Form 8-K Federal-Mogul Holdings For: Mar 06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 6, 2015

Federal-Mogul Holdings Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 001-34029 | 46-5182047 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 27300 West 11 Mile Road, Southfield, Michigan |

48034 | |||

| (Address of principal executive offices) | (Zip Code) | |||

(248) 354-7700

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 8 – Other Events

Item 8.01 – Other Events.

On March 6, 2015, Federal-Mogul Holdings Corporation (the “Company”) commenced its previously announced $250 million rights offering. Under the terms of the rights offering, the Company will grant, at no charge, to each stockholder as of 5:00 p.m. Eastern Time on the record date of March 6, 2015, one transferable subscription right for each whole share of common stock owned by that stockholder on the record date. Each subscription right will entitle a rights holder to purchase 0.126718 shares of the Company’s common stock at a subscription price equal to $13.15 per share, subject to rounding down to avoid the issuance of fractional shares (the “basic subscription right”). The rights offering also will include an over-subscription privilege, which will entitle stockholders who exercise all of their subscription rights in the basic subscription privilege the right to purchase additional shares of common stock in the rights offering, subject to availability and pro-rata allocation of shares among rights holders exercising such over-subscription privilege. The subscription rights will expire if they are not exercised by 5:00 p.m. Eastern Time on March 23, 2015 (unless extended).

A subsidiary of Icahn Enterprises L.P., which benefically owns 80.7% of the Company’s common stock prior to giving effect to the rights offering, has indicated its intent to subscribe for its pro rata share of the rights offering under its basic subscription privilege as well as its willingness to over-subscribe for additional shares, subject to availability and pro-rata allocation among other rights holders who have elected to exercise their over-subscription privilege. However, there can be no assurances that such shareholder will exercise all or any portion of its subscription rights under the basic subscription privilege or over-subscription privilege.

The rights offering will be made pursuant to a shelf registration statement on Form S-3 that was previously filed with the Securities and Exchange Commission (the “SEC”) and became effective on May 1, 2013. The rights offering will be made solely by means of a prospectus and prospectus supplement meeting the requirements of the Securities Act of 1933, as amended, that have been filed with the SEC. Additional information regarding the rights offering is set forth in the prospectus supplement filed with the SEC.

In connection with this rights offering, the Company is filing items included as Exhibits 4.1, 99.1, 99.2, 99.3, 99.4, 99.5 and 99.6 to this Current Report on Form 8-K for the purpose of incorporating such items by reference in the Company’s Registration Statement on Form S-3 (Registration No. 333-187424), of which the prospectus supplement dated March 6, 2015, relating to the rights offering, is a part.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number | Exhibit Description | |

| 4.1 | Form of Federal-Mogul Holdings Corporation Shareholder Subscription Rights Certificate | |

| 99.1 | Form of Instructions as to Use of Federal-Mogul Holdings Corporation Rights Certificates | |

| 99.2 | Form of Letter to Nominee Holders whose Clients are Beneficial Holders | |

| 99.3 | Form of Letter to Stockholders Who are Beneficial Owners | |

| 99.4 | Form of Letter to Clients of Nominee Holders | |

| 99.5 | Form of Beneficial Owner Election Form | |

| 99.6 | Form of Nominee Holder Certification | |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Federal-Mogul Holdings Corporation (Registrant) | ||||||

| Date: March 6, 2015 | By: | /s/ Brett D. Pynnonen | ||||

| Brett D. Pynnonen | ||||||

| Senior Vice President, General Counsel and Secretary | ||||||

3

EXHIBIT INDEX

| Exhibit |

Exhibit Description | |

| 4.1 | Form of Federal-Mogul Holdings Corporation Shareholder Subscription Rights Certificate | |

| 99.1 | Form of Instructions as to Use of Federal-Mogul Holdings Corporation Rights Certificates | |

| 99.2 | Form of Letter to Nominee Holders whose Clients are Beneficial Holders | |

| 99.3 | Form of Letter to Stockholders Who are Beneficial Owners | |

| 99.4 | Form of Letter to Clients of Nominee Holders | |

| 99.5 | Form of Beneficial Owner Election Form | |

| 99.6 | Form of Nominee Holder Certification | |

4

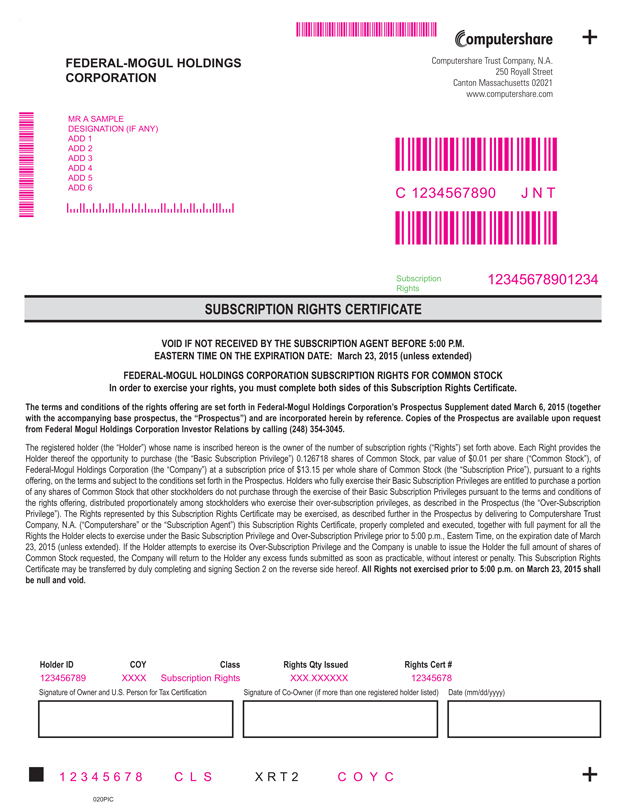

Exhibit 4.1

FEDERAL-MOGUL HOLDINGS CORPORATION

Computershare

Computershare Trust Company, N.A.

250 Royall Street

Canton Massachusetts 02021

www.computershare.com

MR A SAMPLE

DESIGNATION (IF ANY)

ADD 1

ADD 2

ADD 3

ADD 4

ADD 5

ADD 6

C 1234567890 J N T

Subscription 12345678901234

Rights

SUBSCRIPTION RIGHTS CERTIFICATE

VOID IF NOT RECEIVED BY THE SUBSCRIPTION AGENT BEFORE 5:00 P.M. EASTERN TIME ON THE EXPIRATION DATE: March 23, 2015 (unless extended)

FEDERAL-MOGUL HOLDINGS CORPORATION SUBSCRIPTION RIGHTS FOR COMMON STOCK In order to exercise your rights, you must complete both sides of this Subscription Rights Certificate.

The terms and conditions of the rights offering are set forth in Federal-Mogul Holdings Corporation’s Prospectus Supplement dated March 6, 2015 (together with the accompanying base prospectus, the “Prospectus”) and are incorporated herein by reference. Copies of the Prospectus are available upon request from Federal Mogul Holdings Corporation Investor Relations by calling (248) 354-3045.

The registered holder (the “Holder”) whose name is inscribed hereon is the owner of the number of subscription rights (“Rights”) set forth above. Each Right provides the Holder thereof the opportunity to purchase (the “Basic Subscription Privilege”) 0.126718 shares of Common Stock, par value of $0.01 per share (“Common Stock”), of Federal-Mogul Holdings Corporation (the “Company”) at a subscription price of $13.15 per whole share of Common Stock (the “Subscription Price”), pursuant to a rights offering, on the terms and subject to the conditions set forth in the Prospectus. Holders who fully exercise their Basic Subscription Privileges are entitled to purchase a portion of any shares of Common Stock that other stockholders do not purchase through the exercise of their Basic Subscription Privileges pursuant to the terms and conditions of the rights offering, distributed proportionately among stockholders who exercise their over-subscription privileges, as described in the Prospectus (the “Over-Subscription Privilege”). The Rights represented by this Subscription Rights Certificate may be exercised, as described further in the Prospectus by delivering to Computershare Trust Company, N.A. (“Computershare” or the “Subscription Agent”) this Subscription Rights Certificate, properly completed and executed, together with full payment for all the Rights the Holder elects to exercise under the Basic Subscription Privilege and Over-Subscription Privilege prior to 5:00 p.m., Eastern Time, on the expiration date of March 23, 2015 (unless extended). If the Holder attempts to exercise its Over-Subscription Privilege and the Company is unable to issue the Holder the full amount of shares of Common Stock requested, the Company will return to the Holder any excess funds submitted as soon as practicable, without interest or penalty. This Subscription Rights Certificate may be transferred by duly completing and signing Section 2 on the reverse side hereof. All Rights not exercised prior to 5:00 p.m. on March 23, 2015 shall be null and void.

