Form 8-K HERBALIFE LTD. For: Jan 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 20, 2017

Herbalife Ltd.

(Exact Name of Registrant as Specified in Charter)

| Cayman Islands | 1-32381 | 98-0377871 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

| P.O. Box 309GT, Ugland House, South Church Street, Grand Cayman Cayman Islands |

KY1-1106 | |||

| (Address of Principal Executive Offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: c/o (213) 745-0500

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. | Results of Operations and Financial Condition. |

In connection with Herbalife Ltd. (the “Company”) exploring a possible refinancing of certain existing indebtedness and entering into additional financing arrangements, the Company intends to disclose to prospective lenders certain preliminary information regarding the Company’s fourth quarter 2016 financial results and updated information regarding the Company’s 2017 guidance (collectively, the “New Financial Information”). The New Financial Information will be included in a confidential information memorandum the Company intends to provide to prospective lenders. Selected portions of the confidential information memorandum are attached as Exhibit 99.1 to this Current Report on Form 8-K (the “CIM Materials”), and the portions of the CIM Materials providing the New Financial Information included in the “Recent Developments” section under the headings “Fourth quarter 2016 update” and “Updated 2017 Guidance (excludes impact of this potential financing transaction)” are incorporated in this Item 2.02 by reference.

The information contained or incorporated by reference in this Item 2.02 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 7.01. | Regulation FD Disclosure. |

In connection with the discussions with prospective lenders referenced above, the Company intends to disclose certain updated business information that is included in the CIM Materials. The CIM Materials, other than those portions specifically incorporated by reference in Item 2.02 above, are incorporated in this Item 7.01 by reference.

The CIM Materials contain proposed debt terms, which have not been negotiated and remain subject to change.

By furnishing this Current Report on Form 8-K and furnishing the information set forth or incorporated by reference herein, the Company makes no admission as to the materiality of any such information that is required to be disclosed solely by reason of Regulation FD.

The information contained or incorporated by reference in this Item 7.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of such section, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Non-GAAP Financial Information

In addition to its reported results and guidance calculated in accordance with GAAP, the CIM Materials include performance measures that the Securities and Exchange Commission (the “SEC”) defines as “non-GAAP financial measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported or forecasted results, in each case calculated in accordance with GAAP, can provide useful supplemental information for investors because they facilitate a period to period comparative assessment of the Company’s operating performance relative to its performance based on reported or forecasted results under GAAP, while isolating the effects of some items that vary from period to period without any correlation to core operating performance and eliminate certain charges that management believes do not reflect the Company’s operations and underlying operational performance. The Company’s definition of these measures or the calculation thereof pursuant to the Company’s existing credit agreement may not be comparable to similarly titled measures of other companies because other companies may not calculate them in the same manner and should not be viewed in isolation from nor as alternatives to the most directly comparable measure calculated in accordance with GAAP. A reconciliation of these non-GAAP measures to the most directly-comparable GAAP measures is set forth in the CIM Materials.

Forward-Looking Statements

This Current Report on Form 8-K, including the exhibit hereto, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. Forward-looking statements may include the words “may,” “will,” “estimate,” “intend,” “continue,” “believe,” “expect” or “anticipate” and any other similar words.

Although we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent risks and uncertainties, such as those disclosed herein or incorporated by reference in our filings with the SEC. Important factors that could cause our actual results, performance and achievements, or industry results to differ materially from estimates or projections contained in our forward-looking statements include, among others, the following:

| • | our relationship with, and our ability to influence the actions of, our Members; |

| • | improper action by our employees or Members in violation of applicable law; |

| • | adverse publicity associated with our products or network marketing organization, including our ability to comfort the marketplace and regulators regarding our compliance with applicable laws; |

| • | changing consumer preferences and demands; |

| • | the competitive nature of our business; |

| • | regulatory matters governing our products, including potential governmental or regulatory actions concerning the safety or efficacy of our products and network marketing program, including the direct selling market in which we operate; |

| • | legal challenges to our network marketing program; |

| • | the consent order entered into with the FTC, the effects thereof and any failure to comply therewith; |

| • | risks associated with operating internationally and the effect of economic factors, including foreign exchange, inflation, disruptions or conflicts with our third party importers, pricing and currency devaluation risks, especially in countries such as Venezuela; |

| • | uncertainties relating to interpretation and enforcement of legislation in China governing direct selling; |

| • | our inability to obtain the necessary licenses to expand our direct selling business in China; |

| • | adverse changes in the Chinese economy; |

| • | our dependence on increased penetration of existing markets; |

| • | contractual limitations on our ability to expand our business; |

| • | our reliance on our information technology infrastructure and outside manufacturers; |

| • | the sufficiency of trademarks and other intellectual property rights; |

| • | product concentration; |

| • | our reliance upon, or the loss or departure of any member of, our senior management team which could negatively impact our Member relations and operating results; |

| • | U.S. and foreign laws and regulations applicable to our international operations; |

| • | restrictions imposed by covenants in our credit facility; |

| • | uncertainties relating to the application of transfer pricing, duties, value added taxes, and other tax regulations, and changes thereto; |

| • | changes in tax laws, treaties or regulations, or their interpretation; |

| • | taxation relating to our Members; |

| • | product liability claims; |

| • | our incorporation under the laws of the Cayman Islands; |

| • | whether we will purchase any of our shares in the open markets or otherwise; and |

| • | share price volatility related to, among other things, speculative trading and certain traders shorting our common shares. |

Additional factors that could cause actual results to differ materially from our forward-looking statements are set forth herein and in our filings with the SEC, including under the heading “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in our Consolidated Financial Statements and the related Notes.

Forward-looking statements in this Current Report on Form 8-K, including the exhibit hereto, speak only as of the date hereof, and forward-looking statements in documents attached that are incorporated by reference speak only as of the date of those documents. We do not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as required by law.

Item 9.01. Financial Statements and Exhibits.

| (d) | Exhibits. |

| 99.1 | Selected information contained in a confidential information memorandum |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Herbalife Ltd. | ||||||||

| January 20, 2017 | By: | /s/ Mark J. Friedman | ||||||

| Name: | Mark J. Friedman | |||||||

| Title: | General Counsel | |||||||

EXHIBIT INDEX

| Exhibit |

Description of Exhibit | |

| 99.1 | Selected information contained in a confidential information memorandum | |

Exhibit 99.1

Exhibit 99.1

CONFIDENTIAL INFORMATION MEMORANDUM

HERBALIFE

NUTRITION

PUBLIC

$1,325,000,000 SENIOR SECURED CREDIT FACILITIES

$150,000,000 REVOLVING CREDIT FACILITY

$1,175,000,000 TERM LOAN B

January 2017

Confidential

SPECIAL NOTICE REGARDING PUBLICLY AVAILABLE INFORMATION

HERBALIFE LTD. (THE

“COMPANY”) HAS REPRESENTED THAT THE INFORMATION CONTAINED IN THIS CONFIDENTIAL INFORMATION MEMORANDUM IS EITHER (I) PUBLICLY AVAILABLE OR (II) NOT MATERIAL WITH RESPECT TO THE COMPANY OR ITS SUBSIDIARIES OR ANY OF THEIR RESPECTIVE

SECURITIES FOR PURPOSES OF FOREIGN, UNITED STATES FEDERAL AND STATE SECURITIES LAWS. THE RECIPIENT OF THIS CONFIDENTIAL INFORMATION MEMORANDUM HAS STATED THAT IT DOES NOT WISH TO RECEIVE MATERIAL NON-PUBLIC

INFORMATION WITH RESPECT TO THE COMPANY OR ITS SECURITIES AND ACKNOWLEDGES THAT OTHER LENDERS HAVE RECEIVED A CONFIDENTIAL INFORMATION MEMORANDUM THAT CONTAINS ADDITIONAL INFORMATION WITH RESPECT TO THE COMPANY OR ITS SECURITIES THAT MAY BE

MATERIAL. NEITHER THE COMPANY NOR THE ARRANGER NOR ANY OF THEIR RESPECTIVE AFFILIATES TAKE ANY RESPONSIBILITY FOR THE RECIPIENT’S DECISION TO LIMIT THE SCOPE OF THE INFORMATION IT HAS OBTAINED IN CONNECTION WITH ITS EVALUATION OF THE COMPANY

AND THE FACILITIES.

Sole Arranger

CREDIT SUISSE

HERBALIFE NUTRITION

Table of Contents

1. Administrative information 3

2. Executive summary 17

3. Key credit highlights 27

4. Company overview 37

5. Business model 48 6. Management 56

7. Historical financial results 59

CREDIT SUISSE Confidential Page 2 of 65

HERBALIFE NUTRITION

1. Administrative information

CREDIT SUISSE

Confidential

Page 3 of 65

HERBALIFE NUTRITION A. Notice to and undertaking by recipients This Confidential Information Memorandum (this “Confidential Information Memorandum”) has been prepared solely for informational purposes from information supplied by or on behalf of Herbalife Ltd. (the “Company”), and is being furnished by Credit Suisse Securities (USA) LLC (“Credit Suisse” or the “Arranger”) to you in your capacity as a prospective lender (the “Recipient”) in considering the proposed Credit Facilities described in this Confidential Information Memorandum (the “Facilities”). ACCEPTANCE OF THIS CONFIDENTIAL INFORMATION MEMORANDUM CONSTITUTES AN AGREEMENT TO BE BOUND BY THE TERMS OF THIS NOTICE TO AND UNDERTAKING BY RECIPIENTS (THIS “NOTICE AND UNDERTAKING”) AND THE SPECIAL NOTICE SET FORTH ON THE COVER PAGE HEREOF (THE “SPECIAL NOTICE”). IF THE RECIPIENT IS NOT WILLING TO ACCEPT THIS CONFIDENTIAL INFORMATION MEMORANDUM AND OTHER EVALUATION MATERIAL (AS DEFINED HEREIN) ON THE TERMS SET FORTH IN THIS NOTICE AND UNDERTAKING AND THE SPECIAL NOTICE, IT MUST RETURN THIS CONFIDENTIAL INFORMATION MEMORANDUM AND ANY OTHER EVALUATION MATERIAL TO THE ARRANGER IMMEDIATELY WITHOUT MAKING ANY COPIES THEREOF, EXTRACTS THEREFROM OR USE THEREOF. I. Confidentiality As used herein: (a) “Evaluation Material” refers to this Confidential Information Memorandum and any other information regarding the Company or the Facilities furnished or communicated to the Recipient by or on behalf of the Company in connection with the Facilities (whether prepared or communicated by the Arranger, or the Company, their respective advisors or otherwise) and (b) “Internal Evaluation Material” refers to all memoranda, notes, and other documents and analyses developed by the Recipient using any of the information specified under the definition of Evaluation Material. The Recipient acknowledges that the Evaluation Material is confidential, sensitive and proprietary information and agrees that it shall keep the Evaluation Material and Internal Evaluation Material confidential; provided however that (i) it may make any disclosure of such information to which the Company and the Arranger give their prior written consent, (ii) any of such information may be disclosed to it, its affiliates and their respective partners, directors, officers, employees, agents, advisors and other representatives (collectively, “Representatives”) (it being understood that such Representatives shall be informed by it of the confidential nature of such information and shall be directed by the Recipient to treat such information in accordance with the terms of this Notice and Undertaking and the Special Notice) and (iii) it (and each Representative of the Recipient) may make any disclosure to any and all persons, without limitation of any kind, of the U.S. federal income tax treatment and U.S. federal income tax structure of the transaction and all materials of any kind (including opinions or other tax analyses) that are provided to the Recipient (or any Representative of the Recipient) relating to such tax treatment and tax structure. The Recipient agrees to be responsible for any breach of this Notice and Undertaking or the Special Notice that results from the actions or omissions of its Representatives. The Recipient shall be permitted to disclose the Evaluation Material and Internal Evaluation Material in the event that it is required by law or regulation or requested by any governmental agency or other regulatory authority (including any self-regulatory organization) or in connection with any legal proceedings. The Recipient agrees that it will notify the Arranger as soon as practical in the event of any such disclosure (other than at the request of a regulatory authority), unless such notification shall be prohibited by applicable law or legal process. The Recipient shall have no obligation hereunder with respect to any Evaluation Material or Internal Evaluation Material to the extent that such information (i) is or becomes publicly available other than as a result of a disclosure by the Recipient in violation of confidentiality obligations arising hereunder, (ii) was within Recipient’s possession prior to it being furnished pursuant hereto or (iii) becomes available to the Recipient on a non-confidential basis from a source other than the Company, the Arranger or their respective agents, provided that the source of such information was not known by the Recipient to be bound by a confidentiality agreement with or other contractual, legal or fiduciary obligation of confidentiality to the Company, the Arranger or any other party with respect to such information. In the event that the Recipient decides not to participate in the transaction described herein, upon request of the Arranger, the Recipient shall as soon as practicable return all Evaluation Material (other than Internal Evaluation Material) to the CREDIT SUISSE Confidential Page 4 of 65

HERBALIFE

NUTRITION

Arranger and represent in writing to the Arranger that the Recipient has destroyed all copies of the Internal Evaluation Material unless prohibited from doing so by the

Recipient’s internal policies and procedures.

