Form 8-K EARTHSTONE ENERGY INC For: Nov 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: November 7, 2016

(Date of earliest event reported)

(Exact name of registrant as specified in its charter)

| Delaware | 001-35049 | 84-0592823 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

1400 Woodloch Forest Drive, Suite 300

The Woodlands, Texas 77380

(Address of principal executive offices) (Zip Code)

(281) 298-4246

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. | Entry into a Material Definitive Agreement. |

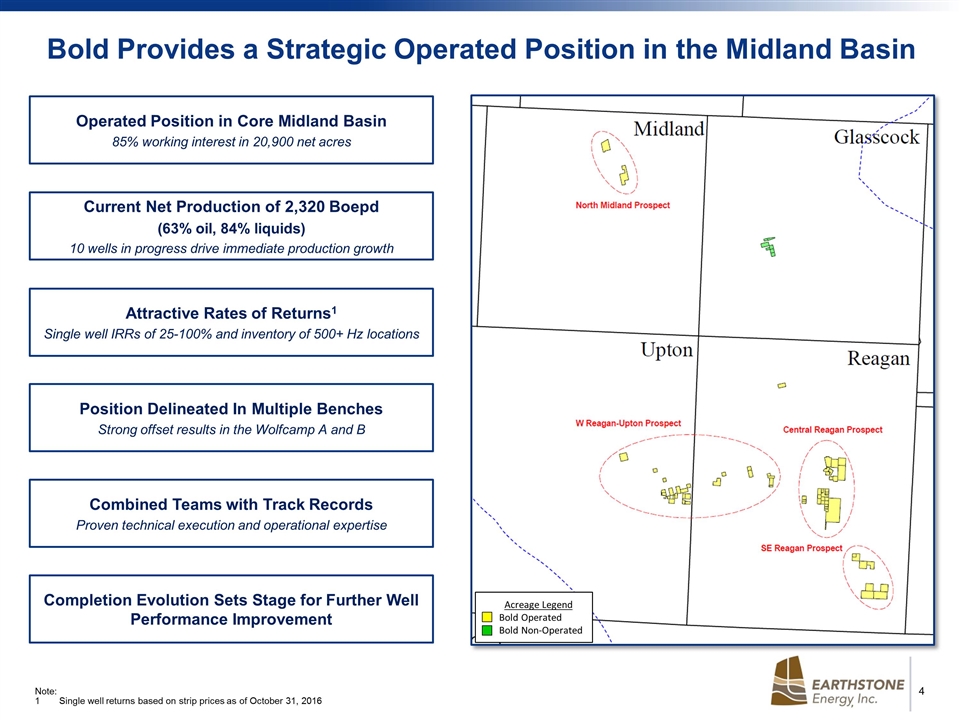

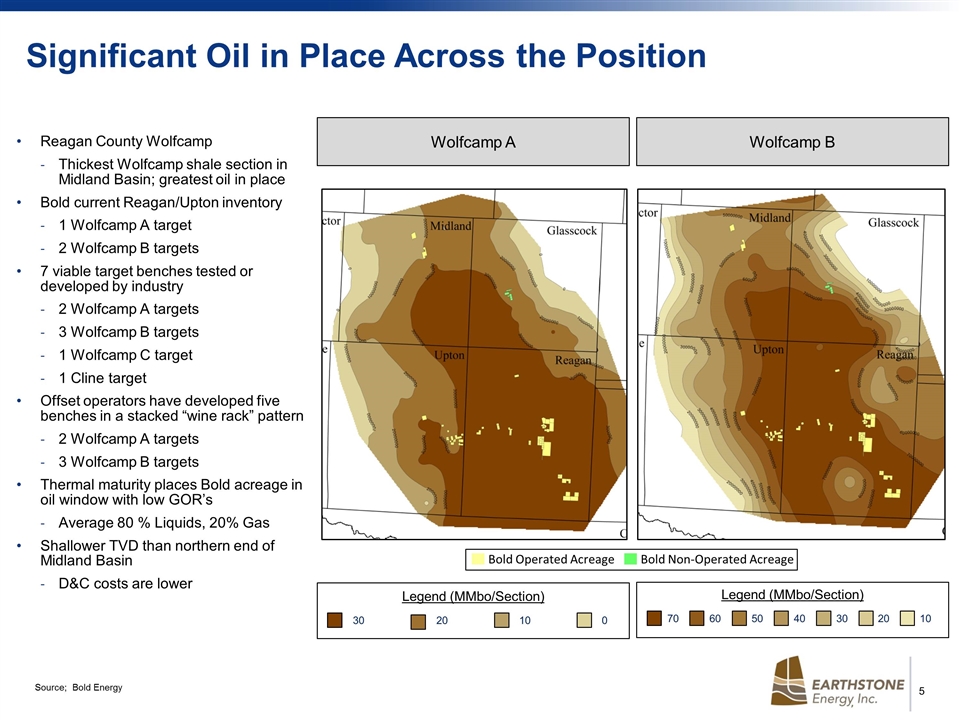

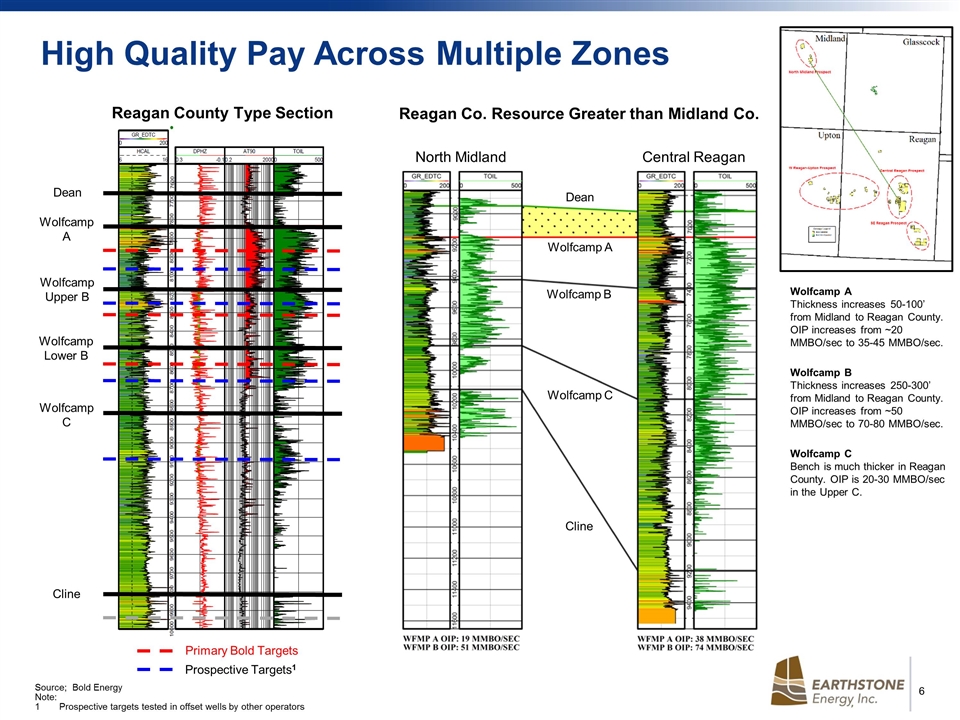

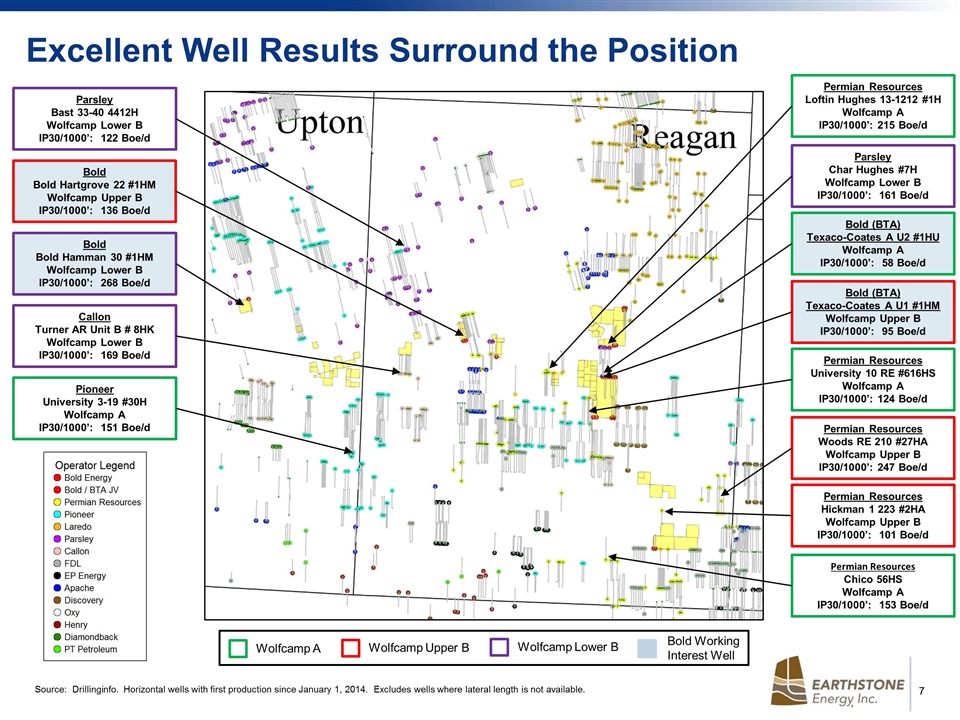

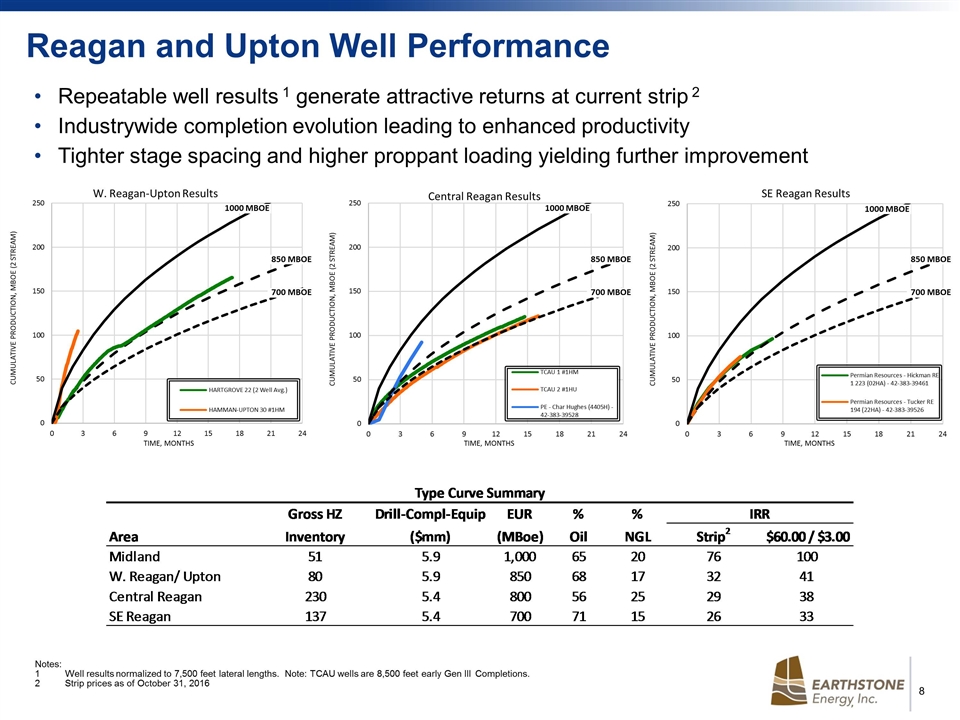

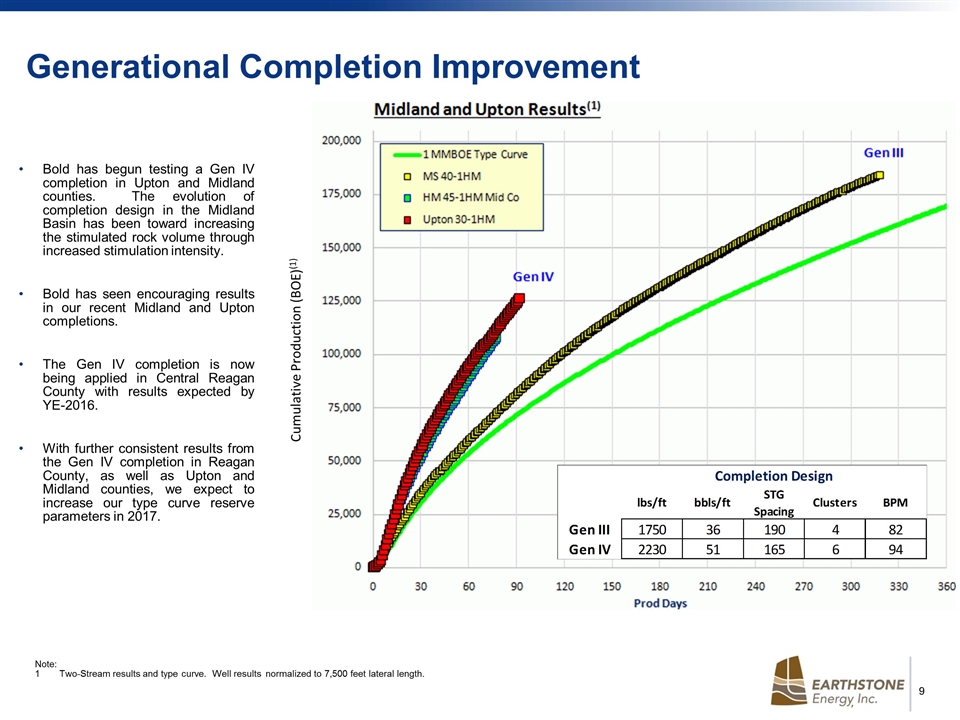

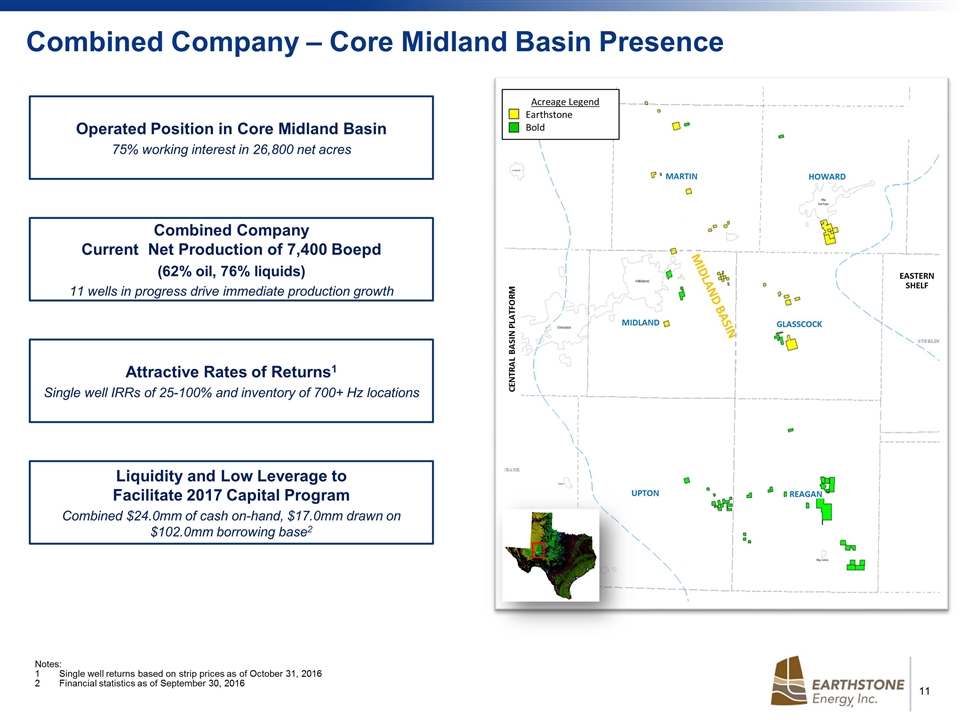

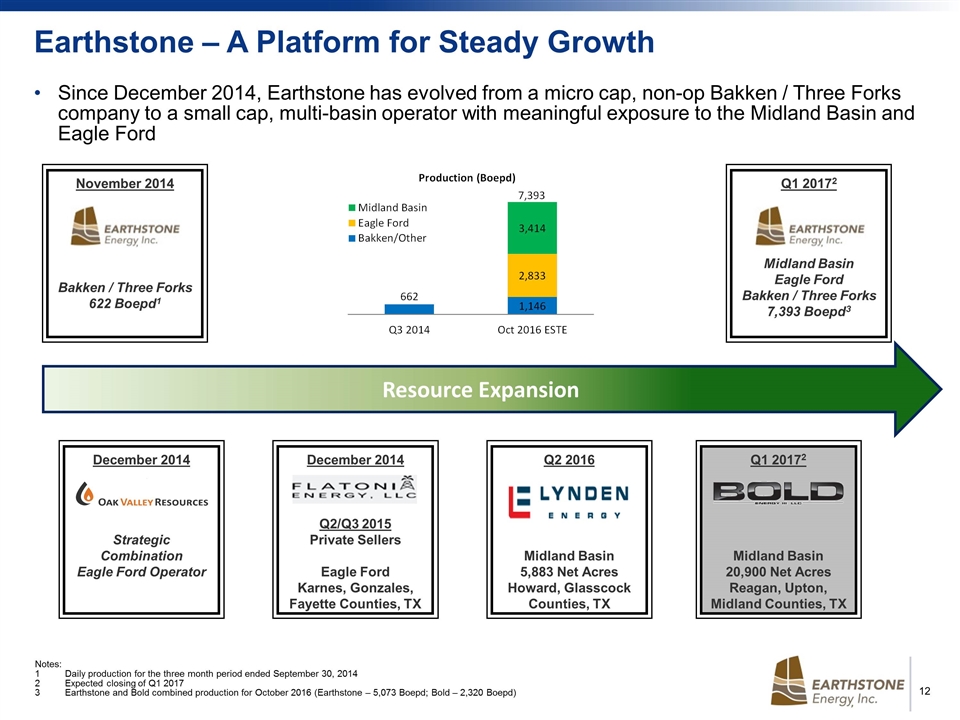

On November 7, 2016, Earthstone Energy, Inc. (“Earthstone”) entered into a Contribution Agreement (the “Agreement”) with Earthstone Energy Holdings, LLC, a Delaware limited liability company and wholly owned subsidiary of Earthstone (“EEH”), Lynden USA Inc., a Utah corporation and wholly owned subsidiary of Earthstone (“Lynden”), Lynden USA Operating, LLC, a Texas limited liability company and wholly owned subsidiary of Lynden (“Lynden Sub”), Bold Energy Holdings, LLC, a Texas limited liability company (“Bold”), and Bold Energy III LLC, a Texas limited liability company (“Bold Sub”). Each of Earthstone, EEH, Lynden, Lynden Sub, Bold and Bold Sub is sometimes referred to in this Current Report on Form 8-K individually as a “Party” and, collectively, they are referred to herein as the “Parties.” The purpose of the Agreement is to provide for, among other things described below, the acquisition by EEH of Bold Sub which owns significant developed and undeveloped oil and gas properties in the Midland Basin of Texas (the “Transaction”). Earthstone, Bold and Bold Sub are each affiliates of funds controlled by EnCap Investments LP. (“EnCap”).

