Form 8-K GREAT SOUTHERN BANCORP For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: September 30, 2015

|

GREAT SOUTHERN BANCORP, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Maryland

|

000-18082

|

43-1524856

|

||

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number

|

I.R.S. Employer

Identification No.)

|

|

1451 East Battlefield, Springfield, Missouri

|

65804

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (417) 887-4400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 7.01 Regulation FD Disclosure

Attached hereto as Exhibit 99.1 is presentation material of Great Southern Bank ("Great Southern"), a wholly-owned subsidiary of Great Southern Bancorp, Inc.

Item 8.01 Other Events

On September 30, 2015, Great Southern issued the press release attached hereto as Exhibit 99.2 announcing its acquisition of 12 branches, including the related deposits and loans, from Fifth Third Bank.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No.

|

Description of Exhibit

|

|

|

99.1

|

Presentation Material

|

|

| 99.2 | Press Release |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

GREAT SOUTHERN BANCORP, INC.

|

|

|

Date: September 30, 2015

|

By: /s/ Joseph W. Turner

|

|

Joseph W. Turner

|

|

|

President and Chief Executive Officer

|

3

EXHIBIT INDEX

|

Exhibit No.

|

Description of Exhibit

|

|

|

99.1

|

Presentation Material

|

|

| 99.2 | Press Release |

4

Exhibit 99.1

1 Banking Center Update - Acquisition of Fifth Third Bank Branches in St. Louis Market AreaSeptember 30, 2015

2 When used in documents filed or furnished by Great Southern Bancorp, Inc. (the “Company”) with the Securities and Exchange Commission (the "SEC"), in this presentation , press releases or other public or stockholder communications, and in oral statements made with the approval of an authorized executive officer, the words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "project," "intends" or similar expressions are intended to identify "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties, including, among other things, (i) non-interest expense reductions from Great Southern’s banking center consolidations might be less than anticipated and the costs of the consolidation and impairment of the value of the affected premises might be greater than expected; (ii) the requisite regulatory approval of Great Southern’s pending acquisition of branches from Fifth Third Bank (the “Branch Acquisition”) might not be obtained within the anticipated time frame or at all; (iii) expected revenues, cost savings, earnings accretion, synergies and other benefits from the Branch Acquisition and the Company’s other merger and acquisition activities might not be realized within the anticipated time frames or at all, and costs or difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater than expected; (iv) changes in economic conditions, either nationally or in the Company’s market areas; (v) fluctuations in interest rates; (vi) the risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses; (vii) the possibility of other-than-temporary impairments of securities held in the Company’s securities portfolio; (viii) the Company’s ability to access cost-effective funding; (ix) fluctuations in real estate values and both residential and commercial real estate market conditions; (x) demand for loans and deposits in the Company’s market areas; (xi) legislative or regulatory changes that adversely affect the Company’s business, including, without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act and its implementing regulations, and the overdraft protection regulations and customers’ responses thereto; (xii) monetary and fiscal policies of the Federal Reserve Board and the U.S. Government and other governmental initiatives affecting the financial services industry; (xiii) results of examinations of the Company and Great Southern by their regulators, including the possibility that the regulators may, among other things, require the Company to increase its allowance for loan losses or to write-down assets; (xiv) the uncertainties arising from the Company’s participation in the Small Business Lending Fund program, including uncertainties concerning the potential future redemption by us of the U.S. Treasury’s preferred stock investment under the program, including the timing of, regulatory approvals for, and conditions placed upon, any such redemption; (xv) costs and effects of litigation, including settlements and judgments; and (xvi) competition. The factors listed above and other risks described from time to time in documents filed or furnished by the Company with the SEC could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements.The Company does not undertake-and specifically declines any obligation- to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Forward-Looking Statements