II. Information

The

Recipient acknowledges and agrees that (i) the Arranger received the Evaluation Material from third party sources (including the Company) and it is provided to the Recipient for informational purposes, (ii) the Arranger and its affiliates bear no

responsibility (and shall not be liable) for the accuracy or completeness (or lack thereof) of the Evaluation Material or any information contained therein, (iii) no representation regarding the Evaluation Material is made by the Arranger or any of

its affiliates, (iv) neither Arranger nor any of its affiliates has made any independent verification as to the accuracy or completeness of the Evaluation Material, and (v) the Arranger and its affiliates shall have no obligation to update or

supplement any Evaluation Material or otherwise provide additional information.

The Evaluation Material has been prepared to assist interested parties in making

their own evaluation of the Company and the Facilities and does not purport to be all-inclusive or to contain all of the information that a prospective participant may consider material or desirable in making its decision to become a lender. The

Recipient should take such steps as it deems necessary to assure that it has the information it considers material or desirable in making its decision to become a lender and should perform its own independent investigation and analysis of the

Facilities or the transactions contemplated thereby and the creditworthiness of the Company. The Recipient represents that it is sophisticated and experienced in extending credit to entities similar to the Company. The information and data contained

herein are not a substitute for the Recipient’s independent evaluation and analysis and should not be considered as a recommendation by the Arranger or any of its affiliates that the Recipient enter into any Facility.

The Evaluation Material may include certain forward looking statements and projections provided by the Company. Any such statements and projections reflect various estimates and

assumptions by the Company concerning anticipated results. No representations or warranties are made by the Company, the Arranger or any of its affiliates as to the accuracy of any such statements or projections. Whether or not any such forward

looking statements or projections are in fact achieved will depend upon future events some of which are not within the control of the Company. Accordingly, actual results may vary from the projected results and such variations may be material.

Statements contained herein describing documents and agreements are summaries only and such summaries are qualified in their entirety by reference to such documents and agreements.

III. General

It is understood that unless and until a definitive agreement regarding the

Facilities between the parties thereto has been executed, the Recipient will be under no legal obligation of any kind whatsoever with respect to any Facility by virtue of this Notice and Undertaking except for the matters specifically agreed to

herein and in the Special Notice.

The Recipient agrees that money damages would not be a sufficient remedy for breach of this Notice and Undertaking or of the

Special Notice, and that in addition to all other remedies available at law or in equity, the Company and the Arranger shall be entitled to equitable relief, including injunction and specific performance, without proof of actual damages.

This Notice and Undertaking and the Special Notice together embody the entire understanding and agreement between the Recipient and the Arranger with respect to the Evaluation

Material and the Internal Evaluation Material and supersede all prior understandings and agreements relating thereto. The terms and conditions of this Notice and Undertaking and the Special Notice shall apply until such time, if any, that the

Recipient becomes a party to the definitive agreements regarding any Facility, and thereafter the provisions of such definitive agreements relating to confidentiality shall govern. If you do not enter into any Facility, the application of this

Notice and Undertaking and the Special Notice shall terminate with respect to all Evaluation Material and Internal Evaluation Material on the date falling two years after the date of this Confidential Information Memorandum.

This Notice and Undertaking and the Special Notice shall be governed by and construed in accordance with the law of the State of New York, without regard to principles of conflicts

of law (except Section 5-1401 of the New York General Obligations Law to the extent that it mandates that the law of the State of New York govern).

CREDIT SUISSE

Confidential

Page 5 of 65

HERBALIFE

NUTRITION

2. Executive summary

CREDIT SUISSE

Confidential

Page 17 of 65

HERBALIFE

NUTRITION

2. Executive summary

The summary below highlights information contained elsewhere in this

Memorandum and is qualified in its entirety by the more detailed information and consolidated financial statements and related notes appearing elsewhere in this Memorandum. Herbalife’s fiscal year closes on December 31.

A. Company overview

Herbalife Ltd. (“Herbalife” or the “Company”) is a

global nutrition company founded in 1980 that sells weight management, healthy meals and snacks, sports and fitness, energy and targeted nutritional products as well as personal care products. The Company sells its products primarily through the

direct-selling channel, which is extremely effective because sales of health, wellness and nutritional products are strengthened by ongoing personal contact, support and education between members and their customers. Key demographic trends related

to health and wellness coupled with the effectiveness of Herbalife’s network marketing have led to growing consumer awareness and increasing demand for the Company’s products.

As of September 30, 2016, the Company sold its products in 94 countries through a network of 4.1 million independent members (“Members”). LTM 9/30/16 net sales and

adjusted EBITDA were $4,542 million and $861 million (19% margin), respectively.

Herbalife’s science-based products have helped consumers from around the

world lose weight and improve their health. As of December 31, 2015, the Company marketed and sold over 140 products encompassing over 5,000 SKUs globally. Its products are sold as part of a portfolio program, which is comprised of a series of

related products designed to simplify weight management and nutrition for consumers. The Company’s bestselling product, Formula 1 Healthy Meal (meal replacement shake) has been approximately 30% of net sales. Herbalife segments its product

portfolio into four groups:

Weight management

Targeted nutrition

Energy, sports and fitness

Outer nutrition and other

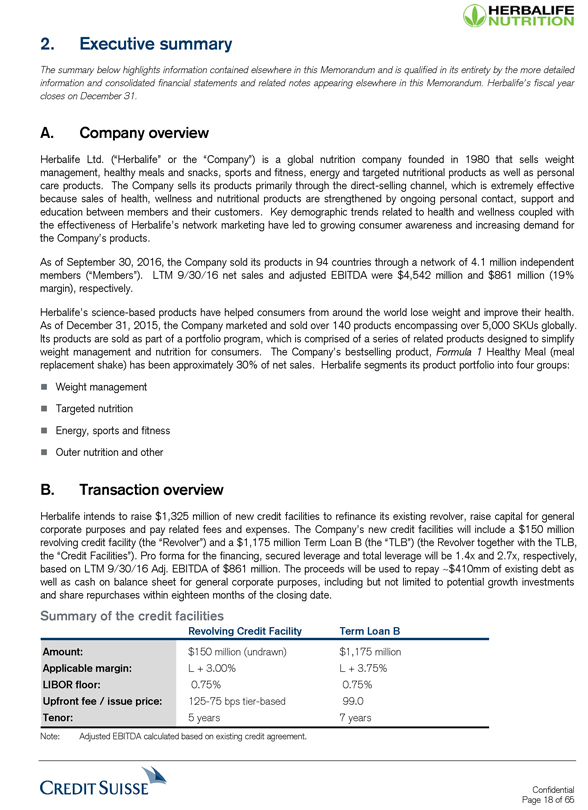

B. Transaction overview

Herbalife intends to raise $1,325 million of new credit facilities to

refinance its existing revolver, raise capital for general corporate purposes and pay related fees and expenses. The Company’s new credit facilities will include a $150 million revolving credit facility (the “Revolver”) and a $1,175

million Term Loan B (the “TLB”) (the Revolver together with the TLB, the “Credit Facilities”). Pro forma for the financing, secured leverage and total leverage will be 1.4x and 2.7x, respectively, based on LTM 9/30/16 Adj. EBITDA

of $861 million. The proceeds will be used to repay ~$410mm of existing debt as well as cash on balance sheet for general corporate purposes, including but not limited to potential growth investments and share repurchases within eighteen months of

the closing date.

Summary of the credit facilities

Revolving Credit Facility

Term Loan B

Amount:

$150 million (undrawn)

$1,175 million

Applicable margin:

L + 3.00%

L + 3.75%

LIBOR floor:

0.75%

0.75%

Upfront fee / issue price:

125-75 bps tier-based

99.0

Tenor:

5 years

7 years

Note: Adjusted EBITDA calculated based on existing credit agreement.

CREDIT SUISSE

Confidential

Page 18 of 65

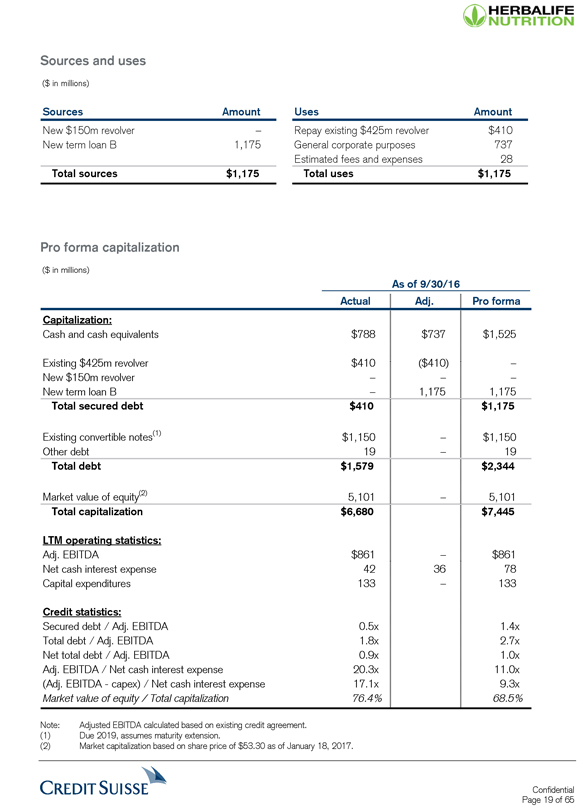

HERBALIFE NUTRITION Sources and uses ($ in millions) Sources Amount New $150m revolver – New term loan B 1,175 Total sources $1,175 Uses Amount Repay existing $425m revolver $410 General corporate purposes 737 Estimated fees and expenses 28 Total uses $1,175 Pro forma capitalization ($ in millions) As of 9/30/16 Actual Adj. Pro forma Capitalization: Cash and cash equivalents $788 $737 $1,525 Existing $425m revolver $410 ($410) – New $150m revolver – – – New term loan B – 1,175 1,175 Total secured debt $410 $1,175 Existing convertible notes(1) $1,150 – $1,150 Other debt 19 – 19 Total debt $1,579 $2,344 Market value of equity(2) 5,101 – 5,101 Total capitalization $6,680 $7,445 LTM operating statistics: Adj. EBITDA $861 – $861 Net cash interest expense 42 36 78 Capital expenditures 133 – 133 Credit statistics: Secured debt / Adj. EBITDA 0.5x 1.4x Total debt / Adj. EBITDA 1.8x 2.7x Net total debt / Adj. EBITDA 0.9x 1.0x Adj. EBITDA / Net cash interest expense 20.3x 11.0x (Adj. EBITDA - capex) / Net cash interest expense 17.1x 9.3x Market value of equity / Total capitalization 76.4% 68.5% Note: Adjusted EBITDA calculated based on existing credit agreement. (1) Due 2019, assumes maturity extension. (2) Market capitalization based on share price of $53.30 as of January 18, 2017. CREDIT SUISSE Confidential Page 19 of 65

HERBALIFE

NUTRITION

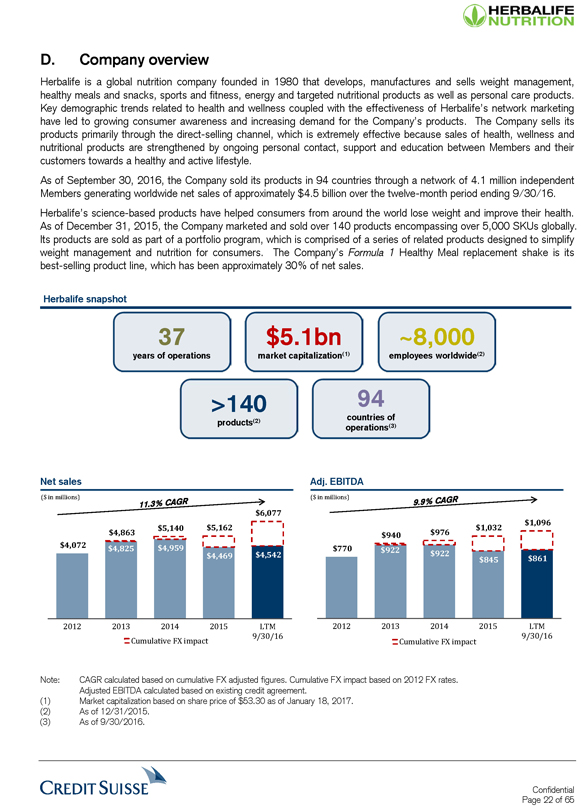

D. Company overview

Herbalife is a global nutrition company founded in 1980 that develops,

manufactures and sells weight management, healthy meals and snacks, sports and fitness, energy and targeted nutritional products as well as personal care products. Key demographic trends related to health and wellness coupled with the effectiveness

of Herbalife’s network marketing have led to growing consumer awareness and increasing demand for the Company’s products. The Company sells its products primarily through the direct-selling channel, which is extremely effective because

sales of health, wellness and nutritional products are strengthened by ongoing personal contact, support and education between Members and their customers towards a healthy and active lifestyle.

