Form 8-K FAIRPOINT COMMUNICATIONS For: May 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 10, 2016

FairPoint Communications, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 001-32408 | 13-3725229 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

521 East Morehead Street, Suite 500, Charlotte, North Carolina | 28202 | |||

(Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code (704) 344-8150

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 | Regulation FD Disclosure |

FairPoint Communications, Inc. (the "Company") plans to conduct a series of investor presentations and meetings at which the Company will use the presentation included as Exhibit 99.1 to this Current Report on Form 8-K (the "Investor Presentation").

Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

Exhibit Number | Description | |

99.1 | Investor Presentation | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FAIRPOINT COMMUNICATIONS, INC. | ||||

By: | /s/ Ajay Sabherwal | |||

Name: | Ajay Sabherwal | |||

Title: | Executive Vice President and Chief Financial Officer | |||

Date: May 10, 2016

EXHIBIT INDEX

Exhibit Number | Description | |

99.1 | Investor Presentation | |

Updated May 10, 2016 with financial data through March 31, 2016 Company Presentation

2 Safe Harbor Statement The information contained herein is current only as of the date hereof; however, unless otherwise indicated, financial information contained herein is as of March 31, 2016. The business, prospects, financial condition or performance of FairPoint Communications, Inc. (“FairPoint”) and its subsidiaries described herein may have changed since that date. FairPoint does not intend to update or otherwise revise the information contained herein. FairPoint makes no representation or warranty, express or implied, as to the completeness of the information contained herein. Market data used throughout this presentation is based on surveys and studies conducted by third parties, as well as industry and general publications. FairPoint has no obligation (express or implied) to update any or all of the information or to advise you of any changes; nor does FairPoint make any express or implied warranties or representations as to the completeness or accuracy nor does it accept responsibility for errors. Some statements herein are known as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include, but are not limited to, statements about our plans, objectives, expectations and intentions and other statements contained herein that are not historical facts. When used herein, the words “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “continue,” “outlook” and similar expressions are generally intended to identify forward-looking statements. Because these forward-looking statements involve known and unknown risks and uncertainties, there are important factors that could cause actual results, events or developments to differ materially from those expressed or implied by these forward-looking statements, including our plans, objectives, expectations and intentions and other factors, including those factors discussed under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and other factors discussed in reports that we file with the Securities and Exchange Commission. You should not place undue reliance on such forward-looking statements, which are based on the information currently available to us and speak only as of the date hereof. FairPoint does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. We provide guidance as to certain financial information herein, which consists of forward-looking statements. Our guidance is not prepared with a view toward compliance with the published guidelines of the American Institute of Certified Public Accountants, and neither our independent registered public accounting firm nor any other independent expert or outside party compiles or examines the guidance and, accordingly, no such person expresses any opinion or any other form of assurance with respect thereto. Guidance is based upon a number of assumptions and estimates that, while presented with numerical specificity, are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and are based upon specific assumptions with respect to future business decisions, some of which will change. We generally state possible outcomes as high and low ranges which are intended to provide a sensitivity analysis as variables are changed but are not intended to represent our actual results which could fall outside of the suggested ranges. The principal reason that we release this data is to provide a basis for our management to discuss our business outlook with analysts and investors. Notwithstanding this, we do not accept any responsibility for any projections or reports published by any such outside analysts or investors. Guidance is necessarily speculative in nature, and it can be expected that some or all of the assumptions or the guidance furnished by us will not materialize or will vary significantly from actual results. Accordingly, our guidance is only an estimate of what management believes is realizable as of the date hereof. Actual results may vary from the guidance and the variations may be material. Investors should also recognize that the reliability of any forecasted financial data diminishes the farther in the future that the data is forecast. In light of the foregoing, investors are urged to put the guidance in context and not to place undue reliance on it. Any inability to successfully implement our operating strategy or the occurrence of any of the events or circumstances discussed therein could result in the actual operating results being different than the guidance, and such differences may be material.

