Form 8-K EXA CORP For: Dec 14

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 14, 2016

EXA CORPORATION

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-35584 | 04-3139906 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

55 Network Drive, Burlington, Massachusetts 01803

(Address of principal executive offices) (Zip Code)

(781) 564-0200

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below).

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure. |

A copy of the Company’s December 14, 2016 Analyst and Investor Day presentation is attached to this Current Report on Form 8-K as Exhibit 99.1. A copy of the presentation is also available on the Company’s website.

In accordance with General Instruction B.2 of Form 8-K, the information contained in Item 7.01 of this Current Report on Form 8-K, including the Exhibit attached hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in Item 7.01 of this Current Report on Form 8-K shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

| 99.1 | December 14, 2016 Analyst and Investor Day Presentation |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| EXA CORPORATION | ||

| By: | /s/ Richard F. Gilbody | |

| Richard F. Gilbody Chief Financial Officer | ||

Date: December 14, 2016

EXHIBIT INDEX

| Exhibit No. |

Description | |

| 99.1 | December 14, 2016 Analyst and Investor Day Presentation | |

| Exhibit 99.1

|

EXA INVESTOR DAY

Steve Remondi | December 2016

|

|

EXA CORPORATE VIDEO

|

|

Safe Harbor Statement

Today’s presentation includes forward-looking statements intended to qualify for the Safe Harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements, including statements regarding our financial expectations, demand for our solutions and growth in our markets, are subject to risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by our forward-looking statements. These factors include, but are not limited to, the risk factors described in our Annual Report on Form 10-K for the year ended January 31, 2016, as filed with the SEC on March 21, 2016. Forward-looking information in this presentation represents our outlook as of today, and we do not undertake any obligation to update these forward-looking statements.

During today’s presentation we may refer to our Adjusted EBITDA. This is a non-GAAP financial measure that has been adjusted for certain non-cash and other items, and that is not computed in accordance with generally accepted accounting principles. The GAAP measure most comparable to Adjusted EBITDA is our net income (loss). A reconciliation of our historical Adjusted EBITDA to our net income (loss) is included in our Form 10-K filed with the SEC.

© Exa Corporation—Public 3

|

|

Agenda

8:30 – 9:30 Registration, Coffee, Demonstrations

9:30 – 11:00 Welcome and Exa Overview, Steve Remondi, CEO

? Company Mission, Strategy and Overview

? Ground Transportation Market Update

? Ecosystem: DENSO Partnership

? Aerospace Market Overview

? Oil & Gas introduction and Market Opportunity

11:00 – 11:15 Break

11:15 – 11:45 Product Strategy, Suresh Sundaram, SVP Products & Marketing

11:45 – 12:15 Financial Update, Rick Gilbody, CFO

? Financial Model and Strategy

? FY 17 & FY 18 Guidance

12:15 – 1:00 Q & A

Box Lunch

© Exa Corporation—Public 4

|

|

Agenda

8:30 – 9:30 Registration, Coffee, Demonstrations

11:00 – 11:15 Break

11:15 – 11:45 Product Strategy, Suresh Sundaram, SVP Products & Marketing

11:45 – 12:15 Financial Update, Rick Gilbody, CFO

? Financial Model and Strategy

? FY 17 & FY 18 Guidance

12:15 – 1:00 Q & A

Box Lunch

© Exa Corporation—Public 5

|

|

OUR MISSION

Enabling better products through simulation–driven design

|

|

Key Messages

Large addressable market … Proven technology and solutions

only fractionally penetrated

Strong and consistent execution Improving profitability with

continued top-line growth

© Exa Corporation—Public 7

|

|

Why Customers Partner with Exa

Highest Degree of Simulation Accuracy Faster Turnaround Time Deep Domain Expertise Return on Investment Robustness and Deployability

© Exa Corporation—Public 8

|

|

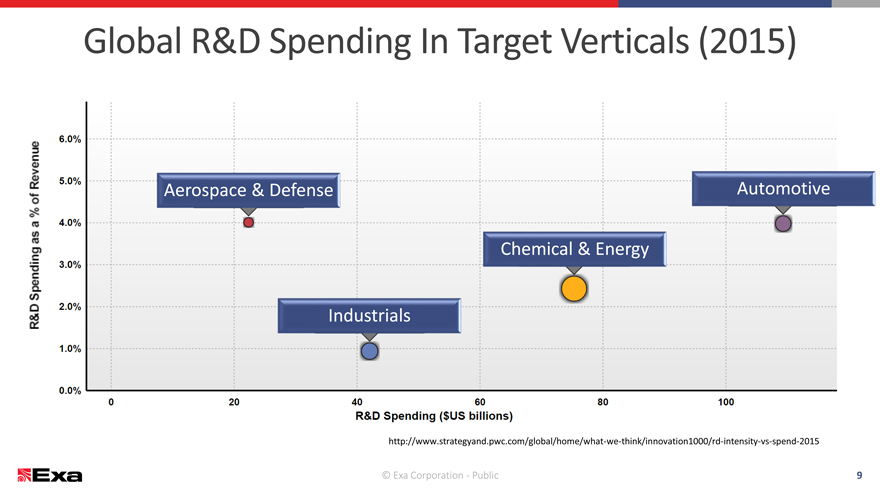

Global R&D Spending In Target Verticals (2015)

Aerospace & Defense Automotive

Chemical & Energy

Industrials

http://www.strategyand.pwc.com/global/home/what-we-think/innovation1000/rd-intensity-vs-spend-2015

© Exa Corporation—Public 9

|

|

GT MARKET UPDATE

© Exa Corporation—Public 10

|

|

Exa Ground Transportation Market

$500 to $700M GT Revenue Opportunity

$30-$40M $30-$40M

Defense

M/Sport Passenger

Supplier Car

$60-$100M $250-$300M

Off-Highway

Truck Highway

$80-$120M Truck

$50-$100M

© Exa Corporation—Public 11

|

|

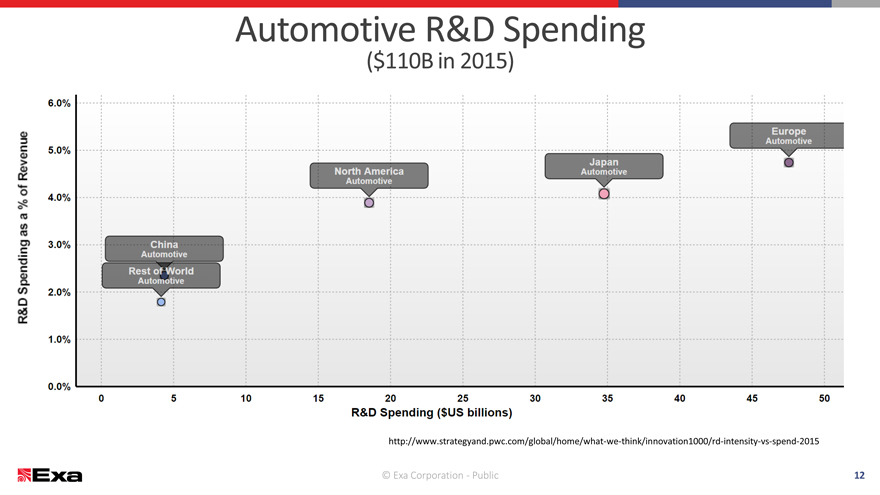

Automotive R&D Spending

($110B in 2015)

http://www.strategyand.pwc.com/global/home/what-we-think/innovation1000/rd-intensity-vs-spend-2015

© Exa Corporation—Public 12

|

|

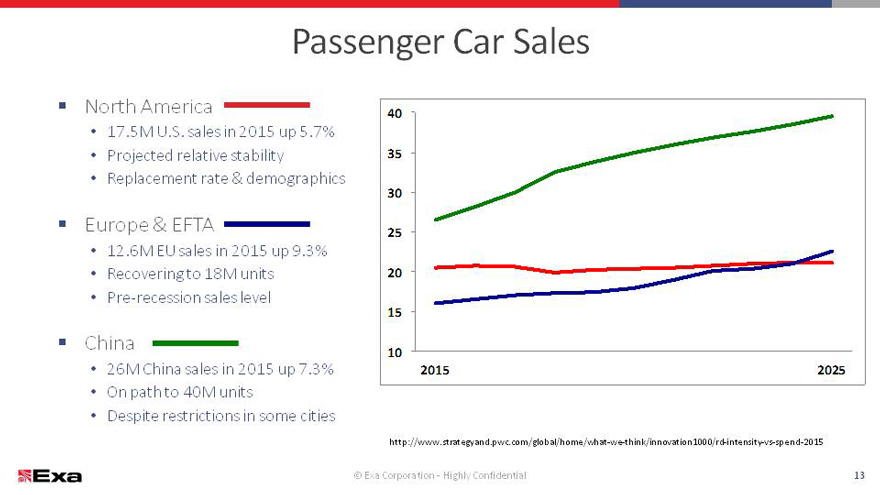

Passenger Car Sales

North America 40

17.5M U.S. sales in 2015 up 5.7%

Projected relative stability35

Replacement rate & demographics

30

Europe & EFTA 25

12.6M EU sales in 2015 up 9.3%

Recovering to 18M units2020

Pre-recession sales level

1515

China

1010

26M China sales in 2015 up 7.3%201520152025

On path to 40M units

Despite restrictions in some cities

http://www.strategyand.pwc.com/global/home/what-we-think/innovation1000/rd-intensity-vs-spend-2015

© Exa Corporation—Public13

|

|

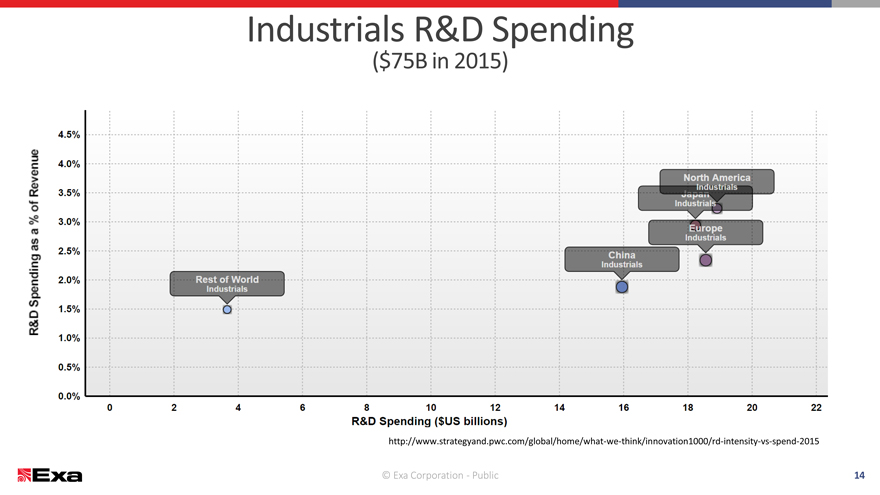

Industrials R&D Spending

($75B in 2015)

http://www.strategyand.pwc.com/global/home/what-we-think/innovation1000/rd-intensity-vs-spend-2015

