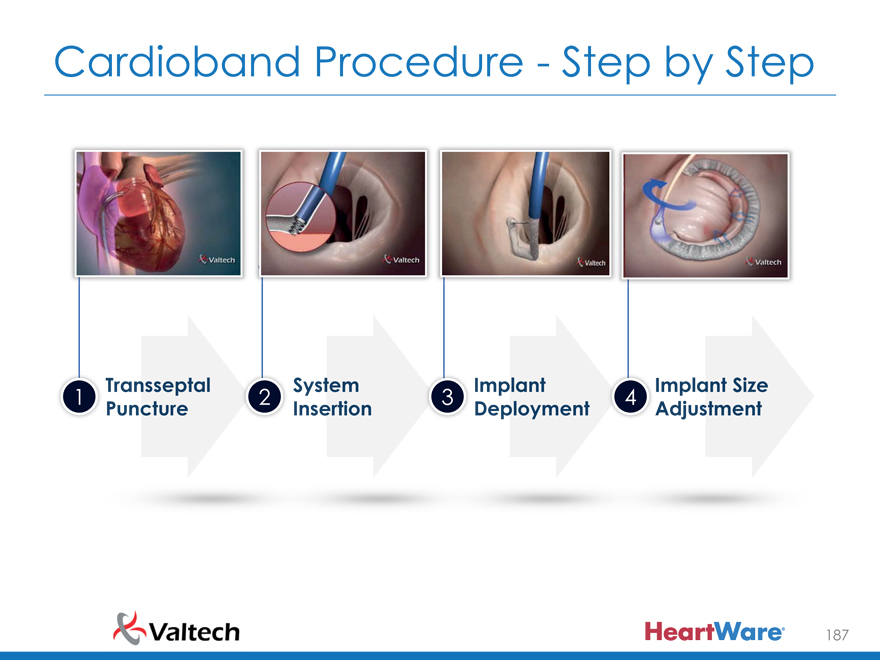

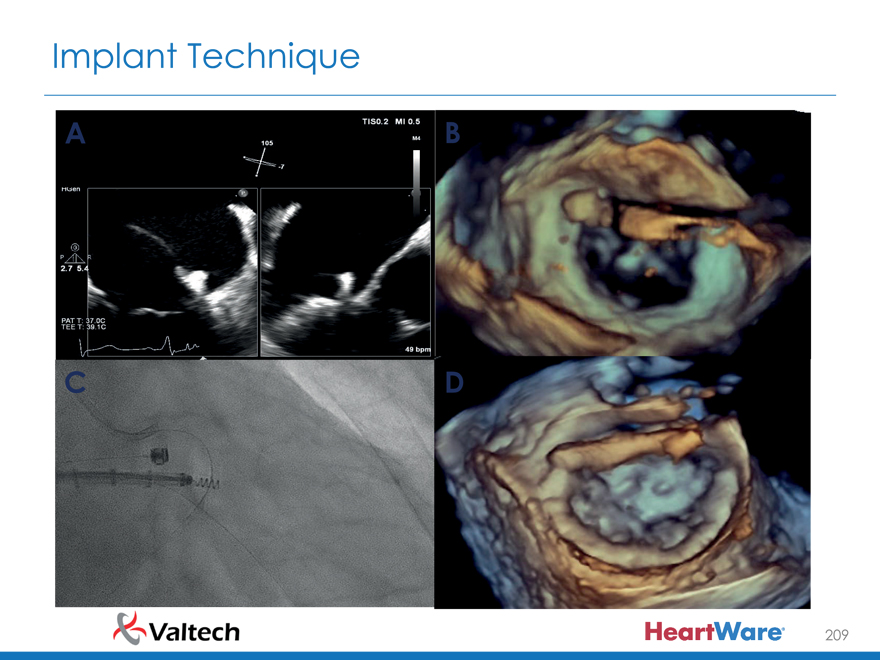

Benefits of Percutaneous Direct Annuloplasty by Cardioband

Trans-femoral venous access (transseptal) –best for safety

Supraannular fixation like in surgery

Significant Reduction of Annular dimensions –device enables reduction of up to size 28 surgical ring Preserves the native anatomy –keeps future options open

