Form 8-K EXELON CORP For: Sep 21 Filed by: BALTIMORE GAS & ELECTRIC CO

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

September 21, 2016

Date of Report (Date of earliest event reported)

| Commission File Number |

Exact Name of Registrant as Specified in Its Charter; State

of |

IRS Employer | ||

| 1-16169 | EXELON CORPORATION (a Pennsylvania corporation) 10 South Dearborn Street P.O. Box 805379 Chicago, Illinois 60680-5379 (800) 483-3220 |

23-2990190 | ||

| 333-85496 | EXELON GENERATION COMPANY, LLC (a Pennsylvania limited liability company) 300 Exelon Way Kennett Square, Pennsylvania 19348-2473 (610) 765-5959 |

23-3064219 | ||

| 1-1839 | COMMONWEALTH EDISON COMPANY (an Illinois corporation) 440 South LaSalle Street Chicago, Illinois 60605-1028 (312) 394-4321 |

36-0938600 | ||

| 000-16844 | PECO ENERGY COMPANY (a Pennsylvania corporation) P.O. Box 8699 2301 Market Street Philadelphia, Pennsylvania 19101-8699 (215) 841-4000 |

23-0970240 | ||

| 1-1910 | BALTIMORE GAS AND ELECTRIC COMPANY (a Maryland corporation) 2 Center Plaza 110 West Fayette Street Baltimore, Maryland 21201 (410) 234-5000 |

52-0280210 | ||

| 001-31403 | PEPCO HOLDINGS LLC (a Delaware limited liability company) 701 Ninth Street, N.W. Washington, D.C. 20068 (202)872-2000 |

52-2297449 | ||

| 001-01072 | POTOMAC ELECTRIC POWER COMPANY (a District of Columbia and Virginia corporation) 701 Ninth Street, N.W. Washington, D.C. 20068 (202)872-2000 |

53-0127880 | ||

| 001-01405 | DELMARVA POWER & LIGHT COMPANY (a Delaware and Virginia corporation) 500 North Wakefield Drive, 2nd Floor Newark, DE 19702 (202)872-2000 |

51-0084283 | ||

| 001-03559 | ATLANTIC CITY ELECTRIC COMPANY (a New Jersey corporation) 500 North Wakefield Drive, 2nd Floor Newark, DE 19702 (202)872-2000 |

21-0398280 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 7 – Regulation FD

Item 7.01. Regulation FD Disclosure.

On September 21, 2016, Exelon Corporation (Exelon) made available a presentation to be used for outreach to investors. A copy of the presentation is attached hereto as Exhibit 99.1. This Form 8-K and the attached exhibits are provided under Items 7.01 and 9.01 of Form 8-K and are furnished to, but not filed with, the Securities and Exchange Commission.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit |

Description | |

| 99.1 | Shareholder outreach presentation | |

* * * * *

This combined Current Report on Form 8-K is being furnished separately by Exelon, Exelon Generation Company, LLC, Commonwealth Edison Company, PECO Energy Company, Baltimore Gas and Electric Company, Pepco Holdings LLC (PHI), Potomac Electric Power Company, Delmarva Power & Light Company, and Atlantic City Electric Company (Registrants). Information contained herein relating to any individual Registrant has been furnished by such Registrant on its own behalf. No Registrant makes any representation as to information relating to any other Registrant.

This report contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from the forward-looking statements made by Registrants include those factors discussed herein, as well as the items discussed in (1) Exelon’s 2015 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 23; (2) PHI’s 2015 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 16; (3) Exelon’s Second Quarter 2016 Quarterly Report on Form 10-Q (to be filed on August 9, 2016) in (a) Part II, Other Information, ITEM 1A. Risk Factors; (b) Part 1, Financial Information, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 18 and (4) other factors discussed in filings with the SEC by the Registrants. Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this report. None of the Registrants undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| EXELON CORPORATION |

| /s/ Jonathan W. Thayer |

| Jonathan W. Thayer |

| Senior Executive Vice President and Chief Financial Officer |

| Exelon Corporation |

| EXELON GENERATION COMPANY, LLC |

| /s/ Bryan P. Wright |

| Bryan P. Wright |

| Senior Vice President and Chief Financial Officer Exelon Generation Company, LLC |

| COMMONWEALTH EDISON COMPANY |

| /s/ Joseph R. Trpik, Jr. |

| Joseph R. Trpik, Jr. |

| Senior Vice President, Chief Financial Officer and Treasurer |

| Commonwealth Edison Company |

| PECO ENERGY COMPANY |

| /s/ Phillip S. Barnett |

| Phillip S. Barnett |

| Senior Vice President, Chief Financial Officer and Treasurer |

| PECO Energy Company |

| BALTIMORE GAS AND ELECTRIC COMPANY |

| /s/ David M. Vahos |

| David M. Vahos |

| Senior Vice President, Chief Financial Officer and Treasurer |

| Baltimore Gas and Electric Company |

| PEPCO HOLDINGS LLC |

| /s/ Donna J. Kinzel |

| Donna J. Kinzel |

| Senior Vice President, Chief Financial Officer and Treasurer, |

| Pepco Holdings LLC |

| POTOMAC ELECTRIC POWER COMPANY |

| /s/ Donna J. Kinzel |

| Donna J. Kinzel |

| Senior Vice President, Chief Financial Officer and Treasurer, |

| Potomac Electric Power Company |

| DELMARVA POWER & LIGHT COMPANY |

| /s/ Donna J. Kinzel |

| Donna J. Kinzel |

| Senior Vice President, Chief Financial Officer and Treasurer, |

| Delmarva Power & Light Company |

| ATLANTIC CITY ELECTRIC COMPANY |

| /s/ Donna J. Kinzel |

| Donna J. Kinzel |

| Senior Vice President, Chief Financial Officer and Treasurer, |

| Atlantic City Electric Company |

September 21, 2016

EXHIBIT INDEX

| Exhibit |

Description | |

| 99.1 | Shareholder outreach presentation | |

Exelon Corporation Shareholder Outreach Fall 2016 Exhibit 99.1

Cautionary Statements Regarding Forward-Looking Information This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from the forward-looking statements made by Exelon Corporation, Exelon Generation Company, LLC, Commonwealth Edison Company, PECO Energy Company, Baltimore Gas and Electric Company, Pepco Holdings LLC (PHI), Potomac Electric Power Company, Delmarva Power & Light Company, and Atlantic City Electric Company (Registrants) include those factors discussed herein, as well as the items discussed in (1) Exelon’s 2015 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 23; (2) PHI’s 2015 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 16; (3) Exelon’s Second Quarter 2016 Quarterly Report on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk Factors; (b) Part 1, Financial Information, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 18; and (4) other factors discussed in filings with the SEC by the Registrants. Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this presentation. None of the Registrants undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation.

