Form 8-K GREEN DOT CORP For: Feb 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

�

FORM 8-K

�

CURRENT REPORT

�

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

�

Date of Report (Date of Earliest Event Reported): February�10, 2015

�

Green Dot Corporation

(Exact Name of the Registrant as Specified in Its Charter)

�

Delaware

(State or Other Jurisdiction of Incorporation)

001-34819 | � | 95-4766827 |

(Commission File Number) | � | (IRS Employer Identification No.) |

� | � | |

3465 East Foothill Blvd. Pasadena, CA 91107 | � | (626) 765-2000 |

(Address of Principal Executive Offices) | � | (Registrant's Telephone Number, Including Area Code) |

Not Applicable�

(Former Name or Former Address, If Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2)

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

Green Dot Corporation has prepared slides for use in connection with its investor presentations during the week of February 9, 2015. These slides contain information regarding its recently released 2015 guidance, including new information regarding non-GAAP earnings per share. A copy of those slides is furnished as an exhibit to this report and is incorporated herein by reference.

The information furnished in this Current Report, including the exhibit hereto, shall not be deemed

filed

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

Exchange Act

), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Number����Description

99.01��������Green Dot Corporation investor presentation materials

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

GREEN DOT CORPORATION | |||

By: | � | /s/ Steven W. Streit | |

� | Steven W. Streit | ||

Chief Executive Officer | |||

Date: February�10, 2015

EXHIBIT INDEX

Number����Description

99.01��������Green Dot Corporation investor presentation materials

Q1 2015 Todays Green Dot Investor Relations discussion materials

�

About Non-GAAP Financial Measures During this presentation, references to financial measures of Green Dot Corporation will include references to non-GAAP financial measures. For an explanation to the most directly comparable GAAP financial measures, see the Appendix to these materials or the Supplemental Non-GAAP Financial Information available at Green Dot Corporations investor relations website at http://ir.greendot.com/ under

Financial Information.

Forward-Looking Statements This presentation contains forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include, among other things, the financial guidance included on the slides captioned "Outlook for 2015,

2014- 2015E Non-GAAP Total Operating Revenue Bridge,

2014-2015E Adjusted EBITDA Bridge,

as well as statements regarding the expected negative impact of the discontinuation of the "MoneyPak PIN" product, the Company's free cash flows, the impact of new fee plans, the compound annual growth rates for the Companys non-GAAP total operating revenues and adjusted EBITDA, the projected revenue concentration associated with the Walmart MoneyCard program and the projected percentage of projected non-GAAP total operating revenues represented by each of the Companys revenue sources. Actual results may differ materially from those contained in the forward-looking statements contained in this presentation, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from those projected include, among other things, the businesses of the Company and TPG may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; the risk that sales of TPG products will not be as high as anticipated; the expected growth opportunities or cost savings from the acquisition may not be fully realized or may take longer to realize than expected; customer losses and business disruption following the acquisition, including adverse effects on relationships with former employees of TPG, may be greater than expected; the risk that the Company may incur unanticipated or unknown losses or liabilities following completion of the acquisition of TPG; and the risk that legislative or regulatory changes, or changes in the way the existing legislation and regulations are interpreted or enforced, may adversely affect the business in which TPG is engaged. Additional factors, that could cause actual results to differ materially from those expressed in the forward-looking statements include the impact of the Companys supply chain management efforts on its revenue growth, the timing and impact of revenue growth activities, the Company's dependence on revenues derived from Walmart, impact of competition, the Company's reliance on retail distributors for the promotion of its products and services, demand for the Company's new and existing products and services, continued and improving returns from the Company's investments in new growth initiatives, including the Companys GoBank product, potential difficulties in integrating operations of acquired entities and acquired technologies, the Company's ability to operate in a highly regulated environment, changes to existing laws or regulations affecting the Company's operating methods or economics, the Company's reliance on third-party vendors and card issuing banks, changes in credit card association or other network rules or standards, changes in card association and debit network fees or products or interchange rates, instances of fraud developments in the prepaid financial services industry that impact prepaid debit card usage generally, business interruption or systems failure, and the Company's involvement litigation or investigations. These and other risks are discussed in greater detail in the Company's Securities and Exchange Commission filings, including its most recent annual report on Form 10-K and quarterly report on Form 10-Q, which are available on the Company's investor relations website at http://ir.greendot.com/ and on the SEC website at www.sec.gov. All information provided in this release and in the attachments is as of February 10, 2015, and the Company assumes no obligation to update this information as a result of future events or developments. 2