As of September 30, 2016, the Company sold its products in 94 countries through a network of 4.1 million independent Members generating worldwide net sales of approximately $4.5

billion over the twelve-month period ending 9/30/16. Herbalife’s science-based products have helped consumers from around the world lose weight and improve their health. As of December 31, 2015, the Company marketed and sold over 140 products

encompassing over 5,000 SKUs globally. Its products are sold as part of a portfolio program, which is comprised of a series of related products designed to simplify weight management and nutrition for consumers. The Company’s Formula 1 Healthy

Meal replacement shake is its best-selling product line, which has been approximately 30% of net sales.

Herbalife snapshot

37

$5.1bn

~8,000

years of operations

market capitalization(1)

employees worldwide(2)

>140

products(2)

94

countries of operations(3)

Net sales ($ in millions) 11.3% CAGR $6,077 $4,863 $5,140 $5,162 $4,072 $4,825 $4,959 $4,469 $4,542 2012 2013 2014 2015 LTM

9/30/16

Cumulative FX impact

Adj. EBITDA

($ in millions)

9.9% CAGR $1,096 $940 $976 $1,032 $770 $922 $922

$845 $861

2012 2013 2014 2015

LTM

9/30/16

Cumulative FX impact

Note: CAGR calculated based on cumulative FX adjusted figures. Cumulative FX impact based on 2012 FX rates.

Adjusted EBITDA calculated based on existing credit agreement.

(1) Market capitalization based

on share price of $53.30 as of January 18, 2017.

(2) As of 12/31/2015.

(3) As

of 9/30/2016.

CREDIT SUISSE

Confidential

Page 22 of 65

HERBALIFE

NUTRITION

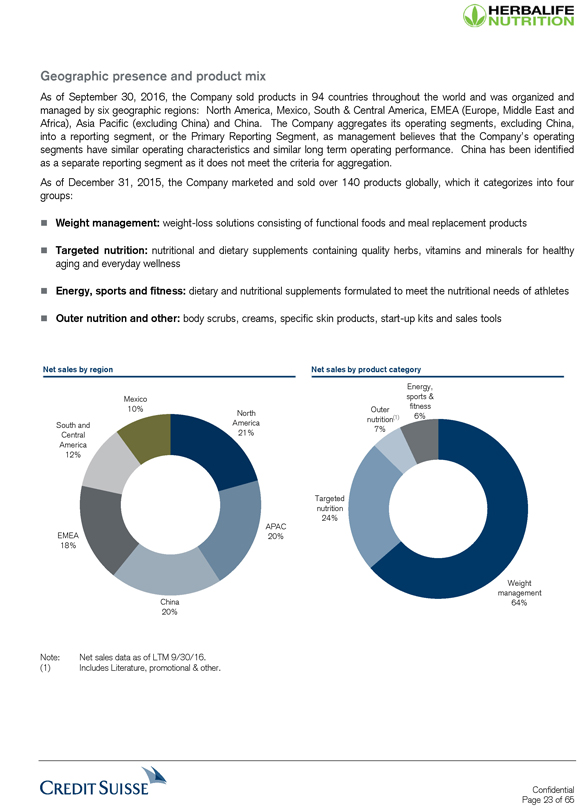

Geographic presence and product mix

As of September 30, 2016, the Company sold products in 94

countries throughout the world and was organized and managed by six geographic regions: North America, Mexico, South & Central America, EMEA (Europe, Middle East and Africa), Asia Pacific (excluding China) and China. The Company aggregates its

operating segments, excluding China, into a reporting segment, or the Primary Reporting Segment, as management believes that the Company’s operating segments have similar operating characteristics and similar long term operating performance.

China has been identified as a separate reporting segment as it does not meet the criteria for aggregation.

As of December 31, 2015, the Company marketed and sold

over 140 products globally, which it categorizes into four groups:

Weight management: weight-loss solutions consisting of functional foods and meal replacement

products

Targeted nutrition: nutritional and dietary supplements containing quality herbs, vitamins and minerals for healthy aging and everyday wellness

Energy, sports and fitness: dietary and nutritional supplements formulated to meet the nutritional needs of athletes

Outer nutrition and other: body scrubs, creams, specific skin products, start-up kits and sales tools

Net sales by region

Mexico 10% North South and America Central 21% America 12% APAC EMEA 20%

18% China 20% Net sales by product category Energy, sports & Outer fitness nutrition(1) 6% 7% Targeted nutrition 24% Weight management 64%

Note: Net sales data

as of LTM 9/30/16.

(1) Includes Literature, promotional & other.

CREDIT

SUISSE

Confidential

Page 23 of 65

HERBALIFE

NUTRITION

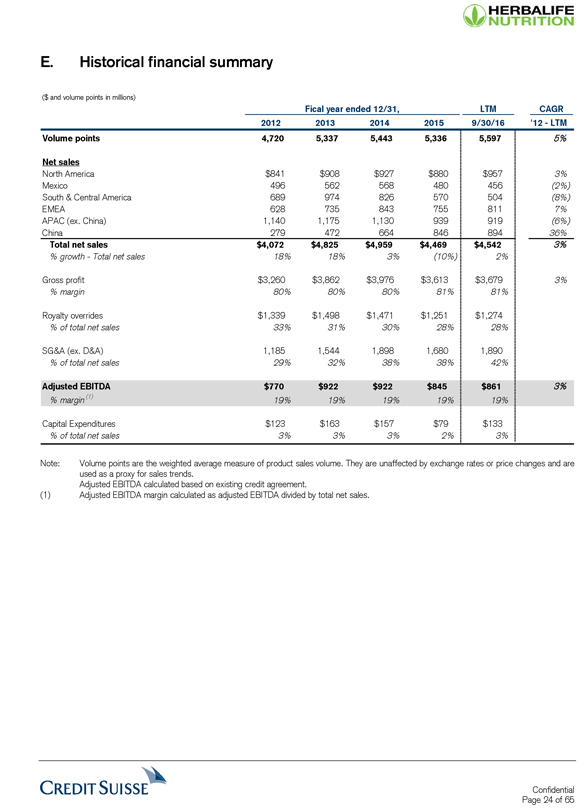

E. Historical financial summary

($ and volume points in millions)

Fical year ended 12/31, LTM CAGR

2012 2013 2014 2015 9/30/16 ‘12 - LTM

Volume points 4,720 5,337 5,443 5,336 5,597 5%

Net sales

North America $841 $908 $927 $880 $957 3%

Mexico 496 562 568 480 456 (2%)

South & Central America 689 974 826 570 504 (8%)

EMEA 628 735 843 755 811 7%

APAC (ex. China) 1,140 1,175 1,130 939 919 (6%)

China 279 472 664 846 894 36%

Total net sales $4,072 $4,825 $4,959 $4,469 $4,542 3% % growth - Total net sales 18% 18% 3% (10%) 2%

Gross profit $3,260 $3,862 $3,976 $3,613 $3,679 3% % margin 80% 80% 80% 81% 81%

Royalty

overrides $1,339 $1,498 $1,471 $1,251 $1,274 % of total net sales 33% 31% 30% 28% 28%

SG&A (ex. D&A) 1,185 1,544 1,898 1,680 1,890 % of total net sales 29%

32% 38% 38% 42%

Adjusted EBITDA $770 $922 $922 $845 $861 3% % margin (1) 19% 19% 19% 19% 19%

Capital Expenditures $123 $163 $157 $79 $133 % of total net sales 3% 3% 3% 2% 3% Note: Volume points are the weighted average measure of product sales volume. They are unaffected

by exchange rates or price changes and are used as a proxy for sales trends.

Adjusted EBITDA calculated based on existing credit agreement.

(1) Adjusted EBITDA margin calculated as adjusted EBITDA divided by total net sales.

CREDIT

SUISSE

Confidential

Page 24 of 65

HERBALIFE

NUTRITION

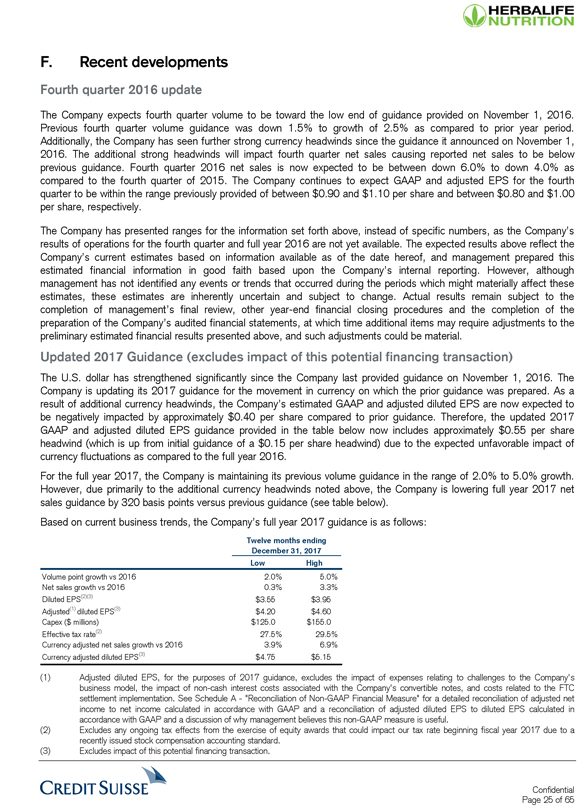

F. Recent developments

Fourth quarter 2016 update

The Company expects fourth quarter volume to be toward the low end of guidance provided on November 1, 2016. Previous fourth quarter volume guidance was down 1.5% to growth of 2.5%

as compared to prior year period. Additionally, the Company has seen further strong currency headwinds since the guidance it announced on November 1, 2016. The additional strong headwinds will impact fourth quarter net sales causing reported net

sales to be below previous guidance. Fourth quarter 2016 net sales is now expected to be between down 6.0% to down 4.0% as compared to the fourth quarter of 2015. The Company continues to expect GAAP and adjusted EPS for the fourth quarter to be

within the range previously provided of between $0.90 and $1.10 per share and between $0.80 and $1.00 per share, respectively.

The Company has presented ranges for

the information set forth above, instead of specific numbers, as the Company’s results of operations for the fourth quarter and full year 2016 are not yet available. The expected results above reflect the Company’s current estimates based

on information available as of the date hereof, and management prepared this estimated financial information in good faith based upon the Company’s internal reporting. However, although management has not identified any events or trends that

occurred during the periods which might materially affect these estimates, these estimates are inherently uncertain and subject to change. Actual results remain subject to the completion of management’s final review, other year-end financial

closing procedures and the completion of the preparation of the Company’s audited financial statements, at which time additional items may require adjustments to the preliminary estimated financial results presented above, and such adjustments

could be material.

Updated 2017 Guidance (excludes impact of this potential financing transaction)

The U.S. dollar has strengthened significantly since the Company last provided guidance on November 1, 2016. The Company is updating its 2017 guidance for the movement in currency

on which the prior guidance was prepared. As a result of additional currency headwinds, the Company’s estimated GAAP and adjusted diluted EPS are now expected to be negatively impacted by approximately $0.40 per share compared to prior

guidance. Therefore, the updated 2017 GAAP and adjusted diluted EPS guidance provided in the table below now includes approximately $0.55 per share headwind (which is up from initial guidance of a $0.15 per share headwind) due to the expected

unfavorable impact of currency fluctuations as compared to the full year 2016.

For the full year 2017, the Company is maintaining its previous volume guidance in

the range of 2.0% to 5.0% growth. However, due primarily to the additional currency headwinds noted above, the Company is lowering full year 2017 net sales guidance by 320 basis points versus previous guidance (see table below).

