Form 8-K Galena Biopharma, Inc. For: Mar 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 10, 2016

GALENA BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

Delaware | 001-33958 | 20-8099512 | ||

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583 (855) 855-4253 | ||||

(Address of Principal Executive Offices) (Zip Code) | ||||

Registrant’s telephone number, including area code: (855) 855-4253 | ||||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 | Results of Operations and Financial Condition. |

On March 10, 2016, Galena Biopharma, Inc. (“we,” “us,” “our” and the “company”) issued a press release announcing our financial results for the fourth quater and year ended December 31, 2015 and providing an update on recent business developments. A copy of the press release is attached to this Report as Exhibit 99.1 and is incorporated herein by reference. The slides from the presentation will be referenced below are incorporated by reference.

The information furnished under this Item 2.02, including the accompanying Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information be deemed to be incorporated by reference in any filing by the company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except as specifically stated in such filing.

Item 7.01 | Regulation FD Disclosure. |

On March 10, 2016, the Company will host a conference call with investors to discuss the Company's financial and operating results for the fourth quarter and year ended December 31, 2015. The discussion including slides will be made available to the public via conference call and webcast that will include slides. The slides from the presentation are being furnished as Exhibit 99.2 to this Current Report on Form 8-K. The information in this Item 7.01 and Exhibits 99.2 to this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

Exhibit No. | Description | ||

99.1 | Press Release of Galena Biopharma, Inc. dated March 10, 2016. | ||

99.2 | The corporate update presentation slides dated March 10, 2016. | ||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

GALENA BIOPHARMA, INC. | ||||||||

Date: | March 10, 2016 | By: | /s/ Mark W. Schwartz | |||||

Mark W. Schwartz Ph.D. President and Chief Executive Officer | ||||||||

Galena Biopharma Reports Fourth Quarter and Year End 2015 Financial Results and Provides a Corporate Update

• | Two Key Milestones in the NeuVax™ (nelipepimut-S) Phase 3, PRESENT Clinical Trial Expected in 1H, 2016 |

• | Webcast and conference call scheduled for today at 2:00 p.m. P.T. / 5:00 p.m. E.T. |

San Ramon, California, March 10, 2016 - Galena Biopharma, Inc. (NASDAQ: GALE), a biopharmaceutical company committed to the development and commercialization of targeted oncology therapeutics that address major unmet medical needs, today reported its financial results for the quarter and year ended December 31, 2015.

“2016 is poised to be a critical year for Galena as we look forward to reaching two significant milestones in our NeuVax Phase 3, PRESENT clinical trial targeting the prevention of breast cancer recurrence,” said Mark W. Schwartz, Ph.D., President and CEO. “As anticipated, we expect to reach the 70th event in the PRESENT trial, defined as a recurrence of the primary cancer, occurrence of another cancer, or death from any cause, within the next few weeks. Once we reach this event, we will prepare the data for review by our Independent Data Monitoring Committee (IDMC), and the IDMC will then conduct an interim safety and futility analysis. We expect this analysis to be completed and announced at the end of the second quarter.”

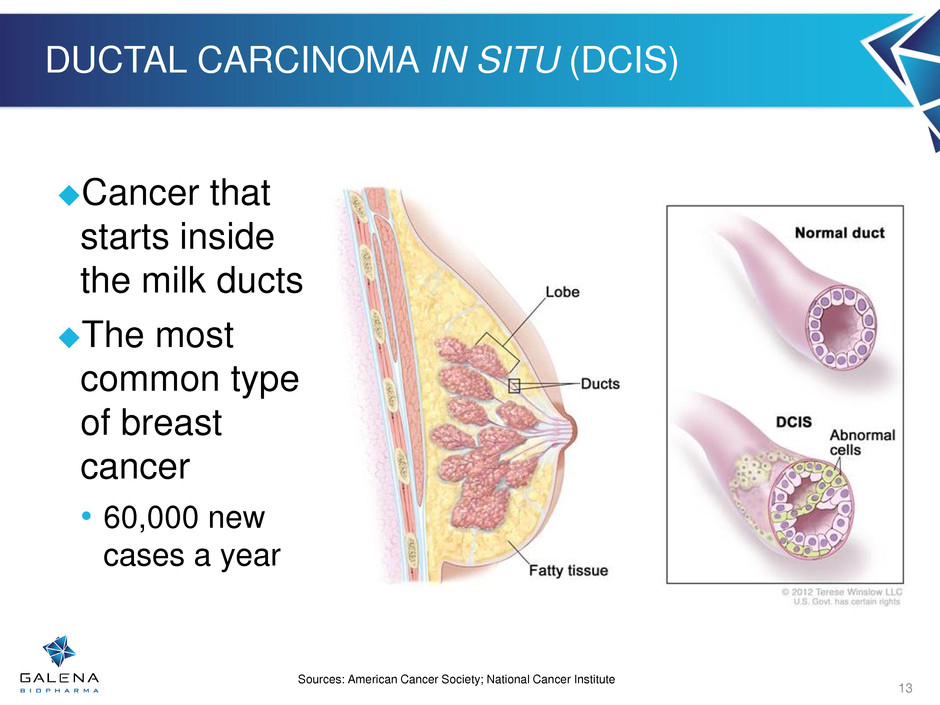

Dr. Schwartz continued, “NeuVax is our most advanced program and represents the greatest commercial potential for Galena. In addition to the PRESENT trial, we are excited to have several additional partner and investigator-sponsored trials with NeuVax in both breast and gastric cancers. This year, we expect preliminary safety data from our NeuVax breast cancer combination trial with trastuzumab, and we look forward to initiating Phase 2 studies with our partners in women diagnosed with Ductal Carcinoma in Situ (DCIS) and in patients with gastric cancer. Our goal for 2016 is to continue the development of the NeuVax franchise by investigating a host of cancer indications, patient populations, and treatment regimens both as a stand-alone therapy and in combination with other technologies where NeuVax can be beneficial to cancer patients.”