The Agreement and Exhibits A through E thereto are attached hereto as Exhibit 2.1 and are incorporated herein by reference. The description of the Agreement set forth below does not purport to be complete and is qualified in its entirety by reference to the provisions of the Agreement. The Agreement is filed herewith to provide information regarding its terms and is not intended to provide any other factual information about the Parties.

Transaction Details

The Transaction has been structured in a manner commonly known as an “Up-C”. Under this structure and the Agreement, Earthstone will recapitalize its common stock into two classes – Class A common stock, $0.001 par value per share of Earthstone (the “Class A Common Stock”), and Class B common stock, $0.001 par value per share of Earthstone (the “Class B Common Stock”), and all of Earthstone’s existing outstanding common stock, $0.001 par value per share (the “Common Stock”), will be converted into Class A Common Stock pursuant to a Second Amended and Restated Certificate of Incorporation of Earthstone (the “Second Amended and Restated Certificate of Incorporation”). Bold will purchase 36,070,828 shares of Class B Common Stock for nominal consideration, with the Class B Common Stock having no economic rights in Earthstone but will have voting rights on a pari passu basis with the newly issued Class A Common Stock. The foregoing description of the Second Amended and Restated Certificate of Incorporation is qualified in its entirety by the terms of the form of Second Amended and Restated Certificate of Incorporation, which is attached to the Agreement as Exhibit A to Exhibit 2.1 and incorporated herein by reference.

