Form 8-K HEALTHSOUTH CORP For: Mar 27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): March 27, 2015

HealthSouth Corporation

(Exact name of Registrant as specified in its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

001-10315 | 63-0860407 |

(Commission File Number) | (IRS Employer Identification No.) |

3660 Grandview Parkway, Suite 200, Birmingham, Alabama 35243

(Address of Principal Executive Offices, Including Zip Code)

(205) 967-7116

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 7.01. Regulation FD Disclosure.

Subsequent to its earnings release for the fourth quarter of 2014, HealthSouth Corporation (“HealthSouth” or the “Company”) assembled an Investor Reference Book, which is attached to this Current Report on Form 8‑K as Exhibit 99.1 (the “Investor Reference Book”). The Investor Reference Book addresses, among other things, an overview of the Company and its industry, a historical perspective of the Company, the Company’s business outlook, the Company’s financial and operational metrics and initiatives, and the Company’s value proposition. The Investor Reference Book is available at

http://investor.healthsouth.com by clicking on an available link.

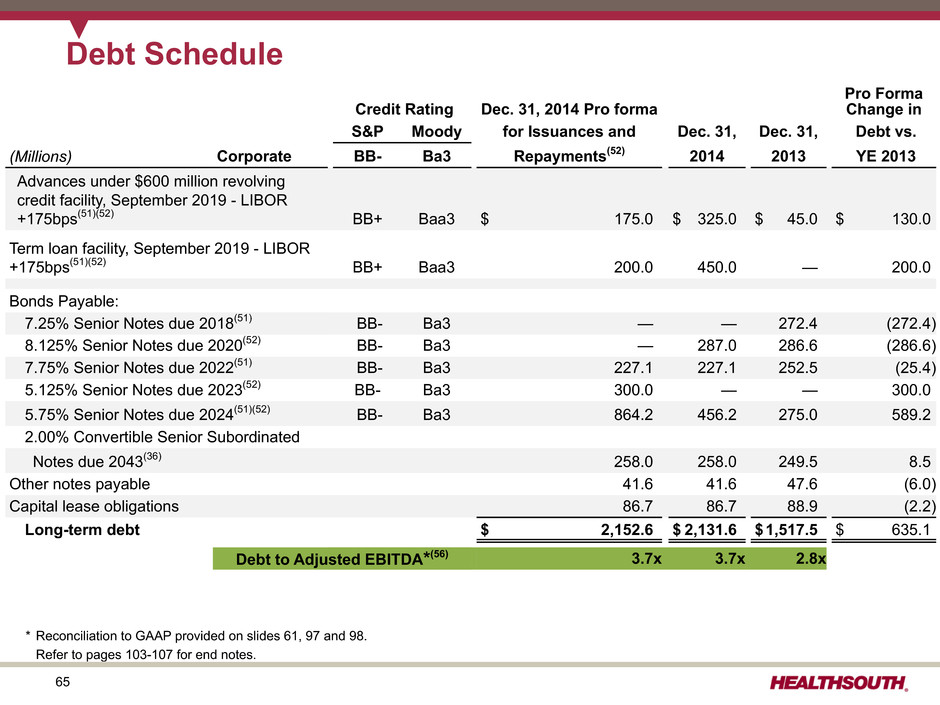

The Company reiterates as of the date hereof its Adjusted EBITDA guidance for 2015, as previously reported in the Current Report on Form 8-K dated February 24, 2015 and during the Company’s earnings conference call held on February 25, 2015. The Company is revising its previously provided earnings per diluted share guidance for 2015 from a range of $2.24 to $2.29 per share to a range of $2.13 to $2.19 per share to include the impact of the following:

• | On March 11, 2015, the Company gave notice of, and made an irrevocable commitment for, the redemption of all the outstanding principal amount of its 8.125% Senior Notes due 2020. On March 12, 2015, the Company completed its registered public offering of $300 million aggregate principal amount of 5.125% Senior Notes due 2023 at a public offering price of 100.00% of the principal amount and will use the proceeds from this offering, along with cash on hand, to complete the redemption of the 8.125% Senior Notes due 2020 in April 2015. As a result of these transactions, the Company expects to record an approximate $21 million, or $0.12 per diluted share, loss on early extinguishment of debt in the second quarter of 2015. This loss will be offset in part by interest savings. |

• | On March 22, 2015, the Company entered into an agreement to settle the lawsuit filed on August 16, 2004 by General Medicine and captioned General Medicine, P.C. v. HealthSouth Corp. Although the specific terms of this settlement agreement are confidential, HealthSouth and General Medicine agreed to dismiss with prejudice the lawsuit pending in the Circuit Court of Jefferson County, Alabama and to release all claims between the parties. In exchange for General Medicine’s release, HealthSouth agreed to pay an amount of cash that is not material to the Company. |

Earnings per share are presented using income from continuing operations attributable to HealthSouth.

The Company uses “same-store” comparisons to explain the changes in certain performance metrics and line items within its financial statements. Same-store comparisons are calculated based on hospitals open throughout both the full current periods and throughout the full prior periods presented. These comparisons include the financial results of market consolidation transactions in existing markets, as it is difficult to determine, with precision, the incremental impact of these transactions on the Company’s results of operations.

The information contained herein is being furnished pursuant to Item 7.01 of Form 8-K, “Regulation FD Disclosure.” This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

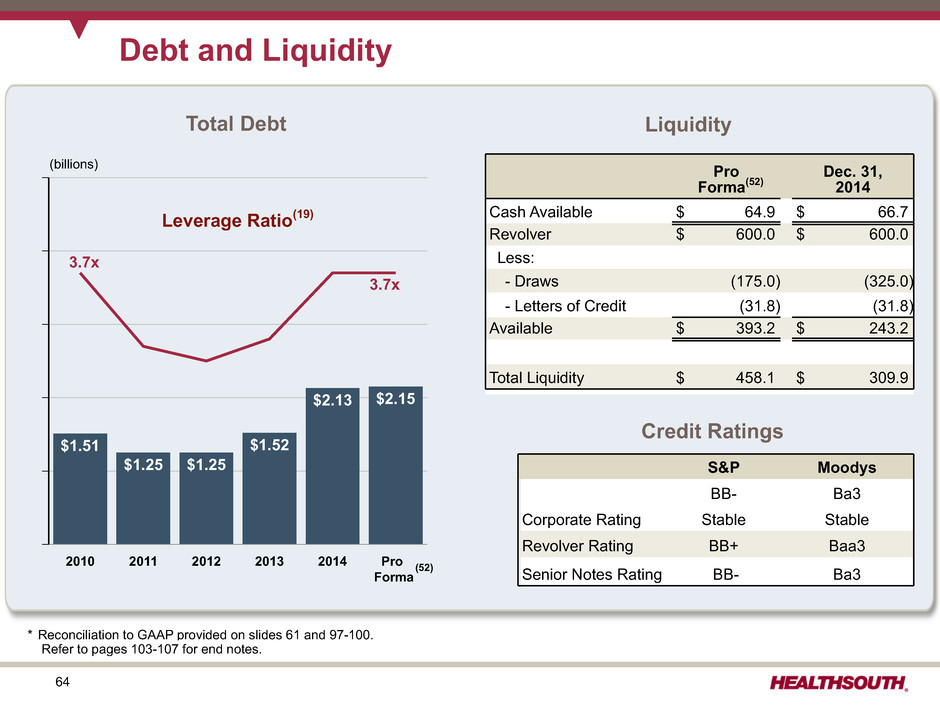

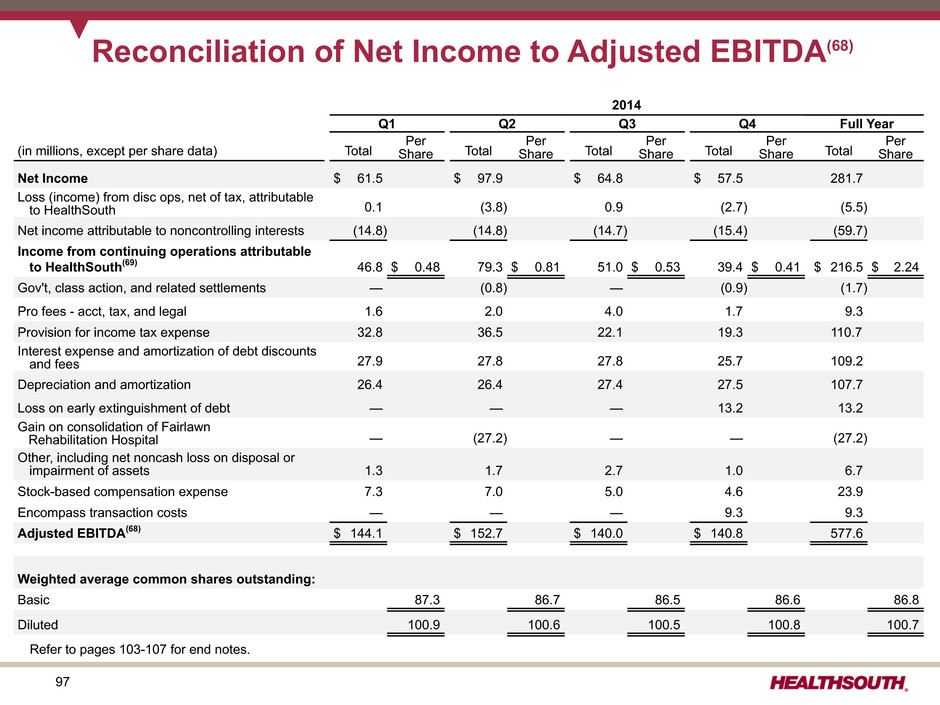

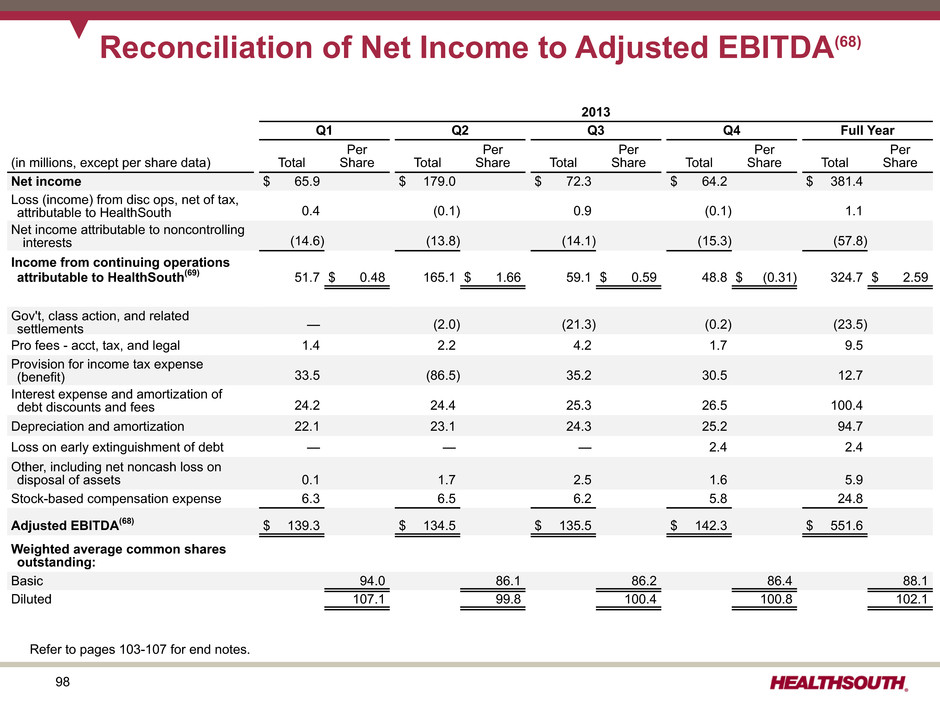

Note Regarding Presentation of Non-GAAP Financial Measures

The financial data contained in the Investor Reference Book attached hereto as Exhibit 99.1 includes non-GAAP financial measures, including the Company’s leverage ratio and Adjusted EBITDA. The leverage ratio referenced therein is defined as the ratio of consolidated total debt to Adjusted EBITDA for the trailing four quarters. The Company believes its leverage ratio and Adjusted EBITDA are measures of its ability to service its debt and its ability to make capital expenditures. Additionally, the leverage ratio is a standard measurement used by investors to gauge the creditworthiness of an institution. The Company’s credit agreement also includes a maximum leverage ratio financial covenant which allows the Company to deduct up to $75 million of cash on hand from consolidated total debt. The Company reconciles Adjusted EBITDA to net income in the Investor Reference Book attached hereto as Exhibit 99.1 and to net cash provided by operating activities in the Investor Reference Book attached hereto as Exhibit 99.1 and below.

The Company uses Adjusted EBITDA on a consolidated basis as a liquidity measure. The Company believes this financial measure on a consolidated basis is important in analyzing its liquidity because it is the key component of certain material covenants contained within the Company’s credit agreement, which is discussed in more detail in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, “Liquidity and Capital Resources,” and Note 8, Long-term Debt, to the consolidated financial statements included in its Annual Report on Form 10‑K for the year

ended December 31, 2014 (the “2014 Form 10‑K”). These covenants are material terms of the credit agreement. Noncompliance with these financial covenants under the credit agreement—its interest coverage ratio and its leverage ratio—could result in the Company’s lenders requiring the Company to immediately repay all amounts borrowed. If the Company anticipated a potential covenant violation, it would seek relief from its lenders, which would have some cost to the Company, and such relief might not be on terms favorable to those in the Company’s existing credit agreement. In addition, if the Company cannot satisfy these financial covenants, it would be prohibited under the credit agreement from engaging in certain activities, such as incurring additional indebtedness, paying common stock dividends, making certain payments, and acquiring and disposing of assets. Consequently, Adjusted EBITDA is critical to the Company’s assessment of its liquidity.

In general terms, the credit agreement definition of Adjusted EBITDA, therein referred to as “Adjusted Consolidated EBITDA,” allows the Company to add back to consolidated net income interest expense, income taxes, and depreciation and amortization and then add back to consolidated net income (1) all unusual or nonrecurring items reducing consolidated net income (of which only up to $10 million in a year may be cash expenditures), (2) costs and expenses related to refinancing transactions (in years prior to 2012), (3) any losses from discontinued operations and closed locations, (4) costs and expenses, including legal fees and expert witness fees, incurred with respect to litigation associated with stockholder derivative litigation, including the matters related to Ernst & Young LLP and Richard Scrushy discussed in Note 18, Contingencies and Other Commitments, to the consolidated financial statements accompanying the 2014 Form 10‑K, and (5) share-based compensation expense. The Company also subtracts from consolidated net income all unusual or nonrecurring items to the extent they increase consolidated net income.

Under the credit agreement, the Adjusted EBITDA calculation does not include net income attributable to noncontrolling interests and includes (1) gain or loss on disposal of assets, (2) professional fees unrelated to the stockholder derivative litigation, and (3) unusual or nonrecurring cash expenditures in excess of $10 million. These items may not be indicative of the Company’s ongoing performance, so the Adjusted EBITDA calculation presented here includes adjustments for them.

Adjusted EBITDA is not a measure of financial performance under generally accepted accounting principles in the United States of America (“GAAP”), and the items excluded from Adjusted EBITDA are significant components in understanding and assessing financial performance. Therefore, Adjusted EBITDA should not be considered a substitute for net income or cash flows from operating, investing, or financing activities. Because Adjusted EBITDA is not a measurement determined in accordance with GAAP and is thus susceptible to varying calculations, Adjusted EBITDA, as presented, may not be comparable to other similarly titled measures of other companies. Revenues and expenses are measured in accordance with the policies and procedures described in Note 1, Summary of Significant Accounting Policies, to the consolidated financial statements accompanying the 2014 Form 10‑K.

The Company also uses adjusted free cash flow as an analytical indicator to assess its performance. Management believes the presentation of adjusted free cash flow provides investors an efficient means by which they can evaluate the Company’s capacity to reduce debt, pursue development activities, and return capital to its common stockholders. The calculation of adjusted free cash flow and a reconciliation of net cash provided by operating activities to adjusted free cash flow are included in the Investor Reference Book attached hereto as Exhibit 99.1. This measure is not a defined measure of financial performance under GAAP and should not be considered as an alternative to net cash provided by operating activities. The Company’s definition of adjusted free cash flow is limited and does not represent residual cash flows available for discretionary spending. Because this measure is not determined in accordance with GAAP and is susceptible to varying calculations, it may not be comparable to other similarly titled measures presented by other companies. See the consolidated statements of cash flows included in the 2014 Form 10-K for the GAAP measures of cash flows from operating, investing, and financing activities.