Dr. Schwartz added, “On the corporate side, I have implemented several major strategic initiatives since I took over as President and CEO. Over the last eighteen months, we have taken positive steps to restructure the Company by divesting our commercial business and sharpening our focus on NeuVax and our additional clinical development programs. In December, we also announced the proposed settlement of both the derivative and securities class action litigation and expect those settlements to be approved by the end of the second quarter of this year. Furthermore, led by our Nominating and Governance Committee, we have begun to expand our

1

Board of Directors with the replacement of one retiring director, and the planned addition of another new director. On the financial side, we successfully raised capital at the beginning of the year to strengthen our balance sheet, and we expect our 2016 quarterly cash burn to be between $9 to $11 million dollars based on our current programs with several non-recurring expenses increasing that burn in the first half of the year, as detailed below. As a result, and given the volatile and unpredictable financial markets, we believe a conservative approach to our clinical spend and maintaining our primary focus on NeuVax, is warranted. Therefore, and in concert with this mission-oriented approach, we are reviewing our non-NeuVax programs and calibrating those programs’ new trial initiation dates in order to optimize the allocation of our resources.”

Dr. Schwartz concluded, “Looking ahead, we are taking the necessary steps to move Galena forward with advancing clinical programs and a strong management team who is focused on two main goals: providing therapeutic modalities to prevent or significantly delay cancer recurrence, and maximizing value for our dedicated shareholders.”

Galena will host a webcast and conference call today at 2:00 p.m. P.T./5:00 p.m. E.T. to discuss its financial and business results. The live webcast will include slides that can be accessed on the Company's website under the Investors section/Events and Presentations: http://investors.galenabiopharma.com/events.cfm. The conference call can be accessed by dialing (844) 825-4413 toll-free in the U.S., or (973) 638-3403 for participants outside the U.S. The Conference ID number is: 50939696. The archived webcast replay will be available on the Company's website for 90 days.

FINANCIAL HIGHLIGHTS

Continuing Operations

Operating loss from Galena’s ongoing development programs, classified as continuing operations, for the fourth quarter of 2015 was $7.6 million, including $0.6 million in stock-based compensation, compared to an operating loss from continuing operations of $9.7 million, including $0.8 million in stock-based compensation for the same period in 2014. Operating loss from continuing operations in 2015 was $34.2 million, including $1.9 million in stock-based compensation, compared to an operating loss from continuing operations of $43.9 million, including $5.4 million in stock-based compensation in 2014. The decrease in net operating loss in the quarter and year ended December 31, 2015 compared to the quarter and year ended December 31, 2014 was primarily the result of the completion of enrollment in the Company’s Phase 3 PRESENT trial for NeuVax, the decrease in stock-based compensation, and a reduction in non-insurance reimbursed legal expenses associated with ongoing litigation and regulatory proceedings.

2

Non-operating income or expenses include charges related to securities and derivative litigation settlement expense, non-cash changes in the fair value estimates of the Company’s warrant liabilities, non-cash change in the contingent purchase price liability, and interest expense. Because the settlement of the securities and derivative litigation was reached in the fourth quarter of 2015, the settlement amount and related costs were expensed in the fourth quarter of 2015. Non-operating expense for the fourth quarter and year ended December 31, 2015 was primarily attributable to the $5.3 million expense incurred for the securities and derivative settlement. Of the $5.3 million charge, $3.3 million is accrued as of year-end, which Galena expects to pay out upon final court approval of the settlement in the second quarter of 2016 comprising $2.3 million in cash and $1 million in Galena common stock. This expense was partially offset by a non-cash gain of $2.1 million during the fourth quarter of 2015 and $1.2 million during the year ended 2015, related to the change in the value of the Company’s warrant liability during both periods. The fourth quarter and year ended 2014 non-operating income was primarily attributable to the non-cash gains of $3.4 million during the fourth quarter of 2014 and $16.6 million during the year ended 2014, respectively, related to the change in the value of the warrant liability.

Loss from continuing operations for the fourth quarter of 2015 was $10.8 million, including a $2.1 million non-cash gain on warrant liability, or $0.07 per basic and diluted share. Loss from continuing operations for the fourth quarter of 2014 was $6.3 million, including a $3.4 million non-cash gain on warrant liability, or $0.05 per basic and diluted share. Loss from continuing operations in 2015 was $39.0 million, including $5.3 million for the securities and litigation settlement and a $1.2 million non-cash gain on warrant liability, or $0.25 per basic and diluted share. Loss from continuing operations in 2014 was $28.3 million, including a $16.6 million non-cash gain on warrant liability, or $0.24 per basic and diluted share.