�

� unbanked � underbanked � unhappily banked � new to banking � millennials to reinvent personal banking for the MASSES our mission 3 A m e r i c a n f a m i l i e s e a r n i n g l e s s t h a n $ 7 5 k

�

Compelling Opportunity Green Dot is a Strong, Diversified, Profitable and Growing

FinTech-Centric Branchless Bank

" Bank of Todays America Providing award-winning, foundational banking solutions to consumers with HHI < $75k per year; a segment comprising >60% of all U.S. households " Enterprise-scale, vertically integrated platform to service this market very efficiently " A pro-consumer company thats aligned with regulators and advocates " An iconic brand name with proven consumer preference and pricing power " Massive distribution through 100K retailers, FSCs, tax preparers and digital channels " Diversified revenue with no one program representing greater than 15% of earnings " Growing at a double-digit pace: 2013-2015 CAGR (estimated at midpoint of 2015 guidance) " Non-GAAP total operating revenues(1): +13% " Adjusted EBITDA(1): +25% 2010-2015 CAGR (estimated at midpoint of 2015 guidance) " Non-GAAP total operating revenues +15% " Adjusted EBITDA: +10% (1) Reconciliations of total operating revenues to non-GAAP total operating revenues, and net income to adjusted EBITDA, respectively, are provided in the tables in the Appendix section. Additional information about our non-GAAP financial measures can be found under the caption

About Non-GAAP Financial Measures.

4

�

About our Revenue Growing, Mostly Recurring and Increasingly Diverse " Revenues generated from the base of reloading GPR customers and from cash processing have historically comprised approximately 70-75% of non-GAAP total operating revenues " In 2015, this recurring revenue from

prepaid

and

processing

is forecast to comprise 80% of non-GAAP total operating revenues(1) " The remaining revenues generally come from new customers on-boarded in a given year, newly introduced products and from new acquisitions " Legacy revenue streams in aggregate are expected to grow organically in the single digits YOY and will generate significant net cash provided by operating activities " Revenue streams from new products tend to grow at a much faster pace, but represent a smaller part of the total " Double-digit YOY growth is forecast to be achieved through a mix of organic growth on legacy product lines, growth from new products as they reach scale and through new, accretive acquisitions " No one program is forecast to represent greater than ~30% of non-GAAP total operating revenues nor greater than approximately ~15% of adjusted EBITDA in 2015 (1) Recurring revenue for a future year is comprised of (x) card revenues and other fees and interchange revenues we expect to generate during that year from the number of active reloading cards outstanding at the end of the prior year and (y) revenues we expect to generate for that year from the number of cash transfers generated from those active, reloading cards and from tax refund processing transactions generated from long term ERO and Transmitter contracts processed in previous years. 5

�

Capital Allocation Our model generates significant net cash provided by operating activities " Vertically integrated, enterprise scale platform and "infrastructure light

distribution model allows a majority of our adjusted EBITDA to convert to cash " Approximately $130-140 million in net cash provided by operating activities forecast in 2015 " Cash has most recently been used to make accretive acquisitions to grow and diversify our company " Future uses of cash could include more accretive acquisitions, funding of major growth initiatives and/or stock repurchases (subject to board/regulatory approval) 6

�

Sources of Revenue " We generate revenues from a diversified group of products and services (

product lines

) and multiple channels within those product lines " Our product lines are as follows: � Branded deposit account programs � Private label deposit account programs � Processing and settlement services � Banking services " Each of these product lines has its own unique revenue drivers, margin characteristics and long term growth opportunities 7

�

Branded Deposit Account Programs Overview: " Consists of revenues derived from Green Dot-branded GPR accounts, GoBank-branded checking accounts, all affinity-branded accounts and open loop gift card programs " Estimated percentage of 2015 non-GAAP total operating revenues: ~40% " Estimated revenue breakdown by channel: 60% from brick & mortar retailers 30% from Green Dot Direct (direct to consumer digital and direct mail) 10% from financial services center (FSC) locations Three-year growth opportunities: " Continued expansion in current channels " Greenfield expansion into new channels (like Tax Disbursement, Payroll, Small Business and Higher Ed) " Higher lifetime revenue per account derived from higher spend and longer retention 8