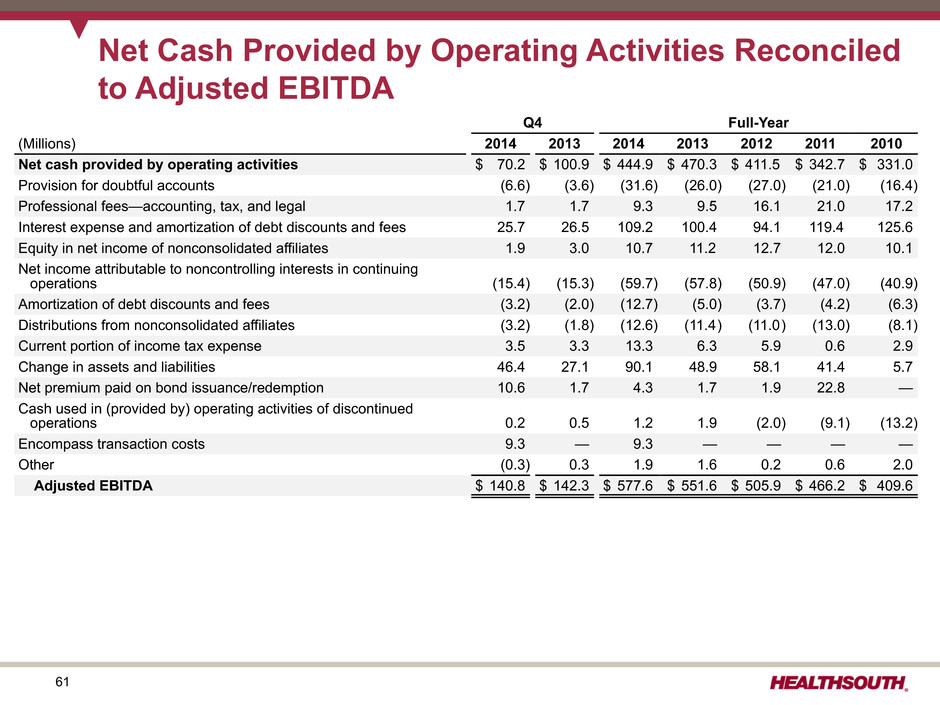

Reconciliation of Net Cash Provided by Operating Activities to Adjusted EBITDA

Three Months Ended | |||||||||||||||||||||||||||

December 31, | Year Ended December 31, | ||||||||||||||||||||||||||

2014 | 2013 | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||||||||

(In Millions) | |||||||||||||||||||||||||||

Net cash provided by operating activities | $ | 70.2 | $ | 100.9 | $ | 444.9 | $ | 470.3 | $ | 411.5 | $ | 342.7 | $ | 331.0 | |||||||||||||

Provision for doubtful accounts | (6.6 | ) | (3.6 | ) | (31.6 | ) | (26.0 | ) | (27.0 | ) | (21.0 | ) | (16.4 | ) | |||||||||||||

Professional fees—accounting, tax, and legal | 1.7 | 1.7 | 9.3 | 9.5 | 16.1 | 21.0 | 17.2 | ||||||||||||||||||||

Interest expense and amortization of debt discounts and fees | 25.7 | 26.5 | 109.2 | 100.4 | 94.1 | 119.4 | 125.6 | ||||||||||||||||||||

Equity in net income of nonconsolidated affiliates | 1.9 | 3.0 | 10.7 | 11.2 | 12.7 | 12.0 | 10.1 | ||||||||||||||||||||

Net income attributable to noncontrolling interests in continuing operations | (15.4 | ) | (15.3 | ) | (59.7 | ) | (57.8 | ) | (50.9 | ) | (47.0 | ) | (40.9 | ) | |||||||||||||

Amortization of debt-related items | (3.2 | ) | (2.0 | ) | (12.7 | ) | (5.0 | ) | (3.7 | ) | (4.2 | ) | (6.3 | ) | |||||||||||||

Distributions from nonconsolidated affiliates | (3.2 | ) | (1.8 | ) | (12.6 | ) | (11.4 | ) | (11.0 | ) | (13.0 | ) | (8.1 | ) | |||||||||||||

Current portion of income tax expense | 3.5 | 3.3 | 13.3 | 6.3 | 5.9 | 0.6 | 2.9 | ||||||||||||||||||||

Change in assets and liabilities | 46.4 | 27.1 | 90.1 | 48.9 | 58.1 | 41.4 | 5.7 | ||||||||||||||||||||

Net premium paid on bond issuance/redemption | 10.6 | 1.7 | 4.3 | 1.7 | 1.9 | 22.8 | — | ||||||||||||||||||||

Cash used in (provided by) operating activities of discontinued operations | 0.2 | 0.5 | 1.2 | 1.9 | (2.0 | ) | (9.1 | ) | (13.2 | ) | |||||||||||||||||

Encompass transaction costs | 9.3 | — | 9.3 | — | — | — | — | ||||||||||||||||||||

Other | (0.3 | ) | 0.3 | 1.9 | 1.6 | 0.2 | 0.6 | 2.0 | |||||||||||||||||||

Adjusted EBITDA | $ | 140.8 | $ | 142.3 | $ | 577.6 | $ | 551.6 | $ | 505.9 | $ | 466.2 | $ | 409.6 | |||||||||||||

For the three months ended December 31, 2014, net cash used in investing activities was $713.6 million and resulted primarily from the acquisition of Encompass. Net cash provided by financing activities during the three months ended December 31, 2014 was $438.8 million and resulted primarily from draws under the revolving and expanded term loan facilities of the Company's credit agreement to fund the acquisition of Encompass offset by the redemption of the Company's existing 7.25% Senior Notes due 2018.

For the three months ended December 31, 2013, net cash used in investing activities was $29.0 million and resulted primarily from capital expenditures. Net cash used in financing activities during the three months ended December 31, 2013 was $72.4 million and resulted primarily from net debt payments, dividends paid on the Company's common stock and convertible perpetual preferred stock, and distributions paid to noncontrolling interests of consolidated affiliates.

For the year ended December 31, 2014, net cash used in investing activities was $876.9 million and resulted primarily from the acquisition of Encompass. Net cash provided by financing activities during the year ended December 31, 2014 was $434.2 million and resulted primarily from draws under the revolving and expanded term loan facilities of the Company's credit

agreement to fund the acquisition of Encompass offset by the redemption of the Company's existing 7.25% Senior Notes due 2018.

For the year ended December 31, 2013, net cash used in investing activities was $226.2 million and resulted primarily from capital expenditures and the acquisition of Walton Rehabilitation Hospital. Net cash used in financing activities during the year ended December 31, 2013 was $312.4 million and resulted primarily from repurchases of common stock as part of the tender offer completed in the first quarter of 2013.

For the year ended December 31, 2012, net cash used in investing activities was $178.8 million and resulted primarily from capital expenditures. Net cash used in financing activities during the year ended December 31, 2012 was $130.0 million and resulted primarily from distributions paid to noncontrolling interests of consolidated affiliates, repurchases of 46,645 shares of the Company's convertible perpetual preferred stock, dividends paid on the Company's convertible perpetual preferred stock, and net principal payments on debt offset by capital contributions from consolidated affiliates.

For the year ended December 31, 2011, net cash used in investing activities was $24.6 million and resulted primarily from capital expenditures, net settlement payments related to interest rate swaps, and purchases of restricted investments offset by proceeds from the sale of five long-term acute care hospitals in August 2011. Net cash used in financing activities during the year ended December 31, 2011 was $336.3 million and resulted primarily from net debt payments, including the optional redemption of the Company’s 10.75% Senior Notes due 2016, distributions paid to noncontrolling interests of consolidated affiliates, and dividends paid on the Company’s convertible perpetual preferred stock.

For the year ended December 31, 2010, net cash used in investing activities was $125.9 million and resulted primarily from capital expenditures, net settlement payments related to interest rate swaps, acquisitions of businesses, and net purchases of restricted investments offset by a decrease in restricted cash and proceeds from the sale of the Company’s hospital in Baton Rouge. Net cash used in financing activities during the year ended December 31, 2010 was $237.5 million and resulted primarily from net debt payments, distributions paid to noncontrolling interests of consolidated affiliates, dividends paid on the Company’s convertible perpetual preferred stock, and debt amendment and issuance costs.

Forward-Looking Statements

Statements contained in this document and the Investor Reference Book attached hereto as Exhibit 99.1 which are not historical facts, such as those relating to the financial guidance, are forward-looking statements. In addition, HealthSouth, through its senior management, may from time to time make forward-looking public statements concerning the matters described herein. All such estimates, projections, and forward-looking information speak only as of the date hereof, and HealthSouth undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise. Such forward-looking statements are necessarily estimates based upon current information, involve a number of risks and uncertainties, and relate to, among other things, future events, HealthSouth’s plan to repurchase its debt or equity securities, dividend strategies or payments, effective income tax rates, HealthSouth’s business strategy, its financial plans, its future financial performance, its projected business results or model, its ability to return value to shareholders, its projected capital expenditures, its leverage ratio, its acquisition opportunities, and the impact of future legislation or regulation. Actual events or results may differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which could cause actual events or results to differ materially from those estimated by HealthSouth include, but are not limited to, the price of HealthSouth’s common or preferred stock as it affects the Company’s willingness and ability to repurchase shares and the financial and accounting effects of any repurchases; any adverse outcome of various lawsuits, claims, and legal or regulatory proceedings involving HealthSouth, including its pending DOJ and HHS-OIG investigations and any matters related to yet

undiscovered issues, if any, at Encompass; any adverse effects on HealthSouth’s stock price resulting from the integration of Encompass; potential disruptions, breaches, or other incidents affecting the proper operation, availability, or security of HealthSouth’s information systems, including unauthorized access to or theft of patient or other sensitive information as well as unforeseen issues, if any, related to integration of Encompass’ systems; the ability to successfully complete and integrate the acquisition of Encompass, including realization of anticipated revenues, cost savings, tax benefits, and productivity improvements arising from the related operations and avoidance of unforeseen exposure to liabilities; significant changes in HealthSouth’s management team; HealthSouth’s ability to successfully complete and integrate de novo developments, acquisitions, investments, and joint ventures consistent with its growth strategy; changes, delays in (including in connection with resolution of Medicare payment reviews or appeals), or suspension of reimbursement for HealthSouth’s services by governmental or private payors; changes in the regulation of the healthcare industry at either or both of the federal and state levels, including as part of national healthcare reform and deficit reduction; competitive pressures in the healthcare industry and HealthSouth’s response thereto; HealthSouth’s ability to obtain and retain favorable arrangements with third-party payors; HealthSouth’s ability to attract and retain nurses, therapists, and other healthcare professionals in a highly competitive environment with often severe staffing shortages and the impact on HealthSouth’s labor expenses from potential union activity and staffing shortages; general conditions in the economy and capital markets; the increase in the costs of defending and insuring against alleged professional liability claims and HealthSouth’s ability to predict the estimated costs related to such claims; and other factors which may be identified from time to time in HealthSouth’s SEC filings and other public announcements, including HealthSouth’s Form 10‑K for the year ended December 31, 2014.

ITEM 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 | HealthSouth Corporation Investor Reference Book - Post Q4 2014 Earnings Release. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

HEALTHSOUTH CORPORATION

By: | /S/ JOHN P. WHITTINGTON | |

Name: | John P. Whittington | |

Title: | Executive Vice President, General Counsel and Corporate Secretary | |

Dated: March 27, 2015

Post Q4 2014 Earnings Release INVESTOR REFERENCE BOOK Last updated March 27, 2015

2 The information contained in this presentation includes certain estimates, projections and other forward- looking information that reflect our current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, development activities, dividend strategies, repurchases of securities, effective tax rates, financial performance, and business model. These estimates, projections and other forward-looking information are based on assumptions that HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance that any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2014, and in other documents we previously filed with the SEC, many of which are beyond our control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. Our Form 8-K, dated March 27, 2015 to which the following supplemental slides are attached as Exhibit 99.1, provides further explanation and disclosure regarding our use of non-GAAP financial measures and should be read in conjunction with these supplemental slides. Forward-Looking Statements

3 Table of Contents Our Company ....................................................................................................................................... 4-20 Industry Structure ................................................................................................................................. 21-39 Historical Perspective .......................................................................................................................... 40-49 Business Outlook: 2015 to 2017 .......................................................................................................... 50-53 Guidance .............................................................................................................................................. 54-56 Free Cash Flow .................................................................................................................................... 57-61 Refinancing and Delevering ................................................................................................................. 62-66 Growth .................................................................................................................................................. 67-78 Operational Initiatives ........................................................................................................................... 79-90 Operational Metrics .............................................................................................................................. 91-95 Reconciliations to GAAP ...................................................................................................................... 96-102 End Notes ............................................................................................................................................ 103-107

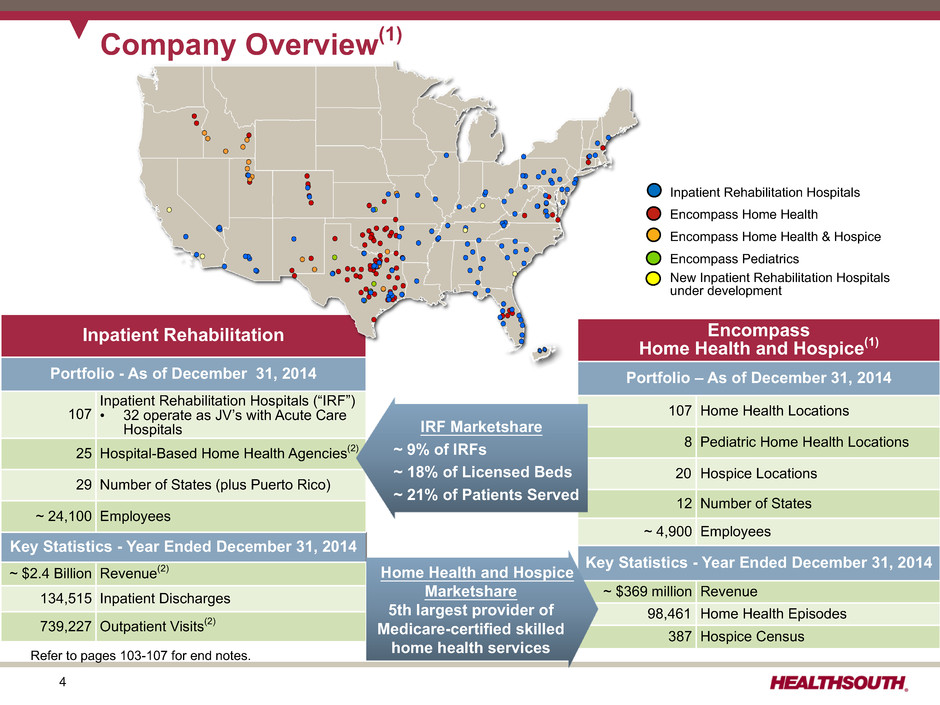

4 Refer to pages 103-107 for end notes. Inpatient Rehabilitation Portfolio - As of December 31, 2014 107 Inpatient Rehabilitation Hospitals (“IRF”) • 32 operate as JV’s with Acute Care Hospitals 25 Hospital-Based Home Health Agencies(2) 29 Number of States (plus Puerto Rico) ~ 24,100 Employees Key Statistics - Year Ended December 31, 2014 ~ $2.4 Billion Revenue(2) 134,515 Inpatient Discharges 739,227 Outpatient Visits(2) Company Overview(1) Encompass Home Health and Hospice(1) Portfolio – As of December 31, 2014 107 Home Health Locations 8 Pediatric Home Health Locations 20 Hospice Locations 12 Number of States ~ 4,900 Employees Key Statistics - Year Ended December 31, 2014 ~ $369 million Revenue 98,461 Home Health Episodes 387 Hospice Census Inpatient Rehabilitation Hospitals Encompass Home Health Encompass Home Health & Hospice Encompass Pediatrics New Inpatient Rehabilitation Hospitals under development IRF Marketshare ~ 9% of IRFs ~ 18% of Licensed Beds ~ 21% of Patients Served Home Health and Hospice Marketshare 5th largest provider of Medicare-certified skilled home health services

5 Our Hospitals (IRFs) Major Services • Rehabilitation Physicians: manage and treat medical needs of patients • Rehabilitation Nurses: oversee treatment programs of patients • Physical Therapists: address physical function, mobility, safety • Occupational Therapists: promote independence and re-integration • Speech-Language Therapists: treat communication and swallowing disorders • Case Managers: coordinate care plan with physician, caregivers and family • Post-discharge services: outpatient therapy and home health 97 of our hospitals hold one or more disease-specific certifications from The Joint Commission’s Disease- Specific Care Certification Program.(3)Inpatient Rehabilitation Refer to pages 103-107 for end notes.

6 Our IRF Patients Referral Sources: 93% Acute Care Hospitals 6% Physician Offices/Home 1% Skilled Nursing Facilities Census Data(4) - Population Growth by Age 5 Year CAGR Age 2015-2020 2020-2025 2025-2030 65 to 69 years 2.5% 2.1% 0.2% 70 to 74 years 5.3% 2.6% 2.2% 75 to 79 years 4.5% 5.4% 2.7% 80 to 84 years 2.4% 4.6% 5.6% 85 to 89 years 0.5% 2.7% 4.9% Total 65 to 89 3.4% 3.2% 2.4% Average Age of a HealthSouth Patient: • All patients = 72 • Medicare FFS = 76 Most Common Conditions (Q4 2014): 1. Neurological 22.4% 2. Stroke 16.3% 3. Other orthopedic conditions 10.0% 4. Fracture of the lower extremity 9.1% 5. Debility 8.6% 6. Brain injury 8.4% 7. Knee/Hip replacement 6.8% 8. Major multiple trauma 4.8% 9. Cardiac 3.9% 10. All other 9.7% Admission to an IRF: • Physicians and acute care hospital case managers are key decision makers. • All IRF patients must meet reasonable and necessary criteria and must be admitted by a physician. • All IRF patients must be medically stable and have potential to tolerate three hours of therapy per day (minimum). • IRF patients receive 24-hour, 7 days a week nursing care. • Average length of stay ~13.2 days As the 1946-1965 baby boom generation reaches 65, the growth in the number of beneficiaries increases from 2% to about 3%.(5) Refer to pages 103-107 for end notes.