112

|

|

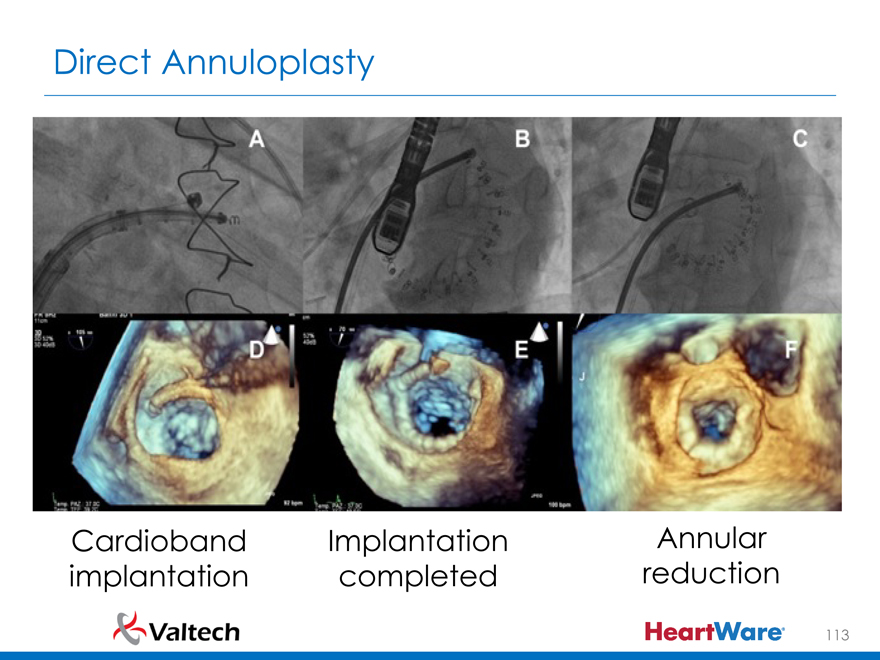

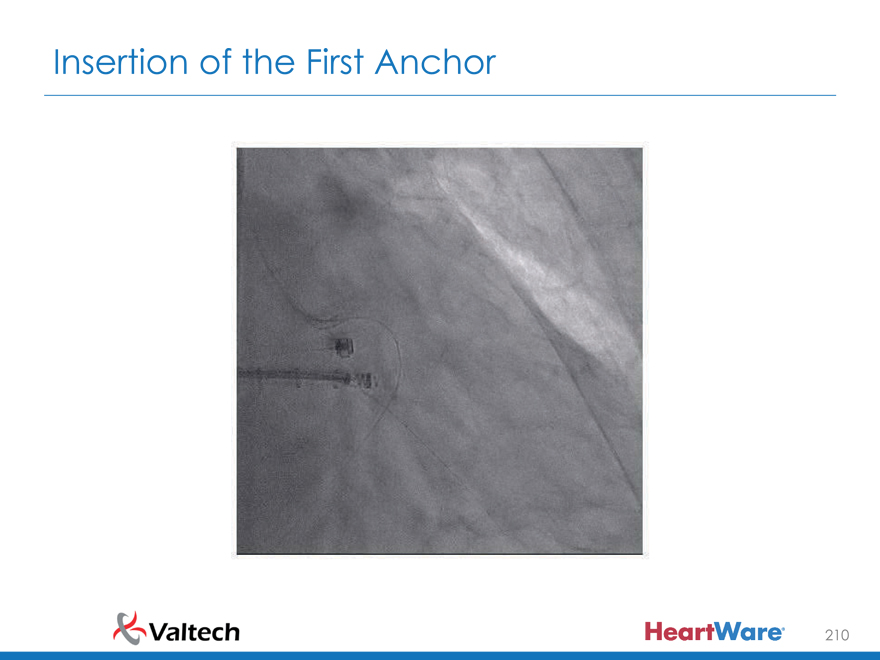

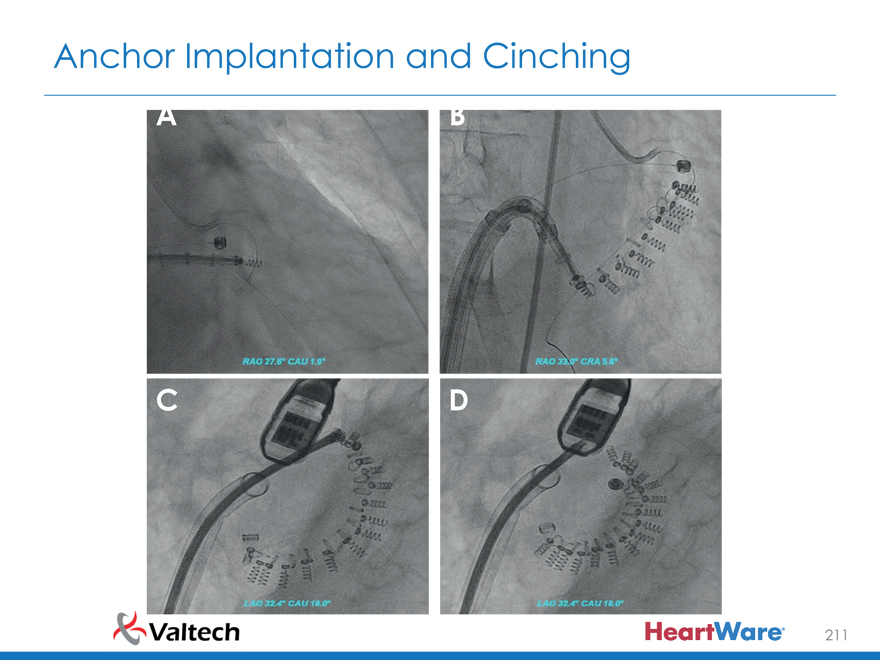

Direct Annuloplasty

Cardioband implantation

Implantation completed

Annular reduction

113

|

|

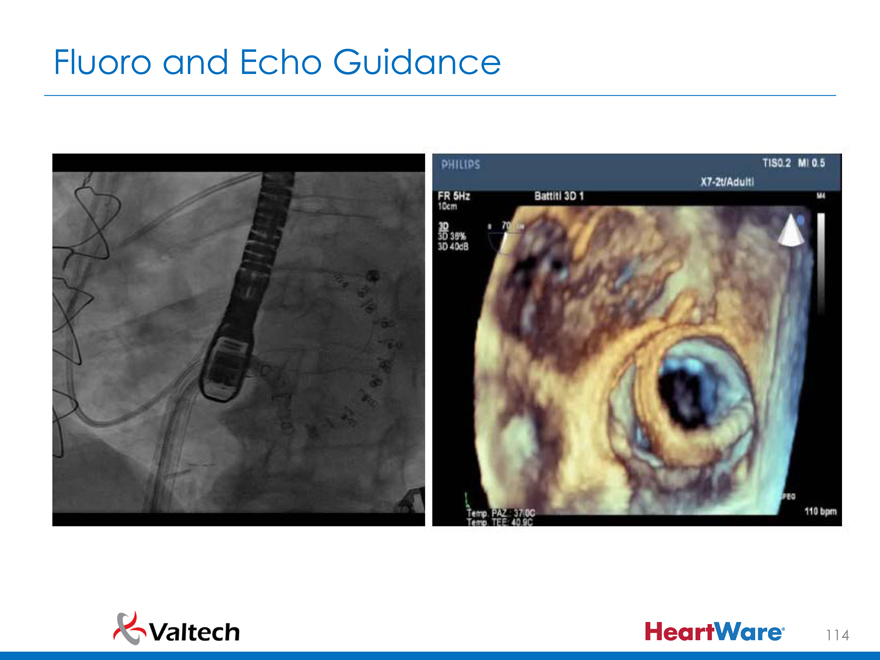

Fluoro and Echo Guidance

114

|

|

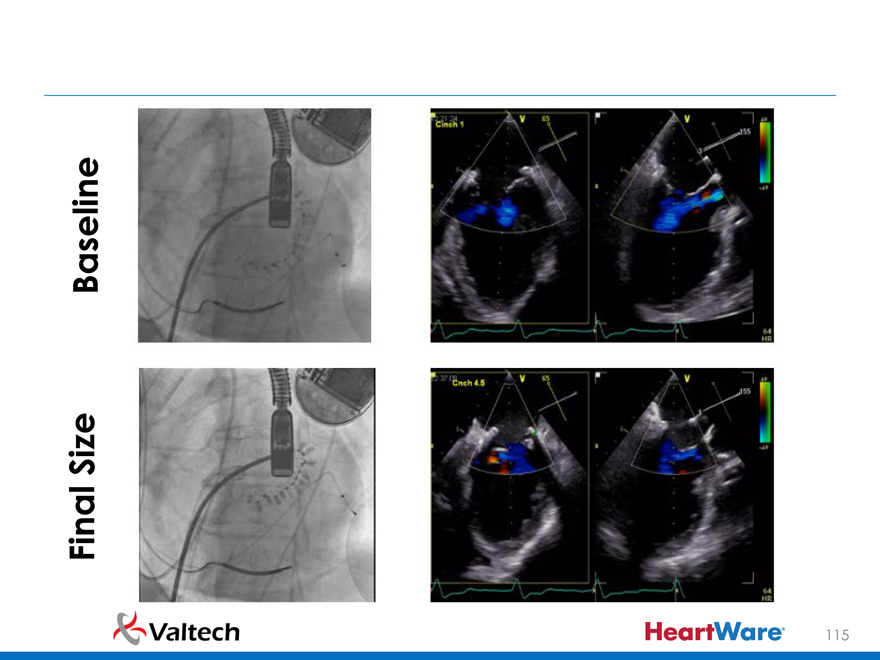

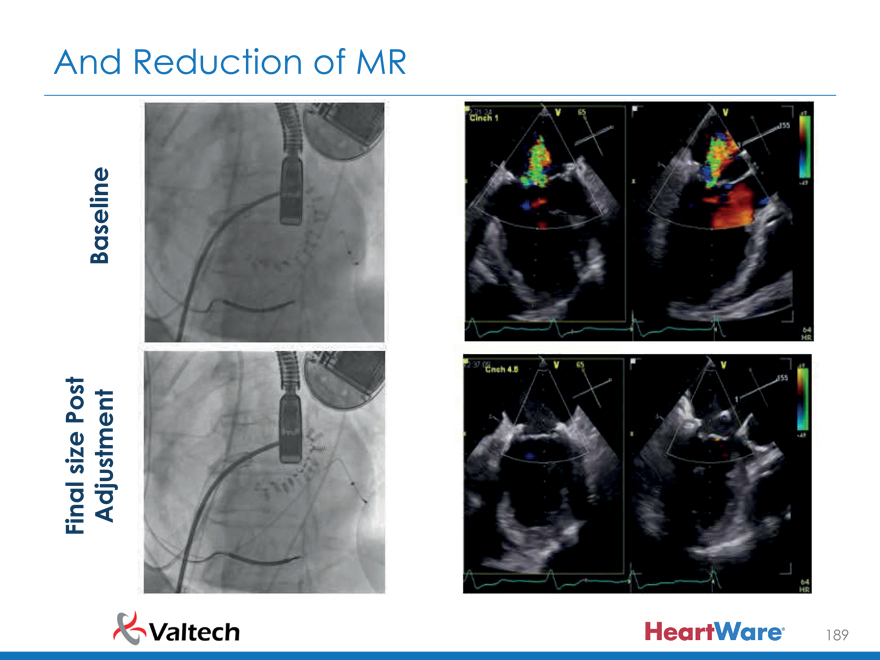

Baseline

Final Size

115

|

|

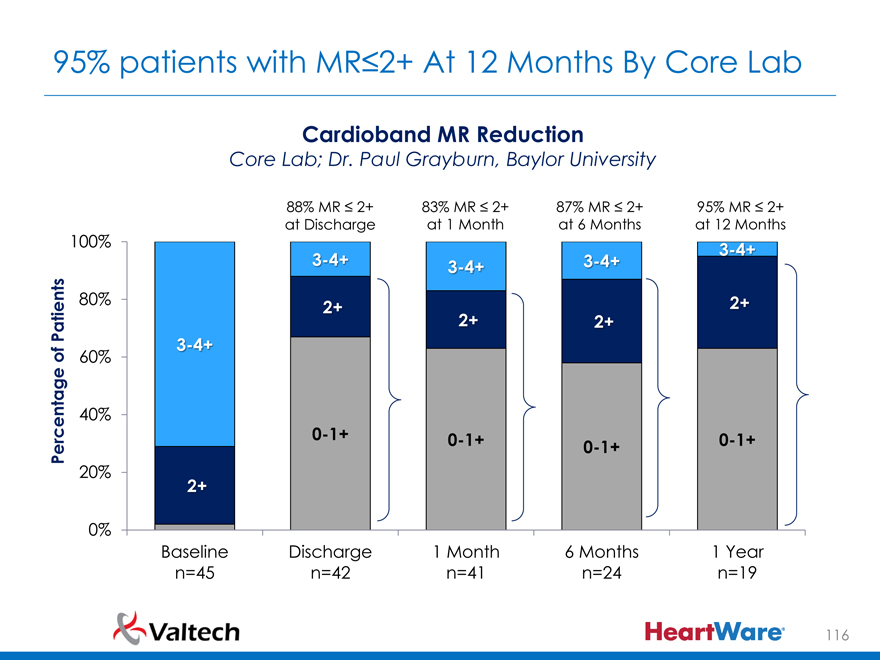

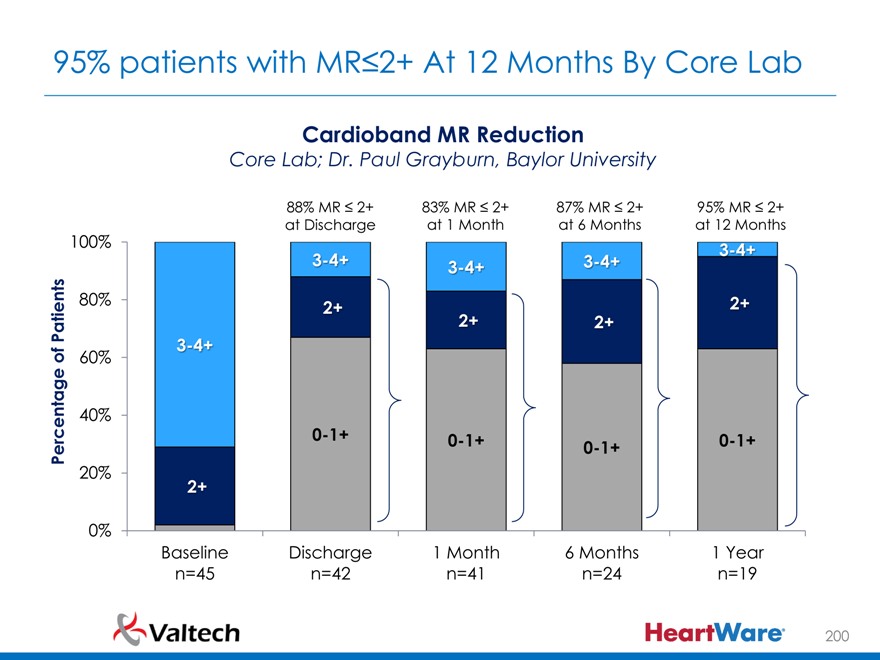

95% patients with MR2+ At 12 Months By Core Lab

Cardioband MR Reduction

Core Lab; Dr. Paul Grayburn, Baylor University

100%

Patients 80% of

60%

Percentage 40% 20%

0%

+

+

Baseline n=45

88% MR 2+ at Discharge

+

+

0-1+

Discharge n=42

83% MR 2+ at 1 Month

+

+

0-1+

| 1 |

|

Month n=41 |

87% MR 2+ at 6 Months

+

+

0-1+

| 6 |

|

Months n=24 |

95% MR 2+ at 12 Months

+

+

0-1+

| 1 |

|

Year n=19 |

116

|

|

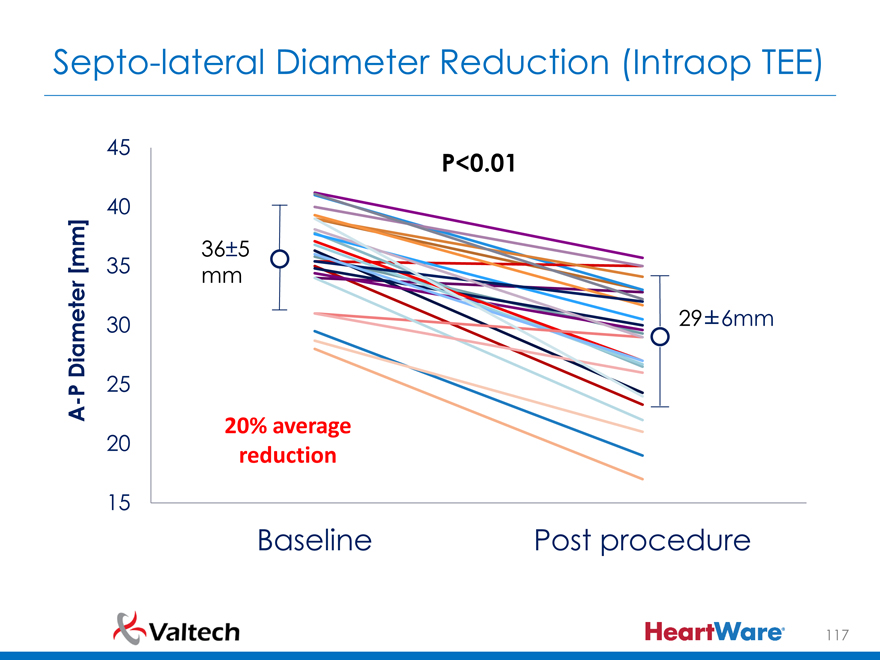

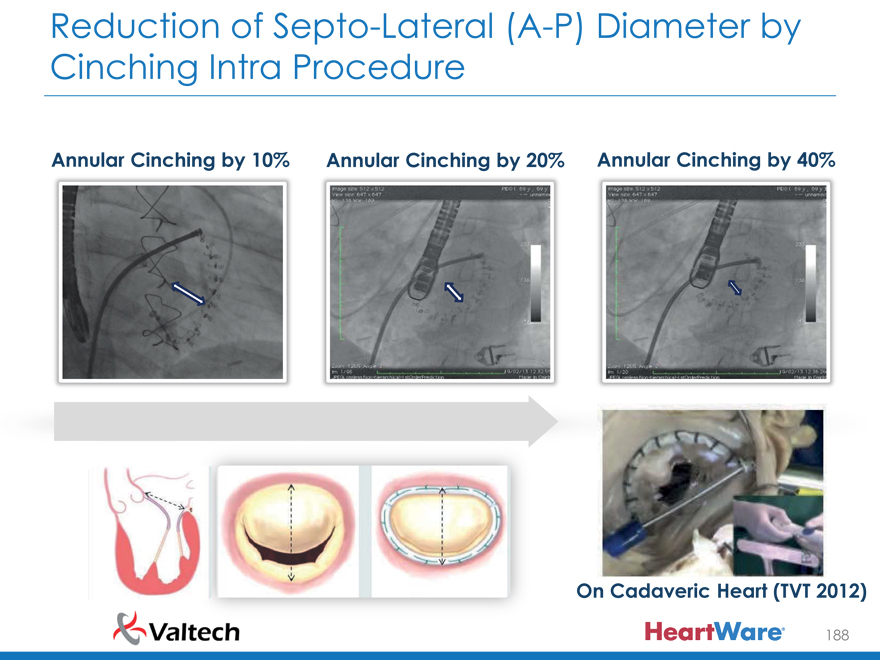

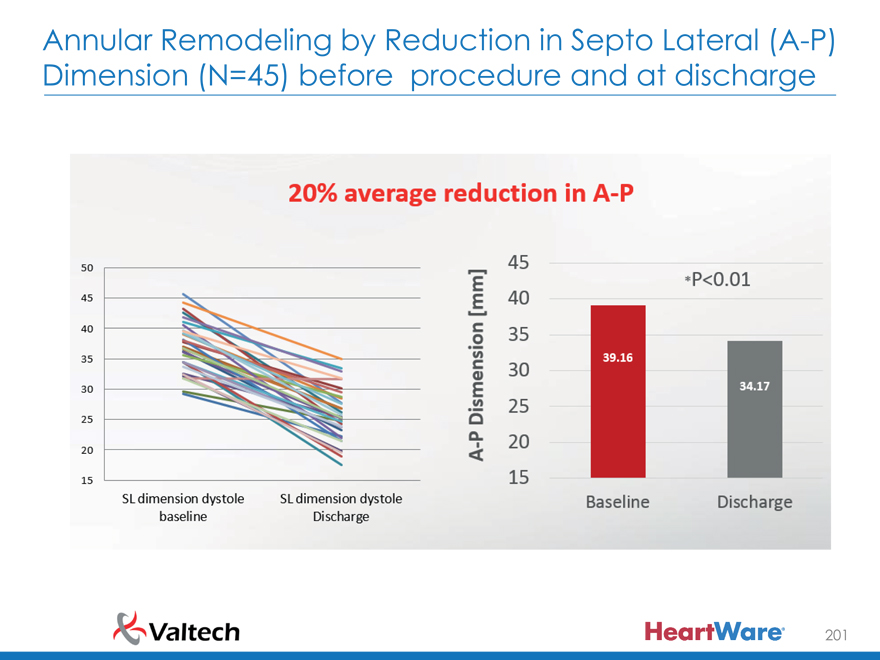

Septo-lateral Diameter Reduction (Intraop TEE)

A-P Diameter [mm]