�

Private Label Deposit Account Programs Overview: " Consists of revenues derived from any private label program. Currently, we have only one private label programthe Walmart MoneyCard program " Estimated percentage of 2015 non-GAAP total operating revenues: ~30% Three-year growth opportunities: " Creating other enterprise-scale private label programs and partnerships " Within Walmart& Securing a long-term renewal with a sustainable rev-share Better merchandising and supply chain controls More aggressive in-store marketing Expanded distribution in approximately 600 new Walmart "neighborhood market" locations Higher lifetime revenue per account derived from increased spend and longer retention 9

�

Processing and Settlement Services Overview: " Consists of cash transfer revenues derived from reloads over the Green Dot Network and revenue derived from tax refund processing services " Estimated percentage of 2015 non-GAAP total operating revenues: ~30% " The revenue from this product line is forecast to be negatively impacted this year by the discontinuation of the

MoneyPak PIN

product Range of negative revenue impact forecast to be between $10m-$40m Range of negative adjusted EBITDA impact forecast to be between $2m-$10m Three-year growth opportunities: " Expanding TPGs market share in the tax refund processing space " Expanding the Green Dot Networks partnership opportunities to capture new types of payment transactions and bill pay services " Expanding reload services to include processing of checks and ACH transfers to prepaid accounts 10

�

Banking Services Overview: " Green Dot Bank delivers material operational synergies on a consolidated basis. (Approximately $16M in fees in 2014 that were formerly paid to third party banks) " Green Dot Bank also earns income from traditional community banking activities and earns

float

from the investing of deposits on account " Our bank provides deep competitive advantages Direct regulatory oversight The opportunity to serve all of our customers banking needs over time The ability to create new products and features in response to fast changing consumer needs Three-year growth opportunities: " Net interest income grows when deposit balances increase and/or interest rates climb " Increasing consolidated margin expansion as we integrate recent acquisitions " The opportunity to use Green Dot Banks balance sheet, leading consumer brand name, leading FinTech capabilities and proprietary consumer data to develop pro-consumer, modern credit offerings (subject to regulatory approval) 11

�

Take a Fresh Look at Todays Green Dot " Todays Green Dot is much larger and much more highly diversified than in 2010 " No program representing more than 30% of non-GAAP total operating revenues " 80% of revenues are recurring in nature " Numerous products and services- all targeted to low and moderate income Americans " GDOT is a proven survivor that has emerged as the undisputed champion of prepaid and a top consumer brand name for financial services " Not just a

prepaid program manager

" Todays Green Dot is a high-tech, data-rich bank holding company with massive national distribution, making us well positioned for the coming

branchless era

of banking " Many key

investor concerns/overhangs

have been resolved or substantially mitigated positively over the years " Historic double-digit CAGR since the IPO and forecasted double-digit growth into 2015 ranks GDOT as a top grower within its industry segments of FinTech and Banking 12