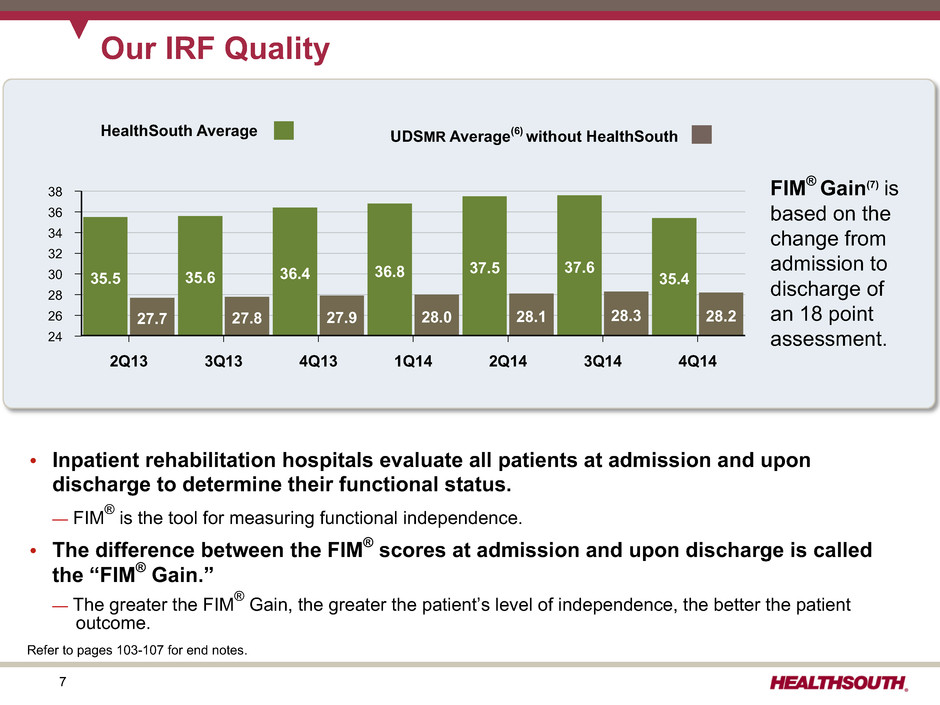

7 Our IRF Quality • Inpatient rehabilitation hospitals evaluate all patients at admission and upon discharge to determine their functional status. — FIM® is the tool for measuring functional independence. • The difference between the FIM® scores at admission and upon discharge is called the “FIM® Gain.” — The greater the FIM® Gain, the greater the patient’s level of independence, the better the patient outcome. FIM® Gain(7) is based on the change from admission to discharge of an 18 point assessment. HealthSouth Average UDSMR Average(6) without HealthSouth 38 36 34 32 30 28 26 24 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 35.5 35.6 36.4 36.8 37.5 37.6 35.4 27.7 27.8 27.9 28.0 28.1 28.3 28.2 Refer to pages 103-107 for end notes.

8 Total Inpatient Rehabilitation Facilities (IRFs): 1,142 Our IRF Cost Effectiveness(8) • The Avg. Est. Total Payment per Discharge has not been reduced by 2% for sequestration.(12) • Medicare pays HealthSouth less per discharge, on average, and HealthSouth treats a higher acuity patient. Avg. Beds per IRF Avg. Medicare Discharges per IRF(10) Case Mix Index(11) Avg. Est. Total Cost per Discharge for FY 2015 Avg. Est. Total Payment per Discharge for FY 2015 HLS(9) = 103 66 932 1.24 $12,129 $18,529 Free- Standing (Non- HLS) = 143 61 617 1.21 $16,403 $19,413 896 24 229 1.16 $19,490 $19,533 Hospital Units = Total 1,142 33 341 1.19 $16,975 $19,258 • HealthSouth differentiates itself by: ü “Best Practices” clinical protocols ü Supply chain efficiencies ü Sophisticated management information systems ü Economies of scale Refer to pages 103-107 for end notes.

9 Workers’ Comp/ Patients/Other Our IRF Payors (Q4 2014) Medicaid- 2.0% Varies by state Prospective Payment System (“PPS”) - Payments based on Case Mix Groups (“CMGs”) • Diagnosis of patient’s treatment - Fixed payment per CMG adjusted for: • Acuity/severity • Regional wage differential • Patient outcomes - Per diems for “short stays” Medicare Payor Source Payment Methodology Per Diem or CMG - Negotiated rate - Some are “tiered” for acuity/severity Variety of methodologies Variety of methodologies Managed Care (includes managed Medicare, which represents ~8% of total revenues 73.9% 18.8% 3.4% Other Third-Party Payors – 1.9%

10 Same-Store HealthSouth vs. Industry 3.3% 2.9% 2.5% 1.3% 2.3% 0.0% (0.7)% (0.2)% Our IRF Discharge Growth vs. Industry ▪ Medicare Enrollment (Age 65+) is growing at approx. 3% per year. ▪ TeamWorks = standardized and enhanced sales & marketing ▪ Bed additions to existing facilities will enhance organic growth. — 51 beds added in 2014 — 68 beds added in 2013 HealthSouth’s volume growth has outpaced competitors’. 2011 2012 2013 2014 HLS Same Store(13) UDS Industry Sites(14) Refer to pages 103-107 for end notes.

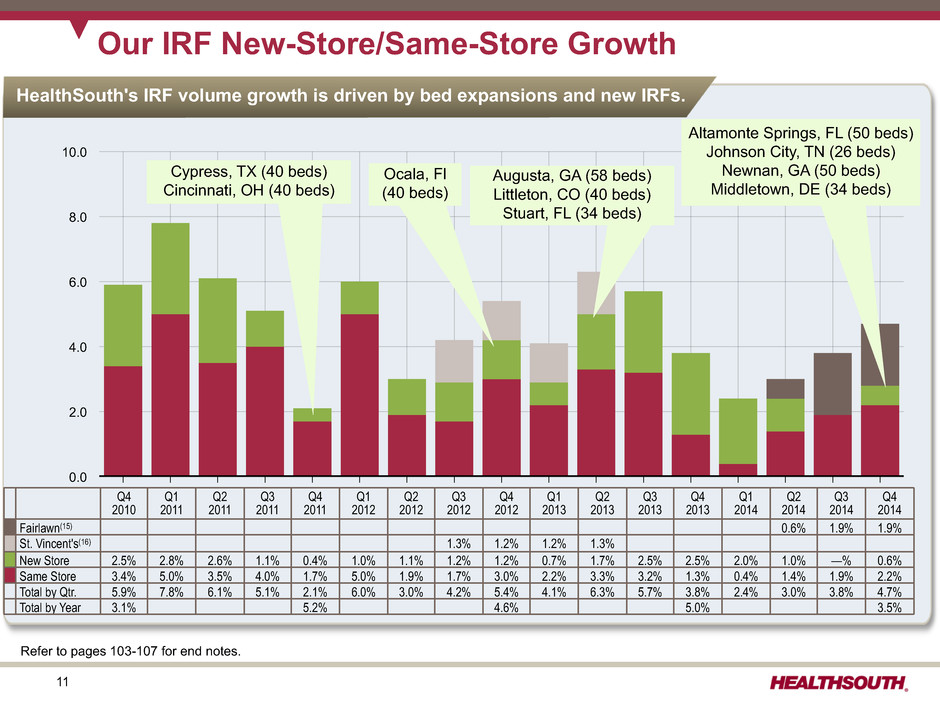

11 10.0 8.0 6.0 4.0 2.0 0.0 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Our IRF New-Store/Same-Store Growth HealthSouth's IRF volume growth is driven by bed expansions and new IRFs. Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Fairlawn(15) 0.6% 1.9% 1.9% St. Vincent's(16) 1.3% 1.2% 1.2% 1.3% New Store 2.5% 2.8% 2.6% 1.1% 0.4% 1.0% 1.1% 1.2% 1.2% 0.7% 1.7% 2.5% 2.5% 2.0% 1.0% —% 0.6% Same Store 3.4% 5.0% 3.5% 4.0% 1.7% 5.0% 1.9% 1.7% 3.0% 2.2% 3.3% 3.2% 1.3% 0.4% 1.4% 1.9% 2.2% Total by Qtr. 5.9% 7.8% 6.1% 5.1% 2.1% 6.0% 3.0% 4.2% 5.4% 4.1% 6.3% 5.7% 3.8% 2.4% 3.0% 3.8% 4.7% Total by Year 3.1% 5.2% 4.6% 5.0% 3.5% Altamonte Springs, FL (50 beds) Johnson City, TN (26 beds) Newnan, GA (50 beds) Middletown, DE (34 beds) Cypress, TX (40 beds) Cincinnati, OH (40 beds) Ocala, Fl (40 beds) Augusta, GA (58 beds) Littleton, CO (40 beds) Stuart, FL (34 beds) Refer to pages 103-107 for end notes.

12 Adjusted EBITDA* Revenue 2010 2011 2012 2013 2014 $1,878 $2,027 $2,162 $2,273 $2,406 2010 2011 2012 2013 2014 $410 $466 $506 $552 $578 Discharge Volume 2010 2011 2012 2013 2014 112,514 118,354 123,854 129,988 134,515 Income from Continuing Operations Attributable to HealthSouth 2010 2011 2012 2013 2014 $890 $159 $181 $325 $217 Our Track Record (18) ’10-’14 CAGR = 6.4 % ’10-’14 CAGR = 4.6 % ’10-’14 CAGR = 9.0 % (17) ($ millions) ($ millions) ($ millions) * Reconciliation to GAAP provided on pages 61 and 97-100. Refer to pages 103-107 for end notes.

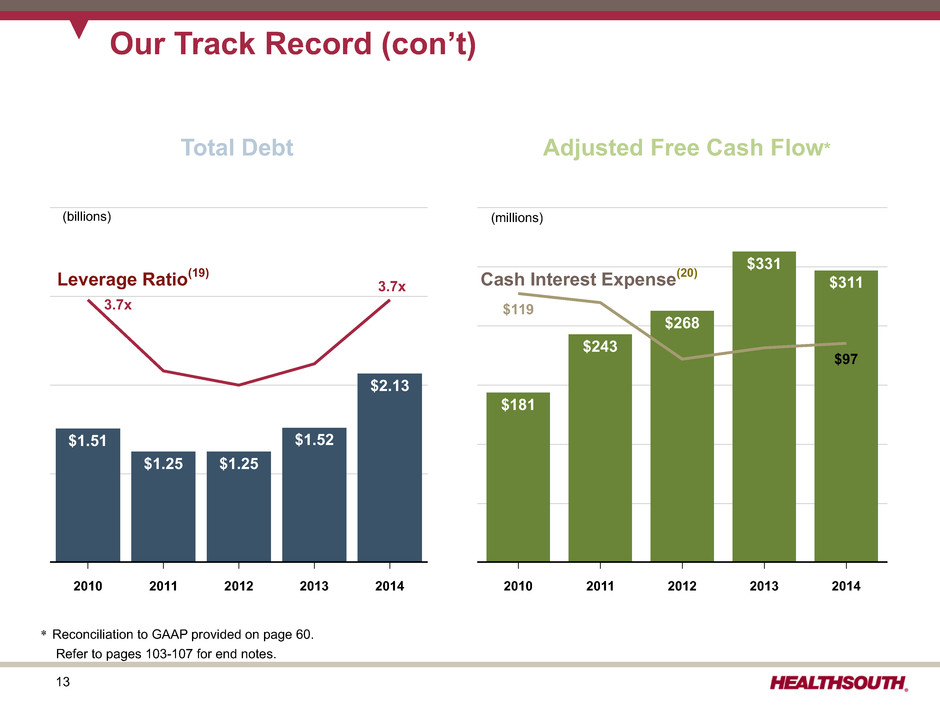

13 2010 2011 2012 2013 2014 $181 $243 $268 $331 $311 $119 $97 Our Track Record (con’t) 2010 2011 2012 2013 2014 $1.51 $1.25 $1.25 $1.52 $2.13 (billions) Leverage Ratio(19) Total Debt (millions) Adjusted Free Cash Flow* Cash Interest Expense(20) 3.7x 3.7x * Reconciliation to GAAP provided on page 60. Refer to pages 103-107 for end notes.

14 Our IRF Assets 107 Inpatient Rehabilitation Hospitals: 7,095 Licensed Beds(21) 27 Lease Building and Land A Certificate of Need (CON) is a legal document required in many states and some federal jurisdictions before proposed acquisitions, expansions, or creations of facilities are allowed. 3,634 Licensed Beds in CON States HealthSouth currently has the option to purchase one leased property in the next five years. 53 Own Building and Land 27 Own Building Only 3,461 Licensed Beds in Non-CON States Refer to pages 103-107 for end notes.

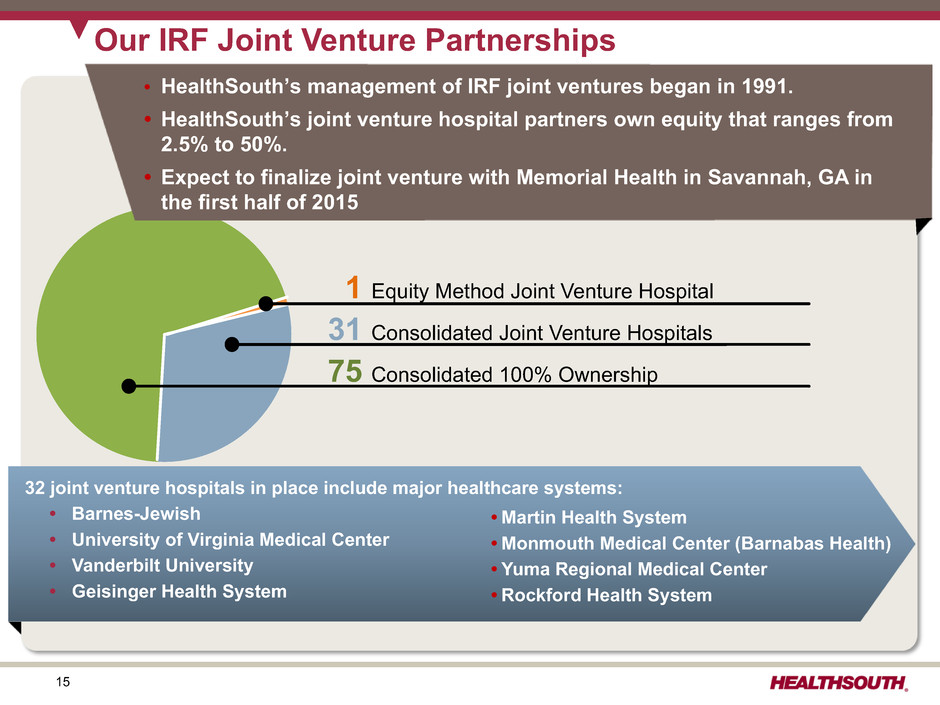

15 Our IRF Joint Venture Partnerships 1 Equity Method Joint Venture Hospital 31 Consolidated Joint Venture Hospitals 75 Consolidated 100% Ownership 32 joint venture hospitals in place include major healthcare systems: • Barnes-Jewish • University of Virginia Medical Center • Vanderbilt University • Geisinger Health System • Martin Health System • Monmouth Medical Center (Barnabas Health) • Yuma Regional Medical Center • Rockford Health System • HealthSouth’s management of IRF joint ventures began in 1991. • HealthSouth’s joint venture hospital partners own equity that ranges from 2.5% to 50%. • Expect to finalize joint venture with Memorial Health in Savannah, GA in the first half of 2015

16 Our Home Health & Hospice: Completed Acquisition December 31, 2014 • 5th largest provider of Medicare-focused (83% Medicare) skilled home health services in the U.S. with 135 locations across 12 states • Approx. 4,900 employees making over 2.1 million total patient visits annually • Approx. revenue of $369 million for full-year 2014 Encompass presence, year of entry and current market position 2007 #1