15 20 25 30 35 40 45

P<0.01

36±5 mm

20% average reduction

Baseline

29±6mm

Post procedure

117

|

|

Surgical MVR

Interventional MV Rep

Interventional MVR

Surgical MV Rep

118

|

|

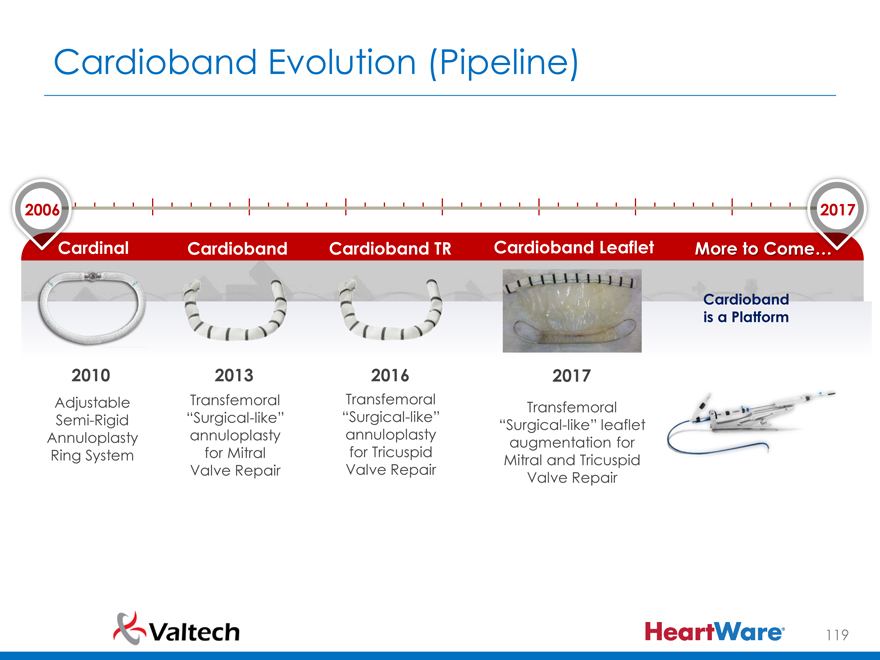

Cardioband Evolution (Pipeline)

2006

2017

Cardinal

2010

Adjustable Semi-Rigid Annuloplasty Ring System

Cardioband

2013

Transfemoral “Surgical-like” annuloplasty for Mitral Valve Repair

Cardioband TR

2016

Transfemoral “Surgical-like” annuloplasty for Tricuspid Valve Repair

Cardioband Leaflet

2017

Transfemoral “Surgical-like” leaflet augmentation for Mitral and Tricuspid Valve Repair