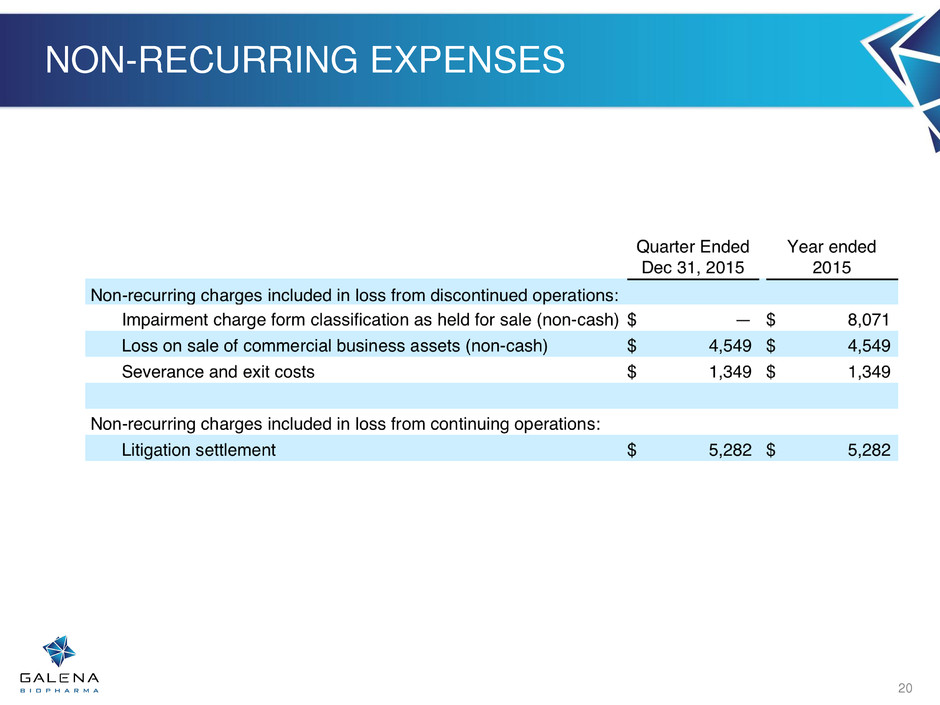

Non-recurring Charges

During the second half of 2015, Galena had several one-time, non-recurring charges that materially affected its earnings per share for the fourth quarter and full year 2015. These one-time charges were the result of the divestiture of the commercial operations, which was classified as discontinued operations beginning in the third quarter of 2015, and the securities and derivate litigation settlement expense in the fourth quarter of 2015.

Quarter Ended | Year ended | ||||||

Non-recurring charges included in loss from discontinued operations: | |||||||

Impairment charge form classification as held for sale (non-cash) | $ | — | $ | 8,071 | |||

Loss on sale of commercial business assets (non-cash) | $ | 4,549 | $ | 4,549 | |||

Severance and exit costs | $ | 1,349 | $ | 1,349 | |||

Non-recurring charges included in loss from continuing operations: | |||||||

Litigation settlement | $ | 5,282 | $ | 5,282 | |||

3

Discontinued Operations

Loss from discontinued operations for the fourth quarter of 2015 was $8.9 million, or $0.05 per basic and diluted share, compared to $1.7 million, or $0.01 per basic and diluted share, for the same period of 2014. Of note, the Company has retrospectively recast its previously issued 2014 annual financial statements to present the commercial business as discontinued operations. The loss from discontinued operations for the fourth quarter of 2015 includes a non-cash charge of $4.5 million on the loss on sale of the commercial business assets and $1.3 million of severance and exit costs. Loss from discontinued operations in 2015 was $24.9 million, or $0.16 per basic and diluted share, compared to $8.3 million, or $0.07 per basic and diluted share, for the same period of 2014. Loss from discontinued operations in 2015 also includes an $8.1 million non-cash impairment charge from classification of assets held for sale in addition to the loss on sale of commercial business assets and severance and exit costs described above.

Cash and Cash Equivalents

As of December 31, 2015, Galena had cash and cash equivalents of $29.7 million, compared with $23.7 million as of December 31, 2014. The $6.1 million increase in cash through the fourth quarter of 2015 represents $47.4 raised from issuance of common stock and $11.3 net proceeds from the sale of commercial assets, partially offset by $38.8 million used in continuing operating activities, $9.4 million used in discontinued operating activities, and $3.9 million in debt service payments.

For the Year Ended December 31, | ||||||||

2015 | 2014 | |||||||

Cash flows from continuing operations: | ||||||||

Cash flows used in continuing operating activities | $ | (38,802 | ) | $ | (37,037 | ) | ||

Cash flows used in continuing investing activities | (354 | ) | (2,472 | ) | ||||

Cash flows provided by continuing financing activities | 43,845 | 24,260 | ||||||

Total cash flows provided by (used in) continuing operating activities | 4,689 | (15,249 | ) | |||||

Cash flows from discontinued operations: | ||||||||

Cash flows used in discontinued operating activities | (9,358 | ) | (5,832 | ) | ||||

Cash flows used in discontinued investing activities | 10,749 | — | (3,056 | ) | ||||

Total cash flows provided by (used in) discontinued operating activities | 1,391 | (8,888 | ) | |||||

Total cash flows: | ||||||||

Cash flows used in operating activities | (48,160 | ) | (42,869 | ) | ||||

Cash flows used in investing activities | 10,395 | (5,528 | ) | |||||

Cash flows provided by financing activities | 43,845 | 24,260 | ||||||

Total increase (decrease) in cash and cash equivalents | 6,080 | (24,137 | ) | |||||

Beginning cash | $ | 23,650 | $ | 47,787 | ||||

Ending cash | $ | 29,730 | $ | 23,650 | ||||

4

Net Loss and Net Loss Per Share

Net loss for the fourth quarter of 2015 was $19.7 million, or $0.12 per basic and diluted share, compared to $8.0 million, or $0.06 per basic and diluted share, for the same period of 2014. Net loss in 2015 was $63.9 million, or $0.41 per basic and diluted share, compared to $36.6 million, or $0.31 per basic and diluted share, for the same period of 2014.