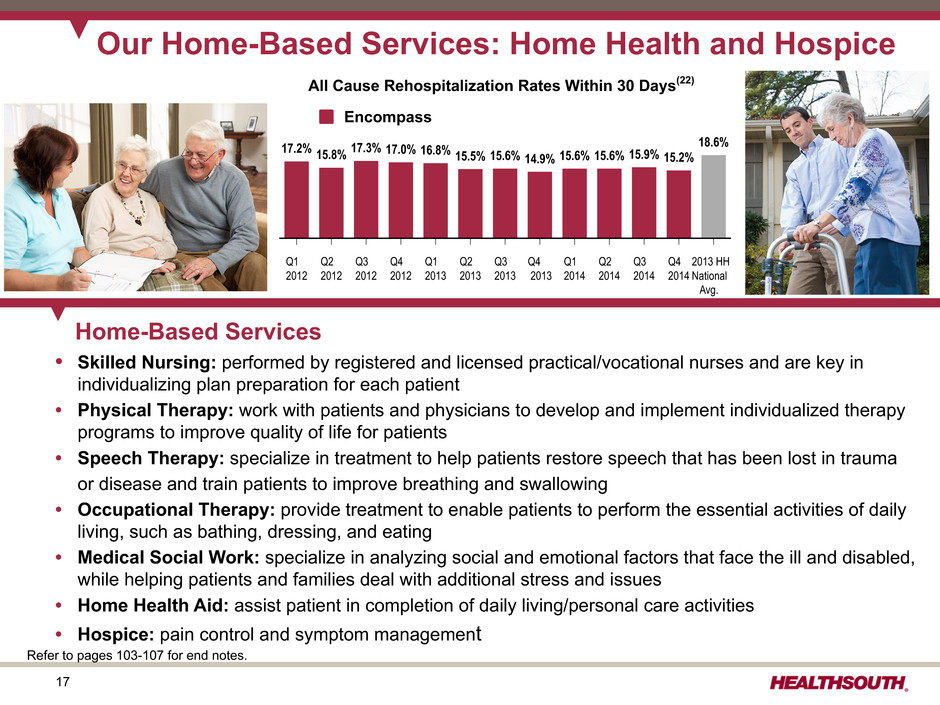

17 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 2013 HH National Avg. 17.2% 15.8% 17.3% 17.0% 16.8% 15.5% 15.6% 14.9% 15.6% 15.6% 15.9% 15.2% 18.6% Our Home-Based Services: Home Health and Hospice Home-Based Services • Skilled Nursing: performed by registered and licensed practical/vocational nurses and are key in individualizing plan preparation for each patient • Physical Therapy: work with patients and physicians to develop and implement individualized therapy programs to improve quality of life for patients • Speech Therapy: specialize in treatment to help patients restore speech that has been lost in trauma or disease and train patients to improve breathing and swallowing • Occupational Therapy: provide treatment to enable patients to perform the essential activities of daily living, such as bathing, dressing, and eating • Medical Social Work: specialize in analyzing social and emotional factors that face the ill and disabled, while helping patients and families deal with additional stress and issues • Home Health Aid: assist patient in completion of daily living/personal care activities • Hospice: pain control and symptom management Refer to pages 103-107 for end notes. All Cause Rehospitalization Rates Within 30 Days(22) Encompass

18 Approx. 54%, or approx. 72,300(23), of HealthSouth's discharges went to home health in 2014. 55% of Encompass' locations overlap with 30% of HealthSouth's hospitals. ~72,300 Discharges to Home Health HealthSouth 70% non-overlap Encompass 45% non-overlap ~21,700 Discharges to Home Health HealthSouth and Encompass Market Overlap Approx. 5,900 discharges, or 8%, went to HealthSouth home health. Approx. 850 discharges, or 1%, went to Encompass home health. Approx. 2,950 discharges, or 14%, went to HealthSouth home health. Approx. 800 discharges, or 4%, went to Encompass home health. Refer to pages 103-107 for end notes. .

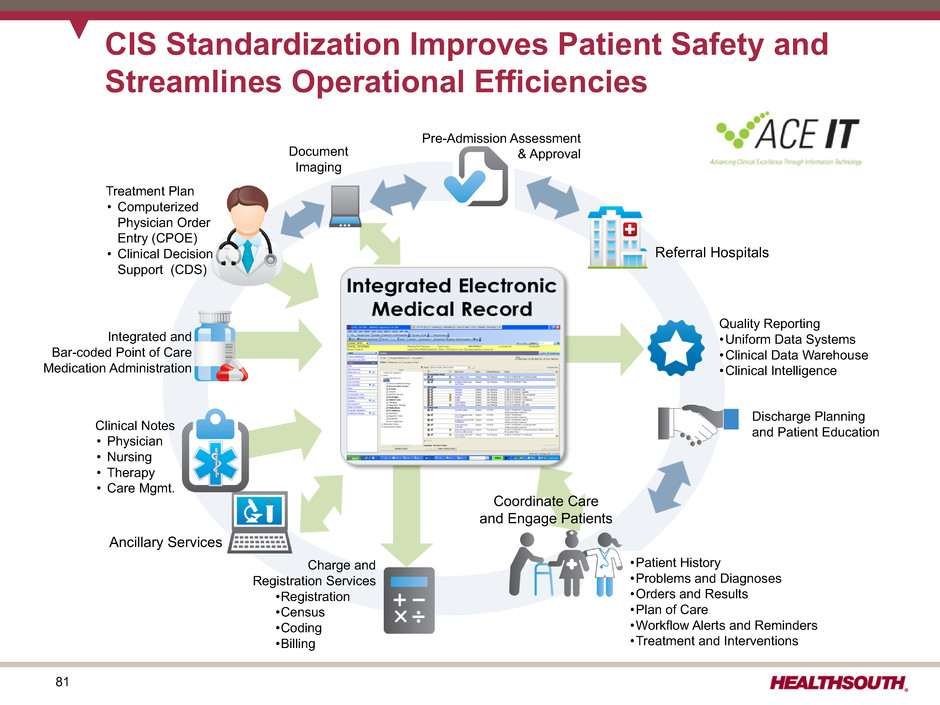

19 Future Growth: Coordinated Care Delivery Models Commitment to coordinated care is enhanced by utilization of technology: • Electronic clinical information system in 58 hospitals as of YE 2014; capable of interfacing with all major acute care EMR systems • Homecare Homebase (HCHB) leading home care technology manages the entire patient work flow. • Ability to use data from both to develop clinical protocol "best practices" Strong balance sheet and free cash flow: • No significant debt maturities prior to 2019 • Ample liquidity under revolving credit facility • Consistently strong free cash flow Currently participating in several initiatives: • 103 IRFs accepted into Phase 1 of CMS bundling initiative; in January 2015, we began the process to seek acceptance into Phase 2 of this initiative for five IRFs with an April 2015 start date. • Encompass has partnered with Premier PHC,TM an ACO serving 20,000 Medicare patients • Exploring ACO participation in several other markets High-quality, cost-effective IRF provider: • FIM® gains consistently exceed industry results. • Scale and operating leverage contribute to low cost per discharge.(24) • On average, Medicare pays HealthSouth less per discharge although HealthSouth treats a higher acuity patient.(24) High-quality, cost-effective home care provider: • Lower re-hospitalization rates than national average(25) • Scale and operating leverage contribute to low cost per visit • Consistent use of evidence-based clinical pathways • Outcome-based "Clinical Specialty Programs" Strong balance sheet and free cash flow: • No significant debt maturities prior to 2019 • Ample liquidity under revolving credit facility • Consistently strong free cash flow • 80 of 107 HealthSouth IRFs are owned vs. leased. Positioned to succeed in coordinated care delivery models by offering both "facility-based" and "home-based" post-acute services Track record of successful partnerships with acute care providers: • 32 IRFs are joint ventured with acute care systems – Barnes-Jewish – University of Virginia Medical Center – Vanderbilt University Refer to pages 103-107 for end notes.

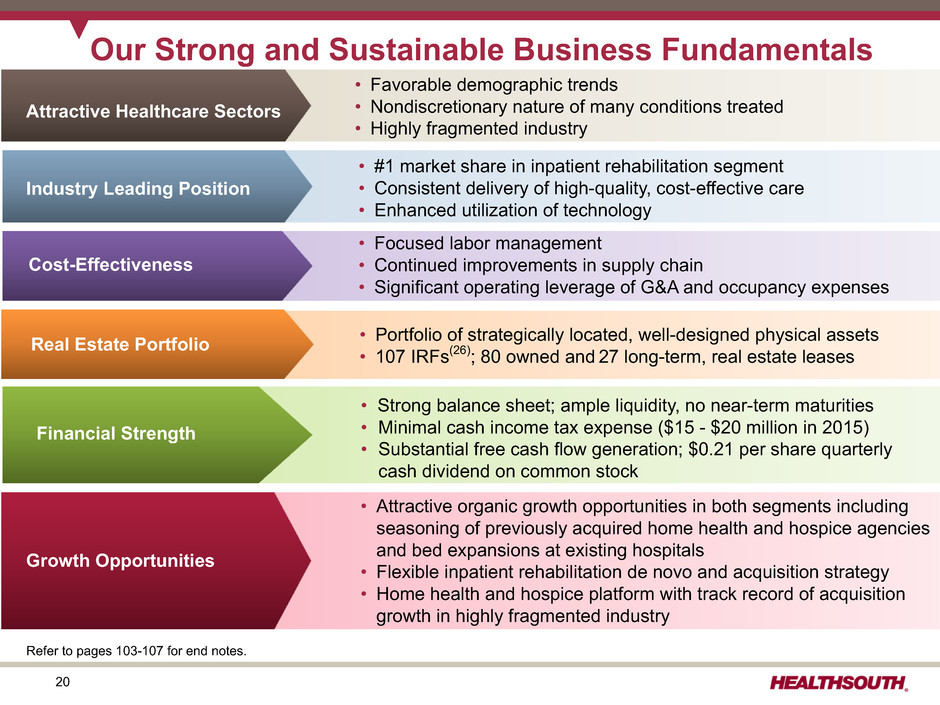

20 Our Strong and Sustainable Business Fundamentals • Focused labor management • Continued improvements in supply chain • Significant operating leverage of G&A and occupancy expenses Cost-Effectiveness Financial Strength • Strong balance sheet; ample liquidity, no near-term maturities • Minimal cash income tax expense ($15 - $20 million in 2015) • Substantial free cash flow generation; $0.21 per share quarterly cash dividend on common stock • #1 market share in inpatient rehabilitation segment • Consistent delivery of high-quality, cost-effective care • Enhanced utilization of technology • Attractive organic growth opportunities in both segments including seasoning of previously acquired home health and hospice agencies and bed expansions at existing hospitals • Flexible inpatient rehabilitation de novo and acquisition strategy • Home health and hospice platform with track record of acquisition growth in highly fragmented industry • Portfolio of strategically located, well-designed physical assets • 107 IRFs(26); 80 owned and 27 long-term, real estate leasesReal Estate Portfolio • Favorable demographic trends • Nondiscretionary nature of many conditions treated • Highly fragmented industry Attractive Healthcare Sectors Growth Opportunities Industry Leading Position Cost-Effectiveness Refer to pages 103-107 for end notes.

21 Industry Structure

22 Overall Healthcare Spending Hospital Care Includes Inpatient Rehabilitation, Long-Term Care Hospitals $151.5 $777.9 $148.2 $79.8 $370.0 Nursing Care Facilities and Continuing Care Retirement Communities Professional Services Other Health, Residential and Personal Care Home Health Care Retail of Medical Products $37.0 $173.6 $75.4 $164.6(billions) National Healthcare Spending: $2,919.1 billion in 2013 Health Consumption Spend: $2,754.5 Personal Healthcare: $2,468. 6 Investment Net Cost of Health Insurance Government Public Health Government Administration $936.9 $155.8 Source: Center for Medicare & Medicaid Services, National Health Expenditure Data for calender year 2013 - Table 2

23 Medicare 2013 Spending = $582.9 Billion $ 28.4B Skilled Nursing $136.8B Inpatient Hospital(27) $68.6B Physician Payments $41.8B Outpatient Hospital $18.4B Home Health $69.3B Other Services(28) $145.9B Medicare Managed Care $69.3B Outpatient Rx $6.8B (1%) Inpatient Rehabilitation Hospitals (Included in Inpatient Hospitals) 12% 3% 7% 12% 12% 25% 24% Medicare Part A Medicare Part B Medicare Parts A&B Medicare Part C Medicare Part D 5% Source: Centers for Medicare & Medicaid Services, Medicare Trustee’s Report July 2014 – page 11 and MedPAc, Medicare Payment Policy, March 2015 Refer to pages 103-107 for end notes.

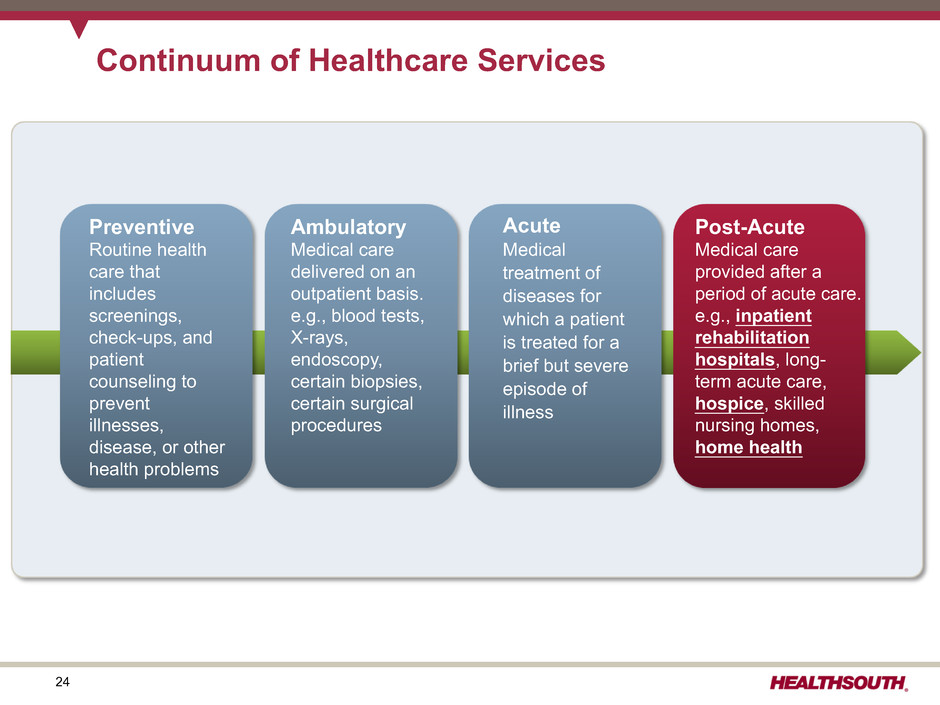

24 Continuum of Healthcare Services Preventive Routine health care that includes screenings, check-ups, and patient counseling to prevent illnesses, disease, or other health problems Ambulatory Medical care delivered on an outpatient basis. e.g., blood tests, X-rays, endoscopy, certain biopsies, certain surgical procedures Acute Medical treatment of diseases for which a patient is treated for a brief but severe episode of illness Post-Acute Medical care provided after a period of acute care. e.g., inpatient rehabilitation hospitals, long- term acute care, hospice, skilled nursing homes, home health

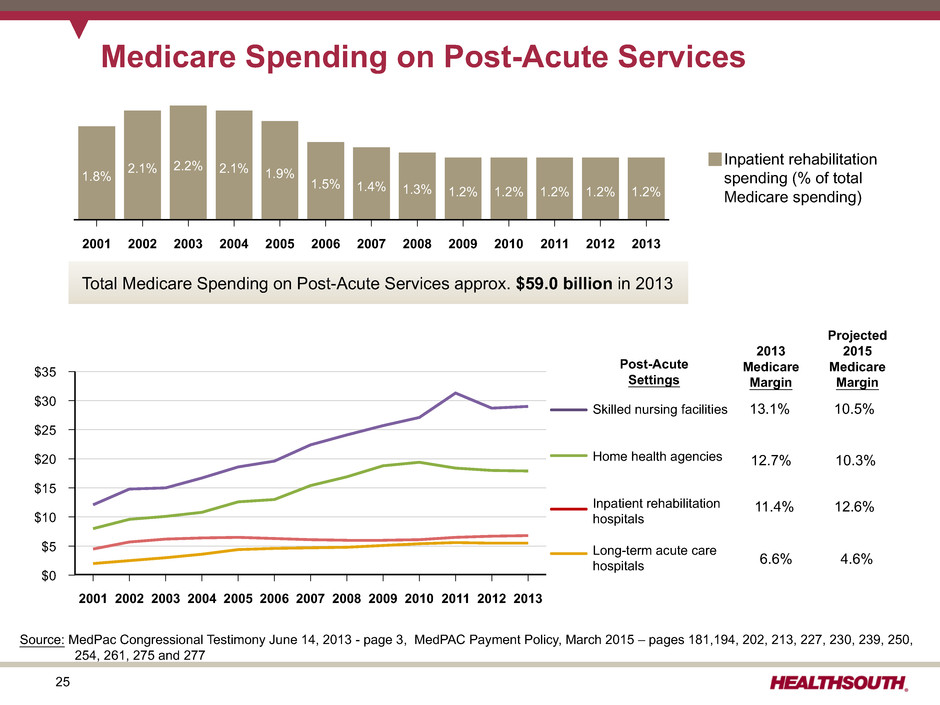

25 $35 $30 $25 $20 $15 $10 $5 $0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Medicare Spending on Post-Acute Services Post-Acute Settings 2013 Medicare Margin Projected 2015 Medicare Margin Sources: (1) 13.1% 10.5% 12.7% 10.3% 11.4% 12.6% 6.6% 4.6% Skilled nursing facilities Home health agencies Inpatient rehabilitation hospitals Long-term acute care hospitals 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 1.8% 2.1% 2.2% 2.1% 1.9% 1.5% 1.4% 1.3% 1.2% 1.2% 1.2% 1.2% 1.2% Inpatient rehabilitation spending (% of total Medicare spending) Total Medicare Spending on Post-Acute Services approx. $59.0 billion in 2013 Source: MedPac Congressional Testimony June 14, 2013 - page 3, MedPAC Payment Policy, March 2015 – pages 181,194, 202, 213, 227, 230, 239, 250, 254, 261, 275 and 277