More to Come…

Cardioband is a Platform

119

|

|

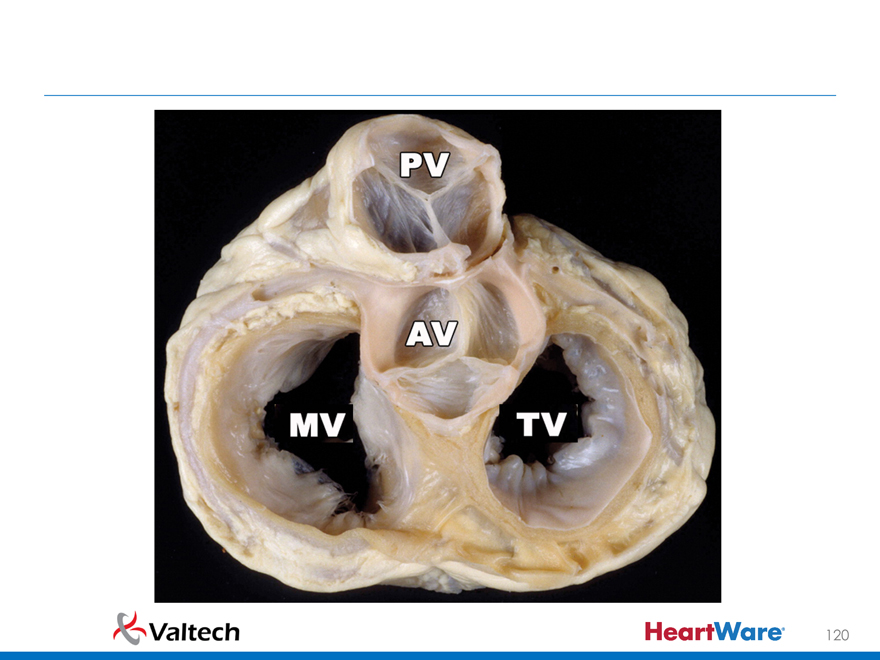

120

|

|

Cardioband Tricuspid

Tricuspid

121

|

|

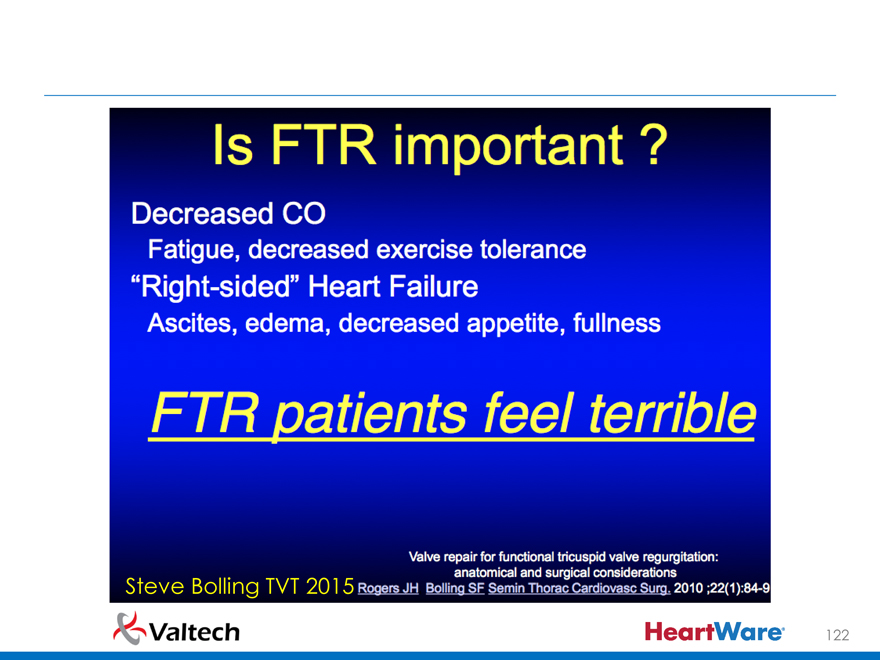

Steve Bolling TVT 2015

122

|

|

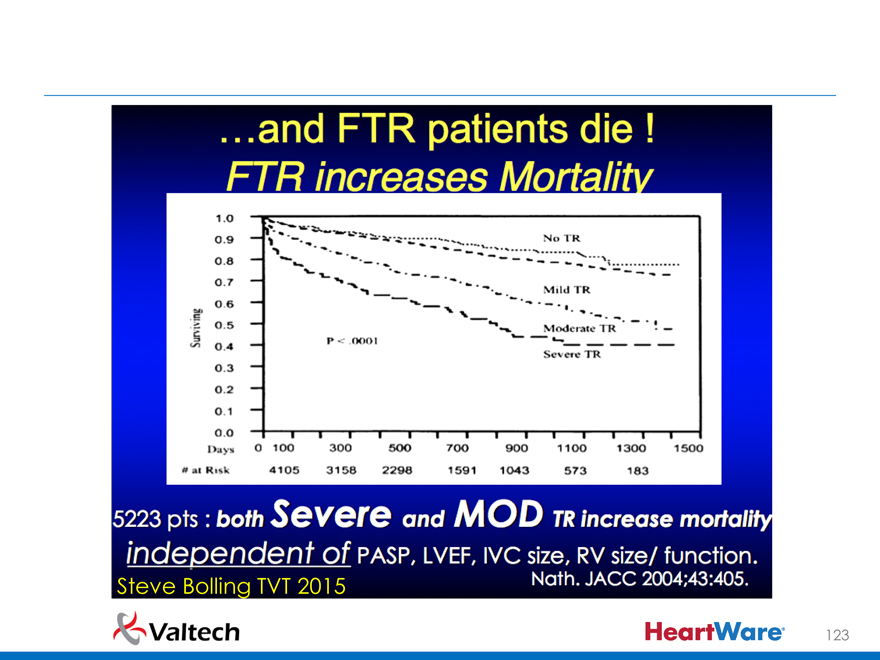

Steve Bolling TVT 2015

123

|

|

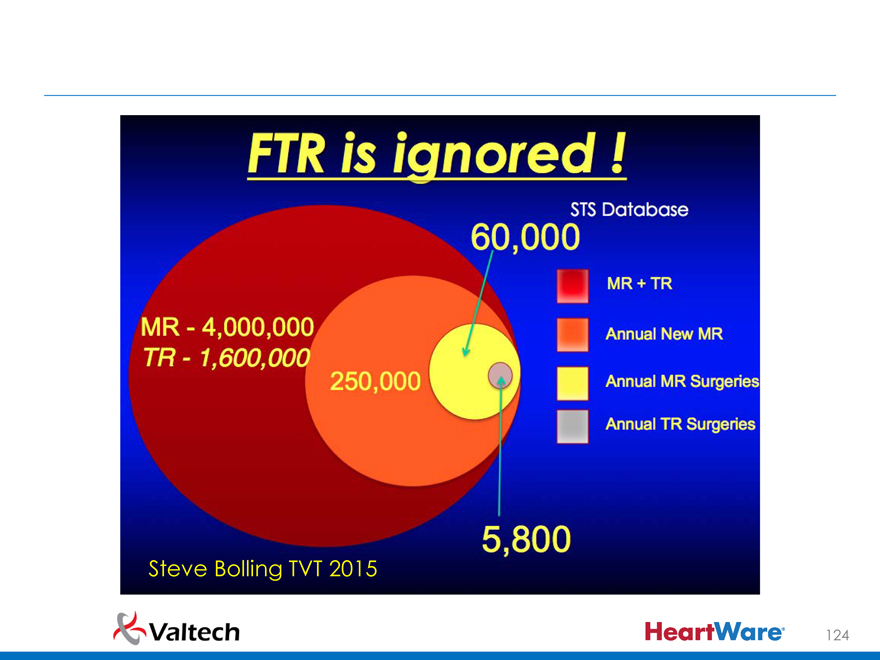

Steve Bolling TVT 2015

124

|

|

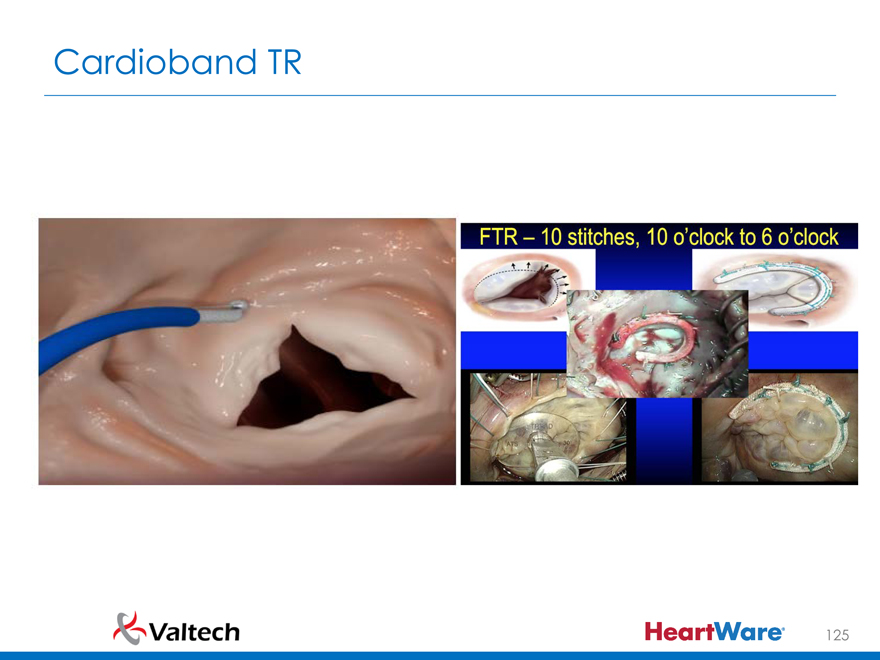

Cardioband TR

125

|

|

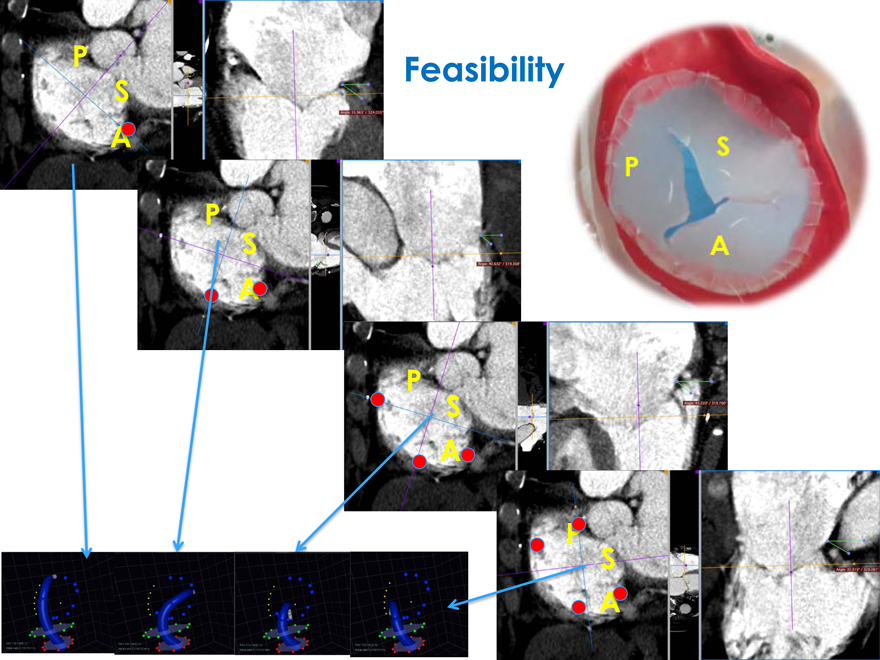

Feasibility

P S

P S

A

P S

A

S A

|

|

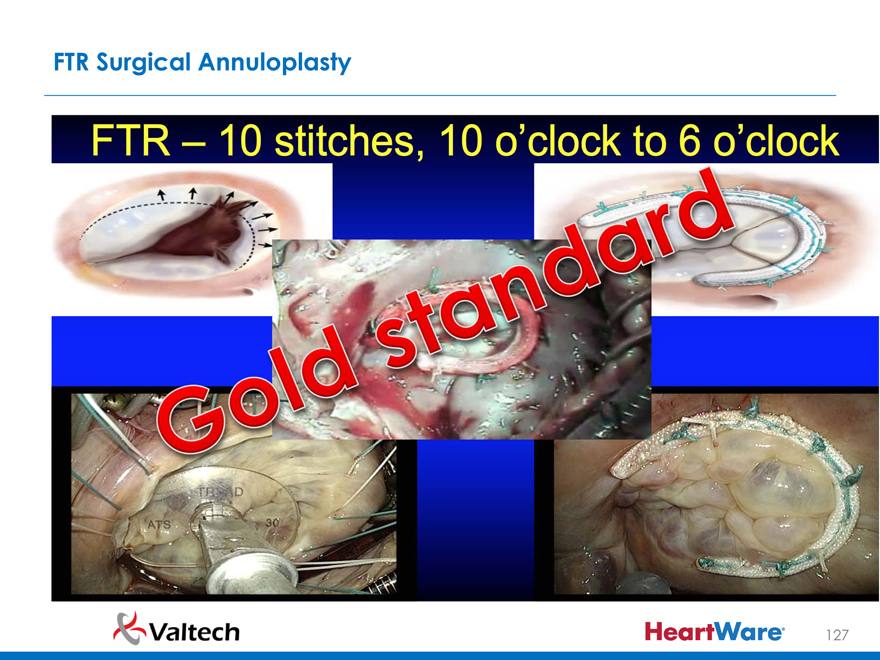

FTR Surgical Annuloplasty

127

|

|

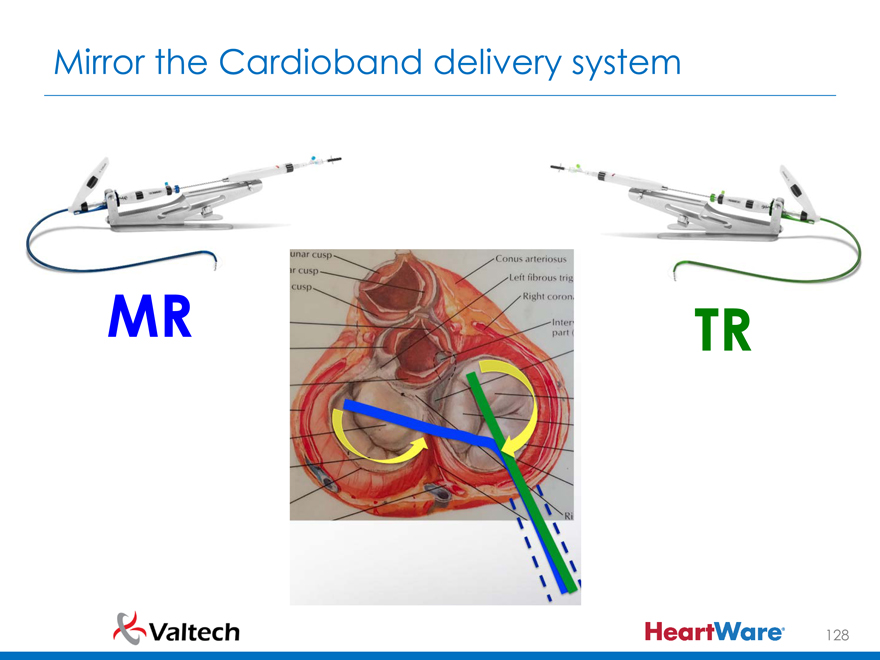

Mirror the Cardioband delivery system

MR TR

128

|

|

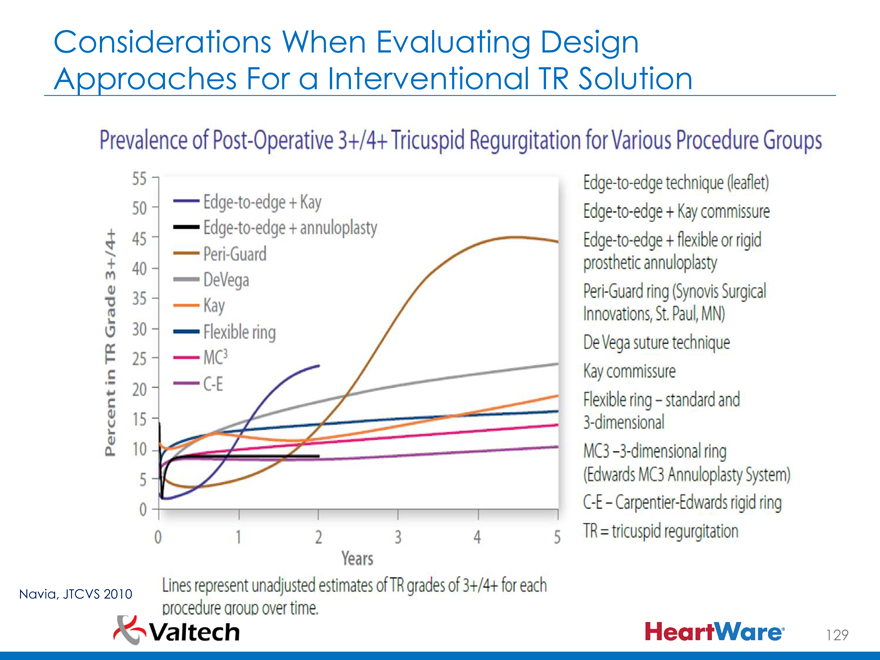

Considerations When Evaluating Design Approaches For a Interventional TR Solution

Navia, JTCVS 2010

129

|

|

130

|

|

Transcatheter Treatment of Mitral Regurgitation

Repair / Replacement

Atrial fibrillation ablation, left appendage closure, tricuspid valve treatment, (left ventricle)

131

|

|

Cardiovalve

132

|

|

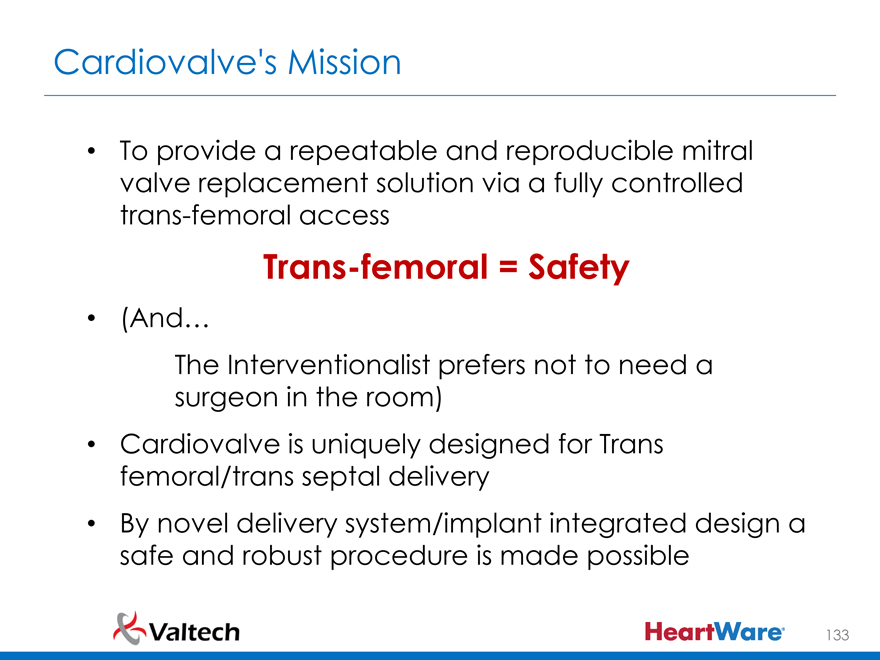

Cardiovalve’s Mission

To provide a repeatable and reproducible mitral valve replacement solution via a fully controlled trans-femoral access

Trans-femoral = Safety

(And…

The Interventionalist prefers not to need a surgeon in the room) Cardiovalve is uniquely designed for Trans femoral/trans septal delivery By novel delivery system/implant integrated design a safe and robust procedure is made possible

133

|

|

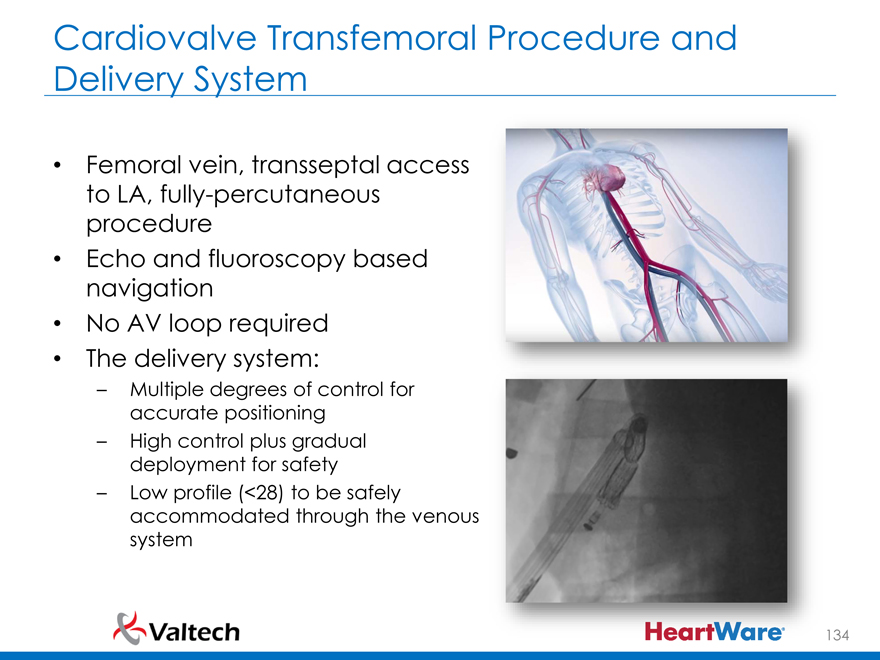

Cardiovalve Transfemoral Procedure and Delivery System

Femoral vein, transseptal access to LA, fully-percutaneous procedure Echo and fluoroscopy based navigation No AV loop required The delivery system:

Multiple degrees of control for accurate positioning High control plus gradual deployment for safety Low profile (<28) to be safely accommodated through the venous system

134

|

|

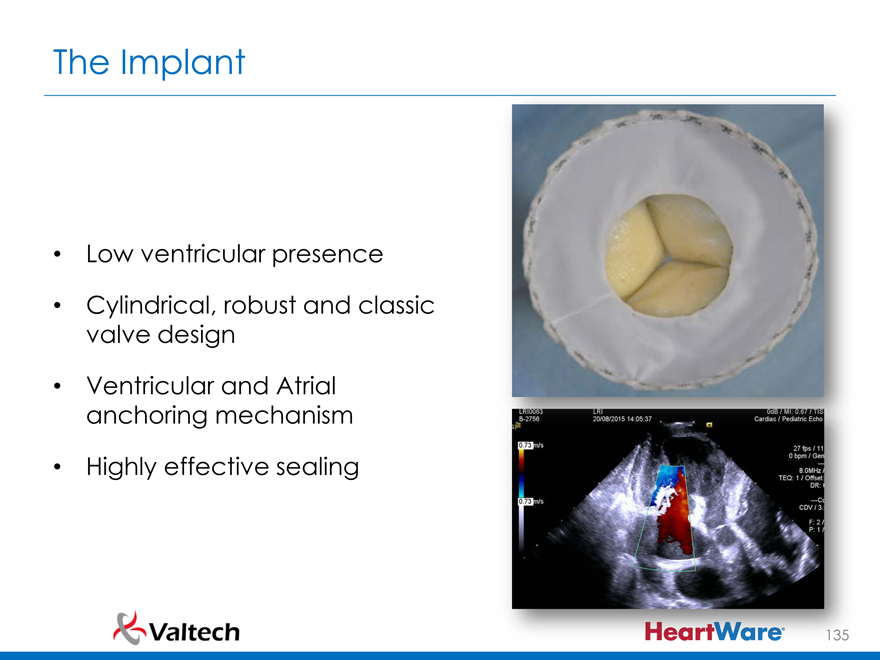

The Implant

Low ventricular presence Cylindrical, robust and classic valve design Ventricular and Atrial anchoring mechanism Highly effective sealing