© Exa Corporation—Public 14

|

|

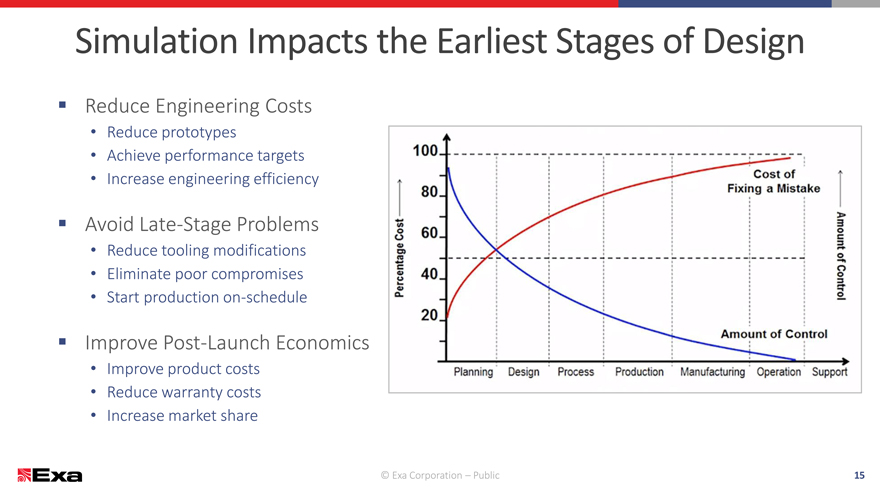

Simulation Impacts the Earliest Stages of Design

Reduce Engineering Costs

Reduce prototypes

Achieve performance targets

Increase engineering efficiency

Avoid Late-Stage Problems

Reduce tooling modifications

Eliminate poor compromises

Start production on-schedule

Improve Post-Launch Economics

Improve product costs

Reduce warranty costs

Increase market share

© Exa Corporation – Public15

|

|

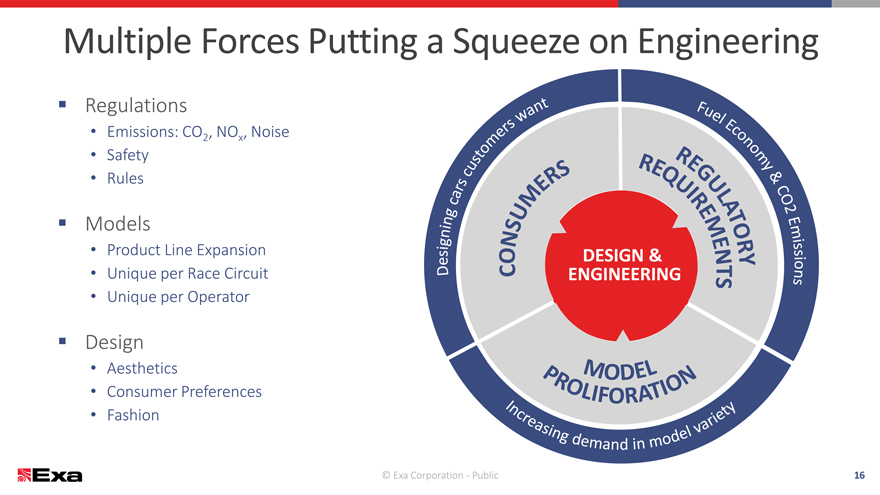

Multiple Forces Putting a Squeeze on Engineering

Regulations

Emissions: CO2 , NOx , Noise

Safety

Rules

Models

Product Line Expansion DESIGN &

Unique per Race Circuit ENGINEERING

Unique per Operator

Design

Aesthetics

Consumer Preferences

Fashion

© Exa Corporation—Public 16

|

|

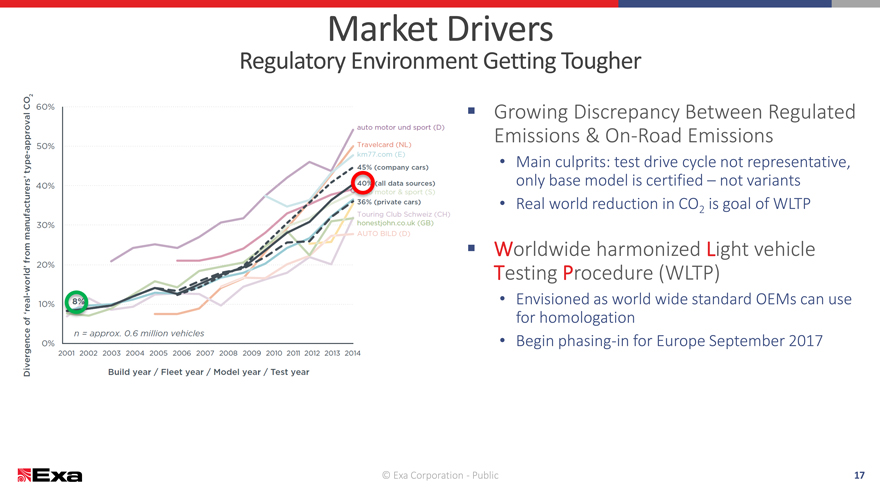

Market Drivers

Regulatory Environment Getting Tougher

Growing Discrepancy Between Regulated

Emissions & On-Road Emissions

Main culprits: test drive cycle not representative,

only base model is certified – not variants

Real world reduction in CO2 is goal of WLTP

Worldwide harmonized Light vehicle

Testing Procedure (WLTP)

Envisioned as world wide standard OEMs can use

for homologation

Begin phasing-in for Europe September 2017

© Exa Corporation—Public 17

|

|

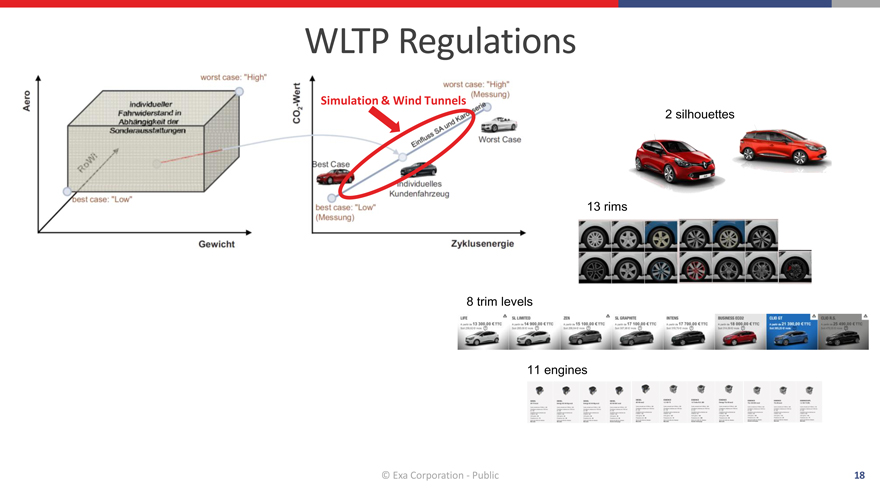

WLTP Regulations

Simulation & Wind Tunnels

2 silhouettes

13 rims

8 trim levels

11 engines

© Exa Corporation—Public 18

|

|

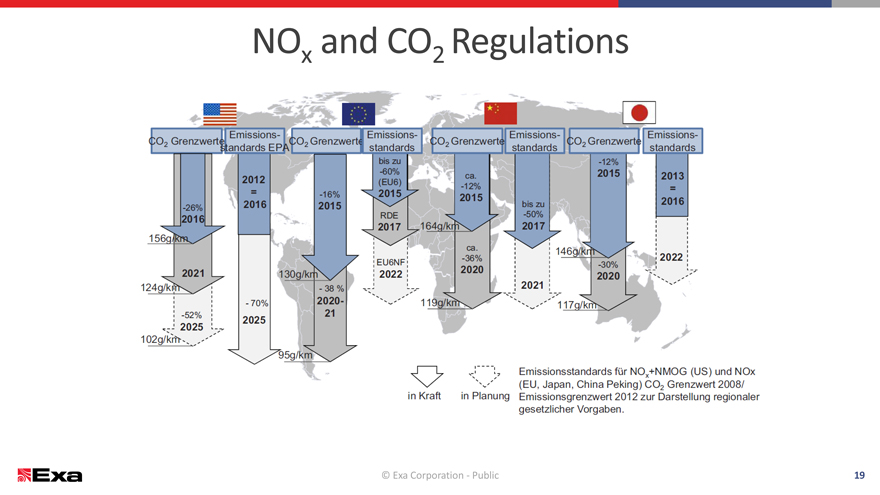

NOx and CO2 Regulations

© Exa Corporation—Public19

|

|

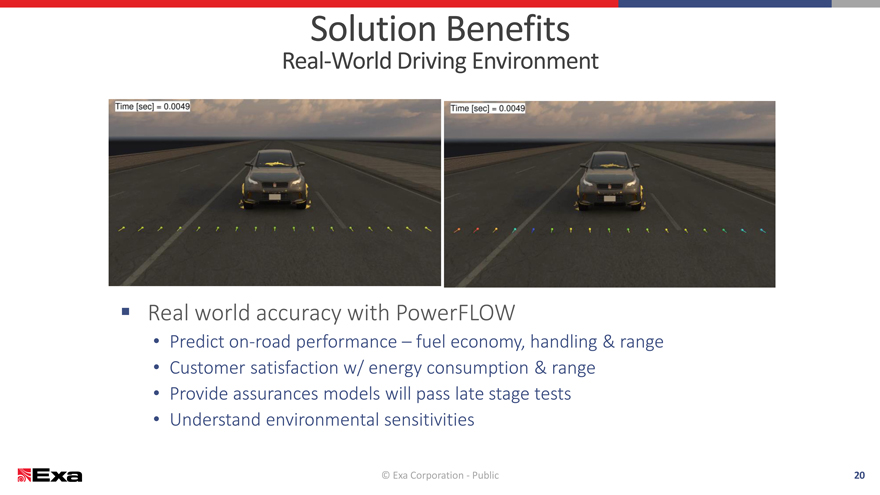

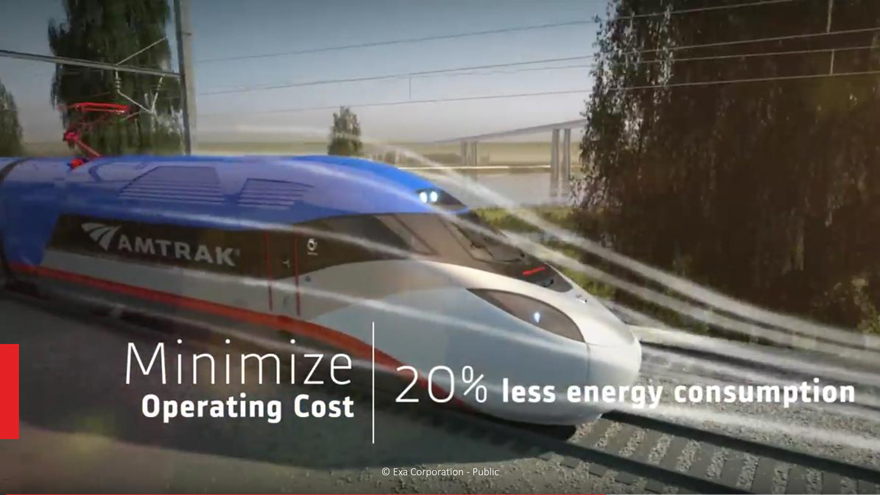

Solution Benefits

Real-World Driving Environment

Real world accuracy with PowerFLOW

Predict on-road performance – fuel economy, handling & range

Customer satisfaction w/ energy consumption & range

Provide assurances models will pass late stage tests

Understand environmental sensitivities

© Exa Corporation—Public 20

|

|

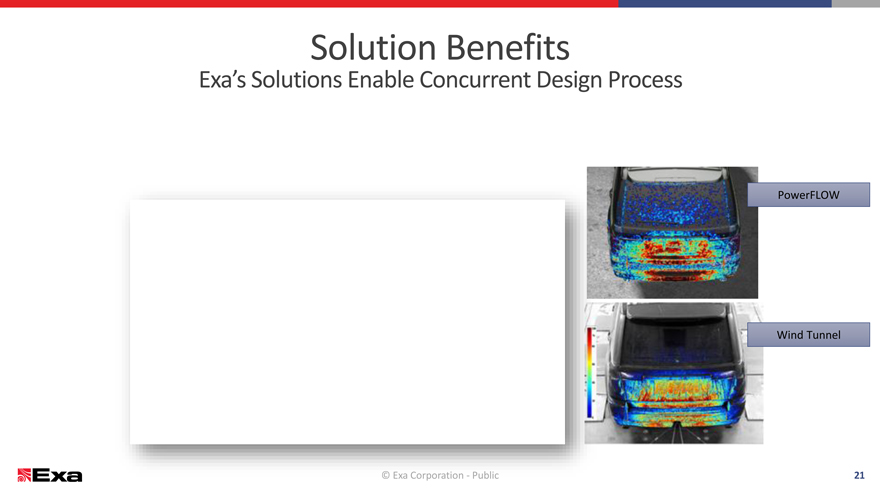

Solution Benefits

Exa’s Solutions Enable Concurrent Design Process

PowerFLOW

Wind Tunnel

© Exa Corporation—Public 21

|

|

Solution Benefits

What is Possible?