26 Geographic Distribution of IRFs, 2012 Source: MedPAC Report to Congress, Medicare Payment Policy, March 2014 – page 243

27 Supply of IRFs Remained Stable Average Annual Change Share of Medicare DischargesType of IRF 2004 2006 2008 2010 2012 2013 2006-2012 2012-2013 All IRFs 100% 1,221 1,225 1,202 1,179 1,166 1,161 -0.8% -0.4% Urban 92 1,024 1,018 1,001 981 973 977 -0.8 0.4 Rural 8 197 207 201 198 193 184 -1.2 -4.7 Freestanding 47 217 217 221 233 239 243 1.6 1.7 Hospital based 53 1,004 1,008 981 946 927 918 -1.4 -1.0 Nonprofit 50 768 758 738 729 698 677 -1.4 -3.0 For profit 41 292 299 291 294 307 322 0.4 4.9 Government 9 161 168 173 156 157 155 -1.1 -1.3 Source: MedPac, Medicare Payment Policy, March 2015 - page 243

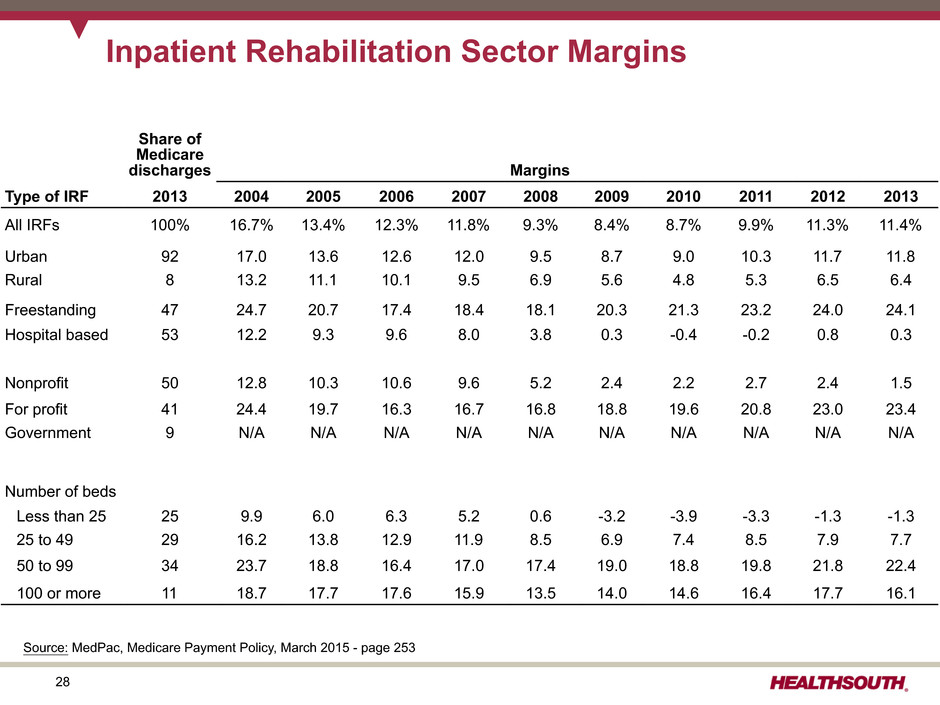

28 Inpatient Rehabilitation Sector Margins Share of Medicare discharges Margins Type of IRF 2013 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 All IRFs 100% 16.7% 13.4% 12.3% 11.8% 9.3% 8.4% 8.7% 9.9% 11.3% 11.4% Urban 92 17.0 13.6 12.6 12.0 9.5 8.7 9.0 10.3 11.7 11.8 Rural 8 13.2 11.1 10.1 9.5 6.9 5.6 4.8 5.3 6.5 6.4 Freestanding 47 24.7 20.7 17.4 18.4 18.1 20.3 21.3 23.2 24.0 24.1 Hospital based 53 12.2 9.3 9.6 8.0 3.8 0.3 -0.4 -0.2 0.8 0.3 Nonprofit 50 12.8 10.3 10.6 9.6 5.2 2.4 2.2 2.7 2.4 1.5 For profit 41 24.4 19.7 16.3 16.7 16.8 18.8 19.6 20.8 23.0 23.4 Government 9 N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A Number of beds Less than 25 25 9.9 6.0 6.3 5.2 0.6 -3.2 -3.9 -3.3 -1.3 -1.3 25 to 49 29 16.2 13.8 12.9 11.9 8.5 6.9 7.4 8.5 7.9 7.7 50 to 99 34 23.7 18.8 16.4 17.0 17.4 19.0 18.8 19.8 21.8 22.4 100 or more 11 18.7 17.7 17.6 15.9 13.5 14.0 14.6 16.4 17.7 16.1 Source: MedPac, Medicare Payment Policy, March 2015 - page 253

29 Inpatient Rehabilitation Standardized Comparison of Costs Type of IRF Mean Adjusted Cost Per Discharge All IRFs $16,517 Hospital based 17,627 Freestanding 12,474 Nonprofit 17,233 For profit 14,632 Government 18,740 Urban 15,969 Rural 19,431 Number of beds 1 to 10 20,173 11 to 21 17,676 22 to 59 15,610 60 or more 12,863 Quartile Characteristic Low Cost High Cost Percent: Hospital based 41.0% 95.0% Freestanding 59.0 5.0 Nonprofit 31.0 63.0 For profit 65.0 21.0 Government 4.0 16.0 Urban 93.0 71.0 Rural 7.0 29.0 Median Medicare Margin: All 26.2% -26.0% Hospital based 21.6 -26.0 Freestanding 29.5 -23.1 Median: Number of beds 44 17 Occupancy rate 70% 47% Case-mix index 1.27 1.22 Median costs per discharge: All $11,227 $21,934 Hospital based 12,127 21,848 Freestanding 10,632 22,514 Mean adjusted costs per discharge are lower for freestanding IRFs and larger facilities. High margins among both hospital-based and freestanding IRFs are in the low-cost quartile of standardized costs. Source: MedPac, Medicare Payment Policy, March 2015 - page 251 and 252

30 Post-Acute Care ("PAC") Setting Percent Discharged from Hospital to PAC Setting Percent Rehospitalized after Using PAC Setting Percent Died in PAC Setting Skilled Nursing Facility 17.3% 22.0% 5.4% Home Health 16.0% 18.1% 0.8% Long-Term Care Hospital 1.0% 10.0% 15.5% Inpatient Rehabilitation 3.2% 9.4% 0.4% Inpatient Psychiatric 0.5% 8.7% 0.4% Hospice 2.1% 4.5% 82.2% TOTAL 40.0% 18.0% 6.2% Readmission Rates Source: MedPAC Data Book, Healthcare Spending and the Medicare program, June 2008 - Chart 9-3

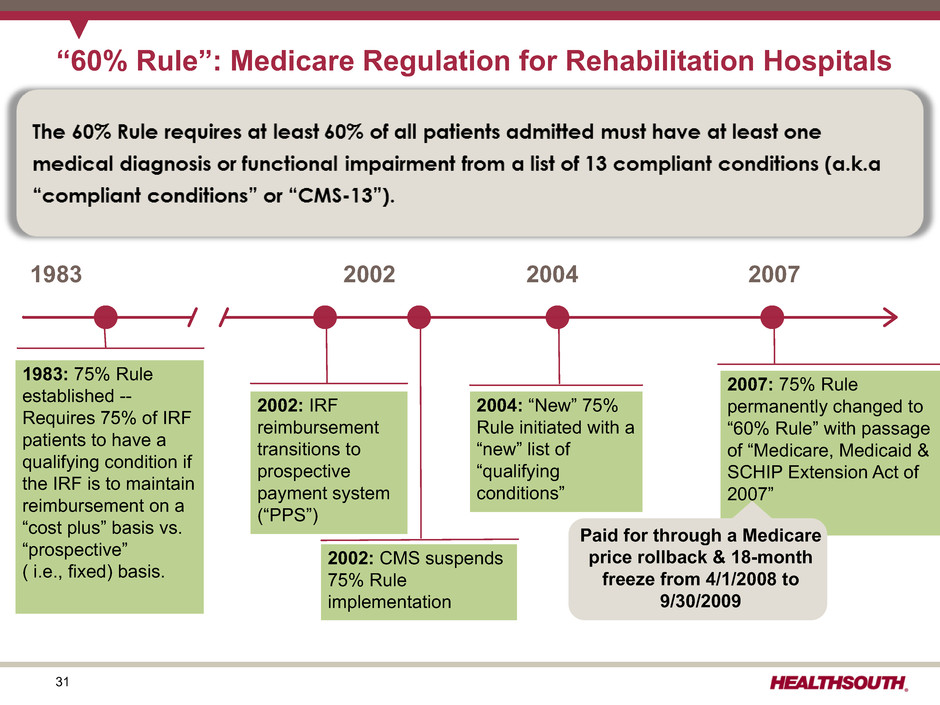

31 “60% Rule”: Medicare Regulation for Rehabilitation Hospitals 1983 1983: 75% Rule established -- Requires 75% of IRF patients to have a qualifying condition if the IRF is to maintain reimbursement on a “cost plus” basis vs. “prospective” ( i.e., fixed) basis. 2002 2004 2007 2002: IRF reimbursement transitions to prospective payment system (“PPS”) 2002: CMS suspends 75% Rule implementation 2004: “New” 75% Rule initiated with a “new” list of “qualifying conditions” 2007: 75% Rule permanently changed to “60% Rule” with passage of “Medicare, Medicaid & SCHIP Extension Act of 2007” Paid for through a Medicare price rollback & 18-month freeze from 4/1/2008 to 9/30/2009

32 Inpatient Rehabilitation Hospital (IRF): Qualifying Conditions 1. Stroke 2. Brain injury 3. Amputation 4. Spinal cord 5. Fracture of the femur 6. Neurological disorder 7. Multiple trauma 8. Congenital deformity 9. Burns 10. Osteoarthritis (after less intensive setting) 11. Rheumatoid arthritis (after less intensive setting) 12. Joint replacement 13. Systemic vasculidities (after less intensive setting) % Lower extremity joint replacement 2006 2008 2011 2012 2013 2014 HealthSouth 14.6% 10.9% 8.4% 8.2% 7.6% 6.9% UDS Industry minus HealthSouth 17.5% 13.6% 11.4% 10.8% 9.6% 8.0% Became 1. Stroke 2. Brain injury 3. Amputation 4. Spinal cord 5. Fracture of the femur 6. Neurological disorder 7. Multiple trauma 8. Congenital deformity 9. Burns Original Qualifying Conditions New Qualifying Conditions § Bilateral § Age ≥ 85 § Body Mass Index >50 10. Polyarthritis (includes "joint replacement") Became

33 Inpatient Rehabilitation Outlier Payments(8) # of Hospitals Total Outlier Payments Avg Outlier Payment per Discharge Hospital Deciles HLS Non- HLS Total HLS Non-HLS Total % HLS Non-HLS Total 90-100 — 114 114 $ — $ 114,351,232 $ 114,351,232 50.9% N/A $ 2,459 $ 2,459 80-90 — 114 114 $ — $ 41,028,154 $ 41,028,154 18.2% N/A $ 1,150 $ 1,150 70-80 1 113 114 $ 242,676 $ 24,397,432 $ 24,640,108 11.0% $ 288 $ 771 $ 758 60-70 2 112 114 $ 294,475 $ 16,349,747 $ 16,644,222 7.4% $ 118 $ 513 $ 485 50-60 4 111 115 $ 375,197 $ 10,698,466 $ 11,073,663 4.9% $ 82 $ 369 $ 330 40-50 8 107 115 $ 523,738 $ 7,370,767 $ 7,894,505 3.5% $ 68 $ 287 $ 237 30-40 9 105 114 $ 352,834 $ 4,679,602 $ 5,032,436 2.2% $ 51 $ 187 $ 158 20-30 18 96 114 $ 432,323 $ 2,427,819 $ 2,860,142 1.3% $ 23 $ 96 $ 65 10-20 33 81 114 $ 324,874 $ 885,953 $ 1,210,827 0.5% $ 10 $ 40 $ 23 0-10 28 86 114 $ 24,319 $ 72,296 $ 96,615 0.0% $ 1 $ 4 $ 2 Totals 103 1,039 1,142 $ 2,570,436 $ 222,261,468 $ 224,831,904 100.0% Mor e Efficien t Les s Outlier observations: • 10% of IRFs receive 51% of the outlier payments; None of the 10% are HealthSouth. • HealthSouth receives approx. 1% of the IRF outlier payments despite treating approx. 25% of the Medicare patients/ discharges. • As a result of outlier payments, CMS pays HealthSouth approx. $731 less per discharge than other providers. • Capping IRF outlier payments at 10% could save Medicare approx. $600 million over 10 years. Refer to pages103-107 for end notes.

34 IRF-PPS Fiscal Year 2015 Final Rule: Key Provisions Source: http://www.gpo.gov/fdsys/pkg/FR-2014-08-06/pdf/2014-18447.pdf Refer to pages 103-107 for end notes. The final rule: • Will implement a net 2.2% market basket increase – 2.9% market basket increase – (20 bps) Affordable Care Act reduction – (50 bps) Affordable Care Act productivity reduction • Updates the outlier threshold • Includes a new data collection requirement (beginning on October 1, 2015) that will capture the minutes/mode of therapy. CMS plans to use this data to potentially support future rule making in this area. • CMS made revisions to the list of codes it uses to presumptively test compliance with the 60% Rule. – The rule eliminates an additional 10 post-amputation ICD-9-CM codes used for presumptive testing – Code changes made in FY 2014 and 2015 will become effective for compliance review periods beginning on or after October 1, 2015 • ICD-10-CM cross walk from ICD-9-CM (effective no earlier than October 1, 2015) • CMS finalized: • Changes to IRF patient assessment instrument (“PAI”) • Two new quality measures for FY 2017: Facility-Wide Inpatient Hospital- Onset Methicillin-Resistant Staphylococcus aureus Bacteremia Outcome Measure and Facility-Wide Inpatient Hospital-Onset Clostridium difficile Infection Outcome Measure • To begin validation audits to ensure completeness and accuracy of submitted quality data. 60 Percent Rule – Update to Presumptive Methodology Code List New Quality Reporting Update to Payment Rates Pricing: • Net pricing impact to HealthSouth expected to be approx. +2.3% for FY 2015 before sequestration(12) • Because of its efficient cost structure, HealthSouth receives very few outlier payments despite higher acuity patients (see page 33). Quality: • HealthSouth will supplement existing quality reporting systems to meet the new requirements. Coding: • Post-amputation cases represent approx. 0.5% of HealthSouth’s Medicare discharges HealthSouth Observations

35 IMPACT Act of 2014 - Enacted October 6, 2014 Company observations and considerations with respect to the IMPACT Act: ▪ It was developed on a bi-partisan basis by the House Ways and Means and Senate Finance Committees and incorporated feedback from healthcare providers and provider organizations that responded to the Committees’ solicitation of post-acute payment reform ideas and proposals. ▪ It directs the United States Department of Health and Human Services (“HHS”), in consultation with healthcare stakeholders, to implement standardized data collection processes for post-acute quality and outcome measures. ▪ Although the IMPACT Act does not specifically call for the development of a new post-acute payment system, the Company believes this act will lay the foundation for possible future post-acute payment policies that would be based on patients’ medical conditions and other clinical factors rather than the setting where the care is provided. ▪ It will create additional data reporting requirements for the Company’s hospitals(29) and home health agencies. The precise details of these new reporting requirements, including timing and content, will be developed and implemented by the United States Centers for Medicare and Medicaid Services through the regulatory process that the Company expects will take place over the next several years. ▪ While the Company cannot quantify the potential financial effect of the IMPACT Act on HealthSouth, the Company believes any post-acute payment system that is data driven and focuses on the needs and underlying medical conditions of post-acute patients will be positive for providers who offer high-quality, cost- effective care. HealthSouth believes it is doing just that and expects this act will be positive for the Company. ▪ However, it will likely take years for the related quality measures to be established, quality data to be gathered, standardized patient assessment data to be assembled and disseminated, and potential payment policies to be developed, tested and promulgated. As the nation’s largest owner and operator of inpatient rehabilitation hospitals, HealthSouth looks forward to working with HHS, the Medicare Payment Advisory Commission and other healthcare stakeholders on these initiatives. Source: https://www.govtrack.us/congress/bills/113/hr4994/text Refer to pages 103-107 for end notes.