At the closing of the Agreement, EEH will issue 16,423,849 of its membership units to Earthstone and 5,865,328 membership units to Lynden, or 22,289,177 membership units in the aggregate, and 36,070,828 membership units to Bold in exchange for each of Earthstone, Lynden and Bold transferring all of their assets to EEH. Each membership unit in EEH held by Bold, together with one share of Class B Common Stock to be issued to Bold, will be convertible into Class A Common Stock on a one-for-one basis. Therefore, stockholders of Earthstone and former unitholders of Bold are expected to own approximately 39% and 61%, respectively, of the combined company’s then outstanding Class A Common Stock on a fully diluted, as converted, basis. After the closing of the Agreement, all former Earthstone and Bold operations will be conducted through EEH, with Earthstone as its sole managing member. The Transaction is expected to close in the first quarter of 2017.

The Parties have made representations, warranties and covenants in the Agreement, including (i) that the parties will, subject to certain exceptions, conduct their respective businesses in the ordinary course and will not engage in certain activities between the execution of the Agreement and the closing of the Transaction; and (ii) the agreement of Earthstone, subject to certain exceptions, not to solicit alternative transactions or provide information in connection with alternative transactions. Completion of the Transaction is conditioned upon: (1) the approval by the stockholders of Earthstone of the Agreement and the various actions contemplated therein; (2) applicable regulatory approvals, including listing authorization for the Class A Common Stock issued pursuant to the Agreement on the NYSE MKT; (3) the absence of legal impediments prohibiting the transactions; and (4) other customary closing conditions.

The Agreement contains certain termination rights for both Earthstone and Bold, including, among others, if the Transaction is not completed by March 31, 2017 or such later date as may be agreed by the Parties. In the event of a termination of the Agreement by Bold under certain circumstances involving an alternative transaction, Earthstone may be required to pay to Bold $5.5 million as a termination fee.

The representations and warranties that the Parties have made to each other in the Agreement are as of specific dates. Except for its status as a contractual document that establishes and governs the legal relations among the Parties, the Agreement is not intended to be a source of factual, business or operational information about any of the Parties. The representations and warranties in the Agreement were made only for purposes of the Agreement, are solely for the benefit of the Parties, and may be subject to limitations agreed between the Parties, including being qualified by disclosures among the Parties. The representations and warranties in the Agreement may have been made to allocate risks among the Parties, including where the Parties do not have complete knowledge of all facts, instead of establishing certain matters as facts. Furthermore, those representations and warranties may be subject to standards of materiality applicable to the Parties that differ from those applicable to investors. The assertions embodied in the representations and

warranties are qualified by information contained in disclosure schedules to the Agreement that the Parties exchanged in connection with the signing of the Agreement. Accordingly, investors and stockholders should not rely on such representations and warranties as characterizations of the actual state of facts or circumstances. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Agreement, which subsequent information may or may not be fully reflected in Earthstone’s disclosures or public disclosures.

Limited Liability Company Agreement

As stated above, if the Agreement is completed, Earthstone, Lynden and Bold will become members of EEH which will conduct all combined oil and gas operations under the First Amended and Restated Limited Liability Company Agreement (the “Limited Liability Company Agreement”). The foregoing description of the Limited Liability Company Agreement is qualified in its entirety by the terms of the form of Limited Liability Company Agreement, which is attached to the Agreement as Exhibit B to Exhibit 2.1 and incorporated herein by reference.

Voting and Support Agreement

Also in connection with the Agreement, Oak Valley Resources, LLC (“Oak Valley”) entered into a voting and support agreement with Earthstone and Bold dated November 7, 2016 (“Voting and Support Agreement”) with respect to Oak Valley’s shares of Common Stock, which consist of 9,162,452 shares or 41.1% of the total outstanding shares of Common Stock. Oak Valley has agreed to vote in favor of the Agreement and the related transactions contemplated thereby at any meeting of stockholders called to vote thereon. The Agreement requires that the Agreement and the transactions contemplated thereby be approved by the affirmative vote or consent of (a) at least a majority of the outstanding shares of Common Stock that are represented in person or by proxy at a special meeting of stockholders of Earthstone to be held as promptly as practicable; and (b) a majority of Earthstone stockholders not including Oak Valley and the executive officers of Earthstone.

The Voting and Support Agreement is attached hereto as Exhibit 10.1 and incorporated herein by reference. The description of the Voting and Support Agreement set forth herein does not purport to be complete and is qualified in its entirety by reference to the provisions of the Voting and Support Agreement.

Voting Agreement

Earthstone, Bold, Oak Valley and EnCap collectively EnCap, Bold and Oak Valley, the “Stockholders”) have agreed to enter into a voting agreement (“Voting Agreement”) at the closing of the Agreement. The Voting Agreement provides that, for so long as it is in effect, the Stockholder shall not vote any shares or take any other action that would in any way alter the composition of Earthstone’s board of directors from its composition immediately following the closing of the Agreement, which shall be composed of nine members, four of whom shall be designated by EnCap (the “EnCap Designated Directors”), three of whom shall be independent (the “Independent Directors”), and two of whom shall be members of Earthstone’s management, including Earthstone’s Chief Executive Officer (the “Earthstone Designated Directors” and, together with the Independent Directors, the “Non-EnCap Designated Directors”). The Voting Agreement will terminate upon the earlier of (i) the fifth anniversary of the closing of the Agreement and (ii) the date upon which the EnCap, Oak Valley and Bold collectively own, of record and beneficially, less than 20% of Earthstone’s outstanding voting interests. At any time during the effectiveness of the Voting Agreement during which EnCap’s collective ownership of Earthstone, beneficially and of record, including through Bold or Oak Valley exceeds 50% of the total issued and outstanding Class A Common Stock and Class B Common Stock, EnCap may remove and replace one Non-EnCap Designated Director, and his or her successors. The foregoing description of the Voting Agreement is qualified in its entirety by the terms of the form of Voting Agreement, which is attached to the Agreement as Exhibit D to Exhibit 2.1 and incorporated herein by reference.

Registration Rights Agreement

Under the Agreement, Earthstone has agreed to enter into a registration rights agreement (the “Registration Rights Agreement”) at the closing of the Agreement whereby Earthstone is required to register, at its cost, with the Securities and Exchange Commission (the “SEC”), the resale of the Class A Common Stock to be issued to holders of membership units and Class B Common Stock upon the exchange by Earthstone. Pursuant to the Registration Rights Agreement, Earthstone has agreed to file a shelf registration statement (the “Shelf Registration Statement”) with the SEC within 10 days after the closing of the Agreement. In addition, if Earthstone files a registration statement, it must offer to the holders of membership units and Class B Common Stock the opportunity to include the resale of the shares of Class A Stock that such EEH membership units and Class B Common Stock are convertible into in the registration statement, subject to customary qualifications and limitations. The foregoing description of the Registration Rights Agreement is qualified in its entirety by the terms of the form of Registration Rights Agreement, which is attached to the Agreement as Exhibit C to Exhibit 2.1 and incorporated herein by reference.

Additional Information and Where to Find It

In connection with the Transaction, Earthstone intends to file with the SEC a proxy statement and other relevant documents in connection with the proposed Transaction. EARTHSTONE URGES INVESTORS AND STOCKHOLDERS TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT EARTHSTONE, BOLD AND THE PROPOSED TRANSACTION. Investors and stockholders will be able to obtain these materials (when they are available) and other documents filed with the SEC free of charge at the SEC’s website, www.sec.gov. In addition, a copy of the proxy statement (when it becomes available) may be obtained free of charge from Earthstone’s website at www.earthstoneenergy.com. Investors and stockholders may also read and copy any reports, statements and other information filed by Earthstone, with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room. In addition, the documents filed with the SEC by Earthstone can be obtained free of charge from Earthstone’s website at www.earthstoneenergy.com or by contacting Earthstone by mail at 1400 Woodloch Forest Drive, Suite 300, The Woodlands, Texas, 77380, or by telephone at (281) 298-4246.

Participants in the Solicitation

Earthstone and its directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed Transaction. Information regarding Earthstone’s directors and executive officers is available in its proxy statement filed with the SEC by Earthstone on October 5, 2016 in connection with its 2016 annual meeting of stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available.

| Item 3.02. | Unregistered Sales of Equity Securities. |

The information disclosed under Item 1.01 is incorporated into this Item 3.02 in its entirety.

Class A Common Stock to be issued to Earthstone stockholders in connection with the Agreement is expected to be issued in reliance upon an exemption from registration under federal securities laws provided by Section 3(a)(9) of the Securities Act of 1933, as amended (the “Securities Act”), for the issuance and exchange of securities by an issuer with its existing security holders exclusively where no commission or other remuneration is paid or given, directly or indirectly, for soliciting such exchange. Earthstone anticipates that, if the Agreement becomes effective under the terms and conditions set forth in the Agreement, the Class B Common Stock to be issued pursuant to the Agreement will be exempt from the registration requirements of the Securities Act pursuant to Section 4(a)(2) thereof as a transaction not involving a public offering.

| Item 7.01. | Regulation FD Disclosure. |

On November 8, 2016, Earthstone and Bold issued a joint press release announcing that they had entered into the Agreement and that they will host a joint conference call to discuss the Transaction. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated into this Item 7.01 by reference.

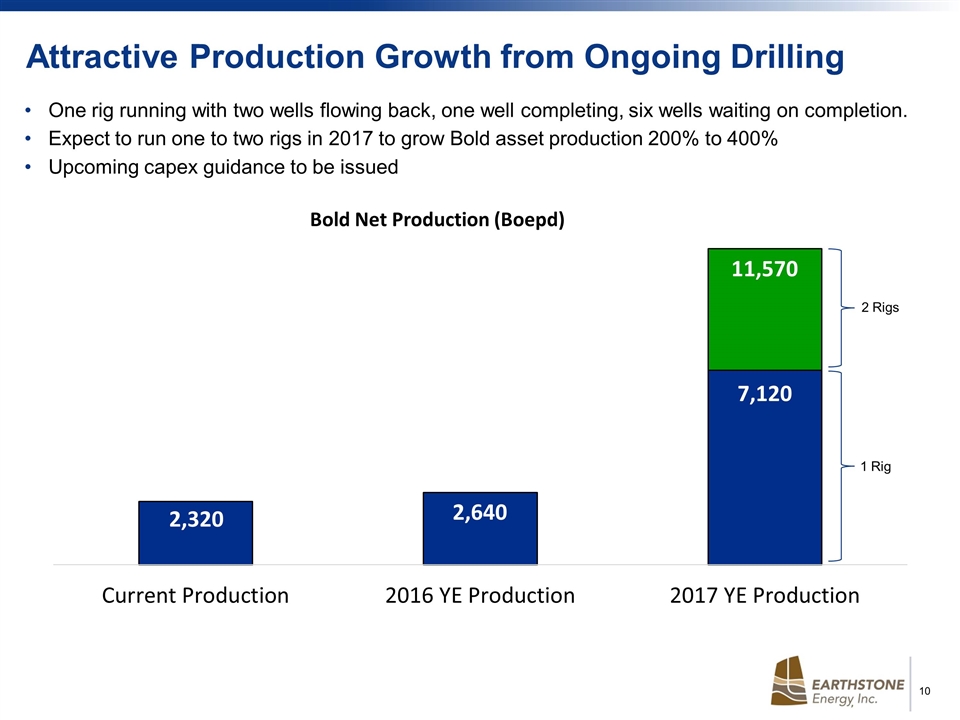

On November 8, 2016, Earthstone and Bold provided supplemental information regarding the Transaction contemplated by the Agreement in connection with a joint investor presentation. A copy of the presentation is furnished as Exhibit 99.2 hereto and is incorporated into this Item 7.01 by reference.