FOURTH QUARTER AND RECENT HIGHLIGHTS

Clinical Development Highlights

Received a Notice of Allowance of a U.S. Patent for NeuVax™ (nelipepimut-S). Galena announced the United States Patent Office issued a Notice of Allowance for an additional U.S. patent application covering multiple uses of NeuVax™ (nelipepimut-S): inducing and maintaining an immune response to HER2 expressing tumor cells in patients in clinical remission with a tumor having a fluorescence in situ hybridization (FISH) rating of less than about 2.0 (FISH <2.0); inducing and sustaining a cytotoxic T-lymphocyte (CTL) response to HER2 in patients in clinical remission from a tumor with a FISH rating of less than about 2.0 (FISH < 2.0); reducing risk of cancer recurrence in patients in clinical remission from a tumor with a FISH rating of less than about 2.0 (FISH < 2.0); and preventing bone only recurrence of a HER2 expressing cancer. This patent will expand both the protection and the potential population of cancer patients NeuVax may address. Once issued, the patent will expire in 2028, not including any patent term extensions.

Presented Observational Study Data in Gastric Cancer Patients at the American Society of Clinical Oncology (ASCO) 2016 Gastrointestinal Cancers Symposium. The Company presented data from an observational study in gastric cancer patients at the ASCO 2016 Gastrointestinal Cancers Symposium. The study was conducted by Galena’s partner, Dr. Reddy’s Laboratories Ltd, who will conduct a Phase 2 clinical trial of NeuVax in gastric cancer patients in India. The poster, entitled, “An observational study evaluating the expression of HER2 (1+, 2+, and 3+) with HLA A2+/A3+ in gastric adenocarcinoma patients,” showed that approximately 25% of the patients met the projected clinical protocol population of all levels of expression of HER2 and HLA A2+ and/or A3+ as defined for the planned NeuVax Phase 2 clinical trial. Results indicate an acceptable potential for enrollment rate, given the high incidence of gastric cancer in this population, and will inform the screen failure rate in the planned Phase 2 clinical study.

5

Presented GALE-302 Preliminary Immunological Data Optimizing GALE-301 at the Society for Immunotherapy of Cancer (SITC) 30th Anniversary Annual Meeting. The poster, entitled, "Preliminary report of a clinical trial supporting the sequential use of an attenuated E39 peptide (E39’) to optimize the immunologic response to the FBP (E39+GM-CSF) vaccine,” compared three primary vaccine series (PVS) sequences of GALE-301 (E39) and GALE-302 (E39’) in ovarian and breast cancer patients to optimize the ex vivo immune responses, local reactions (LR), and delayed type hypersensitivity (DTH) reactions. The data demonstrated that the in vivo immune response is enhanced with the use of the attenuated E39’ (GALE-302) after E39 (GALE-301). The optimal vaccination sequence utilizing three inoculations of GALE-301 followed by three inoculations of GALE-302 produced the most prominent and statistically significant LR and DTH responses.

Announced a collaboration with the National Cancer Institute (NCI) to initiate a new, Phase 2 Clinical Trial With NeuVax in Ductal Carcinoma in Situ (DCIS) Patients. The trial will be entitled, “VADIS: Phase 2 trial of the Nelipepimut-S Peptide VAccine in Women with DCIS of the Breast,” and The University of Texas M.D. Anderson Cancer Center (MDACC) Phase I and II Chemoprevention Consortium is the lead for this multi-center trial. The Consortium is funded through the Division of Cancer Prevention at the NCI, which will provide financial and administrative support for the trial. Galena will provide NeuVax, as well as additional financial and administrative support.

Corporate Highlights

Announced Proposed Settlement of Derivative and Securities Class Action Lawsuits. On February 4, 2016, the United States District Court for the District of Oregon (the "Court") issued an order preliminarily approving the proposed settlement by and among the Company, the Court-appointed co-lead plaintiffs, and all named defendants in the shareholder derivative action entitled In Re Galena Biopharma, Inc. Derivative Litigation, Case No. 3:10cv00382SI. A hearing to determine whether the Court should issue an order of final approval of the settlement has been scheduled for April 21, 2016. On February 16, 2016, the Court also issued an order preliminarily approving the proposed settlement by and among the Company and the current and former officers and directors in the consolidated putative federal class action, In Re Galena Biopharma, Inc. Securities Litigation, pending in the United States District Court for the District of Oregon. A hearing to determine whether the Court should issue an order of final approval of the Settlement has been scheduled for June 23, 2016.

Announced Changes to Board of Directors and Management Team. Galena announced that Steven A. Kriegsman will be retiring as a director of the Company when his current term expires the day prior to the June 2016 Annual Meeting of Stockholders. The Company plans to replace Mr. Kriegsman’s position on the Board of Directors and add one new director. The Company also announced the departure of Chief Financial Officer (CFO), Mr. Ryan Dunlap, due to his inability to relocate to the Company’s headquarters in California. Galena has instituted a search for the two new members to its Board of Directors and for a new CFO.

6

Galena appointed Bijan Nejadnik, M.D., as its Executive Vice President and Chief Medical Officer. Dr. Nejadnik is responsible for managing all of Galena's clinical development programs. Dr. Nejadnik has more than twenty two years of academic and industry experience, including twelve years with pharmaceutical and biotech companies including Jazz Pharmaceuticals, Johnson & Johnson, and Purdue Pharma. During his career, Dr. Nejadnik has successfully developed numerous biologics and small molecules, advancing these agents towards Biologics License Application (BLA) and New Drug Application (NDA) submissions.

