Form 8-K First Connecticut Bancor For: Feb 11

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 11, 2015

First Connecticut Bancorp, Inc.

(Exact name of registrant as specified in its charter)

|

Maryland

|

333-171913

|

45-1496206

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

One Farm Glen Boulevard, Farmington, Connecticut 06032

(860) 676-4600

(Address and Telephone Number)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

TABLE OF CONTENTS

|

|

|

Item 7.01

|

Regulation FD Disclosure

|

|

Item 9.01

|

Financial Statements and Exhibits

|

|

SIGNATURES

|

|

|

EXHIBIT INDEX

|

|

|

EX-99.1

|

Presentation Materials

|

|

Item 7.01

|

Regulation FD Disclosure

|

|

On February 12 and 13, 2015, First Connecticut Bancorp, Inc., the holding company for Farmington Bank, will conduct an Investor Presentation in which it will make available its slide presentation material, which includes among other things, a review of financial results and trends through the period ended December 31, 2014. A copy of the material will also be available on the Company's website, http://www.firstconnecticutbancorp.com

A copy of the material is included as Exhibit 99.1 to this current Form 8-K and is incorporated herein by reference.

|

|

|

Item 9.01

|

Financial Statements and Exhibits

|

|

(a)

|

Not applicable.

|

|

(b)

|

Not applicable.

|

|

(c)

|

Not applicable.

|

|

(d)

|

Exhibits.

|

|

Exhibit Number

|

Description

|

|

99.1

|

Presentation Materials

|

2

|

SIGNATURES

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

FIRST CONNECTICUT BANCORP, INC.

|

|

|

Registrant

|

|

|

February 11, 2015

|

By: John J. Patrick, Jr.

|

|

John J. Patrick, Jr.

|

|

|

Chairman, President and

|

|

|

and Chief Executive Officer

|

|

3

EXHIBIT INDEX

|

Exhibit Number

|

Description

|

|

99.1

|

Presentation Materials

|

4

Sterne Agee Financial Institutions Investor ConferenceFebruary 11 - 13, 2015 John J. Patrick, Jr. Chairman, President and CEOGregory A. White EVP, Chief Financial OfficerMichael T. Schweighoffer EVP, Chief Lending Officer Kenneth F. Burns EVP, Director of Retail Banking and Marketing A Great Past…Dynamic Present…And a Bright Future

Disclaimer & Forward-Looking StatementsStatements in this document and presented orally at the conference, if any, concerning future results, performance, expectations or intentions are forward-looking statements. Actual results, performance or developments may differ materially from forward-looking statements as a result of known or unknown risks, uncertainties and other factors, including those identified from time to time in the Company’s filings with the Securities and Exchange Commission, press releases and other communications. Actual results also may differ based on the Company’s ability to successfully maintain and integrate customers from acquisitions.The Company intends any forward-looking statements to be covered by the Litigation Reform Act of 1995 and is including this statement for purposes of said safe harbor provisions. Readers and attendees are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this presentation. Except as required by applicable law or regulation, the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances that occur after the date as of which such statements are made.The Company’s capital strategy includes deployment of excess capital, the success of which efforts cannot be guaranteed. Forward Looking Statements 2

Farmington Bank, founded in 1851, is a wholly owned subsidiary of First Connecticut Bancorp, Inc.Community bank with a strong capital position, positive trends in earnings, loan and deposit growth, and solid asset qualityFocused on building long term shareholder valueExperienced management team focused on organic growth strategyClear strategic prioritiesLeveraged balance sheet with loans rather than investmentsStrong, scalable franchise in central ConnecticutBroad risk management program focused on “best practices”Culture that encourages a decision-making process that allows for teamwork, yet places clear responsibility and authority with the individual Executive Summary 3

Franchise Overview 4 22 full service branch officesCommercial Loan Production officeStrategically covering affluent Hartford, CT suburbs and opening 2 branches in western Mass in 2015 First Connecticut Bancorp, Inc. - NASDAQ (FBNK)Farmington Bank - wholly owned subsidiaryHeadquarters: Farmington, ConnecticutAssets: $2.5 billion Loans: $2.1 billion Deposits: $1.7 billion Capital: $234 million(as of 12/31/14) Corporate Profile

