Form 8-K EARTHSTONE ENERGY INC For: Jun 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: June 20, 2016

(Date of earliest event reported)

(Exact name of registrant as specified in its charter)

| Delaware | 001-35049 | 84-0592823 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

1400 Woodloch Forest Drive, Suite 300

The Woodlands, Texas 77380

(Address of principal executive offices) (Zip Code)

(281) 298-4246

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. | Regulation FD Disclosure. |

On June 20, 2016, Earthstone Energy, Inc. (“Earthstone”) posted to its website a company presentation (the “Presentation Materials”) that management intends to use from time to time about Earthstone’s operations and performance. Earthstone may use the Presentation Materials, possibly with modifications, in presentations to current and potential investors, lenders, creditors, vendors, customers and others with an interest in Earthstone and its business.

The information contained in the Presentation Materials is summary information that should be considered in the context of Earthstone’s filings with the Securities and Exchange Commission and other public announcements that Earthstone may make by press release or otherwise from time to time. The Presentation Materials speak as of the date of this Current Report on Form 8-K. While Earthstone may elect to update the Presentation Materials in the future or reflect events and circumstances occurring or existing after the date of this Current Report on Form 8-K, Earthstone specifically disclaims any obligation to do so. The Presentation Materials are furnished as Exhibit 99.1 to this Current Report on Form 8-K and are incorporated herein by reference.

Some of the matters discussed in the Presentation Materials contain forward-looking statements that involve uncertainties and risks related to, intense competition in the oil and gas industry, Earthstone’s dependence on its management, volatile oil and gas prices, uncertainties associated with oil and gas reserve estimates, operating and capital costs and Earthstone’s need to replace production and acquire or develop additional oil and gas reserves, among other matters. Actual results could differ materially from those projected and Earthstone cautions readers not to place undue reliance on the forward-looking statements contained in, or made in connection with, the Presentation Materials.

The information in this Current Report on Form 8-K furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section, and they shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. By filing this Current Report on Form 8-K and furnishing this information pursuant to Item 7.01, Earthstone makes no admission as to the materiality of any information in this Current Report on Form 8-K, including Exhibit 99.1, that is required to be disclosed solely by Regulation FD.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits:

The following exhibit is furnished with this Current Report on Form 8-K:

| Exhibit |

Description | |

| 99.1 | Slideshow Presentation dated June 2016. | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| EARTHSTONE ENERGY, INC. | ||||||||

| Date: June 24, 2016 | By: | /s/ Frank A. Lodzinski | ||||||

| Frank A. Lodzinski | ||||||||

| President and Chief Executive Officer | ||||||||

EXHIBIT INDEX

| Exhibit |

Description | |

| 99.1 | Slideshow Presentation dated June 2016. | |

Investor Presentation June 2016 Exhibit 99.1

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are not strictly historical statements constitute forward-looking statements and may often, but not always, be identified by the use of such words such as “expects,” “believes,” “intends,” “anticipates,” “plans,” “estimates,” “potential,” “possible,” or “probable” or statements that certain actions, events or results “may,” “will,” “should,” or “could” be taken, occur or be achieved. The forward-looking statements include statements about oil and gas pricing assumptions, future operations, estimates of reserve and production volumes, estimates of capital expenditures, expansion of production and reserves, future growth potential, possible acquisitions, and the ability to raise future capital. Forward-looking statements are based on expectations and assumptions and analyses made by Earthstone Energy, Inc. (“Earthstone”) in light of experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform with expectations is subject to a number of risks and uncertainties, including adverse changes in oil and gas prices or protracted periods of low oil and gas prices; problems that may arise in the integration of businesses or assets; the risks of the oil and gas industry (for example, operational risks in exploring for, developing and producing crude oil and natural gas, risks and uncertainties involving geology of oil and gas deposits); the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to future production, costs and expenses; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; health, safety and environmental risks and risks related to weather; inability of management to execute its plans to meet its goals; shortages of drilling equipment, oil field personnel and services; unavailability of gathering systems, pipelines and processing facilities; the possibility that government policies may change; and that foreign production rates may change. Earthstone’s Annual Report on Form 10-K for the year ended December 31, 2015 and other Securities and Exchange Commission (“SEC”) filings discuss some of the important risk factors identified that may affect Earthstone’s business, results of operations, and financial condition. Earthstone undertakes no obligation to revise or update publicly any forward-looking statements except as required by law. See Appendix A – Assumptions and Disclosures for further PV-10, net production, and reserve disclosure information.

Frank A. Lodzinski Chairman, President and CEO Formed Oak Valley Resources, LLC in December 2012 and led its strategic combination with Earthstone in December 2014 Former Chairman, President and CEO of GeoResources, Inc. from April 2007 until its merger with Halcón Resources Corporation in August 2012 Over 44 years of oil and gas industry experience Robert J. Anderson Executive Vice President, Corporate Development and Engineering Joined Oak Valley Resources, LLC management team in March 2013 until the closing of its strategic combination with Earthstone in December 2014 Former Executive Vice President and Chief Operating Officer at Halcón Resources Corporation upon acquisition of GeoResources, Inc. where he was Director, EVP and COO – Northern Region Worked with core management team since 2004 Petroleum engineer with over 29 years of diversified domestic and international experience Management Since 1992, the Earthstone team has completed 5 successful corporate exit transactions which includes selling GeoResources in 2012 for approximately $1 billion for a 35% IRR and 4.8x ROIC Through prior companies, management has extensive experience in the Eagle Ford, Permian and Bakken / Three Forks, among other basins The core of the management team has been together through multiple former companies

Investment Highlights Prudently Managed Balance Sheet Adequate cash flow and liquidity on hand to fund initial 2016 capital plans Simple and unburdened capital structure—no term debt outstanding Traditional reserve-based credit facility with standard covenants Managing through downturn with net leverage below 1.5x Proven Management Team Four prior successful public entities Operational excellence Repeat institutional and high net worth investors Market recognition from investors and sellside research analysts Diversified Shale Play Exposure with Growing Inventory Presence in the most prolific, domestic oil-bearing shale plays—Eagle Ford, Midland Basin and Bakken / Three Forks Growth through drill bit and significant acquisitions ~560 total gross drilling locations across core plays Upside from down-spacing and other formations Visible Production Growth & Drilling Program with Substantial Optionality Eagle Ford DUC inventory provides ability to ramp up production quickly Majority of acreage in key areas is HBP Non-consent option provides capital outflow flexibility

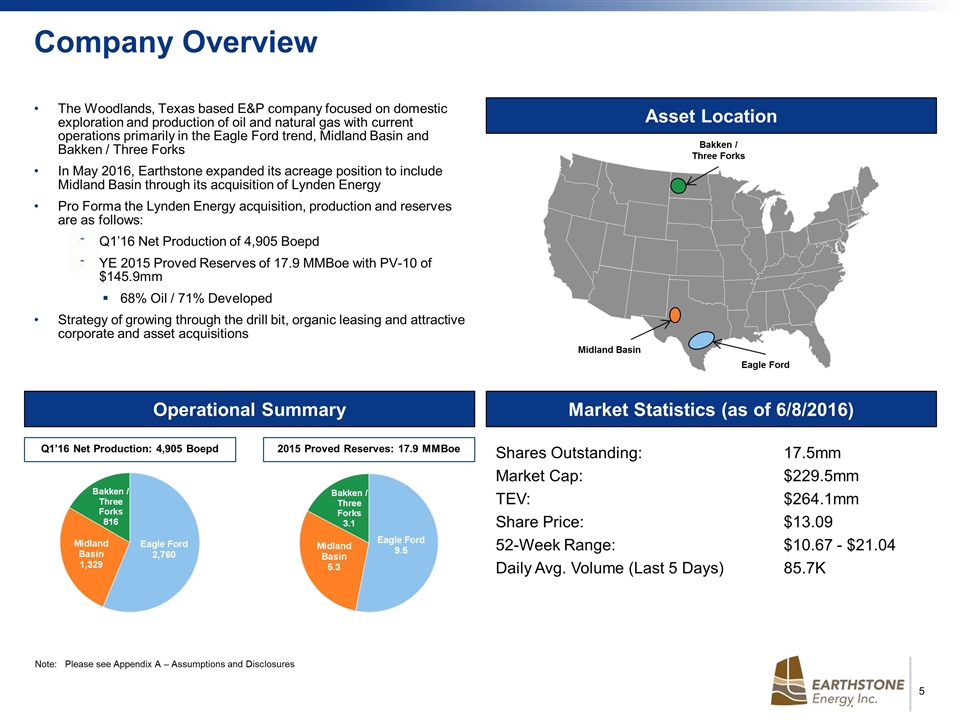

Note: Please see Appendix A – Assumptions and Disclosures Company Overview Asset Location The Woodlands, Texas based E&P company focused on domestic exploration and production of oil and natural gas with current operations primarily in the Eagle Ford trend, Midland Basin and Bakken / Three Forks In May 2016, Earthstone expanded its acreage position to include Midland Basin through its acquisition of Lynden Energy Pro Forma the Lynden Energy acquisition, production and reserves are as follows: Q1’16 Net Production of 4,905 Boepd YE 2015 Proved Reserves of 17.9 MMBoe with PV-10 of $145.9mm 68% Oil / 71% Developed Strategy of growing through the drill bit, organic leasing and attractive corporate and asset acquisitions Market Statistics (as of 6/8/2016) Shares Outstanding:17.5mm Market Cap:$229.5mm TEV:$264.1mm Share Price: $13.09 52-Week Range: $10.67 - $21.04 Daily Avg. Volume (Last 5 Days)85.7K Bakken / Three Forks Eagle Ford Midland Basin 2015 Proved Reserves: 17.9 MMBoe Operational Summary Q1’16 Net Production: 4,905 Boepd