Holder ID COY Class Rights Qty Issued Rights Cert #

123456789 XXXX Subscription Rights XXX.XXXXXX 12345678

Signature of Owner and U.S. Person for Tax Certification Signature of Co-Owner (if more than one registered holder listed) Date (mm/dd/yyyy)

12345678 CLS XRT2 COYC

020PIC

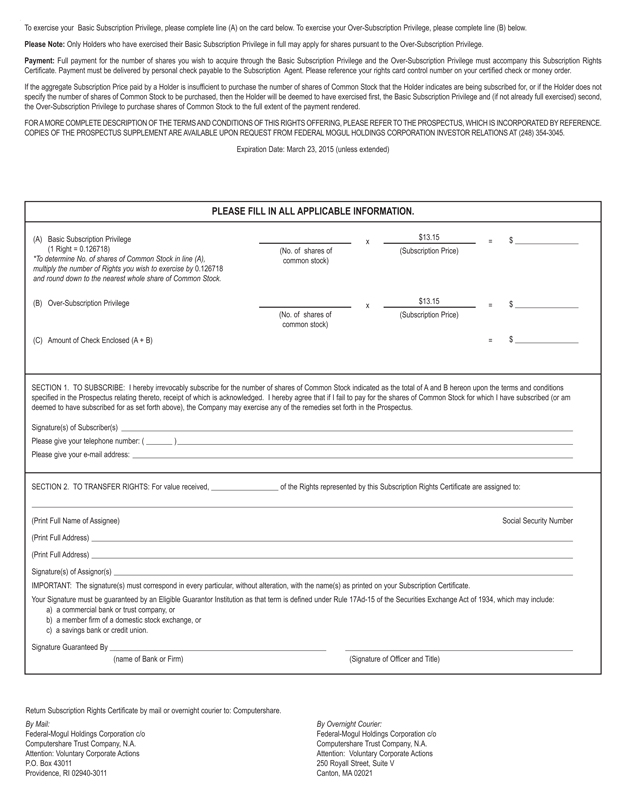

To exercise your Basic Subscription Privilege, please complete line (A) on the card below. To exercise your Over-Subscription Privilege, please complete line (B) below.

Please Note: Only Holders who have exercised their Basic Subscription Privilege in full may apply for shares pursuant to the Over-Subscription Privilege.

Payment: Full payment for the number of shares you wish to acquire through the Basic Subscription Privilege and the Over-Subscription Privilege must accompany this Subscription Rights Certificate. Payment must be delivered by personal check payable to the Subscription Agent. Please reference your rights card control number on your certified check or money order.

If the aggregate Subscription Price paid by a Holder is insufficient to purchase the number of shares of Common Stock that the Holder indicates are being subscribed for, or if the Holder does not specify the number of shares of Common Stock to be purchased, then the Holder will be deemed to have exercised first, the Basic Subscription Privilege and (if not already full exercised) second, the Over-Subscription Privilege to purchase shares of Common Stock to the full extent of the payment rendered.

FOR A MORE COMPLETE DESCRIPTION OF THE TERMS AND CONDITIONS OF THIS RIGHTS OFFERING, PLEASE REFER TO THE PROSPECTUS, WHICH IS INCORPORATED BY REFERENCE. COPIES OF THE PROSPECTUS SUPPLEMENT ARE AVAILABLE UPON REQUEST FROM FEDERAL MOGUL HOLDINGS CORPORATION INVESTOR RELATIONS AT (248) 354-3045.

Expiration Date: March 23, 2015 (unless extended)

PLEASE FILL IN ALL APPLICABLE INFORMATION.

(A) Basic Subscription Privilege x $13.15 = $

(1 Right = 0.126718) (No. of shares of common stock) (Subscription Price)

*To determine No. of shares of Common Stock in line (A), multiply the number of Rights you wish to exercise by 0.126718 and round down to the nearest whole share of Common Stock.

(B) Over-Subscription Privilege x $13.15 = $

(No. of shares of common stock) (Subscription Price)

(C) Amount of Check Enclosed (A + B) = $

SECTION 1. TO SUBSCRIBE: I hereby irrevocably subscribe for the number of shares of Common Stock indicated as the total of A and B hereon upon the terms and conditions specified in the Prospectus relating thereto, receipt of which is acknowledged. I hereby agree that if I fail to pay for the shares of Common Stock for which I have subscribed (or am deemed to have subscribed for as set forth above), the Company may exercise any of the remedies set forth in the Prospectus.

Signature(s) of Subscriber(s)

Please give your telephone number: ( )

Please give your e-mail address:

SECTION 2. TO TRANSFER RIGHTS: For value received, of the Rights represented by this Subscription Rights Certificate are assigned to:

(Print Full Name of Assignee) Social Security Number

(Print Full Address)

(Print Full Address)

Signature(s) of Assignor(s)

IMPORTANT: The signature(s) must correspond in every particular, without alteration, with the name(s) as printed on your Subscription Certificate.

Your Signature must be guaranteed by an Eligible Guarantor Institution as that term is defined under Rule 17Ad-15 of the Securities Exchange Act of 1934, which may include:

a) a commercial bank or trust company, or

b) a member firm of a domestic stock exchange, or

c) a savings bank or credit union.

Signature Guaranteed By

(name of Bank or Firm) (Signature of Officer and Title)

Return Subscription Rights Certificate by mail or overnight courier to: Computershare.

By Mail: By Overnight Courier:

Federal-Mogul Holdings Corporation c/o Federal-Mogul Holdings Corporation c/o

Computershare Trust Company, N.A. Computershare Trust Company, N.A.

Attention: Voluntary Corporate Actions Attention: Voluntary Corporate Actions

P.O. Box 43011 250 Royall Street, Suite V

Providence, RI 02940-3011 Canton, MA 02021

Exhibit 99.1

FORM OF INSTRUCTIONS

AS TO USE OF

FEDERAL-MOGUL HOLDINGS CORPORATION

RIGHTS CERTIFICATES

CONSULT YOUR BANK OR BROKER

AS TO ANY QUESTIONS

The following instructions relate to a rights offering by Federal-Mogul Holdings Corporation, a Delaware corporation (“Federal-Mogul”), to the stockholders of record (the “Recordholders”) of its common stock, par value $0.01 per share (the “Common Stock”), as described in the accompanying prospectus supplement of Federal-Mogul dated March 6, 2015 (together with the accompanying base prospectus, the “Prospectus”). Recordholders as of 5:00 p.m., Eastern Time, on March 6, 2015 (the “Record Date”) are receiving, at no charge, transferable subscription rights (the “Rights”) to subscribe for and purchase shares of Common Stock (the “Underlying Shares”). In the rights offering, Federal-Mogul is offering an aggregate of 19,011,407 Underlying Shares.

Each Recordholder will receive one Right for each share of Common Stock owned of record as of 5:00 p.m., Eastern Daylight Time, on the Record Date. The Rights will expire if not exercised prior to 5:00 p.m., Eastern time, on March 23, 2015, unless Federal-Mogul extends the rights offering period (the “Expiration Date”). All Rights not exercised prior to 5:00 p.m., Eastern Time on the Expiration Date shall be null and void.

As described in the Prospectus, you will receive one Right for each share of Common Stock owned of record as of 5:00 p.m., Eastern Time, on the Record Date. Each Right entitles the holder thereof to purchase 0.126718 shares of Common Stock (the “Basic Subscription Privilege”) at a subscription price of $13.15 per whole share (the “Subscription Price”). As an example, if a holder owned 1,000 shares of Federal-Mogul Common Stock on the Record Date, such holder would receive 1,000 Rights that would entitle the holder to purchase 126 shares of Common Stock (126.718 rounded down to the nearest whole share of Common Stock) at the Subscription Price.