36 Different Levels of Services Rehab Hospital Nursing Home Average length of stay(30) = 12.9 days Covered days per admission(30) = 27.6 days Discharge to community(30) = 75.9% Discharge to community(30) = 37.5% Requirements: Requirements: Rehab hospitals must also satisfy regulatory/policy requirements for hospitals, including Medicare hospital conditions of participation. No similar requirement; Nursing homes are regulated as nursing homes only All patients must be admitted by a rehab physician. No similar requirement Rehab physicians must re-confirm each admission w/n 24 hours. No similar requirement All patients, regardless of diagnoses/condition, must demonstrate need and receive at least three hours of daily intensive therapy. No similar requirement All patients must see a rehabilitation physician “in person” at least three times weekly. No similar requirement; some SNF patients may go a week or longer without seeing a physician, and often a non-rehabilitation physician. Rehab hospitals required to provide 24 hour, 7 days per week nursing care; many nurses are RNs and rehab nurses. No similar requirement Rehab hospitals are required to use a coordinated interdisciplinary team approach led by a rehab physician; includes a rehab nurse, a case manager, and a licensed therapist from each therapy discipline who must meet weekly to evaluate/discuss each patient’s case. No similar requirement; Nursing homes are not required to provide care on a interdisciplinary basis and are not required to hold regular meetings for each patient. Rehab hospitals are required to follow stringent admission/coverage policies and must carefully document justification for each admission; further restricted in number/type of patients (60% Rule) Nursing homes have comparatively few policies governing the number or types of patients they treat. Refer to pages 103-107 for end notes.

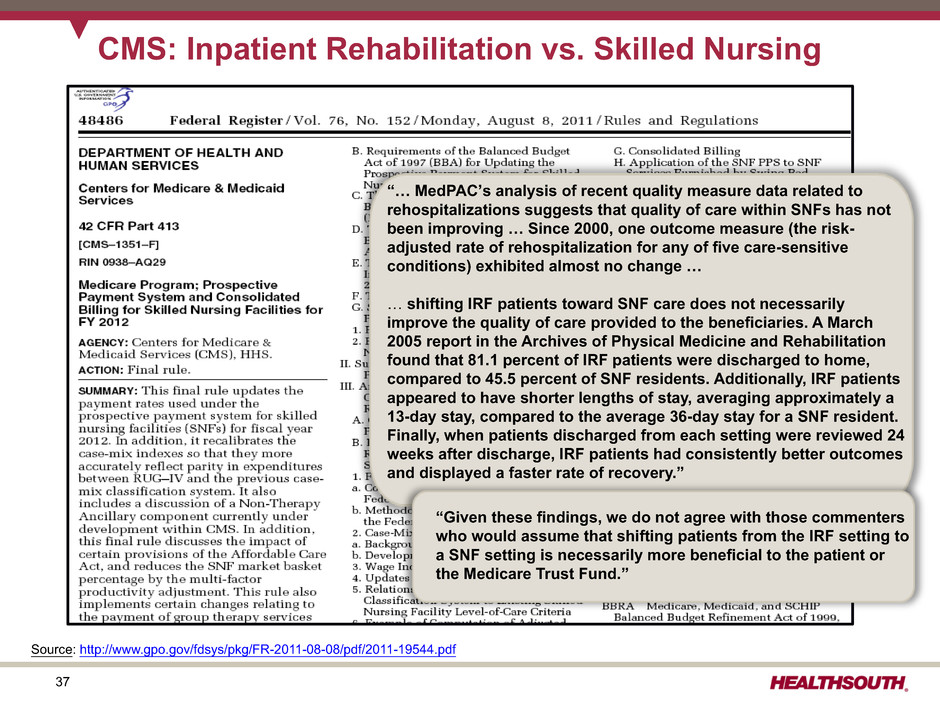

37 CMS: Inpatient Rehabilitation vs. Skilled Nursing “… MedPAC’s analysis of recent quality measure data related to rehospitalizations suggests that quality of care within SNFs has not been improving … Since 2000, one outcome measure (the risk- adjusted rate of rehospitalization for any of five care-sensitive conditions) exhibited almost no change … … shifting IRF patients toward SNF care does not necessarily improve the quality of care provided to the beneficiaries. A March 2005 report in the Archives of Physical Medicine and Rehabilitation found that 81.1 percent of IRF patients were discharged to home, compared to 45.5 percent of SNF residents. Additionally, IRF patients appeared to have shorter lengths of stay, averaging approximately a 13-day stay, compared to the average 36-day stay for a SNF resident. Finally, when patients discharged from each setting were reviewed 24 weeks after discharge, IRF patients had consistently better outcomes and displayed a faster rate of recovery.” “Given these findings, we do not agree with those commenters who would assume that shifting patients from the IRF setting to a SNF setting is necessarily more beneficial to the patient or the Medicare Trust Fund.” Source: http://www.gpo.gov/fdsys/pkg/FR-2011-08-08/pdf/2011-19544.pdf

38 Specific Post-Acute Regulatory Changes Future Regulatory Risk Inpatient Rehabilitation Facility Skilled Nursing Facility Long-Term Acute Care Hospital Home Health Hospice 1. Re-basing payment system No Yes; Rebased in FY 2012 (-12.6%) Starting in FY 2016, LTCHs will be paid “site- neutral payment” rates for certain types of cases; such cases will not be subject to the LTCH >25 day avg. length-of-stay rule Yes; Rebasing pricing reductions being phased in from 2014 through 2017 (not to exceed 3.5%/year); Beginning CY 2015, CMS will recalibrate the HHRG case-mix weights annually. Yes: Required by PPACA no sooner than Oct.1, 2013 2. Major outlier payment adjustments No No Yes; implemented short stay outlier change end of 2012 Yes, 2.5% target for PPS overall; 10% cap per agency No 3. Upcoding adjustments No No 3.9% payment adjustment for FY 2013; phased in over 3-year period No No 4. Patient criteria No; 60% Rule admission criteria already in place No Legislation implementing admission criteria being phased in on or after Oct. 2015 No; Patient – physician “face-to-face” encounter & new therapy documentation implemented in 2011 No; Patient – physician “face-to-face” encounter implemented in 2011 5. Healthcare Reform • Market basket update reductions • Known • Known • Known • Known • Known • Productivity adjustments • Began FY 2012 • Began FY 2012 • Began FY 2012 • Begins 2015 • Began FY 2013 • Bundling pilot established • Began 2013 • Began 2013 • Began 2013 • Began 2013 • N/A • Independent Payment Advisory Board • CY 2019 • FY 2015 • CY 2019 • CY 2015 • CY 2019 • New quality reporting requirements • Began FY 2014 • Beginning FY 2016 • Began FY 2014 • Began CY 2007 • Began FY 2014 • Value based purchasing • Pilot begins 2016 • Begins FY 2019 • Pilot begins 2016 • After 2015 • Pilot begins 2016 • Hospital readmission penalties • Post 2013 • Begins FY 2019 • Post 2013 • N/A • N/A Sources: Healthcare Reform Bill (PPACA, HERA), CMS Regulatory published rules, MMSEA and Pathway for SGR Reform Act of 2013 Protecting Access to Medicare Act of 2014 and the IMPACT ACT of 2014

39 Future Regulatory Risk Inpatient Rehabilitation Facility Skilled Nursing Facility Long-Term Acute Care Hospital Home Health Hospice 6. Other Changes to ICD-9-CM Codes under Presumptive testing for compliance review periods beginning on or after Oct.1, 2015; PAI changes to record mode/minutes of therapy beginning October 1, 2015 Distinct Calendar Days of Therapy captured for therapy payment purposes; Forecast error reduction of 0.5% implemented FY 2014 MMSEA 25% patient threshold relief extended through September 30, 2017; Moratorium on new LTCHs (with limited exception) & LTCH bed additions through Sept. 30, 2017 Limits on transfer of ownership; CMS mandated a temporary moratorium on new provider numbers in select counties in FL, MI, IL, and TX. Modified wage index system being phased in over 7-year period beginning in FY 2010; Removal of “Adult failure to thrive” & “Debility” as primary diagnosis beginning Oct. 1, 2014 • Future efforts to address the cost associated with the prevention of the statutory decrease of more than 20% in Medicare physician reimbursement referred to as the “doc-fix” • Extended “Outpatient Therapy Caps” and manual medical review through March 31, 2015 and increased the multiple procedure payment reduction to 50% effective April 2013. 7. Deficit Reduction • The Budget Control Act of 2011 includes a reduction of 2% (known as "Sequestration") to Medicare payments for all providers that began on April 1, 2013. (as modified by H.R. 8). The Protecting Access to Medicare Act modified these cuts in FY 2024 by requiring a 4% reduction to Medicare payments during the first half of FY 2024 and no cuts (0%) to Medicare payments during the second half of FY 2024. 8. The IMPACT ACT • The IMPACT ACT of 2014 requires standardized data collection on quality and outcome measures. CMS and the National Quality Forum are currently developing quality measures for IRFs, SNFs, HHA, and LTCH relating to patients with new or worsened pressure ulcers (outcome); patients receiving functional assessments and care plans addressing function; patient falls major injury; and 30-day all-cause unplanned readmission rates (see page 35). Specific Post-Acute Regulatory Changes(cont.) Sources: Healthcare Reform Bill (PPACA, HERA), CMS Regulatory published rules, MMSEA and Pathway for SGR Reform Act of 2013 Protecting Access to Medicare Act of 2014 and the IMPACT ACT of 2014

40 Historical Perspective

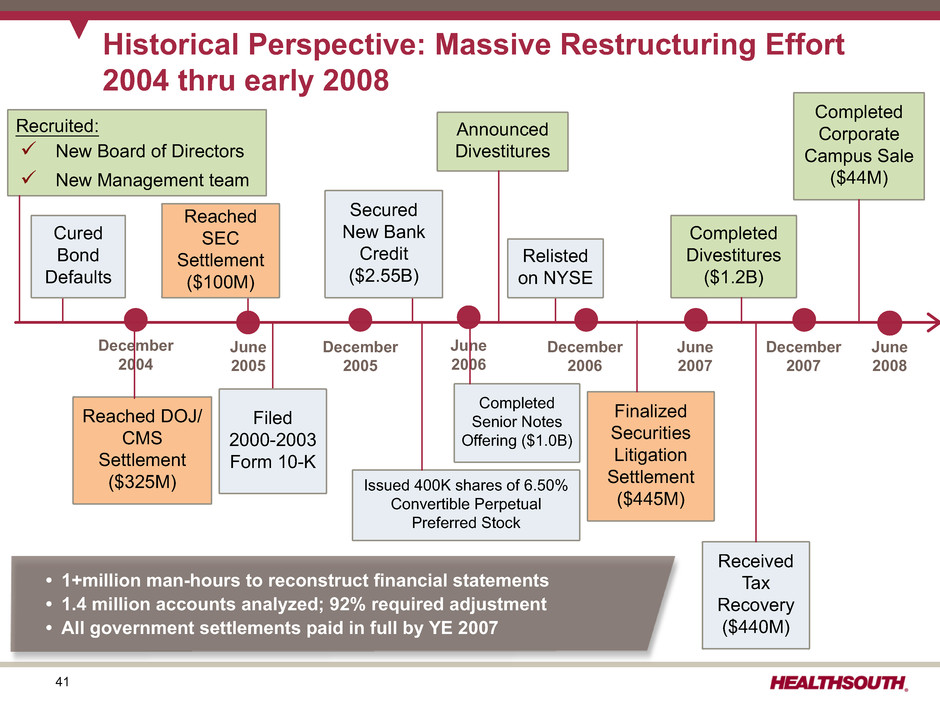

41 Historical Perspective: Massive Restructuring Effort 2004 thru early 2008 December 2004 June 2005 December 2005 June 2006 December 2006 June 2007 December 2007 Received Tax Recovery ($440M) June 2008 Reached DOJ/ CMS Settlement ($325M) Filed 2000-2003 Form 10-K Completed Senior Notes Offering ($1.0B) Announced Divestitures Finalized Securities Litigation Settlement ($445M) Completed Corporate Campus Sale ($44M) Cured Bond Defaults Secured New Bank Credit ($2.55B) Reached SEC Settlement ($100M) Completed Divestitures ($1.2B) Recruited: ü New Board of Directors ü New Management team Issued 400K shares of 6.50% Convertible Perpetual Preferred Stock Relisted on NYSE • 1+million man-hours to reconstruct financial statements • 1.4 million accounts analyzed; 92% required adjustment • All government settlements paid in full by YE 2007

42 Historical Perspective 2010 2011 2012 2013 2014 $410 $466 $506 $552 $578 Adjusted EBITDA* * Reconcilliation to GAAP provided on slides 61 and 97-100. Refer to pages 103-107 for end notes. • Grew volumes 5.2% • Sold five long-term acute care hospitals (LTCHs); closed remaining LTCH • Raised $122 million by reopening 2018 and 2022 Senior Notes • Retired approx. $501 million of 10.75% Senior Notes due 2016 • Opened one de novo (Cypress); acquired Drake; received approval for two CONs • Slowed development efforts due to regulatory uncertainty; reinstated development efforts once the BCA(12) outcome was known. 2011: Focused on Accelerating Organic Growth and Deployment of Free Cash Flow • Healthcare reform passed; reduced future market basket updates • Weak acute care referral volumes • Adjusted annual volume growth target to 2.5-3.5% • Development efforts paid off — 2 de novos, 2 IRF acquisitions, 2 unit acquisitions • Completed Senior Notes offering with 2018 and 2022 maturities (7.25% and 7.75% coupon, respectively) • Refinanced term loans and revolver (Q4) — Repaid $151.2 million in debt — Gained flexibility to repay the 10.75% notes that were due in 2016 and callable beginning in June 2011 2010: Focused on Debt Reduction with Increased Emphasis on Organic Growth

43 $200 $150 $100 $50 Q112 Q212 Q312 Q412 Q113 Q213 Q313 Q413 Q114 Q214 Q314 Q414 Historical Perspective YOY Growth 8.5 % (millions) 2012 Adjusted EBITDA* = $505.9 2012: Focused on Accelerating Organic Growth and Deployment of Free Cash Flow • Established 2012 – 2014 business model(31) — 2.5-3.5% discharge growth; 5-8% Adjusted EBITDA CAGR — 12-17% adjusted free cash flow CAGR • Purchased 46,645 shares of our convertible perpetual preferred stock for $46.5 million • Upgraded to Ba3 and BB– by Moody’s and S&P, respectively • Amended senior secured credit facility • Issued $275 million of 5.75% Senior Notes maturing 2024 • Redeemed 10% of the 2018 and 2022 Senior Notes (~$65 million in Q4) • Continued development efforts: one de novo, two unit consolidations * Reconcilliation to GAAP provided on slides 61 and 97-99. Refer to pages 103-107 for end notes.

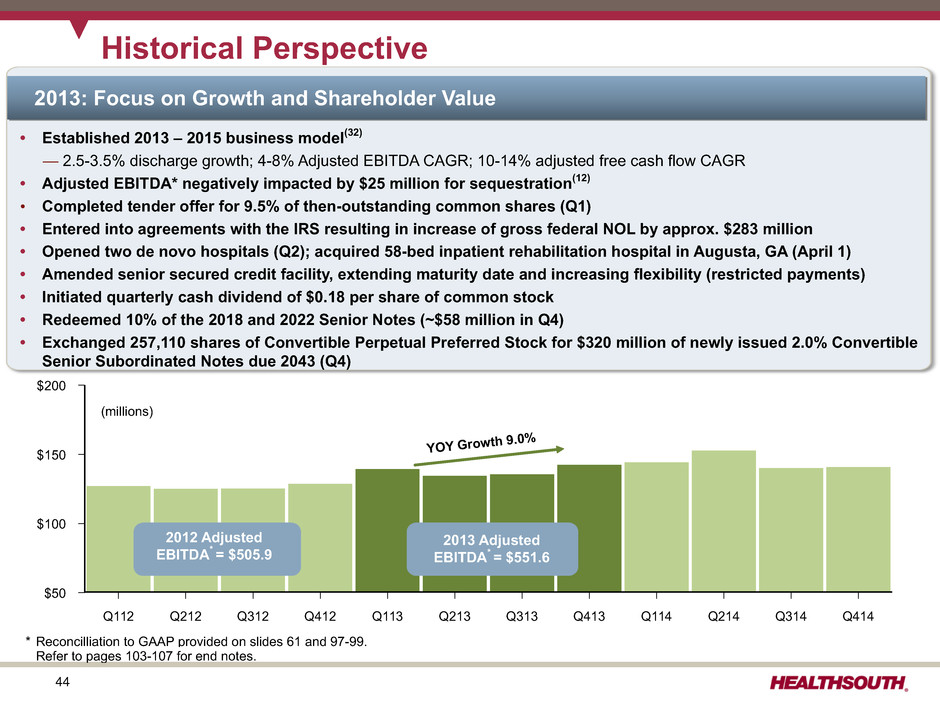

44 $200 $150 $100 $50 Q112 Q212 Q312 Q412 Q113 Q213 Q313 Q413 Q114 Q214 Q314 Q414 Historical Perspective YOY Growth 9.0 % (millions) 2012 Adjusted EBITDA* = $505.9 2013 Adjusted EBITDA* = $551.6 2013: Focus on Growth and Shareholder Value • Established 2013 – 2015 business model(32) — 2.5-3.5% discharge growth; 4-8% Adjusted EBITDA CAGR; 10-14% adjusted free cash flow CAGR • Adjusted EBITDA* negatively impacted by $25 million for sequestration(12) • Completed tender offer for 9.5% of then-outstanding common shares (Q1) • Entered into agreements with the IRS resulting in increase of gross federal NOL by approx. $283 million • Opened two de novo hospitals (Q2); acquired 58-bed inpatient rehabilitation hospital in Augusta, GA (April 1) • Amended senior secured credit facility, extending maturity date and increasing flexibility (restricted payments) • Initiated quarterly cash dividend of $0.18 per share of common stock • Redeemed 10% of the 2018 and 2022 Senior Notes (~$58 million in Q4) • Exchanged 257,110 shares of Convertible Perpetual Preferred Stock for $320 million of newly issued 2.0% Convertible Senior Subordinated Notes due 2043 (Q4) * Reconcilliation to GAAP provided on slides 61 and 97-99. Refer to pages 103-107 for end notes.