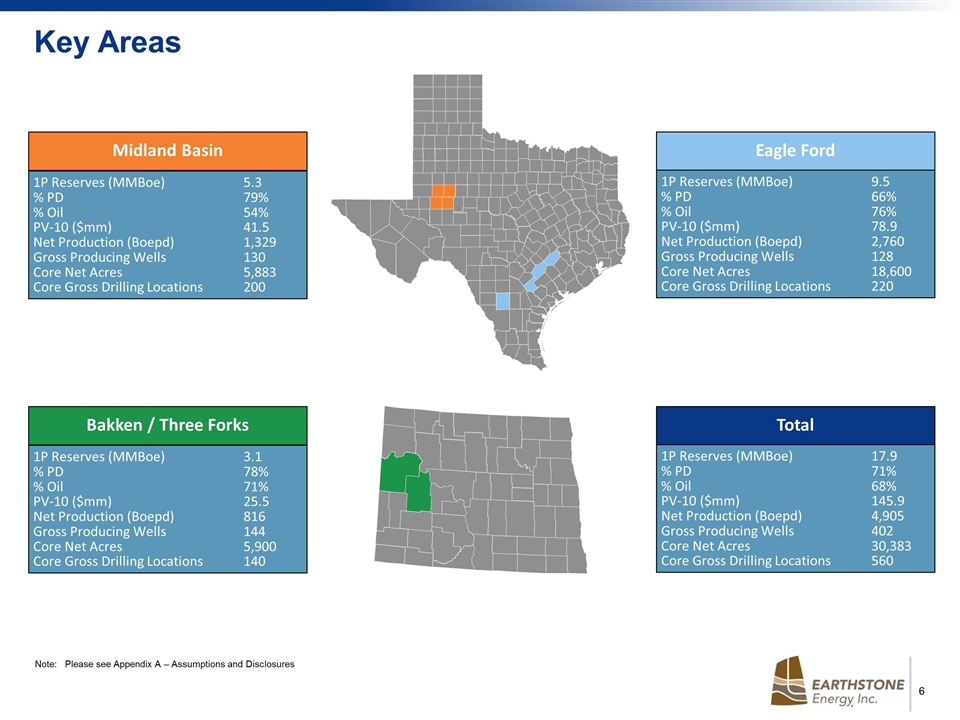

Key Areas Total 1P Reserves (MMBoe)17.9 % PD71% % Oil68% PV-10 ($mm)145.9 Net Production (Boepd)4,905 Gross Producing Wells402 Core Net Acres30,383 Core Gross Drilling Locations560 Bakken / Three Forks 1P Reserves (MMBoe)3.1 % PD78% % Oil71% PV-10 ($mm)25.5 Net Production (Boepd)816 Gross Producing Wells144 Core Net Acres5,900 Core Gross Drilling Locations140 Eagle Ford 1P Reserves (MMBoe)9.5 % PD66% % Oil76% PV-10 ($mm)78.9 Net Production (Boepd)2,760 Gross Producing Wells128 Core Net Acres18,600 Core Gross Drilling Locations220 Midland Basin 1P Reserves (MMBoe)5.3 % PD79% % Oil54% PV-10 ($mm)41.5 Net Production (Boepd)1,329 Gross Producing Wells130 Core Net Acres5,883 Core Gross Drilling Locations200 Note: Please see Appendix A – Assumptions and Disclosures

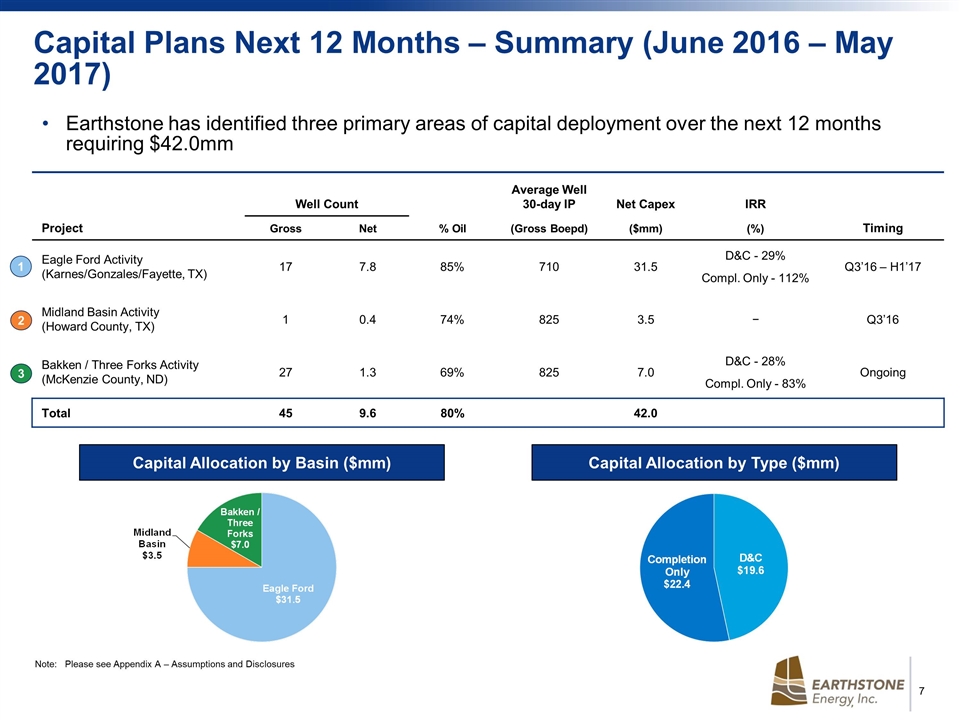

Project Well Count Average Well 30-day IP Net Capex IRR Gross Net % Oil (Gross Boepd) ($mm) (%) Timing Eagle Ford Activity (Karnes/Gonzales/Fayette, TX) 17 7.8 85% 710 31.5 D&C - 29% Compl. Only - 112% Q3’16 – H1’17 Midland Basin Activity (Howard County, TX) 1 0.4 74% 825 3.5 − Q3’16 Bakken / Three Forks Activity (McKenzie County, ND) 27 1.3 69% 825 7.0 D&C - 28% Compl. Only - 83% Ongoing Total 45 9.6 80% 42.0 1 2 3 Earthstone has identified three primary areas of capital deployment over the next 12 months requiring $42.0mm Capital Allocation by Type ($mm) Capital Allocation by Basin ($mm) Note: Please see Appendix A – Assumptions and Disclosures Capital Plans Next 12 Months – Summary (June 2016 – May 2017)

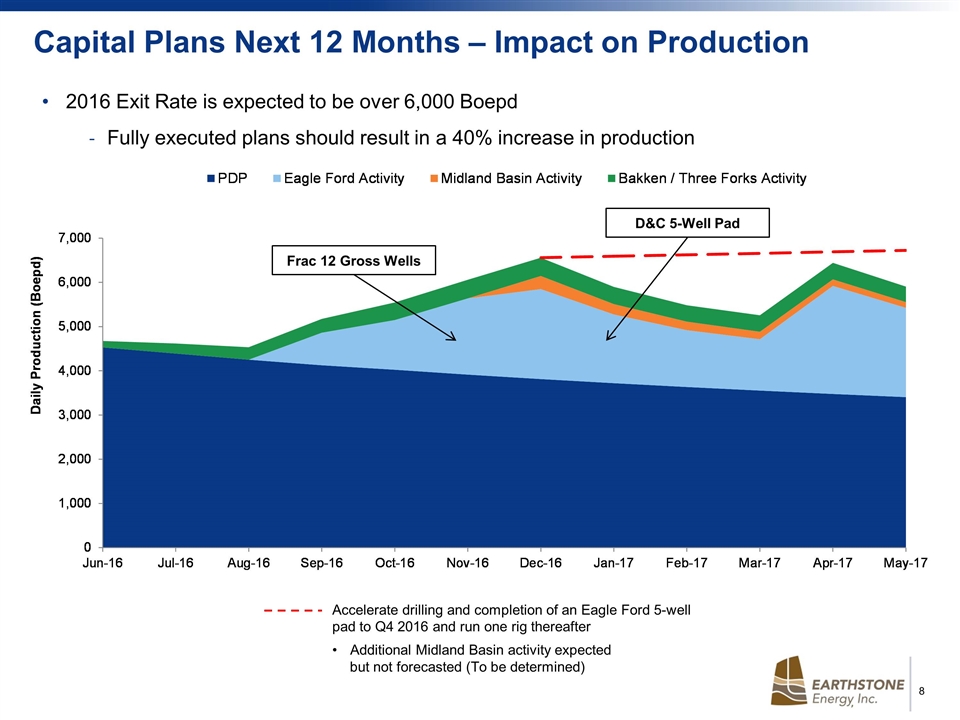

2016 Exit Rate is expected to be over 6,000 Boepd Fully executed plans should result in a 40% increase in production Capital Plans Next 12 Months – Impact on Production Frac 12 Gross Wells D&C 5-Well Pad Accelerate drilling and completion of an Eagle Ford 5-well pad to Q4 2016 and run one rig thereafter Additional Midland Basin activity expected but not forecasted (To be determined)

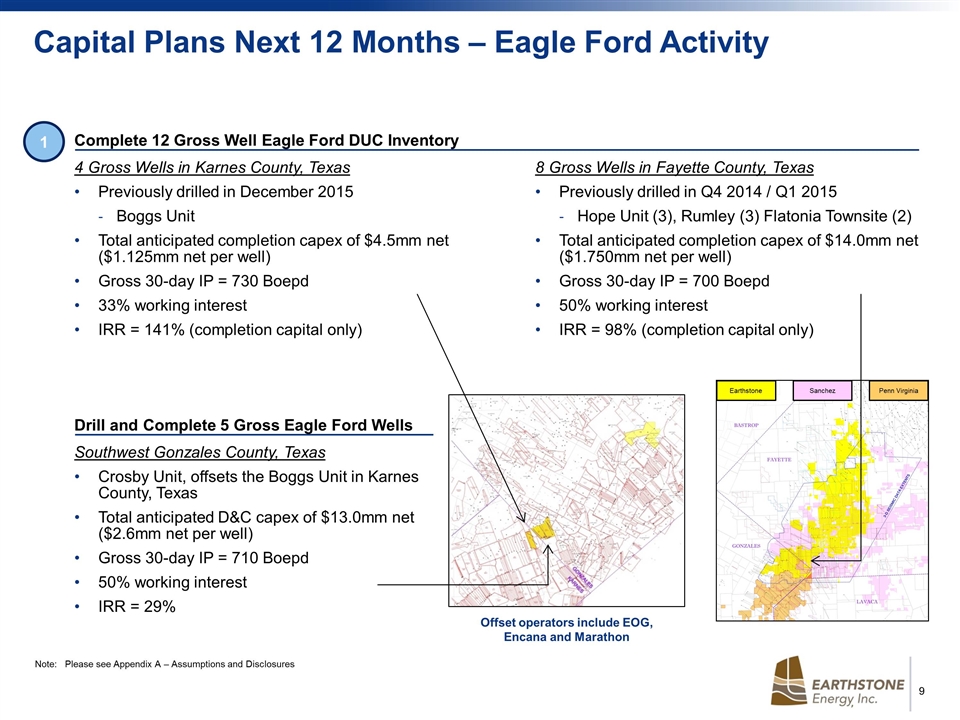

Capital Plans Next 12 Months – Eagle Ford Activity 1 Complete 12 Gross Well Eagle Ford DUC Inventory 8 Gross Wells in Fayette County, Texas Previously drilled in Q4 2014 / Q1 2015 Hope Unit (3), Rumley (3) Flatonia Townsite (2) Total anticipated completion capex of $14.0mm net ($1.750mm net per well) Gross 30-day IP = 700 Boepd 50% working interest IRR = 98% (completion capital only) 4 Gross Wells in Karnes County, Texas Previously drilled in December 2015 Boggs Unit Total anticipated completion capex of $4.5mm net ($1.125mm net per well) Gross 30-day IP = 730 Boepd 33% working interest IRR = 141% (completion capital only) Drill and Complete 5 Gross Eagle Ford Wells Southwest Gonzales County, Texas Crosby Unit, offsets the Boggs Unit in Karnes County, Texas Total anticipated D&C capex of $13.0mm net ($2.6mm net per well) Gross 30-day IP = 710 Boepd 50% working interest IRR = 29% Earthstone Sanchez Penn Virginia Note: Please see Appendix A – Assumptions and Disclosures Offset operators include EOG, Encana and Marathon