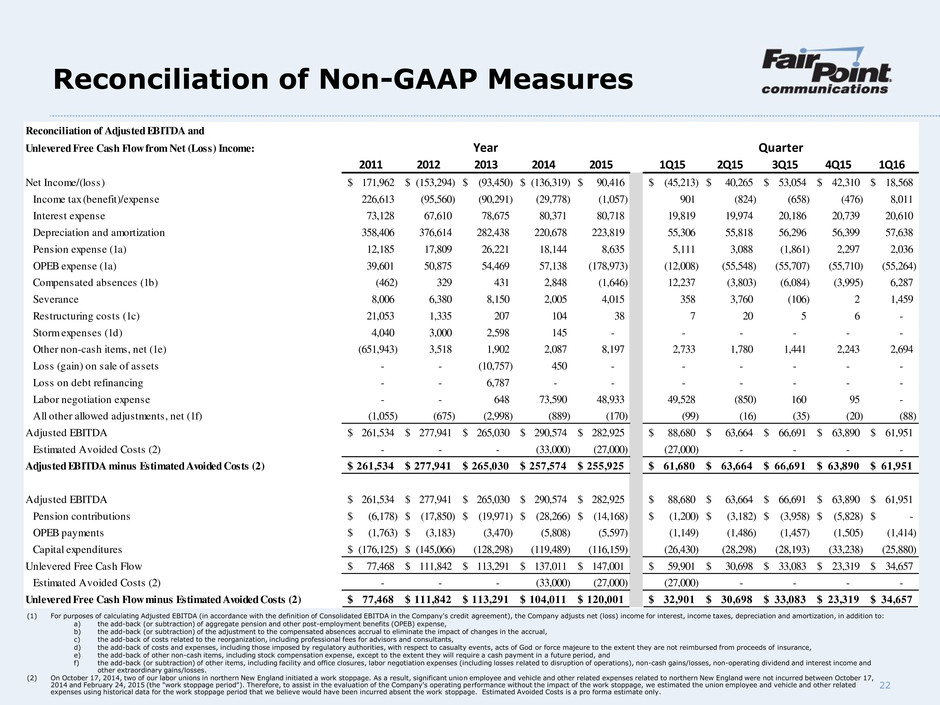

3 Non-GAAP Financial Measures The Company uses certain non-GAAP financial measures in evaluating its performance. Throughout this presentation, reference is made to Adjusted EBITDA, Adjusted EBITDA minus Estimated Avoided Costs, Unlevered Free Cash Flow, Unlevered Free Cash Flow minus Estimated Avoided Costs and adjustments to GAAP and non-GAAP measures to exclude the effect of special items. Management believes the non-GAAP measures are useful for investors because they enable them to view performance in a manner similar to the method used by the Company’s management. Unlevered Free Cash Flow and Unlevered Free Cash Flow minus Estimated Avoided Costs may also be useful to investors in assessing the Company’s ability to generate cash and meet its debt service requirements. The maintenance covenants contained in the Company’s credit facility are based on Adjusted EBITDA. In addition, management believes that the adjustments to GAAP and non-GAAP measures to exclude the effect of special items may be useful to investors in understanding period- to-period operating performance and in identifying historical and prospective trends. On October 17, 2014, two of our labor unions in northern New England initiated a work stoppage. As a result, significant union employee and vehicle and other related expenses related to northern New England were not incurred between October 17, 2014 and February 24, 2015 (the "work stoppage period"). Therefore, to assist in the evaluation of the Company's operating performance without the impact of the work stoppage, we estimated the union employee and vehicle and other related expenses using historical data for the work stoppage period that we believe would have been incurred absent the work stoppage ("Estimated Avoided Costs"). Estimated Avoided Costs is a pro forma estimate only. The non-GAAP financial measures, as used herein, are not necessarily comparable to similarly titled measures of other companies. Furthermore, these non-GAAP measures have limitations as analytical tools and should not be considered in isolation from, or as an alternative to, net income or loss, operating income, cash flow or other combined income or cash flow data prepared in accordance with GAAP. Because of these limitations, Adjusted EBITDA, Adjusted EBITDA minus Estimated Avoided Costs, Unlevered Free Cash Flow, Unlevered Free Cash Flow minus Estimated Avoided Costs should not be considered as measures of discretionary cash available to invest in business growth or reduce indebtedness. The Company compensates for these limitations by relying primarily on its GAAP results and using the non-GAAP measures only supplementally. A reconciliation of Net Income (Loss) to Adjusted EBITDA, Adjusted EBITDA minus Estimated Avoided Costs, Unlevered Free Cash Flow, and Unlevered Free Cash Flow minus Estimated Avoided Costs can be found in the appendix of this presentation. The information in this document should be read in conjunction with the financial statements and footnotes contained in our documents filed with the U.S. Securities and Exchange Commission.

4 Unlevered Free Cash Flow(1) Company Snapshot Overview ̶ Operates in 17 states ̶ 21,000+ fiber route mile network including over 17,000 fiber route miles in northern New England ̶ Proven track record of Unlevered Free Cash Flow generation (1) Unlevered Free Cash Flow (UFCF) means Adjusted EBITDA minus the sum of pension contributions, OPEB payments and capital expenditures. Unlevered Free Cash Flow is a non-GAAP financial measure. A reconciliation of Net Income (Loss) to Adjusted EBITDA and Unlevered Free Cash Flow can be found in the appendix of this presentation. In addition, to assist in the evaluation of the Company’s operating performance without the impact of the work stoppage, we estimated the union employee and vehicle and other related expenses using historical data for the work stoppage period that we believe would have been incurred absent the work stoppage (“Estimated Avoided Costs”). Estimated Avoided Costs have been subtracted from our 2014 and 2015 UFCF results. (2) Approximately 20% of Telecom Group is located in ME, NH and VT Service Territory Northern New England (NNE): ̶ Incumbent wireline provider with extensive “enterprise class” network and scale in three contiguous states of Maine, New Hampshire and Vermont ̶ Over 1,900 Fiber-to-the-tower (FTTT) Ethernet backhaul connections ̶ Direct fiber connections to nearly 3,000 buildings ̶ 32 markets with access to Ethernet connections capable of symmetrical, dedicated data transport speeds of up to 1Gig ̶ Relatively low market share of both residential and business customers ̶ ~90% broadband availability Telecom Group(2): ̶ Consistent, substantial cash flow generation ̶ Local presence and workforce; less competition ̶ ~90% broadband availability $77 $112 $113 $104 $120 $105 to $120 $50 $100 $150 2011 2012 2013 2014 2015 2016(F) (In Millions)