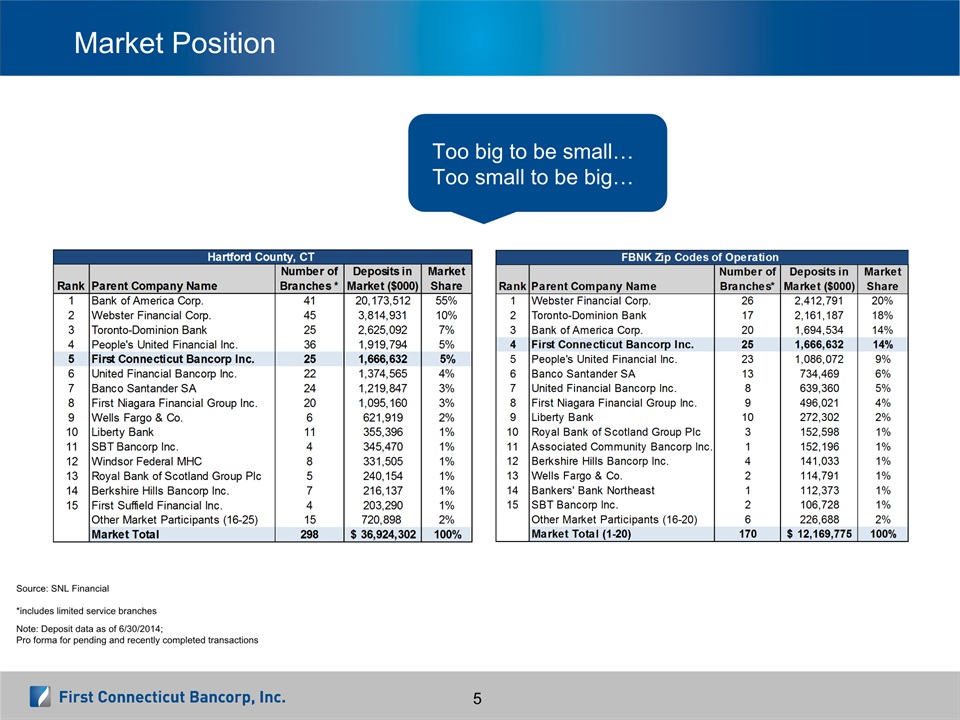

Market Position 5 Too big to be small…Too small to be big… Source: SNL Financial*includes limited service branches Note: Deposit data as of 6/30/2014; Pro forma for pending and recently completed transactions

Leadership Team 6 Name Title Years in Industry Prior Experience John J. Patrick, Jr. Chairman, President and Chief Executive Officer 34 TD Banknorth CT, President and CEO Gregory A. White Executive Vice President, Chief Financial Officer and Treasurer 27 Rockville Bank, Chief Financial Officer and Treasurer Michael T. Schweighoffer Executive Vice President, Chief Lending Officer 26 TD Banknorth, CT State President Kenneth F. Burns Executive Vice President, Director of Retail Banking & Marketing 25 Eagle Bank - EVP, Retail Banking & Marketing Catherine M. Burns Executive Vice President,Chief Risk Officer 33 TD Banknorth, Head of Community BankingCommercial Lending; Credit Manager

Strategic Accomplishments 7 Invested in People, Technology and Franchise Capital Executed Organic Growth Strategy Geographic Diversification of the Deposit Base Enterprise risk management "best practices“ Strategic initiatives to build "best in class": Commercial credit and underwritingCash managementSmall business bankingRetail bankingCompliance Residential lendingGovernment bankingMarketinge-business Operational risk Strong organic loan growth - 63% growth since 2011Significant deposit growth - 47% growth since 2011Established a scalable residential lending platform with goal to become a market leaderCompleted core system conversion in May 2013Expanded Commercial Services into western Mass/opened LPO Raised $172 million of capital in June 2011TBV increased from $14.11 to $14.57 in 2014Repurchased 2,559,707 shares of FBNK stock (since IPO 6/29/11) at an average share price of $14.24 as of 12/31/14Paid a dividend for 13 consecutive quarters; increasing dividend in Q2 and Q3 2014 Opened 10 de novo branches since June 2010; average deposit per de novo of $48.4 million, including over 10,400 checking accountsFocus on transaction accounts and new householdsOver 5,200 net new transaction accounts in 2014Liability side of the balance sheet is well positioned