�

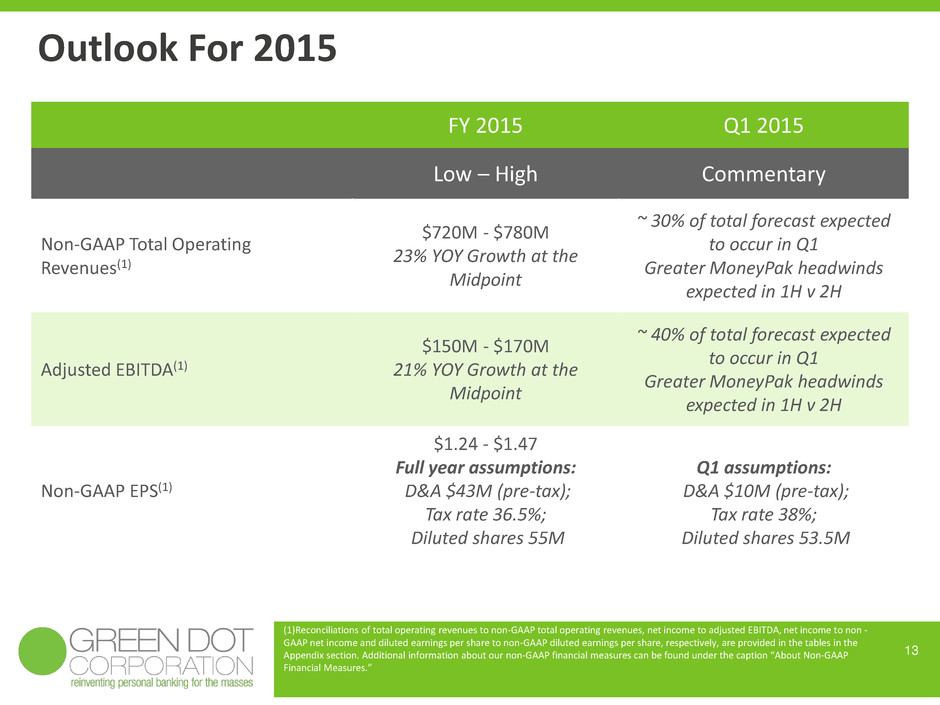

Outlook For 2015 13 FY 2015 Q1 2015 Low High Commentary Non-GAAP Total Operating Revenues(1) $720M - $780M 23% YOY Growth at the Midpoint ~ 30% of total forecast expected to occur in Q1 Greater MoneyPak headwinds expected in 1H v 2H Adjusted EBITDA(1) $150M - $170M 21% YOY Growth at the Midpoint ~ 40% of total forecast expected to occur in Q1 Greater MoneyPak headwinds expected in 1H v 2H Non-GAAP EPS(1) $1.24 - $1.47 Full year assumptions: D&A $43M (pre-tax); Tax rate 36.5%; Diluted shares 55M Q1 assumptions: D&A $10M (pre-tax); Tax rate 38%; Diluted shares 53.5M (1)Reconciliations of total operating revenues to non-GAAP total operating revenues, net income to adjusted EBITDA, net income to non - GAAP net income and diluted earnings per share to non-GAAP diluted earnings per share, respectively, are provided in the tables in the Appendix section. Additional information about our non-GAAP financial measures can be found under the caption

About Non-GAAP Financial Measures.

�

14 (B) (C) (D) (E) (F) (G) (A) 2014-2015E Non-GAAP Total Operating Revenue Bridge Notes: (A) Represents approximate revenue associated with the acquisition of TPG (B) Estimated revenue growth of 20% YoY associated with branded deposit account programs (C) Estimated revenue growth from AccountNow and Achieve Card acquisitions (D) Estimated impact of lower revenues associated with the Companys private label deposit account program (E) Assumes negative impact related to discontinuation of MoneyPak PIN product. This reflects the Company's expectations regarding the range of potential negative impacts from the discontinuation of the MoneyPak PIN product. However, it is not possible to forecast any potential impact with certainty or precision and actual results may differ from the Companys estimate (F) Represents $6M of Q1 2014 non-recurring benefit (G) Reflects midpoint of 2015E non-GAAP total operating revenue range $610 $750 $77 $65 $78 $34 $40 $6 $400 $450 $500 $550 $600 $650 $700 $750 $800 $850 2014 Non-GAAP Total Operating Revenue TPG Growth in Branded Programs Acquired Programs Private Label Decline MoneyPak PIN Removal Q1 2014 Non- Recurring Benefit 2015E Non- GAAP Total Operating Revenue Dollars in millions (1) Reconciliation of total operating revenues to non-GAAP total operating revenues is provided in the tables in the Appendix section. Additional information about our non-GAAP financial measures can be found under the caption

About Non-GAAP Financial Measures.

(1) (1)

�

2014-2015E Adjusted EBITDA Bridge 15 (A) (B) (C) (D) (E) (F) (G) (H) (I) Notes: (A) Represents approximate contribution associated with the acquisition of TPG (B) Estimated contribution growth associated with branded deposit account programs. Reflects 29% estimated adjusted EBITDA margins on incremental revenues (C) Estimated contribution from AccountNow and Achieve Card acquisitions (D) Estimated lower contribution associated with the Companys private label deposit account program. Loss of fee revenue has a disproportionately high impact on adjusted EBITDA in at-scale programs (E) Assumes negative impact related to discontinuation of MoneyPak PIN product. This reflects the Company's expectations regarding the range of potential negative impacts from the discontinuation of the MoneyPak PIN product. However, it is not possible to forecast any potential impact with certainty or precision and actual results may differ from the Companys estimate (F) Represents $6M of Q1 2014 non-recurring benefit (G) Estimated non-recurring incremental cost of processor migration (H) Potential SG&A expenses to be used in the event of new initiatives requiring additional headcount (I) Reflects midpoint of 2015E Adjusted EBITDA range $132 $160 $46 $19 $15 $23 $10 $6 $5 $8 $100 $110 $120 $130 $140 $150 $160 $170 $180 $190 $200 $210 $220 $230 2014 Adj. EBITDA TPG Growth in Branded Programs Acquired Programs Private Label Decline MoneyPak PIN Removal Q1 2014 Non- Recurring Benefit Non-Recurring Processor Migration Costs New Initiative SG&A 2015E Adj. EBITDA Dollars in millions (1) Reconciliation of net income to adjusted EBITDA is provided in the tables in the Appendix section. Additional information about our non- GAAP financial measures can be found under the caption