If you purchase all of the shares of Common Stock available to you pursuant to your Basic Subscription Privilege, you may also choose to purchase additional shares of Common Stock that other stockholders do not purchase through the exercise of their Basic Subscription Privilege (such shares, the “Unsubscribed Shares”) through the exercise an over-subscription privilege (such shares, determined taking into account the limitation described in the remainder of this paragraph, the “Over-Subscription Privilege”). The Over-Subscription Privilege remains subject to the availability and pro-rata allocation of shares among persons exercising their Over-Subscription Privilege and is limited to the maximum number of shares of Common Stock offered in this rights offering, less the number of shares of Common Stock purchased in the Basic Subscription Privilege. If sufficient shares of Common Stock are available, Federal-Mogul will seek to honor each Rights holder’s over-subscription request in full. If over-subscription requests exceed the number of shares available, however, we will allocate the available shares pro-rata among the stockholders exercising the Over-Subscription Privilege in proportion to the number of shares of our Common Stock each of those stockholders owned on the Record Date, relative to the number of shares owned on the Record Date by all stockholders exercising the Over-Subscription Privilege. If this pro-rata allocation results in any stockholder receiving a greater number of shares of Common Stock than the stockholder subscribed for pursuant to the exercise of the Over-Subscription Privilege, then such stockholder will be allocated only that number of shares for which the stockholder over-subscribed, and the remaining shares will be allocated among all other stockholders exercising the Over-Subscription Privilege on the same pro-rata basis described above. The proration process will be repeated until all shares of Common Stock have been allocated.

Each Rights holder will be required to submit payment in full for all the shares it wishes to purchase with its Basic Subscription Privilege and its Over-Subscription Privilege. Because Federal-Mogul will not know the total number of Unsubscribed Shares prior to the Expiration Date, if a Rights holder wishes to maximize the number of shares it may purchase pursuant to the holder’s Over-Subscription Privilege, the holder will need to deliver

payment in an amount equal to the aggregate Subscription Price for the maximum number of shares of Common Stock available to the holder, assuming that no stockholders other than such holder purchases any shares of Common Stock pursuant to their Basic Subscription Privilege and Over-Subscription Privilege.

Fractional shares of Common Stock resulting from the exercise of the over-subscription privilege will be eliminated by rounding down to the nearest whole share of Common Stock. Computershare Trust Company, N.A., a Delaware corporation (“Computershare”), our Subscription Agent for the rights offering, will determine the over-subscription allocation based on the formula described above.

The Rights will be evidenced by transferable Rights certificates (the “Rights Certificates”). You should indicate your wishes with regard to the exercise of your Rights by completing the appropriate portions of your Rights Certificate and returning the certificate to the Subscription Agent in the envelope provided. Federal-Mogul will not be required to issue shares of Common Stock to you if the Subscription Agent does not receive your payment (whether delivered directly if you are a Recordholder or indirectly through a Recordholder if you are a beneficial owner but not a Recordholder) prior to the Expiration Date, regardless of when you send the subscription payment and related documents.

YOUR RIGHTS CERTIFICATES AND SUBSCRIPTION PRICE PAYMENT FOR EACH RIGHT THAT IS EXERCISED PURSUANT TO THE BASIC SUBSCRIPTION PRIVILEGE PLUS THE FULL SUBSCRIPTION PRICE FOR ANY ADDITIONAL SHARES OF COMMON STOCK SUBSCRIBED FOR PURSUANT TO THE OVER-SUBSCRIPTION PRIVILEGE, MUST BE RECEIVED BY THE SUBSCRIPTION AGENT, ON OR BEFORE THE EXPIRATION DATE. ONCE A RIGHTS HOLDER HAS EXERCISED THE BASIC SUBSCRIPTION PRIVILEGE OR THE OVER-SUBSCRIPTION PRIVILEGE, SUCH EXERCISE MAY NOT BE REVOKED. RIGHTS NOT EXERCISED PRIOR TO THE EXPIRATION DATE OF THE RIGHTS OFFERING WILL EXPIRE.

| 1. | Method of Subscription—Exercise of Rights. |

To exercise Rights, complete your Rights Certificate and send the properly completed and executed Rights Certificate evidencing such Rights with any signatures required to be guaranteed so guaranteed, together with payment in full of the Subscription Price for each Underlying Share subscribed for pursuant to the Basic Subscription Privilege plus the full Subscription Price for any Unsubscribed Shares you elect to subscribe for pursuant to the Over-Subscription Privilege, to the Subscription Agent, on or prior to the Expiration Date. Payment of the aggregate Subscription Price will be held in a segregated account to be maintained by the Subscription Agent. All payments must be made in U.S. dollars for the full number of Underlying Shares being subscribed for by personal check payable to Computershare. Payments will be deemed to have been received upon receipt by the Subscription Agent of any certified check drawn upon a U.S. bank or of any postal, telegraphic or express money order.

The Rights Certificate and payment of the aggregate Subscription Price by personal check must be delivered to the Subscription Agent by first class mail or courier service to:

By mail:

Computershare Trust Company, N.A.

Attention: Voluntary Corporate Actions

PO Box 43011

Providence, RI 02940-3011

By overnight courier:

Computershare Trust Company, N.A.

Attention: Voluntary Corporate Actions

250 Royall Street, Suite V

Canton, MA 02021

2

Delivery to an address other than the address above does not constitute valid delivery.

If you have any questions, require assistance regarding the method of exercising Rights or require additional copies of relevant documents, please contact Federal-Mogul Investor Relations at (248) 354-3045.

By making arrangements with your bank or broker for the delivery of funds on your behalf, you may also request such bank or broker to exercise the Rights Certificate on your behalf.

If you do not indicate the number of Rights being exercised, or do not forward full payment of the Subscription Price, then you will be deemed to have exercised your Rights with respect to the maximum number of whole Rights that may be exercised with the aggregate Subscription Price you delivered to the Subscription Agent. If your aggregate Subscription Price is greater than the amount you owe for exercise of your Basic Subscription Privilege in full, you will be deemed to have exercised your Over-Subscription Privilege to purchase the maximum number of shares of Common Stock with your over-payment. If Federal-Mogul does not apply your full Subscription Price payment to your purchase of shares of Common Stock, the excess subscription payment received by the Subscription Agent will be returned to you, without interest, as soon as practicable.

Brokers, dealers, custodian banks and other nominee holders of Rights who exercise the Basic Subscription Privilege and the Over-Subscription Privilege on behalf of beneficial owners of Rights will be required to certify to the Subscription Agent and Federal-Mogul, in connection with the exercise of the Over-Subscription Privilege, as to the aggregate number of Rights that have been exercised pursuant to the Basic Subscription Privilege and the number of shares of Common Stock that are being subscribed for pursuant to the Over-Subscription Privilege by each beneficial owner of Rights (including such nominee itself) on whose behalf such nominee holder is acting.

Federal-Mogul can provide no assurances that each Rights holder will actually be entitled to purchase the number of shares of Common Stock issuable upon the exercise of its Over-Subscription Privilege in full. Federal-Mogul will not be able to satisfy a Rights holder’s exercise of the Over-Subscription Privilege if all of the Rights holders exercise their Basic Subscription Privilege in full, and Federal-Mogul will only honor an Over-Subscription Privilege to the extent sufficient shares of Common Stock are available following the exercise of subscription rights under the Basic Subscription Privilege, subject to the limitations set forth above.

To the extent the aggregate Subscription Price of the maximum number of Unsubscribed Shares available to a Rights holder pursuant to the Over-Subscription Privilege is less than the amount the Rights holder actually paid in connection with the exercise of the Over-Subscription Privilege, the Rights holder will be allocated only the number of Unsubscribed Shares available to it, as soon as practicable after the Expiration Date, and the Rights holder’s excess subscription payment received by the Subscription Agent will be returned, without interest, as soon as practicable.

To the extent the amount a Rights holder actually paid in connection with the exercise of the Over-Subscription Privilege is less than or equal to the aggregate Subscription Price of the maximum number of Unsubscribed Shares available to the Rights holder pursuant to the Over-Subscription Privilege, such Rights holder will be allocated the number of Unsubscribed Shares for which it actually paid in connection with the Over-Subscription Privilege. See “The Rights Offering—The Subscription Rights—Over-subscription Privilege” in the Prospectus.

| 2. | Issuance of Common Stock. |

The following deliveries and payments will be made to the address shown on the face of your Rights Certificate, unless you provide instructions to the contrary in your Rights Certificate.

(a) Basic Subscription Privilege. As soon as practicable after the closing of the rights offering and the valid exercise of Rights, the Subscription Agent will mail to each Rights holder that validly exercises the Basic Subscription Privilege certificates representing shares of Common Stock purchased pursuant to the Basic Subscription Privilege.

3

(b) Over-Subscription Privilege. As soon as practicable after the closing of the rights offering (including after all prorations and adjustments contemplated by the terms of the rights offering, as described in the Prospectus, have been effected), the Subscription Agent will mail to each Rights holder that validly exercises the Over-Subscription Privilege certificates representing the number of shares of Common Stock, if any, allocated to such Rights holder pursuant to the Over-Subscription Privilege.