45 $200 $150 $100 $50 Q112 Q212 Q312 Q412 Q113 Q213 Q313 Q413 Q114 Q214 Q314 Q414 Historical Perspective YOY Growth 4.7 % (millions) 2012 Adjusted EBITDA* = $505.9 2013 Adjusted EBITDA* = $551.6 2014 Adjusted EBITDA* = $577.6 2014: Focus on Growth and Shareholder Value • Established 2014 – 2016 business model — 2.5-3.5% discharge growth; 4-8% Adjusted EBITDA CAGR • Adjusted EBITDA* negatively impacted by $8 million for sequestration(12) • Repurchased $43.1 million of common stock (1,303,201 shares) • Increased ownership and consolidated Fairlawn Rehabilitation Hospital (110 beds) • Amended credit facility; added $150 million term loan and extended maturity to 2019 • Issued additional $175 million of existing 5.75% senior notes due 2024 and redeemed all $271 million of our 7.75% senior notes due 2018 • Opened two 50-bed de novo hospitals (October, December), finalized 26-bed joint venture (November 1), and opened a 34-bed de novo hospital (December) • Acquired Encompass Home Health and Hospice on December 31, 2014 * Reconcilliation to GAAP provided on slides 61 and 97-99. Refer to pages 103-107 for end notes.

46 HealthSouth has successfully managed through Medicare payment cuts and an economic recession… Recession Adjusted EBITDA ($millions) Discharges Sequestration Anniversaried Sequestration Began Medicare Price Rollback & 18-Month Freeze MMSEA (Final Establishment of 60% rule) 1st Medicare IRF Price Increases Since 2007 CMS Implemented New Coverage Criteria for IRF Admissions PPACA Signed Into Law Price Increase: Less PPACA Adjustment $160 $150 $140 $130 $120 $110 $100 $90 $80 $70 $60 $50 $40 $30 $20 $10 $0 36,000 35,000 34,000 33,000 32,000 31,000 30,000 29,000 28,000 27,000 26,000 25,000 Q1 08 Q2 08 Q3 08 Q4 08 Q1 09 Q2 09 Q3 09 Q4 09 Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14

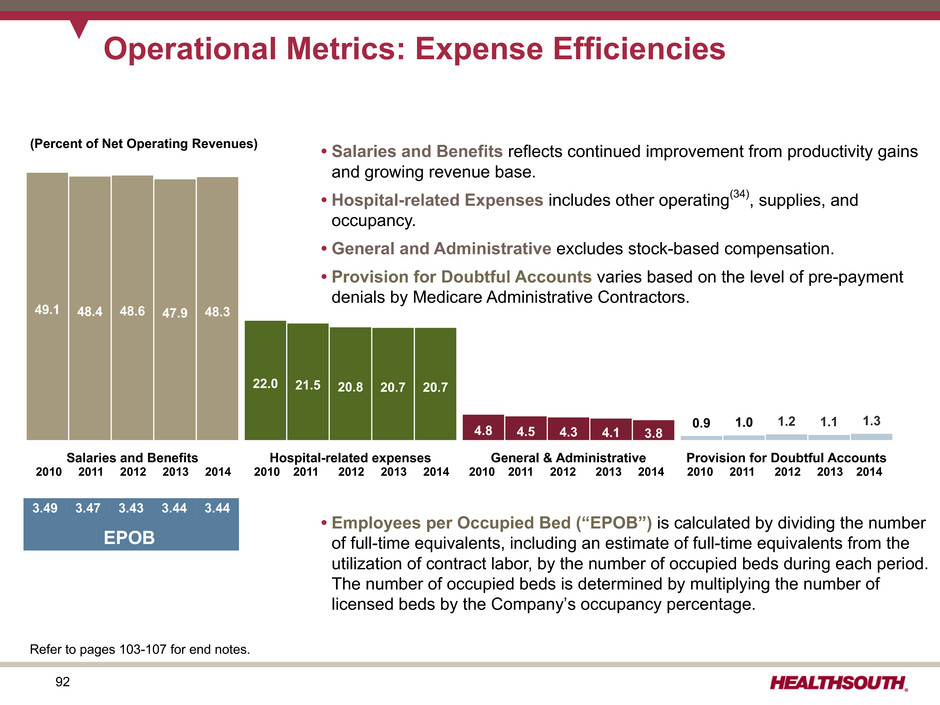

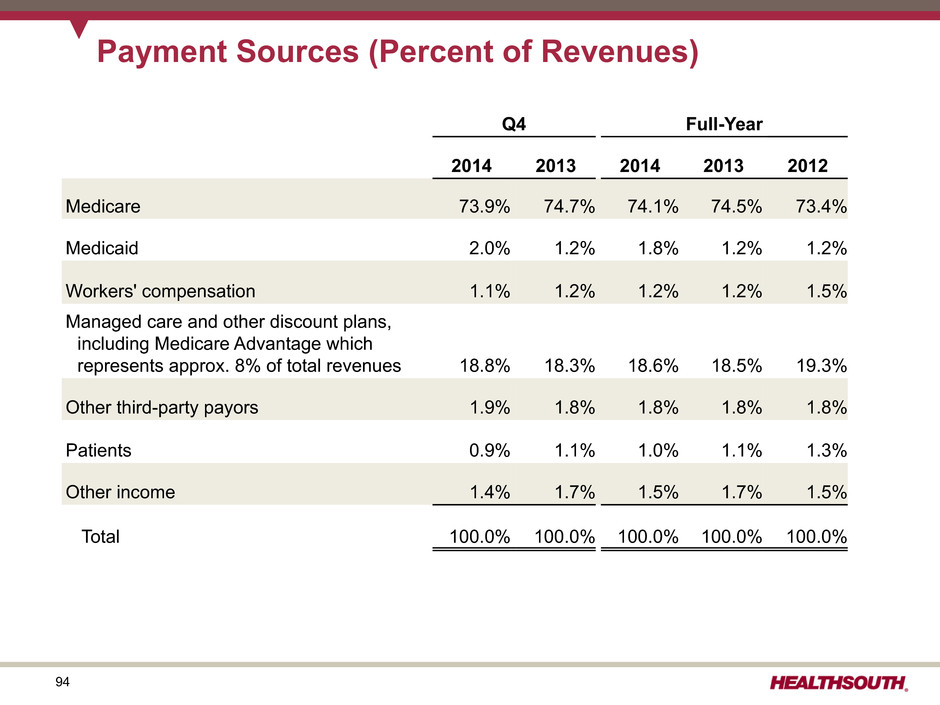

47 Revenues & Expenses Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full-Year Revenues (millions) 2014 2014 2014 2014 2013 2013 2013 2013 2014 2013 2012 Inpatient $ 580.9 $ 563.7 $ 569.7 $ 558.2 $ 537.5 $ 528.8 $ 527.4 $ 537.1 $ 2,272.5 $ 2,130.8 $ 2,012.6 Outpatient and other 32.5 33.2 34.7 33.0 34.6 35.2 37.1 35.5 133.4 142.4 149.3 Consolidated net operating $ 613.4 $ 596.9 $ 604.4 $ 591.2 $ 572.1 $ 564.0 $ 564.5 $ 572.6 $ 2,405.9 $ 2,273.2 $ 2,161.9 (Actual Amounts) Discharges 34,465 33,541 33,620 32,889 32,906 32,307 32,645 32,130 134,515 129,988 123,854 Net patient revenue / discharge $ 16,855 $ 16,806 $ 16,945 $ 16,972 $ 16,334 $ 16,368 $ 16,156 $ 16,716 $ 16,894 $ 16,392 $ 16,250 Expenses (millions) Salaries and benefits $ 300.3 $ 290.0 $ 285.3 $ 286.1 $ 272.0 $ 269.5 $ 273.6 $ 274.6 $ 1,161.7 $ 1,089.7 $ 1,050.2 Percent of net operating revenues 49.0% 48.6% 47.2% 48.4% 47.5% 47.8% 48.5% 48.0% 48.3% 47.9% 48.6% EPOB (employees per occupied bed)(33) 3.52 3.50 3.41 3.34 3.48 3.50 3.45 3.32 3.44 3.44 3.43 Hospital-related expenses (other operating (34), supp., occ.) $ 130.8 $ 123.6 $ 122.7 $ 121.3 $ 118.4 $ 116.9 $ 117.8 $ 116.4 $ 498.4 $ 469.5 $ 450.4 Percent of net operating revenues 21.3% 20.7% 20.3% 20.5% 20.7% 20.7% 20.9% 20.3% 20.7% 20.7% 20.8% General and administrative (excludes stock-based compensation) $ 22.5 $ 22.5 $ 23.2 $ 23.4 $ 24.8 $ 22.6 $ 23.0 $ 23.9 $ 91.6 $ 94.3 $ 93.8 Percent of net operating revenues 3.7% 3.8% 3.8% 4.0% 4.3% 4.0% 4.1% 4.2% 3.8% 4.1% 4.3% Provision for doubtful accounts $ 6.6 $ 8.2 $ 9.3 $ 7.5 $ 3.6 $ 8.0 $ 7.0 $ 7.4 $ 31.6 $ 26.0 $ 27.0 Percent of net operating revenues 1.1% 1.4% 1.5% 1.3% 0.6% 1.4% 1.2% 1.3% 1.3% 1.1% 1.2% Refer to pages 103-107 for end notes.

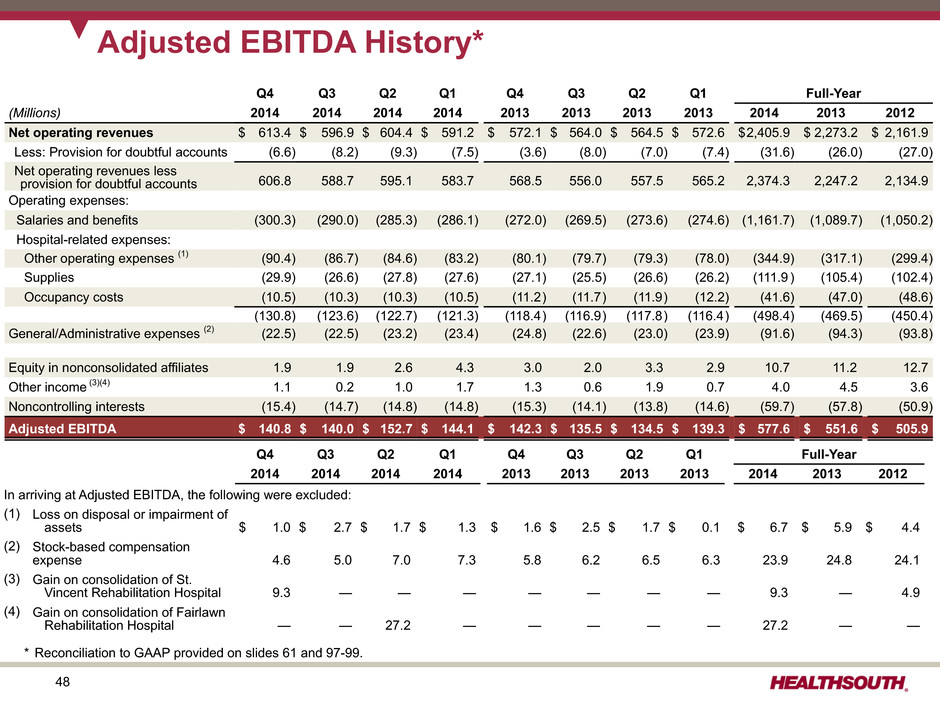

48 Adjusted EBITDA History* Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full-Year (Millions) 2014 2014 2014 2014 2013 2013 2013 2013 2014 2013 2012 Net operating revenues $ 613.4 $ 596.9 $ 604.4 $ 591.2 $ 572.1 $ 564.0 $ 564.5 $ 572.6 $2,405.9 $ 2,273.2 $ 2,161.9 Less: Provision for doubtful accounts (6.6) (8.2) (9.3) (7.5) (3.6) (8.0) (7.0) (7.4) (31.6) (26.0) (27.0) Net operating revenues less provision for doubtful accounts 606.8 588.7 595.1 583.7 568.5 556.0 557.5 565.2 2,374.3 2,247.2 2,134.9 Operating expenses: Salaries and benefits (300.3) (290.0) (285.3) (286.1) (272.0) (269.5) (273.6) (274.6) (1,161.7) (1,089.7) (1,050.2) Hospital-related expenses: Other operating expenses (1) (90.4) (86.7) (84.6) (83.2) (80.1) (79.7) (79.3) (78.0) (344.9) (317.1) (299.4) Supplies (29.9) (26.6) (27.8) (27.6) (27.1) (25.5) (26.6) (26.2) (111.9 ) (105.4) (102.4) Occupancy costs (10.5) (10.3) (10.3) (10.5) (11.2) (11.7) (11.9) (12.2) (41.6) (47.0) (48.6) (130.8) (123.6) (122.7) (121.3) (118.4) (116.9) (117.8) (116.4) (498.4) (469.5) (450.4) General/Administrative expenses (2) (22.5) (22.5) (23.2) (23.4) (24.8) (22.6) (23.0) (23.9) (91.6) (94.3) (93.8) Equity in nonconsolidated affiliates 1.9 1.9 2.6 4.3 3.0 2.0 3.3 2.9 10.7 11.2 12.7 Other income (3)(4) 1.1 0.2 1.0 1.7 1.3 0.6 1.9 0.7 4.0 4.5 3.6 Noncontrolling interests (15.4) (14.7) (14.8) (14.8) (15.3) (14.1) (13.8) (14.6) (59.7) (57.8) (50.9) Adjusted EBITDA $ 140.8 $ 140.0 $ 152.7 $ 144.1 $ 142.3 $ 135.5 $ 134.5 $ 139.3 $ 577.6 $ 551.6 $ 505.9 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full-Year 2014 2014 2014 2014 2013 2013 2013 2013 2014 2013 2012 In arriving at Adjusted EBITDA, the following were excluded: (1) Loss on disposal or impairment of assets $ 1.0 $ 2.7 $ 1.7 $ 1.3 $ 1.6 $ 2.5 $ 1.7 $ 0.1 $ 6.7 $ 5.9 $ 4.4 (2) Stock-based compensation expense 4.6 5.0 7.0 7.3 5.8 6.2 6.5 6.3 23.9 24.8 24.1 (3) Gain on consolidation of St. Vincent Rehabilitation Hospital 9.3 — — — — — — — 9.3 — 4.9 (4) Gain on consolidation of Fairlawn Rehabilitation Hospital — — 27.2 — — — — — 27.2 — — * Reconciliation to GAAP provided on slides 61 and 97-99.