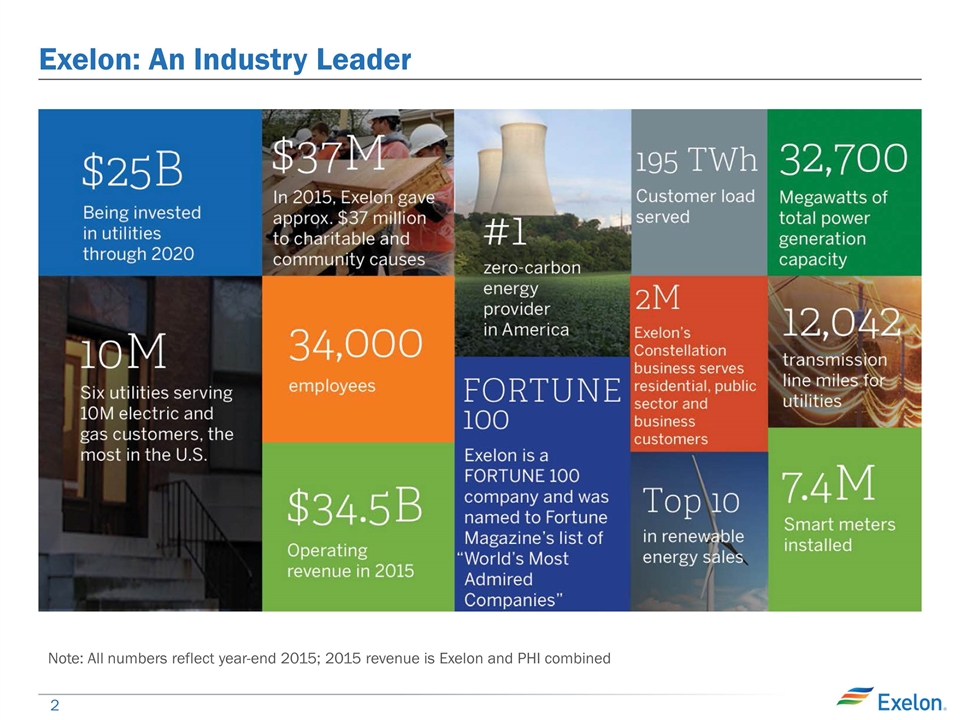

Exelon: An Industry Leader Note: All numbers reflect year-end 2015; 2015 revenue is Exelon and PHI combined

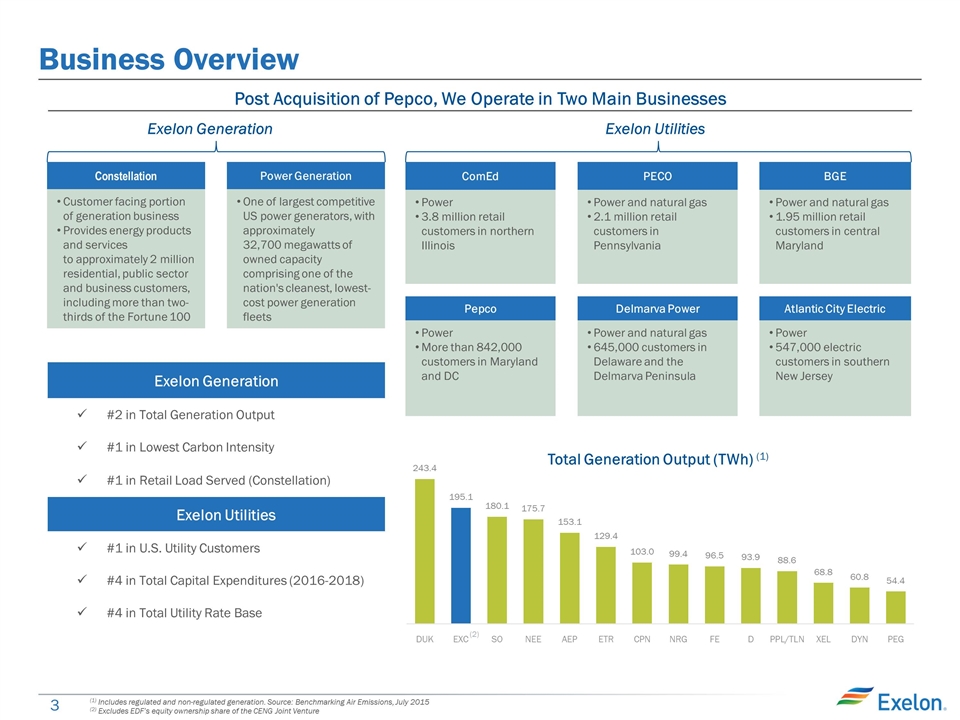

Constellation Power Generation Customer facing portion of generation business Provides energy products and services to approximately 2 million residential, public sector and business customers, including more than two-thirds of the Fortune 100 One of largest competitive US power generators, with approximately 32,700 megawatts of owned capacity comprising one of the nation's cleanest, lowest-cost power generation fleets Business Overview Post Acquisition of Pepco, We Operate in Two Main Businesses Exelon Utilities Total Generation Output (TWh) (1) Exelon Generation ComEd PECO BGE Power 3.8 million retail customers in northern Illinois Power and natural gas 2.1 million retail customers in Pennsylvania Power and natural gas 1.95 million retail customers in central Maryland (1) Includes regulated and non-regulated generation. Source: Benchmarking Air Emissions, July 2015 (2) Excludes EDF’s equity ownership share of the CENG Joint Venture Pepco Delmarva Power Atlantic City Electric Power More than 842,000 customers in Maryland and DC Power and natural gas 645,000 customers in Delaware and the Delmarva Peninsula Power 547,000 electric customers in southern New Jersey (2) Exelon Generation #2 in Total Generation Output #1 in Lowest Carbon Intensity #1 in Retail Load Served (Constellation) Exelon Utilities #1 in U.S. Utility Customers #4 in Total Capital Expenditures (2016-2018) #4 in Total Utility Rate Base