(c) Excess Cash Payments. As soon as practicable after the Expiration Date and after all prorations and adjustments contemplated by the terms of the rights offering, as described in the Prospectus, have been effected, any excess subscription payments received in payment of the Subscription Price by the Subscription Agent will be mailed to each Rights holder, without interest.

| 3. | Sale or Transfer of Rights. |

(a) Sale of Rights through a Bank or Broker. To sell all Rights evidenced by a Rights Certificate through your bank or broker, complete and execute Section 2 (the “Assignment Form”) on the reverse side of your Rights Certificate, leaving the rest of the form blank (your broker will add the buyer’s name later). You must have your signature on the Assignment Form guaranteed by a member firm of a registered national securities exchange or a member of the Financial Industry Regulatory Authority, or from a commercial bank or trust company having an office or correspondent in the United States or from a bank, shareholder, savings and loan association or credit union with membership in an approved signature guarantee medallion program, pursuant to Rule 17Ad-15 of the Securities Exchange Act of 1934, as amended, (each, an “Eligible Institution”) and deliver your Rights Certificate and the accompanying envelope to your bank or broker. Your Rights Certificate should be delivered to your bank or broker in ample time for it to be exercised. If the Assignment Form is completed without designating a transferee, the Subscription Agent may thereafter treat the bearer of the Rights Certificate as the absolute owner of all of the Rights evidenced by such Subscription Rights Certificate for all purposes, and the Subscription Agent shall not be affected by any notice to the contrary. Because your bank or broker cannot issue Rights Certificates, if you wish to sell fewer than all of the Rights evidenced by a Rights Certificate, either you or your bank or broker must instruct the Subscription Agent as to the action to be taken with respect to the Rights not sold, or you or your bank or broker must first have your Rights Certificate divided into Rights Certificates of appropriate denominations by following the instructions in Section (f) of these instructions, below. The Rights Certificates evidencing the number of Rights you intend to sell can then be transferred by your bank or broker in accordance with these instructions.

(b) Transfer of Rights to a Designated Transferee. To transfer all of your Rights to a transferee other than a bank or broker, you must complete the Assignment Form in its entirety, execute the Rights Certificate and have your signature guaranteed by an Eligible Institution. A Rights Certificate that has been properly transferred in its entirety may be exercised by a new holder without having a new Rights Certificate issued. In order to exercise, or otherwise take action with respect to, such a transferred Rights Certificate, the new holder should deliver the Rights Certificate, together with payment of the applicable Subscription Price (with respect to the exercise of both the Basic Subscription Privilege and the Over-Subscription Privilege) and complete separate instructions signed by the new holder, to the Subscription Agent in ample time to permit the Subscription Agent to take the desired action. Because only the Subscription Agent can issue Rights Certificates, if you wish to transfer fewer than all of the Rights evidenced by your Rights Certificate to a designated transferee, you must instruct the Subscription Agent as to the action to be taken with respect to the Rights not sold or transferred, or you must divide your Rights Certificate into Rights Certificates of appropriate smaller denominations by following the instructions in Section (f) below. The Rights Certificate evidencing the number of Rights you intend to transfer can then be transferred by following these instructions.

(c) Transfer of Rights. Rights holders wishing to transfer a portion of their Rights (but not fractional Rights) should allow a sufficient amount of time prior to the Expiration Date for: (i) the transfer instructions to be received and processed by the Subscription Agent; (ii) a new Rights Certificate to be issued and transmitted to the transferee or transferees with respect to transferred Rights and to the transferor with respect to retained Rights, if any; and (iii) the Rights evidenced by such new Rights Certificates to be exercised or sold by the

4

recipients thereof. The Subscription Agent will facilitate transfers of Rights Certificates only until 5:00 p.m., Eastern Time, on March 18, 2015, the third business day before the Expiration Date.

(d) Liability. Neither Federal-Mogul nor the Subscription Agent shall have any liability to a transferee or transferor of Rights if Rights Certificates are not received in time for exercise or sale prior to the Expiration Date. Rights Certificates not exercised by the Expiration Date will expire and have no value. Neither Federal-Mogul nor the Subscription Agent shall have any liability with respect to an expired Rights Certificate.

(e) Commissions, Fees, and Expenses. Federal-Mogul will pay all fees and expenses of the Subscription Agent and has also agreed to indemnify the Subscription Agent from certain liabilities that it may incur in connection with the rights offering. All commissions, fees, and other expenses (including brokerage commissions and transfer taxes) incurred in connection with the purchase, sale or exercise of Rights will be for the account of the transferor of the Rights, and none of such commissions, fees or expenses will be paid by Federal-Mogul or the Subscription Agent.

(f) Division of Rights Certificate into Smaller Denominations. To have a Rights Certificate divided into smaller denominations, send your Rights Certificate, together with complete separate instructions (including specification of the denominations into which you wish your Rights to be divided) signed by you, to the Subscription Agent, allowing a sufficient amount of time for new Rights Certificates to be issued and returned so that they can be used prior to the Expiration Date. Alternatively, you may ask a bank or broker to effect such actions on your behalf. The Subscription Agent will facilitate subdivisions of Rights Certificates only until 5:00 p.m., Eastern Time, on March 18, 2015, the third business day before the Expiration Date. Your signature must be guaranteed by an Eligible Institution if any of the new Rights Certificates are to be issued in a name other than that in which the old Rights Certificate was issued. Rights Certificates may not be divided into fractional Rights, and any instruction to do so will be rejected. As a result of delays in the mail, the time of the transmittal, the necessary processing time and other factors, you or your transferee may not receive the new Rights Certificates in time to enable the Rights holder to complete a sale or exercise by the Expiration Date. Neither Federal-Mogul nor the Subscription Agent will be liable to either a transferor or transferee for any delays.

| 4. | Execution. |

(a) Execution by Registered Holder. The signature on the Rights Certificate must correspond with the name of the registered holder exactly as it appears on the face of the Rights Certificate without any alteration or change whatsoever. Persons who sign the Rights Certificate in a representative or other fiduciary capacity must indicate their capacity when signing and, unless waived by the Subscription Agent in its sole and absolute discretion, must present to the Subscription Agent satisfactory evidence of their authority to so act.

(b) Execution by Person Other than Registered Holder. If the Rights Certificate is executed by a person other than the holder named on the face of the Rights Certificate, proper evidence of authority of the person executing the Rights Certificate must accompany the same unless, for good cause, the Subscription Agent dispenses with proof of authority.

(c) Signature Guarantees. Your signature must be guaranteed by an Eligible Institution (as defined above) if you specify special delivery instructions. See the Rights Certificate(s).

| 5. | Method of Delivery. |

Payment by a personal check to the Subscription Agent’s account will be deemed to have been received by the Subscription Agent immediately upon receipt of such instrument. You bear the risk of delivery of all documents and payments, and neither we nor the Subscription Agent have any responsibility for such deliveries.

5

The method of delivery of Rights Certificates and payment of the aggregate Subscription Price to the Subscription Agent will be at the election and risk of the Rights holder. If sent by mail, we recommend that you send those Rights Certificates and payment by overnight courier or by registered mail, properly insured, with return receipt requested, and that a sufficient number of days be allowed to ensure delivery to the Subscription Agent prior to the expiration of the rights offering.

| 6. | Special Provisions Relating to the Delivery of Rights through the Depository Trust Company. |

In the case of Rights that are held of record through The Depository Trust Company (“DTC”), exercises of the Basic Subscription Right and of the Over-Subscription Right may be effected by instructing DTC to transfer Rights from the DTC account of such holder to the DTC account of the Subscription Agent, together with certification as to the aggregate number of Rights subscribed for pursuant to the Basic Subscription Right and the number of Unsubscribed Shares subscribed for pursuant to the Over-Subscription Right by each beneficial owner of Rights on whose behalf such nominee is acting, and payment to the Subscription Agent of the Subscription Price for each share of Common Stock subscribed for pursuant to the Basic Subscription Right and the Over-Subscription Right.

| 7. | Notice of Important Tax Information and Guidelines for Request for Taxpayer Identification Number and Certification on IRS Form W-9 or IRS Form W-8. |

TO ENSURE COMPLIANCE WITH IRS CIRCULAR 230, YOU ARE HEREBY NOTIFIED THAT: (A) ANY DISCUSSION OF U.S. FEDERAL TAX ISSUES CONTAINED OR REFERRED TO HEREIN IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED BY ANY TAXPAYER FOR THE PURPOSE OF AVOIDING U.S. FEDERAL, STATE OR LOCAL TAX PENALTIES, (B) SUCH DISCUSSION IS WRITTEN IN CONNECTION WITH THE PROMOTION OR MARKETING OF THE TRANSACTION OR MATTERS DISCUSSED HEREIN, AND (C) THE TAXPAYER SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