135

|

|

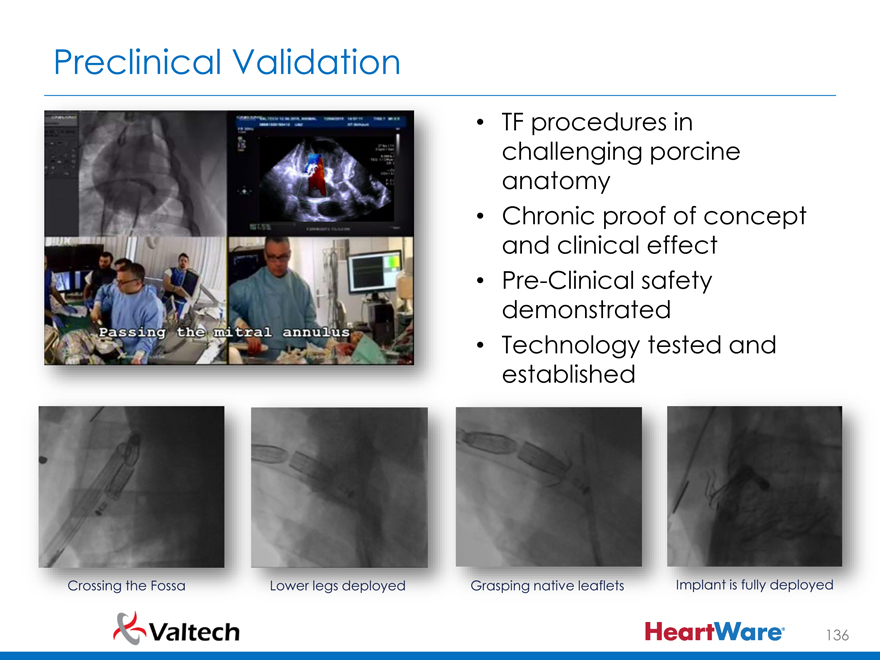

Preclinical Validation

TF procedures in challenging porcine anatomy Chronic proof of concept and clinical effect Pre-Clinical safety demonstrated Technology tested and established

Crossing the Fossa Lower legs deployed Grasping native leaflets Implant is fully deployed

136

|

|

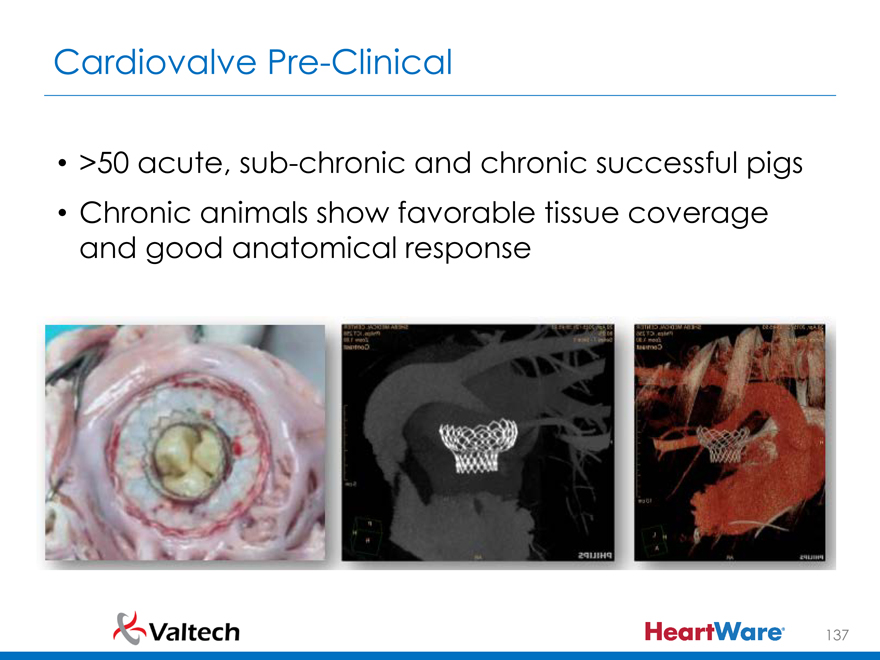

Cardiovalve Pre-Clinical

>50 acute, sub-chronic and chronic successful pigs Chronic animals show favorable tissue coverage and good anatomical response

137

|

|

Case In a Box Movie

138

|

|

Summary and Next Steps

Chronic trials on going

Procedural standardization in full animal set up

Expected FIM within 18 months

139

|

|

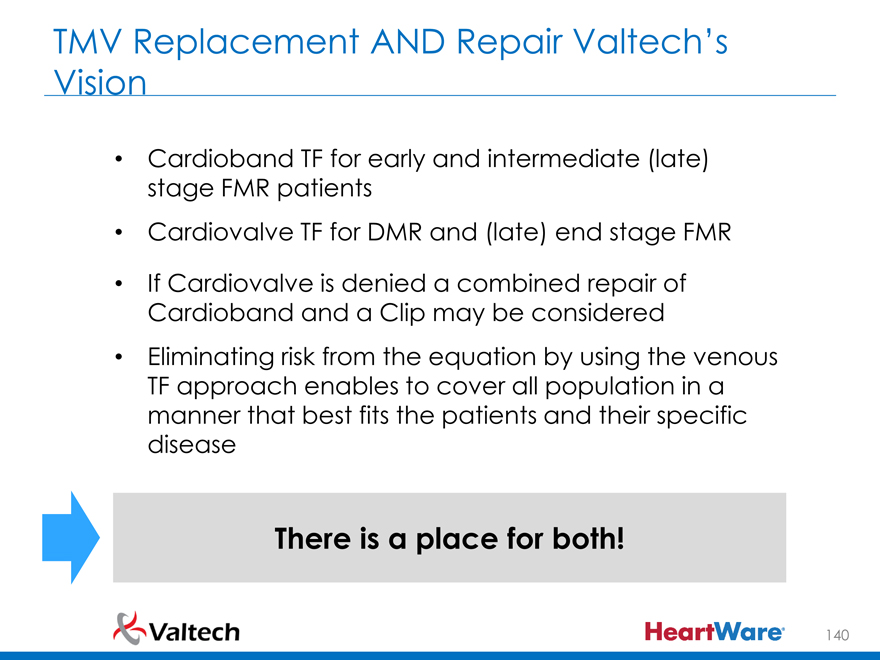

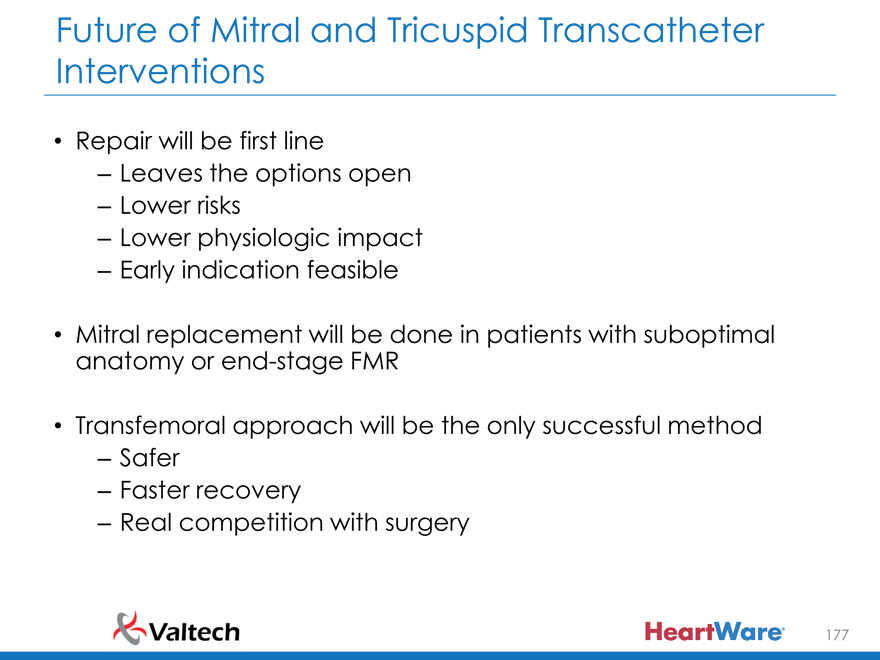

TMV Replacement AND Repair Valtech’s Vision

Cardioband TF for early and intermediate (late) stage FMR patients Cardiovalve TF for DMR and (late) end stage FMR If Cardiovalve is denied a combined repair of Cardioband and a Clip may be considered Eliminating risk from the equation by using the venous TF approach enables to cover all population in a manner that best fits the patients and their specific disease

There is a place for both!