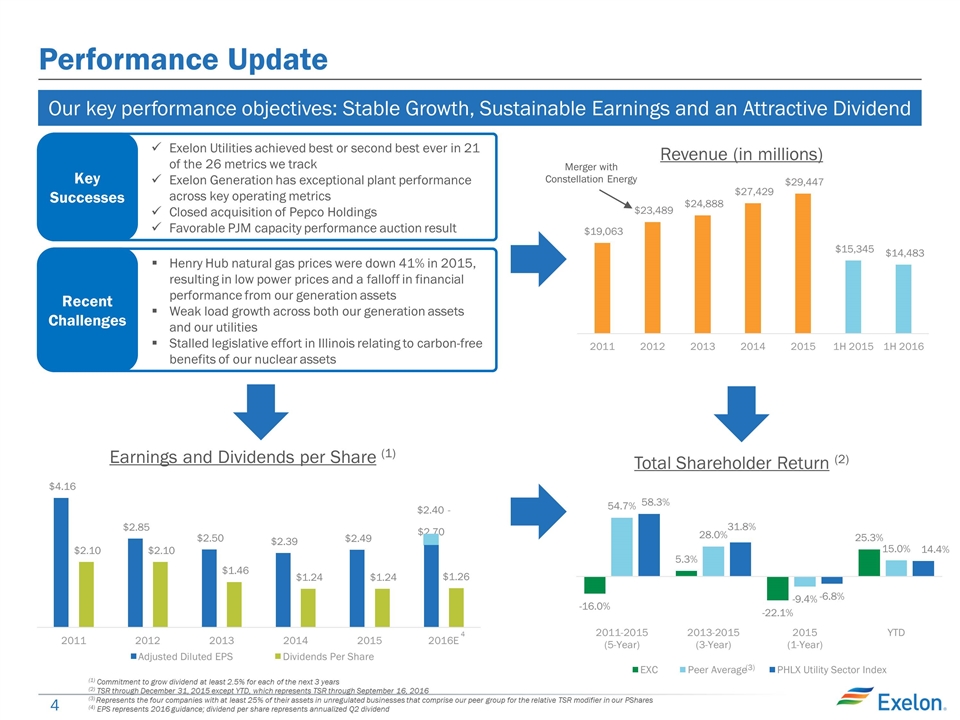

Performance Update (1) Commitment to grow dividend at least 2.5% for each of the next 3 years (2) TSR through December 31, 2015 except YTD, which represents TSR through September 16, 2016 (3) Represents the four companies with at least 25% of their assets in unregulated businesses that comprise our peer group for the relative TSR modifier in our PShares (4) EPS represents 2016 guidance; dividend per share represents annualized Q2 dividend Earnings and Dividends per Share (1) Henry Hub natural gas prices were down 41% in 2015, resulting in low power prices and a falloff in financial performance from our generation assets Weak load growth across both our generation assets and our utilities Stalled legislative effort in Illinois relating to carbon-free benefits of our nuclear assets Recent Challenges Exelon Utilities achieved best or second best ever in 21 of the 26 metrics we track Exelon Generation has exceptional plant performance across key operating metrics Closed acquisition of Pepco Holdings Favorable PJM capacity performance auction result Key Successes Total Shareholder Return (2) Revenue (in millions) Our key performance objectives: Stable Growth, Sustainable Earnings and an Attractive Dividend Merger with Constellation Energy (3) 4 $2.40 -

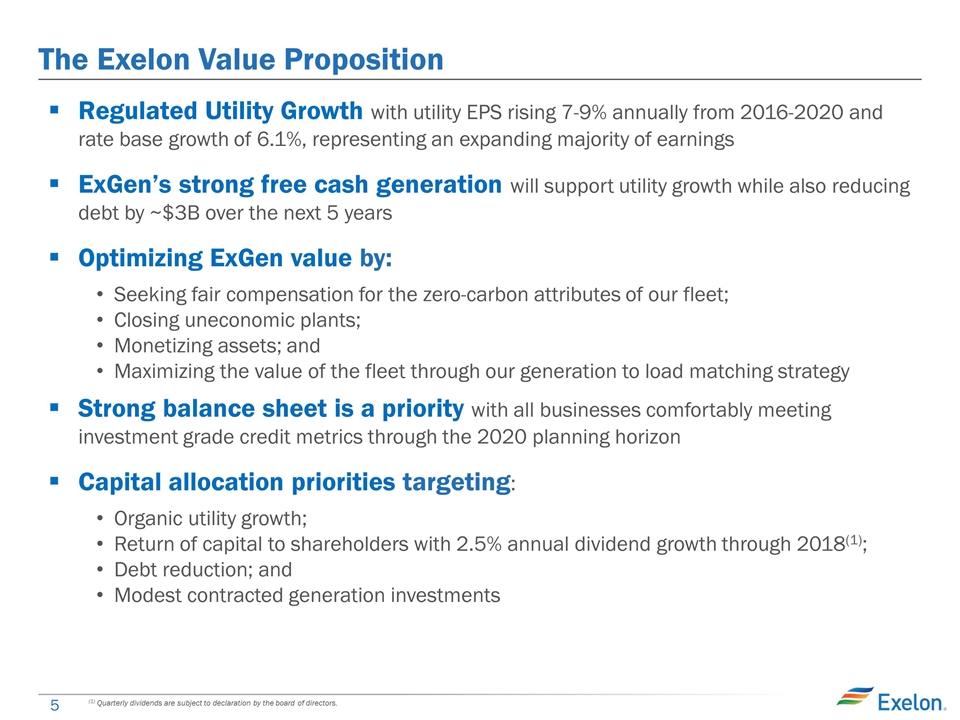

The Exelon Value Proposition Regulated Utility Growth with utility EPS rising 7-9% annually from 2016-2020 and rate base growth of 6.1%, representing an expanding majority of earnings ExGen’s strong free cash generation will support utility growth while also reducing debt by ~$3B over the next 5 years Optimizing ExGen value by: Seeking fair compensation for the zero-carbon attributes of our fleet; Closing uneconomic plants; Monetizing assets; and Maximizing the value of the fleet through our generation to load matching strategy Strong balance sheet is a priority with all businesses comfortably meeting investment grade credit metrics through the 2020 planning horizon Capital allocation priorities targeting: Organic utility growth; Return of capital to shareholders with 2.5% annual dividend growth through 2018(1); Debt reduction; and Modest contracted generation investments (1) Quarterly dividends are subject to declaration by the board of directors.