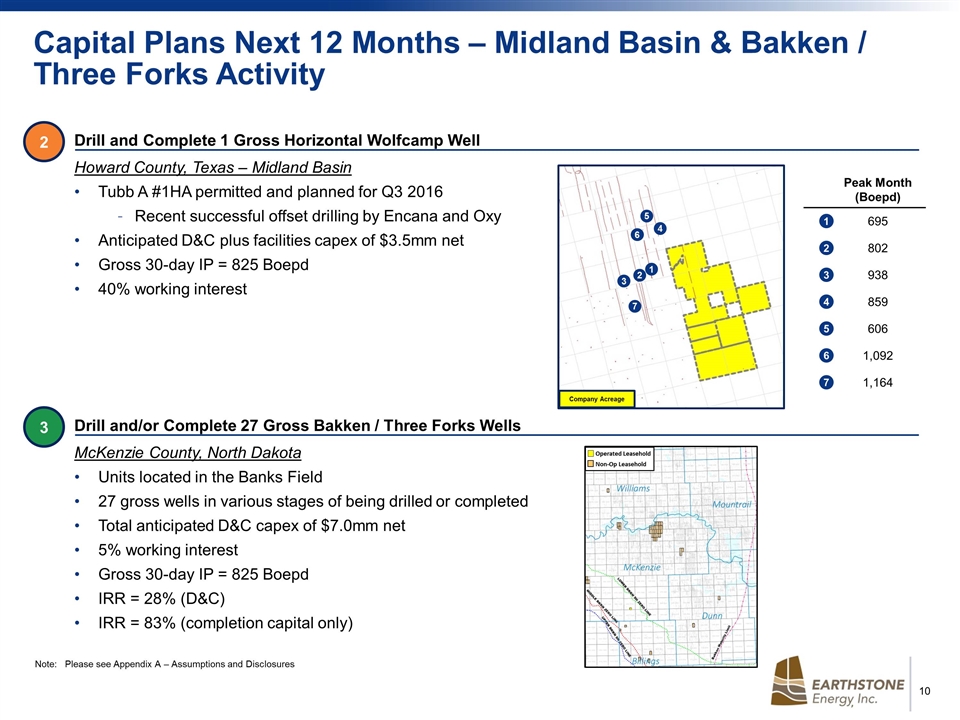

Capital Plans Next 12 Months – Midland Basin & Bakken / Three Forks Activity 2 Drill and Complete 1 Gross Horizontal Wolfcamp Well Howard County, Texas – Midland Basin Tubb A #1HA permitted and planned for Q3 2016 Recent successful offset drilling by Encana and Oxy Anticipated D&C plus facilities capex of $3.5mm net Gross 30-day IP = 825 Boepd 40% working interest Drill and/or Complete 27 Gross Bakken / Three Forks Wells McKenzie County, North Dakota Units located in the Banks Field 27 gross wells in various stages of being drilled or completed Total anticipated D&C capex of $7.0mm net 5% working interest Gross 30-day IP = 825 Boepd IRR = 28% (D&C) IRR = 83% (completion capital only) 3 1 2 3 4 5 6 7 Company Acreage Peak Month (Boepd) 695 802 938 859 606 1,092 1,164 1 2 3 4 5 6 7 Non-Op Leasehold Operated Leasehold Note: Please see Appendix A – Assumptions and Disclosures

Overview of Assets

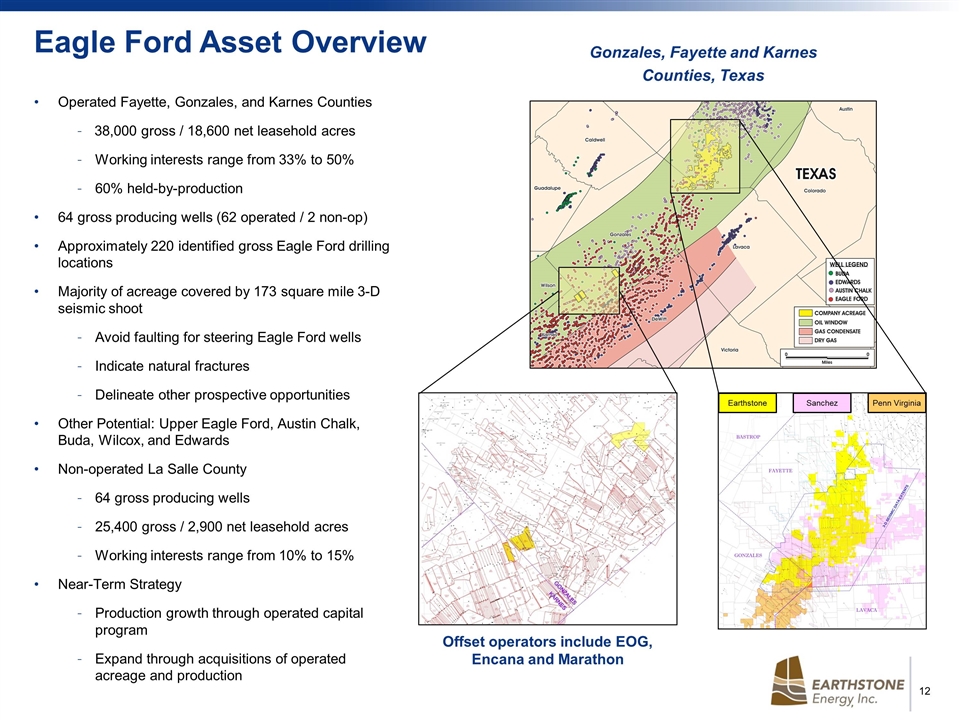

Eagle Ford Asset Overview Operated Fayette, Gonzales, and Karnes Counties 38,000 gross / 18,600 net leasehold acres Working interests range from 33% to 50% 60% held-by-production 64 gross producing wells (62 operated / 2 non-op) Approximately 220 identified gross Eagle Ford drilling locations Majority of acreage covered by 173 square mile 3-D seismic shoot Avoid faulting for steering Eagle Ford wells Indicate natural fractures Delineate other prospective opportunities Other Potential: Upper Eagle Ford, Austin Chalk, Buda, Wilcox, and Edwards Non-operated La Salle County 64 gross producing wells 25,400 gross / 2,900 net leasehold acres Working interests range from 10% to 15% Near-Term Strategy Production growth through operated capital program Expand through acquisitions of operated acreage and production Gonzales, Fayette and Karnes Counties, Texas Earthstone Sanchez Penn Virginia Offset operators include EOG, Encana and Marathon

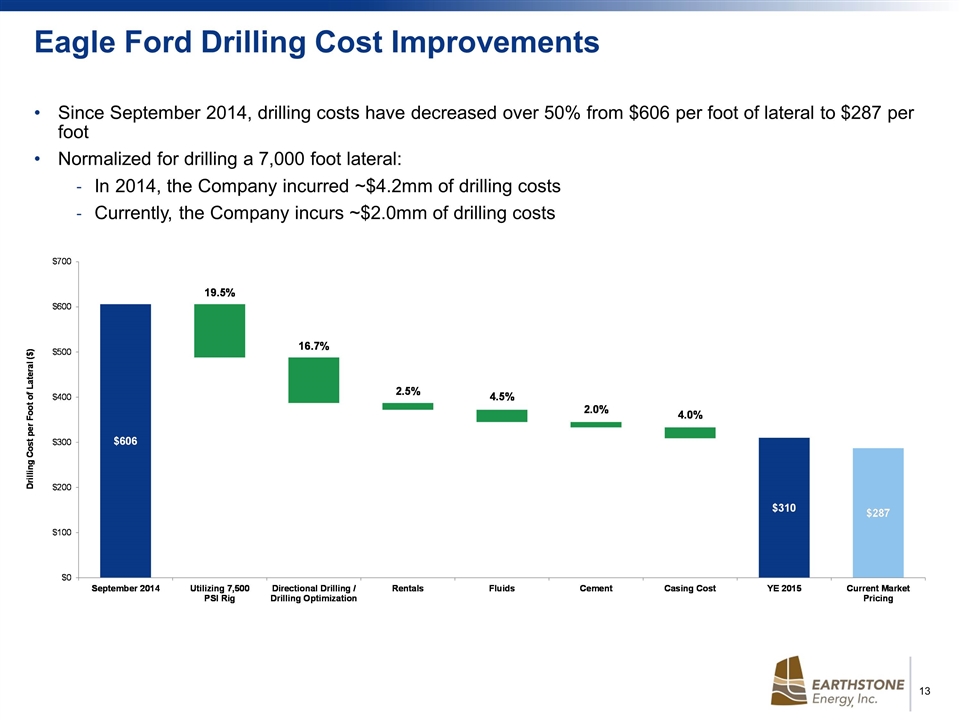

Eagle Ford Drilling Cost Improvements Since September 2014, drilling costs have decreased over 50% from $606 per foot of lateral to $287 per foot Normalized for drilling a 7,000 foot lateral: In 2014, the Company incurred ~$4.2mm of drilling costs Currently, the Company incurs ~$2.0mm of drilling costs

Eagle Ford Drilling Performance – Days vs Depth Boggs Matthews North Matthews South