140

|

|

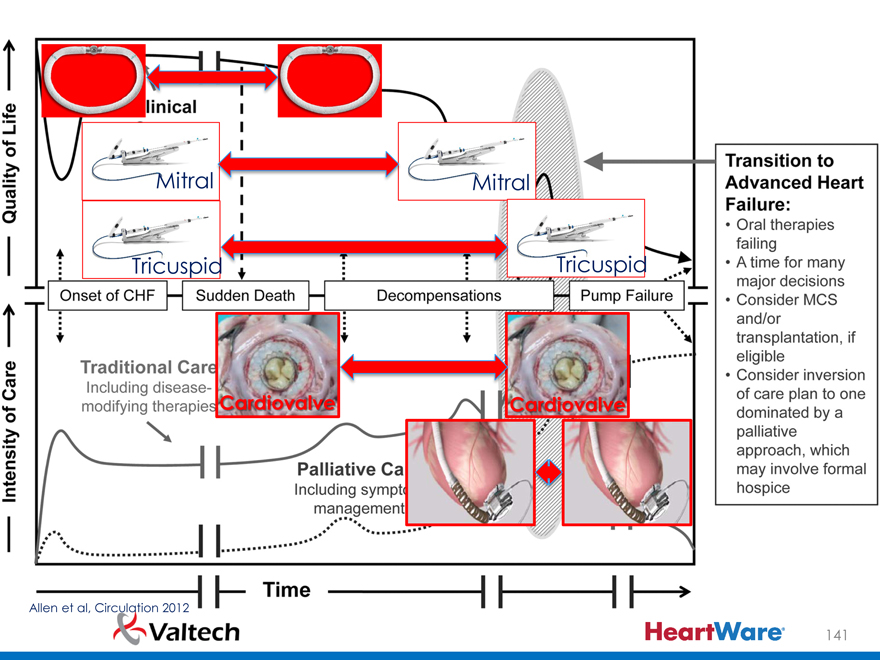

Mitral

Tricuspid

Cardiovalve

Mitral

Tricuspid

Mitral

Tricuspid

Allen et al, Circulation 2012

141

|

|

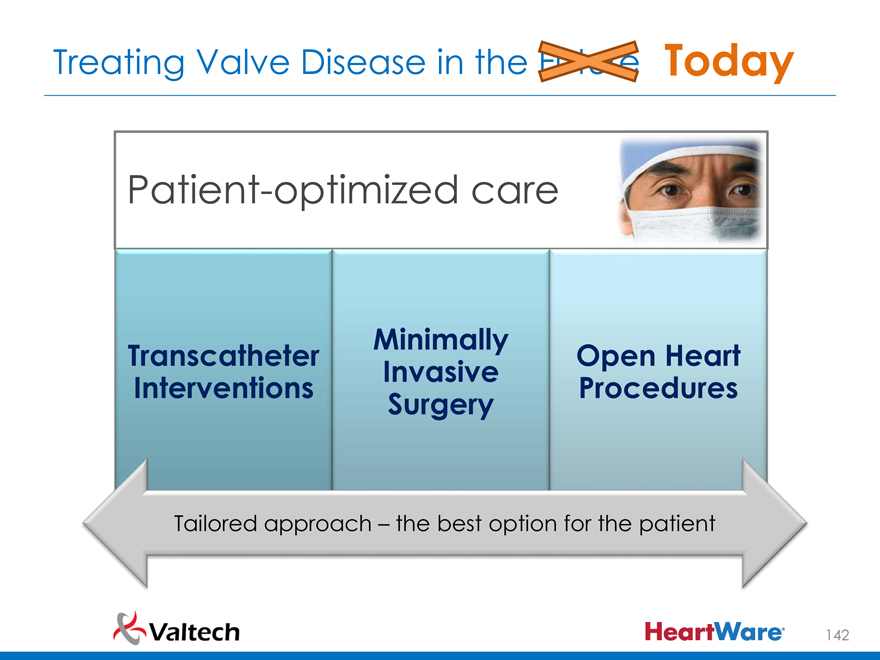

Treating Valve Disease in the Future Today

Patient-optimized care

Transcatheter Interventions

Minimally Invasive Surgery

Open Heart Procedures

Tailored approach – the best option for the patient

142

|

|

Complementary Role of Surgery and Interventions

Minimal invasiveness Maximal safety Tailored approach

Unbiased choice

143

|

|

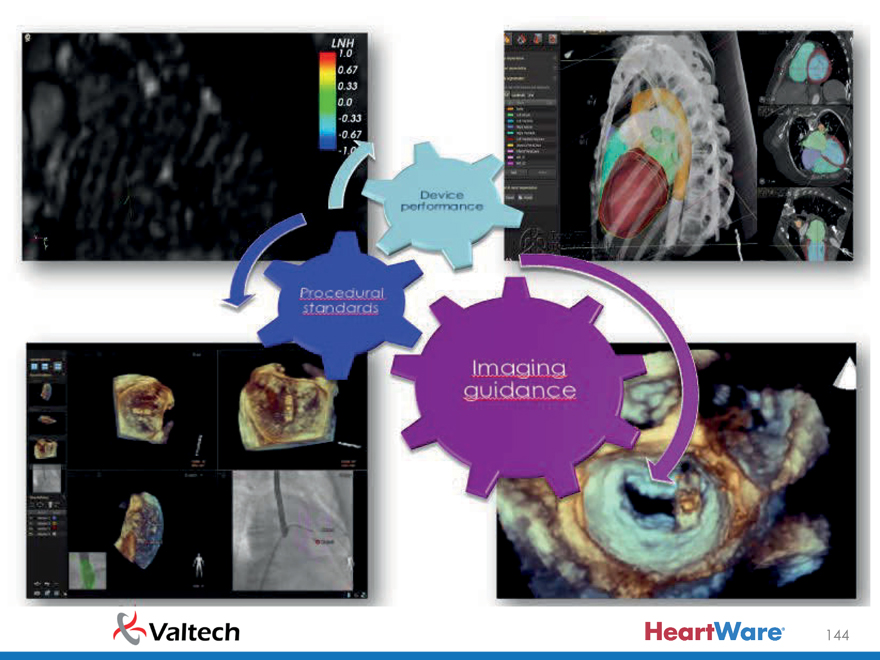

144

Device Performance Procedural standards Imaging guidance

Heartware

|

|

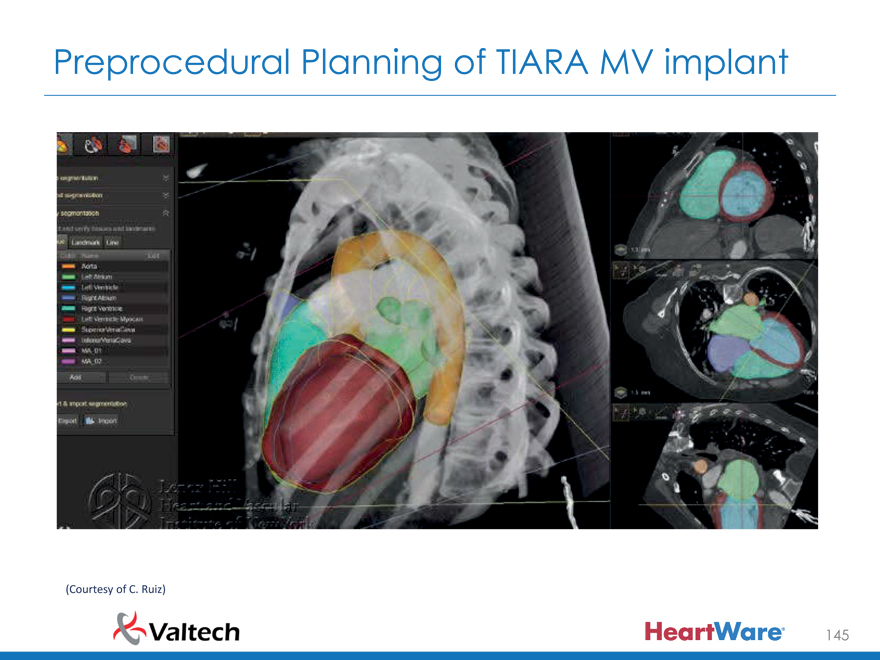

Preprocedural Planning of TIARA MV implant

(Courtesy of C. Ruiz)

145

|

|

Coregistration

146

|

|

Repair and Replacement

Prof. Francesco Maisano, M.D., FESC

University Hospital of Zurich

147

|

|

The Challenges for Transcatheter Mitral Interventions

Anatomical complexity

– Most technologies are different from a “stent-based” approach

Image guidance is sophisticated

– Echocardiography is the leading image guidance method

Variability of mitral valve disease

– Multiple devices

– Multiple techniques

– Associated procedures

Surgical standards are high

148

|

|

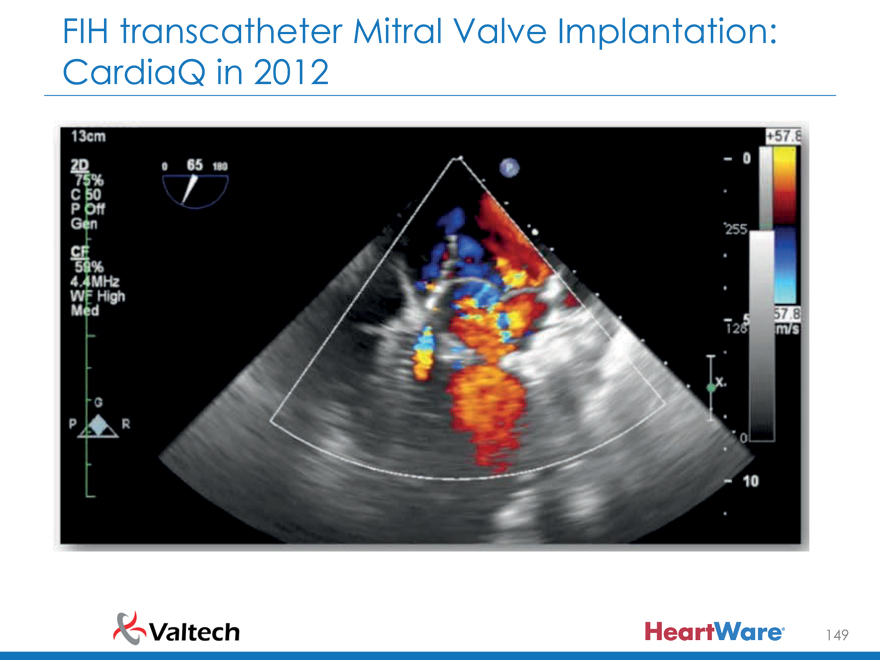

FIH transcatheter Mitral Valve Implantation: CardiaQ in 2012

149

|

|

8 years before…not even on the radar

150

|

|

2003, FIH MitraClip implant in DMR

151

|

|

MitraClip Therapy is Routine in Most High-Volume Centers

More than 25,000 patients have been treated with the MitraClip device worldwide

– Nearly 2,000 patients have been enrolled in prospective clinical trials

– A majority are considered high risk for mitral valve (MV) surgery

In 2008, MitraClip received CE Mark for reconstruction of the insufficient MV through tissue approximation

In 2013, FDA approved MitraClip for treating significant symptomatic degenerative mitral regurgitation (DMR) in patients who have been determined to be at prohibitive risk for MV surgery by a Heart Team

152

|

|

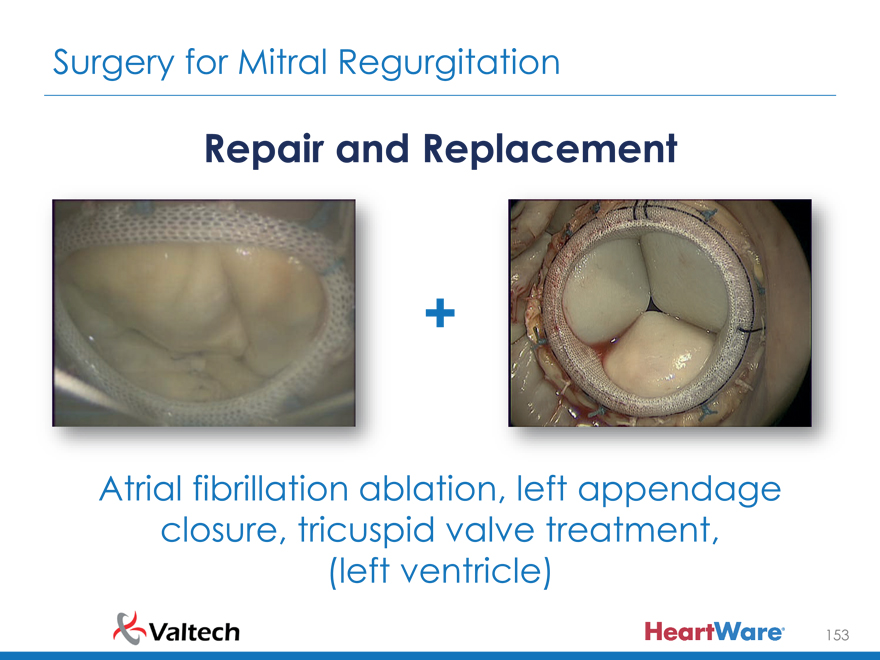

Surgery for Mitral Regurgitation

Repair and Replacement

+

Atrial fibrillation ablation, left appendage closure, tricuspid valve treatment, (left ventricle)

153

|

|

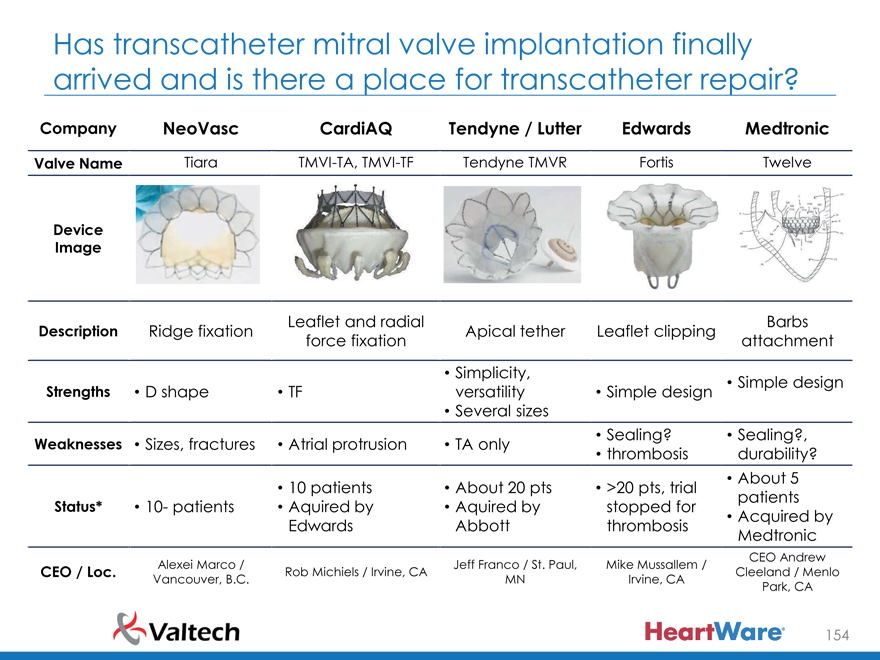

Has transcatheter mitral valve implantation finally arrived and is there a place for transcatheter repair?

Company NeoVasc CardiAQ Tendyne / Lutter Edwards Medtronic

Valve Name Tiara TMVI-TA, TMVI-TF Tendyne TMVR Fortis Twelve

Device Image

Leaflet and radial Barbs Description Ridge fixation Apical tether Leaflet clipping force fixation attachment

Simplicity,

Simple design Strengths D shape TF versatility Simple design

Several sizes

Sealing? Sealing?, Weaknesses Sizes, fractures Atrial protrusion TA only thrombosis durability?

About 5

10 patients About 20 pts >20 pts, trial patients Status* 10- patients Aquired by Aquired by stopped for

Acquired by Edwards Abbott thrombosis Medtronic

CEO Andrew Alexei Marco / Jeff Franco / St. Paul, Mike Mussallem / CEO / Loc. Rob Michiels / Irvine, CA Cleeland / Menlo Vancouver, B.C. MN Irvine, CA

Park, CA

154

|

|

Patient Device Procedura Something Bad luck? selection? issues? issues? else?