Based on current business trends, the Company’s full year 2017 guidance is as follows:

Twelve months ending

December 31, 2017

Low High

Volume point growth vs 2016 2.0% 5.0%

Net sales growth vs 2016 0.3% 3.3%

Diluted EPS(2)(3) $3.55 $3.95

Adjusted(1) diluted EPS(3) $4.20 $4.60

Capex ($ millions) $125.0 $155.0

Effective tax rate(2) 27.5% 29.5%

Currency adjusted net sales growth vs 2016 3.9% 6.9%

Currency adjusted diluted EPS(3) $4.75 $5.15

(1) Adjusted diluted EPS, for

the purposes of 2017 guidance, excludes the impact of expenses relating to challenges to the Company’s business model, the impact of non-cash interest costs associated with the Company’s convertible

notes, and costs related to the FTC settlement implementation. See Schedule A - “Reconciliation of Non-GAAP Financial Measure” for a detailed reconciliation of adjusted net income to net income

calculated in accordance with GAAP and a reconciliation of adjusted diluted EPS to diluted EPS calculated in accordance with GAAP and a discussion of why management believes this non-GAAP measure is useful.

(2) Excludes any ongoing tax effects from the exercise of equity awards that could impact our tax rate beginning fiscal year 2017 due to a recently issued stock

compensation accounting standard. (3) Excludes impact of this potential financing transaction.

CREDIT SUISSE

Confidential

Page 25 of 65

HERBALIFE

NUTRITION

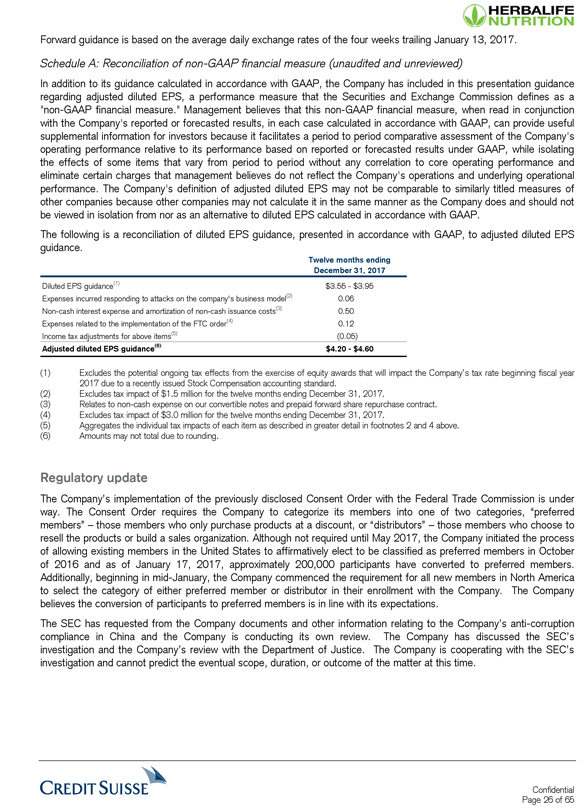

Forward guidance is based on the average daily exchange rates of the four weeks trailing January 13, 2017.

Schedule A: Reconciliation of non-GAAP financial measure (unaudited and unreviewed)

In addition to its guidance calculated in accordance with GAAP, the Company has included in this presentation guidance regarding adjusted diluted EPS, a performance measure that

the Securities and Exchange Commission defines as a “non-GAAP financial measure.” Management believes that this non-GAAP financial measure, when read in

conjunction with the Company’s reported or forecasted results, in each case calculated in accordance with GAAP, can provide useful supplemental information for investors because it facilitates a period to period comparative assessment of the

Company’s operating performance relative to its performance based on reported or forecasted results under GAAP, while isolating the effects of some items that vary from period to period without any correlation to core operating performance and

eliminate certain charges that management believes do not reflect the Company’s operations and underlying operational performance. The Company’s definition of adjusted diluted EPS may not be comparable to similarly titled measures of other

companies because other companies may not calculate it in the same manner as the Company does and should not be viewed in isolation from nor as an alternative to diluted EPS calculated in accordance with GAAP.

The following is a reconciliation of diluted EPS guidance, presented in accordance with GAAP, to adjusted diluted EPS guidance.

| Twelve months ending |

| December 31, 2017 |

| Diluted EPS guidance(1) $3.55 - $3.95 |

| Expenses incurred responding to attacks on the company’s business model(2) 0.06 |

| Non-cash interest expense and amortization of non-cash issuance costs(3) 0.50 |

| Expenses related to the implementation of the FTC order(4) 0.12 |

| Income tax adjustments for above items(5) (0.05) |

| Adjusted diluted EPS guidance(6) $4.20 - $4.60 |

(1) Excludes the potential ongoing tax effects from the exercise of equity awards that will impact the Company’s tax rate beginning

fiscal year 2017 due to a recently issued Stock Compensation accounting standard.

(2) Excludes tax impact of $1.5 million for the twelve months ending December 31,

2017.

(3) Relates to non-cash expense on our convertible notes and prepaid forward share repurchase contract.

(4) Excludes tax impact of $3.0 million for the twelve months ending December 31, 2017.

(5)

Aggregates the individual tax impacts of each item as described in greater detail in footnotes 2 and 4 above.

(6) Amounts may not total due to rounding.

Regulatory update

The Company’s implementation of the previously

disclosed Consent Order with the Federal Trade Commission is under way. The Consent Order requires the Company to categorize its members into one of two categories, “preferred members” – those members who only purchase products at a

discount, or “distributors” – those members who choose to resell the products or build a sales organization. Although not required until May 2017, the Company initiated the process of allowing existing members in the United States to

affirmatively elect to be classified as preferred members in October of 2016 and as of January 17, 2017, approximately 200,000 participants have converted to preferred members. Additionally, beginning in mid-January, the Company commenced the

requirement for all new members in North America to select the category of either preferred member or distributor in their enrollment with the Company. The Company believes the conversion of participants to preferred members is in line with its

expectations.

The SEC has requested from the Company documents and other information relating to the Company’s anti-corruption compliance in China and the

Company is conducting its own review. The Company has discussed the SEC’s investigation and the Company’s review with the Department of Justice. The Company is cooperating with the SEC’s investigation and cannot predict the eventual

scope, duration, or outcome of the matter at this time.

CREDIT SUISSE

Confidential

Page 26 of 65

HERBALIFE

NUTRITION

3. Key credit highlights

CREDIT SUISSE

Confidential

Page 27 of 65

HERBALIFE

NUTRITION

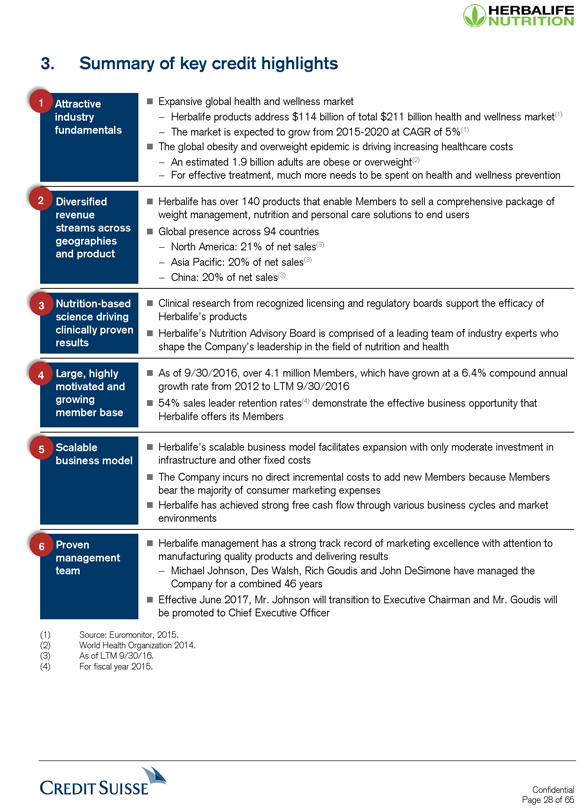

3. Summary of key credit highlights

| 1 Attractive Expansive global health and wellness market |

| industry – Herbalife products address $114 billion of total $211 billion health and wellness market(1) |

| fundamentals – The market is expected to grow from 2015-2020 at CAGR of 5%(1) |

| The global obesity and overweight epidemic is driving increasing healthcare costs |

| – An estimated 1.9 billion adults are obese or overweight(2) |

| – For effective treatment, much more needs to be spent on health and wellness prevention |

| 2 Diversified Herbalife has over 140 products that enable Members to sell a comprehensive package of |

| revenue weight management, nutrition and personal care solutions to end users |

| streams across Global presence across 94 countries |

| geographies – North America: 21% of net sales(3) |

| and product |

| – Asia Pacific: 20% of net sales(3) |

| – China: 20% of net sales(3) |

| 3 Nutrition-based Clinical research from recognized licensing and regulatory boards support the efficacy of |

| science driving Herbalife’s products |

| clinically proven Herbalife’s Nutrition Advisory Board is comprised of a leading team of industry experts who |

| results shape the Company’s leadership in the field of nutrition and health |

| 4 Large, highly As of 9/30/2016, over 4.1 million Members, which have grown at a 6.4% compound annual |

| motivated and growth rate from 2012 to LTM 9/30/2016 |

| growing 54% sales leader retention rates(4) demonstrate the effective business opportunity that |

| member base Herbalife offers its Members |

| 5 Scalable Herbalife’s scalable business model facilitates expansion with only moderate investment in |

| business model infrastructure and other fixed costs |

| The Company incurs no direct incremental costs to add new Members because Members |

| bear the majority of consumer marketing expenses |

| Herbalife has achieved strong free cash flow through various business cycles and market |

| environments |

| 6 Proven Herbalife management has a strong track record of marketing excellence with attention to |

| management manufacturing quality products and delivering results |

| team – Michael Johnson, Des Walsh, Rich Goudis and John DeSimone have managed the |

| Company for a combined 46 years |

| Effective June 2017, Mr. Johnson will transition to Executive Chairman and Mr. Goudis will |

| be promoted to Chief Executive Officer |

(1) Source: Euromonitor, 2015.

(2) World Health

Organization 2014.

(3) As of LTM 9/30/16.

(4) For fiscal year 2015.

CREDIT SUISSE

Confidential

Page 28 of 65

HERBALIFE

NUTRITION

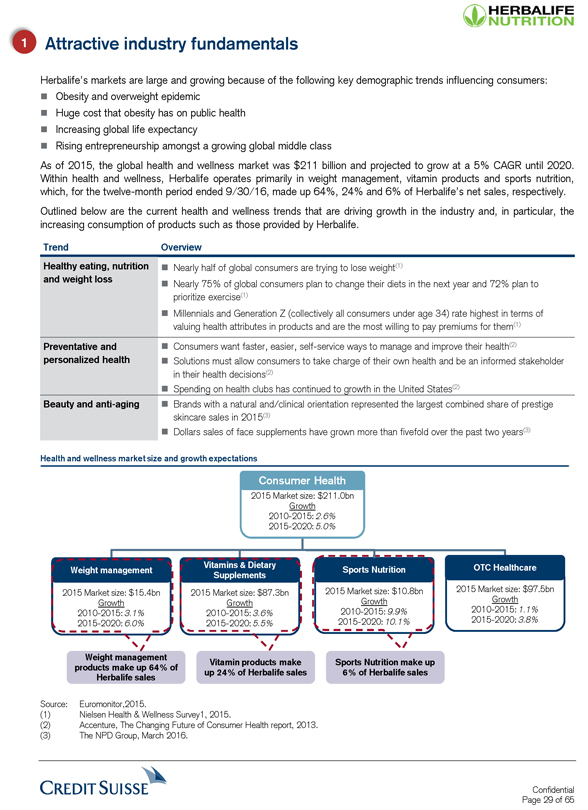

1 Attractive industry fundamentals

Herbalife’s markets are large and growing because of

the following key demographic trends influencing consumers:

Obesity and overweight epidemic

Huge cost that obesity has on public health

Increasing global life expectancy

Rising entrepreneurship amongst a growing global middle class

As of 2015, the global health

and wellness market was $211 billion and projected to grow at a 5% CAGR until 2020. Within health and wellness, Herbalife operates primarily in weight management, vitamin products and sports nutrition, which, for the twelve-month period ended

9/30/16, made up 64%, 24% and 6% of Herbalife’s net sales, respectively. Outlined below are the current health and wellness trends that are driving growth in the industry and, in particular, the increasing consumption of products such as those

provided by Herbalife.

| Trend Overview |

| Healthy eating, nutrition Nearly half of global consumers are trying to lose weight(1) |

| and weight loss Nearly 75% of global consumers plan to change their diets in the next year and 72% plan to |

| prioritize exercise(1) |

| Millennials and Generation Z (collectively all consumers under age 34) rate highest in terms of |

| valuing health attributes in products and are the most willing to pay premiums for them(1) |

| Preventative and Consumers want faster, easier, self-service ways to manage and improve their health(2) |

| personalized health Solutions must allow consumers to take charge of their own health and be an informed stakeholder |

| in their health decisions(2) |

| Spending on health clubs has continued to growth in the United States(2) |

| Beauty and anti-aging Brands with a natural and/clinical orientation represented the largest combined share of prestige |

| skincare sales in 2015(3) |

| Dollars sales of face supplements have grown more than fivefold over the past two years(3) |

Health and wellness market size and growth expectations

| Consumer Health 2015 Market size: $211.0bn Growth 2010-2015: 2.6% 2015-2020: 5.0% | ||||||

| Weight management 2015 Market size: $15.4bn Growth 2010-2015: 3.1% 2015-2020: 6.0% | Vitamins & Dietary Supplements 2015 Market size: $87.3bn Growth 2010-2015: 3.6% 2015-2020: 5.5% | Sports Nutrition 2015 Market size: $10.8bn Growth 2010-2015: 9.9% 2015-2020: 10.1% | OTC Healthcare 2015 Market size: $97.5bn Growth 2010-2015: 1.1% 2015-2020: 3.8% | |||

| Weight management products make up 64% of Herbalife sales | Vitamin products make up 24% of Herbalife sales | Sports Nutrition make up 6% of Herbalife sales | ||||

Source: Euromonitor,2015.