5 Albany Boston Northern New England Network 350 Central Offices Over 17,000 Fiber Route Miles Network • 400G DWDM ROADM • 10G/1G EPS aggregation rings to all 350 offices • IP/MPLS core with terabit routing capacity and NGN design Network extensions • 1 Summer St, Boston MA (on-net) • 80 State St, Albany NY (on-net) • 60 Hudson St, NYC NY (leased 10G waves) Network Operations Center • 24/7/365 network operations and data services center Data Center Capabilities • On-net enterprise data services facility in New Hampshire • Bundled product with CES Over $900 million invested in infrastructure and technology since 2008 VT 93% ME 88% NH 95% Broadband Coverage New York Enterprise Class fiber network designed to meet growing demand of business customers

6 Improve Operations 2011 Focus Competitive Advantages Built from Execution of the Four Pillar Strategy Change Regulatory Environment 2012 Focus Transform and Stabilize Revenue 2013 Focus Execute HR Strategy 2014 Focus C O M P E T IT IV E A D V A N T A G E S Superior Network • High capacity and resilient network • More than 21,000 route miles of fiber • Largest ubiquitous fiber network in NNE • Leverageable network assets in TG Outstanding Operating Platform • Track record of disciplined management and execution of complex projects on time and on budget • Talented and knowledgeable people working collaboratively Technology Development Capability • Proven ability to develop and deploy market-driven, industry-leading products across the full spectrum of customers • Strong vision of market and industry trends FOUNDATION BUILT ON SUCCESSFUL EXECUTION OF FOUR PILLAR STRATEGY

7 Taking Action to Leverage Our Competitive Advantages A C T IO N S Enhance and Leverage the Network Enable Effective and Secure Technology Generate New and Sustain Existing Revenue Provide Excellent Customer Service FOUNDATION BUILT ON SUCCESSFUL EXECUTION OF FOUR PILLARS C O M P E T IT IV E A D V A N T A G E S Superior Network Outstanding Operating Platform Technology Development Capability A C T IO N S Enhance and Leverage the Network Develop Effective and Secure Technology Generate New and Sustain Existing Revenue Provide Excellent Customer Service

8 Develop Effective and Secure Technology Enhance and Leverage the Network • Reach unserved and underserved areas through CAF II and other funding sources Accepted $37.4 million in annual funding plus additional transitional funding to build and operate infrastructure to provide 10 Mbps down/1 Mbps up broadband service to approximately 106,000 unserved and underserved locations in 14 states Build out will aid broadband subscriber growth Lower operating costs by hardening the network and reducing repeat troubles • Contribute to the economic success of our communities through continued infrastructure investment Economic vitality enhances business customer prospects Areas of Focus: • Strategically extend and strengthen the network making it more resilient and redundant Provides opportunities to add new customers and upgrade service to existing customers • Continue to strengthen and broaden core technology competencies Dedicated team of Customer Project Managers and IT, Network and Project Managers Highly experienced customer facing team with a proven track record of success • Anticipate customer needs and continue the development and deployment cycle Developed and deployed Hosted PBX solution and other managed services Best in class FTTT provider and collaborating with small cell providers on solution development • Evolve customer-facing technology to improve the customer experience Enhance customer self-serve portals and online interaction

9 Provide Excellent Customer Service Generate New and Sustain Existing Revenue • Apply an optimal balance of transactional and relationship selling techniques to maximize revenue Fully understand customer needs and advanced products to deliver value-added solutions Maintain consistent outreach activity to identify and close new customers • Utilize expertise to develop customized solutions From basic to complex, provide thought leadership in developing and delivering solutions • Nimbly react to industry forces Understand the competitive challenges and opportunities in our markets • Identify and capitalize on edge-out opportunities Areas of Focus: • Provide communications and product solutions to address the needs of our customers Utilize our network assets and technological expertise to be the first choice for communications solutions in the markets we serve • Continue to enhance processes to efficiently deliver reliable and responsive customer service As the face of the FairPoint brand, the operations team will continue to realign and transform, establishing higher standards for performance, productivity and the customer experience Drive discipline in processes and procedures to ensure a reliable customer experience Utilize operational metrics to be more efficient and effective Systematic testing tools to reduce truck rolls • Continue to expand and evolve technical competencies aligned to new products and emerging technologies Attract and retain talented team members that allow us to provide leading edge solutions to our customers