The information in this Current Report on Form 8-K furnished pursuant to Item 7.01, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under such section, and they shall not be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. By filing this Current Report on Form 8-K and furnishing this information pursuant to Item 7.01, Earthstone makes no admission as to the materiality of any information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, that is required to be disclosed solely by Regulation FD.

Forward-Looking Statements

This current report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Statements that are not strictly historical statements constitute forward-looking statements and may often, but not always, be identified by the use of such words such as “expects,” “believes,” “intends,” “anticipates,” “plans,” “estimates,” “potential,” “possible,” or “probable” or statements that certain actions, events or results “may,” “will,” “should,” or “could” be taken,

occur or be achieved. The forward-looking statements include statements about the expected benefits of the proposed Transaction to Earthstone and Bold and their stockholders, the anticipated completion of the proposed Transaction or the timing thereof, the expected future reserves, production, financial position, business strategy, revenues, earnings, costs, capital expenditures and debt levels of the combined company, and plans and objectives of management for future operations. Forward-looking statements are based on current expectations and assumptions and analyses made by Earthstone, Bold and their management in light of experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: the ability to obtain stockholder, regulatory approvals of the proposed Transaction; the ability to complete the proposed Transaction on anticipated terms and timetable; Earthstone’s and Bold’s ability to integrate successfully after the Transaction and achieve anticipated benefits from it; the possibility that various closing conditions for the Transaction may not be satisfied or waived; risks relating to any unforeseen liabilities of Earthstone or Bold; declines in oil, natural gas liquids or natural gas prices; the level of success in exploration, development and production activities; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices; risks related to level of indebtedness and periodic redeterminations of the borrowing base under Earthstone’s credit agreement; Earthstone’s ability to generate sufficient cash flows from operations to meet the internally funded portion of its capital expenditures budget; Earthstone’s ability to obtain external capital to finance exploration and development operations and acquisitions; the impacts of hedging on results of operations; Earthstone’s ability to replace oil and natural gas reserves; and any loss of senior management or technical personnel. Earthstone’s annual report on Form 10-K for the year ended December 31, 2015, as amended, quarterly reports on Form 10-Q, recent current reports on Form 8-K, and other SEC filings discuss some of the important risk factors identified that may affect Earthstone’s business, results of operations, and financial condition. Earthstone undertakes no obligation to revise or update publicly any forward-looking statements except as required by law.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits. |

The following exhibits are included as part of this Current Report on Form 8-K:

| Exhibit |

Description | |

| 2.1 | Contribution Agreement dated November 7, 2016, by and among Earthstone Energy, Inc., Earthstone Energy Holdings, LLC, Lynden USA Inc., Lynden USA Operating, LLC, Bold Energy Holdings, LLC and Bold Energy III LLC. | |

| 10.1 | Voting and Support Agreement dated November 7, 2016, by and among Bold Energy Holdings, LLC, Oak Valley Resources, LLC, and Earthstone Energy, Inc. | |

| 99.1 | Press Release dated November 8, 2016. | |

| 99.2 | Slideshow Presentation dated November 8, 2016. | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| EARTHSTONE ENERGY, INC. | ||||||

| Date: November 8, 2016 | By: | /s/ G. Bret Wonson | ||||

| G. Bret Wonson | ||||||

| Chief Accounting Officer | ||||||

EXHIBIT INDEX

| Exhibit |

Description | |

| 2.1 | Contribution Agreement dated November 7, 2016, by and among Earthstone Energy, Inc., Earthstone Energy Holdings, LLC, Lynden USA Inc., Lynden USA Operating, LLC, Bold Energy Holdings, LLC and Bold Energy III LLC. | |

| 10.1 | Voting and Support Agreement dated November 7, 2016, by and among Bold Energy Holdings, LLC, Oak Valley Resources, LLC, and Earthstone Energy, Inc. | |