(1) Nielsen Health &

Wellness Survey1, 2015.

(2) Accenture, The Changing Future of Consumer Health report, 2013.

(3) The NPD Group, March 2016.

CREDIT SUISSE

Confidential

Page 29 of 65

HERBALIFE

NUTRITION

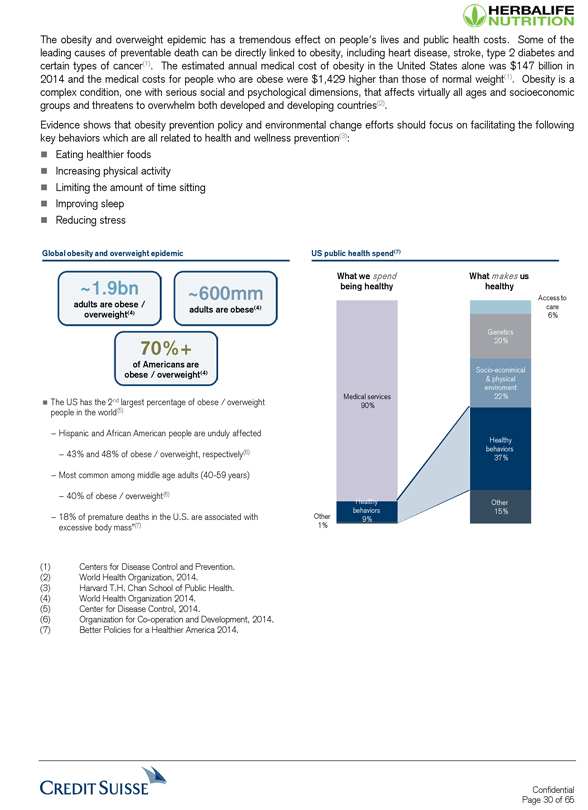

The obesity and overweight epidemic has a tremendous effect on people’s lives and public health costs. Some of the leading causes of preventable death can be directly linked

to obesity, including heart disease, stroke, type 2 diabetes and certain types of cancer(1). The estimated annual medical cost of obesity in the United States alone was $147 billion in 2014 and the medical costs for people who are obese were

$1,429 higher than those of normal weight(1). Obesity is a complex condition, one with serious social and psychological dimensions, that affects virtually all ages and socioeconomic groups and threatens to overwhelm both developed and developing

countries(2).

Evidence shows that obesity prevention policy and environmental change efforts should focus on facilitating the following key behaviors which are all

related to health and wellness prevention(3):

Eating healthier foods

Increasing physical activity

Limiting the amount of time sitting

Improving sleep

Reducing stress

Global obesity and overweight epidemic

~1.9bn

~600mm

adults are obese / overweight(4)

adults are obese(4)

70%+

of Americans are obese / overweight(4)

The US has the 2nd largest percentage of obese /

overweight people in the world(5)

– Hispanic and African American people are unduly affected

– 43% and 48% of obese / overweight, respectively(6)

– Most common among middle age

adults (40-59 years)

– 40% of obese / overweight(6)

– 18% of premature deaths in the U.S. are associated with excessive body mass”(7)

US

public health spend(7)

What we spend

What makes us

being healthy

healthy

Access to

care

6%

Genetics

20%

Socio-econimical

& physical

enviroment

Medical services

22%

90%

Healthy

behaviors

37%

Healthy

Other

behaviors

15%

Other

9%

1%

(1) Centers for Disease Control and Prevention.

(2) World Health Organization, 2014.

(3) Harvard T.H. Chan School of Public Health.

(4) World Health Organization 2014.

(5) Center for Disease Control, 2014.

(6) Organization for Co-operation and Development, 2014.

(7) Better Policies for a Healthier America 2014.

CREDIT SUISSE

Confidential

Page 30 of 65

HERBALIFE

NUTRITION

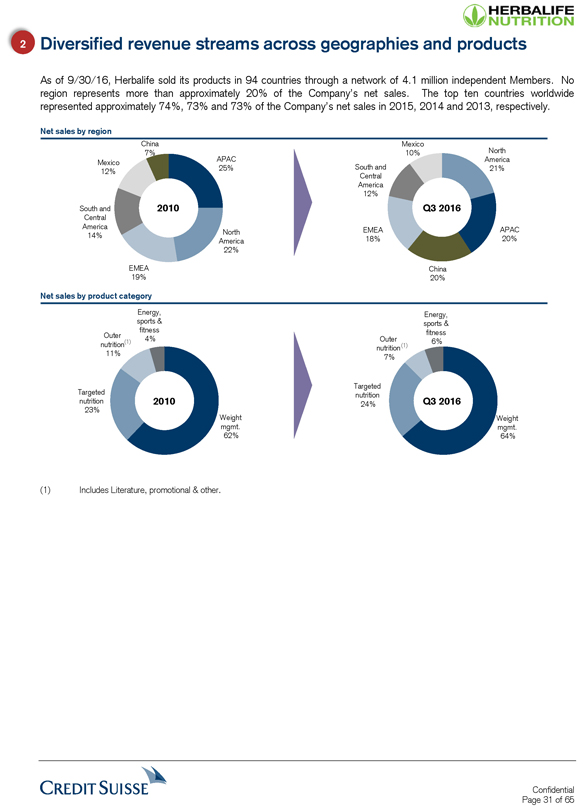

2 Diversified revenue streams across geographies and products

As of 9/30/16, Herbalife sold

its products in 94 countries through a network of 4.1 million independent Members. No region represents more than approximately 20% of the Company’s net sales. The top ten countries worldwide represented approximately 74%, 73% and 73% of

the Company’s net sales in 2015, 2014 and 2013, respectively.

Net sales by region

China

Mexico

7%

10%

North

Mexico

APAC

America

12%

25%

South and

21%

Central

America

12%

South and

2010

Q3 2016

Central

America

North

EMEA

APAC

14%

America

18%

20%

22%

EMEA

China

19%

20%

Net sales by product category

Energy,

Energy,

sports &

sports &

fitness

fitness

Outer

4%

Outer

6%

nutrition(1)

nutrition(1)

11%

7%

Targeted

Targeted

nutrition

nutrition

2010

24%

Q3 2016

23%

Weight

Weight

mgmt.

mgmt.

62%

64%

(1) Includes Literature, promotional & other.

CREDIT SUISSE

Confidential

Page 31 of 65

HERBALIFE

NUTRITION

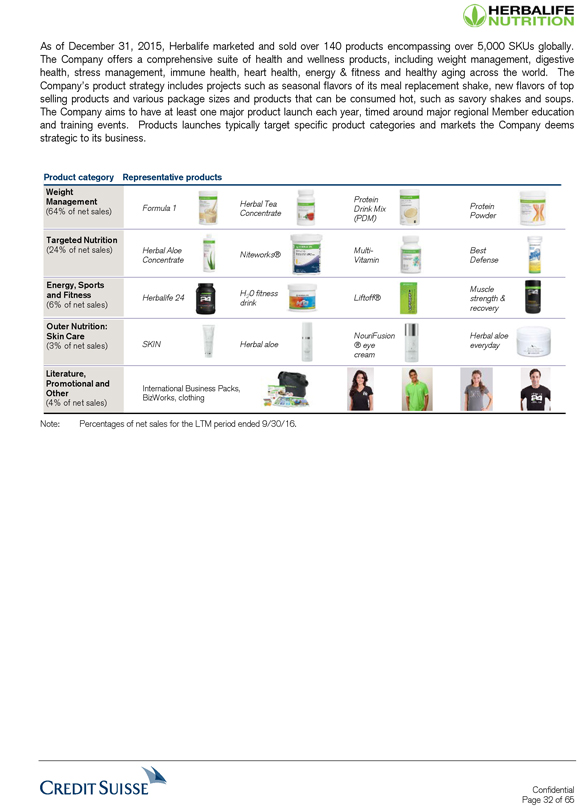

As of December 31, 2015, Herbalife marketed and sold over 140 products encompassing over 5,000 SKUs globally. The Company offers a comprehensive suite of health and wellness

products, including weight management, digestive health, stress management, immune health, heart health, energy & fitness and healthy aging across the world. The Company’s product strategy includes projects such as seasonal flavors of

its meal replacement shake, new flavors of top selling products and various package sizes and products that can be consumed hot, such as savory shakes and soups. The Company aims to have at least one major product launch each year, timed around

major regional Member education and training events. Products launches typically target specific product categories and markets the Company deems strategic to its business.

Product category

Representative products

Weight Management (64% of net sales)

Formula 1

Herbal Tea Concentrate

Protein Drink Mix (PDM)

Protein Powder

Targeted Nutrition (24% of net sales)

Herbal Aloe Concentrate

Niteworks®

Multi- Vitamin

Best Defense

Energy, Sports and Fitness (6% of net sales)

Herbalife 24

H20 fitness drink

Liftoff®

Muscle strength & recovery

Outer Nutrition: Skin Care (3% of net sales)

SKIN

Herbal aloe

NouriFusion ® eye cream

Herbal aloe everyday

Literature, Promotional and Other (4% of net sales)

International Business Packs, BizWorks,

clothing

Note: Percentages of net sales for the LTM period ended 9/30/16.

CREDIT SUISSE

Confidential

Page 32 of 65

HERBALIFE

NUTRITION

3 Nutrition-based science driving clinically proven results

Herbalife invests significantly in

clinical research to develop industry leading products that are safe and effective. Since 2010, the Company has invested over $250 million in self-manufacturing. As a result, Herbalife has a robust

in-house product testing capability.

In addition to ensuring the highest quality ingredients and building the quality into

the finished products, Herbalife tests incoming raw materials for compliance to potency, identity and adherence to strict specifications. Finished products are analyzed for label claim and microbiological purity thereby verifying product safety and

shelf life in the market. For the Company’s self-manufactured products, it does substantially all of its testing in-house at the Company’s modern quality control laboratories in the United States and

China. The Company has major quality control labs in Southern California, Winston-Salem, North Carolina, Suzhou, China and its Worldwide Quality Center of Excellence in Changsha, China. All Herbalife Innovation & Manufacturing

(“H.I.M.”) quality control labs contain modern analytical equipment and are backed by the expertise in testing and methods development of the Company’s scientists.

Herbalife employs over 300 professionals, including 36 PhD’s performing science or technical related functions, which includes product development, quality control and

scientific and regulatory affairs around the world.

Clinical research from recognized licensing and regulatory boards support the efficacy of Herbalife’s

products

“Overall, our study findings indicate that, in METS patients, LCPUFA supplementation and protein meal replacement under calorie-

restricted dietary conditions exert beneficial effects on metabolic parameters…”

journal of functional foods

Lee et al. Journal of Functional Foods, 2015

“These findings demonstrate significant beneficial effects of protein-enriched meal replacements on reduction in waist circumference

among overweight and obese Chinese with hyperlipidemia.”

American College of Nutrition

Chen et al. Journal of the American College of Nutrition, 2016

“A

statistically significant lower prevalence of metabolic syndrome was observed in club members compared to controls, suggesting

better overall cardio metabolic

health.”