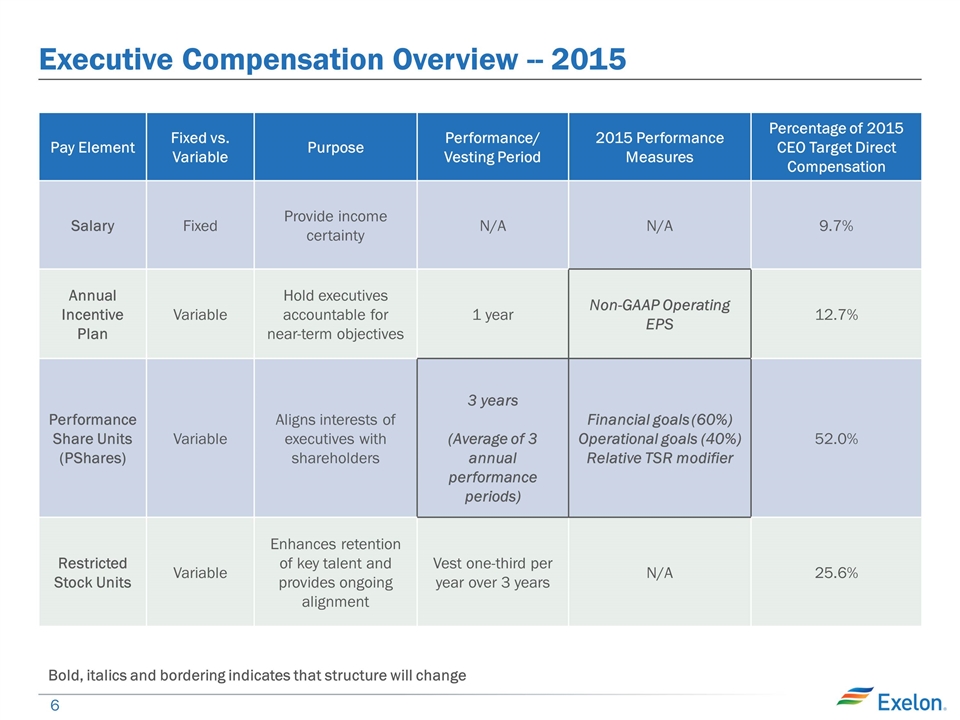

Executive Compensation Overview -- 2015 Pay Element Fixed vs. Variable Purpose Performance/ Vesting Period 2015 Performance Measures Percentage of 2015 CEO Target Direct Compensation Salary Fixed Provide income certainty N/A N/A 9.7% Annual Incentive Plan Variable Hold executives accountable for near-term objectives 1 year Non-GAAP Operating EPS 12.7% Performance Share Units (PShares) Variable Aligns interests of executives with shareholders 3 years (Average of 3 annual performance periods) Financial goals (60%) Operational goals (40%) Relative TSR modifier 52.0% Restricted Stock Units Variable Enhances retention of key talent and provides ongoing alignment Vest one-third per year over 3 years N/A 25.6% Bold, italics and bordering indicates that structure will change

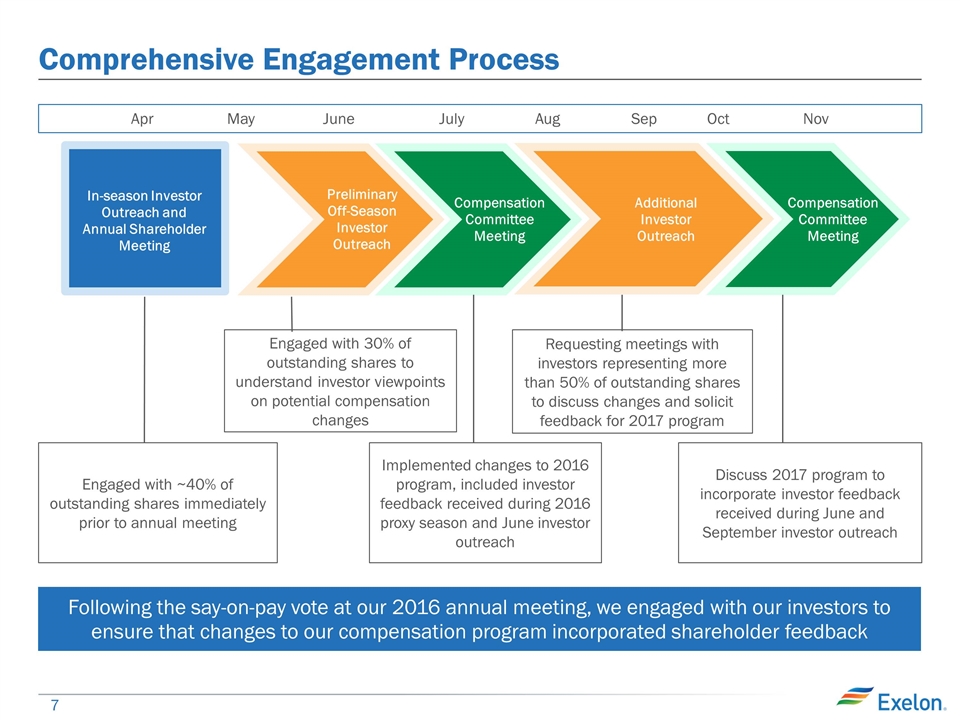

Implemented changes to 2016 program, included investor feedback received during 2016 proxy season and June investor outreach Comprehensive Engagement Process Preliminary Off-Season Investor Outreach Compensation Committee Meeting Additional Investor Outreach Engaged with 30% of outstanding shares to understand investor viewpoints on potential compensation changes Requesting meetings with investors representing more than 50% of outstanding shares to discuss changes and solicit feedback for 2017 program AprMayJune July Aug SepOct Nov Compensation Committee Meeting In-season Investor Outreach and Annual Shareholder Meeting Engaged with ~40% of outstanding shares immediately prior to annual meeting Discuss 2017 program to incorporate investor feedback received during June and September investor outreach Following the say-on-pay vote at our 2016 annual meeting, we engaged with our investors to ensure that changes to our compensation program incorporated shareholder feedback