About Non-GAAP Financial Measures.

(1) (1)

�

APPENDIX

�

Non-GAAP Reconciliations Reconciliation of Total Operating Revenues to Non-GAAP Total Operating Revenues (1) (Unaudited) Year Ended December 31, 2014 (In thousands) Total operating revenues 601,552$ Stock-based retailer incentive compensation (2)(3) 8,932 Non-GAAP total operating revenues 610,484$ Reconciliation of Net Income to Adjusted EBITDA (1) (Unaudited) Year Ended December 31, 2014 (In thousands) Net (loss) income 42,694 Net interest income (3) (2,788) Income tax expense 26,212 Depreciation and amortization (3) 36,984 Employee stock-based compensation expense (3)(4) 20,329 Stock-based retailer incentive compensation (2)(3) 8,932 Other income (3)(5) (7,131) Transaction costs (3)(6) 6,681 Adjusted EBITDA 131,913

�

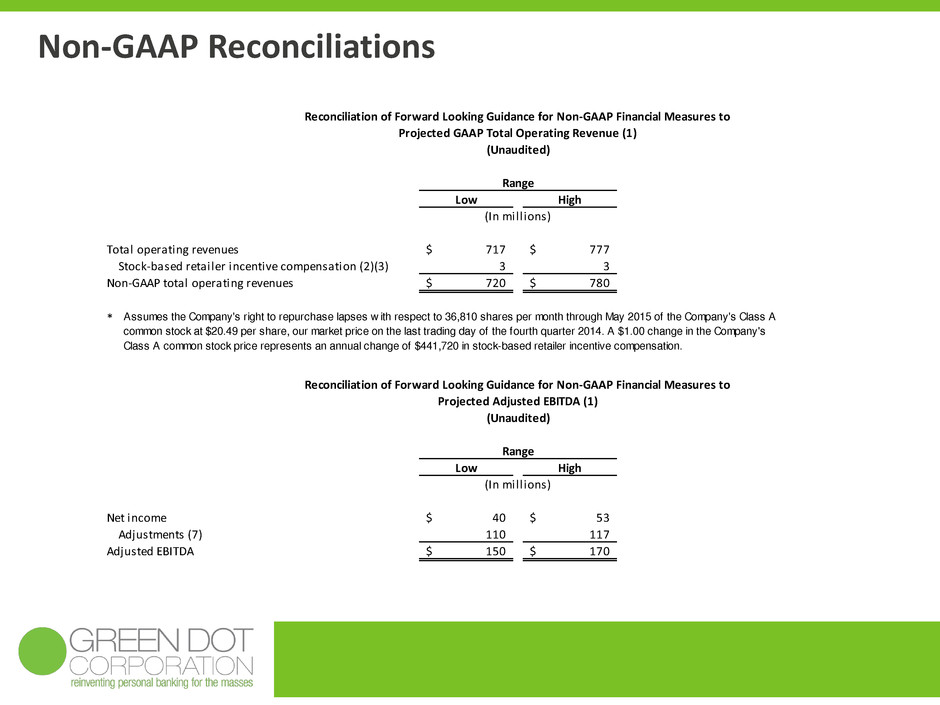

Non-GAAP Reconciliations Reconciliation of Forward Looking Guidance for Non-GAAP Financial Measures to Projected GAAP Total Operating Revenue (1) (Unaudited) Low High Total operating revenues 717$ 777$ Stock-based retailer incentive compensation (2)(3) 3 3 Non-GAAP total operating revenues 720$ 780$ * Reconciliation of Forward Looking Guidance for Non-GAAP Financial Measures to Projected Adjusted EBITDA (1) (Unaudited) Low High Net income 40$ 53$ Adjustments (7) 110 117 Adjusted EBITDA 150$ 170$ Range (In mill ions) Range (In mill ions) Assumes the Company's right to repurchase lapses w ith respect to 36,810 shares per month through May 2015 of the Company's Class A common stock at $20.49 per share, our market price on the last trading day of the fourth quarter 2014. A $1.00 change in the Company's Class A common stock price represents an annual change of $441,720 in stock-based retailer incentive compensation.