Tufts Medical Center

Tufts study presented at the 2015 annual

meeting of The Obesity Society, Los Angeles, CA

Herbalife’s Nutrition Advisory Board (NAB) is comprised of leading experts from around the world in nutrition,

science and health. The NAB helps educate and train distributors on leading a healthy, active lifestyle and getting proper nutrition, including the purpose and use of Herbalife products. The NAB, along with the Company’s in-house scientific team, continually upgrades and introduces new products as new scientific studies become available by regulatory authorities around the world.

Herbalife’s Nutritional Advisory Board is comprised of prominent professionals that help shape the Company’s leadership

John Agwunobi Ph.D. Chief Health and Nutrition Officer

David Heber M.D., Ph.D., F.A.C.P.,

F.A.C.N. Chairman Nutrition Institute and Nutrition Advisory Board

Vasilios Frankos Ph.D. Senior Vice President Global Product Safety Science and Compliance

Louis Ignarro Ph.D. Nobel Laureate in Medicine Nutrition Nutrition Institute and Advisory Board

Luigi Gratton M.D., M.P.H. VP Worldwide Nutrition Education & Development

Rocio

Medina M.D. VP Nutrition Training

Dana Ryam Ph.D. Senior Manager, Sports Performance & Education

John Heiss Ph.D. Senior Director Sports and Fitness, Worldwide Product Marketing

CREDIT SUISSE

Confidential

Page 33 of 65

HERBALIFE

NUTRITION

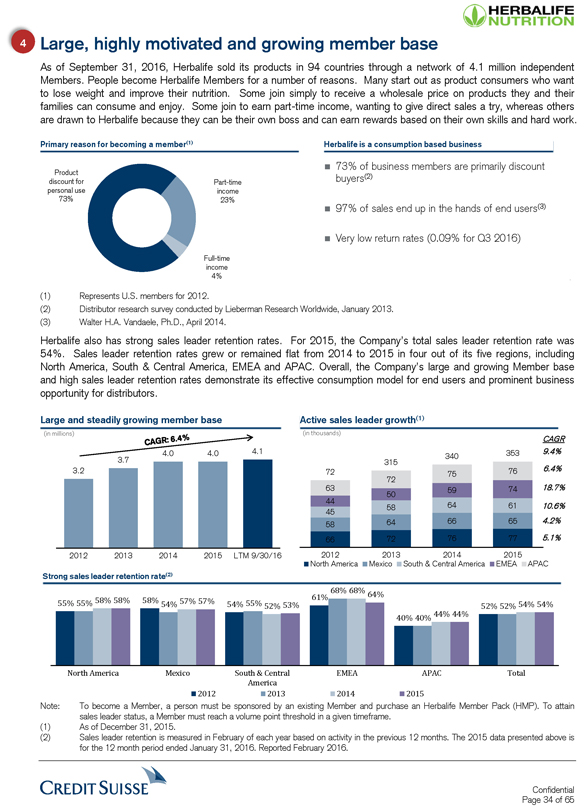

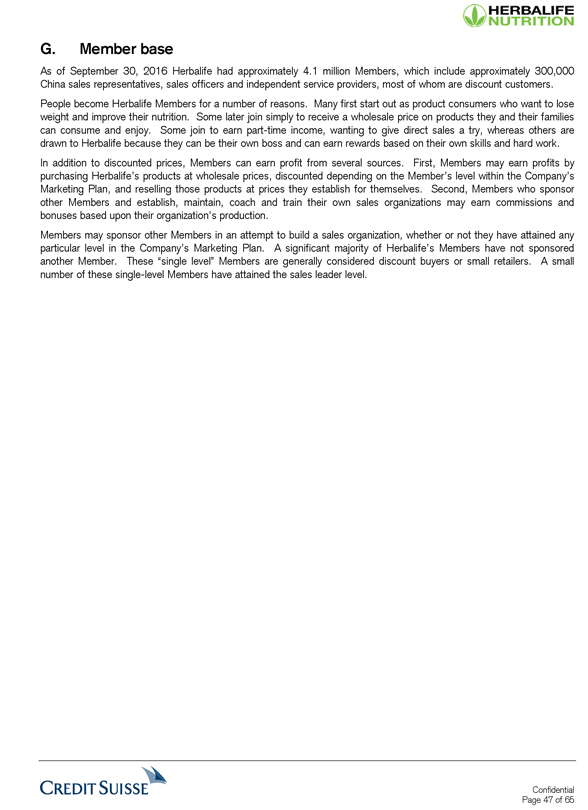

4 Large, highly motivated and growing member base

As of September 31, 2016, Herbalife

sold its products in 94 countries through a network of 4.1 million independent Members. People become Herbalife Members for a number of reasons. Many start out as product consumers who want to lose weight and improve their nutrition. Some join

simply to receive a wholesale price on products they and their families can consume and enjoy. Some join to earn part-time income, wanting to give direct sales a try, whereas others are drawn to Herbalife because they can be their own boss and can

earn rewards based on their own skills and hard work.

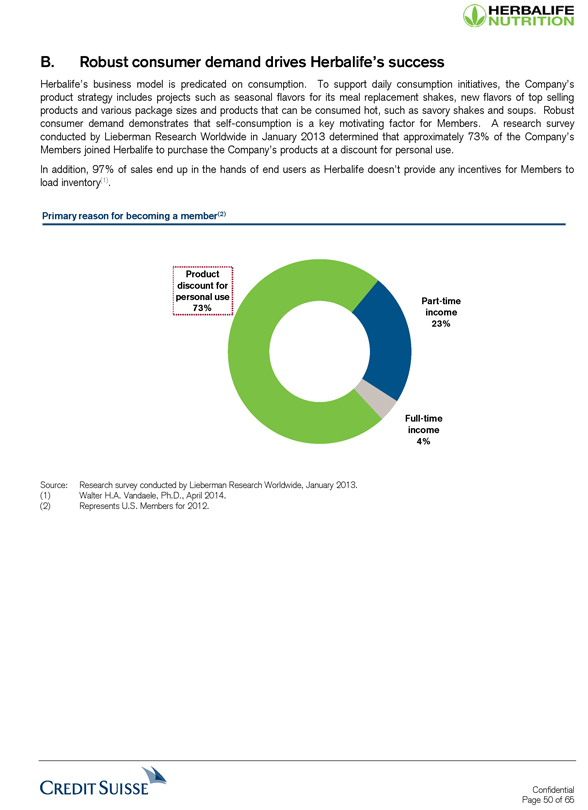

Primary reason for becoming a member(1)

Product discount for Part-time personal use income 73% 23% Full-time income 4%

Herbalife is a

consumption based business

73% of business members are primarily discount buyers(2)

97% of sales end up in the hands of end users(3)

Very low return rates (0.09% for Q3 2016)

(1) Represents U.S. members for 2012.

(2) Distributor research survey

conducted by Lieberman Research Worldwide, January 2013.

(3) Walter H.A. Vandaele, Ph.D., April 2014.

Herbalife also has strong sales leader retention rates. For 2015, the Company’s total sales leader retention rate was 54%. Sales leader retention rates grew or remained flat

from 2014 to 2015 in four out of its five regions, including North America, South & Central America, EMEA and APAC. Overall, the Company’s large and growing Member base and high sales leader retention rates demonstrate its effective

consumption model for end users and prominent business opportunity for distributors.

Large and steadily growing member base

(in millions) CAGR: 6.4%

4.0 4.0 4.1 3.7 3.2

2012 2013 2014 2015 LTM 9/30/16

Active sales leader growth(1)

(in thousands)

CAGR

340 353 9.4%

315

72 75 76 6.4%

72

63 59 74 18.7%

50

44 58 64 61 10.6%

45

58 64 66 65 4.2%

66 72 76 77 5.1%

2012 2013 2014 2015

North America Mexico South & Central America EMEA APAC

Strong sales leader retention rate(2)

55% 55% 58% 58%

58% 54% 57% 57%

54% 55% 52% 53% 61% 68%

68% 64% 40%

40% 44% 44%

52% 52% 54% 54%

North America

Mexico SouthAmerica & Central EMEA APAC Total 2012 2013 2014 2015

Note: To become a

Member, a person must be sponsored by an existing Member and purchase an Herbalife Member Pack (HMP). To attain sales leader status, a Member must reach a volume point threshold in a given timeframe.

(1) As of December 31, 2015.

(2) Sales leader retention is measured in February of each

year based on activity in the previous 12 months. The 2015 data presented above is for the 12 month period ended January 31, 2016. Reported February 2016.

CREDIT SUISSE Confidential

Page 34 of 65

HERBALIFE

NUTRITION

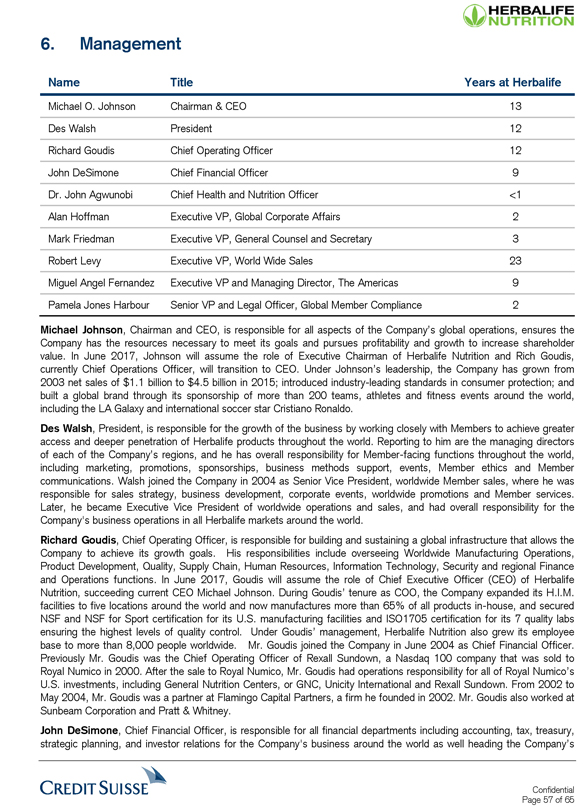

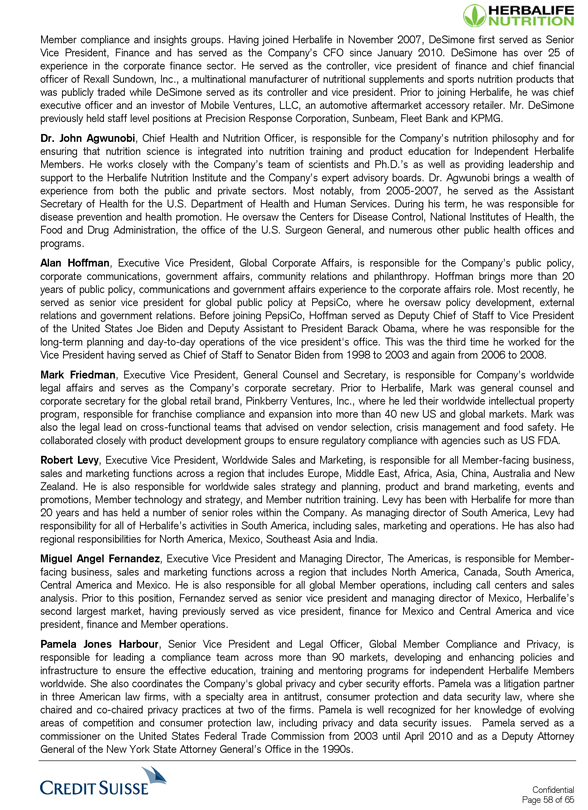

6 Proven management team

Led by Michael Johnson, Des Walsh, Rich Goudis and John DeSimone, who

have collectively spent nearly 50 years at Herbalife, the executive team has been at the forefront of the Company’s evolution to a global nutrition company. Effective June 1, 2017, Michael Johnson will transition to Executive Chairman and

Rich Goudis will assume CEO role. Rich Goudis joined Herbalife in 2004 as CFO and became Chief Operating Officer in 2010. During his tenure as COO, the Company has expanded its H.I.M. facilities to five locations around the world and has gone from

0% self-manufacturing to ~65%.

Name Title Prior experience Years at Herbalife

Michael O. Johnson(1)

Chairman & CEO

Walt Disney Pictures 13

Des Walsh President DMX MUSIC 12

Richard Goudis(2) Chief Operating Officer Sundown Naturals 12

John DeSimone Chief Financial

Officer Sundown Naturals 9

Chief Health and Nutrition Dr. John Agwunobi Walmart <1

Officer Executive VP, Global Alan Hoffman Pepsi 2

Corporate Affairs Executive VP, General Mark

Friedman Pinkberry 3

Counsel and Secretary Executive VP, World Wide Robert Levy HERBALIFE NUTRITION 23

Sales Executive VP and Managing Miguel Angel Fernandez HERBALIFE NUTRITION 9

Director, The

Americas Senior VP and Legal Officer, Pamela Jones Harbour 2

Global Member Compliance

(1) Transitioning to Executive Chairman, effective 6/1/17.