Each Rights holder who is a “United States person” within the meaning of the Internal Revenue Code of 1986, as amended, who elects to exercise Rights must provide the Subscription Agent with a correct Taxpayer Identification Number (“TIN”) on IRS Form W-9. A Rights holder who is not a United States person must provide the Subscription Agent an appropriate IRS Form W-8. Please consult your own tax advisor as to the appropriate IRS Form W-8 to provide. Copies of IRS Form W-9 or IRS Form W-8 may be obtained upon request from the Subscription Agent at the address set forth above or are available at www.irs.gov. In general, failure to provide the required information on the form may subject such holder to a $100.00 penalty for each such failure and to U.S. federal income tax backup withholding (currently at a 28% rate) with respect to dividends that may be paid by Federal-Mogul on shares of Common Stock purchased upon the exercise of Rights (for those holders exercising Rights).

| 8. | Determinations Regarding the Exercise of Your Rights. |

Federal-Mogul will decide, in its sole discretion, all questions concerning the timeliness, validity, form, and eligibility of the exercise of your Rights. Any such determinations by Federal-Mogul will be final and binding. Federal-Mogul, in its sole discretion, may waive, in any particular instance, any defect or irregularity or permit, in any particular instance, a defect or irregularity to be corrected within such time as Federal-Mogul may determine. Federal-Mogul will not be required to make uniform determinations in all cases. Federal-Mogul may reject the exercise of any of your Rights because of any defect or irregularity. Federal-Mogul will not accept any exercise of Rights until all irregularities have been waived by Federal-Mogul or cured by you within such time as Federal-Mogul decides, in its sole discretion.

Neither Federal-Mogul, the Subscription Agent, nor the information agent will be under any duty to notify you of any defect or irregularity in connection with your submission of Rights Certificates, and Federal-Mogul will not be liable for failure to notify you of any defect or irregularity. Federal-Mogul reserves the right to reject your

6

exercise of Rights if Federal-Mogul determines that your exercise is not in accordance with the terms of the rights offering, as set forth in the Prospectus and these Instructions for Use, or in proper form. Federal-Mogul will also not accept the exercise of your Rights if Federal-Mogul’s issuance of shares of Common Stock to you could be deemed unlawful under applicable law.

7

Exhibit 99.2

FORM OF LETTER

FEDERAL-MOGUL HOLDINGS CORPORATION

Subscription Rights to Purchase Shares of Common Stock

Offered Pursuant to Subscription Rights

Distributed to Shareholders

of Federal-Mogul Holdings Corporation

March 6, 2015

To Securities Dealers, Brokers, Commercial Banks, Trust Companies and Other Nominees:

This letter is being distributed to securities dealers, brokers commercial banks, trust companies and other nominees in connection with the rights offering by Federal-Mogul Holdings Corporation (“Federal-Mogul”) of shares of Federal-Mogul common stock, par value $0.01 per share (the “Common Stock”), pursuant to transferable subscription rights (the “Rights”) distributed to all holders of record of shares of Common Stock at 5:00 p.m., Eastern Time, on March 6, 2015 (the “Record Date”). The Rights and Common Stock are described in the accompanying offering prospectus supplement covering the Rights and the shares of Common Stock issuable upon their exercise dated March 6, 2015 (together with the accompanying base prospectus, the “Prospectus”).

In the rights offering, Federal-Mogul is offering an aggregate of 19,011,407 shares of Common Stock, as described in the Prospectus.

The Rights will expire, if not exercised prior to 5:00 p.m., Eastern Time, on March 23, 2015, unless Federal-Mogul extends the offering period (the “Expiration Date”).

As described in the Prospectus, each beneficial owner of shares of Common Stock registered in your name or the name of your nominee is entitled to one Right for each share of Common Stock owned of record as of 5:00 p.m., Eastern Time, on the Record Date. Each Right gives the holder thereof the opportunity to purchase 0.126718 shares of Common Stock (the “Basic Subscription Privilege”) at a subscription price of $13.15 per whole share (the “Subscription Price”). As an example, if a holder owned 1,000 shares of Federal-Mogul Common Stock on the Record Date, such holder would receive 1,000 Rights that would entitle the holder to purchase 126 shares of Common Stock (126.718 rounded down to the nearest whole share of Common Stock) at the Subscription Price.

If you purchase all of the shares of Common Stock available to you pursuant to your Basic Subscription Privilege, you may also choose to purchase additional shares of Common Stock that other stockholders do not purchase through the exercise of their Basic Subscription Privilege (such shares, the “Unsubscribed Shares”) through the exercise an over-subscription privilege (such shares, determined taking into account the limitation described in the remainder of this paragraph, the “Over-Subscription Privilege”). The Over-Subscription Privilege remains subject to the availability and pro-rata allocation of shares among persons exercising their Over-Subscription Privilege and is limited to the maximum number of shares of Common Stock offered in this rights offering, less the number of shares of Common Stock purchased in the Basic Subscription Privilege. If sufficient shares of Common Stock are available, we will seek to honor each Rights holder’s over-subscription request in full. If over-subscription requests exceed the number of shares available, however, we will allocate the available shares pro-rata among the stockholders exercising the Over-Subscription Privilege in proportion to the number of shares of our Common Stock each of those stockholders owned on the Record Date, relative to the number of shares owned on the Record Date by all stockholders exercising the Over-Subscription Privilege. If this pro-rata allocation results in any stockholder receiving a greater number of shares of Common Stock than the stockholder subscribed for pursuant to the exercise of the Over-Subscription Privilege, then such stockholder will be allocated only that number of shares for which the stockholder over-subscribed, and the remaining shares will be allocated among all other stockholders exercising the Over-Subscription Privilege on the same pro-rata basis described above. The proration process will be repeated until all shares of Common Stock have been allocated.

IEH FM Holdings LLC (“IEH”), which beneficially owns approximately 80.7% of our Common Stock before giving effect to the rights offering, has indicated its intent to subscribe for its pro rata share of the rights offering under its Basic Subscription Privilege as well as its willingness to over-subscribe for additional shares, subject to availability and pro-rata allocation among other rights holders who have elected to exercise their Over-Subscription Privileges. However, there can be no assurances that IEH will exercise all or any portion of its subscription rights under the Basic Subscription Privilege or Over-Subscription Privilege.

You will be required to submit payment in full for all the shares you wish to purchase with your Basic Subscription Privilege and your Over-Subscription Privilege. Because Federal-Mogul will not know the total number of Unsubscribed Shares prior to the Expiration Date, if you wish to maximize the number of shares you may purchase pursuant to your Over-Subscription Privilege, you will need to deliver payment in an amount equal to the aggregate Subscription Price for the maximum number of shares of Common Stock available to you, assuming that no stockholders other than you have purchased any shares of Common Stock pursuant to the Basic Subscription Privilege and Over-Subscription Privilege. Fractional shares of Common Stock resulting from the exercise of the Over-Subscription Privilege will be eliminated by rounding down to the nearest whole share of Common Stock. Computershare Trust Company, N.A. (the “Subscription Agent”) will determine the over-subscription allocation based on the formula described above. Any excess subscription payments received by the Subscription Agent will be returned, without interest, as soon as practicable.

Federal-Mogul can provide no assurances that each Rights holder will actually be entitled to purchase the number of shares of Common Stock issuable upon the exercise of its Over-Subscription Privilege in full. Federal-Mogul will not be able to satisfy a Rights holder’s exercise of the Over-Subscription Privilege if the rights offering is subscribed in full, and Federal-Mogul will only honor an Over-Subscription Privilege to the extent sufficient shares of Common Stock are available following the exercise of subscription rights under the Basic Subscription Privilege, subject to the limitations set forth above.

To the extent the aggregate Subscription Price of the maximum number of Unsubscribed Shares available to a Rights holder pursuant to the Over-Subscription Privilege is less than the amount the holder of Rights actually paid in connection with the exercise of the Over-Subscription Privilege, the Rights holder will be allocated only the number of Unsubscribed Shares available to it as soon as practicable after the Expiration Date, and the Rights holder’s excess subscription payment received by the Subscription Agent will be returned, without interest, as soon as practicable.

To the extent the amount the Rights holder actually paid in connection with the exercise of the Over-Subscription Privilege is less than or equal to the aggregate Subscription Price of the maximum number of Unsubscribed Shares available to the Rights holder pursuant to the Over-Subscription Privilege, such Rights holder will be allocated the number of Unsubscribed Shares for which it actually paid in connection with the Over-Subscription Privilege. See “The Rights Offering—The Subscription Rights—Over-subscription Privilege” in the Prospectus.