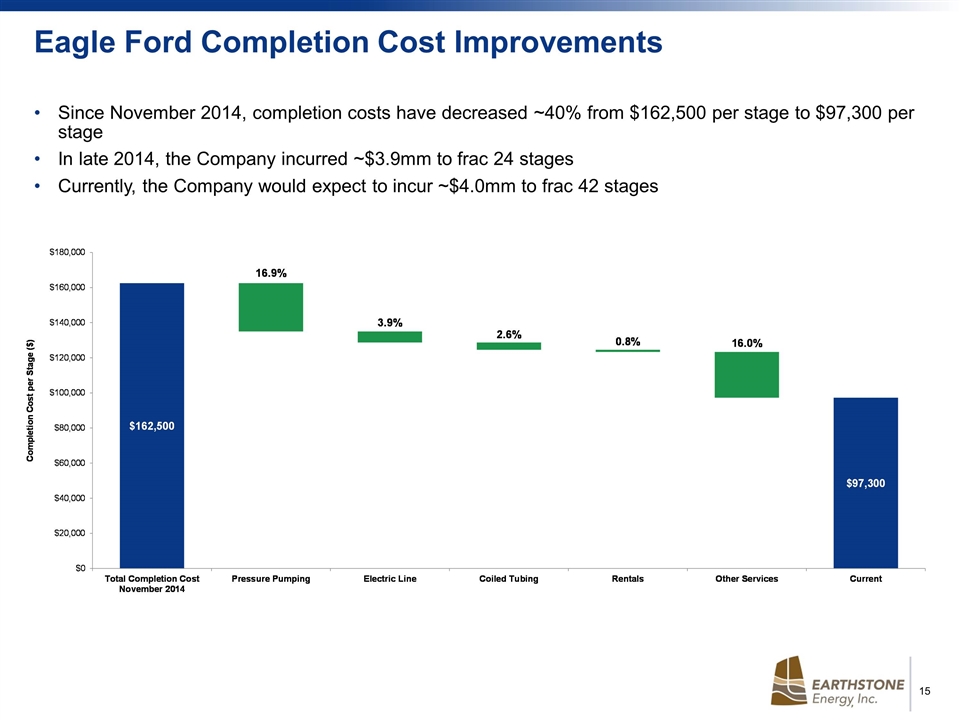

Eagle Ford Completion Cost Improvements Since November 2014, completion costs have decreased ~40% from $162,500 per stage to $97,300 per stage In late 2014, the Company incurred ~$3.9mm to frac 24 stages Currently, the Company would expect to incur ~$4.0mm to frac 42 stages

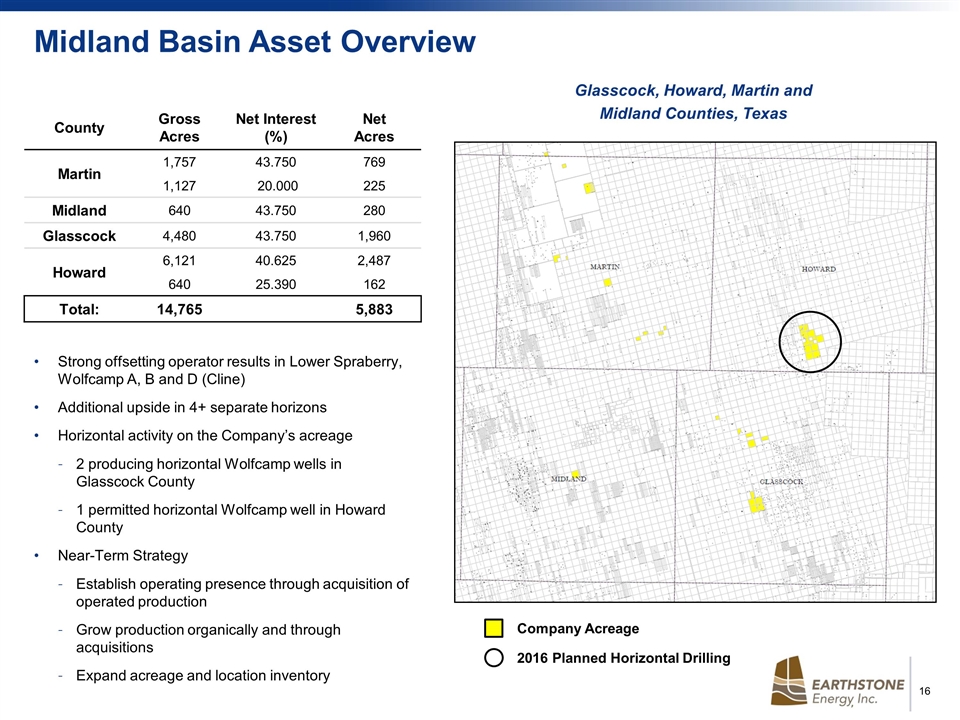

Midland Basin Asset Overview Strong offsetting operator results in Lower Spraberry, Wolfcamp A, B and D (Cline) Additional upside in 4+ separate horizons Horizontal activity on the Company’s acreage 2 producing horizontal Wolfcamp wells in Glasscock County 1 permitted horizontal Wolfcamp well in Howard County Near-Term Strategy Establish operating presence through acquisition of operated production Grow production organically and through acquisitions Expand acreage and location inventory Glasscock, Howard, Martin and Midland Counties, Texas County Gross Acres Net Interest (%) Net Acres Martin 1,757 43.750 769 1,127 20.000 225 Midland 640 43.750 280 Glasscock 4,480 43.750 1,960 Howard 6,121 40.625 2,487 640 25.390 162 Total: 14,765 5,883 2016 Planned Horizontal Drilling Company Acreage

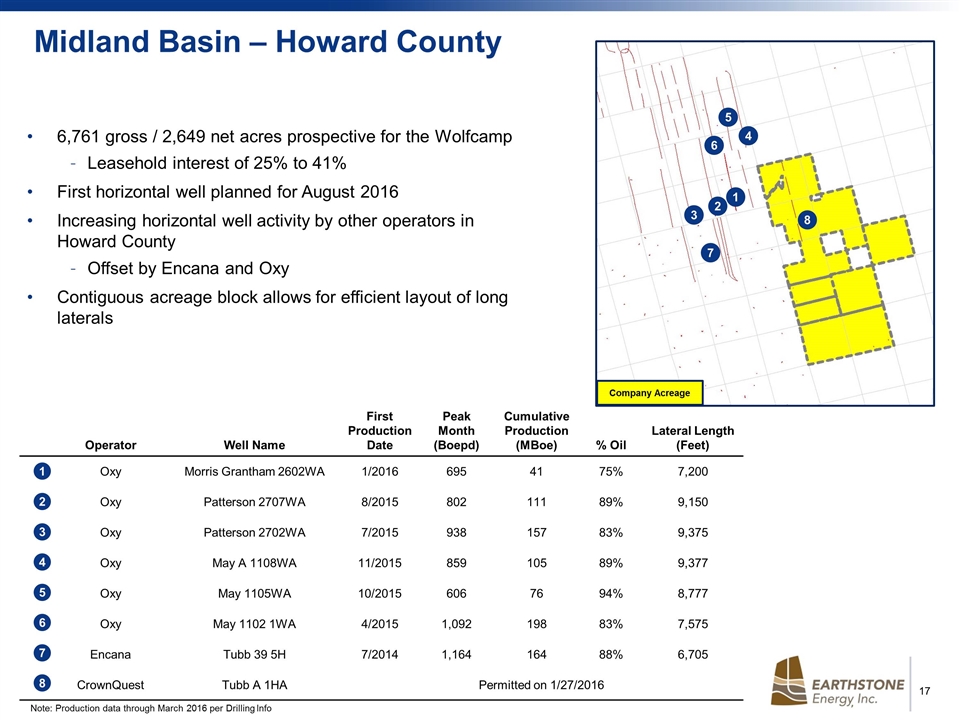

6,761 gross / 2,649 net acres prospective for the Wolfcamp Leasehold interest of 25% to 41% First horizontal well planned for August 2016 Increasing horizontal well activity by other operators in Howard County Offset by Encana and Oxy Contiguous acreage block allows for efficient layout of long laterals Midland Basin – Howard County 1 2 3 4 5 6 7 8 Company Acreage Operator Well Name First Production Date Peak Month (Boepd) Cumulative Production (MBoe) % Oil Lateral Length (Feet) Oxy Morris Grantham 2602WA 1/2016 695 41 75% 7,200 Oxy Patterson 2707WA 8/2015 802 111 89% 9,150 Oxy Patterson 2702WA 7/2015 938 157 83% 9,375 Oxy May A 1108WA 11/2015 859 105 89% 9,377 Oxy May 1105WA 10/2015 606 76 94% 8,777 Oxy May 1102 1WA 4/2015 1,092 198 83% 7,575 Encana Tubb 39 5H 7/2014 1,164 164 88% 6,705 CrownQuest Tubb A 1HA Permitted on 1/27/2016 1 2 3 4 5 6 7 8 Note: Production data through March 2016 per Drilling Info

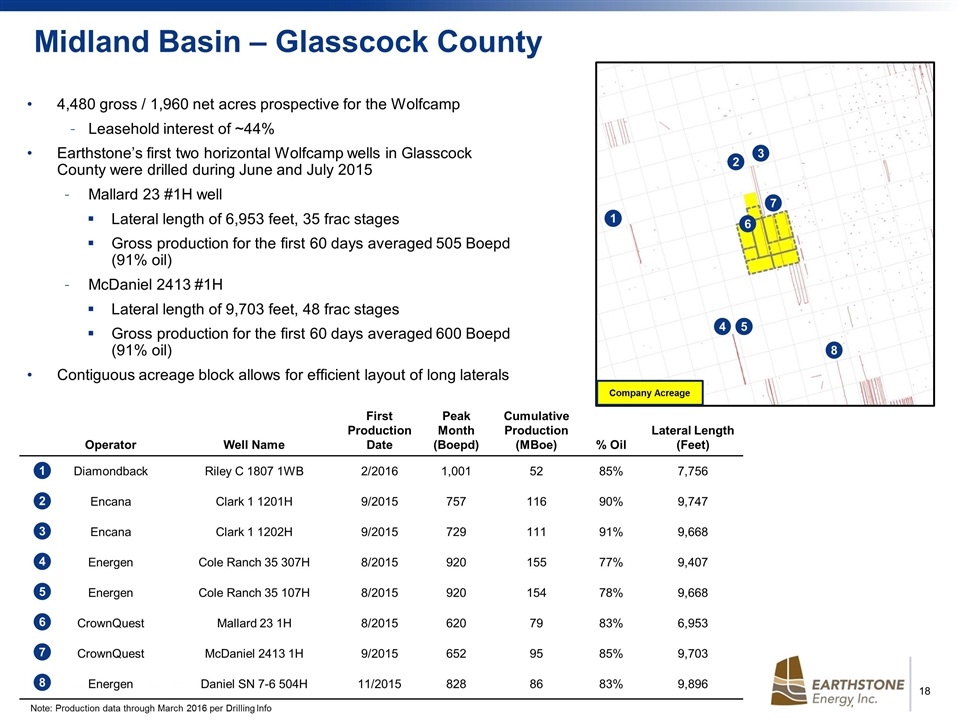

Midland Basin – Glasscock County 4,480 gross / 1,960 net acres prospective for the Wolfcamp Leasehold interest of ~44% Earthstone’s first two horizontal Wolfcamp wells in Glasscock County were drilled during June and July 2015 Mallard 23 #1H well Lateral length of 6,953 feet, 35 frac stages Gross production for the first 60 days averaged 505 Boepd (91% oil) McDaniel 2413 #1H Lateral length of 9,703 feet, 48 frac stages Gross production for the first 60 days averaged 600 Boepd (91% oil) Contiguous acreage block allows for efficient layout of long laterals Operator Well Name First Production Date Peak Month (Boepd) Cumulative Production (MBoe) % Oil Lateral Length (Feet) Diamondback Riley C 1807 1WB 2/2016 1,001 52 85% 7,756 Encana Clark 1 1201H 9/2015 757 116 90% 9,747 Encana Clark 1 1202H 9/2015 729 111 91% 9,668 Energen Cole Ranch 35 307H 8/2015 920 155 77% 9,407 Energen Cole Ranch 35 107H 8/2015 920 154 78% 9,668 CrownQuest Mallard 23 1H 8/2015 620 79 83% 6,953 CrownQuest McDaniel 2413 1H 9/2015 652 95 85% 9,703 Energen Daniel SN 7-6 504H 11/2015 828 86 83% 9,896 Note: Production data through March 2016 per Drilling Info 1 2 3 4 5 6 7 8 Company Acreage 1 2 3 4 5 6 7 8