© Exa Corporation—Public 22

|

|

Aerodynamics Solution Overview

Soiling/Water Management – Wind Screen

23

|

|

MOTORSPORTS

|

|

MOTORSPORTS

|

|

OFF-HIGHWAY

|

|

© Exa Corporation—Public

|

|

ECOSYSTEM

© Exa Corporation—Public 28

|

|

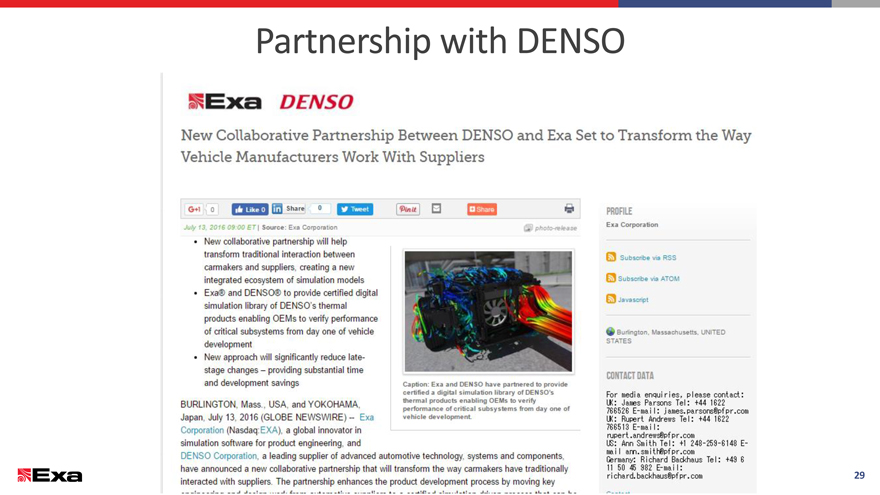

Partnership with DENSO

29

|

|

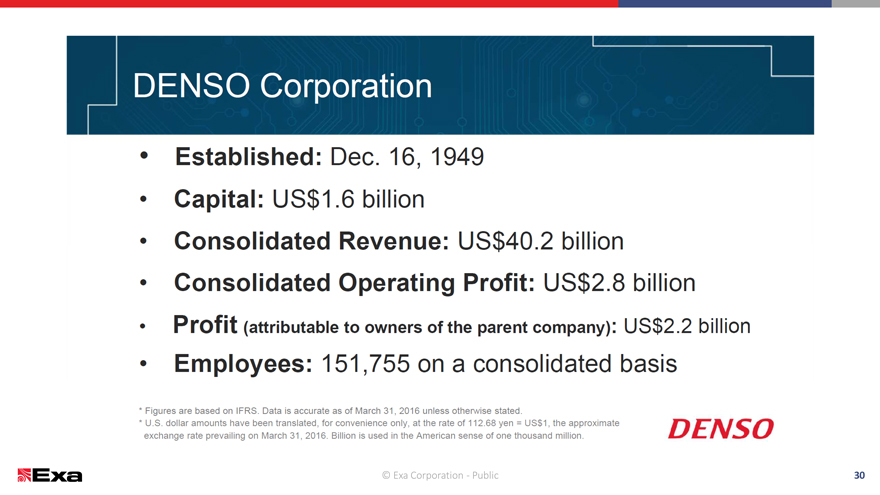

© Exa Corporation—Public 30

|

|

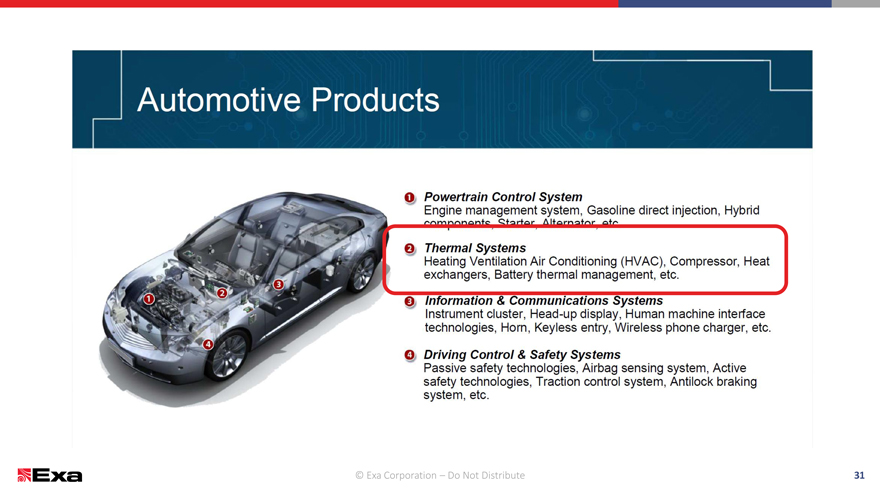

© Exa Corporation – Do Not Distribute 31

|

|

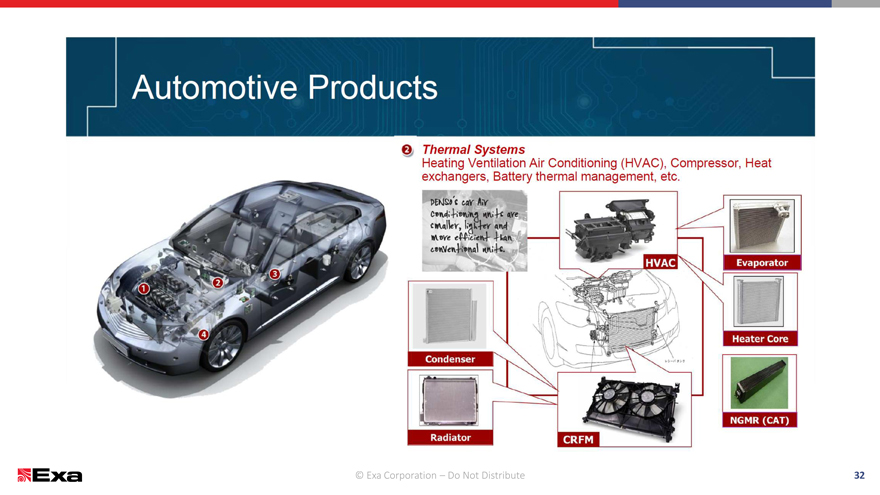

© Exa Corporation – Do Not Distribute 32

|

|

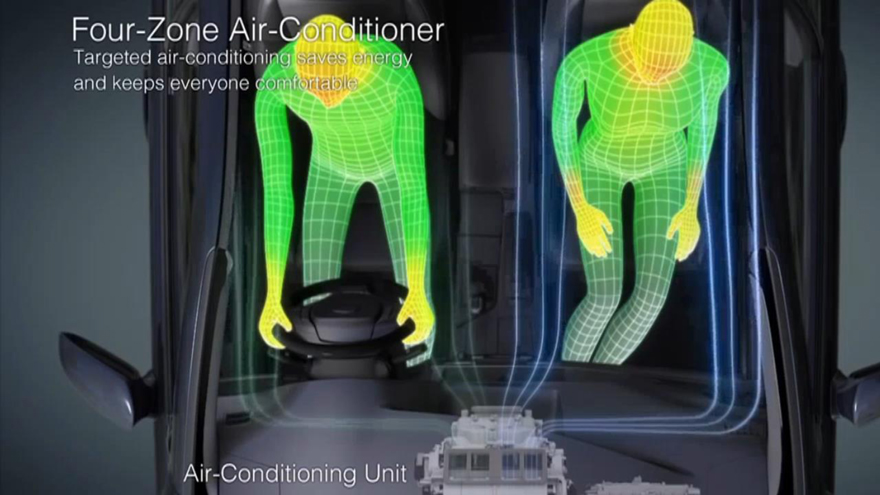

Air-Conditioning Unit

|

|

DENSO Statement to Investors

© Exa Corporation—Public 34

|

|

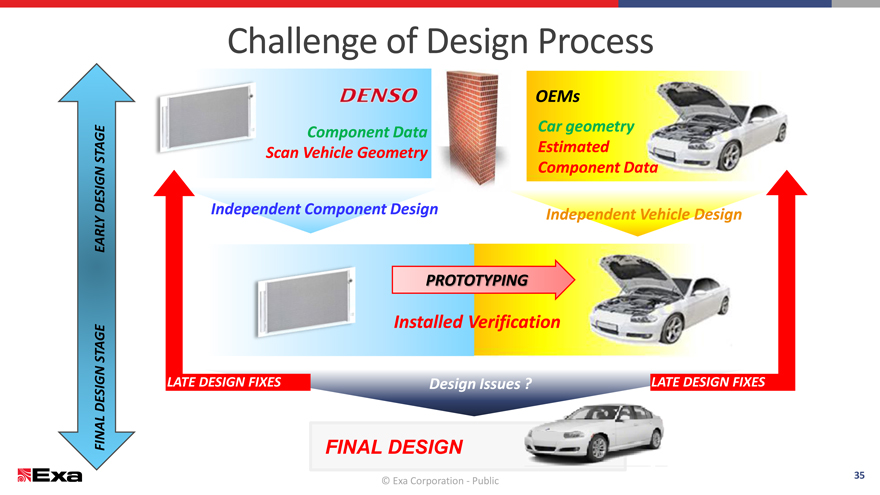

Challenge of Design Process

OEMs

Component DataCar geometry

STAGE Scan Vehicle Geometry Estimated

GN Component Data

DESI Independent Component Design Independent Vehicle Design

EARLY

PROTOTYPING

Installed Verification

STAGE

N

DESIG LATE DESIGN FIXES Design Issues ?LATE DESIGN FIXES

FINAL FINAL DESIGN

© Exa Corporation—Public35

|

|

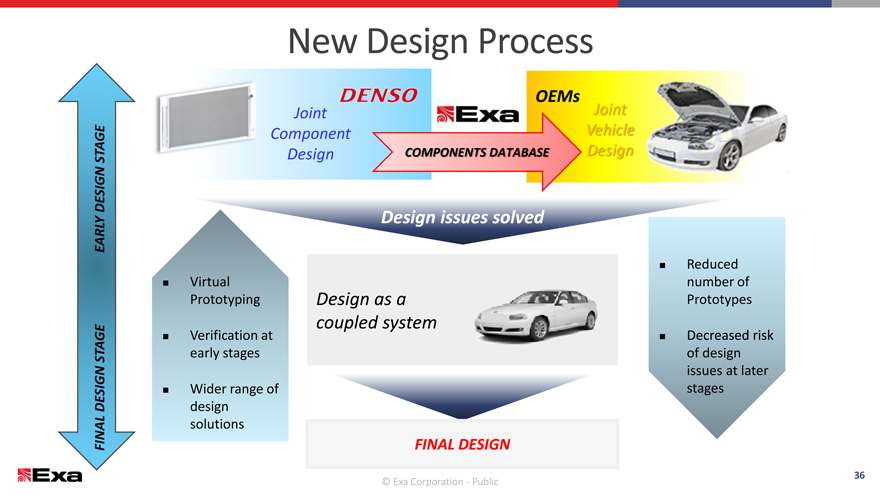

New Design Process

OEMs

JointJoint

ComponentVehicle

STAGE DesignCOMPONENTS DATABASEDesign

GN

DESI

EARLY Design issues solved

?Reduced

? Virtualnumber of

PrototypingDesign as aPrototypes

coupled system

? Verification at?Decreased risk

STAGE early stagesof design

N issues at later

? Wider range ofstages

DESIG design

solutions

FINAL FINAL DESIGN

36

© Exa Corporation—Public

|

|

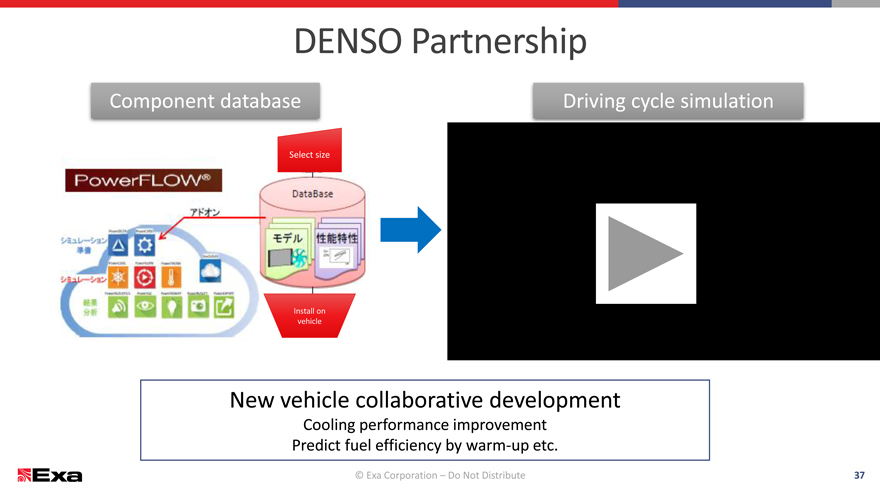

DENSO Partnership

Component database Driving cycle simulation

Select size

Install on

vehicle

New vehicle collaborative development

Cooling performance improvement

Predict fuel efficiency by warm-up etc.

© Exa Corporation – Do Not Distribute 37

|

|

AEROSPACE

© Exa Corporation—Public 38

|

|

AEROSPACE MARKET OVERVIEW

December 14, 2016

© Exa Corporation—Public

|

|

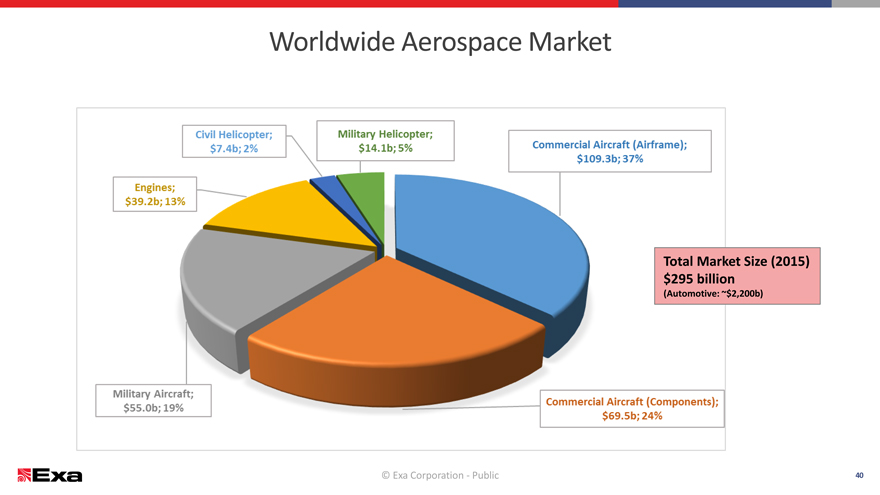

Worldwide Aerospace Market

Total Market Size (2015)

$295 billion

(Automotive: ~$2,200b)

© Exa Corporation—Public 40

|

|

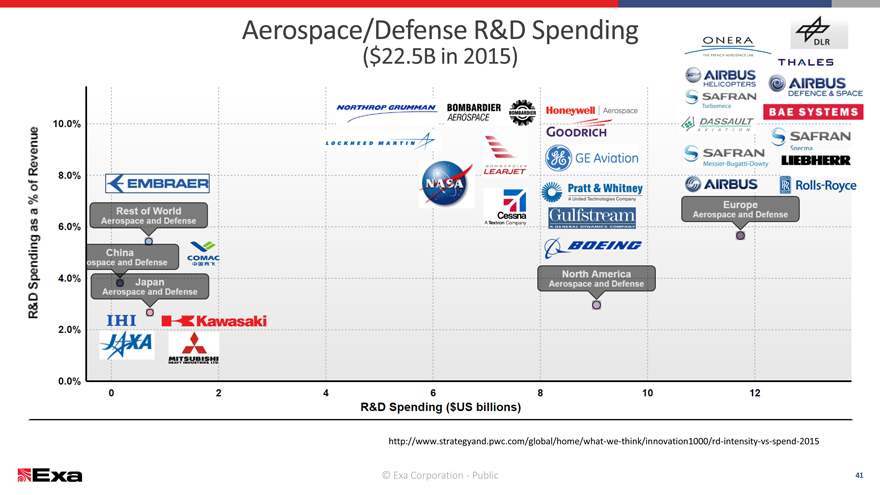

Aerospace/Defense R&D Spending

($22.5B in 2015)

http://www.strategyand.pwc.com/global/home/what-we-think/innovation1000/rd-intensity-vs-spend-2015