10 A CTION S Enhance and Leverage the Network Develop Effective and Secure Technology Generate New and Sustain Existing Revenue Provide Excellent Customer Service FOUNDATION BUILT ON SUCCESSFUL EXECUTION OF FOUR PILLAR STRATEGY C O M P E T IT IV E A D V A N T A G E S Superior Network Outstanding Operating Platform Technology Development Capability Positive Outcomes from Strategy Execution O U T C O M E S Brand Awareness and Support •Leveraging our competitive advantages, our goal is to be the most reliable, responsive and responsible provider of effective and secure communications services Growth and Scale •A path to revenue stability and organic scale generated through execution of our strategy •A resilient network and a competitive offering of reliable products and services will support a more loyal customer base and lower churn

11 Revenue by Strategic Category Transform, Stabilize and Grow Transforming Revenue while Mitigating Year-over-year Declines (1) 1Q11 revenue of $254.8 million (2) 1Q16 revenue of $206.8 million 1Q 2016(2) 5-Year Outlook (2019) Growth = +6% to +10% CAGR Legacy = -5% to -9% CAGR Convertible = -7% to -11% CAGR 1Q 2011(1) Projected Growth Rate Growth = +17% CAGR Legacy = -9% CAGR Convertible = -11% CAGR Historic Growth Rate • Growth revenues are comprised of products such as Retail and Wholesale Ethernet, Hosted Voice, Broadband and FTTT • Sales and marketing efforts focused on driving acceleration of Growth products including the evaluation of new products and services • Convertible revenues are moving from older technologies like Centrex, ATM and Frame Relay • Proactive re-terming and up-selling designed to reduce revenue churn as Convertible customers switch from TDM to IP/Ethernet • Legacy revenues are in managed decline and comprised of Residential Voice and Switched Access • Retention efforts and rate increases structured to slow churn in Legacy category • Regulatory revenues are certain federal and state government funding including: CAF Phase II support, CAF Phase II transition funding, CAF Phase I frozen support, CAF funding under the CAF/ICC Order, and universal service fund support Gr o w th R e v . Strike (Millions) (Millions) (Millions)

12 Actively Manage Expense Structure Focused on meeting Unlevered Free Cash Flow expectations Circuits, Network & Fleet 26% Facilities 8% Contracted Services 6% Employee Expenses 50% Operating Taxes & Other 7% Marketing 4% 3, 26 1 3, 26 0 2, 99 9 2, 86 0 2, 78 7 2, 81 6 2, 80 9 2, 78 4 2, 75 2 2, 69 8 2, 63 1 2, 62 9 2, 63 7 2, 62 9 2, 57 4 2, 55 3 2, 50 3 2, 46 5 2, 27 8 2, 25 9 2, 25 4 74 7 74 9 69 1 68 1 66 7 59 4 58 9 58 5 56 9 55 7 55 1 54 2 52 9 53 1 51 4 49 9 49 1 46 6 45 0 45 9 45 1 2,000 3,000 4,000 Q1'11 Q3'11 Q1'12 Q3'12 Q1'13 Q3'13 Q1'14 Q3'14 Q1'15 Q3'15 Q1'16 NNE Telecom (No. of Employees) (2) • 33% workforce reduction in last 5 years • 2,704 employees as of March 31, 2016 ̶ 1,061 non-represented. 1,644 represented (approx. 1,453 in NNE covered by new CBAs ratified Feb. 22, 2015) • Completed recent workforce reduction plan in July, 2015 Headcount Rationalization 33%(3) ~$604M Cost Structure (TG + NNE)(1) • Utilize enhanced flexibility from new CBAs and new processes identified during the strike to enhance productivity • Continue to groom network to minimize ongoing costs • Minimize contracted services costs and continue effective management of operating taxes • Refine marketing approach to be more effective and efficient (1) FY 2015 adjusted for items added back to compute Adjusted EBITDA. In addition, to assist in the evaluation of the Company’s operating performance without the impact of the work stoppage, we estimated the union employee and vehicle and other related expenses using historical data for the work stoppage period that we believe would have been incurred absent the work stoppage (“Estimated Avoided Costs”). Those costs are included in the approximately $604 million cost structure. (2) NNE = Yellow, Telecom Group = Blue (3) Decrease represents total change in workforce since 1Q11

13 $198 $176 $145 $128 $120 $116 $115 to $120 18.5% 17.1% 14.9% 13.7% 5.0% 7.0% 9.0% 11.0% 13.0% 15.0% 17.0% 19.0% $80 $100 $120 $140 $160 $180 $200 $220 $240 2010 2011 2012 2013 2014 2015 2016(F) Disciplined Approach to Cap Ex (Capital expenditures by year and as a % of revenue ($ in M)) Cap Ex Trend and Allocation Regular Regulatory FTTT O pt im a l L e v e l: L o w te e n s as a % o f R e v . Success-based Network Growth Non-revenue generating • Cap Ex managed through regular review of priorities and initiatives • Cap Ex trending toward optimal level • Completion of CAF II related builds will likely push Cap Ex slightly higher but Cap Ex intensity (Cap Ex divided by Revenue) is expected to remain in the low teens • Success-based includes spending directly attributable to sales • Network growth includes fiber expansion, broadband build-out and speed upgrades • Non-revenue generating includes IT, plant maintenance and cost saving projects Optimizing Cap Ex Levels 13.3% Focused on meeting Unlevered Free Cash Flow expectations 13.5%