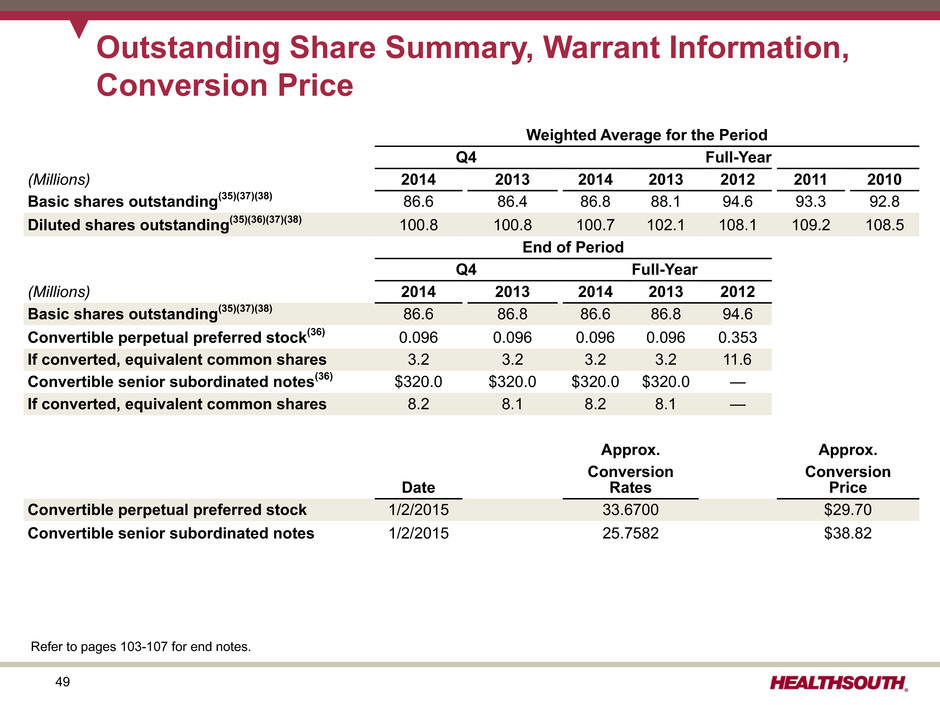

49 Outstanding Share Summary, Warrant Information, Conversion Price Weighted Average for the Period Q4 Full-Year (Millions) 2014 2013 2014 2013 2012 2011 2010 Basic shares outstanding(35)(37)(38) 86.6 86.4 86.8 88.1 94.6 93.3 92.8 Diluted shares outstanding(35)(36)(37)(38) 100.8 100.8 100.7 102.1 108.1 109.2 108.5 End of Period Q4 Full-Year (Millions) 2014 2013 2014 2013 2012 Basic shares outstanding(35)(37)(38) 86.6 86.8 86.6 86.8 94.6 Convertible perpetual preferred stock(36) 0.096 0.096 0.096 0.096 0.353 If converted, equivalent common shares 3.2 3.2 3.2 3.2 11.6 Convertible senior subordinated notes(36) $320.0 $320.0 $320.0 $320.0 — If converted, equivalent common shares 8.2 8.1 8.2 8.1 — Approx. Approx. Date Conversion Rates Conversion Price Convertible perpetual preferred stock 1/2/2015 33.6700 $29.70 Convertible senior subordinated notes 1/2/2015 25.7582 $38.82 Refer to pages 103-107 for end notes.

50 Business Outlook 2015 to 2017 (as of March 27, 2015)

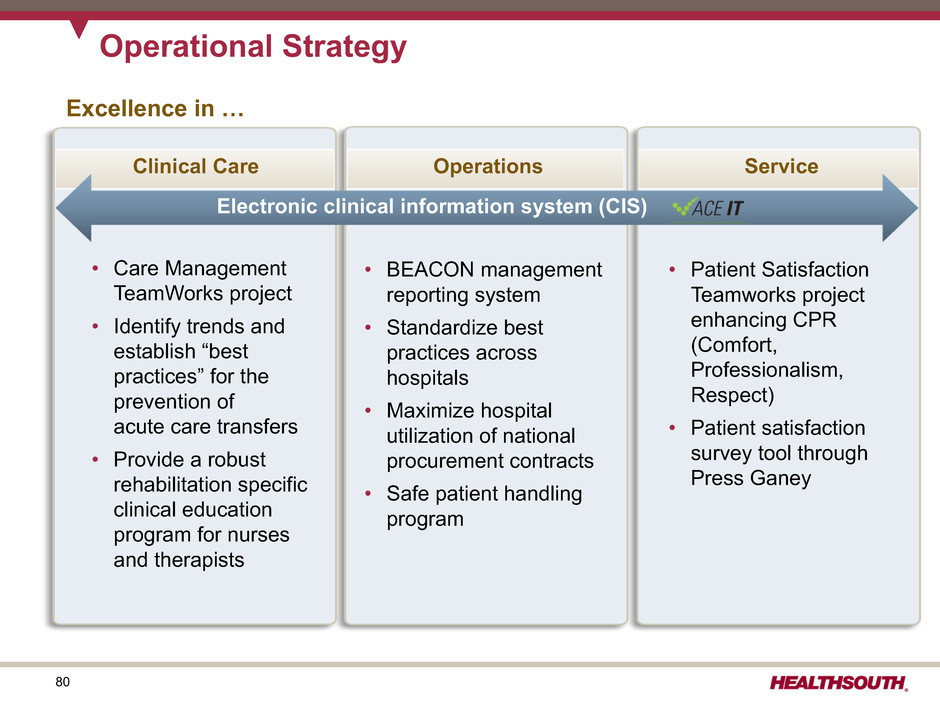

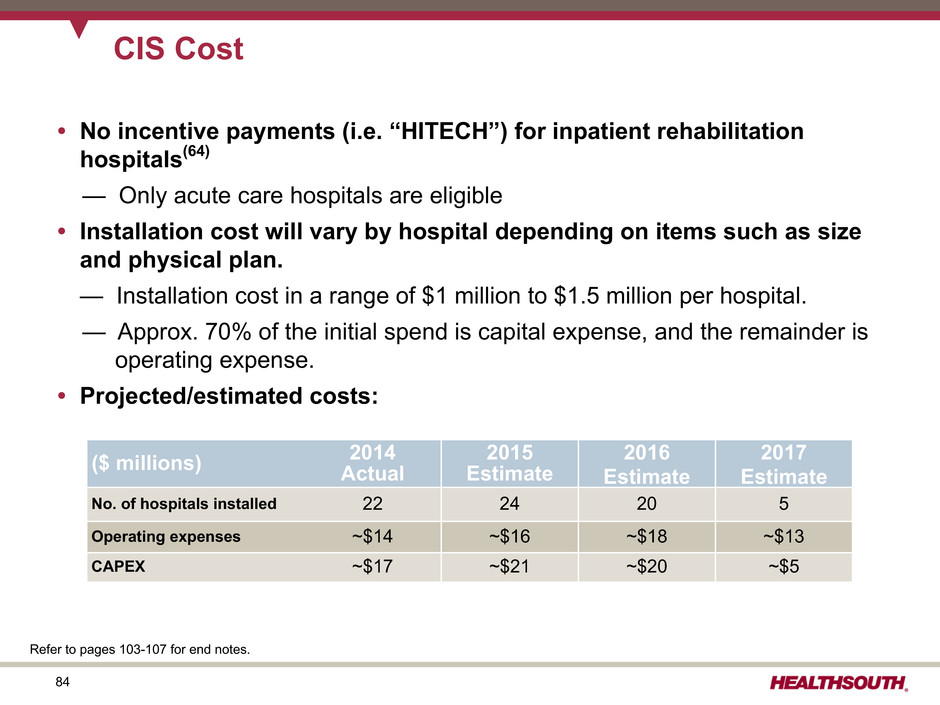

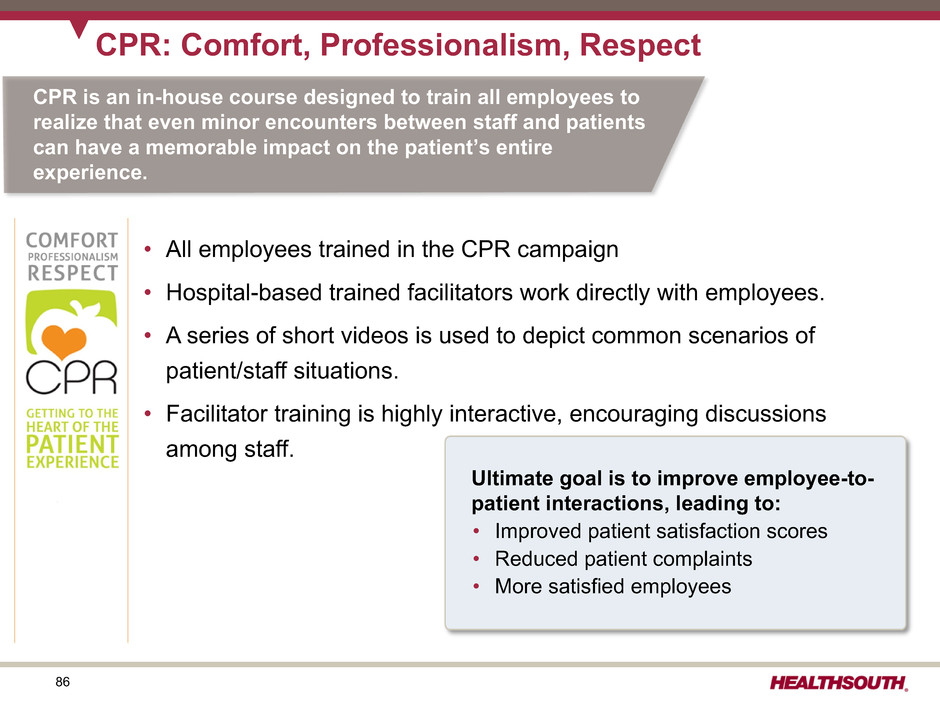

51 Key Operational Initiatives Shareholder Distributions Core Growth Opportunistic Growth 2015 2016 2017 • Quarterly cash dividends • Opportunistic repurchases ($207 million authorization remaining as of December 31, 2014) • Target Leverage < 3.0x (subject to shareholder value-creating opportunities) Strong Balance Sheet • Same-store IRF Growth • New-Store IRF growth (Target 4-6/Year) • Same-store Home Health and Hospice Growth • New-store Home Health and Hospice Growth • Consider acquisitions of other complementary post-acute businesses • Enhance clinical outcomes and patient experience • Implementing CIS: installed in 61 IRF's at January 2015; Expect all IRF's to be on system by YE 2017 • Participate in new delivery and payment models (ACO's; bundling) Strategy Componen t Business Outlook: 2015 to 2017(39) • Adjusted EBITDA* CAGR: 5% - 9% (2014 base-year Adjusted EBITDA includes an estimate for Encompass)(40) • Continued strong free cash flow generation Business Model : *Reconciliation to GAAP provided on slides 61 and 97. Refer to pages 103-107 for end notes.

52 2% Sequestration( ) • 10% to15% annual episode growth • Includes $35-$40 million per annum in agency acquisitions Volume Inpatient Rehabilitation Home Health & Hospice Medicare Pricing Inpatient Rehabilitation Approx. 74% of Revenue Home Health & Hospice Approx. 83% of Revenue FY 2015(41) Q414-Q315 FY 2016 Q415-Q316 FY 2017 Q416-Q317 CY 2015(42) Q115-Q415 CY 2016 Q116-Q416 CY 2017 Q117-Q417 Market basket update 2.9% 2.9% 2.9% 2.6% 2.6% 2.6% Healthcare reform reduction (20) bps (20) bps (75) bps - - - Healthcare reform rebasing adjustment - - - (2.4%)(43) (2.8%) (2.8%) Healthcare reform productivity adjustment (50) bps Approx. (100) bps Approx. (100) bps (50) bps Approx. (100) bps Approx. (100) bps Net impact 2.2% 1.7% 1.15% (0.3%) (1.2%) (1.2%) Managed Care Pricing Inpatient Rehabilitation Approx. 19% of Revenue Home Health & Hospice Approx. 10% of Revenue 2015 2016 2017 2015 2016 2017 Expected increases 2-4% 2-4% 2-4% 2-4% 2-4% 2-4% Business Outlook: Revenue Assumptions 2% Sequestration(12) • 2.5% to 3.5% annual discharge growth (excludes acquisitions) • Includes bed expansions, de novos and unit consolidations • 10% to 15% annual episode growth • Includes $30-$40 million per annum in agency acquisitions Refer to pages 103-107 for end notes.

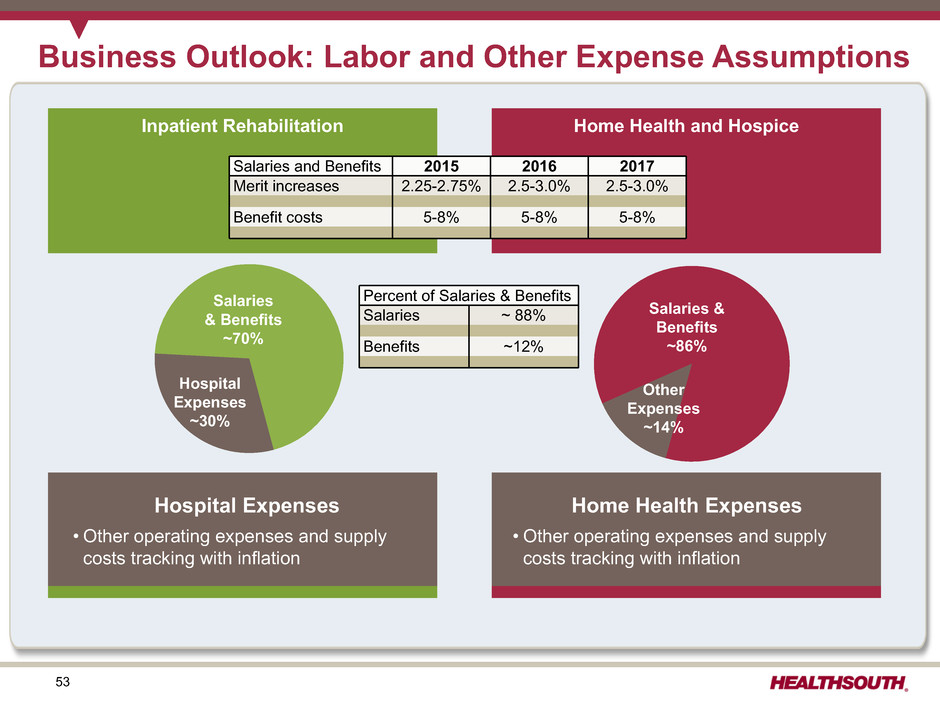

53 Inpatient Rehabilitation Home Health and Hospice Business Outlook: Labor and Other Expense Assumptions Salaries & Benefits ~70% Hospital Expenses ~30% Salaries and Benefits 2015 2016 2017 Merit increases 2.25-2.75% 2.5-3.0% 2.5-3.0% Benefit costs 5-8% 5-8% 5-8% Hospital Expenses • Other operating expenses and supply costs tracking with inflation Salaries & Benefits ~86% Other Expenses ~14% Home Health Expenses • Other operating expenses and supply costs tracking with inflation Percent of Salaries & Benefits Salaries ~ 88% Benefits ~12%

54 Guidance (as of March 27, 2015)

55 2015 Guidance - Adjusted EBITDA* Ÿ Inpatient rehabilitation segment considerations for 2015: ― Revenue growth between 5.9% and 7.3% ― Discharge growth between 3.5% and 4.5% ― Revenue per discharge growth between 2.3% and 2.6% ― Bad debt expense of approx. 1.5% Ÿ Home health and hospice segment considerations for 2015: ― Encompass contribution of approx. $72 million in Adjusted EBITDA after noncontrolling interest (does not include HealthSouth's legacy 25 home health agencies)(2) Ÿ Other considerations for 2015: ― Approx. $10 million of new investments in our operating platform ▪ Contractual increase for our clinical information system (CIS) ▪ New medical services department ▪ Additional hospital staff for quality reporting ▪ Bundling pilot participation Adjusted EBITDA $670 million to $680 million * Reconciliation to GAAP provided on slides 61 and 97. Refer to pages 103-107 for end notes.

56 2015 Guidance - EPS Considerations: Ÿ Higher depreciation and amortization related to recent capital investments Ÿ Higher interest expense and amortization of debt discounts and fees related to the increased debt for the Encompass acquisition Ÿ Assumes provision for income tax of approx. 40% (cash taxes expected to be $15 - $20 million for full-year 2015) Ÿ Share count is before the effect of any potential share repurchase activity. Ÿ Diluted share count includes 3.2 million shares for the convertible preferred security under which the Company has a forced conversion option at a common stock price of $44.55(36). Ÿ Includes approx. $21 million, or approx. $0.12 per share after-tax, loss on early extinguishment of debt in Q1 2015. EPS Guidance Actual Low High (In Millions, Except Per Share Data) 2014 2015 Adjusted EBITDA $ 577.6 $ 670 $ 680 Interest expense and amortization of debt discounts and fees (109.2) (123) Depreciation and amortization (107.7) (134) Stock-based compensation expense (23.9) (28) Other, including noncash loss on disposal and impairment of assets (6.7) (7) 330.1 378 388 Certain Nonrecurring Expenses: Government, class action, and related settlements 1.7 (8) Professional fees - accounting, tax, and legal (9.3) (5) Loss on early extinguishment of debt (13.2) (21) Gain related to consolidation of Fairlawn Rehabilitation Hospital(15) 27.2 — Encompass transaction costs (9.3) — Pre-tax income 327.2 344 354 Income tax (110.7) (138) (142) Income from continuing operations(44) $ 216.5 $ 206 $ 212 Income allocated to participating securities(45) $ (2.3) $ (2) $ (2) Convertible perpetual preferred dividends(45) (6.3) (6) (6) After-tax convertible debt interest expense(46) 9.0 9 9 Basic shares 86.8 87.1 87.1 Diluted shares 100.7 101.1 101.1 Earnings per share $ 2.24 $ 2.13 $ 2.19 Earnings per Share from Continuing Operations Attributable to HealthSouth(44) $ 2.13 to $ 2.19 Refer to pages 103-107 for end notes.

57 Free Cash Flow