The Rights are transferable during the course of the rights offering. If you purchase Rights in the open market or otherwise, and the rights offering is not completed, the purchase price paid for such Rights will not be returned to you.

Federal-Mogul is asking persons who hold shares of Common Stock beneficially and who have received the Rights distributable with respect to those shares through a broker, dealer, commercial bank, trust company or other nominee, as well as persons who hold certificates of Common Stock directly and prefer to have such institutions effect transactions relating to the Rights on their behalf, to contact the appropriate institution or nominee and request it to effect the transactions for them.

All commissions, fees and other expenses (including brokerage commissions and transfer taxes), other than fees and expenses of the Subscription Agent, incurred in connection with the exercise of the Rights will be for the account of the holder of the Rights, and none of such commissions, fees or expenses will be paid by Federal-Mogul or the Subscription Agent.

2

Enclosed are copies of the following documents:

| 1. | The Prospectus; |

| 2. | Instructions as to the Use of Federal-Mogul Holdings Corporation Rights Certificates (including a Notice of Important Tax Information and Guidelines for Request for Taxpayer Identification Number and Certification on IRS Form W-9); |

| 3. | A form of letter which may be sent to your clients for whose accounts you hold shares of Common Stock registered in your name or the name of your nominee (including a Beneficial Owner Election Form), with an attached form of instruction; and |

| 4. | Nominee Holder Certification |

Your prompt action is requested. To exercise the Rights, you should deliver the properly completed and signed Nominee Holder Certification and IRS Form W-9 or W-8, with payment of the Subscription Price in full for each share of Common Stock subscribed for pursuant to the Basic Subscription Privilege and the Over-Subscription Privilege, to the Subscription Agent, as indicated in the Prospectus. The Subscription Agent must receive the Nominee Holder Certification with payment of the Subscription Price prior to the Expiration Date. A Rights holder cannot revoke the exercise of its Rights. Rights not exercised prior to the Expiration Date will expire. Neither Federal-Mogul nor the Subscription Agent undertakes any responsibility or action to contact you concerning an incomplete or incorrect subscription form or payment, nor is Federal-Mogul under any obligation to correct such forms or payment. Federal-Mogul has the sole discretion to determine whether a subscription exercise properly complies with the subscription procedures. You bear the risk of delivery of all documents and payments, and neither Federal-Mogul nor the Subscription Agent have any responsibility for such deliveries.

Additional copies of the enclosed materials may be obtained from Federal-Mogul Investor Relations by calling (248) 354-3045. Any questions or requests for assistance concerning the rights offering should be directed to Federal-Mogul Investor Relations.

Very truly yours,

Federal-Mogul Holdings Corporation

3

Exhibit 99.3

FORM OF LETTER

FEDERAL-MOGUL HOLDINGS CORPORATION

Subscription Rights to Purchase Shares of Common Stock

Offered Pursuant to Subscription Rights

Distributed to Stockholders of Federal-Mogul Holdings Corporation

March 6, 2015

Dear Stockholder:

This letter is being distributed by Federal-Mogul Holdings Corporation (“Federal-Mogul”) to all stockholders of record of shares of its common stock, par value $0.01 per share (the “Common Stock”), at 5:00 p.m., Eastern Time, on March 6, 2015 (the “Record Date”), in connection with a distribution in a “rights offering” of transferable subscription rights (the “Rights”) to subscribe for and purchase shares of Common Stock. The Rights and Common Stock are described in the accompanying offering prospectus supplement, dated March 6, 2015 (together with the accompanying base prospectus, the “Prospectus”), covering the Rights and the shares of Common Stock issuable upon their exercise.

In the rights offering, Federal-Mogul is offering an aggregate of 19,011,407 shares of Common Stock, as described in the Prospectus.

The Rights will expire, if not exercised prior to 5:00 p.m., Eastern Time, on March 23, 2015, unless Federal-Mogul extends the offering period (the “Expiration Date”).

As described in the Prospectus, you will receive one Right for each share of Common Stock owned of record as of 5:00 p.m., Eastern Time, on the Record Date. Each Right gives the holder thereof the opportunity to purchase 0.126718 shares of Common Stock (the “Basic Subscription Privilege”) at a subscription price of $13.15 per whole share (the “Subscription Price”). As an example, if a holder owned 1,000 shares of Federal-Mogul Common Stock on the Record Date, such holder would receive 1,000 Rights that would entitle the holder to purchase 126 shares of Common Stock (126.718 rounded down to the nearest whole share of Common Stock) at the Subscription Price.

If you purchase all of the shares of Common Stock available to you pursuant to your Basic Subscription Privilege, you may also choose to purchase additional shares of Common Stock that other stockholders do not purchase through the exercise of their Basic Subscription Privilege (such shares, the “Unsubscribed Shares”) through the exercise an over-subscription privilege (such shares, determined taking into account the limitation described in the remainder of this paragraph, the “Over-Subscription Privilege”). The Over-Subscription Privilege remains subject to the availability and pro-rata allocation of shares among persons exercising their Over-Subscription Privilege and is limited to the maximum number of shares of Common Stock offered in this rights offering, less the number of shares of Common Stock purchased in the Basic Subscription Privilege. If sufficient shares of Common Stock are available, we will seek to honor each Rights holder’s over-subscription request in full. If over-subscription requests exceed the number of shares available, however, we will allocate the available shares pro-rata among the stockholders exercising the Over-Subscription Privilege in proportion to the number of shares of our Common Stock each of those stockholders owned on the Record Date, relative to the number of shares owned on the Record Date by all stockholders exercising the Over-Subscription Privilege. If this pro-rata allocation results in any stockholder receiving a greater number of shares of Common Stock than the stockholder subscribed for pursuant to the exercise of the Over-Subscription Privilege, then such stockholder will be allocated only that number of shares for which the stockholder over-subscribed, and the remaining shares will be allocated among all other stockholders exercising the Over-Subscription Privilege on the same pro-rata basis described above. The proration process will be repeated until all shares of Common Stock have been allocated.

IEH FM Holdings LLC (“IEH”), which beneficially owns approximately 80.7% of our Common Stock before giving effect to the rights offering, has indicated its intent to subscribe for its pro rata share of the rights offering under its Basic Subscription Privilege as well as its willingness to over-subscribe for additional shares, subject to availability and pro-rata allocation among other rights holders who have elected to exercise their Over-Subscription Privileges. However, there can be no assurances that IEH will exercise all or any portion of its subscription rights under the Basic Subscription Privilege or Over-Subscription Privilege.

You will be required to submit payment in full for all the shares you wish to purchase with your Basic Subscription Privilege and your Over-Subscription Privilege. Because Federal-Mogul will not know the total number of Unsubscribed Shares prior to the Expiration Date, if you wish to maximize the number of shares you may purchase pursuant to your Over-Subscription Privilege, you will need to deliver payment in an amount equal to the aggregate Subscription Price for the maximum number of shares of Common Stock available to you, assuming that no stockholders other than you have purchased any shares of Common Stock pursuant to the Basic Subscription Privilege and Over-Subscription Privilege. Fractional shares of Common Stock resulting from the exercise of the Over-Subscription Privilege will be eliminated by rounding down to the nearest whole share of Common Stock. Computershare Trust Company, N.A. (the “Subscription Agent”) will determine the over-subscription allocation based on the formula described above. Any excess subscription payments received by the Subscription Agent will be returned, without interest, as soon as practicable.

Federal-Mogul can provide no assurances that you will actually be entitled to purchase the number of shares of Common Stock issuable upon the exercise of your Over-Subscription Privilege in full. Federal-Mogul will not be able to satisfy your exercise of the Over-Subscription Privilege if the rights offering is subscribed in full, and Federal-Mogul will only honor an Over-Subscription Privilege to the extent sufficient shares of Common Stock are available following the exercise of subscription rights under the Basic Subscription Privilege, subject to the limitations set forth above.

To the extent the aggregate Subscription Price of the maximum number of Unsubscribed Shares available to you pursuant to the Over-Subscription Privilege is less than the amount you actually paid in connection with the exercise of the Over-Subscription Privilege, you will be allocated only the number of Unsubscribed Shares available to you as soon as practicable after the Expiration Date, and your excess subscription payment received by the Subscription Agent will be returned, without interest, as soon as practicable.