14 Sustainable Unlevered Free Cash Flow Superior Operating Platform Proven Expense Mgmt. Disciplined Cap Ex New Collective Bargain- ing Agree- ments Committed to Driving Unlevered Free Cash Flow $ 7 7 $ 1 1 2 $ 1 1 3 $ 1 0 4 $ 1 2 0 $ 1 0 5 to $ 1 2 0 $50 $100 $150 2011 2012 2013 2014 2015 2016(F) (In Millions) Unlevered Free Cash Flow

15

16 Appendix

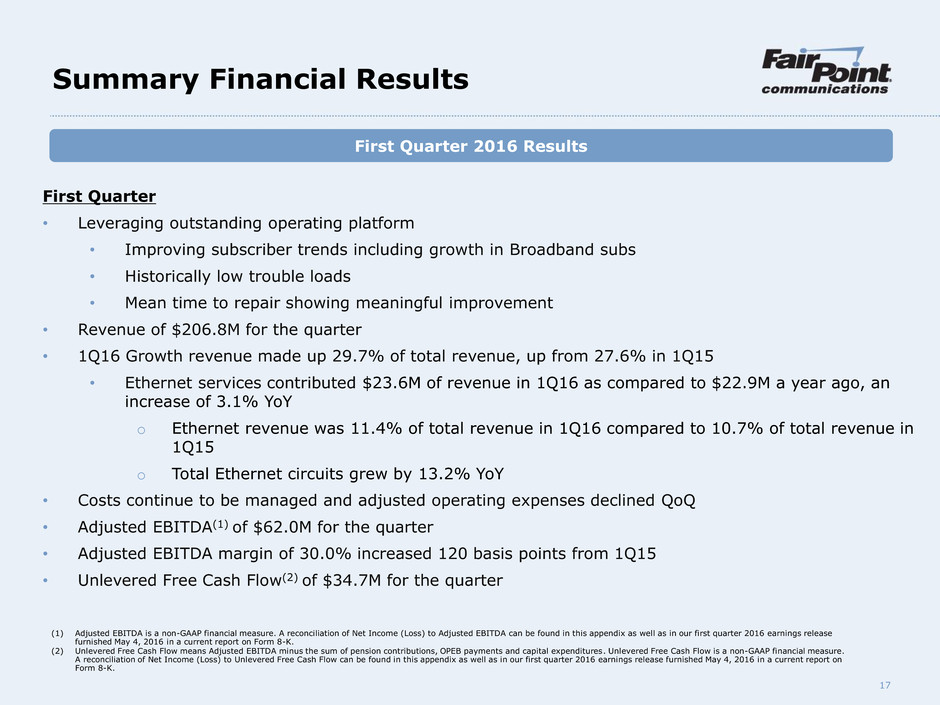

17 Summary Financial Results (1) Adjusted EBITDA is a non-GAAP financial measure. A reconciliation of Net Income (Loss) to Adjusted EBITDA can be found in this appendix as well as in our first quarter 2016 earnings release furnished May 4, 2016 in a current report on Form 8-K. (2) Unlevered Free Cash Flow means Adjusted EBITDA minus the sum of pension contributions, OPEB payments and capital expenditures. Unlevered Free Cash Flow is a non-GAAP financial measure. A reconciliation of Net Income (Loss) to Unlevered Free Cash Flow can be found in this appendix as well as in our first quarter 2016 earnings release furnished May 4, 2016 in a current report on Form 8-K. First Quarter 2016 Results First Quarter • Leveraging outstanding operating platform • Improving subscriber trends including growth in Broadband subs • Historically low trouble loads • Mean time to repair showing meaningful improvement • Revenue of $206.8M for the quarter • 1Q16 Growth revenue made up 29.7% of total revenue, up from 27.6% in 1Q15 • Ethernet services contributed $23.6M of revenue in 1Q16 as compared to $22.9M a year ago, an increase of 3.1% YoY o Ethernet revenue was 11.4% of total revenue in 1Q16 compared to 10.7% of total revenue in 1Q15 o Total Ethernet circuits grew by 13.2% YoY • Costs continue to be managed and adjusted operating expenses declined QoQ • Adjusted EBITDA(1) of $62.0M for the quarter • Adjusted EBITDA margin of 30.0% increased 120 basis points from 1Q15 • Unlevered Free Cash Flow(2) of $34.7M for the quarter