Our Core Business 8

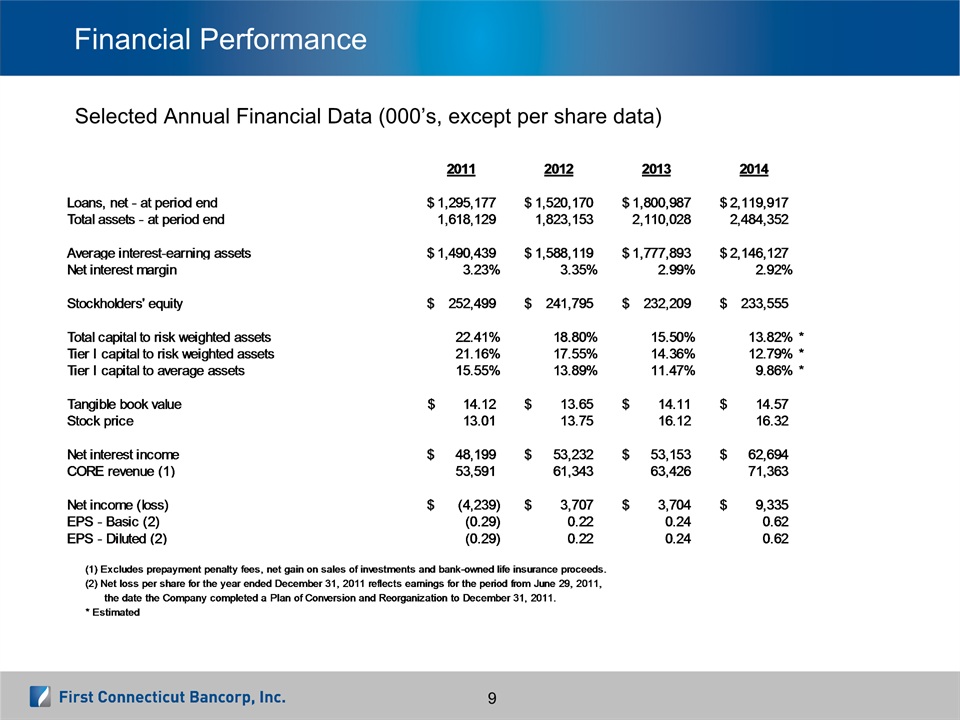

Financial Performance 9 Selected Annual Financial Data (000’s, except per share data)

Financial Performance 10 Selected Quarterly Financial Data (000’s, except per share data)

Financial Performance 11 Accomplishments Performance Data Capital Management *based on the stock price of $15.25 on 1/29/15 Diversified the balance sheet and strong interest rate risk positionIncreased earning assets Invested in people, technology and franchise (franchise is scalable to $3 billion)Instituted measurable strategic planning processSuccessfully completed core conversion Tangible Book Value: $14.57 (as of 12/31/14)Price / Tangible Book Value*: 105% Stock Performance*: 53% appreciation since IPO (6/29/11) Paid quarterly dividend each quarter since December 2011Increased dividend Q2 and Q3 2014Completed 10% stock repurchase, and repurchased 46% of a second 10% stock repurchase plan which was announced on 6/29/13

Diversified Loan Portfolio 12 $2.1 Billion in Total Loans as of 12/31/2014

Total Loan Growth 13 Total Loans (period ended 12/31/2014)