�

Non-GAAP Reconciliations Reconciliation of Forward Looking Guidance for Non-GAAP Financial Measures to Projected GAAP Net Income (1) (Unaudited) Low High Net income 40$ 53$ Adjustments (7) 28 28 Non-GAAP net income 68$ 81$ Diluted earnings per share* GAAP 0.75$ 0.99$ Non-GAAP 1.24$ 1.47$ Diluted weighted-average shares issued and outstanding GAAP 53 53 Non-GAAP 55 55 * Reconciliations between GAAP and non-GAAP diluted weighted-average shares issued and outstanding are provided in the next table. Reconciliation of Forward Looking Guidance for Non-GAAP Financial Measures to Projected GAAP Diluted Weighted-Average Shares Issued and Outstanding (1) (Unaudited) Low High Diluted weighted-average shares issued and outstanding 53$ 53$ Assumed conversion of weighted-average shares of preferred stock 2$ 2$ Weighted-average shares subject to repurchase - - Non-GAAP diluted weighted-average shares issued and outstanding 55$ 55$ Range (In mill ions) Range (In mill ions)

�

2010-2015 CAGR 2013-2015 CAGR Total operating revenues CAGR 15% 14% Stock-based retailer incentive compensation (2)(3) - -1% Non-GAAP total operating revenues CAGR 15% 13% 2010-2015 CAGR 2013-2015 CAGR Net income CAGR 2% 16% Adjustments (7) 8% 9% Adjusted EBITDA CAGR 10% 25% Reconciliation of Net Income CAGR to Adjusted EBITDA CAGR (1) (Unaudited) Reconciliation of Total Operating Revenues CAGR to Non-GAAP Total Operating Revenues CAGR (1) (Unaudited) Non-GAAP Reconciliations

�

Non-GAAP Reconciliation Footnotes 1. To supplement the Companys consolidated financial statements presented in accordance with GAAP, the Company uses measures of operating results that are adjusted to exclude various, primarily non-cash, expenses and charges. These financial measures are not calculated or presented in accordance with GAAP and should not be considered as alternatives to or substitutes for operating revenues, operating income, net income or any other measure of financial performance calculated and presented in accordance with GAAP. These financial measures may not be comparable to similarly-titled measures of other organizations because other organizations may not calculate their measures in the same manner as we do. These financial measures are adjusted to eliminate the impact of items that the Company does not consider indicative of its core operating performance. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate. The Company believes that the non-GAAP financial measures it presents are useful to investors in evaluating the Companys operating performance for the following reasons: " stock-based retailer incentive compensation is a non-cash GAAP accounting charge that is an offset to the Companys actual revenues from operations as the Company has historically calculated them. This charge results from the monthly lapsing of the Companys right to repurchase a portion of the 2,208,552 shares it issued to its largest distributor, Walmart, in May 2010. By adding back this charge to the Companys GAAP 2010 and future total operating revenues, investors can make direct comparisons of the Companys revenues from operations prior to and after May 2010 and thus more easily perceive trends in the Companys core operations. Further, because the monthly charge is based on the then-current fair market value of the shares as to which the Companys repurchase right lapses, adding back this charge eliminates fluctuations in the Companys operating revenues caused by variations in its stock price and thus provides insight on the operating revenues directly associated with those core operations; " the Company records employee stock-based compensation from period to period, and recorded employee stock-based compensation expenses of approximately $20.3 million for the year ended December 31, 2014. By comparing the Companys adjusted EBITDA, non-GAAP net income and non-GAAP diluted earnings per share in different historical periods, investors can evaluate the Companys operating results without the additional variations caused by employee stock-based compensation expense, which may not be comparable from period to period due to changes in the fair market value of the Companys Class A common stock (which is influenced by external factors like the volatility of public markets and the financial performance of the Companys peers) and is not a key measure of the Companys operations; " adjusted EBITDA is widely used by investors to measure a companys operating performance without regard to items, such as interest expense, income tax expense, depreciation and amortization, employee stock-based compensation expense, stock-based retailer incentive compensation expense, other income, transaction costs and impairment charges, that can vary substantially from company to company depending upon their respective financing structures and accounting policies, the book values of their assets, their capital structures and the methods by which their assets were acquired; and " securities analysts use adjusted EBITDA as a supplemental measure to evaluate the overall operating performance of companies. The Companys management uses the non-GAAP financial measures: " as measures of operating performance, because they exclude the impact of items not directly resulting from the Companys core operations; " for planning purposes, including the preparation of the Companys annual operating budget; " to allocate resources to enhance the financial performance of the Companys business; " to evaluate the effectiveness of the Companys business strategies; and " in communications with the Companys board of directors concerning the Companys financial performance.