Acquisition of Fifth Third Bank Branches 3

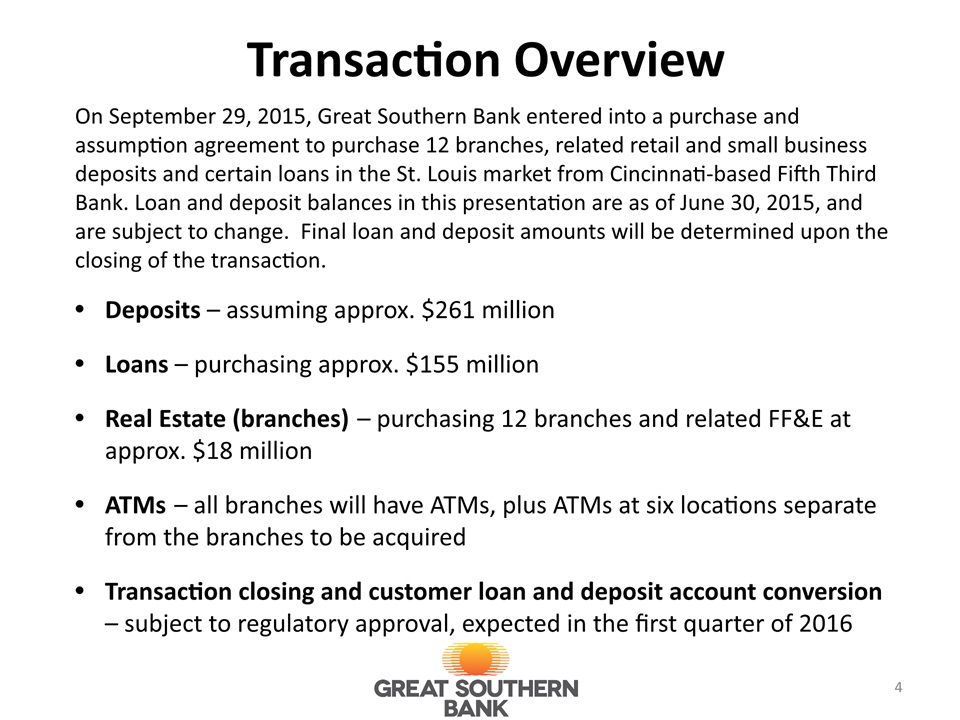

Transaction Overview 4 On September 29, 2015, Great Southern Bank entered into a purchase and assumption agreement to purchase 12 branches, related retail and small business deposits and certain loans in the St. Louis market from Cincinnati-based Fifth Third Bank. Loan and deposit balances in this presentation are as of June 30, 2015, and are subject to change. Final loan and deposit amounts will be determined upon the closing of the transaction. Deposits – assuming approx. $261 millionLoans – purchasing approx. $155 millionReal Estate (branches) – purchasing 12 branches and related FF&E at approx. $18 millionATMs – all branches will have ATMs, plus ATMs at six locations separate from the branches to be acquiredTransaction closing and customer loan and deposit account conversion – subject to regulatory approval, expected in the first quarter of 2016

Strategic Acquisition 5 *Assumes no significant loan or deposit run-off. Includes non-cash core deposit intangible amortization

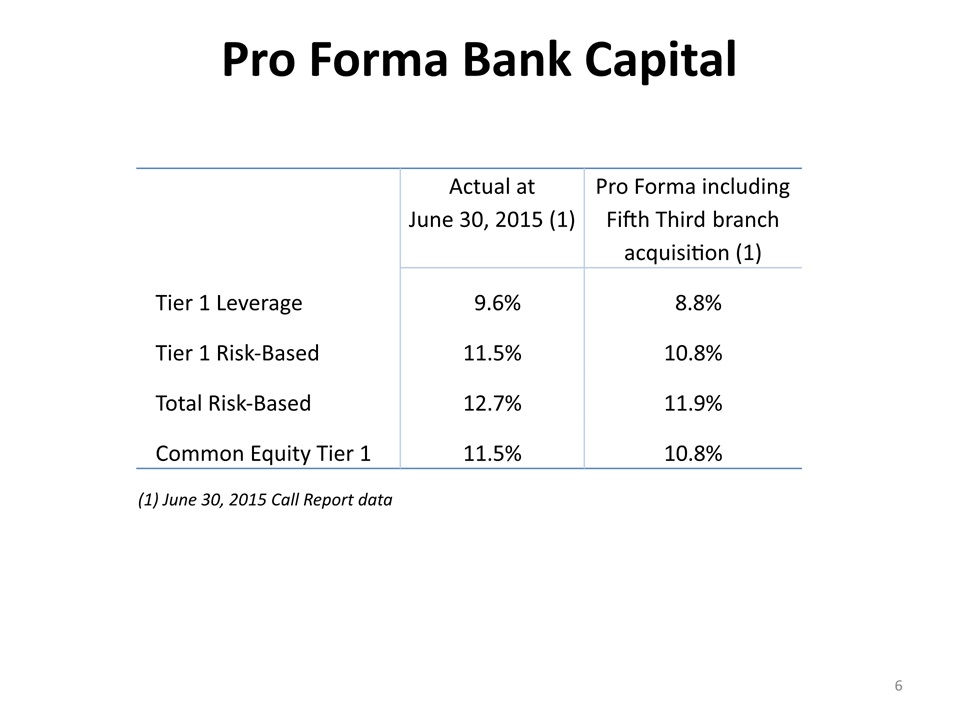

Pro Forma Bank Capital Actual at June 30, 2015 (1) Pro Forma including Fifth Third branch acquisition (1) Tier 1 Leverage 9.6% 8.8% Tier 1 Risk-Based 11.5% 10.8% Total Risk-Based 12.7% 11.9% Common Equity Tier 1 11.5% 10.8% (1) June 30, 2015 Call Report data 6

Fifth Third Branch Assumed Deposits by Type at 06/30/15 7 1.31% avg. rate 0.19% avg. rate

Fifth Third Purchased Loan Portfolio at 06/30/15 8

Exhibit 99.2

September 30, 2015

Reporters May Contact:

Kelly Polonus, Great Southern Bank, (417) 895-5242

Great Southern Bank to Acquire Twelve Branches

Including Deposits and Loans in the St. Louis Region

Branch acquisition doubles total deposit balances in the market area

Springfield, Mo. – Great Southern Bank, a wholly-owned subsidiary of Great Southern Bancorp, Inc. (NASDAQ: GSBC) announced today that it has entered into a purchase and assumption agreement to acquire 12 branches and related deposits and loans from Cincinnati-based Fifth Third Bank. The acquisition, currently representing approximately $261 million in deposits and $155 million in loans, is expected to be completed in the first quarter of 2016, pending regulatory approval. This acquisition will increase Great Southern's St. Louis-area banking center total from eight to 20 offices. Based on the expected amount of loans to be acquired and deposits assumed, it is anticipated that beginning in 2016 this transaction will be accretive to earnings in the range of $0.07 to $0.09 per common share annually.

"Great Southern has served the St. Louis-area market with a physical presence since 2005. During the last 10 years, thanks to our excellent St. Louis team of associates, we have continuously attracted and developed customer relationships, making St. Louis our second largest market. This transaction will significantly strengthen our presence in this vibrant region," said Great Southern President and CEO Joseph W. Turner. "We warmly welcome Fifth Third's retail and small business customers and its strong team of associates to Great Southern and look forward to working with them to build even stronger relationships with area customers."

Fifth Third Bank customers at the St. Louis-area branches should continue to bank as they always have until further notice. Important information about the acquisition will be mailed to customers in the coming days and weeks.

"We expect to transfer Fifth Third customer accounts to Great Southern in the first quarter of next year," said Turner. "Our goal is to make this transition as smooth and timely as possible so that our newest customers can take advantage of our broad range of products and services, including our attractive online and mobile banking options."

Sandler O'Neill acted as exclusive financial advisor and Silver, Freedman, Taff and Tiernan LLP served as legal counsel to Great Southern. Deutsche Bank Securities acted as exclusive financial advisor and Debevoise & Plimpton LLP served as legal counsel to Fifth Third Bank.

More

Page 2

With total assets of $4.1 billion, Great Southern currently offers banking and investment services. Headquartered in Springfield, Mo., the Company operates 110 retail banking centers and more than 200 ATMs in Missouri, Arkansas, Iowa, Kansas, Minnesota and Nebraska, and loan production offices in Tulsa, Okla., and Dallas, Texas. Great Southern Bancorp's common stock (ticker: GSBC) is listed on the NASDAQ Global Select Market.

www.GreatSouthernBank.com

Forward-Looking Statements

When used in documents filed or furnished by the Company with the Securities and Exchange Commission (the "SEC"), in this press release and the Company's other press releases or other public or stockholder communications, and in oral statements made with the approval of an authorized executive officer, the words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "project," "intends" or similar expressions are intended to identify "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties, including, among other things, (i) non-interest expense reductions from Great Southern's banking center consolidations might be less than anticipated and the costs of the consolidation and impairment of the value of the affected premises might be greater than expected; (ii) the requisite regulatory approval of Great Southern's pending acquisition of branches from Fifth Third Bank (the "Branch Acquisition") might not be obtained within the anticipated time frame or at all; (iii) expected revenues, cost savings, earnings accretion, synergies and other benefits from the Branch Acquisition and the Company's other merger and acquisition activities might not be realized within the anticipated time frames or at all, and costs or difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater than expected; (iv) changes in economic conditions, either nationally or in the Company's market areas; (v) fluctuations in interest rates; (vi) the risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses; (vii) the possibility of other-than-temporary impairments of securities held in the Company's securities portfolio; (viii) the Company's ability to access cost-effective funding; (ix) fluctuations in real estate values and both residential and commercial real estate market conditions; (x) demand for loans and deposits in the Company's market areas; (xi) legislative or regulatory changes that adversely affect the Company's business, including, without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act and its implementing regulations, and the overdraft protection regulations and customers' responses thereto; (xii) monetary and fiscal policies of the Federal Reserve Board and the U.S. Government and other governmental initiatives affecting the financial services industry; (xiii) results of examinations of the Company and Great Southern by their regulators, including the possibility that the regulators may, among other things, require the Company to increase its allowance for loan losses or to write-down assets; (xiv) the uncertainties arising from the Company's participation in the Small Business Lending Fund program, including uncertainties concerning the potential future redemption by us of the U.S. Treasury's preferred stock investment under the program, including the timing of, regulatory approvals for, and conditions placed upon, any such redemption; (xv) costs and effects of litigation, including settlements and judgments; and (xvi) competition. The Company wishes to advise readers that the factors listed above and other risks described from time to time in documents filed or furnished by the Company with the SEC could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements.

The Company does not undertake-and specifically declines any obligation- to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Correction: DOVRE GROUP TRADING STATEMENT JANUARY 1 – MARCH 31, 2024

- Fraser Institute News Release: Ontario curricula for Grades 1 to 12 lacking in Canadian history

- Man Group PLC : Form 8.3 - Barratt Developments plc

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share