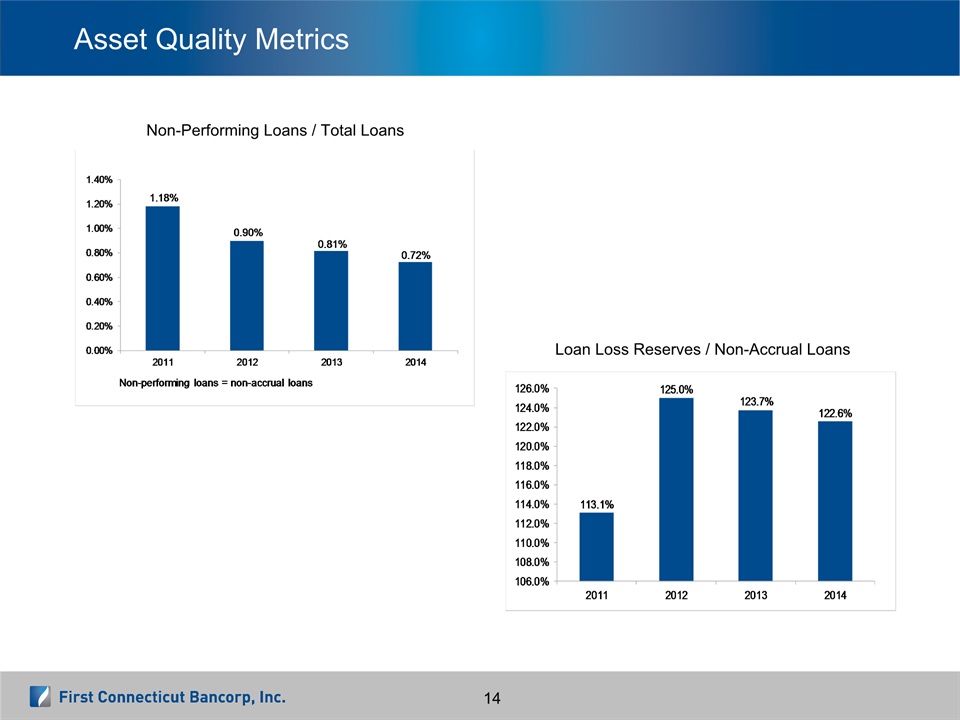

Asset Quality Metrics 14 Non-Performing Loans / Total Loans Loan Loss Reserves / Non-Accrual Loans

Commercial Banking 15 Strong Credit Culture Relationship Banking Major Market Segments Loan Growth Platform centered on building relationships and adding valueBroad and sophisticated lending products and capability4 teams of experienced lenders covering Connecticut and western Mass.Comprehensive cash management services C&I: Manufacturers, distributors, healthcare providers, professional service companies, not-for-profits, higher educationCRE: Office, Apartments, Retail, Warehouse Commercial originations totaled $331 million in 2014$167 million growth in commercial outstandings for 2014 Conservative underwritingAsset quality metrics continue to improveFocused and proactive portfolio management

Small Business Lending 16 General Small Business Lending SBA Lending Efficiencies and Responsiveness Successful Business development calling effort supported by Branch Managers and Business Development Officers Small Business Loan outstandings increased 17.6% in 2014; balances at $66 million on 12/31/14 Currently #2 SBA lender in ConnecticutPreferred SBA status, allowing local decisionsOn staff SBA specialists provide value added understanding Expedited approval process; 6.1 days average decision timeApproval to close in 32 days on averageDedicated underwriters using credit scoring with override

Residential Mortgage and Consumer Lending 17 Mortgage Banking Platform Continue to build Residential platform to achieve economies of scaleTotal loan servicing exceeded $1 billion (including servicing for others)Continue to utilize two-pronged approach with loan sales and portfolio fulfillmentIntroduced new products to the market (CHFA,VA, Home 4U) Sales Channels Loan Growth Expanded Correspondent sales channel with additional Account Executives throughout New England, New York and New JerseyContinue to refine the Inside sales strategy to include portfolio retentionContinue to recruit top talent in residential salesContinue to promote the HELOC product through our branch network 19% growth in residential mortgages in 2014#3 market share in Hartford County

Diversified Deposit Base 18 $1.8* Billion as of 12/31/2014 * Includes repurchased liabilities & excludes mortgagors escrow accounts

Total Deposit Growth 19 Total Deposits* (period ended 12/31/2014) Growth Rate 3.1% 11.4% 12.9% 14.0% *Includes repurchased liabilities & excludes mortgagors escrow accounts