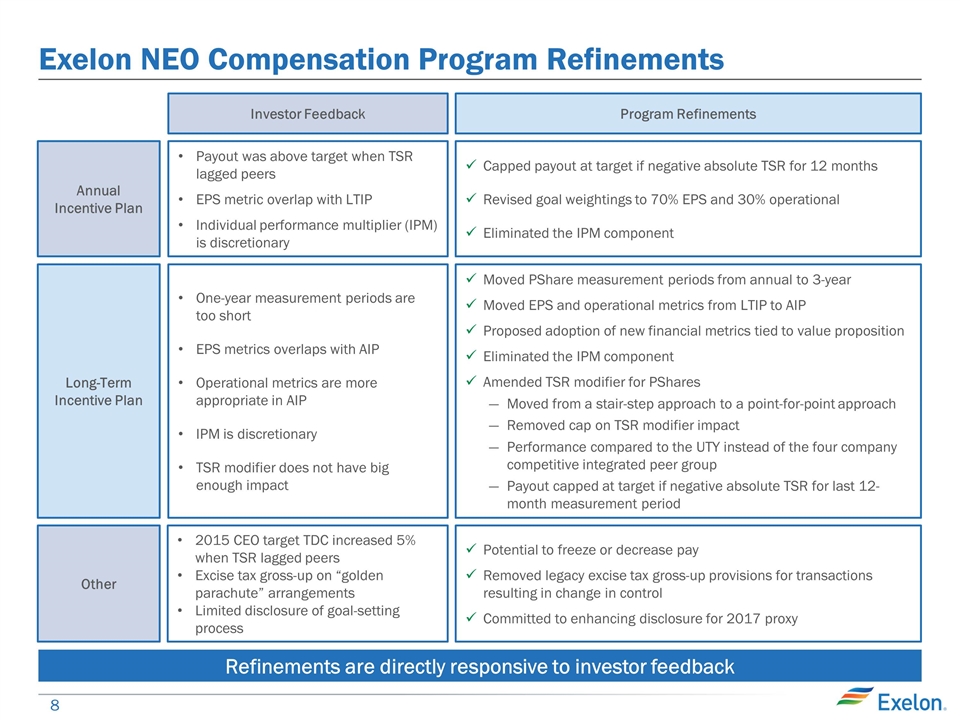

Exelon NEO Compensation Program Refinements Annual Incentive Plan Long-Term Incentive Plan Program Refinements Other Capped payout at target if negative absolute TSR for 12 months Revised goal weightings to 70% EPS and 30% operational Eliminated the IPM component Moved PShare measurement periods from annual to 3-year Moved EPS and operational metrics from LTIP to AIP Proposed adoption of new financial metrics tied to value proposition Eliminated the IPM component Amended TSR modifier for PShares Moved from a stair-step approach to a point-for-point approach Removed cap on TSR modifier impact Performance compared to the UTY instead of the four company competitive integrated peer group Payout capped at target if negative absolute TSR for last 12-month measurement period Potential to freeze or decrease pay Removed legacy excise tax gross-up provisions for transactions resulting in change in control Committed to enhancing disclosure for 2017 proxy Payout was above target when TSR lagged peers EPS metric overlap with LTIP Individual performance multiplier (IPM) is discretionary 2015 CEO target TDC increased 5% when TSR lagged peers Excise tax gross-up on “golden parachute” arrangements Limited disclosure of goal-setting process Investor Feedback One-year measurement periods are too short EPS metrics overlaps with AIP Operational metrics are more appropriate in AIP IPM is discretionary TSR modifier does not have big enough impact Refinements are directly responsive to investor feedback