(2) Promoted to Chief Executive

Officer, effective 6/1/17.

CREDIT SUISSE

Confidential

Page 36 of 65

HERBALIFE

NUTRITION

4. Company overview

CREDIT SUISSE

Confidential

Page 37 of 65

HERBALIFE

NUTRITION

4. Company overview

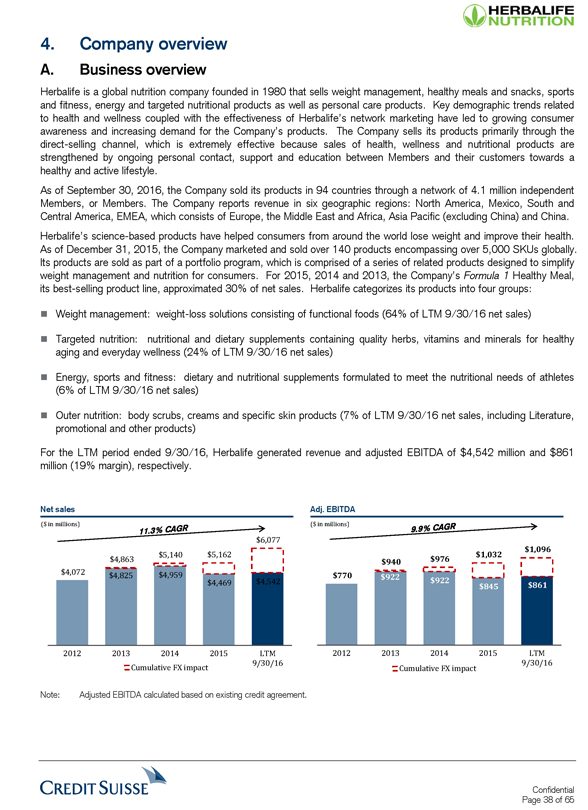

A. Business overview

Herbalife is a global nutrition company founded in 1980 that sells weight management, healthy meals and snacks, sports and fitness, energy and targeted nutritional products as well

as personal care products. Key demographic trends related to health and wellness coupled with the effectiveness of Herbalife’s network marketing have led to growing consumer awareness and increasing demand for the Company’s products. The

Company sells its products primarily through the direct-selling channel, which is extremely effective because sales of health, wellness and nutritional products are strengthened by ongoing personal contact, support and education between Members and

their customers towards a healthy and active lifestyle.

As of September 30, 2016, the Company sold its products in 94 countries through a network of

4.1 million independent Members, or Members. The Company reports revenue in six geographic regions: North America, Mexico, South and Central America, EMEA, which consists of Europe, the Middle East and Africa, Asia Pacific (excluding China) and

China. Herbalife’s science-based products have helped consumers from around the world lose weight and improve their health. As of December 31, 2015, the Company marketed and sold over 140 products encompassing over 5,000 SKUs globally. Its

products are sold as part of a portfolio program, which is comprised of a series of related products designed to simplify weight management and nutrition for consumers. For 2015, 2014 and 2013, the Company’s Formula 1 Healthy Meal, its

best-selling product line, approximated 30% of net sales. Herbalife categorizes its products into four groups:

● Weight management: weight-loss solutions

consisting of functional foods (64% of LTM 9/30/16 net sales)

● Targeted nutrition: nutritional and dietary supplements containing quality herbs, vitamins

and minerals for healthy aging and everyday wellness (24% of LTM 9/30/16 net sales)

● Energy, sports and fitness: dietary and nutritional supplements

formulated to meet the nutritional needs of athletes (6% of LTM 9/30/16 net sales)

● Outer nutrition: body scrubs, creams and specific skin products (7% of

LTM 9/30/16 net sales, including Literature, promotional and other products)

For the LTM period ended 9/30/16, Herbalife generated revenue and adjusted EBITDA of

$4,542 million and $861 million (19% margin), respectively.

Net sales

($ in millions)

11.3% CAGR

$4,863

$5,140

$5,162

$6,077

$4,072

$4,825

$4,959

$4,469

$4,542

2012

2013 2014 2015

9/30/16 LTM

Cumulative FX impact

Note: Adjusted EBITDA calculated based on existing credit agreement.

Adj. EBITDA

($ in millions)

9.9% CAGR

$1,096

$940 $976 $1,032

$770 $922 $922

$845 $861

2012 2013 2014 2015 9/30/16 LTM

Cumulative FX impact

CREDIT SUISSE

Confidential

Page 38 of 65

HERBALIFE

NUTRITION

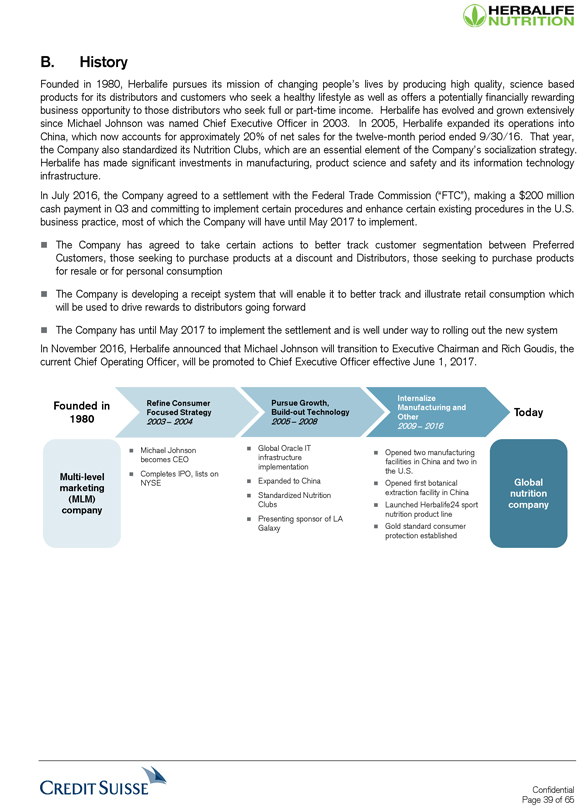

B. History

Founded in 1980, Herbalife pursues its mission of changing people’s lives by

producing high quality, science based products for its distributors and customers who seek a healthy lifestyle as well as offers a potentially financially rewarding business opportunity to those distributors who seek full or part-time income.

Herbalife has evolved and grown extensively since Michael Johnson was named Chief Executive Officer in 2003. In 2005, Herbalife expanded its operations into China, which now accounts for approximately 20% of net sales for the twelve-month period

ended 9/30/16. That year, the Company also standardized its Nutrition Clubs, which are an essential element of the Company’s socialization strategy. Herbalife has made significant investments in manufacturing, product science and safety and its

information technology infrastructure.

In July 2016, the Company agreed to a settlement with the Federal Trade Commission (“FTC”), making a

$200 million cash payment in Q3 and committing to implement certain procedures and enhance certain existing procedures in the U.S. business practice, most of which the Company will have until May 2017 to implement.

The Company has agreed to take certain actions to better track customer segmentation between Preferred Customers, those seeking to purchase products at a discount and Distributors,

those seeking to purchase products for resale or for personal consumption

The Company is developing a receipt system that will enable it to better track and

illustrate retail consumption which will be used to drive rewards to distributors going forward

The Company has until May 2017 to implement the settlement and is

well under way to rolling out the new system

In November 2016, Herbalife announced that Michael Johnson will transition to Executive Chairman and Rich Goudis, the

current Chief Operating Officer, will be promoted to Chief Executive Officer effective June 1, 2017.

Founded in 1980 Refine Consumer Focused Strategy 2003

– 2004 Pursue Growth, Build-out Technology 2005 – 2008 Internalize Manufacturing and Other 2009 – 2016 Today

Michael Johnson becomes CEO Global

Oracle IT infrastructure implementation Opened two manufacturing facilities in China and two in the U.S.

Multi-level marketing (MLM) company Completes IPO, lists

on NYSE Expanded to China Opened first botanical extraction facility in China Global nutrition company

Standardized Nutrition Clubs

Launched Herbalife24 sport nutrition product line

Presenting sponsor of LA Galaxy Gold

standard consumer protection established

CREDIT SUISSE Confidential

Page 39

of 65

HERBALIFE

NUTRITION

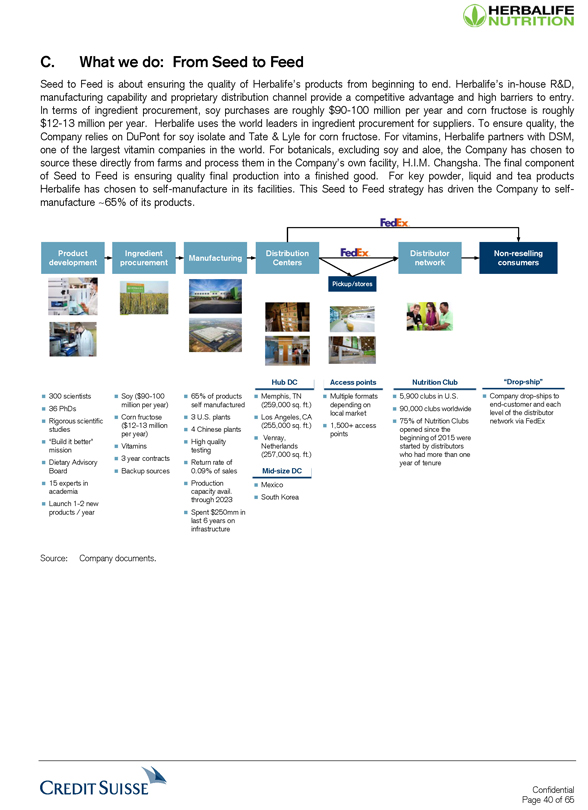

C. What we do: From Seed to Feed

Seed to Feed is about ensuring the quality of

Herbalife’s products from beginning to end. Herbalife’s in-house R&D, manufacturing capability and proprietary distribution channel provide a competitive advantage and high barriers to entry. In

terms of ingredient procurement, soy purchases are roughly $90-100 million per year and corn fructose is roughly $12-13 million per year. Herbalife uses the

world leaders in ingredient procurement for suppliers. To ensure quality, the Company relies on DuPont for soy isolate and Tate & Lyle for corn fructose. For vitamins, Herbalife partners with DSM, one of the largest vitamin companies in the

world. For botanicals, excluding soy and aloe, the Company has chosen to source these directly from farms and process them in the Company’s own facility, H.I.M. Changsha. The final component of Seed to Feed is ensuring quality final production

into a finished good. For key powder, liquid and tea products Herbalife has chosen to self-manufacture in its facilities. This Seed to Feed strategy has driven the Company to self-manufacture ~65% of its products.

FedEX

Product development Ingredient procurement Manufacturing Distribution Centers FedEX

Pickup/stores Distributor network Non-reselling consumers

Hub DC Access points Nutrition Club “Drop-ship”

300 scientists Soy ($90-100 million per year) 65% of products self manufactured Memphis, TN (259,000 sq. ft.) Multiple

formats depending on local market 5,900 clubs in U.S. 90,000 clubs worldwide Company drop-ships to end-customer and each level of the distributor network via FedEx

36 PhDs Corn fructose ($12-13 million per year) 3 U.S. plants 4 Chinese plants Los Angeles, CA (255,000 sq. ft.) 1,500+ access points

75% of Nutrition Clubs opened since the beginning of 2015 were started by distributors who had more than one year of tenure

Rigorous scientific studies Vitamins

High quality testing Venray, Netherlands (257,000 sq. ft.)

“Build it better” mission 3 year contracts Backup sources Return rate of 0.09% of sales

Mid-size DC

Dietary Advisory Board

15 experts in academia Production capacity avail. through 2023 Mexico South Korea

Launch 1-2 new products / year Spent $250mm in last 6 years on infrastructure

Source: Company documents.

CREDIT SUISSE Confidential

Page 40 of 65

HERBALIFE

NUTRITION

D. Product offering overview

For 37 years, the Company’s science-based products have

helped Members and their customers from around the world lose weight, improve their health and experience life-changing results. Herbalife’s products are often sold as part of a program, and therefore its portfolio is comprised of a series of

related products designed to simplify weight management and nutrition for the Company’s Members and their customers.

The Company categorizes its products into

four groups: weight management, targeted nutrition, energy, sports & fitness and outer nutrition and other. For 2015, 2014 and 2013, the Formula 1 Healthy Meal, the Company’s best-selling product line, made up approximately 30% of its

net sales.