Higher early mortality compared to early experience with transcatheter repair

155

|

|

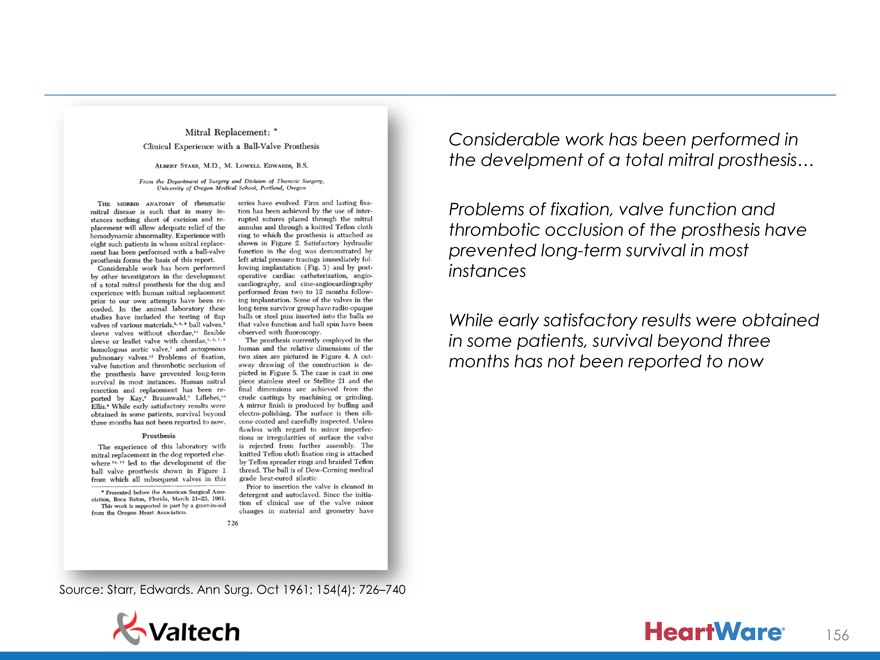

Considerable work has been performed in the develpment of a total mitral prosthesis…

Problems of fixation, valve function and thrombotic occlusion of the prosthesis have prevented long-term survival in most instances

While early satisfactory results were obtained in some patients, survival beyond three months has not been reported to now

Source: Starr, Edwards. Ann Surg. Oct 1961; 154(4): 726–740

156

|

|

….the advantage of prosthesis over plastic procedures on the mitral valve in terms of predictability of hemodynamic result must be balanced by the unknown long-term hazards involved in total dependence upon an intracardiac appliance…

Starr, Edwards. Ann Surg. Oct 1961; 154(4): 726–740 157

|

|

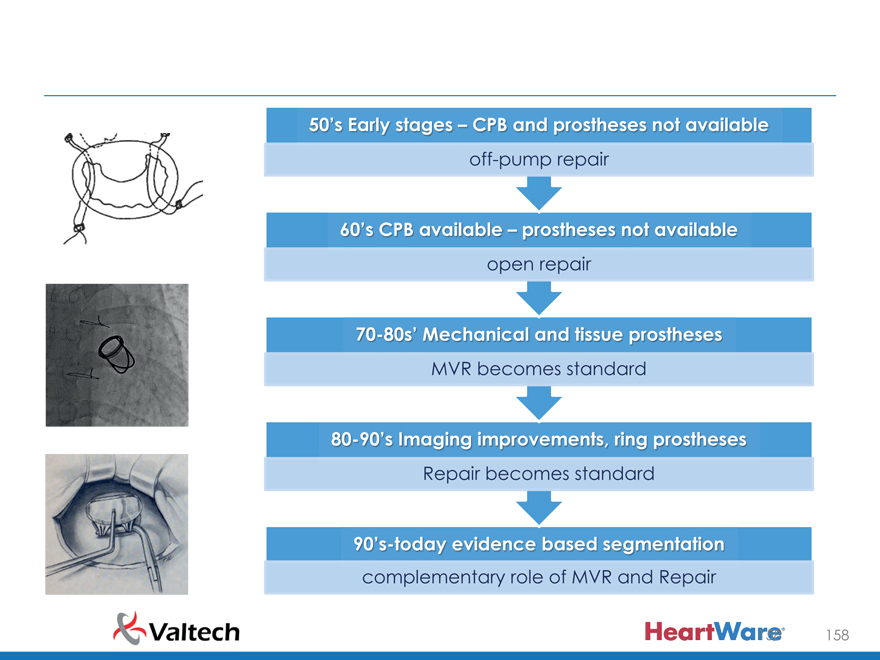

50’s Early stages CPB and prostheses not available off-pump repair

60’s CPB available prostheses not available open repair

70-80’s Mechanica an tissue prostheses

MVR becomes standard

80-90’s Imaging improvement , ring prostheses

Repair becomes standard

90’s today evidence based segmentation complementary role of MVR and Repair 158

|

|

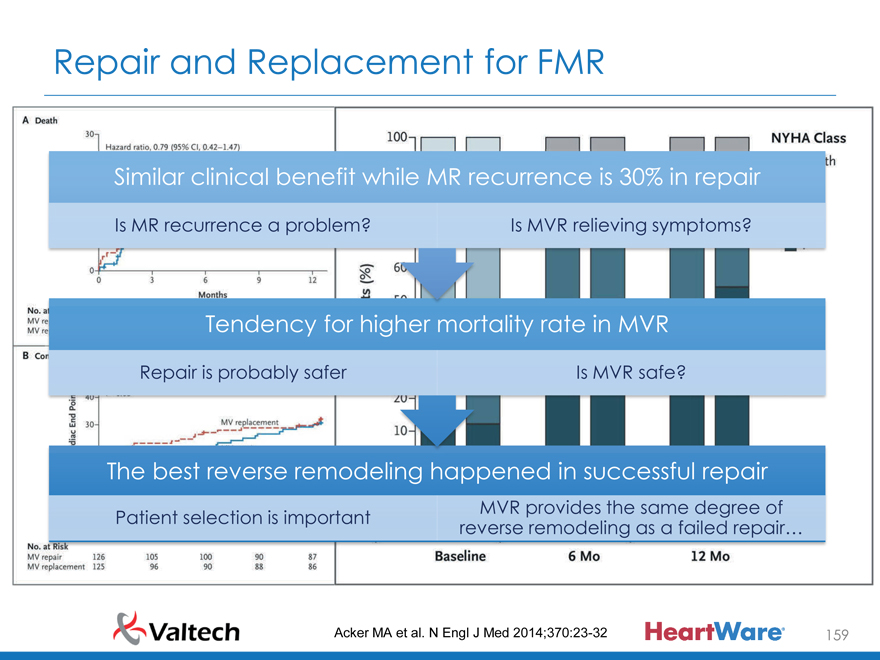

Repair and Replacement for FMR

Similar clinical benefit while MR recurrence is 30% in repair

Is MR recurrence a problem? Is MVR relieving symptoms?

Tendency for higher mortality rate in MVR

Repair is probably safer Is MVR safe?

The best reverse remodeling happened in successful repair

MVR provides the same degree of Patient selection is important reverse remodeling as a failed repair…

Acker MA et al. N Engl J Med 2014;370:23-32 159

|

|

Is It Better To Survive With Recurrent Regurgitation Or Die With A Competent Mitral Valve?

160

|

|

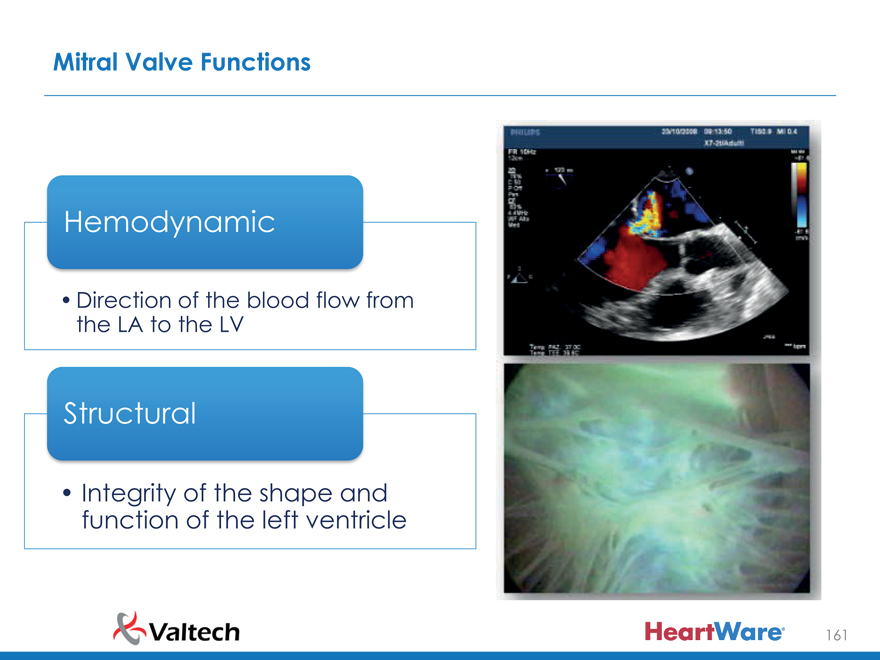

Mitral Valve Functions

Hemodynamic

Direction of the blood flow from the LA to the LV

Structural

Integrity of the shape and function of the left ventricle

161

|

|

The Mitro-Ventricular Architecture

162

|

|

163

|

|

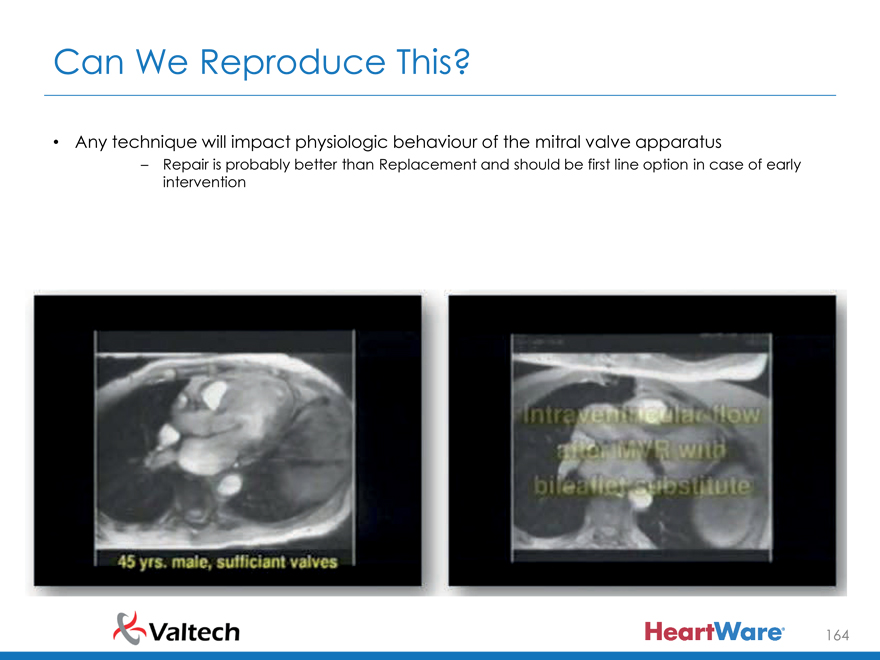

Can We Reproduce This?

Any technique will impact physiologic behaviour of the mitral valve apparatus

– Repair is probably better than Replacement and should be first line option in case of early intervention

164

|

|

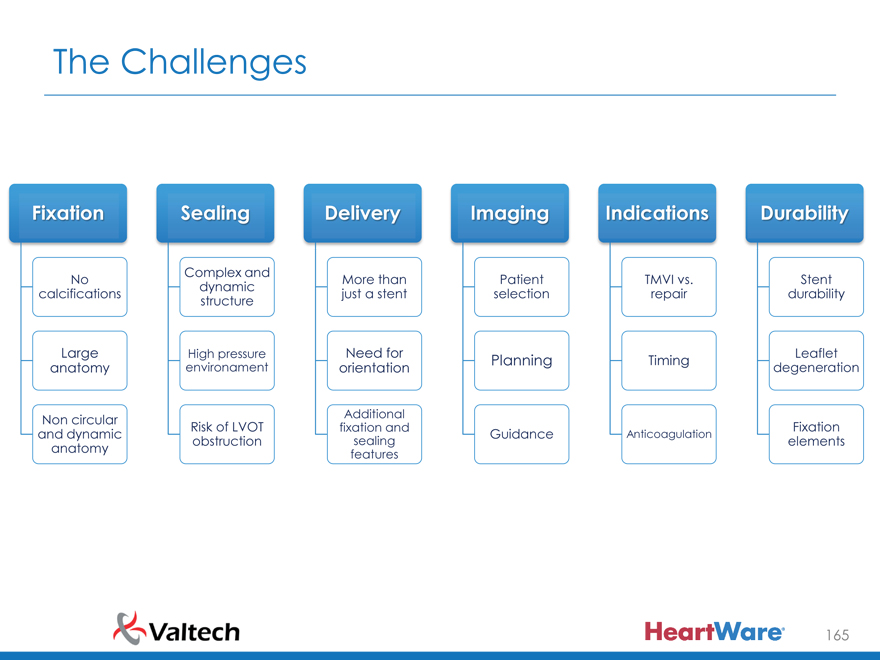

The Challenges

Fixation Sealing Delivery Imaging Indications Durability

Complex and

No More than Patient TMVI vs. Stent dynamic calcifications just a stent selection repair durability structure

Large High pressure Need for Leaflet

Planning Timing anatomy environament orientation degeneration

Non circular Risk of LVOT Additional Fixation fixation and and dynamic Guidance Anticoagulation obstruction sealing elements anatomy features

165

|

|

Different Devices. Different Solutions.