To the extent the amount you actually paid in connection with the exercise of the Over-Subscription Privilege is less than or equal to the aggregate Subscription Price of the maximum number of Unsubscribed Shares available to you pursuant to the Over-Subscription Privilege, you will be allocated the number of Unsubscribed Shares for which you actually paid in connection with the Over-Subscription Privilege. See “The Rights Offering—The Subscription Rights—Over-subscription Privilege” in the Prospectus.

The Rights are evidenced by a transferable Rights certificate (the “Rights Certificate”) registered in your name and will cease to have any value at the Expiration Date. The Rights are transferable during the course of the rights offering. If you purchase Rights in the open market or otherwise, and the rights offering is not completed, the purchase price paid for such Rights will not be returned to you.

Enclosed are copies of the following documents:

| 1. | The Prospectus; |

| 2. | A Rights Certificate evidencing the Rights for which you are the holder of record; and |

| 3. | Instructions as to the Use of Federal-Mogul Holdings Rights Certificates (including a Notice of Important Tax Information and Guidelines for Request for Taxpayer Identification Number and Certification on IRS Form W-9). |

2

Your prompt action is requested. To exercise the Rights, you should deliver the properly completed and signed Rights Certificate and IRS Form W-9 or W-8, with payment of the Subscription Price in full for each share of Common Stock subscribed for pursuant to the Basic Subscription Privilege and the Over-Subscription Privilege, to the Subscription Agent, as indicated in the Prospectus. The Subscription Agent must receive the Rights Certificate and IRS Form W-9 or W-8 with payment of the Subscription Price prior to the Expiration Date. A Rights holder cannot revoke the exercise of its Rights. Rights not exercised prior to the Expiration Date will expire. Neither Federal-Mogul nor the Subscription Agent undertakes any responsibility or obligation to contact you concerning an incomplete or incorrect subscription form or payment, nor is Federal-Mogul or the Subscription Agent under any obligation to correct such forms or payment. Federal-Mogul has the sole discretion to determine whether a subscription exercise properly complies with the subscription procedures. You bear the risk of delivery of all documents and payments, and neither Federal-Mogul nor the Subscription Agent have any responsibility for such deliveries.

Additional copies of the enclosed materials may be obtained from Federal-Mogul Investor Relations by calling (248) 354-3045. Any questions or requests for assistance concerning the rights offering should be directed to Federal-Mogul Investor Relations.

Very truly yours,

Federal-Mogul Holdings Corporation

3

Exhibit 99.4

FORM OF LETTER

FEDERAL-MOGUL HOLDINGS CORPORATION

Subscription Rights to Purchase Shares of Common Stock

Offered Pursuant to Subscription Rights

Distributed to Stockholders of

Federal-Mogul Holdings Corporation

March 6, 2015

To Our Clients:

Enclosed for your consideration is a prospectus supplement, dated March 6, 2015 (together with the accompanying base prospectus, the “Prospectus”) which relates to the “rights offering” by Federal-Mogul Holdings Corporation (“Federal-Mogul”) of shares of Federal-Mogul’s common stock, par value $0.01 per share (the “Common Stock”), pursuant to transferable subscription rights (the “Rights”) distributed to all stockholders of record of shares of Common Stock at 5:00 p.m., Eastern Time, on March 6, 2015 (the “Record Date”). The Rights and Common Stock are described in the Prospectus.

In the rights offering, Federal-Mogul is offering an aggregate amount of 19,011,407 shares of Common Stock, as described in the Prospectus.

The Rights will expire if not exercised prior to 5:00 p.m., Eastern Time, on March 23, 2015, unless Federal-Mogul extends the rights offering period (the “Expiration Date”). All Rights not exercised prior to 5:00 p.m., Eastern Time on the Expiration Date shall be null and void.

As described in the Prospectus, you will receive one Right for each share of Common Stock owned of record as of 5:00 p.m., Eastern Time, on the Record Date. Each Right gives the holder thereof the opportunity to purchase 0.126718 shares of Common Stock (the “Basic Subscription Privilege”) at a subscription price of $13.15 per whole share (the “Subscription Price”). As an example, if a holder owned 1,000 shares of Federal-Mogul Common Stock on the Record Date, such holder would receive 1,000 Rights that would entitle the holder to purchase 126 shares of Common Stock (126.718 rounded down to the nearest whole share of Common Stock) at the Subscription Price.

If you purchase all of the shares of Common Stock available to you pursuant to your Basic Subscription Privilege, you may also choose to purchase additional shares of Common Stock that other stockholders do not purchase through the exercise of their Basic Subscription Privilege (such shares, the “Unsubscribed Shares”) through the exercise an over-subscription privilege (such shares, determined taking into account the limitation described in the remainder of this paragraph, the “Over-Subscription Privilege”). The Over-Subscription Privilege remains subject to the availability and pro-rata allocation of shares among persons exercising their Over-Subscription Privilege and is limited to the maximum number of shares of Common Stock offered in this rights offering, less the number of shares of Common Stock purchased in the Basic Subscription Privilege. If sufficient shares of Common Stock are available, Federal-Mogul will seek to honor each Rights holder’s over-subscription request in full. If over-subscription requests exceed the number of shares available, however, Federal-Mogul will allocate the available shares pro-rata among the stockholders exercising the Over-Subscription Privilege in proportion to the number of shares of our Common Stock each of those stockholders owned on the Record Date, relative to the number of shares owned on the Record Date by all stockholders exercising the Over-Subscription Privilege. If this pro-rata allocation results in any stockholder receiving a greater number of shares of Common Stock than the stockholder subscribed for pursuant to the exercise of the Over-Subscription Privilege, then such stockholder will be allocated only that number of shares for which the stockholder over-subscribed, and the remaining shares will be allocated among all other stockholders exercising the Over-Subscription Privilege on the same pro-rata basis described above. The proration process will be repeated until all shares of Common Stock have been allocated.

IEH FM Holdings LLC (“IEH”), which beneficially owns approximately 80.7% of our Common Stock before giving effect to the rights offering, has indicated its intent to subscribe for its pro rata share of the rights offering under its Basic Subscription Privilege as well as its willingness to over-subscribe for additional shares, subject to availability and pro-rata allocation among other rights holders who have elected to exercise their Over-Subscription Privileges. However, there can be no assurances that IEH will exercise all or any portion of its subscription rights under the Basic Subscription Privilege or Over-Subscription Privilege.

You will be required to submit payment in full for all the shares you wish to purchase with your Basic Subscription Privilege and your Over-Subscription Privilege. Because Federal-Mogul will not know the total number of Unsubscribed Shares prior to the Expiration Date, if you wish to maximize the number of shares you may purchase pursuant to your Over-Subscription Privilege, you will need to deliver payment in an amount equal to the aggregate Subscription Price for the maximum number of shares of Common Stock available to you, assuming that no stockholders other than you have purchased any shares of Common Stock pursuant to the Basic Subscription Privilege and Over-Subscription Privilege. Fractional shares of Common Stock resulting from the exercise of the Over-Subscription Privilege will be eliminated by rounding down to the nearest whole share of Common Stock. Computershare Trust Company, N.A. (the “Subscription Agent”) will determine the over-subscription allocation based on the formula described above. Any excess subscription payments received by the Subscription Agent will be returned, without interest, as soon as practicable.

Federal-Mogul can provide no assurances that you will actually be entitled to purchase the number of shares of Common Stock issuable upon the exercise of its Over-Subscription Privilege in full. Federal-Mogul will not be able to satisfy your exercise of the Over-Subscription Privilege if the rights offering is subscribed in full, and Federal-Mogul will only honor an Over-Subscription Privilege to the extent sufficient shares of Common Stock are available following the exercise of subscription rights under the Basic Subscription Rights, subject to the limitations set forth above.

To the extent the aggregate Subscription Price of the maximum number of Unsubscribed Shares available to you pursuant to the Over-Subscription Privilege is less than the amount you actually paid in connection with the exercise of the Over-Subscription Privilege, you will be allocated only the number of Unsubscribed Shares available to you as soon as practicable after the Expiration Date, and your excess subscription payment received by the Subscription Agent will be returned, without interest, as soon as practicable.

To the extent the amount you actually paid in connection with the exercise of the Over-Subscription Privilege is less than or equal to the aggregate Subscription Price of the maximum number of Unsubscribed Shares available to you pursuant to the Over-Subscription Privilege, you will be allocated the number of Unsubscribed Shares for which you actually paid in connection with the Over-Subscription Privilege. See “The Rights Offering—The Subscription Rights—Over-subscription Privilege” in the Prospectus.

The Rights are transferable during the course of the rights offering. If you instruct us to purchase Rights in the open market or otherwise, and the rights offering is not completed, the purchase price paid for such Rights will not be returned to us or to you.