| 99.1 | Press Release dated November 8, 2016. | |

| 99.2 | Slideshow Presentation dated November 8, 2016. | |

Exhibit 2.1

Execution Version

CONTRIBUTION AGREEMENT

BY AND AMONG

EARTHSTONE ENERGY, INC.,

EARTHSTONE ENERGY HOLDINGS, LLC,

LYNDEN USA INC.,

LYNDEN USA OPERATING, LLC,

BOLD ENERGY HOLDINGS, LLC

AND

BOLD ENERGY III LLC

EXECUTION DATE: NOVEMBER 7, 2016

Table of Contents

| ARTICLE 1 |

DEFINITIONS AND INTERPRETATION |

2 | ||||||||

| Section 1.1 |

Defined Terms |

2 | ||||||||

| Section 1.2 |

References and Rules of Construction |

2 | ||||||||

| ARTICLE 2 |

THE CONTRIBUTIONS |

2 | ||||||||

| Section 2.1 |

The Earthstone Contribution |

2 | ||||||||

| Section 2.2 |

The Lynden Contribution |

2 | ||||||||

| Section 2.3 |

The Bold Contribution |

2 | ||||||||

| ARTICLE 3 |

REPRESENTATIONS AND WARRANTIES OF EARTHSTONE AND ITS SUBSIDIARIES |

3 | ||||||||

| Section 3.1 |

Organization |

3 | ||||||||

| Section 3.2 |

Capitalization of Earthstone and Subsidiaries |

3 | ||||||||

| Section 3.3 |

Authority Relative to This Agreement |

4 | ||||||||

| Section 3.4 |

Noncontravention |

4 | ||||||||

| Section 3.5 |

Governmental Approvals |

5 | ||||||||

| Section 3.6 |

Financial Statements |

5 | ||||||||

| Section 3.7 |

Absence of Undisclosed Liabilities |

5 | ||||||||

| Section 3.8 |

Absence of Certain Changes |

5 | ||||||||

| Section 3.9 |

Title to Properties |

6 | ||||||||

| Section 3.10 |

Compliance With Laws |

6 | ||||||||

| Section 3.11 |

Tax Matters |

7 | ||||||||

| Section 3.12 |

Legal Proceedings |

7 | ||||||||

| Section 3.13 |

Brokerage Fees |

8 | ||||||||

| Section 3.14 |

Permits |

8 | ||||||||

| Section 3.15 |

Environmental Matters |

8 | ||||||||

| Section 3.16 |

Revenue and Expense Information; Records |

8 | ||||||||

| Section 3.17 |

Commitments |

8 | ||||||||

| Section 3.18 |

No Alienation |

8 | ||||||||

| Section 3.19 |

Make-Up Rights |

8 | ||||||||

| Section 3.20 |

Imbalance |

9 | ||||||||

| Section 3.21 |

Preferential Rights and Consents to Assign |

9 | ||||||||

| Section 3.22 |

No Participating Hydrocarbons |

9 | ||||||||

| Section 3.23 |

Insurance |

9 | ||||||||

| Section 3.24 |

Employees |

9 | ||||||||

| Section 3.25 |

Agreements, Contracts and Commitments |

9 | ||||||||

| Section 3.26 |

Hedging |

10 | ||||||||

| Section 3.27 |

Regulatory Agencies |

10 | ||||||||

| Section 3.28 |

Non-Consent |

10 | ||||||||

| Section 3.29 |

Property Boundaries |

10 | ||||||||

| Section 3.30 |

No Other Royalties |

10 | ||||||||

| Section 3.31 |

[Reserved.] |

10 | ||||||||

| Section 3.32 |

Reserve Reports |

11 | ||||||||

| Section 3.33 |

NYSE MKT |

11 | ||||||||

| Section 3.34 |

SEC Filings |

11 | ||||||||

| Section 3.35 |

Securities Laws |

11 | ||||||||

| Section 3.36 |

Sarbanes-Oxley Compliance |

11 | ||||||||

| Section 3.37 |

Earthstone Fairness Opinion |

12 | ||||||||

| Section 3.38 |

Benefit Plans |

12 | ||||||||

| Section 3.39 |

No Excess Parachute Payments; Section 162(m) |

13 | ||||||||

| Section 3.40 |

USA Patriot Act, OFAC and FCPA |

13 | ||||||||

| Section 3.41 |

Intellectual Property |

13 | ||||||||

| Section 3.42 |

No Additional Representations |

14 | ||||||||

| ARTICLE 4 |

REPRESENTATIONS AND WARRANTIES OF EEH |

14 | ||||||||

i

| Section 4.1 |

Organization |

14 | ||||||||

| Section 4.2 |

Capitalization |

14 | ||||||||

| Section 4.3 |

Authority Relative to This Agreement |

15 | ||||||||

| Section 4.4 |

Noncontravention |

15 | ||||||||

| Section 4.5 |

Governmental Approvals |

15 | ||||||||

| ARTICLE 5 |

REPRESENTATIONS AND WARRANTIES OF BOLD AND BOLD SUB |

15 | ||||||||

| Section 5.1 |

Organization |

15 | ||||||||

| Section 5.2 |

Capitalization of Bold and Subsidiaries |

16 | ||||||||

| Section 5.3 |

Authority Relative to This Agreement |

17 | ||||||||

| Section 5.4 |

Noncontravention |

17 | ||||||||

| Section 5.5 |

Governmental Approvals |

17 | ||||||||

| Section 5.6 |

Financial Statements |

17 | ||||||||

| Section 5.7 |

Absence of Undisclosed Liabilities |

18 | ||||||||

| Section 5.8 |

Absence of Certain Changes |

18 | ||||||||

| Section 5.9 |

Title to Properties |

18 | ||||||||

| Section 5.10 |

Compliance With Laws |

19 | ||||||||

| Section 5.11 |

Tax Matters |

19 | ||||||||

| Section 5.12 |

Legal Proceedings |

20 | ||||||||

| Section 5.13 |

Brokerage Fees |

20 | ||||||||

| Section 5.14 |

Permits |

20 | ||||||||

| Section 5.15 |

Environmental Matters |

20 | ||||||||

| Section 5.16 |

Revenue and Expense Information; Records |

20 | ||||||||

| Section 5.17 |

Commitments |

20 | ||||||||

| Section 5.18 |

No Alienation |

21 | ||||||||

| Section 5.19 |

Make-Up Rights |

21 | ||||||||

| Section 5.20 |

Imbalance |

21 | ||||||||

| Section 5.21 |

Preferential Rights and Consents to Assign |

21 | ||||||||

| Section 5.22 |

No Participating Hydrocarbons |

21 | ||||||||

| Section 5.23 |

Insurance |

21 | ||||||||

| Section 5.24 |

Employees |

21 | ||||||||

| Section 5.25 |

Agreements, Contracts and Commitments |

21 | ||||||||

| Section 5.26 |

Hedging |

22 | ||||||||

| Section 5.27 |

Regulatory Agencies |

22 | ||||||||

| Section 5.28 |

Non-Consent |

22 | ||||||||

| Section 5.29 |

Property Boundaries |

22 | ||||||||

| Section 5.30 |

No Other Royalties |

23 | ||||||||

| Section 5.31 |

[Reserved] |

23 | ||||||||

| Section 5.32 |

Reserve Reports |

23 | ||||||||

| Section 5.33 |

Benefit Plans |

23 | ||||||||

| Section 5.34 |

No Excess Parachute Payments; Section 162(m) |

24 | ||||||||

| Section 5.35 |

USA Patriot Act, OFAC and FCPA |

24 | ||||||||

| Section 5.36 |

Intellectual Property |

25 | ||||||||

| Section 5.37 |

No Additional Representations |

25 | ||||||||

| ARTICLE 6 |

COVENANTS OF THE PARTIES |

25 | ||||||||

| Section 6.1 |

Access |

25 | ||||||||

| Section 6.2 |

Government Reviews |

26 | ||||||||

| Section 6.3 |

No Solicitation by Earthstone; Etc. |

26 | ||||||||

| Section 6.4 |

Public Announcements; Confidentiality |

28 | ||||||||

| Section 6.5 |

Operation of Business of Bold and Bold Sub |

29 | ||||||||

| Section 6.6 |

Operation of Business of Earthstone |

30 | ||||||||

| Section 6.7 |

Further Assurances |

32 | ||||||||

| Section 6.8 |

A&R LLC Agreement |

32 | ||||||||

| Section 6.9 |

Preparation of the Proxy Statement; Earthstone Stockholder Meeting |

32 | ||||||||

-ii-

| Section 6.10 |

Registration Rights |

33 | ||||||||

| Section 6.11 |

Listing of the Earthstone Shares |

33 | ||||||||

| Section 6.12 |

Notice Required by Rule 14f-1 under Exchange Act |

33 | ||||||||

| Section 6.13 |

Section 16 Matters |

33 | ||||||||

| Section 6.14 |

Tax Matters |

33 | ||||||||

| Section 6.15 |

Voting Agreement |

34 | ||||||||

| Section 6.16 |

Indemnification and Insurance |

34 | ||||||||

| Section 6.17 |

Bold Employee Matters |

34 | ||||||||

| ARTICLE 7 |

CONDITIONS TO CLOSING |

36 | ||||||||

| Section 7.1 |

Mutual Conditions to Closing |

36 | ||||||||

| Section 7.2 |

Bold’s and Bold Sub’s Conditions to Closing |

37 | ||||||||

| Section 7.3 |

EEH’s Conditions to Closing |

38 | ||||||||

| Section 7.4 |

Earthstone’s Conditions to Closing |

38 | ||||||||

| Section 7.5 |

Lynden’s Conditions to Closing |

39 | ||||||||

| Section 7.6 |

Frustration of Closing Conditions |

39 | ||||||||

| ARTICLE 8 |

CLOSING |

39 | ||||||||

| Section 8.1 |

Time and Place of Closing |

39 | ||||||||

| Section 8.2 |

Obligations of Bold at Closing |

39 | ||||||||

| Section 8.3 |

Obligations of Earthstone at Closing |

40 | ||||||||

| Section 8.4 |

Obligations of EEH at Closing |

41 | ||||||||

| Section 8.5 |

Obligations of Lynden at Closing |

41 | ||||||||

| ARTICLE 9 |

TERMINATION |

41 | ||||||||

| Section 9.1 |

Termination |

41 | ||||||||

| Section 9.2 |

Ability to Terminate |

42 | ||||||||

| Section 9.3 |

Effect of Termination |

42 | ||||||||

| Section 9.4 |

Fees and Expenses |

42 | ||||||||

| ARTICLE 10 |

MISCELLANEOUS |

43 | ||||||||

| Section 10.1 |

Counterparts |

43 | ||||||||

| Section 10.2 |

Notices |

43 | ||||||||

| Section 10.3 |

Certain Fees |

44 | ||||||||

| Section 10.4 |

Governing Law; Jurisdiction |

44 | ||||||||

| Section 10.5 |

Waivers |

45 | ||||||||

| Section 10.6 |

Assignment |

45 | ||||||||

| Section 10.7 |

Entire Agreement |

45 | ||||||||

| Section 10.8 |

Amendment |

45 | ||||||||

| Section 10.9 |

No Third Party Beneficiaries |

45 | ||||||||

| Section 10.10 |

Construction |

45 | ||||||||

| Section 10.11 |

Limitation on Damages |

46 | ||||||||

| Section 10.12 |

Conspicuous |

46 | ||||||||

| Section 10.13 |

Time of Essence |

46 | ||||||||

| Section 10.14 |

Severability |

46 | ||||||||

| Section 10.15 |

Specific Performance |

46 | ||||||||

| APPENDIX: |

||||||||||

| Appendix A |

- Definitions | |||||||||

-iii-

| EXHIBITS: |

||||||||

| Exhibit A | - | Form of Second Amended and Restated Certificate of Incorporation of Earthstone Energy, Inc. | ||||||

| Exhibit B | - | Form of First Amended and Restated Limited Liability Company Agreement of Earthstone Energy Holdings, LLC | ||||||

| Exhibit C | - | Form of Registration Rights Agreement | ||||||

| Exhibit D | - | Form of Voting Agreement | ||||||

| Exhibit E | - | Voting and Support Agreement | ||||||

-iv-

CONTRIBUTION AGREEMENT

This Contribution Agreement (this “Agreement”) is dated as of November 7, 2016 (the “Execution Date”), by and among Earthstone Energy, Inc., a Delaware corporation (“Earthstone”), Earthstone Energy Holdings, LLC, a Delaware limited liability company (“EEH”), Lynden USA Inc., a Utah corporation (“Lynden”), Lynden USA Operating, LLC, a Texas limited liability company (“Lynden Sub”), Bold Energy Holdings, LLC, a Texas limited liability company (“Bold”), and Bold Energy III LLC, a Texas limited liability company (“Bold Sub”). Each of Earthstone, EEH, Lynden, Lynden Sub, Bold and Bold Sub is sometimes referred to herein individually as a “Party” and, collectively, they are referred to herein as the “Parties.”

RECITALS:

WHEREAS, Earthstone owns 100% of the limited liability company interests of EEH;

WHEREAS, at the Closing (as defined below), Earthstone intends to contribute to EEH, or to cause the transfer to EEH of, all of the Earthstone Assets (as defined below), and EEH intends to accept all of the Earthstone Assets as further described herein, in each case in accordance with this Agreement in consideration of the EEH-Earthstone Contribution Units (as defined below);

WHEREAS, at the Closing, Lynden intends to contribute to EEH, or to cause the transfer to EEH of, all of the Lynden Assets (as defined below), and EEH intends to accept all of the Lynden Assets as further described herein, in each case in accordance with this Agreement in consideration of the EEH-Lynden Contribution Units (as defined below);

WHEREAS, following the date hereof and prior to the Closing, the members of Bold Sub intend to collectively contribute all of the Bold Assets to Bold in exchange for all of the issued and outstanding membership interests of Bold;

WHEREAS, at the Closing, Bold intends to (i) contribute to EEH, or to cause the transfer to EEH of, all of the Bold Assets (as defined below), and EEH intends to accept all of the Bold Assets as further described herein, in each case in accordance with this Agreement in consideration of the EEH-Bold Contribution Units (as defined below) and (ii) purchase the Earthstone Shares (as defined below) directly from Earthstone for cash;

WHEREAS, each of the Earthstone Board (as defined below) and the Earthstone Special Committee (as defined below) has unanimously (a) determined that it is in the best interests of Earthstone and its stockholders, and declared it advisable, to enter into this Agreement, (b) approved the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby, including the Earthstone Contribution (as defined below) and (c) resolved to recommend adoption of this Agreement and the transactions contemplated herein by the stockholders of Earthstone;

WHEREAS, as a condition and inducement to Bold’s willingness to enter into this Agreement, Oak Valley Resources, LLC, a Delaware limited liability company (“Oak Valley”), in its capacity as a stockholder of Earthstone, has simultaneously herewith entered into a Voting and Support Agreement substantially in the form attached hereto as Exhibit E (the “Voting and Support Agreement”) in connection with the transactions contemplated hereby; and

WHEREAS, (i) the Board of Managers of Bold Sub has approved the Bold Contribution (as defined below) and this Agreement, and declared the Bold Contribution and this Agreement to be in the best interests of Bold Sub and (ii) EnCap Energy Capital Fund IX, L.P., a Texas limited partnership and the sole member of Bold (“EnCap Fund IX”), has approved the Bold Contribution and this Agreement, and declared the Bold Contribution and this Agreement to be in the best interests of Bold.

1

NOW, THEREFORE, in consideration of the premises and mutual promises, representations, warranties, covenants, conditions and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound by the terms hereof, agree as follows:

ARTICLE 1

DEFINITIONS AND INTERPRETATION

Section 1.1 Defined Terms. In addition to the terms defined in the introductory paragraph of this Agreement, for purposes hereof, capitalized terms used herein and not otherwise defined shall have the meanings set forth in Appendix A.