Closed a Public Offering. On January 12, 2016, Galena closed the previously announced underwritten public offering of common stock and warrants. The net proceeds to the Company were approximately $20.1 million.

7

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(Amounts in thousands, except share and per share data)

Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Operating expenses: | |||||||||||||||

Research and development | $ | 4,849 | $ | 6,211 | $ | 23,611 | $ | 27,674 | |||||||

General and administrative | 2,740 | 3,482 | 10,609 | 16,226 | |||||||||||

Total operating expenses | 7,589 | 9,693 | 34,220 | 43,900 | |||||||||||

Operating loss | (7,589 | ) | (9,693 | ) | (34,220 | ) | (43,900 | ) | |||||||

Non-operating income (expense): | |||||||||||||||

Litigation settlement | (5,282 | ) | — | (5,282 | ) | — | |||||||||

Change in fair value of warrants potentially settleable in cash | 2,143 | 3,382 | 1,162 | 16,556 | |||||||||||

Interest expense, net | (153 | ) | (185 | ) | (760 | ) | (1,110 | ) | |||||||

Other income | 440 | 229 | 509 | 170 | |||||||||||

Total non-operating income (expense), net | (2,852 | ) | 3,426 | (4,371 | ) | 15,616 | |||||||||

Loss before income taxes | (10,441 | ) | (6,267 | ) | (38,591 | ) | (28,284 | ) | |||||||

Income tax expense | 365 | — | 365 | — | |||||||||||

Loss from continuing operations | $ | (10,806 | ) | $ | (6,267 | ) | $ | (38,956 | ) | $ | (28,284 | ) | |||

Discontinued operations | |||||||||||||||

Loss from discontinued operations | (8,872 | ) | (1,689 | ) | (24,946 | ) | (8,322 | ) | |||||||

Net loss | $ | (19,678 | ) | $ | (7,956 | ) | $ | (63,902 | ) | $ | (36,606 | ) | |||

Net loss per common share: | |||||||||||||||

Basic and diluted net loss per share, continuing operations | $ | (0.07 | ) | $ | (0.05 | ) | $ | (0.25 | ) | $ | (0.24 | ) | |||

Basic and diluted net loss per share, discontinued operations | $ | (0.05 | ) | $ | (0.01 | ) | $ | (0.16 | ) | $ | (0.07 | ) | |||

Basic net loss per share | $ | (0.12 | ) | $ | (0.06 | ) | $ | (0.41 | ) | $ | (0.31 | ) | |||

Weighted-average common shares outstanding: basic and diluted | 161,905,422 | 122,917,163 | 155,264,729 | 119,388,366 | |||||||||||

8

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

December 31, 2015 | December 31, 2014 | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 29,730 | $ | 23,650 | |||

Restricted cash | 401 | 200 | |||||

Litigation settlement insurance recovery | 21,700 | — | |||||

Prepaid expenses and other current assets | 1,398 | 1,237 | |||||

Current assets of discontinued operations | 392 | 27,013 | |||||

Total current assets | 53,621 | 52,100 | |||||

Equipment and furnishings, net | 335 | 285 | |||||

In-process research and development | 12,864 | 12,864 | |||||

GALE-401 rights | 9,255 | 9,255 | |||||

Goodwill | 5,898 | 5,897 | |||||

Deposits | 171 | 87 | |||||

Total assets | $ | 82,144 | $ | 80,488 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 1,597 | $ | 1,886 | |||

Accrued expense and other current liabilities | 5,292 | 8,885 | |||||

Litigation settlement payable | 25,000 | — | |||||

Fair value of warrants potentially settleable in cash | 14,518 | 5,383 | |||||

Current portion of long-term debt | 4,739 | 3,910 | |||||

Current liabilities of discontinued operations | 5,925 | 7,169 | |||||

Total current liabilities | 57,071 | 27,233 | |||||

Deferred tax liability, non-current | 5,418 | 5,053 | |||||

Contingent purchase price consideration, net of current portion | 6,142 | 6,651 | |||||

Long-term debt, net of current portion | — | 4,492 | |||||

Total liabilities | 68,631 | 43,429 | |||||

Stockholders’ equity | 13,513 | 37,059 | |||||

Total liabilities and stockholders’ equity | $ | 82,144 | $ | 80,488 | |||

9

About Galena Biopharma

Galena Biopharma, Inc. is a biopharmaceutical company committed to the development and commercialization of targeted oncology therapeutics that address major unmet medical needs. Galena’s development portfolio is focused primarily on addressing the rapidly growing patient populations of cancer survivors by harnessing the power of the immune system to prevent cancer recurrence. The Company’s pipeline consists of multiple mid- to late-stage clinical assets, including novel cancer immunotherapy programs led by NeuVax™ (nelipepimut-S) and GALE-301. NeuVax is currently in a pivotal, Phase 3 breast cancer clinical trial with several concurrent Phase 2 trials ongoing both as a single agent and in combination with other therapies. GALE-301 is in a Phase 2a clinical trial in ovarian and endometrial cancers and in a Phase 1b given sequentially with GALE-302. For more information, visit www.galenabiopharma.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about our 2015 revenue from the sale of Abstral®, our launch of Zuplenz®, the divestiture of the commercial operations including the two commercial products, the issuance and exclusivity of patents, and the progress of development of Galena’s product candidates, including patient enrollment in our clinical trials. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those identified under “Risk Factors” in Galena’s Annual Report on Form 10-K for the year ended December 31, 2014 and most recent Quarterly Reports on Form 10-Q filed with the SEC. Actual results may differ materially from those contemplated by these forward-looking statements. Galena does not undertake to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this press release.