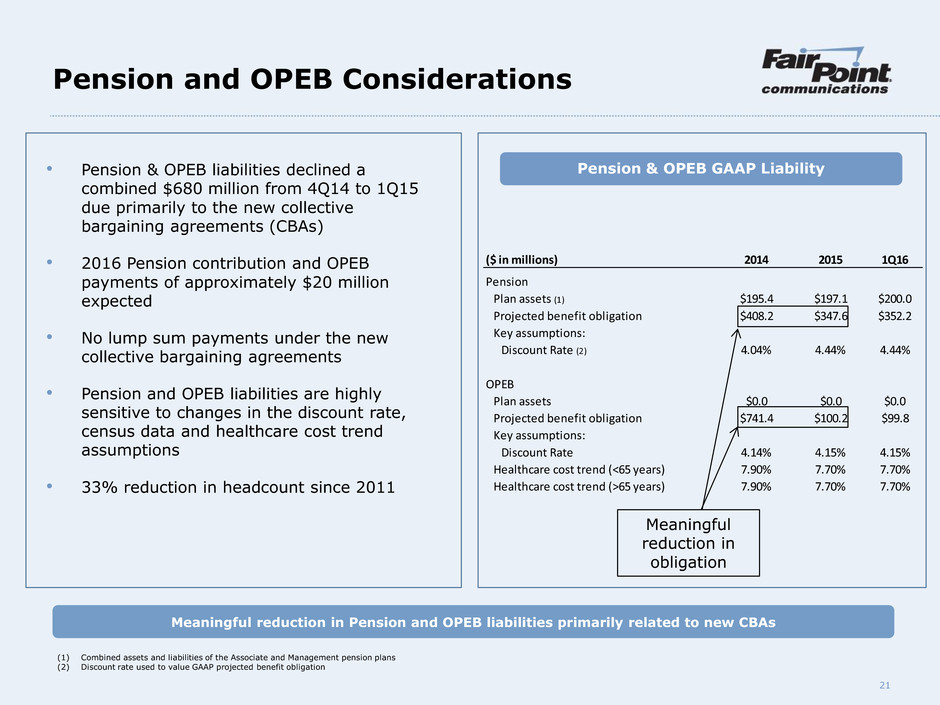

18 Highlights of New Collective Bargaining Agreements • The defined benefit pension plan has been closed to new employees. For employees on the payroll as of October 14, 2014, past accruals have been frozen and effective February 22, 2015, future defined benefit accruals will be at 50% of prior rates and capped after 30 years of total credited service. • Retiree medical for active employees has been eliminated. A transitional monthly medical premium reimbursement arrangement is available for eligible employees who elect to retire in the first 30 months of the contract period. To be eligible for the reimbursement arrangement a retiree must, among other criteria, have commenced a pension under the defined benefit pension plan. The monthly reimbursement arrangement shall not exceed $800 per retiree, plus an additional $400 for a retiree’s spouse, and shall only be for reimbursement of eligible medical insurance premiums. The reimbursement arrangement will be available only until the retiree reaches age 65, or dies, among other limitations, whereupon payments for the retiree’s spouse shall end as well. • Employees will participate in the NECA/IBEW multi-employer medical plan. For 2015, the company’s contribution is approximately equal to 79% of the cost had these employees been on the company’s management health plan. Further, future annual increases in the company’s premium contributions are capped at 4% per year. • ~$8 to $12 million in annualized medical plan expense savings Other Highlights: • Modest change to the 401(k) plan with a dollar-for-dollar match up to 5% of eligible pay. • For existing employees there will be a delayed ratification payment of $400, with general wage increases of 1% in August 2016 and 2% in August 2017. • New hire wage rate increases will occur at 12-month intervals versus 6-month intervals under the expired agreements. • Paid sick days will be limited to 6 per year versus unlimited paid sick days under the expired agreements. • Short term disability benefits will be available under the same 6-month plan as available to management versus 12 months at 100% of normal salary benefit under the expired agreements. • Prohibitions on layoffs included in the expired agreements were eliminated. • Subcontracting rules were liberalized to permit subcontracting in a variety of circumstances including weather emergencies, spikes in service workloads and where management determines that due to evolving technological needs, different skills are necessary. • Other operational rules such as call-outs, standby and transfers among locations were liberalized. • The term of the collective bargaining agreements are from February 22, 2015 through August 4, 2018.

19 Recent Financial Trends (1) Adjusted EBITDA is a non-GAAP financial measure. A reconciliation of Net Income (Loss) to Adjusted EBITDA can be found in this appendix as well as in our first quarter 2016 earnings release furnished May 4, 2016 in a current report on Form 8-K. (2) Unlevered Free Cash Flow means Adjusted EBITDA minus the sum of pension contributions, OPEB payments and capital expenditures. Unlevered Free Cash Flow is a non-GAAP financial measure. A reconciliation of Net Income (Loss) to Unlevered Free Cash Flow can be found in this appendix as well as in our first quarter 2016 earnings release furnished May 4, 2016 in a current report on Form 8-K. (3) 2014 calculations of Adjusted EBITDA and Unlevered Free Cash Flow deduct $33 million of Estimated Avoided Costs experienced in 4Q14 related to the strike. (4) 1Q15 and 2015 calculations of Adjusted EBITDA and Unlevered Free Cash Flow deduct $27 million of Estimated Avoided Costs experienced in 1Q15 related to the strike. ($ in M) 1Q15 2Q15 3Q15 4Q15 1Q16 2014 2015 2016 Guidance Revenue $214.0 $214.1 $221.6 $209.8 $206.8 901.4$ 859.5$ Adjusted EBITDA(1) $61.7 $63.7 $66.7 $63.9 $62.0 257.6$ 255.9$ margin 28.8% 29.8% 30.1% 30.4% 30.0% 28.6% 29.8% Capital expenditures $26.4 $28.3 $28.2 $33.2 $25.9 119.5$ 116.2$ $115 to $120 % of revenue 12.3% 13.2% 12.7% 15.8% 12.5% 13.3% 13.5% Cash Pension & OPEB $2.3 $4.7 $5.4 $7.3 $1.4 $34.1 $19.8 Approx. $20 Unlevered Free Cash Flow(2) $32.9 $30.7 $33.1 $23.3 $34.7 104.0$ 120.0$ Cash on hand $10.3 $9.1 $17.0 $26.6 $23.1 37.6$ 26.6$ Debt, gross $927.2 $925.6 $924.0 $922.4 $920.8 928.8$ 922.4$ $245 to $255 $105 to $120 Financial Highlights (4) (3) (4)