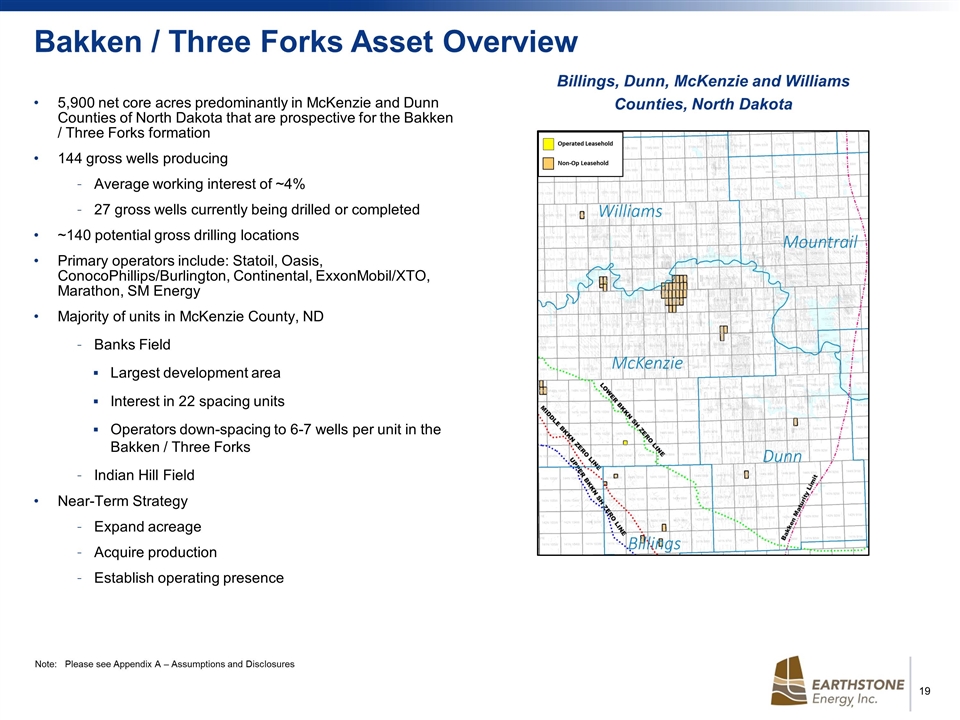

Bakken / Three Forks Asset Overview 5,900 net core acres predominantly in McKenzie and Dunn Counties of North Dakota that are prospective for the Bakken / Three Forks formation 144 gross wells producing Average working interest of ~4% 27 gross wells currently being drilled or completed ~140 potential gross drilling locations Primary operators include: Statoil, Oasis, ConocoPhillips/Burlington, Continental, ExxonMobil/XTO, Marathon, SM Energy Majority of units in McKenzie County, ND Banks Field Largest development area Interest in 22 spacing units Operators down-spacing to 6-7 wells per unit in the Bakken / Three Forks Indian Hill Field Near-Term Strategy Expand acreage Acquire production Establish operating presence Note: Please see Appendix A – Assumptions and Disclosures Non-Op Leasehold Operated Leasehold Billings, Dunn, McKenzie and Williams Counties, North Dakota

Appendix

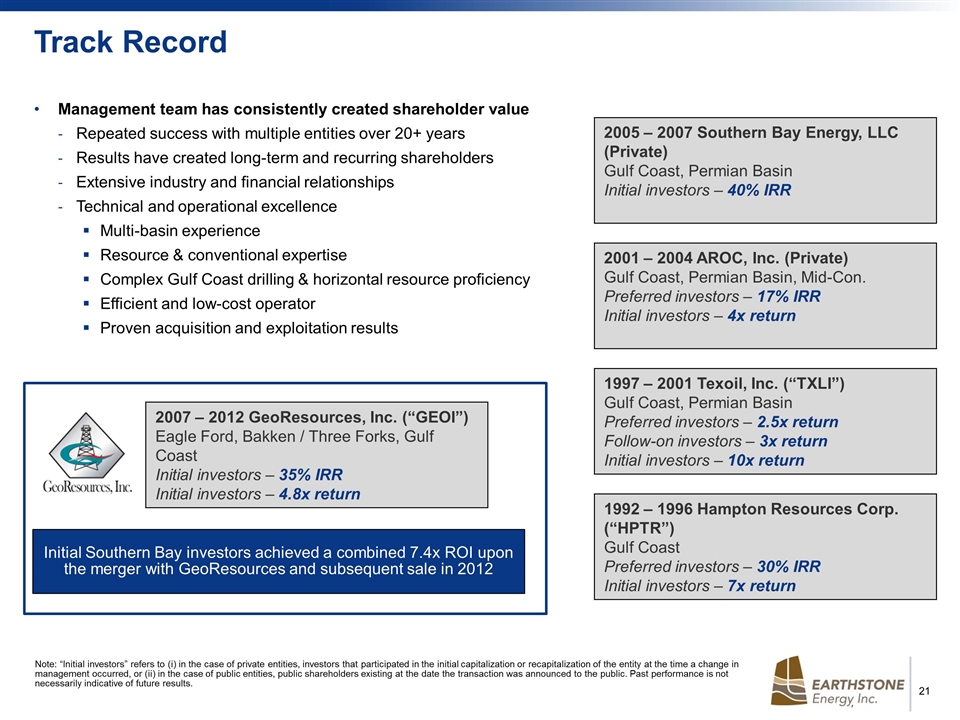

Track Record 2001 – 2004 AROC, Inc. (Private) Gulf Coast, Permian Basin, Mid-Con. Preferred investors – 17% IRR Initial investors – 4x return 2005 – 2007 Southern Bay Energy, LLC (Private) Gulf Coast, Permian Basin Initial investors – 40% IRR 1997 – 2001 Texoil, Inc. (“TXLI”) Gulf Coast, Permian Basin Preferred investors – 2.5x return Follow-on investors – 3x return Initial investors – 10x return 1992 – 1996 Hampton Resources Corp. (“HPTR”) Gulf Coast Preferred investors – 30% IRR Initial investors – 7x return Management team has consistently created shareholder value Repeated success with multiple entities over 20+ years Results have created long-term and recurring shareholders Extensive industry and financial relationships Technical and operational excellence Multi-basin experience Resource & conventional expertise Complex Gulf Coast drilling & horizontal resource proficiency Efficient and low-cost operator Proven acquisition and exploitation results 2007 – 2012 GeoResources, Inc. (“GEOI”) Eagle Ford, Bakken / Three Forks, Gulf Coast Initial investors – 35% IRR Initial investors – 4.8x return Initial Southern Bay investors achieved a combined 7.4x ROI upon the merger with GeoResources and subsequent sale in 2012 Note: “Initial investors” refers to (i) in the case of private entities, investors that participated in the initial capitalization or recapitalization of the entity at the time a change in management occurred, or (ii) in the case of public entities, public shareholders existing at the date the transaction was announced to the public. Past performance is not necessarily indicative of future results.

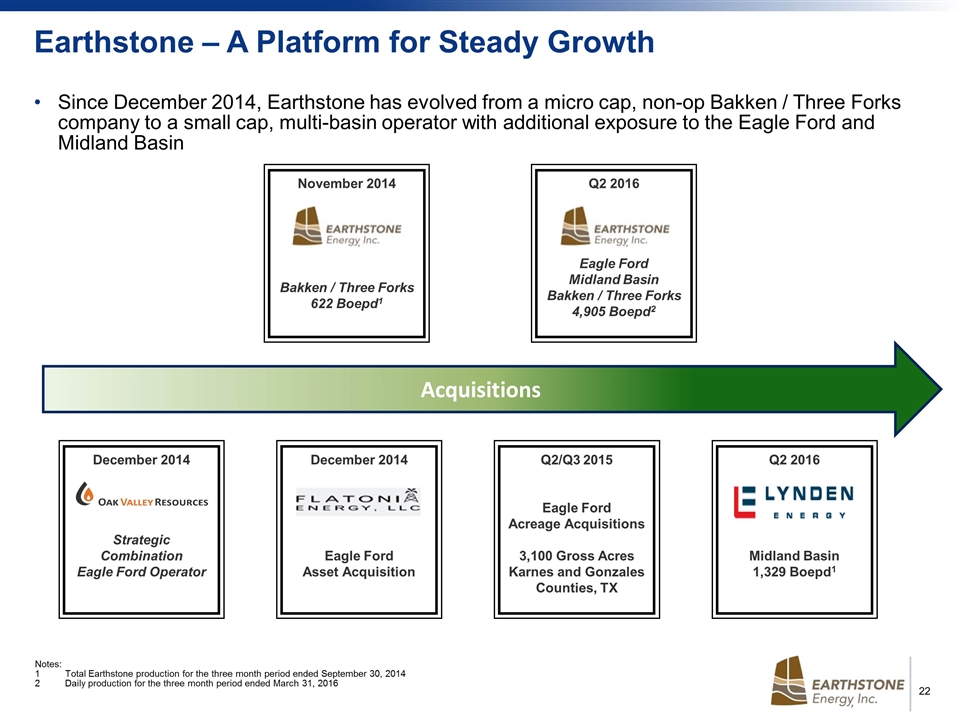

Earthstone – A Platform for Steady Growth December 2014 Eagle Ford Asset Acquisition December 2014 Strategic Combination Eagle Ford Operator Q2/Q3 2015 Eagle Ford Acreage Acquisitions 3,100 Gross Acres Karnes and Gonzales Counties, TX Q2 2016 Midland Basin 1,329 Boepd1 Since December 2014, Earthstone has evolved from a micro cap, non-op Bakken / Three Forks company to a small cap, multi-basin operator with additional exposure to the Eagle Ford and Midland Basin Acquisitions November 2014 Bakken / Three Forks 622 Boepd1 Q2 2016 Eagle Ford Midland Basin Bakken / Three Forks 4,905 Boepd2 Notes: 1Total Earthstone production for the three month period ended September 30, 2014 2Daily production for the three month period ended March 31, 2016