�

Non-GAAP Reconciliation Footnotes The Company understands that, although adjusted EBITDA and other non-GAAP financial measures are frequently used by investors and securities analysts in their evaluations of companies, these measures have limitations as an analytical tool, and you should not consider them in isolation or as substitutes for analysis of the Companys results of operations as reported under GAAP. Some of these limitations are: " that these measures do not reflect the Companys capital expenditures or future requirements for capital expenditures or other contractual commitments; " that these measures do not reflect changes in, or cash requirements for, the Companys working capital needs; " that these measures do not reflect interest expense or interest income; " that these measures do not reflect cash requirements for income taxes; " that, although depreciation and amortization are non-cash charges, the assets being depreciated or amortized will often have to be replaced in the future, and these measures do not reflect any cash requirements for these replacements; and " that other companies in the Companys industry may calculate these measures differently than the Company does, limiting their usefulness as comparative measures. 2. This expense consists of the recorded fair value of the shares of Class A common stock for which the Companys right to repurchase has lapsed pursuant to the terms of the May 2010 agreement under which they were issued to Wal-Mart Stores, Inc., a contra-revenue component of the Companys total operating revenues. Prior to the three months ended June 30, 2010, the Company did not record stock-based retailer incentive compensation expense. The Company will, however, continue to incur this expense through May 2015. In future periods, the Company does not expect this expense will be comparable from period to period due to changes in the fair value of its Class A common stock. The Company will also have to record additional stock-based retailer incentive compensation expense to the extent that a warrant to purchase its Class B common stock vests and becomes exercisable upon the achievement of certain performance goals by PayPal. The Company does not believe these non-cash expenses are reflective of ongoing operating results. 3. The Company does not include any income tax impact of the associated non-GAAP adjustment to non-GAAP total operating revenues or adjusted EBITDA, as the case may be, because each of these non-GAAP financial measures is provided before income tax expense. 4. This expense consists primarily of expenses for employee stock options. Employee stock-based compensation expense is not comparable from period to period due to changes in the fair market value of the Companys Class A common stock (which is influenced by external factors like the volatility of public markets and the financial performance of the Companys peers) and is not a key measure of the Companys operations. The Company excludes employee stock-based compensation expense from its non-GAAP financial measures primarily because it consists of non-cash expenses that the Company does not believe are reflective of ongoing operating results. Further, the Company believes that it is useful to investors to understand the impact of employee stock- based compensation to its results of operations. 5. This income consists of gains in connection with the settlement of a lawsuit a change in the fair value of contingent consideration. The Company excludes such gains from its non-GAAP financial measures primarily because the Company does not believe these gains are reflective of ongoing operating results. 6. These expenses relate to transaction costs associated with Company acquisitions. The Company excludes business combination acquisition costs from its non-GAAP financial measures because the Company does not believe these expenses are reflective of ongoing operating results. 7. These amounts represent estimated adjustments for net interest income, income taxes, depreciation and amortization, employee stock-based compensation expense, and stock-based retailer incentive compensation expense. Employee stock-based compensation expense and stock-based retailer incentive compensation expense include assumptions about the future fair market value of the Companys Class A common stock (which is influenced by external factors like the volatility of public markets and the financial performance of the Companys peers).

�

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Exploring Dubai's Waters with AnyShips Club on a Luxurious Adventure

- D.Law Joins L.A. Times Panel to Share Legal Insights

- ISA Celebrates Third Annual International Automation Professionals Day

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share