Section 1.2 References and Rules of Construction. All references in this Agreement to Exhibits, Schedules, Appendices, Articles, Sections, subsections, clauses and other subdivisions refer to the corresponding Exhibits, Schedules, Appendices, Articles, Sections, subsections, clauses and other subdivisions of or to this Agreement unless expressly provided otherwise. Titles appearing at the beginning of any Exhibits, Schedules, Appendices, Articles, Sections, subsections, clauses and other subdivisions of this Agreement are for convenience only, do not constitute any part of this Agreement and shall be disregarded in construing the language hereof. The words “this Agreement,” “herein,” “hereby,” “hereunder” and “hereof,” and words of similar import, refer to this Agreement as a whole and not to any particular Article, Section, subsection, clause or other subdivision unless expressly so limited. The words “this Article,” “this Section,” “this subsection,” “this clause” and words of similar import refer only to the Article, Section, subsection and clause hereof in which such words occur. The words “including” and “includes” (in their various forms) means “including without limitation” and corresponding derivative expressions. The words “shall” and “will” are used interchangeably and have the same meaning. All references to “$” or “dollars” shall be deemed references to United States dollars. Each accounting term not defined herein will have the meaning given to it under GAAP as interpreted as of the date of this Agreement. Unless expressly provided to the contrary, the word “or” is not exclusive. Pronouns in masculine, feminine or neuter genders shall be construed to state and include any other gender, and words, terms and titles (including terms defined herein) in the singular form shall be construed to include the plural and vice versa, unless the context otherwise requires. Appendices, Exhibits and Schedules referred to herein are attached to and by this reference incorporated herein for all purposes. Reference herein to any federal, state, local or foreign Law shall be deemed to also refer to all rules and regulations promulgated thereunder, unless the context requires otherwise, and reference herein to any agreement, instrument or Law means such agreement, instrument or Law as from time to time amended, modified or supplemented, including, in the case of agreements or instruments, by waiver or consent and, in the case of Laws, by succession of comparable successor Laws. References to a Person are also to its permitted successors and permitted assigns.

ARTICLE 2

THE CONTRIBUTIONS

Section 2.1 The Earthstone Contribution. At the Closing, upon the terms and subject to the conditions of this Agreement, Earthstone shall contribute, convey, assign, transfer and deliver the Earthstone Assets to EEH, and EEH shall acquire and accept the Earthstone Assets and be admitted as a member of any limited liability company whose interests constitute part of the Earthstone Assets, in consideration for EEH’s issuance of the EEH-Earthstone Contribution Units to Earthstone and admission of Earthstone as a member of EEH in respect of such EEH-Earthstone Contribution Units (the “Earthstone Contribution”).

Section 2.2 The Lynden Contribution. At the Closing, upon the terms and subject to the conditions of this Agreement, Lynden shall contribute, convey, assign, transfer and deliver the Lynden Assets to EEH, and EEH shall acquire and accept the Lynden Assets in consideration for EEH’s issuance of the EEH-Lynden Contribution Units to Lynden and admission of Lynden as a member of EEH in respect of such EEH-Lynden Contribution Units (the “Lynden Contribution”).

Section 2.3 The Bold ContributionSection 2.4. At the Closing, upon the terms and subject to the conditions of this Agreement, Bold shall contribute, convey, assign, transfer and deliver the Bold Assets to EEH, and EEH shall acquire and accept the Bold Assets and be admitted as a member of Bold Sub in consideration for EEH’s issuance of the EEH-Bold Contribution Units to Bold and admission of Bold as a member of EEH in respect of such EEH-Bold Contribution Units (the “Bold Contribution”). Immediately following the contribution of the Bold Assets to EEH in exchange for the Bold Contribution, Earthstone shall issue to Bold the Earthstone Shares in exchange for the payment by Bold to Earthstone of cash in an amount equal to $36,071 (the “Bold Cash Payment”).

-2-

ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF EARTHSTONE AND ITS SUBSIDIARIES

Except as disclosed in the disclosure schedule delivered by Earthstone to Bold (the “Earthstone Disclosure Schedule”) prior to the execution of this Agreement (provided that (i) disclosure in any section of the Earthstone Disclosure Schedule shall be deemed to be disclosure with respect to any other section of this Agreement to the extent that it is reasonably apparent on the face of such disclosure that it is applicable to such other section notwithstanding the omission of a reference or cross reference thereto and (ii) the mere inclusion of an item in such Earthstone Disclosure Schedule as an exception to a representation or warranty shall not be deemed an admission that such item represents a material exception or material fact, event or circumstance or that such item has had, would have or would reasonably be expected to have a Material Adverse Effect), Earthstone represents and warrants to Bold that:

Section 3.1 Organization.

(a) Earthstone is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware. Earthstone has full power and authority to own, lease or otherwise hold and operate the Earthstone Properties and to carry on its business as presently conducted. Earthstone is duly qualified and in good standing to do business as a foreign corporation in each jurisdiction in which the conduct or nature of its business or the ownership, leasing, holding or operating of its properties makes such qualification necessary, except such jurisdictions where the failure to be so qualified or in good standing, individually or in the aggregate, would not have a Material Adverse Effect.

(b) Each Earthstone Subsidiary is a corporation or limited liability company, duly organized, validly existing and in good standing under the laws of the state or country of its formation. Each Earthstone Subsidiary has full power and authority to own, lease or otherwise hold and operate the Earthstone Properties and to carry on its business as presently conducted. Each Earthstone Subsidiary is duly qualified and in good standing to do business as a foreign corporation or limited liability company, as the case may be, in each jurisdiction in which the conduct or nature of its business or the ownership, leasing, holding or operating of its properties makes such qualification necessary, except such jurisdictions where the failure to be so qualified or in good standing, individually or in the aggregate, would not have a Material Adverse Effect.

Section 3.2 Capitalization of Earthstone and Subsidiaries.

(a) The authorized capital stock of Earthstone consists of 100,000,000 shares of Earthstone Common Stock and 20,000,000 shares of preferred stock, par value $0.001 per share (the “Earthstone Preferred Stock”). All of the outstanding shares of Earthstone Common Stock have been duly authorized and validly issued in accordance with the Certificate of Incorporation, are fully paid and nonassessable, and, as of the respective dates of the SEC Filings and Earthstone Financial Statements, were issued and held as described therein. On the date hereof, there are 22,289,177 issued and outstanding shares of Earthstone Common Stock. On the date hereof, except as set forth on Section 3.2(a) of the Earthstone Disclosure Schedule, Earthstone has no Earthstone Preferred Stock or other equity securities issued or outstanding.

(b) Subject to the receipt of the Earthstone Stockholder Approval and the filing of the A&R Certificate of Incorporation with the Secretary of State, the shares of Class B Common Stock to be issued pursuant to this Agreement will be duly authorized in accordance with the A&R Certificate of Incorporation, and, when issued and delivered pursuant to this Agreement in accordance with the terms hereof, will be validly issued, fully paid and nonassessable and will be issued free and clear of any lien, claim or Encumbrance.

-3-

(c) Except for the Earthstone Shares and outstanding options, warrants, restricted stock units or other rights to purchase Earthstone Common Stock set forth in the SEC Filings or as set forth on Section 3.2(c) of the Earthstone Disclosure Schedule, there are no preemptive rights or other rights to subscribe for or to purchase any shares of Earthstone Common Stock. Except for the Earthstone Shares to be issued pursuant to this Agreement or as set forth on Section 3.2(c) of the Earthstone Disclosure Schedule, as of the date hereof, there are no shares of Class B Common Stock, shares of Earthstone Preferred Stock or other equity securities of Earthstone held in the treasury of Earthstone, and there are no outstanding options, restricted stock units, warrants or other rights to purchase, agreements or other obligations to issue, or rights to convert any obligations into or exchange any securities for, shares of Earthstone Common Stock or other securities of Earthstone.

(d) Subject to the receipt of the Earthstone Stockholder Approval and filing of the A&R Certificate of Incorporation with the Secretary of State, Earthstone has all requisite power and authority to issue, exchange and deliver the Earthstone Shares in accordance with and upon the terms and conditions set forth in this Agreement. As of the Closing Date, all corporate action for the authorization, issuance, exchange and delivery of the Earthstone Shares shall have been validly taken, and no other authorization by any Person is required therefor.

(e) All of the issued and outstanding equity interests and limited liability company interests of each Earthstone Subsidiary are held beneficially and directly or indirectly of record by Earthstone. All outstanding equity and limited liability company interests of each Earthstone Subsidiary are validly issued, fully paid and non-assessable, and are not subject to preemptive rights. Except as set forth in Section 3.2(e) of the Earthstone Disclosure Schedule, there are outstanding: (i) no limited liability company interests, voting debt or other voting Securities of any Earthstone Subsidiary; (ii) no Securities of any Earthstone Subsidiary convertible into or exchangeable for limited liability company interests, or other voting Securities of any Earthstone Subsidiary; and (iii) no options, warrants, calls, rights (including preemptive rights), commitments or agreements to which any Earthstone Subsidiary is a party or by which it is bound, in any case obligating any Earthstone Subsidiary to issue, deliver, sell, purchase, redeem or acquire, or cause to be issued, delivered, sold, purchased, redeemed or acquired, additional limited liability company interests or any other Securities of any Subsidiary or any other Person or obligating any Earthstone Subsidiary to grant, extend or enter into any such option, warrant, call, right, commitment or agreement. There are not as of the date hereof and there will not be at the Closing Date any member agreements, voting trusts or other agreements or understandings to which any Earthstone Subsidiary is a party or by which it is bound relating to the voting of any limited liability company interests or voting securities of any Earthstone Subsidiary from, or the casting of votes by, the member of any Earthstone Subsidiary with respect to the Earthstone Contribution. The limited liability company agreements of each applicable Earthstone Subsidiary have been duly authorized, executed and delivered by Earthstone and are, and will be at the Closing, valid and legally binding agreements, enforceable against each Earthstone Subsidiary and its member in accordance with its terms.

Section 3.3 Authority Relative to This Agreement. Subject to the receipt of the Earthstone Stockholder Approval: (a) Earthstone has the full power and authority to execute and deliver this Agreement and to consummate the transactions contemplated hereby; (b) the execution, delivery and performance by Earthstone of this Agreement, and the consummation by it of the transactions contemplated hereby, have been duly authorized, and no other corporate proceedings on the part of Earthstone is necessary to authorize the execution, delivery and performance by Earthstone of this Agreement and the consummation of the transactions contemplated hereby; and (c) this Agreement has been duly executed and delivered by Earthstone and constitutes, and each other agreement, instrument or document executed or to be executed by Earthstone in connection with the transactions contemplated hereby has been, or when executed will be, duly executed and delivered by Earthstone and constitutes, or when executed and delivered will constitute, a valid and legally binding obligation of Earthstone enforceable against Earthstone in accordance with their respective terms, except that such enforceability may be limited by (i) applicable bankruptcy, insolvency, reorganization, moratorium and similar laws affecting creditors’ rights generally and (ii) equitable principles which may limit the availability of certain equitable remedies (such as specific performance) in certain instances.