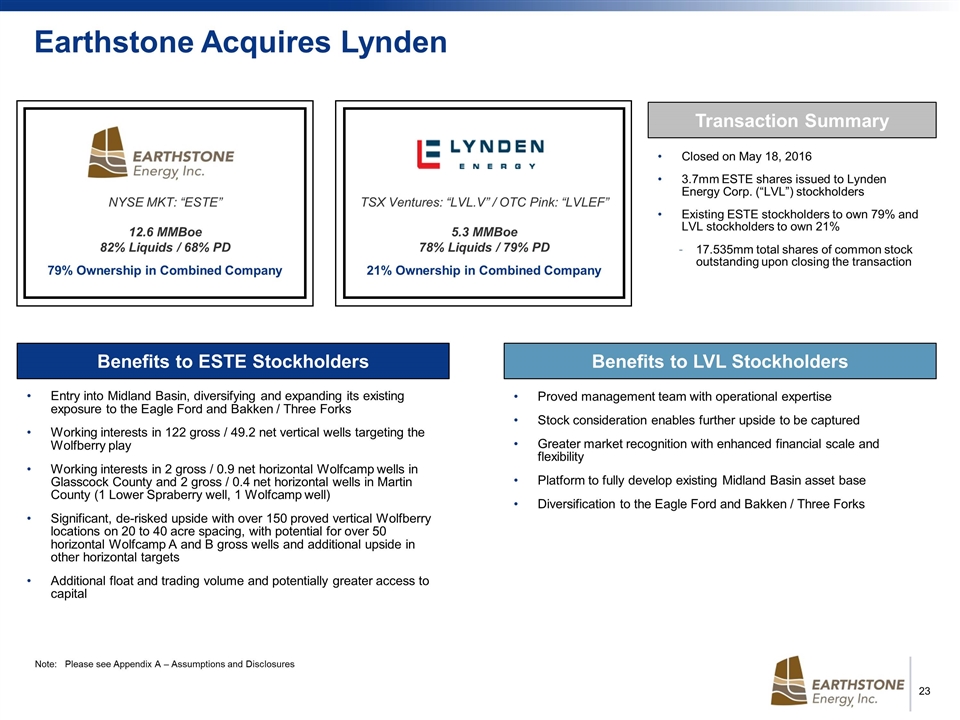

Earthstone Acquires Lynden Closed on May 18, 2016 3.7mm ESTE shares issued to Lynden Energy Corp. (“LVL”) stockholders Existing ESTE stockholders to own 79% and LVL stockholders to own 21% 17.535mm total shares of common stock outstanding upon closing the transaction Transaction Summary NYSE MKT: “ESTE” 12.6 MMBoe 82% Liquids / 68% PD 79% Ownership in Combined Company TSX Ventures: “LVL.V” / OTC Pink: “LVLEF” 5.3 MMBoe 78% Liquids / 79% PD 21% Ownership in Combined Company Entry into Midland Basin, diversifying and expanding its existing exposure to the Eagle Ford and Bakken / Three Forks Working interests in 122 gross / 49.2 net vertical wells targeting the Wolfberry play Working interests in 2 gross / 0.9 net horizontal Wolfcamp wells in Glasscock County and 2 gross / 0.4 net horizontal wells in Martin County (1 Lower Spraberry well, 1 Wolfcamp well) Significant, de-risked upside with over 150 proved vertical Wolfberry locations on 20 to 40 acre spacing, with potential for over 50 horizontal Wolfcamp A and B gross wells and additional upside in other horizontal targets Additional float and trading volume and potentially greater access to capital Benefits to ESTE Stockholders Proved management team with operational expertise Stock consideration enables further upside to be captured Greater market recognition with enhanced financial scale and flexibility Platform to fully develop existing Midland Basin asset base Diversification to the Eagle Ford and Bakken / Three Forks Benefits to LVL Stockholders Note: Please see Appendix A – Assumptions and Disclosures

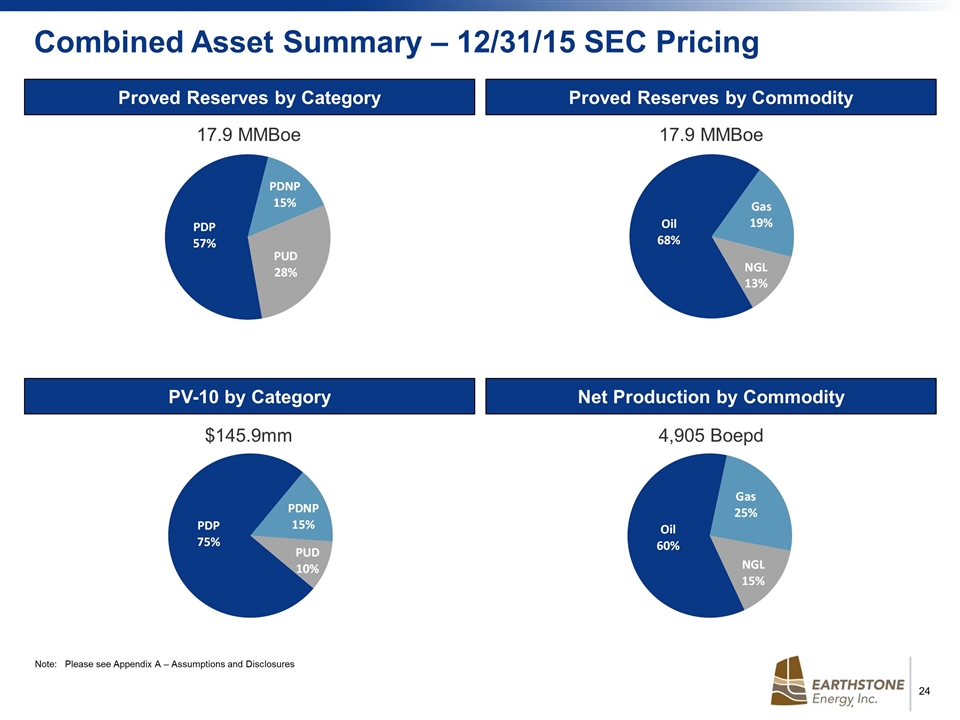

Combined Asset Summary – 12/31/15 SEC Pricing Proved Reserves by Commodity Proved Reserves by Category Net Production by Commodity PV-10 by Category 17.9 MMBoe 4,905 Boepd $145.9mm 17.9 MMBoe Note: Please see Appendix A – Assumptions and Disclosures

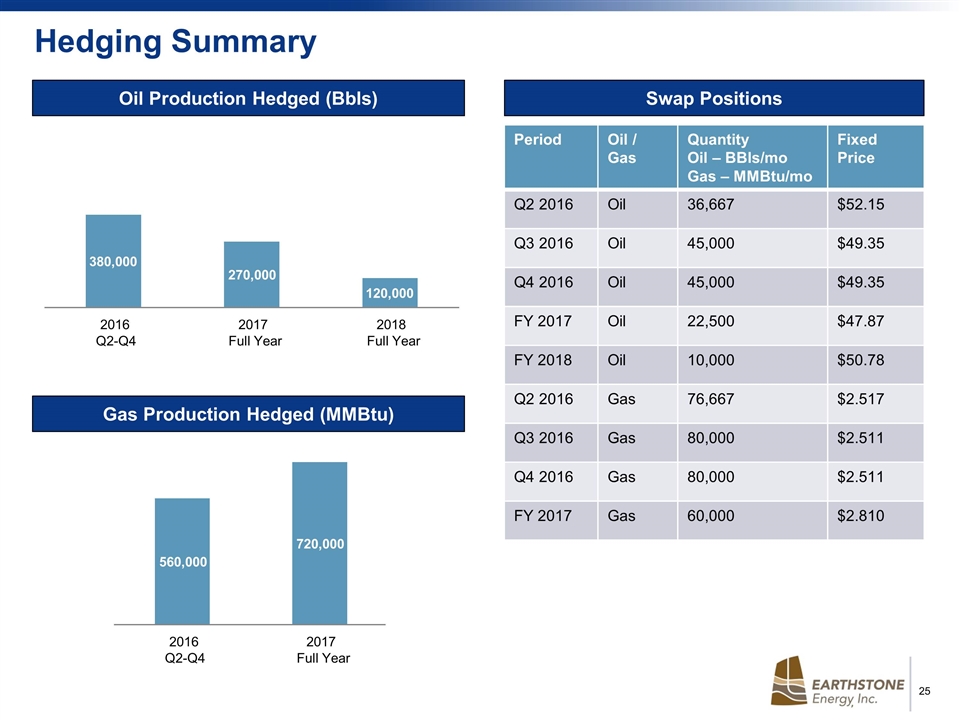

Oil Production Hedged (Bbls) Gas Production Hedged (MMBtu) Swap Positions Period Oil / Gas Quantity Oil – BBls/mo Gas – MMBtu/mo Fixed Price Q2 2016 Oil 36,667 $52.15 Q3 2016 Oil 45,000 $49.35 Q4 2016 Oil 45,000 $49.35 FY 2017 Oil 22,500 $47.87 FY 2018 Oil 10,000 $50.78 Q2 2016 Gas 76,667 $2.517 Q3 2016 Gas 80,000 $2.511 Q4 2016 Gas 80,000 $2.511 FY 2017 Gas 60,000 $2.810 Hedging Summary 380,000 270,000 120,000 2016 Q2-Q4 2017 Full Year 2018 Full Year 560,000 720,000 0 2016 Q2-Q4 2017 Full Year 2018 Full Year