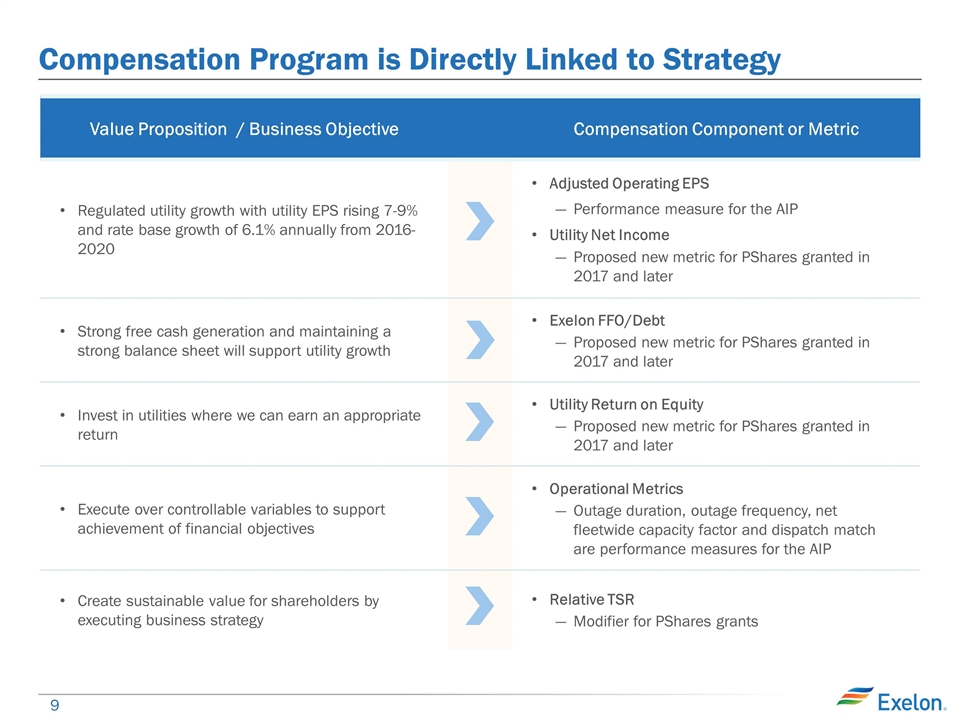

Compensation Program is Directly Linked to Strategy Value Proposition / Business Objective Compensation Component or Metric Regulated utility growth with utility EPS rising 7-9% and rate base growth of 6.1% annually from 2016-2020 Adjusted Operating EPS Performance measure for the AIP Utility Net Income Proposed new metric for PShares granted in 2017 and later Strong free cash generation and maintaining a strong balance sheet will support utility growth Exelon FFO/Debt Proposed new metric for PShares granted in 2017 and later Invest in utilities where we can earn an appropriate return Utility Return on Equity Proposed new metric for PShares granted in 2017 and later Execute over controllable variables to support achievement of financial objectives Operational Metrics Outage duration, outage frequency, net fleetwide capacity factor and dispatch match are performance measures for the AIP Create sustainable value for shareholders by executing business strategy Relative TSR Modifier for PShares grants

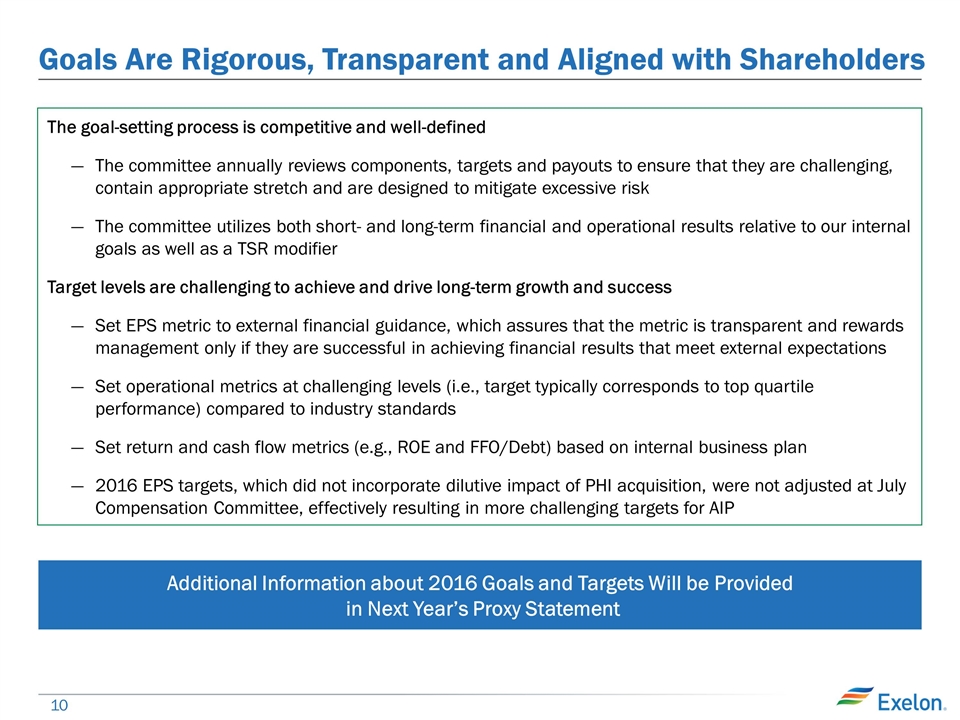

Goals Are Rigorous, Transparent and Aligned with Shareholders The goal-setting process is competitive and well-defined The committee annually reviews components, targets and payouts to ensure that they are challenging, contain appropriate stretch and are designed to mitigate excessive risk The committee utilizes both short- and long-term financial and operational results relative to our internal goals as well as a TSR modifier Target levels are challenging to achieve and drive long-term growth and success Set EPS metric to external financial guidance, which assures that the metric is transparent and rewards management only if they are successful in achieving financial results that meet external expectations Set operational metrics at challenging levels (i.e., target typically corresponds to top quartile performance) compared to industry standards Set return and cash flow metrics (e.g., ROE and FFO/Debt) based on internal business plan 2016 EPS targets, which did not incorporate dilutive impact of PHI acquisition, were not adjusted at July Compensation Committee, effectively resulting in more challenging targets for AIP Additional Information about 2016 Goals and Targets Will be Provided in Next Year’s Proxy Statement