Section 3.4 Noncontravention. Except for the receipt of the Earthstone Stockholder Approval, the required approval of NYSE MKT, the filing of the A&R Certificate of Incorporation with the Secretary of State, and as otherwise indicated on Section 3.4 of the Earthstone

-4-

Disclosure Schedule, the execution, delivery and performance by Earthstone of this Agreement and the consummation by Earthstone of the transactions contemplated hereby do not and will not (a) conflict with or result in a violation of any provision of the Certificate of Incorporation, bylaws or any other governing instruments of Earthstone or any Earthstone Subsidiary, (b) conflict with or result in a violation of any provision of, or constitute (with or without the giving of notice or the passage of time or both) a default under, or give rise (with or without the giving of notice or the passage of time or both) to any right of termination, cancellation or acceleration under, any bond, debenture, note, mortgage, indenture, lease, contract, agreement or other instrument or obligation to which Earthstone or any Earthstone Subsidiary is a party or by which Earthstone, any Earthstone Subsidiary or any Earthstone Property may be bound, (c) result in the creation or imposition of any Encumbrance upon the Earthstone Properties or (d) assuming compliance with the matters referred to in Section 3.5, violate any applicable Law binding upon Earthstone or any Earthstone Subsidiary, except, in the case of clauses (b), (c) and (d) above, for any such conflicts, violations, defaults, terminations, cancellations, accelerations or Encumbrances which would not, individually or in the aggregate, have a Material Adverse Effect on Earthstone.

Section 3.5 Governmental Approvals. To the Knowledge of Earthstone, no material consent, approval, order or authorization of, or declaration, filing or registration with, any Governmental Body is required to be obtained or made by Earthstone in connection with the execution, delivery or performance by Earthstone of this Agreement or the consummation by it of the transactions contemplated hereby, other than (a) compliance with any applicable federal or state securities or takeover laws, including the filing of a proxy statement with the SEC in connection with the Contribution (the “Proxy Statement”), as well as the filing of such other forms, notices and other documents as required under federal securities and state blue sky laws, and (b) filings with Governmental Body to occur in the ordinary course following the consummation of the transactions contemplated hereby.

Section 3.6 Financial Statements. Each of the financial statements (including any related notes thereto) contained in the SEC Filings (the “Earthstone Financial Statements”) (a) complied as to form in all material respects with the published rules and regulations of the SEC with respect thereto as of their respective dates; (b) was prepared from the books and records of Earthstone and in accordance with GAAP applied on a consistent basis throughout the periods involved (except as may be indicated in the notes thereto and, in the case of unaudited interim financial statements, as may be permitted by the SEC for Quarterly Reports on Form 10-Q); and (c) fairly presented in all material respects the financial position of Earthstone at the dates thereof and the results of Earthstone’s operations and cash flows for the periods indicated therein, subject, in the case of unaudited interim financial statements, to normal and year-end audit adjustments as permitted by GAAP and the applicable rules and regulations of the SEC.

Section 3.7 Absence of Undisclosed Liabilities. To the Knowledge of Earthstone, Earthstone does not have any material liability or obligation (whether accrued, absolute, contingent, unliquidated or otherwise), including any liability or obligation with respect to the Earthstone Properties (whether accrued, absolute, contingent, unliquidated or otherwise) except (a) liabilities reflected in the latest unaudited interim financial statements filed with the SEC on Form 10-Q for the quarter ended June 30, 2016 (the “Earthstone Interim Financial Statements”) or described in the notes accompanying the Earthstone Interim Financial Statements, (b) liabilities which have arisen since the date of the Earthstone Interim Financial Statements in the ordinary course of business (none of which is a material liability for breach of contract, tort or infringement), (c) liabilities arising under executory provisions of contracts entered into in the ordinary course of business (none of which is a material liability for breach of contract) and (d) liabilities disclosed on Section 3.7 of the Earthstone Disclosure Schedule.

Section 3.8 Absence of Certain Changes. Except as disclosed on Section 3.8 of the Earthstone Disclosure Schedule, since the date of the Earthstone Interim Financial Statements, (a) there has not been any change, event or condition that would reasonably be expected to result in any Material Adverse Effect on the assets or financial condition of Earthstone, any Earthstone Subsidiary or any of the Earthstone Properties, (b) the business of Earthstone and the Earthstone Subsidiaries has been conducted only in the ordinary course consistent with past practice, (c) none of Earthstone or any Earthstone Subsidiary has incurred any material liability, engaged in any material transaction or entered into any material agreement outside the ordinary course of business consistent with past practice with respect to its business

-5-

and assets, including the Earthstone Properties, and (d) none of Earthstone or any Earthstone Subsidiary has suffered any loss, damage, destruction or other casualty to any of its assets, including the Earthstone Properties (whether or not covered by insurance) that would result in a Material Adverse Effect on Earthstone.

Section 3.9 Title to Properties.

(a) To the Knowledge of Earthstone, except for property sold or otherwise disposed of, impaired or abandoned in the ordinary course of business since the dates of the Earthstone Reserve Report and the Lynden Reserve Report, as applicable, Earthstone has good and defensible title to all oil and gas properties forming the basis for the reserves reflected in the Earthstone Reserve Report and the Lynden Reserve Report as attributable to interests owned or held by Earthstone free and clear of all Encumbrances, except for Encumbrances set forth in Section 3.9(a) of the Earthstone Disclosure Schedule and any other liens, charges, encumbrances, defects or irregularities that do not, individually or in the aggregate, materially detract from the value of or materially interfere with the use or ownership of such oil and gas properties. The oil and gas leases and other agreements that provide Earthstone with operating rights in the oil and gas properties reflected in the Earthstone Reserve Report are in full force and effect as to the oil and gas properties reflected in the Earthstone Reserve Report and the Lynden Reserve Report, and the rentals, royalties and other payments due thereunder have been properly and timely paid and there is no existing default (or event that, with notice or lapse of time or both, would become a default) under any of such oil and gas leases or other agreements, except, in each case, as individually or in the aggregate has not had, and would not be reasonably likely to have or result in, a Material Adverse Effect on Earthstone. For purposes of this Section 3.9, “good and defensible title” means title that is free from reasonable doubt to the end that a prudent person engaged in the business of purchasing and owning, developing, and operating producing or non-producing oil and gas properties in the geographical areas in which they are located, with knowledge of all of the facts and their legal bearing, would be willing to accept, acting reasonably.

(b) To the Knowledge of Earthstone, all producing oil and gas wells included in the Earthstone Properties operated by Earthstone have been drilled, operated and produced in accordance in all material respects with reasonable, prudent oil and gas field practice and in compliance in all material respects with applicable oil and gas leases and applicable Law. All producing oil and gas wells and related material equipment are in an operable state of repair, adequate to maintain normal operations in accordance with past practices, ordinary wear and tear excepted.

(c) To the Knowledge of Earthstone, except as set forth on Section 3.9(c) of the Earthstone Disclosure Schedule, all proceeds from the sale of Hydrocarbons produced from the Earthstone Properties are being received by Earthstone in a timely manner and are not being held in suspense for any reason by any Person by whom proceeds are being paid except for immaterial amounts.

(d) To the Knowledge of Earthstone, except as would not, individually or in the aggregate, have a Material Adverse Effect on Earthstone, neither Earthstone (as to wells operated by Earthstone) nor an applicable operator (as to wells not operated by Earthstone), is in material breach of, or default under, any oil and gas lease, oil, gas, and mineral lease and sublease, royalty, overriding royalty, net profits interest, mineral fee interest, carried interest, interests under a concession, production sharing, risk service, technical service, service, or similar agreement that is, or constitutes an interest in, the Earthstone Properties.

Section 3.10 Compliance With Laws. Except as disclosed on Section 3.10 of the Earthstone Disclosure Schedule, to the Knowledge of Earthstone, Earthstone has complied in all material respects with all applicable Laws (including Environmental Laws). Except as disclosed on Section 3.10 of the Earthstone Disclosure Schedule, Earthstone has not received any written notice from any Governmental Body, which has not been dismissed or otherwise disposed of, that Earthstone has not so complied. Earthstone has not been charged or, to the Knowledge of Earthstone, threatened with, or under investigation with respect to, any material violation of any applicable Law relating to any aspect of the business of Earthstone.

-6-

Section 3.11 Tax Matters.

(a) Earthstone and each of the Earthstone Subsidiaries have filed all Tax Returns required to be filed by such entities, including those relating to real and personal property taxes, ad valorem taxes, severance taxes and any other Taxes imposed on or with respect to assets owned by such entities, including the Earthstone Properties and any production therefrom. All such Tax Returns have been timely filed with the applicable taxing authority, except as set forth on Section 3.11(a) of the Earthstone Disclosure Schedule, and all Taxes owed by Earthstone and each of the Earthstone Subsidiaries (or for which EEH and any of its Subsidiaries may be liable) that are or have become due have been timely paid in full (regardless of whether shown on any Tax Return).

(b) There are no liens for Taxes (other than for Taxes not yet due and payable) upon Earthstone, the Earthstone Subsidiaries or any of their assets, including the Earthstone Properties.

(c) There has been no issue raised or adjustment proposed (and to the Knowledge of Earthstone and the Earthstone Subsidiaries, none is pending) by the IRS or any other taxing authority in connection with any Tax Return of Earthstone or any of the Earthstone Subsidiaries, nor has Earthstone or any of the Earthstone Subsidiaries received any written notice from the IRS or any such other taxing authority that any Tax Return of Earthstone or any of its Subsidiaries is being audited or may be audited or examined.

(d) Neither Earthstone nor any of the Earthstone Subsidiaries has received a written notice of a claim made by any taxing authority in a jurisdiction where Earthstone or any of the Earthstone Subsidiaries does not file Tax Returns that it is or may be subject to Tax in such jurisdiction.

(e) Neither Earthstone nor any of the Earthstone Subsidiaries has agreed to the extension of any statute of limitations on the assessment or collection of any Tax or with respect to any Tax Return of Earthstone or the Earthstone Subsidiaries.

(f) There are no Tax rulings, requests for rulings or closing agreements with any taxing authority with respect to Earthstone or any of the Earthstone Subsidiaries.

(g) Neither Earthstone nor any of the Earthstone Subsidiaries (i) has any current or potential contractual obligation, through Tax sharing agreements or otherwise, to indemnify any other Person with respect to Taxes or to make any distribution with respect to any current or future tax liability or (ii) has been a member of an affiliated group filing a consolidated income Tax Return (other than of a group the common parent of which is Earthstone) or has any liability for the Taxes of any Person (other than Earthstone or any of the Earthstone Subsidiaries) under Treas. Reg. § 1.1502-6 (or any similar provision of state, local or non-U.S. Tax Law), as a transferee or successor, by contract or otherwise.

(h) Neither Earthstone nor any of the Earthstone Subsidiaries has (i) participated, or is currently participating, in any listed transactions or any other reportable transactions within the meaning of Treas. Reg. § 1.6011-4(b), or (ii) engaged or is currently engaging in any transaction that gives rise to a registration obligation under Section 6111 of the Code or a list maintenance obligation under Section 6112 of the Code.