© Exa Corporation—Public 41

|

|

Development Process Today In Aerospace

Wind Tunnels, Simulation and Flight Tests

Wind Tunnel Simulation

10X 1X

100X

Flight Test

Prepare Flight Test

Reduce Program Risk & Cost

Long-Term Goal: Certification by Analysis

© Exa Corporation—Public 42

|

|

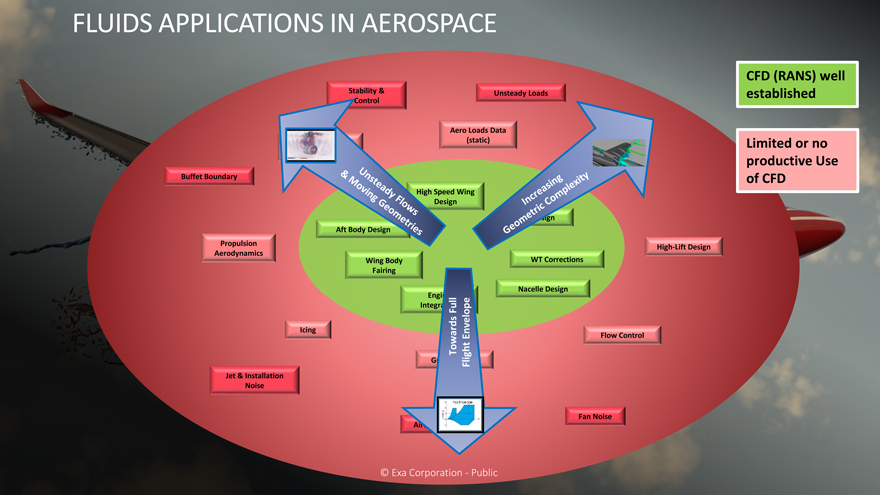

FLUIDS APPLICATIONS IN AEROSPACE

CFD (RANS) well

Stability & Unsteady Loads established

Control

Aero Loads Data

ces & (static) Limited or no

productive Use

Buffet Boundary of CFD

High Speed Wing

Design

Inlet Design

Aft Body Design

Propulsion High-Lift Design

Aerodynamics

Wing Body WT Corrections

Fairing

Nacelle Design

Engine

IntegrationFull

Icing

Towards Envelope Flow Control

Ground EffectFlight

Jet & Installation

Noise

Fan Noise

Airfram

© Exax Corporationti — Publicic

|

|

|

|

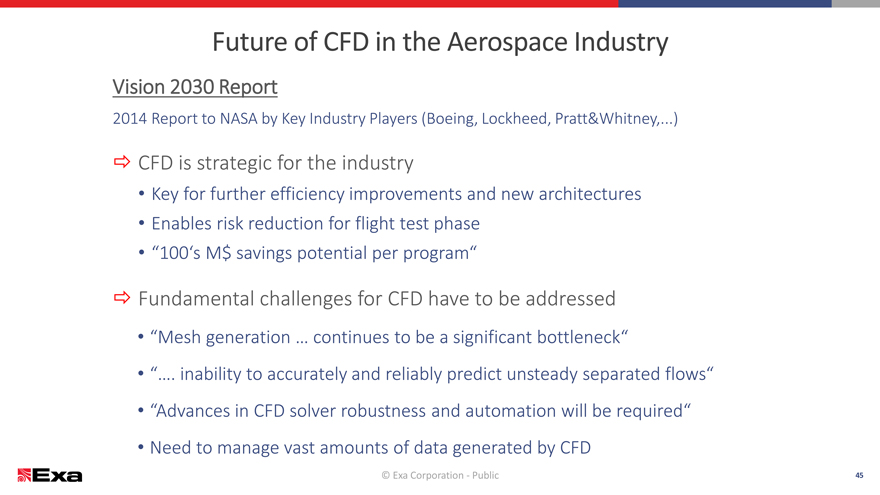

Future of CFD in the Aerospace Industry

Vision 2030 Report

2014 Report to NASA by Key Industry Players (Boeing, Lockheed, Pratt&Whitney,...)

? CFD is strategic for the industry

Key for further efficiency improvements and new architectures

Enables risk reduction for flight test phase

“100‘s M$ savings potential per program“

? Fundamental challenges for CFD have to be addressed

“Mesh generation … continues to be a significant bottleneck“

“…. inability to accurately and reliably predict unsteady separated flows“

“Advances in CFD solver robustness and automation will be required“

Need to manage vast amounts of data generated by CFD

© Exa Corporation—Public 45

|

|

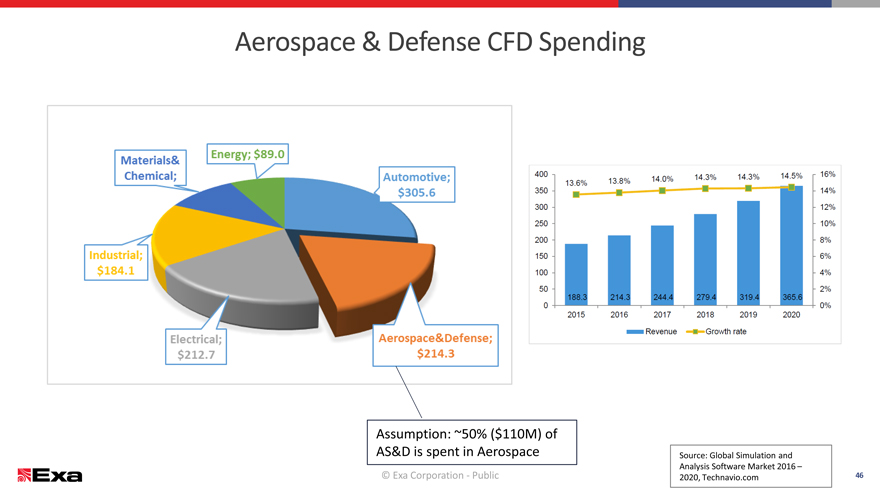

Assumption: ~50% ($110M) of

AS&D

is spent in Aerospace

© Exa Corporation—Public

|

|

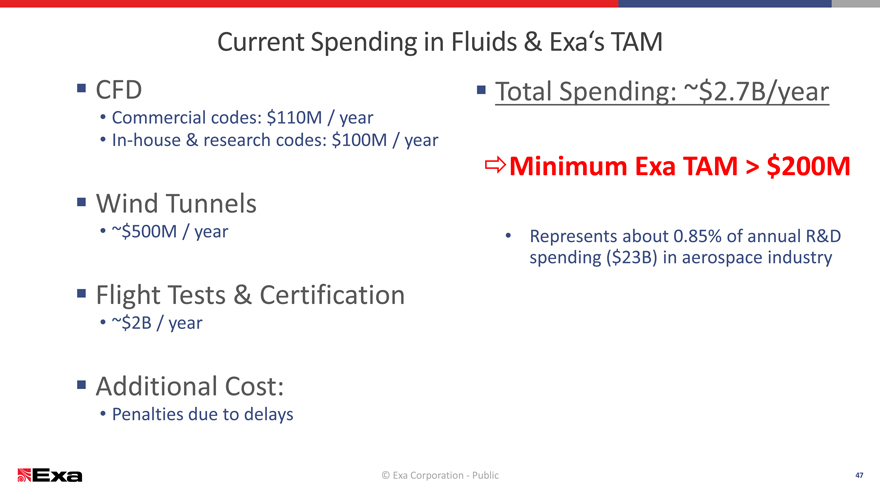

Current Spending in Fluids & Exa‘s TAM

CFD Total Spending: ~$2.7B/year

Commercial codes: $110M / year

In-house & research codes: $100M / year

?Minimum Exa TAM > $200M

Wind Tunnels

~$500M / year Represents about 0.85% of annual R&D

spending ($23B) in aerospace industry

Flight Tests & Certification

~$2B / year

Additional Cost:

Penalties due to delays

© Exa Corporation—Public47

|

|

© Exa Corporation—Public

|

|

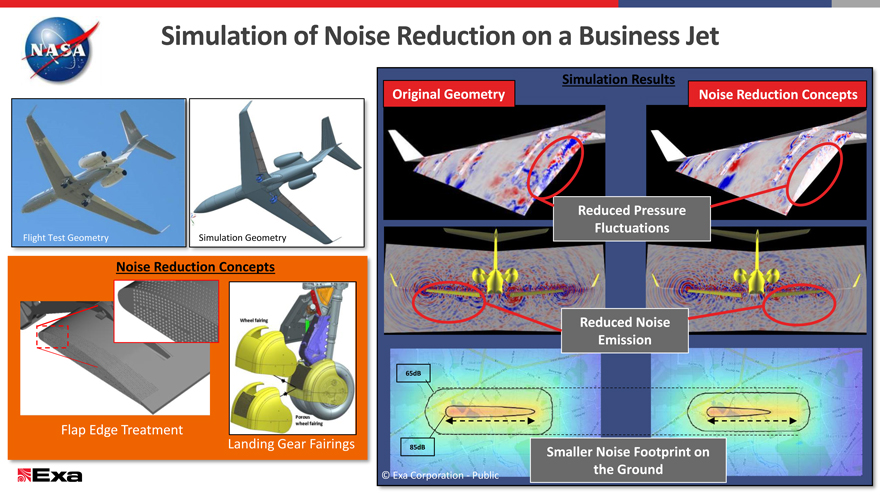

a Business Jet

Simulation Results

Original Geometry Noise Reduction Concepts

Reduced Pressure

Fluctuations

Reduced Noise

Emission

65dB

85dB Smaller Noise Footprint on

© Exa Corporation—Public the Ground

|

|

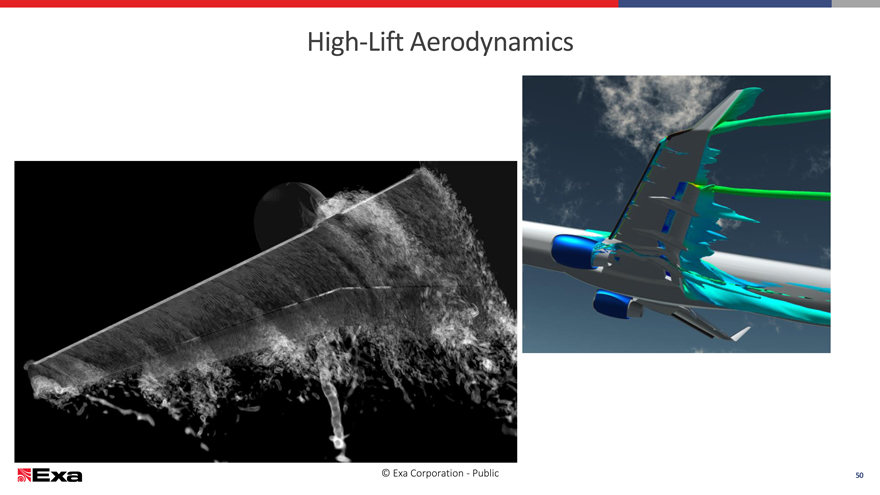

High-Lift Aerodynamics

© Exa Corporation—Public 50

|

|

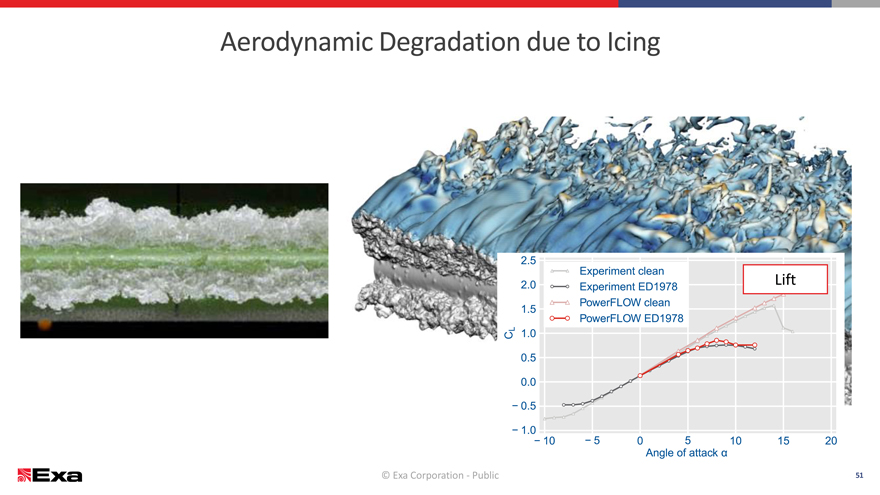

Aerodynamic Degradation due to Icing

Lift

© Exa Corporation—Public 51

|

|

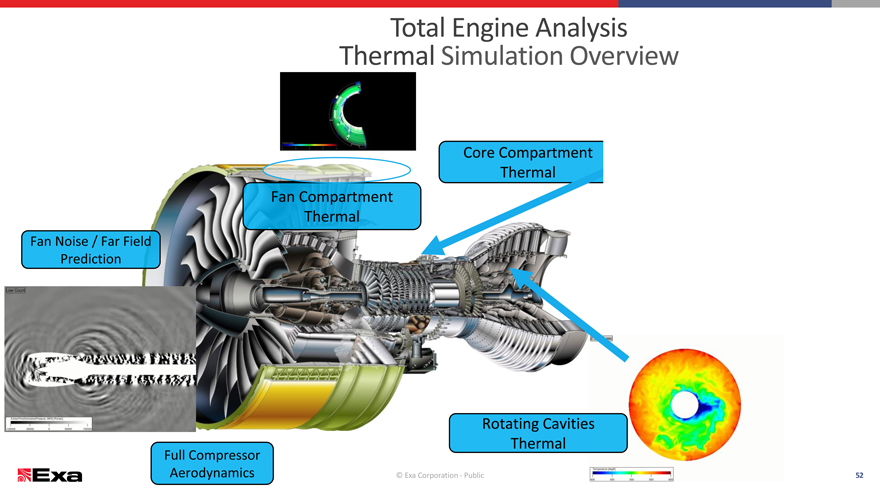

Total Engine Analysis

Thermal Simulation Overview

Core Compartment Thermal Fan Compartment Thermal

Fan Noise / Far Field Prediction

Rotating Cavities

Full Compressor Thermal

Aerodynamics © Exa Corporation—Public 52

|

|

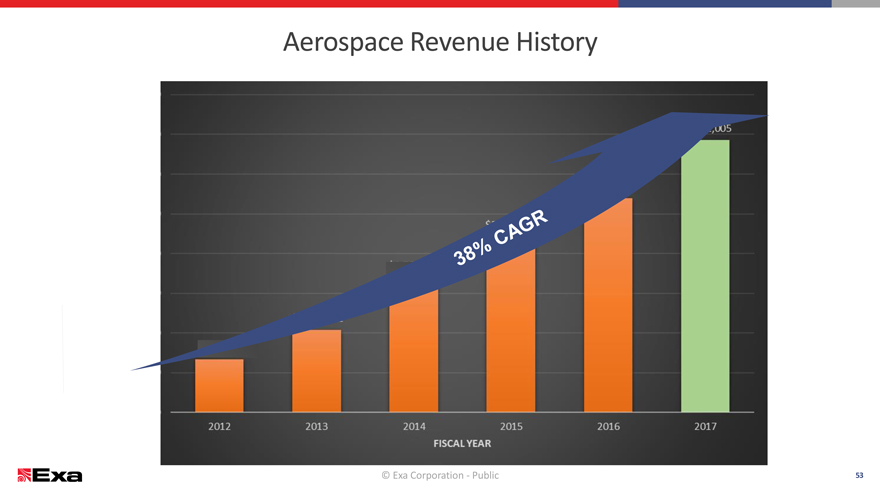

Aerospace Revenue History

© Exa Corporation—Public 53

|

|

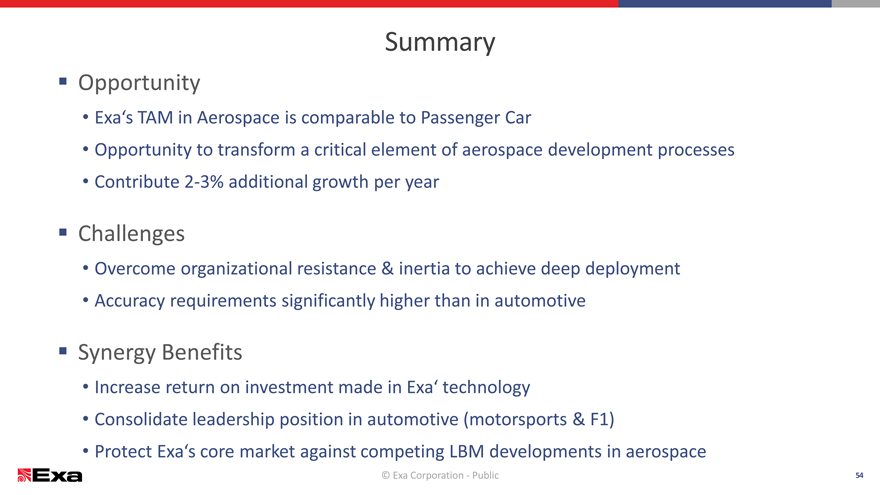

Summary

Opportunity

Exa‘s TAM in Aerospace is comparable to Passenger Car

Opportunity to transform a critical element of aerospace development processes

Contribute 2-3% additional growth per year

Challenges

Overcome organizational resistance & inertia to achieve deep deployment

Accuracy requirements significantly higher than in automotive

Synergy Benefits

Increase return on investment made in Exa‘ technology

Consolidate leadership position in automotive (motorsports & F1)

Protect Exa‘s core market against competing LBM developments in aerospace

© Exa Corporation—Public 54

|

|

OIL & GAS

© Exa Corporation—Public 55

|

|

OIL & GAS INTRODUCTION

December 14, 2016

© Exa Corporation—Public

|

|

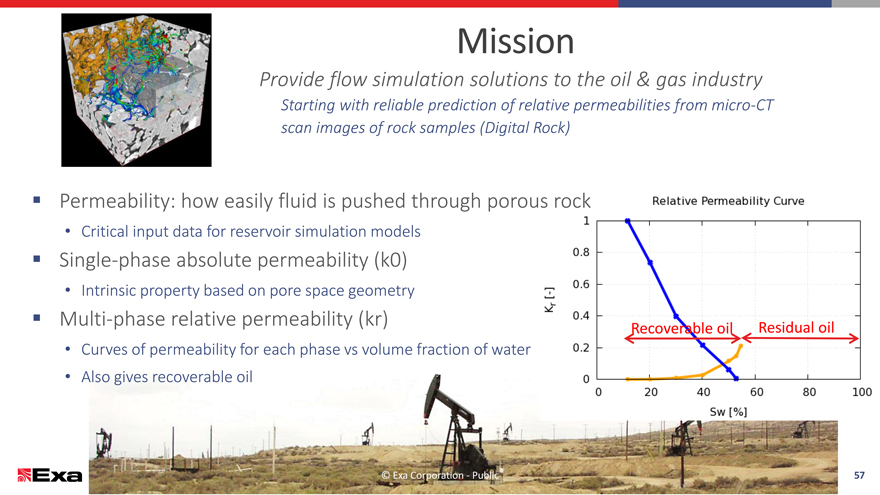

Mission

Provide flow simulation solutions to the oil & gas industry

Starting with reliable prediction of relative permeabilities from micro-CT

scan images of rock samples (Digital Rock)

Permeability: how easily fluid is pushed through porous rock

Critical input data for reservoir simulation models

Single-phase absolute permeability (k0)

Intrinsic property based on pore space geometry

Multi-phase relative permeability (kr) Recoverable oilResidual oil

Curves of permeability for each phase vs volume fraction of water

Also gives recoverable oil

© Exa Corporation—Public57

|

|

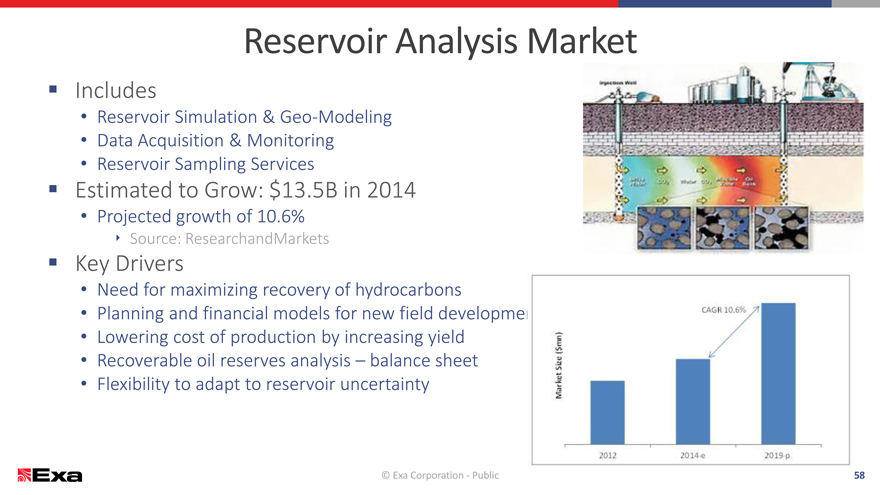

Reservoir Analysis Market

Includes

Reservoir Simulation & Geo-Modeling

Data Acquisition & Monitoring

Reservoir Sampling Services

Estimated to Grow: $13.5B in 2014

Projected growth of 10.6%

? Source: ResearchandMarkets

Key Drivers

Need for maximizing recovery of hydrocarbons

Planning and financial models for new field developmen

Lowering cost of production by increasing yield

Recoverable oil reserves analysis – balance sheet

Flexibility to adapt to reservoir uncertainty

© Exa Corporation—Public58

|

|

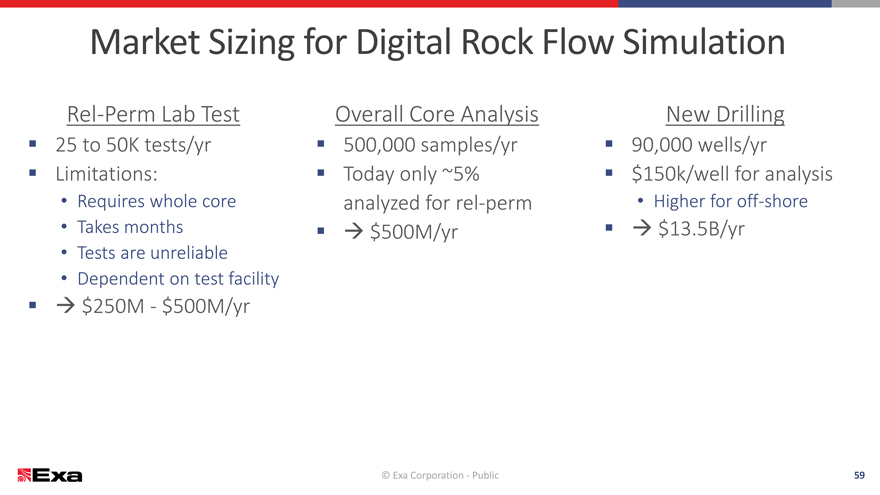

Market Sizing for Digital Rock Flow Simulation

Rel-Perm Lab Test Overall Core AnalysisNew Drilling

25 to 50K tests/yr 500,000 samples/yr 90,000 wells/yr

Limitations: Today only ~5% $150k/well for analysis

Requires whole coreanalyzed for rel-perm Higher for off-shore

Takes months ? $500M/yr ? $13.5B/yr

Tests are unreliable

Dependent on test facility

? $250M—$500M/yr

© Exa Corporation—Public59

|

|

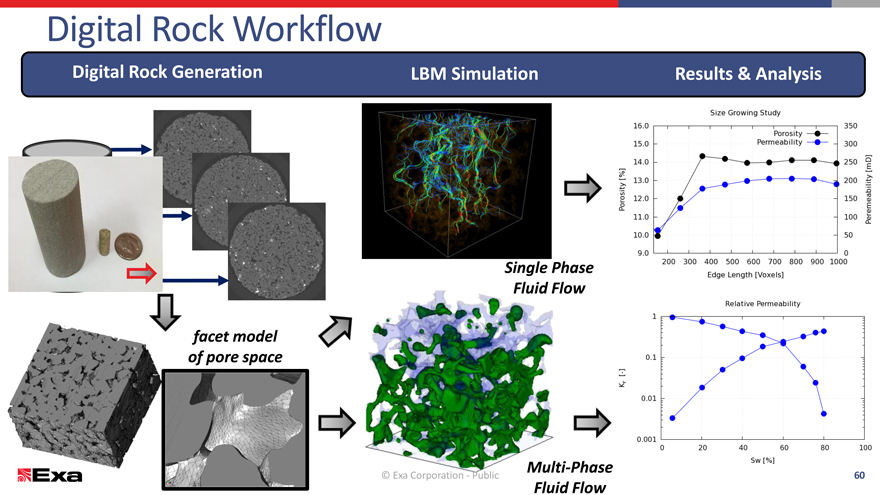

Digital Rock Workflow

Digital Rock Generation LBM Simulation Results & Analysis

Single Phase

Fluid Flow

facet model

of pore space

Multi-Phase

© Exa Corporation—Public 60

Fluid Flow

|

|

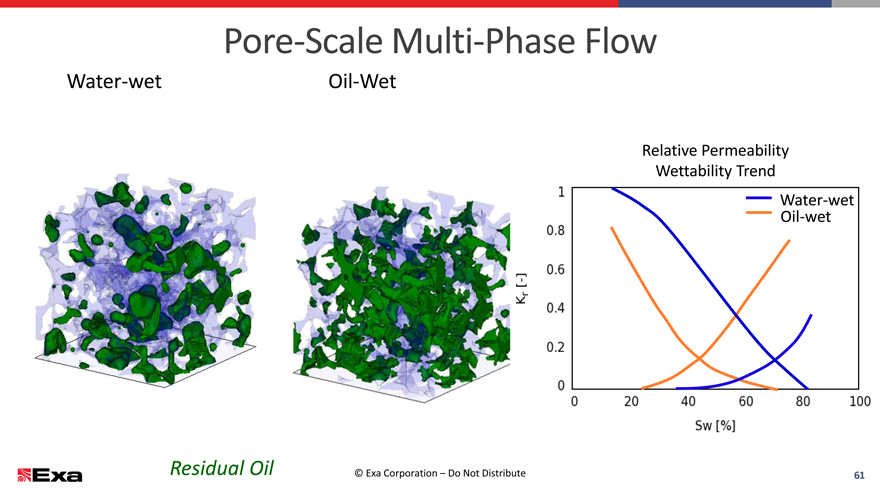

Pore-Scale Multi-Phase Flow

Water-wet Oil-Wet

Relative Permeability

Wettability Trend

Water-wet

Oil-wet

Residual Oil © Exa Corporation – Do Not Distribute61

|

|

Exa Digital Rock Positioning: kr

Capillary Number Trend

Capable Multi-Phase Solver

Accurate physics(%)50

40

Extensive validation

Better Than Physical Testing Saturation30

Faster: days instead of monthsOil20

Consistent: user-independent, reproducible10

Reliable: controlled conditionsResidual0

Application to EOR 1Capillary 10 Number 100 (??106 )1000

Enhanced oil recovery

Screen candidate methods

(steam injection, chemicals)

Test sensitivity to key parameters

(Ca, wettability, viscosity ratio)