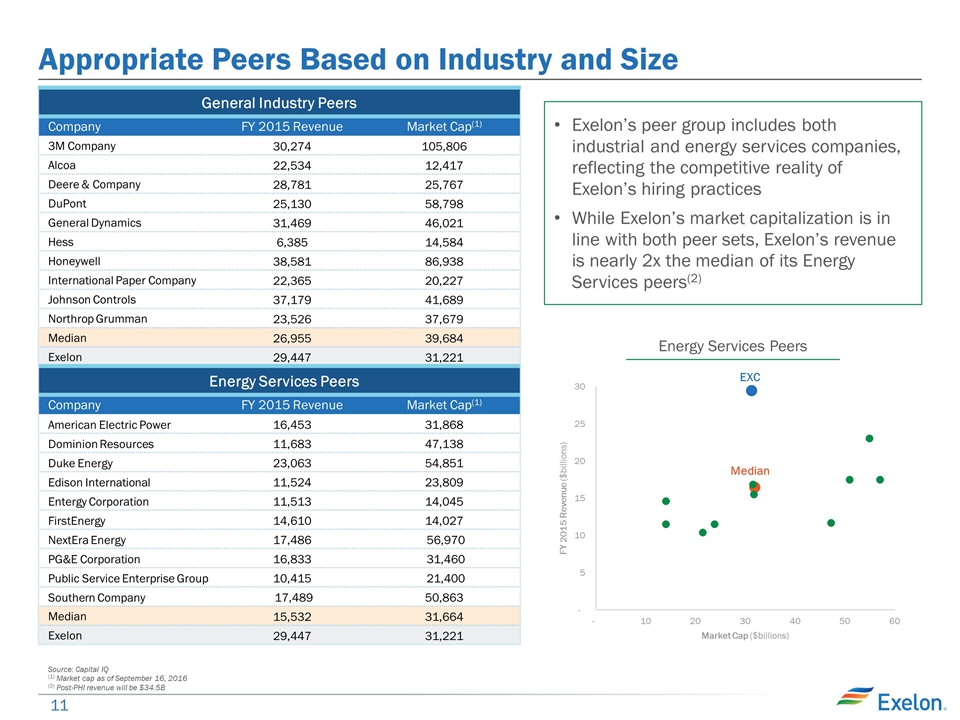

Appropriate Peers Based on Industry and Size General Industry Peers Company FY 2015 Revenue Market Cap(1) 3M Company 30,274 105,806 Alcoa 22,534 12,417 Deere & Company 28,781 25,767 DuPont 25,130 58,798 General Dynamics 31,469 46,021 Hess 6,385 14,584 Honeywell 38,581 86,938 International Paper Company 22,365 20,227 Johnson Controls 37,179 41,689 Northrop Grumman 23,526 37,679 Median 26,955 39,684 Exelon 29,447 31,221 Energy Services Peers Company FY 2015 Revenue Market Cap(1) American Electric Power 16,453 31,868 Dominion Resources 11,683 47,138 Duke Energy 23,063 54,851 Edison International 11,524 23,809 Entergy Corporation 11,513 14,045 FirstEnergy 14,610 14,027 NextEra Energy 17,486 56,970 PG&E Corporation 16,833 31,460 Public Service Enterprise Group 10,415 21,400 Southern Company 17,489 50,863 Median 15,532 31,664 Exelon 29,447 31,221 Source: Capital IQ (1) Market cap as of September 16, 2016 (2) Post-PHI revenue will be $34.5B Exelon’s peer group includes both industrial and energy services companies, reflecting the competitive reality of Exelon’s hiring practices While Exelon’s market capitalization is in line with both peer sets, Exelon’s revenue is nearly 2x the median of its Energy Services peers(2) EXC Energy Services Peers Median

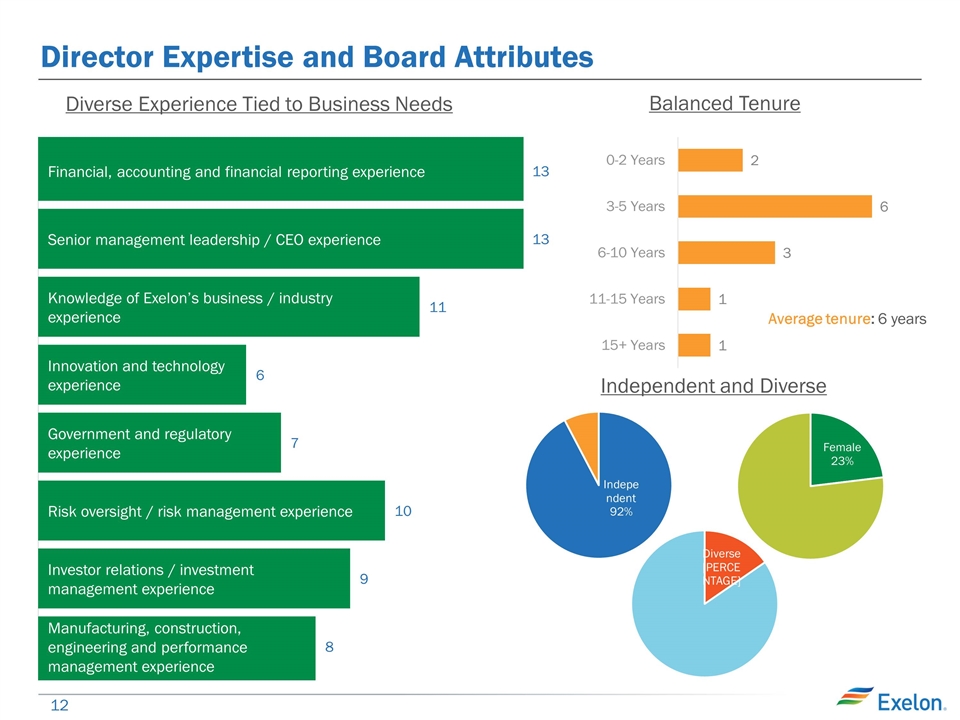

Director Expertise and Board Attributes Financial, accounting and financial reporting experience 13 Senior management leadership / CEO experience 13 Knowledge of Exelon’s business / industry experience 11 Innovation and technology experience 6 Government and regulatory experience 7 Risk oversight / risk management experience 10 Investor relations / investment management experience 9 Manufacturing, construction, engineering and performance management experience 8 Diverse Experience Tied to Business Needs Balanced Tenure Independent and Diverse Average tenure: 6 years