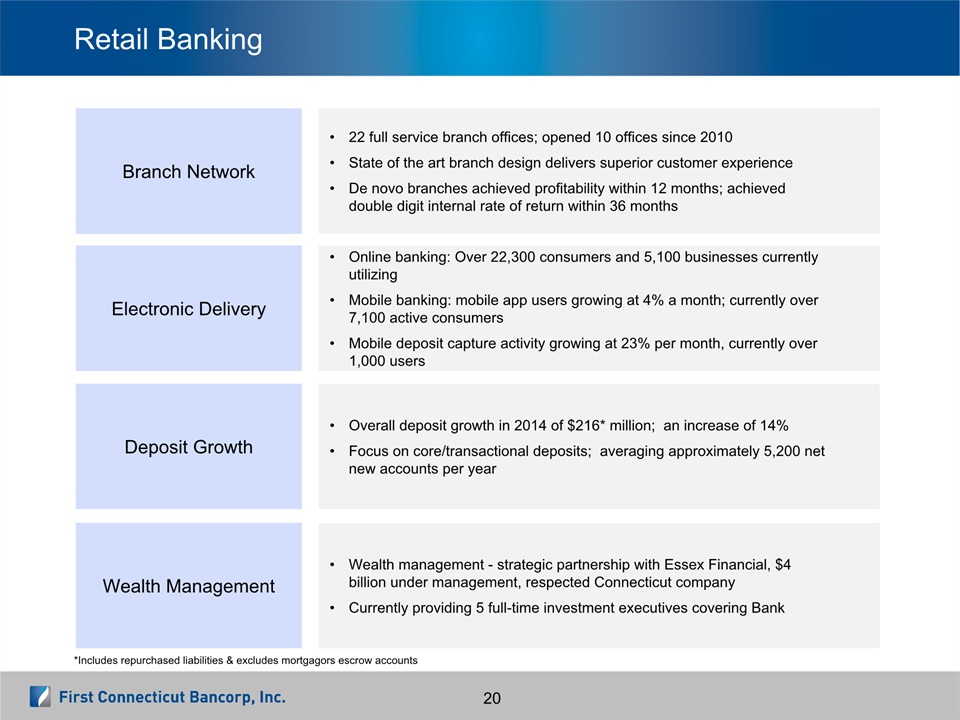

Retail Banking 20 Wealth Management Branch Network Electronic Delivery Deposit Growth 22 full service branch offices; opened 10 offices since 2010State of the art branch design delivers superior customer experienceDe novo branches achieved profitability within 12 months; achieved double digit internal rate of return within 36 months Online banking: Over 22,300 consumers and 5,100 businesses currently utilizingMobile banking: mobile app users growing at 4% a month; currently over 7,100 active consumers Mobile deposit capture activity growing at 23% per month, currently over 1,000 users Overall deposit growth in 2014 of $216* million; an increase of 14% Focus on core/transactional deposits; averaging approximately 5,200 net new accounts per year Wealth management - strategic partnership with Essex Financial, $4 billion under management, respected Connecticut companyCurrently providing 5 full-time investment executives covering Bank *Includes repurchased liabilities & excludes mortgagors escrow accounts

Business Deposits & Government Banking 21 Government Banking Commercial Cash Management Small Business Portfolio of 65 public entities as customers on 12/31/14Overall Government deposit growth of $97 million or 48% growth during 2014On-line tax and fee payment system to generate fee incomeOverall Government cost of funds of 0.31% as of 12/31/14 Seasoned Cash Management team providing solution based commercial deposit servicesComprehensive cash management suite of necessary to compete in the market services 866 net new checking accounts through 12/31/14; 15% growth; balances of $152 million at 12/31/14Currently 6,400 free business checking accounts, average balance per account of $19,678 *Includes repurchased liabilities & excludes mortgagors escrow accounts

Strategic Direction 22 Take in depositsMake good loansGrow revenueMaintain solid asset qualityFocus on expense controlEmphasis on process improvement and efficienciesManage capital Focus on Fundamentals

Conclusion 23 Why Invest in Us? Attractive growing franchise in central ConnecticutStrong management teamScalable platform built for long term growthSuccessfully executing Strategic Plan; proven organic growthStrong capital positionSolid asset qualityRobust enterprise risk management programThirteen consecutive dividends paid out to shareholdersTrack record of building Tangible Book Value