NeuVax is a trademark of Galena Biopharma, Inc.

Contact:

Remy Bernarda

SVP, Investor Relations & Corporate Communications

(925) 498-7709

Source: Galena Biopharma, Inc.

10

Q4 & YEAR END, 2015 Earnings Report & Corporate Update

FORWARD LOOKING STATEMENT This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about our 2015 revenue from the sale of Abstral®, our launch of Zuplenz®, the divestiture of the commercial operations including the two commercial products, the issuance and exclusivity of patents, and the progress of development of Galena’s product candidates, including patient enrollment in our clinical trials, time to complete the trials, and expected time periods for results. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those identified under “Risk Factors” in Galena’s Annual Report on Form 10-K for the year ended December 31, 2015 and most recent Quarterly Reports on Form 10-Q filed with the SEC. Actual results may differ materially from those contemplated by these forward- looking statements. Galena does not undertake to update any of these forward- looking statements to reflect a change in its views or events or circumstances that occur after the date of this press release. 2

EARNINGS CALL PARTICIPANTS Presenters Mark W. Schwartz, Ph.D. President & Chief Executive Officer Bijan Nejadnik, M.D. Executive Vice President, Chief Medical Officer John T. Burns, CPA Controller & Principal Accounting Officer Other Participants Remy Bernarda, MBA SVP, Investor Relations & Corporate Communications Tom Knapp, Esq Interim General Counsel 3

OVERVIEW Mark W. Schwartz, Ph.D. President & Chief Executive Officer

2015 MILESTONES NeuVax™ Enroll N=700 into PRESENT trial Complete enrollment in Phase 3 PRESENT trial GALE-301 GALE- 302 Report Top-Line Phase 2a clinical data Report 1-Year Phase 2a analysis Report GALE-301 + GALE-302 Phase 1b data GALE-401 (anagrelide CR) Report Top-Line efficacy and safety data Report Final Phase 2 data 5

DEVELOPMENT PIPELINE Product Therapeutic Area Phase 1 Phase 2 Phase 3 BLA / NDA Immunotherapy: Breast Cancer NeuVax™ (nelipepimut-S) Node-positive HER2 IHC 1+/2+ NeuVax™ + Herceptin® Node-positive or node negative/triple negative HER2 IHC 1+/2+ NeuVax™ + Herceptin® High risk, node-positive or negative, HER2 IHC 3+ NeuVax™ Ductal Carcinoma in Situ (DCIS) Immunotherapy: Gastric Cancer NeuVax™ Gastric, HER2 IHC 1+/2+/3+ Immunotherapy: Gynecological Cancer GALE-301 Ovarian & Endometrial GALE-301 + GALE-302 Ovarian & Breast Hematology GALE-401 (Anagrelide CR) MPN-related thrombocytosis PRESENT *NeuVax is an investigational product. Efficacy has not been established. Herceptin is a registered trademark of Genentech. Ongoing Planned VADIS 6 2b

CLINICAL DEVELOPMENT Bijan Nejadnik, M.D. Executive Vice President, Chief Medical Officer 7

PHASE 3 PRESENT TRIAL PER SPA 1 2 3 4 Interim analysis by IDMC at n=70 events Endpoint DFS at n=141 events /36 months Dosing by Month + 1 booster dose every 6 months thereafter 5 6 Adjuvant breast cancer patients, randomized 1:1 Double blind Node positive HLA A2/A3+ HER2 IHC 1+/2+ Stratified by stage, type of surgery, hormone receptor, and menopausal status Enrollment complete: n=758 Patients Study Population + GM-CSF Placebo + GM-CSF 8 Prevention of Recurrence in Early-Stage, Node Positive Breast Cancer with Low to Intermediate HER2 Expression with NeuVax Treatment