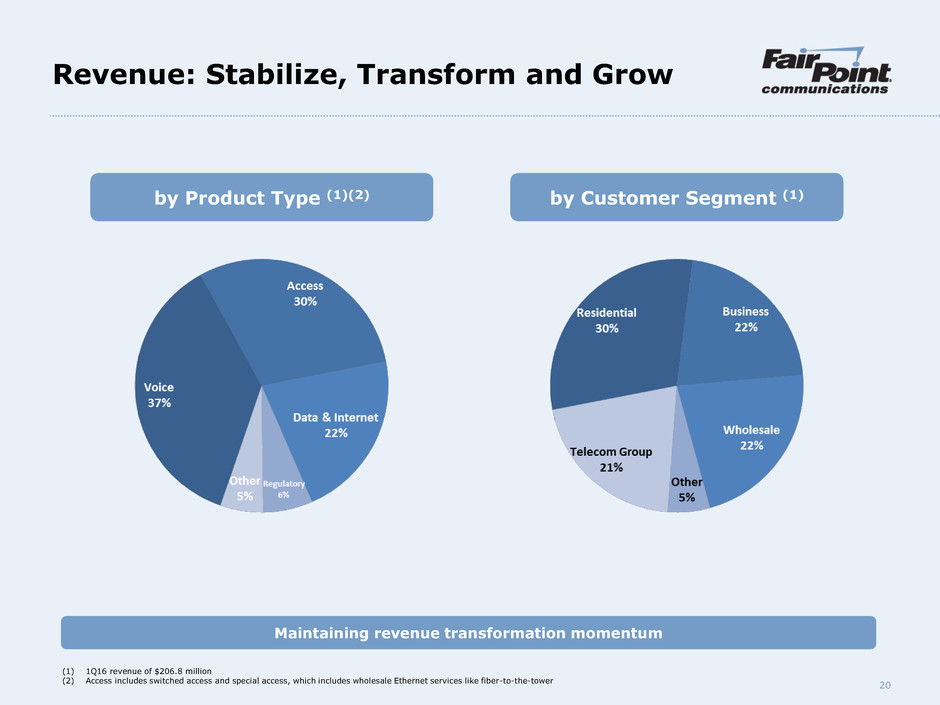

20 Revenue: Stabilize, Transform and Grow by Customer Segment (1) by Product Type (1)(2) (1) 1Q16 revenue of $206.8 million (2) Access includes switched access and special access, which includes wholesale Ethernet services like fiber-to-the-tower (2) Maintaining revenue transformation momentum

21 ($ in millions) 2014 2015 1Q16 Pension Plan assets (1) $195.4 $197.1 $200.0 Projected benefit obligation $408.2 $347.6 $352.2 Key assumptions: Discount Rate (2) 4.04% 4.44% 4.44% OPEB Plan assets $0.0 $0.0 $0.0 Projected benefit obligation $741.4 $100.2 $99.8 Key assumptions: Discount Rate 4.14% 4.15% 4.15% Healthcare cost trend (<65 years) 7.90% 7.70% 7.70% Healthcare cost trend (>65 years) 7.90% 7.70% 7.70% Meaningful reduction in obligation Pension & OPEB GAAP Liability • Pension & OPEB liabilities declined a combined $680 million from 4Q14 to 1Q15 due primarily to the new collective bargaining agreements (CBAs) • 2016 Pension contribution and OPEB payments of approximately $20 million expected • No lump sum payments under the new collective bargaining agreements • Pension and OPEB liabilities are highly sensitive to changes in the discount rate, census data and healthcare cost trend assumptions • 33% reduction in headcount since 2011 (1) Combined assets and liabilities of the Associate and Management pension plans (2) Discount rate used to value GAAP projected benefit obligation Pension and OPEB Considerations Meaningful reduction in Pension and OPEB liabilities primarily related to new CBAs