Supplemental Information Appendix 24

Statement of Income 2011 – 2014 (000’s) Select Financial Data 25

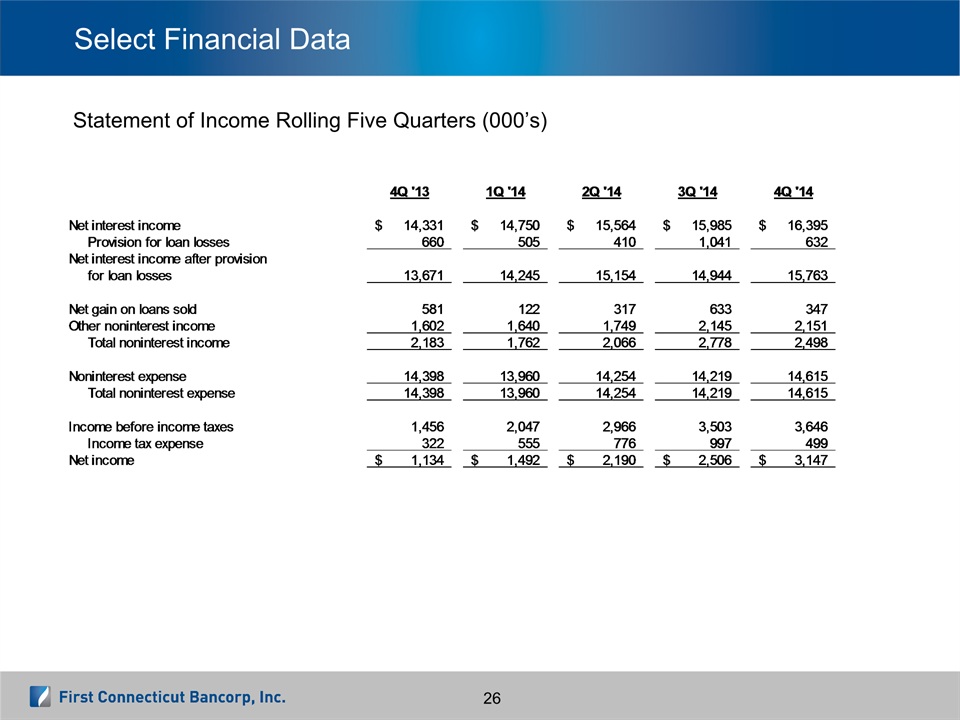

Select Financial Data 26 Statement of Income Rolling Five Quarters (000’s)

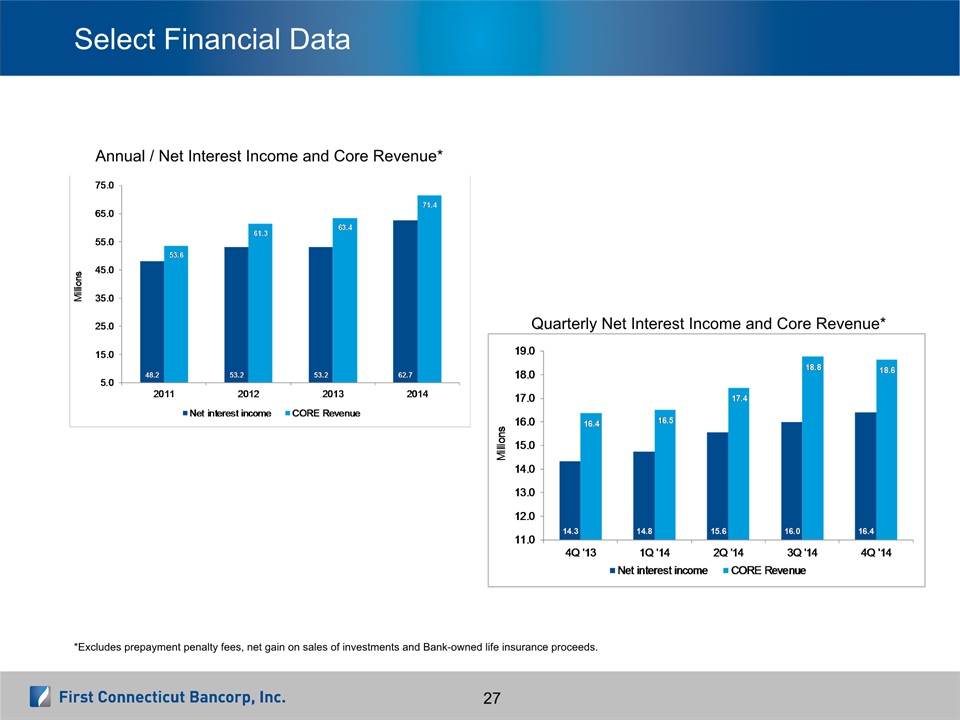

Select Financial Data 27 Quarterly Net Interest Income and Core Revenue* Annual / Net Interest Income and Core Revenue* *Excludes prepayment penalty fees, net gain on sales of investments and Bank-owned life insurance proceeds.