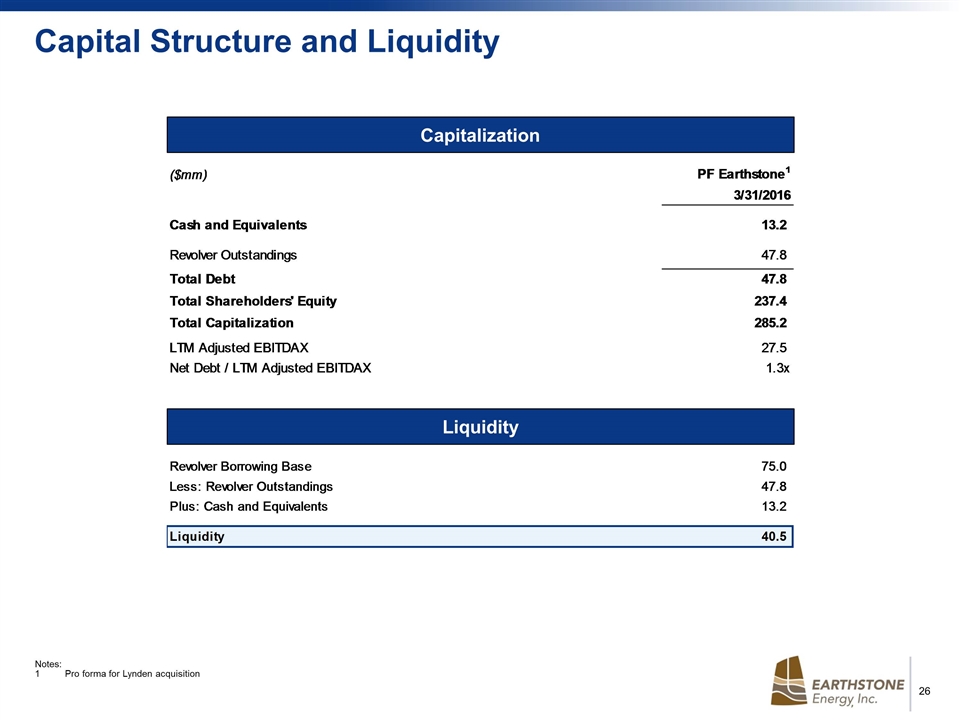

Notes: 1 Pro forma for Lynden acquisition Capital Structure and Liquidity Capitalization Liquidity

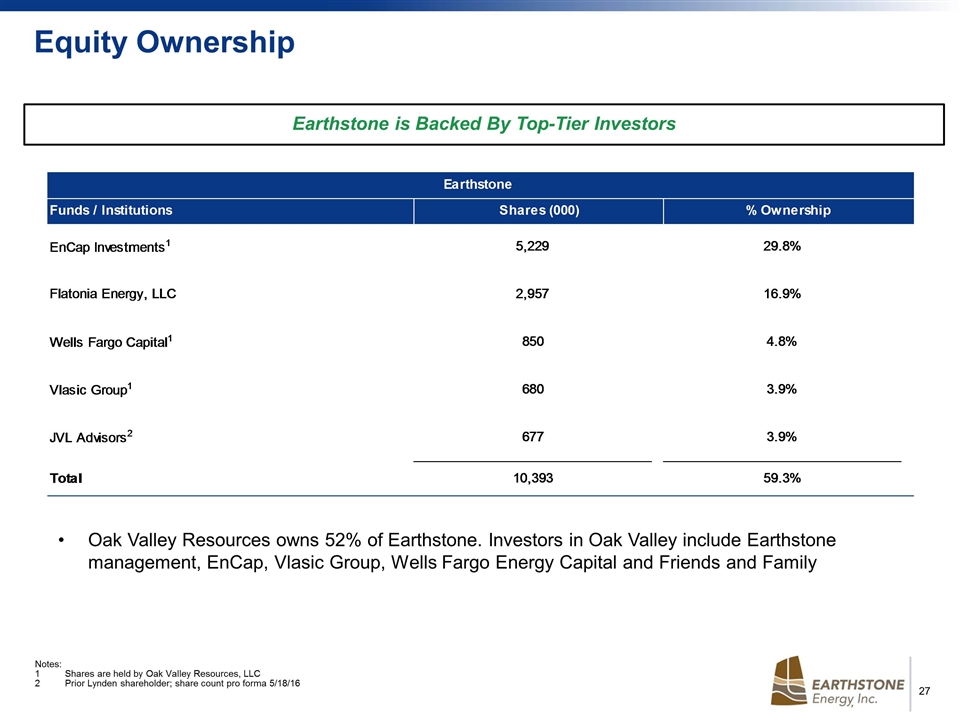

Equity Ownership Earthstone is Backed By Top-Tier Investors Notes: 1Shares are held by Oak Valley Resources, LLC 2Prior Lynden shareholder; share count pro forma 5/18/16 Oak Valley Resources owns 52% of Earthstone. Investors in Oak Valley include Earthstone management, EnCap, Vlasic Group, Wells Fargo Energy Capital and Friends and Family

Management Team Frank A. Lodzinski Chairman, President and CEO Mr. Lodzinski has served as President and Chief Executive Officer of Earthstone Energy, Inc. since December 2014. Previously, he served as President and Chief Executive Officer of Oak Valley Resources, LLC from its formation in December 2012 until the closing of its strategic combination with the Company in December 2014. Prior to his service with Oak Valley, Mr. Lodzinski was Chairman, President and Chief Executive Officer of GeoResources, Inc. from April 2007 until its merger with Halcón Resources Corporation in August 2012. He has over 43 years of oil and gas industry experience. In 1984, he formed Energy Resource Associates, Inc., which acquired management and controlling interests in oil and gas limited partnerships, joint ventures and producing properties. Certain partnerships were exchanged for common shares of Hampton Resources Corporation in 1992, which Mr. Lodzinski joined as a director and President. Hampton was sold in 1995 to Bellwether Exploration Company. In 1996, he formed Cliffwood Oil & Gas Corp. and in 1997, Cliffwood shareholders acquired a controlling interest in Texoil, Inc., where Mr. Lodzinski served as CEO and President. In 2001, Mr. Lodzinski was appointed CEO and President of AROC, Inc., to direct the restructuring and ultimate liquidation of that company. In 2003, AROC completed a monetization of oil and gas assets with an institutional investor and began a plan of liquidation in 2004. In 2004, Mr. Lodzinski formed Southern Bay Energy, LLC, the general partner of Southern Bay Oil & Gas, L.P., which acquired the residual assets of AROC, Inc., and he served as President of Southern Bay Energy, LLC since its formation. The Southern Bay entities were merged into GeoResources in April 2007. Mr. Lodzinski has served as a director and member of the audit committee of Yuma Energy, Inc. since September 2014. He holds a BSBA degree in Accounting and Finance from Wayne State University in Detroit, Michigan. Robert J. Anderson Executive Vice President – Corporate Development and Engineering Mr. Anderson is a petroleum engineer with over 29 years of diversified domestic and international experience. He has served as Executive Vice President, Corporate Development and Engineering of Earthstone Energy, Inc. since December 2014. Previously, he served in a similar capacity with Oak Valley Resources, LLC from March 2013 until the closing of its strategic combination with Earthstone in December 2014. Prior to Oak Valley, he served from August 2012 to February 2013 as Executive Vice President and Chief Operating Officer at Halcón Resources Corporation. Mr. Anderson was employed by GeoResources, Inc. from April 2007 until its merger with Halcón Resources in August 2012, ultimately serving as a director and Executive Vice President, Chief Operating Officer – Northern Region. He was involved in the formation of Southern Bay Energy in September 2004 as Vice President, Acquisitions until its merger with GeoResources in April 2007. From March 2004 to August 2004, Mr. Anderson was employed by AROC, a predecessor company to Southern Bay Energy, as Vice President, Acquisitions and Divestitures. From September 2000 to February 2004, he was employed by Anadarko Petroleum Corporation as a petroleum engineer. In addition, he has worked with major oil companies, including ARCO International/Vastar Resources, and independent oil companies, including Hunt Oil, Hugoton Energy, and Pacific Enterprises Oil Company. His professional experience includes acquisition evaluation, reservoir and production engineering, field development, project economics, budgeting and planning, and capital markets. His domestic acquisition and divestiture experience includes Texas and Louisiana (offshore and onshore), Mid-Continent, and the Rocky Mountain states, and international experience includes Canada, South America, and Russia. Mr. Anderson has a B.S. degree in Petroleum Engineering from the University of Wyoming and an MBA from the University of Denver. Christopher E. Cottrell Executive Vice President – Land and Marketing Mr. Cottrell has been employed in various aspects of land management and commodity marketing activities since 1983. He has served as Executive Vice President, Land and Marketing of Earthstone Energy, Inc. since December 2014. Previously, he served in a similar capacity with Oak Valley Resources, LLC from its formation in December 2012 until the closing of its strategic combination with Earthstone in December 2014. Prior to employment by Oak Valley, he was employed by GeoResources from April 2007 until its merger with Halcón Resources in August 2012, ultimately serving as Vice President of Land and Marketing, responsible for land and operating contract matters including oil and gas marketing, land and lease records, title and division orders. In addition, he was actively involved in due diligence associated with business development matters. He has held previous roles at AROC, Texoil, Williams Exploration, Ashland Exploration, American Exploration, Belco Energy, and Citation Oil & Gas. Mr. Cottrell graduated with a B.B.A. degree in Petroleum Land Management from the University of Texas.

Management Team (Cont’d) Steven C. Collins Executive Vice President – Completions and Operations Mr. Collins is a petroleum engineer with over 27 years of operations and related experience. He has served as Executive Vice President, Completions and Operations of Earthstone Energy, Inc. since December 2014. Previously, he served in a similar capacity with Oak Valley Resources, LLC from its formation in December 2012 until the closing of its strategic combination with Earthstone in December 2014. Prior to employment by Oak Valley, he served from August 2012 to November 2012 as a consultant to Halcón Resources. Mr. Collins was employed by GeoResources from April 2007 until its merger with Halcón Resources in August 2012 and directed field operations, including well completion, production, and workover operations. Prior to employment by GeoResources, he served as Vice President of Operations for Southern Bay, AROC, and Texoil, and as a petroleum and operations engineer at Hunt Oil Company and Pacific Enterprises Oil Company. His experience includes Texas, Louisiana (onshore and offshore), North Dakota, Montana, and the Mid-Continent. Mr. Collins graduated with a B.S. degree in Petroleum Engineering from the University of Texas. Timothy D. Merrifield Executive Vice President – Geology and Geophysics Mr. Merrifield has over 36 years of oil and gas industry experience. He has served as Executive Vice President, Geology and Geophysics of Earthstone Energy, Inc. since December 2014. Previously, he served in a similar capacity with Oak Valley Resources, LLC from its formation in December 2012 until the closing of its strategic combination with Earthstone in December 2014. Prior to employment by Oak Valley, he served from August 2012 to November 2012 as a consultant to Halcón Resources upon its merger with GeoResources in August 2012. From April 2007 to August 2012, Mr. Merrifield led all geology and geophysics efforts at GeoResources. He has held previous roles at AROC, Force Energy, Great Western Resources and other independents. His domestic experience includes Texas, Louisiana (onshore and offshore), North Dakota, Montana, New Mexico, Rocky Mountain states, and the Mid-Continent. In addition, he has international experience in Peru and the East Irish Sea. Mr. Merrifield attended Texas Tech University. Francis M. Mury Executive Vice President – Drilling and Development Mr. Mury has over 41 years of oil and gas industry experience. He has served as Executive Vice President, Drilling and Development of Earthstone Energy, Inc. since December 2014. Previously, he served in a similar capacity with Oak Valley Resources, LLC from its formation in December 2012 until the closing of its strategic combination with Earthstone in December 2014. Prior to employment by Oak Valley, he was employed by GeoResources from April 2007 until its merger with Halcón Resources in August 2012, ultimately serving as an Executive Vice President, Chief Operating Officer–Southern Region. He has held prior roles at AROC, Texoil, Hampton Resources, Wainoco Oil & Gas Company, Diasu Exploration Company, and Texaco, Inc. His experience extends to all facets of petroleum engineering, including reservoir engineering, drilling and production operations, petroleum economics, geology, geophysics, land, and joint operations. Geographical areas of experience include Texas and Louisiana (offshore and onshore), North Dakota, Montana, Mid-Continent, Florida, New Mexico, Oklahoma, Wyoming, Pennsylvania, and Michigan. Mr. Mury graduated from Nicholls State University with a degree in Computer Science. Ray Singleton Executive Vice President - Northern Region Mr. Singleton is a petroleum engineer with over 37 years of experience. He has been a director of Earthstone Energy, Inc. since July 1989 and served as its President and Chief Executive Officer from March 1993 until December 2014. Mr. Singleton joined Earthstone in 1988 as a Production Manager/Petroleum Engineer. From 1983 until 1988 and prior to joining Earthstone, Mr. Singleton was the principal of Singleton & Associates, an engineering consulting company serving the operational and engineering needs of approximately 40 small oil and gas clients. During this period, he was engaged by the Company on various projects in south Texas and the Rocky Mountain region. Mr. Singleton began his career with Amoco Production Company in 1973 as a production engineer in Texas. He was subsequently employed by the predecessor of Union Pacific Resources as a drilling, completion and production engineer from 1980 to 1983. From 1974 to 1980, Mr. Singleton served in the U.S Air Force, where he was a combat qualified fighter pilot in the F-4 Phantom with both nuclear and conventional delivery responsibilities. He attained the rank of captain. In addition, he possesses over 20 years of executive experience and has an intimate knowledge of the Company’s legacy Rocky Mountain and south Texas properties. Mr. Singleton received a B.S. degree in Petroleum Engineering from Texas A&M University in 1973 and received an MBA from Colorado State University’s Executive MBA Program in 1992.