Nutrient-rich products to satisfy daily nutritional needs

Weight

Management Formula 1 is the Company’s top-selling product (~30% of overall net sales)

(64% of net sales)

Solutions to increase customer success with weight-loss

Plan to provide new, healthy meal

variations – such as bars, soups and shakes

Targeted Nutrition Aloe Concentrate is a core offering in the targeted nutrition product line

(24% of net sales) Dietary and nutritional supplements containing quality herbs, vitamins and minerals with focus on healthy aging and everyday wellness

Strengthen current products portfolio using latest science and research

Energy, Sports and

Fitness Formulated to meet the nutritional needs of athletes

Leverage young, trendy image of Herbalife 24

(6% of net sales)

Build awareness and authenticity through our team, athlete and event

sponsorships, and increase member confidence

Outer Nutrition: Skin Care Body scrubs, creams and specific skin type products

(7% of net sales) Utilize Outer Nutrition to attract new set of members and provide members new selling opportunity

Includes Literature, promotional and other products

Note: Percentage of net sales for the LTM

period ending 9/30/16.

Product development

The Company is committed to

providing the highest-quality, science-based products to help its consumers achieve their health and wellness goals. Herbalife relies on the scientific contributions from Members of its Nutrition Advisory Board, along with its in-house scientific team, to continually upgrade or introduce new products as new scientific studies become available and accepted by regulatory authorities around the world. Herbalife also utilizes the expertise of

several international universities and key ingredient suppliers to review, evaluate and formulate new product ideas. Once a particular market opportunity has been identified, the Company’s scientists along with its marketing and sales teams

work closely with Member leadership to successfully develop and launch the product. Herbalife’s aim is to have at least one major product launch each year, timed around the Company’s major regional Member education and training events.

Herbalife only develops functional foods on the basis of sound science using ingredients that have been well studied and discussed in background scientific

literature. Use of these ingredients for their well-established purposes is by definition not novel, and for that reason, most food uses of these ingredients are not subject to patent protection. Notwithstanding the absence of patent protection, the

Company does own proprietary formulations for substantially all of its weight management products and dietary and nutritional supplements. The Company takes care in protecting the intellectual property rights of its proprietary formulas by

restricting access to the formulas within the Company to those persons or departments that require access to them to perform their functions, and by requiring its finished goods-suppliers and consultants to execute supply and non-disclosure agreements that seek to contractually protect the Company’s intellectual property rights.

CREDIT SUISSE

Confidential

Page 41 of 65

HERBALIFE

NUTRITION

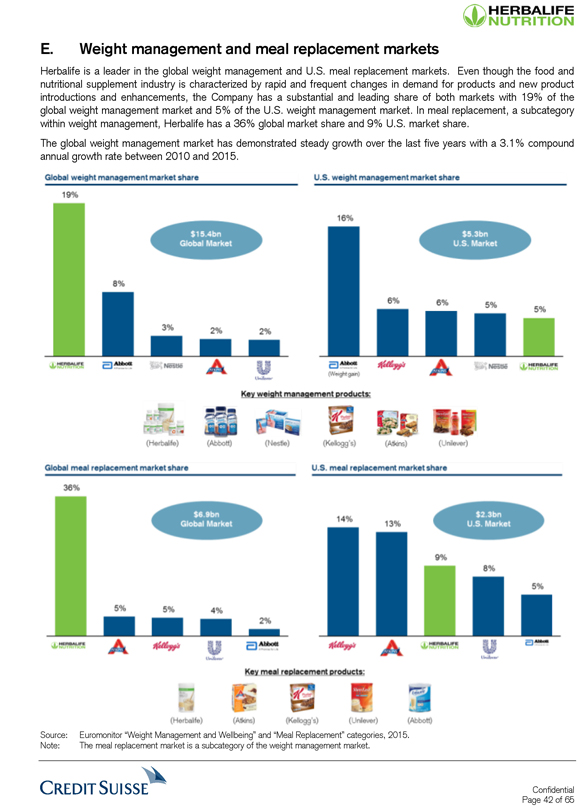

E. Weight management and meal replacement markets

Herbalife is a leader in the global weight

management and U.S. meal replacement markets. Even though the food and nutritional supplement industry is characterized by rapid and frequent changes in demand for products and new product introductions and enhancements, the Company has a

substantial and leading share of both markets with 19% of the global weight management market and 5% of the U.S. weight management market. In meal replacement, a subcategory within weight management, Herbalife has a 36% global market share and 9%

U.S. market share.

The global weight management market has demonstrated steady growth over the last five years with a 3.1% compound annual growth rate between 2010

and 2015.

Global weight management market share

19% 8% 3% 2% 2%

$15.4bn Global Market

Herbalife Nutrition Abbott Nestle Uniliver

U.S. weight management market share

$5.3bn U.S. Market

16% 6% 6% 5% 5%

Abbott Weight Gain Kellogg’s Nestle Herbalife Nutrition

Key weight management products:

Herbalife Abbott Nestle Kellogg’s Atkins Uniliver

Global meal replacement market share

36% 5% 5% 4% 2%

$6.9bn Global Market

Herbalife Nutrition Kellog’s Unilever Abbott

U.S. meal replacement market shares

14% 13% 9% 8% 5%

$2.3bn U.S. Market

Key meal replacement products:

Herbalife Atkins Kellogg’s Unilever Abbott

Source: Euromonitor “Weight Management

and Wellbeing” and “Meal Replacement” categories, 2015.

Note: The meal replacement market is a subcategory of the weight management market.

CREDIT SUISSE Confidential

Page 42 of 65

HERBALIFE

NUTRITION

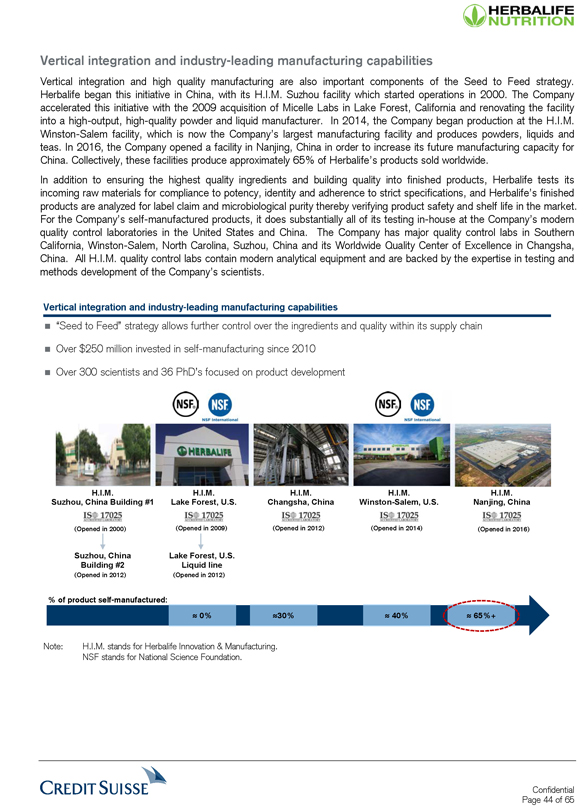

F. Manufacturing, distribution and technology

Ingredient traceability and world class supplier

network

The Company’s objective is to provide the highest quality products to its Members. The Company seeks to accomplish this goal through execution of its

“Seed to Feed” strategy that includes significant investments in quality assurance, scientific personnel, product testing and increasing the amount of self-manufacturing of the Company’s top products. The Seed to Feed strategy is

rooted in using quality ingredients from traceable sources coupled with vertical manufacturing of the Company’s most popular products. For Herbalife’s botanical products, the Seed to Feed strategy also includes self-manufacturing of teas

and herbal ingredients. The Company’s procurement activities include the complete self-processing of teas and botanicals into finished raw materials. The Company traces its products all the way out into the field. For example, each bottle of

Formula 1has its own unique identifier.

Herbalife sources its high quality ingredients from a world class supplier network. Ingredients are sourced from companies

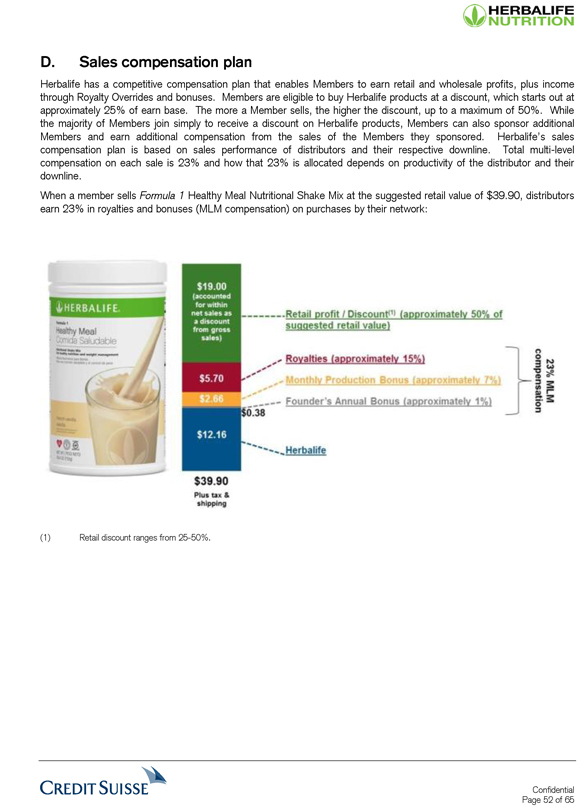

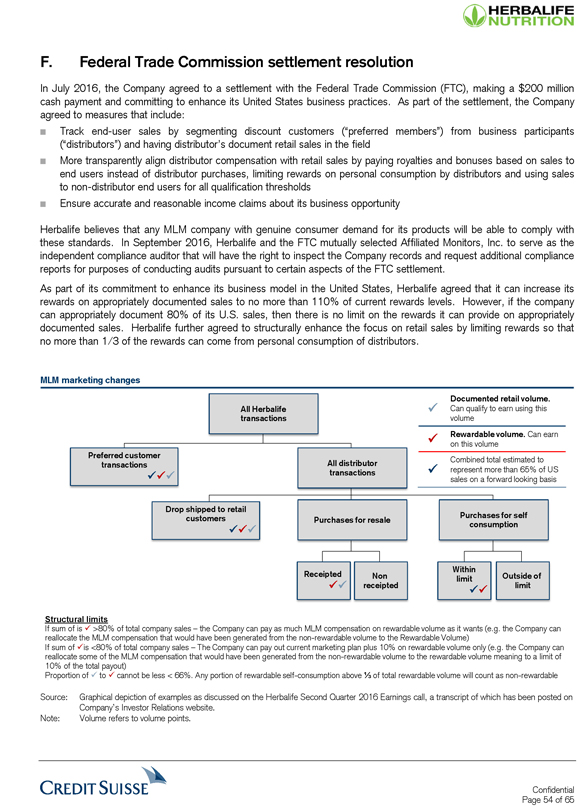

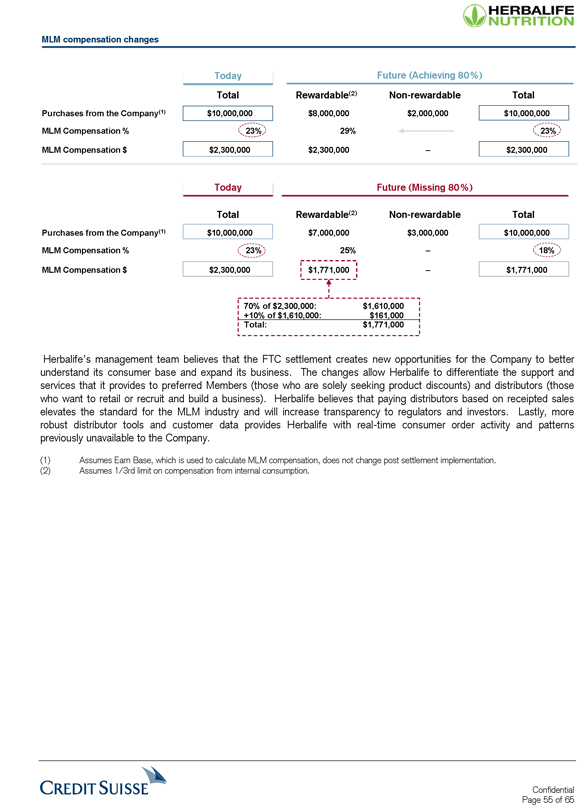

that are large and reputable suppliers in their respective field. For example, soy, the Company’s most often used ingredient, is sourced from DuPont (formerly Solae) and ADM. Vitamins, minerals and other key ingredients come from companies such