Select Financial Data 28 Annual Average Earning Assets and NIM Quarterly Average Earning Assets and NIM

Asset Quality Metrics 29 Loan Loss Reserves / Total Loans Net Charge-Offs / Average Net Loans

Commercial Loan Growth 30

Residential Loan Growth 31

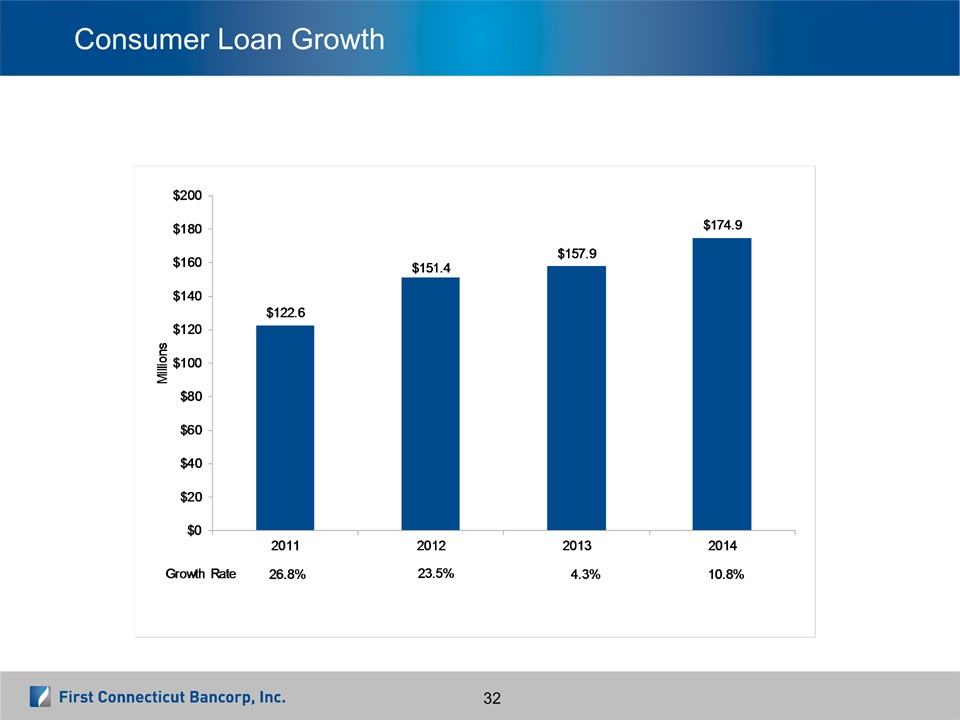

Consumer Loan Growth 32

Consumer Checking Growth (000’s) 33

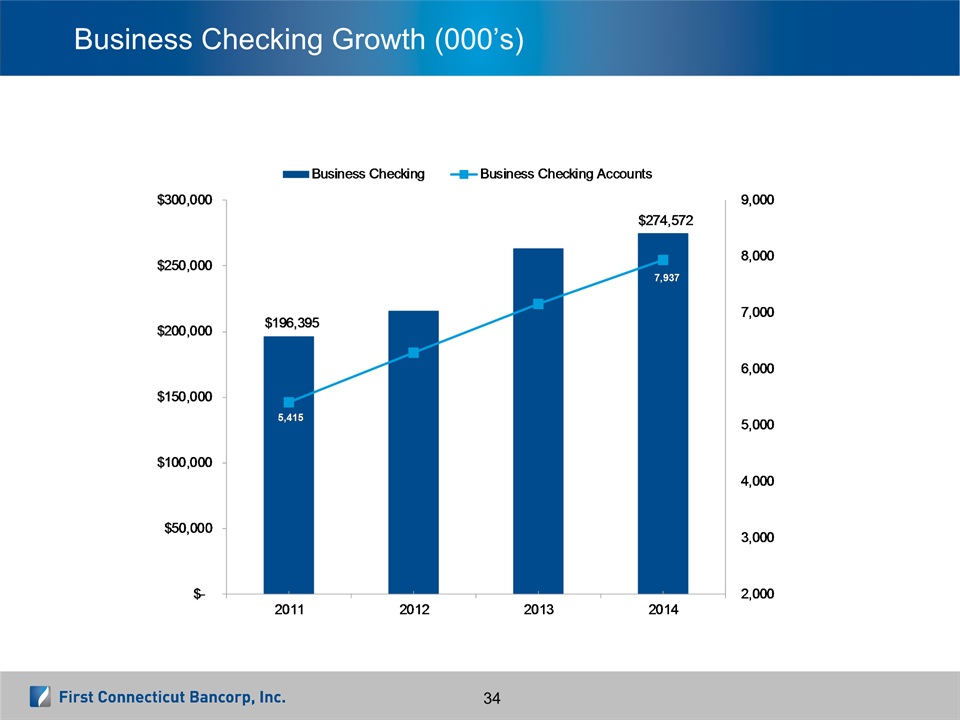

Business Checking Growth (000’s) 34

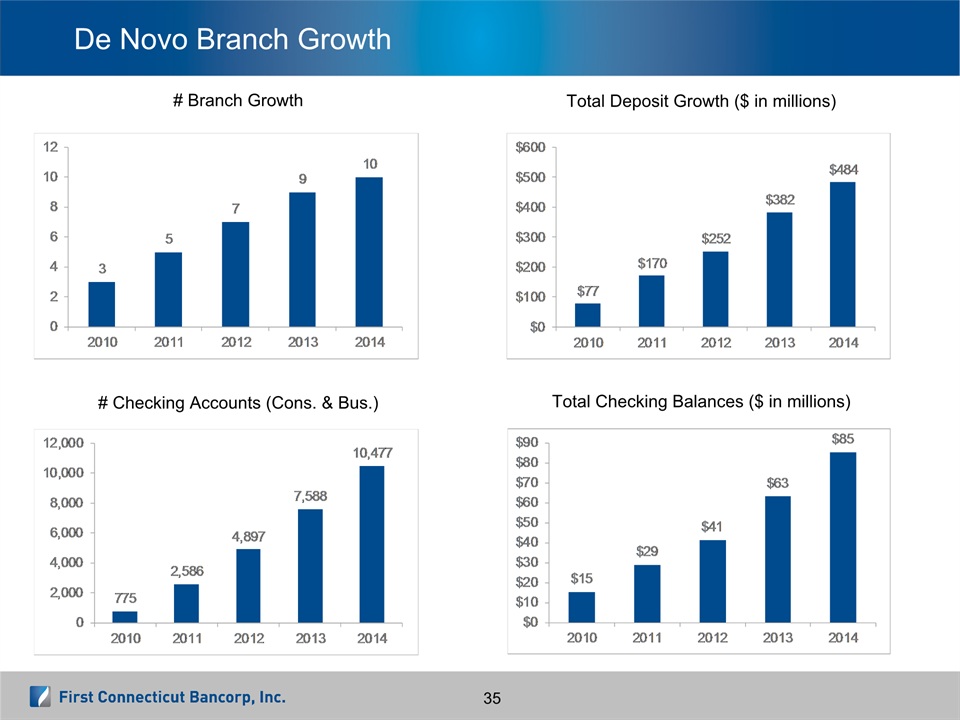

De Novo Branch Growth 35 # Branch Growth Total Deposit Growth ($ in millions) Total Checking Balances ($ in millions) # Checking Accounts (Cons. & Bus.)

Corporate Contacts 36 John J. Patrick, Jr. Chairman, President and Chief Executive OfficerGregory A. White Executive Vice President, Chief Financial OfficerInvestor Information:Jennifer H. Daukas Vice President, Investor Relations Officer 860-284-6359 or [email protected]

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- DECISIONS OF DIGITALIST GROUP PLC’S ANNUAL GENERAL MEETING 25 APRIL 2024 AND THE ORGANIZING MEETING OF THE BOARD OF DIRECTORS

- Predian Announces the Integration of Wholesale and Auction Pricing Into ValueVision®

- BADMAD ROBOTS Announces Listing on Epic Games Store and Steam, Teams Up with Immutable X

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share