166

|

|

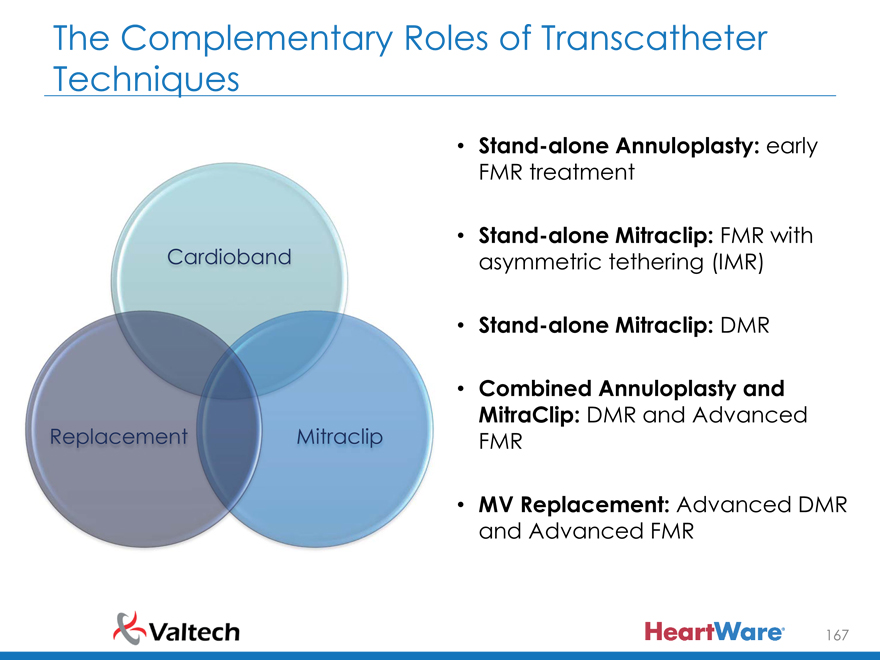

The Complementary Roles of Transcatheter Techniques

Stand-alone Annuloplasty: early FMR treatment

Cardioband • Stand-alone Mitraclip: FMR with asymmetric tethering (IMR)

Stand-alone Mitraclip: DMR

Combined Annuloplasty and

Replacement Mitraclip MitraClip: DMR and Advanced

FMR

MV Replacement: Advanced DMR and Advanced FMR

167

|

|

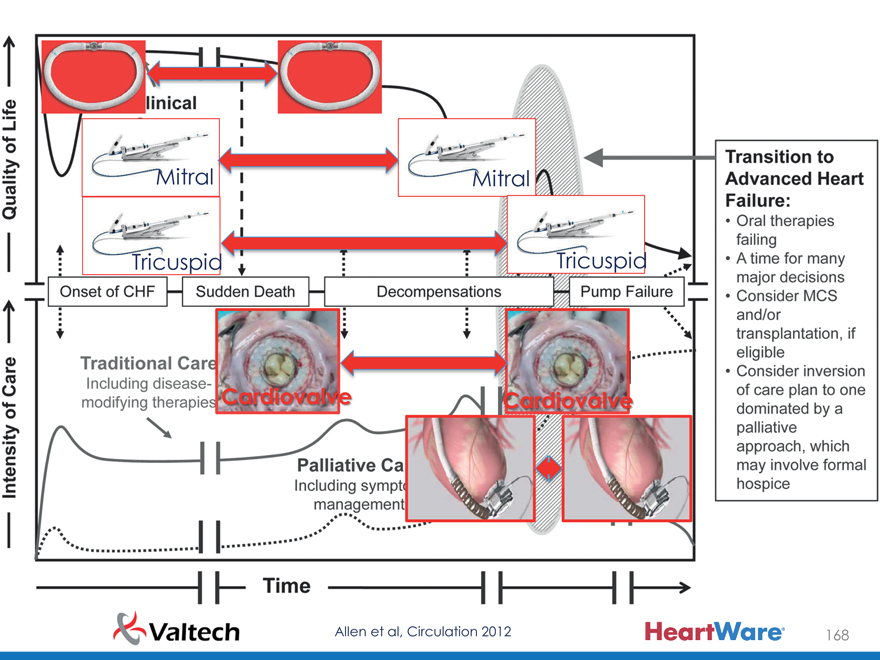

Mitral Mitral

Tricuspid Tricuspid

Cardiovalve Cardiovalve

Allen et al, Circulation 2012 168

|

|

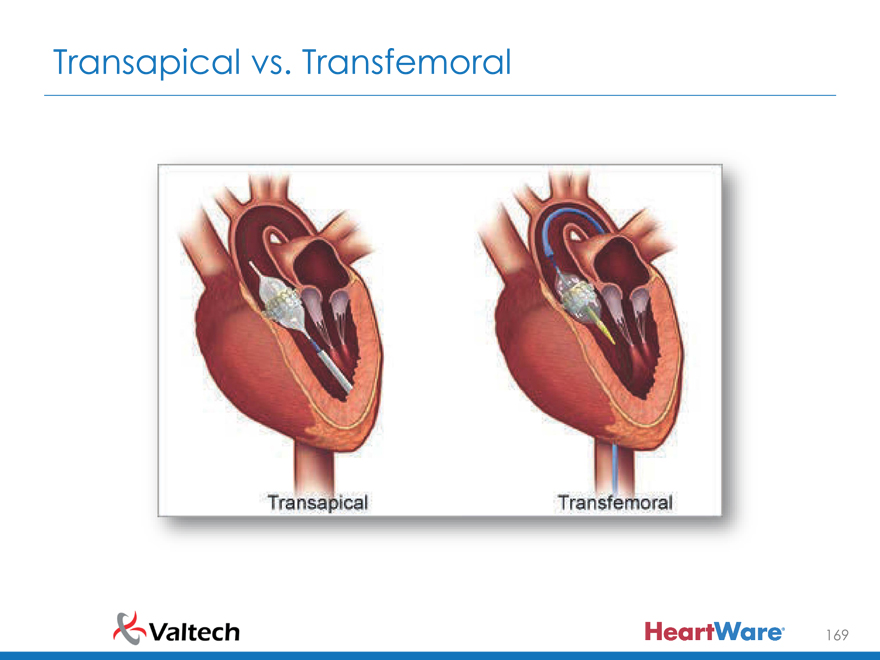

Transapical vs. Transfemoral

169

|

|

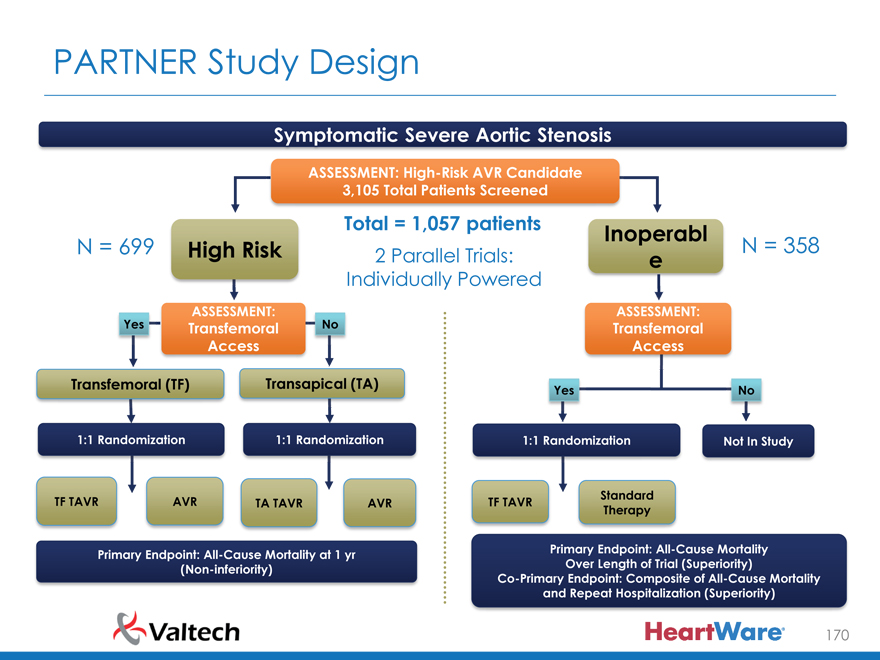

PARTNER Study Design

Symptomatic Severe Aortic Stenosis

ASSESSMENT: High-Risk AVR Candidate 3,105 Total Patients Screened

Total = 1,057 patients Inoperabl

N = 699 High Risk 2 Parallel Trials: N = 358

e

Individually Powered

Yes ASSESSMENT: No ASSESSMENT:

Transfemoral Transfemoral Access Access

Transfemoral (TF) Transapical (TA) Yes No

1:1 Randomization 1:1 Randomization 1:1 Randomization Not In Study

N = 244 N = 248 N = 104 N = 103 N = 179 N = 179

Standard TF TAVR AVR TA TAVR AVR TF TAVR

Therapy

VS VS VS

Primary Endpoint: All-Cause Mortality at 1 yr Primary Endpoint: All-Cause Mortality (Non-inferiority) Over Length of Trial (Superiority) Co-Primary Endpoint: Composite of All-Cause Mortality and Repeat Hospitalization (Superiority)

170

|

|

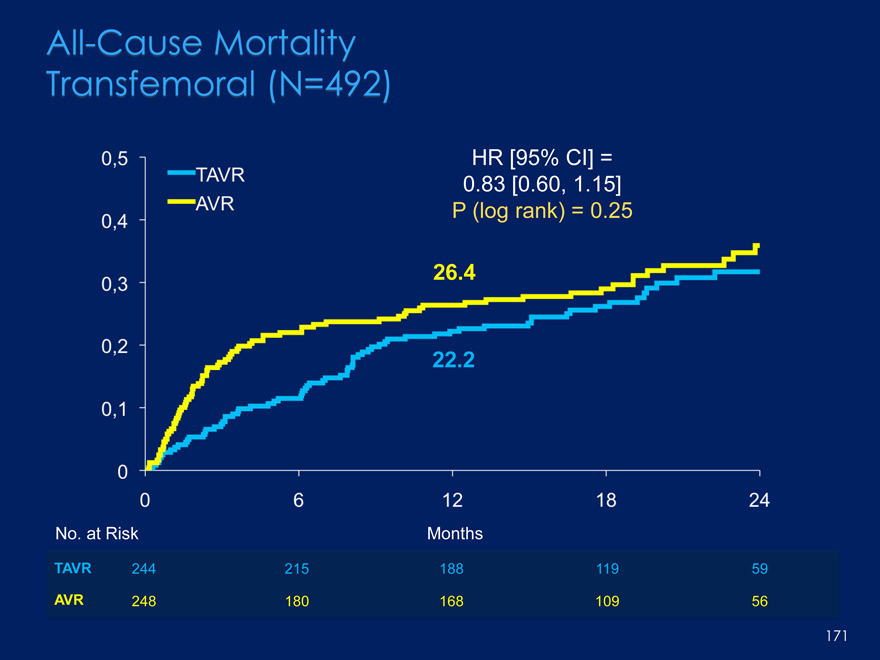

Al Cause Mortality Transfemoral (N 492)

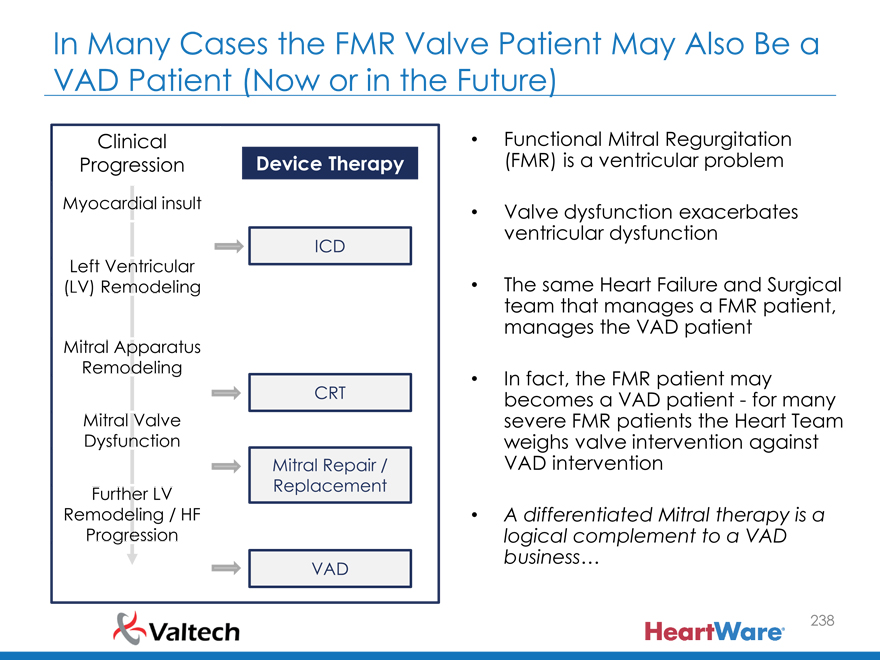

HR [95% CI] =