© Exa Corporation—Public62

|

|

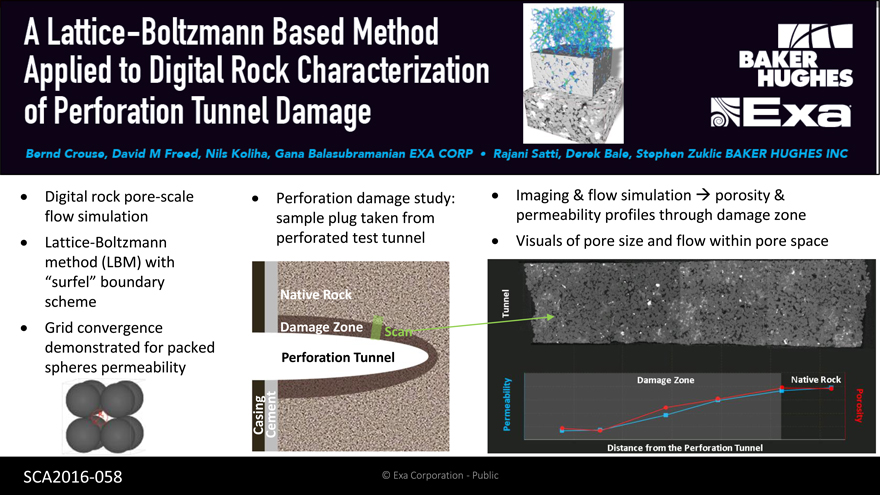

e study: ? Imaging & flow simulation ? porosity &

rom permeability profiles through damage zone

nel ? Visuals of pore size and flow within pore space

n

© Exa Corporation—Public

|

|

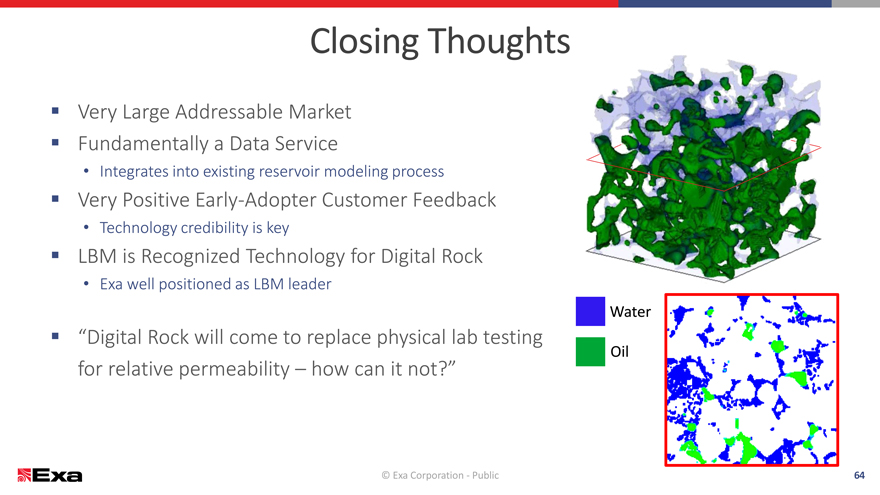

Closing Thoughts

Very Large Addressable Market

Fundamentally a Data Service

Integrates into existing reservoir modeling process

Very Positive Early-Adopter Customer Feedback

Technology credibility is key

LBM is Recognized Technology for Digital Rock

Exa well positioned as LBM leader

Water

“Digital Rock will come to replace physical lab testing

Oil

for relative permeability – how can it not?”

© Exa Corporation—Public 64

|

|

Agenda

8:30 – 9:30 Registration, Coffee, Demonstrations

9:30 – 11:00 Welcome and Exa Overview, Steve Remondi, CEO

? Company Mission, Strategy and Overview

? Ground Transportation Market Update

? Ecosystem: DENSO Partnership

? Aerospace Market Overview

? Oil & Gas introduction and Market Opportunity

11:15 – 11:45 Product Strategy, Suresh Sundaram, SVP Products & Marketing

11:45 – 12:15 Financial Update, Rick Gilbody, CFO

? Financial Model and Strategy

? FY 17 & FY 18 Guidance

12:15 – 1:00 Q & A

Box Lunch

© Exa Corporation—Public 65

|

|

Agenda

8:30 – 9:30 Registration, Coffee, Demonstrations

9:30 – 11:00 Welcome and Exa Overview, Steve Remondi, CEO

? Company Mission, Strategy and Overview

? Ground Transportation Market Update

? Ecosystem: DENSO Partnership

? Aerospace Market Overview

? Oil & Gas introduction and Market Opportunity

11:00 – 11:15 Break

11:45 – 12:15 Financial Update, Rick Gilbody, CFO

? Financial Model and Strategy

? FY 17 & FY 18 Guidance

12:15 – 1:00 Q & A

Box Lunch

© Exa Corporation—Public 66

|

|

PRODUCT STRATEGY

Suresh Sundaram | SVP Products and Marketing | Dec-14-2016

© Exa Corporation—Public

|

|

Suresh Sundaram Bio

Education

B Tech Chemical Engineering – IIT Bombay

MS and PhD Chemical Engineering – MIT

Executive Education, Harvard Business School

Relevant Experience—Aspen Technology, Inc.

Leading provider of simulation and optimization software for the hydrocarbon processing industries

Software Development (7y), Product Management (7y), Sales and Marketing (9y)

Company grew from $14M to $450M in revenue

Board Member, GSE Systems (NASDAQ: GVP)

Provider of simulation software and services to the nuclear power industry

© Exa Corporation—Public 68 68

|

|

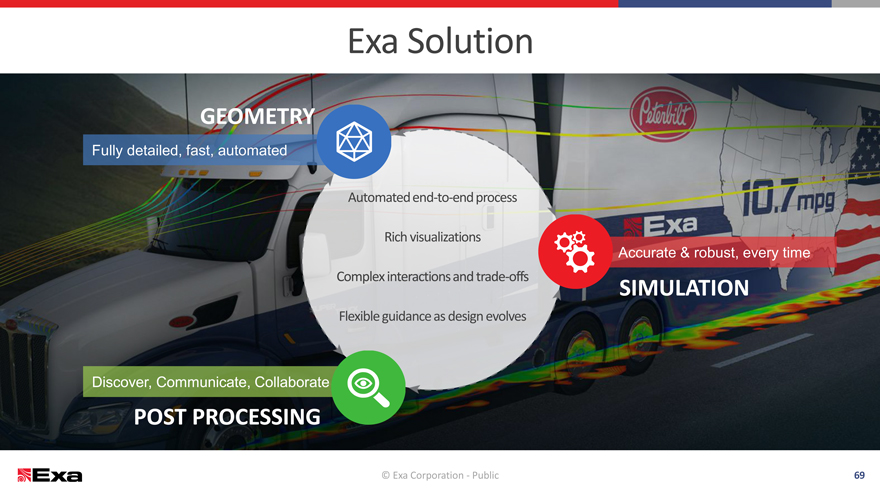

Exa Solution

GEOMETRY

Fully detailed, fast, automated

Automated end-to-end process

Rich visualizations

Accurate & robust, every time

Complex interactions and trade-offs

SIMULATION

Flexible guidance as design evolves

Discover, Communicate, Collaborate

POST PROCESSING

© Exa Corporation—Public 69

|

|

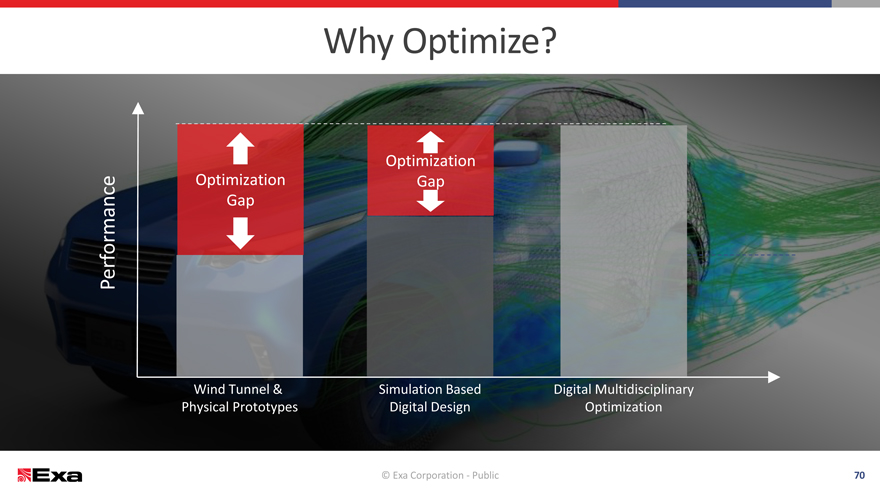

Why Optimize?

Optimization

Optimization Gap

Performance Gap

Wind Tunnel & Simulation BasedDigital Multidisciplinary

Physical Prototypes Digital DesignOptimization

© Exa Corporation—Public70

|

|

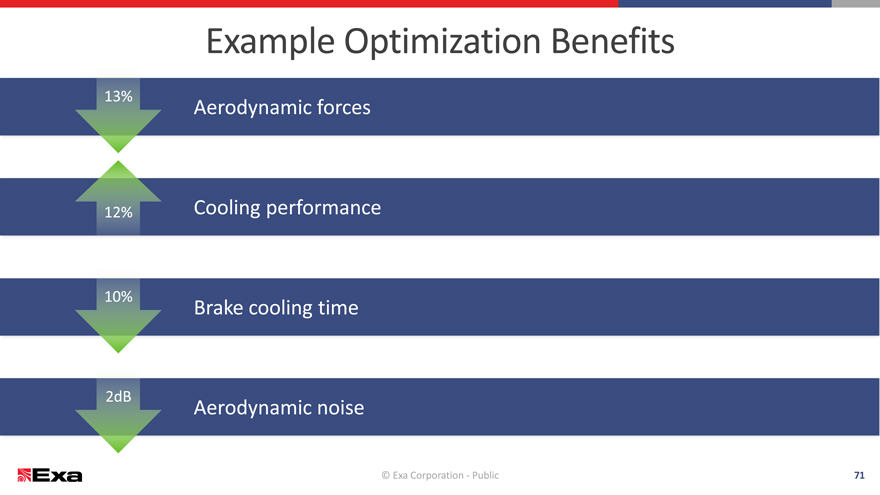

Example Optimization Benefits

13%

Aerodynamic forces

12% Cooling performance

10%

Brake cooling time

2dB

Aerodynamic noise

© Exa Corporation—Public 71

|

|

Strategic Themes

ACCURACY APPLICATIONS AUTOMATIONACCESSIBILITY

Realistic Conditions Best practices Tailored Workflows User Experience

Detailed Geometry Validation Performance Cloud & Ecosystem

© Exa Corporation—Public 72

|

|

NewDevelopments

ACCURACY APPLICATIONS

Realistic Wind Rotating Tire Tread Soiling & Water MgmtDefrost/DemistDrive Cycle

ACCESSIBILITY AUTOMATION

Learning Center ExaCLOUD Realistic RenderingTemplatesAuto MonitoringOptimization

© Exa Corporation—Public73

|

|

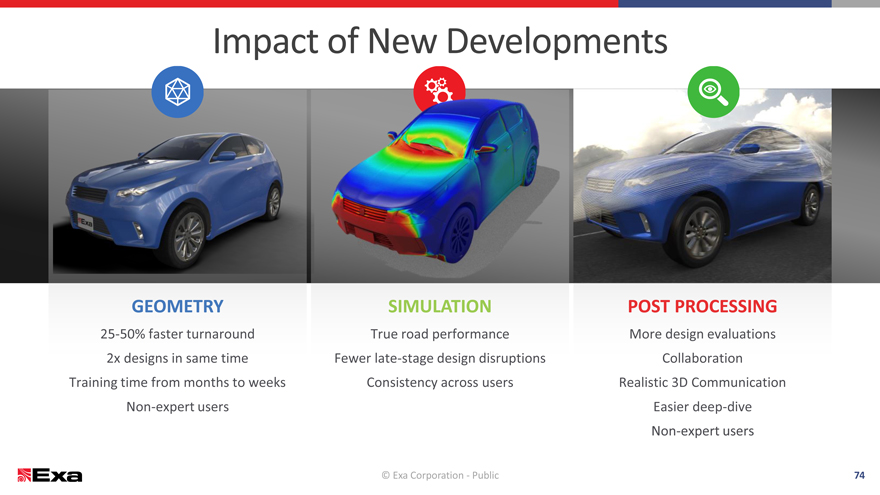

Impact of New Developments

GEOMETRY SIMULATION POST PROCESSING

25-50% faster turnaround True road performance More design evaluations

2x designs in same time Fewer late-stage design disruptions Collaboration

Training time from months to weeks Consistency across users Realistic 3D Communication

Non-expert users Easier deep-dive

Non-expert users

© Exa Corporation—Public 74

|

|

Conclusion

REGULATIONS PRODUCT DIVERSITY

REAL WORLD PERFORMANCE COST-TO-MARKET

QUALITY

Simulation is no longer an option. It is now a business imperative.