Management Team (Cont’d) Neil K. Cohen Vice President – Finance, Treasurer Mr. Cohen has over 12 years of professional experience. He has served as Vice President, Finance, and Treasurer of Earthstone Energy, Inc. since December 2014. Previously, he served in a similar capacity with Oak Valley Resources, LLC from its formation in December 2012 until the closing of its strategic combination with Earthstone in December 2014. He is primarily responsible for all corporate finance, capital markets, and investor relations activities. Prior to joining Oak Valley, he served from September 2012 to December 2012 as a consultant to Texoil Energy, Inc. From February 2006 to October 2011, Mr. Cohen was employed by UBS Investment Bank as a member of the Global Energy Group, with exposure to all energy subsectors and a particular focus on mergers and acquisitions and equity and debt financings on behalf of exploration and production clients, and as a member of UBS’ Debt Capital Markets Group, with a particular focus on investment grade bond offerings on behalf of energy, utility, and real estate clients. He has been involved in ~$43 billion of bookrun equity and debt capital markets offerings and ~$15 billion of announced mergers and acquisitions. He has held previous roles at Merrill Lynch (Debt Capital Markets and Debt Derivatives Finance) and Hess Corporation (Finance). Mr. Cohen graduated with a B.S. degree in Finance from the University of Maryland. G. Bret Wonson Vice President – Chief Accounting Officer Mr. Wonson has over 14 years of professional experience. He has served as Vice President, Principal Accounting Officer of Earthstone Energy, Inc. since December 2014. Previously, he served in a similar capacity with Oak Valley Resources, LLC from February 2013 until the closing of its strategic combination with the Earthstone in December 2014. Prior to Oak Valley, he served from August 2012 to February 2013 as Assistant Controller at Halcón Resources upon its merger with GeoResources, Inc. in August 2012. From February 2012 to August 2012 and from April 2008 to November 2010, Mr. Wonson was Corporate Controller and Controller of GeoResources, respectively. From December 2010 to January 2012, he was an Assistant Controller at Valerus Compression. He has held previous roles at Arthur Andersen, Grant Thornton, and BP. Mr. Wonson holds a bachelor’s degree in Accounting from Mississippi State University and a master’s degree in Accounting from the University of Alabama. Mr. Wonson is a Certified Public Accountant in the State of Texas.

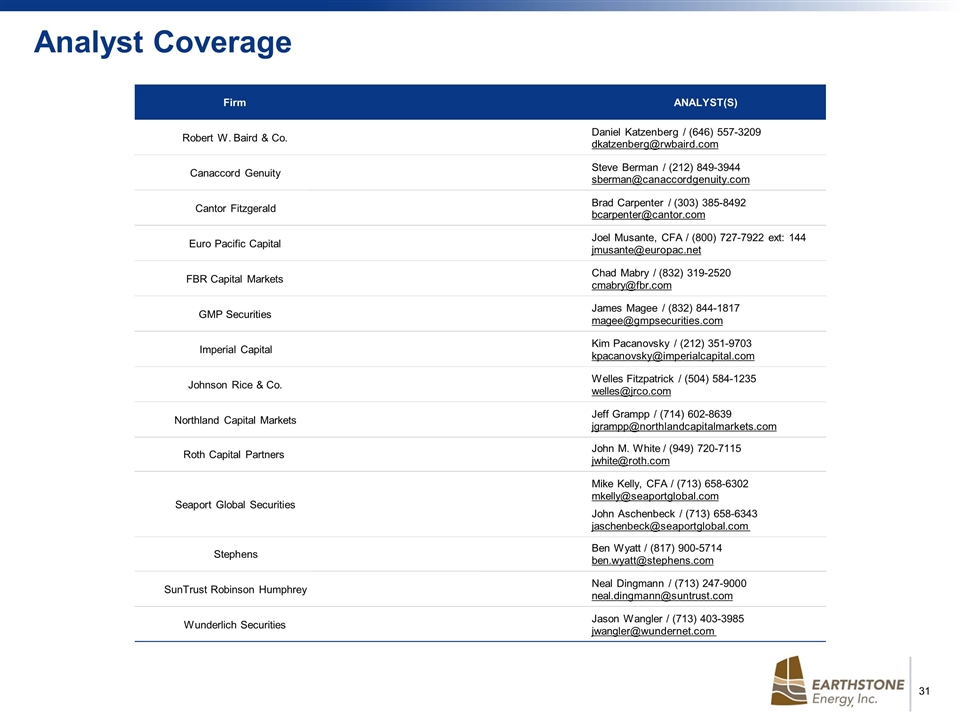

Analyst Coverage Firm ANALYST(S) Daniel Katzenberg / (646) 557-3209 [email protected] Steve Berman / (212) 849-3944 [email protected] Brad Carpenter / (303) 385-8492 [email protected] Joel Musante, CFA / (800) 727-7922 ext: 144 [email protected] Chad Mabry / (832) 319-2520 [email protected] James Magee / (832) 844-1817 [email protected] Kim Pacanovsky / (212) 351-9703 [email protected] Welles Fitzpatrick / (504) 584-1235 [email protected] Jeff Grampp / (714) 602-8639 [email protected] John M. White / (949) 720-7115 [email protected] Mike Kelly, CFA / (713) 658-6302 [email protected] John Aschenbeck / (713) 658-6343 [email protected] Ben Wyatt / (817) 900-5714 [email protected] Neal Dingmann / (713) 247-9000 [email protected] Jason Wangler / (713) 403-3985 [email protected] Robert W. Baird & Co. Cantor Fitzgerald FBR Capital Markets GMP Securities Canaccord Genuity Euro Pacific Capital Imperial Capital Johnson Rice & Co. Seaport Global Securities Wunderlich Securities Stephens Northland Capital Markets Roth Capital Partners SunTrust Robinson Humphrey

Appendix A – Assumptions and Disclosures Track Record / Past Performance is not necessarily indicative of future results. Proved reserves determined utilizing SEC price methodology effective December 31, 2015. Proved reserves associated with Bakken / Three Forks and Eagle Ford properties as estimated by Cawley, Gillespie & Associates, Inc. Proved reserves associated with Midland Basin properties as estimated by Earthstone management. No proved reserves assigned to horizontal drilling locations in the Midland Basin. Eagle Ford includes other Southern region assets. Bakken / Three Forks includes other Northern region assets. Producing well counts and core acreage / drilling locations only include specified reservoirs / areas and not other wells located in the region. Midland Basin acreage excludes Eastern Shelf - Mitchell Ranch acreage. Estimated number of locations include proved undeveloped as well as management’s estimates of additional potential. Actual locations drilled and quantities that may be ultimately recovered from Earthstone’s interests could differ substantially from management’s estimates. Net production for the three month period ended March 31, 2016. Present Value Discounted at 10% (“PV-10”) is a non-GAAP financial measure that differs from the GAAP measure “standardized measure of discounted future net cash flows” in that PV-10 is calculated without regard to future income taxes. Earthstone management believes that the presentation of the PV-10 value is relevant and useful to investors because it presents the estimated discounted future net cash flows attributable to our estimated proved reserves independent of our income tax attributes, thereby isolating the intrinsic value of the estimated future cash flows attributable to our reserves. Because many factors that are unique to each individual company impact the amount of future income taxes to be paid, Earthstone believes the use of a pre-tax measure provides greater comparability of assets when evaluating companies. PV-10 does not necessarily represent the fair market value of oil and natural gas properties. PV-10 is not a measure of financial or operational performance under GAAP, nor should it be considered in isolation or as a substitute for the standardized measure of discounted future net cash flows as defined under GAAP. PV-10s as of December 31, 2015 utilized SEC price methodology and were based on $50.28 per barrel of oil and $2.590 per MMBTU for natural gas. IRRs include wells waiting on completion and therefore only include completion capital expenditures for those wells; IRRs for areas are well count weighted average. IRRs based on NYMEX Strip pricing as of 5/25/16.

Frank Lodzinski President and CEO Robert Anderson EVP, Corporate Development and Engineering Neil Cohen VP, Finance, and Treasurer Corporate Headquarters Houston 1400 Woodloch Forest Drive | Suite 300 | The Woodlands, TX 77380 | (281) 298-4246 Denver 633 17th Street | Suite 2320 | Denver, CO 80202 | (303) 296-3076 Website www.earthstoneenergy.com Contact Information

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- SES’s O3b mPOWER System Starts Providing High-performance Connectivity Services

- HostScore Conducts Extensive ScalaHosting Web Server Load Testing, Offering Insights on Performance of Cloud Servers in Comprehensive Reviews

- Digital Health Leaders Meet at HIMSS24 Europe to Deliver Solutions to Tomorrow’s Healthcare Challenges

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share