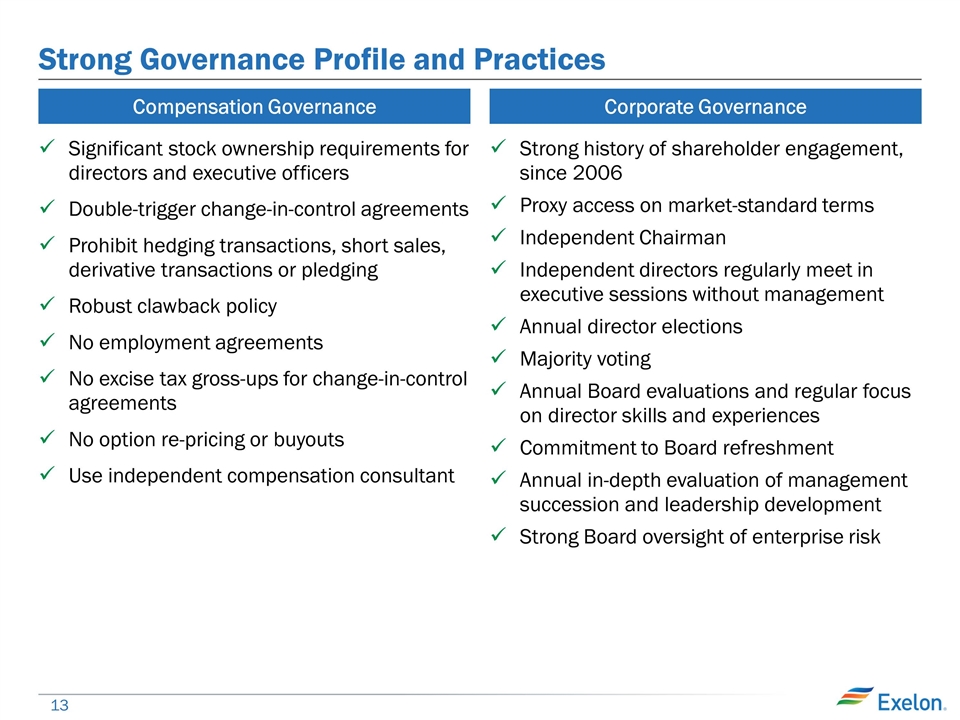

Strong Governance Profile and Practices Significant stock ownership requirements for directors and executive officers Double-trigger change-in-control agreements Prohibit hedging transactions, short sales, derivative transactions or pledging Robust clawback policy No employment agreements No excise tax gross-ups for change-in-control agreements No option re-pricing or buyouts Use independent compensation consultant Strong history of shareholder engagement, since 2006 Proxy access on market-standard terms Independent Chairman Independent directors regularly meet in executive sessions without management Annual director elections Majority voting Annual Board evaluations and regular focus on director skills and experiences Commitment to Board refreshment Annual in-depth evaluation of management succession and leadership development Strong Board oversight of enterprise risk Compensation Governance Corporate Governance

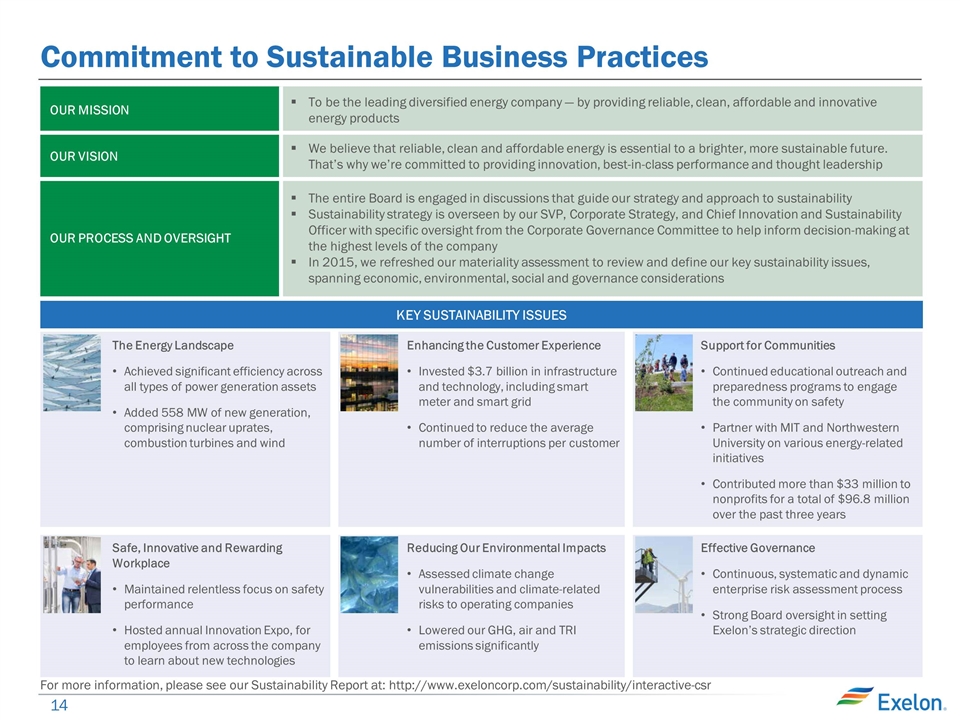

Safe, Innovative and Rewarding Workplace Maintained relentless focus on safety performance Hosted annual Innovation Expo, for employees from across the company to learn about new technologies Reducing Our Environmental Impacts Assessed climate change vulnerabilities and climate-related risks to operating companies Lowered our GHG, air and TRI emissions significantly Effective Governance Continuous, systematic and dynamic enterprise risk assessment process Strong Board oversight in setting Exelon’s strategic direction Commitment to Sustainable Business Practices The Energy Landscape Achieved significant efficiency across all types of power generation assets Added 558 MW of new generation, comprising nuclear uprates, combustion turbines and wind Enhancing the Customer Experience Invested $3.7 billion in infrastructure and technology, including smart meter and smart grid Continued to reduce the average number of interruptions per customer Support for Communities Continued educational outreach and preparedness programs to engage the community on safety Partner with MIT and Northwestern University on various energy-related initiatives Contributed more than $33 million to nonprofits for a total of $96.8 million over the past three years Key Sustainability Issues OUR MISSION To be the leading diversified energy company — by providing reliable, clean, affordable and innovative energy products OUR VISION We believe that reliable, clean and affordable energy is essential to a brighter, more sustainable future. That’s why we’re committed to providing innovation, best-in-class performance and thought leadership OUR PROCESS AND OVERSIGHT The entire Board is engaged in discussions that guide our strategy and approach to sustainability Sustainability strategy is overseen by our SVP, Corporate Strategy, and Chief Innovation and Sustainability Officer with specific oversight from the Corporate Governance Committee to help inform decision-making at the highest levels of the company In 2015, we refreshed our materiality assessment to review and define our key sustainability issues, spanning economic, environmental, social and governance considerations For more information, please see our Sustainability Report at: http://www.exeloncorp.com/sustainability/interactive-csr

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Exelon (EXC) PT Raised to $38 at Morgan Stanley

- NorthEast Community Bancorp, Inc. Reports Results for the Three Months Ended March 31, 2024

- Jessica Holmes Launches the 2024 Defeat Depression Campaign to Encourage Canada-Wide Participation

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share