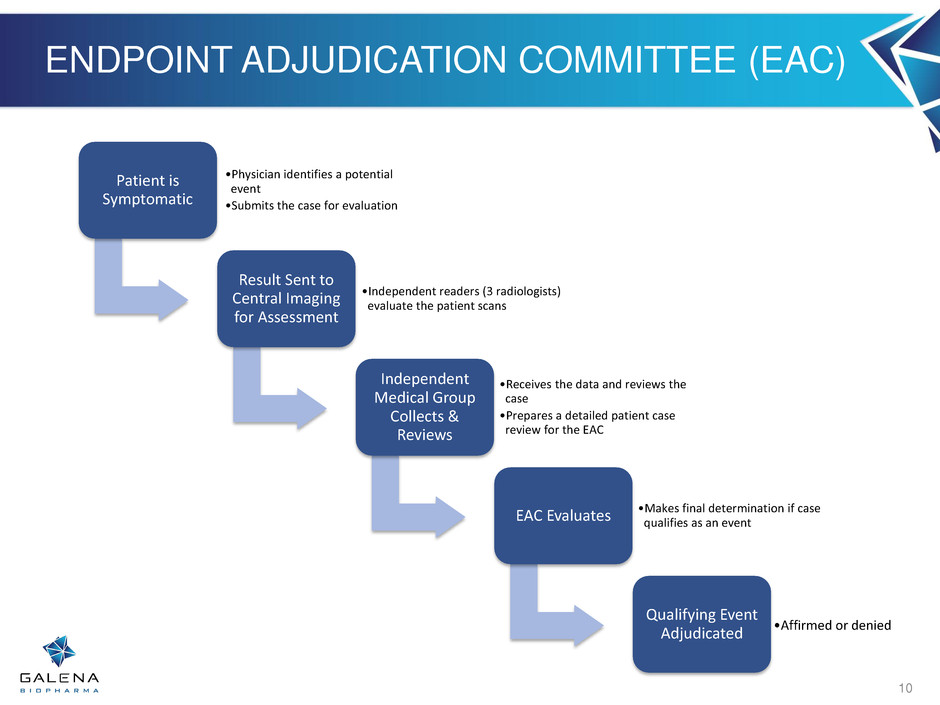

PRESENT TRIAL DEFINITIONS Qualifying Event: • A recurrence of the primary cancer, either locally (breast), regionally (lymph nodes), or distantly (metastatic) • Occurrence of another cancer • Death from any cause Central Imaging: Independent radiology group to evaluate radiographic images • Team includes 3 Radiologists blinded to the treatment assignment Endpoint Adjudication Committee (EAC): an independent team of physicians expert in breast cancer diagnosis that evaluate every potential event • Team includes 2 Oncologists & 1 Radiologist blinded to the treatment assignment Interim Analysis: a pre-specified futility and safety analysis on the first 70 adjudicated events which evaluates the probability of the study to achieve its pre- specified objectives Independent Data Monitoring Committee (IDMC): an independent team of physicians monitoring the overall conduct, status, and safety data of the trial and will perform the interim analysis and provide the recommendation • Team includes two medical oncologists, one cardiologist, and one statistician 9

ENDPOINT ADJUDICATION COMMITTEE (EAC) Patient is Symptomatic •Physician identifies a potential event •Submits the case for evaluation Result Sent to Central Imaging for Assessment •Independent readers (3 radiologists) evaluate the patient scans Independent Medical Group Collects & Reviews •Receives the data and reviews the case •Prepares a detailed patient case review for the EAC EAC Evaluates •Makes final determination if case qualifies as an event Qualifying Event Adjudicated •Affirmed or denied 10

PRESENT INTERIM ANALYSIS 70 Events Confirmed by the EAC Galena Compiles Data • Prepares a detailed review on 70 patients with events and overall safety data set (n=758) • Submits to IDMC IDMC Evaluates • Evaluates 70 patients with events and overall safety data set (n=758) •Makes recommendation on futility and continuation of trial Interim Analysis Results •Estimated timing: End of Q2 11

NEUVAX: DEVELOPMENT COLLABORATIONS Phase Treatment HER2 Status Indication Trial Status Protocol Defined # of Patients Collaborations 3 Single agent PRESENT Study 1+, 2+ BREAST Node Positive HLA A2+, A3+ Enrolled 13 countries ~140 centers 700 (enrolled 758) 2b Combination with trastuzumab 1+, 2+ BREAST Node Positive or High Risk Node Negative HLA A2+, A3+, A24+, A26+ Enrolling U.S. only 33 centers 300 2 Combination with trastuzumab 3+ high risk BREAST Node Positive HLA A2+, A3+ Enrolling U.S. only 28 centers 100 2 Single agent VADIS Study 1+, 2+,3+ BREAST Ductal Carcinoma in Situ (DCIS) HLA A2+ Planned U.S. only 4 centers 48 2 Single agent 1+, 2+,3+ GASTRIC HLA A2+, A3+ Planned India Only 50 12

DUCTAL CARCINOMA IN SITU (DCIS) Cancer that starts inside the milk ducts The most common type of breast cancer • 60,000 new cases a year 13 Sources: American Cancer Society; National Cancer Institute

NEUVAX: VADIS TRIAL (DCIS) 14 Program Goal: Broaden footprint of NeuVax development to include primary prevention. Should the study results be positive, NeuVax may potentially be evaluated in a large randomized trial for primary prevention of invasive breast cancer. • Study Objectives: Primary • Evaluate for nelipepimut-S specific cytotoxic T-cells Secondary • Toxicity profile • Immune response to other tumor antigens • Polyfunctional cytokine responses • Presence of DCIS at resection

GALE-301 & GALE-302: CURRENT CLINICAL DEVELOPMENT 15 Phase Treatment Cancer Type Target Indication Current Status # of Enrolled Patients 1/2a GALE-301 Ovarian, Endometrial HLA A2+ Ovarian Enrolled 51 1b GALE-301 & GALE-302 Ovarian, Breast HLA A2+ Ovarian / Breast Enrolled 39

GALE-401 ANAGRELIDE CONTROLLED RELEASE (CR) Anagrelide •Active ingredient •Reduces the elevated platelet count and the risk of thrombosis in patients with myeloproliferative neoplasms (MPNs) •MPNs are hematological malignancies in which the bone marrow cells develop and function abnormally Immediate Release •Approved for the treatment of patients with thrombocythemia, secondary to MPNs • IR formulation can cause unacceptable side effects believed to be Cmax-related and has largely limited the use due to early treatment withdrawal GALE-401 •Controlled Release (CR) formulation may decrease the frequency or severity of side effects •Phase 2, Proof-of-Concept Trial Results •Well tolerated with primarily Grade 1 and 2 toxicities •Efficacy compares favorably to historical anagrelide IR 16

CLINICAL DEVELOPMENT Bijan Nejadnik, M.D. Executive Vice President, Chief Medical Officer 17