22 Reconciliation of Non-GAAP Measures (1) For purposes of calculating Adjusted EBITDA (in accordance with the definition of Consolidated EBITDA in the Company's credit agreement), the Company adjusts net (loss) income for interest, income taxes, depreciation and amortization, in addition to: a) the add-back (or subtraction) of aggregate pension and other post-employment benefits (OPEB) expense, b) the add-back (or subtraction) of the adjustment to the compensated absences accrual to eliminate the impact of changes in the accrual, c) the add-back of costs related to the reorganization, including professional fees for advisors and consultants, d) the add-back of costs and expenses, including those imposed by regulatory authorities, with respect to casualty events, acts of God or force majeure to the extent they are not reimbursed from proceeds of insurance, e) the add-back of other non-cash items, including stock compensation expense, except to the extent they will require a cash payment in a future period, and f) the add-back (or subtraction) of other items, including facility and office closures, labor negotiation expenses (including losses related to disruption of operations), non-cash gains/losses, non-operating dividend and interest income and other extraordinary gains/losses. (2) On October 17, 2014, two of our labor unions in northern New England initiated a work stoppage. As a result, significant union employee and vehicle and other related expenses related to northern New England were not incurred between October 17, 2014 and February 24, 2015 (the "work stoppage period"). Therefore, to assist in the evaluation of the Company's operating performance without the impact of the work stoppage, we estimated the union employee and vehicle and other related expenses using historical data for the work stoppage period that we believe would have been incurred absent the work stoppage. Estimated Avoided Costs is a pro forma estimate only. Reconciliation of Adjusted EBITDA and Unlevered Free Cash Flow from Net (Loss) Income: 2011 2012 2013 2014 2015 1Q15 2Q15 3Q15 4Q15 1Q16 Net Income/(loss) 171,962$ (153,294)$ (93,450)$ (136,319)$ 90,416$ (45,213)$ 40,265$ 53,054$ 42,310$ 18,568$ Income tax (benefit)/expense 226,613 (95,560) (90,291) (29,778) (1,057) 901 (824) (658) (476) 8,011 Interest expense 73,128 67,610 78,675 80,371 80,718 19,819 19,974 20,186 20,739 20,610 Depreciation and amortization 358,406 376,614 282,438 220,678 223,819 55,306 55,818 56,296 56,399 57,638 Pension expense (1a) 12,185 17,809 26,221 18,144 8,635 5,111 3,088 (1,861) 2,297 2,036 OPEB expense (1a) 39,601 50,875 54,469 57,138 (178,973) (12,008) (55,548) (55,707) (55,710) (55,264) Compensated absences (1b) (462) 329 431 2,848 (1,646) 12,237 (3,803) (6,084) (3,995) 6,287 Severance 8,006 6,380 8,150 2,005 4,015 358 3,760 (106) 2 1,459 Restructuring costs (1c) 21,053 1,335 207 104 38 7 20 5 6 - Storm expenses (1d) 4,040 3,000 2,598 145 - - - - - - Other non-cash items, net (1e) (651,943) 3,518 1,902 2,087 8,197 2,733 1,780 1,441 2,243 2,694 Loss (gain) on sale of assets - - (10,757) 450 - - - - - - Loss on debt refinancing - - 6,787 - - - - - - - Labor negotiation expense - - 648 73,590 48,933 49,528 (850) 160 95 - All other allowed adjustments, net (1f) (1,055) (675) (2,998) (889) (170) (99) (16) (35) (20) (88) Adjusted EBITDA 261,534$ 277,941$ 265,030$ 290,574$ 282,925$ 88,680$ 63,664$ 66,691$ 63,890$ 61,951$ Estimated Avoided Costs (2) - - - (33,000) (27,000) (27,000) - - - - Adjusted EBITDA minus Estimated Avoided Costs (2) 261,534$ 277,941$ 265,030$ 257,574$ 255,925$ 61,680$ 63,664$ 66,691$ 63,890$ 61,951$ Adjusted EBITDA 261,534$ 277,941$ 265,030$ 290,574$ 282,925$ 88,680$ 63,664$ 66,691$ 63,890$ 61,951$ Pension contributions (6,178)$ (17,850)$ (19,971)$ (28,266)$ (14,168)$ (1,200)$ (3,182)$ (3,958)$ (5,828)$ -$ OPEB payments (1,763)$ (3,183)$ (3,470) (5,808) (5,597) (1,149) (1,486) (1,457) (1,505) (1,414) Capital expenditures (176,125)$ (145,066)$ (128,298) (119,489) (116,159) (26,430) (28,298) (28,193) (33,238) (25,880) Unlevered Free Cash Flow 77,468$ 111,842$ 113,291$ 137,011$ 147,001$ 59,901$ 30,698$ 33,083$ 23,319$ 34,657$ Estimated Avoided Costs (2) - - - (33,000) (27,000) (27,000) - - - - Unlevered Free Cash Flow minus Estimated Avoided Costs (2) 77,468$ 111,842$ 113,291$ 104,011$ 120,001$ 32,901$ 30,698$ 33,083$ 23,319$ 34,657$ Year Quarter

23 Operating Footprint

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Oragenics, Inc. Announces Notification of Noncompliance with Additional NYSE American Continued Listing Standards

- Oak Valley Bancorp Reports 1st Quarter Results

- NV Gold Announces Secured Loan Terms

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share