© Exa Corporation—Public 75

|

|

Agenda

8:30 – 9:30 Registration, Coffee, Demonstrations

9:30 – 11:00 Welcome and Exa Overview, Steve Remondi, CEO

? Company Mission, Strategy and Overview

? Ground Transportation Market Update

? Ecosystem: DENSO Partnership

? Aerospace Market Overview

? Oil & Gas introduction and Market Opportunity

11:00 – 11:15 Break

11:15 – 11:45 Product Strategy, Suresh Sundaram, SVP Products & Marketing

12:15 – 1:00 Q & A

Box Lunch

© Exa Corporation—Public 76

|

|

Key Messages- Financial Foundation

Solid progress towards Investments aimed Target Model at size and timing of market opportunity

Focused on recurring Strong, consistent, balanced license revenue execution

© Exa Corporation—Public 77

© Exa Corporation. All rights reserved.

|

|

Key Financial Highlights

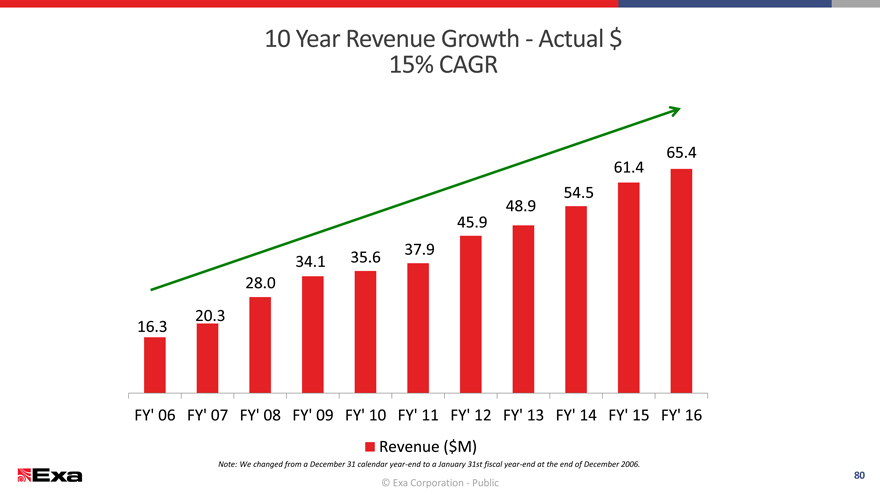

Strong, consistent revenue growth over 10 years

15% cc growth in last two fiscal years

Recurring, predictable, consumption license business model

Strong balance sheet, no debt

Balancing growth and margin leverage

Attractive long-term model, improving margins through revenue mix, deployment and scale

© Exa Corporation. © Exa Corporation All rights —Public reserved. 78

|

|

Exa Revenue Profile

License Revenue

Highly recurring and visible

On-premise and cloud consumption based license models

Expansion through installed base deployment and new customer acquisition

Ratable revenue recognition

Project Revenue

Fixed fee, on-site and T&M

Customer enablement and application validation

License expansion

Consulting services

© Exa Corporation. All rights reserved. 79

© Exa Corporation—Public

|

|

10 Year Revenue Growth—Actual $

15% CAGR

65.4

61.4

54.5

48.9

45.9

34.1 35.637.9

28.0

20.3

16.3

FY’ 06 FY’ 07 FY’ 08 FY’ 09 FY’ 10FY’ 11FY’ 12 FY’ 13 FY’ 14 FY’ 15FY’ 16

Revenue($M)

Note: We changed from a December 31 calendar year-end to a January 31st fiscal year-end at the end of December 2006.

80

© Exa ©Corporation. Exa Corporation All rights—Public reserved.

|

|

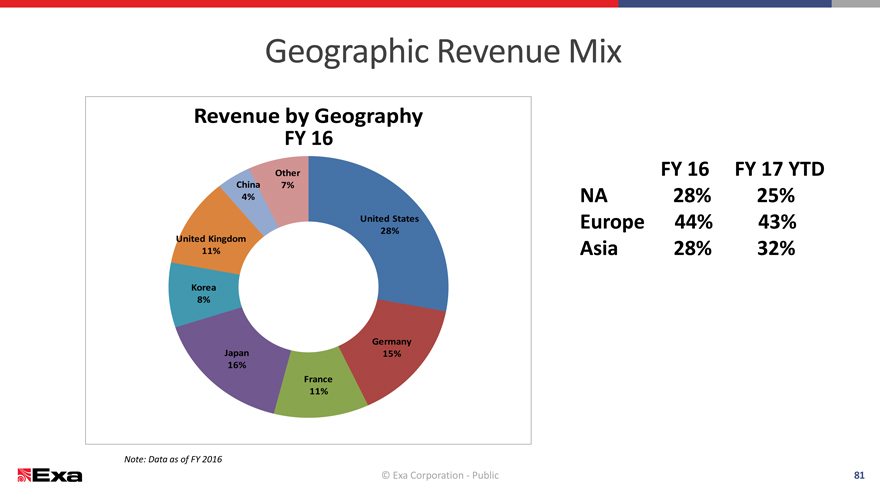

Geographic Revenue Mix

Revenue by Geography

FY 16

Other FY 16FY 17 YTD

China 7%

4% NA28%25%

United States Europe44%43%

28%

United Kingdom

11% Asia28%32%

Korea

8%

Germany

Japan 15%

16%

France

11%

Note: Data as of FY 2016

© Exa Corporation—Public 81

Exa Highly Confidential- Board of Directors Only

|

|

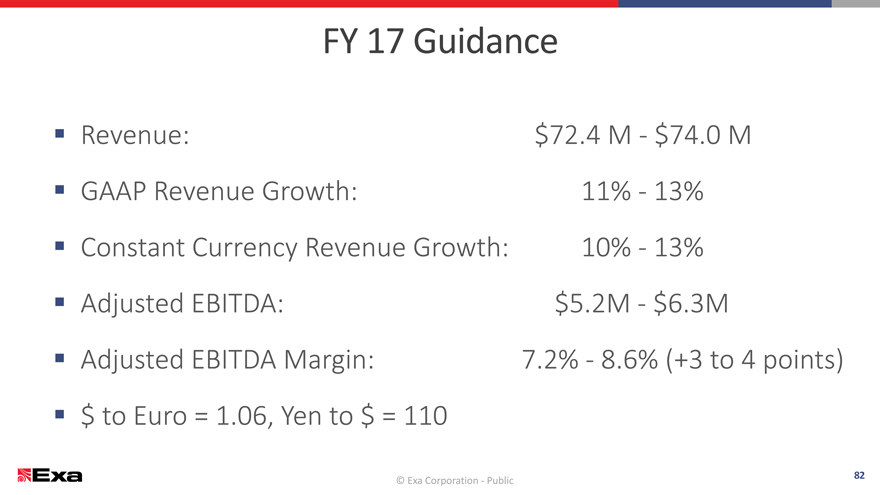

FY 17 Guidance

Revenue: $72.4 M—$74.0 M

GAAP Revenue Growth: 11%—13%

Constant Currency Revenue Growth:10%—13%

Adjusted EBITDA: $5.2M—$6.3M

Adjusted EBITDA Margin: 7.2%—8.6% (+3 to 4points)

$ to Euro = 1.06, Yen to $ = 110

© Exa Corporation. All rights reserved. 82

© Exa Corporation—Public

|

|

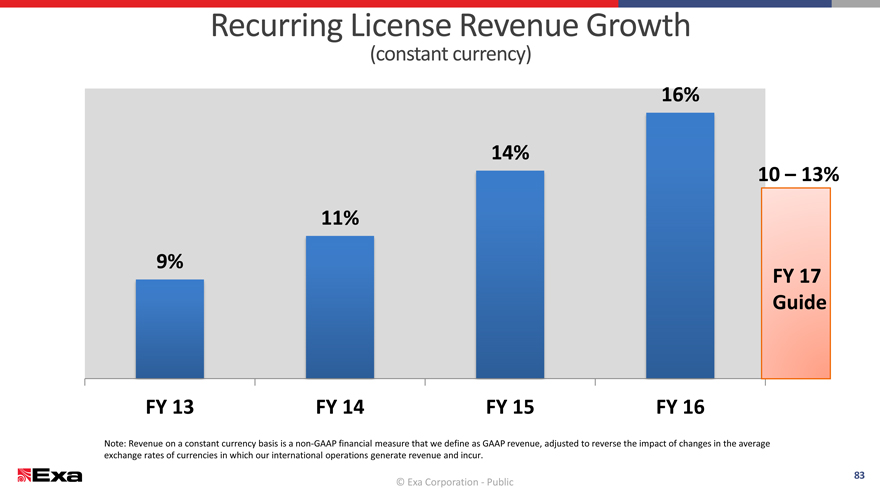

Recurring License Revenue Growth

(constant currency)

16%

14%

10 – 13%

11%

9%

FY 17

Guide

FY 13 FY 14 FY 15FY 16

Note: Revenue on a constant currency basis is a non-GAAP financial measure that we define as GAAP revenue, adjusted to reverse the impact of changes in the average

exchange rates of currencies in which our international operations generate revenue and incur.

© Exa Corporation. All rights reserved. 83

© Exa Corporation—Public

|

|

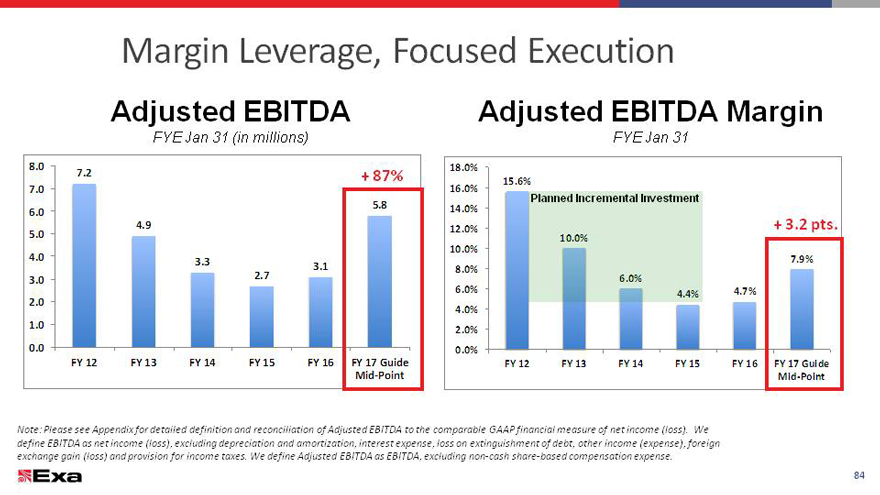

Margin Leverage, Focused Execution

Adjusted EBITDA Adjusted EBITDA Margin

FYE Jan 31 (in millions) FYE Jan 31

8.0 18.0%

7.2 + 87%15.6%

7.0 16.0%

5.814.0%

6.0

4.9 12.0%+ 3.2 pts.

5.0

10.0%

4.0 3.37.9%

3.18.0%

3.0 2.7

6.0%4.7%

2.0

4.0%

1.0 .0%

0.0 .0%

FY 12 FY 13 FY 14FY 15FY 16 FY 17 GuideFY 13FY 14FY 15FY 16 FY 17 Guide

Mid-PointMid-Point

Note: Please see Appendix for detailed definition and reconciliation of Adjusted EBITDA to the comparable GAAP financial measure of net income (loss). We

define EBITDA as net income (loss), excluding depreciation and amortization, interest expense, loss on extinguishment of debt, other income (expense), foreign

exchange gain (loss) and provision for income taxes. We define Adjusted EBITDA as EBITDA, excluding non-cash share-based compensation expense.

© Exa Corporation. All rights reserved.84

84

|

|

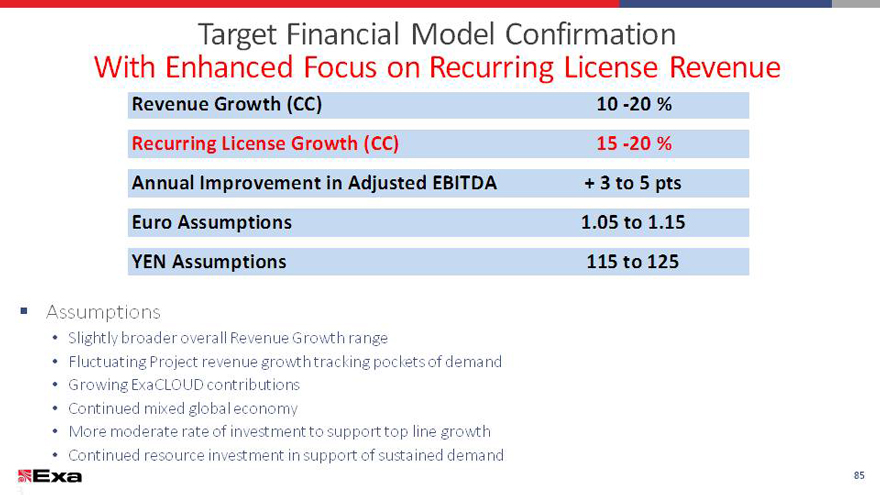

Target Financial Model Confirmation

With Enhanced Focus on Recurring License Revenue

Revenue Growth (CC)10 -20 %

Recurring License Growth (CC)15 -20 %

Annual Improvement in Adjusted EBITDA+ 3 to 5 pts

Euro Assumptions1.05 to 1.15

YEN Assumptions115 to 125

Assumptions

Slightly broader overall Revenue Growth range

Fluctuating Project revenue growth tracking pockets of demand

Growing ExaCLOUD contributions

Continued mixed global economy

More moderate rate of investment to support top line growth

Continued resource investment in support of sustained demand

© Exa Corporation. All rights reserved.85

© Exa Corporation—Public

85

|

|

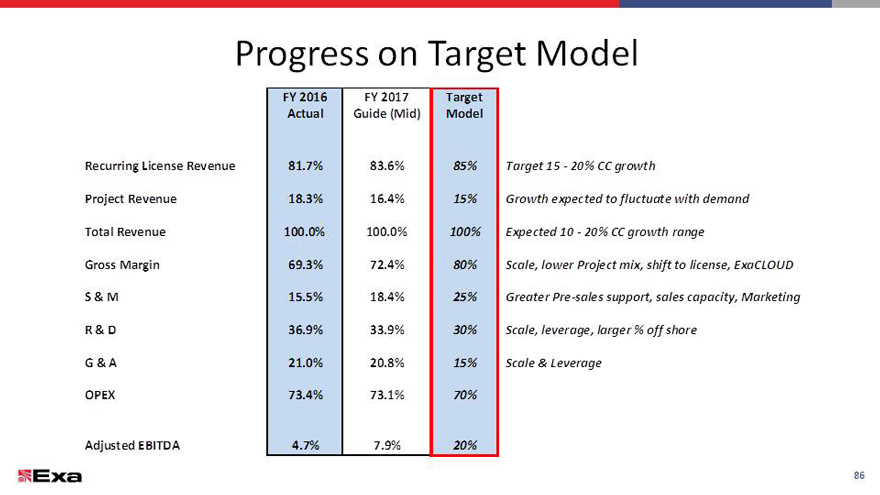

Progress on Target Model

FY 2016 FY 2017Target

Actual Guide (Mid)Model

Recurring License Revenue 81.7% 83.6%85%Target 15—20% CC growth

Project Revenue 18.3% 16.4%15%Growth expected to fluctuate with demand

Total Revenue 100.0% 100.0%100%Expected 10—20% CC growth range

Gross Margin 69.3% 72.4%80%Scale, lower Project mix, shift to license, ExaCLOUD

S & M 15.5% 18.4%25%Greater Pre-sales support, sales capacity, Marketing

R & D 36.9% 33.9%30%Scale, leverage, larger % off shore

G & A 21.0% 20.8%15%Scale & Leverage

OPEX 73.4% 73.1%70%

Adjusted EBITDA 4.7% 7.9%20%

86

|

|

The Power of the ExaCLOUD Platform

The Implementation (since 1/1/15):