(i) Neither Earthstone nor any of the Earthstone Subsidiaries has constituted a “distributing corporation” or a “controlled corporation” (or a successor thereto) in a distribution of stock intended to qualify for tax-free treatment under Section 355 of the Code that is reasonably likely to result in the imposition of Tax on Earthstone or any of the Earthstone Subsidiaries under Section 355(e) of the Code as a result of the transactions contemplated by this Agreement.

(j) EEH is treated as an entity disregarded as separate from Earthstone for U.S. federal income tax purposes pursuant to Treas. Reg. § 301.7701-3. Except for Lynden Energy Corp., Lynden and Basic Petroleum Services, Inc., each Earthstone Subsidiary is treated as an entity disregarded as separate from Earthstone for U.S. federal income tax purposes pursuant to Treas. Reg. § 301.7701-3.

Section 3.12 Legal Proceedings. Except as set forth on Section 3.12 of the Earthstone Disclosure Schedule, there are no Proceedings pending or, to the Knowledge of Earthstone, threatened against or involving Earthstone or rights of Earthstone with respect

-7-

to any of its assets, including the Earthstone Properties (including those Proceedings arising under or pursuant to Environmental Law). Earthstone is not subject to any material judgment, order, writ, injunction, or decree of any Governmental Body (including those judgments, orders, writs, injunctions, or decrees issued pursuant to Environmental Laws). There are no Proceedings pending or, to the Knowledge of Earthstone, threatened against Earthstone or its assets, including the Earthstone Properties, seeking to restrain, prohibit, or obtain damages or other relief in connection with this Agreement or the transactions contemplated hereby or which could reasonably be expected to affect Earthstone’s ability to consummate the transactions contemplated hereby.

Section 3.13 Brokerage Fees. Except for Stephens Inc. (“Stephens”), the fees and expenses of which will be $750,000 and paid solely by Earthstone, neither Earthstone nor any Affiliate has retained any financial advisor, broker, agent or finder or paid or agreed to pay any financial advisor, broker, agent or finder on account of this Agreement, any transaction contemplated hereby or any other transaction.

Section 3.14 Permits. Earthstone holds all material Permits (including those issued pursuant to Environmental Laws) necessary or required for the conduct of its business as currently conducted. Each of such Permits is in full force and effect and Earthstone is in material compliance with each such Permit. Except as disclosed on Section 3.14 of the Earthstone Disclosure Schedule, Earthstone has not received any written notice from any Governmental Body and no Proceeding is pending or, to the Knowledge of Earthstone, threatened with respect to any alleged failure by Earthstone to have any Permit.

Section 3.15 Environmental Matters. Except as disclosed on Section 3.15 of the Earthstone Disclosure Schedule, and except as would not, individually or in the aggregate, have a Material Adverse Effect, (a) Earthstone has not received any written notice of any investigation or inquiry regarding the Earthstone Properties from any Governmental Body under any Environmental Laws; (b) to the Knowledge of Earthstone, the Earthstone Properties have not been used for disposal of any Hazardous Substance; (c) to the Knowledge of Earthstone, there are no facts or circumstances that exist that could result in any obligations or liabilities under any Environmental Laws; and (d) there has been no Release, or threatened Release, of Hazardous Substances that would result in any liabilities or other obligations under any Environmental Laws.

Section 3.16 Revenue and Expense Information; Records. The property list, cash receipts, disbursements and production volumes with respect to the Earthstone Properties are true and correct in all material respects. Earthstone has not received any written notice of and does not have Knowledge of any material adverse claim against Earthstone’s title to the Earthstone Properties. The Earthstone Records are true and correct in all material respects and accurately reflect the ownership and, to the extent the Earthstone Properties are operated by Earthstone, operation of the Earthstone Properties by Earthstone.

Section 3.17 Commitments. Except as set forth on Section 3.17 of the Earthstone Disclosure Schedule, to Earthstone’s Knowledge, Earthstone has incurred no material expenses, and has made no commitments to make material expenditures (and Earthstone has not entered into any agreements that would obligate Earthstone to make material expenditures), in connection with (and no other material obligations or liabilities have been incurred, outside the ordinary course of business consistent with past practices in connection with) the ownership or operation of the Earthstone Properties after the Closing Date.

Section 3.18 No Alienation. Except as set forth on Section 3.18 of the Earthstone Disclosure Schedule, since June 30, 2016, Earthstone has not sold, assigned, conveyed, or transferred or contracted to sell, assign, convey or transfer any right or title to, or interest in, the Earthstone Properties, other than in the ordinary course of business (including the replacement of equipment for equipment of reasonably equivalent or greater value or the sale of Hydrocarbons produced from the Earthstone Properties in the regular course of business).

Section 3.19 Make-Up Rights. To Earthstone’s Knowledge, Earthstone has not, nor has any other Person, received prepayments (including but not

-8-

limited to, payments for gas not taken pursuant to “take-or-pay” or similar arrangements) for any Hydrocarbons produced from the Earthstone Properties as a result of which the obligation does or may exist to deliver Hydrocarbons produced from the Earthstone Properties after the Closing Date without then receiving payment (or without then receiving full payment) therefor or to make repayments in cash, and the working interest owners have not so delivered any Hydrocarbons from the Earthstone Properties or so made any such repayment in cash.

Section 3.20 Imbalance. Any Imbalance among the owners of the interests in the wells and units included in the Earthstone Properties are consistent with those that are normal and customary in the oil and gas industry, and Section 3.20 of the Earthstone Disclosure Schedule sets forth all material gas imbalances affecting the Earthstone Properties as of the date hereof. To Earthstone’s Knowledge, no condition exists affecting the operation of the Earthstone Properties which has materially impaired, or could reasonably be expected to materially impair, production from or the operations of the Earthstone Properties.

Section 3.21 Preferential Rights and Consents to Assign. There are no consents to assignment or waivers of preferential rights to purchase affecting the Earthstone Properties that must be obtained from third parties in order for Earthstone to consummate the transactions contemplated by this Agreement without violating or breaching a duty or obligation of Earthstone.

Section 3.22 No Participating Hydrocarbons. Except as set forth on Section 3.22 of the Earthstone Disclosure Schedule, the Earthstone Properties do not include any unleased Hydrocarbons where Earthstone has agreed to bear a share of drilling, operating or other costs as a participating mineral owner.

Section 3.23 Insurance. Section 3.23 of the Earthstone Disclosure Schedule contains a complete and correct list of material insurance policies maintained by or on behalf of Earthstone as of the date of this Agreement.

Section 3.24 Employees. There are no collective bargaining agreements or other labor union contracts applicable to any employees of Earthstone, and no such agreement or contract has been requested by an employee or group of employees of Earthstone. Earthstone is in compliance in all material respects with all applicable Laws pertaining to employment and employment practices and wages, hours and other terms and conditions of employment in respect of its employees, and has no material accrued liability for any arrears of past-due wages or any material Taxes or penalties for failure to comply with any thereof. There is no pending or, to the Knowledge of Earthstone, threatened material Proceeding against or involving Earthstone by or before, and Earthstone is not subject to any judgment, order, writ, injunction, or decree of or material inquiry from, any Governmental Body in connection with any current, former or prospective employee of Earthstone. All employees currently providing services to Earthstone are employed by Earthstone.

Section 3.25 Agreements, Contracts and Commitments.

(a) Section 3.25(a) of the Earthstone Disclosure Schedule lists all leases, contracts, agreements and instruments to which Earthstone is a party as of the date hereof and which are in any single case of material importance to the conduct of the business of Earthstone (true and correct copies of each such document requested by Bold have been previously delivered to them and a written description of each oral arrangement so listed) (“Earthstone Material Contracts”).

(b) Except as set forth on Section 3.25(b) of the Earthstone Disclosure Schedule and as contemplated hereby, Earthstone does not have as of the date hereof (i) any collective bargaining agreements or any agreements with executive officers that contain any change in control related payments or severance, notice or termination pay or benefit liabilities or obligations, (ii) any agreement of guarantee or indemnification running from Earthstone to any Person except as provided in Earthstone’s Certificate of Incorporation and bylaws, (iii) any agreement, indenture or other instrument for borrowed money and any agreement or other instrument which

-9-

contains restrictions with respect to payment of dividends or any other distribution in respect of the Earthstone Common Stock or any other outstanding securities, (iv) any agreement, contract or commitment containing any covenant limiting the freedom of Earthstone to engage in any line of business or compete with any Person, (v) any agreement, contract or commitment relating to capital expenditures required to be disclosed on Section 3.17 of the Earthstone Disclosure Schedule, (vi) any agreement, contract or commitment relating to the acquisition of assets or capital stock of any business enterprise, or (vii) any agreement, contract or commitment not made in the ordinary course of business.

(c) Except as set forth on Section 3.25(c) of the Earthstone Disclosure Schedule, Earthstone has not materially breached, nor to Earthstone’s Knowledge is there any claim or any legal basis for a claim that Earthstone has materially breached, any of the terms or conditions of any material agreement, contract or commitment set forth in the Earthstone Disclosure Schedule.

Section 3.26 Hedging. Except as set forth on Section 3.26 of the Earthstone Disclosure Schedule, Earthstone is not engaged in any oil, natural gas or other futures or option trading in respect of which it has any material future liability, nor is it a party to any price swaps, hedges, futures or similar instruments. Section 3.26 of the Earthstone Disclosure Schedule sets forth obligations of Earthstone for the delivery of Hydrocarbons attributable to any of the Earthstone Properties in the future on account of prepayment, advance payment, take-or-pay or similar obligations without then or thereafter being entitled to receive full value therefor. Except as set forth on Section 3.26 of the Earthstone Disclosure Schedule, as of the date hereof, Earthstone is not bound by futures, hedge, swap, collar, put, call, floor, cap, option or other contracts that are intended to benefit from, relate to or reduce or eliminate the risk of fluctuations in the price of commodities, including Hydrocarbons, or securities.

Section 3.27 Regulatory Agencies. Except as set forth on Section 3.27 of the Earthstone Disclosure Schedule, all currently effective filings heretofore made by Earthstone with the Federal Energy Regulatory Commission (“FERC”), and all other federal, state and local agencies or commissions (collectively, the “Regulatory Agencies”) were made in compliance with applicable Laws and the factual information contained therein was true and correct in all material respects as of the respective dates of such filings. The right of Earthstone to receive payment pursuant to any tariff, rate schedule or similar instrument filed with or subject to the jurisdiction of any Governmental Body has not been suspended, and Earthstone has not received written notification questioning the validity of any such tariff, rate schedule or similar instrument which is material to the operations of the Earthstone Properties, taken as a whole, from any Governmental Body or customer. Neither Earthstone nor any portion of the Earthstone Properties is subject to the jurisdiction of FERC under the Natural Gas Act of 1938 (“NGA”).