THE MATERIALS ENCLOSED ARE BEING FORWARDED TO YOU AS THE BENEFICIAL OWNER OF COMMON STOCK CARRIED BY US IN YOUR ACCOUNT BUT NOT REGISTERED IN YOUR NAME. EXERCISES AND SALES OF RIGHTS MAY BE MADE ONLY BY US AS THE RECORD OWNER AND PURSUANT TO YOUR INSTRUCTIONS.

| 1. | Notice of Important Tax Information and Guidelines for Request for Taxpayer Identification Number and Certification on IRS Form W-9 or IRS Form W-8. |

Each Rights holder who is a “United States person,” within the meaning of the Internal Revenue Code of 1986, as amended, who elects to exercise Rights must provide the Subscription Agent with a correct Taxpayer Identification Number (“TIN”) on IRS Form W-9. A Rights holder who is not a United States person must

2

provide an appropriate IRS Form W-8 and any applicable attachments. Please consult your own tax advisor as to the appropriate IRS Form W-8 to provide. Copies of IRS Form W-9 or the various IRS Form W-8s may be obtained upon request at the address set forth above or are available at www.irs.gov. In general, the failure to provide the required information on the IRS Form W-9 may subject a United States person Rights holder to a $100.00 penalty for each such failure and to U.S. federal income tax backup withholding (currently at a 28% rate) with respect to dividends that may be paid by Federal-Mogul on shares of Common Stock purchased upon the exercise of Rights (for those holders exercising Rights). In general, Rights holders who are not United States persons and who fail to provide a properly completed IRS Form W-8 will also be subject to backup withholding.

Accordingly, we request instructions as to whether you wish us to elect to subscribe for any shares of Common Stock to which you are entitled pursuant to the terms and subject to the conditions set forth in the enclosed Prospectus. However, we urge you to read the Prospectus carefully before instructing us to exercise your Rights.

If you wish to have us, on your behalf, exercise the Rights for any shares of Common Stock to which you are entitled, please so instruct us by completing, executing and returning to us the instruction form on the reverse side of this letter.

Your instructions and properly completed and executed IRS Form W-9 or W-8 to us should be forwarded as promptly as possible in order to permit us to exercise Rights on your behalf in accordance with the provisions of the rights offering. The rights offering will expire at the Expiration Date. Once you have exercised the Basic Subscription Right or the Over-Subscription Right, such exercise may not be revoked.

Additional copies of the enclosed materials may be obtained from Federal-Mogul Investor Relations by calling (248) 354-3045. Any questions or requests for assistance concerning the rights offering should be directed to Federal-Mogul Investor Relations.

Very truly yours,

3

Exhibit 99.5

BENEFICIAL OWNER ELECTION FORM

The undersigned acknowledge(s) receipt of your letter and the enclosed materials relating to the grant of transferable rights (the “Rights”) to purchase shares of common stock, par value $0.01 per share (the “Common Stock”), of Federal-Mogul Holdings Corporation (“Federal-Mogul”).

With respect to any instructions to exercise (or not to exercise) Rights, the undersigned acknowledges that this form must be completed and returned such that it will actually be received by you by 5:00 p.m., Eastern Time, March 20, 2015, the last business day prior to the scheduled expiration date of the rights offering of March 23, 2015, unless Federal-Mogul extends the offering period. All Rights not exercised prior to 5:00 p.m., Eastern Time on March 23, 2015 shall be null and void.

This will instruct you whether to exercise Rights to purchase shares of Common Stock distributed with respect to the shares of Common Stock held by you as record holder for the account of the undersigned, pursuant to the terms and subject to the conditions set forth in the prospectus supplement dated March 6, 2015 (together with the accompanying base prospectus, the “Prospectus”) and the related “Instructions as to Use of Federal-Mogul Holdings Rights Certificates.”

I (we) hereby instruct you as follows:

(CHECK THE APPLICABLE BOXES AND PROVIDE ALL REQUIRED INFORMATION)

| Box 1. | ¨ | Please DO NOT EXERCISE RIGHTS for shares of Common Stock. | ||

| Box 2. | ¨ | Please EXERCISE RIGHTS for shares of Common Stock as set forth below: |

| (a) | EXERCISE OF BASIC SUBSCRIPTION PRIVILEGE: |

I subscribe for:

(No. of shares of Common Stock) x $13.15 (Subscription Price) = $ (Payment)

To determine No. of shares of Common Stock above, multiply the number of Rights you wish to exercise by 0.126718 and round down to the nearest whole share of Common Stock.

| (b) | EXERCISE OF OVER-SUBSCRIPTION PRIVILEGE*: If you have exercised your Basic Subscription Privilege in full and wish to subscribe for additional shares of Common Stock pursuant to your Over-Subscription Privilege: |

I subscribe for:

(No. of shares of Common Stock) x $13.15 (Subscription Price) = $ (Payment)

| (c) | TOTAL AMOUNT OF PAYMENT ENCLOSED $ (the total of (a) and (b)) |

| * | The Over-Subscription Privilege may be exercised only up to the number of shares purchased under the Basic Subscription Privilege and subject to the limitation that, if any Over-Subscription Privileges are exercised, Federal-Mogul will not issue a number of shares in excess of 19,011,407 shares of Common Stock pursuant to the exercise of Basic Subscription Privileges and Over-Subscription Privileges. |

| Box 3. | ¨ | Payment in the following amount is enclosed: $ | ||

| Box 4. | ¨ | Please deduct payment of $ from the following account maintained by you as follows: |

(The total of Box 3 and Box 4 must equal the total payment specified above.)

Type of Account Account No.

I (we) on my (our) own behalf, or on behalf of any person(s) on whose behalf, or under whose directions, I am (we are) signing this form:

| • | irrevocably elect to purchase the number of shares of Common Stock indicated above upon the terms and conditions specified in the Prospectus; and |

| • | agree that if I (we) fail to pay for the shares of Common Stock I (we) have elected to purchase, you may exercise any remedies available to you under law. |

Name of beneficial owner(s):

Signature of beneficial owner(s):

If you are signing in your capacity as a trustee, executor, administrator, guardian, attorney-in-fact, agent, officer of a corporation or another acting in a fiduciary or representative capacity, please provide the following information:

Name:

Capacity:

Address (including Zip Code):

Telephone Number:

2

Exhibit 99.6

FEDERAL-MOGUL HOLDINGS CORPORATION

NOMINEE HOLDER CERTIFICATION

The undersigned, a broker, dealer, custodian bank, trustee, depositary or other nominee holder of transferable rights (the “Rights”) to purchase shares of common stock (“Common Stock”) of Federal-Mogul Holdings Corporation (“Federal-Mogul”) pursuant to the rights offering described and provided for in the Federal-Mogul prospectus supplement dated March 6, 2015 (together with the accompanying base prospectus, the “Prospectus”), hereby certifies to Federal-Mogul and Computershare Trust Company, N.A., as subscription agent for the rights offering, that (1) the undersigned has exercised, on behalf of the beneficial owners thereof (which may include the undersigned), the number of Rights specified below pursuant to the basic subscription right (as defined in the Prospectus), and on behalf of beneficial owners of Rights who have subscribed for the purchase of additional shares of Common Stock pursuant to the over-subscription privilege (as defined in the Prospectus), the number of shares specified below pursuant to the over-subscription right, listing separately below each such exercised basic subscription right and the corresponding over-subscription right (without identifying any such beneficial owner), and (2) to the extent a beneficial owner has elected to subscribe for shares pursuant to the over-subscription right, each such beneficial owner’s basic subscription right has been exercised in full:

Provide the following information if applicable:

| Number of Shares Owned on the Record Date |

Number of Shares Subscribed for Pursuant to Basic Subscription Privilege |

Number of Shares Subscribed for Pursuant to Over- Subscription Privilege | ||||

| 1. |

| |||||

| 2. |

| |||||

| 3. |

| |||||

| 4. |

| |||||

| 5. |

| |||||

| 6. |

| |||||

| 7. |

| |||||

DEPOSITORY TRUST COMPANY (“DTC”)

Participant Number

[NAME OF NOMINEE]

| By: | ||

| Name: | ||

| Title | ||

DTC Basic Subscription Confirmation Number(s)

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Linklogis Releases 2023 ESG Report: Serving RMB19.2 Billion of Transactions Related to Sustainable Supply Chains

- Galway Metals Announces Closing of Private Placement of Flow-Through Units

- Methanex Reports on Annual General Meeting of Shareholders and Welcomes Roger Perreault to Its Board of Directors

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share