FINANCE John T. Burns, CPA Controller & Principal Accounting Officer 18

STATEMENTS OF OPERATIONS 19

NON-RECURRING EXPENSES 20

CASH & CASH EQUIVALENTS 21

FINANCIAL OVERVIEW Cash Position (as of 2/29/15) $38.2 million Q1 Remaining Burn $2.5-$3.5 million Q2 Projected Burn $13-$15 million Includes legal settlement & fees ~$4-$5 million Debt (as of 12/31/15) $4.7 million Shares Outstanding 182 million Market Cap (9 March 16) ~$170 million 22

MILESTONES & CLOSING REMARKS Mark W. Schwartz, Ph.D. President and Chief Executive Officer 23

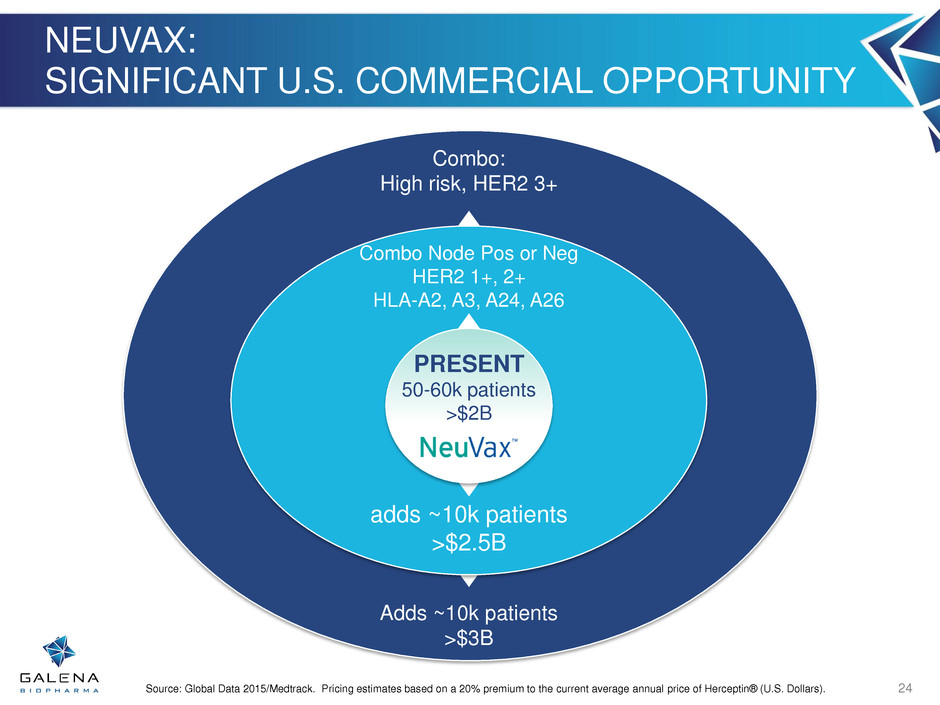

Adds ~10k patients >$3B Combo: High risk, HER2 3+ NEUVAX: SIGNIFICANT U.S. COMMERCIAL OPPORTUNITY 24 adds ~10k patients >$2.5B Combo Node Pos or Neg HER2 1+, 2+ HLA-A2, A3, A24, A26 PRESENT 50-60k patients >$2B Source: Global Data 2015/Medtrack. Pricing estimates based on a 20% premium to the current average annual price of Herceptin® (U.S. Dollars).

2016 MILESTONES 25 PROGRAM MILESTONE PROJECTED DATE NeuVax™ (nelipepimut-S) Initiate DCIS trial March/April PRESENT: Reach 70 events March/April PRESENT: Interim analysis Q2 Combo H&N 1+/2+ Interim safety data Q4 Combo H&N 1+/2+ A24/A26 data Q4 GALE-301 GALE-302 Present 301/302 booster data Q2 Present GALE-301 Phase 2a two year data Q4 GALE-401 (anagrelide CR) Confirmation of 505(b)2 pathway 2H Publish final Phase 2 report Q4

1st IN CLASS PROGRAMS WITH EXPANSION OPPORTUNITIES Mid-stage clinical trials have proven T-cell generation • NeuVax™ (nelipepimut-S) Phase 2 trial demonstrated 2% of the patient’s T-Cells become CD8+, HER2 directed • GALE-301 Phase 1/2: Two year DFS estimate in optimal dose group is 85.7% vaccine vs. 33.6% control (p<.02) Targeting “high value” settings: Prevention of recurrence in breast and ovarian cancer are areas of clear unmet medical needs • No approved drugs for these women with limited late stage competition Multiple trials ongoing as stand-alone therapies and in-combination with other agents Breast & Ovarian are just a start – HER2 and Folate Binding Protein expressed in numerous cancer types HER2 Breast Gastric Prostate Non-Small Cell Lung Bladder Colorectal Ovarian Head & Neck Folate Binding Protein Ovarian Endometrial Breast 26

WHY WE’RE HERE Source: E75 vaccine's final tests start in S.A. By Don Finley, January 22, 2012; Photo credit: Kin Man Hui/San Antonio Express-News/ZUMAPress “I've had several friends who've had (breast cancer) and then…it came back and they had to go through treatment again. So this would be wonderful, not to have to come back.” – First NeuVax Phase 3 patient 27

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Middlefield Canadian Income PCC: Net Asset Value(s)

- Form 8.3 - ABRDN European Logistics Income Plc

- Form 8.3 - Mattioli Woods plc

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share