100% of paid Exa simulation Project revenue delivered via ExaCLOUD

100% of previous Exa OnDemand customers migrated to ExaCLOUD

Over 40 logos have purchased ExaCLOUD capacity in the past 6 quarters

The Value:

Accelerating time to license and higher recurring license mix

Channel for application based digital simulation and leveraged Go-to-Market model

Opportunity to extend digital simulation into new market segments

Providing customers access to over 40,000 HPC cores in 3 data centers worldwide

© Exa Corporation—Public

|

|

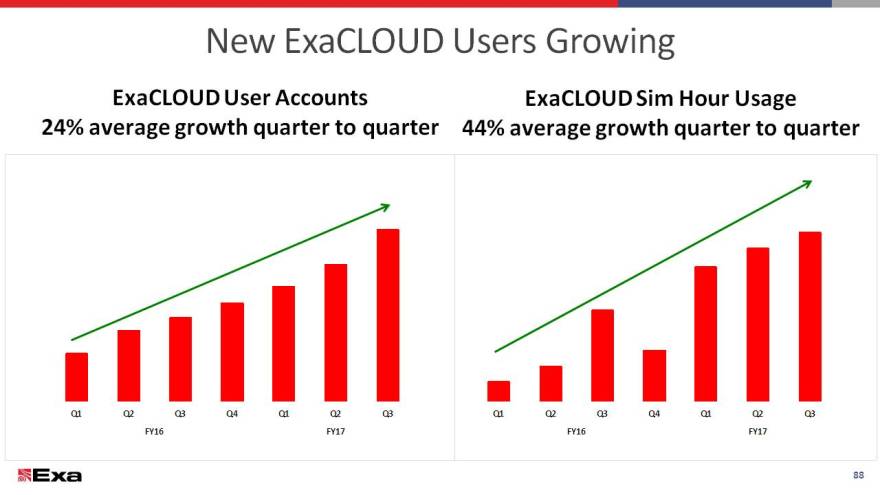

NewExaCLOUD UsersGrowing

ExaCLOUD User Accounts ExaCLOUD Sim-Hour Usage

24% average growth quarter to quarter 44% average growth quarter to quarter

Q1 Q2 Q3Q4Q1Q2Q3Q1Q2Q3Q4Q1Q2Q3

FY16FY17FY16FY17

© Exa Corporation—Public88

|

|

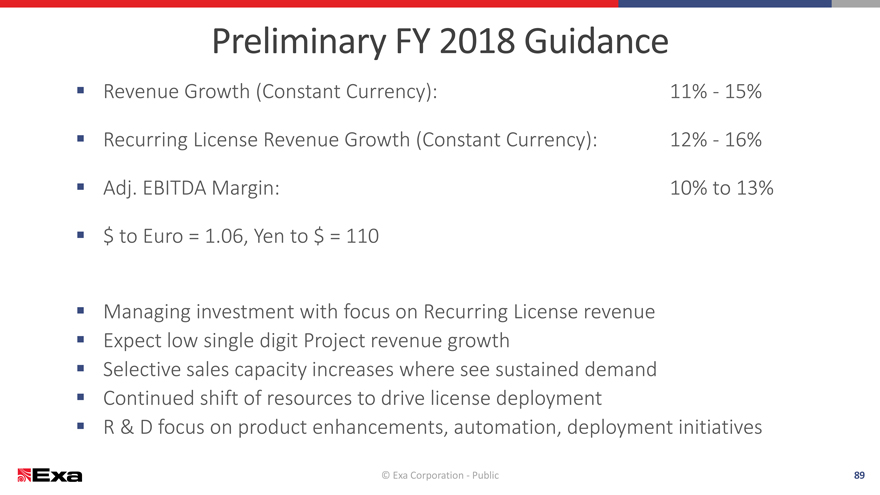

Preliminary FY 2018 Guidance

Revenue Growth (Constant Currency): 11%- 15%

Recurring License Revenue Growth (Constant Currency): 12%- 16%

Adj. EBITDA Margin: 10%to 13%

$ to Euro = 1.06, Yen to $ = 110

Managing investment with focus on Recurring License revenue

Expect low single digit Project revenue growth

Selective sales capacity increases where see sustained demand

Continued shift of resources to drive license deployment

R & D focus on product enhancements, automation, deployment initiatives

© Exa Corporation—Public 89

|

|

Summary

Strong and expanding market opportunity Significant deployment expansion runway Competitive technical advantage Strong customer base Extended market reach via ExaCLOUD Recurring License growth momentum Considerable margin expansion opportunity

© Exa Corporation—Public 90

|

|

Agenda

8:30 – 9:30 Registration, Coffee, Demonstrations

9:30 – 11:00 Welcome and Exa Overview, Steve Remondi, CEO

? Company Mission, Strategy and Overview

? Ground Transportation Market Update

? Ecosystem: DENSO Partnership

? Aerospace Market Overview

? Oil & Gas introduction and Market Opportunity

11:00 – 11:15 Break

11:15 – 11:45 Product Strategy, Suresh Sundaram, SVP Products & Marketing

11:45 – 12:15 Financial Update, Rick Gilbody, CFO

? Financial Model and Strategy

? FY 17 & FY 18 Guidance

Box Lunch

© Exa Corporation—Public 91

|

|

Questions

Large addressable market … Proven technology and solutions

only fractionally penetrated

Strong and consistent execution Improving profitability with

continued top-line growth

© Exa Corporation—Public 92

© Exa Corporation. All rights reserved.

|

|

THANK YOU

© Exa Corporation—Public

|

|

Appendix

© Exa Corporation—Public

|

|

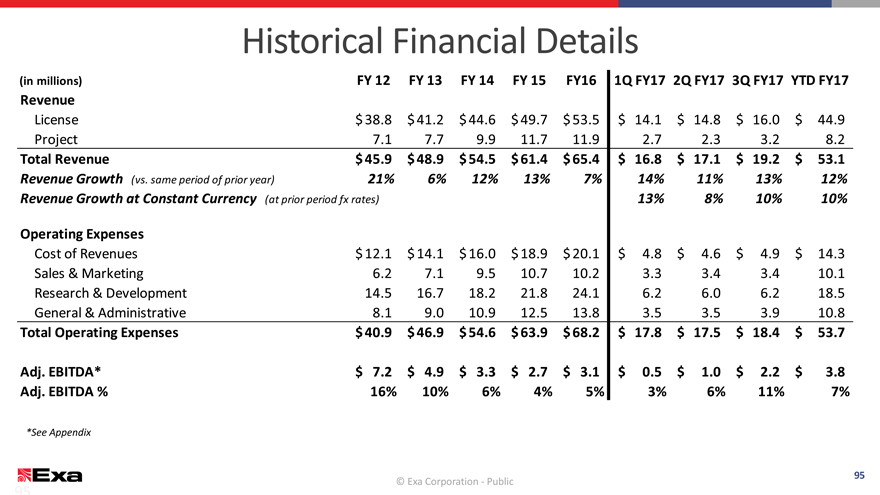

Historical Financial Details

(in millions) FY 12 FY 13FY 14FY 15FY161Q FY172Q FY173Q FY17YTD FY17

Revenue

License $38.8$ 41.2$ 44.6$ 49.7$ 53.5$14.1$14.8$16.0$44.9

Project 7.17.79.911.711.92.72.33.28.2

Total Revenue $45.9$ 48.9$ 54.5$ 61.4$ 65.4$16.8$17.1$19.2$53.1

Revenue Growth (vs. same period of prior year) 21%6%12%13%7%14%11%13%12%

Revenue Growth at Constant Currency (at prior period fx rates) 13%8%10%10%

Operating Expenses

Cost of Revenues $12.1$ 14.1$ 16.0$ 18.9$ 20.1$4.8$4.6$4.9$14.3

Sales & Marketing 6.27.19.510.710.23.33.43.410.1

Research & Development 14.516.718.221.824.16.26.06.218.5

General & Administrative 8.19.010.912.513.83.53.53.910.8

Total Operating Expenses $40.9$ 46.9$ 54.6$ 63.9$ 68.2$17.8$17.5$18.4$53.7

Adj. EBITDA* $7.2$4.9$3.3$2.7$ 3.1$0.5$1.0$2.2$3.8

Adj. EBITDA % 16%10%6%4%5%3%6%11%7%

*See Appendix

© Exa Corporation. All rights reserved. 95

© Exa Corporation—Public

95

|

|

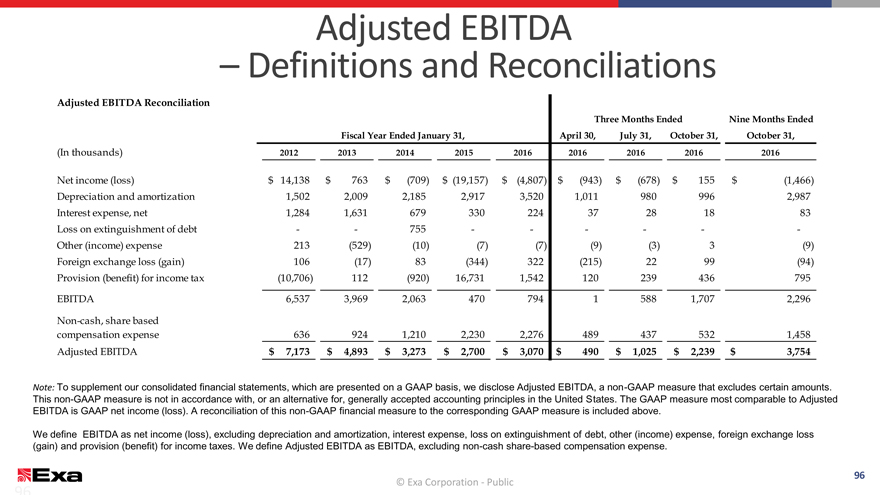

Adjusted EBITDA

– Definitions and Reconciliations

Adjusted EBITDA Reconciliation

Three Months EndedNine Months Ended

Fiscal Year Ended January 31,April 30,July 31,October 31,October 31,

(In thousands) 201220132014201520162016201620162016

Net income (loss) $14,138$763$(709)$(19,157)$(4,807)$(943)$(678)$155$(1,466)

Depreciation and amortization 1,5022,0092,1852,9173,5201,0119809962,987

Interest expense, net 1,2841,63167933022437281883

Loss on extinguishment of debt --755------

Other (income) expense 213(529)(10)(7)(7)(9)(3)3(9)

Foreign exchange loss (gain) 106(17)83(344)322(215)2299(94)

Provision (benefit) for income tax (10,706)112(920)16,7311,542120239436795

EBITDA 6,5373,9692,06347079415881,7072,296

Non-cash, share based

compensation expense 6369241,2102,2302,2764894375321,458

Adjusted EBITDA $7,173$4,893$3,273$2,700$3,070$490$1,025$2,239$3,754

Note: To supplement our consolidated financial statements, which are presented on a GAAP basis, we disclose Adjusted EBITDA, a non-GAAP measure that excludes certain amounts.

This non-GAAP measure is not in accordance with, or an alternative for, generally accepted accounting principles in the United States. The GAAP measure most comparable to Adjusted

EBITDA is GAAP net income (loss). A reconciliation of this non-GAAP financial measure to the corresponding GAAP measure is included above.

We define EBITDA as net income (loss), excluding depreciation and amortization, interest expense, loss on extinguishment of debt, other (income) expense, foreign exchange loss

(gain) and provision (benefit) for income taxes. We define Adjusted EBITDA as EBITDA, excluding non-cash share-based compensation expense.

© Exa Corporation. All rights reserved.96

© Exa Corporation—Public

96

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- 420 with CNW — Study Enumerates Therapeutic Effects, Quality of Life Benefits of Medical Cannabis

- Lincoln Avenue Communities Breaks Ground on Affordable Housing Development in Casa Grande, Arizona

- Publication of 2023 Annual Report of Azerion Group N.V.

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share